Best San Antonio, TX Car Insurance in 2026

State Farm, Geico, and Allstate rank as top choices for the best San Antonio, TX car insurance, boasting rates as low as $33 monthly. These insurers offer cost-effective yet comprehensive coverage, ideal for individuals seeking discounts and dependable protection customized to their driving requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Full Coverage in San Antonio

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in San Antonio

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in San Antonio

A.M. Best Rating

Complaint Level

Pros & Cons

#1 – State Farm: Top Overall Pick

Pros

- Discount Possibilities: State Farm provides various discount options.

- Financial Stability: State Farm is supported by a financially robust company.

- Exceptional Customer Support: State Farm is renowned for its responsive and user-friendly service.

Cons

- Coverage Limitations: Certain driving needs may not be eligible for policy add-ons. Find out more in our State Farm auto insurance review.

- Claims Processing: Individuals may encounter delays or complications when processing claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Innovative Coverage Options: Geico offers unique coverage options like Accident Forgiveness and Deductible Rewards, providing additional value.

- User-friendly Technology: Geico provides intuitive mobile apps and online tools, making policy and claims management easy for customers.

- Strong Financial Stability: Geico’s solid financial standing ensures policyholders have a reliable and stable insurance provider.

Cons

- Possibly Higher Premiums: Some customers may find that Geico’s premiums are slightly higher compared to other insurers.

- Mixed Customer Service Reviews: While many customers have positive experiences, our Geico insurance review highlights some challenges with claims processing.

#3 – Allstate: Best for Comprehensive Policies

Pros

- Discount Opportunities: Allstate offers personalized discount options for individuals.

- Financial Security: Allstate benefits from the support of a financially stable corporation.

- Outstanding Customer Service: Allstate is well-known for its prompt and easily accessible service.

Cons

- Coverage Restrictions: Some additional policy features may not fully meet individual needs. Refer to our Allstate car insurance review for guidance.

- Claims Processing: Individuals may experience delays or challenges during the claims procedure.

#4 – Progressive: Best for Extensive Discounts

Pros

- Tailored Policies: In our Progressive car insurance review, customized coverage options cater to vehicles.

- Competitive Rates: Progressive provides affordable pricing.

- Discount Availability: Progressive offers various discount opportunities, including those specific to automobiles.

Cons

- Claims Processing: Policyholders may experience delays or complications in the claims process with Progressive.

- Limited Discount Options: Progressive may not offer as many discount options as some of its competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Specialized Coverage

Pros

- Customized Policies: Farmers, as discussed in our Farmers car insurance review, tailors coverage to individual needs.

- Competitive Premiums: Farmers offers affordable rates for car insurance.

- Discount Options: Farmers provides various discounts, including those for auto insurance policies.

Cons

- Limited Accessibility: Farmers primarily operates through local agents, which may be unavailable in certain regions.

- Coverage Restrictions: Some additional coverage options offered by Farmers may not fully meet policyholders’ requirements.

#6 – Liberty Mutual: Best for Extensive Coverage

Pros

- Personalized Policies: Liberty Mutual provides tailored coverage options for auto insurance policies.

- Competitive Rates: Liberty Mutual offers affordable premiums.

- Outstanding Customer Support: Liberty Mutual is well-known for its prompt and user-friendly service.

Cons

- Membership Restrictions: Liberty Mutual membership is exclusively available to military members, veterans, and their families.

- Availability Limitations: The availability of Liberty Mutual’s services may vary depending on the location. Please refer to our Liberty Mutual car insurance review for further details.

#7 – Nationwide: Best for Customer Service

Pros

- Diverse Coverage Options: Nationwide provides a wide array of coverage options, enabling customers to customize their policies according to their requirements.

- Deductible Reduction Program: The Vanishing Deductible initiative incentivizes safe driving behavior by gradually reducing deductibles over time.

- Membership Savings: Nationwide offers discounts for different affiliations and memberships, making insurance more affordable for specific groups.

Cons

- Mixed Customer Satisfaction: Satisfaction levels among customers vary, as highlighted in our Nationwide insurance review, with some individuals reporting average experiences.

- Premium Discrepancies: Premium rates may differ based on location and individual profiles, potentially affecting overall affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – AAA: Best for Roadside Assistance

Pros

- Customized Policies: AAA offers tailored coverage options for vehicles in San Antonio, Texas.

- Competitive Rates: AAA provides budget-friendly pricing. Begin your affordability assessment with our AAA auto insurance review.

- Discount Options: AAA extends various discounts, including those specific to automobiles.

Cons

- Limited Local Agent Availability: AAA’s primary operations involve local agents, potentially limiting accessibility.

- Coverage Limitations: Certain policy enhancements may not fully meet the requirements of vehicles.

#9 – American Family: Best for Comprehensive Coverage

Pros

- Innovative Policy Features: American Family offers unique coverage options like Accident Forgiveness and Deductible Rewards, enhancing policy value.

- User-friendly Technology: With intuitive mobile apps and online tools, American Family simplifies policy and claims management for customers.

- Financial Strength: American Family’s strong financial standing guarantees policyholders a dependable and secure insurance provider.

Cons

- Possible Higher Premiums: Some clients may perceive American Family’s premiums as slightly elevated compared to other insurers.

- Varied Customer Service Feedback: Although many clients have positive experiences, our American Family insurance review highlights occasional challenges with claims processing.

#10 – Travelers: Best for Customized Policies

Pros

- Affordable Pricing: Our Travelers car insurance review highlights cost-effective rates that are friendly to most budgets.

- Flexible Coverage Choices: Travelers offers customizable policies to tailor coverage to individual needs.

- Discount Opportunities: Travelers provides various discount options, including those specifically designed for automobiles.

Cons

- Sparse Local Agent Presence: Travelers primarily operates through online platforms and phone services.

- Policy Restrictions: Certain additional coverage options may not fully address the specific requirements of automobiles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cost of Car Insurance in San Antonio

Driving in San Antonio

Military Members and Veterans

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unique San Antonio Laws

Frequently Asked Questions

What is the average cost of car insurance in San Antonio, Texas?

How does age and gender affect car insurance rates in San Antonio?

How does location affect car insurance rates in San Antonio?

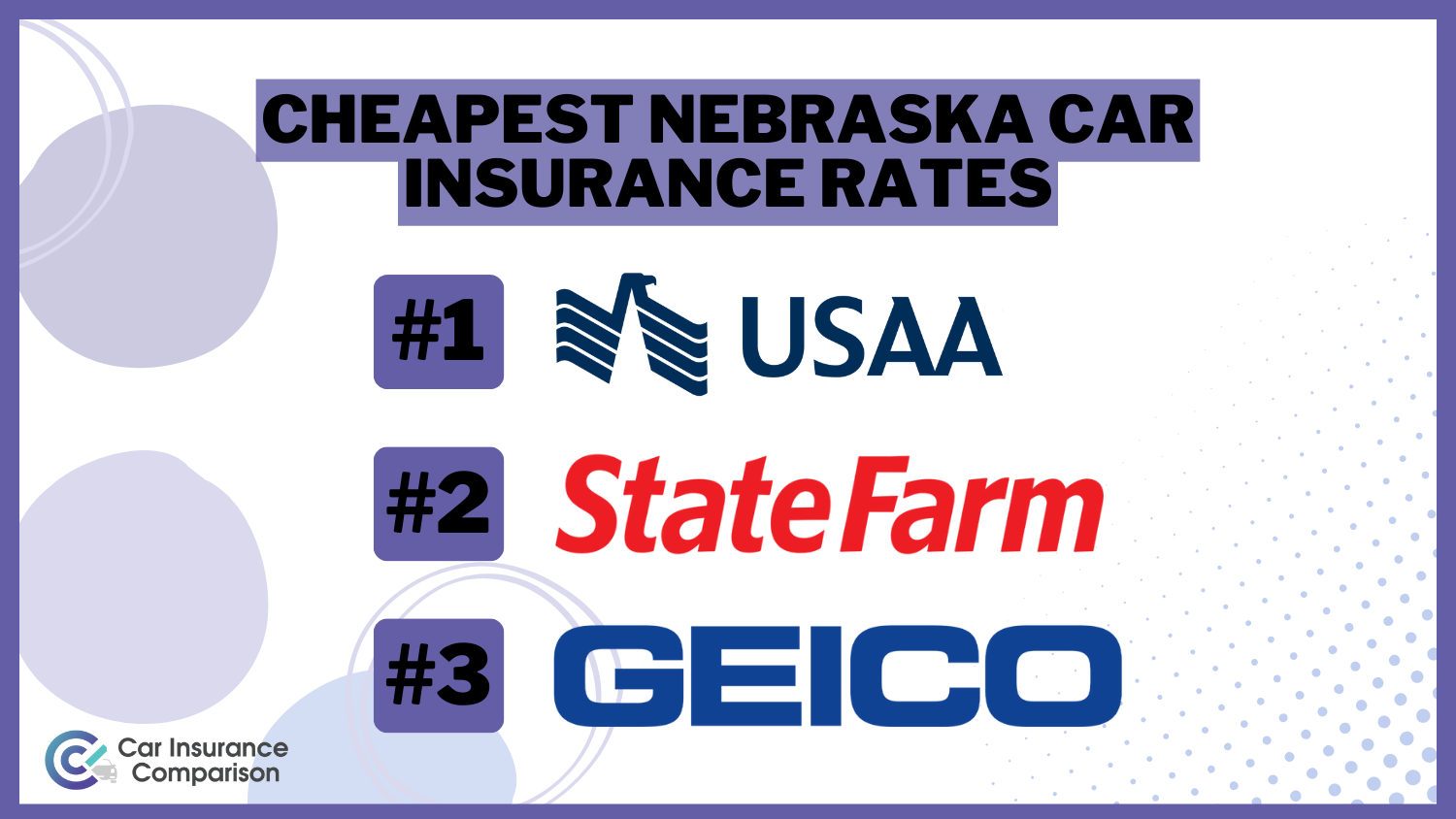

Which company offers the cheapest car insurance rates in San Antonio?

USAA offers the cheapest rates for military members and their families, while State Farm offers the cheapest rates for non-military drivers. The best way to find the best rat is to compare quotes. You can use our free online tool: Start by entering your ZIP code to receive multiple quotes from top-rated car insurance companies.

How does commute distance affect rates in San Antonio?

How difficult is it to get around by car in San Antonio?

Do I even need a car in San Antonio?

How good is car insurance in San Antonio?

What is the minimum amount of car insurance I need in San Antonio?

How does the weather affect driving in San Antonio?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.