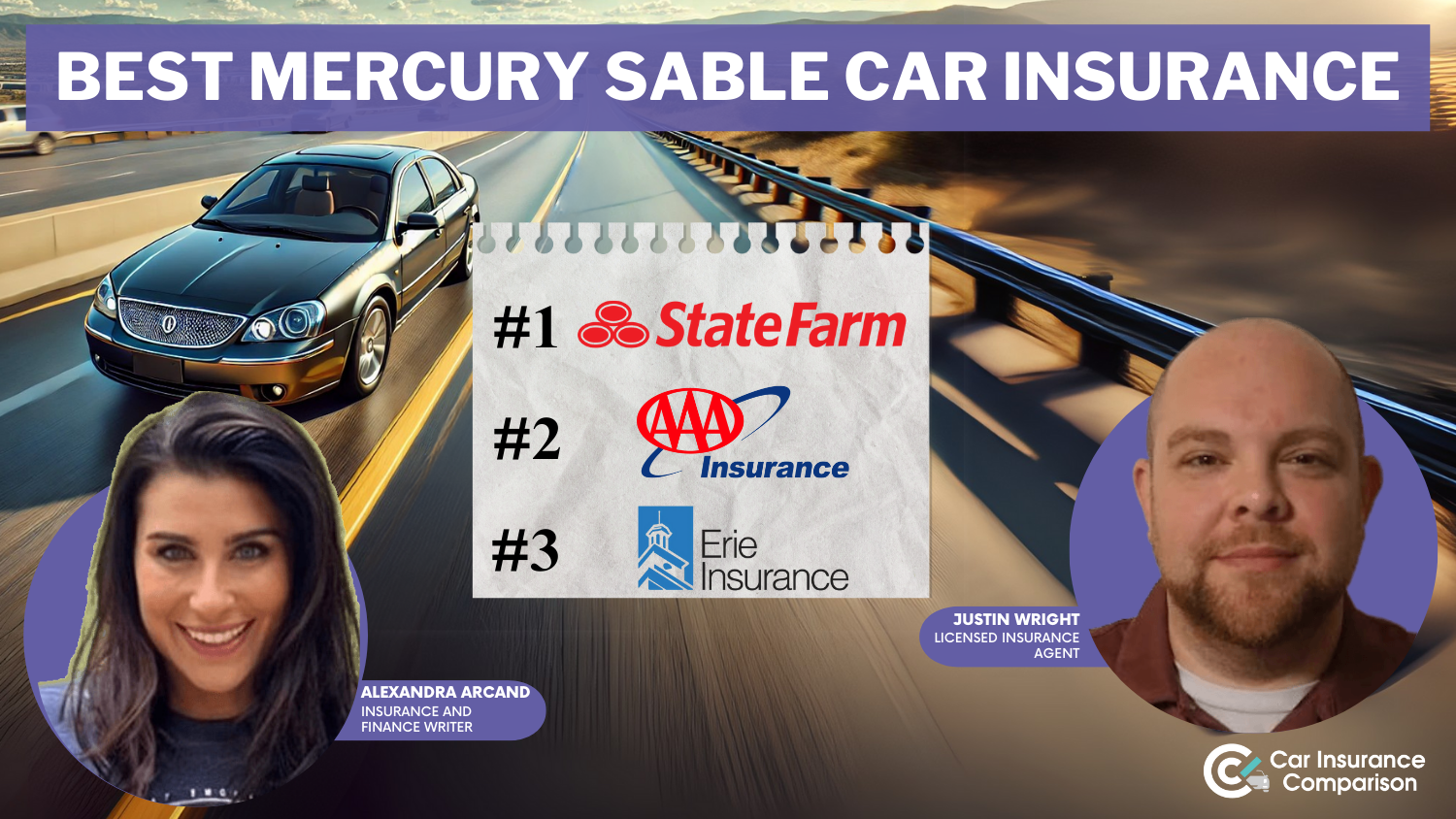

Best Mercury Sable Car Insurance in 2026 (Find the Top 10 Companies Here)

Discover the best Mercury Sable car insurance from State Farm, AAA, and Erie, starting at just $41 a month. These providers lead due to their excellent coverage options, customer service, and affordable rates for Mercury Sable owners, making them the top choices for cost-effective and reliable insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Company Facts

Full Coverage for Mercury Sable

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mercury Sable

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mercury Sable

A.M. Best Rating

Complaint Level

Pros & Cons

The best Mercury Sable car insurance providers are State Farm, AAA, and Erie, known for their superior service and comprehensive coverage options.

These companies stand out in the competitive market by offering tailored policies that cater specifically to Mercury Sable owners, ensuring both affordability and reliability. Their commitment to customer satisfaction and financial stability makes them the top choices for anyone looking to insure this popular vehicle model. Learn more in our article titled “Best Mercury Car Insurance Rates.”

Our Top 10 Company Picks: Best Mercury Sable Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 8% B Many Discounts State Farm

#2 12% A Online App AAA

#3 15% A+ 24/7 Support Erie

#4 10% A+ Add-on Coverages Allstate

#5 18% A++ Military Savings USAA

#6 7% A Local Agents Farmers

#7 14% A Customizable Polices Liberty Mutual

#8 16% A+ Innovative Programs Progressive

#9 9% A++ Custom Plan Geico

#10 13% A+ Usage Discount Nationwide

With their excellent track records, these insurers provide peace of mind for drivers seeking the best protection on the road.

Enter your ZIP code above and see which one offers the coverage you need.

- State Farm leads as the top pick for Mercury Sable car insurance

- Coverage is tailored to the unique safety features of the Mercury Sable

- Policies cater to the affordability and reliability needs of Sable owners

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple Mercury Sable insurance policies. Wondering about their level of customer service? Find out in our guide titled “State Farm Car Insurance Review.”

- Low-Mileage Discount: Mercury Sable owners can benefit from substantial low-mileage discounts with State Farm.

- Wide Coverage Options: State Farm provides various coverage options tailored specifically for Mercury Sable needs.

Cons

- Limited Multi-Policy Discount: For Mercury Sable owners, the multi-policy discount from State Farm is less competitive.

- Higher Premiums: Despite available discounts, premiums for Mercury Sable insurance at State Farm can be higher compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best for Online App

Pros

- Higher Multi-Vehicle Discount: AAA offers a 12% discount for Mercury Sable owners who insure multiple vehicles.

- Strong Financial Rating: With an A.M. Best rating of A, AAA provides reliable coverage for Mercury Sable insurance.

- User-Friendly Online App: The AAA app enhances convenience for managing Mercury Sable insurance policies. Learn more about AAA roadside assistance in our guide titled “AAA Car Insurance Review.”

Cons

- App Dependence: Some Mercury Sable owners might find AAA’s heavy reliance on its app for customer interaction less personal.

- Variable Customer Service: Customer service quality for Mercury Sable insurance can vary significantly between regions with AAA.

#3 – Erie: Best for 24/7 Support

Pros

- Top A.M. Best Rating: Erie’s A+ rating ensures superior reliability for Mercury Sable insurance. Compare Erie’s rates with top competitors in our article titled “Erie Car Insurance Review.”

- Highest Multi-Vehicle Discount: Offering a 15% discount, Erie is highly beneficial for Mercury Sable owners with multiple cars.

- Round-the-Clock Support: Erie provides 24/7 customer support, ensuring Mercury Sable owners have constant assistance.

Cons

- Limited Availability: Erie’s insurance for Mercury Sable is not available in all states, which could be a drawback for some owners.

- Premium Rates: Despite excellent service, Erie’s premium rates for Mercury Sable insurance might be higher due to extensive coverage.

#4 – Allstate: Best for Add-on Coverages

Pros

- Diverse Add-On Options: Allstate offers a range of add-on coverages that can be tailored specifically for Mercury Sable insurance needs.

- Decent Multi-Vehicle Discount: Mercury Sable owners can enjoy a 10% discount when insuring multiple vehicles with Allstate.

- Strong Financial Stability: With an A+ A.M. Best rating, Allstate promises dependable coverage for Mercury Sable owners. Find more information about Allstate’s rates in our article titled “Allstate Car Insurance Review.”

Cons

- Higher Cost of Add-Ons: While beneficial, the add-on coverages for Mercury Sable can significantly increase the overall cost.

- Complex Policy Management: Some Mercury Sable owners might find Allstate’s policy management system complex and less user-friendly.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Exceptional Discounts for Military: USAA offers unmatched discounts for military members, making it a top choice for Mercury Sable owners in the armed forces.

- Highest Multi-Vehicle Discount: With an 18% discount, USAA provides significant savings for Mercury Sable owners insuring multiple cars.

- Top-Tier Financial Rating: An A++ rating from A.M. Best ensures that USAA is highly reliable for insuring a Mercury Sable. Find out why USAA ranks among the cheapest providers in our article titled “USAA Car Insurance Review.”

Cons

- Limited Eligibility: USAA’s Mercury Sable insurance is only available to military members and their families, limiting accessibility.

- Focused Coverage Options: While excellent, USAA’s coverage options are primarily tailored to military needs, which may not suit all Mercury Sable owners.

#6 – Farmers: Best for Local Agents

Pros

- Personalized Service via Local Agents: Farmers leverages local agents to provide personalized service tailored to Mercury Sable insurance needs.

- Reliable Coverage: With an A rating from A.M. Best, Farmers offers dependable insurance coverage for Mercury Sable. Take a look at our article titled “Farmers Car Insurance Review.”

- Competitive Discounts: Though the multi-vehicle discount is 7%, Farmers offers other competitive discounts that benefit Mercury Sable owners.

Cons

- Lower Multi-Vehicle Discount: At 7%, the multi-vehicle discount for Mercury Sable insurance is lower than some other top insurers.

- Variable Agent Quality: The quality of service from Farmers’ local agents can vary, potentially affecting the consistency of customer experience for Mercury Sable owners.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Policies: Liberty Mutual offers extensive customization options for Mercury Sable insurance policies, allowing for tailored coverage.

- Strong Multi-Vehicle Discount: At 14%, Liberty Mutual provides a substantial discount for Mercury Sable owners insuring more than one vehicle.

- Solid Financial Standing: With an A rating from A.M. Best, Liberty Mutual is a reliable choice for insuring a Mercury Sable. To see monthly premiums and honest rankings, read our guide titled “Liberty Mutual Car Insurance Review.”

Cons

- Higher Premiums for Customizations: Customizing policies for a Mercury Sable can lead to higher premiums at Liberty Mutual.

- Complex Claims Process: Some Mercury Sable owners may find Liberty Mutual’s claims process to be overly complicated and time-consuming.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Innovative Programs

Pros

- Innovative Discount Programs: Progressive offers unique discount programs like Snapshot, which can benefit Mercury Sable owners by tracking driving habits.

- Strong Multi-Vehicle Discount: With a 16% discount, Progressive provides significant savings for Mercury Sable owners insuring multiple vehicles.

- Adaptive Policy Options: Progressive’s flexibility in policy customization allows Mercury Sable owners to adjust coverage as their needs change. Learn more about coverage options and monthly rates in our article titled “Progressive Car Insurance Review.”

Cons

- Variable Rate Changes: Progressive’s rates can vary significantly based on usage and driving data, which might be unpredictable for some Mercury Sable owners.

- Customer Service Inconsistencies: While generally good, some customers report inconsistent experiences with Progressive’s service, impacting Mercury Sable owners.

#9 – Geico: Best for Custom Plan

Pros

- Tailored Insurance Plans: Geico allows Mercury Sable owners to create highly customized insurance plans to meet their specific needs.

- Competitive Rates: Known for competitive pricing, Geico offers affordable policy options for insuring a Mercury Sable. Learn more about Geico’s rates in our guide titled “Geico Car Insurance Review.”

- Excellent Financial Stability: With an A++ rating from A.M. Best, Geico is exceptionally reliable for Mercury Sable insurance.

Cons

- Generic Customer Service: Some Mercury Sable owners may find Geico’s customer service to be less personalized, as the company is very large.

-

Complex Online Tools: While comprehensive, some of Geico’s online tools and interfaces for Mercury Sable insurance can be complex and challenging for first-time users.

#10 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Discounts: Nationwide offers significant discounts for Mercury Sable owners who opt for usage-based insurance, rewarding safe driving.

- Strong Financial Rating: With an A+ rating from A.M. Best, Nationwide offers dependable coverage for Mercury Sable owners. Explore more discount options in our guide titled “Nationwide Car Insurance Discounts.”

- Wide Range of Coverage Options: Nationwide provides a variety of coverage options, allowing Mercury Sable owners to find the perfect fit for their insurance needs.

Cons

- Higher Rates Without Discounts: Without the usage-based discounts, Nationwide’s rates can be higher compared to other insurers for Mercury Sable insurance.

- Customer Service Variability: Like many large insurers, Nationwide’s customer service quality can vary, potentially affecting the satisfaction of Mercury Sable owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Rates for Mercury Sable Insurance

Understanding the monthly rates for Mercury Sable car insurance by coverage level and provider helps in making an informed decision. Below is a breakdown of the costs for both minimum and full coverage across various insurance companies.

Mercury Sable Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $62 $193

Allstate $41 $141

Erie $74 $240

Farmers $64 $191

Geico $76 $237

Liberty Mutual $69 $211

Nationwide $60 $185

Progressive $90 $262

State Farm $54 $152

USAA $73 $215

For Mercury Sable owners, the monthly insurance rates vary significantly between minimum and full coverage options. For instance, Allstate offers the most affordable minimum coverage at $41 per month and also has a competitive full coverage rate at $141.

On the higher end, Progressive presents the most expensive minimum coverage at $90 and the highest full coverage rate at $262. Other insurers, such as State Farm and AAA, offer mid-range prices, with State Farm’s full coverage at $152 and AAA’s at $193 monthly.

This variability highlights the importance of comparing rates to find the best fit based on individual coverage needs and budget considerations. See more details on our guide titled “Does car insurance cover all the drivers in a single home?”

What Is the History of the Mercury Sable

When the Taurus was the best-selling vehicle in America starting in 1992, it paved the way for the popularity of the Sable. The Sable’s aerodynamic design and new headlight system captured the interest of consumers in the new car market.

Sales in the 1990s reached six digits for several years before they started to decline. In 2000 the design underwent another facelift with changes to the dashboard.

By 2003, the used car market was flooded with Ford Tauruses and Mercury Sables.

The popularity of this family-sized sedan maintained its grip on consumers through 2008. Even after they went out of production, the demand for used ones was high.

Many young people fit them for 22-inch rims and sport them as show cars. Some are even used for racing. They are also just as popular for police fleets. Discover more about offerings in our article titled “Fleet Car Insurance Explained.”

How Affordable Is Car Insurance for a Mercury Sable

It’s relatively cheap. In 2008, the Taurus and Sable won five-star safety ratings from the National Highway and Traffic Safety Administration or NHTSA, as well as the Insurance Institute for Highway Safety or IIHS.

These cars are equipped with crush zones that absorb the impact of a crash. In addition to the fact that the Mercury Sable is American-made, its safety features make it cheap to insure.

The insurance quote you receive from the car insurance company is determined by the make and model of a particular vehicle, its safety features, and factors such as your:

- Zip Code

- Age

- Credit History

- Driving Record

These are some of the major variables. Other factors, like how many other drivers are in the home, may not weigh as heavily.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

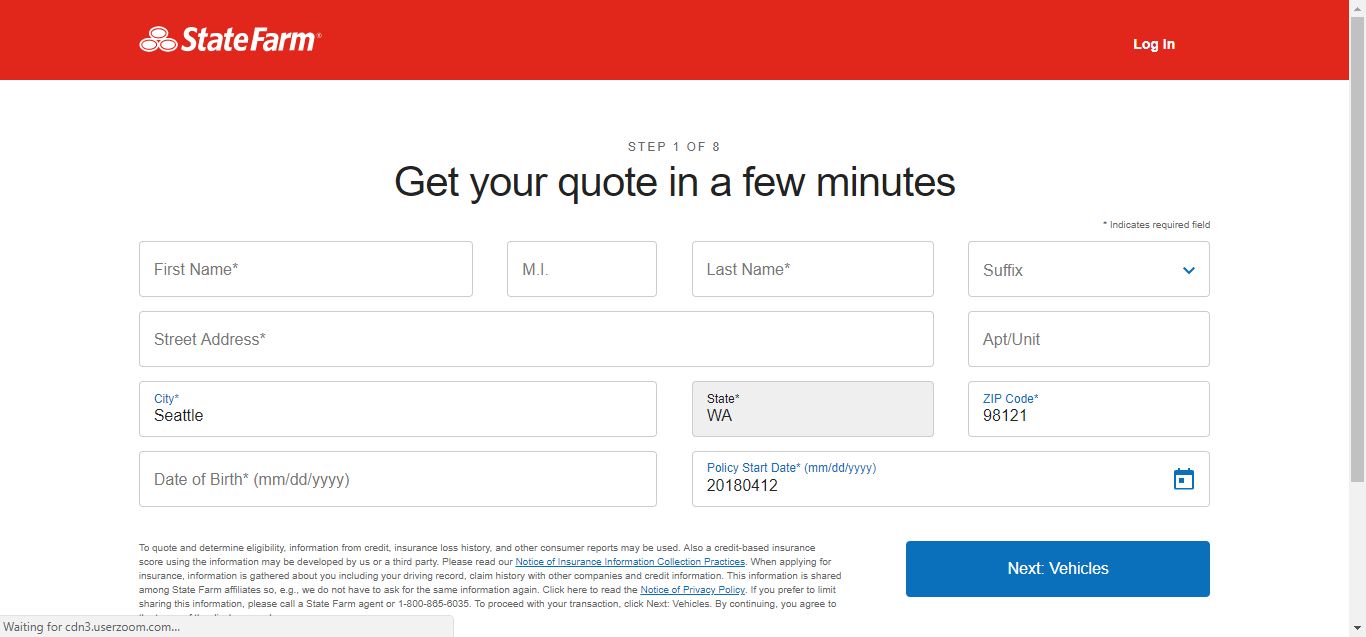

How Do I Find Affordable Car Insurance for the Mercury Sable

Car insurance is mandatory in most states.

If you are not able to purchase car insurance on the spot, some states will allow you to pay an uninsured motorist fee that is renewable for a couple of years. Unlock details in our guide titled “Compare Uninsured/Underinsured Motorist (UM/UIM) Coverage: Rates, Discounts, & Requirements.”

Virginia is one of those states; however, in most cases you must purchase insurance before the car is driven off the dealer lot.

Some people find their insurance carrier via referral, while others take the research route. Insurance carriers are regulated by the states where they are registered.

They are also rated by consumer rating companies for their solvency and reputation in the insurance industry and community. Anyone performing an inquiry has access to this information.

How Can I Maintain the Value of My Mercury Sable

Most Mercury Sable owners are pleased with their spacious ride. The recurring problem seems to be the check engine light and transmission problems.

Car clubs and forums offer solutions to common problems. As an American car, parts are readily available which helps to keep auto insurance costs low. Any recalls that took place will have information online.

State Farm stands out with its competitive full coverage rate of $152, making it an excellent choice for comprehensive Mercury Sable insurance.

Michelle Robbins Licensed Insurance Agent

Just as cars require maintenance, so does your car insurance policy. Every year at the beginning of the year or near the anniversary date, your policy may be in need of changes:

- Streamline Coverage: Assess and remove any insurance coverages that are not essential for your needs, which can help reduce your overall costs.

- Adjust Deductibles: Increase your deductible to lower your monthly premium. This means you’ll pay more out of pocket in the event of a claim, but your regular payments will be less.

- Prepay Premiums: Consider paying your premium upfront for the entire year or policy period. Many insurers offer a discount for this payment method.

- Switch Insurance Providers: Regularly review your insurance options and consider switching to a carrier that offers lower rates or better value for the coverage you need. This can be particularly beneficial at the end of your current policy term.

By strategically adjusting your coverage, increasing deductibles, paying premiums upfront, and periodically reevaluating your insurance provider, you can effectively manage and reduce your insurance costs. Delve into our evaluation of our guide titled “What cars have the lowest car insurance rates?”

To get car insurance quotes for your Mercury Sable or any other car today, enter your ZIP code below.

Frequently Asked Questions

Are there any specific factors that can affect the insurance rates for a Mercury Sable?

Yes, several factors can impact your insurance rates for a Mercury Sable. These factors include your driving record, age, location (ZIP code), credit history, and the coverage options you choose. Insurance companies consider these factors to assess the level of risk associated with insuring your vehicle.

Can I get discounts on car insurance for my Mercury Sable?

Yes, many insurance companies offer various discounts that can help lower your car insurance premiums. Some common discounts include safe driver discounts, multi-policy discounts (if you have multiple insurance policies with the same company), anti-theft device discounts, and good student discounts (for student drivers with good academic records).

Does the age of my Mercury Sable affect insurance rates?

Generally, the age of your vehicle can impact your insurance rates. Newer Mercury Sable models may have higher insurance rates due to their higher value and potential repair costs. As the vehicle gets older, its value decreases, which can lead to lower insurance rates. However, other factors, such as safety features and crash test ratings, also play a role in determining rates.

For additional details, explore our comprehensive resource titled “Safety Features Car Insurance Discounts.”

Can I customize my insurance coverage for my Mercury Sable?

Yes, you can customize your insurance coverage for your Mercury Sable based on your needs. Typical coverage options include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Discuss your coverage options with an insurance agent to determine the best coverage for your specific requirements.

Can I transfer my insurance from my old car to a new Mercury Sable?

Yes, you can typically transfer your insurance from your old car to a new Mercury Sable. Contact your insurance provider and inform them about the change in your vehicle. They will guide you through the necessary steps to update your policy and adjust your coverage accordingly.

Is it possible to bundle my Mercury Sable insurance with other policies?

Yes, bundling your Mercury Sable insurance with other insurance policies, such as home insurance or renters insurance, is often an option. Bundling can result in discounts and cost savings. Contact your insurance provider and inquire about their bundling options and potential discounts.

To find out more, explore our guide titled “Best Companies for Bundling Home and Car Insurance.”

How can I save money on Mercury Sable insurance?

To save money on Mercury Sable insurance, consider increasing your deductible, eliminating unnecessary coverages, and qualifying for discounts.

What is the most trusted car insurance company for Mercury Sable?

State Farm is often cited as the most trusted car insurance company for Mercury Sable, offering reliable coverage and competitive rates.

Who typically has the cheapest Mercury Sable car insurance?

Allstate typically has the cheapest Mercury Sable car insurance, with minimum coverage starting at $41 per month.

To learn more, explore our comprehensive resource on “How do you get Allstate car insurance quotes online?”

Is Mercury or Progressive cheaper for Mercury Sable?

Allstate tends to be cheaper than Progressive for Mercury Sable insurance, offering lower rates for both minimum and full coverage.

What insurance company has the least complaints?

At what age is Mercury Sable car insurance cheapest?

Who is most expensive Mercury Sable car insurance?

Who has the cheapest car insurance for seniors?

What car insurance is the cheapest for full coverage of Mercury Sable?

What is the most expensive type of insurance for Mercury Sable?

What type of insurance has lowest premium for Mercury Sable?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.