Cheapest Rhode Island Car Insurance Rates in 2026 (Save Money With These 10 Companies!)

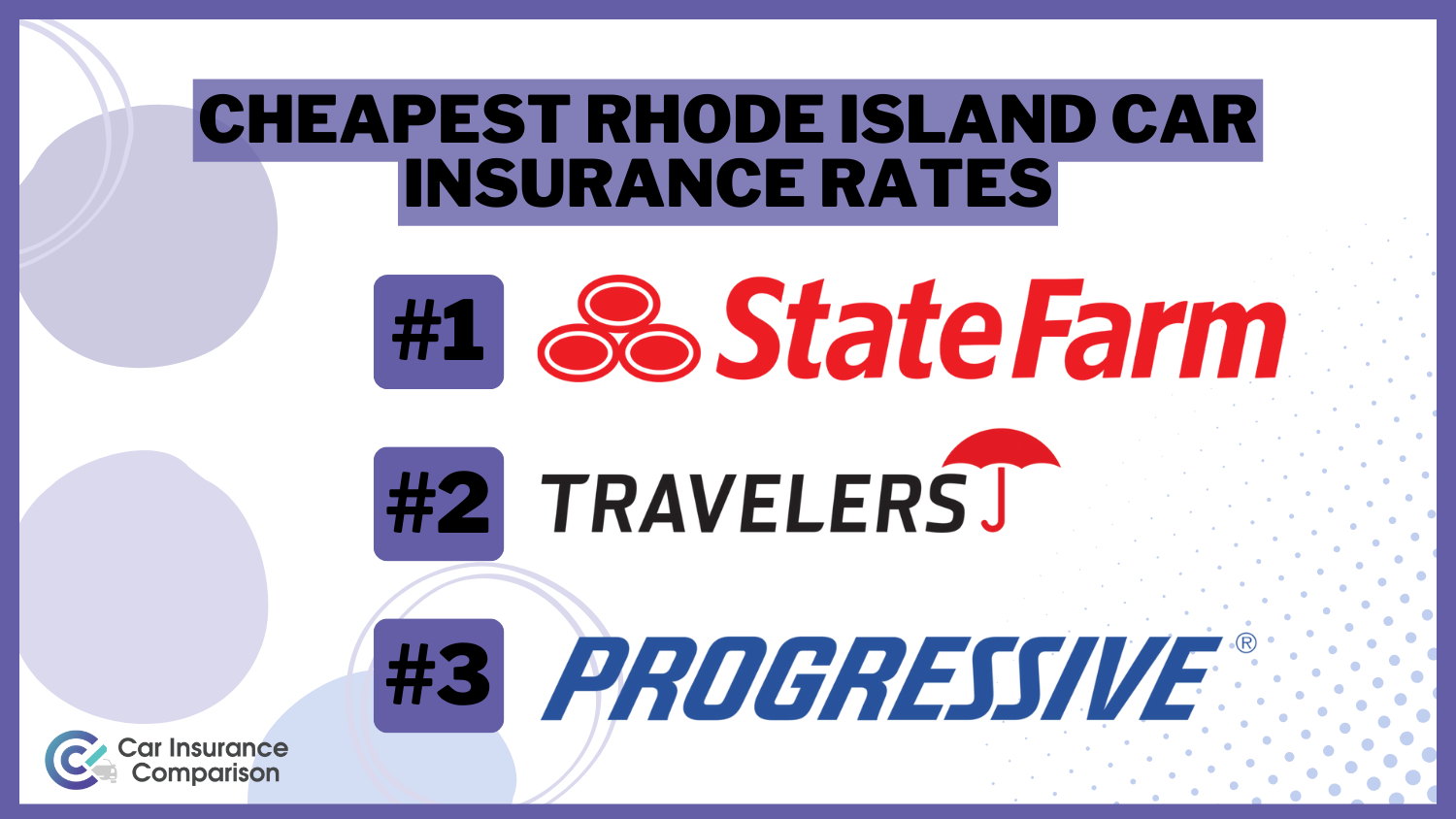

The top providers for the cheapest Rhode Island car insurance rates are from State Farm, Travelers, and Progressive, with rates as low as $32/month. These companies offer competitive rates due to efficient claims processing and comprehensive coverage options, making them the best choices in Rhode Island.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated November 2024

Company Facts

Min. Coverage for Rhode Island

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Rhode Island

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for Rhode Island

A.M. Best Rating

Complaint Level

Pros & Cons

The best providers for the cheapest Rhode Island car insurance rates are State Farm, Travelers, and Progressive, offering competitive rates as low as $32/month.

These companies stand out due to their efficient claims processing and comprehensive coverage options. In a state where car insurance premiums average $198 per month, finding an affordable policy requires careful comparison.

Our Top 10 Company Picks: Cheapest Rhode Island Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $32 B Comprehensive Coverage State Farm

#2 $44 A++ Hybrid Discounts Travelers

#3 $49 A+ Unique Discounts Progressive

#4 $53 A++ Competitive Rates Geico

#5 $64 A Customer Satisfaction American Family

#6 $72 A+ Policyholder Dividends Amica

#7 $78 A Personalized Service Farmers

#8 $80 A+ Safe Driving Allstate

#9 $81 A+ Vanishing Deductible Nationwide

#10 $100 A Customizable Policies Liberty Mutual

This guide provides essential information to help Rhode Island residents navigate the complexities of car insurance and secure the best possible rates.

Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

- State Farm offers the cheapest car insurance in Rhode Island, starting at $32/month

- Consider location and driving record to find affordable car insurance rates

- Comparing multiple quotes helps secure the best rates in Rhode Island

#1 – State Farm: Top Overall Pick

Pros

- Efficient Claims Processing: State Farm car insurance review highlights its reputation for efficient claims processing, ensuring quick and effective handling of claims.

- Comprehensive Coverage Options: State Farm provides a variety of coverage options, allowing customers to tailor their policies to fit their specific needs.

- Customer Satisfaction: State Farm consistently receives high ratings for customer satisfaction, indicating a positive experience for most policyholders.

Cons

- Higher Rates for Young Drivers: Young drivers may find that State Farm’s rates are higher compared to those for older, more experienced drivers.

- Regional Variability in Service: Service quality and customer satisfaction can vary depending on the region, with some areas experiencing less favorable service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Hybrid Discounts

Pros

- Competitive Rates: Travelers offers some of the lowest rates in Rhode Island, starting at $32 per month, making it an affordable option for many drivers.

- Strong Financial Stability: Travelers car insurance review highlights its strong financial stability, exemplified by a high A.M. Best Rating, which showcases reliability and its capacity to fulfill claims promptly.

- Discount Opportunities: Provides multiple discounts, such as safe driver, multi-policy, and multi-car discounts, helping customers save more on their premiums.

Cons

- Higher Rates for High-Risk Drivers: Travelers may charge significantly higher rates for drivers with poor credit scores or less-than-perfect driving records.

- Limited Local Agents: Some customers might find a lack of local agents, making face-to-face interactions less accessible compared to other insurers.

#3 – Progressive: Best for Unique Discounts

Pros

- Comprehensive Coverage Options: They provide a wide range of coverage options including liability, collision, comprehensive, uninsured motorist, and personal injury protection.

- Efficient Claims Processing: Progressive car insurance review showcase its reputation for a rapid and effective claims process, showcasing their commitment to assisting customers promptly after accidents.

- Discount Opportunities: Progressive offers numerous discounts, such as multi-policy, multi-car, good student, and safe driver discounts, helping customers save even more on their premiums.

Cons

- Higher Rates for High-Risk Drivers: Progressive may charge higher premiums for drivers considered high-risk, such as those with multiple traffic violations or accidents.

- Limited Local Agents: Progressive primarily operates online, which might be a disadvantage for customers who prefer face-to-face interactions with insurance agents.

#4 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: Geico is known for offering some of the lowest rates in the car insurance industry, making it a popular choice for budget-conscious consumers.

- User-Friendly Mobile App: The Geico mobile app is highly rated for its ease of use, offering features like digital ID cards, roadside assistance, and the ability to file claims directly from the app.

- 24/7 Customer Service: Geico car insurance review highlights their commitment to round-the-clock customer service, ensuring policyholders can receive assistance whenever they need it.

Cons

- Limited Local Agents: Geico operates primarily through its website and call centers, which might be a drawback for customers who prefer face-to-face interactions with local agents.

- Mixed Customer Satisfaction: While Geico scores well in some customer satisfaction surveys, it has received mixed reviews regarding claims processing and customer service experiences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Customer Satisfaction

Pros

- Comprehensive Coverage Options: American Family offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, and personal injury protection.

- Customer Service: American Family car insurance review highlights its renowned customer service, showcasing efficient claims handling and personalized support for policyholders.

- Mobile App: The user-friendly mobile app allows customers to manage their policies, file claims, and access roadside assistance conveniently.

Cons

- Price: Premiums can be higher compared to some other insurers, especially for drivers with less-than-perfect driving records.

- Limited Online Tools: While the mobile app is robust, the website’s online quote tool and other digital resources are not as comprehensive as those offered by some competitors.

#6 – Amica: Best for Policyholder Dividends

Pros

- Comprehensive Coverage Options: Offers a variety of coverage options including liability, collision, comprehensive, and more, allowing customers to tailor their policies to their needs.

- Efficient Claims Processing: Renowned for quick and efficient claims processing, helping customers get back on the road faster after an incident. For a comprehensive analysis, refer to our detailed guide titled “How do you get an amica mutual car insurance quote online?“

- Discount Opportunities: Offers multiple discounts, such as for safe driving, bundling policies, and loyalty, helping customers save on premiums.

Cons

- Higher Premiums: Compared to some competitors, Amica’s premiums can be higher, which might not suit budget-conscious customers.

- Digital Experience: The digital experience and online tools are less robust compared to some larger insurers, potentially making it less convenient for tech-savvy users.

#7 – Farmers: Best for Personalized Service

Pros

- Customizable Policies: Farmers car insurance review showcases how policyholders can customize their insurance plans to suit their individual requirements, offering enhanced flexibility and personalized coverage options.

- Good Customer Service: Farmers has a reputation for providing responsive and helpful customer service, making it easier for customers to get assistance when needed.

- Discount Opportunities: Farmers offers various discounts, such as for safe driving, bundling multiple policies, and having certain safety features in your car, which can help reduce premium costs.

Cons

- Mixed Customer Reviews: While many customers report positive experiences, some have noted issues with claim handling and customer service, indicating inconsistency.

- Limited Availability: Farmers Insurance may not be available in all states, which can be a limitation for those living in areas where Farmers does not operate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Safe Driving

Pros

- Discount Opportunities: Allstate provides numerous discounts, such as multi-policy, safe driver, and new car discounts, which can help policyholders save significantly on their premiums.

- Strong Financial Stability: Allstate car insurance review highlights its robust financial stability, as evidenced by top ratings from financial institutions such as A.M. Best, ensuring dependable claim payouts.

- Customer Service and Claims Support: Allstate has a solid reputation for customer service and provides 24/7 claims support, making it easier for policyholders to file and manage claims.

Cons

- Mixed Customer Reviews: While many customers are satisfied, there are mixed reviews regarding the claims process, with some customers reporting dissatisfaction with the handling and resolution of their claims.

- Limited Availability of Local Agents: In some areas, customers may find it challenging to access local agents, which can impact personalized service and support.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Discounts and Savings: The company highlights various discounts under Nationwide car insurance discounts, including multi-policy, safe driver, and good student discounts, which showcase opportunities for policyholders to reduce their premiums.

- Customer Service: Nationwide is known for its good customer service, providing easy access to support and claims assistance through multiple channels, including phone, online, and mobile apps.

- Innovative Features: The company offers innovative features like the SmartRide program, which rewards safe driving habits with potential discounts on premiums.

Cons

- Higher Premiums: Some customers report that Nationwide’s premiums can be higher than those of other insurance providers, especially without the applicable discounts.

- Mixed Reviews on Claims Handling: While many customers are satisfied with Nationwide’s claims process, there are some mixed reviews regarding the efficiency and satisfaction of claims handling.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Discount Opportunities: Numerous discounts are available, such as multi-policy, safe driver, good student, and vehicle safety features discounts, helping customers save on premiums.

- Strong Financial Stability: Liberty Mutual car insurance review highlights strong financial strength ratings, showcasing its ability to meet claims obligations reliably and provide dependable service to policyholders.

- Convenient Online Tools: Liberty Mutual offers robust online and mobile tools for managing policies, getting quotes, and handling claims, providing convenience and efficiency for tech-savvy users.

Cons

- Mixed Customer Service Reviews: While many customers report positive experiences, there are also a notable number of complaints regarding customer service and claims handling.

- Regional Variations in Coverage: The availability and terms of certain coverages and discounts can vary by state, potentially limiting options for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Rhode Island Car Insurance Rates

If you’re a resident of the State of Rhode Island and Providence Plantations – and yes, that’s the state’s full name for those of you who didn’t know – you’re required by law, if driving a car, to have car insurance.

Choosing the best coverage for your situation, though, is tough, especially with so many car insurance options and types available to you. As this news story below highlights, even a single factor like where you live can change your rates.

Rhode Island Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $189

American Family $64 $151

Amica $72 $164

Farmers $78 $183

Geico $53 $125

Liberty Mutual $100 $235

Nationwide $81 $190

Progressive $49 $116

State Farm $32 $76

Travelers $44 $103

Here is a comparison of monthly car insurance rates in Rhode Island based on different coverage levels from various providers. For minimum coverage, State Farm offers the lowest rate at $32, while Liberty Mutual has the highest at $100.

For full coverage, State Farm again provides the most affordable option at $76, and Liberty Mutual’s rate is the highest at $235. Other notable providers include Geico, offering minimum coverage at $53 and full coverage at $125, and Progressive with rates of $49 for minimum and $116 for full coverage.

Discover exclusive car insurance discounts offered by top providers in Rhode Island. This comprehensive table outlines savings opportunities from leading insurers like Allstate, American Family, Amica, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, and Travelers.

Discounts range from safe driving and multi-policy benefits to incentives for good students, homeownership, anti-theft measures, and more. Whether you’re looking to save on premiums through loyalty rewards or responsible driving discounts, these options cater to diverse needs, ensuring you find the best coverage at competitive rates.

Car Insurance Requirements in Rhode Island

Rhode Island, like every other state in the union, requires drivers to be covered by a state minimum amount of coverage in order to legally operate on the road. Rhode Island’s minimum coverage includes a 25/50/25 minimum liability policy.

The numbers 25, 50, and 25 represent the minimum liability coverage required in many states like Rhode Island. Specifically, it means $25,000 of bodily injury coverage per person, $50,000 for total injuries per accident, and $25,000 for property damage per accident.

State Farm offers the most competitive rates starting at $32 per month, making it the top choice for affordable car insurance in Rhode Island.

Brad Larson Licensed Insurance Agent

Additionally, Rhode Island mandates $25,000 in uninsured/underinsured motorist coverage, ensuring you’re protected if involved in an accident with someone who lacks sufficient insurance. Note again that this is the minimum coverage required of you if you’re a resident of the state of Rhode Island.

Because medical costs have risen dramatically in the past decade, it’s unlikely that this minimum will be able to provide for all your needs should you end up severely injured. However, it is a good foundation to lay in terms of coverage.

Compare Rhode Island Car Insurance Rates by Gender and Age

Did you know that your gender can impact your insurance rates? You’ve probably heard the old myth that male drivers are a little more reckless than women drivers and are, as such, charged more for their coverage. Is that old myth really true, though?

Age contributes to the car insurance rates a driver has to pay. 17-year-old boys have to pay a significantly higher premium than their female counterparts — complying with the gender myth — but once both genders reach 35, the rates even out.

In Rhode Island, average monthly car insurance rates vary by age and gender across different demographics. For instance, at 17 years old, rates tend to be higher due to less driving experience and higher risk. By age 25, rates typically decrease as drivers gain more experience and maturity. At 35 years old, rates may stabilize further, reflecting a period of lower risk statistically.

By age 60, rates generally remain stable or may decrease slightly, reflecting a mature and experienced driver profile. Gender can also influence rates within these age brackets, with variations based on insurers’ risk assessments and historical claims data.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Car Insurance Requirements and Options in Rhode Island

In Rhode Island, you must carry proof of insurance at all times when driving, required for registration, traffic stops, or after accidents. Violations incur fines and license/registration suspensions, escalating with each offense.

The state’s average annual car insurance premium is $1,688, higher than the national average. Optional coverages like PIP and uninsured motorist protection are recommended due to Rhode Island’s 17% uninsured driver rate. Optional add-ons such as Guaranteed Auto Protection (Gap) and Rental Reimbursement provide additional financial security beyond state requirements.

Navigating Rhode Island’s Driving Regulations

These rules are designed not only to ensure the safety of all road users but also to optimize traffic flow and minimize potential hazards. From speed limits to pedestrian crossings, each regulation plays a crucial role in maintaining order and safety on the roads. To gain further insights, consult our comprehensive guide titled “Safety Features Car Insurance Discounts.”

- Speed Limits: Defined maximum speeds for different road types ensure safety and efficiency, reflecting optimal conditions and potential hazards.

- Traffic Signals: Color-coded signals govern intersections to manage traffic flow and ensure safe passage, promoting orderly driving behavior and preventing accidents.

- Right-of-Way Rules: Regulations determining which vehicle proceeds first at intersections or in merging situations prioritize safety and prevent collisions by establishing clear driving hierarchies.

- Seat Belt Requirements: Mandatory use of seat belts for all occupants enhances vehicle safety, reducing injury severity in accidents and complying with state laws.

- DUI Laws: Strict regulations on blood alcohol content (BAC) levels and penalties for driving under the influence aim to deter impaired driving, safeguarding road users from potential harm.

- Cell Phone Usage: Restrictions on handheld device usage while driving aim to minimize distractions, enhancing driver focus and reducing the likelihood of accidents.

- Parking Regulations: Guidelines for parking locations and restrictions ensure orderly vehicle placement, preventing congestion and maintaining accessibility for all road users.

- Pedestrian Crossings: Rules governing yielding to pedestrians at designated crossings prioritize pedestrian safety, fostering a pedestrian-friendly environment and preventing accidents.

Adhering to these rules not only ensures compliance with state laws but also promotes responsible driving habits that enhance overall road safety.

State Farm stands out with its low rates and efficient claims processing, making it the top pick for Rhode Island drivers seeking affordable and reliable car insurance.

Michelle Robbins Licensed Insurance Agent

Whether you’re a resident or a visitor, understanding and respecting these regulations are essential steps towards safer journeys on Rhode Island’s roads.

Insights into Driving in Rhode Island

Explore beyond Rhode Island’s driving laws to discover vehicle theft trends, with Honda Accords and Civics being frequent targets despite a slightly higher statewide theft rate than the national average. Weather-related fatalities and urban road hazards also pose risks to drivers, supported by data on crash types and speeding incidents. For additional details, explore our comprehensive resource titled “Understanding Car Accidents.”

Understanding these factors is essential for safe navigation throughout the state. Additionally, Rhode Island’s commute times typically range from 5 to 24 minutes, reflecting its compact size and minimal traffic congestion, ensuring reliable travel for residents who predominantly commute by driving alone.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Navigating Car Insurance in Rhode Island

Through a series of case studies, we explore how different individuals in the Ocean State found solutions tailored to their unique circumstances. From young drivers to retirees, each case offers insights into choosing the right coverage while managing costs effectively.

- Case Study #1 – Young Driver’s Dilemma: Sarah, a 19-year-old college student in Providence, Rhode Island, recently purchased her first car. Despite her age and limited driving history, she found an affordable insurance policy with Geico through good student discounts.

- Case Study #2 – Family Savings Strategy: The Rodriguez family in Warwick, RI, sought cheaper car insurance while keeping adequate coverage for their two vehicles. They switched to Progressive for its multi-car discount and competitive rates for their minivan and sedan after comparing quotes.

- Case Study #3 – Senior Citizen’s Security: John, a retired Newport resident, sought to cut car insurance costs. Amica’s senior discounts and stellar service gave him peace of mind on the road. Check out our ranking of the top providers: Best Senior Citizen Car Insurance Discounts

- Case Study #4 – High-Risk Driver’s Solution: Michael, of Cranston, RI, joined the Rhode Island Automobile Insurance Plan (RIAIP) for high-risk drivers after facing insurance challenges due to traffic violations and accidents.

- Case Study #5 – Urban Commuter’s Choice: Emily, who lives in downtown Providence, chose Allstate for comprehensive car insurance with rideshare coverage, ensuring protection for both personal and occasional work use.

Each case study highlights the importance of shopping around and exploring different options to find the best car insurance fit in Rhode Island.

State Farm offers Rhode Island drivers the most competitive rates and comprehensive coverage options, making it the optimal choice for affordable and reliable car insurance.

Daniel Walker Licensed Insurance Agent

Whether it’s leveraging discounts, choosing specialized coverage, or opting for state-assisted plans, these stories demonstrate that informed decisions can lead to significant savings and enhanced peace of mind on the road.

The Bottom Line: Comprehensive Guide to Rhode Island Car Insurance Rates and Providers

This comprehensive guide provides an in-depth look at car insurance options in Rhode Island. It highlights the top providers offering competitive rates, such as State Farm, Travelers, and Progressive, with premiums starting as low as $32 per month. To learn more, explore our comprehensive resource on insurance titled “What Is a Car Insurance Premium?”

The guide covers essential details including minimum coverage requirements, provider comparisons, and insights into factors influencing insurance rates in the state. Whether you’re looking for minimum liability or full coverage, this resource aims to help residents make informed decisions to find the best car insurance fit for their needs and budget.

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

Frequently Asked Questions

Who has the cheapest insurance in Rhode Island?

State Farm, Travelers, and Progressive are known for offering some of the lowest car insurance rates in Rhode Island, with rates starting as low as $32 per month.

How much does car insurance cost in Rhode Island?

The average cost of car insurance in Rhode Island is approximately $198 per month. Rates can vary based on factors such as age, driving history, and the type of coverage chosen.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

What is the minimum coverage for car insurance in Rhode Island?

Rhode Island requires drivers to carry a minimum liability insurance policy with limits of 25/50/25. This means coverage includes $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage per accident.

To delve deeper, refer to our in-depth report titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

What is the cheapest form of car insurance?

The cheapest form of car insurance typically refers to state minimum liability coverage, which provides the basic legal requirement for driving but may not cover all potential expenses in an accident.

Is it illegal to not have car insurance in Rhode Island?

Yes, it is illegal to drive without car insurance in Rhode Island. Drivers must carry at least the minimum required liability coverage to legally operate a vehicle on the road.

Is Rhode Island a no-fault state?

Yes, Rhode Island follows a no-fault system for car insurance. This means that after an accident, each party’s own insurance covers their medical expenses and other losses, regardless of who was at fault.

For a thorough understanding, refer to our detailed analysis titled “Compare No-Fault Car Insurance: Rates, Discounts, & Requirements.”

What is the best car insurance?

The best car insurance varies depending on individual needs and preferences. Companies like State Farm, Travelers, and Progressive often rank highly for their competitive rates and customer service.

What is the lowest car insurance group?

Car insurance groups are typically used in the UK to categorize vehicles based on insurance risk. In the US, insurance rates are influenced more by individual factors like driving history and location rather than group categorization.

Is car insurance more expensive in Rhode Island?

Yes, car insurance in Rhode Island tends to be more expensive than the national average due to factors such as higher population density, traffic congestion, and other local risk factors.

To expand your knowledge, refer to our comprehensive handbook titled “How Traffic Infractions Affect Car Insurance.”

Do you need insurance to drive in Rhode Island?

Yes, drivers in Rhode Island must have proof of insurance coverage to legally operate a vehicle. Failure to provide proof of insurance can result in fines, license suspension, and other penalties.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.