Compare Arizona Car Insurance Rates [2024]

Car insurance in Arizona costs an average of $81 per month, about the same as the national average. Arizona car insurance requirements include a 25/50/15 liability policy, which helps keep minimum insurance rates low. However, you should compare Arizona car insurance rates to find the best price.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 7, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Arizona Statistics Summary | Details |

|---|---|

| Road Miles in State | 65,593 |

| Number of Vehicles Registered | 7.764,367 |

| Population | 7,453,517 |

| Most popular vehicle | Ford F-150 |

| Uninsured % | 12% |

| Total Driving Related Deaths | Speeding: 3,032 Drunk Driving: 673 |

| Full Coverage Annual Premiums | Liability: $508.76 Collision: $277.96 Comprehensive: $186.12 |

| Cheapest Providers | Geico and Travelers |

- Arizona car insurance requirements include a 25/50/15 liability policy

- The average Arizona driver pays $81 for coverage, but you might see different prices based on your unique circumstances

- To find the lowest rates, you should compare Arizona car insurance online and look for discounts

Arizona car insurance rates typically match the national average relatively closely, with the typical driver paying $81 per month for coverage. While car insurance in Arizona is generally affordable, there are exceptions. Drivers with low credit scores, accidents in their driving record, or are very young can see much higher Arizona car insurance quotes.

Although finding the cheapest Arizona car insurance can help you save, knowing where to start can be tricky. From how to find the required auto insurance in your state to picking the most affordable Arizona car insurance company, finding the right policy can feel overwhelming.

Read on to learn where to buy the best car insurance in Arizona. Then, make sure to compare Arizona car insurance rates to find the best policy for your vehicle.

- Car Insurance Rates in Arizona

Compare Arizona Car Insurance Rates

If you love towns with the charm of the “How The West Was Won” culture (think the town of Tombstone, site of the O.K. Corral) and places with some of the best Mexican food, Arizona might be the best place for you to live. But as horses are no longer the preferred method of transportation in Arizona, do you know what it costs to own and operate a vehicle in Arizona?

Minimum Arizona Car Insurance Requirements

| Type of Coverage | Coverage Amount |

|---|---|

| Bodily Injury Liability | Minimum $15,000 per person and $30,000 per accident |

| Property Damage Liability | Minimum $10,000 |

| Uninsured Motorist Bodily Injury | Minimum $15,000 per person and $30,000 per accident |

| Uninsured Motorist Property Damage | Minimum $10,000 |

While Arizona ranks about the middle of the road for uninsured drivers — at 24th in the United States and about 12 percent of Arizona motorists uninsured — it’s important to know that you need, at the minimum, liability insurance.

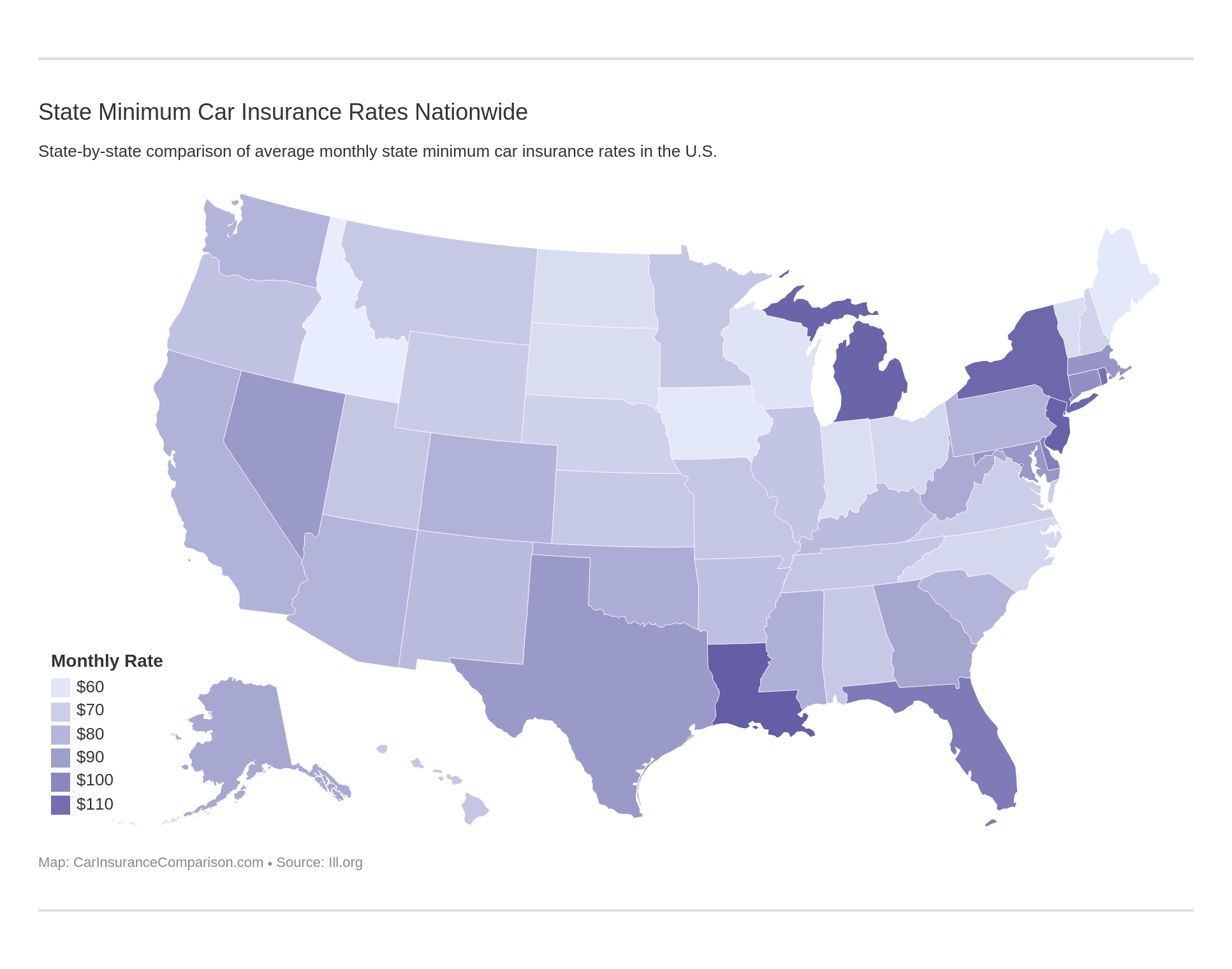

We can see how the minimum costs for car insurance in Arizona compare to the rest of the U.S.

Liability insurance pays all individuals — drivers, passengers, pedestrians, bicyclists, etc. — who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes.

Arizona is an “at-fault” accident state. This means, if you are in an accident and it’s your fault, you are responsible for any personal injury or property claims.

The type of liability insurance required in Arizona involves both bodily injury and property damage. The minimum amount you are required to carry in Arizona if you are at fault in an accident is as follows:

- $25,000 – to cover injury or death per person.

- $50,000 – to cover total injuries or death per person.

- $15,000 – to cover property damage per accident.

Remember, these amounts are minimum requirements. There are additional coverage options you can add to your insurance policy (which we will talk about later).

Your liability coverage kicks in no matter who is driving your car and when you drive a rental vehicle.

Minimum Insurance Alternatives in Arizona

Arizona law requires every driver and every owner of a vehicle to have proof of financial responsibility (proof of liability coverage) at all times.

Here are the four forms of acceptable proof of vehicle liability auto insurance coverage in Arizona:

- Liability insurance policy

- A bond worth $40,000.

- Certificate of deposit worth $40,000.

- $40,000 in cash.

Every time a motorist operates a vehicle, he or she is required to have — on hand — one of the above four forms proving financial responsibility.

Arizona can cancel your insurance for the following reasons:

- Reckless driving.

- Non-payment of your premium.

- The insurance was obtained through fraudulent misrepresentation.

- Your driver’s license is suspended or revoked.

- Permanently disabled and no certificate from a physician testifying to your ability to operate an auto.

- Convicted of criminal negligence arising out of the operation of your vehicle.

- Operating your vehicle while intoxicated under the influence of drugs.

- Leaving the scene of an accident.

- Making false statements on your driver’s license application.

- The insurer is placed in rehabilitation or receivership.

- A private passenger auto is used regularly and frequently for commercial purposes.

- If the continuation of the policy is in violation of the laws of Arizona.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Arizona Auto Insurance Rates as a Percentage of Income

In 2017, the annual per capita disposable personal income in Arizona was $34,321.

Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after their taxes have been paid.

The average annual cost of car insurance in Georgia is $961, which is about 3 percent of the average disposable personal income.

The average Arizona resident has $2,806 each month to spend on necessities. The car insurance bill alone will deduct close to $100 out of that — and even more than that with a less-than-perfect driving history.

American Consumer Credit Counseling suggests saving 20 percent of every paycheck. With Arizona’s DPI, that’s a whopping $561 each month!

Average Arizona Auto Insurance Rates by Coverage Type

Frequently Asked Questions

What are the minimum Arizona car insurance requirements?

In Arizona, the minimum liability insurance requirements are 25/50/15. This means you need coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage.

What are the average Arizona car insurance rates?

The average annual car insurance rate in Arizona is approximately $972.84, or $81.07 per month.

What forms of financial responsibility are required in Arizona?

Arizona law requires drivers to have proof of financial responsibility, which can be provided through liability insurance coverage. The acceptable forms of proof include insurance ID cards, insurance policy documents, insurance binder, and certificate of deposit or self-insurance.

Which coverage options should you add to your Arizona car insurance?

While minimum liability coverage is required, it’s advisable to consider additional coverage options. These may include Med Pay, Uninsured Motorist, Underinsured Motorist, and add-ons like comprehensive and collision coverage.

Which Arizona car insurance companies have the cheapest rates?

There are several cheap car insurance companies in Arizona, including Geico, Travelers, and Progressive. These companies have received positive customer ratings and provide reliably low rates.

Do you need car insurance in Arizona to register a car?

Arizona state law requires you to provide proof of insurance at the MVD before registering your vehicle.

Is Arizona a no-fault state?

Arizona is an at-fault state, which means the driver responsible for an accident has to pay for property damage and bodily injuries they cause.

What happens if you drive without car insurance in Arizona?

Driving without Arizona car insurance is a serious offense. For your first violation, you’ll face a $500 fine, suspension of your license, registration, and license plate for three months, and a possible SR-22 requirement for up to three years.