Best Smart Fortwo Car Insurance in 2026 (Check Out the Top 10 Companies)

The best Smart Fortwo car insurance options come from State Farm, Erie and Geico, with starting rates at $40 per month. These insurers are known for their cheapest minimum coverage options, competitive rates, and excellent customer service, making them ideal choices for best Smart Fortwo car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated September 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Smart Fortwo

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Lincoln Navigator

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Lincoln Navigator

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsLeading choices for insuring best Smart Fortwo car insurance are State Farm, Erie and Geico, with rates starting at just $40 per month.

Remember that car insurance is a business based on a certain risk-to-reward ratio. In other words, your car insurance company is rewarded by profits when it invests the money from your premiums in a number of financial vehicles.

Our Top 10 Company Picks: Best Smart Fortwo Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% | B | Many Discounts | State Farm | |

| #2 | 15% | A+ | 24/7 Support | Erie |

| #3 | 10% | A++ | Custom Plan | Geico | |

| #4 | 12% | A | Local Agents | Farmers | |

| #5 | 14% | A+ | Add-on Coverages | Allstate | |

| #6 | 11% | A | Online App | AAA |

| #7 | 18% | A+ | Innovative Programs | Progressive | |

| #8 | 9% | A+ | Usage Discount | Nationwide |

| #9 | 7% | A | Customizable Polices | Liberty Mutual |

| #10 | 13% | A++ | Military Savings | USAA |

At the same time, the company risks losing all of your premium money, plus the profit it has earned if an accident should ever cause you have filling car insurance claim.

Now gives you instant access to the best online car insurance quotes! Entering your ZIP code.

- Smart Fortwo insurance rates can be hard to find due to the U.S. market

- The Fortwo is Smart’s second model from Daimler AG, who owns Mercedes-Benz

- Smart Fortwos are city cars designed for the driver and one passenger

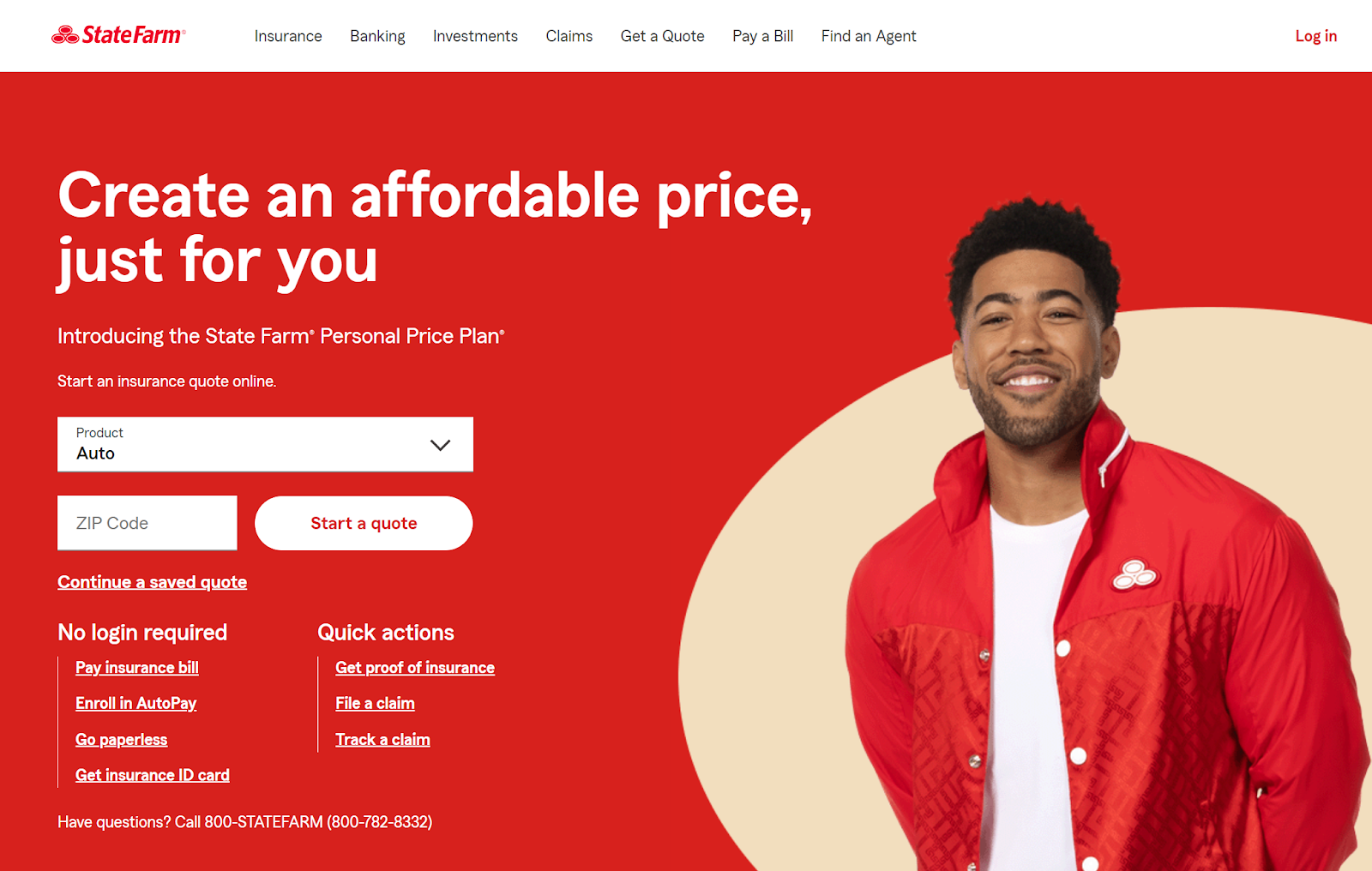

#1 – State Farm: Top Overall Pick

Pros

- Exceptional Customer Service: State Farm is renowned for its superior customer support and efficient claims processing. They consistently receive high ratings for handling inquiries and claims smoothly.

- Diverse Coverage Options: Offers a broad selection of coverage plans, including liability, collision, and comprehensive, which makes it a versatile choice for the best Smart Fortwo car insurance.

- Nationwide Availability: Accessible across all states, making it a convenient option for many seeking the best Smart Fortwo car insurance. Read more in our “State Farm Car Insurance Review.”

Cons

- Potentially Higher Premiums: Rates might be more expensive compared to some competitors, especially in urban areas where the risk is higher.

- Basic Digital Tools: Their online and app features are less advanced compared to some insurers, which may affect the convenience of managing your policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie provides continuous customer service, available day and night for claims and support. This is ideal for ensuring you get help whenever needed with the best Smart Fortwo car insurance.

- Cost-Effective Premiums: Known for offering competitive rates, Erie’s premiums are often lower, making it a budget-friendly choice for Smart Fortwo insurance.

- Comprehensive Coverage: Provides a range of insurance options, including roadside assistance, which can enhance your coverage for the Smart Fortwo. Read it more in Erie car insurance review.

Cons

- Regional Limitations: Erie’s availability is limited to certain states, which might be a drawback if you relocate to a state where they don’t operate.

- Mixed Online Reviews: Some customers have reported issues with online claims processing, which could be a concern for those who prefer digital management.

#3 – Geico: Best for Custom Plan

Pros

- Affordable Premiums: Known for its low-cost insurance, Geico’s competitive rates are attractive for those looking to insure their Smart Fortwo without breaking the bank.

- Advanced Digital Tools: Features a robust app and online platform for managing your policy, making it easy to handle all aspects of your Smart Fortwo insurance, which you can learn about in our “Geico Car Insurance Review.”

- Financial Stability: Geico has strong ratings for financial stability, ensuring reliability in handling your claims and coverage.

Cons

- Variable Customer Service: Customer service quality can vary by location, which might impact your experience with the best Smart Fortwo car insurance.

- Limited Local Agent Access: Fewer options for face-to-face interactions with agents could be a downside for those who prefer personalized assistance.

#4 – Farmers: Best for Local Agents

Pros

- Local Agent Network: Farmers has a vast network of local agents who offer personalized service, which can be beneficial for obtaining the best Smart Fortwo car insurance tailored to your needs.

- Reputable Claims Support: Known for effectively managing claims, Farmers ensures a smooth process if you need to file a claim. Find out more in our “Farmers Car Insurance Review.”

- Educational Resources: Offers valuable resources and advice, which can help you understand and optimize your coverage for the Smart Fortwo.

Cons

- Higher Premiums: Insurance rates may be higher compared to some other providers, potentially making it less affordable for some customers.

- Discount Variability: Availability of discounts can differ based on your location, affecting how much you can save on the best Smart Fortwo car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Add-on Coverages

Pros

- User-Friendly App: Features a well-designed app and online portal that makes managing your insurance easy and efficient. Learn more in our “Allstate Car Insurance Review.”

- Local Agent Network: Availability of local agents for personalized support can help tailor your Smart Fortwo coverage to your specific needs.

- Comprehensive Insurance Options: Allstate offers a wide range of insurance products beyond auto, providing a one-stop solution for all your insurance needs.

Cons

- Higher Premiums: Rates can be higher compared to some competitors, which might be a drawback if you’re looking for the most cost-effective Smart Fortwo insurance.

- Customer Service Issues: Some customers have reported mixed experiences with claims and customer service, which could impact your satisfaction.

#6 – AAA: Best for Online App

Pros

- Roadside Assistance: Renowned for its top-notch roadside assistance services, which can be a significant advantage for Smart Fortwo drivers.

- Member Discounts: Provides exclusive discounts to AAA members, making it an attractive option for those who are already members. Read it more on AAA car insurance review.

- Strong Reputation: Known for high customer satisfaction and a solid overall reputation in the insurance industry.

Cons

- Membership Requirements: Insurance is often limited to AAA members, which might not be ideal for those outside the AAA network.

- Potentially Higher Rates: Premiums may be higher for non-members compared to other insurance providers, which could affect affordability.

#7 – Progressive: Best for Innovative Programs

Pros

- Innovative Programs: Offers unique programs like Snapshots, which rewards safe drawing habits and can potentially lower your Smart Fortwo insurance rates.

- Advanced Online Tools: Features a user-friendly app and online tools for easy policy management and quote comparisons.

- Flexible Payment Plans: Provides various payment options, allowing you to choose a plan that fits your budget. For a complete list, read our “Progressive Car Insurance Review.”

Cons

- Inconsistent Customer Service: Quality of customer service can vary based on location, potentially affecting your experience with the best Smart Fortwo car insurance.

- Policy Complexity: The range of options and add-ons might be overwhelming for some, making it difficult to choose the right coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Usage Discount

Pros

- Comprehensive Coverage Options: Includes a range of coverage plans and benefits, such as new car replacement and accident forgiveness.

- Strong Financial Ratings: Known for high financial stability ratings, ensuring reliable coverage and claims handling.

- Good Customer Support: Generally, receives positive feedback for customer service and support, which you can read more about in our “Review of Allstate vs. Nationwide.”

Cons

- Discount Availability: Discounts and benefits might vary depending on your location, which could impact your savings on Smart Fortwo insurance.

- Higher Premiums for Some: Rates may be higher for certain drivers, affecting affordability for those seeking the best Smart Fortwo car insurance.

#9 – Liberty Mutual: Best for Customizable Polices

Pros

- Competitive Rates: Known for offering competitive pricing and various discount options to make insurance more affordable, which you can check out in our “Liberty Mutual Car Insurance Review.”

- Advanced Digital Tools: Features a robust app and online portal for managing your policy efficiently.

- Good Customer Feedback: Generally, receives positive reviews for customer service and support.

Cons

- Fluctuating Premiums: Insurance rates can vary based on location and driving history, potentially affecting overall cost.

- Regional Variability: Availability and service quality may differ by region, impacting your experience with Smart Fortwo insurance.

#10 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: Offers substantial discounts for military members and their families, making it a top choice for the best Smart Fortwo car insurance in this group.

- Outstanding Customer Service: Highly rated for customer satisfaction and claims handling, ensuring a positive experience, which is covered in our “USAA Car Insurance Review.”

- Comprehensive Coverage: Includes a range of coverage options and additional benefits tailored to the needs of military families.

Cons

- Eligibility Restrictions: Insurance is only available to military members, veterans, and their families, limiting access for others.

- Limited Non-Military Options: May not be the best choice for those outside the military community, as coverage and benefits are tailored specifically to this group.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Evaluating the Smart Fortwo

One of the biggest concerns of the Smart Fortwo in the U.S. market revolves around safety issues. The car did fairly well in its first round of crash tests, giving Smart USA a glimmer of hope that the car was safer than most critics claimed.

However, those tests were done using other cars of similar size and weight.

Smart Fortwo Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $174 |

| $68 | $199 | |

| $58 | $177 |

| $40 | $125 | |

| $69 | $216 | |

| $69 | $218 |

| $85 | $241 |

| $64 | $193 | |

| $50 | $141 | |

| $58 | $171 |

When the Fortwo was tested against larger cars, it did very poorly.

Because the car is so small and lightweight, the second round of testing revealed the possibility of significant injury to any occupants when involved in an accident with a larger vehicle.

The dashboard, steering wheel, and pedals posed significant risk to the driver to the point that fatalities became a real concern.

From an insurance perspective, the safety results tell car insurance companies that the risk posed by the Smart Fortwo is very high.

Coverage Options for the Smart Fortwo

Few auto insurance providers, if any, preclude Smart Fortwo owners from getting coverage. It is important to note that the Smart Fortwo is an Italian car, which means that this vehicle was debuted in Europe before it was sold in the U.S.

Therefore, car insurance companies in other countries might rate the Smart Fortwo differently than insurance providers based in the U.S.

When consumers first go to apply for car insurance quotes, they are asked to supply the vehicle’s make and model or vehicle identification number before they can proceed.

You would immediately known if a car insurance company does not offer insurance on the Smart Fortwo because you would not be able to get information on rates.

Some auto insurance providers specialize in providing best car insurance for Japanese imports, sports cars, or vehicles considered to be a high insurance risk.

Even if you happen to come across a company that does not extend coverage for the Smart Fortwo, you will probably find that this is the exception and not the rule.

In choosing coverage price may matter, it is better to get a car insurance that offers cheapest but best in the quality at the same time. Looking at State Farm, Erie and Geico, you may learn that top provider may help you to save more.

Enter your ZIP code now.

Qualities That Positively Affect Car Insurance Rates for the Smart Fortwo

In terms of collision vs comprehensive what is the difference, one of the things the Fortwo has going for it is that its repair and replacement costs would be relatively low.

Add to that the fact that these cars are still somewhat of a novelty, which keeps their Blue Book value high, and you have a scenario in which a car insurance company could consider the vehicle a total loss and still get by with a reasonable payout.

The car’s small size and light weight frame reduce the potential for property damage in some accidents.

A heavier, full-size sedan might cause significant property damage if it jumps the curb and ends up in someone’s yard, the Smart Fortwo is less likely to do such severe damage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cost Comparison: Insuring a Smart Fortwo vs. Other Vehicles

According to the Insurance Institute for Highway Safety, the 2011 Smart Fortwo has an all around “good” safety rating. The crash and safety tests conducted showed that the Smart Fortwo stood up well during impact.

Smart cars can become significantly damaged during impact, especially when driven at high speeds.

Schimri Yoyo Licensed Agent & Financial Advisor

Smart Fortwo drivers that do a lot of highway driving might be more at risk of being involved in dangerous accidents than those that live in more suburban settings.

Overall, Smart Fortwo owners likely get lower insurance quotes than the owners of larger vehicles because of the Fortwo’s size, price, and functionality. Insurance company that has a best offer for Smart Fortwo are State Farm, Erie and Geico. Enter your ZIP code now to begin comparing.

Frequently Asked Questions

What factors affect the insurance rates for a Smart Fortwo car?

Several factors can influence the insurance rates for a Smart Fortwo car, including the driver’s age, driving history, location, annual mileage, coverage options, deductible amount, and the car’s model year and value.

Is car insurance more expensive for a Smart Fortwo compared to other vehicles?

Car insurance rates can vary depending on several factors, including the make and model of the vehicle. While the Smart Fortwo is a compact car, it does have unique characteristics that can impact insurance rates. Enter your ZIP code now.

Are Smart Fortwo cars expensive to insure?

Are there any specific coverage options or discounts available for insuring a Smart Fortwo?

How can I find the best insurance rates for a Smart Fortwo?

To find the best insurance rates for a Smart Fortwo, it is recommended to gather quotes from multiple insurance providers. You can either contact insurance companies directly or use online comparison tools to obtain and compare quotes. Enter your ZIP code now.

What coverage options are typically recommended for a Smart Fortwo?

Liability, collision, comprehensive, and possibly uninsured motorist coverage. See our top-rated providers in best low-mileage car insurance.

How does the cost of insurance for a Smart Fortwo compare to other small cars?

Insurance is usually lower due to the car’s small size and low repair costs.

Are there discounts available for Smart Fortwo owners?

Yes, discounts may be available for low mileage, safe driving, and sometimes specifically for the Smart Fortwo. Enter your ZIP code now.

What factors should be considered when choosing an insurance provider?

Customer service, claims process, coverage options, and additional benefits. For a comprehensive analysis, refer to our detailed guide on how traffic infractions affect car insurance.

How does driving profile affect the insurance premium?

Urban driving and frequent use generally increase premiums, while rural driving and occasional use may lower them.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.