Best Toyota Prius Car Insurance in 2026 (Compare the Top 10 Companies)

For the best Toyota Prius car insurance, consider Progressive, Allstate, and Travelers, with rates around $80/mo. These insurers are recognized for their competitive pricing, comprehensive coverage, and dependable customer service, making them excellent options for those seeking insurance for their Toyota Prius.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business own...

Laura Kuhl

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated November 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Toyota Prius

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Toyota Prius

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Toyota Prius

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviewsProgressive, Allstate, and Travelers offer top Toyota Prius car insurance, starting at $80/month, with competitive pricing and excellent coverage.

We’ll help you learn all about auto insurance for the Toyota Prius and how to get cheap car insurance with excellent coverage.

Our Top 10 Company Picks: Best Toyota Prius Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Wide Coverage | Progressive | |

| #2 | 25% | A+ | Competitive Rates | Allstate | |

| #3 | 8% | A++ | Local Agents | Travelers | |

| #4 | 20% | B | Strong Discounts | State Farm | |

| #5 | 25% | A++ | Low Prices | Geico | |

| #6 | 25% | A | Flexible Options | Safeco | |

| #7 | 10% | A++ | Military Benefits | USAA | |

| #8 | 10% | A+ | Customer Service | Erie |

| #9 | 20% | A | Comprehensive Policies | American Family | |

| #10 | 25% | A | Discount Opportunities | Liberty Mutual |

Is the Toyota Prius cheap to insure? If you found yourself wondering about Toyota Prius car insurance rates, you aren’t alone.

Using our free online comparison tool, you can now compare quotes for Toyota Prius car insurance rates from some of the best companies.

- Monthly Toyota Prius insurance rates start at $80 per month

- Some insurers offer discounts for Prius owners

- The Prius excels in crash tests

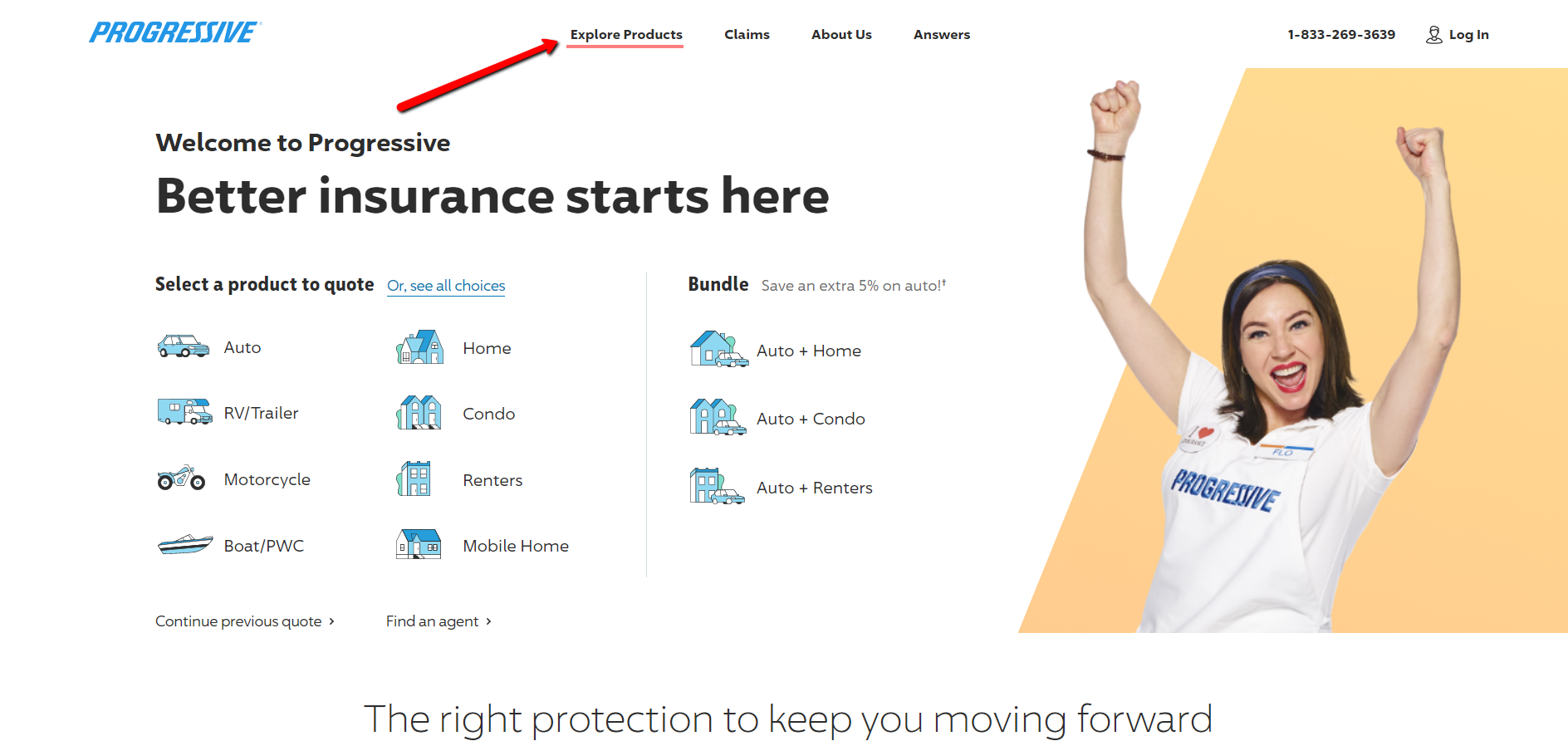

#1 – Progressive: Top Overall Pick

Pros

Pros

- Affordable Rates: Known for providing competitive prices, it is a strong contender for the best Toyota Prius car insurance. This can help you save on monthly premiums.

- Comprehensive Coverage Options: This company offers extensive coverage plans, including options tailored to hybrid vehicles like the Prius. Read more in our Progressive car insurance review.

- User-Friendly App: The Progressive app provides easy access to policy management, which can be valuable for managing the best Toyota Prius car insurance.

Cons

- Customer Service Issues: Some users report challenges with customer service, which can affect the overall experience with the best Toyota Prius car insurance.

- Higher Rates for Certain Drivers: Higher rates may be offered for drivers with less favorable profiles. It could impact affordability for some drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Competitive Rates

Pros

Pros

- Comprehensive Coverage Options: Allstate offers extensive coverage choices, making it a strong contender for the best Toyota Prius car insurance.

- Safe Driving Rewards: Provides programs that reward safe driving, which can benefit those with a clean driving record. Learn more in our Allstate car insurance review.

- Robust Claim Handling: Known for effective and fair claim handling processes. Provides reliable support in the event of a claim.

Cons

- Higher Premiums: Some other providers may charge higher premiums, so it may not be the most cost-effective option.

- Limited Discounts for Hybrid Vehicles: Discounts for hybrid cars like the Prius might be less significant, which could affect overall affordability.

#3 – Travelers: Best for Local Agents

Pros

Pros

- Local Agents: This option offers access to local agents who provide personalized advice and support, making it easier to address specific needs and concerns.

- Flexible Coverage Options: This policy allows a range of coverage choices tailored to individual needs, ensuring you get the protection that suits your lifestyle.

- Strong Financial Stability: Known for its solid financial backing, ensuring reliability in coverage and peace of mind about claim payments. Read more in our Travelers car insurance review.

Cons

- Customer Service Variability: Service quality can vary, which might affect your overall experience with the best Toyota Prius car insurance.

- Higher Rates for Newer Models: Insurance rates for newer Prius models may be higher, impacting the cost-effectiveness of coverage for recent model years.

#4 – State Farm: Best for Strong Discounts

Pros

Pros

- Excellent Customer Service: Highly praised for personalized support and assistance, contributing to a positive insurance experience.

- Local Agents: Provides face-to-face interactions with local agents, which can enhance the customer experience with personalized advice.

- Wide Range of Discounts: Offers various discounts that can help reduce insurance premiums, making it a cost-effective option. Read more in our State Farm car insurance review.

Cons

- Higher Rates for Some Drivers: Certain demographics may face elevated rates, which could make it less affordable for high-risk individuals.

- Limited Online Tools: Some competitors’ online tools and resources may not be as advanced as others, potentially impacting the ease of policy management.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Low Prices

Pros

Pros

- Low Premiums: Known for some of the lowest rates, it is a strong choice for budget-conscious drivers seeking the best Toyota Prius car insurance.

- Discount Opportunities: The program provides numerous discounts that can help lower overall insurance costs, including for safe driving and low mileage.

- Strong Financial Stability: Offers peace of mind with solid financial backing, ensuring reliability in coverage and claims. Learn more in our Geico car insurance review.

Cons

- Limited Coverage Options: This may not offer as many add-on options, which can limit the customization of your policy to fit specific needs.

- Claims Process Complaints: Some users report dissatisfaction with the claims process, which could lead to potential delays or issues with receiving compensation.

#6 – Safeco: Best for Flexible Options

Pros

Pros

- Flexible Coverage Options: Provides a variety of coverage plans tailored to your needs, allowing for customization based on personal requirements.

- Competitive Pricing: Offers competitive rates for hybrid vehicles like the Prius, helping to keep insurance costs manageable. Read more in our Safeco car insurance review.

- Good Customer Service: Known for reliable support and efficient claim handling, contributing to a positive overall experience.

Cons

- Limited Discounts: Fewer discount opportunities compared to some competitors, which might affect overall affordability.

- Inconsistent Regional Availability: Coverage and service quality may vary by location, potentially impacting the customer experience in certain areas.

#7 – USAA: Best for Military Benefits

Pros

Pros

- Exceptional Rates for Military Members: USAA is highly rated for offering great rates to military members, including coverage for the best Toyota Prius car insurance.

- Outstanding Customer Service: Known for excellent customer service, offering a superior experience. Ensures high satisfaction. Read more in our USAA car insurance review.

- Comprehensive Coverage Options: Offers extensive coverage plans suited to various needs. Allows for customized insurance solutions.

Cons

- Eligibility Limitations: Available only to military members and their families. It is not an option for non-military individuals.

- Less Competitive for Non-Members: Rates may not be as competitive for those outside the military community. Limited appeal for general consumers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Customer Service

Pros

Pros

- Excellent Customer Service: Highly rated for providing outstanding customer support and enhancing the overall insurance experience.

- Comprehensive Coverage: Offers a wide range of policy options tailored to individual needs, ensuring thorough protection.

- Competitive Rates: This company provides competitive pricing for Prius owners, helping to keep insurance costs in check. Learn more in our Erie car insurance review.

Cons

- Limited National Presence: Not available in all states, which may limit access for some potential customers.

- Higher Rates for New Drivers: Higher rates may be offered for new or less experienced drivers, impacting affordability for younger drivers.

#9 – American Family: Best for Comprehensive Policies

Pros

Pros

- Comprehensive Policies: This company provides extensive policy options covering various insurance needs, ensuring thorough protection for your Prius. Learn more in our American Family car insurance review.

- Robust Customer Support: Known for good customer service, contributing to a positive insurance experience.

- Flexible Coverage Options: These options allow for customization based on individual requirements, helping to tailor your policy to your specific needs.

Cons

- Higher Premiums for Some Drivers: Premiums may be higher for drivers with certain risk profiles, potentially impacting overall affordability.

- Limited Discounts: Fewer discount opportunities compared to some competitors, which might affect the overall cost of insurance.

#10 – Liberty Mutual: Best for Discount Opportunities

Pros

Pros

- Discount Opportunities: Offers numerous discounts that can help lower insurance costs, including for bundling multiple policies.

- Comprehensive Coverage Options: Provides a range of coverage plans that can be customized to fit individual needs. Read more in our Liberty Mutual car insurance review.

- Good Customer Service: Known for practical support and claim handling, ensuring a positive experience with their services.

Cons

- Higher Rates for Some Drivers: Rates may be higher for drivers with less favorable profiles, potentially impacting affordability.

- Limited Local Agents: Fewer local agents may be available for personalized service, which could affect the level of individual support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Toyota Prius Insurance Cost

The auto insurance rate for age and gender for a Toyota Prius is approximately $1,306, which translates to about $109 per month. However, this estimate can vary based on several factors, including the driver’s location, age, driving history, and the level of coverage selected.

Toyota Prius Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $247 | |

| $94 | $235 | |

| $90 | $220 |

| $80 | $200 | |

| $96 | $240 |

| $90 | $225 | |

| $92 | $225 | |

| $88 | $215 | |

| $85 | $290 | |

| $85 | $210 |

The table above shows that Progressive, Allstate, and Travelers offer the best Toyota Prius car insurance with low rates and can meet your needs.

Additionally, factors like the Prius model year, safety features, and the insurance provider’s specific pricing structure can influence the overall cost.

Toyota Prius Insurance Costs

The chart below illustrates how insurance rates for the Toyota Prius compare with those of other hybrid and electric vehicles, including the Lexus GS 450h, Chrysler Pacifica Hybrid, and Ford Fusion Energi.

Toyota Prius Car Insurance Monthly Rates by Vehicle

| Vehicle | Liability | Comprehensive | Collision | Full Coverage |

|---|---|---|---|---|

| Toyota Prius | $26 | $27 | $44 | $109 |

| Lexus GS 450h | $33 | $33 | $65 | $144 |

| Chrysler Pacifica Hybrid | $28 | $31 | $55 | $125 |

| Ford Fusion Energi | $31 | $28 | $52 | $124 |

| Buick LaCrosse | $28 | $27 | $47 | $113 |

| Chevrolet Volt | $33 | $31 | $65 | $142 |

| Ford Fusion Hybrid | $39 | $27 | $55 | $137 |

This comparison reveals variations in insurance costs based on factors such as vehicle type, luxury status, and overall safety features, providing a clearer understanding of how the Prius’ insurance premiums compare to those of its counterparts.

Car Insurance Discounts From the Top Providers for Toyota Prius

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, Early Signing, Good Student | |

| Safe Driver, Multi-Policy, Good Student, Early Signing | |

| Multi-Policy, Safe Driver, Good Student, Early Signing |

| Safe Driver, Multi-Policy, Good Student, Anti-Theft | |

| Multi-Policy, Safe Driver, Early Signing, Anti-Theft |

| Multi-Policy, Safe Driver, Good Student, Pay-in-Full | |

| Safe Driver, Multi-Policy, Early Signing, Pay-in-Full | |

| Safe Driver, Multi-Policy, Defensive Driving, Good Student | |

| Multi-Policy, Safe Driver, Anti-Theft, Good Student | |

| Safe Driver, Multi-Policy, Good Student, Military |

However, there are a few things you can do to find the cheapest Toyota insurance rates online. For example, you can visit a car insurance comparison site.

Factors Influencing the Cost of Toyota Prius Insurance

The trim and model of your Toyota Prius significantly affect the total price you will pay for insurance coverage. Higher trim levels and newer models often come with more advanced features and higher repair costs, which can lead to increased insurance premiums.

Additionally, hybrid models may have higher insurance rates due to the specialized parts and repair requirements associated with hybrid technology.

Toyota Prius Finance and Insurance Cost

If you are financing a Toyota Prius, most lenders will require you to carry higher coverages, including comprehensive coverage. Be sure to compare Toyota Prius car insurance rates from the best full-coverage car insurance companies using our free comparison tool below.

How much is a Prius? That depends on the year and trim level. The question of how much a Toyota Prius does cost depends on many factors.

Who is the best car insurance company for Toyota auto insurance? While the actual rates you pay will depend on many factors, here are some of the top companies offering Toyota Prius auto insurance coverage (ordered by market share).

Top Toyota Prius Monthly Car Insurance Provider by Premiums Written

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $66,153,063 | 9% | |

| #2 | $46,358,896 | 6% | |

| #3 | $41,737,283 | 6% | |

| #4 | $39,210,020 | 5% | |

| #5 |  | $36,172,570 | 5% |

| #6 | $28,786,741 | 4% | |

| #7 | $24,621,246 | 3% | |

| #8 | $24,199,582 | 3% | |

| #9 | $20,083,339 | 3% | |

| #10 |  | $18,499,967 | 3% |

Based on the table above, State Farm, Geico, and Progressive have the highest market share, which means they offer the best Toyota Prius car insurance and will ensure your safety.

Many of these companies offer discounts for security systems and other safety features that the Toyota Prius provides.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Toyota Prius Insurance Quotes Online

Start comparing Toyota Prius auto insurance quotes for free by using our free online comparison tool.

The cost of insurance is an important consideration when purchasing a new car. Once the decision has been made to buy a Toyota Prius, a common question is the relationship of car insurance rates for hybrid cars.

Though each car insurance company is different, there are some trends in the Toyota Prius’s insurance rates. Several other features can also earn significant discounts on auto insurance rates.

Finding the Cheapest Toyota Prius Car Insurance Rates

It may not be in your best interests to run to a company that offers a 10% hybrid discount. Insurance costs for your Prius could be lower with another company that offers other car insurance discounts.

Shopping around is easy with our free tool. Also, ask for recommendations so that you are not stuck with a cheap policy with no service.Kristen Gryglik Licensed Insurance Agent

Enter your ZIP code to start finding and comparing free Toyota Prius auto insurance quotes online now. This quick process allows you to explore various coverage options tailored to your needs and budget.

Frequently Asked Questions

How can I compare car insurance rates for a Toyota Prius?

To compare car insurance rates for a Toyota Prius, reach out to various insurance companies directly for quotes or use their online tools.

You can also use online comparison platforms to easily compare quotes from multiple insurers and find the best rate for your Toyota Prius.

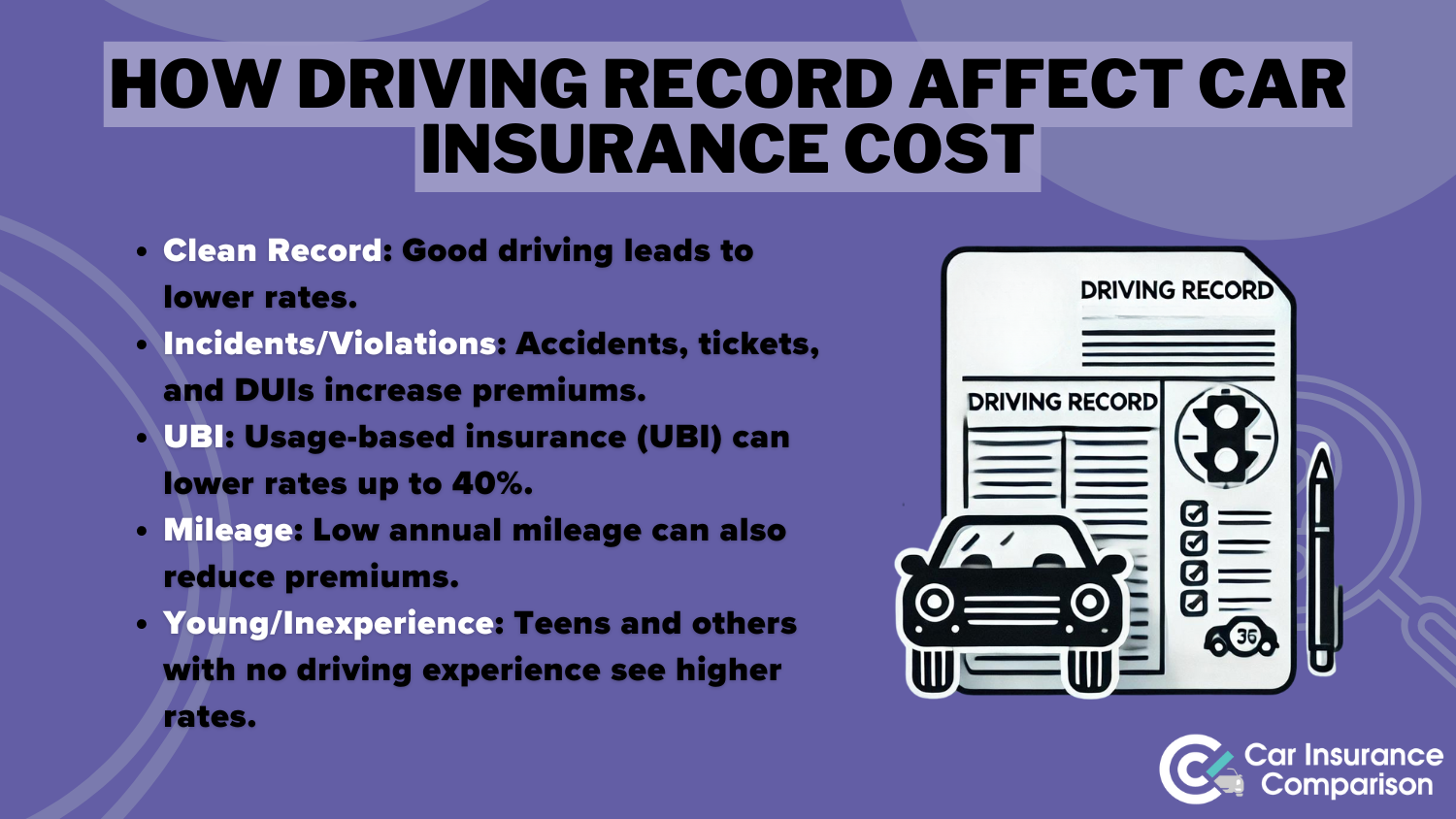

What factors affect car insurance rates for a Toyota Prius?

Car insurance rates for a Toyota Prius depend on factors like the vehicle’s model and year, your driving record, age, location, coverage options, and deductible. Safety features, repair costs, and the frequency of claims also affect rates. Enter your ZIP code now.

Are car insurance rates higher for Toyota Prius compared to other car models?

Toyota Prius insurance rates vary based on repair costs, theft risk, and claim frequency. Comparing rates from multiple insurers can help you understand how they stack up against other models.

Learn more in our guide titled “Factors That Affect Car Insurance Rates.”

Are there any discounts available for Toyota Prius car insurance?

Yes, many insurers offer discounts for Toyota Prius insurance, such as safe driver, multi-policy, good student, low-mileage, and safety feature discounts. Check with providers to see which ones you qualify for.

How can I lower my car insurance rates for my Toyota Prius?

To lower your Toyota Prius insurance rates, keep a clean driving record, choose higher deductibles, bundle policies, and use available discounts. The Prius’s safety features and eco-friendliness also help reduce rates. Enter your ZIP code to begin comparing.

Is it necessary to have full coverage car insurance for a Toyota Prius?

Complete coverage for your Toyota Prius isn’t mandatory, but if financed or leased, it may be required. Liability insurance is usually required by law. You may compare liability car insurance coverage.

What should I do if I can’t afford car insurance for my Toyota Prius?

If you can’t afford Toyota Prius insurance, try adjusting coverage or deductibles, comparing quotes, and exploring low-cost insurance programs in your state.

Which insurance companies are recommended for Toyota Prius coverage?

Top choices include Progressive, Allstate, Travelers, and Geico. These companies offer competitive rates, comprehensive coverage, and vital customer service. Enter your ZIP code now.

How can I compare insurance quotes for my Toyota Prius effectively?

Use online comparison websites or tools, request quotes from multiple insurers directly, and consider speaking with a local insurance agent. Comparing different options helps find the best rate and coverage for your needs.

Are there any specific insurance requirements for hybrid vehicles like the Toyota Prius?

While there are no unique legal requirements for hybrids, insurance providers may offer specific discounts or coverage options tailored to hybrid vehicles. Check with insurers to see what’s available for your Prius.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros