Best San Francisco, CA Car Insurance in 2025

Rates for car insurance in San Francisco, CA, are $451.25/mo on average. California requires 15/30/5 in minimum liability coverage. Compare quotes below for free.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| San Francisco Summary | Stats |

|---|---|

| City Population | 884,363 |

| City Density | 18,939 people per square mile |

| Average Cost of Car Insurance | $5,415 |

| Cheapest Car Insurance Provider | Geico |

| Road Conditions | Poor Share: 71% Mediocre Share: 16% Fair Share: 6% Good Share: 6% VOC: $1,049 |

Car insurance in San Francisco, California, can be among the most expensive car insurance rates in California. New and current residents are often caught off guard by car insurance rates after receiving their registration. However, we’ve put together a guide to give you information on what to expect from car insurance companies.In addition to car insurance premium information, we’ll tell you what it’s like to drive in San Francisco. Also, residents and veterans living in San Francisco will receive additional information on roadway fatalities, education, and frequently asked questions.Are you’re ready to compare rates? Enter your zip code in our tool above to get rates in your area.

The Cost of Car Insurance in San Francisco

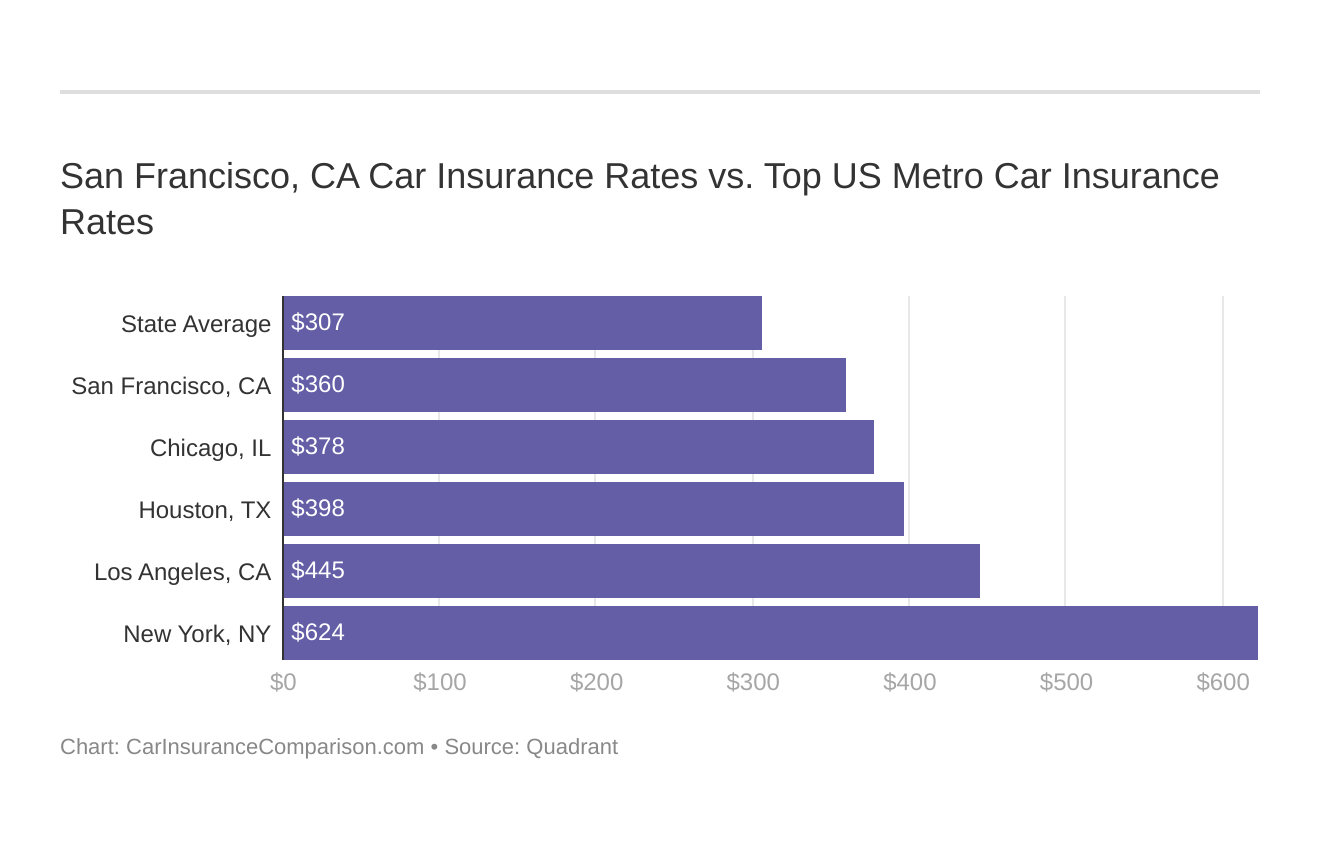

San Francisco ranks as a city with some of the most expensive car insurance rates in the U.S. Like most cities in California, San Francisco has many car insurance companies that offer premiums based on commute mileage, coverage level, and driving record. For new residents, you might be surprised at some of the factors that won’t affect your car insurance rates per year.You might find yourself asking how does my San Francisco, CA stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

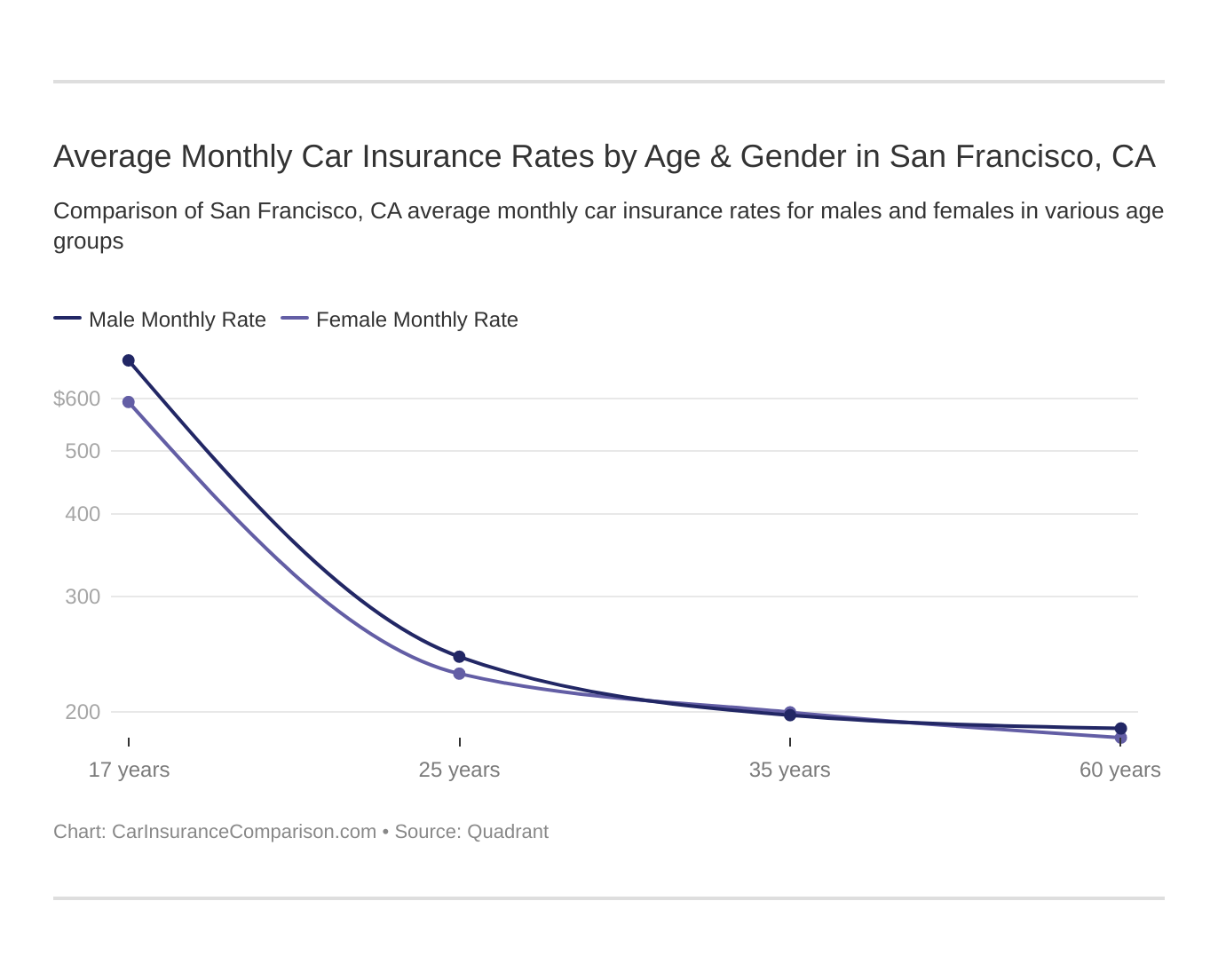

Male vs. Female vs. Age in San Francisco

In California, it’s illegal to increase car insurance rates based on gender. However, the age of a motorist in California can factor into their annual premium. The average age in San Francisco is 38 years old.These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. CA does use gender, so check out the average monthly car insurance rates by age and gender in San Francisco, CA. (For more information, read our “Massachusetts Bay Car Insurance Review“).

We’ve collected data related to age-based car insurance. Here’s what we found.| Age | Annual Premium |

|---|---|

| 17-Years-Old Motorists | $8,142 |

| 25-Year-Old Motorists | $3,712 |

| 35-Year-Old Motorists | $2,888 |

| 60-Year-Old Motorists | $2,559 |

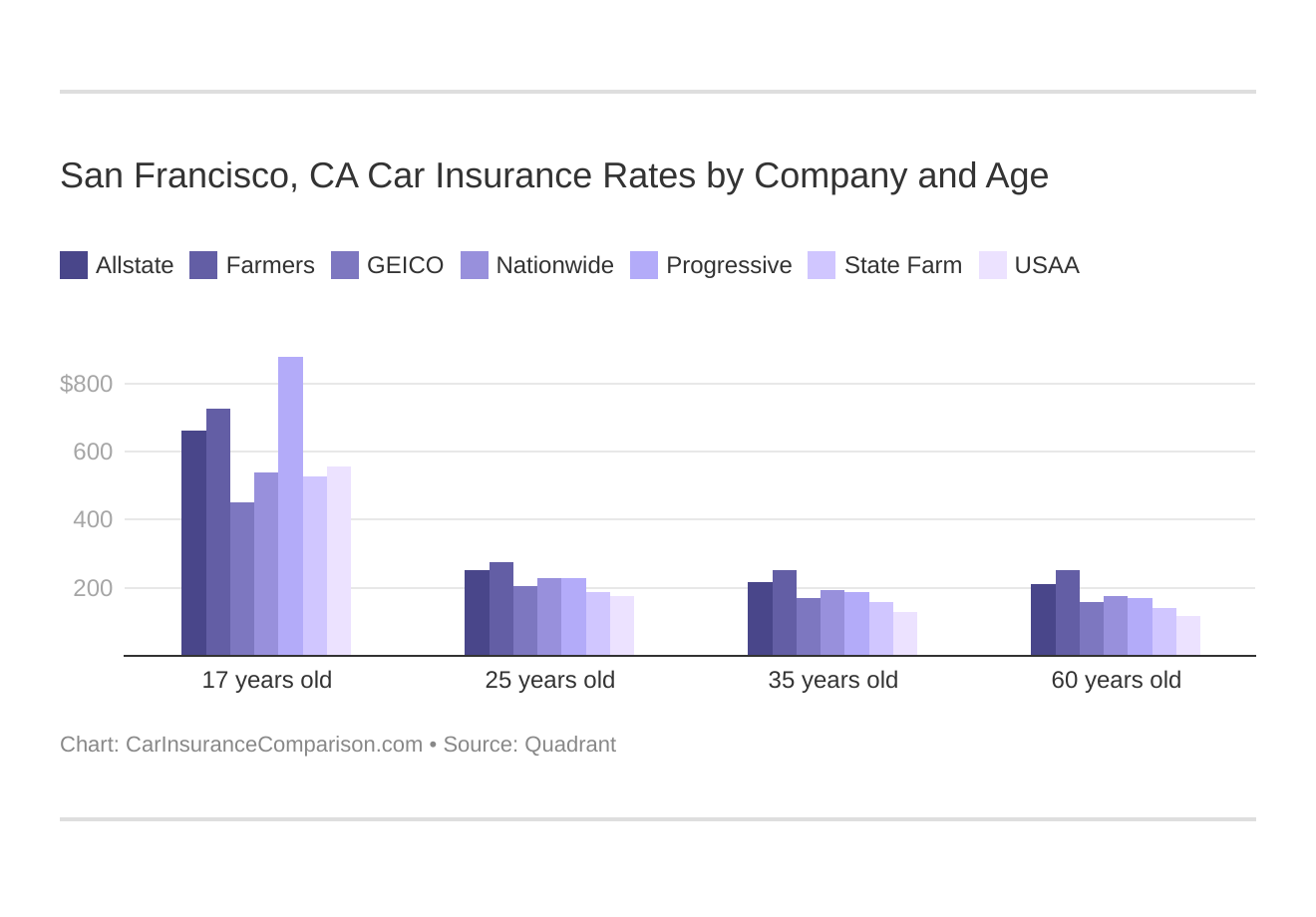

Car insurance for teen drivers can be expensive, but compared to other cities in California, San Francisco is much cheaper. You’re likely to pay more for car insurance premiums in Los Angeles than San Francisco.Sixty-year-old motorists pay the cheapest rates out of all the age groups in the data set.San Francisco, CA car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

Why do drivers over 60 pay cheaper car insurance rates for car insurance? Younger drivers are inexperienced and may engage in risky behavior when operating a motor vehicle. Statistics show that motorists in their teens and 20s are more likely to be in an automobile accident.Cheapest ZIP Codes in San Francisco

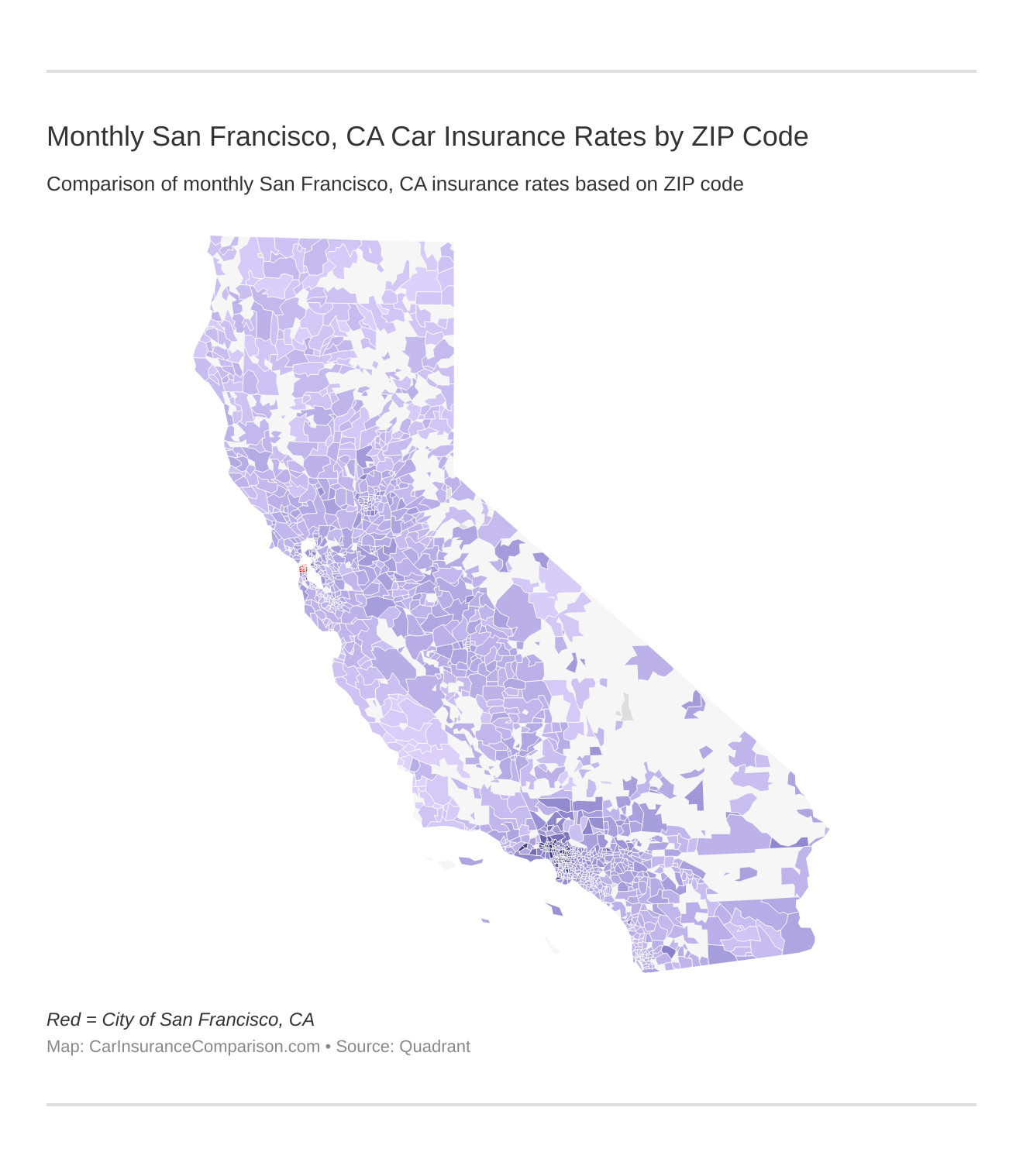

Each city in the U.S. is divided into ZIP codes. Some ZIP codes are in economically-challenged areas, while others are more affluent. Some are safer, some see higher rates of crime. Insurance companies take these factors into consideration when determining your premium.ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly San Francisco, California auto insurance rates by ZIP Code below:

Let’s examine the annual premium rates for all ZIP codes in San Francisco.San Francisco, CA Average Annual Premium by Zip Code| San Francisco Zip Codes | Average Annual Rate |

|---|---|

| 94102 | $6,299.47 |

| 94103 | $6,139.28 |

| 94104 | $6,118.76 |

| 94105 | $5,851.41 |

| 94107 | $5,723.71 |

| 94108 | $6,098.42 |

| 94109 | $5,911.96 |

| 94110 | $5,874.45 |

| 94111 | $5,830.90 |

| 94112 | $6,161.01 |

| 94114 | $5,688.28 |

| 94115 | $6,020.43 |

| 94116 | $6,037.94 |

| 94117 | $5,620.15 |

| 94118 | $5,935.60 |

| 94121 | $6,045.35 |

| 94122 | $5,842.13 |

| 94123 | $5,746.28 |

| 94124 | $6,574.73 |

| 94127 | $5,738.46 |

| 94128 | $5,415.44 |

| 94129 | $5,725.15 |

| 94130 | $6,164.51 |

| 94131 | $5,617.89 |

| 94132 | $6,297.64 |

| 94133 | $6,087.70 |

| 94134 | $6,541.72 |

| 94158 | $5,578.86 |

| 94188 | $5,567.21 |

As you can see, San Francisco car insurance rates fall between $5,400 and $6,600. This is likely determined by population, economic status of the area, and the car insurance companies assessing risks for motorists.

What’s are the best car insurance companiesf in San Francisco?

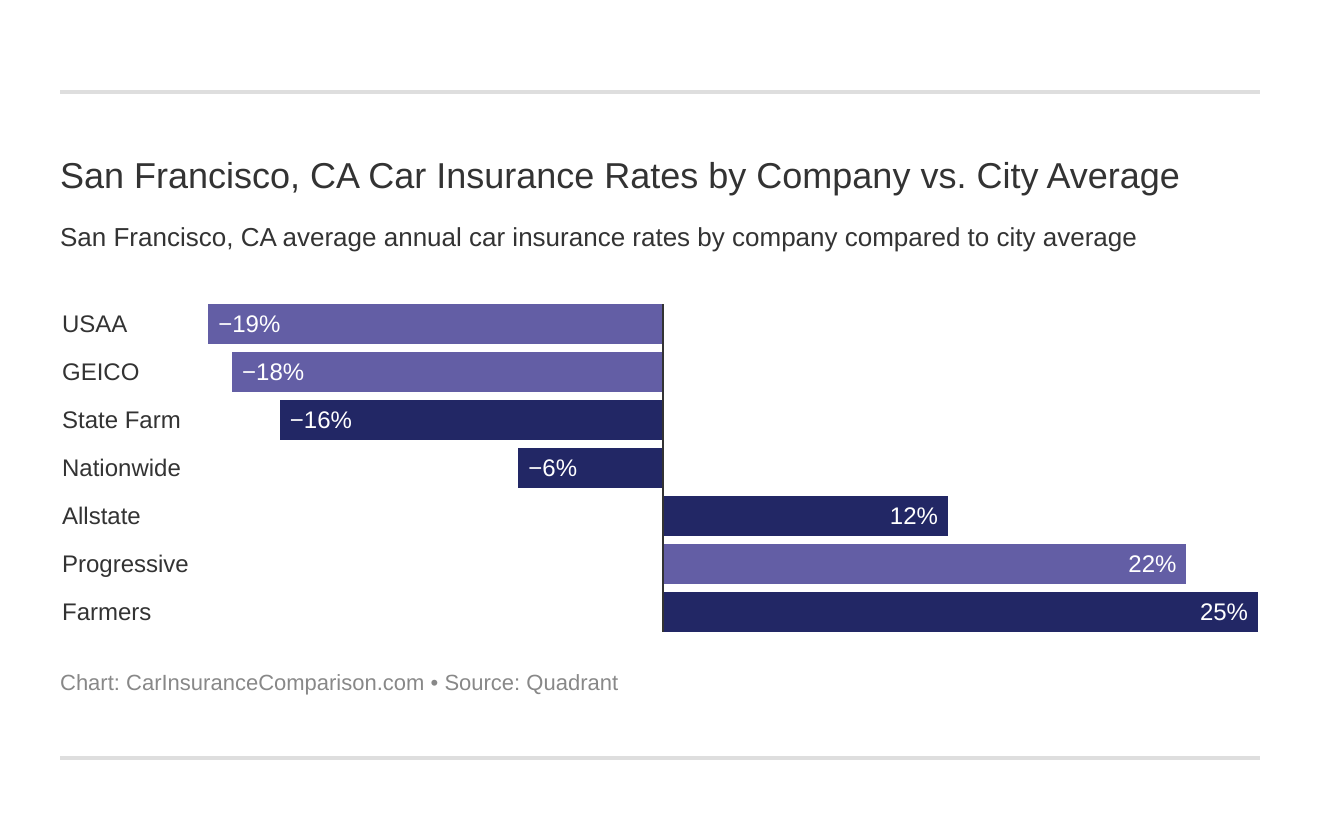

The best car insurance company will be up to you to decide. One of the purposes of this guide is to point you in the right direction for car insurance premiums that work best for you.Which San Francisco, CA car insurance company has the best rates? And how do those rates compare against the average California car insurance company rates? We’ve got the answers below.

Are you searching for a car insurance rate that’s more cost-efficient? Are you searching for the most coverage possible? Continue through the guide to find the perfect car insurance company for your needs.Cheapest Car Insurance Rates by Company in San Francisco

Speaking of car insurance companies, did you know they also consider your commute mileage per year, coverage level, credit history, and driving record when setting premiums? Let’s look at some car insurance companies‘ annual rates.Imported from Manual Input

| Car Insurance Company | Average Annual Premium |

|---|---|

| $5,612.67 | |

| $6,130.34 | |

| $3,050.85 | |

| $3,685.81 |

| $5,782.30 |

| $3,086.38 | |

| $4,473.06 | |

| $3,985.62 | |

| $3,118.95 |

USAA is one of the cheapest companies throughout the U.S. However, only members of the military (current or former) and their immediate families are eligible to enroll in USAA insurance.If you’re not eligible for USAA, your cheapest insurance option will probably be Geico, followed by Progressive.Before you decide, let’s continue through the guide to see if there are cheaper rates available.

Best Car Insurance for Commute Rates in San Francisco

Some car insurance companies will ask you how many miles you plan to drive your vehicle. If you’re driving your vehicle to work every day, you’ll likely pay more for car insurance. However, some companies charge the same rate regardless of the mileage you travel.San Francisco, CA

| Car Insurance Company 10 miles commute | 6,000 annual mileage. 25 miles commute | 12,000 annual mileage |

|---|---|---|

| $5060.79 | $6,164.55 | |

| $5,562.15 | $6,698.51 | |

| $2,771.46 | $3,330.25 | |

| $3,384.36 | $3,987.27 |

| $5,097.29 | $6,467.31 |

| $2,798.13 | $3,374.63 | |

| $4,312.01 | $4,634.10 | |

| $3,576.46 | $4,394.77 | |

| $2,875.86 | $3,362.03 |

The average number of miles driven by California motorists annually is 13,414. Therefore, San Francisco motorists will likely pay premiums over $3,000.The companies with the cheapest rates based on commute are Geico and Progressive. The most expensive are Farmers and Nationwide.

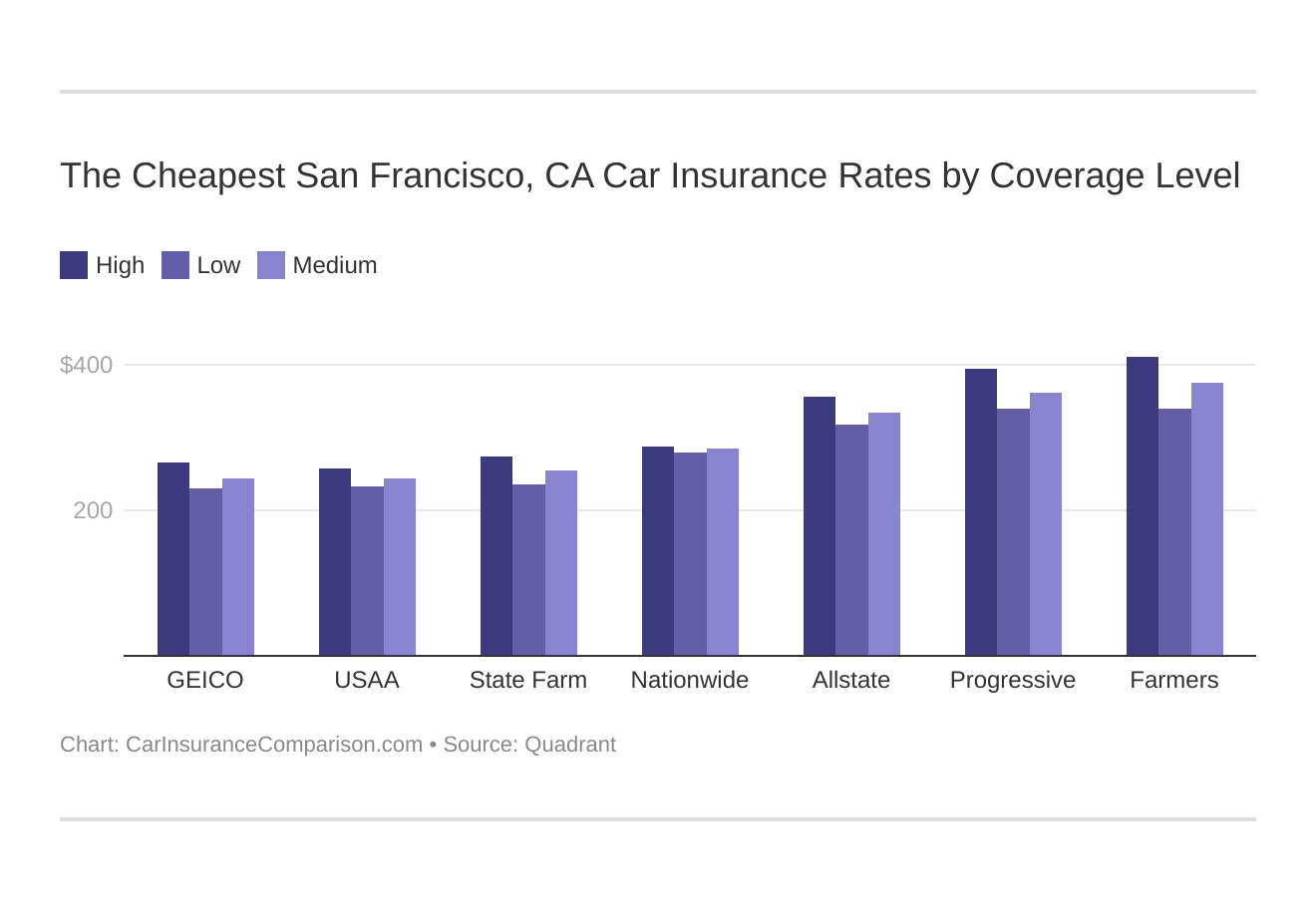

Best Car Insurance for Coverage Level Rates in San Francisco

Coverage levels are based on the minimum coverage required by the state. For example, the minimum coverage in California is based on the 15/30/5 rule, which means $15,000 for bodily damage per person involved in an accident, $30,000 for total bodily damage per accident, and $5,000 for property damage per accident.Your coverage level will play a major role in your San Francisco car insurance rates. Find the cheapest San Francisco, CA car insurance rates by coverage level below:

This is just the minimum; it may be a good idea to invest in more coverage.Coverage levels in the medium and high categories cover more for damages. The California Department of Insurance noted that the highest amount of coverage a California motorist can have is 250/500/100, which can be packaged in full coverage premiums. Medium coverage is generally 50/100/25.Let’s see how much those annual premiums are based on coverage levels.San Francisco, CA Coverage Level Rates by Company| Car Insurance Companies | Low | Medium | High |

|---|---|---|---|

| $5,323.07 | $5,660.00 | $5,854.94 | |

| $5,731.79 | $6,176.68 | $6,482.53 | |

| $2,802.27 | $3,083.32 | $3,266.98 | |

| $3,464.52 | $3,717.31 | $3,875.61 |

| $5,263.50 | $5,881.74 | $6,201.64 |

| $2,777.18 | $3,179.17 | $3,302.80 | |

| $4,061.63 | $4,546.79 | $4,810.75 | |

| $3,474.71 | $4,097.67 | $4,384.47 | |

| $2,862.76 | $3,173.15 | $3,320.94 |

Although the minimum or lowest coverage option is the cheapest, it only covers $5,000 for property damage. If you’re at fault in an accident, your low coverage level will not cover the damages.Some of the companies like Farmers, Geico, Nationwide, and Progressive have coverage levels that are a few hundred dollars between each coverage level. It may be more beneficial to go with medium or high coverage.

Best Car Insurance for Credit History Rates in San Francisco

California is one of three states that have outlawed car insurance companies from adjusting car insurance rates based on credit history. According to United Policy Holders, the practice of charging policyholders based on credit is unfair. This is one factor San Francisco drivers will not have to worry about.

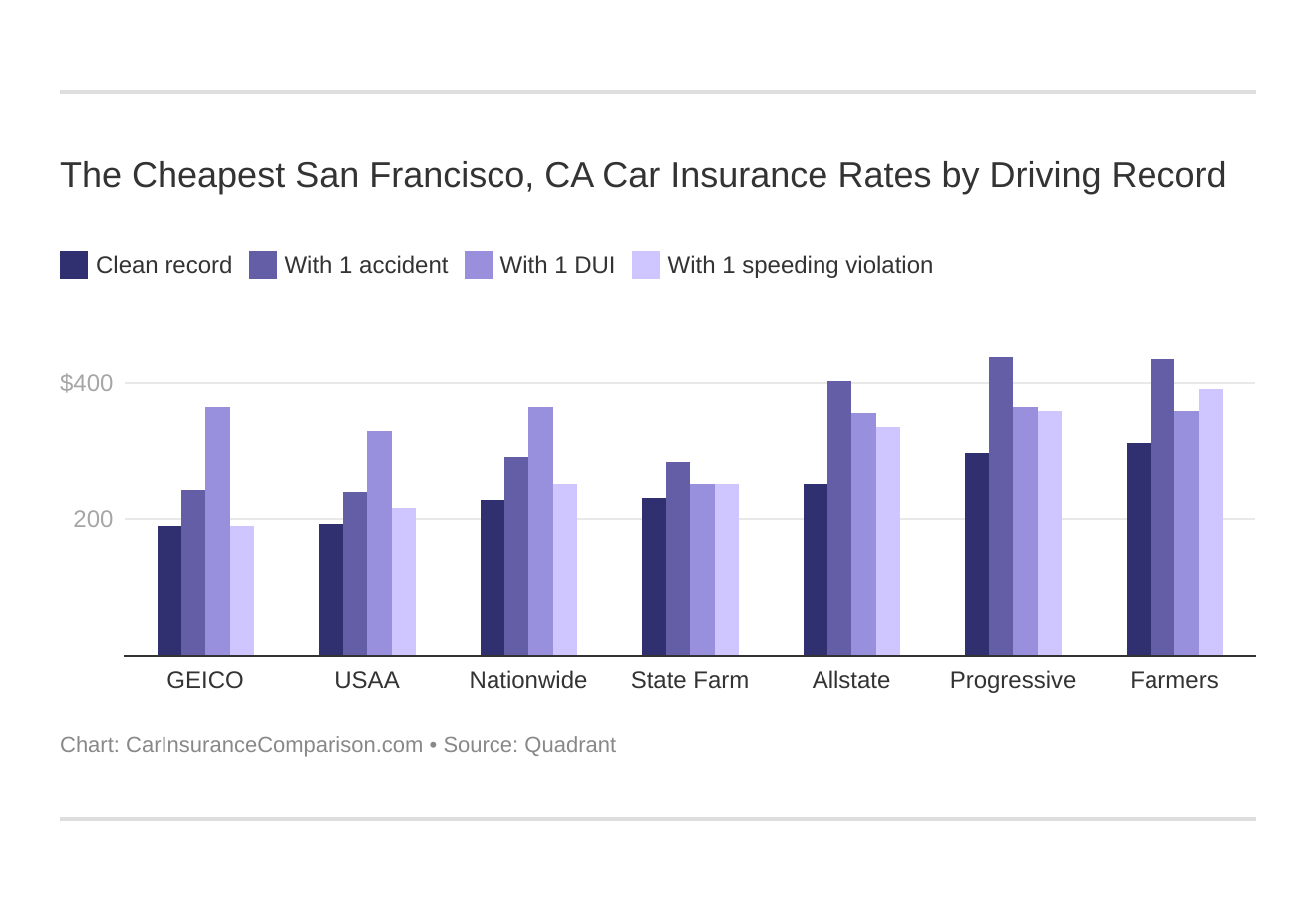

Best Car Insurance for Driving Record Rates in San Francisco

Car insurance companies can and will evaluate your driving record when setting your rate. Do you have a good record? If not, what will it cost you? Let’s examine the annual rates by each major company in San Francisco.Your driving record will play a major role in your San Francisco car insurance rates. For example, other factors aside, a San Francisco, CA DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest San Francisco, CA car insurance rates by driving record.

San Francisco, CA Driving Record Annual Rates| Car Insurance Companies | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| $4,149.84 | $7,025.57 | $11,093.95 | $5,465.62 | |

| $5,457.32 | $7,424.13 | $9,228.04 | $7,366.05 | |

| $2,811.80 | $4,369.58 | $5,454.45 | $3,489.34 | |

| $3,624.85 | $4,850.21 | $4,383.60 | $3,841.35 |

| $4,967.15 | $6,379.89 | $10,833.75 | $6,379.89 |

| $2,674.38 | $4,583.08 | $5,332.27 | $3,864.37 | |

| $4,174.95 | $4,977.11 | $9,389.60 | $4,843.42 | |

| $3,235.94 | $5,455.96 | $6,320.04 | $4,891.24 | |

| $2,330.45 | $3,485.00 | $5,708.26 | $2,555.44 |

Allstate and Nationwide are the most expensive, especially for drivers who’ve been convicted of DUI. The annual premiums for both companies are over $10,000. Most companies listed in the table are fairly lenient when it comes to drivers with one speeding ticket (multiple infractions may raise your rates higher).

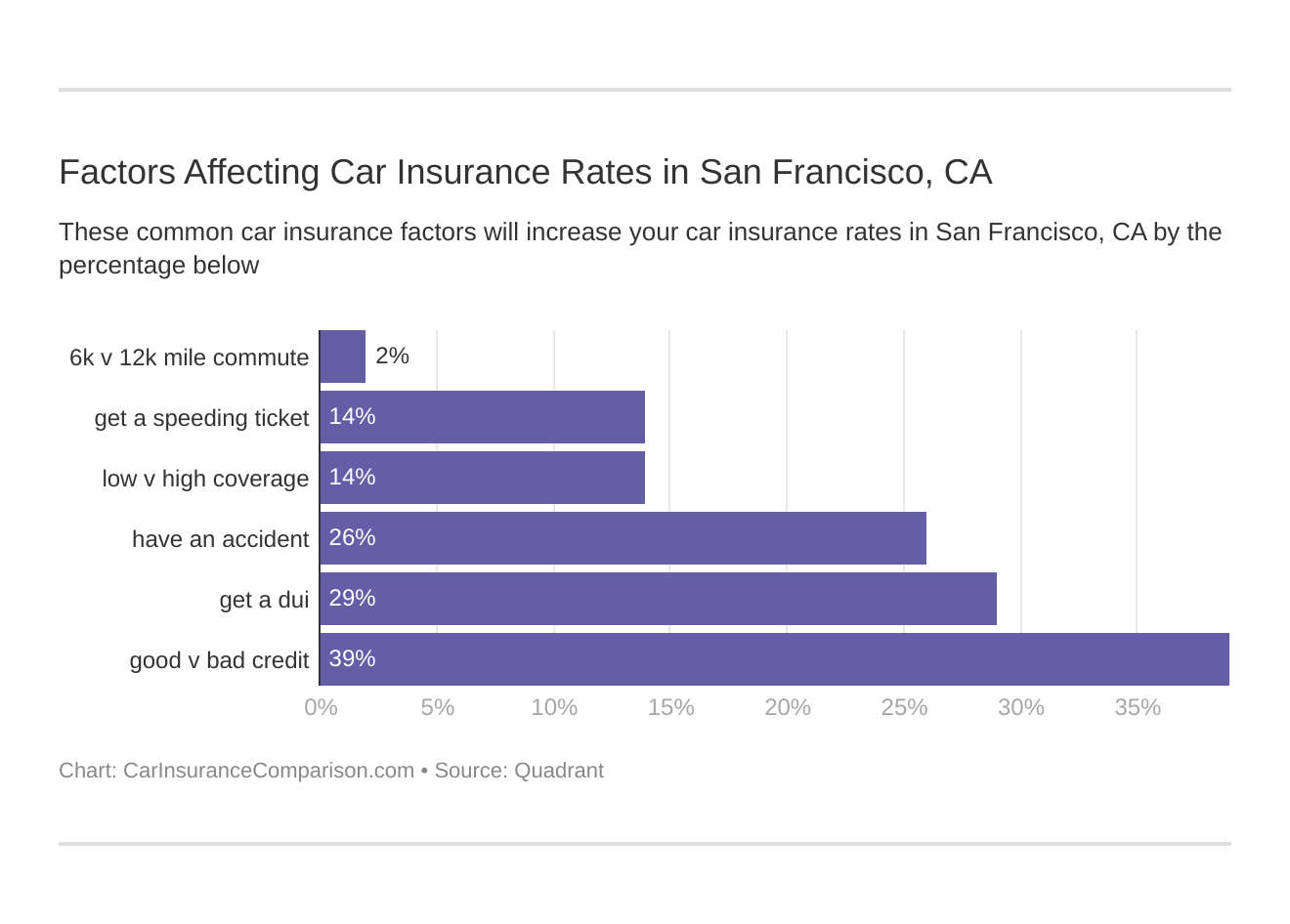

Car Insurance Factors in San Francisco

Earlier, we mentioned the economic challenges and affluence in different parts of San Francisco. In this section, we’ll talk about the overall key factors, economy, ethnicity, wage disparities, education, and employment in San Francisco.Factors affecting car insurance rates in San Francisco, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap San Francisco, California car insurance.

Metro Report – Growth and Prosperity in San Francisco

Metro Reports are provided by the Brookings Institute, a nonprofit public policy organization located in Washington D.C. They offer comprehensive research that identifies various problems societies face on a national and international level. They develop new ideas for solving these problems, as well.In their research, they have graded the growth and prosperity of San Francisco. To be specific, the coverage area of the San Francisco Metro Report is known as San Fransico-Oakland-Hayward, CA.The Brookings Institute ranks cities from 1on to 100, where one to 20 is the best performance, and 81 to 100 is the worst performance. We’ve placed these ratings in the data table below.San Francisco, CA Growth Metro Report Ratings

| Rating | % Change 1-Year | Growth 1-Year Rating | % Change 10-Year | Growth 10-Year Rating |

|---|---|---|---|---|

| Overall Rating | - | 7 | - | 5 |

| % Change in Jobs | 2.20% | 24 | 16.90% | 12 |

| % Change in GMP | 6.30% | 3 | 34.20% | 4 |

| % Change in Jobs in Young Firms | 3.50% | 46 | 11.70% | 3 |

Growth shows the job outlook across San Francisco. Their performance has been moderate from 2016 to 2017, but San Francisco as a whole had excellent job growth for the past decade.But how did San Francisco do with prosperity? This table below will show us those details.San Francisco, CA Prosperity Metro Report Ratings

| Rating | % Change 1-Year | Prosperity 1-Year Rating | % Change 10-Year | Prosperity 10-Year Rating |

|---|---|---|---|---|

| Overall Rating | - | 2 | - | 3 |

| % Change in Productivity | 4.00% | 4 | 14.80% | 7 |

| % Change in Standard of Living | 5.60% | 2 | 18.70% | 3 |

| % Change in Average Annual Wage | 4.10% | 3 | 20.20% | 3 |

For the most part, the cities of San Francisco-Oakland-Hayward have performed well for the last 10 years. The average annual wage increased by over 20 percent, which helped with the cost of living for San Francisco residents.

Median Household Income in San Francisco

Household income can make a big difference when it comes to your car insurance policy, as well. Some people pay a greater share of their income toward car insurance than others.

In San Francisco, the average annual household income is approximately $110,816. That’s much higher than the $60,336 national average.

How does car insurance impact your overall earnings? Another way to determine this is by looking at car insurance as a percentage of income.As seen in the intro table, the average annual rate for car insurance in San Francisco is $5,415.44. To find the percentage of your income you’re paying toward car insurance, you’ll need to divide the annual cost of your premium by your yearly salary.When you do that, you’ll get a decimal answer. Move the decimal over two places (i.e. if the number 0.0324, you’ll move the decimal over until it’s on the right side of the three, giving you 3.24). The value 3.24 is the percentage of your income you pay for car insurance.We’ve provided a table showing how each company’s annual rate affects the average household income in San Francisco.San Francisco, CA Car Insurance Monthly Rates as a Percentage of Income

| Insurance Company | Monthly Rates | Percentage of Income |

|---|---|---|

| $180 | 2.50% | |

| $190 | 2.70% | |

| $160 | 2.20% | |

| $200 | 2.80% |

| $170 | 2.40% |

| $175 | 2.50% | |

| San Francisco Average | $180 | 2.50% |

| $165 | 2.30% | |

| $195 | 2.70% | |

| $150 | 2.00% |

Homeownership in San Francisco

Only 36.5 percent of people in San Francisco own their homes, which is lower than the 63.9-percent national average. The average price of a home in San Francisco is $1.1 million. How does this affect car insurance?People who own homes are likely to pay more for car insurance, but often receive discounts when they bundle their home and auto insurance.

Education in San Francisco

Over 20,000 degrees were awarded by San Francisco colleges and universities in 2016. Data USA statistics show that more women attended college than men; there were about 50,700 female students and roughly 36,800 male students.How many students graduate by race and ethnicity? We’ve put Data USA’s information into a table to show you those numbers.San Francisco, CA Race & Ethnicity Graduates

| Race & Ethnicity | # of Students Graduated | % of Students Graduated |

|---|---|---|

| Asian | 4,652 | 26.10% |

| Hispanic or Latino | 3,423 | 19.20% |

| White | 5,905 | 33.20% |

| Unknown | 1,828 | 10.30% |

We can assume that the unknown value is the collection of African Americans, East Indians, Native Americans, people of two or more races, and all other ethnicities not listed in the data.San Francisco State University, the University of San Francisco, and City College of San Francisco are the largest colleges here, and the City College of San Francisco is the least expensive.

Wage by Race and Ethnicity in Common Jobs

Economic disparities among different ethnic groups affect California like any other state in the U.S. Data USA’s numbers for San Francisco match those for California as a whole. Let’s take a look at the average wages by race and ethnicity.San Francisco, CA Wage by Race & Ethnicity in Common Jobs

| Wage by Race and Ethnicity in Common Jobs | Miscellaneous Managers | Car Insurance as % of Income (MM) | Elementary & Middle School Teachers | Car Insurance as % of Income (E&M Teachers) | Retail Salesperson | Car Insurance as % of Income (Retail) | Drivers/Sales Workers & Truck Drivers | Car Insurance as % of Income (Drivers) | Cashiers | Car Insurance as % of Income (Cashiers) |

|---|---|---|---|---|---|---|---|---|---|---|

| American Indian | $87,447 | 6.23% | $53,588 | 10.15% | $21,277 | 25.59% | $43,823 | 12.43% | $20,573 | 26.46% |

| Asian | $118,884 | 4.58% | $56,743 | 9.59% | $29,399 | 18.51% | $36,337 | 14.98% | $19,950 | 27.29% |

| Black | $76,262 | 7.14% | $52,620 | 10.35% | $22,711 | 23.97% | $39,488 | 13.79% | $18,318 | 29.72% |

| Native Hawaiin and Other Pacific Islander | $128,245 | 4.24% | $48,953 | 11.12% | $25,712 | 21.17% | $42,284 | 12.87% | $17,167 | 31.71% |

| Other | $65,067 | 8.37% | $46,471 | 11.71% | $22,688 | 24% | $41,319 | 13.23% | $15,971 | 34.09% |

| Other Native American | $0 | 0% | $72,969 | 7.46% | $16,935 | 32.15% | $40,539 | 13.43% | $6,238 | 87.27% |

| Two or More Races | $110,079 | 4.95% | $52,813 | 10.31% | $26,840 | 20.28% | $38,941 | 13.98% | $15,090 | 36.08% |

| White | $114,249 | 4.77% | $58,917 | 9.24% | $31,081 | 17.52% | $42,982 | 12.67% | $17,132 | 31.78% |

As you can see, black people and American Indians tend to earn less than white people and Asians across multiple careers, which is largely the case nationwide. Consequently, these individuals tend to pay a higher percentage of their income for car insurance.

Wage by Gender in Common Jobs

Gender wage disparities have been debated frequently over the years. Although California has outlawed car insurance companies from issuing policies based on gender, women as a demographic still pay a higher percentage of their income for car insurance than men, simply because their salaries are lower. See the data in the table below.California Wage by Common Jobs (Male & Female Stats)

| Wage by Common Jobs Summary | Male Stats | Car Insurance as % of Income (Male) | Female Stats | Car Insurance as % of Income (Female) |

|---|---|---|---|---|

| Miscellaneous Managers | $125,706 | 4.33% | $94,699 | 5.75% |

| Elementary & Middle School Teachers | $68,823 | 7.91% | $63,657 | 8.55% |

| Retail Salespersons | $47,957 | 11.35% | $35,791 | 15.21% |

| Drivers/Sales Workers & Truck Drivers | $46,287 | 11.76% | $32,578 | 16.71% |

| Cashiers | $27,490 | 19.80% | $26,863 | 20.26% |

Poverty by Age and Gender

As we’ve covered income, it’s worth discussing the issue of poverty in San Francisco, as well. There aren’t many disparities for some age groups. Let’s take a quick look at the poverty rates by gender.San Francisco, CA Poverty by Age and Gender

| Poverty by Age and Gender | Males in Poverty | Females in Poverty |

|---|---|---|

| Younger than 5 | 1.54% | 1.83% |

| 5 Years Old | 0.47% | 0.36% |

| 6 to 11 Years Old | 2.04% | 2.18% |

| 12 to 14 Years Old | 0.86% | 0.81% |

| 15 Years Old | 0.37% | 0.43% |

| 16 to 17 Years Old | 1.13% | 1.05% |

| 18 to 24 Years Old | 7.82% | 9.07% |

| 25 to 34 Years Old | 8.10% | 9.27% |

| 35 to 44 Years Old | 4.54% | 5.48% |

| 45 to 54 Years Old | 6.80% | 5.74% |

| 55 to 64 Years Old | 6.96% | 5.87% |

| 65 to 74 Years Old | 3.74% | 3.99% |

| 75 Years and Older | 2.75% | 6.83% |

Poverty peaks for individuals from age 18-34. The largest disparity by gender is for those aged 75 and older; 2.75 percent of men in this age group live in poverty and 6.83 percent of women.

Poverty by Race and Ethnicity

Now that we know poverty by gender, let’s see how it affects each race and ethnicity of San Francisco.San Francisco, CA Poverty by Race & Ethnicity

| Poverty by Race and Ethnicity | Population | % of People in Poverty |

|---|---|---|

| Asian | 34,519 | 29.50% |

| White | 34,390 | 29.40% |

| Hispanic | 17,795 | 15.20% |

| Black | 14,068 | 12.00% |

| Other | 9,703 | 8.30% |

| Two or More | 5,313 | 4.55% |

| Pacific Islander | 652 | 0.56% |

| Native American | 451 | 0.39% |

Poverty impacted the Asian community and those who identify as white the most. Together, these groups making up about 60 percent of the people living in poverty in San Francisco.

Employment by Occupations

Employment in San Francisco grew by nearly 5 percent in 2016, from about 511,000 workers to about 535,000. The most common jobs were in management, sales, and administrative support, while 8 percent of San Francisco occupations were IT-related.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Driving in San Francisco

San Francisco has several different options when it comes to commuting. If you drive to work, prepare for higher-than-average car insurance rates and some lengthy commute times. Traffic can be quite a hassle due to the dense population of San Francisco.But don’t worry, we have a few solutions and suggestions to help you with your daily driving in the city.

Roads in San Francisco

The first thing we’ll cover in this subsection is San Francisco roadways. We’ll examine the major interstate and toll roads in the city, as well as some popular sites. Next, we’ll talk about the road conditions you’ll likely encounter. We’ll also explore the use of speed cameras and red light cameras.

Major Highways in San Francisco

The state of California has 12 active routes with over 2,400 miles of roadway. The city of San Francisco has four major highways: Highway 1, I-80, I-280, and US-101.What about toll roads in San Francisco?There are six toll roads on San Francisco roadways. Most, if not all, toll roads use FasTrak, an electronic payment system that eliminates the need to have cash or coins on hand.PlatePass, a service that works in conjunction with FasTrak, has a guide that shows you how to use FasTrak’s services. For now, we’ll show you the toll fees in a data table.San Francisco, CA Toll Roads

| Name of Toll | Toll | Location | Operator |

|---|---|---|---|

| Carquinez Bridge | $6.00 | Spans the Carquinez Strait at the northeastern end of San Francisco Bay | Bay Area Toll Authority Metropolitan Transportation Commission |

| Dumbarton Bridge (Westbound Only) | $6.00 | Spans the San Francisco Bay linking Fremont, CA with Menlo Park, CA | Bay Area Toll Authority Metropolitan Transportation Commission |

| Golden Gate Bridge (Southbound Only) | $8.20 | Spans San Francisco Bay connecting San Francisco to Marin County, CA | Golden Gate Bridge, Highway & Transportation District |

| Oakland Bay Bridge (Westbound Only) | $4.00 Off Peak Hours $5.00 Weekend Hours $6.00 Peak Hour Weekdays | Spans San Francisco Bay linking Oakland, CA to San Francisco, CA | Bay Area Toll Authority Metropolitan Transportation Commission |

| The Richmond-San Rafael Bridge (Westbound Only) | $6.00 | Spans the San Francisco Bay connecting Richmond, CA to San Rafael, CA | Bay Area Toll Authority Metropolitan Transportation Commission |

| San Mateo-Hayward Bridge (Westbound Only) | $6.00 | Spans San Francisco Bay linking San Francisco with San Mateo, CA | Bay Area Toll Authority Metropolitan Transportation Commission |

With FasTrak and PlatePass, you can purchase a monthly pass if you plan to use a toll road frequently.

Popular Road Trip Sites in San Francisco

San Francisco has quite a few tourist attractions that draw many tourists from all over the world.

Road Conditions in San Francisco

Every city in the U.S. has its share of questionable road conditions. For now, we’re going to explore the road conditions of San Francisco. Our data comes from the TRIP Urban Road Report of 2018.

Unfortunately, 71 percent of San Francisco’s roadways are in poor shape, according to the TRIP Road Report.

Sixteen percent of roadways are considered mediocre, while 12 percent were designated fair or good.

Does San Francisco use speeding or red light cameras?

Speed cameras and red light cameras are tools used by law enforcement to catch and ticket those driving too fast or failing to yield to traffic lights.The entire state of California uses red light cameras, including San Francisco. The Insurance Institute for Highway Safety identifies these red light cameras as part of automated enforcement laws. By law, red light cameras are permitted in San Francisco.

The penalty for running a red light in San Francisco is $100, and subsequent offenses can reach up to $400 and add one point to a motorist’s license.

Residents in San Francisco are not fond of the red light cameras.https://www.youtube.com/watch?v=cz7rMMC8jnM

Vehicles in San Francisco

The car culture in San Francisco is very diverse. Due to the city’s economic status, you’ll likely see foreign luxury vehicles along with American-made vehicles. Those who don’t have a car of their own often use public transit, such as buses or the subway.We’ll cover these options, and we’ll also talk about the number of vehicles owned in San Francisco, speed traps in the city, and vehicle theft stats.

Most Popular Vehicles Owned

Instamotor, an app that follows the sale of used cars around select cities, took a poll of the most popular cars owned in San Francisco. The top 10 car brands in the city are Toyota, Honda, BMW, Ford, Mercedes-Benz, Nissan, Volkswagen, Chevrolet, Audi, and MINI.Instamotor representatives reported four out of the top five vehicle brands are imports and two are luxury-brand vehicles.According to Jim Miller of the Sacramento Bee, San Francisco drivers prefer sedans from Toyota and Honda. Toyota and Honda make fuel-efficient vehicles known for their longevity and reasonable prices. But it’s not unusual to see the occasional Ford F series on San Francisco roadways.

How Many Cars Per Household

Data USA reports that most households in San Francisco own only one vehicle. The national average is two vehicles per household.Does this mean San Francisco is struggling economically? No. San Francisco is one of the few cities that’s prospering. It could be due to the higher-than-average car insurance premiums, as well as the availability of reliable public transportation.

Households Without a Car in San Francisco

So how many households in San Francisco don’t own a motor vehicle? About 4 percent of American households nationwide don’t own a motor vehicle. In San Francisco, there are about 115,000 households without a car, which is about 22 percent.

Speed Traps in San Francisco

Speed traps are essentially sting operations on motorists who are speeding or driving recklessly. Although violating the speed limit is a small offense, you’ll likely get a ticket if you get caught, and those tickets will increase your car insurance premiums. It’s better not to take a chance.The latest speed trap recorded was on Sunset Boulevard behind Sloat Bridge near Ocean Avenue in September 2017.There are others. A Traffic Ticket Lawyer representative listed Fulton Street near Park Presidio, Golden Gate Bridge near Highway 101, and I-80 near Fairfield as notable locations for speed traps.Android and Apple iOS GPS have a feature that scans for speed traps as you drive. This will help you monitor your speed more effectively and keep you from being pulled over.

Vehicle Theft in San Francisco

San Francisco is a wonderful city, but it does have its share of crime. The Federal Bureau of Investigations (FBI) found that San Francisco had 4,217 vehicle thefts in 2018.Just like anywhere, some parts of San Francisco are safer than others. Neighborscout lists the top 10 safest neighborhoods on its website. Those neighborhoods are:

- Ocean Ave / Miramar Ave

- Fort Winfield Scott

- Alemany Blvd / Huron Ave

- Teresita Blvd / Los Palmos Dr

- Dwight St / Bowdoin St

- Lincoln Way / 45th Ave

- Taraval St / 20th Ave

- Clement St / Legion Of Honor Dr

- Vicente St / 19th Ave

- Garfield St / Grafton Ave

The idea of a safe neighborhood may be subjective to some readers, so we want to give you some statistics on crime. According to Neighborhoodscout, a person has a one in 138 chance of being a victim of violent crime in San Francisco. The California state average is one in 223.San Francisco, CA Neighborhood Scout Crime Totals

| Summary | Violent | Property | Total |

|---|---|---|---|

| Number of Crimes | 6,410 | 55,253 | 61,663 |

| Crime Rate per 1,000 Residents | 7.25 | 62.48 | 69.73 |

Compared to other U.S. cities with the same population size, San Francisco has a high crime rate. Seven out of 1,000 residents are affected by violent crime, which is higher than the national average.San Francisco residents are even more likely to be a victim of property crime. A total of 55,253 property crimes were reported in 2018, which is roughly 63 property crimes per 1,000 residents.That’s more than double the national average of 24 property crimes per 1,000 residents. Out of 100, where 100 is the safest, the crime index of San Francisco is two.

Traffic in San Francisco

The dense population of over 800,00 people can cause congestion during all hours. There are tons of things to do in San Francisco, so expect traffic to be heavy during sporting events, university events, and all other gatherings that attract large crowds.We’re going to forecast the traffic congestion for you in this section, along with noting some of the busiest highways in San Francisco, common methods of transportation, average commute time from Data USA, fatality data, ridesharing options, and reports from Allstate’s Best Drivers report.

Traffic Congestion in San Fransisco

Traffic can be difficult to predict. The traffic forecasting websites INIRIX and TomTom give drivers across the world a view of traffic conditions in real-time.INIRIX data reported that San Francisco ranks 65th on the list of the most congested cities in the U.S. Most drivers in San Francisco spent 116 hours in traffic in 2018. The cost of congestion per driver is $1,624.TomTom states that traffic is worst at peak times, such as 8 a. m. and 5 p. m., and that commuters should expect delays. Morning traffic can add 17 minutes on average to your commute, and evening traffic adds an average of 21 minutes.

Transportation in San Francisco

How long is the average commute in San Francisco?The average San Franciscan’s commute is 31 minutes. If you compound that with the increases during peak hours, commutes can run 45 minutes or more. This may be a factor in the decision many San Franciscans make to forego driving altogether.

In fact, the most common method of travel in San Francisco is public transit.

Data USA reports that 35 percent of San Francisco residents use public transit as their primary method of travel, followed by driving alone at 32 percent and walking at 12 percent.

Busiest Highways in San Francisco

Earlier, we talked about the number of major highways in San Francisco. Which one is the busiest? According to the Federal Highway Administration, that would be the I-80. It has 12 lanes, and traffic is often slowed to 10-25 mph during peak travel hours.But don’t count out the city’s other major highways. San Francisco is one of the top five most congested cities in the world.

How safe are San Francisco streets and roads?

Fatality rates are another factor car insurance companies consider when setting premiums. They use this information to assess risk. The tables below will show you data on fatalities broken down into different scenarios and demographics.The Metropolitan Transportation Commission lists nine counties in the San Francisco Bay area, so we’ll cover the fatality numbers in those counties, as well. The data listed here is from the NHTSA.The first table is the calculation of all fatalities in San Francisco, broken down by county.San Francisco, CA Fatalities (All Crashes)

| Counties in San Francisco | 2017 Fatalities (All Crashes) |

|---|---|

| Alameda County | 102 |

| Contra Costa County | 66 |

| Marin County | 12 |

| Napa County | 15 |

| San Francisco County | 25 |

| San Mateo County | 33 |

| Santa Clara County | 117 |

| Solano County | 33 |

| Sonoma County | 41 |

The most fatalities occurred in Santa Clara County, and the least occurred in Marin County.Next, let’s examine the fatalities caused by alcohol-impaired drivers.San Francisco, CA 2017 Fatalities Involving Alcohol-Impaired Driver(s)

| Counties in San Francisco | 2017 Fatalities (Involving Alcohol-Impaired Drivers) |

|---|---|

| Alameda County | 32 |

| Contra Costa County | 21 |

| Marin County | 4 |

| Napa County | 3 |

| San Francisco County | 4 |

| San Mateo County | 5 |

| Santa Clara County | 28 |

| Solano County | 12 |

| Sonoma County | 19 |

Alameda County saw the most fatalities caused by alcohol impairment with 32 in 2017. Napa County had the fewest alcohol-impairment fatalities at just three in the same year.Single-vehicle crashes often cause property damage in addition to the death of a person in the vehicle. How many of the total fatal crashes involved a singular vehicle? See the data below.San Francisco, CA 2017 Fatalities Single Vehicle Crash

| Counties in San Francisco | 2017 Fatalities (Single Vehicle Crashes) |

|---|---|

| Alameda County | 60 |

| Contra Costa County | 55 |

| Marin County | 9 |

| Napa County | 8 |

| San Francisco County | 22 |

| San Mateo County | 35 |

| Santa Clara County | 75 |

| Solano County | 22 |

| Sonoma County | 24 |

Santa Clara County had 40 more fatalities than San Mateo County. Napa County had the lowest single-vehicle fatalities.Speeding fatalities are common, which is why some car insurance companies increase annual rates by at least $1,000 when you violate speeding laws. Here are the fatality numbers.San Francisco, CA Fatalities Involving Speeding

| Counties in San Francisco | 2017 Fatalities (Crashes Involving Speeding) |

|---|---|

| Alameda County | 34 |

| Contra Costa | 19 |

| Marin County | 6 |

| Napa County | 1 |

| San Francisco County | 5 |

| San Mateo County | 11 |

| Santa Clara County | 34 |

| Solano County | 6 |

| Sonoma County | 14 |

Alameda County and Santa Clara County tie for the highest number of fatalities in 2017 at 34.Roadway departure fatalities occur when a vehicle crosses the center line or leaves the proper driving lane in some other way. Let’s examine the fatality stats involving roadway departures.San Francisco, CA Roadway Departure Fatalities

| Counties in San Francisco | 2017 Fatalities (Roadway Departure Crashes) |

|---|---|

| Alameda County | 42 |

| Contra Costa County | 28 |

| Marin County | 7 |

| Napa County | 9 |

| San Francisco County | 5 |

| San Mateo County | 11 |

| Santa Clara County | 47 |

| Solano County | 19 |

| Sonoma County | 19 |

San Francisco County had the fewest roadway departure fatalities, followed by Marin County.Intersection fatalities normally occur in inner cities and small towns. Part of the reason red light cameras are legal in San Francisco is to curb fatalities at intersections. Unfortunately, these fatalities occur despite the automated enforcement of the law. Let’s look at the numbers.San Francisco, CA 2017 Fatalities involving Intersection Crashes

| Counties in San Francisco | 2017 Fatalities (Intersection Fatalities) |

|---|---|

| Alameda County | 28 |

| Contra Costa County | 13 |

| Marin County | 1 |

| Napa County | 4 |

| San Francisco County | 12 |

| San Mateo County | 7 |

| Santa Clara County | 42 |

| Solano County | 5 |

| Sonoma County | 13 |

Marin County has the lowest fatality numbers with only one fatality in 2017. Santa Clara County had the most fatalities, with 42.”Passenger car occupants” refers to drivers and anyone else in a standard car at the time of an accident. Let’s see how many fatalities involved passenger car occupants.San Francisco, CA Passenger Car Occupant Fatalities

| Counties in San Francisco | 2017 Fatalities (Passenger Car Occupant) |

|---|---|

| Alameda County | 44 |

| Contra Costa County | 22 |

| Marin County | 4 |

| Napa County | 8 |

| San Francisco County | 0 |

| San Mateo County | 11 |

| Santa Clara County | 39 |

| Solano County | 15 |

| Sonoma County | 15 |

San Francisco County had no fatalities, while Alameda County had the most fatalities involving passenger car occupants at 44.How many fatal in San Francisco accidents involved pedestrians?San Francisco, CA Pedestrian Fatalities 2017

| Counties in San Francisco | 2017 Fatalities (Pedestrians) |

|---|---|

| Alameda County | 27 |

| Contra Costa County | 22 |

| Marin County | 2 |

| Napa County | 2 |

| San Francisco County | 15 |

| San Mateo County | 17 |

| Santa Clara County | 28 |

| Solano County | 3 |

| Sonoma County | 8 |

Marin and Napa Counties tie for the lowest fatalities involving pedestrians at two, while Santa Clara County had the most at 28.Finally, let’s look at bicyclist fatalities in San Francisco.San Francisco, CA Fatalities 2017 Bicyclists

| Counties in San Francisco | 2017 Fatalities (Bicyclists) |

|---|---|

| Alameda County | 3 |

| Contra Costa County | 1 |

| Marin County | 0 |

| Napa County | 0 |

| San Francisco County | 2 |

| San Mateo County | 1 |

| Santa Clara County | 6 |

| Solano County | 1 |

| Sonoma County | 3 |

There were hardly any fatalities involving bicyclists, but once again Santa Clara County saw the most, at six.The National Highway Traffic Safety Administration (NHTSA) has fatality data available via its Fatality Analysis Reporting System (FARS). The table below shows the fatalities that occurred on rural and urban roads, along with expressways.San Francisco FARS Data

| Summary | # of Fatalities |

|---|---|

| Rural Fatalities | 154 |

| Urban Fatalities | 334 |

| Freeway & Expressway Fatalities | 508 |

Fatalities were most common on freeways and expressways, most likely because of the higher speed limits on these roads.What about train fatalities in San Francisco?See the table below for the 2016 train fatality and injury data.San Francisco, CA Train Fatalities by Train Type

| County | Year of Incident | Address | Type of Vehicle Involved | Train Type | Non-Suicide Fatality | Non-Suicide Injury |

|---|---|---|---|---|---|---|

| ALAMEDA | 2016 | 37TH AVENUE | Automobile | Freight Train | 0 | 1 |

| ALAMEDA | 2016 | GLASCOCK AND 29TH AV | Automobile | Freight Train | 0 | 1 |

| ALAMEDA | 2016 | BANCROFT WAY | Pedestrian | Psgr Train | 1 | 0 |

| ALAMEDA | 2016 | GILMAN ST | Pedestrian | B | 0 | 1 |

| ALAMEDA | 2016 | DAVIS ST | Pedestrian | B | 1 | 0 |

| ALAMEDA | 2016 | HIGH ST | Pedestrian | Psgr Train | 1 | 0 |

| ALAMEDA | 2016 | WASHINGTN&CHAPMAN | Pedestrian | Psgr Train | 1 | 0 |

| ALAMEDA | 2016 | INTERMODAL FACILITY | Truck-trailer | Freight Train | 0 | 0 |

| ALAMEDA | 2016 | 7TH STREET & MARITIM | Truck-trailer | Yard/Switch | 0 | 0 |

| CONTRA COSTA | 2016 | S CUTTING BLVD | Pedestrian | Freight Train | 0 | 1 |

| NAPA | 2016 | WHITE LN. | Automobile | Psgr Train | 0 | 0 |

| NAPA | 2016 | PUBLIC | Automobile | Psgr Train | 0 | 0 |

| SAN MATEO | 2016 | WHIPPLE AVENUE | Automobile | C | 0 | 0 |

| SAN MATEO | 2016 | BROADWAY | Automobile | Commuter | 0 | 0 |

| SAN MATEO | 2016 | CENTER STREET | Pedestrian | Commuter | 1 | 0 |

| SANTA CLARA | 2016 | MARY AVENUE | Automobile | Work Train | 0 | 0 |

| SOLANO | 2016 | SUNSET AVE | Pedestrian | Freight Train | 1 | 0 |

There were only six fatalities and four injuries involving trains in San Francisco.

Allstate America’s Best Drivers Report

Allstate’s 2019 Best Drivers Report is in! We’ve summarized the San Francisco data in the table below.San Francisco, CA Allstate Best Driver Report

| 2019 Best Drivers Report Ranking | City | Average Years Between Collisions | 2018 Best Drivers Report Ranking | Change in Ranking From 2018 to 2019 | Relative Claim Likelihood (Compared to National Average) | Drivewise® HardBraking Events per 1,000 Miles |

|---|---|---|---|---|---|---|

| 189 | San Francisco | 6.8 | 183 | -6 | 0.556 | N/A |

San Francisco dropped from a ranking of 183 in 2018 to 189 in 2019. San Francisco drivers go an average of seven years between filing a collision claim. Hard braking stats are currently unavailable.

Ridesharing in San Francisco

San Francisco is one of the most popular and biggest cities in the U.S. Every major ridesharing service is likely to be found there. In addition to Uber and Lyft, the city of San Francisco has 12 other ridesharing services.

E-star Repair Shops

If you’re ever in a collision or need to find a repair shop, E-Star recommends the following in the San Francisco area.San Francisco, CA EStar Repair Shop

| SHOP NAME | ADDRESS | PHONE NUMBER |

|---|---|---|

| ALIOTO'S GARAGE - BAYSHORE | 185 BAYSHORE SAN FRANCISCO CA 94124 | (415) 970-1514 |

| ALIOTO'S GARAGE - FOLSOM | 1835 FOLSOM ST SAN FRANCISCO CA 94103 | (415) 864-3022 |

| ALIOTO'S GARAGE - VAN NESS | 2020 VAN NESS AVE SAN FRANCISCO CA 94109 | (415) 928-0192 |

| CALIBER - OAKLAND - 11TH ST | 149 11TH ST OAKLAND CA 94607 | (510) 444-4574 |

| CARSTAR CHILTON NOB HILL | 1419 PACIFIC AVE SAN FRANCISCO CA 94109 | (415) 346-8788 |

| CARSTAR CHILTON SAN FRANCISCO | 166 WISCONSIN STREET SAN FRANCISCO CA 94107 | (415) 861-0921 |

| DALAND BODY SHOP, INC. | 890 EL CAMINO REAL SOUTH SAN FRANCISCO CA 94080 | (650) 588-1764 |

| F. LOFRANO & SON - FIX AUTO FOLSOM | 1465 FOLSOM ST SAN FRANCISCO CA 94103 | (415) 565-3560 |

| G & C - BERKELEY | 1239 5TH ST BERKELEY CA 94710 | (510) 526-0310 |

| GERMAN MOTORS COLLISION CENTER | 2575 MARIN ST SAN FRANCISCO CA 94124 | (415) 863-9000 |

| PENINSULA AUTO BODY, INC. | 1430 SAN MATEO AVE. SOUTH SAN FRANCISCO CA 94080 | (650) 588-0999 |

| UPTOWN BODY & FENDER | 401 26TH ST OAKLAND CA 94612 | (510) 251-8009 |

Be sure to keep your car insurance information handy if you’re grabbing a quote from any repair shop. Keep your car insurance company informed of the estimates as well.

Weather in San Francisco

What’s the weather like in San Francisco? Does the city see any snowfall? Let’s take a look at the average temperatures in San Francisco.San Francisco, CA Weather Summary

| Weather Summary | Weather Stats |

|---|---|

| Annual high temperature | 63.8°F |

| Annual low temperature | 50.8°F |

| Average temperature | 57.3°F |

| Average annual precipitation - rainfall | 23.64 inch |

| Days per year with precipitation - rainfall | 68 days |

| Annual hours of sunshine | 2,950 hours |

| Av. annual snowfall | - |

San Francisco has about 3,000 hours of sunlight per year. Snowfall is rare, so there aren’t any snowfall totals reported, but San Francisco has had over 24 inches of rainfall this past year.In terms of natural disasters, San Francisco is likely to encounter flooding and winter storms. It’s been recorded that San Francisco has fewer natural disasters than the U.S. average, which is 13 natural disasters per year.To prepare for a natural disaster like flooding, be sure to enroll in comprehensive coverage with your car insurance company. This will cover any damages related to storms, falling objects, or other related damages from natural disasters.

Public Transit in San Francisco

To summarize, San Francisco Travel provides a concise look at the cost of public transportation. Here are the costs you can expect:

- A BART round-trip from SFO to downtown San Francisco is $17.90. One-way trips are $8.95.

- BART round-trips from OAK to downtown San Francisco are $20.40, and one-way it will cost you $10.20.

- Single ride Muni bus/train rides are $2.75 ($2.50 with a Clipper Card or the Muni Mobile App).

- Single ride cable car tickets are $7.

- Rideshares, like Uber or Lyft, cost under $15 for most trips around the city.

- Most taxi rides around the city will cost you about $20.

Alternate Transportation

Did you know Lyft also has a bike rental service? It costs about $32 per day, with an extra $10 if you return it to a different kiosk than the one you rented it from.

Parking in Metro Areas in San Francisco

SpotHero lists over 130 parking locations in San Francisco. Motorists can reserve their spots for a fee of $6 or more. The top three tourist parking locations are Pier 39 Parking (costs $18), The Exploratorium Museum Parking (costs $12), and Chinatown Parking (costs $10).Street parking is self-explanatory. There are usually street signs alerting you of how long you can park in a certain area. Metered parking times depend on how much change you insert into the meter. However, innovation has made it easier for motorists to pay for parking by installing card readers on meters.

Air Quality in San Francisco

With all the traffic congestion, one might wonder about the air quality in San Francisco. Let’s examine the air quality index from the Environmental Protection Agency.San Francisco, CA Air Quality Index 2019

| Air Quality Summary | Air Quality Values |

|---|---|

| CBSA Code | 41860 |

| CBSA | San Francisco-Oakland-Hayward, CA |

| # Days with AQI | 274 |

| Good | 204 |

| Moderate | 61 |

| Unhealthy for Sensitive Groups | 7 |

| Unhealthy | 2 |

| Very Unhealthy | - |

Despite the car congestion and consequent emissions from motor vehicles around San Francisco, the city saw more good air quality days than bad. There hasn’t been a single day where the air quality was unhealthy.

Military/Veterans in San Francisco

Most of the veterans living in San Francisco fought in the Vietnam War. An estimated 6,000 Vietnam veterans live in the city.

Military Bases within an Hour

There are two military bases close to San Francisco, which are the U.S. Army Post and the U.S. Army Engineer Torpedo Station. Both are less than 30 minutes away on Yerba Buena Island. These are historical sites rather than active bases. Military Ocean Terminal Concord Navy Base is 44 minutes away from San Francisco.

Military Discounts by Providers

Throughout the guide, you’ve seen USAA listed within some of the car insurance rate tables. USAA is an insurance company exclusive to military members and their immediate families. The rates are much cheaper than most car insurance companies, but military personnel and veterans are able to receive discounts from other car insurance companies.Companies such as Allstate, Esurance, Farmers, Geico, Liberty Mutual, Metlife, Safe Auto, State Farm, and The General have discounts for military and veterans.Imported from Manual Input

| Car Insurance Company | Average Annual Premium |

|---|---|

| $5,612.67 | |

| $6,130.34 | |

| $3,050.85 | |

| $3,685.81 |

| $5,782.30 |

| $3,086.38 | |

| $4,473.06 | |

| $3,985.62 | |

| $3,118.95 |

Because of their military discount rates, USAA appears to be the cheapest of all the car insurance companies in San Francisco. However, keep in mind that you only qualify if you are a military member or veteran or in the immediate family of one.

Unique San Fransisco Laws

Some laws in San Francisco are bizarre. Did you know that you cannot store anything in your public or private garage except your vehicle? San Francisco doesn’t appear to enforce this law, but if you’re in an apartment complex or have rules from a housing authority, be sure to abide by them.Although it’s probably uncommon, it’s also illegal to wash your car with your underwear.It’s okay to ride a horse through San Francisco, but if you ride your horse while intoxicated, you’re likely to receive a DUI citation.

Hands-Free Laws in San Francisco

The hands-free law in San Francisco is the same as California law: it’s totally banned. Using a device while operating a motor vehicle is a primary offense, which means that law enforcement can pull you over if you’re caught using a device while driving.

Food Trucks in San Francisco

For food trucks in the San Francisco area, mobile food vendors should note that they’ll have to follow regulations enforced by the Board of Supervisors. These regulations say that food truck owners must obtain a permit in addition to a business license.

Tiny Houses in San Francisco

Tiny houses, although popular, have heavy restrictions in San Francisco. Due to the city’s heavy population and limited space, San Francisco as well as other California metropolitan areas. San Francisco Bay area lawmakers have outlawed homes with wheels. Other building codes regarding tiny houses are still ongoing.

Read more: What do I need for my tiny house insurance in California?

Parking Laws in San Francisco

Parking laws of San Francisco detail that no one shall have their car parked along the street for no more than 72 hours. You can park along a residential street as long as you want, but only if you have a permit. Stationary vehicles without a residential permit or that are parked along city streets will be towed.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

San Francisco Car Insurance FAQs

This is the section covering questions you may still have after reading the guide. If there’s anything we missed, leave a comment and we’ll answer the question to the best of our ability.

I can’t afford the car insurance rates. Is there a cheaper insurance rate for low-income residents of San Francisco?

Yes. California is one of three states that offer state-sponsored car insurance options for low-income residents.

What is the minimum car insurance coverage requirement?

All motorists in San Francisco must have liability car insurance, which is the minimum car insurance coverage needed to operate a motor vehicle on the city’s roadways.

Does San Francisco have speeding cameras?

No. At the moment, redlight cameras are the only automated enforcement in use in San Francisco and throughout California.

Why should I get medium coverage instead of minimum coverage?

Minimum coverage in California falls under a 15/30/5 rule. Although $15,000 and $30,000 will likely cover medical bills, the $5,000 property damage coverage will not be enough to cover vehicles that are valued over $5,000. To better prepare for the worst-case scenario, enroll in medium or high coverage so you’re not underinsured.

Do veterans receive discounts for car insurance?

It depends on the company. USAA is an insurance company that serves military service members and their immediate families. Other companies like State Farm, Geico, and Nationwide provide discounts to military members. Always ask the insurance representative about discounts as you’re shopping for a policy that’s right for you.Ultimately, this guide is meant to inform you about the different car insurance rates. We’ve identified the cheapest and most expensive rates to help you decide which direction you want to go in. Driving and transportation data is meant to make you aware of traffic conditions and daily commutes within San Francisco.Use the data and other information above to your advantage. Bookmark this webpage so you can return as needed while you’re shopping for car insurance. We’ll help you find the cheapest car insurance quotes San Francisco insurers have to offer.

Frequently Asked Questions

What factors can affect car insurance rates in San Francisco, CA?

Several factors can influence car insurance rates in San Francisco, CA. These factors include your driving record, age, gender, marital status, type of vehicle, coverage limits, deductible amount, credit history, and even the area where you live within San Francisco.

Are car insurance rates higher in San Francisco compared to other cities in California?

Generally, car insurance rates in San Francisco tend to be higher compared to many other cities in California. This is primarily due to the higher population density, heavy traffic, and a higher likelihood of accidents, thefts, and vandalism in the city.

Are there any specific coverages required by law in San Francisco, CA?

Yes, California state law mandates that all drivers in San Francisco, CA, carry liability insurance, which covers injuries or damages to other people or their property if you are at fault in an accident. The minimum liability coverage limits in California are $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for property damage.

What are some ways to potentially lower car insurance rates in San Francisco?

While individual circumstances may vary, there are a few strategies you can consider to potentially lower your car insurance rates in San Francisco:

- Maintain a clean driving record with no accidents or traffic violations.

- Choose a higher deductible amount, which can lower your premium.

- Bundle your car insurance with other policies, such as homeowners or renters insurance, to qualify for multi-policy discounts.

- Install anti-theft devices or safety features in your vehicle.

- Consider taking defensive driving courses to demonstrate responsible driving behavior.

How can I get car insurance quotes in San Francisco, CA?

To obtain car insurance quotes in San Francisco, CA, you can reach out to insurance agents or brokers operating in the area. Additionally, many insurance companies provide online platforms or tools where you can enter your information to receive quotes from multiple insurers. Comparing quotes from different providers can help you find the most competitive rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.