Best Audi S5 Car Insurance in 2026 (Find the Top 10 Companies Here)

The best Audi S5 car insurance includes State Farm, USAA, and Geico, with rates starting around $68 per month. Mature drivers with excellent records may secure even better rates. These leading providers offer comprehensive coverage and competitive pricing for Audi S5 insurance. Compare quotes and save today.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated November 2024

Company Facts

Full Coverage for Audi S5

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Audi S5

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Audi S5

A.M. Best Rating

Complaint Level

Pros & Cons

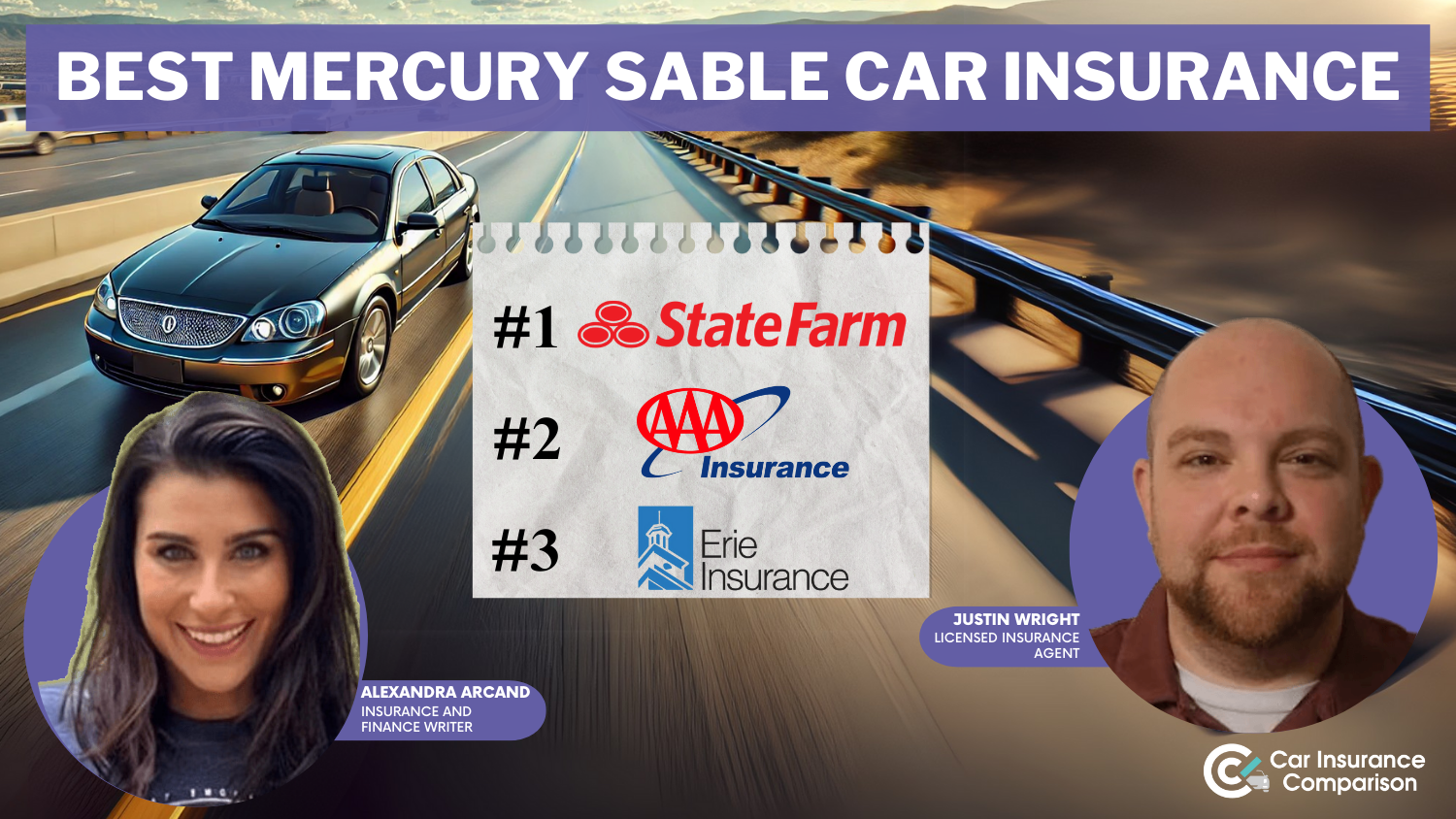

You can get best Audi S5 car insurance starting at just $68 a month from leading insurers, State Farm, USAA, and Geico. State Farm is the best choice overall because it offers great coverage options and affordable prices.

The article also explores what makes car insurance more expensive, such as high-risk factors, vehicle type, and personal driving history. Understanding these factors can help you find more affordable options and manage your Audi S5 insurance costs effectively.

Our Top 10 Company Picks: Best Audi S5 Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Personalized Service State Farm

#2 10% A++ Military Savings USAA

#3 25% A++ Competitive Rates Geico

#4 12% A+ Usage-Based Program Progressive

#5 25% A+ High-Quality Coverage Allstate

#6 20% A+ Vanishing Deductible Nationwide

#7 10% A Flexible Options Liberty Mutual

#8 18% A Comprehensive Options Farmers

#9 23% A Strong Service American Family

#10 13% A++ Extensive Coverage Travelers

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code above into our free comparison tool to find the lowest prices in your area.

- Best Audi S5 Car Insurance starts at $100 per month

- State Farm offers the best rates for Audi S5 insurance

- Factors like driving record affect Audi S5 insurance costs

#1 – State Farm: Top Pick Overall

Pros

- Affordable Audi S5 Insurance: State Farm has a great deal at just $135 a month for Audi S5 insurance, which is cheaper than most other options out there, making it a budget-friendly choice for drivers. More information about their rates in our State Farm car insurance review.

- Extensive Protection Plans: State Farm offers a wide array of coverage options for Audi S5 owners, encompassing collision, comprehensive, liability, and uninsured motorist coverage, thereby guaranteeing comprehensive protection for your vehicle.

- Safety Feature Savings: An Audi S5 with advanced safety features, can snag you some discounts from State Farm and cut down your insurance costs.

Cons

- New Customers Discounts: While State Farm offers various discounts for Audi S5 owners, new customers might find it challenging to qualify for significant savings initially compared to long-term policyholders.

- Claims Process Time: Some customers have reported that the claims process with State Farm can take longer than expected, which could be a drawback for Audi S5 owners needing swift repairs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exclusive Rates for Military Members: USAA offers exclusive and highly competitive rates of $142 per month for Audi S5 owners for military members and their families, making it a top choice for those eligible. Learn more in our USAA car insurance review.

- Excellent Customer Satisfaction: USAA consistently ranks high in customer satisfaction, particularly for claims processing and customer service, which is beneficial for Audi S5 owners seeking reliable support.

- Comprehensive Coverage and Discounts: USAA provides a wide range of coverage options and discounts, including safe driver and vehicle storage discounts, helping Audi S5 owners reduce their insurance costs.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members, veterans, and their families, excluding a large portion of the general population from accessing their competitive Audi S5 insurance rates.

- Limited Physical Locations: With fewer physical offices compared to other insurers, USAA customers might find it less convenient to receive in-person assistance for their Audi S5 insurance needs.

#3 – Geico: Best for Competitive Rates

Pros

- Affordable Rates for Audi S5 Insurance: Geico offers competitive rates at $149 per month, making it an affordable option for Audi S5 owners looking to minimize their insurance costs. Learn more in our Geico car insurance review.

- User-Friendly Online Tools: Geico provides an easy-to-use online platform for managing policies, filing claims, and accessing quotes, which is convenient for tech-savvy Audi S5 owners.

- Wide Range of Discounts: Geico offers numerous discounts, including those for good drivers, multiple vehicles, and safety features, helping Audi S5 owners further reduce their insurance premiums.

Cons

- Mixed Customer Service Reviews: While many customers are satisfied, some have reported issues with customer service, which can be a concern for Audi S5 owners needing reliable support.

- Limited Coverage Options for High-Risk Drivers: Geico may offer fewer coverage options for high-risk drivers, potentially leading to higher rates for Audi S5 owners with less-than-perfect driving records.

#4 – Progressive: Best for Usage-Based Program

Pros

- Snapshot Discount Program: Progressive’s Snapshot program offers personalized discounts based on driving behavior, potentially lowering the $155 monthly rate for safe Audi S5 drivers. Learn more details in our Progressive car insurance review.

- Variety of Coverage Options: Progressive provides extensive coverage options, including gap insurance and custom parts coverage, which are beneficial for Audi S5 owners looking for comprehensive protection.

- Strong Online Presence: Progressive’s robust online tools and mobile app make it easy for Audi S5 owners to manage their policies, file claims, and access customer support.

Cons

- Higher Rates for High-Risk Drivers: Audi S5 owners with poor driving records might find Progressive’s rates less competitive, potentially paying more than the average monthly rate.

- Average Customer Satisfaction: Progressive receives mixed reviews regarding customer satisfaction, with some Audi S5 owners reporting issues with claims processing and customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for High-Quality Coverage

Pros

- Extensive Network of Agents: Allstate’s vast network of local agents provides personalized service and support, which is beneficial for Audi S5 owners who prefer face-to-face interactions.

- Comprehensive Coverage Options: As mentioned in our Allstate car insurance review, Allstate offers a wide range of coverage options, including accident forgiveness and new car replacement, ensuring Audi S5 owners are well-protected.

- Discounts for Bundling Policies: Allstate provides significant discounts for bundling multiple insurance policies, which can help Audi S5 owners save on their overall insurance costs.

Cons

- Pricier Premiums: With rates at $162 a month, Allstate’s coverage costs more than some other options. This might not be the best choice if you’re an Audi S5 owner looking to save on insurance.

- Dissatisfaction Reports: Some customers have reported dissatisfaction with the claims process, indicating potential delays or challenges for Audi S5 owners needing quick and efficient claims handling.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible program rewards safe Audi S5 drivers by reducing their deductible over time, providing additional savings on top of the $168 monthly rate.

- On Your Side Review: Nationwide offers a unique policy review service to help Audi S5 owners ensure they have the best coverage options and discounts available. Check out their ratings in our complete Nationwide car insurance discount.

- Strong Financial Stability: With high ratings from A.M. Best, Nationwide’s financial stability ensures that Audi S5 owners’ claims will be paid reliably and promptly.

Cons

- Higher Average Rates: Nationwide’s average monthly rate of $168 is higher than some other insurers, which may not be the best option for Audi S5 owners on a tight budget.

- Limited Availability of Local Agents: While Nationwide has a strong presence, some areas might have limited access to local agents, which could be a drawback for Audi S5 owners seeking in-person support.

#7 – Liberty Mutual: Best for Flexible Options

Pros

- Customizable Coverage Options: Liberty Mutual offers highly customizable coverage options, allowing Audi S5 owners to tailor their policies to their specific needs and preferences. Learn more in our Liberty Mutual car insurance review.

- Accident Forgiveness Program: Liberty Mutual’s accident forgiveness program ensures that Audi S5 owners won’t see a rate increase after their first accident, providing peace of mind and potential cost savings.

- Discounts for Safety Features: Liberty Mutual provides discounts for vehicles equipped with advanced safety features, helping Audi S5 owners reduce their $175 monthly premium.

Cons

- Higher Monthly Premiums: At $175 per month, Liberty Mutual’s rates are on the higher side compared to other insurers, which might not be suitable for Audi S5 owners looking for the most affordable options.

- Mixed Customer Service Feedback: While many customers are satisfied, some have reported issues with customer service and claims handling, which could be a concern for Audi S5 owners needing reliable support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Comprehensive Options

Pros

- Comprehensive Coverage Options: Farmers offers extensive coverage options, including new car replacement and accident forgiveness, which are beneficial for Audi S5 owners seeking robust protection.

- Discounts for Good Drivers: Farmers provides discounts for good drivers, which can help Audi S5 owners with clean driving records reduce their $182 monthly insurance costs.

- Strong Financial Ratings: Farmers has strong financial stability, ensuring that Audi S5 owners’ claims will be paid promptly and reliably. Learn more in our Farmers car insurance review.

Cons

- Higher Insurance Rates: At $182 per month, Farmers’ rates are higher than several competitors, making it a less attractive option for Audi S5 owners seeking lower premiums.

- Mixed Reviews: Some customers have reported dissatisfaction with Farmers’ claims processing, indicating potential delays or issues for Audi S5 owners needing swift claims resolution.

#9 – American Family: Best for Strong Service

Pros

- Comprehensive Coverage for Audi S5: American Family offers a wide range of coverage options tailored to Audi S5 owners, including gap insurance and accident forgiveness, ensuring robust protection.

- Discounts for Safe Driving: American Family provides significant discounts for safe drivers, helping Audi S5 owners with clean records lower their $189 monthly premiums.

- Strong Customer Support: Known for its excellent customer service, American Family ensures Audi S5 owners receive reliable support for all their insurance needs. More information in our American Family car insurance review.

Cons

- Higher Monthly Premiums: At $189 per month, American Family’s rates are on the higher end, which might not be ideal for Audi S5 owners looking for more affordable insurance options.

- Limited Availability in Some Areas: American Family’s services are not available nationwide, which could be a drawback for Audi S5 owners in regions where coverage is not offered.

#10 – Travelers: Best for Extensive Coverage

Pros

- Comprehensive Coverage Options: Travelers offers extensive coverage options, including new car replacement and accident forgiveness, providing Audi S5 owners with robust protection.

- Innovative Safe Driver Program: Travelers’ IntelliDrive program uses a mobile app to monitor driving habits, rewarding Audi S5 owners with lower rates for safe driving behavior.

- Strong Financial Ratings: With high ratings from A.M. Best, Travelers ensures that Audi S5 owners’ claims will be paid promptly and reliably. See more details on our Travelers car insurance review.

Cons

- Higher Insurance Rates: At $195 per month, Travelers’ rates are higher than many competitors, which might not be the best option for Audi S5 owners seeking lower premiums.

- Mixed Customer Service Reviews: While many customers are satisfied, some have reported issues with customer service and claims handling, which could be a concern for Audi S5 owners needing reliable support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Audi S5 Premium Rates

Comparing insurance rates can help Audi S5 owners find the best coverage options to suit their needs. The table below displays the monthly premiums for both minimum and full coverage offered by different insurance companies.

Audi S5 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $87 $162

American Family $108 $189

Farmers $103 $182

Geico $78 $149

Liberty Mutual $98 $175

Nationwide $93 $168

Progressive $82 $155

State Farm $68 $135

Travelers $113 $195

USAA $72 $142

By reviewing these rates, Audi S5 owners can make informed decisions about their car insurance choices and potentially save on their premiums. See more details on our “How do you get competitive quotes for car insurance?“

Understanding how different factors affect your insurance rates can help you make informed decisions.

Scott W. Johnson LICENSED INSURANCE AGENT

The table below showcases how discount rates, high deductibles, average rates, low deductibles, high-risk drivers, and teen drivers impact annual premiums for the Audi S5.

Audi S5 Car Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Discount Rate | $89 |

| High Deductibles | $130 |

| Average Rate | $151 |

| Low Deductibles | $190 |

| High Risk Driver | $322 |

| Teen Driver | $553 |

By examining these variations, Audi S5 owners can better understand their insurance options and choose coverage that aligns with their budget and needs.

Why Audi S5s are Expensive to Insure

The chart below details how Audi S5 insurance rates compare to other coupes like the MINI Hardtop 2 Door, Mercedes-Benz CLA 250, and Infiniti Q60.

Audi S5 Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| Audi S5 | $33 | $72 | $33 | $151 |

| MINI Hardtop 2 Door | $28 | $45 | $24 | $108 |

| Mercedes-Benz CLA 250 | $33 | $70 | $34 | $150 |

| Infiniti Q60 | $33 | $62 | $32 | $140 |

| Cadillac ATS Coupe | $33 | $57 | $29 | $132 |

| Nissan 370Z | $38 | $60 | $28 | $140 |

| Dodge Challenger | $35 | $57 | $34 | $141 |

To find the cheapest Audi insurance rates online, consider comparing quotes from multiple providers, increasing deductibles, and seeking out discounts for bundling policies or maintaining a clean driving record.

Read More:

Tips to Lower Audi S5 Insurance Cost

There are many ways that you can save on Audi S5 car insurance. Below are five actions you can take to find cheap Audi S5 auto insurance rates.

- Improve your credit score.

- Ask about Audi S5 discounts if you were listed on someone else’s policy.

- Ask about retiree discounts.

- Audit your Audi S5 driving when you move to a new location or start a new job.

- Move to an area with a lower cost of living.

Implementing these strategies can help you reduce your insurance premiums and make your Audi S5 coverage more affordable. By being proactive and exploring available discounts, you can ensure you are getting the best possible rates.

These discounts from top insurance providers for Audi S5 offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road. Access comprehensive insights into our guide titled, “What makes car insurance more expensive?“

Audi S5 Insurance Cost Factors

The Audi S5 trim and model you choose will affect the total price you will pay for Audi S5 insurance coverage, as different trims and models come with varying features, performance specifications, and associated risks that insurers consider when calculating premiums.

For instance, higher-end trims with more powerful engines or advanced technologies might cost more to insure due to increased repair costs and potential for higher claims. Discover more about offerings in our guide titled “What is the minimum amount of liability car insurance coverage required?”

Age of the Vehicle

Insurance for an Audi S5 tends to be pricier for newer models. So, if you’re looking at a 2018 Audi S5, expect to pay more for insurance compared to a 2010 model.

Audi S5 Car Insurance Monthly Rates by Model Year

| Model Year | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| 2024 Audi S5 | $32 | $75 | $36 | $155 |

| 2023 Audi S5 | $32 | $74 | $35 | $153 |

| 2022 Audi S5 | $33 | $73 | $34 | $152 |

| 2021 Audi S5 | $33 | $73 | $34 | $152 |

| 2020 Audi S5 | $33 | $72 | $33 | $151 |

| 2019 Audi S5 | $33 | $72 | $33 | $151 |

| 2018 Audi S5 | $33 | $72 | $33 | $151 |

| 2017 Audi S5 | $35 | $70 | $32 | $150 |

| 2016 Audi S5 | $36 | $67 | $31 | $147 |

| 2015 Audi S5 | $37 | $65 | $29 | $144 |

| 2014 Audi S5 | $38 | $60 | $28 | $139 |

| 2013 Audi S5 | $38 | $57 | $27 | $135 |

| 2012 Audi S5 | $38 | $51 | $26 | $128 |

| 2011 Audi S5 | $38 | $47 | $24 | $122 |

| 2010 Audi S5 | $39 | $44 | $23 | $119 |

Newer Audi S5s usually come with higher insurance bills than the older ones. So, it’s a good idea to keep the model year in mind when figuring out your car insurance budget.

Driver Age

The age of the driver matters much for the cost of insuring an Audi S5. A man of thirty finds he pays more each year for insurance than a man of forty.

Audi S5 Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $553 |

| Age: 18 | $485 |

| Age: 20 | $343 |

| Age: 30 | $158 |

| Age: 40 | $151 |

| Age: 45 | $145 |

| Age: 50 | $138 |

| Age: 60 | $135 |

The cost of insuring an Audi S5 shifts greatly with age. Young drivers, especially teenagers, bear the brunt of the highest premiums. This underscores the importance of meticulous financial planning for these young folks.

Driver Location

Where you live can shape what you pay for Audi S5 insurance. In Los Angeles, the cost might be higher each year than in Philadelphia.

Audi S5 Car Insurance Monthly Rates by City

| State | Rates |

|---|---|

| Los Angeles, CA | $259 |

| New York, NY | $239 |

| Houston, TX | $237 |

| Jacksonville, FL | $219 |

| Philadelphia, PA | $203 |

| Chicago, IL | $200 |

| Phoenix, AZ | $175 |

| Seattle, WA | $147 |

| Indianapolis, IN | $129 |

| Columbus, OH | $126 |

Where you live matters for insurance. An Audi S5 in Los Angeles costs much more to insure than one in Columbus, Ohio. It shows how insurance prices change depending on where you are.

Your Driving Record

The marks on your driving record can hike up the cost of insuring an Audi S5. Young folks, especially teens and those in their twenties, take the hardest hit. Their insurance rates swell with each violation.

Audi S5 Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $553 | $608 | $675 | $850 |

| Age: 18 | $485 | $533 | $592 | $745 |

| Age: 20 | $343 | $373 | $425 | $612 |

| Age: 30 | $158 | $172 | $198 | $362 |

| Age: 40 | $151 | $165 | $190 | $348 |

| Age: 45 | $145 | $158 | $182 | $334 |

| Age: 50 | $138 | $150 | $173 | $317 |

| Age: 60 | $135 | $147 | $170 | $311 |

A driving record marred by violations can drive insurance costs sky-high. Consider the young man of twenty. Even with a spotless record, his rates are steep. Add a few infractions, and the price stays relentless. It’s a harsh truth—age and a clean slate make no difference; they both weigh heavy on what you pay.

Audi S5 Crash Test Ratings

Good crash test ratings for the Audi S5 don’t just keep you safer in an accident. They also mean you’ll pay less for insurance.

Audi S5 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Audi S5 Sportback 4 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2024 Audi S5 Coupe 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2024 Audi S5 Cabriolet AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2023 Audi S5 Sportback 4 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2023 Audi S5 Coupe 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2023 Audi S5 Cabriolet AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2022 Audi S5 Sportback 4 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2022 Audi S5 Coupe 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2022 Audi S5 Cabriolet AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2021 Audi S5 Sportback 4 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2021 Audi S5 Coupe 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2021 Audi S5 Cabriolet AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2020 Audi S5 Sportback 4 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2020 Audi S5 Coupe 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2020 Audi S5 Cabriolet AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2019 Audi S5 Sportback 4 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2019 Audi S5 Coupe AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2019 Audi S5 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2018 Audi S5 Sportback 4 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2018 Audi S5 Coupe AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2018 Audi S5 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2017 Audi S5 Coupe AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2017 Audi S5 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2016 Audi S5 Coupe AWD | 5 stars | 5 stars | 4 stars | 5 stars |

| 2016 Audi S5 2 DR AWD | 5 stars | 5 stars | 4 stars | 5 stars |

The Audi S5 stands firm, a testament to its safety. The 2020 Audi S5 Sportback earned a 5-star rollover rating. This rating means more than just a safer ride; it brings peace of mind and lower insurance bills.

Audi S5 Safety Features

Having a variety of safety features on your Audi S5 can help lower your Audi S5 insurance costs. The Audi S5’s safety features include:

- Electronic Stability Control (ESC), ABS and Driveline Traction Control, and side impact beams.

- Dual-stage driver and passenger seat-mounted side airbags, SIDEGUARD curtain airbags, and a back-up camera.

- Audi connect CARE Emergency Sos, Audi pre sense basic, and tire-specific low tire pressure warning.

- Outboard front lap and shoulder safety belts with height adjusters and pretensioners, and an airbag occupancy sensor.

Equipped with these advanced features, the Audi S5 ensures enhanced safety, which can lead to lower insurance costs. These safety features not only protect occupants but also reduce the risk of accidents and injuries.

Audi S5 Insurance Loss Probability

Review the Audi S5 car insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury. The lower percentage means lower Audi S5 auto insurance costs; higher percentages mean higher Audi S5 auto insurance costs.

Audi S5 Insurance Loss Probability

| Coverage Category | Loss Rates |

|---|---|

| Collision | 97% |

| Property Damage | -15% |

| Comprehensive | 61% |

| Personal Injury | -32% |

| Medical Payment | no data |

| Bodily Injury | no data |

The Audi S5 exhibits varied loss probability rates across insurance categories, with collision coverage showing a high rate of 97%, and personal injury protection reflecting a lower rate of -32%. These statistics significantly influence insurance premiums, as they help insurers gauge the likelihood of claims.

For example, a high collision rate suggests increased risk and could lead to higher premiums, while a lower personal injury rate might result in lower costs.

Additionally, Medical Payments coverage, which assists with medical expenses after an accident, is affected by these loss rates and can further impact overall insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Audi S5 Insurance Providers

Several insurance companies offer competitive rates for the Audi S5 based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Audi S5 drivers organized by market share.

Top Audi S5 Insurance Companies

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.3% |

| #2 | Geico | $46.3 million | 6.6% |

| #3 | Progressive | $41.7 million | 5.6% |

| #4 | Liberty Mutual | $39.2 million | 5.1% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.3% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

Choosing from these top insurers can help Audi S5 drivers find the best coverage options tailored to their needs. By considering market share and competitive rates, you can select an insurance provider that offers both value and reliable service.

Save money by comparing Audi S5 insurance rates with free quotes online now.

Frequently Asked Questions

What is the average cost of Audi S5 car insurance rates?

The average cost of Audi S5 car insurance rates is $1,814 per year or approximately $151 per month.

Can I find cheap Audi S5 insurance rates?

Yes, if you are a good driver with a mature driving record, you may be able to find rates as low as $106 per month for Audi S5 insurance. To find out more, explore our guide titled, “Is it cheaper to purchase car insurance online?“

How can I compare Audi S5 car insurance quotes from different companies?

You can compare Audi S5 car insurance quotes from top companies by using a free online quote tool. Enter your ZIP code below to get started.

Are Audi S5s expensive to insure compared to other coupes?

The chart provided on the page compares Audi S5 insurance rates to other coupes like the MINI Hardtop 2 Door, Mercedes-Benz CLA 250, and Infiniti Q60.

What factors impact the cost of Audi S5 insurance?

Several factors that affect car insurance rates for Audi S5 insurance, including the age of the vehicle, driver’s age, driver’s location, driving record, crash test ratings, safety features, and more.

What are some ways to save on Audi S5 car insurance?

To save on Audi S5 car insurance, consider improving your credit score, asking about discounts if you were listed on someone else’s policy, inquiring about retiree discounts, auditing your driving when you move to a new location or start a new job, and moving to an area with a lower cost of living.

Which companies offer the best insurance rates for the Audi S5?

Several top insurance companies offer competitive rates for the Audi S5, including State Farm, Geico, Progressive, Liberty Mutual, Allstate, Travelers, USAA, Chubb, Farmers, and Nationwide.

How does the age of the Audi S5 affect insurance costs?

Insurance rates for the Audi S5 are generally higher for newer models. For example, insurance for a 2018 Audi S5 typically costs more than for a 2010 Audi S5.

How does driver location influence Audi S5 insurance rates?

Location significantly affects insurance rates. For instance, Audi S5 drivers in Los Angeles may pay considerably more than those in Philadelphia.

What safety features of the Audi S5 help lower insurance costs?

The Audi S5 includes various safety features that can help lower insurance costs, such as Electronic Stability Control, ABS and Driveline Traction Control, side impact beams, dual-stage driver and passenger seat-mounted side airbags, and a back-up camera.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.