Best Car Insurance for Modified Cars in 2025 (Your Guide to the Top 10 Companies)

USAA, Progressive, and State Farm lead as the best car insurance for modified cars, starting at just $45 monthly. These providers offer comprehensive coverage for various modifications, ensuring optimal protection and value for drivers seeking specialized vehicle insurance solutions.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Modified Cars

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Modified Cars

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Modified Cars

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best car insurance for modified cars are USAA, Progressive, and State Farm, renowned for their competitive coverage options.

These providers understand the unique needs of drivers with modified vehicles, offering tailored policies that protect custom enhancements. Learn more in our “Average Car Insurance Rates by Age and Gender.”

Our Top 10 Company Picks: Best Car Insurance for Modified Cars

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Excellent Service USAA

#2 10% A+ Customized Policies Progressive

#3 20% B Coverage Options State Farm

#4 25% A+ Flexible Policies Allstate

#5 20% A+ Competitive Rates Nationwide

#6 15% A Customer Support Farmers

#7 12% A Specialized Coverage Liberty Mutual

#8 20% A Tailored Plans American Family

#9 10% A++ Wide Network Travelers

#10 20% A Member Discounts AAA

As modifications can significantly alter a car’s value and performance, choosing the right insurer is crucial to ensuring comprehensive protection.

Whether you’re enhancing performance or aesthetics, these companies provide the reliability and coverage flexibility you need.

Read on to know more about car insurance companies that allow modifications for your car. If you need to look at quotes from top car insurance companies in your area, enter your ZIP code into our free tool above.

- USAA is the top pick for best car insurance for modified cars

- Coverage options specifically cater to the unique risks of modified vehicles

- Tailored policies ensure comprehensive protection for custom enhancements

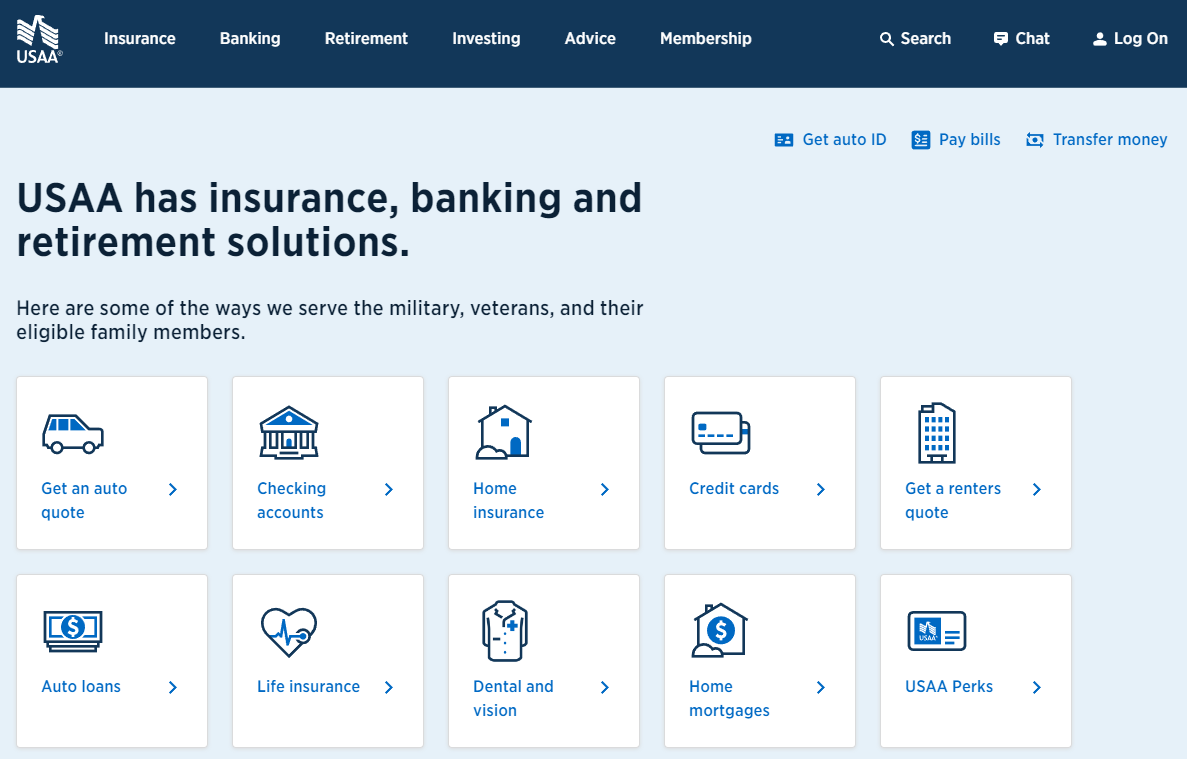

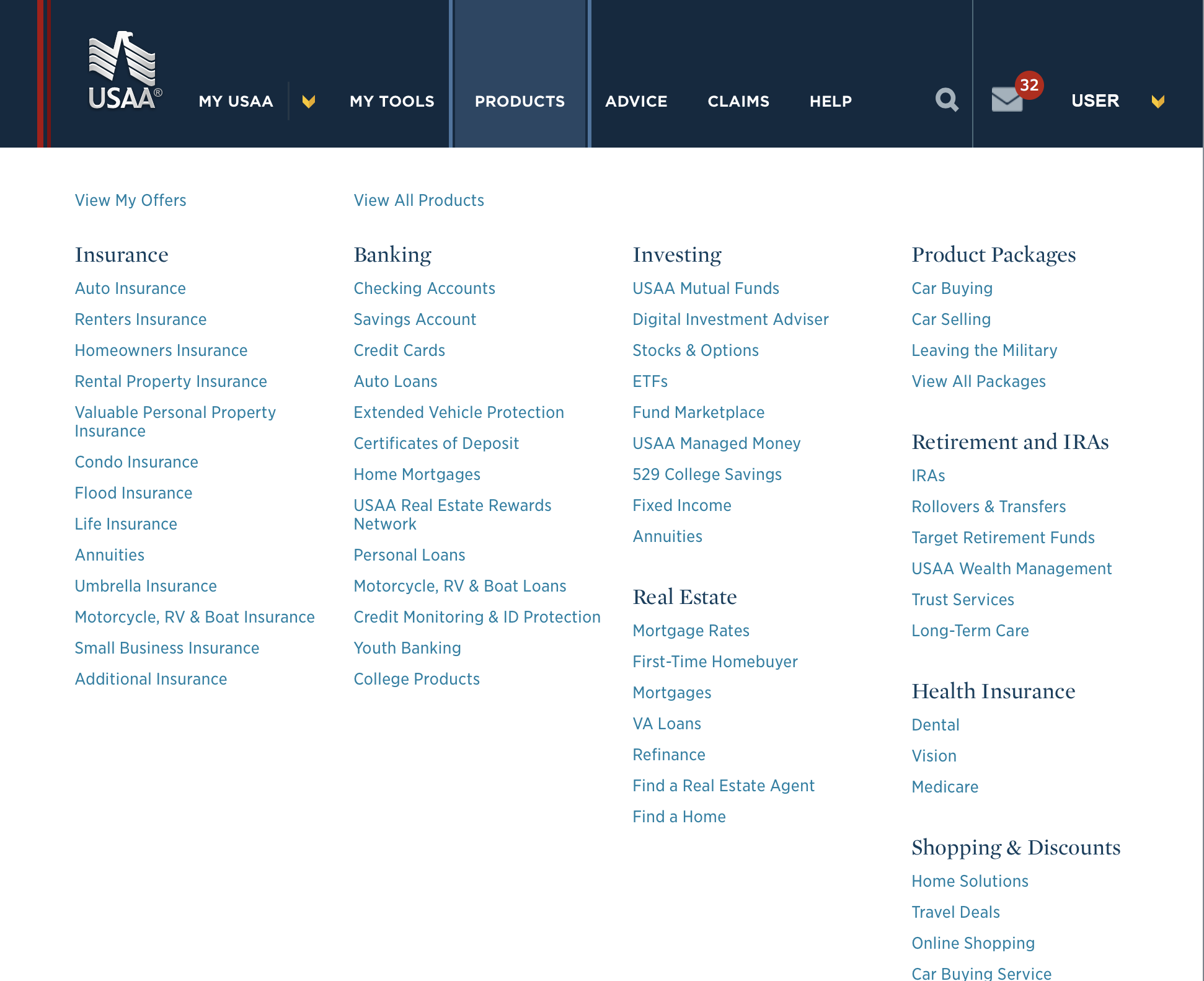

#1 – USAA: Top Overall Pick

Pros

- High Multi-Policy Discount: USAA offers up to 25% off for bundling different insurance policies. See more details on our USAA car insurance review.

- Top-Rated Customer Service: Consistently high ratings for customer support and claims satisfaction.

- Military-Focused Benefits: Tailored benefits and discounts specifically for military members and their families.

Cons

- Limited Availability: Services restricted to military members, veterans, and their families.

- Fewer Physical Locations: Limited number of physical branches, which might affect those preferring in-person service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Customized Policies

Pros

- Customizable Coverages: Offers a wide array of options to tailor policies to individual needs.

- Loyalty Rewards: Progressive rewards long-term customers with discounts and perks.

- Online Tools: Excellent digital tools for policy management and claims filing. More information is available about this provider in our Progressive car insurance review.

Cons

- Inconsistent Agent Experience: Customer experiences can vary significantly depending on the agent.

- Higher Rates for Riskier Drivers: Tends to charge higher premiums for drivers with poor records.

#3 – State Farm: Best for Coverage Option

Pros

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Various coverage options tailored for different needs. Read up on the “State Farm Car Insurance Review” for more information.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#4 – Allstate: Best for Flexibility Policies

Pros

- Multiple Discount Options: Offers a range of discounts including multi-policy and safe driving bonuses.

- Innovative Tools: Provides innovative tools like Drivewise to help customers manage their policies and driving habits.

- Flexible Coverage Options: Wide range of customizable policy options. Check out insurance savings in our complete Allstate car insurance review.

Cons

- Pricing Variability: Pricing can vary greatly depending on location and personal circumstances.

- Customer Service Variations: Some customers report variability in service quality.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Competitive Rates

Pros

- Competitive Premiums: Offers competitive rates especially when combined with various discounts.

- Wide Range of Discounts: Substantial discounts available for multi-policy, safe drivers, and more.

- Strong Financial Stability: High rating from A.M. Best indicating robust financial health. Discover more about offerings in our Nationwide car insurance discounts.

Cons

- Policy Upselling: Some customers report aggressive upselling of additional features.

- Claim Response Times: Occasional complaints about slower claim response times.

#6 – Farmers: Best for Customer Support

Pros

- Dedicated Agents: Known for personalized service through dedicated agents.

- Customizable Options: Offers a variety of customizable options to suit different customer needs.

- Good Driver Discounts: Attractive discounts for safe drivers. Access comprehensive insights into our Farmers car insurance review.

Cons

- Higher Base Prices: Generally higher base prices compared to some other insurers.

- Complex Policy Options: Some customers find policy options complex and difficult to navigate.

#7 – Liberty Mutual: Best for Specialized Coverage

Pros

- Specialty Coverages: Offers unique and specialized coverages that may not be widely available.

- Accident Forgiveness: Includes accident forgiveness policies to prevent premium spikes after an accident.

- Variety of Discounts: Wide range of discounts available, enhancing affordability. Delve into our evaluation of Liberty Mutual car insurance review.

Cons

- Higher Premiums for Some Policies: Some policies come at a higher premium compared to competitors.

- Mixed Customer Service Reviews: Customer service quality can be inconsistent.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Tailored Plans

Pros

- Highly Tailored Policies: Provides highly customized policies to meet specific customer needs.

- Loyalty Discounts: Offers discounts for long-term policyholders. Unlock details in our American Family car insurance review.

- Effective Claims Process: Known for a smooth and efficient claims process.

Cons

- Limited Availability: Coverage not available in all states.

- Premium Fluctuations: Premiums can fluctuate based on policy changes and renewals.

#9 – Travelers: Best for Wide Network

Pros

- Extensive Network: Benefits from a wide network of agents and services across the country.

- Bundling Opportunities: Significant discounts for bundling auto, home, and other insurance.

- Robust Coverage Options: Offers robust coverage options for a wide range of needs. If you want to learn more about the company, head to our Travelers car insurance review.

Cons

- Higher Pricing in Some Regions: Can be more expensive in certain regions.

- Complexity in Policy Management: Some customers find the policy management system complex.

#10 – AAA: Best for Member Discounts

Pros

- Exclusive Member Discounts: Offers exclusive discounts and benefits for AAA members.

- Comprehensive Services: Provides a broad range of services beyond insurance including roadside assistance.

- Diverse Policy Options: Wide selection of policy options to cater to diverse needs. Discover insights in our AAA Car Insurance Review.

Cons

- Membership Requirement: Requires AAA membership to access insurance services.

- Varied Service Quality: Service quality can vary depending on regional clubs and representatives.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Monthly Insurance Rates for Modified Cars by Coverage Level

The table below offers an in-depth overview of the monthly insurance rates for modified cars, highlighting both minimum and full coverage options from different providers. This enables car owners to compare and choose the modified vehicle coverage that best aligns with their budget and coverage requirements.

Car Insurance Monthly Rates for Modified Vehicles by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $50 $100

Allstate $60 $120

American Family $55 $110

Farmers $65 $130

Liberty Mutual $70 $140

Nationwide $55 $115

Progressive $70 $135

State Farm $50 $105

Travelers $60 $125

USAA $45 $95

The rates span from economical choices like USAA, which offers minimum coverage at just $45 and full coverage at $95, to more premium options like Liberty Mutual with minimum coverage at $70 and full coverage at $140.

Other providers such as State Farm and AAA also offer competitive rates with minimum coverage starting at $50 and full coverage reaching up to $105 and $100, respectively.

This spectrum of rates reflects the diverse offerings in the market, catering to different levels of coverage and financial preferences of car owners with modified vehicles. Learn more in our “Compare Car Insurance by Coverage Type.”

Which Car Insurance Companies Allow Modifications to Your Car

Below are 14 companies that may offer coverage for modified cars. There are some major car insurance companies, but we have included specialty companies: American Collectors, American Modern, Chubb, Grundy, and Hagerty.

Car Insurance Companies That Allow Modifications

| Insurance Company | Modification Coverage | Classic Car Coverage |

|---|---|---|

| Allstate | Yes | Yes, with Hagerty |

| American Collectors | Yes | Yes |

| American Modern | Yes | Yes |

| Chubb | Yes | Yes |

| Farmers | Yes | Yes |

| Geico | Yes | Yes |

| Grundy | Yes | Yes |

| Haggerty | Yes | Yes |

| Nationwide | Yes | Yes, with Hagerty |

| New Jersey Manufacturers | Yes | Yes, with American Modern |

| Progressive | Yes | Yes |

| Safeco | Yes | Yes, by itself |

| State Farm | Yes | Yes |

| USAA | Yes | Yes |

From the regular car insurance companies, Allstate and Farmers offer custom parts and equipment coverage. State Farm modified car insurance coverage only applies to safety modifications.

To qualify for Geico’s modified car insurance, you must also have a primary-use vehicle listed on your policy. You also need collision and comprehensive car insurance coverage.

Also, many companies listed here will allow you to use the agreed value for a classic car. Companies that cover modifications also offer agreed value for the equipment.

That means they will pay you the agreed-upon amount if your car is totaled.

Which Car Insurance Companies Don’t Allow Modifications

The following table shows the car insurance companies that don’t allow modifications of any kind:

1Car Insurance Companies That Don’t Allow Modifications

| Car Insurance Company | Coverage for Modifications | Classic Car or Collector Car Insurance Coverage |

|---|---|---|

| 21st Century | No | Yes |

| AAA | No | Yes |

| American Family | No | Yes |

| Amica Mutual | No | No |

| Auto Owners Insurance | No | Yes |

| Erie | No | Yes |

| Esurance | No | Yes |

| Germania | No | No |

| Kemper | No | No |

| Liberty Mutual | No | Yes |

| Mercury Insurance | No | No |

| Plymouth Rock | No | Yes (in Massachusetts and New Jersey) |

| Shelter Insurance | No | No |

| Tennessee Farmers | No | No |

| The Hanover Insurance Group | No | Yes (works with American Modern) |

| The Hartford | No | Yes |

| West Bend | No | Yes |

Please note that Shelter offers no specialized insurance, but most of the other companies listed here do provide classic car insurance coverage.

Read More:

- Plymouth Rock Car Insurance Review

- Germania Car Insurance Review

- Hagerty Car Insurance Review

- Does car insurance cover performance parts?

- American Standard Car Insurance Review

How Much Does Modified Car Insurance Cost

A few quick notes to be aware of before you buy auto insurance from car insurance companies that allow modifications:

- Haggerty’s minimum yearly rate is listed here.

- NJM’s Policyholders in Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania can take advantage of the insurer’s classic and collector car insurance program.

- Full coverage with Allstate, Esurance, Geico, and other regular insurers does not include extra coverage for classic, collectible, or modified cars. However, rates for classic cars might be a little over half of what you can expect to pay for regular vehicles.

Of course, the cost of your modified or classic car insurance depends on the following factors:

- The Make of the Car

- Your Car’s Age

- How Expensive the Modifications Are

- How Often You Will Drive the Car

You can save money by driving your modified cars less. You also can save with discounts. Companies like Safeco and Allstate will also offer you discounts to go along with their classic auto insurance.

USAA consistently offers the lowest rates for both minimum and full coverage, with monthly premiums starting at just $45.

Brad Larson Licensed Insurance Agent

For example, Safeco offers a diminishing deductible for claims-free cycles and a low mileage discount.

However, choosing an agreed-value policy will increase your rates.

Read More:

- Compare Best Car Insurance Companies That Offer Agreed Value

- 21st Century vs. USAA Car Insurance Comparison

- Compare Best Car Insurance Companies That Beat Quotes

How to Determine Your Modified Car Insurance Rates

It is much harder to determine how high your yearly car insurance rates will be for a modified car.

Your typical auto insurance policy is influenced by several elements such as your age, your car’s model, and your driving history. Additionally, the cost of insurance for custom cars may also hinge on these factors, as well as the overall expense of the modifications you have implemented.

Typically, a modified car necessitates more coverage, meaning your monthly and yearly rates for modified insurance will be higher than those for a standard car insurance policy.

However, you might get some discounts by adding specific safety or anti-theft features to your car.

Generally, discussions about insurance modified cars often involve percentages. For example, your monthly premiums could amount to up to 10% of your modified car’s value.

Otherwise, you might have to set up an agreed value arrangement with your insurance company.

How to Find Extra Savings With Specialty Car Insurance Companies

As you can see from the third table, you can save on modified car insurance by buying a policy from a specialty car insurance company.

For instance, American Collects claims that it can save policyholders up to 40% compared to a standard personal car insurance policy. American Collector policyholders can take advantage of discounts for garaging, safe driving, multiple vehicles, and high-value vehicles.

Leading insurers such as Allstate might apply some of their standard discounts to your modified car, but specialty companies provide additional discounts along with their already low rates, offering the best modified car insurance options.

You may enjoy the most savings with American Modern. It offers discounts for four types of anti-theft devices, taking a defensive driving course, and belonging to a qualifying car club. All told, you might be able to save up to 45% with American Modern insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Top Tips for Drivers Looking for Modified Car Insurance

Here is what you can do to find affordable car insurance if you modify your existing vehicle or buy a modified car:

- First, talk to your insurance agent or company: An insurance agent can inform you about the types of modifications your insurer permits and provide quotes for modify car insurance based on different factors.

- Get any rates in writing: If you seek quotes from car insurance companies that allow modifications, make sure to obtain them in writing. These companies are obligated to honor the rates provided for insurance modified cars if you decide to go with their coverage.

- Make sure that the modifications you get are legal: State regulations vary, and you should at least comply with regulations in your state.

- Only get modifications from reputable shops: The best customization shops will keep abreast of state regulations, as well.

- Be honest with your car insurance company: Inform your insurer about any modifications to your car so they can properly assess the risk of insuring a modified car. Failing to do so may result in denied claims or cancellation of your coverage after an accident.

Ultimately, weigh the costs of customizing your car against any potential benefits and shop around with multiple car insurance companies that allow modifications before you buy. See more details on our “How can I find affordable car insurance rates?“

Look up car insurance rates for top insurers in your area with our free quote tool below. Enter your ZIP code to get started.

For more information on modified car insurance coverage and how to save if your modifications are necessary, read our FAQ section below.

Frequently Asked Questions

Can I modify my car and still get insurance coverage?

Yes, many car insurance companies allow modifications to vehicles and provide coverage for them. However, the specific modifications that are covered and the extent of coverage can vary among insurance providers.

For additional details, explore our comprehensive resource titled “What Is Covered by Your Car Insurance.”

What types of modifications are typically covered by car insurance companies?

Common modifications that are often covered include changes to the engine, exhaust system, suspension, body kit, wheels, and audio systems. However, it’s important to check with your insurance provider to confirm which modifications they cover.

How can I find the best car insurance companies that allow modifications?

To find the best car insurance companies that accommodate modifications, consider the following steps:

- Research and compare insurance providers that explicitly mention coverage for modified vehicles.

- Check customer reviews and ratings to gauge the quality of service and claims handling.

- Evaluate the flexibility of coverage options and the specific modifications each company allows.

- Obtain quotes from multiple insurers to compare prices and coverage terms.

Are there any limitations or restrictions on modifications that insurance companies impose?.

Yes, insurance companies may impose limitations or restrictions on modifications. Some common restrictions include modifications that increase the vehicle’s speed capabilities, significantly alter its appearance, or affect its safety features. Additionally, certain modifications may require additional coverage or attract higher premiums

Can I add modifications to my car after purchasing an insurance policy?

It depends on the insurance provider. Some companies allow you to add modifications to your coverage mid-policy, while others may require you to notify them before making any modifications. It’s best to inform your insurance provider in advance to ensure your modifications are adequately covered.

To find out more, explore our guide titled “Can I change my car insurance company mid-policy?“

What do modified vehicle insurance specialists offer that regular insurers don’t?

Modified vehicle insurance specialists provide policies specifically designed to cover the unique risks and values of enhanced vehicles, often including agreed value coverage and customization-specific claims support.

How can I obtain custom car insurance quotes for my modified vehicle?

You can obtain custom car insurance quotes by contacting insurers that specialize in modified vehicles, providing detailed information about your modifications, and comparing rates for the best coverage.

What should I look for when choosing modified car insurance?

Look for insurers that offer comprehensive coverage for modifications, agree on the value of the car post-modification, and provide transparent pricing and claims processes.

Who offers the best insurance for modified cars?

Companies like USAA, Progressive, and State Farm are highly regarded for offering the best insurance for modified cars, offering tailored coverage options at competitive rates.

To learn more, explore our comprehensive resource on “USAA Car Insurance Discounts.”

Is insurance for modified cars more expensive than standard auto insurance?

Yes, insurance for modified cars can be more expensive due to the increased value and risks associated with vehicle modifications.

What does custom car insurance typically cover?

Custom car insurance covers standard auto insurance protections along with additional coverage for aftermarket parts, performance enhancements, and custom modifications.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

What is included in mods coverage by car insurance companies?

Mods coverage typically includes protection for aftermarket additions such as custom wheels, body kits, enhanced audio systems, and performance upgrades that are not covered by standard policies.

How does vehicle modification car insurance differ from regular car insurance?

Vehicle modification car insurance specifically covers the increased value and risk associated with modified vehicles, which regular car insurance might not cover fully or at all.

Learn more by reading our guide titled “Does car insurance cover all the drivers in a single home?“

What are the benefits of car insurance for modified cars?

The primary benefit of car insurance for modified cars is that it provides financial protection specifically tailored to cover the high-cost parts and potential risks involved with modifications.

How do I get a modified car insurance quote?

To get a modified car insurance quote, provide a detailed list of all modifications made to your vehicle to insurance providers that specialize in modified cars, ensuring accurate coverage assessment and pricing.

What type of insurance is most important for cars?

Auto liability insurance is required by law in the majority of states. Drivers must obtain at least the state-mandated minimum amount of liability insurance. This coverage includes two parts: Bodily injury liability, which can assist in covering expenses associated with injuries to another individual if you are at fault in an accident.

Which insurance cover is best for car?

Comprehensive car insurance provides coverage for a wide range of risks such as accidental damage, theft, vandalism, and any damage or injury inflicted on another person or their property. This type of coverage is ideal for first-time car owners or those purchasing new vehicles.

Access comprehensive insights into our guide titled “Does car insurance cover dealer damage?“

Is it okay to modify a car?

Modifications may not automatically invalidate a warranty, but any alteration leading to vehicle malfunction or damage can nullify warranties for affected components. For instance, certain large wheel and tire setups might collide with the vehicle’s sheet metal and steering parts, resulting in damage.

What is the fastest modified car?

Currently, the Bloodhound LSR holds the title for the highest top speed among modified cars. This vehicle is far from your typical road car; it’s a supersonic, land speed record-breaking car built specifically to break the sound barrier on wheels.

What is the best insurance for first time car owners?

The top choices for the best car insurance for new drivers are Geico and State Farm. Each of these insurers provides opportunities for policyholders to save money through student discounts and multi-car insurance savings.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.