Best Houston, TX Car Insurance in 2026

Car insurance in Houston, TX averages $600.54 per month. You'll need at least the minimum liability coverage that's required by Texas of 30/60/25. The cheapest auto insurance companies in Houston, Texas are USAA and State Farm. You can save money on your car insurance rates by searching for auto insurance discounts and shopping around. Learn more.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated October 2024

- Average car insurance rates in Houston, TX after a DUI are $5,412/year

- Average car insurance rates in Houston, TX are $4,771/year

- The cheapest ZIP code in Houston is 77059

Are you looking for the best car insurance in Houston, TX? Or maybe just the cheapest car insurance?

Were here to review Houston, TX car insurance companies.

When you shop for car insurance, you want to make sure you get the best rate for your situation.

Not everyone has a lot of money to spend, so it’s wise to look for the best insurance coverage you can afford. And it can be tough if you can’t cover the costs.

One of the perks of modern life is that you have freedom of choice — a variety of options are available. And we’ve made your research easier.

We’ve found the best Houston, TX car insurance rates and offer useful advice on a number of factors that affect car insurance coverage to help your decision-making.

We’re going to take a look at car insurance rate by a number of different factors like age, gender, and location. We’ll even dig into specifics like Esurance E-star shops and the average cost of car insurance in Houston, TX.

Let’s get started if you need low cost car insurance in Houston, Texas.

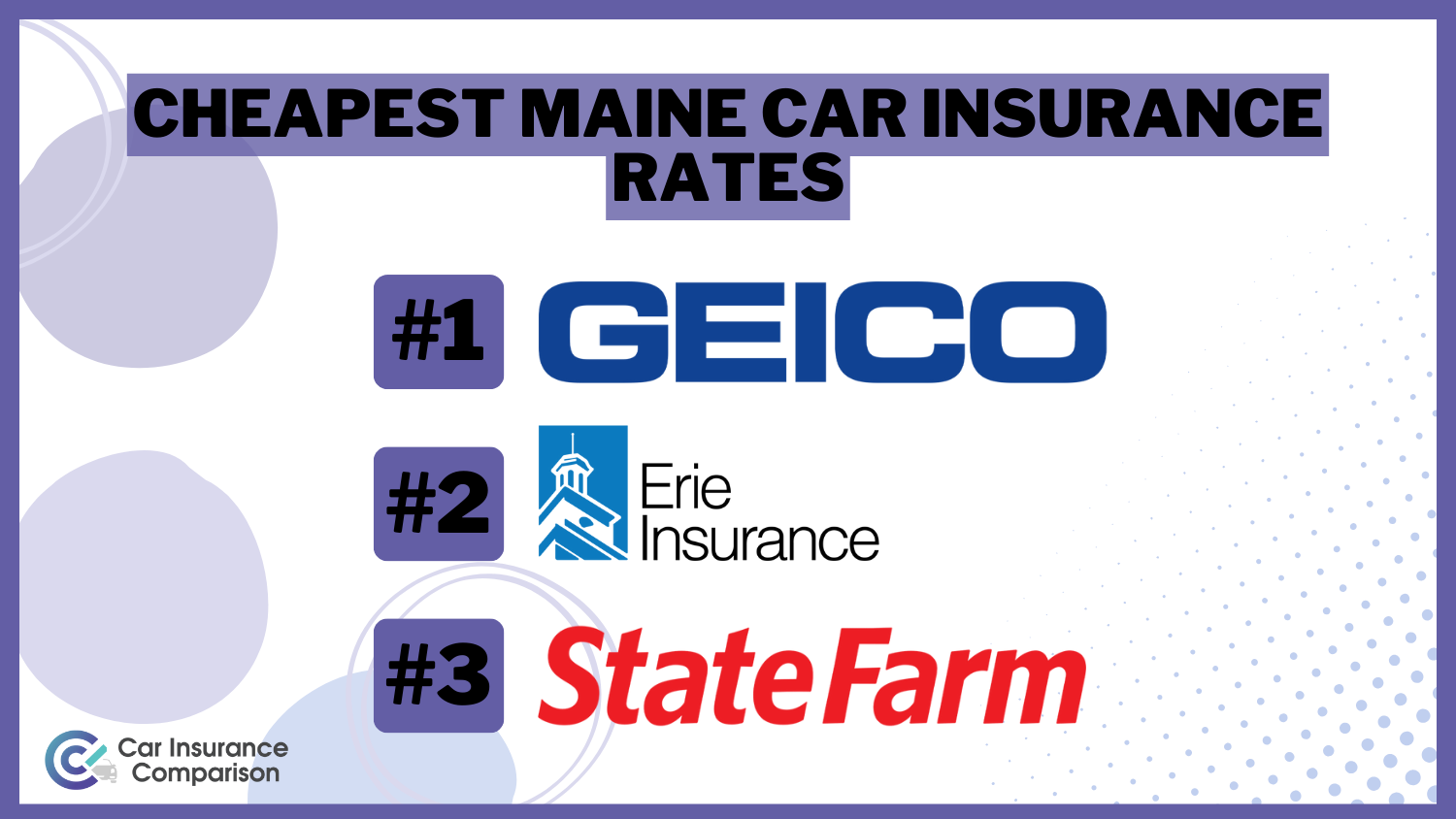

What city you reside in will impact your car insurance. That’s why it’s essential to compare Houston, TX against other top US metro areas’ auto insurance costs.

Read on to find the average costs of car insurance in Houston, and how those rates compare based on your needs.

Before you buy Houston, TX car insurance, enter your zip code in our free online tool above to start shopping for Texas car insurance.

We can help you find affordable Houston, TX car insurance quotes.

Minimum Car Insurance in Houston, TX

Every driver must carry the minimum car insurance in Houston, TX. Don’t forget to check out what is the minimum car insurance required by each state. Take a look at the Texas car insurance requirements.

Minimum Required Car Insurance Coverage in Houston, Texas

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $30,000 per person $60,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

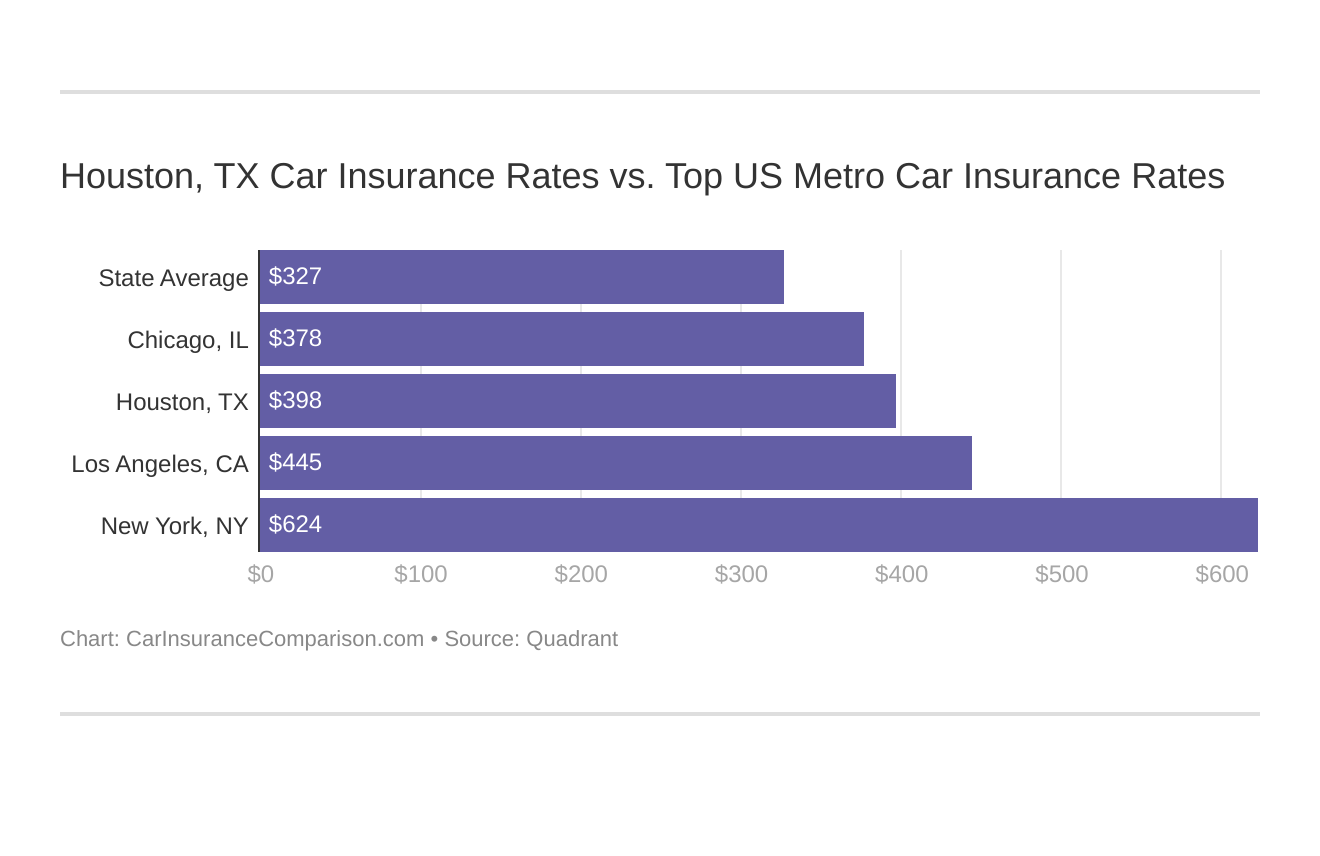

Male vs. Female vs. Age Car Insurance Rates

As you’ll see below, your age and gender influence insurers’ rates. The youngest drivers usually pay more than older, more experienced drivers, and the rates tend to decrease with age.

The median age in Houston is 33, meaning that most Houston drivers won’t face high premiums.

The cheapest age for insurance in Houston is 60 years old, and the cheapest rate is $2,791.00 per year.

Age is a significant factor for Houston, TX car insurance rates. Young drivers are often considered high-risk, and high-risk tends to mean higher rates. But there are tips for finding car insurance for young drivers. This Houston, Texas does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Houston, TX.

Houston, TX Average Annual Car Insurance Rates by Age

| Driver Age | Average Annual Car Insurance Rates |

|---|---|

| 60 | $2,876.24 |

| 35 | $3,018.83 |

| 25 | $3,794.62 |

| 17 | $9,393.23 |

Married 60-year-old males and females have the best rates, as shown below.

Houston, TX Average Annual Car Insurance Rates by Gender & Marital Status

| Driver Age, Gender, and Marital Status | Average Annual Caro Insurance Rates |

|---|---|

| Married 60-year old female | $2,791.00 |

| Married 60-year old male | $2,961.47 |

| Married 35-year old female | $2,969.61 |

| Married 35-year old male | $3,068.06 |

| Single 25-year old female | $3,683.32 |

| Single 25-year old male | $3,905.93 |

| Single 17-year old female | $8,559.72 |

| Single 17-year old male | $10,226.74 |

For males and females, the insurance rates start to decrease quite a bit after age 17.

The best solution, of course, regardless of your age and gender, is to find a provider with the best rates, regardless of those factors.

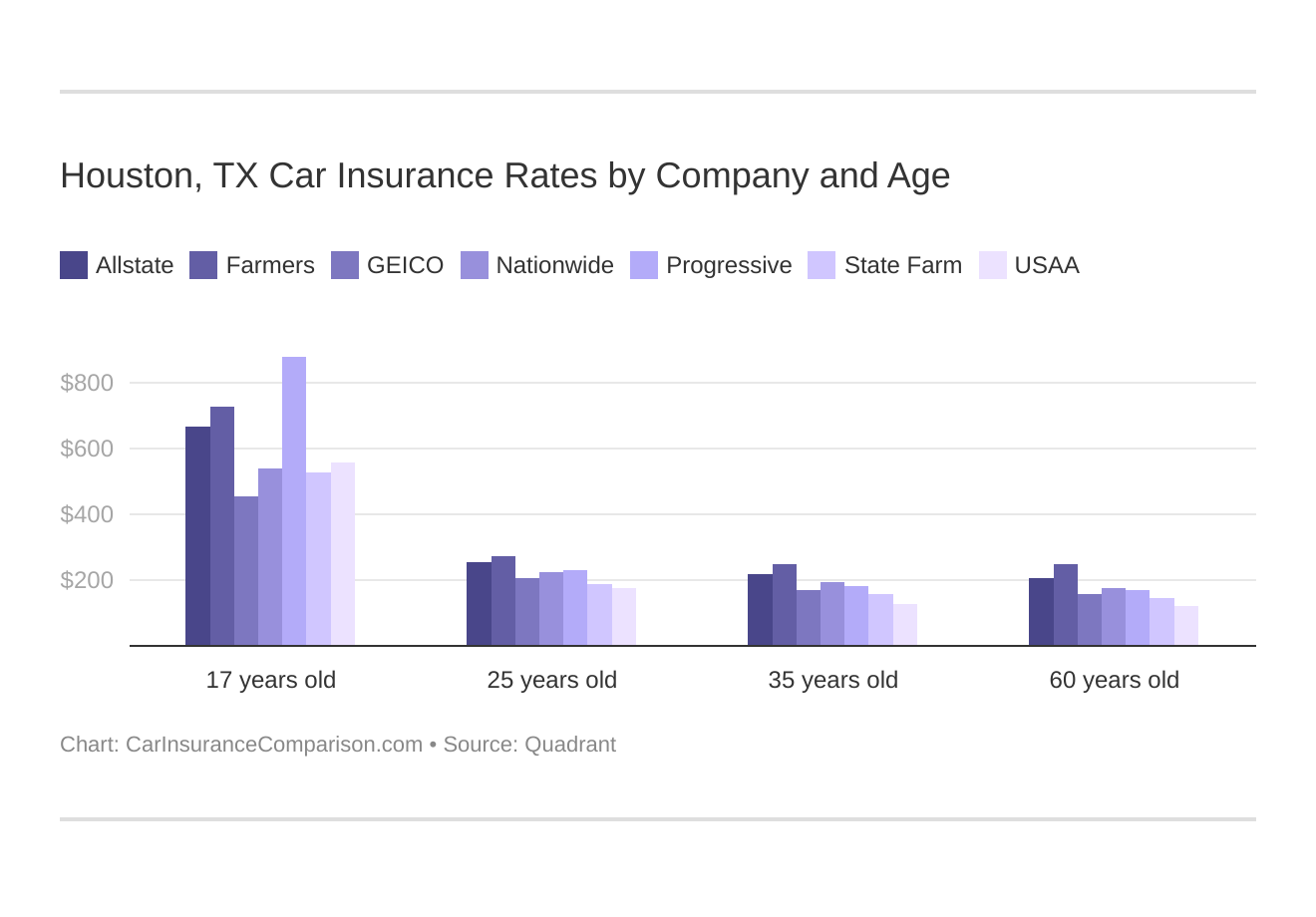

Houston, Texas car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

Cheapest Car Insurance Rates by ZIP Codes in Houston, TX

Where you live can impact finding cheap car insurance in Texas.

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Houston, TX auto insurance rates by ZIP Code below:

Insurance rates can vary in the same city based on crime rates, natural disasters, and other factors. These are some of the lowest rates for Houston ZIP codes.

Average Annual Car Insurance Rates in 25 Cheapest Houston, TX ZIP Codes

| ZIP Codes | Average Annual Car Insurance Rates |

|---|---|

| 77059 | $6,254.85 |

| 77062 | $6,263.54 |

| 77058 | $6,308.38 |

| 77339 | $6,351.62 |

| 77079 | $6,441.61 |

| 77005 | $6,459.12 |

| 77094 | $6,513.47 |

| 77598 | $6,523.91 |

| 77336 | $6,538.79 |

| 77006 | $6,550.05 |

| 77098 | $6,594.26 |

| 77069 | $6,608.68 |

| 77046 | $6,623.26 |

| 77070 | $6,655.34 |

| 77025 | $6,664.14 |

| 77089 | $6,714.46 |

| 77007 | $6,724.72 |

| 77027 | $6,740.78 |

| 77056 | $6,743.45 |

| 77030 | $6,751.63 |

| 77024 | $6,766.97 |

| 77018 | $6,787.86 |

| 77489 | $6,794.35 |

| 77064 | $6,795.54 |

| 77068 | $6,797.24 |

In comparison, the table below shows the 25 most expensive ZIP codes in Houston.

Average Annual Car Insurance Rates in 25 Most Expensive Houston, TX ZIP Codes

| ZIP Code | Average Annual Car Insurance Rates |

|---|---|

| 77023 | $7,399.43 |

| 77014 | $7,408.80 |

| 77045 | $7,420.16 |

| 77017 | $7,427.19 |

| 77090 | $7,441.20 |

| 77086 | $7,471.65 |

| 77061 | $7,479.15 |

| 77048 | $7,486.87 |

| 77051 | $7,489.43 |

| 77201 | $7,492.29 |

| 77204 | $7,496.11 |

| 77004 | $7,497.22 |

| 77050 | $7,505.14 |

| 77020 | $7,514.53 |

| 77026 | $7,553.90 |

| 77038 | $7,567.20 |

| 77028 | $7,579.76 |

| 77093 | $7,592.70 |

| 77099 | $7,600.09 |

| 77039 | $7,601.85 |

| 77022 | $7,605.82 |

| 77081 | $7,609.75 |

| 77088 | $7,612.47 |

| 77067 | $7,613.31 |

| 77016 | $7,629.02 |

| 77091 | $7,644.01 |

| 77060 | $7,664.73 |

| 77037 | $7,670.41 |

| 77083 | $7,670.98 |

| 77076 | $7,684.94 |

| 77078 | $7,700.94 |

| 77053 | $7,747.72 |

| 77033 | $7,840.97 |

| 77072 | $7,909.04 |

| 77036 | $8,150.71 |

What’s the Best Car Insurance Company in Houston, TX?

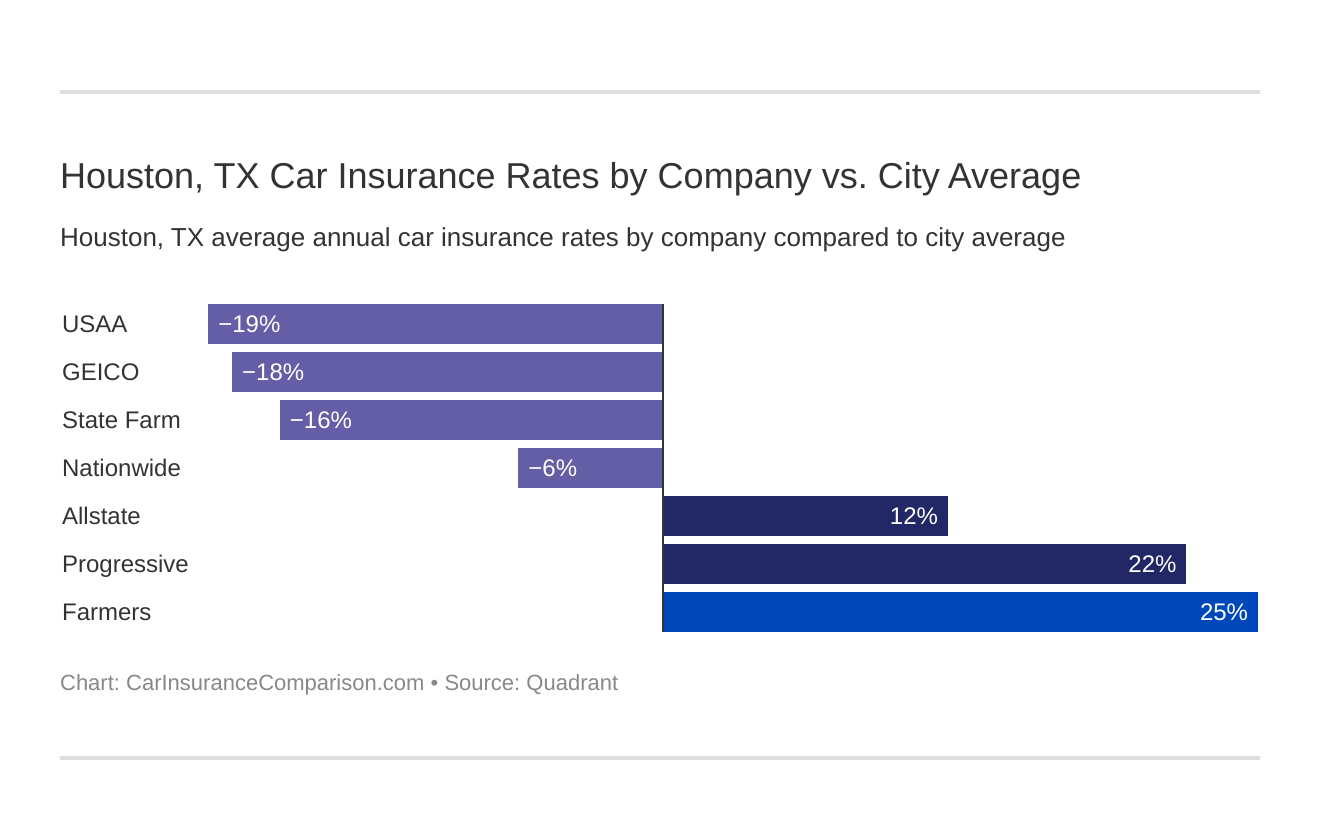

Who are the best Texas car insurance companies? The best way to find that out is to compare Texas car insurance [rates + cheap coverage guide].

The cheapest Houston, TX car insurance providers can be found below. You also might be wondering, “How do those Houston, TX rates compare against the average Texas car insurance company rates?” We uncover that too.

That’s an interesting question and one that we’ll help you answer, based on your needs and budget, with the data we received from our partner Quadrant below.

So, let’s dive in.

Cheapest Car Insurance Rates by Company in Houston, TX

These are the cheapest car insurance providers by age and demographics in Houston.

Houston, TX Average Annual Car Insurance Rates by Age and Gender

| Companies | Average Annual Rates for a Married 60-Year Old Female | Average Annual Rates for a Married 60-Year Old Male | Average Annual Rates for a Single 25-Year Old Female | Average Annual Rates for a Single 25-Year Old Male | Average Annual Rates for a Married 35-Year Old Female | Average Annual Rates for a Married 35-Year Old Male | Average Annual Rates for a Single 17-Year Old Female | Average Annual Rates for a Single 17-Year Old Male | Average |

|---|---|---|---|---|---|---|---|---|---|

| $1,788.73 | $1,764.79 | $2,474.00 | $2,628.93 | $1,861.20 | $1,862.59 | $5,316.68 | $5,756.42 | $2,931.67 | |

| $2,150.86 | $2,150.86 | $2,624.53 | $2,699.21 | $2,409.57 | $2,409.57 | $5,837.21 | $7,446.90 | $3,466.09 | |

| $2,414.89 | $2,556.62 | $3,231.22 | $3,497.33 | $2,737.94 | $2,781.67 | $7,905.73 | $10,151.58 | $4,409.62 |

| $2,470.71 | $2,516.22 | $3,311.60 | $3,372.89 | $2,780.15 | $2,646.22 | $11,780.27 | $13,178.71 | $5,257.10 | |

| $2,838.28 | $3,271.55 | $3,158.48 | $3,120.96 | $2,912.28 | $3,169.25 | $6,541.74 | $6,741.68 | $3,969.28 | |

| $3,710.26 | $4,306.92 | $5,781.26 | $6,621.66 | $3,868.87 | $4,362.69 | $11,317.80 | $14,803.09 | $6,846.57 | |

| $4,163.30 | $4,163.30 | $5,202.14 | $5,400.52 | $4,217.27 | $4,244.40 | $11,218.58 | $13,508.79 | $6,514.79 |

On average, USAA car insurance, State Farm car insurance, and Geico car insurance have the lowest rates for all age groups and genders; this information can help determine company rates based on your demographic rather than the lowest prices overall.

Best Car Insurance for Commute Rates in Houston, TX

Besides your age and gender, another crucial factor in your insurance rates is your regular commute; the longer it is, the more you can tend to pay.

Houston, TX Average Annual Car Insurance Rates by Commute

| Companies | Average Annual Rates for a 10 Miles Commute 6,000 Annual Mileage | Average Annual Rates for a 25 Miles Commute 12,000 Annual Mileage | Average Annual Car Insurance Rates |

|---|---|---|---|

| $2,471.80 | $2,535.03 | $2,503.42 | |

| $3,111.91 | $3,111.91 | $3,111.91 | |

| $3,417.61 | $3,543.16 | $3,480.39 | |

| $3,421.67 | $3,421.67 | $3,421.67 |

| $4,343.44 | $4,343.44 | $4,343.44 | |

| $4,769.79 | $4,769.79 | $4,769.79 | |

| $5,360.96 | $5,632.01 | $5,496.49 |

The average miles driven in the state of Texas are 17,099,340; it’s the second largest U.S. state, so there are lots of roads to travel. As the table above shows, USAA and State Farm have the best rates for distance traveled, and there’s not much, if any difference, between the rates for 10-mile and 25-mile commutes.

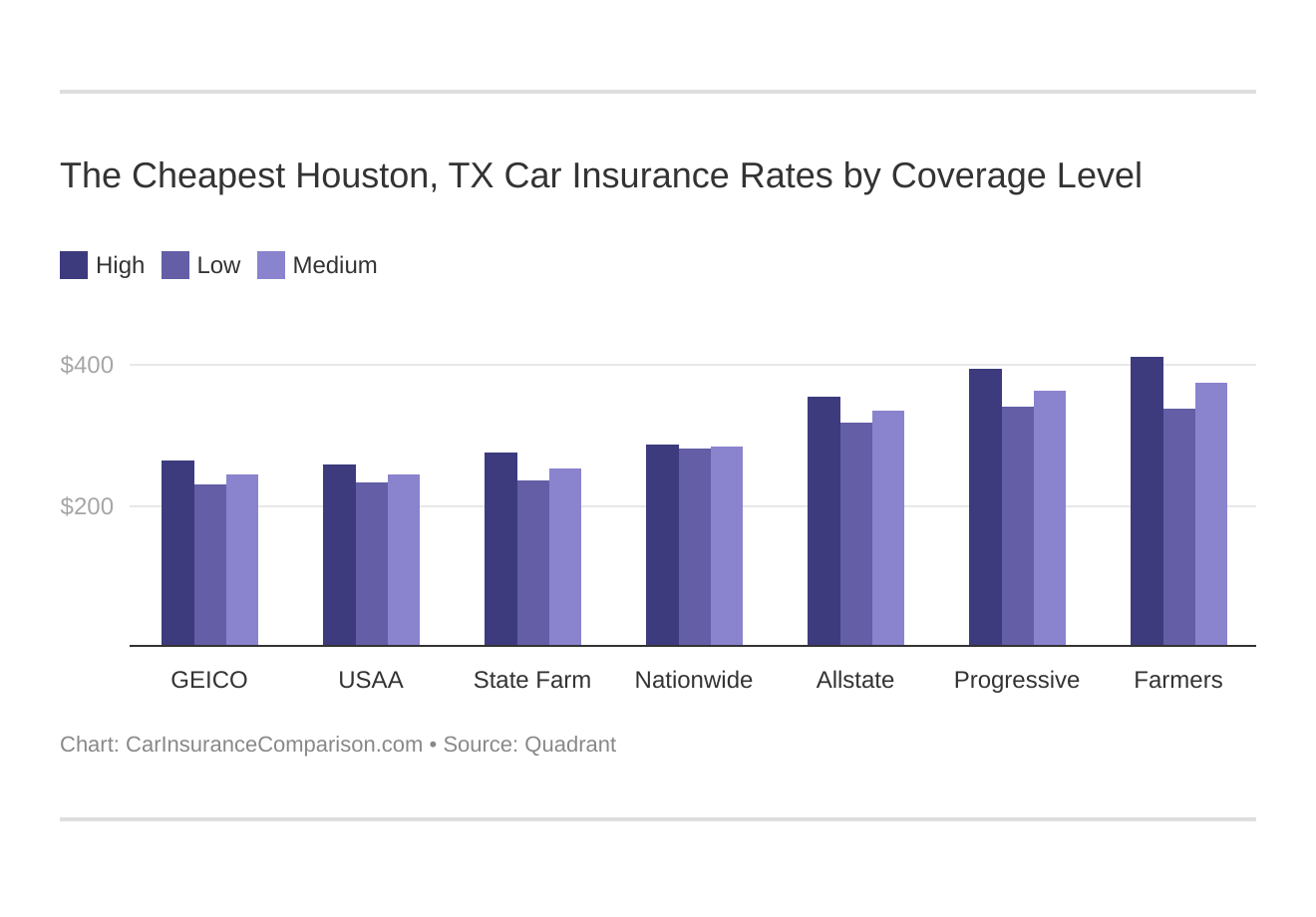

Best Car Insurance for Coverage Level Rates in Houston, TX

As the chart below shows, there’s not much difference in the costs among low, medium, and high insurance rates, so you have a variety of options to find the best price for you.

Your coverage level will play a major role in your Houston, TX car insurance costs. Find the cheapest Houston, Texas car insurance costs by coverage level below:

Houston, TX Average Annual Car Insurance Rates by Coverage Level

| Companies | Average Annual Rates for High Coverage | Average Annual Rates for Low Coverage | Average Annual Rates for Medium Coverage | Average Annual Rates |

|---|---|---|---|---|

| $3,063.36 | $2,814.10 | $2,917.54 | $2,931.67 | |

| $3,675.87 | $3,268.93 | $3,453.47 | $3,466.09 | |

| $4,269.74 | $4,739.31 | $4,219.83 | $4,409.63 |

| $4,275.87 | $3,723.01 | $3,908.95 | $3,969.28 | |

| $5,526.99 | $5,009.56 | $5,234.74 | $5,257.10 | |

| $6,747.80 | $6,345.48 | $6,451.07 | $6,514.78 | |

| $7,693.82 | $6,295.82 | $6,550.06 | $6,846.57 |

At companies like State Farm, the increase from low to high coverage is only about $300 a year, or an extra $25 a month. If the best coverage is still too expensive, medium coverage is a good alternative for budget and your overall safety.

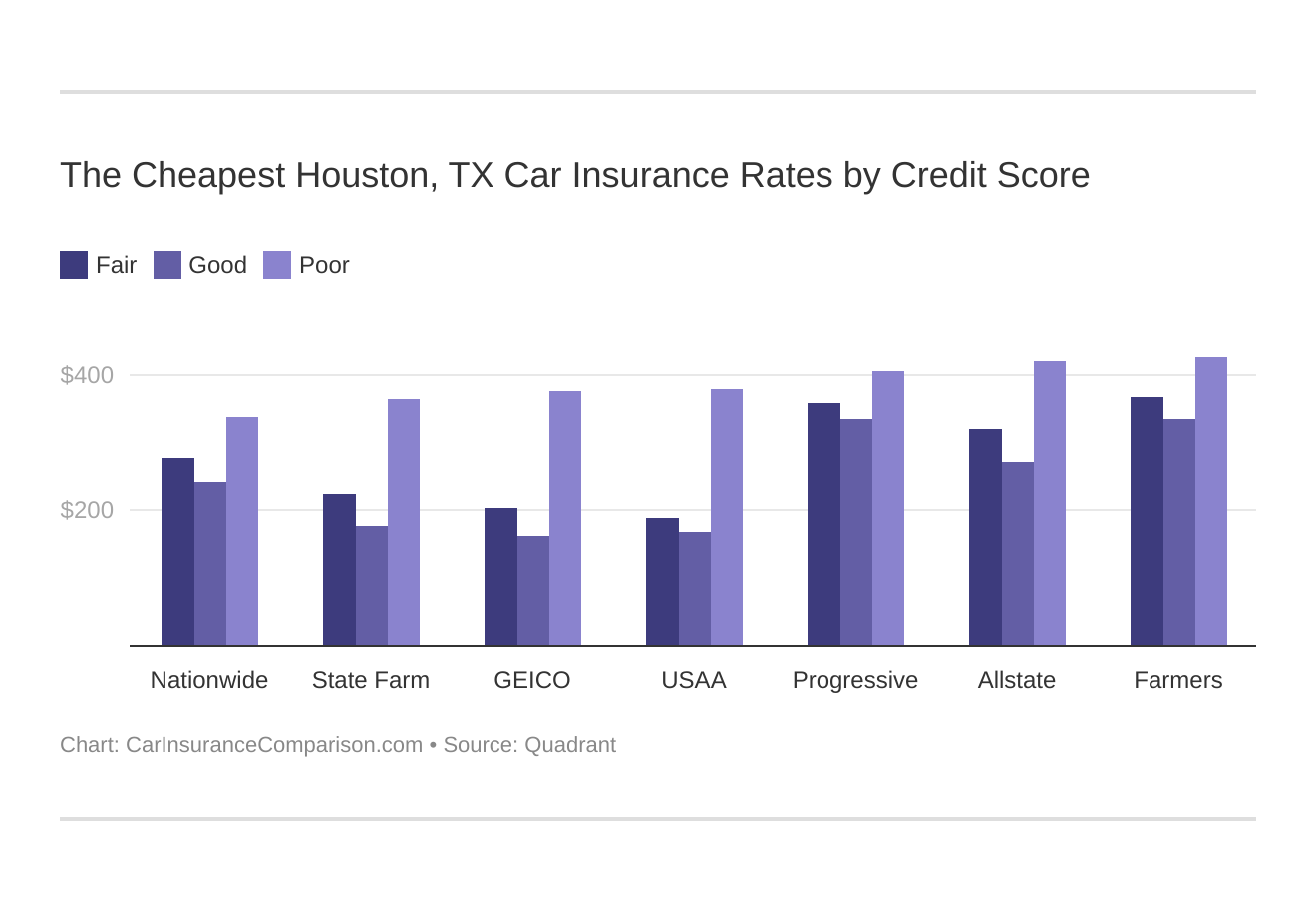

Best Car Insurance for Credit History Rates in Houston, TX

Your credit score can make your rates go up or down. Let’s see how.

Your credit score will play a major role in your Houston, TX car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Houston, Texas car insurance costs by credit score below.

Houston, TX Average Annual Car Insurance Rates by Credit History

| Companies | Average Annual Rates with Good Credit | Average Annual Rates with Fair Credit | Average Annual Rates with Poor Credit | Average Annual Rates |

|---|---|---|---|---|

| $2,013.20 | $2,496.22 | $4,285.58 | $2,931.67 | |

| $2,293.67 | $3,462.39 | $6,151.78 | $3,969.28 | |

| $2,439.19 | $3,057.10 | $4,901.97 | $3,466.09 | |

| $3,684.52 | $4,248.38 | $5,295.97 | $4,409.62 |

| $4,736.52 | $5,113.92 | $5,920.85 | $5,257.10 | |

| $5,193.73 | $6,064.69 | $8,285.94 | $6,514.79 | |

| $5,253.86 | $6,015.71 | $9,270.13 | $6,846.57 |

The cost difference between poor and good credit can vary as much as $3,000 to $4,000 at some companies. At American Family car insurance, a premium for a driver with poor credit can cost over $9,000 a year.

Before you buy Houston, TX car insurance, be sure to compare rates from multiple companies or check out the best car insurance companies for bad credit.

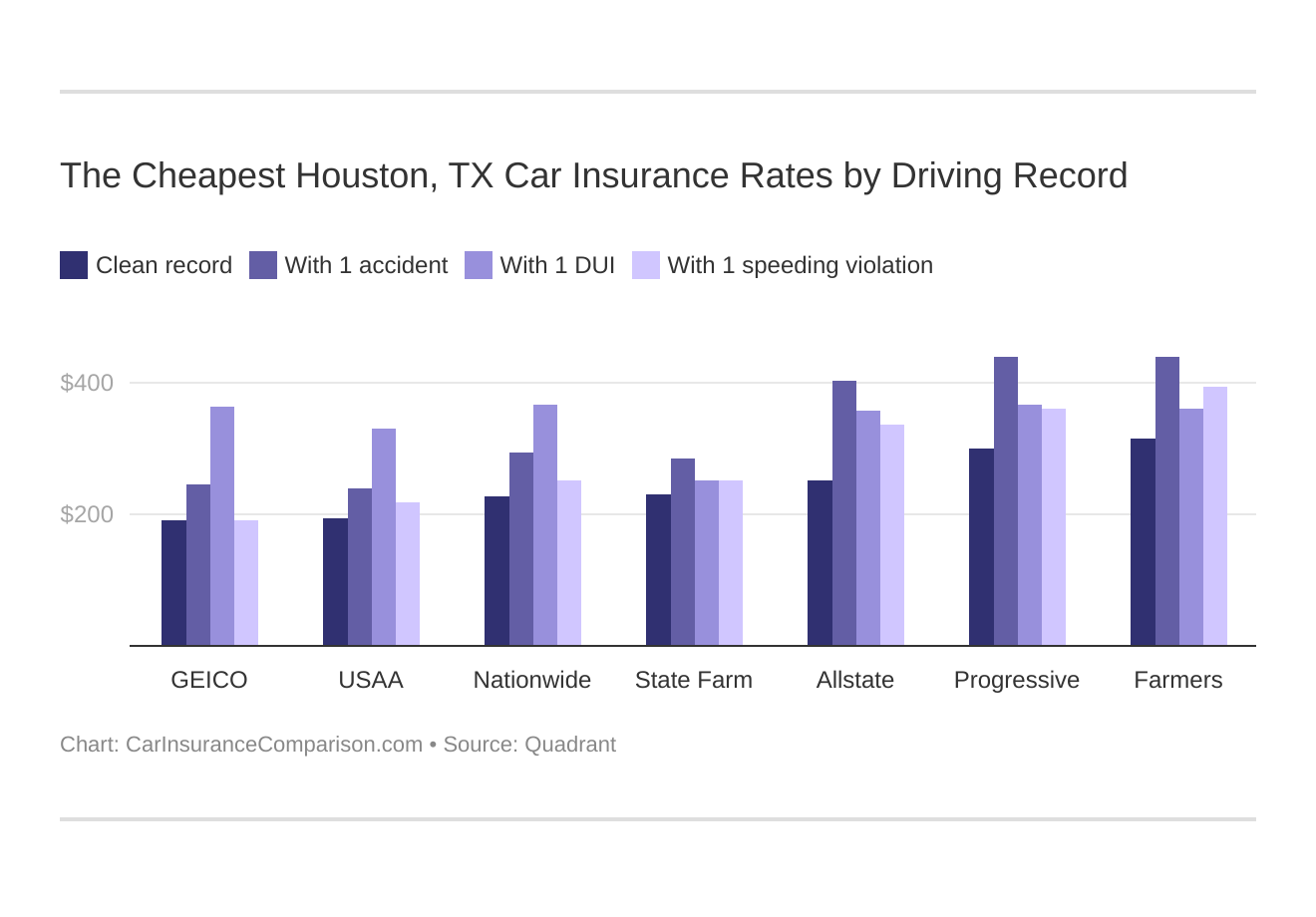

Best Car Insurance for Driving Record Rates in Houston, TX

Do car insurance companies check your driving records? Yes, a poor driving record is another contributor to your overall insurance rates. Like your credit, the better your track record, the better your rates.

Your driving record will affect your Houston, TX car insurance costs. For example, a Houston, Texas DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Houston, Texas car insurance costs by driving record.

Houston, TX Average Annual Car Insurance Rates by Driving History

| Companies | Average Annual Rates with a Clean Record | Average Annual Rates with One accident | Average Annual Rates with One DUI | Average Annual Rates with One Speeding Violation | Average Annual Rates |

|---|---|---|---|---|---|

| $2,174.69 | $3,238.80 | $3,814.31 | $2,498.87 | $3,075.93 | |

| $3,071.33 | $3,533.51 | $4,188.19 | $3,071.33 | $3,597.68 | |

| $3,360.70 | $4,480.89 | $3,696.17 | $4,339.34 | $3,845.92 | |

| $3,820.09 | $3,820.09 | $5,678.74 | $4,319.57 | $4,439.64 |

| $4,576.28 | $5,935.65 | $5,356.54 | $5,159.92 | $5,289.49 | |

| $5,026.59 | $7,838.42 | $8,167.54 | $5,026.59 | $7,010.85 | |

| $6,204.20 | $7,997.66 | $6,980.21 | $6,204.20 | $7,060.69 |

As shown, among offenses, the most costly are accidents and DUIs, which can raise your rates $1,000 or more, depending on the insurer.

Cheapest Houston, TX Car Insurance for Teen Drivers

Teen car insurance in Houston, TX can be expensive. Take a look at rates from the top car insurance companies in Houston for teenagers.

Annual Car Insurance Rates for Teen Drivers in Houston, Texas

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male |

|---|---|---|

| Allstate | $11,219 | $13,509 |

| American Family | $11,318 | $14,803 |

| Geico | $6,542 | $6,742 |

| Nationwide | $7,906 | $10,152 |

| Progressive | $11,780 | $13,179 |

| State Farm | $5,837 | $7,447 |

| USAA | $5,317 | $5,756 |

Cheapest Houston, TX Car Insurance for Seniors

Take a look at Houston, TX car insurance for seniors from top companies. Shopping around can make a big difference for senior drivers.

Annual Car Insurance Rates for Senior Drivers in Houston, Texas

| Insurance Company | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|

| Allstate | $4,163 | $4,163 |

| American Family | $3,710 | $4,307 |

| Geico | $2,838 | $3,272 |

| Nationwide | $2,415 | $2,557 |

| Progressive | $2,471 | $2,516 |

| State Farm | $2,151 | $2,151 |

| USAA | $1,789 | $1,765 |

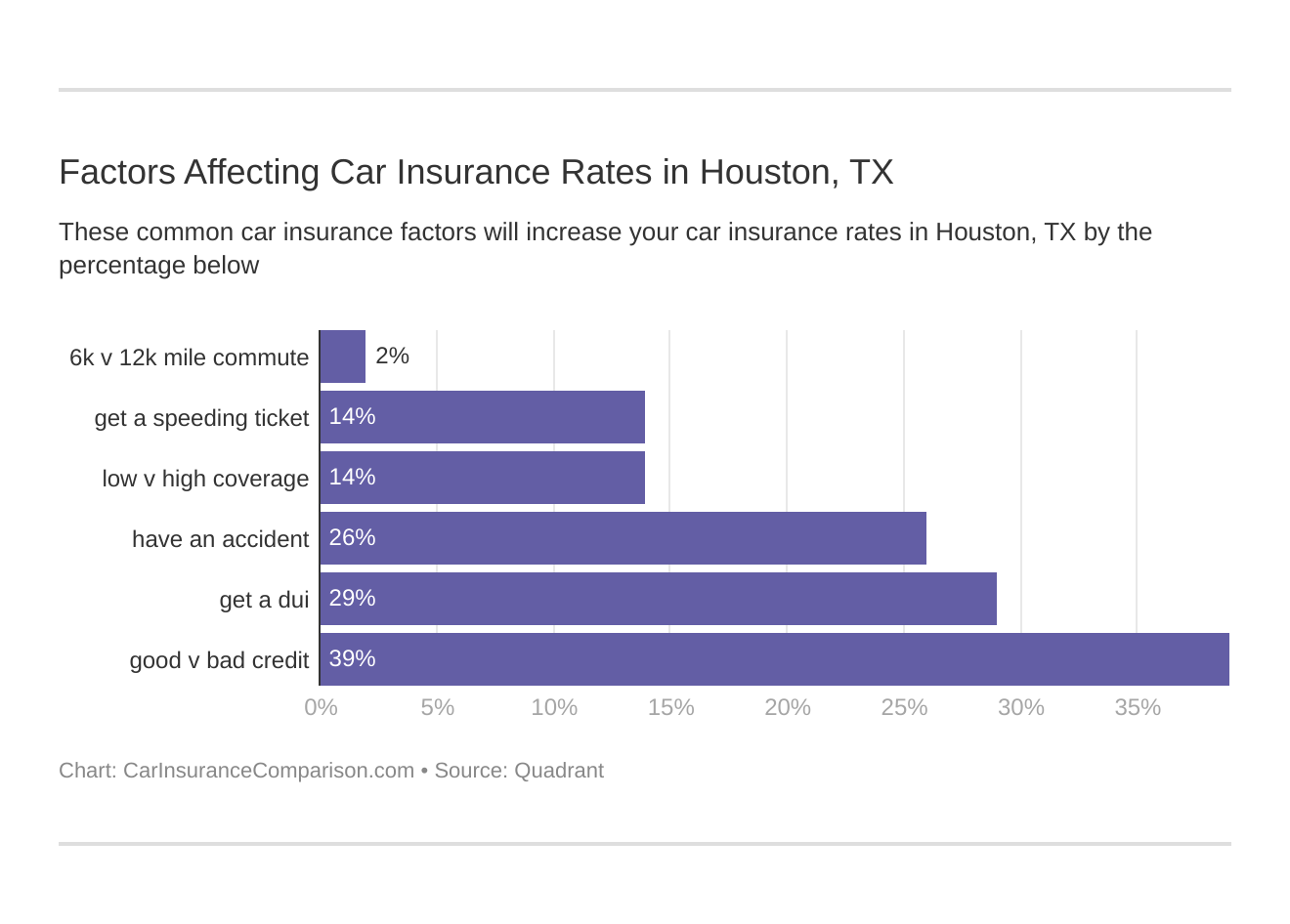

Car Insurance Factors in Houston, TX

What are the factors that affect car insurance rates? Many aspects of city life factor into local car insurance coverage and rates. This data can affect how much you can pay for car insurance.

Controlling these risk factors will ensure you have the cheapest Houston, TX car insurance. Factors affecting car insurance rates in Houston, Texas may include your commute, coverage level, tickets, DUIs, and credit.

Growth & Prosperity

Metro Monitor statistics show that from 2005 to 2015, the Houston-Woodlands-Sugar Land areas ranked second for growth, third in prosperity, and 12th for inclusion.

Houston has historically been among the fastest-growing metropolitan areas in the United States; according to Census estimates, it gained 156,371 residents from 2013 to 2014.

Greater Houston is the fifth-most populated metropolitan statistical area (MSA) in the nation, encompassing nine counties along the Gulf Coast in southeastern Texas. With a 2018 estimated population of 6,997,384, it’s the second metroplex in Texas after Dallas–Fort Worth.

Growth

Growth indicators measure the change in the size of an urban area’s economy and its level of entrepreneurial activity. Growth and entrepreneurship create new opportunities for individuals and can help a metro economy become more efficient. These figures measure growth in gross metropolitan product, the number of jobs, and the amount of jobs at young firms.

Here’s how the Greater Houston area grew from 2005 to 2015:

- Jobs: +25.7 percent (3rd of 100)

- Gross metropolitan product (GMP): +47.4 percent (3rd of 100)

- Jobs at young firms: +12.7 percent (4th of 100)

The expected job growth in the area was 9.2 percent higher than the national average, whereas the actual job growth was 26 percent, and the difference between real and expected job growth hovered around 17 percent.

The industries with the most growth included wholesale electronic markets and agents and brokers, management of scientific and technical consulting services, and managers of companies and enterprises.

Prosperity

Prosperity captures changes in the average wealth and income an economy produces. When worker productivity contributes to a metropolitan area’s growth, through innovation or training, for example, the value of those workers’ labor rises.

As the value of labor rises, so can wages. Increases in productivity and wages are what ultimately improve living standards for workers and families and the competitiveness of metropolitan economies.

This is how Houston/The Woodlands/Sugar Land increased in prosperity from 2005 to 2015:

- Productivity: +17.2 percent (4th of 100)

- Standard of living: +15.9 percent (4th of 100)

- Average annual wage: +18.4 percent (4th of 100)

Median Household Income in Houston, TX

It helps to compare how much you earn versus how much you pay for car insurance annually.

The average Houstonian’s household income is $50,896 per year, which is lower than the state average and neighboring counties, and $10,000 less than the average U.S. income.

What are the average car insurance rates in Houston, TX? Take a look at the table below.

Houston, TX Insurance as a Percentage of Income

| Average Annual Car Insurance Rates | Average Annual Income | Car Insurance as a Percentage of Income |

|---|---|---|

| $7,206.52 | $50,896.00 | 14.16% |

CalculatorPro

Homeownership in Houston, TX

Homeownership can keep your insurance rates low. For instance, some companies offer discounts if you insure your car and your home through them.

In Greater Houston, about 43 percent of residents are homeowners, which is below the national average of 64 percent. It’s also lower than the average in Texas and of neighboring counties.

The value of most Houston homeowners’ properties in 2017 averaged $173,600. Though it’s $20,000 lower than the national average, it is higher than the average in Texas, which was $151,500, but it’s lower than most areas nearby.

Education in Houston, TX

The largest local universities are the University of Houston (9,524 degrees awarded in 2016), Houston Community College (8,129 degrees), and the University of Houston-Downtown (2,882 degrees).

The Houston Community College System (HCCS) operates schools in Houston, Missouri City, Greater Katy, and Stafford, Texas.

It’s known for recruiting actively internationally and for the high amount of international students enrolled, which was over 5,700 in 2015. Its open enrollment policies don’t require fluency in English, but students can take a full-time 18-month English proficiency program and remedial courses.

Wage by Race and Ethnicity for Common Jobs in Houston, TX

In 2017, the highest paid race/ethnicity of Houston workers was Asian. They earned 1.26 times more than white workers, who made the second highest salary of any race/ethnicity. Managers of all races and ethnicities earned more than those in the other four most common full-time occupations in Houston.

How does this affect your car insurance premiums? Below you’ll see how much the top-earning races and ethnicities’ incomes go to car insurance.

Houston, TX Average Annual Wage by Race

| Race | Average Annual Car Insurance Rates | Average Annual Income | Car Insurance Rates as a Percentage of Income |

|---|---|---|---|

| American Indian | $7,206.52 | $111,159 | 6.48% |

| Asian | $7,206.52 | $106,579 | 6.76% |

| White | $7,206.52 | $103,116 | 6.99% |

| Two or More Races | $7,206.52 | $86,431 | 8.34% |

| Black | $7,206.52 | $69,172 | 10.42% |

| Other | $7,206.52 | $62,098 | 11.61% |

Wage by Gender for Common Jobs in Houston, TX

There’s still a gender gap in wages, with males still earning more than females in Houston. But for some jobs, such as cashiers and school teachers, that gap is closing.

- Houston Female Average Salary — $47,183

- Houston Male Average Salary — $65,834

Overall, males in Houston earned 1.4 times more — or $22,000 higher — than their female counterparts.

Poverty by Age and Gender in Houston, TX

Gender and age also affect poverty rates.

According to Data USA, 473,000 of Greater Houston residents, or 21 percent, live below the poverty line. That rate is higher than the national average of 13 percent. Most of those living in poverty are females ages 25-44 and boys ages 6-11.

Poverty by Race and Ethnicity in Houston, TX

The number of Hispanics and whites who live below the poverty line in the Houston area is almost even (36 versus 34 percent). Half or fewer than half of blacks and other races and ethnicities live in poverty.

Employment by Occupations in Houston, TX

As shown in the chart below, from 2016 to 2017, employment in Houston declined at a rate of -1.48 percent from 1.12-1.11 million employees.

Below are the top three most common job groups:

- Other Management Occupations Except Farmers, Ranchers, & Other Agricultural Managers — 60,011 people

- Building Cleaning & Pest Control Workers — 49,970 thousand people

- Driver/Sales Workers & Truck Drivers — 31,598 people

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving in Houston, TX

Driving in cities as large as Houston, with heavy, congested traffic, can be frustrating.

Need to find the best routes along Houston’s highways and by-ways? We’ve collected everything you need below, so keep reading to chart the best course for your journey.

This video will give you an idea of what it’s like to drive in Houston:

Roads in Houston, TX

Texas has 25 active interstates, which take up 3,501 miles of roadway and spread in different directions like spokes on a wheel.

Toll roads and metro lanes the Fort Bend County Toll Road Authority (FBCTRA), Harris County Toll Road Authority (HCTRA), Montgomery County Toll Road Authority (MCTRA), and Metropolitan Transit Authority of Harris County (METRO) operate appear below:

- Westpark Tollway

- Fort Bend Parkway & Extension

- Grand Parkway: Fort Bend County, TxDOT

- Hardy Toll Road

- Hardy Airport Connector

- Sam Houston Ship Channel

- Sam Houston Tollway

- SH 242

- Tomball Tollway

- Katy Freeway Managed lanes I-10 QuickRide and US 290

- US-290 (Northwest Freeway) HOT Lanes

- US-59 North (Eastex Freeway) HOT Lanes

- US-59 South (Southwest Freeway) HOT Lanes

- I-45 North (North Freeway) HOT Lanes

- I-45 South (Gulf Freeway) HOT Lanes

How much you’ll pay to take them depends on your route and the tag you use. According to MoneyWise, State Highway 242 connector ramp (No. 9) near The Woodlands, Fort Bend Parkway (No. 4) and the State Highway 249 connector ramp (No. 3) in North Houston are among the most expensive toll roads in the country.

You can pay using tags such as TxTag, NTTA TollTag, HCTRA EZ Tag, EZ TAG. You can also use video tolling systems such as Pay by Mail on TxDOT roads or ZipCash on NTTA roads. TxTag works at all Texas locations that accept it; bridges on the Mexico-Texas border only accept cash. At all other places, you can use TxTag or NTTA TollTag.

Most Texas toll roads don’t have cash toll plazas. If you have a Tolltag or TxTag or another interoperable tag such as PikePass, toll plazas will scan them. If you don’t carry a TollTag, the agency will photograph your license plate and send you a bill. They will only send you a bill when you’ve accumulated a certain amount.

It’s cheaper to get a TollTag or TxTag if you drive on the toll road several times.

Popular Road Trip Sites near Houston, TX

Houston is home to the world-famous Space Center and numerous other attractions worthy of a road trip. Below are some ideas for your next adventure.

8 Absolutely Amazing Places To Visit In Houston – from the Gerald D. Hines Waterwall Park to the Camino Market, these are some low and no-cost stops worth a visit.

Houston Museum District a Cultural Mecca for All Ages – the extensive Museum of Fine Arts (MFA), The Holocaust Museum of Houston, and the Children’s Museum of Houston are among the many museums to visit for memorable and educational experiences.

Market Square Historic District in Houston – Dining, sightseeing, and dancing are among the things to do in this more than 150-year-old section of the city, which also features many well-preserved Victorian, Art-Deco, and Beaux Arts-style buildings.

18 Cool, Hidden, and Unusual Things to Do in Houston, Texas – The National Museum of Funeral History and the Beer Can Museum are a few of the local oddities to check out for something off the beaten path.

Haunted Houston – As one of the most haunted places in the U.S., you’ll find plenty of spooky spots, such as the Rice Hotel, where President Kennedy spent his last night, and the Spaghetti Warehouse, which once housed fur pelts and pharmaceuticals. Sadly, a young pharmacist died tragically in the building and his spirit, among other lost souls, are said to call it home.

And, if that’s not enough for you, here is Expedia’s Houston Travel Guide:

Houston has many interesting, eclectic, and historic sights worth a weekend getaway. The variety of attractions throughout the fourth most populated city in Texas and the U.S. might surprise you.

Road Conditions

The following are pavement conditions and vehicle operating costs in Houston from TRIP, a national transportation research group:

Houston, Texas Road Conditions

| Road Conditions | Percentage of Total Roads |

|---|---|

| Poor Share | 24% |

| Mediocre Share | 28% |

| Fair Share | 11% |

| Good Share | 38% |

| Vehicle Operating Costs (VOC) | $610 |

Many of the roads are in poor and mediocre rather than good shape, so the quality of the ground you cover may vary as you travel to your destination.

Does Houston use speeding or red light cameras?

Houston doesn’t use speeding or red light cameras, however, another city in the area, Sugar Land, has had red light cameras for a decade. Sugar Land officials credit the cameras for reducing the number of crashes. Just be on the look out and know what red light cameras look like before driving around Sugar Land.

Houston once had red light cameras, but voters decided to turn them off several years ago. Lone Star State Lawmakers have tried to ban them, and they plan to continue to keep this issue on the table.

This video debates the issue of whether red light cameras caused accidents in Houston:

Vehicles in Houston, TX

Houstonians are used to the safety, theft, and traffic issues involved with car ownership, and the potential headaches involved. Let’s see how your car compares in Greater Houston.

Most Popular Vehicles in Houston, TX

These are some interesting statistics from YourMechanic:

- Most Unusually Popular Car: Ford F-250 Super Duty

- The Hybrid Index = 0.7 percent of cars YourMechanic services in Houston are hybrids (41 out of 81 cities)

- The Muscle Car Index = 18.5 percent of vehicles YourMechanic repairs in Houston have V8 engines; the city ranked third on their list

- The Subaru Index = 0.5 percent of cars YourMechanic fixes there are Subarus (ranked 65th out of 81 towns)

According to these numbers, Houstonians prefer rugged vehicles with powerful engines, and the most popular, Ford F-250, meets those requirements. Overall gas mileage for the 2019 model isn’t great, at 15 miles per gallon — ten in the city and up to 20 on the highway.

Consumer Reports stated that it’s “probably among the clumsiest handling vehicle we’ve ever tested.

The F-250 practically takes a village to make it turn…That doesn’t mean the F-250 is unsafe. In our avoidance maneuver, it managed almost 47 mph, albeit with some effort due to the slow steering and low front-end grip. Pushing it further on our track revealed low cornering capabilities but nonetheless, a predictable and forgiving behavior.”

The Ford F-250 Crew Cab scored a four-star rating in NHTSA’s 5 Star Safety Rating. The test includes a front, side crash, and rollover test.

How Many Cars Per Household?

The average Houstonian owns two cars, followed by one and three vehicles.

Households Without a Car

Below are statistics from 2015 and 2016 for Houston households that don’t own cars.

Houston Households Without Vehicles

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Vehicles Per Household |

|---|---|---|---|

| 8.30% | 8.10% | 1.58 | 1.59 |

A small number, only eight percent, don’t use cars; the average number of vehicles owned matches Data USA’s figures (above).

Speed Traps in Houston, TX

The National Speed Trap Exchange reports that over the past five years, motorists have named Houston the worst Texas speed trap city.

Houston Speed Traps

| Number of Speed Traps | Acknowledgement Rate* |

|---|---|

| 44 | 77% |

Houston hosts more than double the number of speed traps than Austin, ranked second on the list.

* Acknowledgement rate = the number of “Yes, this is a speed trap” votes for the city over the defined time divided by the total number of “yes” plus “no” votes.

Vehicle Theft in Houston, TX

Neighborhood Scout states 11,680 motor vehicle thefts occurred in 2017, which is an estimated five per 1,000 people out of a population of 2.3 million.

This news report reveals how Houston police caught two men who were part of a massive auto theft ring:

The safest Houston neighborhood is Dogwood Acres/Walden Woods in the north of the city.

Other safe neighborhoods that round out the top 10:

- Westheimer Parkway / S Ferry Road

- Clodine

- Sandtown Circle / Sandtown Lane

- Clodine Reddick Rd. / Beechnut Blvd.

- Olcott

- Porter Heights

- River Terrace

- Echo Mountain Dr. / Mills Branch Dr.

- Telge Rd. / Northwest Freeway

These locations are great to keep in mind as safe neighborhoods. Overall, Houston ranks four out of 100 for safe cities (100 is the safest).

Below are stats for violent crimes in Houston:

Houston, TX Violent Crimes

| Type of Crimes | Total Number of Crimes | Crime Rates per 1,000 Population |

|---|---|---|

| Rape | 269 | 0.12 |

| Robbery | 1,386 | 0.60 |

| Assault | 9,842 | 4.26 |

| Murder | 14,346 | 6.20 |

Per 1,000 residents, you have a one in 89 chance of being a victim of violent crime in Houston. That’s lower than the statewide average of one in 228. But, these numbers for overall annual crimes in 2017 are startling.

As shown below, property crime in Houston is more likely than violent crime.

Houston, TX Annual Crimes

| Type of Crimes | Number of Crimes | Crime Rates per 1,000 Population |

|---|---|---|

| Violent | 25,843 | 11.17 |

| Property | 98,197 | 42.46 |

| Total | 124,040 | 53.63 |

For more details about car insurance and car theft, see does car insurance cover theft?

Traffic in Houston, TX

Numbeo measures statistics about the traffic in major North American cities.

Houston ranks sixth on their list, with a Traffic Index of 208.54. The Traffic Index is a composite index of time consumed in traffic due to job commute, and an estimate of time consumption dissatisfaction, carbon dioxide consumption in traffic, and overall inefficiencies in the traffic system.

Their Time Index shows that the average Houstonian spends 42 minutes and 21 seconds in traffic (one way). The Inefficiency Index of 242.95 is an estimate of how such inadequacies as long commute times and driving a car instead of using public transportation affect overall traffic.

Transportation in Houston, TX

Houstonians spend a lot of time in traffic. Compared to the national average of 25.3 minutes, Houston residents have a longer commute of 26.5 minutes, and two percent of the workforce has a “super commute” of more than 90 minutes.

As part of the traffic congestion, as the chart below shows, an overwhelming majority of Houston commuters drove alone, more than seven times the number of those who carpooled or used other forms of transportation.

Busiest Highways in Houston, TX

According to the Federal Highway Administration (FHA), the Houston highways with the most lanes are route 6, US-59, I-10, and I-610, all which have 12 lanes. The number of lanes represents the total number of lanes in both directions for multi-directional facilities, e.g., northbound and southbound lanes. It doesn’t include toll plazas.

Texas A&M’s Transportation Institute statistics show that the 610 Loop from I-10 to I-69 in uptown Houston is the most congested in Texas with 1.6 million wasted hours in traffic per mile.

The Southwest Freeway from the 610 Loop to Highway 288 comes in second, with annual wasted hours in traffic of 1,372,657. Texas A&M estimated the annual congestion cost (associated with fuel consumption) for Houstonians traveling on the Uptown 610 Loop at $119 million and over $146 million for the Southwest Freeway.

So, if possible, avoid those routes, especially at peak traffic times.

The video covers some of Houston’s worst commutes:

How Safe are Houston’s Streets and Roads?

Busy highways affect traffic safety, but many factors, including driver impairment and distraction, also create risks on the road.

Below are the National Highway Traffic Safety Administration (NHTSA) crash statistics for Harris County. First, let’s look at the total fatal crashes in 2017.

Harris County, TX Total Car Crashes by Year

| Years | Total Car Crashes |

|---|---|

| 2013 | 369 |

| 2014 | 417 |

| 2015 | 391 |

| 2016 | 447 |

| 2017 | 456 |

As shown, the number of crashes has gone up and down since 2013, with most hovering around 400 per year.

Next, let’s see some sobering statistics about alcohol-impaired fatalities.

Harris County (Houston Texas) Alcohol-Impaired Crash Stats

| Years | Total Fatal Crashes Involving an Alcohol-Impaired Driver |

|---|---|

| 2013 | 174 |

| 2014 | 210 |

| 2015 | 170 |

| 2016 | 209 |

| 2017 | 202 |

See NHTSA data below on crash types in Harris County.

Harris County, TX Single Vehicle Crash Fatalities

| Year | Total Fatal Car Crashes |

|---|---|

| 2013 | 209 |

| 2014 | 216 |

| 2015 | 220 |

| 2016 | 263 |

| 2017 | 242 |

The numbers, unfortunately, have risen steadily since 2013.

Here are recent statistics for the number of Harris County crashes involving speed.

Harris County, TX Speeding Crash Fatalities

| Years | Total Speeding Crash Fatalities |

|---|---|

| 2013 | 121 |

| 2014 | 136 |

| 2015 | 107 |

| 2016 | 135 |

| 2017 | 105 |

The figures have remained pretty consistent, with slight ups and downs.

Here we have the amounts of fatalities involving road departures.

Harris County, TX Road Departure Crash Fatalities

| Years | Total Fatal County Road Departure Crashes |

|---|---|

| 2013 | 155 |

| 2014 | 177 |

| 2015 | 166 |

| 2016 | 175 |

| 2017 | 173 |

Like many of the prior statistics, these numbers have also climbed since 2013, but in recent years, have remained steady.

These are statistics for crashes that involved intersections or were related to them.

Harris County, TX Road Intersection Crash Fatalities

| Years | Total Fatal Intersection Crashes |

|---|---|

| 2013 | 77 |

| 2014 | 103 |

| 2015 | 89 |

| 2016 | 102 |

| 2017 | 115 |

As time has passed, these numbers have continued to rise.

Next, let’s look at stats for occupants of cars with passengers.

Harris County, TX Passenger Car Occupant Crash Fatalities

| Years | Total Fatal Passenger Car Occupant Crashes |

|---|---|

| 2013 | 118 |

| 2014 | 146 |

| 2015 | 124 |

| 2016 | 147 |

| 2017 | 149 |

Like other figures for other crashes noted above, these have continued to rise since 2013.

Now, let’s explore the numbers of pedestrian/motor vehicle crashes in recent years.

Harris County, TX Passenger Pedestrian Crash Fatalities

| Years | Total Fatal Pedestrian Crashes |

|---|---|

| 2013 | 93 |

| 2014 | 90 |

| 2015 | 98 |

| 2016 | 130 |

| 2017 | 109 |

These numbers have hovered around 100 for the past several years.

Here are some statistics for crashes involving bicyclists.

Harris County (Houston Texas) Pedacyclist Crash Stats

| Years | Total Fatal Pedacyclist Crashes |

|---|---|

| 2013 | 9 |

| 2014 | 12 |

| 2015 | 10 |

| 2016 | 11 |

| 2017 | 14 |

Fortunately, these numbers are low, given the fewer amounts of bicyclists who share the road with drivers, however, it would be best if there were none.

Next, we have NHTSA’s information on Harris County highways with the most fatal crashes. Let’s see how the numbers compare based on each road type.

Harris County, TX Passenger FARS Data

| Road Type | Number of Fatal Car Crashes |

|---|---|

| Interstate (Rural) | 2 |

| Interstate (Urban) | 91 |

| Freeway and Expressway | 63 |

| Other Principal Arterial | 101 |

| Minor Arterial | 101 |

| Collector Arterial | 38 |

| Local | 34 |

| Unknown | 1 |

| Total | 431 |

An arterial road is a high-capacity urban road. Depending on the amount of traffic, the arterial road may be classified as a highway or a minor arterial road.

A collector road gathers traffic from local roads and takes drivers to arterial roads.

Most of Harris County’s fatal crashes occur on major and minor arterial roads. Be extra cautious when driving through these areas.

Another driving hazard is railroad crashes. The U.S. Department of Transportation (DOT) collected information on Houston’s fatalities and injuries from railway accidents.

Harris County, TX Railroad and Highway Car Crash Incidents

| Highway User Speed | Highway | Highway User Type | Rail Equipment Type | Non-Suicide Fatalities | Non-Suicide Injuries |

|---|---|---|---|---|---|

| 0 | Long Dr | Truck-trailer | Freight Train | 0 | 0 |

| 0 | Lyons Ave | Pedestrian | Freight Train | 0 | 0 |

| 5 | Oil Tanking W Main | Automobile | Freight Train | 0 | 0 |

| 20 | Lyons Ave | Automobile | Freight Train | 0 | 1 |

| 10 | 5800 Long Rd | Automobile | Freight Train | 0 | 1 |

| 0 | Fondren Rd | Automobile | Freight Train | 0 | 0 |

| 0 | Kempwood Dr | Pick-up truck | Freight Train | 0 | 0 |

| 10 | Lyons Ave | Pick-up truck | Freight Train | 0 | 0 |

| 0 | Long St | Truck-trailer | Freight Train | 0 | 0 |

| 19 | Parker St | Automobile | Freight Train | 0 | 0 |

| 10 | Long Dr | Automobile | Freight Train | 0 | 0 |

| 0 | Oil Tanking E Main | Truck-trailer | Freight Train | 0 | 0 |

| 3 | In the Yard | Pick-up truck | Light Loco(s) | 0 | 0 |

| 5 | Jacinto Blvd Crossing | Truck-trailer | Cut of Cars | 0 | 0 |

Most of the crashes involved cars and tractor-trailer trucks. Pay attention to the traffic around you and slow down around railroad crossings.

Allstate America’s Best Drivers Report

Insurance companies keep track of driving statistics, and Allstate car insurance is no exception. Below are some figures regarding insurance claims drivers file in the Greater Houston area.

Allstate America's Houston, TX Area Driver Report

| Best Drivers Report Ranking | Average Years Between Claims | Relative Claim Likelihood (Compared to National Average) | 2018 Drivewise® Hard-Braking Events Per 1 1,000 Miles |

|---|---|---|---|

| 164 | 6.9 | 44.40% | N/A |

Allstate’s report ranked the area as the 164th safest to drive in 2018. The average amount of time between claims, seven years, indicates that many drivers don’t often experience major accidents. In the vicinity, the likelihood of a claim being made compared to the national average is 44 percent.

Ridesharing in Houston, TX

It’s helpful to know the ridesharing services available and their rates. You can also find out insurance information at rideshare insurance.

Depending on the type of Uber service you choose, generally, Uber is the cheapest in Houston, followed by local taxi services. Lyft’s and Uber’s premium services compete with each other after that.

E-star® Repair Shops

A program from Esurance, E-star® helps drivers find the best repair shop in their areas. According to E-star®, these are the top ten repair shops in and around Houston:

- Miller Auto & Body Repair

4816 N. Shepherd

Houston, TX 77018

email: [email protected]

P: (713) 864-7820

F: (713) 864-6280 - Russell & Smith Ford Honda

1109 South Loop W

Houston, TX 77054

email: [email protected]

P: (713) 663-4216

F: (713) 663-4110 - Service King Galleria

5919 Westheimer Road

Houston,TX 77057

email: [email protected]

P: (713) 243-1400

F: (713) 266-4316 - Carstar Premier

9520 Richmond Ave.

Houston, TX 77063

email: [email protected]

P: (713) 952-3777 - Service King Southwest Freeway

10475 Southwest Freeway

Houston, TX 77074

email: [email protected]

P: (713) 773-5000

F: (713) 772-1746 - Service King Pearland

2330 Smith Ranch Road

Pearland, TX 77584

email: [email protected]

P: (713) 795-3100

F: (800) 214-2373 - Sunrise Paint & Body Inc.

4211 Cook Rd

Houston, TX 77072

email: [email protected]

P: (281) 933-7473

F: (281) 933-9426 - Charlton’s Body Repair

1131 Staffordshire Rd

Stafford, TX 77477

email: [email protected]

P: (281) 499-1126

F: (281) 499-1694 - Greenfield Collision Center

15920 Kuykendahl

Houston, TX 77068

email: [email protected]

P: (281) 580-1994

F: (281) 580-3205 - Service King Humble

450 E Fm 1960

Humble, TX 77338

email: [email protected]

P: (281) 446-6660

F: (800) 214-2373

Weather in Houston, TX

Houston’s weather is pretty temperate and sunny throughout most of the year, however the city gets a lot of rainfall and is susceptible to floods. With average low temperatures of 60 degrees, snowfall isn’t typically a problem.

Houston, TX Average Weather Conditions

| Weather Conditions | Details |

|---|---|

| Annual high temperature: | 78.3°F |

| Annual low temperature: | 59.8°F |

| Average temperature: | 69.05°F |

| Average annual precipitation - rainfall: | 45.28 inches |

| Days per year with precipitation - rainfall: | 106 days |

| Annual hours of sunshine: | 2633 hours |

| Av. annual snowfall: | - |

Despite the beautiful weather, according to City-Data.com, Harris County has more natural disasters, an average of 29 yearly, than the national average of 13.

There have been 22 major presidential declarations of disasters and six emergencies. Notably, storms, floods, hurricanes, tornadoes, and the occasional tropical storm are among the threats.

The best way to protect your car from these and other natural disasters is to have comprehensive insurance coverage in case of hail, fire, and damage from water and high winds. It will also pay for other potential vehicle damage, such as vandalism.

Public Transit in Houston, TX

Houston residents who don’t own cars or choose not to take them can buy tickets to ride on the METRO Bus or METRORail. The fare for both is $1.25.

METRO offers a 50 percent discount on all bus and light-rail service for students, seniors, Medicare cardholders, and the disabled. Children ages five and under ride free. Free local bus and rail rides are offered to qualified veterans and those who serve jury duty. See their website for more fare options and details.

Alternate Transportation in Houston, TX

For a different type of ride, renting a bike or a scooter are other potentially cost-effective transportation options.

Locally, the bike sharing service Houston B Cycle offers monthly memberships for $9.00 and annual ones for $99.00. Similar services that might come to the area sometime in the future are below.

- Lime offers bike and scooter rentals but doesn’t currently offer service in Greater Houston. It serves other Texas metropolitan areas: Austin, Dallas, Lubbock, Plano, and San Antonio.

- Bird provides scooter rentals. Like Lime, Bird has fixed rates per minute that vary by city, and it doesn’t currently offer service in Houston, but in other parts of Texas: Abilene, Austin, Dallas, Lubbock, and San Antonio.

Parking in Metro Areas in Houston, TX

It’s not always easy to find a place to park. Let’s see some of your options in Greater Houston.

Parkopedia offers a map of area parking garages available; most average $15.00 per space. Meanwhile, SpotAngel’s map shows street-level parking, including metered spaces, together with garages.

ParkHouston helps residents save money on metered parking. The solar-powered pay stations offer more payment options than the traditional coin-operated meters, making paying for parking more convenient than ever. The pay stations accept coins, bills, and credit or debit cards. Residents can pay at stations the following ways:

- Pay-by-Plate – Enter your license plate number to pay – no need to keep the receipt on your dashboard

- Pay-by-App – Download the ParkHouston app – powered by Parkmobile

- Pay-and-Display – Pay the meter and put your receipt on your dashboard

In downtown Houston, metered parking is available during the daytime for up to three hours at a time in one spot. The meters accept cash, credit cards, and pay-by-phone via the Parkmobile app; hourly prices vary depending on location. Parking isn’t allowed in valet or commercial zones (marked with red meters or red striping on the street).

The good news is that after 6:00 p.m. Monday through Saturday and all day Sunday parking is free. Parking also isn’t enforced on City official holidays.

ChargeHub lists the most popular electric car charging stations in Houston.

Satellite parking is generally available at airports, stadiums, hotels, the METRO station, the University of Houston, and at other college campuses,

Air Quality in Houston, TX

Let’s face it: with all the cars and trucks on the road, despite emissions control standards and other improvements, much pollution fills the air these days.

Below are Environmental Protection Agency (EPA) figures for air quality in the Greater Houston Area.

Houston, TX Air Quality Index

| Air Quality Condition | 2016 Air Quality Index | 2017 Air Quality Index | 2018 Air Quality Index |

|---|---|---|---|

| Days With AQI | 366 | 365 | 365 |

| Good Days | 164 | 184 | 166 |

| Moderate Days | 179 | 156 | 164 |

| Days Unhealthy for Sensitive Groups | 22 | 22 | 26 |

| Unhealthy Days | 1 | 3 | 7 |

| Very Unhealthy Days | 0 | 0 | 2 |

Fortunately, there were few harmful or very harmful air quality days from 2016 to 2018, but the amount of pollution in recent years has crept up slightly.

The Texas Department of Motor Vehicles requires all gas-powered vehicles from two to 24 model years old in Harris County to undergo annual emissions testing. New cars don’t require emissions testing until they are at least two model years old.

With these testing standards and the use of cleaner fuels, hopefully, our air will eventually become cleaner.

Military/Veterans in Houston, TX

Depending on your age, gender, location, and driving record, car insurance may be expensive and finding the right deal can be a chore.

Good news: if you’re in active military service or a veteran, you could be eligible for car insurance discounts for military members.

And, we’ve gathered everything you need to know to help you save money and time so that you can find the right deal.

Read on for info about Houston area service periods, military bases, and discounts.

Veterans by Service Period

Similar to national figures, in 2017, most Houston area veterans served in Vietnam (almost two times the number of other conflicts), followed by the most recent Gulf War.

Next, we’ll look at Houston area military bases.

Military Bases Within an Hour of Houston, TX

Texas has several military bases, but the closest one in Houston is 15 miles southeast of the downtown, the United States Coast Guard Air Station Houston on the Ellington Field Joint Reserve Base (JRB).

As part of the Eighth Coast Guard District, “Coast Guard Air Station Houston has provided 24/7 Search and Rescue capability to Texas and the Louisiana Gulf Coast since 1963. With three MH-65D ‘Dolphin’ helicopters, AIRSTA Houston’s area of responsibility extends from the Colorado River to White Lake, Louisiana.”

Military Discounts by Provider

If you are or were military personnel, most car insurance companies will want to give back by serving you. Many car insurance providers offer discounts to military personnel.

Below is a list of known providers who give military discounts. We excluded those who offer military discounts only to other states.

Military Car Insurance Discounts Available in Houston, TX

| Insurance Companies | Percentage Saved with Military Discount |

|---|---|

| NA | |

| 15% | |

| 4% |

| 15% |

| NA |

*USAA gives a 15 percent military garage discount for garaging cars on a military base.

USAA Available in Texas, TX

USAA car insurance is car insurance available only to U.S. military personnel and their families.

Compared to other insurers, USAA generally offers lower and more affordable rates. Below, you will see USAA’s rates and other competitive insurers’ rates compared to the national rate average in Texas, which is $4,043.

Houston, TX Average Annual Car Insurance Rates Compared to State Average

| Companies | Average Annual Car Insurance Rates | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| $2,487.89 | -$1,555.39 | -62.52% |

| $2,879.94 | -$1,163.34 | -40.39% | |

| $3,263.28 | -$780.00 | -23.90% | |

| $3,867.55 | -$175.73 | -4.54% |

| $4,664.69 | $621.41 | 13.32% | |

| $5,485.44 | $1,442.16 | 26.29% |

USAA offers the best rates, which are almost half of the state average.

Unique Houston, TX Laws

Like every state, every city has specific laws everyone should pay attention to so they can avoid fines and other penalties.

We want you to know everything about Greater Houston area laws so you won’t miss anything important.

Let’s discover what you should know about driving in the area and the laws involved.

Hands-Free Driving Laws

Like the state of Texas, Houston doesn’t prohibit hands-free cell phone use while driving. The state just bans “using a wireless communications device for electronic messaging while operating a motor vehicle. Texting, as well as reading or writing email, is prohibited while driving in Texas.”

Food Trucks

Those who operate food trucks in Houston must follow city laws. Below are some of the most crucial requirements for food trucks.

- A fixed location mobile food unit (cart) is limited in size to four feet wide by eight feet long and eight feet high and operates from the premises from a permitted food establishment which serves as the commissary.

- The unit should be easy for one person to move when fully loaded.

- Unrestricted carts require a water system.

- The units may operate in a city park as a Licensed Park Vendor with approval from the Parks and Recreation Department.

Food truck owners must also follow rules regarding parking, music use, and other laws. What insurance is required for a food truck in Texas? You’ll want to know what insurance is required to protect yourself and your business.

Tiny Homes

Tiny homes have become a big thing these days. Currently, it’s illegal to build a tiny house on land in Houston.

Despite the lack of a formal zoning code, other Houston laws regulate setbacks, lot size, and parking. Home builders must also submit plans for approval and have their houses inspected. Sometimes, to get around these rules, homeowners mount their small houses on wheels to qualify them as recreational vehicles (RVs) and park them where it’s legal to do so.

Parking Laws

It can be tough to find a good parking space in a city. Parking in the wrong direction could lead to a ticket, so be careful to face the same direction as the traffic in the lane nearest yours.

As we mentioned earlier, Houston has many parking garages, and you may be able to reserve spots there or at airports or hotels to save time.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Houston, TX Car Insurance Rates FAQs

Want answers to your Houston area car insurance and related questions? You’ve come to the right place.

These are some frequently asked questions (FAQs) we’ve compiled to clarify the details on the topic, which can help, especially if you’re new to the area.

So, read on to find out everything you must know about Greater Houston car insurance requirements.

Frequently Asked Questions

What is the average cost of car insurance in Houston, TX?

The average cost of car insurance in Houston, TX is $600.54 per month.

What is the minimum liability coverage required in Texas for car insurance?

Texas requires a minimum liability coverage of 30/60/25. This means you need at least $30,000 in bodily injury liability coverage per person, $60,000 in bodily injury liability coverage per accident, and $25,000 in property damage liability coverage.

Which are the cheapest auto insurance companies in Houston, TX?

The cheapest auto insurance companies in Houston, TX are USAA and State Farm.

How can I save money on car insurance rates in Houston, TX?

You can save money on car insurance rates in Houston, TX by searching for auto insurance discounts offered by insurance companies. Additionally, shopping around and comparing quotes from different insurance providers can help you find the best rate.

How does the cost of car insurance in Houston, TX compare to other top US metro areas?

The cost of car insurance in Houston, TX may vary compared to other top US metro areas. It’s important to compare the auto insurance costs of Houston, TX with those of other cities to get a better understanding of the price differences.

How does my age, gender, and marital status affect car insurance rates in Houston, TX?

Age, gender, and marital status can impact car insurance rates in Houston, TX. Insurance companies may consider these factors when determining your premiums. Rates can vary based on statistical data that shows certain age groups, genders, and marital statuses may have different risk profiles.

How can I find affordable car insurance for teen drivers in Houston, TX?

Teen car insurance in Houston, TX can be expensive, but there are ways to find more affordable options. You can compare rates from different car insurance companies and consider discounts specifically available for teen drivers, such as good student discounts or driver’s education discounts. Shopping around and comparing quotes can help you find the best rates for teen car insurance in Houston.

How does my credit score affect car insurance rates in Houston, TX?

Your credit score can have an impact on car insurance rates in Houston, TX. Insurance providers often consider credit history when determining coverage and rates. Generally, a higher credit score may result in lower insurance premiums, while a lower credit score may lead to higher premiums.

Will my driving record affect car insurance rates in Houston, TX?

Yes, your driving record can affect car insurance rates in Houston, TX. Insurance companies typically check your driving record to assess your risk as a driver. Having a clean driving record with no accidents or traffic violations may result in lower premiums, while a history of accidents or violations can lead to higher rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.