Best Nissan Armada Car Insurance in 2026 (Your Guide to the Top 10 Companies)

Delivering a competitive monthly rate of $37, State Farm, USAA, and Geico emerge as the top choices for the best Nissan Armada car insurance. State Farm is the top pick for affordability, USAA excels in customer service for military families, and Geico offers competitive pricing with wide coverage options

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2026

Company Facts

Full Coverage for Nissan Armada

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Nissan Armada

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Nissan Armada

A.M. Best Rating

Complaint Level

Pros & Cons

The best Nissan Armada car insurance providers are State Farm, USAA, and Geico, each offering top-tier coverage tailored to different needs.

State Farm stands out for its balance of affordability and comprehensive options, while USAA excels in customer service, particularly for military families. Geico is known for its competitive pricing and extensive coverage choices, making it a strong contender for budget-conscious drivers. Get more info in our detailed report titled “Best Car Insurance for Veterans.”

Our Top 10 Company Picks: Best Nissan Armada Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 13% B Many Discounts State Farm

![]()

#2 15% A++ Military Savings USAA

![]()

#3 10% A++ Custom Plan Geico

#4 12% A Online App AAA

#5 17% A+ 24/7 Support Erie

#6 11% A+ Innovative Programs Progressive

#7 14% A++ Accident Forgiveness Travelers

#8 16% A+ Add-on Coverages Allstate

#9 18% A Local Agents Farmers

#10 19% A Customizable Polices Liberty Mutual

Explore these options to find the coverage that best suits your needs.

Get the right car insurance at the best price — enter your ZIP code above to shop for Nissan Armada insurance coverage from the top insurers.

#1 – State Farm: Top Overall Pick

Pros

- Multi-Vehicle Discount: Offering a 13% discount, this discount is particularly beneficial for families who own more than one Nissan Armada, as it helps lower overall insurance costs while ensuring all vehicles are adequately covered

- Diverse Policy Options: Provides a variety of coverage options that may be adjusted to the individual requirements of Nissan Armada owners.

- Extensive Agent Network: A large network of agents provides individual attention and support to Nissan Armada insurance policyholders. See if State Farm offers affordable rates near you in our article titled “State Farm Car Insurance Review.”

Cons

- Inconsistency in Customer Service: Service quality can vary significantly from one agent to another, impacting the insurance experience for some Nissan Armada owners.

- Geographical Coverage Limitations: In some areas, coverage options or discounts for the Nissan Armada might be limited compared to other regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA offers a 15% multi-vehicle discount, which is beneficial for military families with more than one Nissan Armada. Check out insurance savings for military members and their families in our complete article titled “USAA Car Insurance Review.”

- Tailored Services for Military: Provides services and coverage options specifically tailored for military members who own a Nissan Armada, including deployment discounts.

- Strong Customer Loyalty: High levels of customer satisfaction and loyalty, indicating a positive overall insurance experience for Nissan Armada owners.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families, limiting access for the general public who own a Nissan Armada.

- Limited Physical Locations: Fewer in-person service locations, which might be a drawback for Nissan Armada owners preferring face-to-face interactions.

#3 – Geico: Best for Custom Plan

Pros

- Flexible Coverage Options: Geico offers customizable insurance plans for the Nissan Armada, allowing owners to adjust coverage levels and deductibles.

- Competitive Multi-Vehicle Discount: A 10% discount for insuring multiple vehicles can benefit Nissan Armada owners with more than one car.

- Robust Online Tools: Excellent online and mobile tools for managing Nissan Armada insurance policies, claims, and payments. Learn more about Geico’s rates in our guide titled “Geico Car Insurance Review.”

Cons

- Variable Customer Service: Service quality can vary, potentially affecting the insurance experience for some Nissan Armada owners.

- Generic Policy Offerings: Some Nissan Armada owners might find the coverage options too generic, lacking specialization for specific needs.

#4 – AAA: Best for Online App

Pros

- Intuitive Online App: AAA offers a user-friendly online app that simplifies managing Nissan Armada insurance policies and claims.

- Substantial Multi-Vehicle Discount: Provides a 12% discount for Nissan Armada owners insuring more than one vehicle, enhancing affordability.

- Helpful Roadside Assistance: AAA’s renowned roadside assistance can be a valuable addition to Nissan Armada insurance, providing extra peace of mind. Learn more about AAA roadside assistance in our guide titled “AAA Car Insurance Review.”

Cons

- Membership Requirement: Requires a membership fee, which might increase overall costs for Nissan Armada insurance.

- Customer Service Variability: The quality of customer service can vary significantly, which might affect the insurance experience for some Nissan Armada owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for 24/7 Support

Pros

- Around-the-Clock Support: Erie provides 24/7 customer support, ensuring Nissan Armada owners have access to help whenever needed. Dive into our in-depth “Erie Car Insurance Review” to find the best policy for your needs.

- Highest Multi-Vehicle Discount: Offers a 17% discount for multi-vehicle policies, which is very attractive for households with more than one Nissan Armada.

- Local Agent Network: Extensive network of local agents provides tailored assistance and detailed coverage explanations for Nissan Armada insurance.

Cons

- No Online Quote System: Lacks an online quote system, which can inconvenience Nissan Armada owners accustomed to digital services.

- Premium Costs: While Erie offers significant discounts, base premium rates for Nissan Armada insurance might still be higher than some competitors.

#6 – Progressive: Best for Innovative Programs

Pros

- Usage-Based Savings: Progressive car insurance review offers the Snapshot program, which allows Nissan Armada owners to save on insurance based on driving behavior, ideal for cautious drivers.

- Loyalty Rewards: Progressive rewards long-term Nissan Armada customers with loyalty benefits, including decreasing deductibles and accident forgiveness.

- Comprehensive Coverage Options: Offers a wide range of coverage choices for the Nissan Armada, from standard liability to full comprehensive and collision.

Cons

- Complexity in Policy Customization: While offering many options, the customization process for Nissan Armada insurance can be complex and confusing for some.

- Inconsistency in Claim Satisfaction: Some Nissan Armada owners might experience inconsistencies in the claims process, affecting the perceived reliability of services.

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Travelers car insurance review offers accident forgiveness policies which can prevent premium increases after the first at-fault accident, beneficial for Nissan Armada owners.

- High Multi-Vehicle Discounts: A 14% discount for insuring multiple vehicles makes it cost-effective for families with more than one Nissan Armada.

- Superior Financial Rating: An A++ A.M. Best rating underscores Travelers’ strong capacity to meet Nissan Armada insurance liabilities.

Cons

- Limited Customization for Basic Plans: Basic insurance plans offer limited customization, which may not meet all Nissan Armada owners’ needs.

- Geographical Availability Issues: Coverage and discount availability can vary by location, affecting access to certain benefits for some Nissan Armada owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Add-on Coverages

Pros

- Wide Range of Add-on Options: Allstate car insurance review offers numerous add-ons like roadside assistance and new car replacement, enhancing the insurance package for Nissan Armada owners.

- Generous Multi-Vehicle Discount: A 16% discount for multiple vehicles benefits Nissan Armada owners with several cars.

- Superior Claims Service: Known for an efficient claims process, Allstate provides a streamlined experience for Nissan Armada insurance claims.

Cons

- Higher Premiums without Discounts: Premiums can be relatively high for Nissan Armada owners not qualifying for multiple discounts.

- Customer Service Inconsistency: Quality of customer service can vary, impacting the insurance experience for some Nissan Armada owners.

#9 – Farmers: Best for Local Agents

Pros

- High Multi-Vehicle Discount: Farmers car insurance review offers an 18% discount for customers who insure more than one vehicle, ideal for households with multiple Nissan Armadas.

- Fast Claims Service: Known for its efficient claims processing, ensuring quick and effective resolution for Nissan Armada insurance claims.

- Dedicated Customer Support: Farmers prioritizes customer support, providing dedicated help for inquiries and issues related to Nissan Armada insurance.

Cons

- Higher Base Premiums: Base rates for Nissan Armada insurance can be higher compared to some competitors, potentially offsetting discount benefits.

- Complexity in Policy Management: Some Nissan Armada owners might find the policy management and renewal process complicated.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Coverage: Liberty Mutual car insurance review offers one of the most customizable policy structures, allowing Nissan Armada owners to tailor their coverage to exact needs.

- Largest Multi-Vehicle Discount: Provides a 19% discount for insuring multiple vehicles, which is the highest among the top insurers, greatly benefiting Nissan Armada owners.

- Accident Forgiveness: Includes options like accident forgiveness which can prevent rate increases after the first accident, providing peace of mind for Nissan Armada owners.

Cons

- Policy Pricing Complexity: Some Nissan Armada owners may find the pricing structure complex, making it hard to understand the actual cost of their coverage.

- Selective Coverage Availability: Not all coverage features or discounts are available in every state, which may limit options for some Nissan Armada owners.

Nissan Armada Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

AAA $37 $156

Allstate $64 $114

Erie $50 $198

Farmers $51 $130

Geico $52 $178

Liberty Mutual $62 $198

Progressive $52 $174

State Farm $60 $157

Travelers $47 $213

USAA $77 $159

The table provided outlines monthly rates for both minimum and full coverage across various insurance companies for the Nissan Armada. For instance, AAA offers the lowest minimum coverage rate at $37, making it an affordable option for basic protection, while its full coverage rate stands at $156. In contrast, Travelers presents the highest full coverage rate at $213 but a more moderate minimum coverage rate at $47.

Notably, USAA, typically serving military families, has the highest minimum coverage rate at $77 but a reasonable full coverage rate of $159. Companies like Erie and Liberty Mutual are on the higher end for full coverage, both priced at $198, indicating premium services or additional features that might be included in their comprehensive plans.

Meanwhile, companies such as Allstate and Farmers offer a balance between affordability and extensive protection, with Allstate’s rates at $64 for minimum and $114 for full coverage, and Farmers at $51 and $130 respectively. This spread in pricing reflects the diverse offerings and value each company provides, catering to different insurance needs and preferences of Nissan Armada owners.

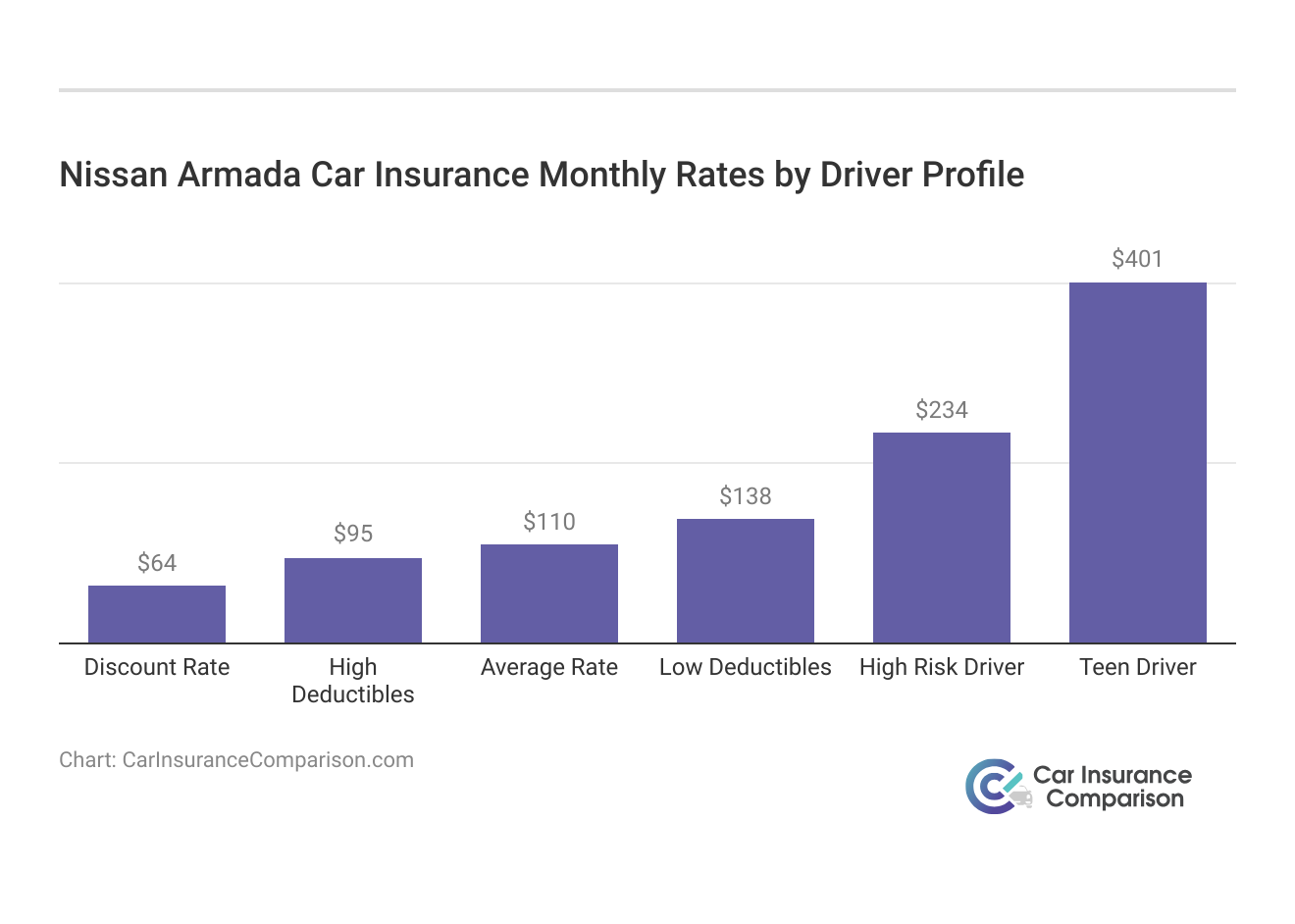

Nissan Armada Insurance Cost

The typical monthly cost for insuring a Nissan Armada averages out to $110. This figure represents the standard rate for auto insurance on this model. Such a cost is applicable to a general insurance plan covering the Nissan Armada. Get more details in our article titled “Best Nissan Car Insurance Rates.”

The average monthly insurance cost for a Nissan Armada is $110, with rates varying based on factors like deductible amount and driver risk profile. Comparing insurance rates for different scenarios such as high deductibles, average rates, low deductibles, high-risk drivers, and teen drivers can help owners find the most cost-effective coverage for their needs.

Understanding Insurance Costs for Nissan Armada

The chart below details how Nissan Armada insurance rates compare to other SUVs like the Jeep Wrangler, Toyota 4Runner, and Toyota Land Cruiser.

Nissan Armada Car Insurance Monthly Rates vs. Other Vehicles Coverage Level

Vehicle Comprehensive Collision Liability Full Coverage

Nissan Armada $26 $45 $28 $110

Jeep Wrangler $23 $31 $35 $105

Toyota 4Runner $28 $43 $28 $109

Toyota Land Cruiser $35 $65 $33 $146

Buick Enclave $29 $50 $31 $123

Jeep Cherokee $29 $52 $39 $137

Honda Pilot $28 $39 $31 $111

There are several strategies you can employ to secure the most affordable Nissan insurance rates online. Exploring these options can significantly reduce your premiums.

Read more: Compare Toyota Car Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Influencing Nissan Armada Insurance Rates

The cost of insuring a Nissan Armada is influenced by a variety of factors that insurance companies consider when determining premiums. The age of the vehicle is pivotal; newer models generally cost more to insure due to their higher market value and potentially higher repair costs, whereas older models may attract lower rates as they depreciate.

Driver age significantly impacts insurance costs, with younger, less experienced drivers facing higher premiums that typically decrease as they age and gain experience. Geographic location and driving history significantly impact insurance rates; premiums are higher in urban areas with greater traffic and theft risks, and a history of accidents or violations can increase costs, while a clean record may lower them.

Coverage level, credit scores, and safety features like airbags and anti-lock brakes influence the cost of Nissan Armada insurance, with more comprehensive coverage costing more. Understanding these factors can help owners secure lower rates. Get more info in our detailed report titled “Best Car Insurance Companies That Don’t Use Credit Scores.”

Age of the Vehicle

The average Nissan Armada car insurance rates are higher for newer models. For example, monthly car insurance rates for a 2018 Nissan Armada are approximately $110, while rates for a 2010 Nissan Armada are around $90, a difference of about $20 per month.

Nissan Armada Car Insurance Monthly Rates by Model Year & Coverage Type

Model Year Comprehensive Collision Liability Full Coverage

2024 Nissan Armada $28 $47 $27 $112

2023 Nissan Armada $28 $46 $27 $111

2022 Nissan Armada $27 $46 $27 $110

2021 Nissan Armada $27 $45 $28 $110

2020 Nissan Armada $26 $45 $28 $110

2019 Nissan Armada $26 $45 $28 $110

2018 Nissan Armada $26 $45 $28 $110

2017 Nissan Armada $25 $44 $30 $109

2015 Nissan Armada $23 $40 $31 $106

2014 Nissan Armada $22 $38 $32 $103

2013 Nissan Armada $21 $35 $32 $100

2012 Nissan Armada $20 $32 $33 $96

2011 Nissan Armada $19 $29 $33 $92

2010 Nissan Armada $18 $27 $33 $90

As demonstrated, Nissan Armada insurance rates generally decrease with the age of the vehicle, reflecting lower costs for older models as shown by the gradual reduction in premiums from 2018 to 2010.

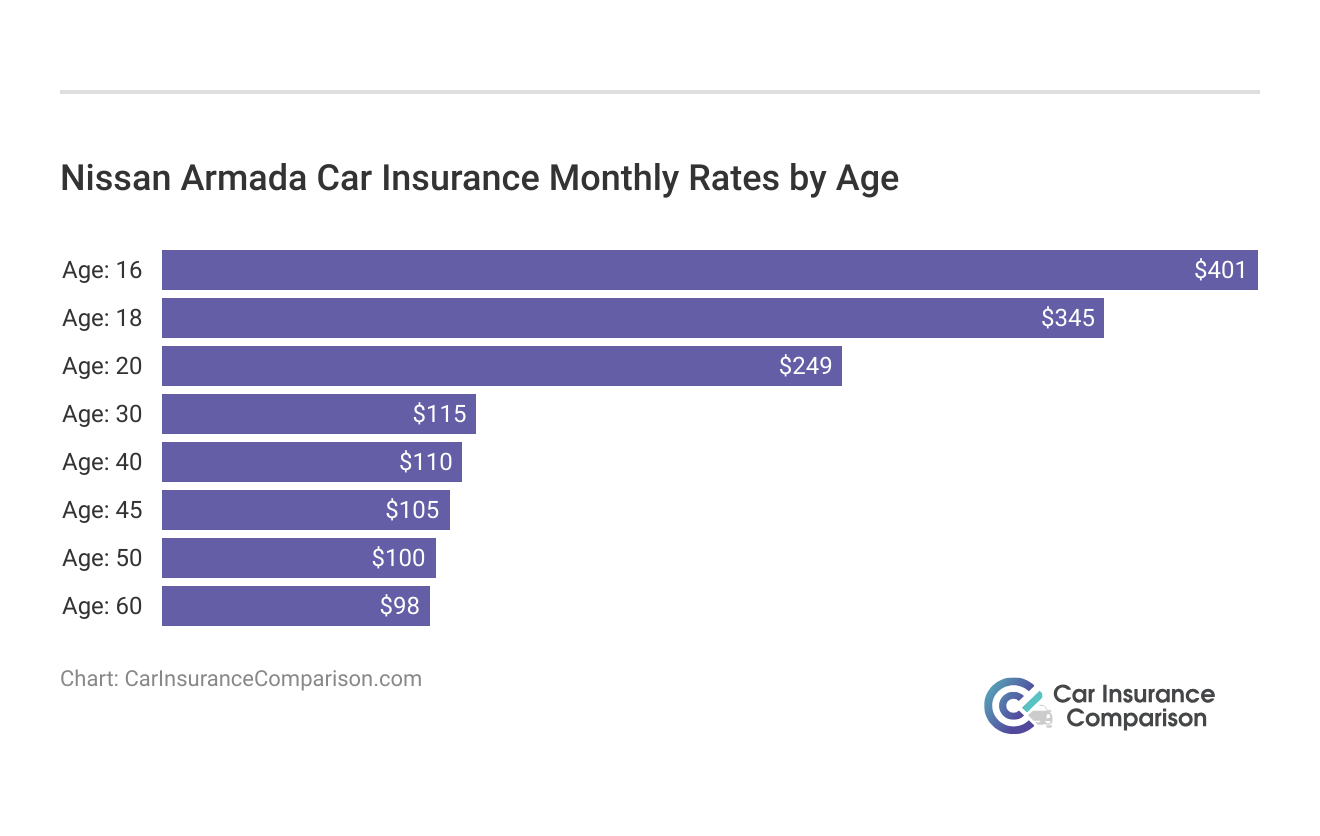

Driver Age

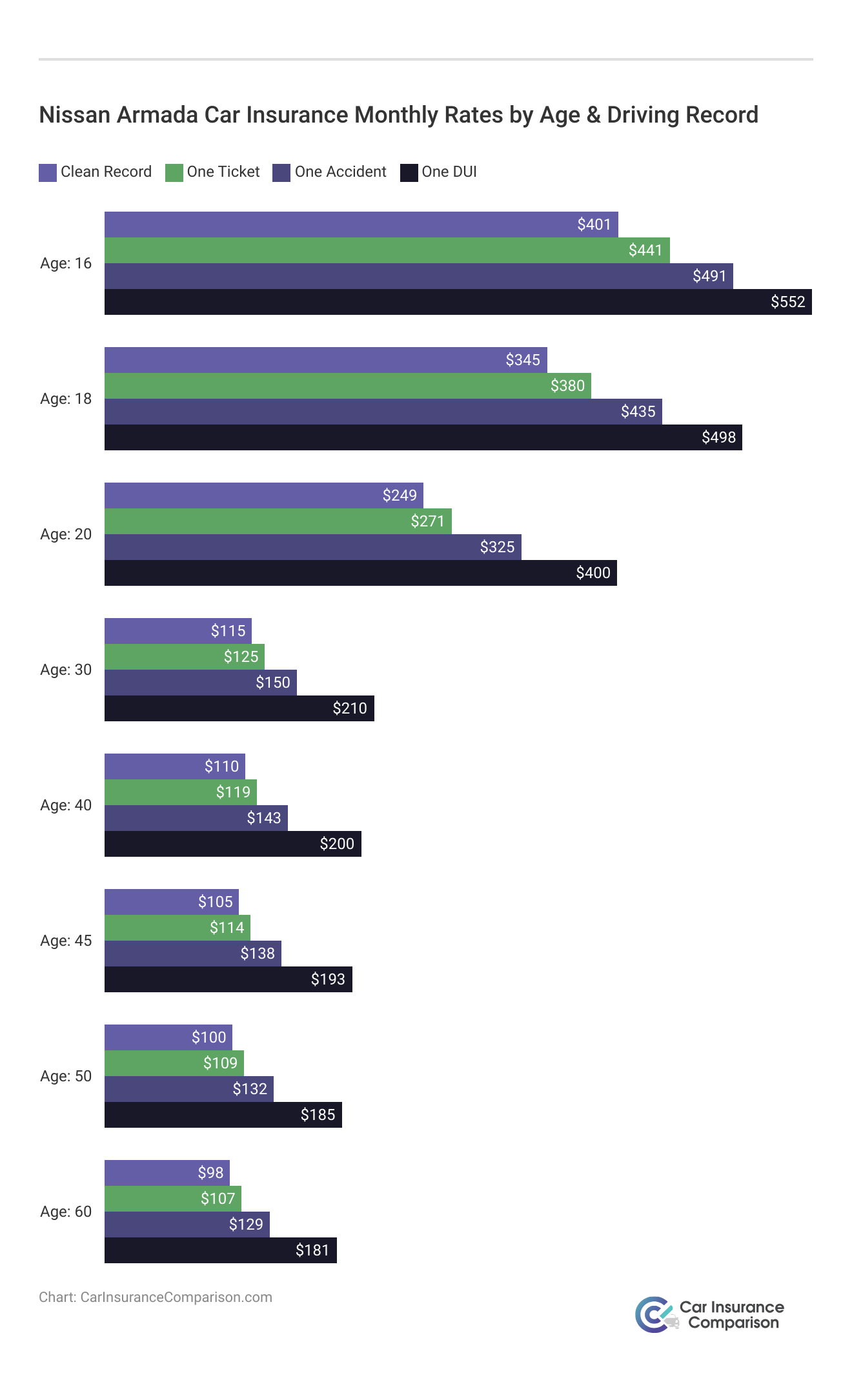

Driver age can have a significant effect on Nissan Armada car insurance rates. For example, 20-year-old drivers pay approximately $134 more for their Nissan Armada car insurance each month than 30-year-old drivers.

Driver age significantly impacts Nissan Armada insurance rates, with younger drivers typically paying more, reflecting their higher risk profile.

Driver Location

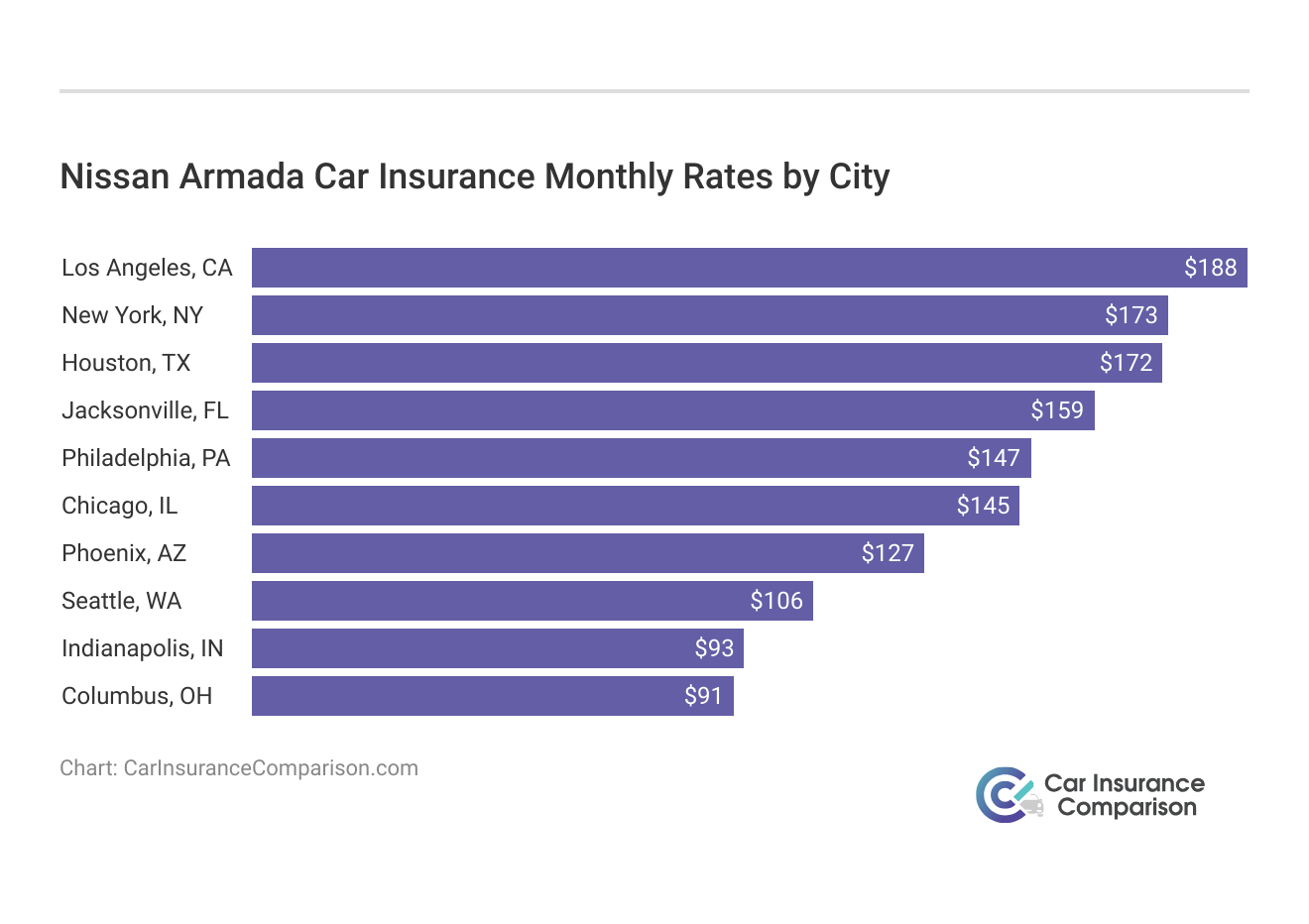

Where you live can have a large impact on Nissan Armada insurance rates. For example, drivers in Los Angeles may pay about $94 a month more than drivers in Indianapolis.

The geographic location significantly affects Nissan Armada insurance rates, with costs varying widely across U.S. cities, as drivers in places like Los Angeles and New York face much higher premiums than those in cities like Indianapolis and Columbus.

Your Driving Record

Your driving record can have an impact on the cost of Nissan Armada car insurance. Teens and drivers in their 20’s see the highest jump in their Nissan Armada car insurance rates with violations on their driving record.

A clean driving record significantly lowers Nissan Armada insurance costs, while teens and drivers in their 20s experience the steepest rate increases due to violations and accidents. Explore more coverage options in our guide titled “Best Car Insurance for Multiple Accidents.”

Nissan Armada Crash Test Ratings

The crash test ratings of the Nissan Armada can impact your Nissan Armada car insurance rates.

Nissan Armada Crash Test Ratings

Vehicle Tested Overall Frontal Side Rollover

2024 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2024 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

2023 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2023 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

2022 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2022 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

2021 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2021 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

2020 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2020 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

2019 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2019 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

2018 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2018 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

2017 Nissan Armada SUV RWD 4 stars 3 stars 5 stars 3 stars

2017 Nissan Armada SUV AWD 4 stars 3 stars 5 stars 3 stars

The consistent crash test ratings of the Nissan Armada, primarily achieving four stars overall, directly influence the insurance rates for this vehicle, reflecting its safety performance.

Nissan Armada Safety Features

The Nissan Armada safety features play a vital role in keeping passengers safe in crashes, but they can also help lower your Nissan Armada auto insurance rates. The Nissan Armada’s safety features include:

- Comprehensive Air Bag System

- Advanced ABS and Brake Assist

- Stability and Traction Control

- Essential Safety Features

- Signal Mirrors and Tow Tooks

The Nissan Armada’s robust safety features not only enhance passenger safety during crashes but also contribute to lowering insurance rates. Features such as a comprehensive air bag system, advanced braking technology, and stability controls are critical in mitigating risks and reducing potential insurance costs.

Nissan Armada Insurance Loss Probability

Review the Nissan Armada car insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury. The lower percentage means lower Nissan Armada auto insurance costs; higher percentages mean higher Nissan Armada auto insurance costs. Unlock details in our guide titled “Best Personal Injury Protection (PIP) Car Insurance.”

Nissan Armada Insurance Loss Probability

Category Probability

Collision -6%

Property Damage 4%

Comprehensive -7%

Personal Injury 6%

Medical Payment no data

Bodily Injury -13%

The loss probability rates for the Nissan Armada show that lower rates in collision, comprehensive, and bodily injury categories could reduce insurance costs, whereas higher rates in property damage and personal injury might increase premiums. These trends underscore the importance of evaluating specific loss probabilities when choosing insurance coverage for the Nissan Armada.

Nissan Armada Finance and Insurance Cost

When considering the purchase of a Nissan Armada, it’s essential to evaluate the combined financial implications of both financing and insuring this vehicle. Financing involves securing a loan to cover the cost of the SUV, with terms and interest rates varying based on factors like your credit score and the loan duration, typically between 36 to 72 months.

Insurance costs, on the other hand, depend on the level of coverage, your location, driving history, and the vehicle’s age, with full coverage recommended for financed vehicles to protect your investment. Explore more ways to save in our guide titled “Does the age of a car affect car insurance rates?”

Monthly expenses will therefore include both your loan payment and insurance premium, making it crucial to shop around for favorable loan terms and competitive insurance rates. By integrating these costs into your monthly budget, you can ensure a balanced financial plan that accommodates the ownership of a Nissan Armada without overextending your resources.

Ways to Save on Nissan Armada Insurance

There are several ways you can save even more on your Nissan Armada car insurance rates. Take a look at the following five tips:

- Get the Nissan Armada insurance coverage you need without including teen drivers.

- To reduce rental car expenses, contact your credit card issuer.

- It is important for young drivers living at home to be included to their parents’ insurance plan.

- Take a look at installing a tracker in your Nissan Armada.

- Every six months, you should review your Nissan Armada quote.

By implementing strategies such as excluding teen drivers from your policy, using credit card benefits for rental car expenses, adding young drivers to their parents’ insurance, installing a tracker, and regularly reviewing your Nissan Armada insurance quotes, you can significantly reduce your car insurance costs. See other discounts you may qualify for in our article titled “Best Car Insurance for Parents.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

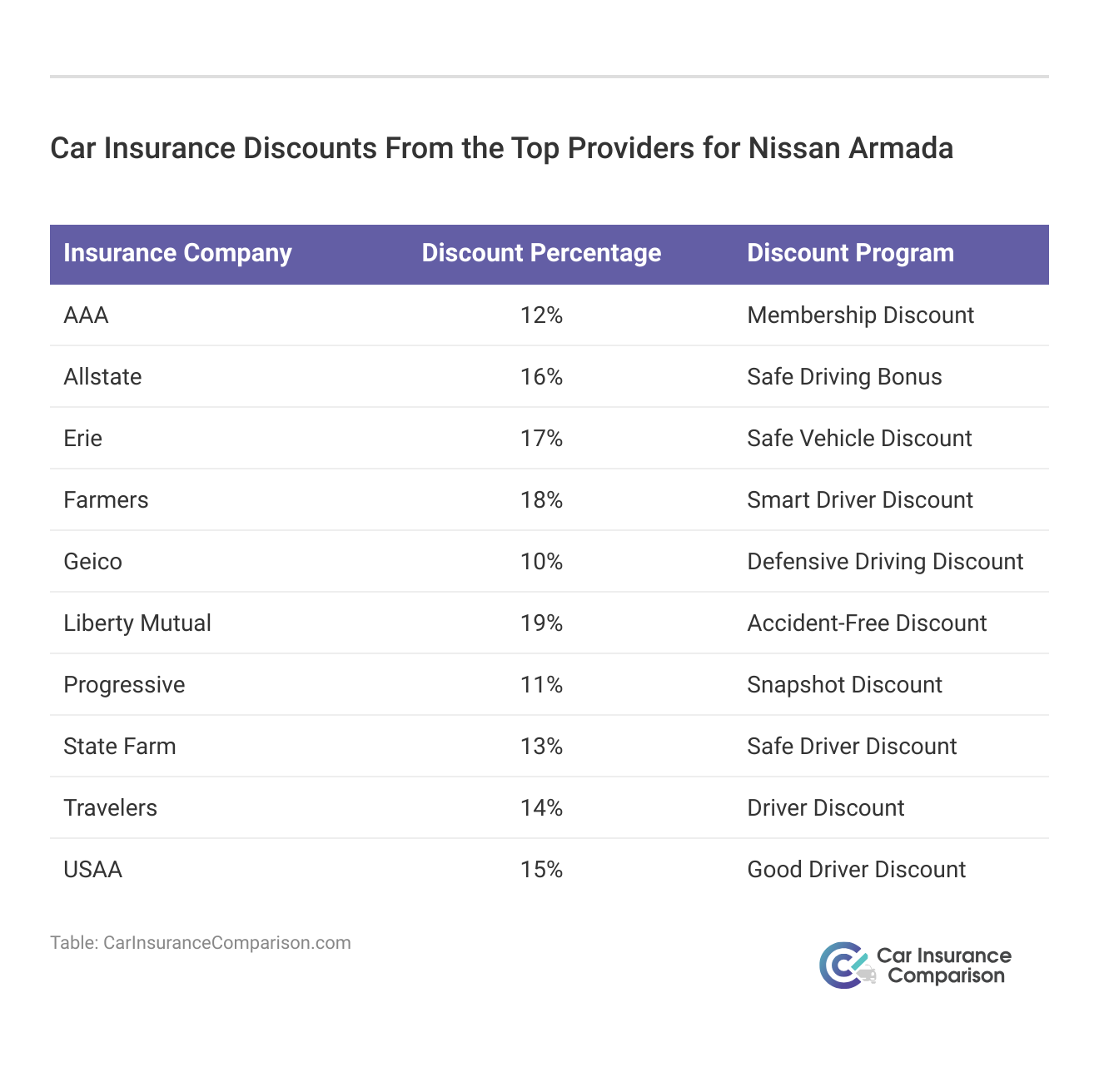

Top Nissan Armada Insurance Companies

Several top car insurance companies offer competitive rates for the Nissan Armada rates based on factors like discounts for safety features. Take a look at this list of top car insurance companies that are popular with Nissan Armada drivers organized by market share.

Top Nissan Armada Insurance Companies

Rank Insurance Company Premiums Written Market Share

#1 State Farm $65.6 million 9.3%

#2 Geico $46.1 million 6.6%

#3 Progressive $39.2 million 5.6%

#4 Liberty Mutual $35.6 million 5.1%

#5 Allstate $35 million 5%

#6 Travelers $28 million 4%

#7 USAA $23.4 million 3.3%

#8 Chubb $23.3 million 3.3%

#9 Farmers $20.6 million 2.9%

#10 Nationwide $18.4 million 2.6%

When selecting insurance for the Nissan Armada, it’s beneficial to consider top insurers like State Farm, Geico, and Progressive, which lead in market share and offer competitive rates. These companies are favored among Nissan Armada owners for their ability to provide tailored coverage options, including discounts for safety features, which can significantly lower premium costs.

By comparing these leading insurers based on their market presence and specific offerings for the Nissan Armada, drivers can find the best coverage to meet their needs while optimizing cost efficiency.

Compare Free Nissan Armada Insurance Quotes Online

Finding the right insurance for your Nissan Armada doesn’t have to be a daunting task. With a variety of insurers offering competitive rates and tailored coverage options, the best way to ensure you’re getting a good deal is to compare quotes.

State Farm leads with a competitive 9.3% market share, reflecting its strong customer trust and comprehensive coverage options for Nissan Armada owners.

Daniel Walker Licensed Insurance Agent

By entering your ZIP code below, you can access a comprehensive list of insurance quotes from top providers specifically for the Nissan Armada. This allows you to directly compare prices, coverage options, and special discounts, ensuring that you find a policy that fits your needs and budget perfectly. Explore more coverage options in our guide titled “Where to Find Car Insurance Company Reviews.”

Don’t miss out on the opportunity to save money and get the coverage that’s right for you—enter your ZIP code and start comparing Nissan Armada insurance quotes today.

Frequently Asked Questions

How much does Nissan Armada insurance cost?

On average, Nissan Armada insurance costs $110 per month. Monthly costs for comprehensive, collision, and liability insurance are approximately $27, $39, and $31, respectively.

Are Nissan Armadas expensive to insure?

Compared to other SUVs like the Jeep Wrangler, Toyota 4Runner, and Toyota Land Cruiser, Nissan Armadas have comparable insurance rates. However, there are ways to find the cheapest Nissan insurance rates online.

Access comprehensive insights into our guide titled “Best Jeep Car Insurance Rates.”

What factors impact the cost of Nissan Armada insurance?

Several factors can influence the cost of Nissan Armada insurance, including the age of the vehicle, driver age, driver location, and driving record. Newer models and younger drivers tend to have higher insurance rates.

How does the age of the vehicle affect Nissan Armada insurance rates?

Insurance rates for newer Nissan Armada models are generally higher compared to older models. For example, a 2018 Nissan Armada may have monthly insurance rates of approximately $110, while a 2010 Nissan Armada may have rates around $90.

Does driver age affect Nissan Armada insurance rates?

Yes, driver age can significantly impact Nissan Armada insurance rates. For example, 20-year-old drivers typically pay about $134 more per month for insurance compared to 30-year-old drivers.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your Nissan Armada.

Does driver location affect Nissan Armada insurance rates?

Yes, where you live can significantly affect Nissan Armada insurance rates. Drivers in areas like Los Angeles may pay about $94 more per month compared to drivers in Indianapolis.

Why is Nissan Armada insurance so high?

Nissan Armada insurance is high due to its large size, higher repair costs, and value, which increase risk and potential claim amounts.

Who is known for the cheapest Nissan Armada car insurance?

AAA is known for offering the cheapest Nissan Armada car insurance, with competitive rates starting as low as $37 per month.

Learn more by reading our guide titled “How do you get AAA car insurance quotes online?”

What is the most expensive Nissan Armada car insurance group?

The most expensive Nissan Armada car insurance group typically includes providers like Travelers, which offers extensive coverage but at higher rates.

Is Geico cheaper than Progressive for Nissan Armada car insurance?

Yes, Geico tends to be cheaper than Progressive for Nissan Armada car insurance, offering lower premiums for comparable coverage.

Is USAA insurance cheaper for Nissan Armada insurance?

Who has the lowest Nissan Armada insurance rates?

Is car insurance for Toyota cheaper than Nissan Armada?

What age is Nissan Armada car insurance most expensive?

Are newer Nissan Armada cars higher on insurance?

Why is Nissan Altima insurance so high?

What color car is the most expensive to insure for Nissan Armada?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.