Compare Columbus, GA Car Insurance Rates [2024]

The cheapest car insurance company in Columbus, GA, is GEICO. However, your Columbus, GA car insurance quotes will depend on your driving record, credit score, and age. Also, you'll need to carry 25/50/25 in liability insurance. You can secure Columbus, GA car insurance rates as low as $222/mo when you compare quotes from multiple auto insurance companies online.

Stop Paying Too Much For Car Insurance

Compare Free Quotes Online In Minutes, Check Now

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Feb 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

A/B Active Test Data

Not visible on live sitesTest Name: ab_mda_paid_copy_1

Test Info: Starting when a user lands on one of our basic fire templates, we either leave the hero MDA heading & subheading as it is (control), or we replace it with copy we use on paid traffic (variant). This control/variant assignment will be passed along via experiment ID with any MDA submission after the user lands on a basic fire template.

Test Assignment: MDAPaidCopy1:variant

Control Heading: Free Car Insurance Comparison

Control Subheading: Compare Quotes From Top Companies and Save

Variant Heading: Stop Paying Too Much For Car Insurance

Variant Subheading: Compare Free Quotes Online In Minutes, Check Now

- Car insurance in Columbus, GA, is $1,087 more per year than the national average

- The cheapest car insurance company in Columbus, Georgia, is Geico

- Secure cheap car insurance by maintaining a clean driving history and good credit score

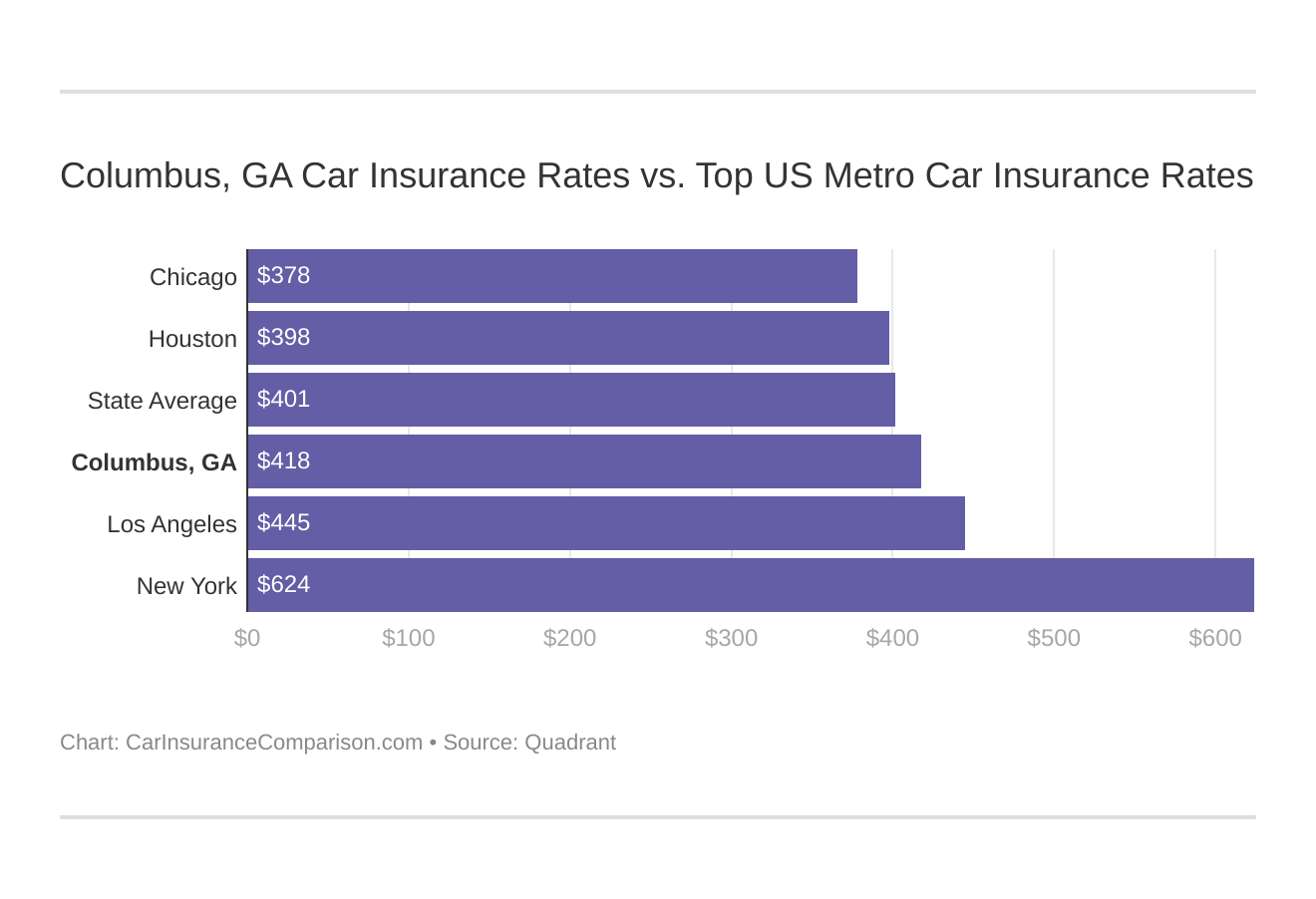

On average, Columbus, GA car insurance costs $1,087 more than the national average and $52 more than the Georgia car insurance average.

But why is it so expensive to purchase an auto policy in Columbus, GA?

Car insurance rates are determined by various factors, including the company you choose, your driving history, and much more. Don’t worry – we’re here to help.

Our guide explains how you can secure cheap auto insurance in Columbus, GA, as well as looking into the wide variety of factors that go into how companies price their insurance policies.

Ready to find affordable Columbus, GA car insurance? Enter your ZIP code above to get started.

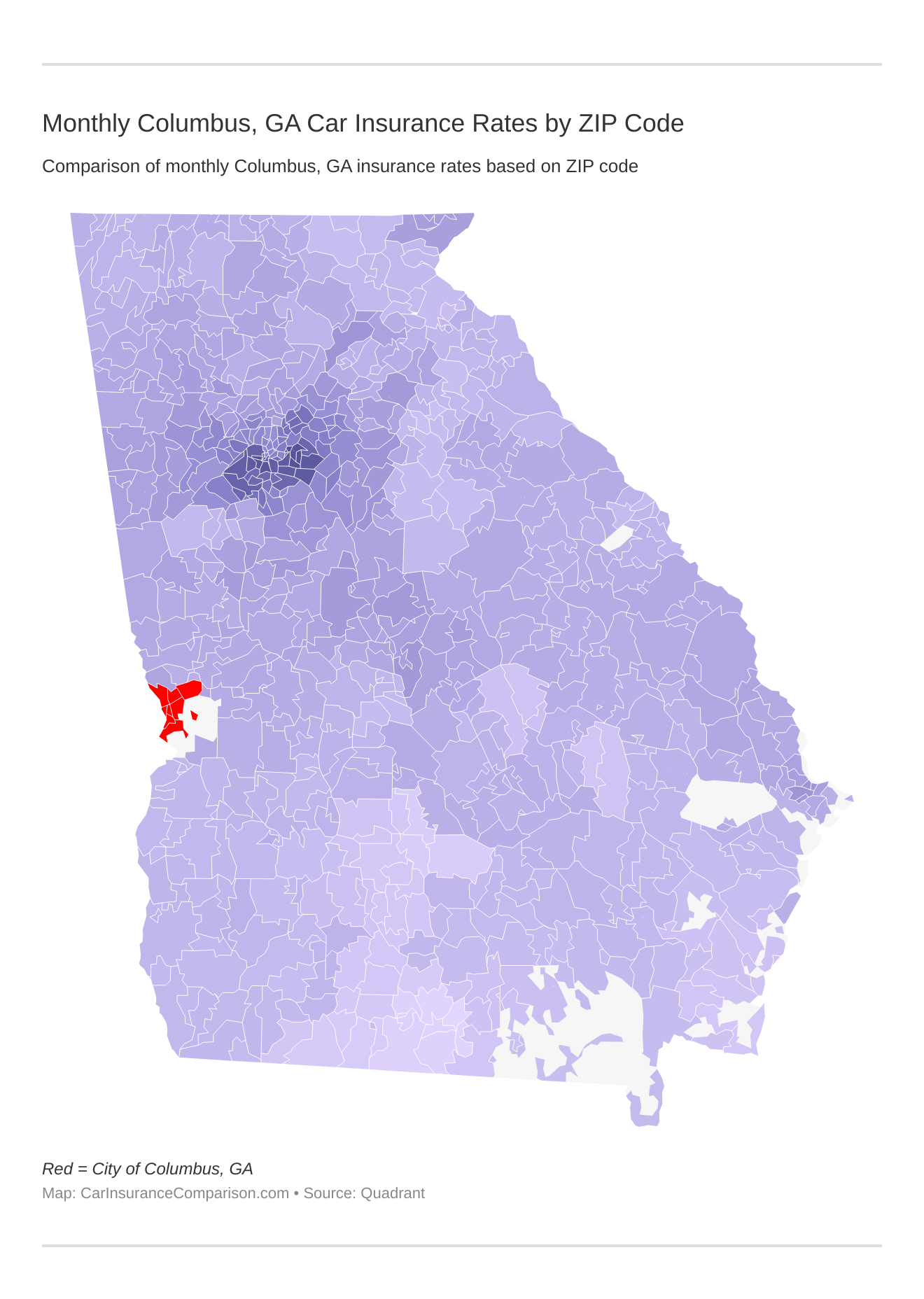

What are the monthly Columbus, GA car insurance rates by ZIP code?

It might not be as commonly known as you may think, but where you live determines the average rates that you’ll pay for even just the most minimum coverage offered by insurers. You’ll find the cheapest rates in locations that don’t see much theft or crime, because there isn’t a high risk of your car being stolen or vandalized. You can even see how Georgia compares with the 15 States with the Highest Vehicle Theft Rates.

Living in a ZIP code with higher than average rates of crime could mean you’re paying more for your insurance premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are the Columbus, GA car insurance rates vs. top US metro car insurance rates?

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Columbus, Georgia against other top US metro areas’ auto insurance rates. This is a great way to see what the average cost will be.

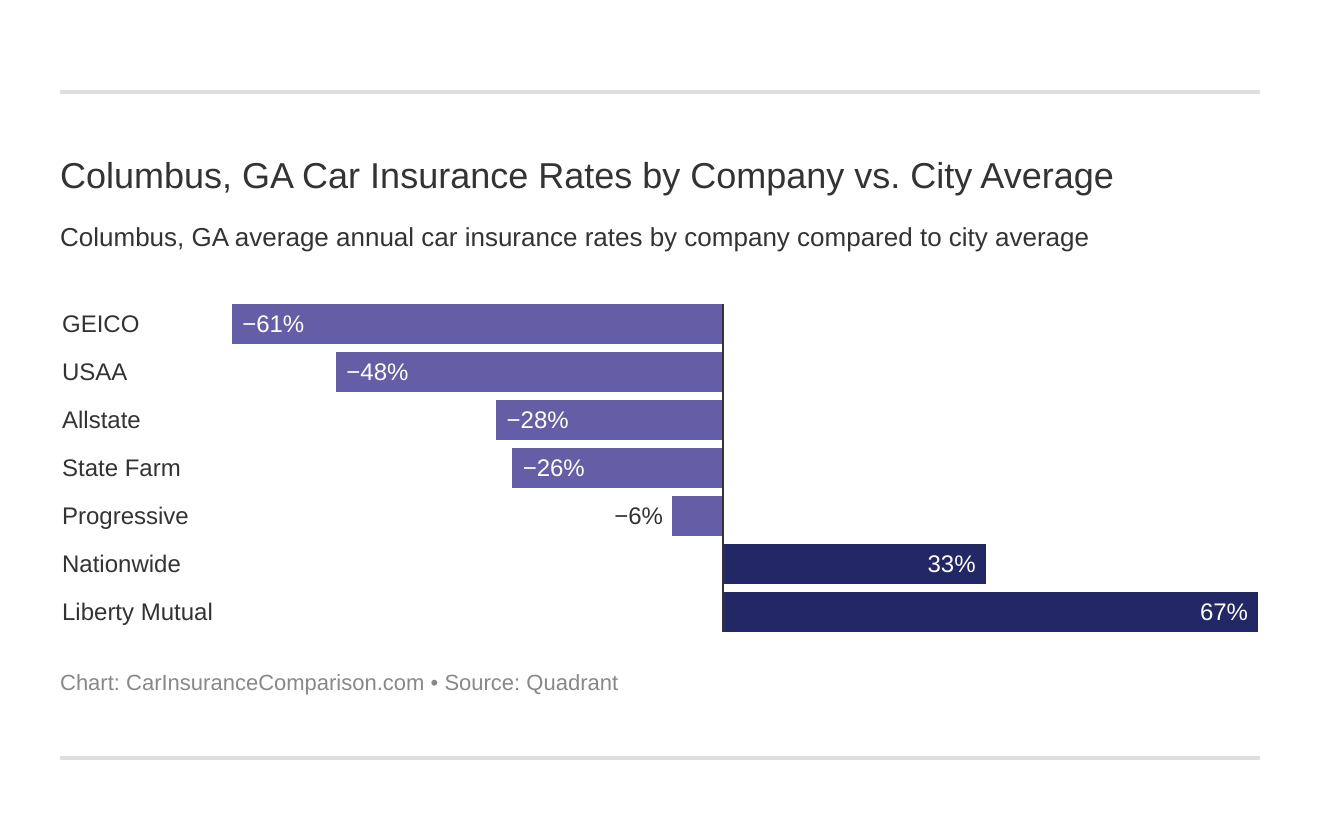

What is the cheapest car insurance company in Columbus, GA?

When you’re attempting to find affordable car insurance, you’re no doubt going to be looking at more than a few insurers. The cheapest car insurance company in Columbus, GA, is Geico. The following most affordable companies are USAA and Allstate.

The cheapest Columbus, GA auto insurance company can be discovered below. You then might be asking, “how do those rates compare against the average Georgia auto insurance company rates?” We cover that as well.

Here are the best auto insurance companies in Columbus, Georgia, ranked from cheapest to most expensive:

- Geico – $2,662

- USAA – $3,075

- Allstate – $3,792

- State Farm – $3,859

- Progressive – $4,716

- Nationwide – $7,004

- Liberty Mutual – $10,024

Geico, USAA, Allstate, State Farm, and Progressive are the only Columbus car insurance providers with cheaper than average car insurance rates. However, your auto insurance rates will depend on personal factors, and what insurance options you’re looking for.

Do car insurance companies check your driving records? The answer is yes, and it’s the most important factor insurance providers review. Some auto insurance companies provide at least fifteen percent off annual premiums if you have a clean driving history. Someone with a history of reckless driving may end up seeing higher rates than someone who practices safe driving habits. You can find an even more affordable rate if your credit score is good.

https://www.youtube.com/watch?v=-3oONClGBd8

Another crucial factor that determines auto insurance is location. Car insurance providers can base your rates on the neighborhood ZIP code.

So what’s the cheapest neighborhood in Columbus, GA? The most affordable ZIP code in Columbus, GA, is 31901, and its average car insurance cost is $396 per month.

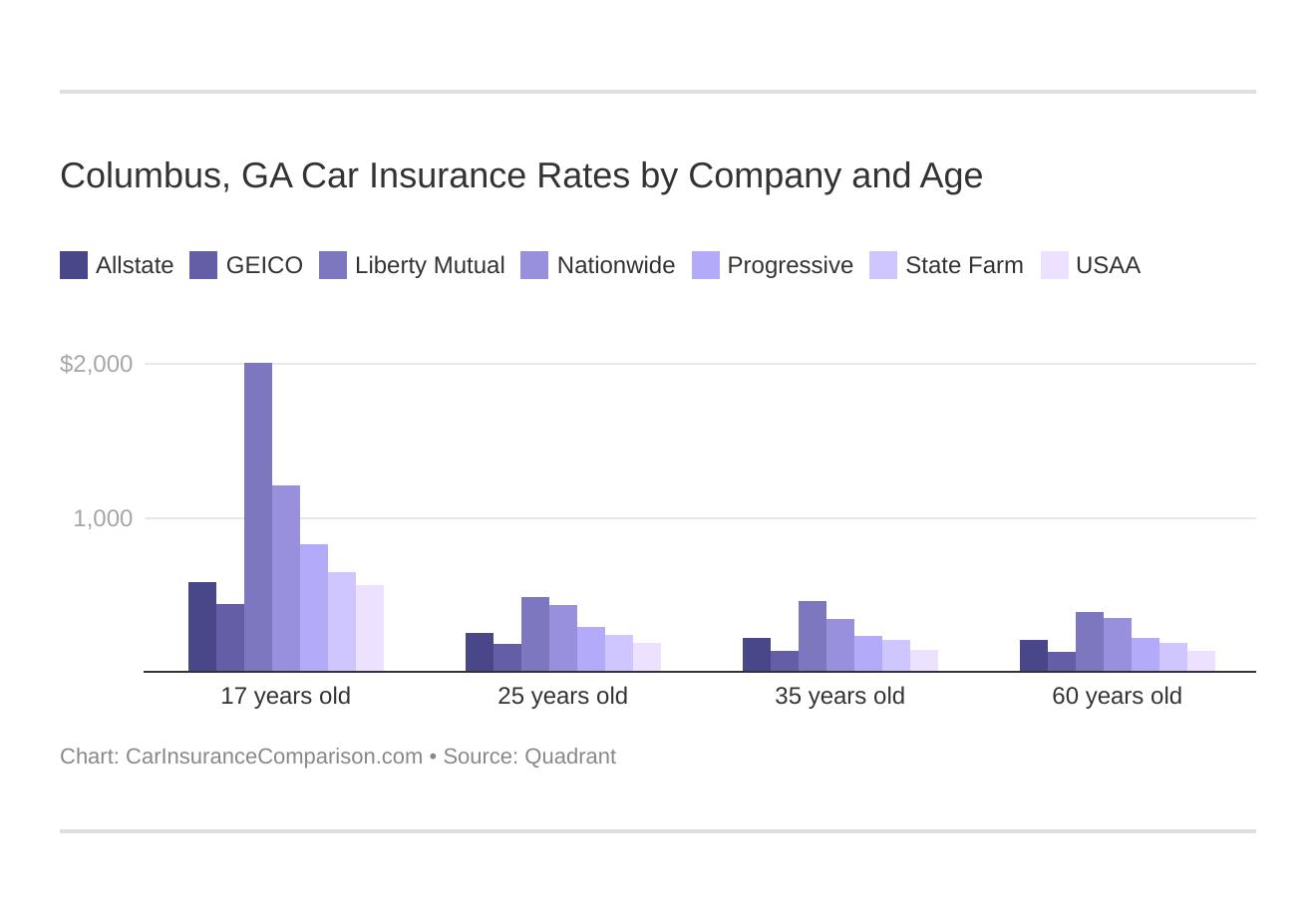

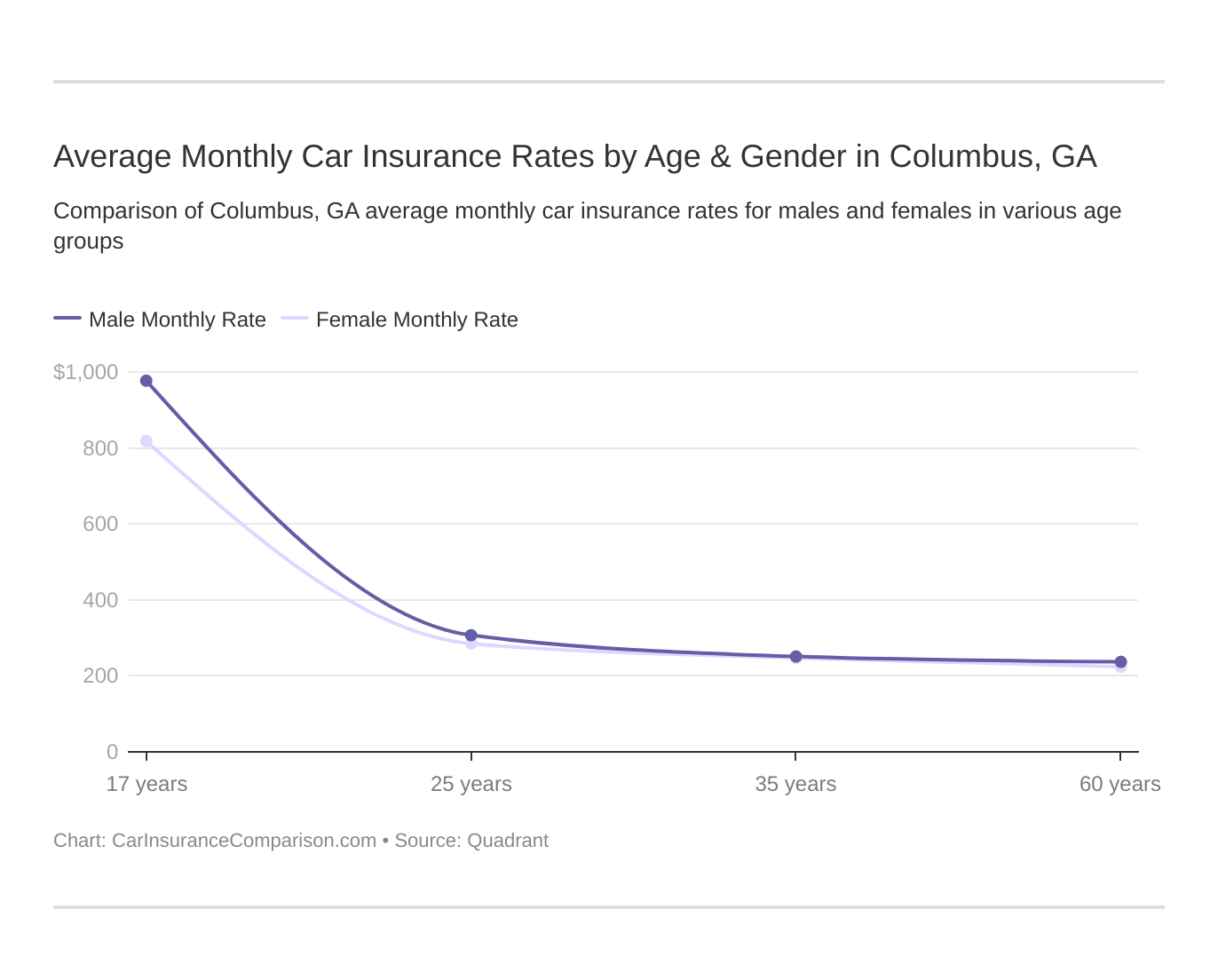

Columbus male drivers under 25 have the most expensive car insurance rates, but you can find cheap car insurance for young male drivers. Meanwhile, married drivers who are 25 and older pay hundreds of dollars less. To find out more about single vs. married drivers, see the cost of married car insurance vs. single car insurance.

What are the Columbus, GA car insurance rates by company and age?

Columbus, Georgia auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

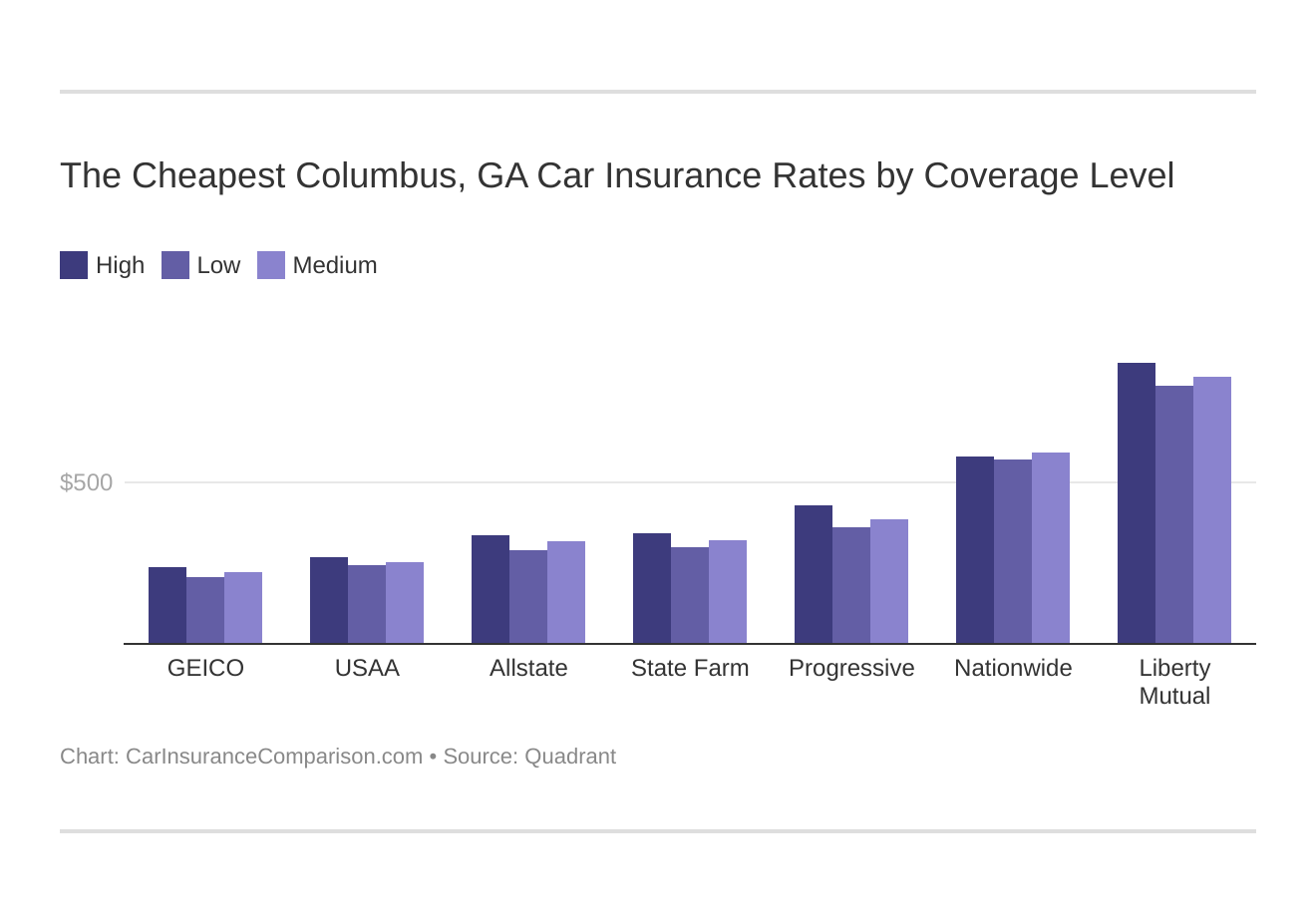

What are the cheapest Columbus, GA car insurance rates by coverage level?

Your level of coverage will play a significant role in your Columbus, GA auto insurance rates. Depending on the type of coverage that you’re required to have, you could see a decrease in your monthly premium if you end up reducing what you include on your policy. Though if you have a new car, you may not be allowed to drop things like collision coverage or comprehensive coverage, because your provider won’t want to pay out for such an expensive vehicle in the event you’re in an accident or it gets vandalized.

To find out more about both collision and comprehensive coverage, see collision vs. comprehensive: what is the difference?

Find the cheapest Columbus, Georgia auto insurance rates by coverage level below.

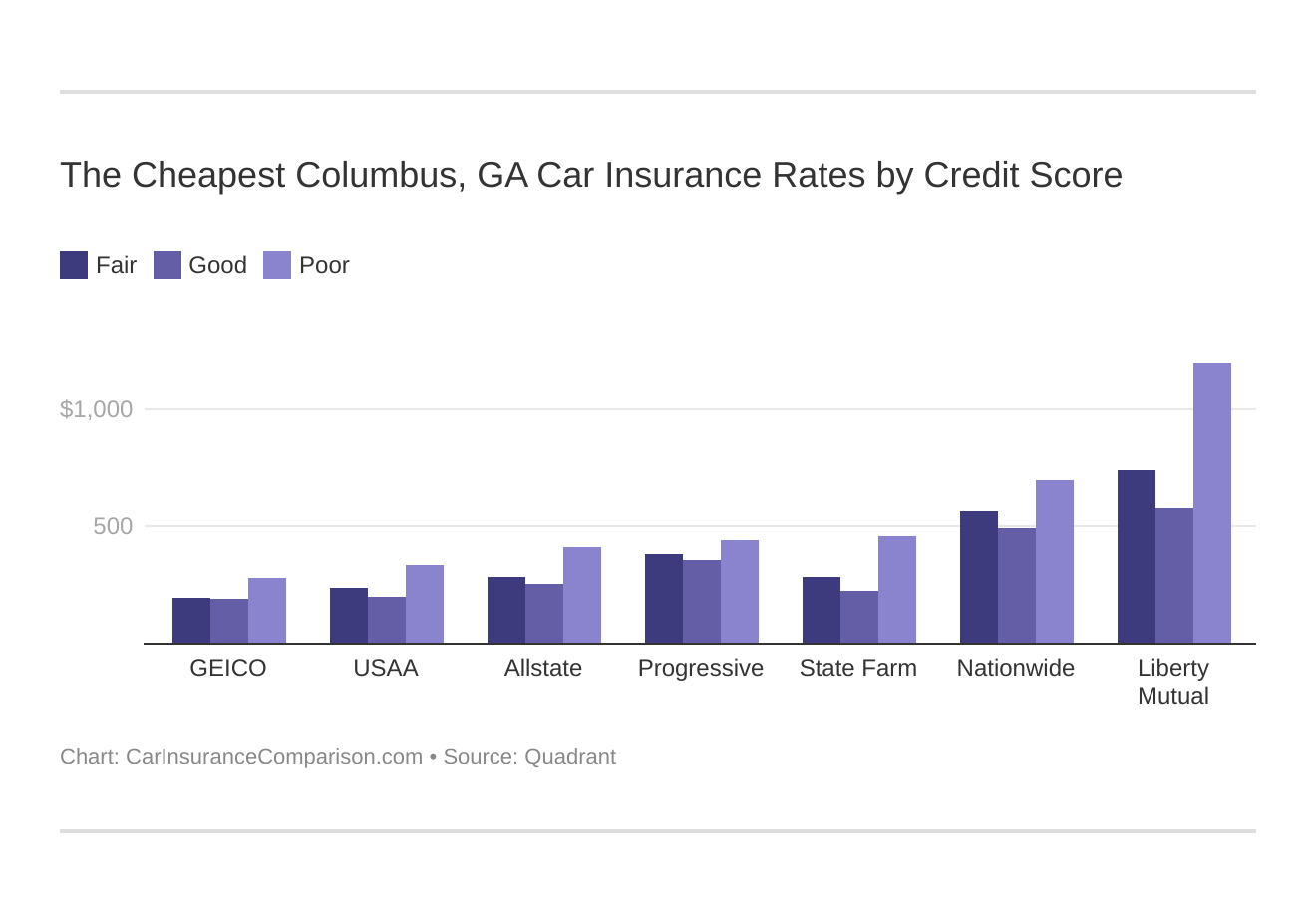

What are the cheapest Columbus, GA car insurance rates by credit score?

Your credit score will play a major role in your Columbus, GA auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Having good credit ensures that you’ll have a low annual rate. In some cases it may even mean that you’ll be offered more flexible payment options, since the company will have a higher level of financial trust in you. Some providers even offer a good credit discount for qualified drivers.

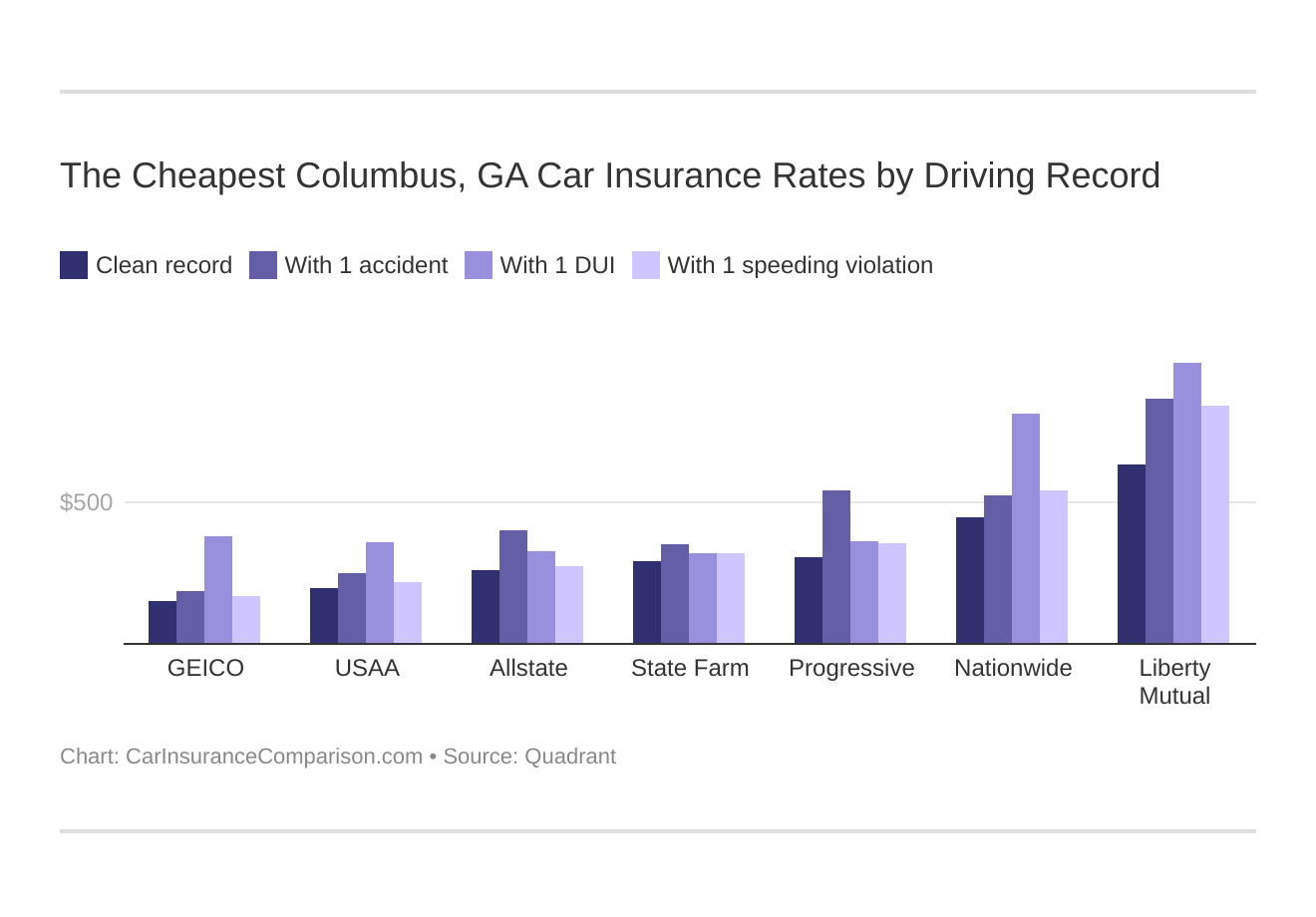

What are the cheapest Columbus, GA car insurance rates by driving record?

Your driving record will affect your Columbus auto insurance rates. For example, a Columbus, Georgia DUI may increase your auto insurance rates 40 to 50 percent. This may also lead to a provider instating minimum coverage limits on your policy; the higher risk you pose as a driver means they’ll need to cover their own bases.

Each state has their own DUI laws, so it’s a good idea to understand the Georgia DUI insurance laws.

Read more: What are the DUI insurance laws in Georgia?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

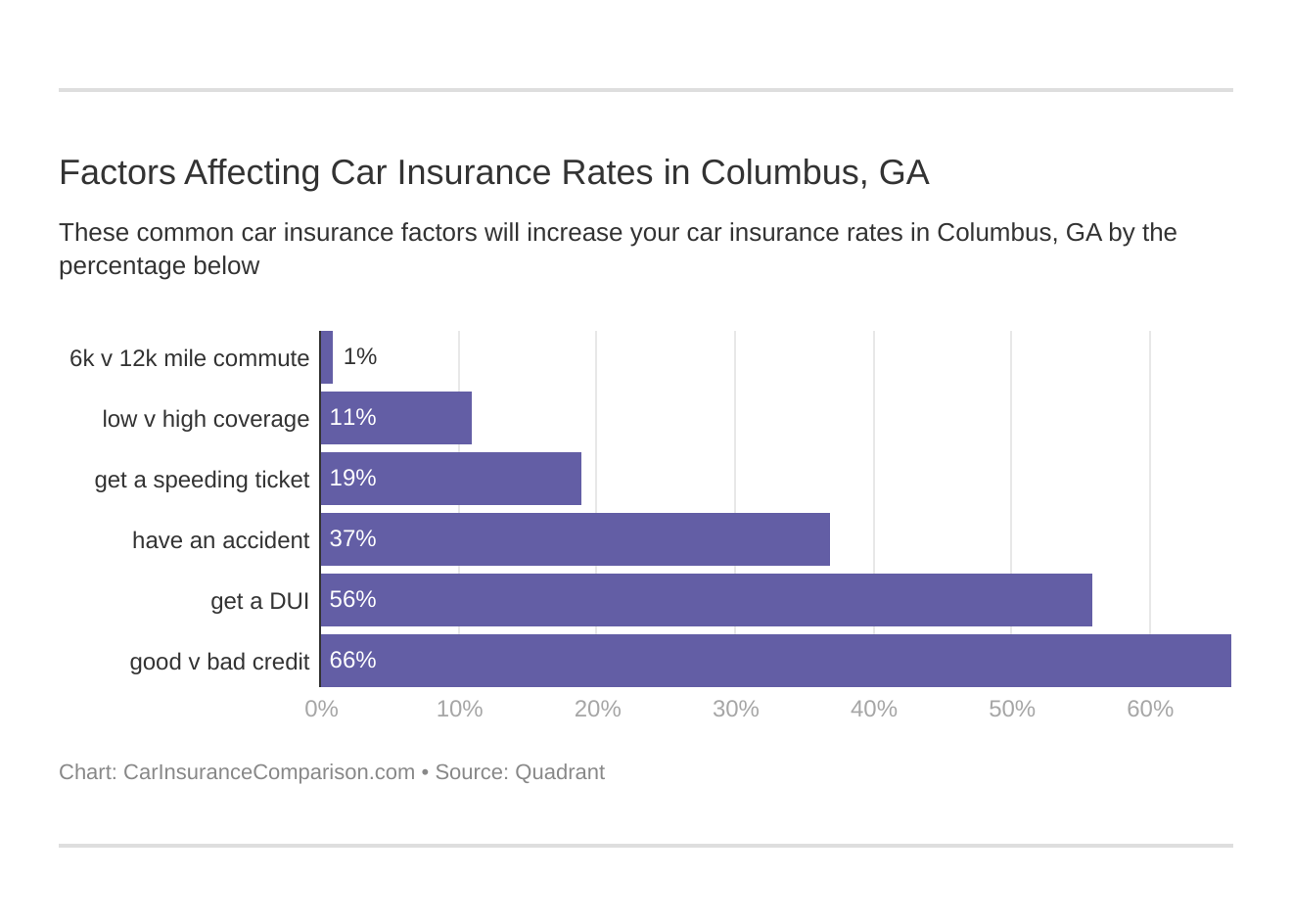

What are the factors affecting car insurance rates in Columbus, GA?

Factors affecting auto insurance rates in Columbus, GA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Columbus, Georgia auto insurance.

These common car insurance factors will increase your car insurance rates in Columbus, GA by the percentage below.

What are the average monthly car insurance rates by age & gender in Columbus, GA?

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Columbus. Georgia does use gender, so check out the average monthly auto insurance rates by age and gender in Columbus, GA.

See why is the cost of car insurance higher for teenage boys than teenage girls? for more details about how and why gender can affect insurance rates.

What are the minimum car insurance coverage requirements in Columbus, GA?

Before you can drive in Columbus, the Georgia DMV and Georgia Department of Insurance requires all drivers to carry the minimum auto insurance requirements, which are:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $25,000 per incident for property damage

Georgia has strict motor vehicle laws, so be sure you’re carrying the minimum requirements. Also, consider raising your coverage limit to cut possible out-of-pocket costs.

Be aware that the Columbus, GA DMV will not issue you a driver’s license if you do not meet the state’s minimum auto insurance requirements.

Find out more: what is the minimum car insurance required by each state?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What affects car insurance rates in Columbus, GA?

Your commute to work and your city’s vehicle theft rate can determine your auto insurance rates. Your chances of getting into an accident go up the more you drive. Vehicle thefts, on the other hand, determine your chances of filing a comprehensive insurance claim.

The city of Columbus, Georgia, didn’t participate in sharing vehicle theft data in 2019. However, NeighborhoodScout reported that Columbus residents have a one in 27 chance of becoming a victim of property crime.

What about your daily drive to work? According to City-Data, the average Columbus, GA, commute is 20 minutes, which is five minutes faster than the national average.

What is the bottom line when it comes to service in Columbus, GA?

You can secure cheap car insurance in Columbus, GA, by maintaining a clean driving record. If you have a good credit history, take advantage of the low prices provided by your auto insurance provider. Safe drivers can end up being offered discounts, while not having to sacrifice valuable coverage to fit a budget.

Also, your vehicle’s safety and anti-theft features can save you money on car insurance.

Before you buy car insurance in Columbus, GA, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Columbus, GA car insurance quotes.

Frequently Asked Questions

What factors can impact car insurance rates in Columbus, GA?

Several factors can impact car insurance rates in Columbus, GA. These include your age, driving record, the type of vehicle you drive, your credit history, the coverage options you choose, and the deductible amount. Additionally, factors such as the local crime rate, population density, and traffic conditions in Columbus may also influence insurance rates.

What are the minimum car insurance requirements in Columbus, GA?

In Columbus, GA, the minimum car insurance requirements are the same as the state of Georgia. The state law mandates a minimum coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident. It’s important to note that these are the minimum requirements, and it’s often recommended to consider higher coverage limits for better protection.

Are there any specific insurance considerations for Columbus, GA?

Columbus, GA is a city located in Muscogee County. When considering car insurance in Columbus, it’s important to be aware of factors such as weather-related incidents like storms or flooding. Additionally, the local traffic conditions, road infrastructure, and crime rate in Columbus may also be important considerations when selecting car insurance coverage.

How can I find affordable car insurance in Columbus, GA?

To find affordable car insurance in Columbus, GA, it’s important to shop around and compare quotes from different insurance providers. Consider factors such as coverage options, deductibles, and available discounts. Maintaining a good driving record, bundling your car insurance with other policies, and taking advantage of discounts, such as safe driver or multi-vehicle discounts, can also help lower your insurance premiums.

What discounts are available for car insurance in Columbus, GA?

Insurance providers in Columbus, GA may offer various discounts for car insurance. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features such as anti-lock brakes or airbags. It’s advisable to check with insurance providers to see which discounts may apply to you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.