Best Cadillac STS Car Insurance in 2026 (Top 10 Companies Ranked)

State Farm, Farmers, and Geico offer the best Cadillac STS car insurance with comprehensive coverage and competitive rates starting at $47 per month. These companies are known for their reliability, excellent customer service, and affordability, making them top choices for insuring your Cadillac STS.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2026

Company Facts

Full Coverage for Cadillac STS

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Cadillac STS

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Cadillac STS

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Farmers, and Geico offer the best Cadillac STS car insurance with rates starting at $47 per month. State Farm stands out as the top choice for its comprehensive coverage and exceptional customer service.

Understanding what makes car insurance more expensive can help you make informed decisions and find ways to reduce premiums, ensuring you get the best value for your Cadillac STS insurance.

Our Top 10 Company Picks: Best Cadillac STS Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 13% B Many Discounts State Farm

![]()

#2 10% A Local Agents Farmers

![]()

#3 15% A++ Custom Plan Geico

#4 12% A Customizable Polices Liberty Mutual

#5 14% A+ Online Convenience Progressive

#6 11% A++ Accident Forgiveness Travelers

#7 9% A+ Usage Discount Nationwide

#8 18% A+ Add-on Coverages Allstate

#9 16% A Online App AAA

#10 17% A++ Military Savings USAA

The article also explores factors influencing higher insurance costs, such as driver age, location, and vehicle safety features. Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cadillac STS Insurance Cost

Understanding the cost of car insurance is crucial for managing your budget effectively. The following table provides a comprehensive look at the monthly insurance rates for the Cadillac STS, comparing both minimum and full coverage options across various providers.

Cadillac STS Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $84 $258

Allstate $111 $353

Farmers $68 $208

Geico $84 $255

Liberty Mutual $47 $148

Nationwide $75 $227

Progressive $82 $234

State Farm $58 $168

Travelers $71 $205

USAA $68 $201

This information can help you gauge how different insurance companies price coverage for the Cadillac STS and make informed decisions about where to seek coverage.

Be sure to consider both coverage options and provider reputations to ensure you choose the policy that offers the best balance of cost and protection.

Brad Larson LICENSED INSURANCE AGENT

When assessing the affordability of car insurance, different factors such as deductibles and driver risk levels play a significant role. Cadillac STS car insurance rates vary by coverage level, with discounted rates being the lowest, followed by high deductibles and average rates. Low deductible plans are more expensive, with high-risk drivers and teen drivers facing the highest rates.

By understanding these differences, you can better manage your insurance expenses and choose the best options that align with your financial situation and risk tolerance.

Cutting Costs on Cadillac STS Insurance

Cadillac STS Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| Buick Regal | $33 | $45 | $26 | $117 |

| Cadillac STS | $33 | $52 | $27 | $125 |

| Honda Civic | $35 | $55 | $23 | $128 |

| Nissan Maxima | $33 | $53 | $31 | $129 |

| Subaru Impreza | $33 | $45 | $27 | $118 |

| Subaru WRX | $28 | $47 | $27 | $113 |

Benchmarked to insurance costs of similar models, the analysis provides perspective on insurance costs of Cadillac STS. It may be useful in the sense of ascertaining whether the insurance premiums of the STS variant in question are lower or higher compared with competitors’ models to enable an informed decision.

If you want to reduce the cost of your Cadillac STS insurance rates, follow these tips below. Adopting these strategies can lead to substantial savings and make managing your insurance budget more efficient.

- Move to the countryside.

- Avoid the temptation to file a claim for minor incidents.

- Use paperless billing for your Cadillac STS insurance policy.

- Pay your Cadillac STS insurance upfront.

- Ask about mature driver discounts for drivers over 50.

Implementing these strategies can help you lower your Cadillac STS insurance rates effectively. These practical steps not only help reduce your insurance costs but also contribute to a more economical and manageable insurance experience.

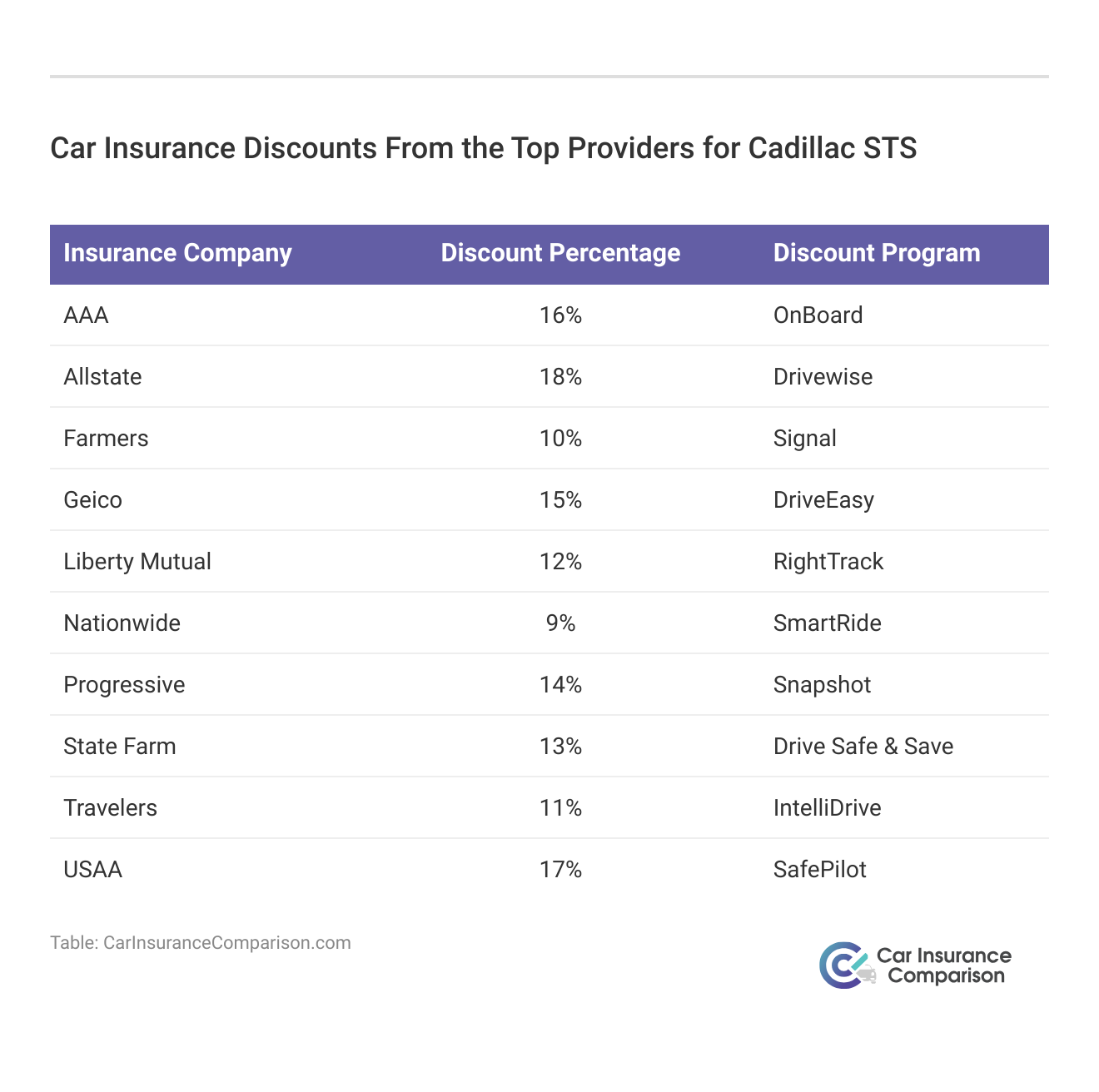

Here are the best discounts from the leading insurance companies for Cadillac STS that can help car owners to be secured with lesser costs and risks on the road.

Read More: 16 Ways to Lower the Cost of Your Insurance

Factors Affecting the Cost of Cadillac STS Insurance Rates

You might have noticed that there is a multitude of factors that impact Cadillac STS car insurance rates. Your age, location, driving record, and model year all play a role in what you will ultimately pay to insure the Cadillac STS and your car insurance deductible.

They also factor in things on your particular vehicle. Some cars lack safety features that can get you a discount, but most include at least some in addition to the other features and optional equipment like heated seats and/or leather seats, remote engine start, heated steering wheel, and more. These likely don’t impact your rates, but passenger air bags and seat belts definitely will.

Age of the Vehicle

Cadillac STS insurance tends to be pricier for the newer models. Take the 2011 Cadillac STS, for example; its insurance runs $109. The 2010 model is a bit cheaper at $106. Just a three dollar difference.

Cadillac STS Car Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| 2024 Cadillac STS | $39 | $52 | $35 | $126 |

| 2023 Cadillac STS | $38 | $51 | $34 | $125 |

| 2022 Cadillac STS | $38 | $50 | $33 | $124 |

| 2021 Cadillac STS | $38 | $49 | $32 | $123 |

| 2020 Cadillac STS | $37 | $48 | $31 | $122 |

| 2019 Cadillac STS | $37 | $48 | $31 | $122 |

| 2018 Cadillac STS | $37 | $48 | $31 | $121 |

| 2017 Cadillac STS | $39 | $47 | $30 | $120 |

| 2016 Cadillac STS | $40 | $45 | $29 | $119 |

| 2015 Cadillac STS | $41 | $43 | $28 | $117 |

| 2014 Cadillac STS | $42 | $41 | $27 | $114 |

| 2013 Cadillac STS | $42 | $38 | $26 | $111 |

| 2012 Cadillac STS | $42 | $35 | $25 | $107 |

| 2011 Cadillac STS | $42 | $32 | $24 | $103 |

Newer models tend to have higher premiums, so if you own an older STS, you might benefit from slightly lower insurance costs. Keep this in mind when budgeting for insurance and considering vehicle upgrades.

Driver Age

The age of the driver serves as a significant determinant influencing the auto insurance premiums for the Cadillac STS. For example, a 40-year-old driver typically pays $139 less per month for insurance compared to a 20-year

Cadillac STS Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $285 |

| Age: 18 | $270 |

| Age: 20 | $240 |

| Age: 30 | $155 |

| Age: 40 | $140 |

| Age: 45 | $134 |

| Age: 50 | $128 |

| Age: 60 | $121 |

Younger drivers, particularly teens, face substantially higher premiums, while older drivers may benefit from lower rates. This information can help in assessing how age-related factors affect your insurance budget.

Driver Location

Geographical location can play a significant role in the difference of Cadillac STS insurance premiums. The base rates of drivers may vary; for instance, drivers from Los Angeles may be charged higher rates than those from Phoenix.

Cadillac STS Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $250 |

| Columbus, OH | $112 |

| Houston, TX | $270 |

| Indianapolis, IN | $225 |

| Jacksonville, FL | $310 |

| Los Angeles, CA | $325 |

| New York, NY | $300 |

| Philadelphia, PA | $290 |

| Phoenix, AZ | $240 |

| Seattle, WA | $230 |

If you live in a city with higher insurance costs, such as Los Angeles, you might be paying significantly more compared to other areas. Explore potential savings or adjustments based on your location.

Driving Record

The records of your driving can be relevant in determining the cost of your Cadillac STS car insurance. The young people, in particular teenagers and drivers in their 20s, face the biggest increase in the Cadillac STS car insurance with violations in their records.

Cadillac STS Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $720 | $980 | $1,350 | $920 |

| Age: 18 | $470 | $680 | $900 | $640 |

| Age: 20 | $290 | $450 | $620 | $420 |

| Age: 30 | $135 | $230 | $350 | $210 |

| Age: 40 | $130 | $220 | $340 | $205 |

| Age: 45 | $125 | $215 | $330 | $200 |

| Age: 50 | $120 | $210 | $320 | $195 |

| Age: 60 | $118 | $205 | $315 | $190 |

The table highlights how a clean driving record can lead to lower insurance rates, while violations can substantially increase costs. Maintaining a good driving history is crucial for keeping your Cadillac STS insurance premiums manageable.

Safety Ratings

The following is a table showing the safety ratings of the Cadillac STS to help the client understand, how much he is likely to be charged based on the safety of the vehicle. For example, manufacturers or dealers with vehicles having superior safety ratings normally charge a lower insurance price.

Cadillac STS Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Not Tested |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Acceptable |

| Roof strength | Not Tested |

| Head restraints and seats | Poor |

Investing in a car with higher safety ratings can potentially lead to lower insurance premiums, emphasizing the importance of safety features in your insurance decisions.

Crash Test Ratings

The Cadillac STS has favorable crash test results. You can afford to pay less for more insurance for your Cadillac STS because of the increased safety.

Cadillac STS Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Cadillac STS | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2023 Cadillac STS | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2022 Cadillac STS | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2021 Cadillac STS | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2020 Cadillac STS | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2019 Cadillac STS | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

| 2018 Cadillac STS | 4 Stars | 4 Stars | 5 Stars | 4 Stars |

Better ratings typically correlate with lower insurance costs, highlighting the importance of vehicle safety in managing insurance expenses.

Cadillac STS Safety Features

Good Cadillac STS safety features can result in insurers giving you car insurance discounts. The safety features for the 2020 Cadillac STS are:

- Driver and Passenger Air Bags: Includes driver air bag, passenger air bag with an on/off switch, and both front and rear head air bags.

- Side Air Bags: Front side air bags enhance protection in side collisions.

- Braking System: Features 4-wheel ABS, disc brakes, and brake assist for improved braking performance.

- Stability and Control: Equipped with electronic stability control and traction control.

- Visibility and Safety: Includes daytime running lights and child safety locks for added safety.

The comprehensive safety features of the 2020 Cadillac STS not only enhance driver and passenger protection but also potentially qualify you for insurance discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leading Cadillac STS Insurance Providers

Take a look at this list of top car insurance companies that are popular with Cadillac STS drivers organized by market share.

Top Cadillac STS Car Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9% |

| #2 | Geico | $46.1 million | 6% |

| #3 | Progressive | $39.2 million | 5% |

| #4 | Liberty Mutual | $35.6 million | 5% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3% |

| #8 | Chubb | $23.3 million | 3% |

| #9 | Farmers | $20.6 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

Several top car insurance companies offer competitive rates for the Cadillac STS rates based on factors like discounts for safety features.

Financing Your Cadillac STS and Insurance Costs

If you are financing a Cadillac STS, you will pay more if you purchase Cadillac STS auto insurance at the dealership, so explore your options to secure the best deal for your Cadillac STS. For more information, read our article titled “Best Cadillac Car Insurance Rates.”

Be sure to shop around and compare Cadillac STS auto insurance quotes from the best companies using our free tool below.

Frequently Asked Questions

What factors affect the insurance rates for a Cadillac STS?

Several factors can influence the insurance rates for a Cadillac STS. These factors include the driver’s age, driving record, location, credit score, the model and year of the car, safety features, and the chosen coverage options.

How can I find the best insurance rates for a Cadillac STS?

To find the best insurance rates for your Cadillac STS, it is recommended to shop around and compare quotes from different insurance providers. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Are there any specific insurance providers that offer competitive rates for Cadillac STS?

Insurance rates can vary between providers, so it’s advisable to obtain quotes from multiple insurers. However, some insurance companies may offer specialized coverage or discounts for luxury vehicles like the Cadillac STS. It’s worth exploring options from well-known providers, including those that offer tailored coverage for high-end vehicles.

Are there any ways to reduce insurance costs for a Cadillac STS?

Yes, there are a different ways to lower car insurance rates for your Cadillac STS. Maintaining a clean driving record, bundling your auto insurance with other policies, increasing your deductibles, and installing anti-theft devices or safety features in your vehicle are some of the common ways to potentially lower your insurance premiums.

Are Cadillac STS considered expensive to insure?

The insurance costs for a Cadillac STS can vary depending on several factors, including the model, year, and location. Generally, luxury vehicles tend to have higher insurance rates due to their higher cost of repair and replacement. However, other factors such as your personal driving profile and the coverage options you choose also contribute to the overall cost of insurance.

What makes car insurance more expensive for a Cadillac STS?

Factors such as the vehicle’s age, repair costs, and driver risk profile contribute to higher insurance premiums.

Can installing safety features lower my Cadillac STS insurance rates?

Yes, adding safety features like anti-theft devices and advanced driver assistance systems can help reduce insurance costs.

How does my driving history affect Cadillac STS insurance rates?

A clean driving record generally results in lower insurance premiums, while a history of violations or accidents can increase rates. For more information, read our article titled “Do all car insurance companies check your driving records?”

Do insurance rates vary significantly between Cadillac STS model years?

Yes, newer models often come with higher insurance premiums due to their increased repair and replacement costs.

Are there discounts available for Cadillac STS owners?

Many insurers offer discounts for bundling policies, good driving habits, and maintaining a low mileage on your Cadillac STS. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.