Root Car Insurance Review [2026]

Root car insurance rates are calculated based on your driving performance which is measured on the Root app using GPS sensors. To see if you qualify for Root car insurance, you must take a test drive.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated October 2024

- You’ll need to take a test drive to be able to get Root insurance coverage

- Root Insurance has a robust app, allowing for quick access to your Root insurance card, billing statement, and more

- You can pay for Root month-to-month or pay off a six-month auto insurance policy in one payment

Note: We are not associated with Root and cannot provide any assistance with Root insurance claims or other issues.

We looked deeper into Root to get a feel for their company and to understand how their auto insurance works. Read on to learn more and find out whether they could be a good fit for you.

It’s all about you. We want to help you make the right coverage choices. On the market for better coverage? Click here and enter your zip code to get multiple personalized quotes from local auto insurance providers to save.

What is Root car insurance?

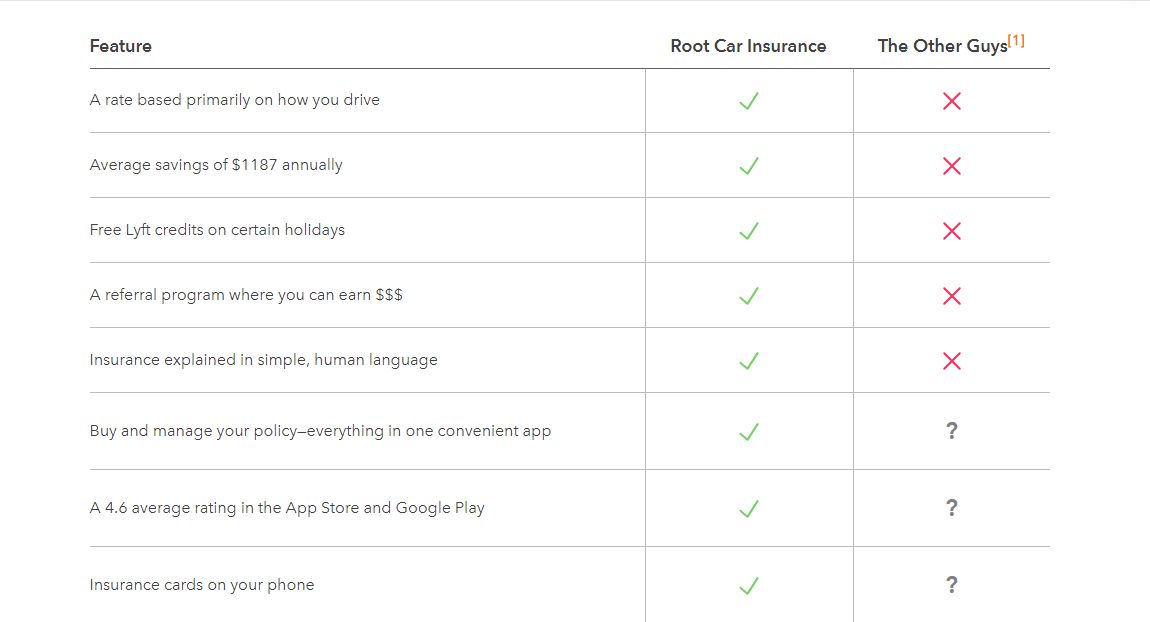

Car insurance is expensive, and more drivers are looking for alternative options to traditional auto insurance policies to save money. Root is a new car insurance company that strives to take the work out of getting car insurance with “no agents, no phone calls, no hassle”.

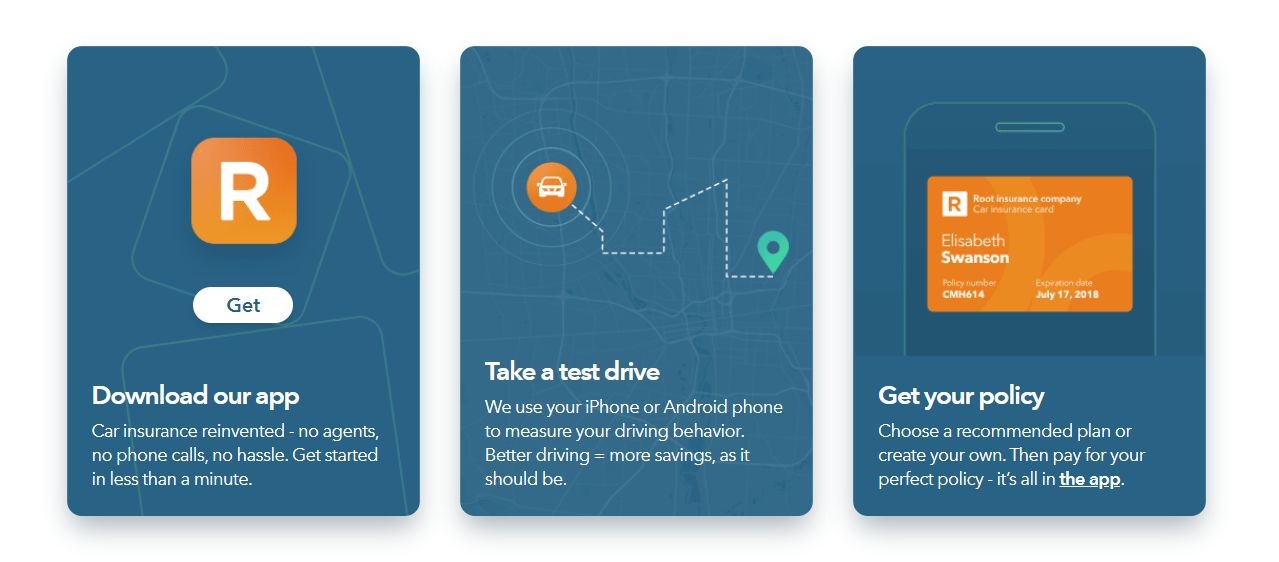

One of the most novel aspects about Root is the fact it’s entirely app-based. Despite having a great website design chock-full of important information and explanations, all the actual insurance work happens on your Apple or Android device.

Root claims to be able to save good drivers up to 52 percent on car insurance, but how? Is Root a legitimate insurance company considering that it sells car insurance through an app?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Know About Root Auto Insurance

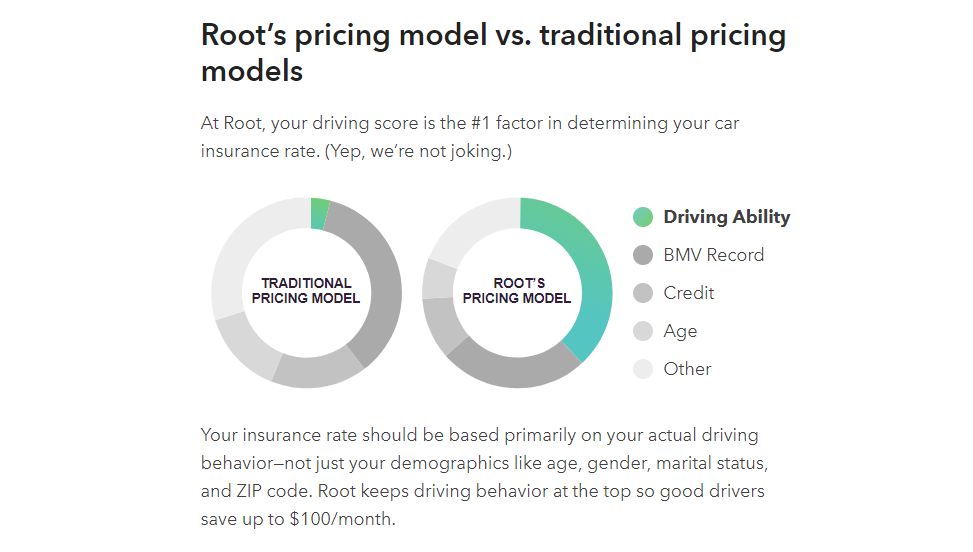

Every car insurance company has their own way of calculating car insurance premiums but all of them are based on a series of criteria such as location, age, and even your job. Root, as its name implies, gets to the origins of what really matters when it comes to what you should pay for premiums— how well you drive.

Dubbed by Forbes as “real-time, context-based” insurance, Root launched as a startup originally for Tesla owners but has since expanded and now offers lower coverage to drivers of any vehicle.

Founder Alexander Timm has over 14 years experience in the insurance industry; he understands what works, and, more importantly, knows where it could be improved. He founded Root to make car insurance less of a hassle and more of an asset.

How Does Root Car Insurance Work

Root embraces modern times and uses technology to determine exactly how well you drive and reflects the results in the cost of your car insurance. When you download the app, you’ll have to take a driving test for Root Insurance to determine your eligibility.

Using your smartphone’s GPS and motion sensors, Root will test your driving abilities based off a variety of factors like braking, smoothness, and traffic habits.

Your results will be evaluated by an AI, and the results will determine whether or not Root offers you a quote.

Who is Root Car Insurance Good for

Root is a good choice for people with a good driving record who want to save more on car insurance. Root breaks down how their car insurance pricing works on their site, and we have to say, their algorithm poses a new model that could dramatically cut costs and make insurance a lot more affordable.

Like we said earlier, a lot of factors go into determining car insurance costs. Every company has their own algorithm, but your driving record doesn’t play as large of a role as it should in most cases.

After answering tons of questions online, you’re ultimately placed in a risk pool that will determine how much you pay from any given company.

Sure, you can save money by qualifying for additional insurance discounts and participating in savings programs like Liberty Mutual’s RightTrack and State Farm’s Drive Safe & Save. But your driving record and daily habits don’t typically influence your premiums the most, which is unfair to a lot of people to say the least.

If you’re someone who is typically given high quotes due to your age, gender, or location, Root might be able to cut down major costs and give you a quote that reflects how well you drive and the type of coverage you actually need.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

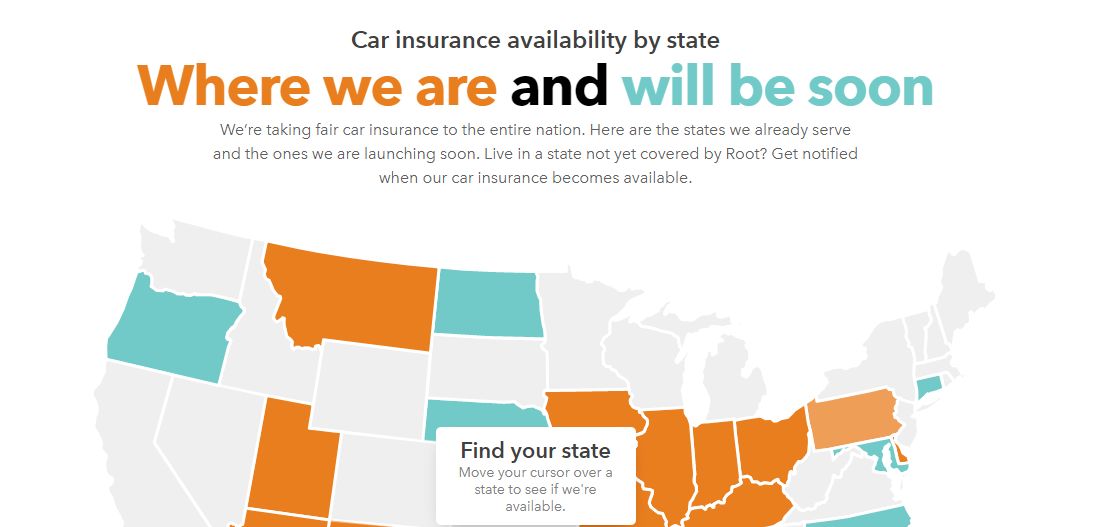

Root Insurance Availability

Root is based out of Columbus, OH, and has plans to expand its business across the nation. The company recently started offering coverage in Kentucky and Philadelphia, bringing its availability up to a total of 17 states. Here’s the full list of states you can buy Root car insurance in:

- Arizona

- Arkansas

- Delaware

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Mississippi

- Missouri

- Montana

- New Mexico

- Ohio

- Oklahoma

- Pennsylvania

- Texas

- Utah

Root Insurance Options

They offer a lot of the major types of car insurance coverages required by state and needed by drivers. Here’s a full list of their offerings:

Root offers liability coverage required in every state as well as additional coverages every driver should have like comprehensive and collision. There are also additional offers that will keep you secure in the event of an accident like under/uninsured motorist coverage and Personal Injury Protection (PIP).

Roadside assistance is included with every package, so you’ll never have to worry about being stranded. There’s also optional rental insurance that will make it easier to afford to get back on the road while your car is in the shop.

Root Insurance Discounts

You know about discount programs at other auto insurance companies. The difference between Root Insurance and its larger competitors is that their entire model is based off giving you discounts.

Instead of having to install a device, download a separate app or wait an entire policy period to find out what you can save, Root offers instant discounts on car insurance coverage all from their main app, and your savings are applied to all your coverages as soon as you’re eligible.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Root Pay-as-You-Go Car Insurance

Some people only need temporary coverage; Root’s auto insurance allows you to pay-as-you-go. You can sign up and pay for your insurance monthly or switch to one payment every 6 months. If you switch to a six-month payment plan, you won’t be able to switch pack until your policy’s 6-month renewal.

Even if you choose a later start date for your policy, payments are deducted immediately, so make sure you’re serious about switching to Root before you buy from them.

Is Root insurance legit?

It’s understandable that you’d be wondering if Root insurance is real since you bought on an app. In case you’re worried Root Insurance could be a scam, we did our homework. Root is accredited by the Better Business Bureau. Root insurance rating from the BBB is an A+.

Root insurance customer reviews matter, too. At the time of this Root insurance review, the company was rated 4.5 stars on the App Store and 4.4 on Google Play Store with over almost 10,000 combined ratings.

How to Get a Root Insurance Quote Online

Root wants to take the work out of car insurance. Everyone needs it, but that doesn’t mean it should be such a chore (or a bore).

You’ll find out whether or not you’re eligible for coverage, and then Root will walk you through the buying process. It’s fast, easy, and by far the most modern car insurance company we’ve seen so far.

Of course, just because Root insurance is easy to get doesn’t mean you should immediately buy it. You still need to employ the smart shopping skills that can save money without cutting back on coverage.

To get Root insurance quotes, download the Root app on the Apple App or Google Play store and sign up for a test drive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Save Money by Comparison Shopping

Enter your zip code below and get matched with personalized auto insurance quotes. Why enter the same information over and over again on car insurance websites when you can be one and done with our site? We encourage you to take some time, explore our articles and learn about car insurance coverage and the buying process.

Like Root, we believe auto insurance should be easy to find and cheap to keep. Good drivers deserve fair premiums. We’re glad you’ve stopped by. Now stay and start saving.

Compare Cheap Root Auto Insurance Quotes Online

- Root calculates your insurance premium based off how you drive

- For those who have a good driving record and are tired of the traditional insurance model, Root might be the right choice

- To get a quote from Root, you’ll have to take a driving test using your smartphone

Root car insurance is a new company that is changing the system. Technology is changing the landscape of every industry, and insurance is no exception.

Check out our Root car insurance review to find out if Root is a good car insurance company.

Don’t want to take the driving test? Didn’t make the cut? That’s okay. There are still plenty of other options out there to explore. Enter your ZIP code above to get free car insurance quotes from multiple insurers.

Step #1 – Get the Scoop on Root

Visit Root’s site to find out what makes them tick. Their site is easy to follow and offers a clear breakdown of the quote and purchase process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #2 – Explore Coverage Options

Step #3 – Make Sure Your State is Covered

Root is a growing company, so it isn’t available in every state yet. On the Availability page, you can get a full overview of all the states that Root currently services and get a glimpse at where they’re headed next.

They’re currently available (summer 2018) in:

- Arizona

- Arkansas

- Delaware

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Mississippi

- Missouri

- Montana

- New Mexico

- Ohio

- Oklahoma

- Pennsylvania

- Texas

- Utah

Step #5 – Create an Account

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #6 – Download the Root App for Car Insurance

Head over to the App or Google Play Store (depending on your phone) and download the Root Car Insurance app.

Step #7 – Take the Driving Test

Rather than have you waste time answering a bunch of questions to give you a generic rate, Root calculates your premium based off how well you drive.

The Root test drive

Step #8 – Buy a Policy

Root auto insurance policies are renewed on a month-to-month basis. If you’ve been looking for temporary car insurance, this company is a great option.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Step #9 – Customize Your Coverage

When you buy a policy, Root lets you choose different types of insurance coverage and adjust the limits of each. You can check out your state’s requirements, but we suggest going higher than the bare minimum so you have guaranteed coverage in the event of an accident.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Step #10 – Find More Ways to Save

If you’re not convinced or still want to see what’s out there, let us help. Enter your ZIP code on our site to get free car insurance quotes.

We can also help you get in touch with an insurance agent right away and get one-on-one counseling to find the perfect coverage for you.

Frequently Asked Questions

What is Root Insurance Company?

Root is a car insurance company that offers app-based insurance coverage and calculates rates based on driving performance.

How does Root Insurance work?

Root uses GPS sensors on your smartphone to measure your driving performance and determine your insurance rates. You need to take a test drive using the Root app to qualify for coverage.

Is Root a good insurance company for everyone?

Root is a good car insurance choice for drivers with a good driving record who want to save money on car insurance. It offers personalized rates based on driving habits and coverage needs.

What states is Root currently available in?

Root is based in Columbus, OH, and currently offers coverage in 17 states. The availability may vary, so it’s best to check their website for the most up-to-date information.

Does Root Insurance offer any discounts?

Yes, Root offers instant discounts on car insurance coverage through their app. They have a model based on providing discounts rather than traditional discount programs offered by other insurance companies.

How good is Root car insurance?

Root is well-regarded for its technology-driven approach to car insurance. Customers who qualify for lower rates based on safe driving habits often find Root insurance to be a cost-effective option.

Does Root insurance cover rental cars?

Root offers rental car reimbursement as an optional add-on to their policies.

Does Root have SR-22 insurance?

Root customers can get an SR-22 insurance through the app.

Does Root offer full coverage?

Yes, you apply for full coverage car insurance with Root by combining liability, comprehensive, and collision coverage.

Is Root car insurance cheap?

Root Insurance can be cheap, especially for safe drivers who qualify for discounted rates based on their driving behavior.

How cheap is Root insurance?

How does Root test drive work?

How to pay Root insurance online?

How reliable is Root insurance?

Is Root a real insurance company?

Is Root Insurance worth it?

How much is Root insurance?

Why did my Root insurance go up?

What’s Root insurance A.M. Best rating?

What’s Root car insurance phone number?

Can you get a Root insurance quote without test drive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.