Best Buick Regal Sportback Car Insurance in 2026 (Top 10 Companies Ranked)

State Farm, Progressive, and Liberty Mutual are the top picks for the best Buick Regal Sportback car insurance, starting at just $83 per month. These providers excel in coverage options, affordability, and customer support, making them the premier choices for insuring your Buick Regal Sportback effectively.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

Company Facts

Full Coverage for Buick Regal Sportback

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Buick Regal Sportback

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Buick Regal Sportback

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Buick Regal Sportback car insurance are State Farm, Progressive, and Liberty Mutual, known for their exceptional coverage and customer service.

These companies stand out in the competitive insurance market by offering tailored policies that meet the unique needs of Buick Regal Sportback owners. Learn more in our “What is the best car insurance?”

Our Top 10 Company Picks: Best Buick Regal Sportback Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 20% B Reliable Rates State Farm

#2 12% A+ Competitive Pricing Progressive

#3 30% A Diverse Discounts Liberty Mutual

#4 25% A+ Comprehensive Coverage Allstate

#5 20% A Personalized Service American Family

#6 10% A+ Customer Satisfaction Erie

#7 8% A++ Safe Driver Travelers

#8 20% A Reward Programs Farmers

#9 25% A+ Exceptional Service Amica

#10 20% A+ Policy Bundles Nationwide

With comprehensive options that include collision, comprehensive, and liability coverage, they ensure drivers receive the protection they require at competitive terms. Additionally, their proven customer support and claims handling offer peace of mind to car owners seeking reliable and responsive insurance services.

To compare Buick Regal Sportback auto insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- State Farm leads as the top choice for Buick Regal Sportback insurance

- Tailored coverage options cater specifically to Buick Regal Sportback owners

- Features like collision and comprehensive benefits enhance protection

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers substantial discounts for bundling Buick Regal Sportback insurance with other policies.

- High Low-Mileage Discount: Drivers of the Buick Regal Sportback can benefit from significant low-mileage discounts. Unlock details in our State Farm car insurance review.

- Wide Coverage: Provides a variety of coverage options specifically tailored to meet the needs of Buick Regal Sportback owners.

Cons

- Limited Multi-Policy Discount: Compared to competitors, State Farm’s multi-policy discount is not as competitive for Buick Regal Sportback insurance.

- Premium Costs: Even with discounts, State Farm’s premiums for Buick Regal Sportback insurance may still be relatively high.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Pricing

Pros

- Customizable Policies: Progressive allows Buick Regal Sportback owners to customize their policies extensively.

- Loyalty Rewards: Offers loyalty rewards that benefit long-term Buick Regal Sportback insurance holders. Delve into our evaluation of Progressive car insurance review.

- A+ A.M. Best Rating: Indicates strong financial stability, reassuring Buick Regal Sportback owners of claim-paying ability.

Cons

- Higher Rates for High-Risk Drivers: Buick Regal Sportback owners with poor driving records may face significantly higher rates.

- Customer Service Variability: Some customers may experience inconsistencies in service quality.

#3 – Liberty Mutual: Best for Diverse Discounts

Pros

- High Multi-Vehicle Discount: Offers a 30% discount for Buick Regal Sportback owners insuring multiple vehicles. Read up on the Liberty Mutual car insurance review for more information.

- Accident Forgiveness: Includes accident forgiveness options, which can be beneficial for Buick Regal Sportback insurance.

- Tailored Add-Ons: Provides several add-on coverages that are ideal for the unique aspects of insuring a Buick Regal Sportback.

Cons

- Variable Pricing: Premiums for Buick Regal Sportback insurance can vary widely depending on location and driver profile.

- Claim Process Issues: Some users report a less streamlined claim process, which could affect satisfaction.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Wide-Ranging Coverage Options: Allstate offers extensive coverage choices that are well-suited for Buick Regal Sportback owners.

- Generous Multi-Vehicle Discount: Provides a 25% discount for customers who insure more than one vehicle, including the Buick Regal Sportback.

- Safe Driving Rewards: Rewards Buick Regal Sportback drivers with discounts for safe driving habits. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Premiums: Allstate’s premiums can be on the higher side, especially without qualifying discounts for the Buick Regal Sportback.

- Customer Feedback: Some customers have reported dissatisfaction with claim response times.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Personalized Service

Pros

- Personalized Agent Interaction: Offers dedicated agents to help tailor Buick Regal Sportback insurance policies to individual needs.

- Discounts for Safety Features: Provides discounts for Buick Regal Sportbacks equipped with advanced safety technologies. See more details on our American Family car insurance review.

- Flexibility in Coverage: American Family offers flexible coverage options that can be adjusted as the needs of Buick Regal Sportback owners change.

Cons

- Availability: American Family’s services are not available in all states, which can be a limitation for some Buick Regal Sportback owners.

- Rate Fluctuations: Customers might experience fluctuations in premium rates at renewal times.

#6 – Erie: Best for Customer Satisfaction

Pros

- Rate Lock Feature: Erie offers a rate lock feature that can help Buick Regal Sportback owners stabilize their insurance costs over time. Learn more in our Erie car insurance review.

- Highly Rated Customer Service: Known for exceptional customer service, which is a significant benefit for Buick Regal Sportback insurance holders.

- Annual Policy Reviews: Ensures that Buick Regal Sportback insurance policies are always up to date with the owners’ current needs.

Cons

- Limited Geographic Coverage: Erie’s coverage is not available in all states, which could be a drawback for some Buick Regal Sportback owners.

- No Online Claims: Claims must be filed through an agent, which might not be convenient for everyone.

#7 – Travelers: Best for Safe Driver

Pros

- Safe Driver Discounts: Travelers offers significant discounts for Buick Regal Sportback drivers with a clean driving record.

- High A.M. Best Rating: With an A++ rating, Travelers assures financial stability and reliability in handling claims. See more details on our Travelers car insurance review.

- Customizable Coverage Options: Allows Buick Regal Sportback owners to tailor their coverage to fit their specific needs.

Cons

- Premium Rate Variability: Premiums can vary widely depending on the driver’s history and the specific details of the Buick Regal Sportback.

- Complex Policy Options: Some customers find the range of options confusing and the policies complex to understand.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Reward Programs

Pros

- Rewarding Loyalty Programs: Farmers offers unique reward programs that benefit loyal Buick Regal Sportback insurance holders. Learn more in our Farmers car insurance review.

- Customized Insurance Packages: Allows for highly customized packages that cater specifically to the needs of Buick Regal Sportback owners.

- Wide Range of Discounts: Offers a variety of discounts, including for new cars and electronic payments, applicable to Buick Regal Sportback policies.

Cons

- Higher Cost for Additional Features: Additional features and coverages can significantly increase the insurance cost for a Buick Regal Sportback.

- Customer Service Variability: While generally good, some customers have reported inconsistent experiences with customer service.

#9 – Amica: Best for Exceptional Service

Pros

- Top-Tier Customer Service: Amica is renowned for its exceptional customer service, crucial for Buick Regal Sportback insurance.

- High Customer Satisfaction: High levels of customer satisfaction indicate reliable and efficient handling of claims and inquiries. Unlock details in our guide titled, “How do you get an Amica mutual car insurance quote online?“

- Extensive Coverage Options: Offers a broad range of coverage options, allowing Buick Regal Sportback owners to find exactly what they need.

Cons

- Pricing Above Average: While offering exceptional service, Amica’s pricing can be higher than average for Buick Regal Sportback insurance.

- Limited Availability: Amica’s full range of services and discounts may not be available in all regions.

#10 – Nationwide: Best for Policy Bundles

Pros

- Competitive Multi-Policy Discounts: Nationwide offers competitive discounts for customers who bundle their Buick Regal Sportback insurance with other policies.

- Flexible Payment Options: Offers a variety of payment options to suit the financial preferences of Buick Regal Sportback owners.

- Accident Forgiveness: Includes accident forgiveness, which can prevent premium increases after a first at-fault accident. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Average Claim Response Times: Some customers have experienced average claim response times, which can be a drawback during stressful periods.

- Policy Cost Variations: Nationwide’s policy costs can vary significantly, affecting affordability for some Buick Regal Sportback owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buick Regal Sportback Insurance Cost Breakdown

When choosing car insurance for a Buick Regal Sportback, it’s essential to consider both minimum and full coverage options. This table provides a snapshot of what you might expect to pay monthly with various providers. Whether you opt for basic legality or comprehensive protection, these figures help you budget accordingly.

Buick Regal Sportback Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $100 $170

American Family $88 $145

Amica $90 $153

Erie $83 $140

Farmers $97 $165

Liberty Mutual $95 $160

Nationwide $89 $148

Progressive $91 $155

State Farm $85 $150

Travelers $92 $157

The monthly rates for Buick Regal Sportback car insurance vary significantly between providers and coverage levels. For minimum coverage, Erie offers the lowest rate at $83, while Allstate’s rate is the highest at $100.

On the other hand, full coverage rates are also competitive, with Erie again providing the most affordable option at $140, and Allstate being the most expensive at $170.

American Family, Amica, and Nationwide offer middle-ground options, balancing affordability with comprehensive benefits. This range allows Buick Regal Sportback owners to choose a plan that fits their budget and coverage needs.

Learn more: Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements

Are Vehicles Like the Buick Regal Sportback Expensive to Insure

Take a look at how insurance rates for similar models to the Buick Regal Sportback look. These insurance rates for other sedans like the Hyundai G90, Porsche Taycan, and Chrysler New Yorker give you a good idea of what to expect.

The insurance costs for sedans like the Buick Regal Sportback can vary widely, as demonstrated by the comparison with models like the Hyundai G90 and Porsche Taycan.

This data provides a clear perspective on what potential owners can expect to pay for comprehensive, collision, and liability coverage.

The comparison of insurance rates across different models shows significant variation, with costs ranging from moderately affordable to quite premium. Understanding these figures can help prospective buyers budget appropriately for their automotive insurance needs.

Insurance Rates for Vehicles Similar to the Buick Regal Sportback

To better understand how the insurance costs for the Buick Regal Sportback stack up, we’ve compared it with rates from a variety of other vehicles, ranging from the economical Honda Insight to the luxurious Jaguar XF.

Buick Regal Sportback Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Level

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi A3 | $24 | $47 | $33 | $117 |

| Honda Accord | $23 | $42 | $31 | $109 |

| Honda Insight | $18 | $38 | $38 | $107 |

| Jaguar XF | $34 | $67 | $33 | $147 |

| Lincoln Town Car | $20 | $39 | $38 | $111 |

| Mercedes-Benz C300 | $34 | $60 | $31 | $138 |

| Mitsubishi Lancer Evolution | $27 | $56 | $37 | $133 |

| Nissan Altima | $27 | $50 | $31 | $121 |

This comparison underscores the spectrum of insurance costs for vehicles similar to the Buick Regal Sportback, illustrating a range from modestly priced models to high-end luxury cars. The data provides valuable insights for prospective buyers into the potential insurance expenses associated with different vehicle choices. Learn more in our “Is it cheaper to purchase car insurance online?”

What Impacts the Cost of Buick Regal Sportback Insurance

The Buick Regal Sportback trim and model you choose can impact the total price you will pay for Buick Regal Sportback insurance coverage. You can also expect your Buick Regal Sportback rates to be affected by where you live, your driving history, and in most states your age and gender. Access comprehensive insights into our guide titled, “What affects a car insurance quote?”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Buick Regal Sportback Insurance

Reducing the cost of your Buick Regal Sportback insurance is achievable with the right strategies and knowledge. Here are some effective tips to help you lower your premiums without sacrificing coverage.

- Ask for a Buick Regal Sportback discount if you have a college degree

- Ask about Buick Regal Sportback low mileage discounts

- Ask about a student away-from-home discount

- Compare Buick Regal Sportback quotes for free online

- Remove unnecessary insurance once your Buick Regal Sportback is paid off

By leveraging discounts for educational achievements, low mileage, and student status, as well as comparing quotes and adjusting coverage, you can significantly reduce the cost of insuring your Buick Regal Sportback. Take advantage of these opportunities to ensure your insurance expenses are as economical as possible.

Learn more by reading our guide: 16 Ways to Lower the Cost of Your Insurance

Top Buick Regal Sportback Insurance Companies

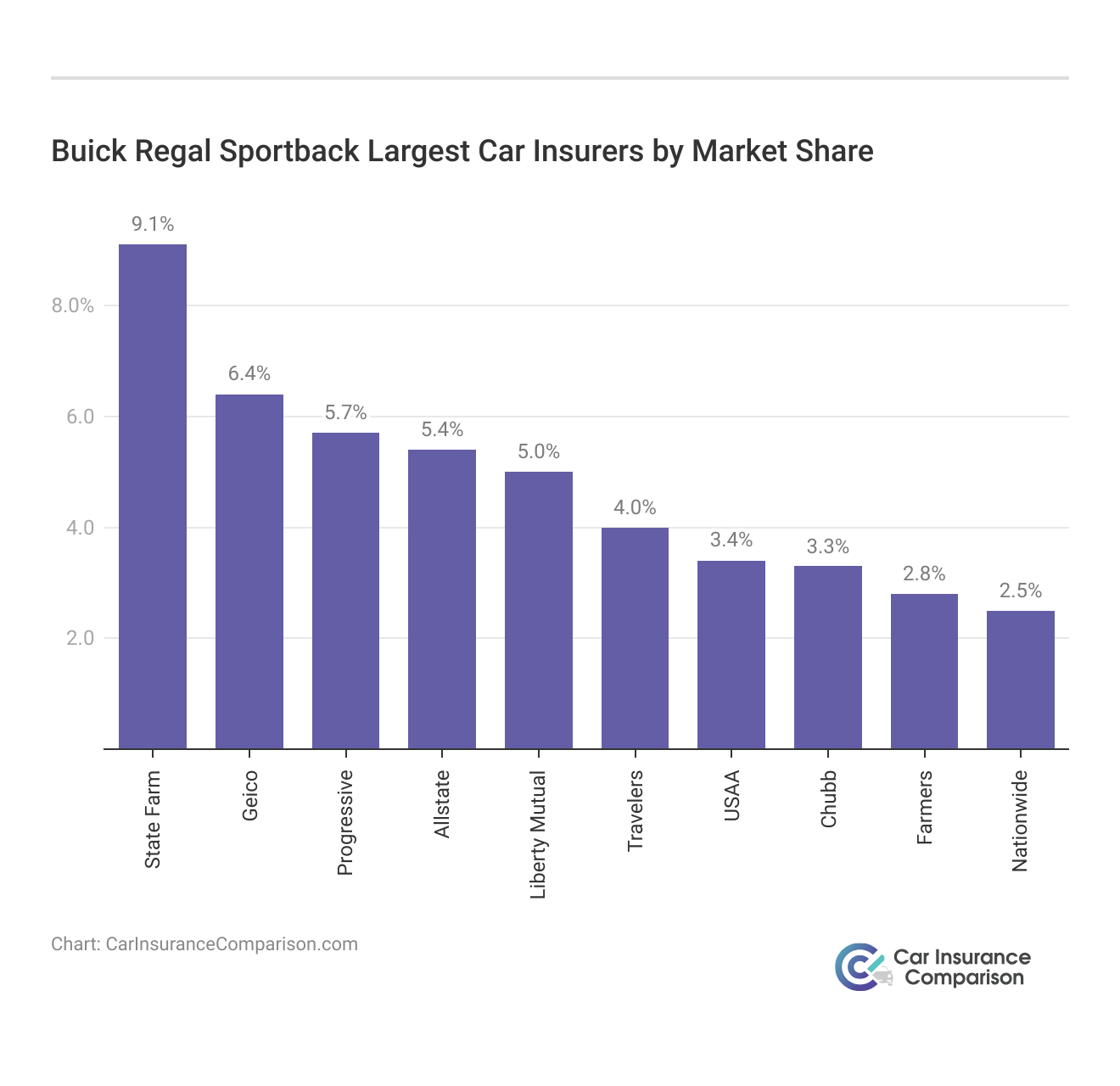

What is the best auto insurance company for Buick Regal Sportback insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Buick Regal Sportback auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features found on the Buick Regal Sportback.

Identifying the best insurance provider for the Buick Regal Sportback means looking at companies that not only offer competitive rates but also value added through discounts for safety features.

Choosing State Farm means securing top-tier insurance with a focus on affordability and customer satisfaction for your Buick Regal Sportback.

Brad Larson Licensed Insurance Agent

The list above highlights the largest auto insurers by market share, helping you make an informed decision based on their prominence and the benefits they offer.

Largest Auto Insurers by Market Share

Understanding the landscape of the largest auto insurers by market share provides insight into the industry’s major players. Here’s a detailed look at the top insurers for the Buick Regal Sportback.

Buick Regal Sportback Largest Car Insurers by Market Share

| Rank | Company | Volume | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

This overview of the largest auto insurers by market share reveals the significant presence of companies like State Farm, Geico, and Progressive in the industry. It provides valuable insights for consumers looking to choose an insurer with a strong market position and reliability. To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

Using our free online tool, you can compare quotes for Buick Regal Sportback auto insurance rates from some of the best auto insurance companies.

Frequently Asked Questions

How can I compare insurance rates for a Buick Regal Sportback?

To compare insurance rates for a Buick Regal Sportback, you have a few options. You can contact individual insurance companies and request quotes directly. Another option is to use online insurance comparison websites that allow you to compare rates from multiple insurers at once. These websites typically require you to provide some personal information and details about your vehicle to generate accurate quotes.

For additional details, explore our comprehensive resource titled, “How do you get competitive quotes for car insurance?“

What factors can affect the insurance rates for a Buick Regal Sportback?

Several factors can influence the insurance rates for a Buick Regal Sportback. These factors may include your age, location, driving history, credit score, the coverage limits you choose, the deductible amount, and the specific model and year of your Buick Regal Sportback. Insurance companies also consider the cost of repairs and replacement parts, the vehicle’s safety features, and its overall theft and accident rates.

Are there any discounts available for insuring a Buick Regal Sportback?

Yes, insurance companies often offer various discounts that can help lower your insurance premiums for a Buick Regal Sportback.

Some common discounts may include multi-policy discounts (if you have multiple insurance policies with the same company), safe driver discounts, good student discounts (for students with good grades), anti-theft device discounts, and discounts for vehicles equipped with safety features like anti-lock brakes and airbags. It’s best to check with individual insurance providers to see what discounts they offer.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

How much does insurance typically cost for a Buick Regal Sportback?

The cost of insurance for a Buick Regal Sportback can vary depending on several factors, including the ones mentioned earlier. On average, you can expect to pay between $100 and $150 per month for full coverage insurance. However, this is just an estimate, and your actual premiums may be higher or lower based on your specific circumstances and the insurance provider you choose.

Can I get a quote for Buick Regal Sportback car insurance online?

Yes, many insurance companies provide online platforms where you can obtain a quote for Buick Regal Sportback car insurance.

These platforms usually require you to input relevant information such as your location, driving history, and vehicle details to generate an accurate quote. Additionally, as mentioned earlier, there are also online insurance comparison websites that allow you to receive quotes from multiple insurers simultaneously.

To find out more, explore our guide titled, “Finding Free Car Insurance Quotes Online.”

Are Buick Regal Sportbacks expensive to insure?

Insurance costs for the Buick Regal Sportback are generally moderate, aligning with average rates for sedans, influenced by factors such as safety features and repair costs.

Is a Buick Regal Sportback considered a luxury car for insurance purposes?

For insurance purposes, the Buick Regal Sportback is categorized as a mid-luxury vehicle, which may lead to slightly higher premiums due to costlier parts and repair services.

Who offers the best insurance for a classic Buick Regal Sportback?

For classic Buick Regal Sportbacks, insurers like Hagerty and Grundy are best due to their specialized coverage that caters specifically to the unique needs of classic and collectible cars.

Which insurance provider is best for older Buick Regal Sportbacks?

Insurance providers such as Hagerty and State Farm are recommended for older Buick Regal Sportbacks, offering policies that account for the car’s age and potential historic value.

To learn more, explore our comprehensive resource on “Cheap Car Insurance for Older Vehicles.”

What is the best insurance company for a Buick Regal Sportback?

The best insurance provider for a Buick Regal Sportback depends on individual needs, but State Farm, Geico, and Progressive are often preferred for their comprehensive coverage options, competitive rates, and reliable customer service.

Is there a recall on Buick Regal Sportbacks that affects insurance rates?

What year was the fastest Buick Regal Sportback and how does it impact insurance costs?

How does the performance of the Buick Regal Sportback affect its insurance rates?

When was the Buick Regal Sportback last produced and what does that mean for insurance availability?

Is the fuel efficiency of the Buick Regal Sportback beneficial for insurance rates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.