Cheapest Wyoming Car Insurance Rates in 2026 (Big Savings With These 10 Companies!)

Compare cheapest Wyoming car insurance rates that starts as low as $17 per month with top providers like Liberty Mutual, State Farm, and Travelers. Renowned for their competitive rates. Endorsed by the state's Better Business Bureau and offer mandatory 25/50/20 coverage, ensuring both affordability and reliability.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated June 2024

Company Facts

Min. Coverage for Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Wyoming

A.M. Best Rating

Complaint Level

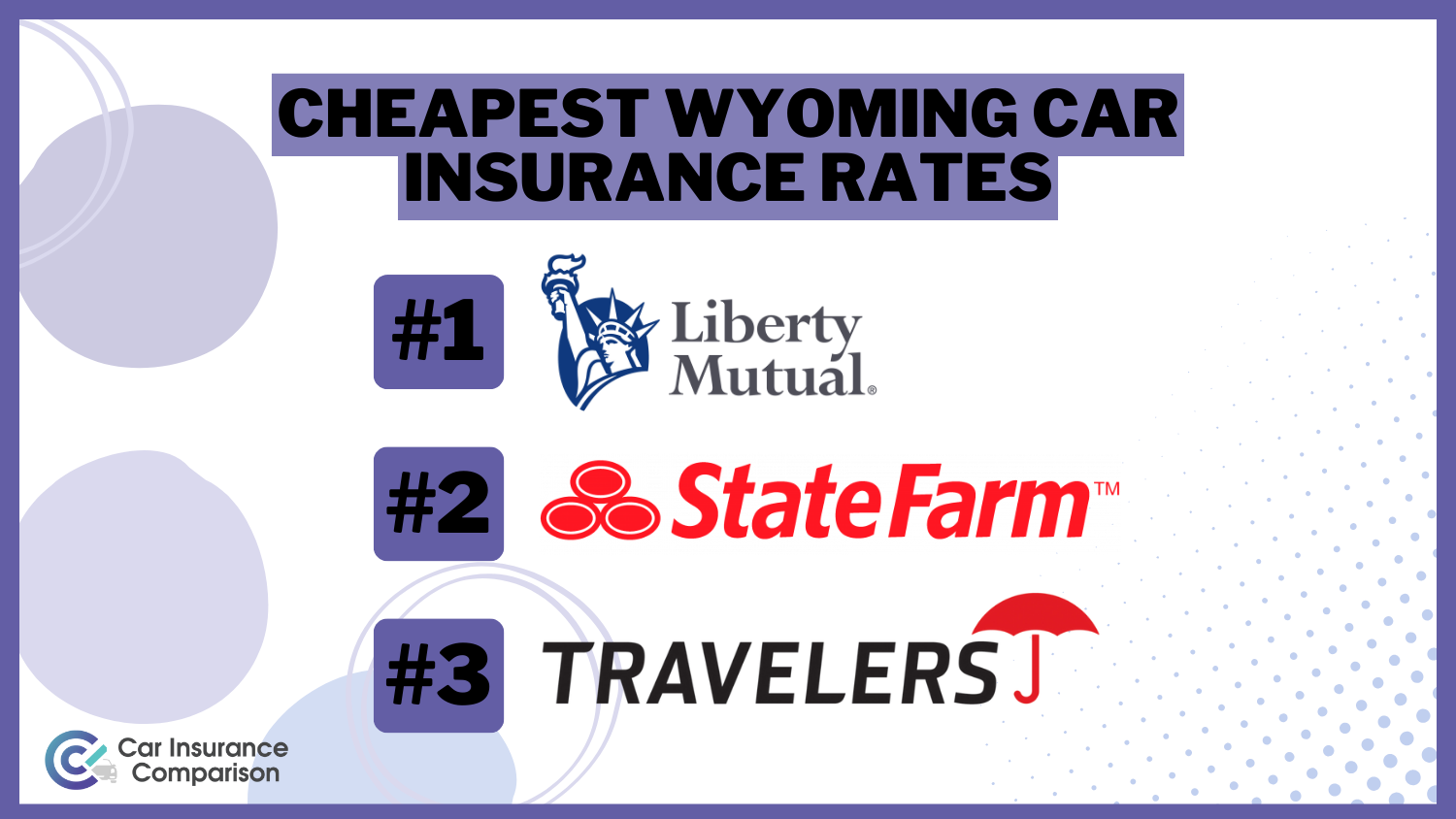

Get the cheapest Wyoming car insurance rates as low as $17 per month with Liberty Mutual, State Farm, and Travelers from the cowboy state of Wyoming. A great place to run a cheapest car insurance companies comparison. Wyoming, like every other state, requires mandatory insurance should you get into an accident with another driver.

Wyoming requires a minimum of 25,000/50,000 for bodily injury and property damage coverage at $20,000.

Our Top 10 Company Picks: Cheapest Wyoming Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $17 A Many Discounts Liberty Mutual

#2 $19 B Claims Service State Farm

#3 $23 A++ Competitive Rates Travelers

#4 $24 A+ Snapshot Program Progressive

#5 $25 A Affordable Rates American Family

#6 $26 A++ Online Tools Geico

#7 $27 A+ Customer Service Nationwide

#8 $28 A Financial Stability Safeco

#9 $30 A Personalized Service Farmers

#10 $36 A+ Local Agents Allstate

This is known as a 25/50/20 and covers things as simple as a broken headlight to the other driver’s auto up to major body or engine damage, along with medical bills.

Compare Wyoming car insurance rates by entering your zip code above into our free comparison tool.

- There is a broad range of car insurance companies in Wyoming

- Wyoming requires a bare minimum of 25,000/50,000 for bodily injury

- Progressive, Geico, Allstate, and Met are available in Wyoming

- Compare Wyoming Car Insurance Rates

#1 – Liberty Mutual: Top Overall Pick

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options and add-ons, including accident forgiveness and new car replacement.

- Discount Opportunities: The company provides various discounts, such as multi-policy, good student, and multi-car discounts, which can help lower premiums.

- Strong Customer Service: Liberty Mutual is known for good customer service, offering personalized support through local agents. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be higher compared to some other insurers, which might not be ideal for budget-conscious customers.

- Mixed Claims Satisfaction: While many customers report positive experiences, some have reported issues with claims handling and satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Claims Service

Pros

- Extensive Agent Network: State Farm has a large network of local agents, providing personalized service and support.

- Strong Financial Stability: With high financial ratings, State Farm ensures reliability in paying out claims and overall company stability.

- Comprehensive Coverage Options: State Farm offers a variety of coverage options and discounts, making it easy to customize policies.

Cons

- Higher Premiums: State Farm’s rates can be higher than some competitors, which may not suit all budgets. Unlock details in our State Farm car insurance review.

- Inconsistent Customer Service: While generally positive, some customers report mixed experiences with customer service and claims handling.

#3 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Travelers is known for offering competitive rates, often making it a more affordable option for car insurance.

- Strong Financial Ratings: Travelers has strong financial stability, ensuring reliability in claims payments. Read more in our Travelers car insurance review.

- Extensive Coverage Options: The company offers a wide range of coverage options, including new car replacement and accident forgiveness.

Cons

- Mixed Customer Reviews: Some customers report issues with customer service and claims processing, indicating inconsistency in service quality.

- Limited Local Agents: Travelers relies more on online and phone services, which might be less convenient for those who prefer in-person interactions.

#4 – Progressive: Best for Snapshot Program

Pros

- Competitive Rates: Progressive is known for offering competitive rates, often making it one of the cheaper options for car insurance in Wyoming.

- Usage-Based Programs: Progressive’s Snapshot program can offer additional savings based on your driving habits, potentially lowering premiums for safe drivers.

- Wide Range of Discounts: Progressive provides various discounts, including multi-policy, multi-car, and good driver discounts, making it easier to save on premiums.

Cons

- Mixed Customer Service Reviews: While some customers report positive experiences, others have noted issues with customer service responsiveness and claims handling.

- Price Increases: Some customers have reported significant price increases after the initial policy period, making long-term affordability a concern. Delve into our evaluation of Progressive car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Affordable Rates

Pros

- Strong Customer Service: American Family is known for good customer service, offering personalized support through local agents.

- Comprehensive Coverage Options: As mentioned in our American Family car insurance review, the company provides a wide range of coverage options and discounts, allowing for customized insurance plans.

- Financial Stability: American Family has strong financial ratings, ensuring reliability in paying out claims and overall company health.

Cons

- Higher Premiums: American Family’s rates can be higher compared to some other insurers, which might not be ideal for budget-conscious customers.

- Limited Availability: American Family’s services are not available in all areas, which can limit options for some customers.

#6 – Geico: Best for Online Tools

Pros

- Affordable Premiums: Geico is often highlighted for its low-cost car insurance, making it a popular choice for budget-conscious drivers.

- Strong Financial Stability: Geico’s strong financial ratings ensure reliability in paying out claims and overall company stability.

- User-Friendly Online Tools: Geico offers a comprehensive and easy-to-use website and mobile app for managing policies, filing claims, and accessing customer service.

Cons

- Limited Local Agents: Geico primarily operates online and via phone, which might be less convenient for those who prefer in-person interactions. Learn more in our Geico car insurance review.

- Potential Rate Hikes: Customers have reported unexpected premium increases upon renewal, which can be a drawback for long-term cost planning.

#7 – Nationwide: Best for Customer Service

Pros

- Comprehensive Coverage Options: Nationwide offers a wide range of coverage options, including accident forgiveness and vanishing deductible.

- Strong Financial Ratings: Nationwide has high financial stability, ensuring reliability in paying out claims.

- Discount Opportunities: The company provides various discounts, such as multi-policy, good student, and safe driver discounts. Find out more in our article on Nationwide car insurance discounts.

Cons

- Higher Premiums: Nationwide’s rates can be higher compared to some other insurers, which might not be ideal for budget-conscious customers.

- Mixed Customer Reviews: Some customers report issues with customer service and claims handling, indicating inconsistency in service quality.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Safeco: Best for Financial Stability

Pros

- Comprehensive Coverage Options: Safeco offers a wide range of coverage options and add-ons, including accident forgiveness and new car replacement.

- Discount Opportunities: The company provides various discounts, such as multi-policy, good student, and multi-car discounts.

- Strong Financial Stability: Safeco has strong financial ratings, ensuring reliability in claims payments. Learn more in our Safeco car insurance review.

Cons

- Mixed Customer Service Reviews: Some customers have reported issues with customer service responsiveness and claims handling.

- Higher Premiums: Safeco’s premiums can be higher compared to some other insurers, which might not be ideal for budget-conscious customers.

#9 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers offers personalized service through a network of local agents, providing tailored support and advice.

- Comprehensive Coverage Options: The company provides a variety of coverage options and discounts, making it easy to customize policies.

- Strong Financial Stability: Farmers has high financial ratings, ensuring reliability in paying out claims.

Cons

- Higher Premiums: Farmers’ rates can be higher than some competitors, which may not suit all budgets. Learn more in our Farmers car insurance review.

- Mixed Customer Reviews: Some customers report issues with customer service and claims handling, indicating inconsistency in service quality.

#10 – Allstate: Best for Local Agents

Pros

- Comprehensive Coverage Options: Allstate offers a wide variety of coverage options and add-ons, allowing for highly customizable insurance plans.

- Local Agents: With a strong network of local agents, Allstate provides personalized customer service and local expertise. Discover more in our Allstate car insurance review.

- Strong Claims Satisfaction: Allstate has a reputation for good claims handling and customer satisfaction in the claims process.

Cons

- Higher Premiums: Allstate’s premiums tend to be higher compared to some other insurers, which might not be ideal for budget-conscious customers.

- Mixed Customer Reviews: Some customers have reported issues with customer service and billing, indicating inconsistency in service quality.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Available Resources in Wyoming

Be an informed consumer when shopping for insurance in Wyoming. Compare quotes and check out as many car insurance company reviews as possible. Progressive, Geico, Allstate, and Met are available in Wyoming and are approved by the state’s Better Business Bureau. Policies may be purchased via telephone sales, online, or through in-state insurance brokers licensed to sell the policies.

A very reliable source for insurance in Wyoming is through the American Automobile Association’s Rocky Mountain division.

You must be a member to enjoy the insurance benefits of the club, also known as AAA. AAA insurance agents find Better Business Bureau and AAA-approved underwriters in Wyoming to provide the best possible insurance for your driver’s record and budget.

Travel and Auto Clubs

AAA insurers have the ability to scan all approved underwriters to find you the lowest possible policy and AAA car insurance discounts for your vehicle and needs. In addition to the insurance benefits, AAA membership comes with its own set of safety insurance in the form of free roadside assistance and towing.

Cheyenne

The Wyoming Better Business Bureau lists approved insurance underwriters on its website through the state of Wyoming. Cheyenne-based companies such as Farmers Insurance Agency and the Stevenson Agency enjoy BBB approval and are rated high in the state from both consumer reviews and state audits.

In order to gain good reviews and approved status, Wyoming car insurance companies are rated by the cost of policies as well as customer service. Because Wyoming has a small population, getting friendly, “neighborly” customer service ranks high on the “best” scale.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Western Wyoming

In Western Wyoming, the hamlet Jackson Hole is home to several thousand people. State Farm of Jackson holds BBB-approved status and has earned a reputation throughout the community as being a solid insurance provider with integrity.

When dealing with Wyoming agencies, it helps when the agent is from the area. This allows them to direct you to add-ons that are pertinent to car insurance rates in Wyoming.

For example, according to the Wyoming Department of Transportation, Wyoming is known for fierce winters and rough roads. The good agents know enough to recommend auto-glass coverage as cracked windshields are common throughout Wyoming.

Other Parts of the State

Heading northwest from Jackson brings you to West Yellowstone. This area is the rugged extension of the Rocky Mountains and has a sparse population. The Shawn Keefer-Allstate Insurance Company is held as a BBB-approved agency in the region and knows how to direct you to the proper policy for your auto.

Wyoming Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $36 $155

American Family $25 $111

Farmers $30 $130

Geico $26 $111

Liberty Mutual $17 $75

Nationwide $27 $114

Progressive $24 $106

Safeco $28 $71

State Farm $19 $82

Travelers $23 $98

In addition to the West Yellowstone Allstate agency, AAA Insurance underwriter Ryan Buck is approved to offer the club’s discounted rates and policies to consumers.

How Much Auto Insurance Costs in Wyoming

Explore car insurance costs in Wyoming’s Casper with insights into factors shaping rates, aiding informed decisions about coverage.

Whether you’re a Casper resident or elsewhere in Wyoming, this brief analysis provides essential information for navigating the state’s auto insurance landscape.

Shop and Compare Car Insurance

As you shop around between the agencies, prepare yourself with VIN numbers, your driver’s license, and your auto’s year, make, and model. Do not purchase the first quote you get. Wyoming, as in most states, has different zones that affect policy prices.

In addition, your daily estimated mileage for commuting to work affects the policy price. When you’re comparing Wyoming car insurance rates, ask if there are discounts on policies for taking defensive driving, winter driving, or corrective driving courses.

Read More: Car Insurance Discounts

Comparing multiple car insurance quotes is crucial to finding the best rates and coverage options.

Brad Larson LICENSED INSURANCE AGENT

Not all underwriters allow this for Wyoming insurance, so it pays to ask as it may save you a few dollars each month. These classes typically take eight to 16 hours, done over several days.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Arrange Your Payments

Since the state is spread out, in most circumstances, it is easiest to use telephone quotes to get a variety of policy rates. Notate the cost, how the payments are spread out, and ask if they arrange auto-payments should you prefer to have a monthly amount charged to a debit or credit card.

Wyoming maintains a database of insured vehicles. In order to prove financial responsibility, you must carry the cards sent from the Wyoming DMV.

Driving without insurance or failing to keep the insurance current negates the policies and may result in fines of up to $750. Should you not be able to produce proof of financial responsibility to police during traffic stops, you have up to seven days to provide the cards or documentation.

Here are car insurance discounts from leading providers in Wyoming, featuring multi-policy savings, safe driver rewards, and more:

When comparing auto insurance in Wyoming, make sure you do not just look at one company or just one insurance agent, do your own research online to find the best car insurance for your needs. The easiest way to find multiple car insurance quotes for free is to enter your zip code below in our car insurance comparison tool.

Frequently Asked Questions

How can I contact the Wyoming Insurance Department for assistance or to file a complaint?

If you need assistance or want to file a complaint regarding car insurance in Wyoming, you can contact the Wyoming Insurance Department. You can reach them through their website at insurance.wyo.gov or by calling their Consumer Helpline at 1-800-438-5768.

Are online car insurance quotes accurate for Wyoming?

Online car insurance quotes can provide a general idea of the rates you might expect in Wyoming. However, the final premium may vary based on additional factors and specific underwriting guidelines. It’s always a good idea to verify the details and discuss your options with an insurance agent directly.

Read More: How do you get competitive quotes for car insurance?

How often should I review my car insurance policy and rates in Wyoming?

It is recommended to review your car insurance policy and rates in Wyoming at least once a year. Life circumstances, such as changes in your driving habits, vehicle ownership, or eligibility for additional discounts, may impact your insurance needs and potential for savings.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Can I get car insurance if I have a bad driving record in Wyoming?

Having a bad driving record may make it more challenging to find affordable car insurance in Wyoming. However, there are insurance companies that specialize in providing coverage for high-risk drivers. While the rates may be higher, it is still possible to obtain car insurance with a bad driving record.

Are there any discounts available to lower car insurance rates in Wyoming?

Yes, many insurance companies offer various discounts that can help lower car insurance rates in Wyoming. These discounts may include safe driver discounts, multi-policy discounts (if you have multiple policies with the same insurer), good student discounts, discounts for certain safety features in your vehicle, and more.

Read More: 16 Ways to Lower the Cost of Your Insurance

What factors affect car insurance rates in Wyoming?

Several factors can influence car insurance rates in Wyoming, including your age, driving history, type of vehicle, credit score, and location. Additionally, the amount of coverage and deductibles you choose can also impact your premium.

Is uninsured/underinsured motorist coverage required in Wyoming?

Wyoming does not require uninsured/underinsured motorist coverage by law. However, it is highly recommended as it can provide protection if you are involved in an accident with a driver who does not have sufficient insurance.

How can I find out if an insurance company is licensed to operate in Wyoming?

You can verify if an insurance company is licensed to operate in Wyoming by checking with the Wyoming Insurance Department. Their website provides a list of licensed insurers, or you can contact their Consumer Helpline for assistance.

What should I do if I’m involved in a car accident in Wyoming?

If you are involved in a car accident in Wyoming, first ensure everyone’s safety and call emergency services if necessary. Exchange information with the other driver(s), document the scene with photos, and contact your insurance company to report the accident and begin the claims process.

Read More: Understanding Car Accidents

Can I switch car insurance companies at any time in Wyoming?

Yes, you can switch car insurance companies at any time in Wyoming. However, it’s important to ensure there is no lapse in coverage when making the switch. Notify your current insurer of the cancellation and confirm your new policy is active before ending the old one.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.