Compare New Mexico Car Insurance Rates [2024]

Drivers who compare New Mexico car insurance rates will find the best deals on car insurance coverage. All drivers in New Mexico must carry 25/50/10 of liability insurance, which costs an average of $38 per month. Drivers who choose full coverage in New Mexico will pay an average of $120 per month.

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Aug 26, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 26, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| New Mexico Summary Statistics | Details |

|---|---|

| Road Miles in State | 69,069 |

| Total Registered Vehicles | 1,760,197 |

| State Population | 2,095,428 |

| Most Popular Vehicle in State | Ford F-150 |

| Uninsured Drivers | 20.80% |

| Total Driving Related Deaths (2008 to 2017) | Speeding: 1,217 Drunk Driving: 1,090 |

| Average Annual Premiums | Liability: $488 Collision: $276 Comprehensive: $172 |

| Cheapest Provider | USAA |

- New Mexico requires drivers to have 25/50/10 liability car insurance

- Minimum liability insurance in New Mexico is an average of $38 per month

- New Mexico full coverage costs an average of $120 per month

If you want to get affordable New Mexico car insurance, the best way is to compare New Mexico car insurance rates. However, you will first need to decide what car insurance coverages you want besides the required minimums before you compare cheap car insurance.

To help you make decisions about your New Mexico car insurance policy, we cover everything from New Mexico car insurance requirements to the best companies. If you know what coverages you want, you can dive into finding cheap New Mexico car insurance at any time with our free quote comparison tool.

New Mexico Car Insurance Coverage and Rates

You spend hundreds each year on car insurance. This dent in your wallet is painful, which is why most people want to make sure they are paying for something worthwhile.How do you know what coverages and rates best fit your needs? The types of car insurance coverage can be overwhelming to sift through.Luckily, we’ve covered New Mexico’s coverages and rates, so that you can see how rates compare and what coverages best fit your needs.Let’s jump right into it!

New Mexico Minimum Coverage Requirements

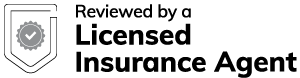

Is car insurance required in New Mexico? Yes, every state has different insurance coverage requirements and costs, as we can see below.

In New Mexico, drivers need bodily injury and property damage coverages. You need to have bodily injury and property damage insurance in the following MINIMUM amounts.- $25,000 for injuries per person in an accident

- $50,000 for total injuries per accident

- $10,000 for property damages caused by an accident

New Mexico also requires you to have uninsured motorist coverage, but you can opt out of this coverage. If you want to refuse uninsured motorist coverage, you will need to sign a form and give it to your insurance provider.Bear in mind, though, that uninsured motorist coverage is highly recommended, and we will cover the reasons why shortly.

Not having New Mexico’s minimum coverages is illegal and could result in fines, jail time, and license/registration suspension. As well, take note that these are the minimum coverages — many experts encourage drivers to purchase additional coverages in case of an accident.This is because once your insurer’s minimum coverage limits run out, you will have to pay the rest of the bills yourself.

Forms of Financial Responsibility

Anytime you are pulled over, register a car, or are in an accident, you must provide a form of financial responsibility. Financial responsibility forms prove that you are abiding by the law by having minimum auto insurance coverage. Acceptable forms of financial responsibility are:

- A current insurance ID card

- Copy of current auto insurance policy

- A letter from your auto insurance company verifying that you have auto insurance coverage

New Mexico also has an electronic verification system that tracks the insurance status of all vehicles registered in New Mexico. Officers can access this database whenever they pull you over. If you don’t have the proper insurance, New Mexico will suspend your car’s registration.

Learn more: How to Verify Car Insurance Coverage

Premiums as a Percentage of Income

Every year, you have a certain amount of money to spend or save after taxes — your per capita disposable income. In every state, the per capita disposable income is different.

New Mexico’s average per capita disposable income is $33,358. This means New Mexico residents have $2,779 to spend each month on living expenses — from groceries to car insurance.

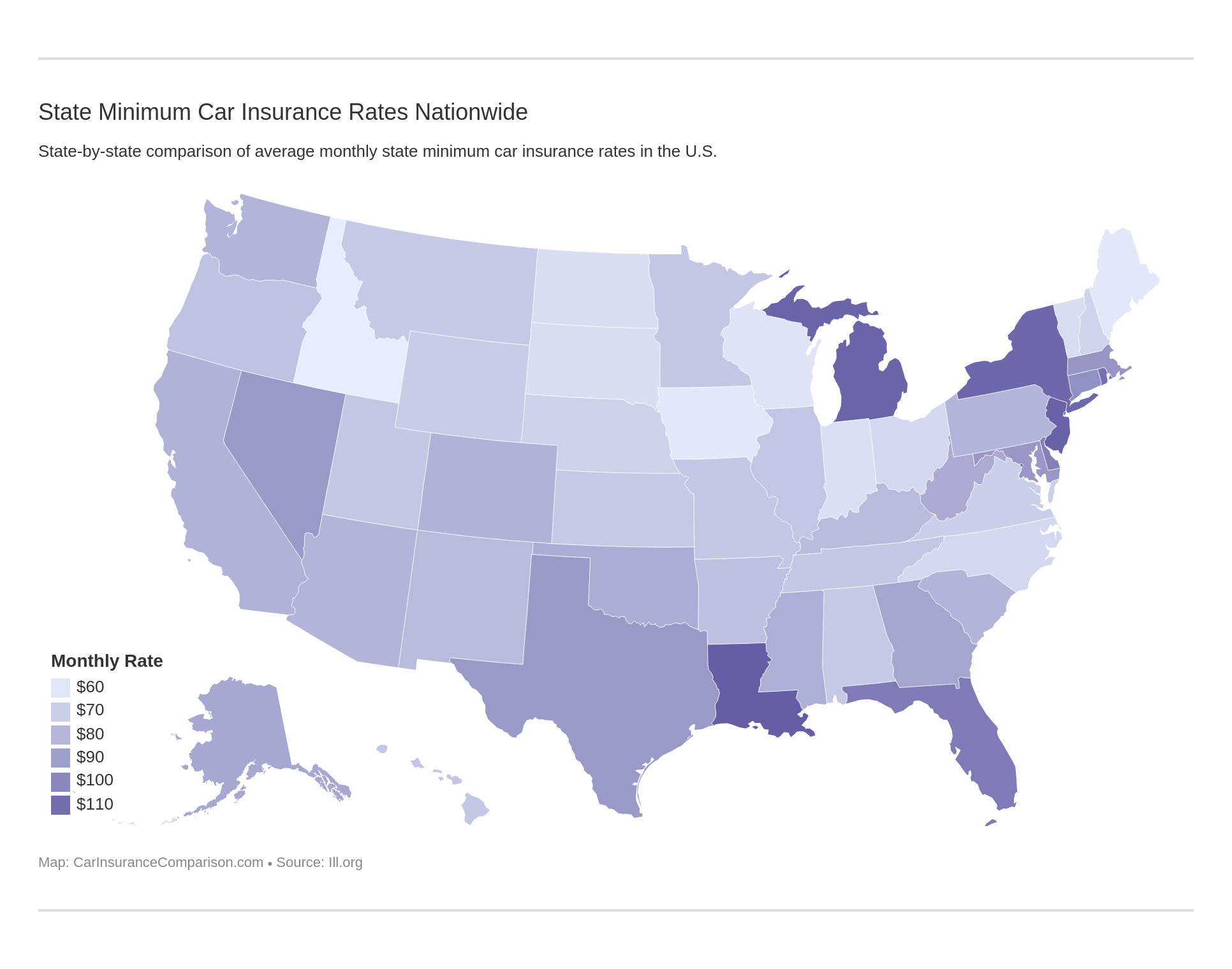

So how do these numbers factor into car insurance? Every year, New Mexico residents pay an average of $920 for car insurance (or $76 a month). This means $76 is deducted out of your monthly budget for car insurance.This number might make you wince a little, but New Mexico’s car insurance costs are actually slightly lower than the countywide insurance average of $981. In fact, the premium average is over a thousand in some states!

Average Annual Car Insurance Rates in NM (Liability, Collision, Comprehensive)

What coverages should you have? Some coverages, such as liability car insurance coverage, are required. A good insurance plan, though, has all three core coverages. We have listed the main coverages in New Mexico below.| Coverage | Average Annual Cost | Countrywide Average Annual Cost |

|---|---|---|

| Liability | $488 | $538 |

| Collision | $276 | $322 |

| Comprehensive | $172 | $148 |

| Annual Premium | $937 | $1,009 |

New Mexico’s core coverage costs are all lower than the countrywide average, which is good news.

Additional Liability Coverages in NM

The two main coverages that are frequently added onto insurance plans are Medpay and uninsured/underinsured coverages. Here’s why you should consider them.

- Medpay coverage covers yours and others’ medical costs in an accident, from ambulance rides to treatment.

- Uninsured/underinsured motorist coverage protects you if you are in an accident with an uninsured driver. If uninsured drivers are at fault, they won’t be able to pay off all the costs of an accident (unless you are extremely lucky).

Uninsured/underinsured coverage is one of the most important coverages you can get in New Mexico. Why? Because the state of New Mexico ranks as 3rd in the U.S. for its incredibly high number of uninsured drivers!

In New Mexico, 20 percent of the drivers on the road with you are uninsured, which is a high potential to be involved in risky accidents with uninsured drivers who can’t pay off accident costs!

Let’s take a look at these additional coverages’ loss ratios. Basically, a loss ratio shows how well a company is doing, and we want to see how well Medpay and uninsured/underinsured coverages are performing in New Mexico.

| Year | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medpay Loss Ratio | 75.02% | 73.52% | 68.39% |

| Uninsured/Underinsursured Loss Ratio | 74.82% | 73.12% | 66.18% |

Unfortunately, both coverages’ loss ratios have gone down slightly. Why is this bad?A low loss ratio means a company isn’t paying out enough claims, meaning you have less of a chance to receive claim approval. On the other hand, a high loss ratio that is over 100 percent means a company is paying out too many claims.

Companies that do this risk going bankrupt.Bottom line? Make sure to always check a company’s loss ratios, and make sure to have additional liability coverage if you live in New Mexico. All it takes is one accident to deplete your savings if you aren’t sufficiently protected!

Add-ons, Endorsements, and Riders

We’ve talked about required, core, and additional coverages. Let’s take a look at more additional insurance options — add-on protections. These extra options are affordable and allow you to pick and chose which protections work best for you.Below, we have listed some of the main add-ons that are available at insurers.

- GAP insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive Insurance

Add any of the above coverages for a customized insurance plan. These coverages are great for when you want just a little extra coverage or want a specific service (such as roadside assistance).

Average Monthly Car Insurance Rates by Age & Gender in NM

Did you know that rates are affected by various demographic factors? From where you live to your marital status, it all plays a role in how much insurers are charging you. We have partnered with Quadrant to bring you this information, which reveals significant factors in rates.

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,516.34 | $2,528.61 | $2,298.09 | $2,418.45 | $2,795.93 | $2,965.82 | $8,382.58 | $9,698.44 |

| Farmers Ins Co Of AZ | $2,404.81 | $2,396.01 | $2,152.83 | $2,295.21 | $2,703.37 | $2,790.84 | $9,750.62 | $10,025.51 |

| Geico General | $2,776.17 | $2,853.11 | $2,612.63 | $2,612.63 | $2,924.53 | $2,950.75 | $7,978.18 | $10,952.99 |

| AMCO Insurance | $2,405.85 | $2,446.69 | $2,185.49 | $2,293.80 | $2,714.96 | $2,908.12 | $5,818.94 | $7,338.72 |

| Progressive Direct | $1,666.84 | $1,613.98 | $1,510.13 | $1,515.71 | $2,017.17 | $2,087.52 | $6,833.07 | $7,700.89 |

| State Farm Mutual Auto | $1,523.13 | $1,523.13 | $1,383.93 | $1,383.93 | $1,704.41 | $1,881.32 | $4,131.10 | $5,189.28 |

| USAA | $1,530.57 | $1,520.66 | $1,459.73 | $1,455.56 | $1,891.06 | $2,025.18 | $3,987.84 | $4,506.45 |

The younger you are, the more you will pay! Insurers consider teenage drivers a higher risk because they are new drivers, which means insurance companies charge significantly MORE for younger drivers.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Geico General | Single 17-year old male | $10,952.99 |

| Farmers Ins Co Of AZ | Single 17-year old male | $10,025.51 |

| Farmers Ins Co Of AZ | Single 17-year old female | $9,750.62 |

| Allstate F&C | Single 17-year old male | $9,698.44 |

| Allstate F&C | Single 17-year old female | $8,382.58 |

| Geico General | Single 17-year old female | $7,978.18 |

| Progressive Direct | Single 17-year old male | $7,700.89 |

| AMCO Insurance | Single 17-year old male | $7,338.72 |

| Progressive Direct | Single 17-year old female | $6,833.07 |

| AMCO Insurance | Single 17-year old female | $5,818.94 |

| State Farm Mutual Auto | Single 17-year old male | $5,189.28 |

| USAA | Single 17-year old male | $4,506.45 |

| State Farm Mutual Auto | Single 17-year old female | $4,131.10 |

| USAA | Single 17-year old female | $3,987.84 |

| Allstate F&C | Single 25-year old male | $2,965.82 |

| Geico General | Single 25-year old male | $2,950.75 |

| Geico General | Single 25-year old female | $2,924.53 |

| AMCO Insurance | Single 25-year old male | $2,908.12 |

| Geico General | Married 35-year old male | $2,853.11 |

| Allstate F&C | Single 25-year old female | $2,795.93 |

| Farmers Ins Co Of AZ | Single 25-year old male | $2,790.84 |

| Geico General | Married 35-year old female | $2,776.17 |

| AMCO Insurance | Single 25-year old female | $2,714.96 |

| Farmers Ins Co Of AZ | Single 25-year old female | $2,703.37 |

| Geico General | Married 60-year old female | $2,612.63 |

| Geico General | Married 60-year old male | $2,612.63 |

| Allstate F&C | Married 35-year old male | $2,528.61 |

| Allstate F&C | Married 35-year old female | $2,516.34 |

| AMCO Insurance | Married 35-year old male | $2,446.69 |

| Allstate F&C | Married 60-year old male | $2,418.45 |

| AMCO Insurance | Married 35-year old female | $2,405.85 |

| Farmers Ins Co Of AZ | Married 35-year old female | $2,404.81 |

| Farmers Ins Co Of AZ | Married 35-year old male | $2,396.01 |

| Allstate F&C | Married 60-year old female | $2,298.09 |

| Farmers Ins Co Of AZ | Married 60-year old male | $2,295.21 |

| AMCO Insurance | Married 60-year old male | $2,293.80 |

| AMCO Insurance | Married 60-year old female | $2,185.49 |

| Farmers Ins Co Of AZ | Married 60-year old female | $2,152.83 |

| Progressive Direct | Single 25-year old male | $2,087.52 |

| USAA | Single 25-year old male | $2,025.18 |

| Progressive Direct | Single 25-year old female | $2,017.17 |

| USAA | Single 25-year old female | $1,891.06 |

| State Farm Mutual Auto | Single 25-year old male | $1,881.32 |

| State Farm Mutual Auto | Single 25-year old female | $1,704.41 |

| Progressive Direct | Married 35-year old female | $1,666.84 |

| Progressive Direct | Married 35-year old male | $1,613.98 |

| USAA | Married 35-year old female | $1,530.57 |

| State Farm Mutual Auto | Married 35-year old female | $1,523.13 |

| State Farm Mutual Auto | Married 35-year old male | $1,523.13 |

| USAA | Married 35-year old male | $1,520.66 |

| Progressive Direct | Married 60-year old male | $1,515.71 |

| Progressive Direct | Married 60-year old female | $1,510.13 |

| USAA | Married 60-year old female | $1,459.73 |

| USAA | Married 60-year old male | $1,455.56 |

| State Farm Mutual Auto | Married 60-year old female | $1,383.93 |

| State Farm Mutual Auto | Married 60-year old male | $1,383.93 |

Luckily, if parents add their children to the parents’ policy rather than making teenagers purchase insurance on their own, there isn’t such a dramatic jump in rates.

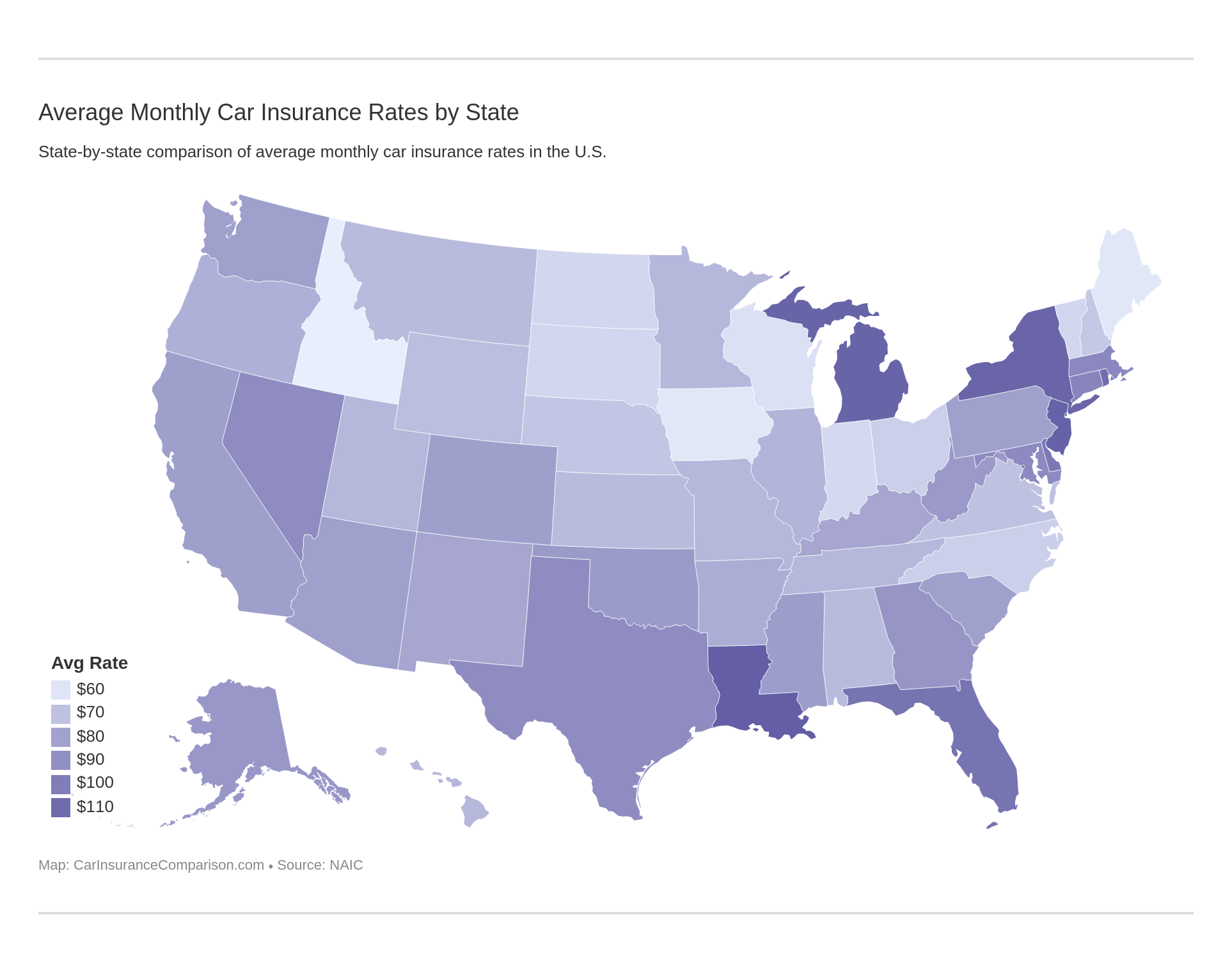

Car Insurance Rates by ZIP Code in New Mexico

The area you live in also plays a role in rates. Just like some places are more expensive when purchasing homes, car insurance rates vary from area to area.

Check the ZIP codes below to see the average cost in your area, as well as the average costs of different insurance providers.| Zipcode | Average Annual Rate | Allstate F&C Annual Rate | Farmers Ins Co Of AZ Annual Rate | Geico General Annual Rate | AMCO Insurance Annual Rate | Progressive Direct Annual Rate | State Farm Mutual Auto Annual Rate | USAA Annual Rate |

|---|---|---|---|---|---|---|---|---|

| 87121 | $4,364.29 | $4,712.16 | $5,171.07 | $6,113.48 | $4,380.45 | $4,109.77 | $3,277.27 | $2,785.85 |

| 87105 | $4,275.84 | $4,712.16 | $5,142.70 | $6,113.48 | $4,380.45 | $3,651.22 | $3,255.24 | $2,675.61 |

| 87102 | $4,184.38 | $4,532.86 | $5,171.07 | $6,113.48 | $3,947.10 | $3,906.61 | $3,047.06 | $2,572.49 |

| 87108 | $4,166.27 | $4,712.16 | $5,421.26 | $5,016.10 | $4,289.85 | $3,981.78 | $3,067.13 | $2,675.61 |

| 87022 | $4,154.37 | $4,712.16 | $5,142.70 | $6,113.48 | $4,097.95 | $3,389.71 | $2,838.74 | $2,785.85 |

| 87101 | $4,134.80 | $4,712.16 | $4,737.85 | $6,113.48 | $3,947.10 | $3,893.89 | $2,966.60 | $2,572.49 |

| 87115 | $4,078.29 | $4,712.16 | $5,390.85 | $5,136.33 | $4,097.95 | $3,643.18 | $2,988.08 | $2,579.51 |

| 87123 | $4,048.65 | $4,712.16 | $5,421.26 | $5,016.10 | $3,913.61 | $3,664.39 | $2,957.43 | $2,655.61 |

| 87112 | $4,021.69 | $4,532.86 | $5,421.26 | $5,016.10 | $3,923.38 | $3,659.48 | $2,997.99 | $2,600.80 |

| 87117 | $4,013.99 | $4,712.16 | $5,390.85 | $5,136.33 | $3,913.61 | $3,519.00 | $2,988.08 | $2,437.87 |

| 87104 | $4,013.24 | $4,532.86 | $5,171.07 | $5,016.10 | $3,947.10 | $3,678.47 | $3,071.50 | $2,675.61 |

| 87059 | $4,002.49 | $4,712.16 | $5,390.85 | $5,136.33 | $3,799.32 | $3,646.94 | $2,754.22 | $2,577.62 |

| 87107 | $3,999.83 | $4,532.86 | $5,194.38 | $5,016.10 | $3,926.21 | $3,652.29 | $3,009.02 | $2,667.96 |

| 87116 | $3,997.82 | $4,712.16 | $5,390.85 | $5,016.10 | $3,913.61 | $3,368.94 | $3,047.93 | $2,535.14 |

| 87106 | $3,997.74 | $4,532.86 | $5,138.18 | $5,016.10 | $3,840.75 | $3,845.12 | $3,038.71 | $2,572.49 |

| 87110 | $3,991.63 | $4,532.86 | $5,435.32 | $4,845.86 | $3,840.75 | $3,598.17 | $3,012.87 | $2,675.61 |

| 87122 | $3,988.31 | $4,532.86 | $5,405.50 | $4,845.86 | $3,936.97 | $3,489.12 | $3,145.66 | $2,562.23 |

| 87111 | $3,987.13 | $4,532.86 | $5,435.32 | $4,845.86 | $3,936.97 | $3,642.62 | $2,860.96 | $2,655.29 |

| 87008 | $3,979.48 | $4,712.16 | $5,390.85 | $5,136.33 | $3,799.32 | $3,467.33 | $2,772.71 | $2,577.62 |

| 87109 | $3,972.16 | $4,532.86 | $5,435.32 | $4,845.86 | $3,926.21 | $3,568.56 | $2,947.07 | $2,549.28 |

| 87131 | $3,964.89 | $4,154.87 | $5,138.18 | $5,016.10 | $3,840.75 | $4,061.14 | $2,966.60 | $2,576.63 |

| 87113 | $3,958.74 | $4,532.86 | $5,040.07 | $4,992.13 | $3,926.21 | $3,489.00 | $3,055.28 | $2,675.61 |

| 87002 | $3,949.58 | $4,462.11 | $5,141.18 | $5,136.33 | $4,097.95 | $3,683.98 | $2,590.28 | $2,535.21 |

| 87120 | $3,927.06 | $4,532.86 | $4,905.89 | $4,992.13 | $3,878.21 | $3,533.86 | $3,151.26 | $2,495.26 |

| 87068 | $3,922.38 | $4,712.16 | $5,141.18 | $5,136.33 | $4,097.95 | $3,298.14 | $2,601.49 | $2,469.42 |

| 87042 | $3,919.14 | $4,462.11 | $5,141.18 | $5,136.33 | $4,097.95 | $3,508.80 | $2,618.16 | $2,469.42 |

| 87031 | $3,893.50 | $4,462.11 | $5,141.18 | $5,136.33 | $4,097.95 | $3,286.79 | $2,594.93 | $2,535.21 |

| 87047 | $3,888.99 | $4,532.86 | $4,870.65 | $5,136.33 | $3,799.32 | $3,824.38 | $2,481.79 | $2,577.62 |

| 87114 | $3,865.66 | $4,234.52 | $4,888.31 | $4,992.13 | $3,878.21 | $3,545.69 | $2,941.26 | $2,579.51 |

| 87048 | $3,852.73 | $4,532.86 | $4,874.07 | $4,992.13 | $3,806.61 | $3,530.41 | $2,711.14 | $2,521.88 |

| 87004 | $3,813.92 | $4,532.86 | $5,020.59 | $5,136.33 | $3,824.68 | $3,244.81 | $2,437.14 | $2,501.07 |

| 87144 | $3,799.75 | $4,532.86 | $4,737.85 | $4,992.13 | $3,824.68 | $3,310.39 | $2,701.76 | $2,498.58 |

| 87015 | $3,798.72 | $4,532.86 | $4,666.36 | $5,136.33 | $3,799.32 | $3,336.01 | $2,571.67 | $2,548.45 |

| 87017 | $3,752.18 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,661.34 | $2,760.24 | $2,454.61 |

| 87043 | $3,751.22 | $4,282.80 | $5,020.59 | $5,136.33 | $3,799.32 | $3,045.79 | $2,519.11 | $2,454.61 |

| 87551 | $3,750.61 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,465.78 | $2,864.21 | $2,535.21 |

| 87124 | $3,742.33 | $4,234.52 | $4,737.85 | $4,992.13 | $3,806.61 | $3,247.14 | $2,746.25 | $2,431.82 |

| 87001 | $3,732.99 | $4,527.36 | $4,870.65 | $4,977.79 | $3,589.37 | $3,156.95 | $2,554.17 | $2,454.61 |

| 87012 | $3,725.45 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,648.78 | $2,585.69 | $2,454.61 |

| 87510 | $3,724.57 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,397.57 | $2,546.15 | $2,454.61 |

| 87508 | $3,716.45 | $4,527.36 | $4,498.20 | $4,698.56 | $3,605.15 | $3,574.22 | $2,507.25 | $2,604.45 |

| 87520 | $3,711.69 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,099.54 | $2,958.01 | $2,535.21 |

| 87506 | $3,711.43 | $4,449.53 | $4,498.20 | $4,698.56 | $3,626.70 | $3,579.27 | $2,516.17 | $2,611.60 |

| 87530 | $3,710.81 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,335.92 | $2,511.46 | $2,454.61 |

| 87531 | $3,710.66 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,272.28 | $2,546.15 | $2,482.54 |

| 87514 | $3,710.61 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,340.58 | $2,565.29 | $2,496.54 |

| 87072 | $3,709.52 | $4,532.86 | $4,498.20 | $4,977.79 | $3,589.37 | $3,359.62 | $2,554.17 | $2,454.61 |

| 87582 | $3,706.27 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,241.53 | $2,546.15 | $2,482.54 |

| 87527 | $3,705.56 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,272.82 | $2,509.89 | $2,482.54 |

| 87539 | $3,705.41 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,263.47 | $2,546.15 | $2,454.61 |

| 87581 | $3,702.24 | $4,323.72 | $4,498.20 | $4,977.79 | $3,773.90 | $3,279.72 | $2,607.74 | $2,454.61 |

| 87575 | $3,702.21 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,445.04 | $2,546.15 | $2,535.21 |

| 87548 | $3,701.31 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,241.53 | $2,511.46 | $2,482.54 |

| 87579 | $3,697.76 | $4,276.25 | $4,392.10 | $4,977.79 | $3,773.90 | $3,425.97 | $2,503.08 | $2,535.21 |

| 87511 | $3,696.89 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,241.53 | $2,480.48 | $2,482.54 |

| 87522 | $3,696.42 | $4,276.25 | $4,498.20 | $4,698.56 | $3,873.95 | $3,535.53 | $2,509.89 | $2,482.54 |

| 87537 | $3,694.94 | $4,323.72 | $4,498.20 | $4,977.79 | $3,873.95 | $3,218.69 | $2,489.69 | $2,482.54 |

| 87517 | $3,693.92 | $4,329.21 | $4,538.41 | $4,977.79 | $3,773.90 | $3,199.82 | $2,503.08 | $2,535.21 |

| 87064 | $3,693.66 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,465.78 | $2,546.15 | $2,454.61 |

| 87515 | $3,693.66 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,465.78 | $2,546.15 | $2,454.61 |

| 87516 | $3,693.66 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,465.78 | $2,546.15 | $2,454.61 |

| 87518 | $3,693.66 | $4,323.72 | $4,498.20 | $4,977.79 | $3,589.37 | $3,465.78 | $2,546.15 | $2,454.61 |

| 87529 | $3,692.25 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,199.82 | $2,538.87 | $2,535.21 |

| 87557 | $3,691.42 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,239.88 | $2,493.00 | $2,535.21 |

| 87571 | $3,688.03 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,164.46 | $2,583.34 | $2,496.54 |

| 87554 | $3,687.74 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,241.53 | $2,546.15 | $2,454.61 |

| 87576 | $3,687.14 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,199.82 | $2,503.08 | $2,535.21 |

| 87577 | $3,687.14 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,199.82 | $2,503.08 | $2,535.21 |

| 87525 | $3,681.62 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,199.82 | $2,503.08 | $2,496.54 |

| 87556 | $3,674.41 | $4,281.76 | $4,126.09 | $4,977.79 | $3,773.90 | $3,419.87 | $2,606.27 | $2,535.21 |

| 87549 | $3,672.76 | $4,276.25 | $4,498.20 | $4,977.79 | $3,773.90 | $3,210.93 | $2,489.69 | $2,482.54 |

| 87543 | $3,672.19 | $4,281.76 | $4,538.41 | $4,977.79 | $3,773.90 | $3,199.82 | $2,398.40 | $2,535.21 |

| 87521 | $3,670.38 | $4,281.76 | $4,392.10 | $4,977.79 | $3,773.90 | $3,341.76 | $2,390.10 | $2,535.21 |

| 87528 | $3,670.23 | $4,323.72 | $3,963.52 | $4,977.79 | $3,589.37 | $3,522.05 | $2,779.95 | $2,535.21 |

| 87535 | $3,669.52 | $4,527.36 | $4,498.20 | $4,698.56 | $3,817.21 | $3,046.60 | $2,550.29 | $2,548.45 |

| 87566 | $3,667.66 | $4,323.72 | $4,498.20 | $4,698.56 | $3,873.95 | $3,286.73 | $2,509.89 | $2,482.54 |

| 87507 | $3,666.97 | $4,277.30 | $4,498.20 | $4,698.56 | $3,664.97 | $3,307.37 | $2,610.79 | $2,611.60 |

| 87532 | $3,666.58 | $4,151.51 | $4,498.20 | $4,698.56 | $3,873.95 | $3,451.41 | $2,509.89 | $2,482.54 |

| 87567 | $3,666.53 | $4,151.51 | $4,498.20 | $4,698.56 | $3,873.95 | $3,441.03 | $2,390.87 | $2,611.60 |

| 87023 | $3,664.21 | $4,462.11 | $5,141.18 | $4,266.08 | $3,190.87 | $3,499.82 | $2,554.17 | $2,535.21 |

| 87578 | $3,663.47 | $4,323.72 | $4,498.20 | $4,698.56 | $3,873.95 | $3,221.15 | $2,546.15 | $2,482.54 |

| 87052 | $3,663.34 | $4,532.86 | $4,569.70 | $4,977.79 | $3,589.37 | $3,098.97 | $2,420.08 | $2,454.61 |

| 87044 | $3,657.76 | $4,532.86 | $4,185.72 | $4,977.79 | $3,589.37 | $3,309.83 | $2,554.17 | $2,454.61 |

| 87553 | $3,657.08 | $4,281.76 | $4,392.10 | $4,977.79 | $3,773.90 | $3,248.70 | $2,390.10 | $2,535.21 |

| 87501 | $3,656.08 | $4,277.30 | $4,498.20 | $4,698.56 | $3,626.70 | $3,330.44 | $2,549.80 | $2,611.60 |

| 87574 | $3,650.42 | $4,527.36 | $4,498.20 | $4,698.56 | $3,626.70 | $3,087.42 | $2,503.08 | $2,611.60 |

| 87041 | $3,647.70 | $4,532.86 | $4,498.20 | $4,977.79 | $3,589.37 | $3,105.04 | $2,376.03 | $2,454.61 |

| 87053 | $3,645.43 | $4,532.86 | $4,089.28 | $4,977.79 | $3,589.37 | $3,352.67 | $2,520.59 | $2,455.46 |

| 87580 | $3,645.09 | $4,281.76 | $4,126.09 | $4,977.79 | $3,773.90 | $3,356.47 | $2,503.08 | $2,496.54 |

| 87524 | $3,638.73 | $4,281.76 | $4,155.41 | $4,977.79 | $3,773.90 | $3,243.92 | $2,503.08 | $2,535.21 |

| 87564 | $3,637.87 | $4,281.76 | $4,126.09 | $4,977.79 | $3,773.90 | $3,180.87 | $2,589.48 | $2,535.21 |

| 87056 | $3,633.98 | $4,527.36 | $4,622.40 | $4,266.08 | $3,678.25 | $3,278.70 | $2,516.65 | $2,548.45 |

| 87558 | $3,633.30 | $4,281.76 | $4,126.09 | $4,977.79 | $3,773.90 | $3,199.82 | $2,538.50 | $2,535.21 |

| 87519 | $3,632.43 | $4,281.76 | $4,155.41 | $4,977.79 | $3,773.90 | $3,199.82 | $2,503.08 | $2,535.21 |

| 87505 | $3,631.62 | $4,277.30 | $4,498.20 | $4,698.56 | $3,605.15 | $3,142.72 | $2,587.77 | $2,611.60 |

| 87010 | $3,631.57 | $4,527.36 | $4,498.20 | $4,698.56 | $3,605.15 | $3,087.28 | $2,392.83 | $2,611.60 |

| 87512 | $3,629.09 | $4,281.76 | $4,126.09 | $4,977.79 | $3,773.90 | $3,199.82 | $2,509.02 | $2,535.21 |

| 87029 | $3,627.66 | $4,323.72 | $4,066.09 | $4,977.79 | $3,589.37 | $3,435.88 | $2,546.15 | $2,454.61 |

| 87024 | $3,607.64 | $4,532.86 | $4,089.28 | $4,977.79 | $3,589.37 | $3,023.73 | $2,585.87 | $2,454.61 |

| 87016 | $3,606.69 | $4,712.16 | $4,739.63 | $4,266.08 | $3,678.25 | $3,257.25 | $2,456.29 | $2,137.19 |

| 87540 | $3,605.26 | $4,401.56 | $4,321.45 | $4,698.56 | $3,605.15 | $3,095.41 | $2,503.08 | $2,611.60 |

| 87025 | $3,601.04 | $4,282.80 | $4,089.28 | $4,977.79 | $3,589.37 | $3,322.81 | $2,490.62 | $2,454.61 |

| 87009 | $3,593.18 | $4,712.16 | $4,739.63 | $4,266.08 | $3,678.25 | $3,237.79 | $2,381.13 | $2,137.19 |

| 87035 | $3,580.84 | $4,712.16 | $4,666.36 | $4,266.08 | $3,678.25 | $3,165.38 | $2,440.43 | $2,137.19 |

| 88240 | $3,577.38 | $4,173.18 | $4,729.34 | $4,444.38 | $3,744.20 | $3,359.89 | $2,399.34 | $2,191.30 |

| 87006 | $3,576.83 | $4,462.11 | $4,739.63 | $4,266.08 | $3,190.87 | $3,289.75 | $2,554.17 | $2,535.21 |

| 87083 | $3,573.04 | $4,532.86 | $4,498.20 | $4,266.08 | $3,589.37 | $3,116.01 | $2,554.17 | $2,454.61 |

| 87027 | $3,564.28 | $4,157.01 | $3,949.44 | $4,977.79 | $3,589.37 | $3,186.95 | $2,554.17 | $2,535.21 |

| 88230 | $3,554.80 | $4,220.63 | $4,459.91 | $4,444.38 | $3,739.34 | $3,255.09 | $2,438.83 | $2,325.43 |

| 87046 | $3,548.47 | $4,157.01 | $3,949.44 | $4,977.79 | $3,589.37 | $3,076.26 | $2,554.17 | $2,535.21 |

| 87063 | $3,537.91 | $4,208.36 | $4,739.63 | $4,266.08 | $3,678.25 | $3,305.88 | $2,429.97 | $2,137.19 |

| 88232 | $3,536.09 | $4,220.63 | $4,459.91 | $4,444.38 | $3,739.34 | $3,206.07 | $2,356.89 | $2,325.43 |

| 88256 | $3,535.19 | $4,220.63 | $4,690.75 | $4,444.38 | $3,739.34 | $3,040.68 | $2,481.95 | $2,128.64 |

| 87007 | $3,535.16 | $4,462.11 | $4,779.11 | $4,266.08 | $3,190.87 | $3,461.31 | $2,155.03 | $2,431.62 |

| 88264 | $3,533.93 | $4,173.18 | $4,729.34 | $4,444.38 | $3,744.20 | $3,114.40 | $2,381.13 | $2,150.85 |

| 88220 | $3,532.36 | $4,220.63 | $4,690.75 | $4,444.38 | $3,739.34 | $2,937.62 | $2,565.18 | $2,128.64 |

| 87573 | $3,532.07 | $4,154.87 | $4,498.20 | $4,266.08 | $3,817.21 | $3,469.81 | $2,381.13 | $2,137.19 |

| 88242 | $3,531.05 | $4,173.18 | $4,729.34 | $4,444.38 | $3,744.20 | $3,045.94 | $2,388.97 | $2,191.30 |

| 87538 | $3,529.15 | $4,208.36 | $4,381.39 | $4,266.08 | $3,817.21 | $3,512.67 | $2,381.13 | $2,137.19 |

| 87036 | $3,525.97 | $3,886.24 | $4,739.63 | $4,266.08 | $3,678.25 | $3,562.99 | $2,411.41 | $2,137.19 |

| 88253 | $3,524.49 | $4,220.63 | $4,459.91 | $4,444.38 | $3,739.34 | $3,161.02 | $2,320.76 | $2,325.43 |

| 87018 | $3,523.21 | $4,151.51 | $3,949.44 | $4,977.79 | $3,589.37 | $3,081.49 | $2,377.66 | $2,535.21 |

| 88260 | $3,521.66 | $4,173.18 | $4,729.34 | $4,444.38 | $3,744.20 | $3,071.81 | $2,297.41 | $2,191.30 |

| 87061 | $3,520.90 | $4,712.16 | $4,739.63 | $4,266.08 | $3,678.25 | $2,731.89 | $2,381.13 | $2,137.19 |

| 87013 | $3,520.12 | $4,282.80 | $4,089.28 | $4,977.79 | $3,400.48 | $3,189.63 | $2,269.24 | $2,431.62 |

| 88201 | $3,519.88 | $4,220.63 | $4,459.91 | $4,444.38 | $3,739.34 | $2,991.28 | $2,458.19 | $2,325.43 |

| 88262 | $3,517.08 | $4,173.18 | $4,613.58 | $4,444.38 | $3,744.20 | $3,071.81 | $2,381.13 | $2,191.30 |

| 87715 | $3,515.84 | $4,281.76 | $4,371.75 | $4,266.08 | $3,817.21 | $3,355.75 | $2,381.13 | $2,137.19 |

| 88265 | $3,515.75 | $4,173.18 | $4,729.34 | $4,444.38 | $3,744.20 | $2,987.13 | $2,381.13 | $2,150.85 |

| 88424 | $3,515.52 | $4,667.50 | $4,286.56 | $4,266.08 | $3,788.12 | $3,082.05 | $2,381.13 | $2,137.19 |

| 88254 | $3,508.61 | $4,220.63 | $4,720.06 | $4,444.38 | $3,739.34 | $2,926.11 | $2,381.13 | $2,128.64 |

| 87713 | $3,507.60 | $3,981.61 | $4,538.41 | $4,266.08 | $3,817.21 | $3,431.56 | $2,381.13 | $2,137.19 |

| 88255 | $3,507.60 | $4,220.63 | $4,690.75 | $4,444.38 | $3,739.34 | $2,926.11 | $2,381.13 | $2,150.85 |

| 87710 | $3,506.61 | $4,461.06 | $4,155.41 | $4,266.08 | $3,788.12 | $3,272.69 | $2,465.70 | $2,137.19 |

| 87040 | $3,506.57 | $4,336.31 | $5,006.13 | $4,266.08 | $3,190.87 | $3,159.95 | $2,155.03 | $2,431.62 |

| 88203 | $3,506.26 | $4,220.63 | $4,459.91 | $4,444.38 | $3,739.34 | $3,010.13 | $2,458.19 | $2,211.21 |

| 88231 | $3,504.75 | $4,173.18 | $4,729.34 | $4,444.38 | $3,744.20 | $2,863.98 | $2,427.30 | $2,150.85 |

| 88263 | $3,504.43 | $4,220.63 | $4,690.75 | $4,444.38 | $3,739.34 | $2,926.11 | $2,381.13 | $2,128.64 |

| 88268 | $3,504.43 | $4,220.63 | $4,690.75 | $4,444.38 | $3,739.34 | $2,926.11 | $2,381.13 | $2,128.64 |

| 87026 | $3,502.88 | $4,462.11 | $4,779.11 | $4,266.08 | $3,190.87 | $3,189.48 | $2,200.91 | $2,431.62 |

| 87038 | $3,502.66 | $4,336.31 | $4,779.11 | $4,266.08 | $3,190.87 | $3,359.62 | $2,155.03 | $2,431.62 |

| 87714 | $3,501.22 | $4,461.06 | $4,155.41 | $4,266.08 | $3,788.12 | $3,286.90 | $2,413.79 | $2,137.19 |

| 88439 | $3,499.53 | $4,160.91 | $4,410.71 | $4,266.08 | $3,817.21 | $3,323.46 | $2,381.13 | $2,137.19 |

| 87732 | $3,497.38 | $4,109.56 | $4,361.66 | $4,266.08 | $3,817.21 | $3,348.05 | $2,441.91 | $2,137.19 |

| 88418 | $3,496.57 | $4,461.06 | $4,286.56 | $4,266.08 | $3,788.12 | $3,155.85 | $2,381.13 | $2,137.19 |

| 87552 | $3,496.36 | $4,154.87 | $4,381.39 | $4,266.08 | $3,817.21 | $3,294.79 | $2,422.96 | $2,137.19 |

| 87562 | $3,494.87 | $4,208.36 | $4,381.39 | $4,266.08 | $3,817.21 | $3,272.69 | $2,381.13 | $2,137.19 |

| 87569 | $3,494.87 | $4,208.36 | $4,381.39 | $4,266.08 | $3,817.21 | $3,272.69 | $2,381.13 | $2,137.19 |

| 87749 | $3,494.53 | $4,461.06 | $4,155.41 | $4,266.08 | $3,788.12 | $3,272.69 | $2,381.13 | $2,137.19 |

| 87729 | $3,493.43 | $4,461.06 | $4,155.41 | $4,266.08 | $3,788.12 | $3,265.02 | $2,381.13 | $2,137.19 |

| 88422 | $3,489.24 | $4,461.06 | $4,286.56 | $4,266.08 | $3,788.12 | $3,104.50 | $2,381.13 | $2,137.19 |

| 88213 | $3,486.50 | $4,173.18 | $4,613.58 | $4,444.38 | $3,744.20 | $2,898.20 | $2,381.13 | $2,150.85 |

| 87711 | $3,486.21 | $4,208.36 | $4,381.39 | $4,266.08 | $3,817.21 | $3,212.06 | $2,381.13 | $2,137.19 |

| 88419 | $3,478.48 | $4,333.11 | $4,155.41 | $4,266.08 | $3,788.12 | $3,288.30 | $2,381.13 | $2,137.19 |

| 88252 | $3,478.11 | $4,173.18 | $4,729.34 | $4,444.38 | $3,744.20 | $2,819.22 | $2,285.59 | $2,150.85 |

| 88267 | $3,475.02 | $4,173.18 | $4,613.58 | $4,444.38 | $3,744.20 | $2,874.06 | $2,324.88 | $2,150.85 |

| 88436 | $3,474.93 | $4,495.31 | $4,286.56 | $4,266.08 | $3,788.12 | $2,970.12 | $2,381.13 | $2,137.19 |

| 87723 | $3,470.06 | $3,981.61 | $4,361.66 | $4,266.08 | $3,817.21 | $3,272.69 | $2,453.93 | $2,137.19 |

| 87560 | $3,469.18 | $4,029.07 | $4,381.39 | $4,266.08 | $3,817.21 | $3,338.95 | $2,314.38 | $2,137.19 |

| 88415 | $3,469.12 | $4,495.31 | $4,286.56 | $4,266.08 | $3,788.12 | $2,898.75 | $2,411.80 | $2,137.19 |

| 87736 | $3,466.92 | $3,981.61 | $4,381.39 | $4,266.08 | $3,817.21 | $3,272.69 | $2,412.26 | $2,137.19 |

| 88430 | $3,464.99 | $4,495.31 | $4,140.03 | $4,266.08 | $3,788.12 | $3,047.05 | $2,381.13 | $2,137.19 |

| 87712 | $3,462.47 | $3,981.61 | $4,381.39 | $4,266.08 | $3,817.21 | $3,272.69 | $2,381.13 | $2,137.19 |

| 87728 | $3,462.20 | $4,461.06 | $4,155.41 | $4,266.08 | $3,788.12 | $3,046.44 | $2,381.13 | $2,137.19 |

| 87724 | $3,457.51 | $4,208.36 | $4,381.39 | $4,266.08 | $3,817.21 | $3,011.19 | $2,381.13 | $2,137.19 |

| 87742 | $3,456.82 | $3,981.61 | $4,381.39 | $4,266.08 | $3,817.21 | $3,233.09 | $2,381.13 | $2,137.19 |

| 88410 | $3,456.70 | $4,495.31 | $4,140.03 | $4,266.08 | $3,788.12 | $2,989.04 | $2,381.13 | $2,137.19 |

| 88433 | $3,455.36 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $3,272.69 | $2,381.13 | $2,137.19 |

| 87731 | $3,454.92 | $4,154.87 | $4,381.39 | $4,266.08 | $3,817.21 | $3,260.17 | $2,167.53 | $2,137.19 |

| 87730 | $3,454.78 | $4,160.91 | $4,286.56 | $4,266.08 | $3,788.12 | $3,163.47 | $2,381.13 | $2,137.19 |

| 87747 | $3,453.90 | $4,461.06 | $4,155.41 | $4,266.08 | $3,788.12 | $2,911.84 | $2,457.60 | $2,137.19 |

| 87014 | $3,452.84 | $4,462.11 | $4,779.11 | $4,266.08 | $3,190.87 | $2,885.02 | $2,155.03 | $2,431.62 |

| 88114 | $3,452.13 | $4,173.18 | $4,315.88 | $4,444.38 | $3,744.20 | $2,955.26 | $2,381.13 | $2,150.85 |

| 87746 | $3,450.19 | $4,160.91 | $4,296.21 | $4,266.08 | $3,788.12 | $3,121.70 | $2,381.13 | $2,137.19 |

| 87701 | $3,450.08 | $4,029.07 | $4,381.39 | $4,266.08 | $3,817.21 | $3,366.85 | $2,152.77 | $2,137.19 |

| 88134 | $3,448.70 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $3,226.09 | $2,381.13 | $2,137.19 |

| 87735 | $3,448.47 | $4,109.56 | $4,155.41 | $4,266.08 | $3,817.21 | $3,272.69 | $2,381.13 | $2,137.19 |

| 88421 | $3,447.45 | $4,160.91 | $4,149.68 | $4,266.08 | $3,817.21 | $3,219.93 | $2,381.13 | $2,137.19 |

| 87743 | $3,445.89 | $4,160.91 | $4,296.21 | $4,266.08 | $3,788.12 | $3,091.60 | $2,381.13 | $2,137.19 |

| 87733 | $3,445.46 | $4,160.91 | $4,140.03 | $4,266.08 | $3,788.12 | $3,093.65 | $2,532.23 | $2,137.19 |

| 87070 | $3,444.11 | $4,532.86 | $4,381.39 | $4,266.08 | $3,678.25 | $2,731.89 | $2,381.13 | $2,137.19 |

| 88123 | $3,442.86 | $4,220.63 | $4,315.88 | $4,266.08 | $3,529.71 | $3,249.41 | $2,381.13 | $2,137.19 |

| 87722 | $3,440.41 | $3,981.61 | $4,155.41 | $4,266.08 | $3,817.21 | $3,344.20 | $2,381.13 | $2,137.19 |

| 88210 | $3,440.01 | $4,220.63 | $4,459.91 | $4,444.38 | $3,739.34 | $2,831.25 | $2,233.69 | $2,150.85 |

| 87062 | $3,439.65 | $4,336.31 | $4,739.63 | $4,266.08 | $3,190.87 | $3,355.58 | $2,051.88 | $2,137.19 |

| 87565 | $3,439.47 | $4,029.07 | $4,381.39 | $4,266.08 | $3,817.21 | $3,138.90 | $2,306.41 | $2,137.19 |

| 88122 | $3,437.11 | $4,220.63 | $4,315.88 | $4,266.08 | $3,529.71 | $3,209.18 | $2,381.13 | $2,137.19 |

| 88431 | $3,436.99 | $4,160.91 | $4,149.68 | $4,266.08 | $3,817.21 | $3,146.73 | $2,381.13 | $2,137.19 |

| 88427 | $3,436.72 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $3,142.17 | $2,381.13 | $2,137.19 |

| 88136 | $3,434.49 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $3,126.58 | $2,381.13 | $2,137.19 |

| 87750 | $3,433.71 | $3,981.61 | $4,410.71 | $4,266.08 | $3,817.21 | $3,042.01 | $2,381.13 | $2,137.19 |

| 87753 | $3,433.01 | $3,981.61 | $4,175.13 | $4,266.08 | $3,817.21 | $3,272.69 | $2,381.13 | $2,137.19 |

| 88435 | $3,431.92 | $4,160.91 | $4,381.39 | $4,266.08 | $3,817.21 | $2,974.80 | $2,285.85 | $2,137.19 |

| 87718 | $3,429.72 | $4,461.06 | $4,155.41 | $4,266.08 | $3,773.90 | $2,833.23 | $2,381.13 | $2,137.19 |

| 88321 | $3,427.42 | $4,208.36 | $4,381.39 | $4,266.08 | $3,678.25 | $2,939.55 | $2,381.13 | $2,137.19 |

| 87745 | $3,426.37 | $3,981.61 | $4,381.39 | $4,266.08 | $3,817.21 | $3,114.81 | $2,286.27 | $2,137.19 |

| 87734 | $3,425.93 | $3,981.61 | $4,175.13 | $4,266.08 | $3,817.21 | $3,223.15 | $2,381.13 | $2,137.19 |

| 88414 | $3,425.42 | $4,333.11 | $4,155.41 | $4,266.08 | $3,788.12 | $2,916.89 | $2,381.13 | $2,137.19 |

| 88426 | $3,419.96 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $3,051.79 | $2,354.25 | $2,137.19 |

| 87752 | $3,419.45 | $3,981.61 | $4,175.13 | $4,266.08 | $3,817.21 | $3,177.79 | $2,381.13 | $2,137.19 |

| 87740 | $3,417.77 | $4,333.11 | $4,155.41 | $4,266.08 | $3,788.12 | $2,903.14 | $2,341.35 | $2,137.19 |

| 88126 | $3,417.29 | $4,173.18 | $4,315.88 | $4,266.08 | $3,529.71 | $2,999.15 | $2,381.13 | $2,255.88 |

| 88417 | $3,414.14 | $4,160.91 | $4,149.68 | $4,266.08 | $3,817.21 | $2,986.73 | $2,381.13 | $2,137.19 |

| 87028 | $3,411.15 | $4,336.31 | $4,739.63 | $4,266.08 | $3,190.87 | $3,292.65 | $1,915.32 | $2,137.19 |

| 88125 | $3,410.51 | $4,173.18 | $4,315.88 | $4,266.08 | $3,529.71 | $2,951.71 | $2,381.13 | $2,255.88 |

| 87051 | $3,410.17 | $4,336.31 | $4,121.73 | $4,266.08 | $3,400.48 | $3,159.95 | $2,155.03 | $2,431.62 |

| 88121 | $3,406.79 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $2,932.66 | $2,381.13 | $2,137.19 |

| 88434 | $3,404.02 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $2,913.28 | $2,381.13 | $2,137.19 |

| 88401 | $3,402.41 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $2,889.23 | $2,393.93 | $2,137.19 |

| 87823 | $3,402.30 | $4,336.31 | $4,739.63 | $4,266.08 | $3,190.87 | $3,247.99 | $1,915.32 | $2,119.91 |

| 88119 | $3,401.83 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $2,866.68 | $2,412.46 | $2,137.19 |

| 87049 | $3,401.32 | $4,336.31 | $4,121.73 | $4,266.08 | $3,400.48 | $3,159.95 | $2,093.06 | $2,431.62 |

| 88416 | $3,401.14 | $3,838.79 | $4,140.03 | $4,266.08 | $3,817.21 | $3,227.52 | $2,381.13 | $2,137.19 |

| 88343 | $3,400.16 | $4,220.63 | $4,459.91 | $4,266.08 | $3,304.95 | $3,031.21 | $2,381.13 | $2,137.19 |

| 87365 | $3,399.22 | $4,157.01 | $4,121.73 | $4,212.52 | $3,589.37 | $3,159.95 | $2,155.03 | $2,398.90 |

| 88411 | $3,395.42 | $4,173.18 | $4,140.03 | $4,266.08 | $3,817.21 | $2,858.67 | $2,375.56 | $2,137.19 |

| 88133 | $3,393.89 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $3,129.87 | $2,381.13 | $2,137.19 |

| 88124 | $3,393.52 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,961.13 | $2,428.64 | $2,255.88 |

| 88113 | $3,388.51 | $4,173.18 | $4,315.88 | $4,266.08 | $3,529.71 | $2,797.71 | $2,381.13 | $2,255.88 |

| 88135 | $3,385.34 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,952.76 | $2,379.74 | $2,255.88 |

| 88318 | $3,381.31 | $3,838.79 | $3,976.66 | $4,266.08 | $3,678.25 | $3,299.19 | $2,473.03 | $2,137.19 |

| 87831 | $3,381.13 | $4,336.31 | $4,739.63 | $4,266.08 | $3,190.87 | $3,082.49 | $1,915.32 | $2,137.19 |

| 88118 | $3,379.69 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,992.20 | $2,419.45 | $2,137.19 |

| 87357 | $3,376.70 | $4,336.31 | $4,083.14 | $4,266.08 | $3,190.87 | $3,159.95 | $2,168.93 | $2,431.62 |

| 87325 | $3,376.32 | $4,157.01 | $4,083.14 | $4,212.52 | $3,589.37 | $3,056.83 | $2,105.40 | $2,429.99 |

| 87034 | $3,374.60 | $4,336.31 | $4,121.73 | $4,266.08 | $3,190.87 | $3,159.95 | $2,115.62 | $2,431.62 |

| 87328 | $3,374.19 | $4,157.01 | $4,083.14 | $4,212.52 | $3,589.37 | $3,007.13 | $2,140.16 | $2,429.99 |

| 87347 | $3,371.39 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,155.03 | $2,431.62 |

| 87322 | $3,366.72 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,155.03 | $2,398.90 |

| 87319 | $3,366.06 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,117.71 | $2,431.62 |

| 87375 | $3,363.95 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,104.54 | $2,429.99 |

| 87311 | $3,363.72 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,101.34 | $2,431.62 |

| 87323 | $3,363.44 | $4,282.80 | $4,121.73 | $4,212.52 | $3,589.37 | $2,814.35 | $2,091.71 | $2,431.62 |

| 87326 | $3,363.43 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,099.31 | $2,431.62 |

| 87316 | $3,362.57 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,093.26 | $2,431.62 |

| 87547 | $3,359.91 | $4,277.30 | $4,498.20 | $4,102.11 | $3,456.48 | $2,875.90 | $2,051.05 | $2,258.31 |

| 87005 | $3,358.18 | $4,157.01 | $4,121.73 | $4,266.08 | $3,400.48 | $3,074.30 | $2,056.04 | $2,431.62 |

| 87317 | $3,357.10 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $3,159.95 | $2,087.69 | $2,398.90 |

| 87021 | $3,355.45 | $4,336.31 | $4,121.73 | $4,266.08 | $3,400.48 | $2,875.88 | $2,056.04 | $2,431.62 |

| 88120 | $3,354.00 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,850.69 | $2,381.13 | $2,137.19 |

| 87544 | $3,352.46 | $4,277.30 | $4,498.20 | $4,102.11 | $3,456.48 | $2,875.90 | $2,046.76 | $2,210.51 |

| 88112 | $3,352.14 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,837.63 | $2,381.13 | $2,137.19 |

| 88132 | $3,349.46 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,652.69 | $2,428.64 | $2,255.88 |

| 87455 | $3,346.97 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $3,247.47 | $2,271.81 | $2,429.99 |

| 87011 | $3,346.80 | $4,527.36 | $4,320.99 | $4,266.08 | $3,190.87 | $3,069.79 | $1,915.32 | $2,137.19 |

| 88116 | $3,343.47 | $4,220.63 | $4,140.03 | $4,266.08 | $3,529.71 | $2,610.86 | $2,381.13 | $2,255.88 |

| 88250 | $3,343.26 | $4,220.63 | $4,459.91 | $4,444.38 | $2,870.59 | $2,875.32 | $2,381.13 | $2,150.85 |

| 87310 | $3,343.15 | $4,157.01 | $4,083.14 | $4,212.52 | $3,589.37 | $2,804.31 | $2,125.71 | $2,429.99 |

| 87461 | $3,342.77 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $3,247.47 | $2,242.43 | $2,429.99 |

| 87320 | $3,340.72 | $4,157.01 | $4,083.14 | $4,212.52 | $3,589.37 | $2,834.24 | $2,078.75 | $2,429.99 |

| 87045 | $3,340.29 | $4,157.01 | $4,083.14 | $4,212.52 | $3,589.37 | $2,848.86 | $2,059.51 | $2,431.62 |

| 87321 | $3,340.25 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $2,962.09 | $2,134.90 | $2,431.62 |

| 87313 | $3,338.44 | $4,157.01 | $4,121.73 | $4,212.52 | $3,589.37 | $2,704.56 | $2,048.65 | $2,535.21 |

| 87828 | $3,338.42 | $4,014.18 | $4,739.63 | $4,266.08 | $3,190.87 | $3,105.66 | $1,915.32 | $2,137.19 |

| 87315 | $3,337.93 | $4,336.31 | $4,083.14 | $4,266.08 | $3,190.87 | $2,902.43 | $2,155.03 | $2,431.62 |

| 87364 | $3,335.30 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $3,247.47 | $2,190.15 | $2,429.99 |

| 88101 | $3,328.33 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,756.86 | $2,375.02 | $2,057.45 |

| 87801 | $3,319.20 | $4,208.36 | $4,517.76 | $4,266.08 | $3,190.87 | $3,042.39 | $1,889.03 | $2,119.91 |

| 88350 | $3,312.94 | $4,220.63 | $3,947.36 | $4,444.38 | $2,870.59 | $3,512.67 | $1,915.32 | $2,279.61 |

| 87419 | $3,309.45 | $4,151.51 | $3,828.47 | $4,212.52 | $3,589.37 | $2,799.27 | $2,155.03 | $2,429.99 |

| 87312 | $3,308.59 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $2,720.32 | $2,155.03 | $2,431.62 |

| 87305 | $3,306.49 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $2,750.62 | $2,110.03 | $2,431.62 |

| 87020 | $3,305.59 | $4,157.01 | $4,121.73 | $4,266.08 | $3,400.48 | $2,706.14 | $2,056.04 | $2,431.62 |

| 88130 | $3,305.22 | $4,173.18 | $4,140.03 | $4,266.08 | $3,529.71 | $2,517.82 | $2,410.11 | $2,099.61 |

| 88351 | $3,300.97 | $3,886.24 | $4,101.72 | $4,266.08 | $3,304.95 | $3,029.48 | $2,381.13 | $2,137.19 |

| 87301 | $3,299.46 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $2,750.62 | $2,093.52 | $2,398.90 |

| 87825 | $3,298.12 | $4,462.11 | $4,121.73 | $4,266.08 | $3,190.87 | $2,861.42 | $2,064.69 | $2,119.91 |

| 87327 | $3,297.93 | $4,157.01 | $4,083.14 | $4,212.52 | $3,400.48 | $2,737.34 | $2,063.36 | $2,431.62 |

| 88324 | $3,292.85 | $3,886.24 | $3,947.36 | $4,266.08 | $3,304.95 | $3,189.65 | $2,381.13 | $2,074.53 |

| 88338 | $3,290.95 | $3,838.79 | $3,947.36 | $4,266.08 | $3,304.95 | $3,161.15 | $2,381.13 | $2,137.19 |

| 87412 | $3,290.21 | $4,151.51 | $3,828.47 | $4,212.52 | $3,589.37 | $2,664.58 | $2,155.03 | $2,429.99 |

| 87827 | $3,289.37 | $4,014.18 | $4,083.14 | $4,266.08 | $3,190.87 | $3,436.08 | $1,915.32 | $2,119.91 |

| 87413 | $3,288.51 | $4,151.51 | $3,828.47 | $4,212.52 | $3,281.52 | $2,898.63 | $2,226.38 | $2,420.50 |

| 87037 | $3,287.01 | $3,886.24 | $3,828.47 | $4,212.52 | $3,249.38 | $3,247.47 | $2,155.03 | $2,429.99 |

| 87416 | $3,286.20 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $2,876.81 | $2,217.10 | $2,429.99 |

| 88346 | $3,284.31 | $3,886.24 | $3,947.36 | $4,266.08 | $3,304.95 | $3,266.61 | $2,244.38 | $2,074.53 |

| 88336 | $3,280.77 | $3,886.24 | $3,947.36 | $4,266.08 | $3,304.95 | $3,042.45 | $2,381.13 | $2,137.19 |

| 87410 | $3,279.58 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $2,839.85 | $2,217.19 | $2,420.50 |

| 87418 | $3,277.89 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $2,880.72 | $2,155.03 | $2,429.99 |

| 87420 | $3,276.36 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $2,868.16 | $2,156.89 | $2,429.99 |

| 87402 | $3,274.88 | $4,157.01 | $3,828.47 | $4,212.52 | $3,249.38 | $2,907.33 | $2,176.37 | $2,393.05 |

| 87417 | $3,267.89 | $4,157.01 | $3,828.47 | $4,212.52 | $3,249.38 | $2,815.70 | $2,182.15 | $2,429.99 |

| 88342 | $3,263.06 | $4,220.63 | $4,180.65 | $4,266.08 | $2,859.49 | $3,512.67 | $1,915.32 | $1,886.57 |

| 87421 | $3,256.32 | $4,157.01 | $3,828.47 | $4,212.52 | $3,281.52 | $2,682.23 | $2,202.52 | $2,429.99 |

| 87832 | $3,255.21 | $3,886.24 | $4,320.99 | $4,266.08 | $3,190.87 | $3,069.79 | $1,915.32 | $2,137.19 |

| 88349 | $3,252.14 | $4,220.63 | $3,654.29 | $4,266.08 | $2,870.59 | $3,512.67 | $1,915.32 | $2,325.43 |

| 87829 | $3,250.90 | $4,014.18 | $4,083.14 | $4,266.08 | $3,190.87 | $3,044.12 | $2,038.01 | $2,119.91 |

| 88325 | $3,250.56 | $4,220.63 | $3,654.29 | $4,266.08 | $2,859.49 | $3,512.67 | $1,915.32 | $2,325.43 |

| 88348 | $3,250.17 | $3,886.24 | $3,947.36 | $4,266.08 | $3,304.95 | $2,909.59 | $2,299.75 | $2,137.19 |

| 88345 | $3,249.71 | $3,886.24 | $3,947.36 | $4,266.08 | $3,304.95 | $3,004.77 | $2,264.02 | $2,074.53 |

| 88323 | $3,249.33 | $3,838.79 | $3,947.36 | $4,266.08 | $3,304.95 | $2,869.84 | $2,381.13 | $2,137.19 |

| 87415 | $3,245.76 | $4,029.07 | $3,828.47 | $4,212.52 | $3,249.38 | $2,767.58 | $2,212.82 | $2,420.50 |

| 87821 | $3,244.88 | $4,014.18 | $3,861.40 | $4,266.08 | $3,190.87 | $3,346.37 | $1,915.32 | $2,119.91 |

| 88312 | $3,244.31 | $3,838.79 | $3,947.36 | $4,266.08 | $3,304.95 | $2,997.11 | $2,281.33 | $2,074.53 |

| 88341 | $3,240.99 | $3,886.24 | $3,947.36 | $4,266.08 | $3,304.95 | $2,763.96 | $2,381.13 | $2,137.19 |

| 87401 | $3,231.15 | $4,157.01 | $3,828.47 | $4,212.52 | $3,249.38 | $2,566.04 | $2,184.14 | $2,420.50 |

| 88316 | $3,228.63 | $3,838.79 | $3,947.36 | $4,266.08 | $3,304.95 | $2,821.88 | $2,284.16 | $2,137.19 |

| 88024 | $3,225.07 | $3,886.24 | $4,180.65 | $3,887.86 | $2,942.89 | $3,285.32 | $2,263.88 | $2,128.64 |

| 88301 | $3,220.80 | $3,838.79 | $3,947.36 | $4,266.08 | $3,304.95 | $2,842.91 | $2,208.33 | $2,137.19 |

| 87830 | $3,219.75 | $3,966.72 | $3,900.01 | $4,266.08 | $3,190.87 | $3,108.29 | $1,986.37 | $2,119.91 |

| 87933 | $3,214.85 | $3,886.24 | $4,185.68 | $4,266.08 | $3,022.65 | $3,090.77 | $1,915.32 | $2,137.19 |

| 88339 | $3,214.75 | $4,220.63 | $3,947.36 | $4,266.08 | $2,870.59 | $2,842.86 | $2,030.32 | $2,325.43 |

| 87820 | $3,213.50 | $3,966.72 | $3,928.95 | $4,266.08 | $3,190.87 | $3,106.64 | $1,915.32 | $2,119.91 |

| 88081 | $3,211.13 | $3,886.24 | $4,180.65 | $3,887.86 | $2,942.89 | $3,101.13 | $2,350.50 | $2,128.64 |

| 88340 | $3,207.96 | $3,886.24 | $3,947.36 | $4,266.08 | $3,304.95 | $2,939.58 | $1,982.85 | $2,128.64 |

| 87824 | $3,204.10 | $3,966.72 | $3,900.01 | $4,266.08 | $3,190.87 | $3,069.79 | $1,915.32 | $2,119.91 |

| 88008 | $3,199.10 | $3,886.24 | $4,180.65 | $3,887.86 | $2,942.89 | $2,926.06 | $2,441.40 | $2,128.64 |

| 88063 | $3,188.98 | $3,886.24 | $4,208.76 | $3,887.86 | $2,942.89 | $2,830.28 | $2,438.21 | $2,128.64 |

| 87943 | $3,184.65 | $3,886.24 | $3,902.96 | $4,266.08 | $3,022.65 | $3,162.09 | $1,915.32 | $2,137.19 |

| 88344 | $3,177.56 | $4,220.63 | $3,947.36 | $4,266.08 | $2,870.59 | $2,743.34 | $1,915.32 | $2,279.61 |

| 88347 | $3,175.44 | $4,220.63 | $3,947.36 | $4,266.08 | $2,870.59 | $2,682.67 | $1,915.32 | $2,325.43 |

| 88028 | $3,173.98 | $3,838.79 | $3,900.01 | $4,266.08 | $3,022.65 | $3,087.42 | $1,983.01 | $2,119.91 |

| 88039 | $3,173.68 | $3,966.72 | $3,900.01 | $4,266.08 | $3,022.65 | $3,025.10 | $1,915.32 | $2,119.91 |

| 87930 | $3,173.20 | $3,838.79 | $3,784.79 | $4,266.08 | $3,022.65 | $3,247.56 | $1,915.32 | $2,137.19 |

| 88055 | $3,171.09 | $3,886.24 | $3,900.01 | $4,266.08 | $3,022.65 | $3,087.42 | $1,915.32 | $2,119.91 |

| 88052 | $3,170.58 | $3,886.24 | $4,180.65 | $3,887.86 | $2,864.06 | $2,982.72 | $2,263.88 | $2,128.64 |

| 88036 | $3,167.20 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $3,087.42 | $1,915.32 | $2,137.19 |

| 88021 | $3,166.16 | $3,886.24 | $4,180.65 | $3,887.86 | $2,942.89 | $2,742.71 | $2,394.15 | $2,128.64 |

| 87940 | $3,165.29 | $3,886.24 | $4,200.35 | $3,887.86 | $3,022.65 | $2,869.09 | $2,162.21 | $2,128.64 |

| 88051 | $3,164.31 | $3,838.79 | $3,900.01 | $4,266.08 | $3,022.65 | $3,087.42 | $1,915.32 | $2,119.91 |

| 88038 | $3,164.01 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $3,087.42 | $1,910.27 | $2,119.91 |

| 88354 | $3,162.74 | $4,220.63 | $3,947.36 | $4,266.08 | $2,870.59 | $2,593.77 | $1,915.32 | $2,325.43 |

| 88032 | $3,161.79 | $3,886.24 | $4,180.65 | $3,887.86 | $2,864.06 | $2,982.72 | $2,202.34 | $2,128.64 |

| 87939 | $3,154.58 | $3,886.24 | $3,784.79 | $4,266.08 | $3,022.65 | $3,069.79 | $1,915.32 | $2,137.19 |

| 88317 | $3,153.45 | $3,886.24 | $3,947.36 | $4,266.08 | $2,870.59 | $2,792.91 | $1,985.54 | $2,325.43 |

| 87931 | $3,151.42 | $3,886.24 | $3,784.79 | $4,266.08 | $3,022.65 | $3,015.41 | $1,947.55 | $2,137.19 |

| 88034 | $3,150.32 | $3,838.79 | $3,784.79 | $4,266.08 | $3,022.65 | $3,087.42 | $1,915.32 | $2,137.19 |

| 87935 | $3,149.99 | $3,886.24 | $3,784.79 | $4,266.08 | $3,022.65 | $3,069.79 | $1,883.17 | $2,137.19 |

| 88002 | $3,142.13 | $3,886.24 | $4,180.65 | $3,887.86 | $2,870.59 | $2,956.82 | $2,084.14 | $2,128.64 |

| 88007 | $3,139.39 | $3,886.24 | $4,180.65 | $3,887.86 | $2,864.06 | $2,814.18 | $2,214.13 | $2,128.64 |

| 88009 | $3,139.19 | $3,838.79 | $3,724.16 | $4,266.08 | $3,022.65 | $3,087.42 | $1,915.32 | $2,119.91 |

| 88056 | $3,139.19 | $3,838.79 | $3,724.16 | $4,266.08 | $3,022.65 | $3,087.42 | $1,915.32 | $2,119.91 |

| 88029 | $3,137.51 | $3,838.79 | $3,784.79 | $4,266.08 | $3,022.65 | $3,087.42 | $1,917.06 | $2,045.78 |

| 88072 | $3,136.81 | $3,886.24 | $4,180.65 | $3,887.86 | $2,870.59 | $2,683.02 | $2,320.67 | $2,128.64 |

| 88022 | $3,136.15 | $4,014.18 | $3,902.96 | $4,266.08 | $3,022.65 | $2,743.44 | $1,866.52 | $2,137.19 |

| 88003 | $3,134.27 | $3,886.24 | $4,208.76 | $3,887.86 | $2,825.01 | $2,709.71 | $2,293.66 | $2,128.64 |

| 88047 | $3,131.72 | $3,886.24 | $4,180.65 | $3,887.86 | $2,870.59 | $2,659.62 | $2,308.45 | $2,128.64 |

| 88048 | $3,129.53 | $3,886.24 | $4,180.65 | $3,887.86 | $2,870.59 | $2,636.92 | $2,315.84 | $2,128.64 |

| 88040 | $3,128.60 | $3,838.79 | $3,724.16 | $4,266.08 | $3,022.65 | $3,087.42 | $1,915.32 | $2,045.78 |

| 88042 | $3,127.46 | $3,838.79 | $3,784.79 | $4,266.08 | $3,022.65 | $2,927.41 | $1,915.32 | $2,137.19 |

| 87942 | $3,126.79 | $3,886.24 | $3,784.79 | $4,266.08 | $3,022.65 | $2,877.83 | $1,912.74 | $2,137.19 |

| 88049 | $3,122.29 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $2,773.01 | $1,915.32 | $2,137.19 |

| 88044 | $3,120.13 | $3,838.79 | $4,180.65 | $3,887.86 | $2,870.59 | $2,566.59 | $2,367.80 | $2,128.64 |

| 88005 | $3,119.89 | $3,886.24 | $4,180.65 | $3,887.86 | $2,864.06 | $2,610.73 | $2,281.06 | $2,128.64 |

| 87937 | $3,118.33 | $3,886.24 | $4,200.35 | $3,887.86 | $3,022.65 | $2,532.74 | $2,169.83 | $2,128.64 |

| 88001 | $3,113.45 | $3,886.24 | $4,208.76 | $3,887.86 | $2,825.01 | $2,609.98 | $2,247.68 | $2,128.64 |

| 88025 | $3,111.00 | $3,838.79 | $3,900.01 | $4,266.08 | $3,022.65 | $2,714.22 | $1,915.32 | $2,119.91 |

| 87901 | $3,109.65 | $3,886.24 | $3,784.79 | $4,266.08 | $3,022.65 | $2,771.75 | $1,898.83 | $2,137.19 |

| 88041 | $3,107.02 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $2,696.83 | $1,884.61 | $2,137.19 |

| 88023 | $3,105.97 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $2,686.03 | $1,888.11 | $2,137.19 |

| 88011 | $3,102.08 | $3,886.24 | $4,180.65 | $3,887.86 | $2,825.01 | $2,583.15 | $2,223.04 | $2,128.64 |

| 88043 | $3,102.04 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $2,749.88 | $1,888.11 | $2,045.78 |

| 88061 | $3,096.73 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $2,717.89 | $1,882.99 | $2,045.78 |

| 88026 | $3,092.44 | $3,838.79 | $3,902.96 | $4,266.08 | $3,022.65 | $2,605.06 | $1,874.34 | $2,137.19 |

| 88020 | $3,091.27 | $3,838.79 | $3,724.16 | $4,266.08 | $3,022.65 | $2,751.96 | $1,915.32 | $2,119.91 |

| 88314 | $3,085.78 | $3,886.24 | $3,947.36 | $4,266.08 | $2,859.49 | $2,597.37 | $1,915.32 | $2,128.64 |

| 88012 | $3,083.03 | $3,886.24 | $4,180.65 | $3,887.86 | $2,864.06 | $2,505.83 | $2,127.94 | $2,128.64 |

| 88337 | $3,082.91 | $3,886.24 | $3,654.29 | $4,266.08 | $2,859.49 | $2,796.09 | $1,989.53 | $2,128.64 |

| 87936 | $3,080.48 | $3,886.24 | $3,784.79 | $3,887.86 | $3,022.65 | $2,589.34 | $2,263.88 | $2,128.64 |

| 88045 | $3,080.42 | $3,838.79 | $3,724.16 | $4,266.08 | $3,022.65 | $2,727.23 | $1,864.12 | $2,119.91 |

| 87941 | $3,064.73 | $3,886.24 | $3,784.79 | $3,887.86 | $3,022.65 | $2,606.59 | $2,136.38 | $2,128.64 |

| 88030 | $3,064.14 | $3,838.79 | $3,784.79 | $4,266.08 | $3,022.65 | $2,687.13 | $1,803.80 | $2,045.78 |

| 88352 | $3,055.37 | $3,886.24 | $3,654.29 | $4,266.08 | $2,859.49 | $2,595.08 | $1,997.76 | $2,128.64 |

| 88330 | $2,963.73 | $3,886.24 | $3,654.29 | $3,887.86 | $2,859.49 | $2,623.25 | $1,948.40 | $1,886.57 |

| 88310 | $2,948.89 | $3,886.24 | $3,654.29 | $3,887.86 | $2,859.49 | $2,428.26 | $1,989.53 | $1,936.58 |

Between the most and least expensive ZIP codes, there is a $1,416 difference in price! That’s a significant change in price based purely on where you live.Prefer to search for rates by city rather than by ZIP code? Take a look at the table below.

| City | Average Annual Rate |

|---|---|

| ALAMOGORDO | $2,948.89 |

| HOLLOMAN AIR FORCE BASE | $2,963.73 |

| TULAROSA | $3,055.37 |

| DEMING | $3,064.14 |

| SALEM | $3,064.73 |

| LORDSBURG | $3,080.42 |

| GARFIELD | $3,080.48 |

| LA LUZ | $3,082.91 |

| BENT | $3,085.78 |

| ANIMAS | $3,091.26 |

| SANTA CLARA | $3,092.44 |

| SILVER CITY | $3,096.73 |

| HURLEY | $3,102.03 |

| BAYARD | $3,105.97 |

| HANOVER | $3,107.01 |

| TRUTH OR CONSEQUENCES | $3,109.65 |

| BUCKHORN | $3,111.00 |

| LAS CRUCES | $3,115.35 |

| HATCH | $3,118.33 |

| LA MESA | $3,120.13 |

| MIMBRES | $3,122.28 |

| WILLIAMSBURG | $3,126.79 |

| HILLSBORO | $3,127.46 |

| HACHITA | $3,128.60 |

| MESQUITE | $3,129.53 |

| MESILLA PARK | $3,131.72 |

| ARENAS VALLEY | $3,136.14 |

| VADO | $3,136.81 |

| COLUMBUS | $3,137.51 |

| PLAYAS | $3,139.19 |

| RODEO | $3,139.19 |

| WHITE SANDS MISSILE RANGE | $3,142.13 |

| ELEPHANT BUTTE | $3,149.98 |

| FAYWOOD | $3,150.32 |

| CABALLO | $3,151.41 |

| CLOUDCROFT | $3,153.45 |

| MONTICELLO | $3,154.58 |

| DONA ANA | $3,161.79 |

| WEED | $3,162.74 |

| GILA | $3,164.01 |

| MULE CREEK | $3,164.31 |

| RINCON | $3,165.29 |

| ANTHONY | $3,166.16 |

| FORT BAYARD | $3,167.20 |

| ORGAN | $3,170.58 |

| REDROCK | $3,171.09 |

| ARREY | $3,173.19 |

| GLENWOOD | $3,173.68 |

| CLIFF | $3,173.98 |

| SACRAMENTO | $3,175.44 |

| PINON | $3,177.56 |

| WINSTON | $3,184.65 |

| SUNLAND PARK | $3,188.98 |

| SANTA TERESA | $3,199.10 |

| LUNA | $3,204.10 |

| MESCALERO | $3,207.96 |

| CHAPARRAL | $3,211.13 |

| ARAGON | $3,213.50 |

| MAYHILL | $3,214.75 |

| DERRY | $3,214.85 |

| RESERVE | $3,219.75 |

| CARRIZOZO | $3,220.80 |

| BERINO | $3,225.07 |

| CAPITAN | $3,228.63 |

| NOGAL | $3,240.99 |

| ALTO | $3,244.31 |

| DATIL | $3,244.88 |

| FLORA VISTA | $3,245.76 |

| FORT STANTON | $3,249.34 |

| RUIDOSO | $3,249.71 |

| SAN PATRICIO | $3,250.17 |

| HIGH ROLLS MOUNTAIN PARK | $3,250.56 |

| QUEMADO | $3,250.90 |

| SUNSPOT | $3,252.14 |

| FARMINGTON | $3,253.02 |

| SAN ANTONIO | $3,255.21 |

| WATERFLOW | $3,256.32 |

| OROGRANDE | $3,263.06 |

| KIRTLAND | $3,267.89 |

| SHIPROCK | $3,276.36 |

| LA PLATA | $3,277.89 |

| AZTEC | $3,279.58 |

| HONDO | $3,280.77 |

| RUIDOSO DOWNS | $3,284.31 |

| FRUITLAND | $3,286.20 |

| NAGEEZI | $3,287.01 |

| BLOOMFIELD | $3,288.50 |

| PIE TOWN | $3,289.37 |

| BLANCO | $3,290.21 |

| LINCOLN | $3,290.95 |

| GLENCOE | $3,292.85 |

| ZUNI | $3,297.93 |

| MAGDALENA | $3,298.12 |

| TINNIE | $3,300.97 |

| GALLUP | $3,302.98 |

| PORTALES | $3,305.22 |

| GRANTS | $3,305.59 |

| CONTINENTAL DIVIDE | $3,308.59 |

| NAVAJO DAM | $3,309.45 |

| TIMBERON | $3,312.94 |

| SOCORRO | $3,319.20 |

| CLOVIS | $3,328.33 |

| SHEEP SPRINGS | $3,335.30 |

| FENCE LAKE | $3,337.93 |

| POLVADERA | $3,338.42 |

| CROWNPOINT | $3,338.44 |

| RAMAH | $3,340.25 |

| PREWITT | $3,340.29 |

| MEXICAN SPRINGS | $3,340.72 |

| SANOSTEE | $3,342.77 |

| BRIMHALL | $3,343.15 |

| HOPE | $3,343.26 |

| ELIDA | $3,343.47 |

| CLAUNCH | $3,346.80 |

| NEWCOMB | $3,346.97 |

| ROGERS | $3,349.46 |

| BROADVIEW | $3,352.14 |

| LOS ALAMOS | $3,352.46 |

| GRADY | $3,354.00 |

| MILAN | $3,355.45 |

| GAMERCO | $3,357.10 |

| BLUEWATER | $3,358.18 |

| #N/A | $3,359.90 |

| FORT WINGATE | $3,362.57 |

| VANDERWAGEN | $3,363.43 |

| THOREAU | $3,363.44 |

| CHURCH ROCK | $3,363.72 |

| YATAHEY | $3,363.95 |

| MENTMORE | $3,366.06 |

| REHOBOTH | $3,366.72 |

| JAMESTOWN | $3,371.39 |

| NAVAJO | $3,374.19 |

| PUEBLO OF ACOMA | $3,374.60 |

| TOHATCHI | $3,376.32 |

| PINEHILL | $3,376.70 |

| FLOYD | $3,379.69 |

| SAN ACACIA | $3,381.13 |

| CORONA | $3,381.31 |

| TEXICO | $3,385.34 |

| CAUSEY | $3,388.51 |

| MELROSE | $3,393.52 |

| SAINT VRAIN | $3,393.89 |

| BARD | $3,395.42 |

| SMITH LAKE | $3,399.22 |

| PICACHO | $3,400.16 |

| CONCHAS DAM | $3,401.14 |

| SAN FIDEL | $3,401.32 |

| FORT SUMNER | $3,401.83 |

| LEMITAR | $3,402.30 |

| TUCUMCARI | $3,402.41 |

| SAN JON | $3,404.02 |

| HOUSE | $3,406.78 |

| SAN RAFAEL | $3,410.17 |

| MILNESAND | $3,410.51 |

| LA JOYA | $3,411.15 |

| CUERVO | $3,414.13 |

| PEP | $3,417.29 |

| RATON | $3,417.77 |

| WAGON MOUND | $3,419.45 |

| LOGAN | $3,419.96 |

| CAPULIN | $3,425.42 |

| OCATE | $3,425.93 |

| SAPELLO | $3,426.37 |

| ENCINO | $3,427.42 |

| EAGLE NEST | $3,429.72 |

| SANTA ROSA | $3,431.92 |

| WATROUS | $3,433.01 |

| VALMORA | $3,433.71 |

| YESO | $3,434.49 |

| MCALISTER | $3,436.71 |

| NEWKIRK | $3,436.99 |

| KENNA | $3,437.12 |

| SAN JOSE | $3,439.46 |

| VEGUITA | $3,439.65 |

| ARTESIA | $3,440.01 |

| GUADALUPITA | $3,440.41 |

| LINGO | $3,442.86 |

| CLINES CORNERS | $3,444.11 |

| MOSQUERO | $3,445.46 |

| ROY | $3,445.89 |

| GARITA | $3,447.45 |

| OJO FELIZ | $3,448.47 |

| TAIBAN | $3,448.70 |

| LAS VEGAS | $3,450.08 |

| SOLANO | $3,450.19 |

| CROSSROADS | $3,452.13 |

| CUBERO | $3,452.84 |

| SPRINGER | $3,453.90 |

| MILLS | $3,454.78 |

| MONTEZUMA | $3,454.92 |

| QUAY | $3,455.36 |

| AMISTAD | $3,456.70 |

| ROCIADA | $3,456.82 |

| LA LOMA | $3,457.51 |

| MAXWELL | $3,462.21 |

| BUENA VISTA | $3,462.47 |

| NARA VISA | $3,464.99 |

| RAINSVILLE | $3,466.92 |

| CLAYTON | $3,469.12 |

| RIBERA | $3,469.18 |

| HOLMAN | $3,470.05 |

| SEDAN | $3,474.93 |

| TATUM | $3,475.02 |

| JAL | $3,478.11 |

| FOLSOM | $3,478.48 |

| ANTON CHICO | $3,486.20 |

| CAPROCK | $3,486.50 |

| GLADSTONE | $3,489.24 |

| MIAMI | $3,493.43 |

| UTE PARK | $3,494.53 |

| ROWE | $3,494.87 |

| SERAFINA | $3,494.87 |

| PECOS | $3,496.36 |

| DES MOINES | $3,496.57 |

| MORA | $3,497.38 |

| TREMENTINA | $3,499.53 |

| CIMARRON | $3,501.22 |

| NEW LAGUNA | $3,502.66 |

| LAGUNA | $3,502.88 |

| MALAGA | $3,504.43 |

| WHITES CITY | $3,504.43 |

| EUNICE | $3,504.75 |

| PAGUATE | $3,506.57 |

| ANGEL FIRE | $3,506.61 |

| CHACON | $3,507.60 |

| LOCO HILLS | $3,507.60 |

| LAKEWOOD | $3,508.61 |

| ROSWELL | $3,513.07 |

| GRENVILLE | $3,515.52 |

| MONUMENT | $3,515.75 |

| CLEVELAND | $3,515.84 |

| MCDONALD | $3,517.09 |

| CUBA | $3,520.12 |

| TORREON | $3,520.90 |

| LOVINGTON | $3,521.66 |

| COUNSELOR | $3,523.21 |

| LAKE ARTHUR | $3,524.50 |

| MOUNTAINAIR | $3,525.97 |

| ILFELD | $3,529.15 |

| TERERRO | $3,532.07 |

| CARLSBAD | $3,532.36 |

| MALJAMAR | $3,533.93 |

| CASA BLANCA | $3,535.16 |

| LOVING | $3,535.20 |

| HAGERMAN | $3,536.09 |

| WILLARD | $3,537.91 |

| REGINA | $3,548.47 |

| HOBBS | $3,554.22 |

| DEXTER | $3,554.80 |

| LA JARA | $3,564.28 |

| COCHITI LAKE | $3,573.04 |

| BOSQUE | $3,576.83 |

| MORIARTY | $3,580.84 |

| CEDARVALE | $3,593.18 |

| JEMEZ SPRINGS | $3,601.04 |

| LAMY | $3,605.26 |

| ESTANCIA | $3,606.69 |

| JEMEZ PUEBLO | $3,607.64 |

| LINDRITH | $3,627.66 |

| AMALIA | $3,629.08 |

| CERRILLOS | $3,631.57 |

| CERRO | $3,632.42 |

| RED RIVER | $3,633.30 |

| STANLEY | $3,633.98 |

| SAN CRISTOBAL | $3,637.87 |

| COSTILLA | $3,638.72 |

| VALDEZ | $3,645.09 |

| SAN YSIDRO | $3,645.43 |

| PENA BLANCA | $3,647.70 |

| TESUQUE | $3,650.42 |

| PENASCO | $3,657.08 |

| PONDEROSA | $3,657.76 |

| SANTO DOMINGO PUEBLO | $3,663.34 |

| TRUCHAS | $3,663.47 |

| JARALES | $3,664.21 |

| SANTA CRUZ | $3,666.53 |

| ESPANOLA | $3,666.58 |

| OHKAY OWINGEH | $3,667.66 |

| GLORIETA | $3,669.52 |

| DULCE | $3,670.23 |

| CHAMISAL | $3,670.37 |

| LLANO | $3,672.19 |

| OJO CALIENTE | $3,672.76 |

| QUESTA | $3,674.41 |

| SANTA FE | $3,676.51 |

| TAOS SKI VALLEY | $3,681.61 |

| TRAMPAS | $3,687.14 |

| TRES PIEDRAS | $3,687.14 |

| PETACA | $3,687.74 |

| TAOS | $3,688.03 |

| RANCHOS DE TAOS | $3,691.42 |

| EL PRADO | $3,692.25 |

| CANJILON | $3,693.66 |

| CANONES | $3,693.66 |

| CEBOLLA | $3,693.66 |

| YOUNGSVILLE | $3,693.66 |

| CARSON | $3,693.92 |

| HERNANDEZ | $3,694.94 |

| CHIMAYO | $3,696.42 |

| ALCALDE | $3,696.89 |

| VADITO | $3,697.76 |

| MEDANALES | $3,701.31 |

| TIERRA AMARILLA | $3,702.21 |

| VALLECITOS | $3,702.24 |

| LA MADERA | $3,705.41 |

| DIXON | $3,705.56 |

| VELARDE | $3,706.27 |

| COCHITI PUEBLO | $3,709.52 |

| ARROYO SECO | $3,710.61 |

| EMBUDO | $3,710.66 |

| EL RITO | $3,710.81 |

| CHAMA | $3,711.69 |

| ABIQUIU | $3,724.57 |

| COYOTE | $3,725.45 |

| ALGODONES | $3,732.99 |

| LOS OJOS | $3,750.61 |

| PLACITAS | $3,751.22 |

| GALLINA | $3,752.18 |

| RIO RANCHO | $3,771.04 |

| EDGEWOOD | $3,798.71 |

| BERNALILLO | $3,813.92 |

| CORRALES | $3,852.73 |

| SANDIA PARK | $3,888.99 |

| LOS LUNAS | $3,893.50 |

| PERALTA | $3,919.14 |

| BOSQUE FARMS | $3,922.38 |

| BELEN | $3,949.58 |

| CEDAR CREST | $3,979.48 |

| TIJERAS | $4,002.49 |

| KIRTLAND AFB | $4,013.99 |

| ALBUQUERQUE | $4,046.92 |

| ISLETA | $4,154.37 |

There is a $1,206 difference between the most and least expensive cities in New Mexico. This may seem unfair, but some areas carry more risks than others, such as crime rate or natural disasters, that hike up insurers’ prices.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

New Mexico Car Insurance Companies

With over a million cars registered in New Mexico, there is no lack of insurance companies offering car insurance. With so many companies clamoring for your attention, it can be hard to know which company is right for your needs.

It can be so daunting, in fact, that most people stick with the same provider for years even if their provider isn’t right for them.We want to help you make this difficult choice, which is why we have outlined companies’ ratings, complaint records, market share, and average rates.

The Largest Companies’ Financial Ratings

The financial ratings of a company tell a customer how likely the company is to succeed in the future. One of the most popular financial ratings is an AM Best rating, which measures a company’s financial health.

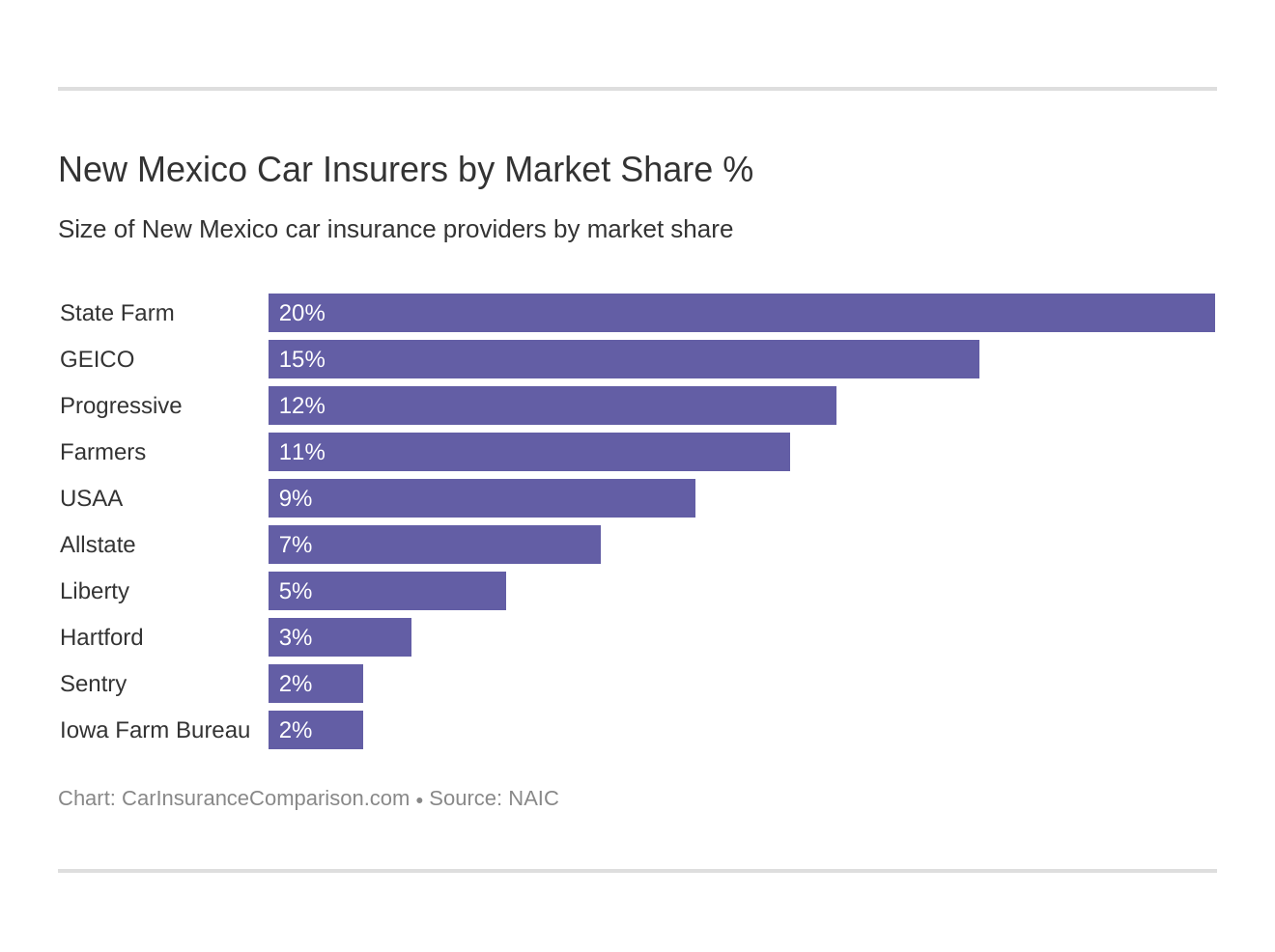

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A | $277,878 | 58.73% | 20.04% |

| Geico | A++ | $207,105 | 86.73% | 14.94% |

| Progressive Group | A+ | $160,619 | 61.50% | 11.58% |

| Farmers Insurance Group | A | $155,049 | 60.51% | 11.18% |

| USAA Group | A++ | $127,970 | 76.06% | 9.23% |

| Allstate Insurance Group | A+ | $97,610 | 51.94% | 7.04% |

| Liberty Mutual Group | A | $69,048 | 60.23% | 4.98% |

| Hartford Fire & Casualty Group | A+ | $41,760 | 77.10% | 3.01% |

| Sentry Insurance Group | A+ | $32,713 | 54.68% | 2.36% |

| Iowa Farm Bureau Group | A- | $30,209 | 68.10% | 2.18% |

AM Best describes its financial rating scale as the following (we have only included the explanations of the above companies’ ratings).

- A++ and A+ (Superior). AM Best considers these companies to have a superior ability to meet future financial obligations (paying claims, etc.).

- A and A- (Excellent). These companies have an excellent ability to meet future financial obligations (paying claims, etc.).

Part of determining a company’s financial strength is looking at its loss ratio. All of the largest companies in New Mexico have loss ratios above 50 percent and below 100 percent, which is great.

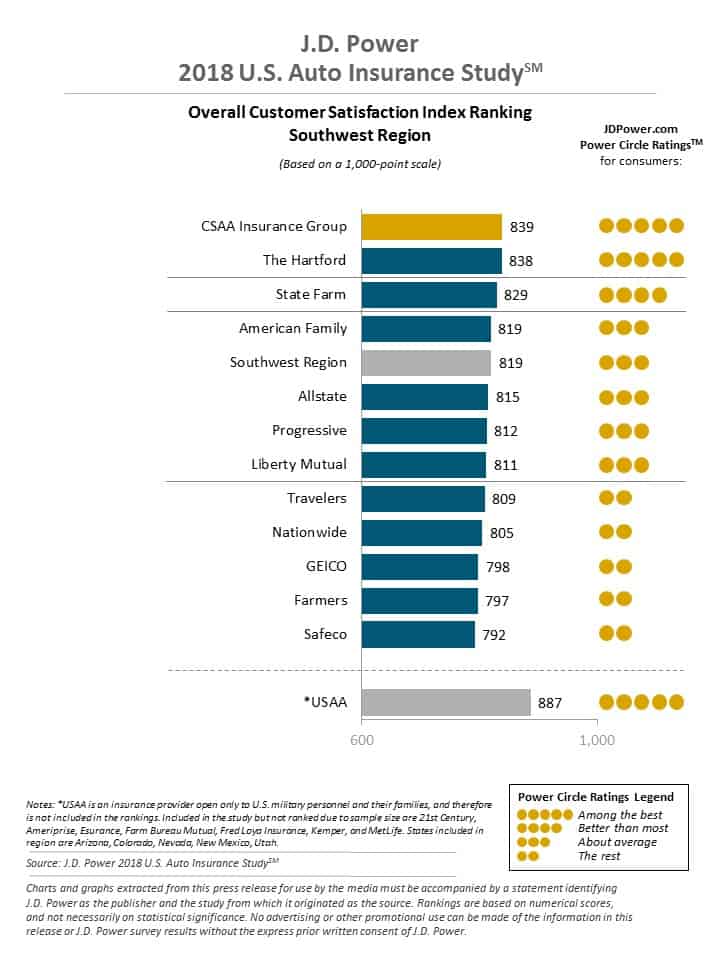

Companies with the Best Ratings

JD Power ranks companies based purely on customer satisfaction. The 2018 study looked at responses from 44,622 auto insurance customers and judged companies’ customer satisfaction on the following five factors:

- Interaction

- Policy Offerings

- Price

- Billing Process/Policy Information

- Claims

To see how JD power ranked companies in New Mexico, take a look at the graphic below. Bear in mind that the worst rated companies may not be terrible at customer service, it’s just that other companies perform better!

Companies with Most Complaints in New Mexico

We’ve looked at the largest companies AM Best ratings and loss ratios, but let’s now look further into customer satisfaction. Below, you will see the complaint ratio for the ten largest companies in New Mexico.

| Company | Total Complaints 2017 | Complaint Ratio 2017 |

|---|---|---|

| State Farm Group | 1482 | 0.44 |

| Liberty Mutual Group | 222 | 5.95 |

| Progressive Group | 120 | 0.75 |

| Allstate Insurance Group | 163 | 0.5 |

| Iowa Farm Bureau Group | 32 | 0.77 |

| Hartford Fire & Casualty Group | 9 | 4.68 |

| Geico | 2 | 0 |

| USAA Group | 2 | 0 |

| Sentry Insurance Group | 1 | 6.53 |

| Farmers Insurance Group | 0 | 0 |

Some of the companies have a high number of complaints but low complaint ratios — these numbers are relevant to the number of customers a company has. What may seem like a large number of complaints may actually only be a small percentage of the company’s customers.And of course, how a company handles customers’ dissatisfaction is also important.Let’s move onto another important factor that is always on the forefront of shoppers’ minds — prices.

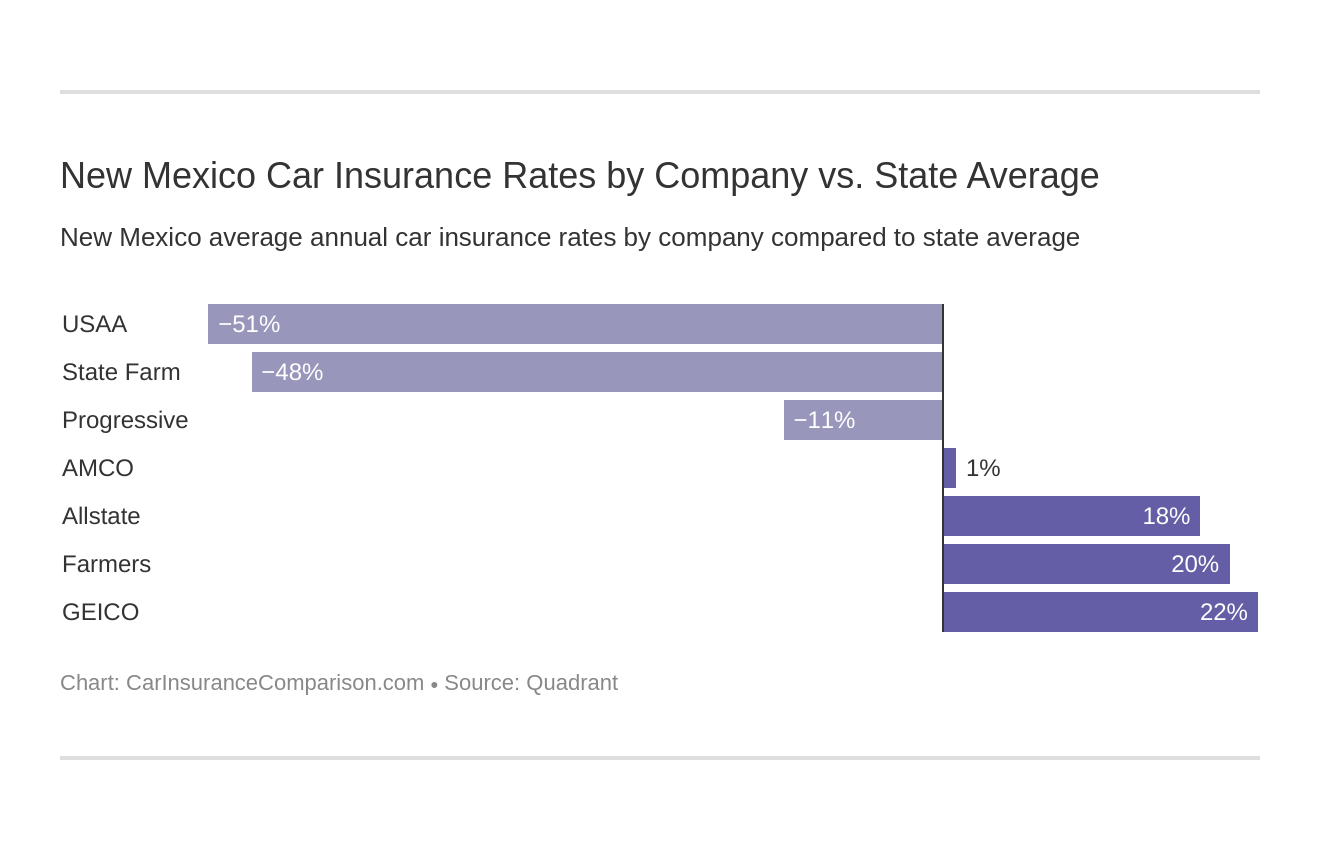

New Mexico Car Insurance Rates by Company

Every company bases its rates on a number of different factors. To help you find the best rates in New Mexico, we have partnered with Quadrant to bring you a full breakdown of companies’ rates.

| Company | Average Annual Rate | Compared to State Average ($) | Compared to State Average (%) |

|---|---|---|---|

| Allstate F&C | $4,200.53 | $737.32 | 17.55% |

| Farmers Ins Co Of AZ | $4,314.90 | $851.69 | 19.74% |

| Geico General | $4,457.62 | $994.42 | 22.31% |

| AMCO Insurance | $3,514.07 | $50.86 | 1.45% |

| Progressive Direct | $3,118.17 | -$345.04 | -11.07% |

| State Farm Mutual Auto | $2,340.03 | -$1,123.18 | -48.00% |

| USAA | $2,297.13 | -$1,166.08 | -50.76% |

The cost of rates varies SIGNIFICANTLY from carrier to carrier. USAA is 50 percent less than the state average, whereas Allstate is 17 percent over the state average!

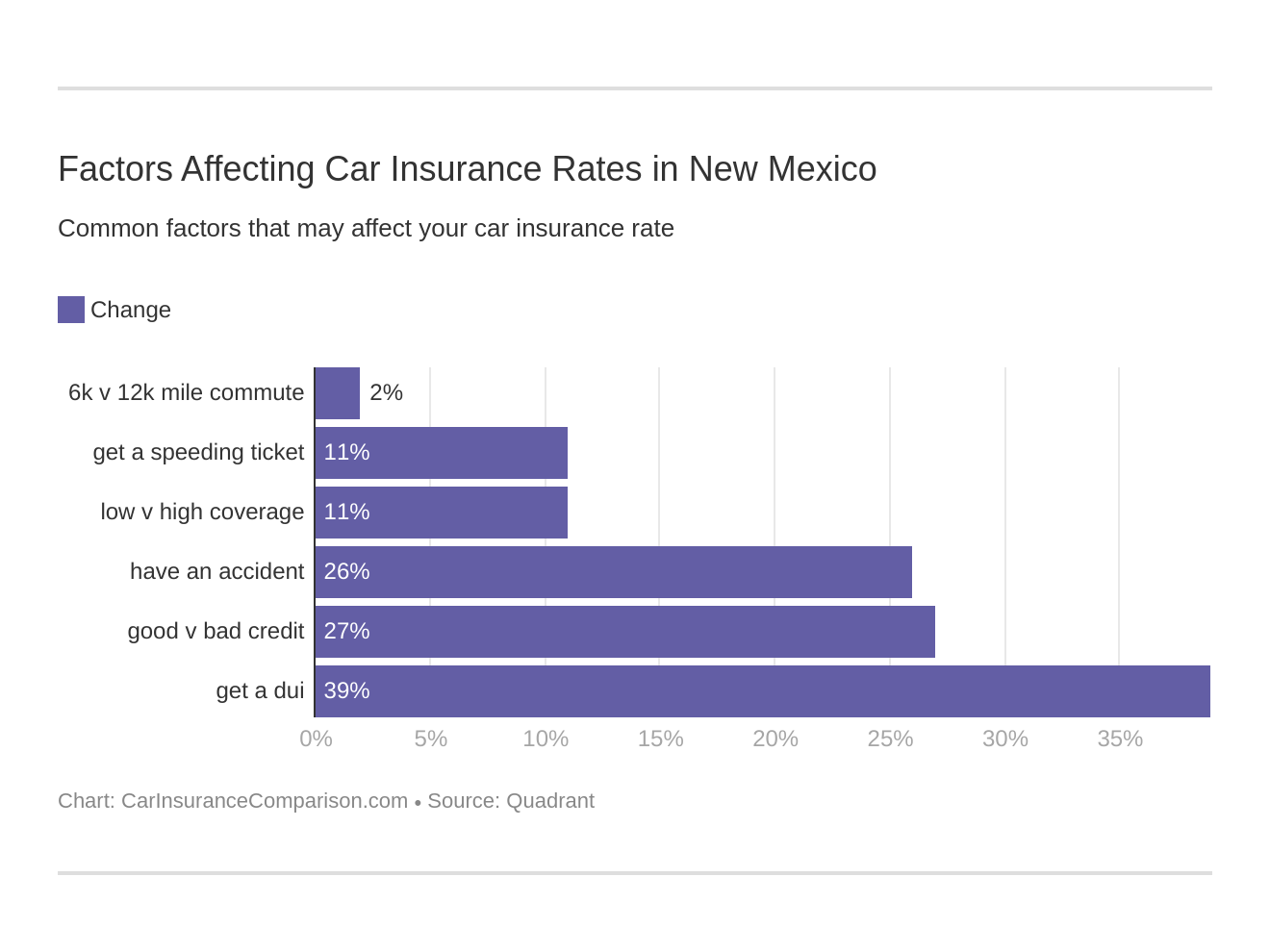

Commute Rates

Did you know that sometimes your commute distance can impact your rates? At some companies, a longer commute means higher prices!

| Company | Commute and Annual Mileage | Average Annual Rate |

|---|---|---|

| Geico | 25 miles commute. 12000 annual mileage. | $4,525.62 |

| Geico | 10 miles commute. 6000 annual mileage. | $4,389.62 |

| Farmers | 10 miles commute. 6000 annual mileage. | $4,314.90 |

| Farmers | 25 miles commute. 12000 annual mileage. | $4,314.90 |

| Allstate | 10 miles commute. 6000 annual mileage. | $4,200.53 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,200.53 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,514.07 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,514.07 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,118.17 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,118.17 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,398.36 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,365.79 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,281.70 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,228.48 |

Coverage Level Rates

A high coverage level is always best, but sometimes the fear of a high price difference can discourage people from purchasing a high coverage plan. This doesn’t need to be the case. By shopping around for providers, you can find a company that has economical price increases.

| Company | Coverage Type | Average Annual Rate |

|---|---|---|

| Geico | High | $4,771.00 |

| Farmers | High | $4,732.85 |

| Geico | Medium | $4,446.29 |

| Allstate | High | $4,390.87 |

| Farmers | Medium | $4,275.73 |

| Allstate | Medium | $4,192.35 |

| Geico | Low | $4,155.59 |

| Allstate | Low | $4,018.38 |

| Farmers | Low | $3,936.11 |

| Nationwide | High | $3,600.05 |

| Nationwide | Medium | $3,479.90 |

| Nationwide | Low | $3,462.26 |

| Progressive | High | $3,261.94 |

| Progressive | Medium | $3,117.04 |

| Progressive | Low | $2,975.51 |

| State Farm | High | $2,540.25 |

| USAA | High | $2,448.12 |

| State Farm | Medium | $2,347.45 |

| USAA | Medium | $2,307.89 |

| USAA | Low | $2,135.39 |

| State Farm | Low | $2,132.39 |

At companies like Nationwide, there is only a $138 difference in price between low and high coverage. This amounts to only an extra $11.50 a month!

When coverage costs are compared like this, the extra payments seem much more manageable.So make sure to shop around for providers, as you could go from low to high coverage for a small monthly price increase.

Credit History Rates

Did you know that your credit history often has more of an influence on your rates than your driving record? The average credit score in the U.S. is 675, and unfortunately, New Mexico’s average is slightly below this.

New Mexico’s average credit score is 659, which means that rates could be slightly higher for New Mexico residents who have below average credit scores.

Take a look at the table below to see how credit history has a SIGNIFICANT impact on your rates!

| Group | Credit History | Average Annual Rate |

|---|---|---|

| Geico | Poor | $4,999.10 |

| Farmers | Poor | $4,950.09 |

| Allstate | Poor | $4,887.46 |

| Geico | Fair | $4,349.78 |

| Nationwide | Poor | $4,300.68 |

| Farmers | Fair | $4,097.94 |

| Allstate | Fair | $4,028.34 |

| Geico | Good | $4,023.99 |

| Farmers | Good | $3,896.67 |

| Allstate | Good | $3,685.79 |

| Progressive | Poor | $3,420.75 |

| Nationwide | Fair | $3,341.72 |

| State Farm | Poor | $3,337.18 |

| Progressive | Fair | $3,049.36 |

| Nationwide | Good | $2,899.82 |

| Progressive | Good | $2,884.38 |

| USAA | Poor | $2,874.97 |

| USAA | Fair | $2,151.55 |

| State Farm | Fair | $2,056.00 |

| USAA | Good | $1,864.88 |

| State Farm | Good | $1,626.91 |

A poor credit history can cost you HUNDREDS or THOUSANDS of dollars in increased rates. That’s a hefty price to pay for having poor or fair credit!

Driving Record Rates

Another significant factor in determining rates is your driving record. The cleaner your record, the lower your rates. After all, a bad driving record shows a company that you are a higher-risk driver — which means the company has a higher likelihood of having to pay out claims to you.

| Group | Driving Record | Average Annual Rate |

|---|---|---|

| Geico | With 1 DUI | $8,351.31 |

| Allstate | With 1 DUI | $4,877.87 |

| Nationwide | With 1 DUI | $4,765.82 |

| Farmers | With 1 accident | $4,694.44 |

| Farmers | With 1 DUI | $4,584.30 |

| Allstate | With 1 accident | $4,561.80 |

| Farmers | With 1 speeding violation | $4,334.25 |

| Geico | With 1 accident | $4,217.02 |

| Allstate | With 1 speeding violation | $3,898.80 |

| Nationwide | With 1 accident | $3,688.87 |

| Progressive | With 1 accident | $3,686.49 |

| Farmers | Clean record | $3,646.60 |

| Allstate | Clean record | $3,463.66 |

| Progressive | With 1 speeding violation | $3,184.99 |

| USAA | With 1 DUI | $3,122.21 |

| Nationwide | With 1 speeding violation | $2,975.73 |

| Progressive | With 1 DUI | $2,904.96 |

| Progressive | Clean record | $2,696.21 |

| Geico | Clean record | $2,631.09 |

| Geico | With 1 speeding violation | $2,631.09 |

| Nationwide | Clean record | $2,625.87 |

| State Farm | With 1 DUI | $2,387.59 |

| State Farm | With 1 accident | $2,387.59 |

| State Farm | With 1 speeding violation | $2,387.59 |

| USAA | With 1 accident | $2,372.97 |

| State Farm | Clean record | $2,197.36 |

| USAA | With 1 speeding violation | $1,987.15 |

| USAA | Clean record | $1,706.19 |