Compare Washington DC Car Insurance Rates [2024]

Washington D.C. car insurance requires a minimum of 25/50/10 for bodily injury, property damage, and Uninsured Motorist coverage. Washington D.C. car insurance will cost you about $110.92/mo or $1,331/yr.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Nov 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Washington D.C. Summary Statistics | Details |

|---|---|

| Road Miles | Total in the District: 1,503 Vehicle Miles Driven: 3.5 Billion |

| Driving Deaths | Speeding: 17 - 55% Drunk Driving: 16 - 52% |

| Vehicles | Registered: 329,881 Total Stolen: 3,783 - 11% |

| Most Popular Vehicle | Honda Civic |

| Average Premiums (Annual) | Liability: $629 Collision: $469 Comprehensive: $233 Combined Premiums: $1,331 |

| Uninsured Motorists | 15.6% State Rank: 10th |

| Cheapest Provider | Pharmacists Mutual |

Driving in our nation’s capital isn’t always fun. In fact, TripSavvy wrote a whole article on why you should avoid driving in D.C. if at all possible. However, driving in these parts is unavoidable for many. Especially considering how the District of Columbia has a higher population density than any state or territory in the U.S., with 81,991 people for every square mile. Hundreds of thousands of people, many of great importance, live and work in this busy metro area.

The District’s population was 693,972 in 2017 (up 122k since 2010), BUT Monday through Friday, D.C.’s population increases by 72 percent to a daytime population of over one million.

Have no fear! We’re here to help all you D.C. drivers out there. We can’t eliminate traffic, but we can help you understand the laws and costs governing car insurance in your area, as well as help you compare Washington, D.C. car insurance rates. We aim to eliminate the frustration and confusion surrounding one of the most valuable types of insurance available today: CAR INSURANCE.

Washington D.C. Car Insurance Coverage and Rates

Do you ever wonder: “What’s the point of car insurance??” We get asked this question all the time. It can be very upsetting to spend a good portion of your time comparing comprehensive car insurance, then spending a good portion of your hard-earned money on that very same coverage that you may not fully understand or even see the value of, which is exactly why we created this D.C. auto insurance guide. Below, we break down the many policy options you probably don’t even know you have, explain why particular types of coverage are essential, and teach you terms the biggest and best insurers often intimidate their customers with.

There’s no hidden agenda here. We are car insurance experts (who don’t sell car insurance). You can trust our unbiased opinions and research-based data.

The purpose of this guide is for you to have the benefit of being informed citizens and car insurance consumers. Okay, time to jump right in with coverage requirements and the costs that come along with them.

Minimum Car Insurance Requirements in Washington D.C.

| Required Coverage | Minimum Limits (25/50/10) |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

| Uninsured Motorist Bodily Injury | $20,000 per person $50,000 per accident |

| Uninsured Motorist Property Damage | $5,000 per accident w/$200 deductible |

“Driving without insurance in the District is a serious offense that can result in the suspension of your driver’s license, costly fines, and issues for you at work and at home.”– Criminal Defense Attorney BenowitzUnfortunately, nearly 16 percent of motorists in D.C. are willing to take that risk.

D.C. is ranked 10th in the nation for having the most people driving around illegally—without auto insurance, which is why uninsured motorist coverage is an essential element of the minimum requirements.

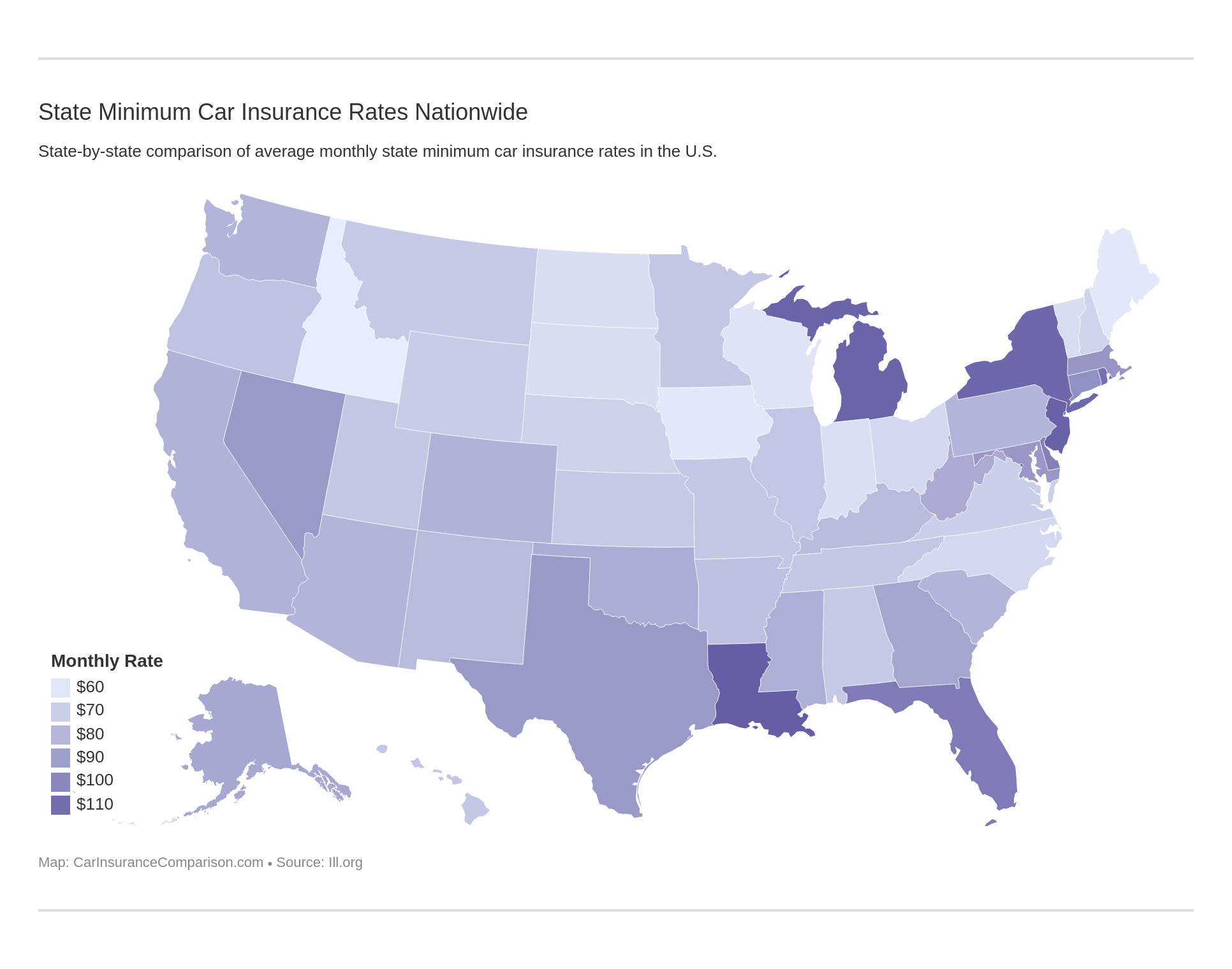

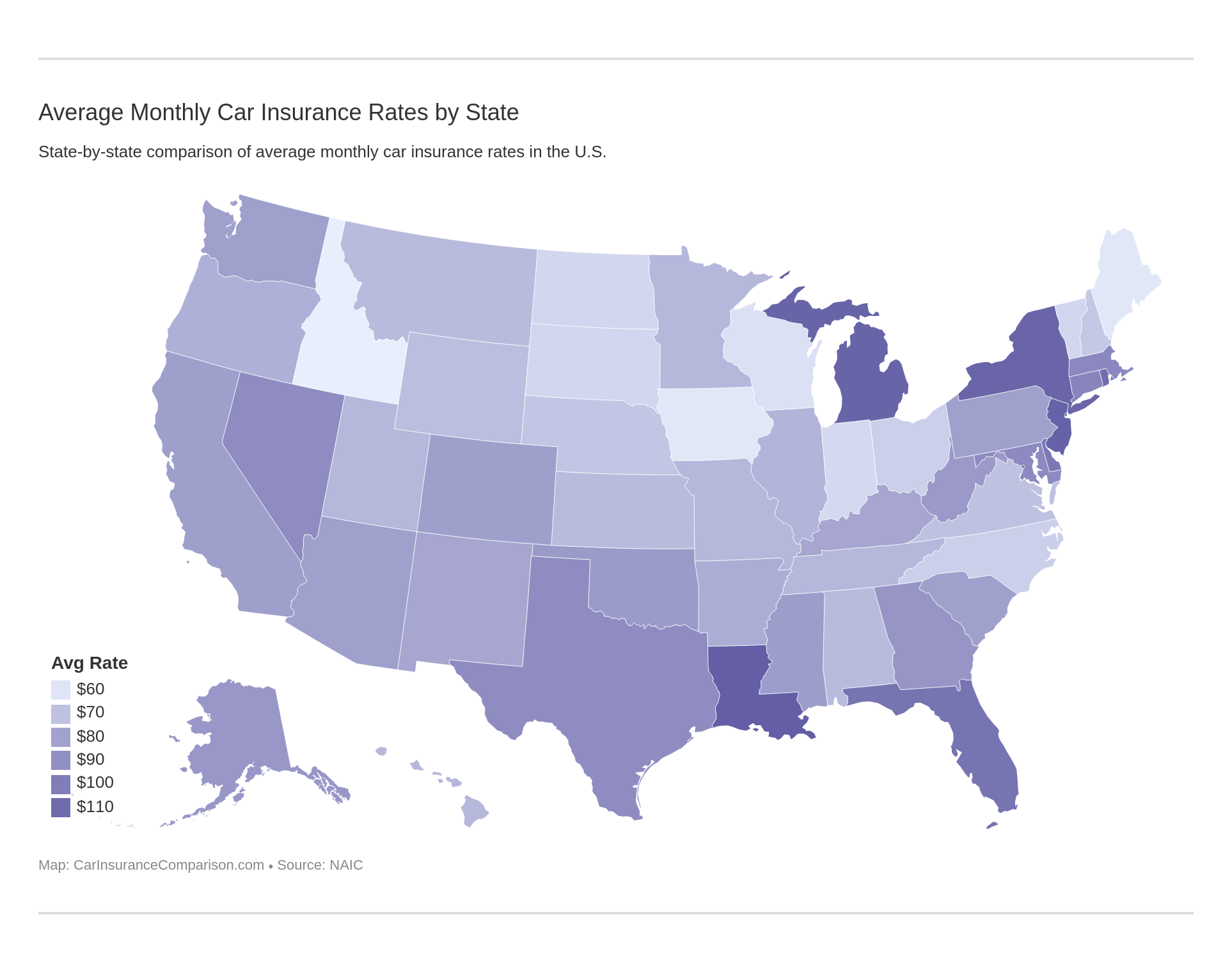

Only 19 states and Washington D.C. require their drivers to have uninsured or underinsured motorist coverage. Remember, no one enjoys having to pay more for their car insurance, but it’s there to protect the responsible individuals (YOU and your family) on the road. Please note: the requirements listed above are often not enough. This video helps to explain why every D.C. driver should at least consider investing in more coverage:https://www.youtube.com/watch?v=BKEPPnnm55wThe D.C. attorney warns,“…you don’t want to carry just the minimum…that doesn’t cover very much. Many times people try to save money on their insurance coverage not realizing that it is very inexpensive to get the uninsured and underinsured motorist coverage high enough to protect your interest in the event someone else does not have the appropriate coverage.”Take a look at how minimum coverage costs vary from state to state.

Now that you know the minimum coverage you are required by law to have in D.C., you can shop around to price compare what the top providers have to offer. Just enter your ZIP code in our free comparison tool.Proof of Insurance in Washington D.C.

If, for any reason, you are pulled over in D.C., you are required by law to show the officer your driver’s license, vehicle registration, and proof of insurance.

The “Proof of Insurance Law” is strictly enforced in D.C. You will receive a civil fine and infraction if you fail to have this proof readily available.

Here’s why leaders in the District have this strict requirement: “Uninsured drivers are a serious problem, undermining traffic safety and driving up the costs for insured, law-abiding motorists.”– DC.govAccording to District law, proof of insurance is defined as “a document issued by an insurance company that lists the name of the insurance company, the policy number, the name or names of the insured, and the period of coverage for the insurance.”

Premiums as Percentage of Income in Washington D.C.

| Rates vs Income | Cost/Percent |

|---|---|

| Annual Full Coverage Average Premiums | $1,324 |

| Monthly Full Coverage Average Premiums | $110 |

| Annual Per Capita Disposable Personal Income | $59,936 |

| Monthly Per Capita Disposable Personal Income | $4,995 |

| Percent of Income | 2.21% |

The above data was collected from the NAIC (National Association for Insurance Commissioners) December 2017 auto insurance report. Disposable Personal Income (DPI) is the total amount of money you have left to spend (or save) after you pay your taxes.

In 2017, annual car insurance in the District of Columbia cost about $1,324, which was over two percent of the average disposable personal income.

The average D.C. resident has less than $5,000 each month to pay for everything – food, living expenses, car payments, etc. – and the monthly car insurance bill is averaging over $100 even with safe driving insurance discounts. American Consumer Credit Counseling suggests saving 20 percent of every paycheck. With the average D.C. disposable income, that comes to $999 each month you should be saving. No simple task!

Average Monthly Auto Insurance Rates in Washington D.C. (Liability, Collision, Comprehensive)

Here were the average annual costs for the three types of core coverage – along with the price for the combined package – in D.C. from 2013 to 2015:

| Coverage | 2013 | 2014 | 2015 |

|---|---|---|---|

| Liability | $635 | $629 | $629 |

| Collision | $452 | $461 | $469 |

| Comprehensive | $230 | $234 | $233 |

| Combined | $1,316 | $1,324 | $1,331 |

The above table shows the most recent data provided by the NAIC. Expect car insurance rates in D.C. to be significantly higher in 2019 and later

There are other coverage options you can add to your insurance package at minimal costs that can make a huge difference when it comes to protecting your investments (and actually saving you money) in the unfortunate event of a crash. Keep reading.Additional Liability Coverage in Washington D.C.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 63% | 82% | 55% |

| Medical Payments (Med Pay) | 194% | 93% | 29% |

| Uninsured/Underinsured Motorist | 65% | 70% | 74% |

Fact: PIP, Med Pay, and Underinsured Motorist coverage are all optional in the District of Columbia, but they’re still extremely helpful to have. Here’s WHY:

In 2015, 15.6 percent of motorists in D.C. were uninsured – most of these illegal drivers would go bankrupt before they could pay off bills for damage and injuries they cause you in a serious car accident.

PIP, Med Pay, and Underinsured/Uninsured Motorist coverage will protect you when no one else can. Did you notice that crazy jump from 194 to 29 percent Med Pay loss ratio in just two years? A real-time example of a 29 percent loss ratio: you pay $1,000 for coverage, and your provider pays $290 for damages — nope, not an impressive return on investment. Here’s how the attorneys at Murphy and Prachthauser explain it: “Lower pay loss ratio means the insurance company is paying more for salaries, defense costs, and advertising, rather than paying the policyholders who purchased their coverage. All other things being equal, try to find car insurance companies with a higher pay-loss ratio.”

Add-ons, Endorsements, and Riders in Washington D.C.

Helping you get the coverage you need for an affordable price is our goal. Good news: there are lots of powerful – and cheap – extras you can add to your policy. Here’s a list of useful coverage available to you in D.C. (links are provided, which will take you to articles fully explaining each option):

- Guaranteed Auto Protection (GAP) Insurance

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Car Insurance for Engine Failures

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

You can also save money if you don’t drive much with low-mileage discounts. Read on to find out how!

Pay-As-You-Drive or Usage-Based Insurance in Washington D.C.

There are many names for this new way of determining your car insurance rates: pay-as-you-drive, usage-based insurance (UBI), telematics, driver monitoring, etc., but they all mean the same thing:

You will install a device in your vehicle that will report back to your insurer on how many miles you drove and how safely you navigated through each of those miles on the roads.

While there’s plenty of controversy surrounding telematics in regards to privacy, many motorists across the U.S. don’t mind these “spies” riding along with them, thanks to saving about $300 per vehicle. Here’s a video from Allstate on the program they offer called Milewise:https://www.youtube.com/watch?v=fNFQdhUWf2oSpeaking of controversy, there are more hot topics below (scroll down) in regards to D.C. auto insurance.

Average Monthly Auto Insurance Rates by Age & Gender in Washington D.C.

Click here for the driving record and personal profile used to obtain the above quotes. A handful of states have taken measures to legally prevent males and females from paying different rates for their car insurance, however, this is not the case in Washington, D.C. Males pay more than females, especially in the younger demographic. Check out this chart showing D.C.’s auto insurance rates by age and gender:

Wait, how much more?! Our researchers retrieved specific rate quotes for female drivers in D.C. that were $240 a year more than those given for males who were the same age and had identical profiles and driving records.Rates by Location and ZIP Code

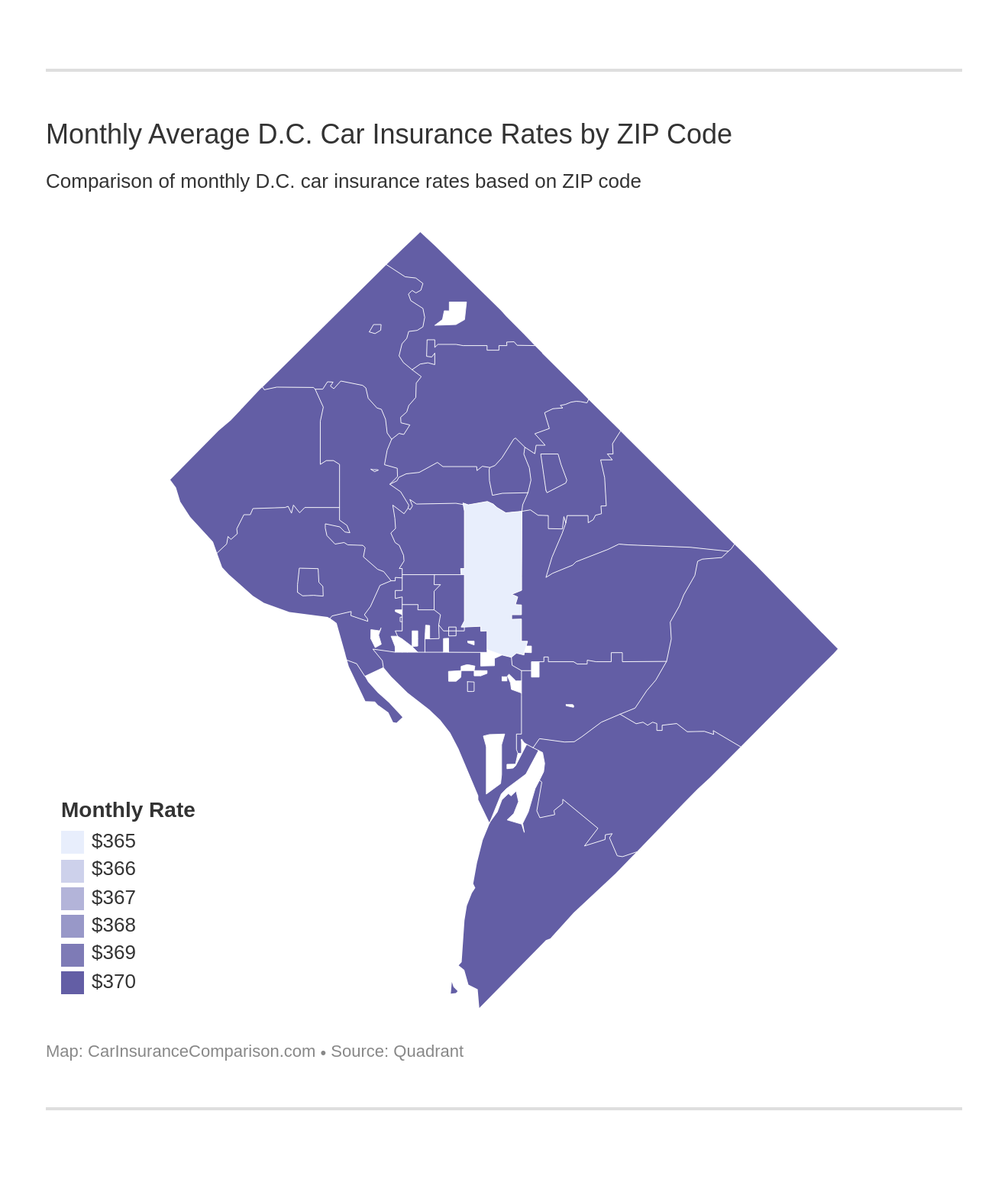

In most states proper, your ZIP code has a tremendous impact on your rates, simply due to different driving conditions and risk factors. In the District, this is not the case, and most ZIP codes pay a very similar rate on average.

Okay, now that you know the District’s insurance requirements and rates, let’s find out which providers in D.C. have the best (and worst!) ratings and reviews.Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Washington D.C. Car Insurance Companies

When there are hundreds of car insurance providers competing for your business, it’s nearly impossible to know who you can trust. You might be asking yourself, “Is it safe to switch to this new, smaller company that’s offering me lower rates?”

We did the dirty work for you. Our research will help you know which auto insurance companies mean what they say and have the financial stability to protect you and your investments.

You can start by conducting a best car insurance companies comparison with our free tools. Keep reading to get the inside scoop on who the best providers are (and why) across the District of Columbia.

Ratings! How D.C. Car Insurance Companies Compare

We’ll begin with the financial strength of the providers in your area. Bottom line: an insurance provider must be strong financially for you to trust them with your hard-earned money.

The 10 Largest D.C. Car Insurance Companies’ Financial Ratings

| Companies | A.M. Best Rating |

|---|---|

| Berkshire Hathaway | A++ |

| State Farm | A++ |

| Travelers | A++ |

| USAA | A++ |

| Allstate | A+ |

| Erie | A+ |

| Hartford | A+ |

| Nationwide | A+ |

| Progressive | A+ |

| Liberty Mutual | A |

What’s just as important as how financially secure the company is? How they treat YOU! Let’s see how car insurance customers feel about the providers in D.C. You don’t want to miss this!

Washington D.C.’s Car Insurance Providers with the BEST Customer Ratings

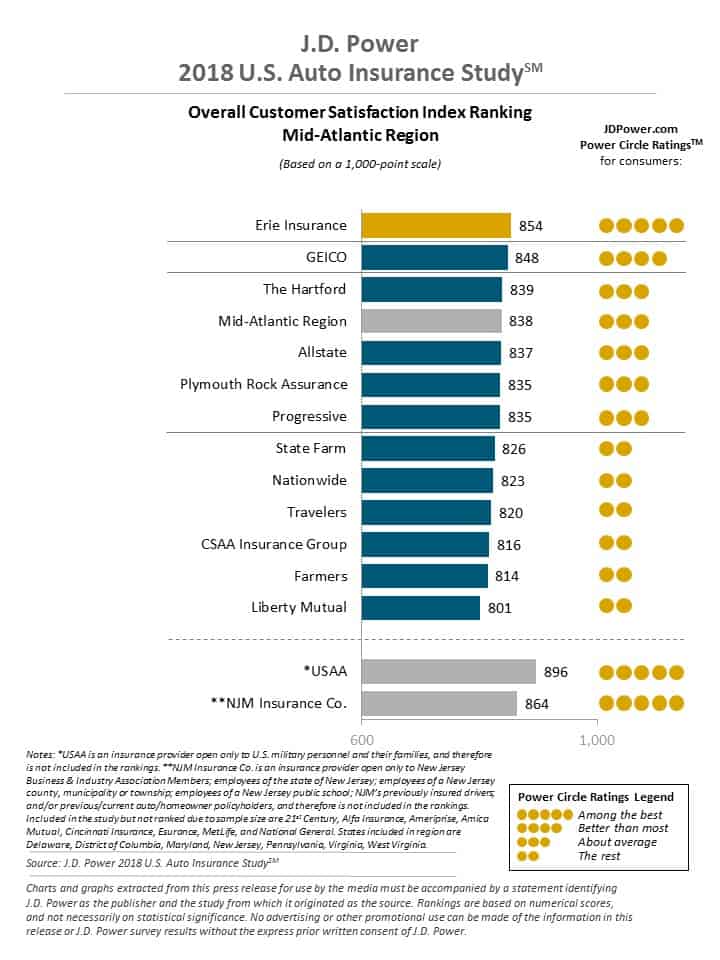

With an impressive total of 854 out of 1,000 possible points, Erie Insurance was the auto insurance provider in the Mid-Atlantic Region to win J.D. Power’s 2018 Customer Satisfaction Study.“Cost is not the sole indicator of customer satisfaction in the auto insurance industry. Low prices may attract new customers, but it’s service that keeps them.”– J.D. Power Business ConsultantDue to how the regions were split up, there were only 11 first-place winners in the U.S., and Erie Car Insurance was one of them. D.C. residents have only three car insurance companies with a “better than most” or “among the best” rating: Erie, Geico, and USAA. Note: since the auto insurance provider USAA is only available to active and retired members of the U.S. military (and their family members), it wasn’t ranked against the other companies in this study.

Not only did Erie Insurance get the highest customer satisfaction ranking in six states and D.C., but it also received an A+ from A.M. Best and is the 9th largest car insurance provider in our nation’s capital—now that’s saying something.

Read More: Erie Car Insurance Review

On to the juicy stuff . . . the LEAST favorite insurance providers among customers.

D.C.’s Car Insurance Companies with the MOST Customer Complaints

Here are the ten auto insurance companies in Washington D.C. that had the most justified complaints in 2017:

| Company | Complaint Ratio | Total Complaints |

|---|---|---|

| Allstate | 0.5 | 163 |

| American Family | 0.8 | 73 |

| Amica Mutual | 0.5 | 52 |

| Geico | 0.7 | 333 |

| J. Whited | 7.4 | 253 |

| Liberty Mutual | 6.1 | 222 |

| Metropolitan | 1.3 | 70 |

| Progressive | 0.8 | 120 |

| State Farm | 0.4 | 1482 |

| USAA | 0.7 | 296 |

Interestingly, two of the companies with the most complaints had the highest scores in the J.D. Power customer satisfaction survey.

This data proves that a company can have a high volume of complaints, but still deliver exceptional customer service. It’s what the company does with those complaints that really matters.

In addition, what says more about a company isn’t the number of complaints it receives (bigger companies will usually get more complaints), but rather the company’s complaint ratio. Defined: In this case, the complaint ratio is the number of complaints the auto insurance company received for every 1,000 accident claims it filed. Liberty Mutual, J. Whited, and Metropolitan have the most work to do in cutting down on customer complaints.

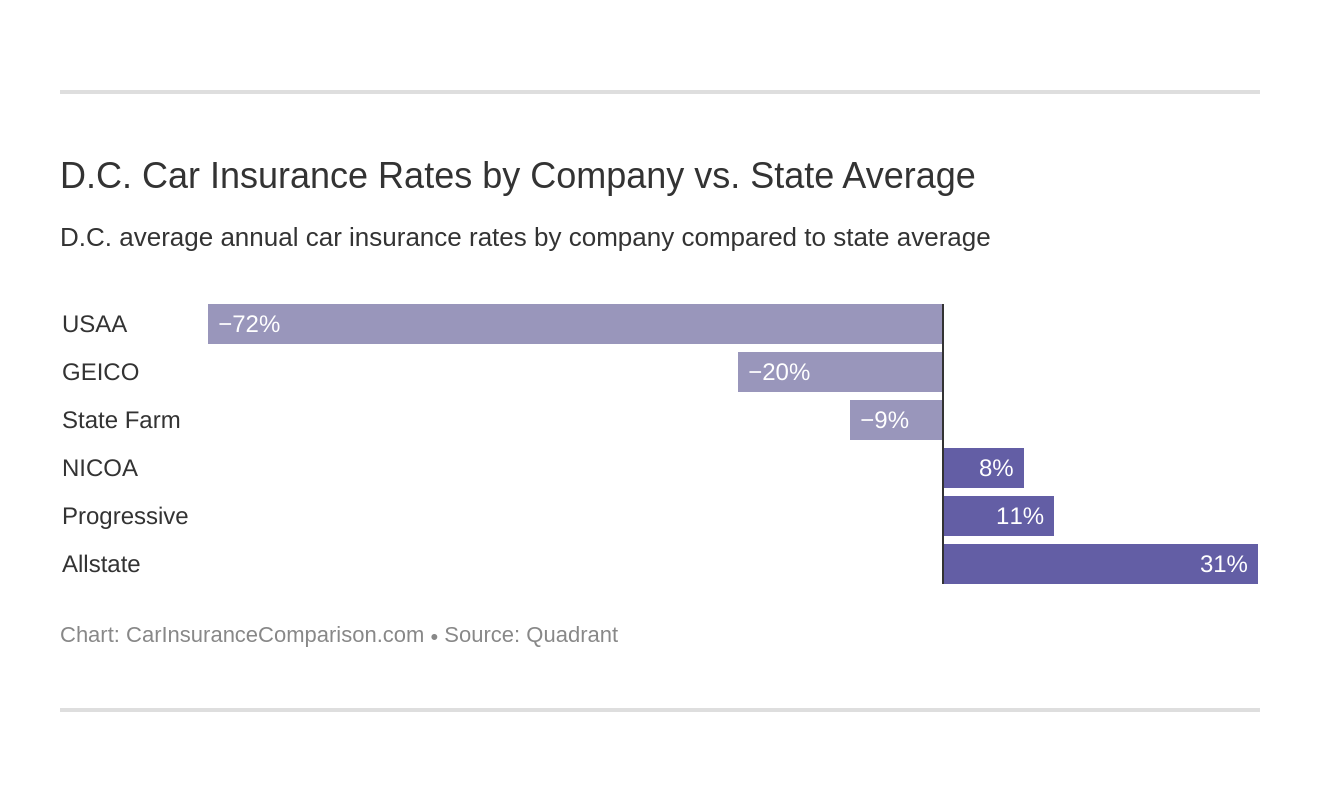

Washington D.C. Car Insurance Rates by Provider

| 10 Cheapest Providers | Annual Rates | 10 Most Expensive Providers | Annual Rates |

|---|---|---|---|

| Pharmacists Mutual | $280 | State Farm | $1,200 |

| Geico Advantage | $422 | Geico Choice | 1,264 |

| Horace Mann | $448 | LM General | $1,340 |

| USAA Casualty | $484 | Erie | $1,448 |

| IDS Property Casualty | $528 | Nationwide | $1,638 |

| USAA | $566 | California Casualty | $1,874 |

| Progressive Casualty | $580 | Great Northern | $2,154 |

| Amica | $614 | Allstate Property | $2,424 |

| Progressive Direct | $662 | LM Insurance | $2,824 |

| AIG Property Casualty | $702 | Allstate Indemnity | $5,774 |

Those averages are helpful, but how about some more specific rate quotes? We’ve got you covered! Check out these age-specific car insurance rates for the five most and least expensive D.C. providers below:

The above chart clearly illustrates how you can easily spend thousands of dollars more for the same car insurance coverage if you don’t shop around.

Here’s our free tool to help you price-compare the various providers in your area:

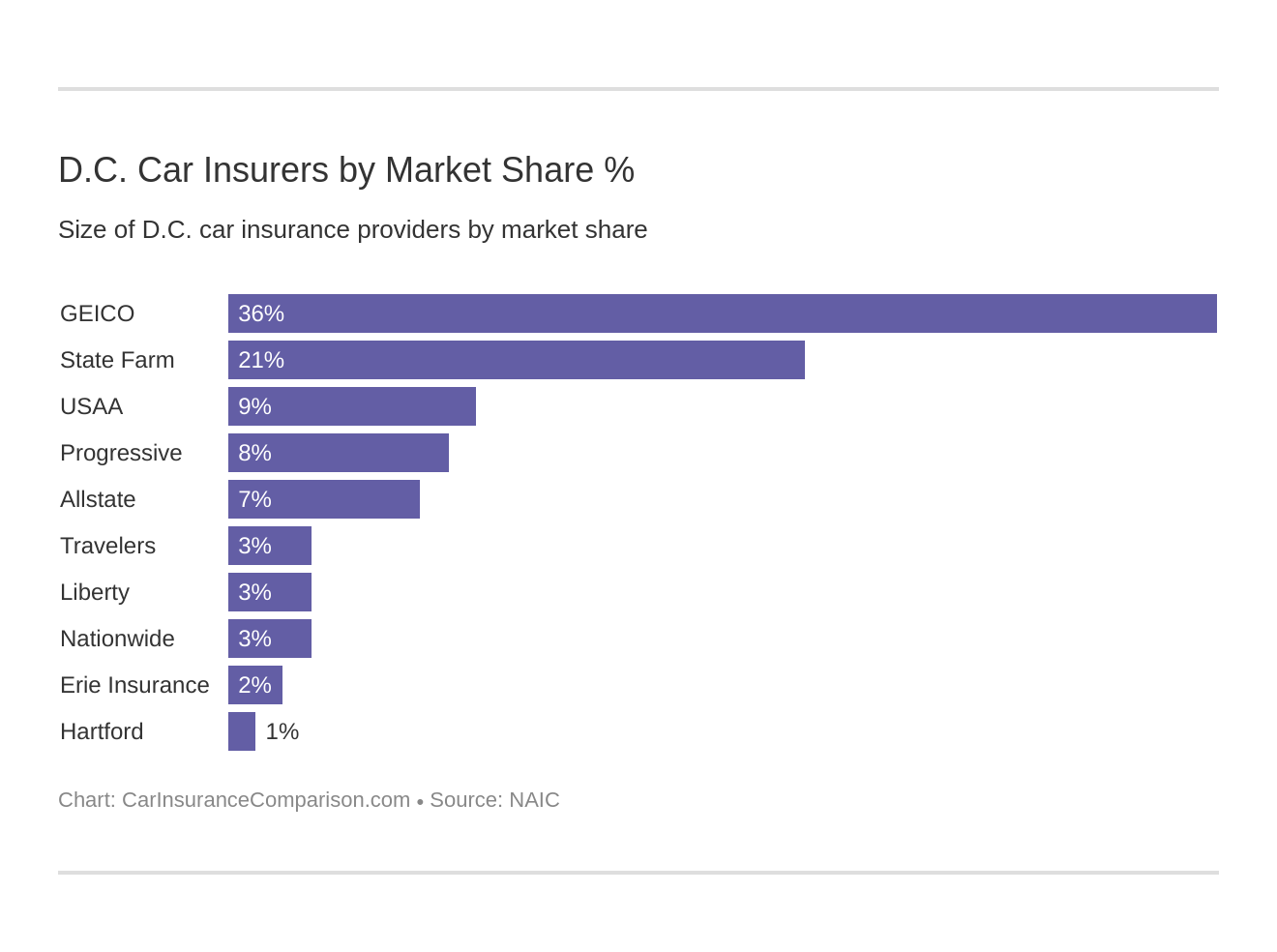

The 10 Largest Car Insurance Companies in Washington D.C.

| Provider | Premiums Written | Market Share |

|---|---|---|

| Hartford | 5,086 | 1.46% |

| Erie | 8,358 | 2.41% |

| Nationwide | 11,738 | 3.38% |

| Liberty Mutual | 11,876 | 3.42% |

| Travelers | 12,010 | 3.46% |

| Allstate | 23,392 | 6.73% |

| Progressive | 29,455 | 8.48% |

| USAA | 31,477 | 9.06% |

| State Farm | 72,050 | 20.74% |

| Berkshire Hathaway | 125,829 | 36.22% |

Feel like you don’t know much about the largest auto insurance provider in D.C.?Here’s a video showing how this company became so successful with the help of its chairman and CEO, Warren Buffet – who also happens to be one of the richest people in the world:https://www.youtube.com/watch?v=ee5BzwBCERENow there’s some financial smarts and security you can trust.

Number of Car Insurance Providers in Washington D.C.

Below are the total number of property and casualty insurance providers currently active in the District of Columbia:

| Provider Type | Total |

|---|---|

| Domestic | 6 |

| Foreign | 790 |

| Total | 796 |

Laws in Washington D.C.

In order to keep your car insurance rates low, you must follow the law. Turns out, you can’t do that if you don’t know the laws where you live and drive.

Don’t get a fine and points on your record for doing something you didn’t know was against the law.

We’re here to educate drivers. Scroll down so you can know, and stay on top of, the laws in our nation’s capital.

Washington D.C. Car Insurance Laws

It’s surprising how many different laws there are regarding car insurance across the U.S.

Remember, these laws keep dangerous drivers off the road and hold insurance providers accountable – that’s good for the responsible, safe individuals who drive in the District.

Law talk can seem dry, but stay with us! There’s important stuff covered below.

How Washington D.C.’s Insurance Rates & Laws are Determined

The NAIC’s classification of D.C.’s auto insurance approval process is “File and Use,” which is defined as: “Rates/forms must be filed with the state insurance department prior to their use. Specific approval is not required.” Exception: if an insurance commissioner in D.C. decides a car insurance rate is too high or too low, he or she can order a price adjustment to be made.

High-Risk Insurance in Washington D.C.

In D.C., a high-risk driver must hold a type of insurance called SR-22. Here are some examples of why D.C. drivers would be required to get this high-risk coverage:

- Getting caught driving uninsured

- Being convicted of a DUI

- Causing a serious accident

- Having too many points on your driving record

What makes car insurance more expensive? The above events are just some of the reasons a motorist would be required to carry this more expensive, high-risk insurance as proof of their liability in the District – usually for a minimum of three years. Your insurance provider will file your SR22 with the D.C. DMV for all vehicles that are registered under your name or that are driven by you.

Low-Cost or Low-Income Insurance in Washington D.C.

Currently, California, Hawaii, and New Jersey are the only three states that offer government-funded car insurance programs for lower-income families and car insurance for welfare recipients. However, D.C. does have its own line of auto insurance that’s been around since 1982 to ensure that every driver is properly insured.

The District of Columbia Automobile Insurance Plan (D.C. AIP) is available to motorists who are turned down from other providers due to a bad driving record or high-risk personal factors.

Maryland just recently expanded its program insuring high-risk drivers to now include low-income families. Hopefully, more states and D.C. will soon do the same.

Washington D.C.’s Windshield and Glass Repair Laws

38 states have laws on where and how vehicle repairs are done and what parts are allowed to be used for replacements due to damage. Some allow paying for car repairs without going through insurance.

Surprisingly, the District of Columbia does not have any laws regarding vehicle repairs or replacements.

You should know: Just because D.C. doesn’t have set laws on windshield cracks doesn’t mean you can’t get pulled over and ticketed for one. Drivers in D.C. are not allowed to operate a vehicle that has anything causing an obstructed view of the road. There are many companies out there (like the one below) eager to repair your broken windows. Don’t wait until it’s a danger to yourself or others.https://www.youtube.com/watch?v=nYfqPdPNHsoMotorists in D.C. have the option of adding a zero-deductible glass replacement benefit to their insurance policy, but this coverage is not required by law.

Automobile Insurance Fraud in Washington D.C.

Only 19 states have four or more of the following in place. Clearly, D.C. leaders take insurance fraud seriously:

| Efforts | D.C. Law |

|---|---|

| Insurance Fraud Classified as a Crime | Yes: penalties include fine and prison time |

| Immunity Statues Established | Yes: protects the proper exchange of information between customer and insurer |

| Fraud Bureaus in Place | Yes: the Enforcement and Investigation Bureau in the Department of Insurance investigates fraud in all three financial sectors |

| Mandatory Insurer Fraud Plan | Yes: requires insurers to create and implement programs to reduce insurance fraud |

| Mandatory Auto Photo Inspection | No: five states require photos to be taken of used cars before collision or comprehension coverage is provided |

Leaders in D.C. define insurance fraud as when a person knowingly defrauds or fraudulently obtains property.This is serious. Here are more specifics on what you can’t do according to Washington D.C. law:

- Present false information or knowingly conceal information when applying for or renewing an insurance policy, making a claim, applying for financing, selling an insurance policy, applying for an insurance license, or writing a financial statement

- Buy or sell insurance from or to someone who has a strong likelihood of not being able to pay off the debt owed

- Remove or change records of claims, official documents, or material assets regarding the insurance

- Misuse or hide insurance funds that come from claims, business transactions, or mergers

- Sell or buy insurance to/from someone without a license or certificate of authority

- Act as an agent to falsely obtain information or insurance money

- File a fraudulent claim against an insurer or the insured customer

And if you do any of the above, here are the consequences in the District:

| Crime Level | Fraud Level | Fine | Prison Time |

|---|---|---|---|

| Misdemeanor | Attempt - any value | Up to $1,000 | Up to 180 days |

| 2nd Degree | Attempt - value at $1,000 or more | 1st offense - up to $10,000 2nd offense - up to $20,000 | 1st offense - up to 5 years 2nd offense - up to 10 years |

| 1st Degree | Succeed - value at $1,000 or more | Up to $50,000 | Up to 15 years |

Bottom line: don’t do it. You might think fooling someone else is worth it, but you’ll be the only fool in the end.

The Statute of Limitations in Washington D.C.

Injured? Vehicle damaged? The statute of Limitations is just a fancy term for how long you have to file a claim, go to court, or otherwise fight for the money owed to you.

In Washington D.C. for both personal injury and property damage you have three years from the date of the incident to take legal action.

That’s good news for D.C. drivers and residents. The statute of limitations is only one or two years for personal injury in 25 states and for property damage in 15 states.

Specific Laws for Washington D.C.

Not being its own state, D.C. doesn’t have direct representation in Congress, which means that all of the laws District leaders want to be passed must go through the city council and a congressional review period before they can become official law.Since it’s not a state, you can probably get away with a lot more in D.C., right? WRONG.The below video discusses how over $1 million in parking fines were given out for D.C. cars that were completely snowed in! Even during a blizzard, D.C. drivers are held accountable.https://www.youtube.com/watch?v=-xUixiiUKOQThis small, but mighty area in the U.S. has its own specific laws called the District of Columbia Official Code; within this code is Title 50 that clearly defines all the laws having to do with vehicles and driving.Title 50 is made up of 27 chapters covering laws on commercial vehicles, government vehicles, taxicabs, environmental protection, registration, inspection, licensing, ownership, parking, and much more. The chapters are split up into 47 sections with links to navigate to each one.

Washington D.C.’s Vehicle Licensing Laws

Ever feel like being a law-abiding citizen is doing no good and only making you broke?

The penalties in D.C. are far from weak. Take our word for it, breaking the law is more expensive.

Read on for the cold, hard facts on why knowing and obeying D.C. law is always in your favor.

Results of Ignoring Insurance Laws in Washington D.C.

| Owning an Uninsured Vehicle | Fine | License Suspension | Reinstatement Fee |

|---|---|---|---|

| First Offense | $30 | 30 days | $98 |

| Subsequent Offenses | $30 + $150 ($7 each day after 1st 30 days up to $2,500) | 60 days | $98 |

| Driving an Uninsured Vehicle | Fine | License Suspension | Reinstatement Fee |

|---|---|---|---|

| First Offense | $30 + $500 Civil Fine | 30 days | $98 |

| Subsequent Offenses | $30 + $750 (Civil Fine increases by 50% each offense) | 60 days | $98 |

You and your vehicle don’t just have to be properly insured, you have to be able to prove it at all times while operating a vehicle on public roads.

Even if you’re following the law, if you’re pulled over and can’t prove you and your vehicle are insured, you face all of the same penalties.If you missed the section covering the “Proof of Insurance Law” in D.C., click here for a quick refresher.

How Washington D.C. Enforces Insurance Laws

If you are pulled over, stopped at random, or involved in an accident, a D.C. police officer will ask to see proof of your insurance.As discussed above, if you can’t show acceptable proof, you will receive a ticket for driving uninsured on the spot.There’s more! D.C. insurers are required by law to update the DMV of any and all status changes – such as cancellations or non-renewals – regarding their policyholders. Plus, the DMV randomly tests registrations on file to ensure they are properly, actively insured.Even if you aren’t driving your vehicle you can get fined:“You must maintain your vehicle insurance as long as your vehicle is registered. If you no longer have or intend to drive your vehicle, do not cancel your vehicle insurance until you return your vehicle tags to DC DMV. If you let your vehicle insurance lapse, you will be fined.”– DC.gov

The fines for owning an uninsured vehicle can quickly reach $2,500, and the fourth time you’re caught driving uninsured you have to pay $1,718—that number rapidly increases with each offense.

Moral of the story: consider your auto insurance to be just as necessary as a properly functioning vehicle. The insurance is there to protect you, your loved ones, and your financial investments, AND it will keep you from serious penalties and steep fines.

Teen Driver Laws in Washington D.C.

Sorry, bad news for teens! D.C. has the oldest minimum age requirement in America for getting a driver’s license.

In some states you can get a license at only 15 years-old, but in D.C. young drivers have to wait until they are 16 and a half!

Those six months can feel like an eternity when you are craving freedom. The teen driver restrictions don’t stop there:

| Requirements for Getting a Driver's License | Time/Age |

|---|---|

| Mandatory holding period | 6 months |

| Minimum supervised driving time | 40 hrs in learner’s stage 10 hrs at night in intermediate stage |

| Minimum age | 16.5 years-old |

You think that’s strict? There’s more! Take a look at these rules:

| Restrictions for Learner's to Intermediate License | Specifics |

|---|---|

| Driving | Learner's: prohibited 9pm-6am Intermediate: prohibited Sep to June: 11pm-6am (Sun-Thurs) & 12:01am-6am (Sat-Sun) July to Aug: 12:01am-6am |

| Passengers | None for either license stage (unless immediate family) |

Let me repeat: No passengers are allowed in the car unless they are the teen driver’s immediate family. This means no picking up your friends and heading to the movies or, well, anywhere. D.C.’s teen driver restrictions are NOT just for a short time period either. The learner’s permit stage is mandatory regardless of age (and getting learner’s permit car insurance isn’t a bad idea, either). The intermediate stage must be completed or the driver must turn 21, whichever comes first before the above restrictions are lifted.

Passenger and night driving restrictions in D.C. get more lenient once the driver turns 18, but they are not fully lifted until the driver is 21 years old and a full two years removed from his/her teen years!

Drivers under 18: even if they complete the intermediate stage, they must continue to follow the nighttime driving restrictions. After they complete the intermediate phase, they can have passengers, but no more than two under the age of 21. D.C. is onto something with these strict teen driver rules and regulations. The Insurance Institute for Highway Safety (IIHS) paints a clear picture of how deadly these “High-Risk Years” truly are:https://www.youtube.com/watch?v=DmIhjMwZs5A

Compare car insurance rates for teen drivers if you’re looking to find the best coverage for your young driver in Washington, D.C.

License Renewal Procedures in Washington D.C.

Important! No matter how old you are, every driver in D.C. must get their license renewed every eight years. This is actually pretty lenient – in some states, it’s twice as often at every four years.

Regardless of age, in D.C. all motorists must show proof of adequate vision at every license renewal (every eight years).

Trying to avoid a dreaded visit to the DMV? You’re in luck!D.C. allows drivers under the age of 70 to renew their license by mail or online for every other renewal. As long as you are under 70, you can avoid the DMV for 16 straight years! Once drivers are 70 and older, they must renew their license in person every eight years so that the DMV can attest to their physical and mental abilities.

Vehicle Inspection Requirements in Washington D.C.

| Inspection Type | Private Passenger Vehicle | Commercial Vehicle | For-Hire Vehicle |

|---|---|---|---|

| Emissions | Every 2 years | Annual | Annual |

| Safety | Not required | Annual | Annual |

Curious what those inspections are going to run you? Here’s the breakdown:

| Vehicle Type | Cost |

|---|---|

| New Vehicle | $10 |

| Private Passenger Vehicle | $35 |

| For-Hire Vehicle | $35 |

| Commercial Vehicle | $35 |

| Re-Inspection (after failing) | $35 (after 20 days) |

| Inspection Sticker Replacement | $10 |

Free passes! if your vehicle fails the inspection, you have two free re-inspections you can use within 20 days. After 20 days you have to pay the $35 fee again.

New Residents to Washington D.C.

Are you moving to D.C.? Here’s what you’ll need to do:

- Step 1: Make sure your current car insurance meets D.C.’s minimum requirements – this is a good time to shop around to get the best deal.

- Step 2: Complete a vehicle inspection – all vehicles in D.C. must pass an emission inspection; commercial and for-hire vehicles require safety inspections. Every 30-day period you fail to get the inspection(s) is awarded a $20 late fee.

- Step 3: Register your car with the D.C. DMV – this must be done in person and within 30 days of moving to the area. Make sure you bring proof of your new D.C. address (bill, lease/mortgage etc).

For more helpful information, visit DC.gov’s “New Residents” section which covers many important topics and includes over 30 links to various resources.

Washington D.C. Driver Points System

Like much of the U.S., the District of Columbia uses a car insurance points system for moving violations and other illegal motorist activity.

When D.C. drivers get 10 to 11 points, their license gets suspended and they lose their driving privileges for 90 days. If they get 12 or more points, their license gets revoked and they lose their driving privileges for at least six months.

Curious how many points a specific mistake will award you? Here is what you will get in D.C. for the most common violations:

| Violation | Points Awarded |

|---|---|

| Drive with an expired license (under 90 days expired) | 2 |

| Drive a vehicle without the required class of license | 2 |

| Follow another vehicle too closely (tailgate) | 2 |

| Commit a moving violation that doesn't contribute to an accident (and isn't listed below) | 2-3 |

| Break the seatbelt laws | 3 |

| Commit moving violations that contribute to an accident | 3 |

| Fail to yield or stop for a pedestrian | 3 |

| Speed 11-15 mph over the posted speed limit | 3 |

| Speed 16-20 mph over the posted speed limit | 4 |

| Fail to stop for a school bus when lights flashing | 4 |

| Drive when in violation of your restricted license | 4 |

| Drive with a learner's permit without a licensed driver | 5 |

| Speed 21 mph over the posted speed limit | 5 |

| Commit a misdemeanor crime involving a motor vehicle | 6 |

| Fail to yield to an emergency vehicle | 6 |

| Reckless driving | 6 |

| Leave the scene of a collision (when no personal injuries occurred) | 8 |

| Turn off headlights to avoid being seen by a police officer | 8 |

The following 11 acts will instantly cost you your license if committed in Washington D.C.:

| Violation | Points Awarded |

|---|---|

| Flee or attempt to elude a police officer | 12 |

| Leave the scene of an accident where personal injury occurred (hit and run) | 12 |

| Aggravated reckless driving | 12 |

| Drive with a suspended or revoked driver license | 12 |

| Drive with someone else's driver license | 12 |

| Get convicted for an assault or homicide by vehicle | 12 |

| Drive under the influence of alcohol or drugs | 12 |

| Drive under 21 with any measurable amount of alcohol | 12 |

| Commit a felony crime by vehicle | 12 |

| Make a false affidavit or statement under any law relating to driving or vehicles | 12 |

| Commit any violation while driving without the permission of the owner | 12 |

Don’t ever forget: driving is a privilege that can be easily lost by just one foolish decision.

Washington D.C.’s Rules of the Road

The best way to avoid points on your license and having to pay higher car insurance rates after a ticket is to simply obey the law. This guide will help you stay points-free and pay the cheapest rates possible by keeping you in the know. Scroll down to quickly learn the key laws in D.C. that every motorist must follow or else they’ll pay – in more ways than one.

Fault vs No-Fault

Washington D.C. is a “no-fault” district.

No matter who is at fault for a car accident in D.C., those hurt can use their personal injury protection (PIP) or “no-fault” insurance to get compensation for medical bills and lost wages from their insurance company.

However, PIP or no-fault insurance is not the best option for the innocent victims in an accident or when there are major damages. In D.C., it’s best for the injured (and innocent) parties to submit a claim against the at-fault driver. Take action: after an accident, all who were involved have 60 days to either use their no-fault coverage or file a claim against someone else’s insurance (usually the driver responsible). Normally you can’t file a claim against the at-fault driver and receive no-fault benefits, but in D.C. you can if both of the following criteria are met:

- Your medical bills exceed your insurance policy’s PIP coverage

- Your injuries cause permanent impairment or disfigurement, scarring, or disability lasting at least 180 days

Evaluate your risks! If both the monetary and injury requirements listed above aren’t met, the charges against the driver will be dropped.Still confused? Here’s a helpful video that covers no-fault coverage in great detail:https://www.youtube.com/watch?v=nxUNSUnqb-w

Keep Right and Move Over Laws in Washington D.C.

Shocker! Even though ALL 50 states have laws and penalties in place to make sure motorists move over to provide safety and space for an emergency vehicle or police officer on the side of the road, Washington, D.C. does NOT!

If you live in D.C. please know that Maryland has had a “Move Over” law since 2010 and Virginia has since 2002, and these laws are strictly enforced to keep our first responders safe.

In D.C. it is legal for drivers to pass on the left or the right, but slower vehicles must keep right. Here is the exact wording for D.C.’s “Keep Right” law: When you are driving more slowly than the traffic flow on a highway that has two or more lanes in your direction, you should move to and stay in the right lane. And as far as “Move Over” goes, it’s a strong suggestion: If you see a vehicle stopped on the shoulder, you should slow down and move to the left part of your lane or the next lane, if available. In summary: usually keep right, but not always!

Speed Limits in Washington D.C.

Prior to 1995, the U.S. Congress would withhold highway funds from states that had posted speed limits that were higher than 55 mph.

Even though it’s now 23 years later, and nine states allow vehicles to travel 75 to 80 mph, D.C.’s speed limits still don’t exceed 55 mph.

Taking it slow: Washington D.C.’s roads have speed limits ranging from 25 to 55 mph. D.C. is the minority in this department; as of January 2019, 41 states had speed limits at or above 70 mph.

Seat Belt and Car Seat Laws in Washington D.C.

Since October 1, 1997, seat belt laws in the District of Columbia have been mandated with primary enforcement.

In D.C., police officers can pull drivers over if anyone in the vehicle appears to be breaking the restraint requirements. In 18 states it’s a secondary law, meaning officers need another reason to pull the car over.

| Seat Belt Laws | Specifics |

|---|---|

| Effective Since | December 12, 1985 |

| Primary Enforcement | Yes |

| Age/Seats Applicable | 16+ years old in all seats |

| 1st Offense Fine | $50 plus fees |

That’s not all! D.C. and 30 states have laws in place prohibiting passengers from riding in the bed of pickup trucks. Laws involving children are taken even more seriously. Why? Extra precautions are needed so insurance can cover car seat replacement and we can keep our littlest, most helpless passengers safe. Most states have laws that specify the location in the vehicle, the type of seat, and even the buckle that is required for children passengers, but D.C.’s laws don’t go into those specifics:

| Car Seat Laws | Specifics |

|---|---|

| Car Seat Required | Children 7 yrs old and under |

| Rear-Facing Seat Required | No Law |

| Forward-Facing Seat Allowed | No Law |

| Booster Seat Allowed | No Law |

| Adult Seat Belt Allowed | Children 8 yrs old and older |

| Rear Seats Required | No Law |

| 1st Offense Fine | $75 |

Steep Penalties! On top of the $50 to $75 fines, D.C. drivers face points being added to their license when breaking both the seat belt and car seat laws.Heed the warnings from the D.C. mom who shares her story below. You don’t just need the correct car seat for your child, you need to make sure it’s installed correctly.See for yourself in the horrifying collision photos displayed in this ABC news clip:https://www.youtube.com/watch?v=b7z7jZwK0B8

Ridesharing in Washington D.C.

Lyft, Uber, and 17 other companies listed in the DC.gov “Ridesharing and Ridematching Services” section of the government-funding site, all service the District.

Allstate, Geico, and Liberty Mutual all offer car insurance in D.C. to drivers using their vehicle for rideshare, delivery, and ride hailing services.

Here are some rules governing the two largest rideshare companies operating across the District of Columbia:

| Requirements | Lyft | Uber |

|---|---|---|

| Vehicle Year | 2006 or newer | 2007 or newer |

| Vehicle Size | 4-door with 5-8 seats | 4-door car or minivan |

| Vehicle Safety | Must pass DMV check and background check | Must pass inspection, be in good condition, & no cosmetic damage (no commercial branding allowed) |

| Driver | Must be over 21 and have a valid driver's license | Must be over 21 and have a valid driver's license |

| Insurance & Registration | Must have state/local insurance and vehicle registration | Must have state/local insurance and vehicle registration |

Of course, there are more rules than that!Here are the legislative regulations from D.C.’s Public Vehicle-for-Hire Innovation Act:

- Privately owned vehicles can be used as for-hire public transportation if the drivers are notified electronically

- Rideshare drivers are prohibited from picking up passengers that hail them from the street

- Rideshare drivers are prohibited from offering rides at taxi stands designated for D.C. taxis

- If illegal behavior is suspected, the driver must provide law enforcement their trip records

- Background checks and insurance are required for all drivers

- Companies must provide passengers with a photo of the driver and license plate before pickup

- Drivers must pass a criminal background check, sex offender database check, and driver history check

- App-based services must provide insurance coverage of at least $50,000 per person per accident, up to $100,000 available to all, and at least $25,000 for property damage (higher than D.C.’s minimum requirements)

- A rideshare driver may work for more than one company (unless not allowed by the company)

Automation on the Roads in Washington D.C.

The capital of our country is at the forefront of the vehicle technology advancements happening now.

While most of the U.S. has only approved the testing of autonomous vehicles, D.C. and just ten states allow “full deployment” of automatic vehicles on their roadways.

Below are the rules governing the use of autonomous vehicles in the District of Columbia – updated January 2019:

| AV Use | Extent Allowed |

|---|---|

| Driving Allowed | Full deployment |

| Operator License Required | Yes |

| Operator Required to be in the Vehicle | Yes |

| Liability Insurance Required | No |

Risky Business! D.C. is one of only three areas in the U.S. that allows full deployment of AVs, but does not require extra liability insurance – most states require $5,000,000 in coverage!

Washington D.C.’s Laws Against Driving Impaired

In 2016 the District of Columbia had an alarming 51 percent of its traffic deaths involve a driver who had been drinking.

38 percent of the deaths that occurred on D.C.’s roads in 2016 involved a driver with a BAC of .08 or higher—100 percent preventable deaths when you subtract drunk driving from the equation!

Here are some key facts on DUIs in our nation’s capital:

| Driving Impaired | Specifics |

|---|---|

| Name for Offense | Driving Under the Influence (DUI) |

| BAC Limit | .08 |

| High BAC Categories | .20-.25 .25-.30 .30+ |

| Criminal Status | Misdemeanor |

| Look Back Period | 15 years |

Lingo Defined: the look back or washout period is the amount of time an offense remains on your record. In regards to a DUI, the District of Columbia is one of the least forgiving areas in the U.S. with this period lasting 15 years – some states let you have a clean slate after only five years!Here’s the breakdown for first, second, and third DUIs in D.C.:

| 1st Offense | Penalties |

|---|---|

| License Revoked | 6 months |

| Jail Time | BAC over .20: 10 days BAC over .25: 15 days BAC over .30: 20 days up to 180 days |

| Fine | up to $1,000 |

| Vehicle Impounded | No Law |

| DUI Program | Alcohol Diversion Program possible |

| Community Service | Determined in Court |

| Mandatory Ignition Interlock Device | Yes |

| Required to get License Reinstated | $98 min, SR22 insurance, and retake driver test |

| Probation | Determined in Court |

| 2nd Offense: | Penalties: |

|---|---|

| License Revoked | 1 year |

| Jail Time | BAC below .20: 5 min BAC over .20: 10 days BAC over .25: 20 days up to 1 year |

| Fine | up to $5,000 |

| Vehicle Impounded | No Law |

| DUI Program | Determined in Court |

| Community Service | 30 days possible |

| Mandatory Ignition Interlock Device | Yes |

| Required to get License Reinstated | $98 min, SR22 insurance, and retake driver test |

| Probation | Determined in Court |

| 3rd Offense | Penalties |

|---|---|

| License Revoked | 3 years |

| Jail Time | BAC under .20: 5 days min BAC over .20: 15 days BAC over .25: 25 days up to 1 year |

| Fine | up to $10,000 |

| Vehicle Impounded | No Law |

| DUI Program | Determined in Court |

| Community Service | 30 days possible |

| Mandatory Ignition Interlock Device | Yes |

| Required to get License Reinstated | $98 min, SR22 insurance, and retake driver test |

| Probation | Determined in Court |

The above fines and penalties all apply even if the vehicle never moves an inch! According to D.C. law, being behind the wheel with the keys in the ignition while impaired is enough to earn a DUI.

“Did You Know? The average DUI costs the offender about $10,000.”– DC.govHear directly from a local lawyer on how the various BAC levels are handled in D.C. and what to do if you get convicted of driving impaired:https://www.youtube.com/watch?v=jwiU7gO1M38D.C. doesn’t currently have any specific laws regarding marijuana drugged driving. However, that doesn’t mean you can’t get a DUI after smoking pot.“Drug or alcohol use can cause impairment, and marijuana stays in the blood for days after and could be used to convict if someone shows other signs of impaired driving.”– D.C. DUI Defense Lawyer, David BenowitzBottom line: driving impaired – whether by alcohol or drugs – is deadly for you, your passengers, and anyone on the road around you—just don’t do it.

Distracted Driving Laws in Washington D.C.

Crash data proves that driving distracted can be just as deadly as driving impaired.

D.C. takes distracted driving more seriously than most of the U.S. Only 32 percent of our nation has a law making hand-held cellphone use while driving illegal.

Here are the laws in D.C. regarding phone use behind the wheel – updated January 2019:

| Cellphones Laws: | Who? |

|---|---|

| Hand-held use banned | All drivers |

| All use banned | Learner's permit holders |

| Texting banned | All drivers |

| Enforcement | Primary |

Primary vs Secondary Laws in regards to police enforcement is explained here. Beware! Not only was D.C. first to completely ban texting while driving (by three whole years!), but it is also known for giving the most texting tickets with nearly 90,000 written in D.C. alone in under a decade!

Washington D.C.’s Can’t-Miss Facts

Skimming through the above portion of this Auto Insurance Guide for District of Columbia, you will get a basic understanding of the intricate laws, penalties, and requirements that hold D.C. drivers and insurers accountable.

Great! You know the insurance and traffic laws in D.C., but are you aware of the risks and costs involved with owning a car here or even just commuting to/through this portion of the country?

Not only do we want you to have insurance for when things go wrong, but we also are here to help you avoid having things go wrong in the first place. The section below will give you quick, clear statistics to help you know what dangers to look out for as a responsible car owner and operator in the various regions of our nation’s capital.

Vehicle Theft in Washington D.C.

What type of car do you drive?You’re going to want to see these totals for the ten most stolen vehicles in D.C. from the National Insurance Crime Bureau for 2015:

| Make & Model | Vehicle Year | Total Thefts |

|---|---|---|

| Chevrolet Impala | 2013 | 40 |

| Chrysler 300/300M | 2005 | 40 |

| Chevrolet Full Size Pickup | 1999 | 41 |

| Ford Full Size Pickup | 1997 | 49 |

| Nissan Altima | 2015 | 62 |

| Toyota Corolla | 2010 | 70 |

| Toyota Camry | 2014 | 95 |

| Jeep Cherokee/Grand Cherokee | 2001 | 109 |

| Honda Accord | 1997 | 132 |

| Dodge Caravan | 2002 | 167 |

Take Note: Specific vehicle model and years are often targeted by car thieves.

FBI reports show there were 3,147 stolen vehicles in Washington D.C. alone in 2013, and they have been on the rise since.

Plus, your only concern shouldn’t be your car being stolen—consider the valuables you leave inside of it too.There’s a lesson we can all learn from the story below. Hear how a thief took all of the essential wedding plans and private details from a devastated D.C. couple that was about to get married:https://www.youtube.com/watch?v=GhyhxL75IAM

Deadly Car Crash Statistics in Washington D.C.

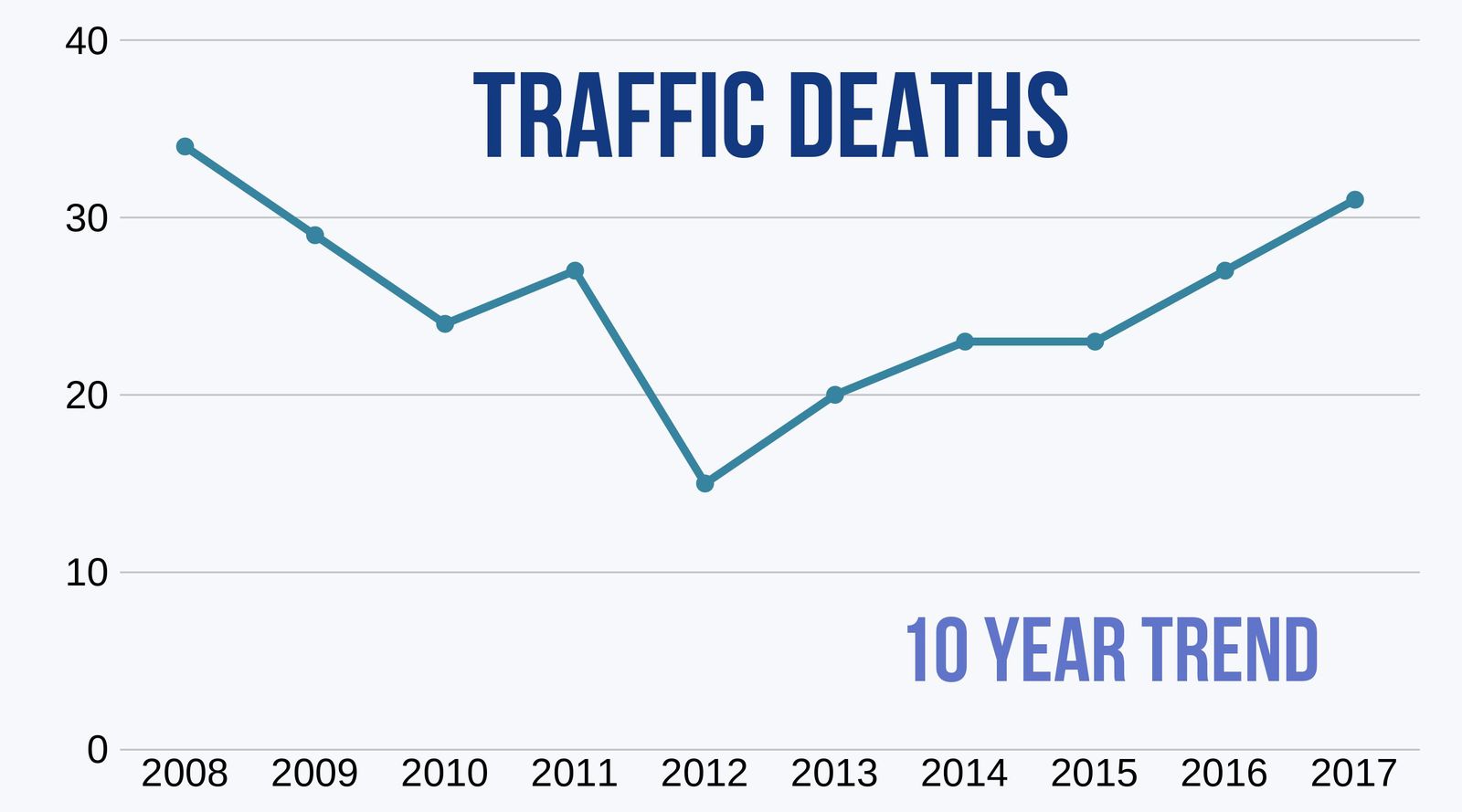

Let’s dive right into an alarming 10-year trend of deaths resulting from deadly car crashes on roads across the District.

| Year | Total Deaths | Year | Total Deaths |

|---|---|---|---|

| 2008 | 34 | 2013 | 20 |

| 2009 | 29 | 2014 | 23 |

| 2010 | 24 | 2015 | 23 |

| 2011 | 27 | 2016 | 27 |

| 2012 | 15 | 2017 | 31 |

Here’s a visual for those 253 total traffic fatalities over a decade in D.C.:

What were these people doing when they were killed? Walking, riding a bike, travelling by car (and what type?), driving a motorcycle??

Here’s a five-year trend for traffic deaths by who was killed:

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Motorcyclists | 3 | 3 | 3 | 6 | 4 |

| Pedestrians | 9 | 9 | 13 | 8 | 11 |

| Bicyclists | 1 | 1 | 1 | 1 | 2 |

| Passenger Car Occupants | 4 | 7 | 6 | 8 | 12 |

| Truck & Van Occupants | 3 | 3 | 0 | 4 | 2 |

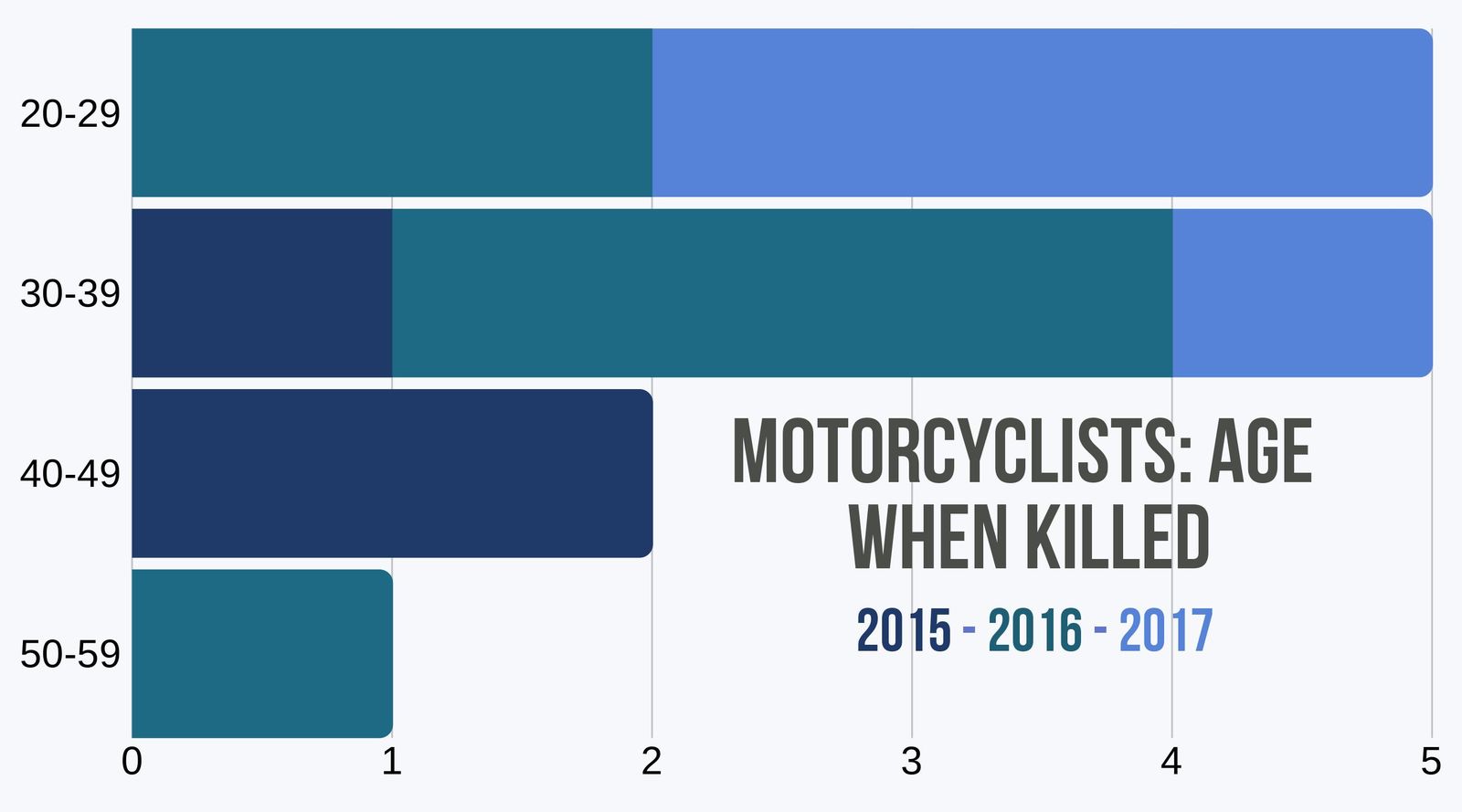

This chart shows the ages of the motorcyclists that were lost in those devastating accidents:

Tragic Reality: The largest number of motorcyclists who were killed in crashes (in two consecutive years) in D.C. were only in their 20s—with a whole life ahead of them.

On to another big question: “What types of car crashes are killing these people??”Check out another eye-opening crash chart:

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle Crash | 13 | 16 | 17 | 18 | 24 |

| Large Truck Involved | 3 | 5 | 2 | 0 | 0 |

| Speeding Involved | 9 | 12 | 7 | 16 | 17 |

| Rollover Involved | 3 | 4 | 1 | 3 | 4 |

| Alcohol-Impaired Driver | 7 | 5 | 7 | 12 | 16 |

| Involving an Intersection | 10 | 10 | 10 | 10 | 10 |

| Roadway Departure Involved | 6 | 7 | 5 | 11 | 13 |

Let’s take a look specifically at two of the deadliest driver decisions and how many deaths these mistakes caused:

EMS Response Time in Washington D.C.

Enough of that depressing death talk. Time to move on to more encouraging statistics for the District of Columbia.

No matter the cause or time of day, if you’re hurt in a traffic accident, D.C. is well equipped with medical teams to help you!

Let’s see how fast D.C.’s Emergency Medical Services are to arrive on the scene and get those who are injured the help that they need.

| Status | Time |

|---|---|

| Time of Crash to EMS Notification | 1 minute 57 seconds |

| Notification to EMS Arrival | 3 minutes 39 seconds |

| Time of Crash to Hospital Arrival | 48 minutes 40 seconds |

Great news! In under four minutes, medically-trained professionals arrive to help injured victims after a deadly collision in D.C.

Now for the BAD News: Compared to the entire U.S., EMS teams in the District have the longest average time (over 48 minutes) to get the injured to the hospital after a fatal crash. Seven states have their crash-to-hospital total time at under 30 minutes!

The average EMS response times for D.C. listed above were provided by the NHTSA for urban fatal car crashes in 2016.

Washington D.C. Transportation

Ever wonder how many cars most D.C. residents have in their driveways and garages?

Interesting Fact: In Washington D.C. there’s a significantly higher number of families that have ZERO or just one vehicle to their name than the average U.S. family.

In 2016, 25.4 percent of D.C. households didn’t own a car, 43.4 percent owned one, 23.5 percent owned two, and only 5.3 percent owned three. Check out this interactive chart showing four years of car ownership in D.C. compared to the U.S. average: According to WTOP, D.C. residents don’t need a car: In fact, between 2010 and 2012, the number of car-free households in the District increased by 12,612, according to information from the U.S. Census Bureau. In addition, 88 percent of new households citywide were car-free.Let’s move on to the topic of commute times and traffic congestion in Washington D.C.

The District of Columbia had an estimated population of 703,608 in 2018 and has an average monthly growth rate of 803 residents!

“Washington, DC continues to attract new residents from around the region and across the globe. We are a city where people want to do business, raise a family, and age in place – a city committed to our residents and DC values. As we continue to grow, my Administration remains laser-focused on creating jobs, producing and preserving affordable housing, accelerating school reform, and building a safer, stronger DC.” – Mayor BowserThat’s exciting news for D.C., but what about traffic? . . . Well, it’s not great folks!A huge traffic study was performed by INRIX experts, and out of 1,360 cities in 5 continents and 38 countries, Washington D.C. ranked 18th – at the top for the most traffic globally!

| Subject | Result |

|---|---|

| 2016 Ranking | 15th |

| 2017 Ranking | 18th |

| 2016 INRIX Scorecard Ranking | 13th |

| 2017 INRIX Scorecard Ranking | 13th |

| Annual Time Stuck in Traffic | 63 hours |

| INRIX Congestion Index | 10.8 |

| Percentage of Driving Time Stuck in Traffic | Peak: 20% Daytime: 9% Overall: 11% |

Keep in mind those rankings are out of 1,360 cities—top 20 in all four rankings is pretty rough. Here’s how D.C. commute times compare to the U.S. average:For four consecutive years now, D.C. residents have had longer commute times than the average American.For 29 percent of D.C. employees, it’s taking 40 to 90 minutes just to get to work! Over 7,000 D.C. households have to sit in their cars for a minimum of three hours to go to and from work every weekday. It’s hard to like a job after all that time spent on the road away from home.With those figures in mind, it’s not hard to understand how all that time spent in your car can affect your car insurance. Of course, that’s not the only factor companies consider.

Okay we know that lots of D.C. homes are car-free, there’s lots of traffic, and commute times can get quite lengthy. So, how do people employed in D.C. get to work?From 2013 to 2016, nearly 40 percent of D.C. employees utilized public transportation for commuting to/from work while the U.S. average was just five percent those same four years!

Considering it’s only made up of 68.34 square miles of land, it’s rather impressive all of the public transportation D.C. has to offer. DC.gov has a page dedicated to the Mass Transit and related programs it has to offer, here.But for the 38 to 41 percent of you driving alone or carpooling to work, and for all the D.C. residents who own at least one car (it’s still the majority of you), be sure you have adequate car insurance coverage and that you’re getting a good deal. Use our free tool to compare a few policies in your area today!

Frequently Asked Questions

How can I compare car insurance rates in Washington DC?

To compare car insurance rates in Washington DC, gather information, research insurance providers, request quotes, compare coverage options, consider customer reviews, analyze costs, and make an informed decision.

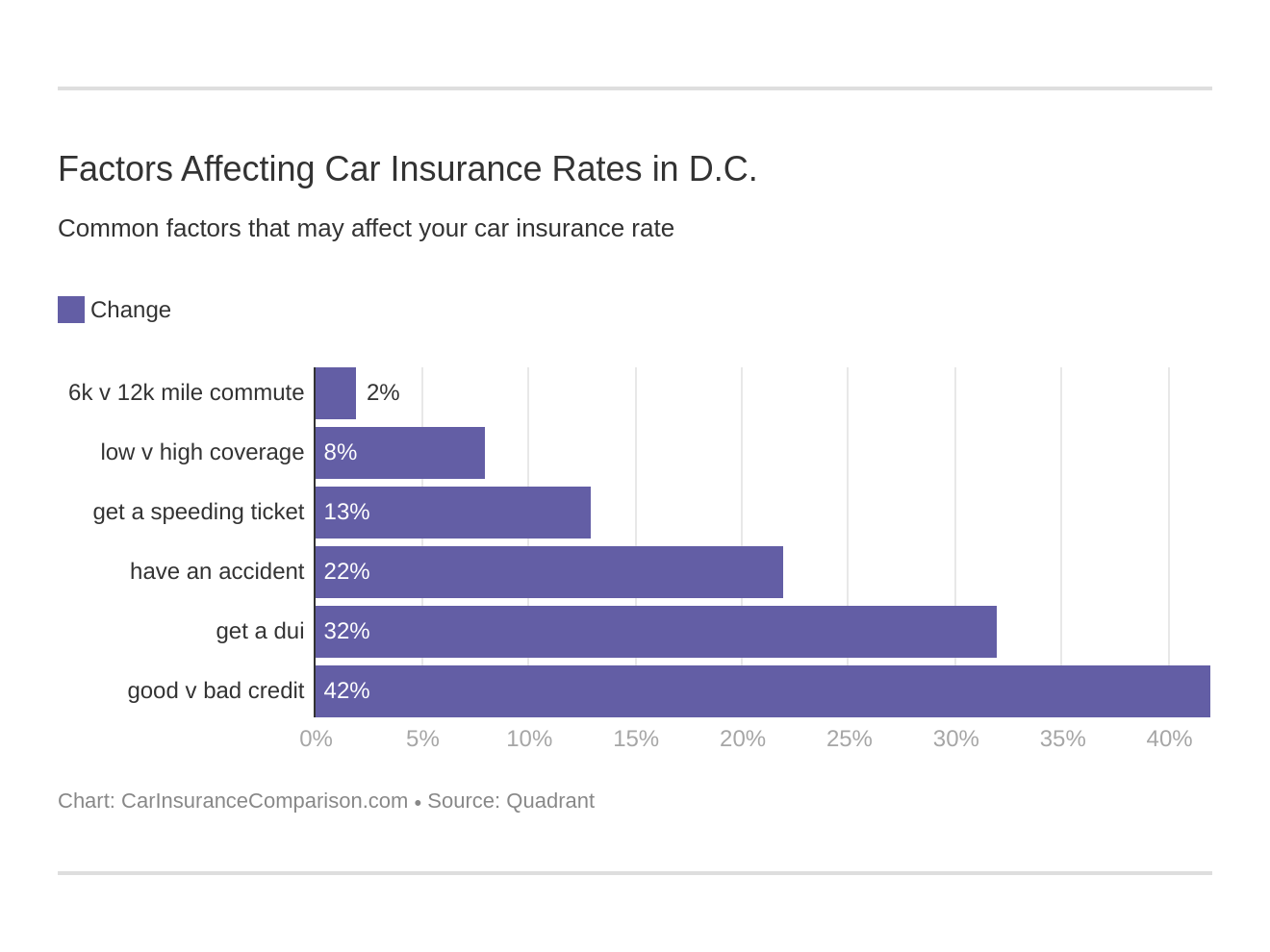

What factors influence car insurance rates in Washington DC?

Factors that affect car insurance rates in Washington DC include driving record, vehicle details, coverage limits, deductibles, age, gender, credit history, mileage, location, claim history, and insurance coverage history.

Are there specific car insurance requirements in Washington DC?

Yes, Washington DC requires drivers to carry liability insurance with minimums of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

Are there discounts available to lower car insurance rates in Washington DC?

Yes, discounts in Washington DC may include good driver, bundling, safety features, good student, defensive driving course, low mileage, and affiliation discounts.

Can my credit score affect my car insurance rates in Washington DC?

Yes, credit scores can impact car insurance rates in Washington DC, as some insurers use credit-based insurance scores to assess claim likelihood.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.