Best Volkswagen Atlas Car Insurance in 2026 (Your Guide to the Top 10 Companies)

State Farm, USAA, and Erie have the best Volkswagen Atlas car insurance, with rates starting at $36 per month. These companies excel in providing numerous discounts, military savings, and 24/7 support, ensuring comprehensive and affordable protection for your Volkswagen Atlas.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated March 2026

Company Facts

Full Coverage for Volkswagen Atlas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Volkswagen Atlas

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Volkswagen Atlas

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, USAA, and Erie have the best Volkswagen Atlas car insurance. These top providers deliver exceptional value with rates starting as low as $36 per month.

State Farm is the top choice, offering competitive pricing, extensive coverage, and excellent customer service. For details, see our guide titled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements“.

Our Top 10 Company Picks: Best Volkswagen Atlas Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 10% B Many Discounts State Farm

![]()

#2 15% A++ Military Savings USAA

#3 12% A+ 24/7 Support Erie

#4 18% A Online App AAA

#5 17% A+ Add-on Coverages Allstate

#6 20% A+ Innovative Programs Progressive

#7 13% A++ Accident Forgiveness Travelers

#8 11% A++ Custom Plan Geico

#9 16% A Local Agents Farmers

#10 14% A Customizable Polices Liberty Mutual

Whether you seek affordability or comprehensive protection, these companies provide the best solutions for insuring your Volkswagen Atlas.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- State Farm is the top pick for competitive rates and comprehensive coverage

- Find the best Volkswagen Atlas car insurance with rates as low as $36/month

- Top providers offer significant discounts, military savings, and 24/7 support

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers numerous discounts that can reduce the cost of insurance for your Volkswagen Atlas. Read more in our review of State Farm.

- Competitive Pricing: With competitive rates, State Farm provides affordable insurance options for the Volkswagen Atlas.

- Extensive Coverage Options: State Farm offers a range of coverage options tailored to protect your Volkswagen Atlas comprehensively.

Cons

- Availability: State Farm’s rates and discounts might not be available in all regions, potentially limiting options for some Volkswagen Atlas owners.

- Customer Service: While generally good, some users have reported mixed experiences with State Farm’s customer service regarding claims for the Volkswagen Atlas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers special discounts for military members, which can significantly reduce insurance costs for their Volkswagen Atlas.

- Excellent Coverage: Known for comprehensive coverage options, USAA provides strong protection for the Volkswagen Atlas, which you can learn about in our USAA review.

- High Customer Satisfaction: USAA has a reputation for high customer satisfaction, which benefits Volkswagen Atlas owners.

Cons

- Eligibility: USAA insurance is available only to military personnel and their families, excluding non-military Volkswagen Atlas owners.

- Higher Premiums for Some: For non-military Volkswagen Atlas owners, finding comparable rates elsewhere might be necessary.

#3 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie provides around-the-clock support, ensuring assistance is available anytime for your Volkswagen Atlas insurance needs.

- Competitive Rates: Erie offers competitive rates for insuring the Volkswagen Atlas, potentially saving you money.

- Comprehensive Coverage: Erie’s policies are known for offering extensive coverage options for the Volkswagen Atlas. Find out more in our Erie review.

Cons

- Availability: Erie’s coverage may not be available in all states, potentially limiting options for some Volkswagen Atlas owners.

- Customer Service: While generally good, Erie’s customer service may vary, with some users reporting slower response times for Volkswagen Atlas claims.

#4 – AAA: Best for Online App

Pros

- Online App: AAA’s user-friendly online app makes managing your Volkswagen Atlas insurance convenient and accessible, which is covered in our AAA review.

- Roadside Assistance: AAA offers extensive roadside assistance, adding extra security for Volkswagen Atlas owners.

- Discount Opportunities: AAA provides various discounts that can help lower the cost of insuring your Volkswagen Atlas.

Cons

- Membership Requirement: To access AAA insurance benefits, you need to be a member, which might be an additional cost for Volkswagen Atlas owners.

- Limited Coverage Options: Some users may find AAA’s coverage options less extensive compared to other providers for the Volkswagen Atlas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Allstate offers various add-on coverages that can be customized to better protect your Volkswagen Atlas. For a complete list, read our Allstate review.

- Good Claims Service: Known for reliable claims service, Allstate provides solid support for Volkswagen Atlas insurance claims.

- Flexible Coverage Options: Allstate’s flexible coverage options allow you to tailor your policy to fit the needs of your Volkswagen Atlas.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some competitors, which might be less cost-effective for Volkswagen Atlas owners.

- Inconsistent Service: Customer service experiences can vary, with some Volkswagen Atlas owners reporting less satisfactory interactions.

#6 – Progressive: Best for Innovative Programs

Pros

- Innovative Programs: Progressive offers innovative insurance programs that can provide unique benefits for your Volkswagen Atlas.

- Competitive Rates: Progressive’s rates are competitive, potentially offering savings on insurance for the Volkswagen Atlas, which you can check out in our Progressive review.

- Customizable Policies: Progressive allows for customizable policies, helping to tailor coverage to your Volkswagen Atlas needs.

Cons

- Complex Options: The range of options and programs may be overwhelming, making it harder for some Volkswagen Atlas owners to choose the right coverage.

- Claims Process: Some users have reported a more complex claims process, which could affect the experience for Volkswagen Atlas insurance claims.

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness, which can help protect your Volkswagen Atlas insurance rates after an accident.

- Comprehensive Coverage: Provides a range of coverage options that can be tailored for the Volkswagen Atlas.

- Customer Support: Travelers has a good reputation for customer support, benefiting Volkswagen Atlas owners. Read our Travelers review to learn what else is offered.

Cons

- Higher Rates for New Drivers: New drivers may find higher rates, which could be less favorable for those insuring a Volkswagen Atlas.

- Regional Availability: Travelers may not be available in all regions, potentially limiting access for some Volkswagen Atlas owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Custom Plan

Pros

- Custom Plan: Geico offers customizable insurance plans, allowing you to tailor coverage for your Volkswagen Atlas, which you can read more about in our review of Geico.

- Competitive Rates: Known for competitive pricing, Geico provides affordable insurance options for the Volkswagen Atlas.

- Good Customer Service: Geico is recognized for its effective customer service, aiding Volkswagen Atlas owners in managing their insurance needs.

Cons

- Limited Add-Ons: Geico may have fewer add-on coverage options compared to other providers, which could be a drawback for some Volkswagen Atlas owners.

- Claims Processing: Some users have reported longer processing times for claims, potentially affecting the insurance experience for Volkswagen Atlas drivers.

#9 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers’ local agents offer personalized service, which can be beneficial for Volkswagen Atlas owners seeking tailored insurance solutions.

- Good Coverage Options: Farmers provides a range of coverage options to fit the needs of your Volkswagen Atlas. Discover our Farmers review for a full list.

- Customizable Policies: Farmers allows for customization of policies, helping to better meet the specific needs of Volkswagen Atlas drivers.

Cons

- Higher Costs: Farmers’ premiums can be higher compared to some competitors, potentially making it less affordable for Volkswagen Atlas owners.

- Inconsistent Availability: Availability of coverage and local agents can vary by region, which might impact access for some Volkswagen Atlas owners.

#10 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing Volkswagen Atlas owners to tailor coverage to their specific needs.

- Various Discounts: Liberty Mutual provides multiple discounts that can help reduce insurance costs for the Volkswagen Atlas.

- Comprehensive Coverage: Offers extensive coverage options for the Volkswagen Atlas, including additional protections. Learn more in our Liberty Mutual review.

Cons

- Potentially Higher Premiums: Liberty Mutual’s premiums may be higher compared to some other insurance providers, impacting cost for Volkswagen Atlas owners.

- Service Quality Variability: Customer service quality can vary, with some Volkswagen Atlas owners reporting mixed experiences with Liberty Mutual.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Volkswagen Atlas Insurance Rates and Discounts by Provider

When insuring your Volkswagen Atlas, exploring available discounts can significantly reduce your costs. Each insurance provider offers unique savings opportunities based on various criteria, from driving habits to vehicle features. For additional details, explore our comprehensive resource titled “Safe Driver Car Insurance Discounts.”

Volkswagen Atlas Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $36 $153

Allstate $50 $194

Erie $52 $173

Farmers $51 $128

Geico $62 $112

Liberty Mutual $61 $200

Progressive $52 $170

State Farm $59 $154

Travelers $45 $209

USAA $75 $156

Monthly insurance rates for a Volkswagen Atlas vary by coverage level and provider. For minimum coverage, rates range from $36 with AAA to $75 with USAA. Full coverage costs range from $112 with Geico to $209 with Travelers. The rates reflect differences among providers, offering a range of options depending on the level of coverage desired.

Volkswagen Atlas owners can access various discounts: AAA offers 18% for defensive driving, Allstate 17% for new cars, and Erie 12% for multi-policy holders. Farmers gives 16% for alternative fuel, Geico 11% for military, and Liberty Mutual 14% for online purchases. Progressive offers 20% for homeowners, State Farm 10% for safe drivers, Travelers 13% for early quotes, and USAA 15% for good students.

By taking advantage of these discounts, you can tailor your insurance policy to both your needs and budget. Compare options and find the best deal to ensure your Volkswagen Atlas is protected while saving on premiums.

Rising Insurance Costs for the Volkswagen Atlas

When insuring a Volkswagen Atlas, monthly rates can vary significantly depending on the coverage level and the insurance provider you choose. Understanding these differences can help you find the most cost-effective option that meets your needs.

Volkswagen Atlas Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Volkswagen Atlas | $31 | $60 | $31 | $135 |

| Mitsubishi Outlander Sport | $23 | $43 | $28 | $105 |

| Ford Explorer | $26 | $39 | $31 | $109 |

| Chevrolet Suburban | $28 | $44 | $31 | $117 |

| Lexus LX 570 | $37 | $70 | $33 | $153 |

| Volkswagen Touareg | $31 | $58 | $33 | $134 |

| Ford Edge | $22 | $42 | $31 | $108 |

The Volkswagen Atlas has higher monthly insurance rates than similar vehicles, averaging $135 for full coverage, though it’s still more affordable than the Lexus LX 570, and comparing rates from providers like Geico, AAA, and Travelers can help you find the best balance between cost and coverage. To learn more, check out our resource, “Compare Car Insurance by Coverage Type.”

Key Drivers of Insurance Costs for the Volkswagen Atla

You might have noticed that there is a multitude of factors that impact Volkswagen Atlas car insurance rates. Your age, location, driving record, and model year all play a role in what you will ultimately pay to insure the Volkswagen Atlas. For more details, check our report titled “Over Age 55 Car Insurance Discounts.”

Finding Out Your Vehicle’s Age

Insuring a Volkswagen Atlas can result in varying monthly premiums based on the model year and coverage type you select. Knowing these variations can assist you in making a well-informed decision about your insurance options and managing your budget effectively.

Volkswagen Atlas Car Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Volkswagen Atlas | $33 | $63 | $32 | $138 |

| 2023 Volkswagen Atlas | $32 | $62 | $32 | $138 |

| 2022 Volkswagen Atlas | $32 | $62 | $31 | $138 |

| 2021 Volkswagen Atlas | $32 | $61 | $31 | $137 |

| 2020 Volkswagen Atlas | $31 | $60 | $31 | $135 |

| 2019 Volkswagen Atlas | $30 | $58 | $33 | $133 |

| 2018 Volkswagen Atlas | $29 | $57 | $33 | $132 |

Volkswagen Atlas insurance rates vary by model year and coverage. Monthly costs are $138 for full coverage and $32 for minimum. Older models, like the 2018 Atlas, have slightly lower rates, with full coverage at $132 and minimum at $33. For details, see our analysis titled “Minimum Car Insurance Requirements by State.”

State Farm offers the best overall value for Volkswagen Atlas insurance with its competitive rates and outstanding customer service.

Brad Larson Licensed Insurance Agent

By comparing the insurance rates across different model years, you can find the best coverage that fits your needs and budget. Whether you’re looking at a brand-new Atlas or an older model, knowing these rates ensures you’re well-prepared for the costs involved in protecting your vehicle.

The Age Factor: Understanding Its Role in Driving Behavior

Insurance rates for a Volkswagen Atlas vary significantly by age. Younger drivers typically face higher premiums, with costs decreasing as they gain experience. This overview highlights how monthly insurance rates change from age 16 to 60.

Volkswagen Atlas Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $610 |

| Age: 18 | $495 |

| Age: 20 | $307 |

| Age: 30 | $141 |

| Age: 40 | $135 |

| Age: 45 | $130 |

| Age: 50 | $123 |

| Age: 60 | $121 |

Monthly insurance rates for a Volkswagen Atlas decrease significantly with age, starting at $610 for a 16-year-old and dropping to $121 by age 60 as drivers gain experience and are seen as lower risk. For more details, see our handbook, “Compare Car Insurance Rates by Vehicle Make and Model.”

Driver Position Tracking

Discover how car insurance rates for a Volkswagen Atlas differ across major cities. Whether you’re in a bustling metropolis or a quieter locale, understanding these variations can help you plan your budget better. For deep insights, check out our guide titled “How can I find affordable car insurance rates?”

Volkswagen Atlas Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $231 |

| New York, NY | $214 |

| Houston, TX | $212 |

| Jacksonville, FL | $196 |

| Philadelphia, PA | $181 |

| Chicago, IL | $179 |

| Phoenix, AZ | $157 |

| Seattle, WA | $131 |

| Indianapolis, IN | $115 |

| Columbus, OH | $112 |

Monthly insurance rates for a Volkswagen Atlas vary widely. In Los Angeles, CA, rates are highest at $231, while Columbus, OH offers the lowest at $112. Other rates include $214 in New York, $212 in Houston, and $115 in Indianapolis.

By comparing the monthly insurance rates from cities like Los Angeles to Columbus, you can see how location impacts your insurance costs. Use this information to find the best rates and make informed decisions for your Volkswagen Atlas.

A Review of Your Driving History

Explore how factors like age and driving history affect the cost of insuring a Volkswagen Atlas. Our detailed overview offers a clear view of monthly insurance rates across different age groups and driving records. For a comprehensive overview, explore our detailed resource titled “Does the age of a car affect car insurance rates?“

Volkswagen Atlas Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $610 | $790 | $1,100 | $760 |

| Age: 18 | $495 | $710 | $910 | $580 |

| Age: 20 | $307 | $470 | $700 | $380 |

| Age: 30 | $141 | $210 | $340 | $180 |

| Age: 40 | $135 | $200 | $330 | $175 |

| Age: 45 | $130 | $195 | $320 | $170 |

| Age: 50 | $123 | $185 | $310 | $165 |

| Age: 60 | $121 | $180 | $300 | $160 |

Insurance costs for a Volkswagen Atlas vary significantly by age and driving history, with young drivers paying higher rates—$610 for a 16-year-old versus $121 for a 60-year-old—and driving violations can further increase premiums, so consulting an insurance agent can help you make informed decisions and potentially lower your costs.

Volkswagen Atlas: Comprehensive Safety Ratings and Features

The Volkswagen Atlas delivers exceptional safety performance, ensuring peace of mind for drivers and passengers alike. For more insights, check out our resource titled “Does car insurance cover all other drivers?”

Volkswagen Atlas Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Volkswagen Atlas excels with top “Good” safety ratings in all critical categories, including front and side impacts, roof strength, and head restraints, making it a reliable and secure choice for families and travelers.

Volkswagen Atlas Safety Ratings: Crash Test Results

When it comes to vehicle safety, the Volkswagen Atlas and Atlas Cross Sport stand out with exceptional crash test ratings. Known for their robust safety features, these models deliver top-tier protection across different driving conditions. For detailed information, refer to our comprehensive report titled “Understanding Your Car Insurance Policy.”

Volkswagen Atlas Crash Test Ratings by Model Year

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Volkswagen Atlas SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Volkswagen Atlas SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Volkswagen Atlas Cross Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Volkswagen Atlas Cross Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Volkswagen Atlas SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Volkswagen Atlas SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Volkswagen Atlas Cross Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Volkswagen Atlas Cross Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Volkswagen Atlas SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Volkswagen Atlas SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Volkswagen Atlas Cross Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Volkswagen Atlas Cross Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Volkswagen Atlas SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Volkswagen Atlas SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Volkswagen Atlas Cross Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Volkswagen Atlas Cross Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Volkswagen Atlas SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Volkswagen Atlas SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Volkswagen Atlas Cross Sport SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Volkswagen Atlas Cross Sport SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Volkswagen Atlas SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Volkswagen Atlas SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Volkswagen Atlas SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Volkswagen Atlas SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

The Volkswagen Atlas and Atlas Cross Sport, with their top 5-star ratings for frontal and side impact protection and a solid 4-star rating for rollover safety, demonstrate Volkswagen’s commitment to delivering reliable and secure vehicles.

Volkswagen Atlas: Top Safety Features

In modern vehicles, advanced safety features play a crucial role in enhancing driving convenience and protection. These technologies are designed to assist drivers in various situations, making every journey safer and more manageable.

- Backup camera

- Blind-spot detection

- Rear traffic alert

- Collision warning system

- Pedestrian recognition

With these advanced safety technologies, you can drive with greater confidence and peace of mind. For a comprehensive analysis, refer to our detailed guide titled “Safety Features Car Insurance Discounts.”

State Farm offers the best overall value for Volkswagen Atlas insurance with its competitive rates and exceptional customer service.

Michelle Robbins Licensed Insurance Agent

Each feature is engineered to support you on the road, helping to prevent accidents and simplify complex driving scenarios. Embracing these innovations can lead to a safer and more enjoyable driving experience for everyone.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Tips for Reducing Your Volkswagen Atlas Insurance Costs

Finding ways to lower your Volkswagen Atlas insurance premiums can make a significant difference in your overall budget. By taking some proactive steps, you can ensure that you’re getting the best possible rate. Here are some practical tips to help you save on insurance for your Volkswagen Atlas.

- Compare Multiple Quotes: Use online comparison tools to get quotes from various insurers. Comparing rates helps you find the best deal and ensures you’re not overpaying for coverage.

- Utilize Discounts: Take advantage of available discounts. Look for savings on safe driving, multi-policy bundles, vehicle safety features, and affiliations like military service.

- Maintain a Clean Driving Record: A clean driving history without accidents or violations can significantly lower your premiums. Safe driving habits reduce the risk of accidents and insurance claims.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premiums. Just ensure you have enough savings to cover the deductible in case of a claim.

- Consider Bundling Policies: Combine your auto insurance with other policies (e.g., home or renters insurance) from the same provider. Many insurers offer discounts for bundling multiple policies.

By following these strategies, you can effectively reduce your Volkswagen Atlas insurance costs while maintaining comprehensive coverage. For further information, visit our resource titled “Different Ways to Lower Car Insurance Rates.”

Regularly reviewing your insurance options and making informed decisions will help you keep expenses in check and ensure you’re always getting the best value for your coverage.

Best Insurance Providers for Your Volkswagen Atlas

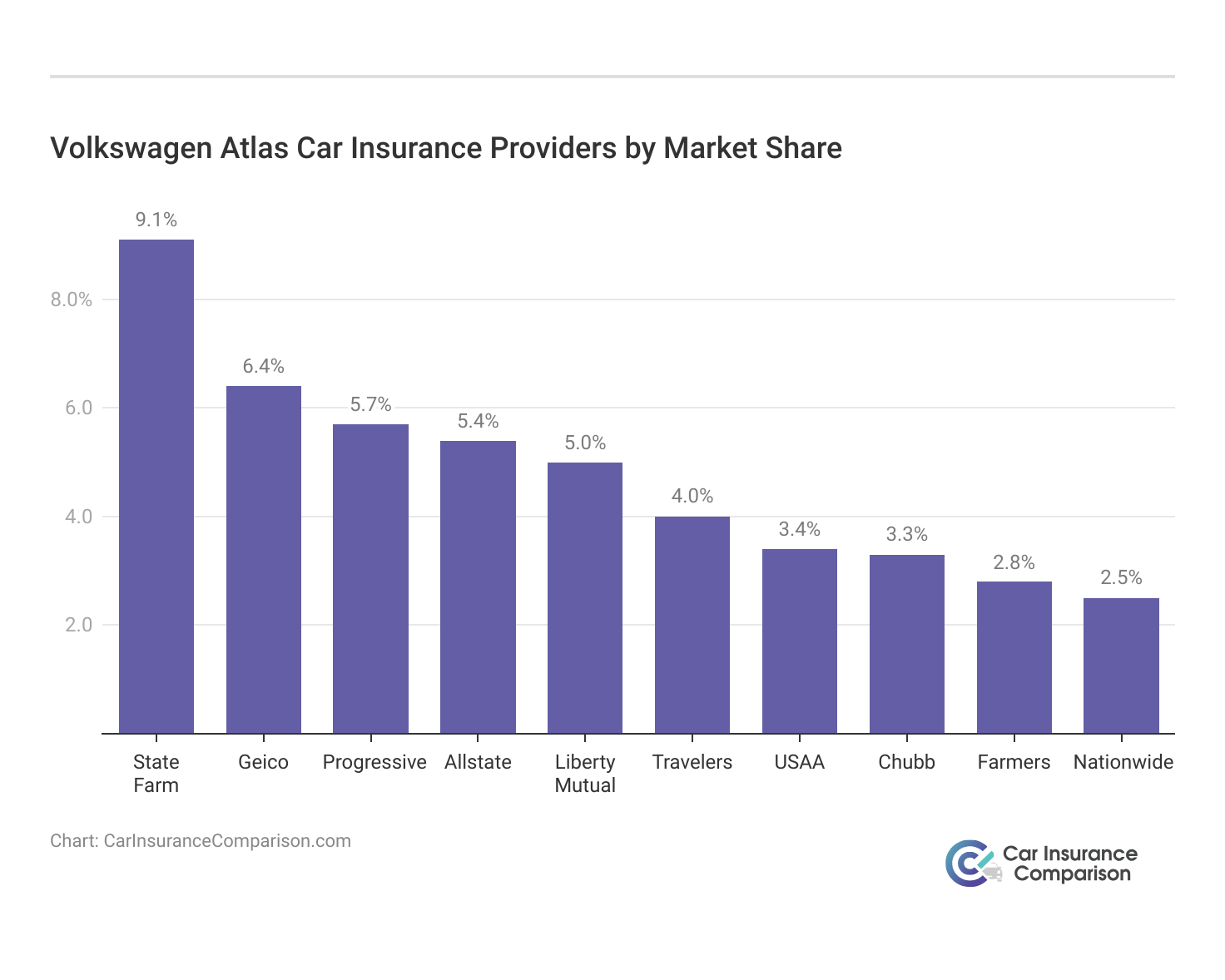

Several top car insurance companies offer competitive rates for the Volkswagen Atlas rates based on factors like discounts for safety features. Take a look at this list of top car insurance companies that are popular with Volkswagen Atlas drivers organized by market share.

Top Volkswagen Atlas Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Here’s a snapshot of the top insurance providers for Volkswagen Atlas by market share: State Farm leads with 9%, followed by Geico and Progressive at 6% each. Allstate and Liberty Mutual each hold 5%, with Travelers, USAA, Chubb, Farmers, and Nationwide rounding out the top ten.

This chart displays the market share distribution of various car insurance providers for the Volkswagen Atlas. It highlights the percentage of coverage each insurer holds, with State Farm leading the market, followed by Geico and Progressive. The data provides a clear view of how different insurance companies compare in terms of their share in the Volkswagen Atlas insurance market.

Find the Best Free Volkswagen Atlas Insurance Quotes Online

For Volkswagen Atlas car insurance, top providers include State Farm for its competitive pricing and comprehensive coverage, USAA for military families, and Erie for 24/7 support. The average cost is $135 monthly. Insurance rates vary based on vehicle age, driver age, location, and driving record.

To save on premiums, maintain a clean driving record, compare quotes, and utilize safety feature discounts. Notable companies to consider are AAA, Allstate, Progressive, Travelers, Geico, Farmers, and Liberty Mutual. For an in-depth review, consult our guide titled “What is a car insurance premium?”

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

Frequently Asked Questions

What factors influence the cost of Volkswagen Atlas insurance?

Factors include the vehicle’s age, your age, driving history, location, and the specific coverage options you choose.

Are there discounts available for Volkswagen Atlas insurance?

Yes, many insurance companies offer discounts for safety features, good driving records, multi-policy bundles, and even certain affiliations like military service.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

How can I lower my Volkswagen Atlas insurance premiums?

To lower your premiums, maintain a clean driving record, compare quotes from different insurers, and take advantage of any available discounts.

For additional insights, refer to our detailed guide titled “Why is my car insurance so expensive?”

Does the Volkswagen Atlas’s safety rating affect my insurance rates?

Yes, higher safety ratings can lead to lower insurance rates, as safer vehicles are less likely to be involved in costly accidents.

How does my driving history impact my Volkswagen Atlas insurance costs?

A clean driving record can help you secure lower rates, while a history of traffic violations or accidents may result in higher premiums.

What is considered full coverage for a Volkswagen Atlas?

Full coverage typically includes liability insurance, collision coverage, comprehensive coverage, and often uninsured/underinsured motorist coverage.

To find more information, check out our resource titled “Collision vs. Comprehensive: What is the difference?”

Does the location where I live affect my Volkswagen Atlas insurance rate?

Yes, insurance rates can vary based on your location due to factors like local accident rates, crime rates, and the cost of repairs.

Are there any specific insurance providers known for offering good rates for Volkswagen Atlas owners?

Providers like State Farm, USAA, and Erie are known for offering competitive rates and good coverage options for Volkswagen Atlas owners.

What types of coverage are recommended for a Volkswagen Atlas?

Recommended coverage typically includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage to protect against a wide range of risks.

To gain more insights, check out our detailed resource on insurance titled “Compare Uninsured/Underinsured Motorist (UM/UIM) Coverage: Rates, Discounts, & Requirements.”

How often should I compare car insurance quotes for my Volkswagen Atlas?

It’s a good idea to compare quotes at least annually or whenever you experience significant life changes, such as moving to a new location or getting a new vehicle.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.