Best Car Insurance for 50-Year-Olds in 2025 (Top 10 Companies)

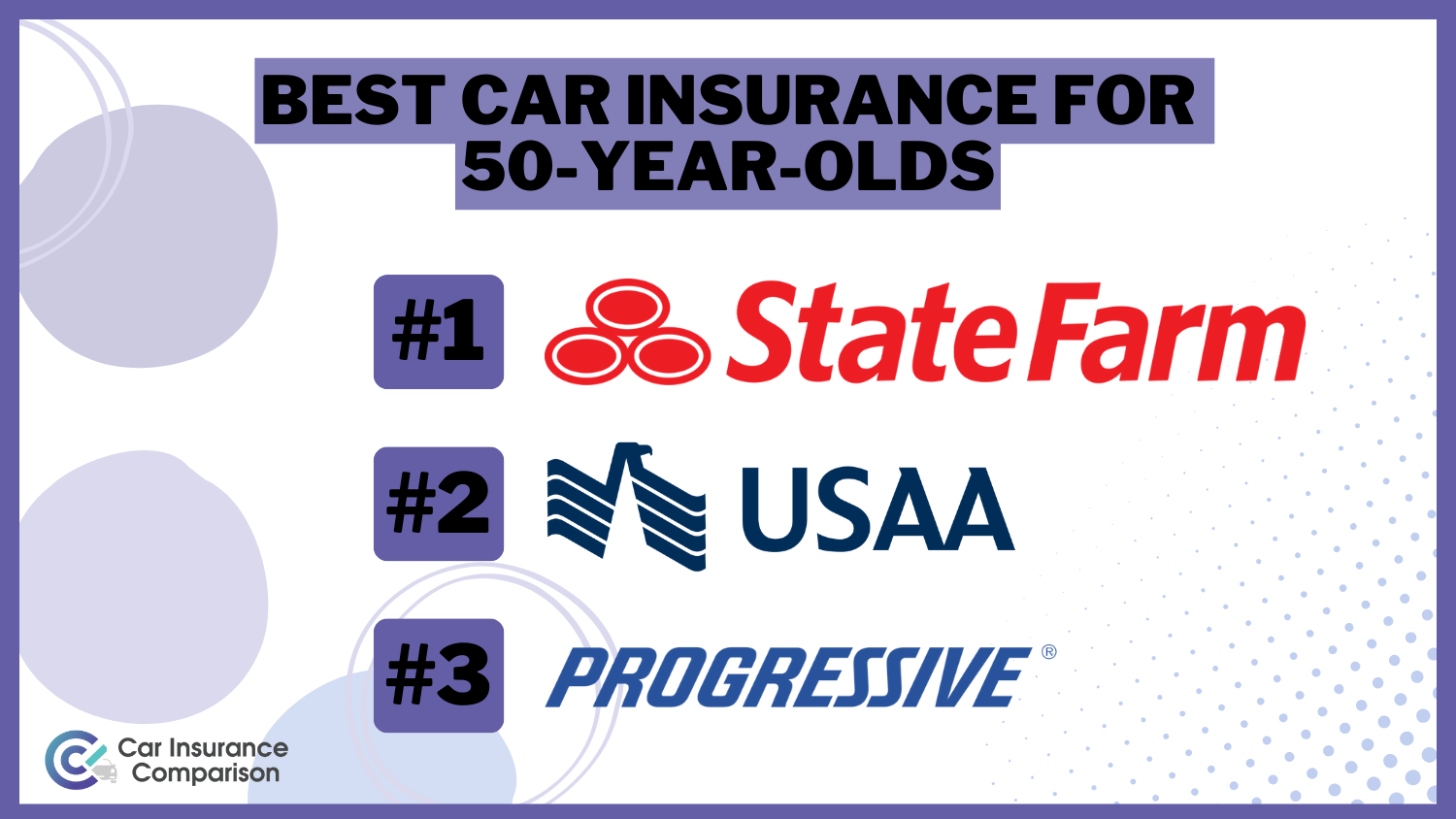

Get the best car insurance for 50-year-olds with State Farm, USAA, and Progressive. State Farm stands out with many discounts. Other providers offering up to 30% discounts. Evaluate tailored options for comprehensive coverage in this informative guide.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for 50-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for 50-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for 50-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsDriver age is something a lot of insurance companies consider when pricing car insurance policies. So does car insurance go up at 65? Some people could spend hours researching answers to this question, but actually, car insurance for people over 50-years-old can be less expensive than policies for younger drivers.

Our Top 10 Company Picks: Best Car Insurance for 50-Year-Olds

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 10% | Many Discounts | State Farm | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 10% | 30% | Online Convenience | Progressive | |

| #4 | 25% | 30% | Add-on Coverages | Allstate | |

| #5 | 20% | 30% | Usage Discount | Nationwide |

| #6 | 25% | 10% | Local Agents | Farmers | |

| #7 | 25% | 10% | Customizable Polices | Liberty Mutual |

| #8 | 20% | 20% | Student Savings | American Family | |

| #9 | 13% | 10% | Accident Forgiveness | Travelers | |

| #10 | 15% | 10% | Local Agents | AAA |

They can also sign up for any sort of senior driving program, which would also give them a chance to lower their rates. Enter your ZIP code above to receive car insurance rates from multiple companies today.

- State Farm, USAA, and Progressive are top companies for 50-year-olds

- Mature drivers often qualify for lower rates

- Consider factors like credit score, mileage, and coverage level for potential savings

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: As mentioned in our State Farm car insurance review they stand out for its diverse range of discounts, providing potential savings for various customer profiles.

- Financial Stability: With an A+ rating from A.M. Best, State Farm demonstrates financial strength and reliability.

- Low Complaint Level: State Farm’s low complaint level indicates high customer satisfaction and efficient claims processing.

Cons

- Average Monthly Rate: While competitive, the average monthly rate for good drivers may be higher compared to some other companies.

- Limited Online Presence: State Farm’s online tools and services may not be as advanced or user-friendly as those of some competitors.

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA caters exclusively to military personnel, offering substantial discounts and specialized coverage.

- Exceptionally Low Rates: USAA provides remarkably low average monthly rates, making it an affordable option for eligible individuals.

- A+ Financial Rating: USAA’s A+ rating from A.M. Best ensures financial strength and reliability. Learn more in our USAA car insurance review.

Cons

- Limited Eligibility: USAA membership is restricted to military members, veterans, and their families, excluding a significant portion of the population.

- Few Physical Locations: USAA primarily operates online and through phone services, limiting access to in-person support.

#3 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive excels in providing an easy and convenient online experience, from quotes to claims processing.

- Competitive Rates: Progressive offers competitive rates for good drivers, coupled with discounts for online users and low-mileage drivers.

- A Rating From A.M. Best: As mentioned in our Progressive car insurance review, they hold a solid A rating, ensuring financial stability and reliability.

Cons

- Customer Service Varied: While many customers are satisfied, some reviews indicate mixed experiences with Progressive’s customer service.

- May not be Ideal for High-Risk Drivers: Progressive’s focus on safe driving discounts may mean higher rates for drivers with less-than-perfect records.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-On Coverage

Pros

- Comprehensive add-ons: As outlined in our Allstate car insurance review, they stand out for its extensive list of add-on coverages.

- Maximum discounts: Allstate offers some of the highest multi-policy and low-mileage discounts in the industry.

- Strong financial rating: With an A+ rating from A.M. Best, Allstate demonstrates financial strength and stability.

Cons

- Higher average rates: Allstate’s average rates for good drivers may be higher compared to some competitors.

- Mixed customer reviews: While many customers are satisfied, some reviews suggest inconsistencies in claims processing and customer service.

#5 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Discounts: Nationwide offers discounts based on usage patterns, appealing to drivers with specific mileage habits.

- Broad Coverage Options: Nationwide provides a range of coverage options. (Read more: Nationwide Car Insurance Discounts)

- Strong Financial Rating: With an A+ rating from A.M. Best, Nationwide demonstrates financial stability.

Cons

- Average Rates: While competitive, Nationwide’s average rates may not be the lowest available.

- Limited Discounts: Some competitors offer a wider array of discounts, potentially making Nationwide less cost-effective for certain drivers.

#6 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers Insurance provides a local agent network, ensuring personalized service and easy access to support.

- Maximum Multi-Policy Discount: Farmers offers one of the highest multi-policy discounts in the industry.

- Strong Financial Rating: As mentioned in our Farmers car insurance review, they hold a solid financial rating, indicating stability and reliability.

Cons

- Limited Online Presence: Farmers’ online tools and services may not be as advanced or user-friendly as those of some competitors.

- Mixed Customer Reviews: While many customers are satisfied, some reviews suggest variations in customer service experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual stands out with customizable policies, allowing customers to tailor coverage to their specific needs.

- Maximum Multi-Policy Discount: Liberty Mutual offers one of the highest multi-policy discounts in the industry.

- Strong Financial Rating: With an A rating from A.M. Best, Liberty Mutual demonstrates financial stability.

Cons

- Mixed Customer Reviews: While many customers are satisfied, some reviews suggest variations in customer service experiences.

- Average Rates: Liberty Mutual’s average rates for good drivers may be higher compared to some competitors. Learn more about their rates in our Liberty Mutual car insurance review.

#8 – American Family: Best for Student Savings

Pros

- Student Savings: American Family offers significant discounts for students, making it an attractive choice for families.

- Maximum Multi-Policy Discount: American Family car insurance provides a substantial multi-policy discount for customers bundling their insurance.

- Strong Financial Rating: With an A rating from A.M. Best, American Family demonstrates financial strength and reliability.

Cons

- Average Rates: American Family’s average rates may be higher compared to some competitors.

- Limited Online Presence: The online tools and services provided by American Family may not be as advanced or user-friendly as those of some competitors.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers Insurance offers accident forgiveness options, providing peace of mind for customers concerned about potential accidents.

- Maximum Multi-Policy Discount: Travelers provides a substantial multi-policy discount for customers bundling their insurance.

- Strong Financial Rating: With an A++ rating from A.M. Best, Travelers demonstrates exceptional financial stability. Learn more about their reviews in our Travelers car insurance review.

Cons

- Average Rates: Travelers’ average rates for good drivers may be higher compared to some competitors.

- Limited Local Agents: Travelers may have fewer local agents, limiting access to in-person support for some customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for Local Agents

Pros

- Local Agents: AAA operates with a network of local agents, providing personalized service and easy access to support.

- Maximum Multi-Policy Discount: AAA offers a substantial multi-policy discount for customers bundling their insurance.

- Additional Member Benefits: AAA provides additional benefits beyond insurance, such as roadside assistance and travel discounts.

Cons

- Membership Fees: AAA requires membership for access to insurance services, which includes associated membership fees. Find out their fees in our AAA car insurance review.

- Mixed Customer Reviews: While many customers are satisfied, some reviews suggest variations in customer service experiences.

Compare Car Insurance Rates for 50-Year-Old Drivers With the Best Companies

When it comes to car insurance for 50-year-old drivers, selecting the right insurance company is crucial. The choice often depends on various factors, including affordability, customer service, and the extent of coverage. Here, we compare the best insurance companies, considering both minimum and full coverage rates.

Car Insurance for 50-Year-Olds: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $30 | $81 |

| Allstate | $58 | $152 |

| American Family | $41 | $111 |

| Farmers | $50 | $131 |

| Liberty Mutual | $64 | $165 |

| Nationwide | $41 | $109 |

| Progressive | $37 | $100 |

| State Farm | $31 | $82 |

| Travelers | $35 | $94 |

| USAA | $21 | $56 |

State Farm stands out with widespread availability and personalized service, offering competitive rates of $31 for minimum coverage and $82 for full coverage. Following closely is USAA, exclusively serving military members, with rates at $21 for minimum coverage and $56 for full coverage.

State Farm stands out as the top choice for 50-year-old drivers, offering comprehensive coverage, tailored options, and competitive rates starting at $31 for minimum coverage and $82 for full coverage.

Brad Larson Licensed Insurance Agent

Progressive, known for innovation, maintains its position with rates of $37 for minimum coverage and $100 for full coverage. The decision among these insurers depends on individual priorities, with State Farm, USAA, and Progressive catering to different preferences, whether it be comprehensive coverage, affordability, or innovative features.

Low Premium Rates Available for Seniors

Car insurance buyers who are mature adults and have safe driving practices can qualify for much lower rates than younger drivers who are interested in buying coverage. (For more information read our “Best Senior Citizen Car Insurance Discounts“.)

In many cases, they have a number of years of experience behind the wheel to draw on. An car insurance provider is going to look at not just how long someone has been driving, but also how good someone is behind the wheel.

If someone over the age of 50 has never been given a traffic ticket, or had any sort of traffic violation, they’re going to be regarded as a safe investment, and rewarded in kind. Versus someone over the age of 50 who has violated numerous traffic laws, who may end up seeing an increase in what they pay.

However, since people in this age group are less likely to make claims against their car insurance policies, they are considered low-risk for car insurance purposes.

The fact they have been driving for some time, have developed safe driving practices at this point in their life, and are much less likely to take risks while doing so means that a number of mature drivers can qualify for preferred pricing on their monthly car insurance bill.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Senior Discounts: What You Need to Know

Do seniors get a discount on car insurance? There are a number of discounts available to senior drivers. Customers who have never made a claim against their car insurance policy should be able to get a discount on their coverage.

Ask if you can get a better price on the cost of your coverage by paying your premium annually. You can also ask if taking driving tests will help you save money too.

Paying for your coverage monthly may be more convenient, but it also means higher administrative costs for the insurance company.

These costs are passed along to you, the customer, in fees charged for paying for your coverage monthly.

If you can’t pay for your policy on a 12-month basis, ask if you can get a price break by paying for your coverage in six-month increments instead.

Couples can save money on the cost of their car insurance coverage by deciding to buy a single policy that covers all the vehicles in their household.

By combining coverage for multiple vehicles on a single policy, customers can take advantage of a discount offered by most car insurance providers.

If you ask for a quote for more than one vehicle on the same policy and you are not offered a price break, either ask whether this discount is available or move on to another company that will give it to you.

Buying your car insurance coverage from the same company that holds your home insurance policy is a savvy move.

Not only will you get a discount on your car insurance, but the company should also give you a price break on your house insurance as well. When you are looking for coverage, be sure to ask whether the companies you are considering offer multi-policy discounts.

So yes, a mature driver, or someone who falls into the senior category by being over a certain age, can find discounts available to them.

Read more: Best Senior Citizen Car Insurance Discounts

Why Seniors Should Shop Around for the Best Rates

What is the best car insurance for seniors? Who has the cheapest car insurance for seniors? There are a lot of questions that exist, and so the key to getting the best prices on car insurance coverage is to shop around.

Rates do vary, depending on the provider, for the same type and level of coverage. It all depends on what they look at – driving history and driver age are both common factors but may not render the same results. Spending some time online getting car insurance quotes can pay off at significantly lower rates for your coverage.

If you are retired or semi-retired, let your car insurance provider know.

It can help to save money on your car insurance premiums. A person who is spending less time behind the wheel because they are not commuting back and forth on weekdays can qualify for a low annual mileage discount on the cost of his or her car insurance coverage. (For more information, read our “Compare Low-Mileage Car Insurance: Rates, Discounts, & Requirements“).

It’s a good idea to review your coverage at regular intervals.

This is true when looking at car insurance for senior customers as well as protecting those in younger age groups. As your needs change, so should your coverage.

An experienced driver can see lower rates, but it comes from knowing what to look for. If your current company isn’t offering you any sort of discounts, look at the customer reviews of other providers and see if you could save money with them instead. Make a point of going over your insurance policy at least once a year and be ready to make adjustments as necessary to make sure you have the level of protection you need.

Enter your ZIP code below to receive car insurance quotes from multiple companies today!

Case Studies: Tailoring Insurance for 50-Year-Old Drivers With the Industry Leaders

Drivers who are 50 years old have unique insurance needs, which are addressed by industry leaders like State Farm, USAA, and Progressive. These providers offer tailored solutions, from customizable policies to military-focused discounts and innovative online tools. Let’s explore how they cater to the distinct circumstances of mature drivers.

- Case Study 1 – A Comprehensive Approach With State Farm: Mary, a 50-year-old professional with a clean driving record, values comprehensive coverage that caters to her diverse needs. She has a teenager about to start driving, and she’s concerned about finding affordable coverage for both herself and her new teenage driver. State Farm, with its extensive range of discounts and customizable policies, stands out as an option for Mary to ensure she gets the coverage tailored to her family’s unique situation.

- Case Study 2 – Exceptional Service With USAA: John, a 50-year-old military veteran, seeks insurance that understands and appreciates his military background. With USAA’s exclusive focus on military personnel, he benefits from exceptional service, military discounts, and specialized coverage options. This emphasizes how USAA caters to the unique needs of military members, providing John with peace of mind and a cost-effective solution.

- Case Study 3 – Embracing Online Convenience With Progressive: Emily, a tech-savvy 50-year-old professional, values convenience and efficiency in her insurance experience. Progressive’s innovative online tools and competitive rates appeal to Emily’s preferences. We explore how Progressive’s emphasis on online convenience, coupled with discounts for safe driving and low mileage, aligns with Emily’s lifestyle, offering her a seamless and cost-effective insurance solution.

The case studies demonstrate how State Farm, USAA, and Progressive provide tailored coverage for 50-year-old drivers. Through personalized services and specialized options, these providers ensure peace of mind and cost-effective solutions that align with the unique preferences and lifestyles of mature drivers.

Read more: Does driving less affect car insurance rates?

Frequently Asked Questions

Do 50-year-old drivers qualify for lower car insurance rates?

Yes, mature drivers with safe driving practices often qualify for lower car insurance rates compared to younger drivers. Factors such as clean driving records and years of driving experience contribute to being considered a low-risk investment by insurance providers.

Read more: Defensive Driver Car Insurance Discounts

Are there specific discounts available for senior drivers aged 50 and above?

Yes, senior drivers, including those over 50, may be eligible for various discounts. Maintaining a clean claims history, paying premiums annually, and completing driving tests can often lead to discounts. Additionally, senior couples may save by combining multiple vehicles on a single policy.

Is it advisable for seniors to shop around for the best car insurance rates?

Absolutely. Rates for car insurance coverage vary among providers, even for the same type and level of coverage. Seniors, including those over 50, can benefit from shopping around to find the best prices tailored to their driving history and needs.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What should seniors consider when choosing car insurance coverage?

Seniors, especially 50-year-old drivers, should regularly review their coverage to align it with changing needs. It’s essential to explore available discounts, inquire about multi-policy discounts by combining home and car insurance, and consider providers offering personalized coverage options catering to individual preferences.

How can 50-year-old drivers maximize their savings on car insurance?

50-year-old drivers can maximize savings by exploring discounts for good driving records, bundling multiple policies with the same provider, and considering pay-per-mile or usage-based insurance programs that cater to lower annual mileage.

How does retirement or reduced driving time impact car insurance premiums for seniors?

Seniors who are retired or spend less time behind the wheel due to reduced commuting can qualify for discounts. Many insurance providers offer low annual mileage discounts for those who drive less frequently, resulting in potential savings on car insurance premiums. (For more information about premiums, read our “What Is a Car Insurance Premium?“)

Does driving a newer car affect car insurance rates for 50-year-old drivers?

Yes, driving a newer car can influence car insurance rates. Newer cars may have higher insurance premiums due to increased replacement costs, but they also offer advanced safety features that could qualify for discounts.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Are there special programs for 50-year-old drivers to improve their driving skills and lower premiums?

Many insurance companies offer safe driving programs for mature drivers. These programs may include refresher courses on road rules and safe driving techniques, which can lead to discounts on insurance premiums upon completion.

What impact does credit score have on car insurance rates for 50-year-old drivers?

A higher credit score often leads to lower car insurance rates. Insurance providers may view individuals with good credit as lower risk, resulting in more favorable pricing. Learn more in our article called “Good Credit Car Insurance Discounts“.

How does the type of vehicle affect car insurance rates for 50-year-old drivers?

The make, model, and age of the vehicle can affect insurance rates. Vehicles with high safety ratings and lower repair costs may result in lower premiums. Conversely, luxury or high-performance cars could lead to higher rates due to potential repair expenses and perceived higher risk.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.