Best Car Insurance for 19-Year-Olds in 2026 (Top 10 Companies)

Discover the best car insurance for 19-year-olds with providers like State Farm, USAA, and Progressive. Enjoy up to 20% discounts with State Farm. This guide identifies the coverage options, rates, and unique offerings for making decisions and securing the best coverage for young adult drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for 19-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for 19-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for 19-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsIf you’re shopping for cheap quotes for 19-year-olds, you need to prepare yourself for the task. It’s not easy to find cheap car insurance for young people, simply because they don’t have as much experience.

Our Top 10 Company Picks: Best Car Insurance for 19-Year-Olds

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 20% | Many Discounts | State Farm | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 10% | 30% | Online Convenience | Progressive | |

| #4 | 10% | 25% | Add-on Coverages | Allstate | |

| #5 | 20% | 25% | Usage Discount | Nationwide |

| #6 | 25% | 10% | Cheap Rates | Geico | |

| #7 | 5% | 10% | Local Agents | Farmers | |

| #8 | 25% | 15% | Customizable Polices | Liberty Mutual |

| #9 | 5% | 10% | 24/7 Support | Erie | |

| #10 | 8% | 15% | Accident Forgiveness | Travelers |

There are options, however, so don’t be too discouraged. If you want cheap car insurance for 19-year-old drivers, start comparison shopping today by entering your ZIP code. The average rates might be a little higher, but you can still get free quotes.

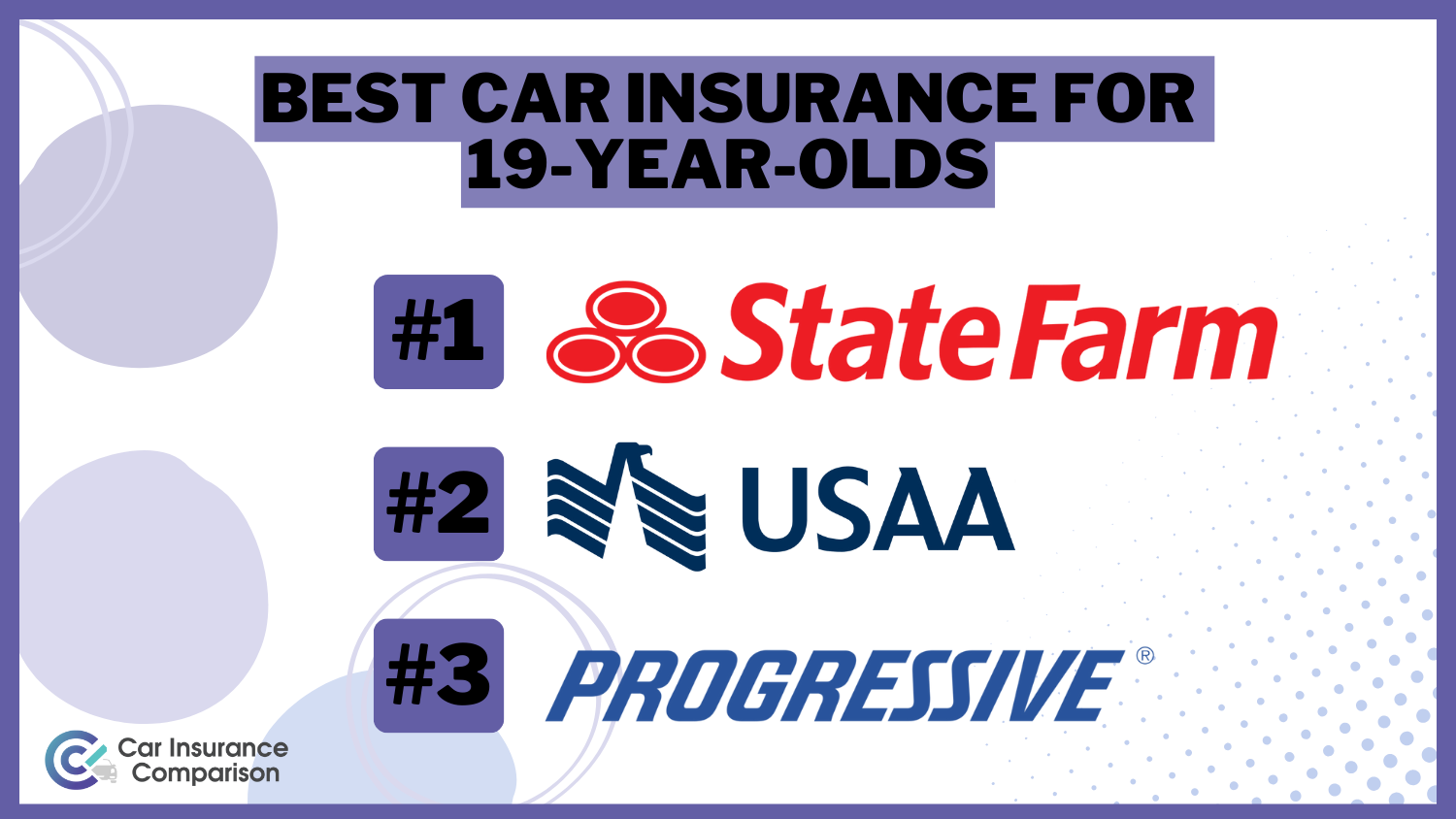

- State Farm, USAA, and Progressive are the most affordable car insurance providers

- Insurance rates are high due to statistics showing teens’ increased accident risk

- Explore discounts, maintain a clean record, and compare rates

#1 – State Farm: Top Overall Pick

Pros

- Affordability: As mentioned in our State Farm car insurance review, the company offers competitive rates, making it an attractive option for budget-conscious individuals.

- Extensive Discounts: The company provides various discounts, including multi-policy and low-mileage discounts, helping policyholders save on premiums.

- Financial Strength: State Farm has a solid financial standing, reflected in its A+ rating from A.M. Best, ensuring customers of the company’s stability.

Cons

- May not be the Cheapest: While competitive, State Farm might not always offer the absolute lowest rates compared to some other insurers.

- Availability: State Farm agents might not be as widely available in certain regions, potentially limiting accessibility for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA caters to military personnel, offering exclusive discounts and benefits for members of the armed forces.

- Top-Rated Customer Service: USAA consistently receives high ratings for customer service. Learn more in our USAA car insurance review.

- Financial Stability: With an A+ rating from A.M. Best, USAA demonstrates strong financial stability, instilling confidence in its policyholders.

Cons

- Limited Eligibility: USAA is available only to military members, veterans, and their families, limiting its accessibility to a specific demographic.

- May Lack Some Discounts: While USAA offers competitive rates, it may not have as many discounts as some other providers.

#3 – Progressive: Best for Online Convenience

Pros

- Online Convenience: As mentioned in our Progressive car insurance review, they excel in online services.

- Varied Discounts: Progressive offers a range of discounts, including multi-policy and safe driver discounts, contributing to cost savings for customers.

- Innovative Snapshot Program: The Snapshot program uses telematics to monitor driving behavior, potentially leading to personalized discounts for safe drivers.

Cons

- Customer Service Reviews: Some customers have reported mixed reviews about Progressive’s customer service, with occasional dissatisfaction.

- Snapshot Privacy Concerns: While innovative, the Snapshot program raises privacy concerns for some customers, as it involves monitoring driving habits.

#4 – Allstate: Best for Add-On Coverages

Pros

- Add-on Coverages: As outlined in our Allstate car insurance review, they offer a variety of add-on coverages.

- Drivewise Program: Allstate’s Drivewise program rewards safe driving habits with potential discounts, encouraging responsible behavior.

- Local Agents: With a network of local agents, Allstate provides a personalized touch to customer service, catering to individual needs.

Cons

- Higher Premiums: Allstate’s premiums may be on the higher side compared to some other insurers, potentially impacting affordability.

- Mixed Customer Reviews: While many customers are satisfied, there are mixed reviews about Allstate’s customer service and claims handling.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discounts

Pros

- Usage Discount: Nationwide offers a usage-based discount, allowing customers to save based on their driving habits.

- Many Discounts: The company provides various discounts, such as multi-policy and safe driver discounts. (Read more: Nationwide Car Insurance Discounts)

- Financial Stability: Nationwide’s A+ rating from A.M. Best reflects its strong financial stability, assuring policyholders of its reliability.

Cons

- Limited Local Agents: While Nationwide has agents, the availability may vary, and some customers may prefer more face-to-face interactions.

- Coverage Options: Some customers may find that Nationwide’s coverage options are not as extensive or customizable as those of other providers.

#6 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico is often known for providing affordable rates, making it an attractive option for budget-conscious customers.

- Generous Discounts: With a range of discounts, including multi-policy and good driver discounts, Geico offers opportunities for cost savings.

- Online Convenience: Geico’s user-friendly online platform allows for easy policy management, claims filing, and obtaining quotes. Learn more in our Geico car insurance review.

Cons

- Limited Local Agents: Geico primarily operates online and over the phone, which may be a drawback for customers who prefer in-person interactions.

- May Not Cater to High-Risk Drivers: While Geico is known for affordable rates, it may not be the best option for high-risk drivers seeking specialized coverage.

#7 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers has a network of local agents, providing personalized service and assistance tailored to individual customer needs.

- Coverage Options: As mentioned in our Farmers car insurance review, they offer a variety of coverage options, allowing customers to customize policies based on their specific requirements.

- Discount Opportunities: Farmers provides several discounts, such as multi-policy and claims-free discounts, contributing to overall affordability.

Cons

- Higher Premiums: Farmers’ premiums may be relatively higher compared to some other insurers, impacting overall affordability.

- Mixed Customer Reviews: Some customers have reported mixed experiences with Farmers’ customer service and claims handling.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor coverage to their specific needs.

- Generous Discounts: With a range of discounts, including multi-policy and safe driver discounts, Liberty Mutual provides opportunities for cost savings.

- Accident Forgiveness: Liberty Mutual’s Accident Forgiveness program ensures that a policyholder’s rates won’t increase after their first accident.

Cons

- Average Customer Service Ratings: While not poor, Liberty Mutual’s customer service ratings are generally average, with room for improvement.

- May not be the Cheapest: While competitive, Liberty Mutual may not always provide the absolute lowest rates compared to some other insurers. Learn more about their rates in our Liberty Mutual car insurance review.

#9 – Erie: Best for 24/7 Support

Pros

- Affordability: Erie is often praised for its affordable rates, making it an appealing option for customers seeking budget-friendly coverage.

- Personalized Service: With a focus on customer satisfaction, Erie provides personalized service through local agents, fostering strong customer relationships.

- Wide Range of Coverage: Erie offers a comprehensive selection of coverage options, allowing customers to build policies tailored to their needs.

Cons

- Limited Availability: Erie primarily operates in select regions, limiting its accessibility for customers in certain areas. Find out the available areas in our Erie car insurance review.

- Discount Opportunities: While Erie offers discounts, the variety may not be as extensive as some other providers.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers’ Accident Forgiveness program prevents rate increases for policyholders after their first at-fault accident.

- Customizable Policies: Travelers offers customizable policies, allowing customers to tailor coverage based on their specific needs.

- Wide Range of Discounts: With various discounts, including multi-policy and safe driver discounts, Travelers provides opportunities for cost savings.

Cons

- Mixed Customer Reviews: Some customers have reported mixed experiences with Travelers’ customer service, with occasional dissatisfaction. Learn more about their reviews in our Travelers car insurance review.

- May Have Higher Premiums: Travelers’ premiums may be on the higher side compared to some other insurers, potentially impacting affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Average Monthly Rates for 19-Year-Old Driver With Top 10 Car Insurance Companies

When it comes to securing car insurance for 19-year-olds, a careful evaluation of rates from different providers is crucial. Here, we compare the best car insurance companies and break down the average monthly rates for both minimum and full coverage, shedding light on the considerations that make some stand out.

Car Insurance for 19-Year-Olds: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $190 | $464 |

| Erie | $260 | $601 |

| Farmers | $230 | $536 |

| Geico | $90 | $212 |

| Liberty Mutual | $235 | $555 |

| Nationwide | $140 | $297 |

| Progressive | $240 | $598 |

| State Farm | $105 | $254 |

| Travelers | $145 | $311 |

| USAA | $75 | $188 |

State Farm and USAA stand out for their affordability, offering minimum coverage at $105 and $75, and full coverage at $254 and $188, respectively. Progressive, while pricier with rates of $240 for minimum and $598 for full coverage, provides comprehensive protection. Geico and USAA emerge as cost-effective options for both minimum ($90 and $75) and full coverage ($212 and $188).

State Farm stands out as the top choice for affordable car insurance for 19-year-old drivers, offering competitive rates and comprehensive coverage options.

Melanie Musson Published Insurance Expert

In contrast, Erie and Progressive feature higher full coverage rates, indicating a focus on extensive protection. Overall, the decision depends on individual priorities, with factors such as financial considerations, comprehensive protection needs, and company reputation influencing the optimal choice in the realm of car insurance for 19-year-olds.

Car Insurance Costs for 19-Year-Olds

Why is the average cost for car insurance for 19-year-olds so high? It has a lot more to do with statistics than the people behind the wheel. Car insurance rates are calculated by using data and looking at probabilities. Since rating factors change the statistical likelihood of a claim, it’s important to know why statistics work against teen drivers.

According to the CDC, 2,364 teens were killed in 2017 from car accidents. Another 300,000 were treated for injuries. The Insurance Institute for Highway Safety (IIHS) reported that in 2017, car accidents were one of the leading causes of death for 13 to 19-year-olds.Here are some other statistics that demonstrate why teen rates are high:

- 33 percent of teen deaths are caused by motor accidents

- Teens have higher crash rates than any other drivers

- One out of five teen drivers will have an accident in the first year of driving

- Six teens die of motor vehicle accident injuries daily

- The crash rate per mile is three times higher for drivers 16 to 19

- Teens are responsible for more property damage in accidents than any other age group

Car insurance policies take How much higher are car insurance rates for teens? Take a look at this table to see the difference age plays in determining rates.Car Insurance Monthly Rates by Age, Gender and Marital Status

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| $774 | $887 | $285 | $298 | $263 | $260 | $243 | $249 | |

| $500 | $678 | $191 | $225 | $184 | $185 | $166 | $168 | |

| $710 | $762 | $246 | $253 | $213 | $213 | $195 | $204 | |

| $471 | $523 | $198 | $189 | $192 | $193 | $187 | $190 | |

| $968 | $1,143 | $330 | $375 | $317 | $321 | $287 | $307 |

| $480 | $598 | $224 | $241 | $197 | $199 | $178 | $185 |

| $724 | $802 | $225 | $230 | $191 | $181 | $166 | $171 | |

| $496 | $610 | $195 | $213 | $173 | $173 | $156 | $156 | |

| $776 | $1,071 | $194 | $208 | $182 | $183 | $171 | $173 | |

| $401 | $449 | $166 | $177 | $129 | $128 | $121 | $121 |

Read more: Compare 17-Year-Old Driver Car Insurance Rates

Teen drivers pay an average of $691 a month for car insurance. Insurance premiums do end up becoming lower; the average monthly rate drops to just $233 once the driver turns 25.

Understanding How Car Insurance Rates Are Determined

The most common factors that are considered when determining car insurance rates are:

- Age

- Driving experience

- Gender

- Driving habits

- Motor vehicle record

- Accident history

- Vehicle type and safety record

- Coverage limits

- Rating territory

- Credit-based insurance score

The following video further explains the factors affecting car insurance rates.

In some states, insurers can’t raise rates for age-related reasons. You’ll have to shop for coverage to see if this applies to your state or not.Car insurance for a 19-year-old new driver will be higher than a driver that started at age 16.

Read more: Car Insurance for New Drivers

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Gender Disparities in Car Insurance

Are average car insurance rates for a 19-year-old female cheaper than the average cost of car insurance for a 19-year-old male? It might surprise you to learn that car insurance rates are affected by age and gender. Average 19-year-old car insurance rates for a teenage male are high because they are in the highest risk class. Why is this?

- Males between 15 and 20 have a death rate two times higher than females

- Males under 20 years old cause damages of $19 billion in accidents, whereas females cause damages of about $7 billion

- Natural competitiveness, testosterone, and impulsive tendencies are believed to contribute to the skewed statistics

The standard car insurance rate for a 19-year-old female driver is still high, just not quite as high as the average car insurance rates for a 19-year-old male

Read more: How old do you have to be to own a car?

Examining the Disparity in Insurance Costs Between Genders

It’s difficult to say exactly how much more a male will pay for coverage than a female. For women’s car insurance read our article called “Women’s Car Insurance Quotes“.

Over a male’s lifetime, they’ll pay around $15,000 more on car insurance rates.

For one year’s rate, male drivers will boost an existing policy’s rates an average of 98 percent and female drivers will boost rates by about 73 percent.

Anticipating Decreases in Your Insurance Rates

It’s very important to keep your record blemish-free while you’re young when you want to keep your rates reasonable. A clean driving record will be regarded favorably with most any car insurance company.

In most cases, teens with the unrestricted license can get a good driver discount after they’ve had their license for three years.

In states where the discount is available, you can expect a drop in your rates after you have three years of experience.

Some companies will only give teen drivers discounts when they have five years of experience.

The biggest drop will be when a driver has nine years of licensing history.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Steps to Secure Your Own Car Insurance Policy

There comes a time when an insurance policy will no longer cover certain age groups. You’ll want to check with your insurance provider, to make sure that if you have any teenage drivers, they’re covered up until a certain age.

Now, if you move out of your parent’s home and into your own, you won’t be able to save money by being on your parent’s car insurance any longer. You need to buy your own coverage so you can establish your own insurance history. There is no single best car insurance company for 19-year-olds. Shop around and get a car insurance quote so you can find a rate that best fits into your budget.

Considerations for Purchasing Insurance While Living With Parents

If you’re still living in your parent’s home, that doesn’t stop you from buying your own car and then applying for your own individual policy. Can a 19-year-old get car insurance on their own? Yes, but it might not be a great idea; insurance costs can be a lot for a teen to handle. Here are some of the benefits of staying on your parent’s policy:

- You can get multi-car discounts on your vehicle by adding your policy to your parents’ insurance.

- You’ll qualify for all of the loyalty discounts that your parents are already receiving.

- If your parents have other lines of insurance, you’ll receive a multi-line discount on your car’s rate.

- You may be able to be rated as a secondary operator if there are multiple experienced drivers in the home.

Staying on your parent’s policy as long as you can is beneficial. If you live with your parents, you qualify for coverage under their policy even when you own your own car. You can also qualify for their coverage because you’re still a resident relative and a dependent.

Read more: How long can you stay on your parents’ car insurance?

Options for College Students Seeking Car Insurance With Parents

If you’re going off to college, that doesn’t mean you’ll be kicked off your parent’s policy. If you’re going away without a car, you may be eligible for some full-time student insurance discounts. This can save everyone money while still guaranteeing you’ll have protection when you’re visiting home or renting or borrowing a car.

If you’re taking your car with you, you still can keep the car on the policy as long as the vehicle stays registered in the state.

By keeping your residency at your parent’s address, you’ll still be eligible for car insurance for a 19-year-old college student combined with your parents. This is good news when you’re living on a student’s budget, since there is suddenly a wide range of financial needs what with the cost of books and housing. Need to buy 19-year-old car insurance now? There are plenty of policy service options out there, waiting to be looked at.

Read more: Compare Student Driver Car Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Navigating Car Insurance for 19-Year-Old Drivers

This section presents a series of case studies that provide a practical perspective on how three different young drivers have found car insurance options that suit their unique circumstances and preferences. Each case study highlights the drivers’ experiences with various insurance providers, showcasing how these companies’ offerings align with the needs and goals of young drivers.

- Case Study 1 – Maria’s Affordability Dilemma With State Farm: Maria, a 19-year-old college student, is navigating the complexities of car insurance. With limited income, Maria explores affordable options and discovers State Farm’s competitive rates. This delves into Maria’s journey, emphasizing how State Farm’s affordability aligns with the article’s insights.

- Case Study 2 – John’s Military Savings With USAA: John, a 19-year-old serving in the military, seeks car insurance that caters to his unique needs. This shows how John benefits from USAA’s military savings, showcasing the company’s commitment to serving the armed forces, as highlighted in the article.

- Case Study 3 – Emily’s Online Convenience With Progressive: Emily, a tech-savvy 19-year-old, values the convenience of managing her car insurance online. This illustrates how Progressive’s online services align with Emily’s preferences, emphasizing the importance of digital solutions for young drivers, as mentioned in our Progressive car insurance review.

By exploring affordability, unique benefits for specific groups, and the convenience of online services, these stories demonstrate how different insurance providers can cater to young adults in a variety of ways.

Start comparison shopping today for cheap insurance quotes for 19-year-olds by using our free online quote tool. Enter your ZIP code to compare the cheapest car insurance for 19-year-olds.

Frequently Asked Questions

Why is car insurance for 19-year-old drivers more expensive?

Car insurance rates for 19-year-olds tend to be higher due to the perceived risk associated with this age group. Statistics show that teens, including 19-year-olds, are more likely to be involved in accidents, making them high-risk drivers.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What factors influence car insurance rates for 19-year-olds?

Several factors impact insurance rates for 19-year-olds, including age, driving record, coverage level, credit score, and mileage. Understanding these factors can help young drivers make informed choices when seeking affordable coverage.

Which companies offer competitive rates for 19-year-old drivers?

State Farm, USAA, and Progressive emerge as top choices for 19-year-old drivers. These companies provide competitive rates, diverse coverage options, and unique discounts tailored to the needs of young drivers.

If you got a DUI record read our article called “How long will a DUI affect my car insurance?“.

Can 19-year-olds get affordable car insurance?

Despite the challenges, affordable car insurance is attainable for 19-year-olds. Comparison shopping is crucial, and companies like State Farm, USAA, and Progressive offer affordability options through various discounts and coverage choices.

Are there specific discounts available for 19-year-old drivers?

Yes, many insurers offer discounts tailored to young drivers. These can include good student discounts, safe driver discounts, and multi-policy discounts. Be sure to ask your insurance provider about available discounts when seeking a policy.

How can a 19-year-old driver save on car insurance?

19-year-old drivers can save on car insurance by taking advantage of discounts offered by insurers. For instance, maintaining a clean driving record, bundling policies, and exploring low-mileage discounts can contribute to cost savings. Additionally, opting for companies known for their competitive rates, such as State Farm, USAA, and Progressive, can be a strategic choice.

Read more: Guide to the Cheapest Car Insurance for New Drivers

How does the type of car a 19-year-old drives affect insurance rates?

The type of car can significantly impact insurance rates. Generally, newer and more expensive vehicles tend to have higher premiums due to their higher replacement costs. Conversely, older and less expensive vehicles often result in lower rates.

What coverage levels should a 19-year-old consider?

A 19-year-old should consider a mix of liability, collision, and comprehensive coverage based on their needs and budget. Liability coverage is required by law, while collision and comprehensive provide additional protection for their vehicle.

Can 19-year-olds be added to their parents’ insurance policy?

Yes, many 19-year-olds can remain on their parents’ insurance policy, which is often more cost-effective. However, this depends on the insurer’s policies and the specific situation. It’s important to verify with the insurer whether staying on a parent’s policy is an option.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How can 19-year-olds improve their chances of securing lower rates in the future?

Maintaining a clean driving record, staying claims-free, and completing defensive driving courses can help 19-year-olds improve their driving profile. Over time, as they gain more experience, their rates may decrease as they demonstrate responsible driving behavior.

Here’s Geico’s Defensive Driving Course: All the Details, so you can secure lower rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.