Best Ford F-350 Super Duty Car Insurance in 2026 (Find the Top 10 Companies Here)

The top providers for the best Ford F-350 Super Duty car insurance are Progressive, Geico, and State Farm, with rates starting as low as $58/month. These companies offer competitive prices, comprehensive coverage, and strong protection for your Ford F-350 Super Duty, ensuring great value and reliability.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated September 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Ford F-350 Super Duty

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Ford F-350 Super Duty

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Ford F-350 Super Duty

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top pick for the best Ford F-350 Super Duty car insurance is Progressive, offering comprehensive coverage and rates starting as low as $58/month. Geico and State Farm are also strong options, providing competitive pricing and robust coverage plans for diverse needs.

This article explores how vehicle age, driver demographics, and location affect insurance premiums, helping you secure the best rates. To delve deeper, refer to our report titled, “Different Ways to Lower Car Insurance Rates.”

Our Top 10 Company Picks: Best Ford F-350 Super Duty Car Insurance

| Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Competitive Rates | Progressive | |

| #2 | 22% | A++ | Digital Tools | Geico | |

| #3 | 15% | B | Young Drivers | State Farm | |

| #4 | 30% | A++ | Military Families | USAA | |

| #5 | 20% | A | Local Service | Mercury | |

| #6 | 20% | A+ | Customizable Policies | Erie |

| #7 | 10% | A+ | Bundling Options | Nationwide |

| #8 | 15% | A | Family Discounts | American Family | |

| #9 | 20% | A | Comprehensive Coverage | Farmers | |

| #10 | 23% | A++ | Large Families | Travelers |

It offers key insights to help you achieve the most cost-effective coverage. You’ll also find strategies for reducing costs and enhancing savings tailored to your specific situation.

Find cheap car insurance quotes by entering your ZIP code above.

- Progressive is the top pick for competitive rates and comprehensive coverage

- Rates vary based on factors like vehicle age, driver age, and location

- Insurance for the Ford F-350 Super Duty starts at $58 per month

#1 – Progressive: Overall Top Pick

Pros:

- Affordable Premiums: Progressive offers some of the lowest rates for Ford F-350 Super Duty car insurance, making it a budget-friendly option.

- Extensive Coverage Options: Progressive provides a wide range of coverage choices tailored to the Ford F-350 Super Duty, ensuring comprehensive protection. Read more in our resource titled, “Progressive Car Insurance Review.”

- User-Friendly Tools: Their online tools make it easy to customize Ford F-350 Super Duty car insurance policies and compare rates instantly.

Cons:

- Complexity of Policies: Progressive’s extensive options for Ford F-350 Super Duty car insurance can be overwhelming for some users.

- Customer Service Issues: There have been complaints about customer service delays, which might affect handling Ford F-350 Super Duty car insurance claims efficiently.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Digital Tools

Pros:

- Innovative Digital Features: Geico offers advanced digital tools for managing Ford F-350 Super Duty car insurance, such as a mobile app for easy policy management. Find out more in our “Geico Car Insurance Review.”

- Quick Quote Process: Geico’s online quote system allows for rapid comparisons and adjustments for Ford F-350 Super Duty car insurance.

- User-Friendly Interface: Their website is designed to simplify the process of getting and maintaining Ford F-350 Super Duty car insurance.

Cons:

- Limited Local Agent Support: Geico’s digital focus may reduce access to personalized local support for Ford F-350 Super Duty car insurance needs.

- Customer Satisfaction Variability: Some users report mixed experiences with Geico’s customer service for Ford F-350 Super Duty car insurance.

#3 – State Farm: Best for Young Drivers

Pros:

- Competitive Rates for Young Drivers: State Farm offers special discounts for younger drivers with Ford F-350 Super Duty car insurance.

- Educational Resources: State Farm provides resources aimed at improving driving habits, which can benefit young Ford F-350 Super Duty drivers.

- Flexible Payment Options: State Farm offers various payment plans suitable for young drivers managing Ford F-350 Super Duty car insurance which you can check out in our “State Farm Car Insurance Review.”

Cons:

- Higher Rates for Newer Drivers: Despite discounts, new young drivers might still face higher premiums for Ford F-350 Super Duty car insurance.

- Limited Online Tools: State Farm’s digital tools for managing Ford F-350 Super Duty car insurance are less advanced compared to competitors.

#4 – USAA: Best for Military Families

Pros:

- Specialized Coverage for Military: USAA provides tailored Ford F-350 Super Duty car insurance options specifically designed for military families.

- Exceptional Customer Service: Known for high-quality service, USAA offers excellent support for Ford F-350 Super Duty car insurance claims.

- Discounts for Military Members: USAA offers additional savings on Ford F-350 Super Duty car insurance for active duty and veteran military personnel.

Cons:

- Eligibility Restrictions: USAA’s Ford F-350 Super Duty car insurance is only available to military families, limiting its accessibility. Discover our “USAA Car Insurance Review” for a full list.

- Geographic Availability: Some regions may have limited USAA service options for Ford F-350 Super Duty car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Mercury: Best for Local Service

Pros:

- Strong Local Presence: Mercury provides personalized Ford F-350 Super Duty car insurance service through local agents which is covered in our “American Mercury Car Insurance Review.”

- Customized Policies: Mercury’s local agents can tailor Ford F-350 Super Duty car insurance policies to specific regional needs.

- Community Focus: Known for community involvement, Mercury offers Ford F-350 Super Duty car insurance with local customer care.

Cons:

- Higher Costs in Some Areas: Local service may come with higher premiums for Ford F-350 Super Duty car insurance compared to national providers.

- Limited Digital Tools: Mercury’s digital tools for managing Ford F-350 Super Duty car insurance are less advanced than those of larger insurers.

#6 – Erie: Best for Customizable Policies

Pros:

- Tailored Coverage Options: Erie offers highly customizable Ford F-350 Super Duty car insurance policies to meet specific needs.

- Flexible Add-Ons: Erie provides various add-on options to enhance Ford F-350 Super Duty car insurance coverage. Read our “Erie Car Insurance Review” to learn what else is offered.

- Personalized Service: Erie’s agents work closely with clients to design Ford F-350 Super Duty car insurance plans that fit individual preferences.

Cons:

- Potentially Higher Premiums: Customization features can lead to higher costs for Ford F-350 Super Duty car insurance.

- Complex Policy Details: The extensive options might complicate the selection process for Ford F-350 Super Duty car insurance.

#7 – Nationwide: Best for Bundling Options

Pros:

- Bundling Discounts: Nationwide offers significant discounts for bundling Ford F-350 Super Duty car insurance with other policies which you can explore in our guide titled, “Nationwide Car Insurance Discounts.”

- Comprehensive Coverage: Nationwide’s bundling options allow for extensive Ford F-350 Super Duty car insurance coverage.

- Convenient Management: Bundling policies with Nationwide simplifies managing multiple insurance needs, including Ford F-350 Super Duty car insurance.

Cons:

- Discount Complexity: Navigating the bundling discounts for Ford F-350 Super Duty car insurance can be complex.

- Service Variability: Customer service quality for bundled Ford F-350 Super Duty car insurance may vary.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Family Discounts

Pros:

- Family-Friendly Discounts: American Family offers special discounts for families, making Ford F-350 Super Duty car insurance more affordable.

- Tailored Coverage for Families: Provides coverage options that suit the needs of families owning a Ford F-350 Super Duty.

- Additional Benefits: Family discounts can be combined with other perks for Ford F-350 Super Duty car insurance. For additional details, explore our comprehensive resource titled, “American Family Car Insurance Review.”

Cons:

- Discounts May Have Limits: Family discounts might not be applicable for all Ford F-350 Super Duty car insurance scenarios.

- Potential for Higher Base Rates: The base rates for Ford F-350 Super Duty car insurance could be higher before applying discounts.

#9 – Farmers: Best for Comprehensive Coverage

Pros:

- Broad Coverage Options: Farmers provides extensive coverage options for Ford F-350 Super Duty car insurance, ensuring comprehensive protection.

- Customizable Plans: Offers flexible plans to tailor Ford F-350 Super Duty car insurance to specific needs. For detailed information, refer to our comprehensive report titled, “Farmers Car Insurance Review.”

- Strong Reputation: Farmers has a solid reputation for providing thorough Ford F-350 Super Duty car insurance coverage.

Cons:

- Higher Premiums: Comprehensive coverage from Farmers can lead to higher premiums for Ford F-350 Super Duty car insurance.

- Complex Policy Structures: The variety of options might make it challenging to understand and compare Ford F-350 Super Duty car insurance policies.

#10 – Travelers: Best for Large Families

Pros:

- Family-Oriented Discounts: Travelers offers discounts tailored for large families, making Ford F-350 Super Duty car insurance more cost-effective.

- Comprehensive Family Coverage: Provides extensive coverage suitable for large families with Ford F-350 Super Duty vehicles.

- Flexible Payment Plans: Offers flexible payment options that cater to the needs of large families insuring a Ford F-350 Super Duty.

Cons:

- Potential for Higher Rates: Larger family policies may result in higher costs for Ford F-350 Super Duty car insurance. For a comprehensive analysis, refer to our detailed guide titled, “Travelers Car Insurance Review.”

- Limited Local Presence: Travelers may have less localized support compared to other insurers for Ford F-350 Super Duty car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford F-350 Super Duty Car Insurance Monthly Rates & Discounts

When selecting car insurance for your Ford F-350 Super Duty, understanding the various coverage levels and potential discounts can significantly impact your monthly premiums. This guide provides a detailed breakdown of monthly insurance rates for both minimum and full coverage options across top insurance providers.

Ford F-350 Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $67 | $108 |

| Erie | $65 | $105 |

| Farmers | $66 | $106 |

| Geico | $60 | $98 |

| Mercury | $62 | $100 |

| Nationwide | $64 | $107 |

| Progressive | $58 | $95 |

| State Farm | $68 | $112 |

| Travelers | $69 | $113 |

| USAA | $70 | $114 |

Additionally, we highlight available discounts that can help reduce your overall insurance costs. Securing the best car insurance for your Ford F-350 Super Duty doesn’t just depend on the provider but also on the discounts you can leverage. Explore our guide “Compare Full Coverage vs. Liability Car Insurance” for more insights.

By taking advantage of offers from top insurers you can significantly lower your premiums while ensuring comprehensive coverage. Compare your options, consider the discounts available, and make an informed choice to keep both your truck and your wallet protected.

Understanding Ford F-350 Super Duty Insurance Cost

Choosing the right insurance for your Ford F-350 Super Duty involves understanding the factors that impact your insurance costs is essential. From the vehicle’s robust features to the driver’s profile, several elements can influence your premiums.

Progressive offers the best value for Ford F-350 Super Duty insurance with its exceptional rates and comprehensive coverage options.

Brandon Frady Licensed Insurance Agent

This guide provides a detailed analysis of the average costs linked to different levels of coverage and driver profiles. It includes insights into basic rates, available discounts, and the impact of varying deductible amounts. By evaluating how these factors affect insurance costs, you can make informed decisions to adjust your coverage.

Ford F-350 Super Duty Car Insurance Rates by Drive Profile

| Driver Profile | Monthly Rates |

|---|---|

| Average Rate | $137 |

| Discount Rate | $81 |

| High Deductibles | $118 |

| High Risk Driver | $292 |

| Low Deductibles | $173 |

| Teen Driver | $501 |

Analyzing how these factors impact insurance costs will offer valuable insights into adjusting your coverage to achieve the right mix of protection and affordability, allowing you to find the most suitable and cost-effective insurance plan for your needs. Find out more in our resource titled, “How do you get competitive quotes for car insurance?”

Ford F-350 Super Duty Insurance Monthly Rates Comparison

This comparison highlights the monthly insurance rates for the Ford F-350 Super Duty alongside other popular vehicles, broken down by coverage type. The rates include comprehensive, collision, minimum, and full coverage options. For a complete list, read our report titled, “Compare Car Insurance by Coverage Type.”

Ford F-350 Super Duty Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Chevrolet Silverado | $27 | $47 | $35 | $124 |

| GMC Canyon | $23 | $40 | $33 | $109 |

| Honda Ridgeline | $26 | $45 | $38 | $123 |

| Ford Ranger | $21 | $39 | $31 | $105 |

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| GMC Sierra | $28 | $50 | $31 | $122 |

For instance, while the Ford F-350 Super Duty typically incurs higher costs compared to smaller trucks, it’s essential to consider the differences in coverage levels. This guide allows you to compare Ford F-350 Super Duty insurance costs with those of other models, helping you choose the best coverage for your vehicle.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Ford F-350 Super Duty Insurance Rates

There are several key factors come into play when determining insurance rates for the Ford F-350 Super Duty. This overview examines how the age of the vehicle, the driver’s age, location, and driving record impact monthly insurance costs. By considering these factors, you can better evaluate and optimize your insurance choices for the Ford F-350 Super Duty.

Age of the Vehicle

Insurance rates for the Ford F-350 Super Duty vary by model year and coverage. This breakdown provides a detailed look at monthly insurance costs for different model years of the Ford F-350 Super Duty, including comprehensive, collision, minimum, and full coverage options.

Ford F-350 Super Duty Car Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Ford F-350 Super Duty | $30 | $51 | $48 | $142 |

| 2023 Ford F-350 Super Duty | $29 | $50 | $48 | $140 |

| 2022 Ford F-350 Super Duty | $29 | $49 | $48 | $140 |

| 2021 Ford F-350 Super Duty | $28 | $49 | $47 | $139 |

| 2020 Ford F-350 Super Duty | $28 | $48 | $47 | $139 |

| 2019 Ford F-350 Super Duty | $28 | $48 | $47 | $138 |

| 2018 Ford F-350 Super Duty | $28 | $48 | $46 | $138 |

| 2017 Ford F-350 Super Duty | $29 | $49 | $43 | $137 |

| 2016 Ford F-350 Super Duty | $28 | $47 | $45 | $136 |

| 2015 Ford F-350 Super Duty | $26 | $45 | $46 | $134 |

| 2014 Ford F-350 Super Duty | $25 | $42 | $47 | $131 |

| 2013 Ford F-350 Super Duty | $24 | $39 | $48 | $128 |

| 2012 Ford F-350 Super Duty | $23 | $35 | $48 | $123 |

| 2011 Ford F-350 Super Duty | $22 | $32 | $48 | $119 |

| 2010 Ford F-350 Super Duty | $21 | $30 | $48 | $116 |

Whether you opt for a newer or older model, this information will help you identify the trends, ensuring you find the most suitable coverage option for your needs and budget. To expand your knowledge, refer to our comprehensive handbook titled, “Does the age of a car affect car insurance rates?”

Driver Age

Being aware of how insurance rates vary by age can provide valuable insights for Ford F-350 Super Duty owners. This breakdown of monthly insurance costs by age highlights the significant differences in premiums as drivers mature.

Ford F-350 Super Duty Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $740 |

| Age: 18 | $501 |

| Age: 20 | $311 |

| Age: 30 | $143 |

| Age: 40 | $137 |

| Age: 45 | $130 |

| Age: 50 | $125 |

| Age: 60 | $123 |

Younger drivers typically face much higher premiums compared to their older counterparts. To gain in-depth knowledge, consult our comprehensive resource titled, “How old do you have to be to own a car?” By examining these rates, you can better understand how age influences insurance costs and how to plan accordingly for more affordable coverage.

Driver Location

Location can significantly impact your monthly premium when choosing car insurance for your Ford F-350 Super Duty. Here’s a breakdown of average insurance rates by city to help you understand how where you live affects your costs that is discussed in our resource titled, “Compare Car Insurance Rates by State.”

Ford F-350 Super Duty Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $235 |

| New York, NY | $217 |

| Houston, TX | $215 |

| Jacksonville, FL | $199 |

| Philadelphia, PA | $184 |

| Chicago, IL | $181 |

| Phoenix, AZ | $159 |

| Seattle, WA | $133 |

| Indianapolis, IN | $117 |

| Columbus, OH | $114 |

These city-specific insurance rates for the Ford F-350 Super Duty highlight the regional variations in premiums. These details will help you to better gauge your potential insurance expenses and find the most cost-effective coverage based on your location.

Your Driving Record

Your driving record significantly impacts the cost of insuring a Ford F-350 Super Duty, with younger drivers facing the steepest increases in premiums due to violations. The table below illustrates how monthly insurance rates for a Ford F-350 Super Duty vary based on age and driving record.

Ford F-350 Super Duty Car Insurance Monthly Rates by Age & Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $740 | $980 | $1,200 | $1,050 |

| Age: 18 | $501 | $661 | $905 | $771 |

| Age: 20 | $311 | $410 | $563 | $480 |

| Age: 30 | $143 | $190 | $268 | $224 |

| Age: 40 | $137 | $183 | $255 | $210 |

| Age: 45 | $130 | $174 | $240 | $198 |

| Age: 50 | $125 | $168 | $232 | $190 |

| Age: 60 | $123 | $165 | $227 | $185 |

Younger drivers and those with poor driving histories face higher premiums, while older drivers with clean records enjoy lower rates. Understanding these factors can help manage and reduce your Ford F-350 Super Duty insurance costs which you can read more in our guide titled, “Do all car insurance companies check your driving records?”

Ford F-350 Super Duty Safety Features

The Ford F-350 Super Duty is equipped with a range of advanced safety features designed to enhance driver and passenger protection. From robust safety systems to innovative technology, these features help ensure a secure driving experience for every journey. The Ford F-350 Super Duty’s safety features include:

- AdvanceTrac with Roll Stability Control: Enhances stability and reduces rollover risk.

- ABS and Traction Control: Improves braking and traction on all surfaces.

- Air Bags with Safety Canopy: Comprehensive protection with dual-stage air bags.

- Adjustable Front Safety Belts: Customizable seat belts for optimal safety.

- MyKey System: Limits speed, volume, and provides early fuel warnings for safer driving.

These safety technologies not only safeguard occupants but can also lead to potential savings on insurance premiums. Insurers often reward vehicles with higher safety ratings and advanced safety features with lower rates, making safety a crucial factor in both protection and cost-effectiveness.

Ensure you’re making the most of these features by regularly maintaining them and informing your insurer about your truck’s safety technologies. This proactive approach can lead to a safer driving experience and more cost-effective insurance coverage which you can learn more about in our guide “Safety Features Car Insurance Discounts.”

Ford F-350 Super Duty Finance and Insurance Cost

Financing a Ford F-350 Super Duty often involves higher insurance costs due to lender requirements for comprehensive coverage. The substantial value and size of the F-350 Super Duty mean that insurance premiums can be higher compared to smaller vehicles. Lenders typically mandate robust coverage options, including comprehensive and collision insurance, to protect their investment.

It’s crucial for buyers to budget for these increased insurance costs alongside their financing plan. Comparing insurance quotes from various providers can help mitigate these expenses, ensuring you find the most cost-effective coverage while meeting lender requirements.

Ways to Save on Ford F-350 Super Duty Insurance

Finding ways to save on Ford F-350 Super Duty insurance can make a significant difference in your overall expenses. With its heavy-duty nature and robust features, the F-350 typically comes with higher insurance premiums. However, by exploring various strategies and leveraging available discounts, you can reduce your insurance costs without compromising on coverage.

This guide will walk you through effective methods to cut down on your insurance premiums, including tips on utilizing discounts, optimizing your coverage, and making informed choices that align with your driving habits and vehicle features. Here are the practical tips and options to help you save money on your Ford F-350 Super Duty insurance.

- Get Insurance Through Costco: Use Costco membership for potential insurance discounts.

- Monitor Your Odometer: Track your F-350’s mileage to optimize premiums.

- Disclose Multiple Drivers: Ensure all F-350 drivers are reported for proper coverage.

- Consider a Tracking Device: Install a device to potentially lower your insurance rate.

- Inquire About Low Mileage Discounts: Inquire about discounts if you drive your F-350 less often.

Reducing your Ford F-350 Super Duty insurance costs is achievable with the right strategies. By applying these different ways to lower car insurance rates, you can manage your premiums more effectively. Remember, a well-informed approach to your insurance can lead to significant savings while ensuring your F-350 well-protected.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

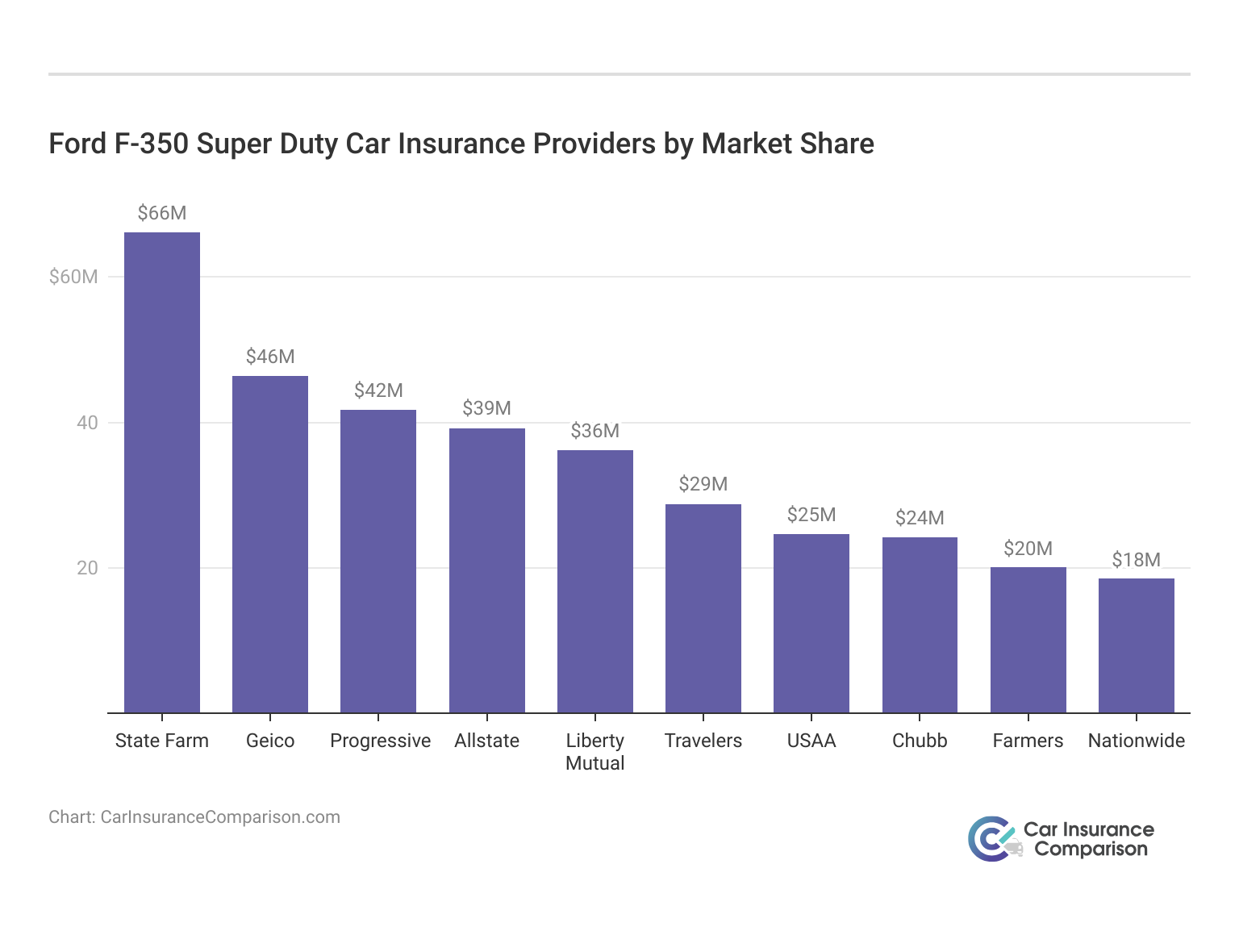

Top Ford F-350 Super Duty Insurance Companies

Selecting the best insurance provider for your Ford F-350 Super Duty is crucial for getting the right balance of cost and coverage. With several major companies leading the market, knowing their market share and premium offerings can guide your decision. For a comprehensive overview, explore our resource titled, “Do car insurance companies share information?”

Top Ford F-350 Super Duty Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Here’s an overview of the top Ford F-350 Super Duty car insurance providers by market share, showcasing the leading options in the industry. The right insurance provider can greatly impact your Ford F-350 Super Duty’s coverage and costs.

By reviewing the market share and premium data of these top insurers, you can make a more informed decision that aligns with your specific requirements. Whether your priority is comprehensive coverage, budget-friendly rates, or outstanding service, this list provides a valuable foundation for your selection process.

Guide to the Best Ford F-350 Super Duty Car Insurance

Discover the best car insurance options for your Ford F-350 Super Duty, featuring top providers like Progressive, Geico, and State Farm. These insurers offer competitive rates starting from $58/month, along with comprehensive coverage tailored for your truck’s needs. Factors such as vehicle age, driver demographics, and location impact your insurance premiums.

Our guide delves into how factors like the age of your vehicle, driver demographics, and your location can impact insurance costs. Learn how to leverage discounts and choose optimal coverage to boost protection and savings. Utilize our comparison tool to find the best and most affordable insurance for your Ford F-350 Super Duty. For an in-depth analysis, refer to our guide titled, “Should you shop around for car insurance?”

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

What factors impact the cost of Ford F-350 Super Duty insurance?

Factors such as the age of the vehicle, driver’s age, driver’s location, and driving record can impact the cost of Ford F-350 Super Duty insurance. To gain profound insights, consult our guide titled “What affects a car insurance quote?”

How can I save on Ford F-350 Super Duty insurance?

You can save by comparing quotes from multiple providers, taking advantage of discounts, and maintaining a clean driving record.

Is the Ford F-350 reliable?

Yes, the Ford F-350 is known for its reliability, with strong performance and durability in various driving conditions.

What is the Ford F-350 good for?

The Ford F-350 is ideal for heavy-duty tasks such as towing, hauling, and off-road driving, making it suitable for work and recreational use.

What type of F-350 car insurance gives you the most coverage?

Full coverage insurance provides the most extensive protection, including liability, comprehensive, and collision coverage. Find out more in our guide “Compare Collision Car Insurance.”

How long can a Ford F-350 last?

With proper maintenance, a Ford F-350 can last over 200,000 miles or more.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

What is considered high mileage for a F-350?

Generally, over 150,000 miles is considered high mileage for a Ford F-350, though it can vary based on maintenance and usage.

What is the top-of-the-line Ford F-350?

The Ford F-350 Limited is the top-of-the-line model, offering premium features and luxury options.

Are Ford F-350 Super Dutys expensive to insure compared to other trucks?

Yes, Ford F-350 Super Dutys can be more expensive to insure due to their size, value, and the cost of comprehensive coverage. Comparing quotes can help find more affordable options. Read more in our resource titled “Understanding Your Car Insurance Policy.”

What engine is in a Ford F-350?

The Ford F-350 typically comes with several engine options, including a 6.2-liter V8, a 7.3-liter V8, and a 6.7-liter Power Stroke V8 turbo-diesel.

What is the meaning of Super Duty?

Are Ford F-350 Super Dutys expensive to insure compared to other trucks?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.