Compare Kansas Car Insurance Rates [2024]

Compare Kansas car insurance rates at $58/mo. Minimum liability is 25/50/25 for injury/property. This coverage compensates for accident-related injuries/damage, including drivers, passengers, pedestrians, cyclists. SR-22 is needed for drivers with violations, penalties, or being uninsured. Kansas mandates SR-22 after certain violations, including failure to prove insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

CEO and CFP®

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

CEO and CFP®

UPDATED: Nov 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Kansas Statistics Summary | Details |

|---|---|

| Annual Road Miles | 140,476 Vehicle Miles Driven: 30,710 million |

| Vehicles | Registered in State: 2,445,861 |

| State Population | 2,911,505 |

| Most Popular Vehicle | Ford F150 |

| Uninsured Motorists | 7.2 Percent |

| Total Driving Fatalities | 2008-2017 Speeding: 104 DUI: 102 |

| Average Annual Premiums | Liability: $358.24 Collision: $263.33 Comprehensive |

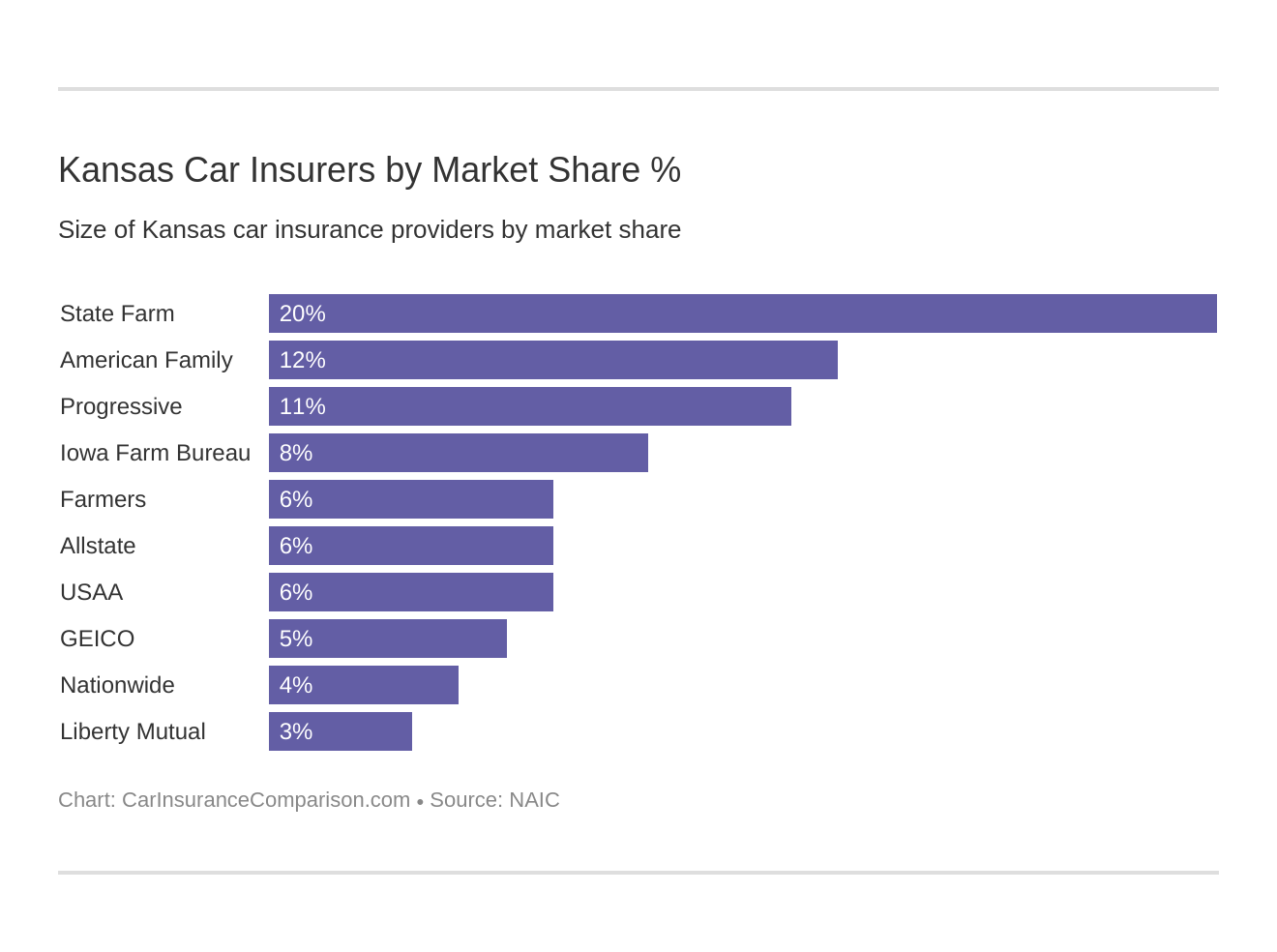

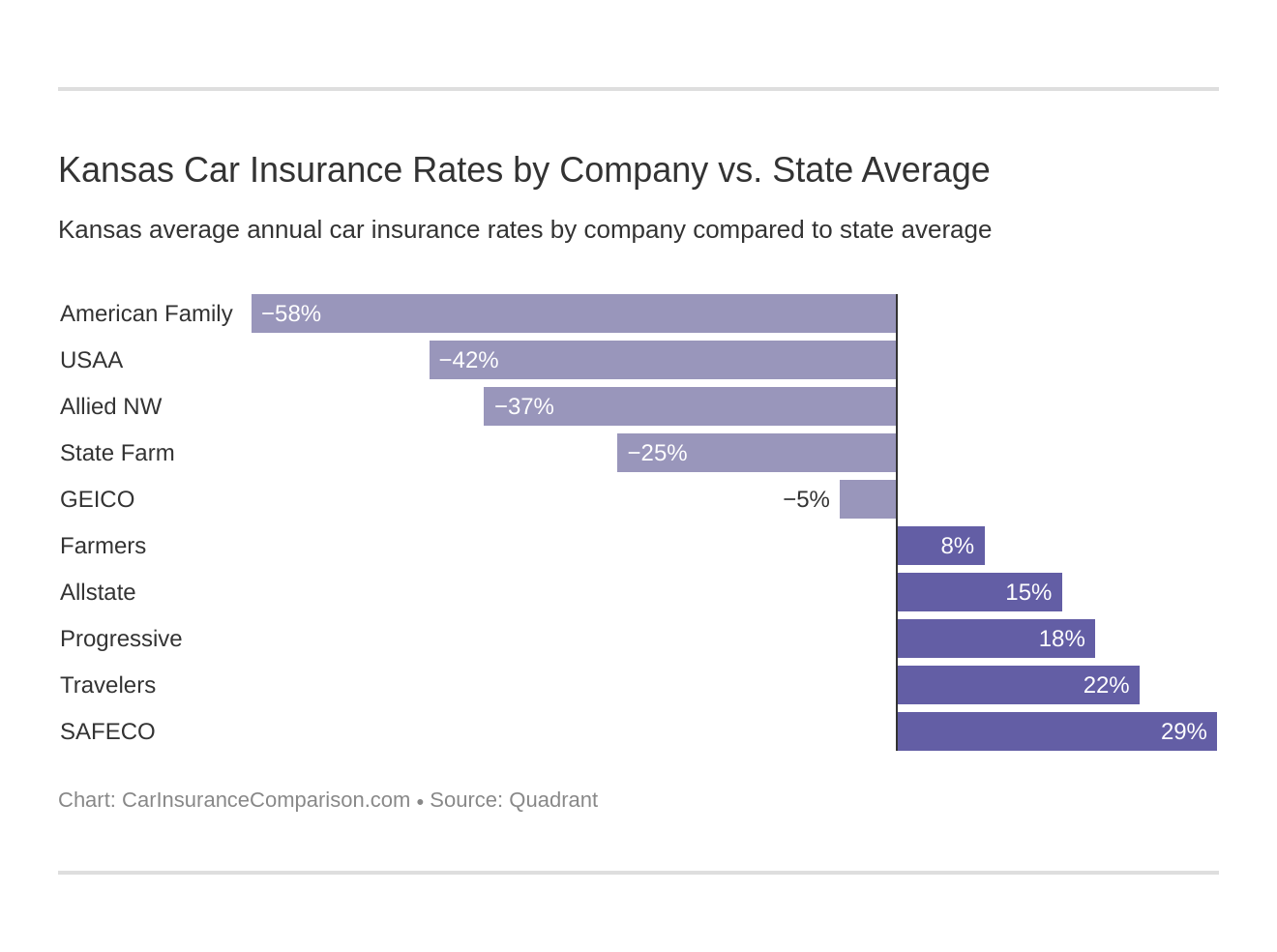

| Cheapest Provider | American Family Mutual |

With over 140,000 miles of public road, Kansas has the country’s third-largest state highway system after Texas and California. Kansas is also said to be flatter than a pancake – that can make for some easy driving along the plains, which are often filled with wheat, a grain it produces more of than any other state.

Oftentimes, researching car insurance isn’t easy, and can lead to some bumps along the road. Many of us would prefer to put it off or avoid it altogether.

We want your ride while you shop around to be a smooth one. You’ll find everything you need here — your one-stop guide to all things insurance and then some.

We’ve got the best coverage and rates, information on providers, and safety options to consider when you choose your insurance. To top it off, you’ll also learn about state laws and driving statistics.

Enter your ZIP code now to search for the best car insurance rates in Kansas!

Kansas Insurance Coverage and Rates

It can be tough to pay lots of money every year for a car insurance policy. Kansas requires all drivers to have insurance and finding the best coverage and prices can be frustrating.

We’re going to explain insurance options, rates, and companies to help you understand what you’re buying.

So, look no further. Let’s dive in!

- Car Insurance Rates in Kansas

- Compare Wellington, KS Car Insurance Rates [2024]

- Compare Topeka, KS Car Insurance Rates [2024]

- Compare Salina, KS Car Insurance Rates [2024]

- Compare Manhattan, KS Car Insurance Rates [2024]

- Compare Emporia, KS Car Insurance Rates [2024]

- Compare Edna, KS Car Insurance Rates [2024]

- Compare Bird City, KS Car Insurance Rates [2024]

- Compare Augusta, KS Car Insurance Rates [2024]

- Compare Anthony, KS Car Insurance Rates [2024]

- Compare Olathe, KS Car Insurance Rates [2024]

Kansas Minimum Insurance Coverage

Kansas is a “no-fault” accident state, which means that you submit your claim to your insurance company. Your basic Personal Injury Protection (PIP) coverage will pay for your medical bills and certain other out-of-pocket losses regardless of who caused the crash.

Below are the minimum PIP requirements in Kansas:

- $4,500/person for medical expenses

- $900/month for one year for disability/loss of income

- $25/day for in-home services

- $2,000 for a funeral, burial, or cremation

- $4,500 for rehabilitation

- Survivor Benefits: Disability/loss of income up to $900/month for one year

- In-home services up to $25/day for one year

Liability insurance pays everyone owed money for property damage and/or injuries from a car accident that you or anyone under your policy has caused – drivers, passengers, pedestrians, bicyclists, etc.

Kansas’s minimum liability insurance coverage requirements are as follows:

- $25,000 for injury or death per person in an accident caused by you

- $50,000 to cover total injuries or the death per accident the insured caused by you

- $25,000 for property damage in an accident the insured driver caused by you

State law requires drivers to also carry uninsured/underinsured motorist coverage with minimums of $25,000 per person and $50,000 per accident.

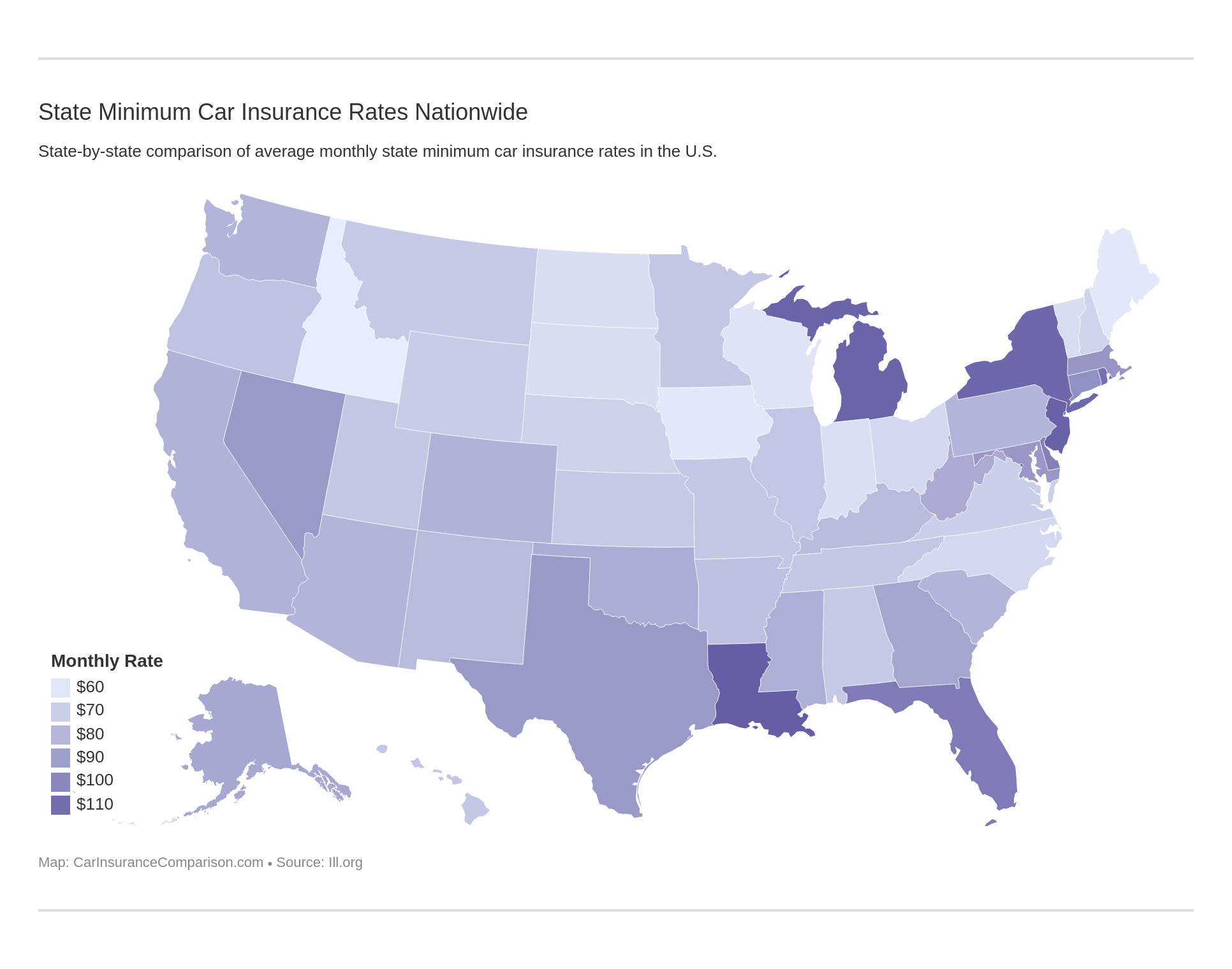

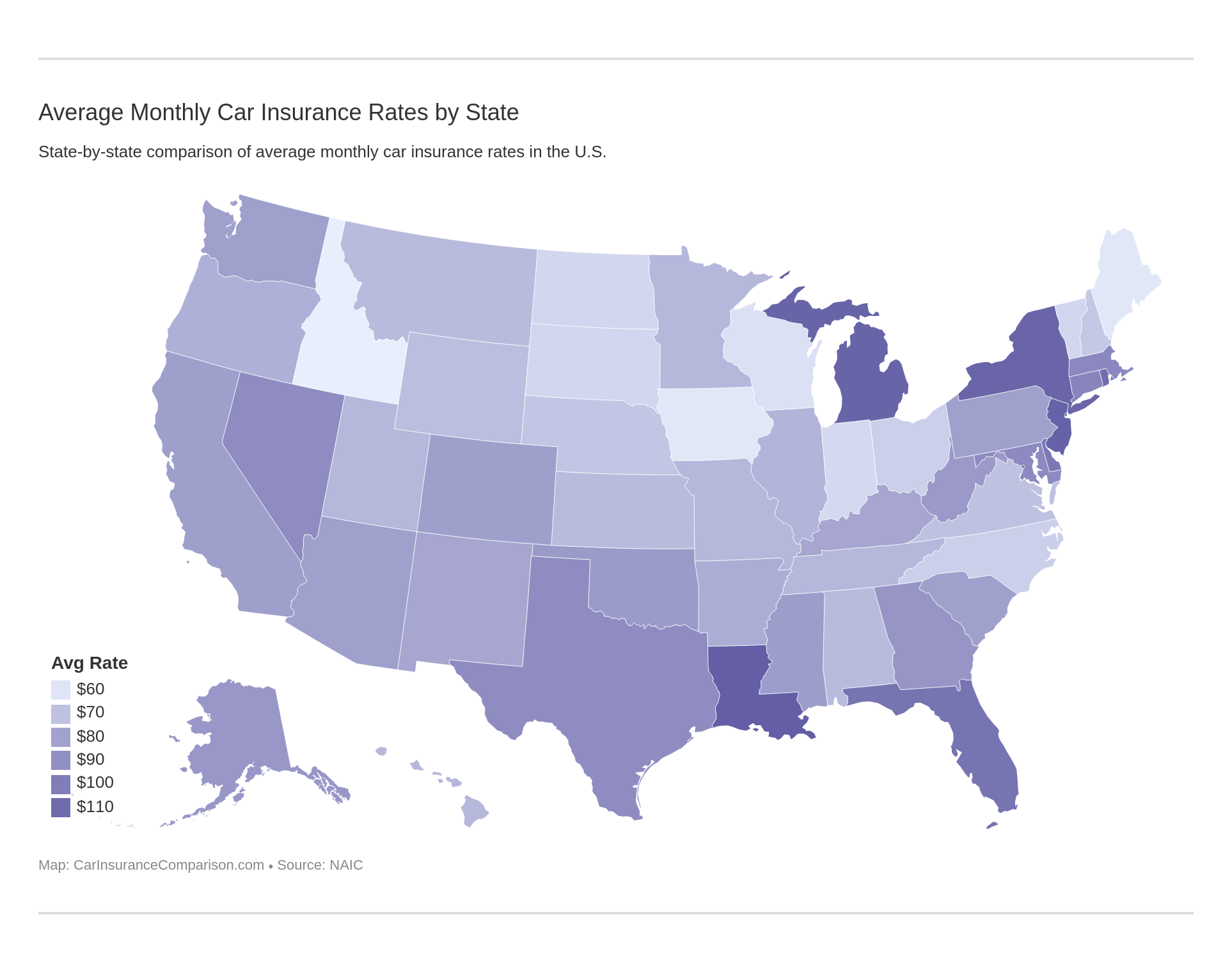

Take a look at how different states can affect the minimum coverage costs.

Forms of Financial Responsibility

Kansas law requires drivers to have car insurance and to show proof of coverage when a law enforcement officer asks them to do so. The Sunflower State doesn’t have a financial responsibility law but accepts the SR-22 and SR-26 for major convictions such as driving under the influence.

The filing requirement period is one year and terminates automatically with no notice to the Kansas Department of Revenue – Division of Vehicles at that time. If coverage ends in less than 12 months, an SR-26 is necessary. The driver is required to keep the SR-22 valid and current with the state for one year. The one-year period begins when the Division receives the SR-22.

The penalties for driving without insurance can include:

- fines of $300 to $1,000 for first-time offenders

- subsequent violations: fines of $800 to $2,500

- six months in prison for continuing violations

- suspension of vehicle registration with a $100 fee for reinstatement

Next, we’ll look at how much the average Kansan spends on car insurance to help you determine how much you can afford.

Premiums as a Percentage of Income

In 2014, the annual per capita disposable personal income (DPI) in Kansas, after taxes have been paid, was $41,634.

The average annual cost of car insurance in Kansas is $851, which is two percent of the average DPI.

The average Kansas resident has $3,470 each month to buy food, pay bills, etc. Car insurance will take about $71 out of that, and possibly more if your driving record isn’t clean.

| Annual Full Coverage Average Premiums | Monthly Full Coverage Average Premiums | Annual Per Capita Disposable Personal Income | Monthly Per Capita Disposable Personal Income | Percentage of Income |

|---|---|---|---|---|

| $850.79 | $70.90 | $41,634.00 | $3,469.50 | 2.04% |

Liability, comprehensive, and collision insurance are all part of full coverage policies. This is the average cost of each:

| Liability | $358.24 |

| Collision | $263.33 |

| Comprehensive | $358.24 |

| Combined | $862.93 |

Average Monthly Car Insurance Rates in KS (Liability, Collision, Comprehensive)

The above data is from the National Association of Insurance Commissioners. You can expect car insurance rates in Kansas to be significantly higher for 2019 and on.

Remember: though having the required insurance is important, you should also buy additional coverage to protect yourself and others in case you’re in an accident.

Next, you’ll find extra coverage options you can add to a basic insurance plan.

Additional Liability Coverage

Kansas drivers also can buy optional medical payments coverage (MedPay) of at least $5,000 to cover more medical expenses after an accident regardless of who is at fault for the crash.

How much risk you’re willing to take when you drive is up to you, whether you want to get the minimum or buy more coverage to protect yourself and your loved ones from extra costs and potential lawsuits from damaging accidents.

The experts at the Wall Street Journal advise drivers who buy liability insurance make sure that they increase the limits to 100/300/50.

Now, let’s see some stats about loss ratios in Kansas.

Loss Ratio

A loss ratio compares how much a company spends on claims to how much money they take in on premiums. A loss ratio of 60 percent indicates the company spent $60 on claims out of every $100 earned in premiums.

MedPay is optional in Kansas, however, uninsured motorist coverage is required. In 2015, 13 percent of drivers in the U.S. and 7.2 percent of motorists in Kansas were uninsured, despite the potential penalties.

Kansas ranked 44th in the nation in 2015 for uninsured or underinsured drivers.

Unless you sign a form that states you don’t want uninsured motorist coverage, your agent is legally required to provide it to you.

Add-ons, Endorsements, Riders

We know getting the complete coverage you need for an affordable price is your goal.

One helpful resource is Auto & Homeowners’ Insurance Shoppers Guide by the Kansas Department of Insurance. It details all the insurance options available. And, the information doesn’t stop there! The Kansas DOI’s Auto Shoppers Worksheet is a useful checklist for finding the best rates.

You can add many powerful but cheap extras to your policy.

One option is Usage-Based Insurance programs (UBI), such as SmartRide from Nationwide, Snapshot from Progressive, or Drivewise from Allstate. They give discounts to drivers based on how well they drive.

Check out these optional coverage enhancements:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

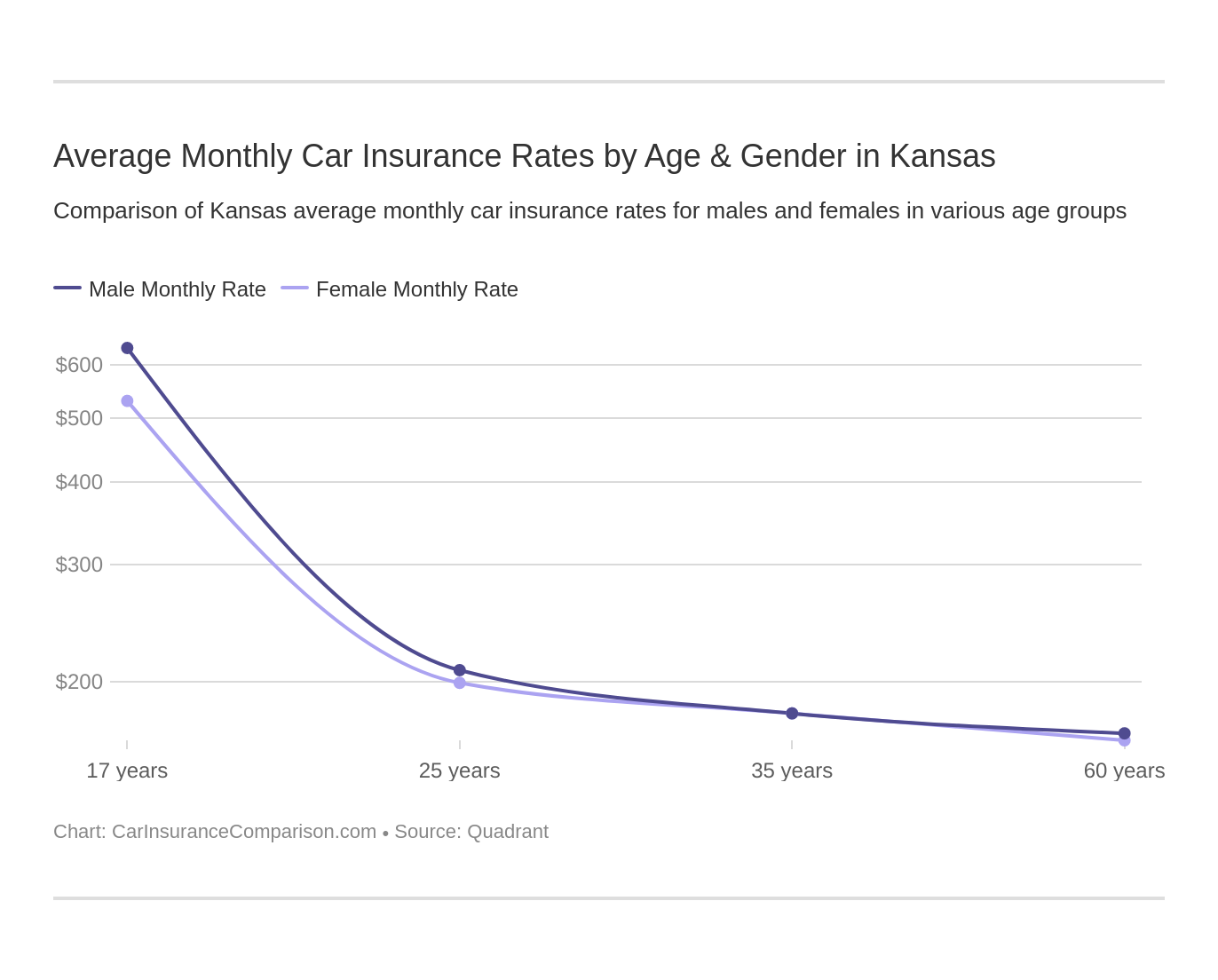

Average Monthly Car Insurance Rates by Age & Gender in KS

It’s a common conception that men pay more for car insurance than women, but did you know that age actually has a greater impact on your rates?

Your gender can affect your car insurance rates, as you’ll see below:

| Company | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $7,474.95 | $8,345.39 | $2,852.27 | $2,961.36 | $2,762.11 | $2,693.77 | $2,459.67 | $2,532.29 |

| American Family Mutual | $3,254.11 | $3,902.70 | $1,689.32 | $1,896.08 | $1,689.32 | $1,689.32 | $1,525.16 | $1,525.16 |

| Farmers Ins Co | $6,878.76 | $7,120.82 | $2,869.95 | $3,019.19 | $2,550.50 | $2,532.32 | $2,279.13 | $2,379.53 |

| Geico General | $4,611.95 | $6,193.68 | $2,915.19 | $2,128.91 | $2,525.49 | $2,469.16 | $2,548.98 | $2,371.80 |

| SAFECO Ins Co of America | $10,903.92 | $12,181.54 | $2,610.47 | $2,825.91 | $2,382.54 | $2,575.62 | $2,265.92 | $2,529.43 |

| Allied NW Affin PPBM | $3,738.47 | $4,586.41 | $2,123.07 | $2,262.55 | $1,828.05 | $1,886.51 | $1,625.16 | $1,754.49 |

| Progressive NorthWestern | $8,765.21 | $9,892.22 | $2,832.16 | $3,034.90 | $2,396.45 | $2,286.23 | $1,933.26 | $2,014.64 |

| State Farm Mutual Auto | $4,733.91 | $6,039.48 | $2,009.84 | $2,268.58 | $1,789.13 | $1,789.13 | $1,564.97 | $1,564.97 |

Here you’ll find the Most Expensive Demographicrates in Kansas.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Travelers Home & Marine Ins Co | Single 17-year old male | $13,203.91 |

| SAFECO Ins Co of America | Single 17-year old male | $12,181.54 |

| SAFECO Ins Co of America | Single 17-year old female | $10,903.92 |

| Progressive NorthWestern | Single 17-year old male | $9,892.22 |

| Progressive NorthWestern | Single 17-year old female | $8,765.21 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $8,451.14 |

| Allstate F&C | Single 17-year old male | $8,345.39 |

| Allstate F&C | Single 17-year old female | $7,474.95 |

| Farmers Ins Co | Single 17-year old male | $7,120.82 |

| Farmers Ins Co | Single 17-year old female | $6,878.76 |

| Geico General | Single 17-year old male | $6,193.68 |

| State Farm Mutual Auto | Single 17-year old male | $6,039.48 |

| USAA | Single 17-year old male | $5,008.53 |

| USAA | Single 17-year old female | $4,760.88 |

| State Farm Mutual Auto | Single 17-year old female | $4,733.91 |

| Geico General | Single 17-year old female | $4,611.95 |

| Allied NW Affin PPBM | Single 17-year old male | $4,586.41 |

| American Family Mutual | Single 17-year old male | $3,902.70 |

| Allied NW Affin PPBM | Single 17-year old female | $3,738.47 |

| American Family Mutual | Single 17-year old female | $3,254.11 |

| Progressive NorthWestern | Single 25-year old male | $3,034.90 |

| Farmers Ins Co | Single 25-year old male | $3,019.19 |

| Allstate F&C | Single 25-year old male | $2,961.36 |

| Geico General | Single 25-year old female | $2,915.19 |

| Farmers Ins Co | Single 25-year old female | $2,869.95 |

| Allstate F&C | Single 25-year old female | $2,852.27 |

| Progressive NorthWestern | Single 25-year old female | $2,832.16 |

| SAFECO Ins Co of America | Single 25-year old male | $2,825.91 |

| Allstate F&C | Married 35-year old female | $2,762.11 |

| Allstate F&C | Married 35-year old male | $2,693.77 |

| SAFECO Ins Co of America | Single 25-year old female | $2,610.47 |

| SAFECO Ins Co of America | Married 35-year old male | $2,575.62 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $2,554.14 |

| Farmers Ins Co | Married 35-year old female | $2,550.50 |

| Geico General | Married 60-year old female | $2,548.98 |

| Farmers Ins Co | Married 35-year old male | $2,532.32 |

| Allstate F&C | Married 60-year old male | $2,532.29 |

| SAFECO Ins Co of America | Married 60-year old male | $2,529.43 |

| Geico General | Married 35-year old female | $2,525.49 |

| Geico General | Married 35-year old male | $2,469.16 |

| Allstate F&C | Married 60-year old female | $2,459.67 |

| Progressive NorthWestern | Married 35-year old female | $2,396.45 |

| SAFECO Ins Co of America | Married 35-year old female | $2,382.54 |

| Farmers Ins Co | Married 60-year old male | $2,379.53 |

| Geico General | Married 60-year old male | $2,371.80 |

| Progressive NorthWestern | Married 35-year old male | $2,286.23 |

| Farmers Ins Co | Married 60-year old female | $2,279.13 |

| State Farm Mutual Auto | Single 25-year old male | $2,268.58 |

| SAFECO Ins Co of America | Married 60-year old female | $2,265.92 |

| Allied NW Affin PPBM | Single 25-year old male | $2,262.55 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $2,154.17 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $2,145.07 |

| Geico General | Single 25-year old male | $2,128.91 |

| Allied NW Affin PPBM | Single 25-year old female | $2,123.07 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $2,105.98 |

| Travelers Home & Marine Ins Co | Married 60-year old male | $2,072.85 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $2,044.19 |

| Progressive NorthWestern | Married 60-year old male | $2,014.64 |

| State Farm Mutual Auto | Single 25-year old female | $2,009.84 |

Regardless of your age, gender, or marital status, it pays to find the best rates.

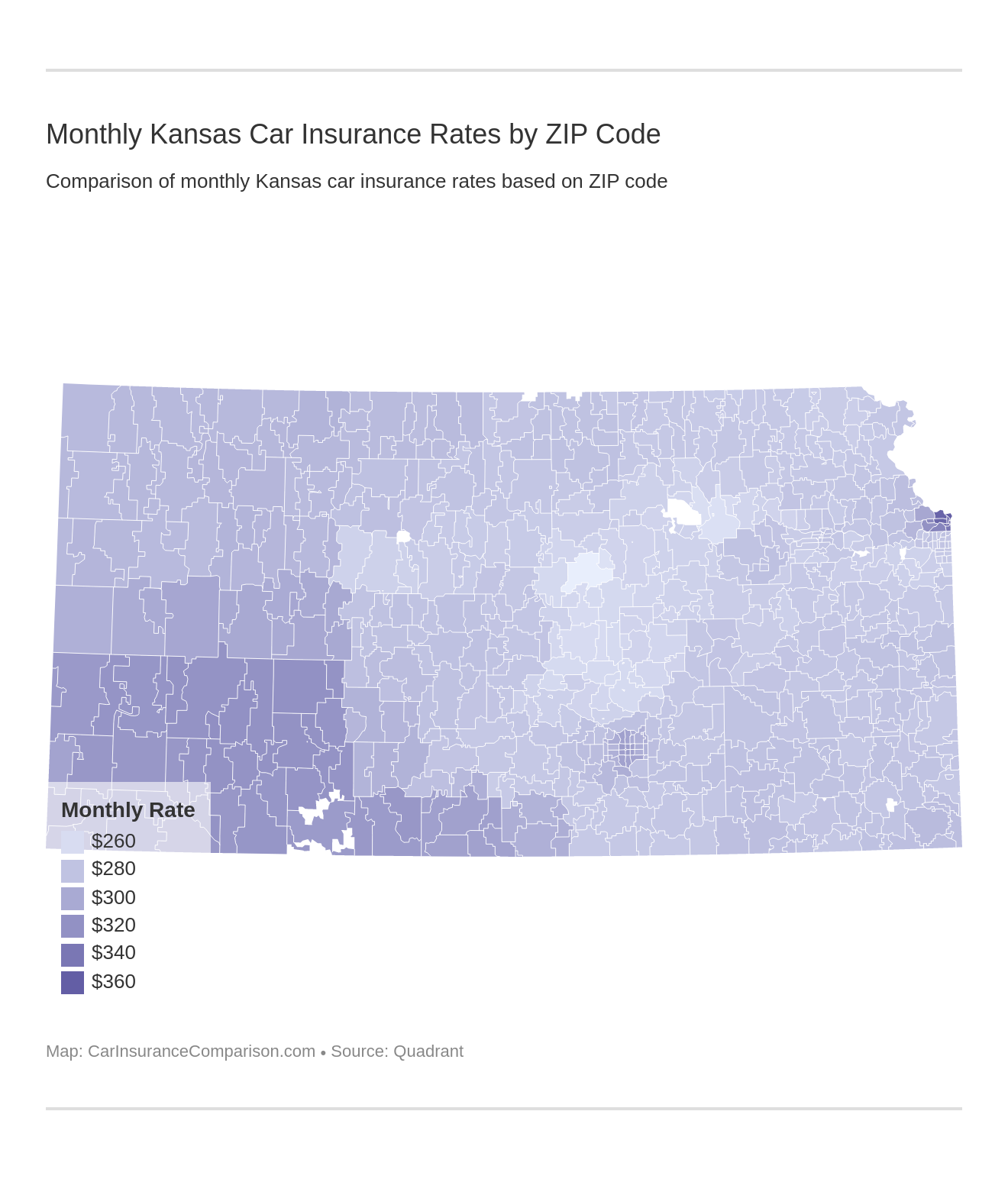

Kansas Insurance Rates by ZIP Code

Where do you think you’ll find the lowest car insurance rates?

Let’s examine the most expensive ZIP codes in Kansas, together with the average annual premiums for each insurance carrier by city and ZIP code:

| City | Zipcode | Average Annual Rate | Allstate F&C Annual Rate | American Family Mutual Annual Rate | Farmers Ins Co Annual Rate | Geico General Annual Rate | SAFECO Ins Co of America Annual Rate | Allied NW Affin PPBM Annual Rate | Progressive NorthWestern Annual Rate | State Farm Mutual Auto Annual Rate | Travelers Home & Marine Ins Co Annual Rate | USAA Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| KANSAS CITY | 66115 | $4,318.12 | $6,181.07 | $2,456.88 | $4,047.31 | $3,824.21 | $6,513.43 | $2,672.84 | $5,944.54 | $3,177.15 | $5,667.95 | $2,695.84 |

| KANSAS CITY | 66104 | $4,257.23 | $6,181.07 | $2,456.88 | $4,445.70 | $3,824.21 | $6,513.43 | $2,672.84 | $4,950.36 | $3,164.07 | $5,667.95 | $2,695.84 |

| KANSAS CITY | 66102 | $4,233.28 | $6,181.07 | $2,456.88 | $4,445.70 | $3,824.21 | $6,513.43 | $2,672.84 | $4,710.33 | $3,164.54 | $5,667.95 | $2,695.84 |

| KANSAS CITY | 66105 | $4,217.19 | $6,181.07 | $2,456.88 | $4,376.60 | $3,824.21 | $6,513.43 | $2,672.84 | $4,797.32 | $3,151.92 | $5,501.77 | $2,695.84 |

| KANSAS CITY | 66101 | $4,216.05 | $6,181.07 | $2,456.88 | $4,176.21 | $3,824.21 | $6,513.43 | $2,672.84 | $4,781.85 | $3,190.20 | $5,667.95 | $2,695.84 |

| KANSAS CITY | 66118 | $4,212.34 | $6,181.07 | $2,456.88 | $4,094.35 | $3,824.21 | $6,513.43 | $2,672.84 | $4,826.68 | $3,190.20 | $5,667.95 | $2,695.84 |

| KANSAS CITY | 66160 | $4,174.73 | $6,181.07 | $2,456.88 | $3,796.38 | $2,896.90 | $6,513.43 | $2,672.84 | $6,107.66 | $2,758.41 | $5,667.95 | $2,695.84 |

| KANSAS CITY | 66103 | $4,097.95 | $5,360.29 | $2,456.88 | $4,148.64 | $3,824.21 | $6,513.43 | $2,672.84 | $4,487.50 | $3,151.92 | $5,667.95 | $2,695.84 |

| KANSAS CITY | 66106 | $3,944.33 | $5,360.29 | $2,456.88 | $4,180.19 | $3,824.21 | $5,347.58 | $2,672.84 | $4,571.67 | $3,113.66 | $5,220.21 | $2,695.84 |

| KANSAS CITY | 66112 | $3,924.22 | $6,181.07 | $2,456.88 | $4,060.41 | $3,073.89 | $5,347.58 | $2,672.84 | $4,715.82 | $3,138.87 | $5,209.79 | $2,385.02 |

| PIERCEVILLE | 67868 | $3,855.65 | $5,045.84 | $2,351.02 | $4,264.45 | $3,858.77 | $5,174.70 | $2,642.76 | $4,862.84 | $2,835.47 | $4,943.42 | $2,577.23 |

| INGALLS | 67853 | $3,838.60 | $5,045.84 | $2,262.97 | $4,160.00 | $3,858.77 | $5,174.70 | $2,544.45 | $4,969.78 | $2,848.89 | $4,943.42 | $2,577.23 |

| JETMORE | 67854 | $3,835.59 | $5,045.84 | $2,263.27 | $4,097.40 | $3,858.77 | $5,174.70 | $2,579.23 | $4,933.19 | $2,874.30 | $4,952.02 | $2,577.23 |

| KANSAS CITY | 66111 | $3,833.58 | $5,360.29 | $2,456.88 | $3,992.39 | $3,073.89 | $5,347.58 | $2,672.84 | $4,698.30 | $3,138.87 | $5,209.79 | $2,385.02 |

| ENSIGN | 67841 | $3,833.27 | $5,045.84 | $2,262.97 | $4,097.40 | $3,858.77 | $5,174.70 | $2,544.45 | $4,992.41 | $2,835.47 | $4,943.42 | $2,577.23 |

| HOLCOMB | 67851 | $3,830.89 | $5,045.84 | $2,351.02 | $4,042.92 | $3,858.77 | $5,174.70 | $2,642.76 | $4,775.67 | $2,896.54 | $4,943.42 | $2,577.23 |

| COPELAND | 67837 | $3,828.09 | $5,045.84 | $2,262.97 | $4,133.90 | $3,858.77 | $5,174.70 | $2,544.45 | $4,904.13 | $2,835.47 | $4,943.42 | $2,577.23 |

| WRIGHT | 67882 | $3,826.88 | $5,045.84 | $2,312.08 | $4,133.90 | $3,858.77 | $5,174.70 | $2,579.23 | $4,808.14 | $2,835.47 | $4,943.42 | $2,577.23 |

| RICHFIELD | 67953 | $3,826.20 | $5,045.84 | $2,312.08 | $4,256.61 | $3,858.77 | $5,174.70 | $2,544.45 | $4,713.46 | $2,835.47 | $4,943.42 | $2,577.23 |

| CIMARRON | 67835 | $3,825.54 | $5,045.84 | $2,262.97 | $4,160.00 | $3,858.77 | $5,174.70 | $2,544.45 | $4,839.15 | $2,848.89 | $4,943.42 | $2,577.23 |

| DODGE CITY | 67801 | $3,824.90 | $5,045.84 | $2,312.08 | $3,914.76 | $3,858.77 | $5,174.70 | $2,579.23 | $4,888.64 | $2,857.74 | $5,040.02 | $2,577.23 |

| HANSTON | 67849 | $3,821.64 | $5,045.84 | $2,263.27 | $4,097.40 | $3,858.77 | $5,174.70 | $2,579.23 | $4,832.48 | $2,835.47 | $4,952.02 | $2,577.23 |

| KISMET | 67859 | $3,819.33 | $5,045.84 | $2,312.08 | $4,281.56 | $3,858.77 | $5,174.70 | $2,544.45 | $4,606.41 | $2,848.89 | $4,943.42 | $2,577.23 |

| FORT DODGE | 67843 | $3,817.80 | $5,045.84 | $2,312.08 | $3,914.76 | $3,858.77 | $5,174.70 | $2,579.23 | $4,936.47 | $2,835.47 | $4,943.42 | $2,577.23 |

| GARDEN CITY | 67846 | $3,817.24 | $5,045.84 | $2,351.02 | $3,888.68 | $3,858.77 | $5,174.70 | $2,642.76 | $4,793.47 | $2,896.54 | $4,943.42 | $2,577.23 |

| FORD | 67842 | $3,812.40 | $5,045.84 | $2,312.08 | $4,101.85 | $3,858.77 | $5,174.70 | $2,579.23 | $4,695.40 | $2,835.47 | $4,943.42 | $2,577.23 |

| MONTEZUMA | 67867 | $3,810.87 | $5,045.84 | $2,262.97 | $4,097.40 | $3,858.77 | $5,174.70 | $2,544.45 | $4,755.04 | $2,848.89 | $4,943.42 | $2,577.23 |

| KENDALL | 67857 | $3,808.37 | $5,045.84 | $2,262.97 | $4,133.90 | $3,858.77 | $5,174.70 | $2,544.45 | $4,706.96 | $2,835.47 | $4,943.42 | $2,577.23 |

| HUGOTON | 67951 | $3,805.58 | $5,045.84 | $2,251.77 | $4,139.95 | $3,858.77 | $5,174.70 | $2,544.45 | $4,670.73 | $2,848.89 | $4,943.42 | $2,577.23 |

| BUCKLIN | 67834 | $3,803.94 | $5,045.84 | $2,312.08 | $4,047.07 | $3,858.77 | $5,174.70 | $2,579.23 | $4,634.73 | $2,866.32 | $4,943.42 | $2,577.23 |

| SPEARVILLE | 67876 | $3,803.16 | $5,045.84 | $2,312.08 | $4,047.07 | $3,858.77 | $5,174.70 | $2,579.23 | $4,634.95 | $2,858.33 | $4,943.42 | $2,577.23 |

| SUBLETTE | 67877 | $3,802.88 | $5,045.84 | $2,262.97 | $4,185.21 | $3,858.77 | $5,174.70 | $2,544.45 | $4,587.36 | $2,848.89 | $4,943.42 | $2,577.23 |

| MINNEOLA | 67865 | $3,801.29 | $5,045.84 | $2,263.27 | $4,010.55 | $3,858.77 | $5,174.70 | $2,544.45 | $4,874.42 | $2,855.42 | $4,808.29 | $2,577.23 |

| MOSCOW | 67952 | $3,799.41 | $5,045.84 | $2,251.77 | $4,139.95 | $3,858.77 | $5,174.70 | $2,544.45 | $4,622.54 | $2,835.47 | $4,943.42 | $2,577.23 |

| DEERFIELD | 67838 | $3,798.29 | $5,045.84 | $2,251.77 | $4,082.39 | $3,858.77 | $5,174.70 | $2,544.45 | $4,668.85 | $2,835.47 | $4,943.42 | $2,577.23 |

| FOWLER | 67844 | $3,797.46 | $5,045.84 | $2,244.76 | $4,097.40 | $3,858.77 | $5,174.70 | $2,544.45 | $4,621.69 | $2,866.32 | $4,943.42 | $2,577.23 |

| MEADE | 67864 | $3,796.91 | $5,045.84 | $2,244.76 | $4,139.95 | $3,858.77 | $5,174.70 | $2,544.45 | $4,565.24 | $2,874.75 | $4,943.42 | $2,577.23 |

| ROLLA | 67954 | $3,787.16 | $5,045.84 | $2,312.08 | $4,100.48 | $3,858.77 | $5,174.70 | $2,544.45 | $4,460.21 | $2,854.41 | $4,943.42 | $2,577.23 |

| LAKIN | 67860 | $3,787.09 | $5,045.84 | $2,251.77 | $4,042.92 | $3,858.77 | $5,174.70 | $2,544.45 | $4,556.06 | $2,875.78 | $4,943.42 | $2,577.23 |

| PLAINS | 67869 | $3,785.98 | $5,045.84 | $2,244.76 | $4,139.95 | $3,858.77 | $5,174.70 | $2,544.45 | $4,464.38 | $2,866.32 | $4,943.42 | $2,577.23 |

| LIBERAL | 67901 | $3,785.10 | $5,045.84 | $2,312.08 | $3,954.52 | $3,858.77 | $5,174.70 | $2,544.45 | $4,600.09 | $2,839.88 | $4,943.42 | $2,577.23 |

| ULYSSES | 67880 | $3,784.36 | $5,045.84 | $2,278.93 | $4,026.30 | $3,858.77 | $5,174.70 | $2,544.45 | $4,546.54 | $2,847.45 | $4,943.42 | $2,577.23 |

| WILMORE | 67155 | $3,783.84 | $5,045.84 | $2,215.79 | $4,067.80 | $3,858.77 | $5,174.70 | $2,544.45 | $4,754.40 | $2,835.47 | $4,763.94 | $2,577.23 |

| JOHNSON | 67855 | $3,783.45 | $5,045.84 | $2,339.78 | $4,058.91 | $3,858.77 | $5,174.70 | $2,544.45 | $4,425.08 | $2,866.32 | $4,943.42 | $2,577.23 |

| ENGLEWOOD | 67840 | $3,781.82 | $5,045.84 | $2,263.27 | $4,037.24 | $3,858.77 | $5,174.70 | $2,544.45 | $4,672.92 | $2,835.47 | $4,808.29 | $2,577.23 |

| SATANTA | 67870 | $3,780.86 | $5,045.84 | $2,262.97 | $4,065.77 | $3,858.77 | $5,174.70 | $2,544.45 | $4,486.57 | $2,848.89 | $4,943.42 | $2,577.23 |

| ELKHART | 67950 | $3,780.20 | $5,045.84 | $2,312.08 | $4,058.91 | $3,858.77 | $5,174.70 | $2,544.45 | $4,467.97 | $2,818.67 | $4,943.42 | $2,577.23 |

| WICHITA | 67276 | $3,774.01 | $4,174.44 | $2,404.89 | $4,071.00 | $3,394.05 | $5,234.43 | $2,689.96 | $5,904.62 | $2,700.29 | $4,619.37 | $2,547.06 |

| PROTECTION | 67127 | $3,763.10 | $5,045.84 | $2,215.79 | $4,013.28 | $3,858.77 | $5,174.70 | $2,544.45 | $4,562.23 | $2,874.75 | $4,763.94 | $2,577.23 |

| SYRACUSE | 67878 | $3,761.07 | $5,045.84 | $2,262.97 | $4,022.39 | $3,858.77 | $5,174.70 | $2,544.45 | $4,325.94 | $2,855.02 | $4,943.42 | $2,577.23 |

| COOLIDGE | 67836 | $3,754.55 | $5,045.84 | $2,262.97 | $3,976.75 | $3,858.77 | $5,174.70 | $2,544.45 | $4,325.94 | $2,835.47 | $4,943.42 | $2,577.23 |

| ASHLAND | 67831 | $3,748.10 | $5,045.84 | $2,263.27 | $3,849.54 | $3,858.77 | $5,174.70 | $2,544.45 | $4,593.72 | $2,856.86 | $4,716.60 | $2,577.23 |

| COLDWATER | 67029 | $3,744.78 | $5,045.84 | $2,215.79 | $3,784.33 | $3,858.77 | $5,174.70 | $2,544.45 | $4,617.45 | $2,865.32 | $4,763.94 | $2,577.23 |

| WICHITA | 67202 | $3,735.56 | $4,174.44 | $2,404.89 | $4,246.92 | $3,394.05 | $5,234.43 | $2,810.44 | $4,422.50 | $3,117.41 | $4,956.33 | $2,594.21 |

| WICHITA | 67211 | $3,728.99 | $4,046.52 | $2,404.89 | $4,244.92 | $3,394.05 | $5,146.92 | $2,781.15 | $4,504.83 | $3,045.38 | $5,127.02 | $2,594.21 |

| WICHITA | 67203 | $3,726.17 | $4,174.44 | $2,404.89 | $4,245.27 | $3,394.05 | $5,234.43 | $2,810.44 | $4,450.27 | $3,139.53 | $4,814.18 | $2,594.21 |

| WICHITA | 67214 | $3,715.01 | $4,174.44 | $2,404.89 | $4,251.51 | $3,394.05 | $5,234.43 | $2,810.44 | $4,403.50 | $3,053.95 | $4,828.72 | $2,594.21 |

| WICHITA | 67213 | $3,704.52 | $4,174.44 | $2,404.89 | $4,033.85 | $3,394.05 | $5,234.43 | $2,689.96 | $4,608.92 | $3,081.77 | $4,828.72 | $2,594.21 |

| WICHITA | 67218 | $3,698.53 | $4,046.52 | $2,396.53 | $4,159.98 | $3,394.05 | $5,146.92 | $2,781.15 | $4,502.75 | $3,078.70 | $4,884.47 | $2,594.21 |

| LAKE CITY | 67071 | $3,695.41 | $5,045.84 | $2,262.03 | $4,002.57 | $3,858.77 | $4,685.08 | $2,394.82 | $4,544.42 | $2,835.47 | $4,747.92 | $2,577.23 |

| WICHITA | 67204 | $3,694.24 | $4,174.44 | $2,232.74 | $4,320.81 | $3,394.05 | $5,234.43 | $2,782.14 | $4,466.06 | $2,916.87 | $4,826.65 | $2,594.21 |

| SHARON | 67138 | $3,693.94 | $5,045.84 | $2,262.03 | $4,075.74 | $3,858.77 | $4,685.08 | $2,394.82 | $4,456.48 | $2,835.47 | $4,747.92 | $2,577.23 |

| KIOWA | 67070 | $3,689.06 | $5,045.84 | $2,262.03 | $4,074.34 | $3,858.77 | $4,685.08 | $2,394.82 | $4,371.70 | $2,872.86 | $4,747.92 | $2,577.23 |

| HARDTNER | 67057 | $3,685.43 | $5,045.84 | $2,262.03 | $4,078.50 | $3,858.77 | $4,685.08 | $2,394.82 | $4,368.62 | $2,835.47 | $4,747.92 | $2,577.23 |

| WICHITA | 67208 | $3,682.69 | $4,100.74 | $2,396.53 | $4,081.02 | $3,097.34 | $5,159.74 | $2,810.44 | $4,431.94 | $3,053.95 | $5,148.12 | $2,547.06 |

| MEDICINE LODGE | 67104 | $3,681.61 | $5,045.84 | $2,262.03 | $4,043.14 | $3,858.77 | $4,685.08 | $2,394.82 | $4,339.35 | $2,861.96 | $4,747.92 | $2,577.23 |

| SUN CITY | 67143 | $3,680.12 | $5,045.84 | $2,262.03 | $4,002.57 | $3,858.77 | $4,685.08 | $2,394.82 | $4,391.46 | $2,835.47 | $4,747.92 | $2,577.23 |

| HAZELTON | 67061 | $3,677.82 | $5,045.84 | $2,262.03 | $4,010.54 | $3,858.77 | $4,685.08 | $2,394.82 | $4,360.52 | $2,835.47 | $4,747.92 | $2,577.23 |

| WICHITA | 67216 | $3,672.28 | $4,046.52 | $2,232.74 | $4,015.51 | $3,394.05 | $5,146.92 | $2,781.15 | $4,419.10 | $3,049.89 | $5,042.68 | $2,594.21 |

| WICHITA | 67217 | $3,671.06 | $4,046.52 | $2,266.63 | $4,120.28 | $3,394.05 | $5,146.92 | $2,648.03 | $4,539.40 | $3,055.51 | $4,899.01 | $2,594.21 |

| WICHITA | 67260 | $3,670.19 | $4,028.35 | $2,404.89 | $4,238.68 | $3,394.05 | $5,234.43 | $2,810.44 | $4,429.94 | $3,076.74 | $4,537.35 | $2,547.06 |

| MANTER | 67862 | $3,664.26 | $3,658.58 | $2,339.78 | $4,185.21 | $3,858.77 | $5,174.70 | $2,544.45 | $4,524.98 | $2,835.47 | $4,943.42 | $2,577.23 |

| WICHITA | 67210 | $3,662.61 | $4,046.52 | $2,404.89 | $3,961.88 | $3,394.05 | $5,146.92 | $2,637.92 | $4,442.89 | $2,869.81 | $5,127.02 | $2,594.21 |

| WICHITA | 67219 | $3,660.09 | $4,174.44 | $2,143.32 | $4,263.09 | $3,394.05 | $5,234.43 | $2,782.14 | $4,388.01 | $2,845.64 | $4,828.72 | $2,547.06 |

| ARNOLD | 67515 | $3,632.15 | $3,658.58 | $2,170.10 | $3,871.93 | $3,858.77 | $5,174.70 | $2,642.76 | $4,729.22 | $3,012.38 | $4,625.87 | $2,577.23 |

| SCOTT CITY | 67871 | $3,630.30 | $3,658.58 | $2,158.89 | $3,960.83 | $3,858.77 | $5,174.70 | $2,642.76 | $4,643.10 | $3,002.30 | $4,625.87 | $2,577.23 |

| NESS CITY | 67560 | $3,621.91 | $3,658.58 | $2,170.10 | $3,759.70 | $3,858.77 | $5,174.70 | $2,642.76 | $4,748.84 | $3,002.58 | $4,625.87 | $2,577.23 |

| KANSAS CITY | 66109 | $3,620.81 | $3,984.07 | $2,284.71 | $4,017.64 | $3,073.89 | $5,347.58 | $2,672.84 | $4,566.88 | $2,921.49 | $4,953.97 | $2,385.02 |

| HEALY | 67850 | $3,614.99 | $3,658.58 | $2,168.81 | $3,731.89 | $3,858.77 | $5,174.70 | $2,642.76 | $4,691.63 | $3,019.71 | $4,625.87 | $2,577.23 |

| BAZINE | 67516 | $3,613.86 | $3,658.58 | $2,170.10 | $3,736.86 | $3,858.77 | $5,174.70 | $2,642.76 | $4,674.01 | $3,019.71 | $4,625.87 | $2,577.23 |

| RANSOM | 67572 | $3,612.21 | $3,658.58 | $2,170.10 | $3,756.74 | $3,858.77 | $5,174.70 | $2,642.76 | $4,679.86 | $2,977.51 | $4,625.87 | $2,577.23 |

| DIGHTON | 67839 | $3,611.28 | $3,658.58 | $2,168.81 | $3,800.31 | $3,858.77 | $5,174.70 | $2,642.76 | $4,588.60 | $3,017.13 | $4,625.87 | $2,577.23 |

| BROWNELL | 67521 | $3,610.99 | $3,658.58 | $2,170.10 | $3,836.58 | $3,858.77 | $5,174.70 | $2,642.76 | $4,587.85 | $2,977.51 | $4,625.87 | $2,577.23 |

| MARIENTHAL | 67863 | $3,605.39 | $3,658.58 | $2,186.09 | $3,921.37 | $3,858.77 | $5,174.70 | $2,544.45 | $4,529.34 | $2,977.51 | $4,625.87 | $2,577.23 |

| BEELER | 67518 | $3,601.97 | $3,658.58 | $2,170.10 | $3,645.93 | $3,858.77 | $5,174.70 | $2,642.76 | $4,688.27 | $2,977.51 | $4,625.87 | $2,577.23 |

| WICHITA | 67220 | $3,584.43 | $4,100.74 | $2,224.34 | $3,914.22 | $3,097.34 | $5,159.74 | $2,709.95 | $4,263.06 | $2,845.64 | $4,982.22 | $2,547.06 |

| UTICA | 67584 | $3,582.76 | $3,658.58 | $2,170.10 | $3,600.28 | $3,858.77 | $5,174.70 | $2,642.76 | $4,541.79 | $2,977.51 | $4,625.87 | $2,577.23 |

| LEOTI | 67861 | $3,581.60 | $3,658.58 | $2,186.09 | $3,731.89 | $3,858.77 | $5,174.70 | $2,544.45 | $4,451.11 | $3,007.33 | $4,625.87 | $2,577.23 |

| WICHITA | 67205 | $3,574.06 | $4,028.35 | $2,143.32 | $4,012.30 | $3,394.05 | $5,234.43 | $2,782.14 | $4,129.84 | $2,781.18 | $4,655.40 | $2,579.55 |

| MCCONNELL AFB | 67221 | $3,573.15 | $4,028.35 | $2,232.74 | $4,060.44 | $3,092.66 | $5,146.92 | $2,637.92 | $4,396.33 | $2,806.91 | $4,734.99 | $2,594.21 |

| WALDRON | 67150 | $3,570.21 | $3,820.50 | $2,351.02 | $4,129.39 | $3,858.77 | $4,685.08 | $2,394.82 | $4,437.05 | $2,700.29 | $4,747.92 | $2,577.23 |

| KECHI | 67067 | $3,568.79 | $4,100.74 | $2,134.95 | $4,086.50 | $3,394.05 | $5,159.74 | $2,709.95 | $4,285.45 | $2,774.76 | $4,494.68 | $2,547.06 |

| WICHITA | 67228 | $3,568.76 | $4,100.74 | $2,232.74 | $4,072.09 | $3,097.34 | $5,159.74 | $2,709.95 | $4,227.26 | $2,806.91 | $4,701.32 | $2,579.55 |

| ATTICA | 67009 | $3,566.97 | $3,820.50 | $2,351.02 | $4,013.28 | $3,858.77 | $4,685.08 | $2,394.82 | $4,540.05 | $2,681.01 | $4,747.92 | $2,577.23 |

| FREEPORT | 67049 | $3,566.43 | $3,820.50 | $2,351.02 | $4,143.84 | $3,858.77 | $4,685.08 | $2,394.82 | $4,384.85 | $2,700.29 | $4,747.92 | $2,577.23 |

| WICHITA | 67206 | $3,565.70 | $4,100.74 | $2,224.34 | $3,996.36 | $3,097.34 | $5,159.74 | $2,637.92 | $4,284.41 | $2,841.14 | $4,767.97 | $2,547.06 |

| HAYSVILLE | 67060 | $3,563.63 | $4,007.07 | $2,266.63 | $4,133.90 | $3,394.05 | $4,762.75 | $2,602.78 | $4,410.82 | $3,062.42 | $4,416.31 | $2,579.55 |

| ISABEL | 67065 | $3,557.41 | $3,795.40 | $2,262.03 | $4,020.84 | $3,858.77 | $4,685.08 | $2,394.82 | $4,396.59 | $2,835.47 | $4,747.92 | $2,577.23 |

| WICHITA | 67207 | $3,551.82 | $4,100.74 | $2,224.34 | $3,816.57 | $3,097.34 | $5,159.74 | $2,637.92 | $4,296.68 | $2,869.81 | $4,767.97 | $2,547.06 |

| BLUFF CITY | 67018 | $3,550.68 | $3,820.50 | $2,351.02 | $4,002.57 | $3,858.77 | $4,685.08 | $2,394.82 | $4,368.62 | $2,700.29 | $4,747.92 | $2,577.23 |

| TRIBUNE | 67879 | $3,545.80 | $3,658.58 | $2,144.29 | $3,760.80 | $3,858.77 | $5,174.70 | $2,544.45 | $4,154.47 | $3,007.33 | $4,577.33 | $2,577.23 |

| ANTHONY | 67003 | $3,543.73 | $3,820.50 | $2,351.02 | $3,989.81 | $3,858.77 | $4,685.08 | $2,394.82 | $4,365.12 | $2,646.99 | $4,747.92 | $2,577.23 |

| DANVILLE | 67036 | $3,542.05 | $3,820.50 | $2,351.02 | $3,953.32 | $3,858.77 | $4,653.39 | $2,394.82 | $4,363.20 | $2,700.29 | $4,747.92 | $2,577.23 |

| WICHITA | 67209 | $3,539.28 | $4,007.07 | $2,177.27 | $4,071.00 | $2,972.63 | $4,919.59 | $2,689.96 | $4,284.30 | $3,057.36 | $4,619.37 | $2,594.21 |

| WICHITA | 67226 | $3,533.22 | $4,100.74 | $2,134.95 | $4,027.43 | $3,097.34 | $5,159.74 | $2,709.95 | $4,045.87 | $2,774.76 | $4,734.33 | $2,547.06 |

| GREENSBURG | 67054 | $3,532.72 | $3,795.40 | $2,215.79 | $4,010.31 | $3,092.66 | $5,174.70 | $2,579.23 | $4,732.41 | $2,883.76 | $4,520.12 | $2,322.87 |

| WICHITA | 67215 | $3,532.61 | $4,007.07 | $2,266.63 | $4,045.68 | $2,972.63 | $4,919.59 | $2,648.03 | $4,276.87 | $3,050.46 | $4,544.90 | $2,594.21 |

| WICHITA | 67223 | $3,524.26 | $4,028.35 | $2,177.27 | $3,856.82 | $3,394.05 | $5,234.43 | $2,482.71 | $4,039.87 | $2,806.91 | $4,642.66 | $2,579.55 |

| WICHITA | 67230 | $3,521.85 | $4,028.35 | $2,224.34 | $3,968.98 | $3,097.34 | $5,146.92 | $2,637.92 | $4,169.62 | $2,770.26 | $4,595.19 | $2,579.55 |

| KINSLEY | 67547 | $3,515.53 | $3,795.40 | $2,233.58 | $3,940.08 | $3,092.66 | $5,174.70 | $2,579.23 | $4,745.90 | $2,883.76 | $4,387.08 | $2,322.87 |

| HAVILAND | 67059 | $3,515.52 | $3,795.40 | $2,215.79 | $3,971.09 | $3,092.66 | $5,174.70 | $2,579.23 | $4,599.61 | $2,883.76 | $4,520.12 | $2,322.87 |

| ALMENA | 67622 | $3,512.96 | $3,658.58 | $2,172.70 | $3,781.58 | $3,858.77 | $4,739.32 | $2,546.92 | $4,222.22 | $3,061.84 | $4,510.41 | $2,577.23 |

| HARPER | 67058 | $3,510.45 | $3,820.50 | $2,351.02 | $3,806.54 | $3,858.77 | $4,685.08 | $2,394.82 | $4,181.58 | $2,681.01 | $4,747.92 | $2,577.23 |

| NORTON | 67654 | $3,506.87 | $3,658.58 | $2,172.70 | $3,754.43 | $3,858.77 | $4,739.32 | $2,546.92 | $4,213.26 | $3,037.09 | $4,510.41 | $2,577.23 |

| GRAINFIELD | 67737 | $3,502.97 | $3,658.58 | $2,187.33 | $3,647.09 | $3,858.77 | $4,739.32 | $2,546.92 | $4,451.27 | $2,977.51 | $4,385.65 | $2,577.23 |

| MULLINVILLE | 67109 | $3,500.63 | $3,795.40 | $2,215.79 | $3,853.42 | $3,092.66 | $5,174.70 | $2,579.23 | $4,616.61 | $2,835.47 | $4,520.12 | $2,322.87 |

| GRINNELL | 67738 | $3,498.00 | $3,658.58 | $2,187.33 | $3,552.63 | $3,858.77 | $4,739.32 | $2,546.92 | $4,471.04 | $3,002.58 | $4,385.65 | $2,577.23 |

| GOVE | 67736 | $3,496.94 | $3,658.58 | $2,187.33 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $4,473.19 | $2,977.51 | $4,385.65 | $2,577.23 |

| PARK | 67751 | $3,496.42 | $3,658.58 | $2,187.33 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $4,467.92 | $2,977.51 | $4,385.65 | $2,577.23 |

| LEWIS | 67552 | $3,492.68 | $3,795.40 | $2,233.58 | $3,786.66 | $3,092.66 | $5,174.70 | $2,579.23 | $4,670.85 | $2,883.76 | $4,387.08 | $2,322.87 |

| OGALLAH | 67656 | $3,492.31 | $3,658.58 | $2,197.25 | $3,861.66 | $3,858.77 | $4,739.32 | $2,546.92 | $4,120.23 | $2,977.51 | $4,385.65 | $2,577.23 |

| SHARON SPRINGS | 67758 | $3,487.54 | $3,658.58 | $2,155.42 | $3,742.11 | $3,858.77 | $4,739.32 | $2,546.92 | $4,082.42 | $3,012.38 | $4,502.21 | $2,577.23 |

| SELDEN | 67757 | $3,486.41 | $3,658.58 | $2,144.29 | $3,571.34 | $3,858.77 | $4,739.32 | $2,546.92 | $4,253.03 | $3,012.38 | $4,502.21 | $2,577.23 |

| GEM | 67734 | $3,485.42 | $3,658.58 | $2,111.15 | $3,653.49 | $3,858.77 | $4,739.32 | $2,466.10 | $4,309.88 | $2,977.51 | $4,502.21 | $2,577.23 |

| COLLYER | 67631 | $3,485.01 | $3,658.58 | $2,197.25 | $3,727.40 | $3,858.77 | $4,739.32 | $2,546.92 | $4,181.45 | $2,977.51 | $4,385.65 | $2,577.23 |

| HOXIE | 67740 | $3,484.46 | $3,658.58 | $2,144.29 | $3,713.16 | $3,858.77 | $4,739.32 | $2,546.92 | $4,091.77 | $3,012.38 | $4,502.21 | $2,577.23 |

| WICHITA | 67212 | $3,483.63 | $4,007.07 | $2,143.32 | $3,978.34 | $2,972.63 | $4,919.59 | $2,810.44 | $4,078.79 | $2,781.83 | $4,550.09 | $2,594.21 |

| QUINTER | 67752 | $3,483.32 | $3,658.58 | $2,187.33 | $3,571.34 | $3,858.77 | $4,739.32 | $2,546.92 | $4,304.11 | $3,003.96 | $4,385.65 | $2,577.23 |

| BELPRE | 67519 | $3,481.56 | $3,795.40 | $2,233.58 | $3,756.96 | $3,092.66 | $5,174.70 | $2,579.23 | $4,637.62 | $2,835.47 | $4,387.08 | $2,322.87 |

| BONNER SPRINGS | 66012 | $3,480.71 | $3,735.92 | $2,284.71 | $3,992.39 | $2,896.90 | $5,096.99 | $2,672.84 | $4,281.06 | $2,700.33 | $4,760.92 | $2,385.02 |

| REXFORD | 67753 | $3,480.54 | $3,658.58 | $2,111.15 | $3,564.96 | $3,858.77 | $4,739.32 | $2,466.10 | $4,346.71 | $2,980.38 | $4,502.21 | $2,577.23 |

| OFFERLE | 67563 | $3,479.74 | $3,795.40 | $2,233.58 | $3,750.60 | $3,092.66 | $5,174.70 | $2,579.23 | $4,625.86 | $2,835.47 | $4,387.08 | $2,322.87 |

| WICHITA | 67227 | $3,478.29 | $4,028.35 | $2,177.27 | $3,929.85 | $2,972.63 | $4,919.59 | $2,482.71 | $4,130.82 | $3,072.15 | $4,489.96 | $2,579.55 |

| CLAYTON | 67629 | $3,474.05 | $3,658.58 | $2,172.70 | $3,647.09 | $3,858.77 | $4,739.32 | $2,546.92 | $4,051.97 | $2,977.51 | $4,510.41 | $2,577.23 |

| BREWSTER | 67732 | $3,473.33 | $3,658.58 | $2,111.15 | $3,552.63 | $3,858.77 | $4,739.32 | $2,466.10 | $4,289.82 | $2,977.51 | $4,502.21 | $2,577.23 |

| WALLACE | 67761 | $3,469.16 | $3,658.58 | $2,155.42 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $4,110.71 | $2,977.51 | $4,502.21 | $2,577.23 |

| WICHITA | 67232 | $3,467.30 | $4,028.35 | $2,232.74 | $3,660.56 | $3,097.34 | $5,146.92 | $2,637.92 | $4,084.31 | $2,806.91 | $4,398.43 | $2,579.55 |

| DRESDEN | 67635 | $3,467.29 | $3,658.58 | $2,172.70 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $4,074.69 | $2,977.51 | $4,502.21 | $2,577.23 |

| JENNINGS | 67643 | $3,467.29 | $3,658.58 | $2,172.70 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $4,074.69 | $2,977.51 | $4,502.21 | $2,577.23 |

| GREENWICH | 67055 | $3,466.15 | $4,028.35 | $2,143.32 | $4,319.54 | $3,092.66 | $4,754.59 | $2,709.95 | $4,066.38 | $2,774.76 | $4,224.84 | $2,547.06 |

| HERNDON | 67739 | $3,465.65 | $3,658.58 | $2,172.70 | $3,571.34 | $3,858.77 | $4,739.32 | $2,546.92 | $4,051.97 | $2,977.51 | $4,502.21 | $2,577.23 |

| KANORADO | 67741 | $3,462.63 | $3,658.58 | $2,109.88 | $3,626.54 | $3,858.77 | $4,739.32 | $2,546.92 | $4,029.36 | $2,977.51 | $4,502.21 | $2,577.23 |

| LENORA | 67645 | $3,462.40 | $3,658.58 | $2,172.70 | $3,583.65 | $3,858.77 | $4,739.32 | $2,546.92 | $3,998.89 | $2,977.51 | $4,510.41 | $2,577.23 |

| TOPEKA | 66683 | $3,461.79 | $3,573.76 | $1,997.64 | $3,711.73 | $3,177.65 | $4,634.69 | $2,433.72 | $5,763.17 | $2,685.78 | $4,304.88 | $2,334.93 |

| NORCATUR | 67653 | $3,460.70 | $3,658.58 | $2,172.70 | $3,597.56 | $3,858.77 | $4,739.32 | $2,546.92 | $3,976.17 | $2,977.51 | $4,502.21 | $2,577.23 |

| CLEARWATER | 67026 | $3,460.44 | $4,028.35 | $2,177.27 | $3,936.07 | $3,092.66 | $4,653.39 | $2,482.71 | $4,359.95 | $3,063.05 | $4,231.38 | $2,579.55 |

| WESKAN | 67762 | $3,458.54 | $3,658.58 | $2,155.42 | $3,647.09 | $3,858.77 | $4,739.32 | $2,546.92 | $3,922.36 | $2,977.51 | $4,502.21 | $2,577.23 |

| WAKEENEY | 67672 | $3,458.47 | $3,658.58 | $2,197.25 | $3,633.60 | $3,858.77 | $4,739.32 | $2,546.92 | $3,974.97 | $3,012.38 | $4,385.65 | $2,577.23 |

| COLBY | 67701 | $3,457.65 | $3,658.58 | $2,111.15 | $3,600.01 | $3,858.77 | $4,739.32 | $2,466.10 | $4,075.42 | $2,987.74 | $4,502.21 | $2,577.23 |

| LEVANT | 67743 | $3,456.87 | $3,658.58 | $2,111.15 | $3,564.96 | $3,858.77 | $4,739.32 | $2,466.10 | $4,092.82 | $2,997.53 | $4,502.21 | $2,577.23 |

| SAWYER | 67134 | $3,455.67 | $3,795.40 | $2,124.49 | $3,814.22 | $3,858.77 | $4,685.08 | $2,394.82 | $4,000.99 | $2,872.86 | $4,432.87 | $2,577.23 |

| MC DONALD | 67745 | $3,455.58 | $3,658.58 | $2,172.70 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $3,957.59 | $2,977.51 | $4,502.21 | $2,577.23 |

| ATWOOD | 67730 | $3,453.13 | $3,658.58 | $2,172.70 | $3,600.01 | $3,858.77 | $4,739.32 | $2,546.92 | $3,836.28 | $3,039.31 | $4,502.21 | $2,577.23 |

| OBERLIN | 67749 | $3,452.34 | $3,658.58 | $2,172.70 | $3,612.32 | $3,858.77 | $4,739.32 | $2,546.92 | $3,842.95 | $3,012.38 | $4,502.21 | $2,577.23 |

| EDSON | 67733 | $3,452.31 | $3,658.58 | $2,109.88 | $3,571.34 | $3,858.77 | $4,739.32 | $2,546.92 | $3,981.32 | $2,977.51 | $4,502.21 | $2,577.23 |

| BIRD CITY | 67731 | $3,451.91 | $3,658.58 | $2,154.20 | $3,552.63 | $3,858.77 | $4,739.32 | $2,546.92 | $3,909.58 | $3,019.71 | $4,502.21 | $2,577.23 |

| SAINT FRANCIS | 67756 | $3,448.91 | $3,658.58 | $2,154.20 | $3,552.63 | $3,858.77 | $4,739.32 | $2,546.92 | $3,886.86 | $3,012.38 | $4,502.21 | $2,577.23 |

| LUDELL | 67744 | $3,446.32 | $3,658.58 | $2,172.70 | $3,600.01 | $3,858.77 | $4,739.32 | $2,546.92 | $3,829.93 | $2,977.51 | $4,502.21 | $2,577.23 |

| WINONA | 67764 | $3,444.16 | $3,658.58 | $2,049.90 | $3,587.96 | $3,858.77 | $4,739.32 | $2,466.10 | $3,989.18 | $3,012.38 | $4,502.21 | $2,577.23 |

| HILL CITY | 67642 | $3,443.00 | $3,658.58 | $2,172.70 | $3,610.58 | $3,858.77 | $4,739.32 | $2,546.92 | $3,995.86 | $3,012.38 | $4,257.67 | $2,577.23 |

| WICHITA | 67235 | $3,441.89 | $4,028.35 | $2,143.32 | $4,011.94 | $2,972.63 | $4,919.59 | $2,482.71 | $3,955.26 | $2,788.21 | $4,537.35 | $2,579.55 |

| GOODLAND | 67735 | $3,440.84 | $3,658.58 | $2,109.88 | $3,552.63 | $3,858.77 | $4,739.32 | $2,546.92 | $3,862.92 | $2,999.99 | $4,502.21 | $2,577.23 |

| MONUMENT | 67747 | $3,438.85 | $3,658.58 | $2,049.90 | $3,564.96 | $3,858.77 | $4,739.32 | $2,466.10 | $3,993.92 | $2,977.51 | $4,502.21 | $2,577.23 |

| KIRWIN | 67644 | $3,437.84 | $3,880.12 | $2,262.03 | $3,769.95 | $3,092.66 | $4,739.32 | $2,550.99 | $4,443.72 | $3,028.48 | $4,288.26 | $2,322.87 |

| LEBANON | 66952 | $3,436.23 | $3,880.12 | $2,187.33 | $3,881.96 | $3,092.66 | $4,739.32 | $2,550.99 | $4,452.88 | $2,965.90 | $4,288.26 | $2,322.87 |

| PENOKEE | 67659 | $3,436.04 | $3,658.58 | $2,172.70 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $3,971.87 | $3,012.38 | $4,257.67 | $2,577.23 |

| PHILLIPSBURG | 67661 | $3,435.93 | $3,880.12 | $2,262.03 | $3,742.11 | $3,092.66 | $4,739.32 | $2,550.99 | $4,452.46 | $3,028.48 | $4,288.26 | $2,322.87 |

| LONG ISLAND | 67647 | $3,435.00 | $3,880.12 | $2,262.03 | $3,742.11 | $3,092.66 | $4,739.32 | $2,550.99 | $4,433.38 | $3,038.28 | $4,288.26 | $2,322.87 |

| AGRA | 67621 | $3,434.95 | $3,880.12 | $2,262.03 | $3,742.11 | $3,092.66 | $4,739.32 | $2,550.99 | $4,452.46 | $3,018.65 | $4,288.26 | $2,322.87 |

| ATHOL | 66932 | $3,434.59 | $3,880.12 | $2,187.33 | $3,881.96 | $3,092.66 | $4,739.32 | $2,550.99 | $4,452.59 | $2,949.80 | $4,288.26 | $2,322.87 |

| OAKLEY | 67748 | $3,434.35 | $3,658.58 | $2,049.90 | $3,600.01 | $3,858.77 | $4,739.32 | $2,466.10 | $3,911.05 | $2,980.38 | $4,502.21 | $2,577.23 |

| BOGUE | 67625 | $3,433.79 | $3,658.58 | $2,172.70 | $3,552.63 | $3,858.77 | $4,739.32 | $2,546.92 | $3,996.61 | $2,977.51 | $4,257.67 | $2,577.23 |

| MORLAND | 67650 | $3,432.55 | $3,658.58 | $2,172.70 | $3,564.96 | $3,858.77 | $4,739.32 | $2,546.92 | $3,971.87 | $2,977.51 | $4,257.67 | $2,577.23 |

| LOGAN | 67646 | $3,431.48 | $3,880.12 | $2,262.03 | $3,742.11 | $3,092.66 | $4,739.32 | $2,550.99 | $4,407.91 | $3,028.48 | $4,288.26 | $2,322.87 |

| SMITH CENTER | 66967 | $3,430.79 | $3,880.12 | $2,187.33 | $3,836.33 | $3,092.66 | $4,739.32 | $2,550.99 | $4,452.88 | $2,957.17 | $4,288.26 | $2,322.87 |

| COLUMBUS | 66725 | $3,429.39 | $3,966.78 | $2,190.57 | $3,898.85 | $3,092.66 | $4,783.76 | $2,478.86 | $4,346.30 | $2,804.27 | $4,318.80 | $2,413.01 |

| PRAIRIE VIEW | 67664 | $3,429.00 | $3,880.12 | $2,262.03 | $3,754.43 | $3,092.66 | $4,739.32 | $2,550.99 | $4,433.38 | $2,965.90 | $4,288.26 | $2,322.87 |

| GAYLORD | 67638 | $3,425.05 | $3,880.12 | $2,187.33 | $3,780.52 | $3,092.66 | $4,739.32 | $2,550.99 | $4,442.54 | $2,965.90 | $4,288.26 | $2,322.87 |

| CEDAR | 67628 | $3,424.80 | $3,880.12 | $2,187.33 | $3,803.71 | $3,092.66 | $4,739.32 | $2,550.99 | $4,416.79 | $2,965.90 | $4,288.26 | $2,322.87 |

| LARNED | 67550 | $3,423.62 | $3,795.40 | $2,233.58 | $3,854.01 | $3,092.66 | $4,685.08 | $2,579.23 | $4,427.70 | $2,884.01 | $4,361.62 | $2,322.87 |

| KENSINGTON | 66951 | $3,423.45 | $3,880.12 | $2,187.33 | $3,754.43 | $3,092.66 | $4,739.32 | $2,550.99 | $4,452.59 | $2,965.90 | $4,288.26 | $2,322.87 |

| MAIZE | 67101 | $3,421.46 | $4,028.35 | $2,177.27 | $3,986.23 | $3,092.66 | $4,754.59 | $2,482.71 | $4,102.73 | $2,785.67 | $4,224.84 | $2,579.55 |

| GODDARD | 67052 | $3,421.05 | $4,028.35 | $2,177.27 | $3,808.89 | $3,092.66 | $4,653.39 | $2,482.71 | $4,381.55 | $2,774.76 | $4,231.38 | $2,579.55 |

| GLADE | 67639 | $3,418.82 | $3,880.12 | $2,262.03 | $3,742.11 | $3,092.66 | $4,739.32 | $2,550.99 | $4,343.94 | $2,965.90 | $4,288.26 | $2,322.87 |

| ROZEL | 67574 | $3,415.52 | $3,795.40 | $2,233.58 | $3,730.70 | $3,092.66 | $4,685.08 | $2,579.23 | $4,450.70 | $2,903.39 | $4,361.62 | $2,322.87 |

| TREECE | 66778 | $3,414.35 | $3,966.78 | $2,190.57 | $3,787.98 | $3,092.66 | $4,783.76 | $2,478.86 | $4,333.67 | $2,777.43 | $4,318.80 | $2,413.01 |

| ANDOVER | 67002 | $3,411.89 | $4,028.35 | $2,305.78 | $4,126.86 | $3,092.66 | $4,636.65 | $2,460.69 | $4,066.52 | $2,679.50 | $4,234.67 | $2,487.19 |

| GARDEN PLAIN | 67050 | $3,410.31 | $4,028.35 | $2,177.27 | $3,808.89 | $3,092.66 | $4,653.39 | $2,482.71 | $4,285.66 | $2,763.22 | $4,231.38 | $2,579.55 |

| LANSING | 66043 | $3,409.13 | $3,984.07 | $2,223.35 | $3,809.27 | $2,908.94 | $4,802.82 | $2,672.84 | $4,347.67 | $2,829.48 | $4,433.82 | $2,079.05 |

| LEAVENWORTH | 66048 | $3,408.62 | $3,984.07 | $2,223.35 | $3,861.45 | $2,908.94 | $4,802.82 | $2,672.84 | $4,300.89 | $2,818.97 | $4,433.82 | $2,079.05 |

| BAXTER SPRINGS | 66713 | $3,408.30 | $3,966.78 | $2,190.57 | $3,687.55 | $3,092.66 | $4,783.76 | $2,478.86 | $4,345.14 | $2,805.83 | $4,318.80 | $2,413.01 |

| MULVANE | 67110 | $3,404.70 | $4,028.35 | $2,256.47 | $4,000.87 | $3,092.66 | $4,653.39 | $2,394.82 | $4,095.12 | $2,683.19 | $4,354.99 | $2,487.19 |

| SEDAN | 67361 | $3,404.33 | $4,217.36 | $2,306.68 | $3,686.96 | $3,092.66 | $4,794.42 | $2,347.66 | $4,272.36 | $2,680.50 | $4,231.72 | $2,413.01 |

| SCAMMON | 66773 | $3,404.05 | $3,966.78 | $2,190.57 | $3,685.81 | $3,092.66 | $4,783.76 | $2,478.86 | $4,324.79 | $2,785.49 | $4,318.80 | $2,413.01 |

| MOLINE | 67353 | $3,403.41 | $4,217.36 | $2,278.93 | $3,791.91 | $3,092.66 | $4,794.42 | $2,347.66 | $4,179.16 | $2,687.26 | $4,231.72 | $2,413.01 |

| GALENA | 66739 | $3,403.37 | $3,966.78 | $2,190.57 | $3,662.92 | $3,092.66 | $4,783.76 | $2,478.86 | $4,320.47 | $2,805.83 | $4,318.80 | $2,413.01 |

| VIOLA | 67149 | $3,403.26 | $4,028.35 | $2,177.27 | $3,558.61 | $3,092.66 | $4,653.39 | $2,482.71 | $4,258.31 | $2,970.34 | $4,231.38 | $2,579.55 |

| WEIR | 66781 | $3,402.85 | $3,966.78 | $2,190.57 | $3,673.92 | $3,092.66 | $4,783.76 | $2,478.86 | $4,304.31 | $2,805.83 | $4,318.80 | $2,413.01 |

| TYRO | 67364 | $3,401.30 | $3,966.78 | $2,137.34 | $3,662.33 | $3,440.87 | $4,794.42 | $2,524.20 | $4,214.82 | $2,627.50 | $4,231.72 | $2,413.01 |

| ANDALE | 67001 | $3,401.18 | $4,028.35 | $2,177.27 | $3,698.02 | $3,092.66 | $4,653.39 | $2,482.71 | $4,305.21 | $2,763.22 | $4,231.38 | $2,579.55 |

| GARFIELD | 67529 | $3,399.28 | $3,795.40 | $2,233.58 | $3,633.33 | $3,092.66 | $4,685.08 | $2,579.23 | $4,427.42 | $2,861.59 | $4,361.62 | $2,322.87 |

| WEST MINERAL | 66782 | $3,399.09 | $3,966.78 | $2,190.57 | $3,644.20 | $3,092.66 | $4,783.76 | $2,478.86 | $4,324.79 | $2,777.43 | $4,318.80 | $2,413.01 |

| CHETOPA | 67336 | $3,397.60 | $3,966.78 | $2,218.33 | $3,798.44 | $3,092.66 | $4,783.76 | $2,384.44 | $4,296.97 | $2,664.98 | $4,356.67 | $2,413.01 |

| NIOTAZE | 67355 | $3,397.30 | $4,217.36 | $2,306.68 | $3,686.96 | $3,092.66 | $4,794.42 | $2,347.66 | $4,182.22 | $2,700.29 | $4,231.72 | $2,413.01 |

| BURDETT | 67523 | $3,396.33 | $3,795.40 | $2,233.58 | $3,619.44 | $3,092.66 | $4,685.08 | $2,579.23 | $4,411.78 | $2,861.59 | $4,361.62 | $2,322.87 |

| WOODSTON | 67675 | $3,394.88 | $3,880.12 | $2,215.79 | $3,831.53 | $3,092.66 | $4,739.32 | $2,546.92 | $4,120.00 | $2,965.90 | $4,233.67 | $2,322.87 |

| CRESTLINE | 66728 | $3,394.64 | $3,966.78 | $2,190.57 | $3,624.41 | $3,092.66 | $4,783.76 | $2,478.86 | $4,300.13 | $2,777.43 | $4,318.80 | $2,413.01 |

| FORT LEAVENWORTH | 66027 | $3,394.46 | $3,984.07 | $2,223.35 | $3,904.56 | $2,908.94 | $4,802.82 | $2,672.84 | $4,259.29 | $2,865.79 | $4,243.86 | $2,079.05 |

| COATS | 67028 | $3,393.74 | $3,795.40 | $2,124.49 | $3,786.83 | $3,092.66 | $4,685.08 | $2,579.23 | $4,256.40 | $2,861.59 | $4,432.87 | $2,322.87 |

| PLAINVILLE | 67663 | $3,393.01 | $3,880.12 | $2,215.79 | $3,791.39 | $3,092.66 | $4,739.32 | $2,546.92 | $4,140.39 | $2,966.96 | $4,233.67 | $2,322.87 |

| HOWARD | 67349 | $3,391.28 | $4,217.36 | $2,278.93 | $3,655.80 | $3,092.66 | $4,794.42 | $2,347.66 | $4,203.83 | $2,677.45 | $4,231.72 | $2,413.01 |

| CEDAR VALE | 67024 | $3,390.26 | $4,217.36 | $2,306.68 | $3,668.84 | $3,092.66 | $4,794.42 | $2,347.66 | $4,147.05 | $2,683.19 | $4,231.72 | $2,413.01 |

| LATHAM | 67072 | $3,389.53 | $4,028.35 | $2,305.78 | $4,053.29 | $3,092.66 | $4,653.39 | $2,460.69 | $3,896.11 | $2,700.29 | $4,217.50 | $2,487.19 |

| MACKSVILLE | 67557 | $3,389.35 | $3,795.40 | $2,195.98 | $3,806.24 | $3,092.66 | $4,685.08 | $2,579.23 | $4,170.91 | $2,874.57 | $4,370.57 | $2,322.87 |

| DAMAR | 67632 | $3,387.17 | $3,880.12 | $2,215.79 | $3,754.43 | $3,092.66 | $4,739.32 | $2,546.92 | $4,120.00 | $2,965.90 | $4,233.67 | $2,322.87 |

| ELLINWOOD | 67526 | $3,387.15 | $3,795.40 | $2,152.95 | $3,887.58 | $3,092.66 | $4,685.08 | $2,532.72 | $4,197.45 | $2,874.57 | $4,330.28 | $2,322.87 |

| PERU | 67360 | $3,387.07 | $4,217.36 | $2,306.68 | $3,628.26 | $3,092.66 | $4,794.42 | $2,347.66 | $4,185.46 | $2,653.44 | $4,231.72 | $2,413.01 |

| ESKRIDGE | 66423 | $3,386.79 | $4,217.36 | $2,046.16 | $3,898.62 | $3,092.66 | $4,757.09 | $2,578.20 | $4,119.19 | $2,529.16 | $4,306.63 | $2,322.87 |

| ELK FALLS | 67345 | $3,386.53 | $4,217.36 | $2,278.93 | $3,610.12 | $3,092.66 | $4,794.42 | $2,347.66 | $4,179.16 | $2,700.29 | $4,231.72 | $2,413.01 |

| PALCO | 67657 | $3,386.30 | $3,880.12 | $2,215.79 | $3,754.43 | $3,092.66 | $4,739.32 | $2,546.92 | $4,111.28 | $2,965.90 | $4,233.67 | $2,322.87 |

| PIEDMONT | 67122 | $3,385.87 | $4,217.36 | $2,203.03 | $3,804.32 | $3,092.66 | $4,794.42 | $2,440.86 | $4,096.40 | $2,648.09 | $4,148.51 | $2,413.01 |

| IUKA | 67066 | $3,385.42 | $3,795.40 | $2,124.49 | $3,829.99 | $3,092.66 | $4,685.08 | $2,579.23 | $4,130.06 | $2,861.59 | $4,432.87 | $2,322.87 |

| SHAWNEE | 66217 | $3,385.22 | $3,735.92 | $2,110.78 | $3,667.78 | $2,992.75 | $4,906.40 | $2,495.00 | $4,293.84 | $2,744.70 | $4,803.72 | $2,101.35 |

| BENEDICT | 66714 | $3,384.39 | $4,217.36 | $2,190.57 | $3,659.40 | $3,092.66 | $4,794.42 | $2,347.66 | $4,248.98 | $2,648.09 | $4,231.72 | $2,413.01 |

| JAMESTOWN | 66948 | $3,383.58 | $3,880.12 | $2,075.79 | $3,830.87 | $3,092.66 | $4,685.08 | $2,550.99 | $4,427.32 | $2,512.60 | $4,457.51 | $2,322.87 |

| GREELEY | 66033 | $3,383.54 | $4,217.36 | $2,130.29 | $3,665.38 | $3,092.66 | $4,794.42 | $2,467.52 | $4,232.17 | $2,655.00 | $4,167.56 | $2,413.01 |

| MISSION | 66202 | $3,383.52 | $3,767.13 | $2,112.31 | $3,922.45 | $2,992.75 | $4,649.16 | $2,485.34 | $4,250.27 | $2,742.37 | $4,812.10 | $2,101.35 |

| DOWNS | 67437 | $3,383.30 | $3,880.12 | $2,188.61 | $3,845.43 | $3,092.66 | $4,739.32 | $2,550.99 | $4,440.24 | $2,539.07 | $4,233.67 | $2,322.87 |

| RIVERTON | 66770 | $3,383.23 | $3,966.78 | $2,190.57 | $3,497.15 | $3,092.66 | $4,783.76 | $2,478.86 | $4,313.32 | $2,777.43 | $4,318.80 | $2,413.01 |

| HOISINGTON | 67544 | $3,383.14 | $3,795.40 | $2,152.95 | $3,822.35 | $3,092.66 | $4,685.08 | $2,532.72 | $4,231.95 | $2,865.11 | $4,330.28 | $2,322.87 |

| GRENOLA | 67346 | $3,383.00 | $4,217.36 | $2,278.93 | $3,705.06 | $3,092.66 | $4,794.42 | $2,347.66 | $4,061.94 | $2,687.26 | $4,231.72 | $2,413.01 |

| EDNA | 67342 | $3,382.55 | $3,966.78 | $2,218.33 | $3,717.99 | $3,092.66 | $4,783.76 | $2,384.44 | $4,309.24 | $2,664.98 | $4,274.27 | $2,413.01 |

| TOPEKA | 66616 | $3,382.00 | $3,573.76 | $2,063.79 | $3,945.20 | $3,177.65 | $4,634.69 | $2,553.86 | $4,546.03 | $2,685.25 | $4,304.88 | $2,334.93 |

| CLYDE | 66938 | $3,381.94 | $3,880.12 | $2,075.79 | $3,830.87 | $3,092.66 | $4,685.08 | $2,550.99 | $4,419.31 | $2,504.23 | $4,457.51 | $2,322.87 |

| GREAT BEND | 67530 | $3,381.47 | $3,795.40 | $2,152.95 | $3,786.33 | $3,092.66 | $4,685.08 | $2,532.72 | $4,241.82 | $2,874.57 | $4,330.28 | $2,322.87 |

| VALLEY CENTER | 67147 | $3,380.93 | $3,795.40 | $2,143.32 | $4,086.50 | $3,092.66 | $4,463.05 | $2,482.71 | $4,218.03 | $2,728.53 | $4,219.59 | $2,579.55 |

| STOCKTON | 67669 | $3,380.58 | $3,880.12 | $2,215.79 | $3,760.80 | $3,092.66 | $4,739.32 | $2,546.92 | $4,046.73 | $2,966.96 | $4,233.67 | $2,322.87 |

| BENTLEY | 67016 | $3,380.38 | $4,028.35 | $2,177.27 | $3,759.51 | $3,092.66 | $4,653.39 | $2,482.71 | $4,054.97 | $2,756.16 | $4,219.21 | $2,579.55 |

| JEWELL | 66949 | $3,380.19 | $3,880.12 | $2,155.42 | $3,845.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,300.82 | $2,510.95 | $4,457.51 | $2,322.87 |

| BISON | 67520 | $3,378.74 | $3,795.40 | $2,170.10 | $3,762.41 | $3,092.66 | $4,685.08 | $2,579.23 | $4,158.72 | $3,037.81 | $4,183.06 | $2,322.87 |

| FALL RIVER | 67047 | $3,378.50 | $4,217.36 | $2,203.03 | $3,720.99 | $3,092.66 | $4,794.42 | $2,440.86 | $4,099.50 | $2,654.64 | $4,148.51 | $2,413.01 |

| MOUNT HOPE | 67108 | $3,378.22 | $4,028.35 | $2,177.27 | $3,734.63 | $3,092.66 | $4,653.39 | $2,482.71 | $4,115.80 | $2,767.72 | $4,150.09 | $2,579.55 |

| KINCAID | 66039 | $3,377.79 | $4,217.36 | $2,130.29 | $3,691.17 | $3,092.66 | $4,794.42 | $2,467.52 | $4,167.63 | $2,636.27 | $4,167.56 | $2,413.01 |

| HUDSON | 67545 | $3,377.53 | $3,795.40 | $2,195.98 | $3,756.96 | $3,092.66 | $4,685.08 | $2,532.72 | $4,161.43 | $2,861.59 | $4,370.57 | $2,322.87 |

| PARKER | 66072 | $3,377.36 | $3,966.78 | $2,218.33 | $3,671.62 | $3,092.66 | $4,794.42 | $2,467.52 | $4,293.01 | $2,688.64 | $4,167.56 | $2,413.01 |

| BUFFALO | 66717 | $3,377.33 | $4,217.36 | $2,190.57 | $3,585.50 | $3,092.66 | $4,794.42 | $2,347.66 | $4,252.29 | $2,648.09 | $4,231.72 | $2,413.01 |

| LA CROSSE | 67548 | $3,377.23 | $3,795.40 | $2,170.10 | $3,682.41 | $3,092.66 | $4,685.08 | $2,579.23 | $4,213.92 | $3,047.61 | $4,183.06 | $2,322.87 |

| LACYGNE | 66040 | $3,377.08 | $3,966.78 | $2,218.33 | $3,679.93 | $3,092.66 | $4,794.42 | $2,467.52 | $4,306.19 | $2,664.44 | $4,167.56 | $2,413.01 |

| CONCORDIA | 66901 | $3,377.07 | $3,880.12 | $2,075.79 | $3,854.56 | $3,092.66 | $4,685.08 | $2,550.99 | $4,330.14 | $2,521.00 | $4,457.51 | $2,322.87 |

| WINCHESTER | 66097 | $3,377.05 | $3,984.07 | $2,135.46 | $3,873.98 | $3,092.66 | $4,631.12 | $2,371.32 | $4,409.46 | $2,797.59 | $4,207.26 | $2,267.59 |

| COLWICH | 67030 | $3,376.96 | $4,028.35 | $2,177.27 | $3,642.02 | $3,092.66 | $4,653.39 | $2,482.71 | $4,084.64 | $2,797.64 | $4,231.38 | $2,579.55 |

| WEBBER | 66970 | $3,376.87 | $3,880.12 | $2,155.42 | $3,857.74 | $3,092.66 | $4,685.08 | $2,550.99 | $4,283.04 | $2,483.27 | $4,457.51 | $2,322.87 |

| RANDALL | 66963 | $3,376.41 | $3,880.12 | $2,155.42 | $3,845.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,290.73 | $2,483.27 | $4,457.51 | $2,322.87 |

| RUSH CENTER | 67575 | $3,376.13 | $3,795.40 | $2,170.10 | $3,729.81 | $3,092.66 | $4,685.08 | $2,579.23 | $4,155.48 | $3,047.61 | $4,183.06 | $2,322.87 |

| ALTOONA | 66710 | $3,375.56 | $4,217.36 | $2,190.57 | $3,659.40 | $3,092.66 | $4,783.76 | $2,347.66 | $4,182.10 | $2,637.33 | $4,231.72 | $2,413.01 |

| MOUND CITY | 66056 | $3,374.92 | $3,966.78 | $2,218.33 | $3,684.94 | $3,092.66 | $4,794.42 | $2,467.52 | $4,247.48 | $2,696.51 | $4,167.56 | $2,413.01 |

| CHENEY | 67025 | $3,373.30 | $4,028.35 | $2,177.27 | $3,615.89 | $3,092.66 | $4,653.39 | $2,482.71 | $4,101.59 | $2,770.24 | $4,231.38 | $2,579.55 |

| TONGANOXIE | 66086 | $3,373.19 | $3,984.07 | $2,305.78 | $3,657.57 | $2,908.94 | $4,802.82 | $2,672.84 | $4,184.80 | $2,808.07 | $4,185.56 | $2,221.43 |

| DEARING | 67340 | $3,372.93 | $3,966.78 | $2,137.34 | $3,717.99 | $3,440.87 | $4,598.73 | $2,524.20 | $4,276.23 | $2,648.09 | $4,006.04 | $2,413.01 |

| MUNDEN | 66959 | $3,372.75 | $3,880.12 | $2,124.49 | $3,830.87 | $3,092.66 | $4,685.08 | $2,550.99 | $4,272.01 | $2,510.95 | $4,457.51 | $2,322.87 |

| SAINT PAUL | 66771 | $3,372.72 | $3,966.78 | $2,112.10 | $3,717.99 | $3,092.66 | $4,783.76 | $2,440.86 | $4,292.72 | $2,655.00 | $4,252.32 | $2,413.01 |

| ROSE HILL | 67133 | $3,372.70 | $4,028.35 | $2,305.78 | $3,747.31 | $3,092.66 | $4,636.65 | $2,460.69 | $3,916.76 | $2,693.01 | $4,358.58 | $2,487.19 |

| CLAFLIN | 67525 | $3,372.21 | $3,795.40 | $2,152.95 | $3,868.02 | $3,092.66 | $4,685.08 | $2,532.72 | $4,086.86 | $2,855.31 | $4,330.28 | $2,322.87 |

| OSKALOOSA | 66066 | $3,371.69 | $3,984.07 | $2,135.46 | $4,044.82 | $3,092.66 | $4,631.12 | $2,371.32 | $4,185.01 | $2,797.59 | $4,207.26 | $2,267.59 |

| FORMOSO | 66942 | $3,371.62 | $3,880.12 | $2,155.42 | $3,830.87 | $3,092.66 | $4,685.08 | $2,550.99 | $4,200.00 | $2,540.73 | $4,457.51 | $2,322.87 |

| LONGTON | 67352 | $3,370.94 | $4,217.36 | $2,278.93 | $3,610.12 | $3,092.66 | $4,794.42 | $2,347.66 | $4,023.22 | $2,700.29 | $4,231.72 | $2,413.01 |

| GARNETT | 66032 | $3,370.65 | $4,217.36 | $2,130.29 | $3,715.79 | $3,092.66 | $4,794.42 | $2,467.52 | $4,062.68 | $2,645.18 | $4,167.56 | $2,413.01 |

| COURTLAND | 66939 | $3,370.63 | $3,880.12 | $2,124.49 | $3,830.87 | $3,092.66 | $4,685.08 | $2,550.99 | $4,278.45 | $2,483.27 | $4,457.51 | $2,322.87 |

| NEKOMA | 67559 | $3,369.92 | $3,795.40 | $2,170.10 | $3,694.47 | $3,092.66 | $4,685.08 | $2,579.23 | $4,144.93 | $3,031.44 | $4,183.06 | $2,322.87 |

| BASEHOR | 66007 | $3,369.89 | $3,984.07 | $2,289.60 | $3,635.62 | $2,908.94 | $4,802.82 | $2,672.84 | $4,179.11 | $2,818.97 | $4,185.56 | $2,221.43 |

| AGENDA | 66930 | $3,369.54 | $3,880.12 | $2,124.49 | $3,845.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,253.01 | $2,483.27 | $4,457.51 | $2,322.87 |

| PECK | 67120 | $3,369.54 | $3,820.50 | $2,256.47 | $3,845.97 | $3,092.66 | $4,653.39 | $2,394.82 | $4,229.79 | $2,683.19 | $4,231.38 | $2,487.19 |

| ERIE | 66733 | $3,369.13 | $3,966.78 | $2,112.10 | $3,717.99 | $3,092.66 | $4,783.76 | $2,440.86 | $4,248.98 | $2,662.87 | $4,252.32 | $2,413.01 |

| SEVERY | 67137 | $3,368.86 | $4,217.36 | $2,203.03 | $3,631.15 | $3,092.66 | $4,794.42 | $2,440.86 | $4,099.50 | $2,648.09 | $4,148.51 | $2,413.01 |

| SAINT JOHN | 67576 | $3,368.76 | $3,795.40 | $2,195.98 | $3,816.93 | $3,092.66 | $4,685.08 | $2,532.72 | $4,010.64 | $2,864.77 | $4,370.57 | $2,322.87 |

| FREDONIA | 66736 | $3,367.87 | $4,217.36 | $2,190.57 | $3,585.50 | $3,092.66 | $4,794.42 | $2,347.66 | $4,159.04 | $2,646.77 | $4,231.72 | $2,413.01 |

| CUBA | 66940 | $3,367.83 | $3,880.12 | $2,124.49 | $3,845.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,206.59 | $2,512.60 | $4,457.51 | $2,322.87 |

| BELLEVILLE | 66935 | $3,367.23 | $3,880.12 | $2,124.49 | $3,845.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,193.77 | $2,519.36 | $4,457.51 | $2,322.87 |

| PLEASANTON | 66075 | $3,367.19 | $3,966.78 | $2,218.33 | $3,561.75 | $3,092.66 | $4,794.42 | $2,467.52 | $4,301.23 | $2,688.64 | $4,167.56 | $2,413.01 |

| NEODESHA | 66757 | $3,366.96 | $4,217.36 | $2,190.57 | $3,585.50 | $3,092.66 | $4,794.42 | $2,347.66 | $4,186.03 | $2,610.71 | $4,231.72 | $2,413.01 |

| HAMILTON | 66853 | $3,366.36 | $4,217.36 | $2,203.03 | $3,595.28 | $3,092.66 | $4,794.42 | $2,440.86 | $4,121.15 | $2,637.33 | $4,148.51 | $2,413.01 |

| GRANTVILLE | 66429 | $3,366.33 | $3,984.07 | $2,135.46 | $3,643.92 | $3,177.65 | $4,631.12 | $2,553.86 | $4,282.65 | $2,797.97 | $4,189.04 | $2,267.59 |

| EASTON | 66020 | $3,365.24 | $3,984.07 | $2,239.53 | $3,692.65 | $2,908.94 | $4,802.82 | $2,672.84 | $4,267.94 | $2,818.97 | $4,185.56 | $2,079.05 |

| CANEY | 67333 | $3,365.19 | $3,966.78 | $2,137.34 | $3,736.24 | $3,440.87 | $4,598.73 | $2,524.20 | $4,191.40 | $2,637.33 | $4,006.04 | $2,413.01 |

| ALTAMONT | 67330 | $3,365.14 | $3,966.78 | $2,218.33 | $3,631.15 | $3,092.66 | $4,783.76 | $2,384.44 | $4,221.98 | $2,664.98 | $4,274.27 | $2,413.01 |

| MORAN | 66755 | $3,364.73 | $4,217.36 | $2,112.10 | $3,596.45 | $3,092.66 | $4,783.76 | $2,440.86 | $4,093.11 | $2,669.38 | $4,228.68 | $2,413.01 |

| OSWEGO | 67356 | $3,364.64 | $3,966.78 | $2,218.33 | $3,572.45 | $3,092.66 | $4,783.76 | $2,384.44 | $4,275.73 | $2,664.98 | $4,274.27 | $2,413.01 |

| OSBORNE | 67473 | $3,364.54 | $3,880.12 | $2,188.61 | $3,688.50 | $3,092.66 | $4,739.32 | $2,550.99 | $4,409.63 | $2,539.07 | $4,233.67 | $2,322.87 |

| BYERS | 67021 | $3,364.34 | $3,795.40 | $2,124.49 | $3,778.85 | $3,092.66 | $4,685.08 | $2,579.23 | $3,970.35 | $2,861.59 | $4,432.87 | $2,322.87 |

| SCANDIA | 66966 | $3,364.32 | $3,880.12 | $2,124.49 | $3,830.87 | $3,092.66 | $4,685.08 | $2,550.99 | $4,179.30 | $2,519.36 | $4,457.51 | $2,322.87 |

| REPUBLIC | 66964 | $3,363.96 | $3,880.12 | $2,124.49 | $3,839.19 | $3,092.66 | $4,685.08 | $2,550.99 | $4,203.40 | $2,483.27 | $4,457.51 | $2,322.87 |

| CHASE | 67524 | $3,363.92 | $3,795.40 | $2,152.95 | $3,808.97 | $3,092.66 | $4,685.08 | $2,532.72 | $4,091.86 | $2,874.57 | $4,282.11 | $2,322.87 |

| EUREKA | 67045 | $3,363.69 | $4,217.36 | $2,203.03 | $3,629.14 | $3,092.66 | $4,794.42 | $2,440.86 | $4,051.19 | $2,646.77 | $4,148.51 | $2,413.01 |

| GIRARD | 66743 | $3,363.53 | $3,966.78 | $2,203.20 | $3,788.83 | $3,116.07 | $4,783.76 | $2,143.40 | $4,135.17 | $2,766.25 | $4,318.80 | $2,413.01 |

| MOUND VALLEY | 67354 | $3,363.26 | $3,966.78 | $2,218.33 | $3,631.15 | $3,092.66 | $4,783.76 | $2,384.44 | $4,203.23 | $2,664.98 | $4,274.27 | $2,413.01 |

| DOUGLASS | 67039 | $3,363.13 | $4,028.35 | $2,305.78 | $3,645.80 | $3,092.66 | $4,653.39 | $2,460.69 | $4,047.34 | $2,693.01 | $4,217.09 | $2,487.19 |

| BENTON | 67017 | $3,363.01 | $4,028.35 | $2,305.78 | $3,705.93 | $3,092.66 | $4,653.39 | $2,460.69 | $3,992.39 | $2,686.25 | $4,217.50 | $2,487.19 |

| MAHASKA | 66955 | $3,361.63 | $3,880.12 | $2,075.79 | $3,903.41 | $3,092.66 | $4,685.08 | $2,550.99 | $4,129.46 | $2,483.27 | $4,492.70 | $2,322.87 |

| ALBERT | 67511 | $3,361.32 | $3,795.40 | $2,152.95 | $3,636.67 | $3,092.66 | $4,685.08 | $2,532.72 | $4,202.95 | $2,861.59 | $4,330.28 | $2,322.87 |

| LAWRENCE | 66044 | $3,360.98 | $3,984.07 | $2,030.73 | $3,625.81 | $2,908.94 | $4,939.56 | $2,672.84 | $3,998.13 | $2,818.97 | $4,409.31 | $2,221.43 |

| BARTLETT | 67332 | $3,360.92 | $3,966.78 | $2,218.33 | $3,580.77 | $3,092.66 | $4,783.76 | $2,384.44 | $4,247.06 | $2,648.09 | $4,274.27 | $2,413.01 |

| LINWOOD | 66052 | $3,360.87 | $3,984.07 | $2,305.78 | $3,746.12 | $2,908.94 | $4,802.82 | $2,672.84 | $3,973.12 | $2,808.07 | $4,185.56 | $2,221.43 |

| ATLANTA | 67008 | $3,360.73 | $4,028.35 | $2,218.33 | $3,736.52 | $3,092.66 | $4,653.39 | $2,347.66 | $4,125.82 | $2,700.29 | $4,217.09 | $2,487.19 |

| RAYMOND | 67573 | $3,360.65 | $3,795.40 | $2,152.95 | $3,760.87 | $3,092.66 | $4,685.08 | $2,532.72 | $4,120.30 | $2,861.59 | $4,282.11 | $2,322.87 |

| DERBY | 67037 | $3,360.65 | $4,028.35 | $2,143.32 | $3,843.42 | $2,726.29 | $4,762.75 | $2,602.78 | $4,122.48 | $2,763.22 | $4,381.55 | $2,232.33 |

| OLMITZ | 67564 | $3,360.53 | $3,795.40 | $2,152.95 | $3,643.19 | $3,092.66 | $4,685.08 | $2,532.72 | $4,185.06 | $2,865.11 | $4,330.28 | $2,322.87 |

| WELDA | 66091 | $3,360.31 | $4,217.36 | $2,130.29 | $3,621.08 | $3,092.66 | $4,794.42 | $2,467.52 | $4,051.12 | $2,648.09 | $4,167.56 | $2,413.01 |

| OVERLAND PARK | 66207 | $3,360.06 | $3,767.13 | $2,112.31 | $3,818.52 | $2,992.75 | $4,807.79 | $2,538.16 | $4,144.20 | $2,765.25 | $4,553.15 | $2,101.35 |

| THAYER | 66776 | $3,359.93 | $3,966.78 | $2,112.10 | $3,672.34 | $3,092.66 | $4,783.76 | $2,347.66 | $4,311.62 | $2,647.11 | $4,252.32 | $2,413.01 |

| ALTON | 67623 | $3,359.64 | $3,880.12 | $2,188.61 | $3,754.43 | $3,092.66 | $4,739.32 | $2,550.99 | $4,350.44 | $2,483.27 | $4,233.67 | $2,322.87 |

| HAVANA | 67347 | $3,359.57 | $3,966.78 | $2,137.34 | $3,736.24 | $3,440.87 | $4,598.73 | $2,524.20 | $4,135.17 | $2,637.33 | $4,006.04 | $2,413.01 |

| MC CRACKEN | 67556 | $3,359.39 | $3,795.40 | $2,170.10 | $3,665.82 | $3,092.66 | $4,685.08 | $2,579.23 | $4,068.20 | $3,031.44 | $4,183.06 | $2,322.87 |

| BRONSON | 66716 | $3,359.17 | $3,966.78 | $2,130.29 | $3,599.16 | $3,092.66 | $4,783.76 | $2,440.86 | $4,262.13 | $2,687.07 | $4,216.03 | $2,413.01 |

| FRONTENAC | 66763 | $3,358.91 | $3,966.78 | $2,203.20 | $3,846.09 | $3,116.07 | $4,596.92 | $2,143.40 | $4,160.67 | $2,785.49 | $4,357.44 | $2,413.01 |

| LEAWOOD | 66211 | $3,358.81 | $3,767.13 | $2,112.31 | $3,724.95 | $2,992.75 | $4,906.40 | $2,582.23 | $4,068.70 | $2,752.52 | $4,579.77 | $2,101.35 |

| MC CUNE | 66753 | $3,358.75 | $3,966.78 | $2,203.20 | $3,644.20 | $3,116.07 | $4,783.76 | $2,143.40 | $4,222.19 | $2,776.06 | $4,318.80 | $2,413.01 |

| TOPEKA | 66607 | $3,358.49 | $3,573.76 | $2,063.79 | $3,770.43 | $3,177.65 | $4,634.69 | $2,553.86 | $4,517.14 | $2,653.74 | $4,304.88 | $2,334.93 |

| OTIS | 67565 | $3,358.30 | $3,795.40 | $2,170.10 | $3,657.11 | $3,092.66 | $4,685.08 | $2,579.23 | $4,066.04 | $3,031.44 | $4,183.06 | $2,322.87 |

| STARK | 66775 | $3,357.81 | $3,966.78 | $2,112.10 | $3,631.15 | $3,092.66 | $4,783.76 | $2,440.86 | $4,237.36 | $2,648.09 | $4,252.32 | $2,413.01 |

| KANOPOLIS | 67454 | $3,357.62 | $3,880.12 | $2,158.89 | $3,739.84 | $3,092.66 | $4,685.08 | $2,532.72 | $4,085.75 | $2,943.33 | $4,134.95 | $2,322.87 |

| FARLINGTON | 66734 | $3,357.11 | $3,966.78 | $2,203.20 | $3,767.81 | $3,116.07 | $4,783.76 | $2,143.40 | $4,080.84 | $2,777.43 | $4,318.80 | $2,413.01 |

| ALEXANDER | 67513 | $3,356.42 | $3,795.40 | $2,170.10 | $3,559.41 | $3,092.66 | $4,685.08 | $2,579.23 | $4,144.93 | $3,031.44 | $4,183.06 | $2,322.87 |

| TOPEKA | 66605 | $3,356.14 | $3,573.76 | $1,997.64 | $3,868.22 | $3,177.65 | $4,634.69 | $2,553.86 | $4,357.15 | $2,674.76 | $4,388.74 | $2,334.93 |

| AUGUSTA | 67010 | $3,355.25 | $4,028.35 | $2,305.78 | $3,646.96 | $3,092.66 | $4,636.65 | $2,460.69 | $3,946.50 | $2,709.25 | $4,238.47 | $2,487.19 |

| ALMA | 66401 | $3,354.85 | $4,217.36 | $2,046.16 | $3,637.37 | $3,092.66 | $4,757.09 | $2,578.20 | $4,067.80 | $2,522.40 | $4,306.63 | $2,322.87 |

| YATES CENTER | 66783 | $3,354.52 | $4,217.36 | $2,130.29 | $3,641.91 | $3,092.66 | $4,794.42 | $2,440.86 | $4,025.01 | $2,653.05 | $4,136.59 | $2,413.01 |

| CHERRYVALE | 67335 | $3,354.51 | $3,966.78 | $2,137.34 | $3,631.15 | $3,440.87 | $4,598.73 | $2,524.20 | $4,189.68 | $2,637.33 | $4,006.04 | $2,413.01 |

| AURORA | 67417 | $3,354.36 | $3,880.12 | $2,075.79 | $3,649.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,345.90 | $2,483.27 | $4,457.51 | $2,322.87 |

| PAWNEE ROCK | 67567 | $3,354.18 | $3,795.40 | $2,152.95 | $3,596.81 | $3,092.66 | $4,685.08 | $2,532.72 | $4,148.97 | $2,884.01 | $4,330.28 | $2,322.87 |

| PRATT | 67124 | $3,353.81 | $3,795.40 | $2,124.49 | $3,721.62 | $3,092.66 | $4,685.08 | $2,579.23 | $3,909.32 | $2,874.57 | $4,432.87 | $2,322.87 |

| PRAIRIE VILLAGE | 66208 | $3,353.77 | $3,767.13 | $2,112.31 | $3,922.45 | $2,992.75 | $4,649.16 | $2,538.16 | $4,222.17 | $2,778.51 | $4,453.69 | $2,101.35 |

| LENEXA | 66227 | $3,353.43 | $3,735.92 | $2,110.78 | $3,825.68 | $3,073.89 | $4,906.40 | $2,497.49 | $4,163.06 | $2,737.21 | $4,445.66 | $2,038.20 |

| ELSMORE | 66732 | $3,353.21 | $4,217.36 | $2,112.10 | $3,473.27 | $3,092.66 | $4,783.76 | $2,440.86 | $4,122.31 | $2,648.09 | $4,228.68 | $2,413.01 |

| COTTONWOOD FALLS | 66845 | $3,352.68 | $4,217.36 | $2,077.04 | $3,854.41 | $3,092.66 | $4,757.09 | $2,337.13 | $4,149.84 | $2,468.14 | $4,250.24 | $2,322.87 |

| LORRAINE | 67459 | $3,351.27 | $3,880.12 | $2,158.89 | $3,594.76 | $3,092.66 | $4,685.08 | $2,532.72 | $4,143.71 | $2,966.96 | $4,134.95 | $2,322.87 |

| MATFIELD GREEN | 66862 | $3,351.15 | $4,217.36 | $2,077.04 | $3,849.97 | $3,092.66 | $4,757.09 | $2,337.13 | $4,111.32 | $2,495.81 | $4,250.24 | $2,322.87 |

| LIBERTY | 67351 | $3,351.03 | $3,966.78 | $2,137.34 | $3,585.50 | $3,440.87 | $4,598.73 | $2,524.20 | $4,200.50 | $2,637.33 | $4,006.04 | $2,413.01 |

| DENNIS | 67341 | $3,350.94 | $3,966.78 | $2,218.33 | $3,585.50 | $3,092.66 | $4,783.76 | $2,384.44 | $4,134.07 | $2,656.58 | $4,274.27 | $2,413.01 |

| MAPLE HILL | 66507 | $3,350.75 | $4,217.36 | $2,046.16 | $3,674.21 | $3,092.66 | $4,757.09 | $2,578.20 | $4,006.89 | $2,512.60 | $4,299.48 | $2,322.87 |

| MADISON | 66860 | $3,350.58 | $4,217.36 | $2,203.03 | $3,558.78 | $3,092.66 | $4,794.42 | $2,440.86 | $4,009.69 | $2,627.50 | $4,148.51 | $2,413.01 |

| NEAL | 66863 | $3,350.57 | $4,217.36 | $2,203.03 | $3,478.34 | $3,092.66 | $4,757.09 | $2,440.86 | $4,005.08 | $2,648.09 | $4,250.24 | $2,413.01 |

| BURR OAK | 66936 | $3,350.50 | $3,880.12 | $2,155.42 | $3,625.74 | $3,092.66 | $4,685.08 | $2,550.99 | $4,187.14 | $2,547.47 | $4,457.51 | $2,322.87 |

| CHEROKEE | 66724 | $3,350.34 | $3,966.78 | $2,203.20 | $3,544.64 | $3,116.07 | $4,783.76 | $2,143.40 | $4,228.26 | $2,785.49 | $4,318.80 | $2,413.01 |

| OVERLAND PARK | 66212 | $3,350.34 | $3,767.13 | $2,112.31 | $3,721.45 | $2,992.75 | $4,807.79 | $2,526.47 | $4,153.98 | $2,766.98 | $4,553.15 | $2,101.35 |

| MANKATO | 66956 | $3,350.26 | $3,880.12 | $2,155.42 | $3,649.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,176.19 | $2,532.35 | $4,457.51 | $2,322.87 |

| STAFFORD | 67578 | $3,350.06 | $3,795.40 | $2,195.98 | $3,747.55 | $3,092.66 | $4,685.08 | $2,532.72 | $3,902.49 | $2,855.31 | $4,370.57 | $2,322.87 |

| CHAUTAUQUA | 67334 | $3,349.61 | $4,217.36 | $2,306.68 | $3,628.26 | $3,092.66 | $4,598.73 | $2,347.66 | $4,185.46 | $2,700.29 | $4,006.04 | $2,413.01 |

| PRESCOTT | 66767 | $3,349.58 | $3,966.78 | $2,218.33 | $3,748.05 | $3,092.66 | $4,794.42 | $2,467.52 | $3,938.86 | $2,688.64 | $4,167.56 | $2,413.01 |

| WALNUT | 66780 | $3,349.10 | $3,966.78 | $2,203.20 | $3,572.45 | $3,116.07 | $4,783.76 | $2,143.40 | $4,196.08 | $2,777.43 | $4,318.80 | $2,413.01 |

| INDEPENDENCE | 67301 | $3,349.02 | $3,966.78 | $2,137.34 | $3,631.15 | $3,440.87 | $4,598.73 | $2,524.20 | $4,144.55 | $2,627.50 | $4,006.04 | $2,413.01 |

| LENEXA | 66220 | $3,348.43 | $3,735.92 | $2,110.78 | $3,747.37 | $3,073.89 | $4,906.40 | $2,497.49 | $4,045.69 | $2,748.76 | $4,579.77 | $2,038.20 |

| PAXICO | 66526 | $3,348.31 | $4,217.36 | $2,046.16 | $3,638.35 | $3,092.66 | $4,757.09 | $2,578.20 | $4,018.36 | $2,512.60 | $4,299.48 | $2,322.87 |

| VIRGIL | 66870 | $3,348.07 | $4,217.36 | $2,203.03 | $3,497.91 | $3,092.66 | $4,794.42 | $2,440.86 | $4,024.88 | $2,648.09 | $4,148.51 | $2,413.01 |

| MAPLE CITY | 67102 | $3,347.76 | $3,820.50 | $2,218.33 | $4,042.99 | $3,092.66 | $4,653.39 | $2,347.66 | $3,907.29 | $2,700.29 | $4,207.28 | $2,487.19 |

| SYLVIA | 67581 | $3,347.52 | $4,058.06 | $2,058.84 | $3,822.18 | $3,092.66 | $4,685.08 | $2,443.88 | $4,016.20 | $2,646.99 | $4,399.82 | $2,251.46 |

| HILLSDALE | 66036 | $3,346.49 | $4,217.36 | $2,157.43 | $3,762.42 | $3,092.66 | $4,481.55 | $2,298.51 | $4,277.46 | $2,648.09 | $4,116.35 | $2,413.01 |

| HUMBOLDT | 66748 | $3,345.46 | $4,217.36 | $2,112.10 | $3,522.33 | $3,092.66 | $4,783.76 | $2,440.86 | $3,979.38 | $2,664.44 | $4,228.68 | $2,413.01 |

| WILSON | 67490 | $3,345.46 | $3,880.12 | $2,158.89 | $3,612.32 | $3,092.66 | $4,685.08 | $2,532.72 | $4,093.55 | $2,941.40 | $4,134.95 | $2,322.87 |

| DELIA | 66418 | $3,344.70 | $3,880.12 | $2,047.42 | $3,992.64 | $3,092.66 | $4,757.09 | $2,393.73 | $4,256.08 | $2,512.60 | $4,191.84 | $2,322.87 |

| MISSION | 66205 | $3,344.54 | $3,767.13 | $2,112.31 | $3,892.47 | $2,992.75 | $4,649.16 | $2,538.16 | $4,171.39 | $2,766.98 | $4,453.69 | $2,101.35 |

| BUSHTON | 67427 | $3,344.09 | $3,795.40 | $2,152.95 | $3,597.56 | $3,092.66 | $4,685.08 | $2,532.72 | $4,117.98 | $2,861.59 | $4,282.11 | $2,322.87 |

| GALESBURG | 66740 | $3,344.06 | $3,966.78 | $2,112.10 | $3,585.50 | $3,092.66 | $4,783.76 | $2,440.86 | $4,145.48 | $2,648.09 | $4,252.32 | $2,413.01 |

| MORROWVILLE | 66958 | $3,343.91 | $3,880.12 | $2,075.79 | $3,876.53 | $3,092.66 | $4,685.08 | $2,550.99 | $3,979.06 | $2,483.27 | $4,492.70 | $2,322.87 |

| LITTLE RIVER | 67457 | $3,343.72 | $3,795.40 | $2,152.95 | $3,649.72 | $3,092.66 | $4,685.08 | $2,532.72 | $4,068.37 | $2,855.31 | $4,282.11 | $2,322.87 |

| MAPLETON | 66754 | $3,343.60 | $3,966.78 | $2,130.29 | $3,602.52 | $3,092.66 | $4,783.76 | $2,440.86 | $4,142.00 | $2,648.09 | $4,216.03 | $2,413.01 |

| TOPEKA | 66603 | $3,343.12 | $3,573.76 | $1,997.64 | $3,711.73 | $3,177.65 | $4,634.69 | $2,433.72 | $4,554.44 | $2,707.74 | $4,304.88 | $2,334.93 |

| WAVERLY | 66871 | $3,342.95 | $4,217.36 | $2,011.33 | $3,702.78 | $3,092.66 | $4,794.42 | $2,467.52 | $4,030.49 | $2,532.35 | $4,167.56 | $2,413.01 |

| STRONG CITY | 66869 | $3,342.70 | $4,217.36 | $2,077.04 | $3,900.14 | $3,092.66 | $4,757.09 | $2,337.13 | $3,986.47 | $2,486.00 | $4,250.24 | $2,322.87 |

| GARLAND | 66741 | $3,342.37 | $3,966.78 | $2,130.29 | $3,706.66 | $3,092.66 | $4,783.76 | $2,440.86 | $4,025.56 | $2,648.09 | $4,216.03 | $2,413.01 |

| NATOMA | 67651 | $3,342.35 | $3,880.12 | $2,188.61 | $3,655.87 | $3,092.66 | $4,739.32 | $2,550.99 | $4,228.71 | $2,530.67 | $4,233.67 | $2,322.87 |

| ALDEN | 67512 | $3,342.32 | $3,795.40 | $2,152.95 | $3,697.22 | $3,092.66 | $4,685.08 | $2,532.72 | $3,987.58 | $2,874.57 | $4,282.11 | $2,322.87 |

| HEPLER | 66746 | $3,342.30 | $3,966.78 | $2,203.20 | $3,554.96 | $3,116.07 | $4,783.76 | $2,143.40 | $4,160.98 | $2,762.04 | $4,318.80 | $2,413.01 |

| MULBERRY | 66756 | $3,342.26 | $3,966.78 | $2,203.20 | $3,788.83 | $3,116.07 | $4,596.92 | $2,143.40 | $4,135.17 | $2,785.49 | $4,273.74 | $2,413.01 |

| HARTFORD | 66854 | $3,342.14 | $4,217.36 | $1,964.72 | $4,096.37 | $3,092.66 | $4,757.09 | $2,289.13 | $4,085.63 | $2,482.20 | $4,250.24 | $2,186.01 |

| TORONTO | 66777 | $3,342.02 | $4,217.36 | $2,130.29 | $3,497.91 | $3,092.66 | $4,794.42 | $2,440.86 | $4,049.06 | $2,648.09 | $4,136.59 | $2,413.01 |

| PORTIS | 67474 | $3,341.80 | $3,880.12 | $2,188.61 | $3,665.53 | $3,092.66 | $4,739.32 | $2,550.99 | $4,260.96 | $2,483.27 | $4,233.67 | $2,322.87 |

| OZAWKIE | 66070 | $3,341.63 | $3,984.07 | $2,135.46 | $3,699.18 | $3,092.66 | $4,631.12 | $2,371.32 | $4,248.25 | $2,797.59 | $4,189.04 | $2,267.59 |

| SAVONBURG | 66772 | $3,341.30 | $4,217.36 | $2,112.10 | $3,427.60 | $3,092.66 | $4,783.76 | $2,440.86 | $4,048.86 | $2,648.09 | $4,228.68 | $2,413.01 |

| ELWOOD | 66024 | $3,341.15 | $3,880.12 | $2,218.33 | $3,863.78 | $3,092.66 | $4,481.55 | $2,393.73 | $4,208.90 | $2,808.07 | $4,152.77 | $2,311.63 |

| SHAWNEE | 66216 | $3,341.13 | $3,767.13 | $2,110.78 | $3,659.87 | $2,992.75 | $4,906.40 | $2,495.00 | $4,279.97 | $2,742.37 | $4,355.68 | $2,101.35 |

| BEAUMONT | 67012 | $3,340.96 | $4,028.35 | $2,305.78 | $3,664.05 | $3,092.66 | $4,636.65 | $2,460.69 | $3,795.51 | $2,700.29 | $4,238.47 | $2,487.19 |

| WESTPHALIA | 66093 | $3,340.96 | $4,217.36 | $2,130.29 | $3,427.60 | $3,092.66 | $4,794.42 | $2,467.52 | $4,051.12 | $2,648.09 | $4,167.56 | $2,413.01 |

| CENTERVILLE | 66014 | $3,340.50 | $3,966.78 | $2,130.29 | $3,608.05 | $3,092.66 | $4,794.42 | $2,467.52 | $4,116.64 | $2,648.09 | $4,167.56 | $2,413.01 |

| STERLING | 67579 | $3,340.26 | $3,795.40 | $2,152.95 | $3,719.39 | $3,092.66 | $4,685.08 | $2,532.72 | $3,954.37 | $2,865.01 | $4,282.11 | $2,322.87 |

| SIMPSON | 67478 | $3,340.06 | $3,880.12 | $2,036.16 | $3,658.54 | $3,092.66 | $4,685.08 | $2,550.99 | $4,233.41 | $2,483.27 | $4,457.51 | $2,322.87 |

| PARSONS | 67357 | $3,339.95 | $3,966.78 | $2,218.33 | $3,749.17 | $3,092.66 | $4,783.76 | $2,384.44 | $4,185.09 | $2,664.98 | $3,941.24 | $2,413.01 |

| TROY | 66087 | $3,339.92 | $3,880.12 | $2,218.33 | $3,880.40 | $3,092.66 | $4,481.55 | $2,393.73 | $4,237.32 | $2,787.07 | $4,116.35 | $2,311.63 |

| CAWKER CITY | 67430 | $3,339.92 | $3,880.12 | $2,036.16 | $3,649.43 | $3,092.66 | $4,685.08 | $2,550.99 | $4,241.07 | $2,483.27 | $4,457.51 | $2,322.87 |

| TECUMSEH | 66542 | $3,339.86 | $3,573.76 | $2,063.79 | $3,746.96 | $3,177.65 | $4,620.38 | $2,553.86 | $4,490.80 | $2,631.27 | $4,205.24 | $2,334.93 |

| BLUE MOUND | 66010 | $3,339.37 | $3,966.78 | $2,218.33 | $3,473.27 | $3,092.66 | $4,794.42 | $2,467.52 | $4,113.05 | $2,687.07 | $4,167.56 | $2,413.01 |