Mercer Insurance Group Car Insurance Review [2026]

Mercer Insurance Group car insurance reviews are found under the name of their parent company, United Fire Group (UFG). The company sells personal car insurance in New York, New Jersey, and Pennsylvania, and commercial insurance in other states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated July 2024

- Mercer Insurance was purchased by United Fire Group (UFG) in 2010

- UFG only offers personal car insurance in New York, New Jersey, and Pennsylvania

- UFG writes commercial car insurance in many other states.

UFG Car Insurance Rates

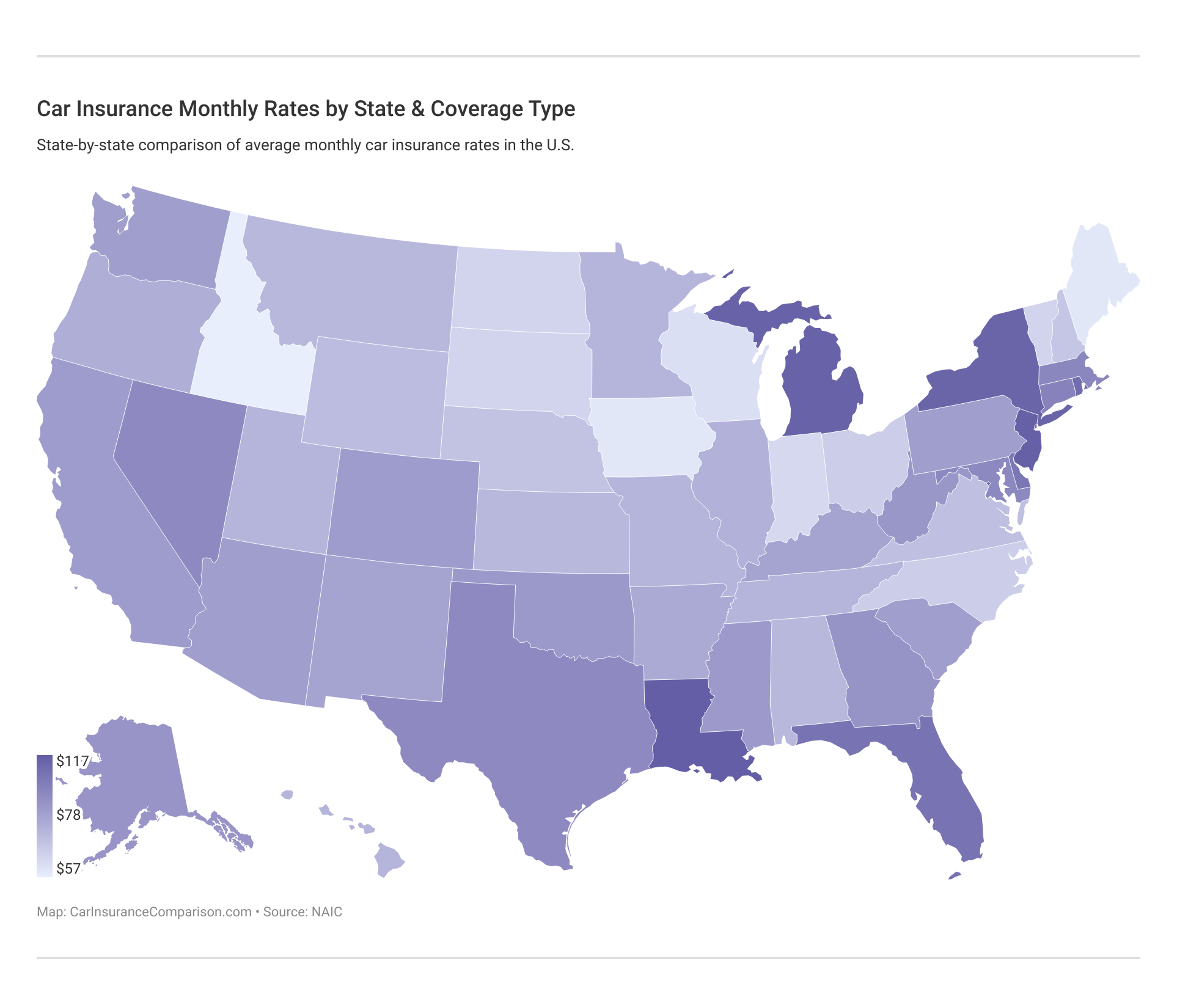

UFG provides a wide range of insurance products, which include both commercial car insurance policy and personal car insurance policies, some of which are sold under the Mercer Group name. However, the availability of the products or types of coverage is dependent on the location.UFG sells its products through agents and therefore does not offer any type of online quoting system for their products. Because of this, we are unable to provide rate information for UFG. However, you can take a look at the map below to find the average rates for full coverage insurance in your area.

Keep in mind that the numbers above are based on full coverage, so if you only need liability you may pay less for your insurance. They are also averages, which means some people will pay much less and some people will pay much more, depending on your driving history and your ZIP code.What is UFG availability by state?

In New Jersey, Pennsylvania, and New York, Mercer Insurance Company and the Mercer Insurance of New Jersey only offer commercial car insurance. Meanwhile, subsidiary Franklin Insurance Company offers personal car insurance only in limited areas.

If you happen to live in the areas being serviced by the Mercer Group (including UFG and its subsidiaries), you can also get standard personal auto loan at reasonable rates.

Outside New Jersey, Pennsylvania, or New York, prospecting clients are better off looking at other companies for auto coverage.

UFG Car Insurance Coverages Offered

The odds are good that UFG offers a discount for having multiple lines of insurance open through the company, so it might save you money if you buy both auto and homeowner’s insurance through the company.

We don’t know exactly what discounts they offer, however, because they only sell their products through local agents. You’ll need to reach out to your agent directly to find out what discounts, including a bundling discount, might apply to you.

What discounts are offered by UFG?

As we mentioned above, UFG does not have a list of standard discounts available on their website. Take a look at the table below to find some of the discounts available through other insurance companies:Car Insurance Discounts Offered by Company

| Discount Name | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Adaptive Headlights | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Anti-lock Brakes | 10% | ✓ | ✓ | 5% | 5% | 5% | ✓ | 5% | ||

| Anti-Theft | 10% | ✓ | 23% | 20% | 25% | ✓ | 15% | |||

| Claim Free | 35% | ✓ | ✓ | 26% | ✓ | 10% | ✓ | 15% | 23% | 12% |

| Continuous Coverage | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | ||

| Daytime Running Lights | 2% | ✓ | 3% | 5% | 5% | ✓ | ✓ | |||

| Defensive Driver | 10% | 10% | ✓ | ✓ | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | ✓ | ✓ | ✓ | ✓ | 10% | ✓ | 7% | ||

| Driver's Ed | 10% | ✓ | ✓ | ✓ | 10% | ✓ | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | ✓ | ✓ | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | ✓ | ✓ | ✓ | ✓ | 8% | ✓ | ✓ | 10% | 12% |

| Electronic Stability Control | 2% | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Emergency Deployment | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Engaged Couple | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Family Legacy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 10% |

| Family Plan | ✓ | ✓ | ✓ | ✓ | ✓ | 25% | ✓ | ✓ | ✓ | ✓ |

| Farm Vehicle | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Fast 5 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Federal Employee | ✓ | ✓ | 12% | 10% | ✓ | ✓ | ✓ | ✓ | ||

| Forward Collision Warning | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | |

| Full Payment | 10% | ✓ | ✓ | $50 | ✓ | ✓ | ✓ | 8% | ✓ | |

| Further Education | ✓ | ✓ | 10% | 15% | ✓ | ✓ | ||||

| Garaging/Storing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 90% | ||

| Good Credit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Good Student | 20% | ✓ | 15% | 23% | 10% | ✓ | 25% | 8% | 3% | |

| Green Vehicle | 10% | ✓ | 5% | ✓ | 10% | ✓ | ✓ | ✓ | 10% | ✓ |

| Homeowner | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | 3% | 5% | ✓ | |

| Lane Departure Warning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Life Insurance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Low Mileage | ✓ | ✓ | ✓ | 30% | ||||||

| Loyalty | ✓ | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | |

| Married | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Membership/Group | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | |||

| Military | ✓ | ✓ | 15% | 4% | ✓ | ✓ | ||||

| Military Garaging | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% |

| Multiple Drivers | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Multiple Policies | 10% | 29% | ✓ | 10% | 20% | 10% | 12% | 17% | 13% | |

| Multiple Vehicles | ✓ | ✓ | 25% | 10% | 20% | 10% | 20% | 8% | ||

| New Address | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Customer/New Plan | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| New Graduate | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| New Vehicle | 30% | ✓ | ✓ | 15% | ✓ | 40% | 10% | 12% | ||

| Newly Licensed | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Newlyweds | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Non-Smoker/Non-Drinker | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Occasional Operator | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Occupation | ✓ | 10% | 15% | ✓ | ✓ | ✓ | ||||

| On-Time Payments | 5% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 15% | ✓ | |

| Online Shopper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7% | ✓ | ✓ | ✓ |

| Paperless Documents | 10% | ✓ | ✓ | ✓ | 5% | $50 | ✓ | ✓ | ✓ | |

| Paperless/Auto Billing | 5% | ✓ | ✓ | ✓ | $30 | ✓ | $20 | 3% | 3% | |

| Passive Restraint | 30% | 30% | 40% | 20% | ✓ | 40% | ||||

| Recent Retirees | ✓ | ✓ | ✓ | ✓ | 4% | ✓ | ✓ | ✓ | ✓ | ✓ |

| Renter | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Roadside Assistance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Safe Driver | 45% | ✓ | 15% | ✓ | 35% | 31% | 15% | 23% | 12% | |

| Seat Belt Use | ✓ | ✓ | ✓ | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Senior Driver | 10% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Stable Residence | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Students & Alumni | ✓ | ✓ | ✓ | 10% | 7% | ✓ | ✓ | ✓ | ||

| Switching Provider | ✓ | ✓ | 10% | ✓ | ✓ | ✓ | ✓ | |||

| Utility Vehicle | 15% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Vehicle Recovery | 10% | ✓ | ✓ | 15% | 35% | 25% | ✓ | 5% | ||

| VIN Etching | ✓ | ✓ | ✓ | ✓ | 5% | ✓ | ✓ | |||

| Volunteer | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Young Driver | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | $75 |

Keep in mind that companies can and do update the discounts they choose to offer all the time. You will need to check with your insurance company or your agent to make sure that you are receiving any available discounts that apply to you.

Canceling Your UFG Insurance Policy

Since you purchased your UFG policy through an agent, your best option would be to reach out to them and let them know you would like to cancel your policy.If you’ve signed up for new coverage already you may also find that your new insurance company will take care of your cancellation for you, so make sure to ask when you are setting up your new policy if taking care of the termination of your old policy is a service that they offer.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is there a cancellation fee or a refund?

Both cancellation fees and refunds will be determined by local laws and regulations, so when you tell your agent you want to cancel your policy ask them about both fees and refunds.

When can I cancel?

Most states allow you to cancel a car insurance policy at any time as long as you have a new policy to replace it to prevent a gap in coverage.

Some states may have different rules, however, so check with your state’s insurance website or your agent for details on your specific situation.

Typically, policies go into effect at midnight and are terminated effective 11:59 p.m. This is the best way to guarantee you are never left with a gap in coverage.

How To Make a UFG Car Insurance Claim

Even though the number of traffic fatalities has dropped significantly in the last 30 years according to the Insurance Institute for Highway Safety (IIHS), accidents still happen and insurance claims still need to be filed. In the event that you need to file a claim, reach out to your agent and they can help you with the process. You can also use your UFG or Mercer insurance sign-in on the UFG website to access your account, reach out to your agent, or file a claim.Once your claim is filed you will hear from a claims adjuster who will keep you up-to-date on your claim until a final decision has been made.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

UFG and Mercer Car Insurance Ratings

If there is one thing that Mercer Insurance can be proud of, it is the group’s stable ratings from A.M. Best, a reputable ratings agency for the insurance industry.Ever since the foundation of the original Mercer Mutual Insurance Company in 1844, the group has consistently shown growing financial strength. As of 2019, UFG earned an A (Excellent) rating from A.M. Best. UFG is Better Business Bureau accredited with an A+ rating.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

The Bottom Line: Mercer Insurance Group Car Insurance Review

UFG and Mercer offer an excellent product that comes with a high financial rating, but the need to work with an agent can be limiting. Your average driver would benefit from getting a variety of quotes from various insurance companies to find the best rates in your area.So where can I find auto insurance near me, you ask? Well, now that you’ve finished this Mercer car insurance review, it’s time to get rates from top car insurance companies. Enter your ZIP code in the FREE tool below to see a side-by-side quote comparison.

Frequently Asked Questions

What states does Mercer Insurance Group (UFG) provide car insurance coverage in?

Mercer Insurance Group offers personal car insurance in New York, New Jersey, and Pennsylvania, while commercial insurance is available in other states.

Does UFG offer bundling options for car insurance?

While UFG does offer bundling discounts, the specific details of the discounts are not provided on their website. It is recommended to reach out to your agent to inquire about available discounts.

Are there any cancellation fees or refunds for UFG insurance policies?

The cancellation fees and refunds for UFG policies are determined by local laws and regulations. It is advisable to contact your agent directly to inquire about the specific fees and refund policies.

Can I cancel my UFG car insurance policy at any time?

In most states, you can cancel your car insurance policy at any time as long as you have a new policy to replace it and avoid a coverage gap. However, it is recommended to check with your state’s insurance website or your agent for detailed information based on your specific situation.

How can I make a car insurance claim with UFG?

To file a car insurance claim with UFG, you can reach out to your agent who will guide you through the process. Alternatively, you can use your UFG or Mercer insurance sign-in on the UFG website to access your account, contact your agent, or file a claim.

Who owns Mercer insurance?

Mercer insurance is owned by Marsh & McLennan Companies.

Who is the parent company of Mercer?

The parent company of Mercer is Marsh & McLennan Companies.

Who is the founder of Mercer Group?

William M. Mercer is the founder of Mercer Group.

Who is known for the cheapest car insurance?

Geico is known for the cheapest car insurance.

Which type of insurance is best?

The best type of insurance depends on individual needs, but health insurance is often considered essential.

Which type of car insurance is best?

Which is the most expensive form of car insurance?

Which insurance coverage is best for my car?

Which category of car insurance is best?

Which car insurance coverage is the best?

What services does Mercer offer?

What kind of company is Mercer?

What is the most important car insurance you should buy?

What is the most expensive car insurance group?

What is the lowest form of car insurance?

What is the lowest car insurance group?

What is the highest price for car insurance?

What is the cheapest category for car insurance?

What is the cheapest car insurance called?

What are Mercer’s ratings?

What is Mercer’s insurance A.M. Best rating?

What is Mercer famous for?

What is fully comprehensive car insurance?

What group has the highest car insurance rates?

What car insurance is the most popular?

Is Mercer worth it?

Is Mercer private or public?

Is Mercer an insurance broker?

Is Mercer accredited?

Is Mercer a legit company?

Is Mercer a health insurance company?

Is Mercer a good company?

Is Mercer a big company?

Does Mercer have a good reputation?

Does Mercer do insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.