Best Baltimore, MD Car Insurance in 2024

The average Baltimore car insurance rates are $84.73/mo. Baltimore car insurance must meet Maryland's minimum coverage requirements of 20/40/15 for bodily injury and property damage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The city of Baltimore has a rich history and a currently thriving economy

- Because Baltimore is a popular place, the large population plays a part in higher insurance costs

- Maryland uses the Tort System

- The state upholds minimum requirements for car insurance coverage

- The average Baltimore car insurance rates for full coverage are $1,016.81/yr or $84.73/mo

If you are a Baltimore resident, comparing car insurance is important in order for you to save money. Formerly a tobacco shipyard, Baltimore used to not have a need for cars as it was accessible only by boat.

A vigorous trade in corn, tomatoes, and tobacco sprang up from the surrounding areas’ fertile farmlands, making Baltimore a hub even in those early days.

Now that it is home to many cars, you will need Maryland car insurance in order to drive in Baltimore.

What you should know about Baltimore

Trade by sea made Baltimore a boomtown.

During the War of 1812, when the British tried to shut down Baltimore, an attorney named Francis Scott Key was aboard a British warship, attempting to free a prisoner.

Watching the Battle of Baltimore from that vantage point, he wrote a poem about the battle which later was put to music and became the national anthem.

Since then, Baltimore has spread over the countryside, been rebuilt several times, and burned to the ground.

Its urban renewal efforts have won the praise of presidents, and its concentration on the Inner Harbor beauty and utility has won home offices of such big business as Legg Mason, T. Rowe Price, and Black and Decker.

Baltimore has more to offer tourists than they might have time to see.

It is the home of the Baltimore Orioles and the Baltimore Ravens. Two huge sports complexes named after them make Baltimore “Birdland.”

Entertainment acts such as Jeff Dunham have appeared in Raven Stadium.

The National Aquarium is located in Baltimore, along with zoos, museums, the Inner Harbor, and lots of shopping. The food is exquisite and varied, catering to many tastes.

The neighborhoods are set like jewels among the scenery and the people are friendly and charming.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are Baltimore auto insurance requirements?

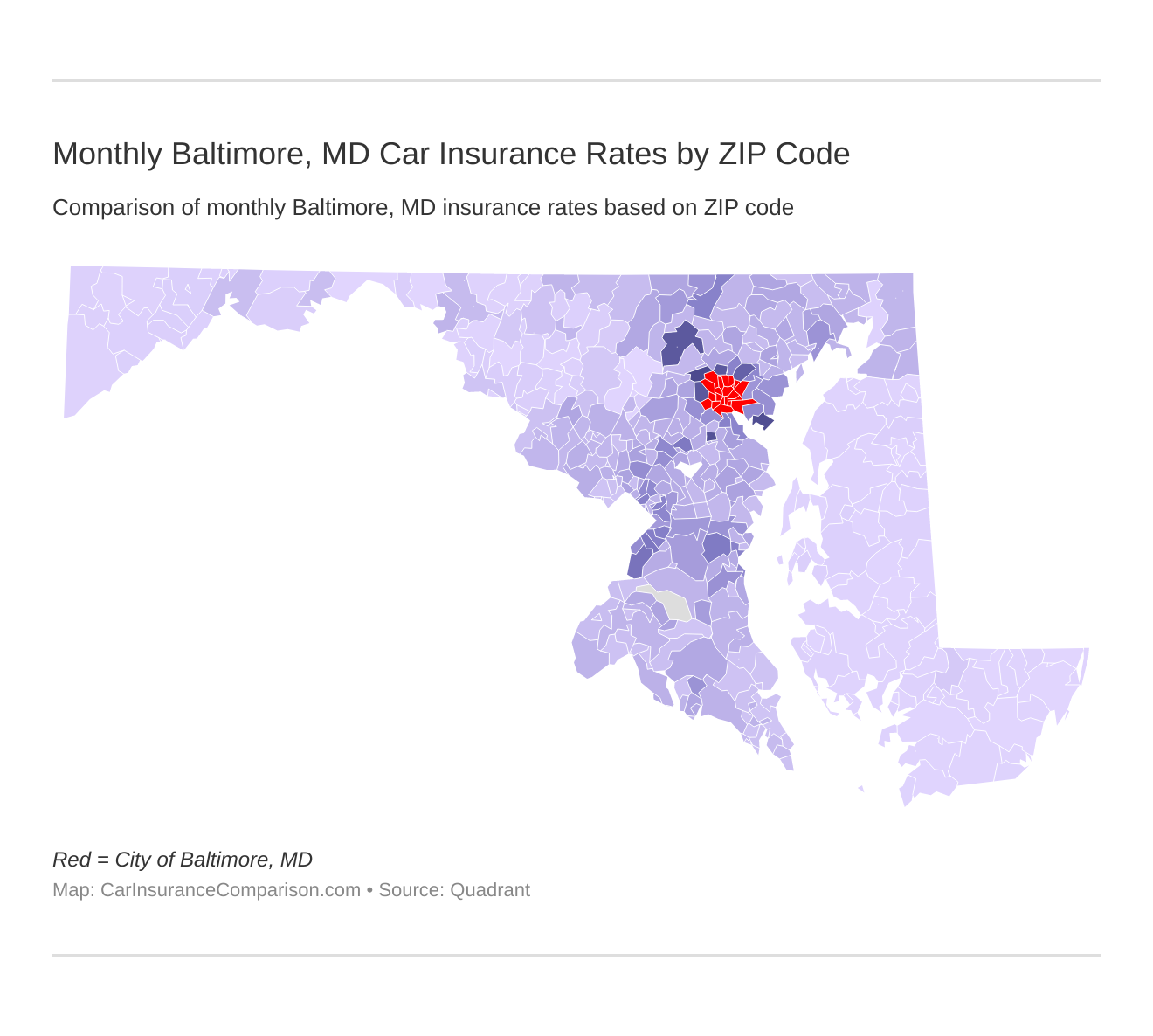

What are the monthly Baltimore, MD car insurance rates by ZIP code?

Check out the monthly Baltimore, MD auto insurance rates by ZIP Code below:

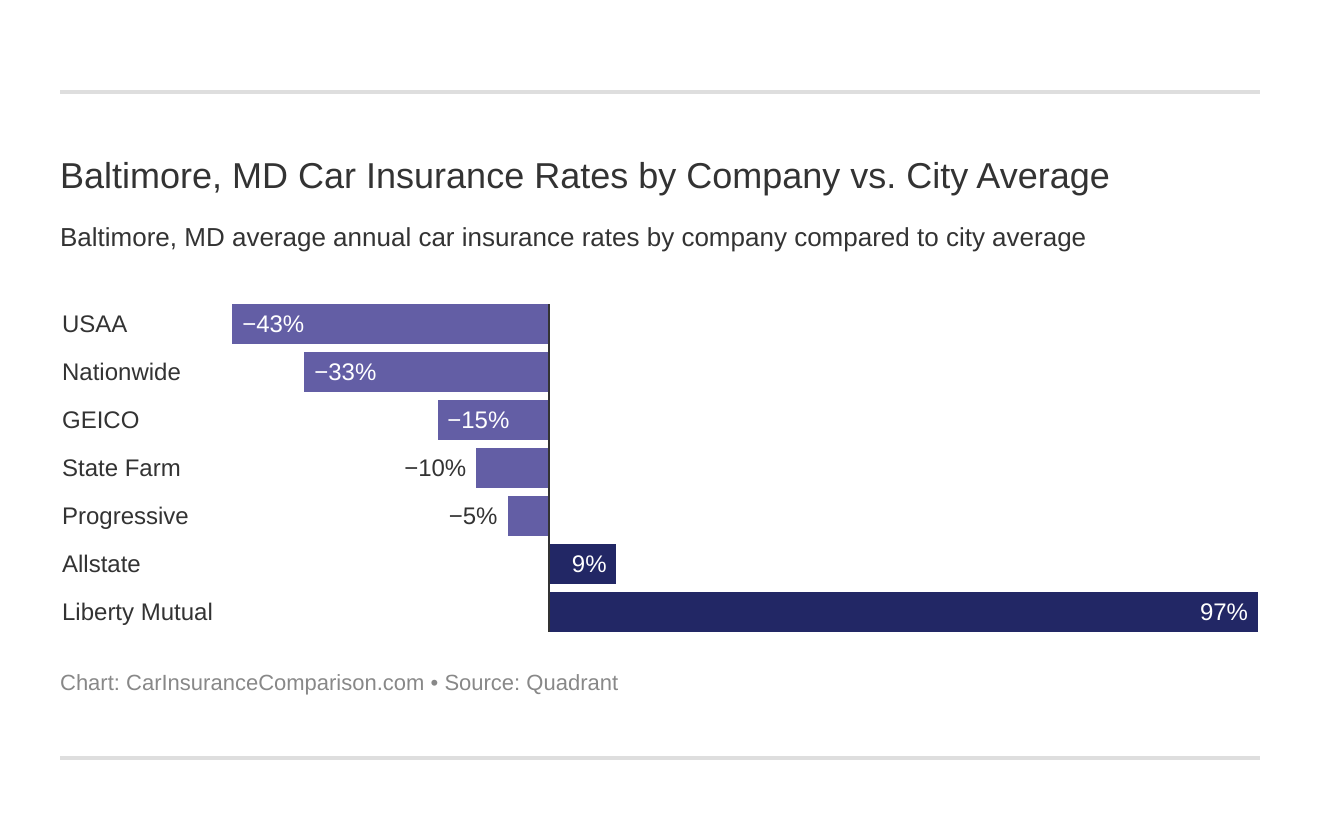

What are the average Baltimore, MD car insurance rates by company and city?

Which Baltimore, MD auto insurance company has the cheapest rates? And how do those rates compare against the average Maryland rates from the top car insurance companies? We’ve got the answers below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

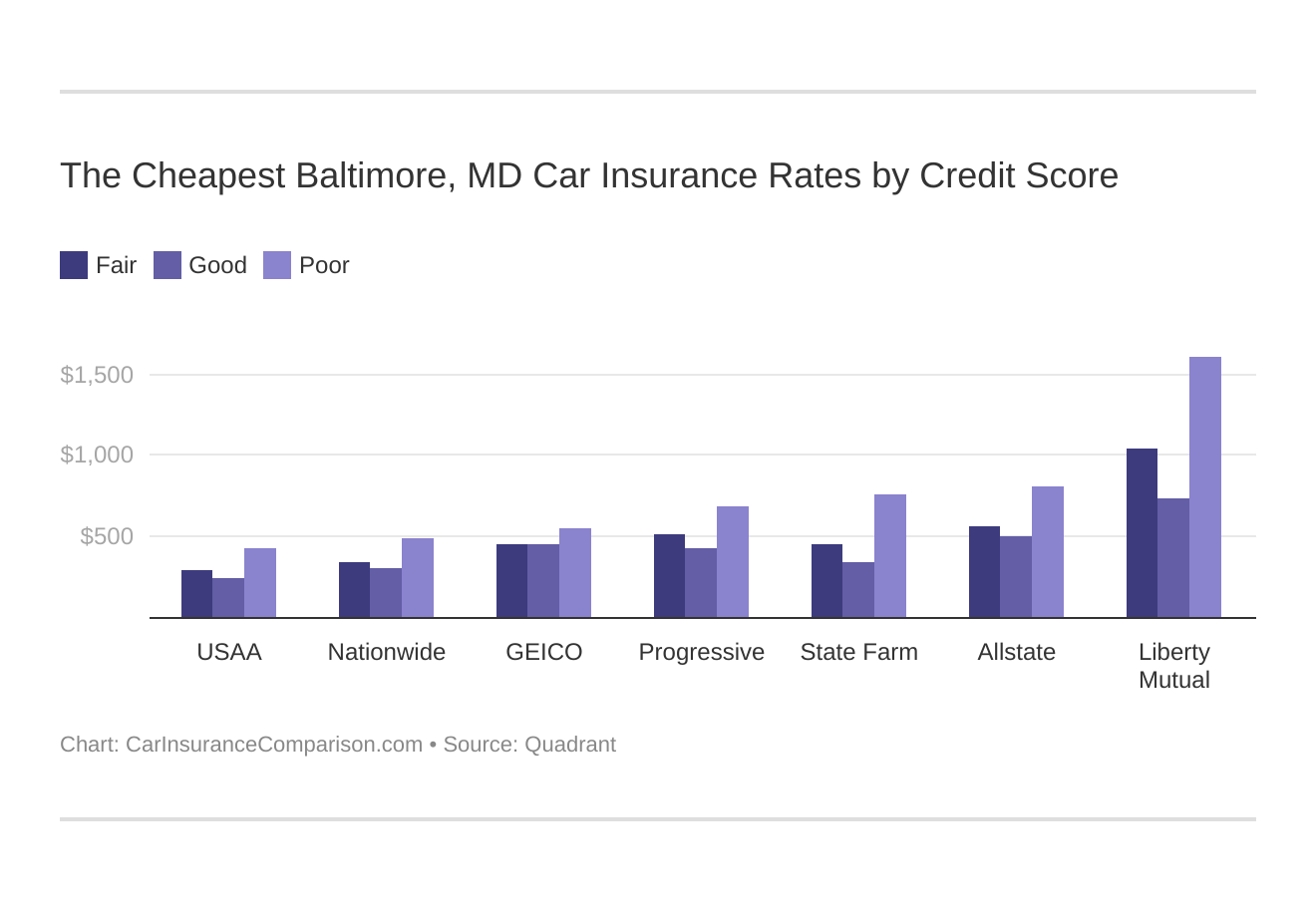

What are the cheapest Baltimore, MD car insurance rates by credit score?

Your credit score will play a major role in your Baltimore auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. If your credit is good, you may be able to get a good credit discount. Find the cheapest Baltimore, MD auto insurance rates by credit score below.

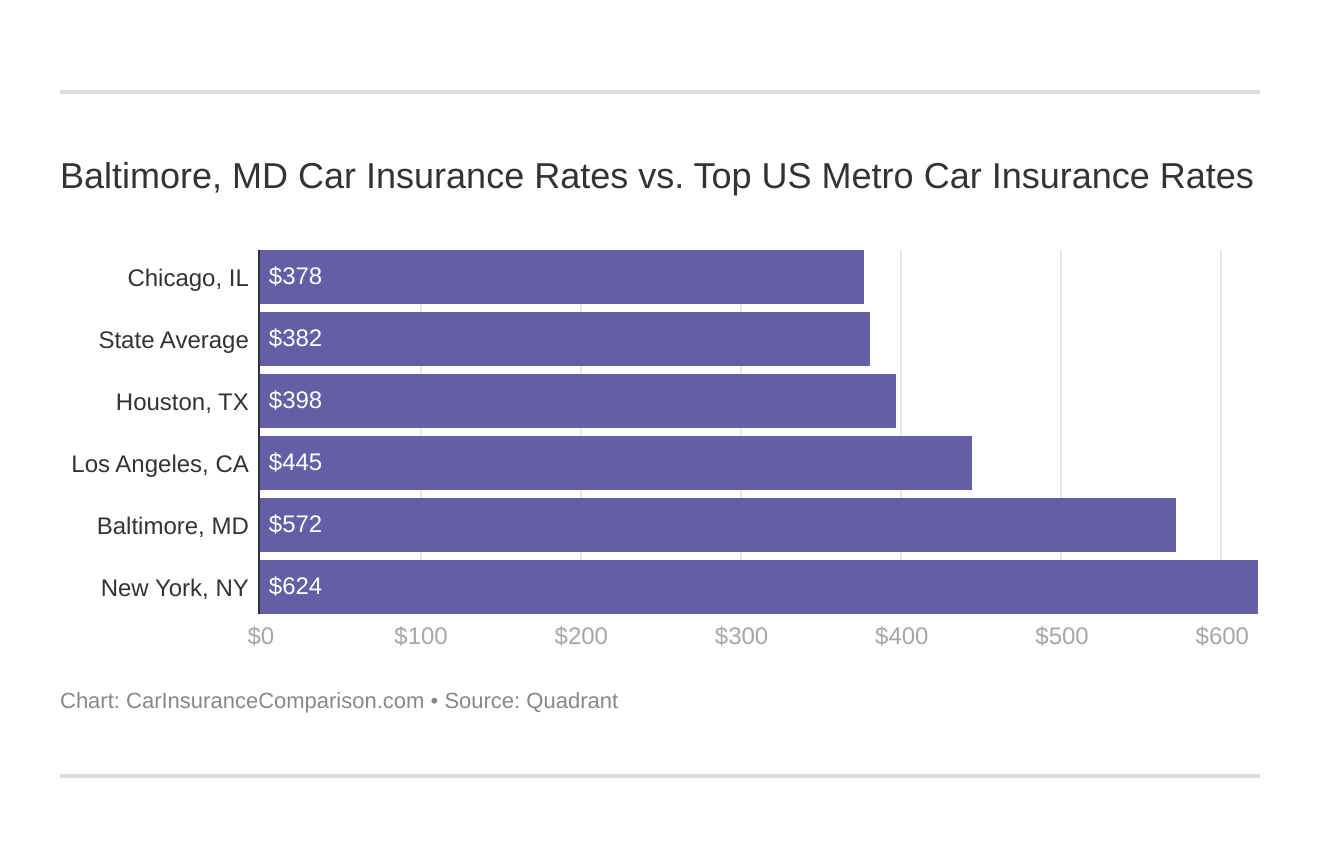

How do Baltimore, MD car insurance rates compare to the top US metro car insurance rates?

You might find yourself asking how does my Baltimore, MD stack up against other top metro auto insurance rates? We’ve got your answer below.

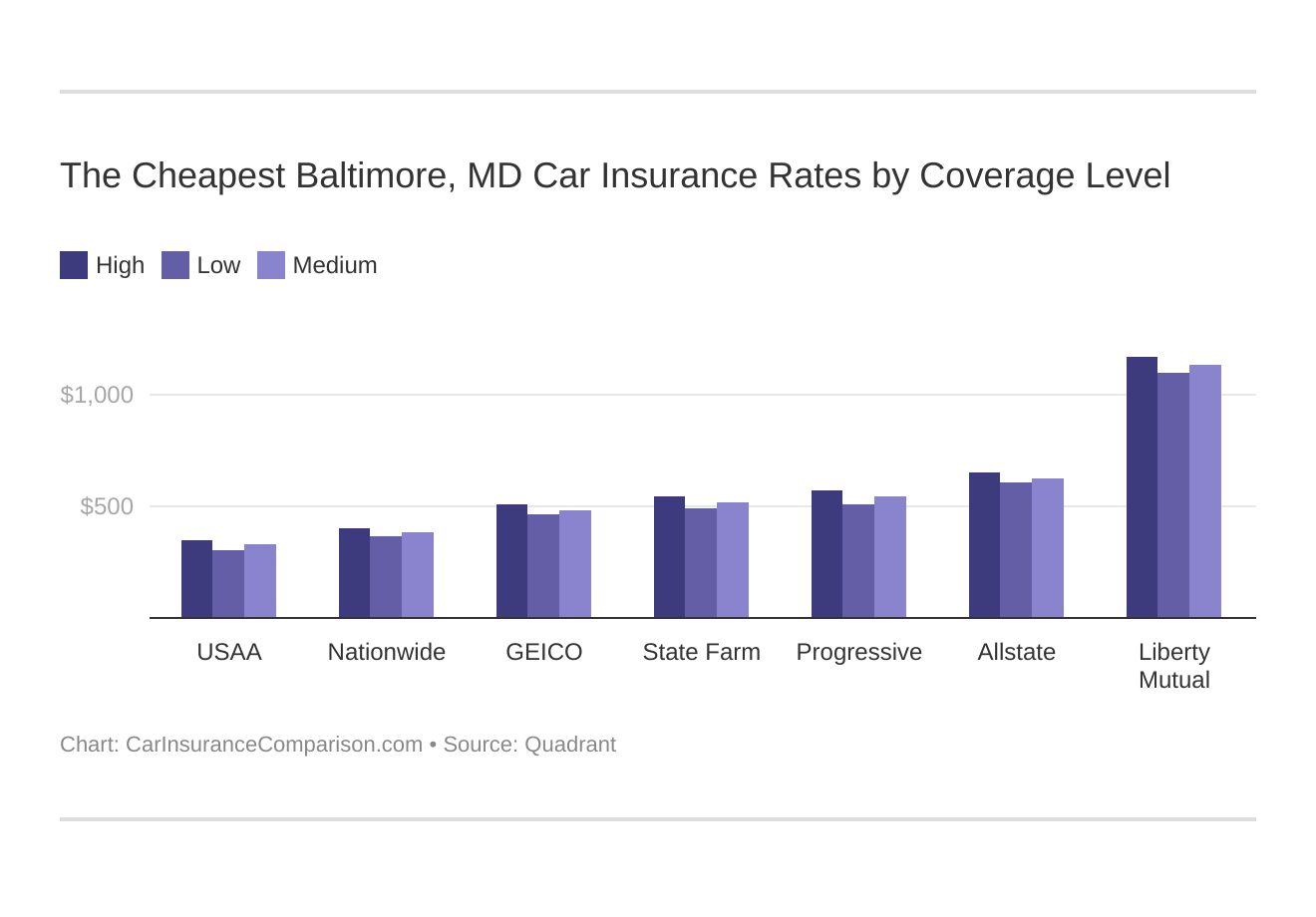

What are the cheapest Baltimore, MD car insurance rates by coverage level?

How much car insurance you need will play a major role in your Baltimore auto insurance rates. Find the cheapest Baltimore, MD auto insurance rates by coverage level below:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

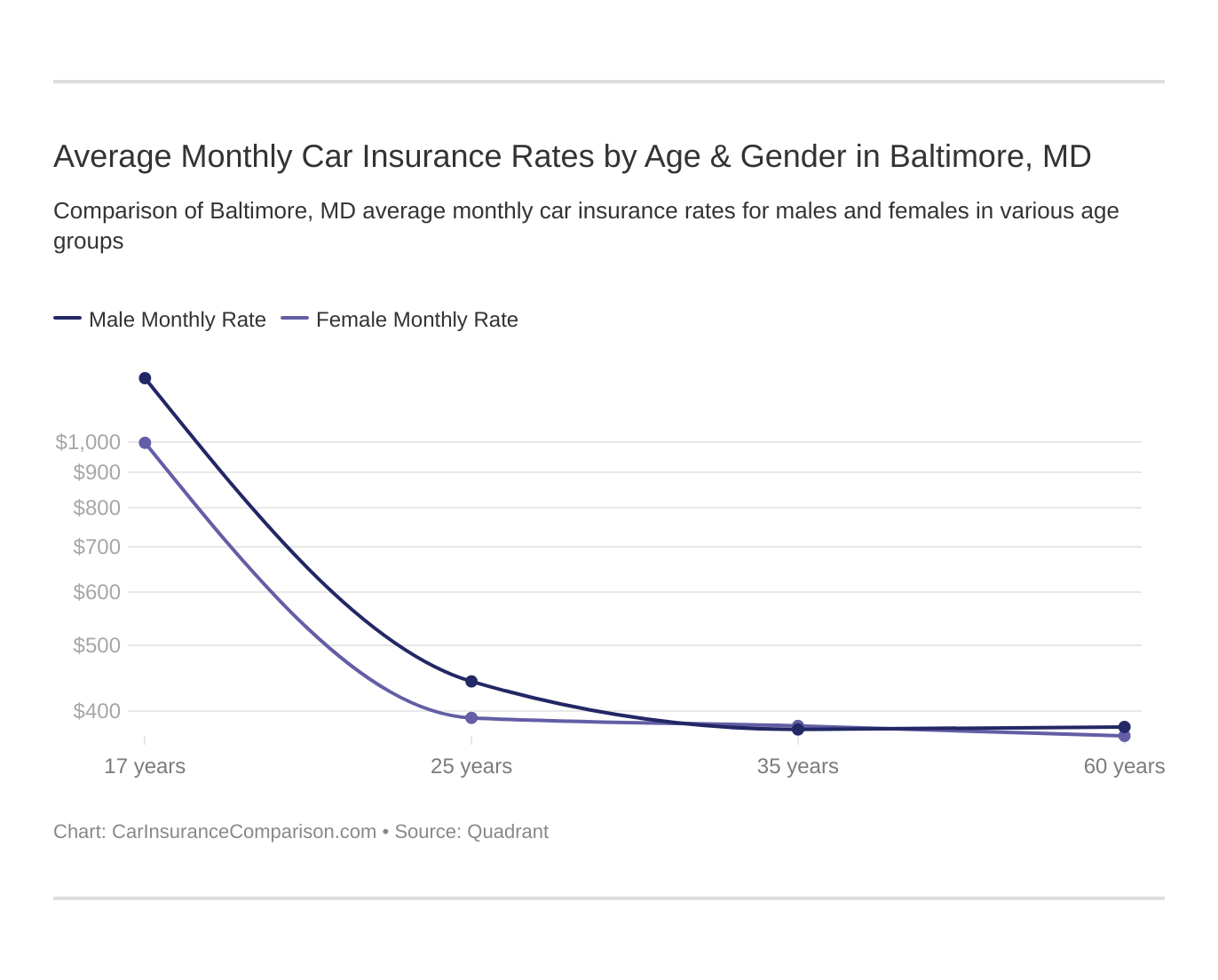

What are the average monthly car insurance rates by age & gender in Baltimore, MD?

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. Baltimore does use gender, so check out the average monthly car insurance rates by age and gender in Baltimore, MD.

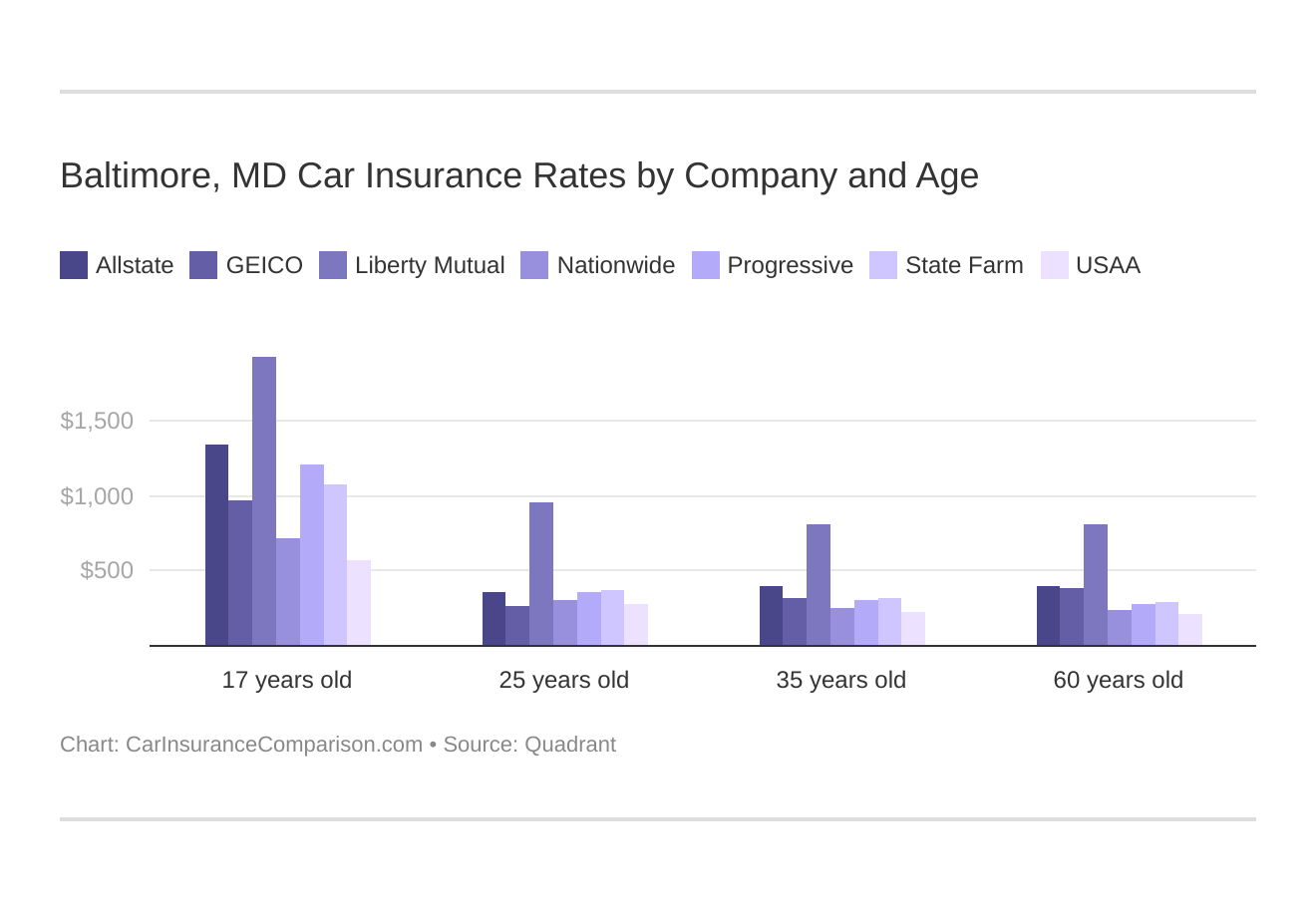

How do Baltimore, MD car insurance rates compare by company and age?

Baltimore, MD auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

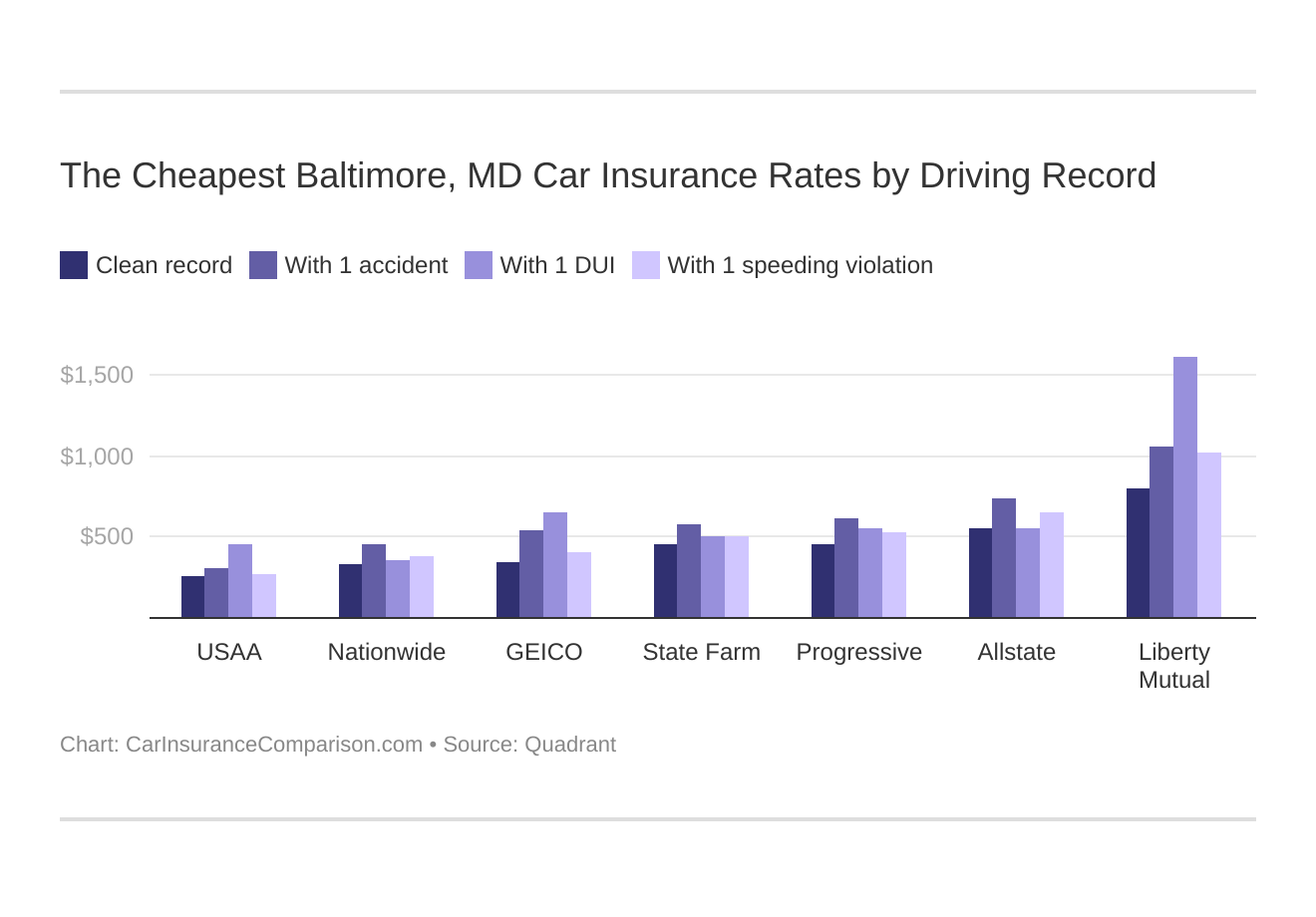

What are the cheapest Baltimore, MD car insurance rates by driving record?

Your driving record will play a major role in your Baltimore auto insurance rates. For example, other factors aside, a Baltimore, MD DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Baltimore, MD car insurance rates with a bad driving record.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

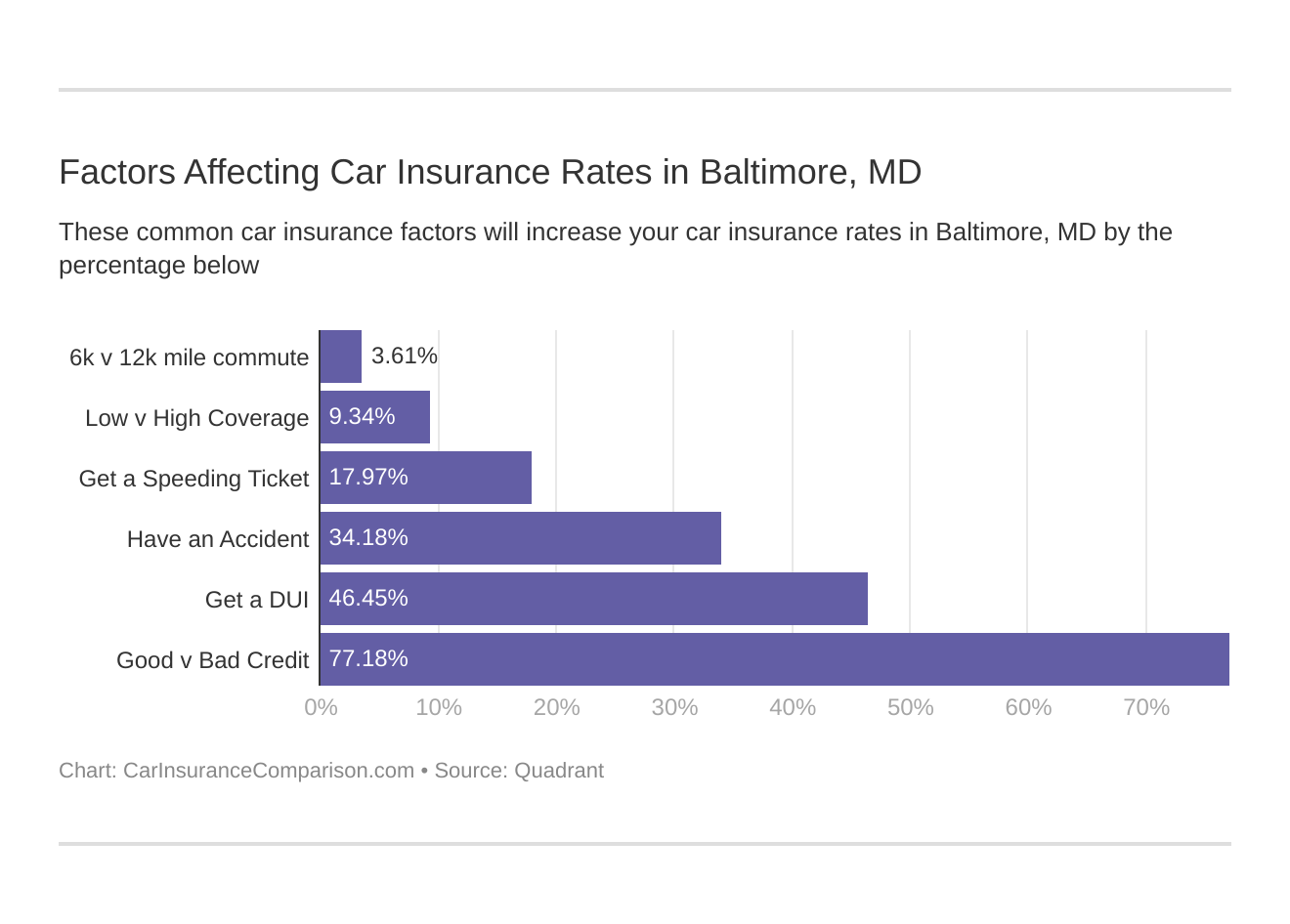

Which factors affect car insurance rates in Baltimore, MD?

Factors affecting car insurance rates in Baltimore, MD may include your commute, coverage level, traffic tickets, DUIs, and poor credit history. Controlling these factors will help you maintain cheap Baltimore, Maryland auto insurance.

For example, the best low-cost car insurance can be found in areas with a low population because there are not many vehicles on the highways. The chances for major accidents are less likely.

Credit score rating is also important when determining car insurance rates. Those who have bad credit will pay higher monthly rates compared to someone who has an excellent driving record.

Furthermore, older and more experienced drivers get lower Baltimore auto insurance rates. Insurance companies will charge higher monthly rates if you have a lot of speeding violations on your record because you’re more likely to file claims.

Marital status can also influence auto insurance in Baltimore, thus helping you get cheaper rates. Car insurance rates are higher for singles than married couples.

Maryland’s population is on the healthy side of a half million, which is one facet that affects Baltimore city car insurance rates.

Speed limits, cell phone use while driving, type of car driven, age of the driver, and driving infractions all combine to make the average Baltimore driver pay around $86 per month, or a little over $1,000 per year for car insurance policies.

Maryland uses the Tort system, meaning there will always be a party at fault in an accident.

This party and its Baltimore carrier would be required to pay for damages incurred in the accident.

If the individual at fault is uninsured or underinsured, the other person involved in the accident and his car insurance company would jump in to cover damages from the accident.

Everyone should check the differences between limited tort and full tort car insurance.

Read more: Compare Full Tort Car Insurance: Rates, Discounts, & Requirements

Baltimore has a minimum requirement for car insurance coverage. Motorists may use only these minimums, but a little more, especially in the case of medical coverage, is recommended.

- Bodily Injury Liability Coverage – a minimum of $20,000 per injured person in the accident and up to $40,000 per accident

- Property Damage Liability Coverage – a minimum of $15,000 is necessary

- Uninsured and Underinsured Motorist Coverage – a minimum of $20,000 per person and $40,000 per accident to cover damages caused by uninsured motorists

- Personal Injury Protection Coverage – $2,500 is deemed minimum for medical coverage for driver and passengers

The minimum limits protect you from accidents you cause and from financial liability if an uninsured motorist hits you. Maryland drivers are typically paying around $151 for monthly auto insurance premiums, however, Baltimore insurance rates may be as low as $66 per month.

What are the car insurance laws for Baltimore?

Baltimore and the state of Maryland realize that not every state requires drivers to use automobile insurance.

Baltimore also recognizes that not everyone is rich and can afford unlimited benefits in their auto insurance policy. This is why minimum auto insurance requirements are available.

Baltimore’s car insurance laws are simple:

- You must purchase the minimum auto insurance coverage in liability, property damage, medical, and uninsured car insurance.

- Maryland is a no-fault state. This means that each driver is responsible for his own medical coverage, regardless of coverage by at-fault drivers in an accident.

- Stiff fines and possibly jail time await the uninsured driver in Baltimore. For those hit by an uninsured motorist, their own coverage will take care of the accident.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What do Baltimore driving and car insurance statistics indicate?

Car insurance rates for Baltimore drivers take into account such points as dangerous intersections, median speed limit, time driving to work, and driver safety precautions.

These things cause a hike in auto insurance premiums, in addition to some new points to consider as technology advances.

- Distractions – In 2007, 65% of accidents among 18 to 34-year-olds involved distractions such as cell phone use, loud music, and adjusting seats and mirrors. 65% of these accidents occurred less than five miles from home.

- Sheer Numbers -Baltimore spans ninety-two square miles, and over half a million people drive its roads, spending 28.9 minutes per day driving. In 2007, forty-one fatal car crashes were reported involving 105 people and fifty-five cars. The average speed was roughly 30 MPH.

- Popularity – Certain makes and years of cars are stolen with alarming regularity. This, too, makes rates go up, because insurance companies factor this into the premium along with other important points. If you don’t drive one of these cars, you might pay lesser auto insurance premiums.

- Proposed Law for Baltimore – The geographical area is one way Baltimore companies have of figuring rates. The proposed law will enable those living in suburban areas to get Baltimore insurance rates different from city dwellers.

Many drivers have wondered if a car’s color increases car insurance rates. Drivers of red cars are said to be speed demons and red cars are hit more often than cars of any other color. (For more information, read our “Do red cars cost more for car insurance coverage?“).

Rates are not affected by the color the vehicle, but by the owner’s driving record, the car’s safety features, and its geographical location.

Statistics cannot show any correlation between car color and driver performance. So get a red car if you like; just drive safely to keep your rates down.

Compare car insurance quotes from multiple companies for FREE with our zip code search!

Frequently Asked Questions

What are Baltimore auto insurance requirements?

Baltimore drivers must meet Maryland’s minimum coverage requirements of 20/40/15 for bodily injury and property damage.

What are the monthly Baltimore, MD car insurance rates by ZIP code?

Please check the monthly car insurance rates by ZIP code using our free search tool.

What are the average Baltimore, MD car insurance rates by company and city?

To find the average car insurance rates by company and city in Baltimore, please use our free quote tool.

What are the cheapest Baltimore, MD car insurance rates by credit score?

Your credit score can affect your car insurance rates. Find the cheapest rates by credit score using our tool.

How do Baltimore, MD car insurance rates compare to the top US metro car insurance rates?

Compare Baltimore car insurance rates to other top metro areas using our comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.