How To Combine Car Insurance Coverage With the Right Deductible

Raise your car insurance deductible to save up to 28% on your monthly rates. Compare quotes online to find the best deal for a variety of coverages.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated November 2024

Coverage/Deductible Intro Table

| Coverage and Deductible Overview | Details |

|---|---|

| Cheapest State for Liability Coverage: | North Dakota Average Cost: $282.55 |

| Cheapest State for Collision Coverage: | South Dakota Average Cost: $200.10 |

| Cheapest State for Comprehensive Coverage: | Oregon Average Cost: $89.66 |

| Cheapest State for Full Coverage: | Idaho Average Cost: $656.95 |

| Common Deductibles | Zero-Deductible $500 Deductible $1,000 Deductible |

It can be hard to pick the right coverages while also meeting your budget. While you may be familiar with basic coverages like collision protection, there are many more coverages to choose from.

Add into this mess of options finding the right deductible, and it can be even harder to get the right rates. If you need help picking out the right coverages and deductibles, this guide is for you.

We cover everything you need to know about basic coverages, rates, deductibles, and more, so you can make an informed decision about your insurance policy. If you want to start comparing rates today, enter your ZIP code in our free online tool above.

Car Insurance Coverages

There are quite a few different coverages available for your vehicle. It can be hard to choose what you need, especially because each option added to your auto policy increases the price of your premium.

If the thought of finding the right coverages and the right prices makes your head hurt, worry no longer. We will go over the different types of coverages and rates to help you make the right decision. So keep reading to see how to protect both your vehicle and your wallet best.

What are the types of car insurance coverage?

The first thing we want to look at is the types of car insurance coverage. How much coverage you need depends on what state you live in, what type of car you have, and other important factors.

If you aren’t sure what you want or what the laws require you to have, keep on reading to see what the basic coverages, add-on coverages, and coverage limits are in your area.

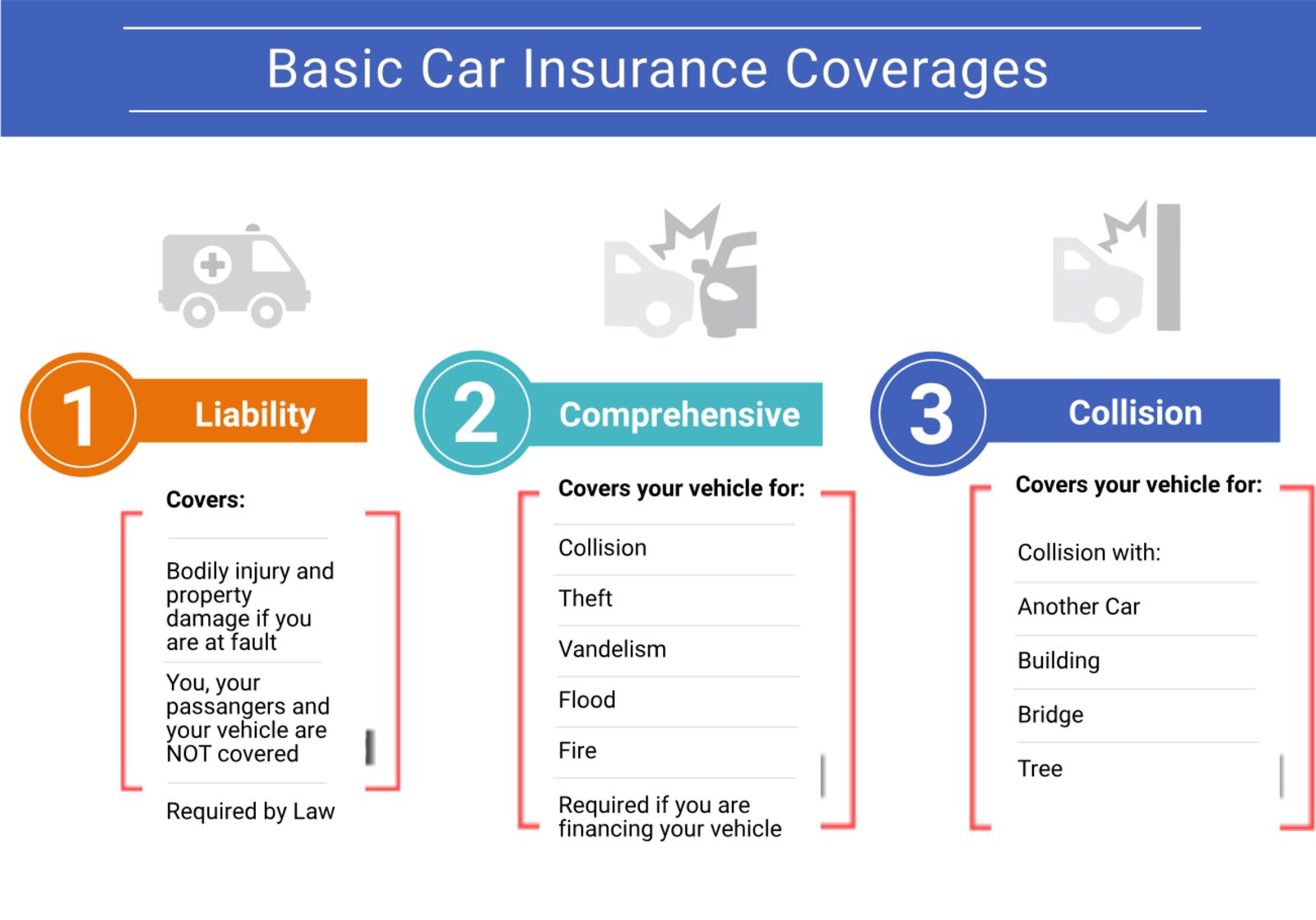

Basic Car Insurance Coverage

Basic liability coverage is the building block of a policy. Regardless of whether you live in an at-fault or no-fault state, there is a good chance your state will require basic liability coverages.

Not sure what the difference between an at-fault and no faults state is?

- At-Fault State — Whoever caused the accident is liable for the other driver’s accident costs.

- No-Fault State — a driver’s insurance provider will cover the driver’s own accident costs, regardless of who caused the accident.

In either at-fault or no-fault states, it is important that drivers have basic protection on their vehicles. The three basic types of coverages are liability, collision, and comprehensive.

Let’s take a look at what common liability coverages are in the U.S. (these coverages are required in at-fault states).

- Bodily Injury Liability Coverage — If you cause an accident that injures another driver, bodily injury liability insurance will cover the other driver’s medical costs. So if you give the other driver a concussion by ramming into the back of his or her car, this coverage will cover their hospital and treatment bills.

- Property Damage Liability Coverage — If you run into someone’s car or object, property damage liability coverage will cover the other driver’s repair or replacement costs. So if you take out a mailbox or fence, or dent someone’s bumper, this coverage will pay for the repairs.

These two coverages are an excellent baseline to start off of. As liability coverages, they protect you if you cause an accident and injure another driver or damage property. Even if your state doesn’t require you to have either of these coverages, you may want to consider getting them for complete protection in accidents.

Now that you know what coverages protect you by paying for other driver’s accident costs, let’s see what coverages protect you and your property.

- Collision Coverage — If you run into another car and damage or total your car, collision coverage covers your repair or replacement costs. This coverage also covers collisions with objects (running into a telephone pole) or damages from rollovers.

- Comprehensive Coverage — Comprehensive cover basically everything other than collision. It protects in cases of natural disasters, collisions with something other than a vehicle (animals), theft, and vandalism.

- Personal Injury Protection (PIP) Coverage — PIP is similar to bodily injury liability coverage, but instead of paying for the other driver’s medical costs, it covers the driver’s and passengers’ medical costs and lost wages regardless of who caused the accident. It will also cover funeral bills in case of a fatality. Generally, no-fault states require this coverage.

- Medpay Coverage — Medpay coverage is similar to PIP, but it only pays for medical coverage (making it less comprehensive than PIP).

- Underinsured Motorist Coverage — If you live in an at-fault state and the driver who caused your accident has poor insurance, underinsured motorist coverage will cover the costs the other driver can’t. This prevents you from having to pay out of pocket for your medical or property damage costs.

- Uninsured Motorist Coverage — This is another great coverage, and it is usually offered in conjunction with underinsured coverage. Uninsured coverage will cover your costs if the driver who caused the accident has no insurance. This makes uninsured coverage useful in cases of hit and run accidents.

What coverages you should get partially depend on if you live in an at-fault or no-fault state. For example, if you live in an at-fault state, you will definitely need liability coverages and should consider collision, comprehensive, and PIP coverages.

So make sure to talk to your insurer about what basic requirements your state requires and what else you should consider getting. The last thing you want is to be in an accident and find out you lack essential coverages on your vehicle.

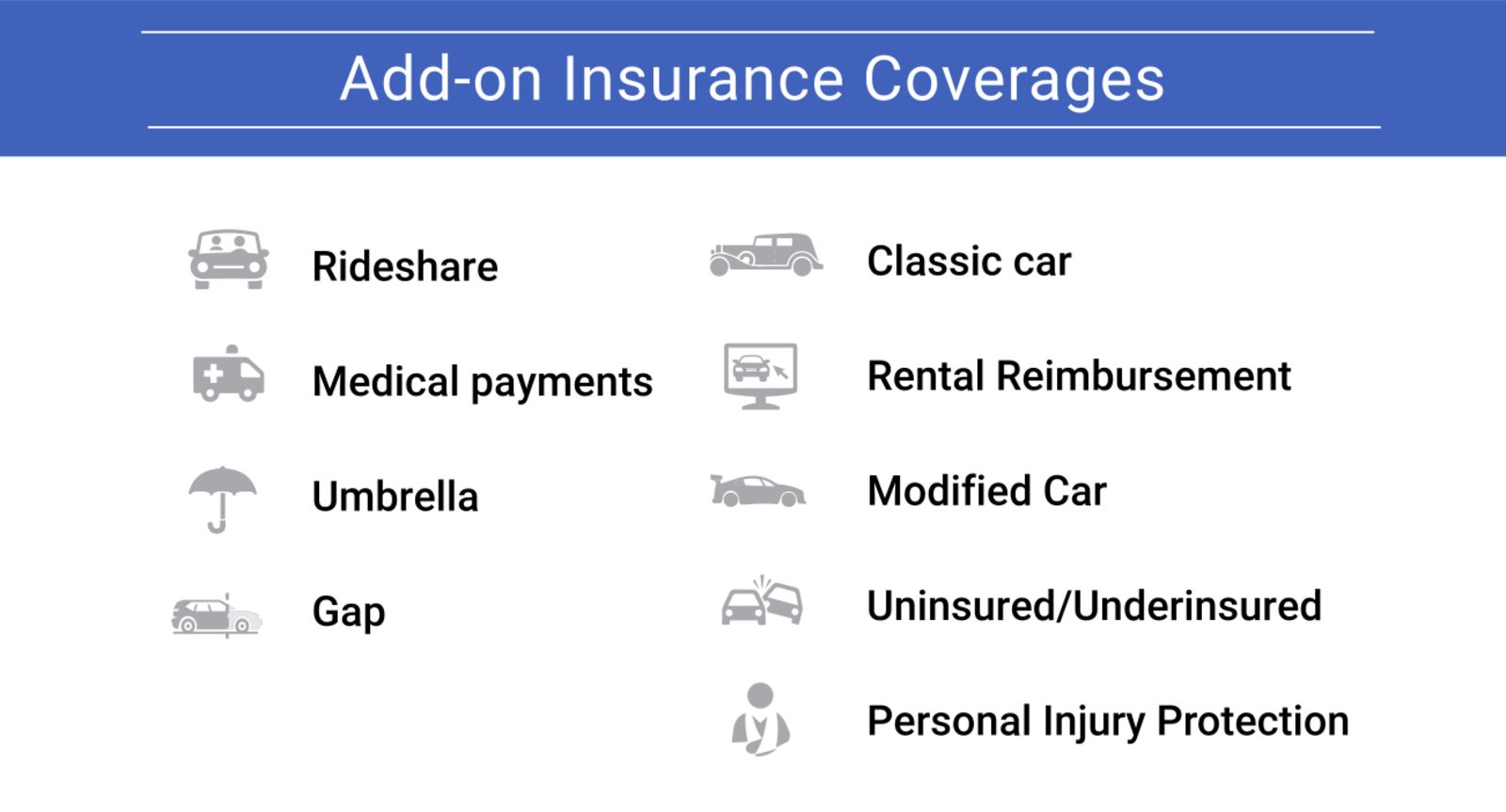

Add-On Coverages

Add-on coverages are simply coverages that aren’t required by state liability laws. They are coverages that can be added onto the basic building blocks of a policy, so customers can flesh out their policies to meet their particular needs.

So take a close look at the list below to see if any of the optional coverages would help your policy be more complete.

- Classic Car Coverage — Vintage cars often cost less to insure because they are driven less. Insurers may have different criteria for what counts as a classic car, though, so make sure to talk to your insurer to find out what qualifies as a classic car in your area.

- Gap Coverage — Gap coverage (also known as loan or lease coverage), protects you if your loaned or leased car is totaled. How? It pays the difference between the value of the car and what is left on your loan or lease.

- Modified Car Coverage — If you have a new stereo or a special paint job on your car, you may want to consider modified car coverage. In fact, your insurer may require it.

- Rental Car Reimbursement Coverage — Some insurers offer the option of rental car reimbursement. This doesn’t mean that they will pay for your vacation rental car. If your car is in the shop after a claimable accident, insurers will cover the cost of a rental car.

- Rideshare Coverage — Driving for a rideshare company requires rideshare insurance. This is in addition to your personal insurance, which covers you when you aren’t rideshare driving.

- Roadside Assistance Coverage — This extra coverage is great for covering incidents where drivers run out of gas, lock themselves out of their car, get a flat tire, or need a jumpstart.

- Umbrella Coverage — While umbrella coverage is a form of liability coverage, at-fault states do not require it. Still, it is useful in case of a bad accident where the other driver may try to sue you. Umbrella coverage provides extra liability coverage, which will help pay court costs (such as the fee for a lawyer).

None of the above coverages are required (except sometimes modified car insurance), but even though they are optional, they are great coverages. While PIP was not included on this list, it is an optional add-on in some states. Take a good look at your policy to determine what you already have protection for, and you’d like to have added protection on.

– What are my car insurance coverage limits?

We’ve talked about car insurance coverages required in at-fault versus no-fault states, but you may not be aware of what your state currently requires. Or perhaps you are moving to a new state and want to know what your new coverages will be like.

The Insurance Information Institute (III) has a complete list of car insurance coverage requirements and minimum coverage limits by state. Take a look below to see what you’ll need to have in your area.

Insurance Coverage/Limits by State (III)

| State | Insurance Law in State | Required Insurance | Minimum Liability Limits |

|---|---|---|---|

| Alabama | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/25 |

| Alaska | At-Fault | Bodily Injury Liability Property Damage Liability | 50/100/25 |

| Arizona | At-Fault | Bodily Injury Liability Property Damage Liability | 15/30/10 |

| Arkansas | At-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 25/50/25 |

| California | At-Fault | Bodily Injury Liability Property Damage Liability | 15/30/5 |

| Colorado | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/15 |

| Connecticut | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/20 |

| Delaware | At-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 25/50/10 |

| Florida | No-Fault | Property Damage Liability Personal Injury Protection | 10/20/10 |

| Georgia | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/25 |

| Hawaii | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 20/40/10 |

| Idaho | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/15 |

| Illinois | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/20 |

| Indiana | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/25 |

| Iowa | At-Fault | Bodily Injury Liability Property Damage Liability | 20/40/15 |

| Kansas | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 25/50/25 |

| Kentucky | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection Uninsured Motorist Underinsured Motorist | 25/50/25 |

| Louisiana | At-Fault | Bodily Injury Liability Property Damage Liability | 15/30/25 |

| Maine | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist Medpay | 50/100/25 |

| Maryland | At-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection Uninsured Motorist Underinsured Motorist | 30/60/15 |

| Massachusetts | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 20/40/5 |

| Michigan | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 20/40/10 |

| Minnesota | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection Uninsured Motorist Underinsured Motorist | 30/60/10 |

| Mississippi | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/25 |

| Missouri | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist | 25/50/25 |

| Montana | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/20 |

| Nebraska | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/25 |

| Nevada | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/20 |

| New Hampshire | At-Fault | Financial Responsibility Only | 25/50/25 |

| New Jersey | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection Uninsured Motorist Underinsured Motorist | 15/30/5 |

| New Mexico | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/10 |

| New York | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection Uninsured Motorist Underinsured Motorist | 25/50/10 |

| North Carolina | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 30/60/25 |

| North Dakota | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection Uninsured Motorist Underinsured Motorist | 25/50/25 |

| Ohio | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/25 |

| Oklahoma | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/25 |

| Oregon | At-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection Uninsured Motorist Underinsured Motorist | 25/50/20 |

| Pennsylvania | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 15/30/5 |

| Rhode Island | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/25 |

| South Carolina | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/25 |

| South Dakota | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/25 |

| Tennessee | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/15 |

| Texas | At-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 30/60/25 |

| Utah | No-Fault | Bodily Injury Liability Property Damage Liability Personal Injury Protection | 25/65/15 |

| Vermont | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/10 |

| Virginia | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/20 |

| Washington | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/10 |

| West Virginia | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Underinsured Motorist | 25/50/25 |

| Wisconsin | At-Fault | Bodily Injury Liability Property Damage Liability Uninsured Motorist Medpay | 25/50/10 |

| Wyoming | At-Fault | Bodily Injury Liability Property Damage Liability | 25/50/20 |

Read more:

So what do the minimum liability limits mean? Let’s use Alabama’s 25/50/25 as an example.

The first number (25) means that Alabama residents must have $25,000 in coverage to cover bodily injuries per person in an accident. 50 (the second number) means drivers must have $50,000 in coverage to total bodily injuries per accident. Finally, the last number means drivers need $25,000 to cover property damage in an accident.

So the numbers mean the following in each state:

- The first number refers to bodily injury liability coverage amount per person.

- The second number refers to total bodily injury liability coverage per accident.

- The third number refers to property damage liability coverage.

You may have noticed that higher amounts are required in at-fault states. As well, you can see that there are only 12 no-fault states in the U.S. The majority of states have at-fault coverage.

So pay attention to what is required in your state and buy insurance accordingly. You are breaking the law if you don’t have the required coverages and coverage limits in your home state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Rates by Coverage

It’s one thing to know what coverages you want, and it’s another thing to pay for them. Car insurance rates can change drastically based on what types of coverages you purchase.

Knowing what the rates are beforehand can help you pick what coverages you absolutely need and determine which ones you can go without. It can also help you find cheaper coverage that is more affordable.

So let’s jump right into car insurance coverage costs.

What does liability car insurance coverage cost by state?

Since liability insurance is required in every state, we want to look at the average cost of liability insurance by state. Remember, liability insurance is composed of bodily injury liability and property damage liability coverages.

All of the following rate data is from the National Association of Insurance Commissioners (NAIC). An important note to keep in mind is that the NAIC’s rates are based on the state minimum.

This means that the rates won’t include rates for drivers who purchase more the state minimum, who have poor driving records, or who have higher rates in general.

Depending on what your personal driving record is like, your rates could be higher than the averages covered in this section. Still, these numbers are important to look at to establish a price baseline.

Let’s start by looking at liability rates.

https://docs.google.com/spreadsheets/d/1DA7O8uoueN3xKFu40Kn6_GZSVadpPdGgoVFUHXzF_K4/edit#gid=426325915

| Liability Coverage Cost by State | 2011 | 2012 | 2013 | 2014 | 2015 | Average |

|---|---|---|---|---|---|---|

| Alabama | $354.35 | $359.88 | $372.44 | $381.98 | $394.21 | $372.57 |

| Alaska | $546.71 | $544.66 | $555.04 | $550.59 | $539.68 | $547.34 |

| Arizona | $462.94 | $473.30 | $490.78 | $507.18 | $508.76 | $488.59 |

| Arkansas | $367.29 | $371.02 | $380.78 | $392.46 | $394.13 | $381.14 |

| California | $439.39 | $443.41 | $463.56 | $478.71 | $489.66 | $462.95 |

| Colorado | $441.41 | $449.65 | $473.68 | $500.72 | $520.04 | $477.10 |

| Connecticut | $613.77 | $626.47 | $635.62 | $642.95 | $650.94 | $633.95 |

| Delaware | $745.53 | $759.04 | $783.30 | $795.35 | $799.30 | $776.50 |

| Florida | $813.60 | $856.39 | $860.36 | $837.24 | $857.64 | $845.05 |

| Georgia | $439.02 | $454.76 | $485.40 | $516.63 | $557.38 | $490.64 |

| Hawaii | $464.55 | $453.45 | $457.09 | $458.83 | $458.54 | $458.49 |

| Idaho | $327.96 | $326.00 | $339.50 | $348.12 | $344.29 | $337.17 |

| Illinois | $424.12 | $422.12 | $424.92 | $434.80 | $446.72 | $430.54 |

| Indiana | $368.61 | $376.23 | $363.00 | $371.69 | $382.68 | $372.44 |

| Iowa | $290.86 | $290.46 | $291.24 | $294.97 | $299.18 | $293.34 |

| Kansas | $327.21 | $329.67 | $342.27 | $354.24 | $358.24 | $342.33 |

| Kentucky | $503.52 | $516.40 | $522.34 | $523.10 | $529.21 | $518.91 |

| Louisiana | $687.56 | $698.21 | $723.93 | $750.23 | $775.83 | $727.15 |

| Maine | $328.25 | $332.07 | $333.69 | $336.70 | $338.87 | $333.92 |

| Maryland | $590.02 | $594.28 | $596.17 | $607.19 | $609.74 | $599.48 |

| Massachusetts | $565.87 | $578.75 | $589.38 | $598.71 | $606.04 | $587.75 |

| Michigan | $600.14 | $660.93 | $742.38 | $811.43 | $795.32 | $722.04 |

| Minnesota | $417.37 | $428.63 | $441.81 | $453.29 | $456.82 | $439.58 |

| Mississippi | $418.34 | $424.58 | $434.88 | $448.60 | $460.50 | $437.38 |

| Missouri | $385.39 | $390.04 | $399.08 | $406.67 | $415.88 | $399.41 |

| Montana | $387.71 | $383.76 | $388.54 | $392.53 | $386.29 | $387.77 |

| Nebraska | $339.58 | $340.33 | $347.54 | $353.26 | $364.64 | $349.07 |

| Nevada | $612.84 | $619.71 | $648.19 | $673.05 | $681.56 | $647.07 |

| New Hampshire | $387.51 | $390.72 | $391.92 | $395.51 | $400.56 | $393.24 |

| New Jersey | $833.20 | $860.59 | $882.82 | $881.58 | $869.57 | $865.55 |

| New Mexico | $432.78 | $441.11 | $464.51 | $484.62 | $488.03 | $462.21 |

| New York | $752.43 | $780.41 | $791.14 | $796.39 | $804.51 | $784.98 |

| North Carolina | $358.16 | $356.63 | $355.19 | $358.56 | $359.42 | $357.59 |

| North Dakota | $260.86 | $272.71 | $285.12 | $295.87 | $298.18 | $282.55 |

| Ohio | $357.31 | $362.97 | $374.53 | $388.88 | $397.11 | $376.16 |

| Oklahoma | $416.16 | $428.09 | $443.88 | $458.72 | $461.01 | $441.57 |

| Oregon | $507.19 | $527.64 | $562.95 | $585.26 | $584.13 | $553.43 |

| Pennsylvania | $486.66 | $495.22 | $497.28 | $496.87 | $499.06 | $495.02 |

| Rhode Island | $678.60 | $702.52 | $719.53 | $739.87 | $759.80 | $720.06 |

| South Carolina | $469.12 | $485.30 | $495.96 | $510.04 | $527.09 | $497.50 |

| South Dakota | $277.16 | $281.04 | $289.39 | $297.38 | $300.22 | $289.04 |

| Tennessee | $376.90 | $387.40 | $400.64 | $409.79 | $413.91 | $397.73 |

| Texas | $473.31 | $477.18 | $496.68 | $516.26 | $528.75 | $498.44 |

| Utah | $451.94 | $454.35 | $465.62 | $486.87 | $497.53 | $471.26 |

| Vermont | $335.79 | $340.55 | $343.85 | $341.60 | $343.12 | $340.98 |

| Virginia | $394.70 | $401.50 | $415.86 | $427.94 | $425.61 | $413.12 |

| Washington | $541.42 | $547.11 | $569.42 | $589.97 | $596.67 | $568.92 |

| West Virginia | $500.31 | $503.05 | $506.60 | $505.40 | $491.83 | $501.44 |

| Wisconsin | $356.54 | $346.74 | $354.57 | $367.00 | $374.37 | $359.84 |

| Wyoming | $320.47 | $316.53 | $323.25 | $335.59 | $321.04 | $323.38 |

| Countrywide | $492.03 | $503.28 | $517.88 | $530.01 | $538.73 | $516.39 |

Unfortunately, the cost of liability car insurance increased over the years in the majority of states. The good news is that in most states, it didn’t increase by too much.

For example, in North Dakota (the cheapest state for liability insurance), the cost increased by $38 from 2011 to 2015. This is a low amount and is typical of most of the states’ price increases over the five-year period.

What does collision car insurance coverage cost by state?

While not required in states’ coverage laws, collision coverage is a basic coverage that drivers should definitely purchase. Why?

Unlike property damage liability insurance, collision coverage covers your property damage costs.

Collision coverage covers drivers in collisions with other vehicles or objects. So if you run into another car or back into a mailbox, collision coverage will pay for your vehicle repairs. Let’s take a look at the basic prices by state.

Collision Coverage Cost by State

| Collision Coverage Cost by State | 2011 | 2012 | 2013 | 2014 | 2015 | Average |

|---|---|---|---|---|---|---|

| Alabama | $293.84 | $287.59 | $292.40 | $303.71 | $317.96 | $299.10 |

| Alaska | $363.42 | $365.92 | $361.42 | $359.34 | $350.81 | $360.18 |

| Arizona | $249.01 | $245.64 | $254.85 | $269.07 | $277.96 | $259.31 |

| Arkansas | $290.74 | $295.55 | $301.90 | $314.38 | $321.80 | $304.87 |

| California | $341.65 | $348.94 | $361.34 | $374.31 | $396.55 | $364.56 |

| Colorado | $251.14 | $252.40 | $255.38 | $270.86 | $287.00 | $263.36 |

| Connecticut | $334.64 | $334.23 | $347.07 | $359.03 | $368.51 | $348.70 |

| Delaware | $282.62 | $286.06 | $291.67 | $303.86 | $318.77 | $296.60 |

| Florida | $236.68 | $234.53 | $242.47 | $259.86 | $282.96 | $251.30 |

| Georgia | $320.44 | $316.13 | $313.28 | $320.57 | $331.83 | $320.45 |

| Hawaii | $293.12 | $289.26 | $291.89 | $301.33 | $313.17 | $297.75 |

| Idaho | $206.32 | $205.64 | $203.02 | $210.96 | $219.05 | $209.00 |

| Illinois | $268.92 | $273.55 | $278.01 | $294.41 | $309.71 | $284.92 |

| Indiana | $231.62 | $234.89 | $229.16 | $240.00 | $250.29 | $237.19 |

| Iowa | $198.47 | $201.86 | $205.15 | $210.25 | $219.75 | $207.10 |

| Kansas | $244.65 | $244.10 | $247.35 | $257.88 | $263.33 | $251.46 |

| Kentucky | $245.47 | $247.95 | $254.45 | $260.85 | $267.91 | $255.33 |

| Louisiana | $386.31 | $372.20 | $380.26 | $402.04 | $414.36 | $391.03 |

| Maine | $243.08 | $241.00 | $245.85 | $255.07 | $259.98 | $249.00 |

| Maryland | $317.96 | $319.30 | $327.89 | $339.48 | $353.99 | $331.72 |

| Massachusetts | $324.13 | $343.43 | $361.12 | $376.42 | $388.28 | $358.68 |

| Michigan | $366.62 | $368.51 | $377.08 | $390.03 | $413.83 | $383.21 |

| Minnesota | $197.75 | $205.12 | $210.03 | $222.82 | $234.40 | $214.02 |

| Mississippi | $292.55 | $291.79 | $299.27 | $307.98 | $323.22 | $302.96 |

| Missouri | $249.74 | $253.12 | $257.09 | $263.02 | $275.28 | $259.65 |

| Montana | $240.85 | $247.30 | $255.50 | $265.54 | $265.32 | $254.90 |

| Nebraska | $211.63 | $218.30 | $220.74 | $229.70 | $237.13 | $223.50 |

| Nevada | $297.14 | $289.92 | $284.79 | $293.18 | $303.86 | $293.78 |

| New Hampshire | $262.53 | $265.80 | $279.36 | $293.37 | $307.42 | $281.70 |

| New Jersey | $352.22 | $356.37 | $364.34 | $371.36 | $381.86 | $365.23 |

| New Mexico | $268.32 | $262.06 | $261.94 | $268.09 | $276.98 | $267.48 |

| New York | $340.21 | $345.96 | $354.70 | $366.36 | $385.02 | $358.45 |

| North Carolina | $238.12 | $248.78 | $263.06 | $279.35 | $293.59 | $264.58 |

| North Dakota | $208.25 | $216.62 | $229.09 | $239.16 | $244.09 | $227.44 |

| Ohio | $236.10 | $243.78 | $251.13 | $260.20 | $269.84 | $252.21 |

| Oklahoma | $285.70 | $289.80 | $290.08 | $307.00 | $318.47 | $298.21 |

| Oregon | $207.18 | $203.52 | $206.78 | $218.05 | $226.83 | $212.47 |

| Pennsylvania | $296.23 | $296.33 | $301.49 | $315.28 | $327.24 | $307.31 |

| Rhode Island | $352.16 | $357.12 | $372.15 | $392.36 | $411.51 | $377.06 |

| South Carolina | $239.42 | $239.30 | $242.85 | $251.46 | $265.07 | $247.62 |

| South Dakota | $190.84 | $195.84 | $200.60 | $204.63 | $208.58 | $200.10 |

| Tennessee | $268.90 | $280.82 | $292.01 | $301.17 | $309.07 | $290.39 |

| Texas | $314.32 | $321.10 | $335.01 | $357.61 | $374.49 | $340.51 |

| Utah | $253.73 | $247.80 | $248.39 | $256.23 | $265.90 | $254.41 |

| Vermont | $269.61 | $269.57 | $272.27 | $285.01 | $295.42 | $278.38 |

| Virginia | $251.72 | $254.02 | $263.54 | $273.70 | $280.52 | $264.70 |

| Washington | $242.85 | $241.32 | $243.50 | $257.25 | $265.74 | $250.13 |

| West Virginia | $305.94 | $313.43 | $319.49 | $326.95 | $329.67 | $319.10 |

| Wisconsin | $198.38 | $200.37 | $207.71 | $217.19 | $226.00 | $209.93 |

| Wyoming | $272.66 | $267.19 | $260.25 | $273.49 | $278.83 | $270.48 |

| Countrywide | $284.60 | $287.87 | $295.27 | $308.32 | $322.61 | $299.73 |

Overall, South Dakota has the cheapest rate for collision coverage, while Lousiana has the most expensive rate.

What does comprehensive car insurance coverage cost by state?

Another coverage that states don’t require by law is comprehensive coverage. This coverage is sometimes confused with collision coverage.

However, you may recall that comprehensive coverage is important in covering cars in the following situations:

- Damage from natural disasters

- Damage from animal collisions

- Damage from vandalism

- Vehicle theft

So let’s see how much it will cost to protect your car from a run-in with a deer.

Comprehensive Coverage Cost by State

| Comprehensive Coverage Cost by State | 2011 | 2012 | 2013 | 2014 | 2015 | Average |

|---|---|---|---|---|---|---|

| Alabama | $136.19 | $140.60 | $146.91 | $151.40 | $156.31 | $146.28 |

| Alaska | $143.36 | $142.96 | $141.68 | $140.15 | $137.26 | $141.08 |

| Arizona | $187.38 | $180.97 | $180.88 | $185.63 | $186.12 | $184.20 |

| Arkansas | $171.10 | $176.51 | $185.45 | $193.34 | $190.41 | $183.36 |

| California | $100.02 | $99.34 | $97.80 | $98.73 | $100.54 | $99.29 |

| Colorado | $142.95 | $147.69 | $158.50 | $167.94 | $174.61 | $158.34 |

| Connecticut | $119.78 | $121.57 | $126.34 | $130.80 | $131.62 | $126.02 |

| Delaware | $106.45 | $108.49 | $112.21 | $116.49 | $122.49 | $113.23 |

| Florida | $109.86 | $105.66 | $106.88 | $111.68 | $116.53 | $110.12 |

| Georgia | $153.03 | $151.16 | $150.65 | $154.05 | $159.18 | $153.61 |

| Hawaii | $104.28 | $101.41 | $95.18 | $98.01 | $101.56 | $100.09 |

| Idaho | $107.69 | $107.55 | $108.06 | $114.05 | $116.55 | $110.78 |

| Illinois | $110.00 | $110.54 | $116.34 | $124.89 | $128.13 | $117.98 |

| Indiana | $110.13 | $113.31 | $112.34 | $117.25 | $122.06 | $115.02 |

| Iowa | $159.67 | $164.52 | $171.71 | $178.45 | $183.53 | $171.58 |

| Kansas | $208.56 | $211.94 | $226.19 | $238.67 | $241.36 | $225.34 |

| Kentucky | $123.49 | $124.11 | $128.20 | $133.55 | $141.39 | $130.15 |

| Louisiana | $207.68 | $204.69 | $203.52 | $211.90 | $215.17 | $208.59 |

| Maine | $90.95 | $94.60 | $95.40 | $97.35 | $104.98 | $96.66 |

| Maryland | $140.88 | $143.24 | $147.29 | $149.70 | $152.72 | $146.77 |

| Massachusetts | $121.13 | $125.88 | $129.97 | $132.64 | $134.96 | $128.92 |

| Michigan | $143.88 | $142.50 | $144.74 | $149.11 | $154.85 | $147.02 |

| Minnesota | $162.06 | $166.49 | $171.87 | $180.52 | $184.27 | $173.04 |

| Mississippi | $184.79 | $186.58 | $190.98 | $201.01 | $210.33 | $194.74 |

| Missouri | $155.14 | $155.98 | $163.62 | $175.70 | $181.27 | $166.34 |

| Montana | $187.65 | $190.62 | $198.70 | $210.48 | $211.91 | $199.87 |

| Nebraska | $181.00 | $192.56 | $205.36 | $223.03 | $229.25 | $206.24 |

| Nevada | $119.89 | $114.45 | $114.77 | $117.20 | $117.63 | $116.79 |

| New Hampshire | $96.52 | $99.24 | $102.02 | $106.62 | $110.77 | $103.03 |

| New Jersey | $118.10 | $117.64 | $122.54 | $126.26 | $131.35 | $123.18 |

| New Mexico | $168.75 | $163.02 | $162.39 | $167.70 | $172.57 | $166.89 |

| New York | $144.13 | $147.33 | $155.65 | $165.07 | $171.12 | $156.66 |

| North Carolina | $111.83 | $115.06 | $121.66 | $130.37 | $136.08 | $123.00 |

| North Dakota | $219.63 | $225.42 | $229.05 | $233.06 | $231.04 | $227.64 |

| Ohio | $104.21 | $107.30 | $113.02 | $117.58 | $121.61 | $112.74 |

| Oklahoma | $179.63 | $185.01 | $197.45 | $219.85 | $225.84 | $201.56 |

| Oregon | $90.21 | $86.92 | $86.53 | $90.79 | $93.87 | $89.66 |

| Pennsylvania | $121.57 | $124.28 | $131.71 | $138.27 | $144.21 | $132.01 |

| Rhode Island | $118.21 | $116.41 | $118.86 | $125.17 | $132.19 | $122.17 |

| South Carolina | $149.16 | $156.22 | $165.41 | $175.19 | $180.94 | $165.38 |

| South Dakota | $201.21 | $214.07 | $227.31 | $242.27 | $258.11 | $228.59 |

| Tennessee | $122.03 | $126.31 | $136.73 | $144.60 | $148.45 | $135.62 |

| Texas | $172.24 | $176.41 | $186.11 | $192.33 | $206.42 | $186.70 |

| Utah | $103.69 | $103.18 | $106.91 | $109.56 | $109.50 | $106.57 |

| Vermont | $110.74 | $116.45 | $118.70 | $120.18 | $125.48 | $118.31 |

| Virginia | $122.53 | $125.87 | $130.00 | $134.50 | $136.54 | $129.89 |

| Washington | $105.55 | $102.61 | $101.12 | $104.88 | $106.38 | $104.11 |

| West Virginia | $186.32 | $189.20 | $195.28 | $200.10 | $204.28 | $195.04 |

| Wisconsin | $115.07 | $119.69 | $127.49 | $132.64 | $136.81 | $126.34 |

| Wyoming | $198.01 | $212.43 | $221.02 | $235.25 | $247.57 | $222.86 |

| Countrywide | $131.80 | $133.30 | $137.77 | $143.45 | $148.04 | $138.87 |

Overall, Oregan has the cheapest rate for comprehensive coverage, costing an average of only $90. This is $139 less than the most expensive rate for comprehensive coverage in South Dakota. Of course, the cost of comprehensive coverage varies from state to state based on the number of natural disasters, theft, or wildlife in the area.

So if you live in a state with frequent winter storms or an overabundance of deer, you can expect to pay slightly more for comprehensive coverage.

What does full coverage car insurance coverage cost by state?

Just because a state has the most expensive rate for a coverage type doesn’t mean it has the most expensive rate overall. Let’s combine all the coverage costs we’ve looked at so far to see what the cost of full coverage is by state. (For more information, read our “Combined Single-Limit Car Insurance: Explained Simply“).

Full Coverage Cost by State

| Full Coverage Cost by State | 2011 | 2012 | 2013 | 2014 | 2015 | Average |

|---|---|---|---|---|---|---|

| Alabama | $784.38 | $788.07 | $811.75 | $837.09 | $868.48 | $817.95 |

| Alaska | $1,053.48 | $1,053.54 | $1,058.15 | $1,050.09 | $1,027.75 | $1,048.60 |

| Arizona | $899.33 | $899.91 | $926.52 | $961.88 | $972.85 | $932.10 |

| Arkansas | $829.13 | $843.07 | $868.13 | $900.18 | $906.34 | $869.37 |

| California | $881.07 | $891.68 | $922.69 | $951.75 | $986.75 | $926.79 |

| Colorado | $835.50 | $849.74 | $887.57 | $939.52 | $981.64 | $898.79 |

| Connecticut | $1,068.18 | $1,082.28 | $1,109.03 | $1,132.78 | $1,151.07 | $1,108.67 |

| Delaware | $1,134.60 | $1,153.59 | $1,187.18 | $1,215.69 | $1,240.57 | $1,186.33 |

| Florida | $1,160.13 | $1,196.57 | $1,209.70 | $1,208.77 | $1,257.13 | $1,206.46 |

| Georgia | $912.49 | $922.05 | $949.33 | $991.25 | $1,048.40 | $964.70 |

| Hawaii | $861.95 | $844.12 | $844.16 | $858.16 | $873.28 | $856.33 |

| Idaho | $641.96 | $639.19 | $650.57 | $673.13 | $679.89 | $656.95 |

| Illinois | $803.04 | $806.21 | $819.27 | $854.10 | $884.56 | $833.44 |

| Indiana | $710.36 | $724.44 | $704.50 | $728.93 | $755.03 | $724.65 |

| Iowa | $648.99 | $656.84 | $668.09 | $683.67 | $702.46 | $672.01 |

| Kansas | $780.43 | $785.72 | $815.82 | $850.79 | $862.93 | $819.14 |

| Kentucky | $872.48 | $888.46 | $904.99 | $917.49 | $938.51 | $904.39 |

| Louisiana | $1,281.55 | $1,275.10 | $1,307.72 | $1,364.17 | $1,405.36 | $1,326.78 |

| Maine | $662.28 | $667.66 | $674.94 | $689.12 | $703.82 | $679.56 |

| Maryland | $1,048.86 | $1,056.82 | $1,071.35 | $1,096.37 | $1,116.45 | $1,077.97 |

| Massachusetts | $1,011.14 | $1,048.06 | $1,080.48 | $1,107.76 | $1,129.29 | $1,075.35 |

| Michigan | $1,110.64 | $1,171.94 | $1,264.20 | $1,350.58 | $1,364.00 | $1,252.27 |

| Minnesota | $777.17 | $800.24 | $823.70 | $856.62 | $875.49 | $826.64 |

| Mississippi | $895.69 | $902.95 | $925.13 | $957.59 | $994.05 | $935.08 |

| Missouri | $790.27 | $799.14 | $819.79 | $845.39 | $872.43 | $825.40 |

| Montana | $816.21 | $821.68 | $842.74 | $868.55 | $863.52 | $842.54 |

| Nebraska | $732.21 | $751.18 | $773.64 | $805.99 | $831.02 | $778.81 |

| Nevada | $1,029.87 | $1,024.09 | $1,047.74 | $1,083.42 | $1,103.05 | $1,057.63 |

| New Hampshire | $746.57 | $755.76 | $773.30 | $795.50 | $818.75 | $777.98 |

| New Jersey | $1,303.52 | $1,334.59 | $1,369.70 | $1,379.20 | $1,382.79 | $1,353.96 |

| New Mexico | $869.85 | $866.19 | $888.83 | $920.42 | $937.59 | $896.58 |

| New York | $1,236.77 | $1,273.70 | $1,301.49 | $1,327.82 | $1,360.66 | $1,300.09 |

| North Carolina | $708.10 | $720.47 | $739.91 | $768.28 | $789.09 | $745.17 |

| North Dakota | $688.74 | $714.75 | $743.27 | $768.09 | $773.30 | $737.63 |

| Ohio | $697.61 | $714.05 | $738.68 | $766.66 | $788.56 | $741.11 |

| Oklahoma | $881.50 | $902.90 | $931.41 | $985.58 | $1,005.32 | $941.34 |

| Oregon | $804.59 | $818.07 | $856.26 | $894.10 | $904.83 | $855.57 |

| Pennsylvania | $904.47 | $915.83 | $930.48 | $950.42 | $970.51 | $934.34 |

| Rhode Island | $1,148.97 | $1,176.05 | $1,210.55 | $1,257.40 | $1,303.50 | $1,219.29 |

| South Carolina | $857.70 | $880.82 | $904.22 | $936.69 | $973.10 | $910.51 |

| South Dakota | $669.20 | $690.95 | $717.30 | $744.28 | $766.91 | $717.73 |

| Tennessee | $767.82 | $794.53 | $829.38 | $855.56 | $871.43 | $823.74 |

| Texas | $959.87 | $974.68 | $1,017.81 | $1,066.20 | $1,109.66 | $1,025.64 |

| Utah | $809.35 | $805.32 | $820.92 | $852.66 | $872.93 | $832.24 |

| Vermont | $716.14 | $726.57 | $734.82 | $746.79 | $764.02 | $737.67 |

| Virginia | $768.95 | $781.38 | $809.40 | $836.14 | $842.67 | $807.71 |

| Washington | $889.82 | $891.04 | $914.04 | $952.10 | $968.80 | $923.16 |

| West Virginia | $992.57 | $1,005.68 | $1,021.37 | $1,032.45 | $1,025.78 | $1,015.57 |

| Wisconsin | $669.99 | $666.79 | $689.77 | $716.83 | $737.18 | $696.11 |

| Wyoming | $791.14 | $796.14 | $804.52 | $844.33 | $847.44 | $816.71 |

| Countrywide | $908.43 | $924.45 | $950.92 | $981.77 | $1,009.38 | $954.99 |

Idaho, Iowa, and Maine have the cheapest rates for full coverage car insurance. On the other hand, New Jersey, Louisiana, and New York have the most expensive rates

So if you live in one of the most expensive states, make sure to shop around at providers to find the best rates.

Choosing the Right Car Insurance Coverage

We’ve covered what types of coverages are available and what the prices are, but how do you know how much car insurance to get? It can be hard to determine what coverages you should purchase beyond the minimum. It’s important to consider if you should simply buy the cheapest coverage or focus on quality over price.

If you are confused over what to buy, keep reading for advice on car insurance coverage.

How much car insurance do I really need?

This is a common question most people ask themselves or their insurers. It can be hard to know how much insurance is just right. Having poor coverage, despite the lower price, will backfire in case of an accident, while expensive coverage may be more than you need.

So how much insurance should you get?

The basic answer is that you need the minimum insurance coverages and limits required in your state.

However, this is only what the state thinks you need at the bare minimum. This means that just purchasing the basic coverages required by law will leave you with rather poor protection.

So while it can be tempting to skimp on coverages to save money, you should have more than the state minimum. For example, if you live in an at-fault state, the minimum liability coverages won’t do much to protect you.

We recommend buying collision and comprehensive coverages in addition to liability coverage. Personal Injury Protection or Medpay are also good choices in case of expensive medical bills.

https://youtu.be/Nhjaiz6wzCQ

As for other coverages, such as gap coverage or umbrella coverage, these coverages are completely up to your needs and preferences. (For more information, read our “How do I find out if GAP insurance is included in my car lease?“).

If you want to get them, that is great and will give you even more protection. But if you find your budget is already strained, stick to the basic liability and collision coverages. You can also pick and choose among coverages if you own more than one car to create individual policy plans.

For example, if you have a new car that is leased, buy gap coverage for only that one car. Or if you have a custom paint job on just one car, only get modified car coverage for the custom car.

Of course, you don’t have to get these coverages at all. But only buying additional coverages for the cars that absolutely need it will be cheaper than buying it for every car in your garage.

Is it better to buy the best or the cheapest car insurance coverage?

This is an important question to ask – quality over price? There are a number of factors to consider, as the cheapest isn’t always the best.

So when isn’t the cheapest option the right choice?

- When the lower price means few coverage options and lower limits. If the insurer has a cheap price but has low limits and only offers a few basic coverages, you may want to look elsewhere.

- When the lower price is matched with poor reviews or ratings. An insurer may have a cheap price, but does it have poor customer service? Or worse, does it have poor financial ratings? This could signify an insurer may go bankrupt in the near future.

- When the lower price means you pay more out of pocket. Every insurer has a deductible, the amount that you have to pay out of pocket before an insurer covers costs in an accident. A lower price could mean you have to pay more after an accident.

As you can see, there are a number of factors to consider when a price seems too good to be true. Always see what others are saying about a company, such as its reliability and hidden fees.

If you want to calculate better how much a rate will eat into your budget, use our car insurance as a percentage of income calculator below. It will help you determine if the cost of an insurer is too expensive for your yearly income.

CalculatorPro

Deductibles and Car Insurance Rates

Deductibles relate directly to car insurance rates. We just mentioned that they are important to look at when considering a cheap car insurance rate, but deductibles are also vital in determining how much you’ll pay after an accident.

If you aren’t sure what deductible to purchase, or what a deductible even is, we’ve got you covered. Keep reading to learn about the basics of car insurance deductibles, the different types, and how to choose the right one.

How do car insurance deductibles work?

Basically, a car insurance deductible is how much money you have to spend on each claimable accident before your insurance provider steps in to cover the rest.

Let’s say you have a $500 deductible on your car insurance plan. You get into an accident, and the bill for repairs is $1,500. You are responsible for paying $500 of the repair bill, and your insurer will cover the remaining $1,000. However, there are two types of deductibles that can change how much you pay.

- Paying Deductible — With this deductible, you have to pay a certain amount until your insurer covers the rest.

- Non-Paying Deductible — With this deductible, coverage kicks in immediately (you don’t have to pay anything).

A non-paying deductible plan is going to be more expensive to purchase than a paying deductible plan. However, it could save you money in an accident, as you have to pay nothing — insurance will automatically cover all costs.

The flip side is that having a paying deductible could save you money as you pay less on your premium. The catch is that if you are in an accident, you’ll have to pay a certain amount on the bill.

Picking between a paying or non-paying deductible will influence your rates over time.

Make sure to consider the long-term costs of paying and non-paying deductibles. If you are in an accident, a non-paying deductible may make the higher premium cost worth it.

What are the types of car insurance deductibles?

We’ve covered the basics of paying versus non-paying deductibles, but deductibles are a bit more complicated than that. If you aren’t sure what type of deductible is right for you and your wallet, keep reading. This section covers everything you need to know about car insurance deductible types.

High vs. Low Paying Deductibles

We’ve talked about paying deductibles, but there are also different price options. Let’s take a look at what most insurers offer.

- $500 Deductible — You’ll have to pay $500 of the bill.

- $1,000 Deductible — You’ll have to pay $1,000 of the bill.

If you have a $1,000 deductible, you will pay less on your premium than you would for a $500 deductible. However, if you are in an accident, insurers will probably make back the money you saved because you have to pay $1,000.

This means that choosing a higher deductible comes with the risk of having to pay more than you saved in an accident.

Disappearing Deductibles

When watching TV, you may have seen a car insurance commercial boasting about its disappearing deductible. Also known as vanishing deductibles, a disappearing deductible program encourages drivers to remain accident-free.

So how do these programs work? While it varies from company to company, the basic concept is the same.

For every year a driver remains accident-free, the deductible amount will go down.

The amount taken off the deductible varies from provider to provider, but it is generally no more than $100. Still, if you have a $500 deductible, staying accident-free can take off a significant amount after a few years.

Below is an example of a company’s advertisement for its disappearing deductible program.

https://youtu.be/cjEqAKhCPvE

However, some companies will set a limit on how much can be subtracted from a deductible. This way, drivers can’t completely vanish their deductibles after five or so years of accident-free driving.

Still, a vanishing deductible is a great way to encourage drivers to drive safely.

Zero-Deductible Policy

A zero-deductible policy is just another way of saying a non-paying deductible. As we said before, a zero-deductible policy will cost more. Because drivers don’t have to pay anything on a claimable accident, insurers charge more on the premium to take on the risk of paying more in the future.

However, a zero-deductible policy should pay itself off after a claimable accident, as you won’t have to pay a single dollar on the accident bill.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Right Car Insurance Deductible

We’ve thrown a lot of information about deductibles at you, and you may still be confused about what you should choose. To help clear things up for you, we are going to go through what types of coverages require deductibles and why your likelihood of getting into an accident matters.

Let’s jump right into it.

What kind of car insurance coverages require a deductible?

Not all coverages need a deductible. For example, you won’t need a deductible on most add-on coverages, such as roadside assistance or rental car reimbursement.

What you will need deductibles on, though, are the basic coverages.

The NAIC says that insurers usually require deductibles on collision and comprehensive coverages.

So while you won’t see a deductible on add-on coverages, you will probably have a deductible on coverages like:

- Collision

- Comprehensive

- Personal Injury Protection

Deductibles are up to the insurer, so requirements will vary. Talk to insurers about what deductibles they require and in what amounts.

How likely are you to file a car insurance claim?

This is a very important question to ask yourself when choosing a car insurance deductible. It will help you determine between a non-paying or paying deductible.

If you aren’t likely to get into an accident and file a claim, then a paying deductible will help lower your rates long-term. The risk you take with this is that you may get into an accident and be stuck paying a high deductible. So consider if the cost of the deductible is something you can pay if you get into an accident. If it is, then a paying deductible may be a good choice and worth the risk.

If you are likely to get into an accident and file a claim, then the higher premium you pay will be worth it after an accident.

Bottom line? Consider your accident risk and budget before committing to a non-paying or paying deductible. Remember that it doesn’t matter how good a driver you are when it comes to accidents. If your state is filled with risky drivers, it may be best to have a paying deductible.

To see how risky your state is, take a look at the National Highway Traffic Safety Administration’s (NHTSA) 2016 to 2017 data below.

Traffic Fatalities by State Percent Change (NHTSA)

| Traffic Fatalities by State | 2016 Fatalities | 2017 Fatalities | Percent Change from 2016 to 2017 |

|---|---|---|---|

| Alabama | 1,083 | 948 | -12 |

| Alaska | 84 | 79 | -6 |

| Arizona | 952 | 1,000 | +5 |

| Arkansas | 561 | 493 | -12 |

| California | 3,837 | 3,602 | -6 |

| Colorado | 608 | 648 | +7 |

| Connecticut | 304 | 278 | -9 |

| Delaware | 119 | 119 | 0 |

| Dist of Columbia | 27 | 31 | +15 |

| Florida | 3,176 | 3,112 | -2 |

| Georgia | 1,556 | 1,540 | -1 |

| Hawaii | 120 | 107 | -11 |

| Idaho | 253 | 244 | -4 |

| Illinois | 1,078 | 1,097 | +2 |

| Indiana | 829 | 914 | +10 |

| Iowa | 402 | 330 | -18 |

| Kansas | 429 | 461 | +7 |

| Kentucky | 834 | 782 | -6 |

| Louisiana | 757 | 760 | +0 |

| Maine | 160 | 172 | +8 |

| Maryland | 522 | 550 | +5 |

| Massachusetts | 387 | 350 | -10 |

| Michigan | 1,065 | 1,030 | -3 |

| Minnesota | 392 | 357 | -9 |

| Mississippi | 687 | 690 | +0 |

| Missouri | 947 | 930 | -2 |

| Montana | 190 | 186 | -2 |

| Nebraska | 218 | 228 | +5 |

| Nevada | 329 | 309 | -6 |

| New Hampshire | 136 | 102 | -25 |

| New Jersey | 602 | 624 | +4 |

| New Mexico | 405 | 379 | -6 |

| New York | 1,041 | 999 | -4 |

| North Carolina | 1,450 | 1,412 | -3 |

| North Dakota | 113 | 115 | +2 |

| Ohio | 1,132 | 1,179 | +4 |

| Oklahoma | 687 | 655 | -5 |

| Oregon | 498 | 437 | -12 |

| Pennsylvania | 1,188 | 1,137 | -4 |

| Rhode Island | 51 | 83 | +63 |

| South Carolina | 1,020 | 988 | -3 |

| Tennessee | 1,037 | 1,040 | +0 |

| Texas | 3,797 | 3,722 | -2 |

| Utah | 281 | 273 | -3 |

| Vermont | 62 | 69 | +11 |

| Virginia | 760 | 839 | +10 |

| Washington | 536 | 565 | +5 |

| West Virginia | 269 | 303 | +13 |

| Wisconsin | 607 | 613 | +1 |

| Wyoming | 112 | 123 | +10 |

| Puerto Rico | 279 | 290 | +4 |

| National | 37,806 | 37,133 | -2 |

The worst state in 2017 for fatal vehicle crashes was Texas. Of course, this could have something to do with the size of the state’s population.

If you live in an area with a high number of crashes, your risk of getting into a crash will be higher. As well, if you live in a no-fault state, you will be responsible for your own accident costs no matter who caused the crash.

Case Studies: Combining Car Insurance Coverage With the Right Deductible

Case Study 1: Saving on Monthly Rates With Increased Deductible

In this case study, we explore how Sarah, a responsible driver, was able to save on her monthly car insurance rates by raising her deductible. Sarah compared quotes online and found that by increasing her deductible from $500 to $1,000, she could save up to 28% on her monthly premiums.

Despite the higher deductible, Sarah felt confident in her driving abilities and decided to take advantage of the savings. This highlights the importance of evaluating your risk tolerance and financial situation when considering deductible options.

Case Study 2: Finding the Best Deal for Various Coverages

John, a car owner with multiple vehicles, wanted to ensure he had the right coverage for each of his cars. He used an online comparison tool to gather quotes from top insurance companies and compare coverages. Through this process, John was able to find the best deal for his specific needs.

By customizing his coverage for each vehicle and selecting appropriate deductibles, John was able to optimize his insurance policy while keeping his premiums affordable. This emphasizes the importance of tailoring your coverage to fit your unique circumstances.

Case Study 3: Maximizing Coverage While Staying Within Budget

Lisa, a new driver, wanted to make sure she had adequate coverage while staying within her budget. She reviewed the different types of car insurance coverage and their associated costs. Lisa also considered her state’s minimum coverage requirements and her own risk tolerance.

By carefully selecting the right combination of coverages and deductibles, Lisa was able to strike a balance between affordability and comprehensive protection. This demonstrates the importance of understanding your coverage options and making informed decisions based on your budget and needs.

Car Insurance Coverage and Deductible FAQs

Do you still have questions about coverages and deductibles? While talking to your insurer can always help clear up some questions, we want to cover what others are asking.

Keep reading to see what others are asking, which will hopefully answer any remaining questions you have.

Will my car insurance deductible go away if I file a claim?

Unfortunately, deductibles apply for every claimable accident. So every time you file a claim, you will have first to pay your deductible amount. As well, if you are on a vanishing deductible program, these programs usually reset your deductible amount to the original amount after a claimable accident.

So if you had a $500 deductible to start with and were down to a $300 deductible after two accident-free years, your deductible will reset to $500 after you pay your $300 on a claimable accident.

Are car insurance deductibles per claim?

Yes, auto insurance deductibles aren’t like health insurance deductibles that pay for medical costs the rest of the year after a deductible is met. At the majority of car insurance providers, you will have to pay your deductible with each claim.

However, most people only make a claim every few years. So you won’t be paying a deductible multiple times a year unless you have terrible luck.

What if the accident wasn’t my fault?

The answer to this depends on if you live in a no-fault or at-fault state. If you live in a no-fault state, your insurer is still responsible for your costs, and you will have to pay the deductible.

Drivers in at-fault states, though, will be covered by the other driver’s insurance, which means they won’t have to pay the deductible because the other driver is responsible for accident costs.

Will a glass claim ruin my car insurance deductible?

It depends. If you have comprehensive coverage with a zero-deductible policy, you won’t have to pay anything, and your deductible won’t change.

This isn’t always the case, though, so talk to your insurer first about glass claims and deductibles.

What if I can’t afford my car insurance deductible?

First, talk to your insurer to see if you have to pay up-front for the claim to go through or if the deductible will be subtracted from the insurer’s check (such as if your car was totaled).

Unfortunately, if you need to pay up-front, your claim won’t go through until you pay your deductible. If your car is in the shop, talk to your mechanic about making payments until the deductible is met.

So make sure your deductible is one that you can afford, as you don’t want to be stranded without a workable car.

How can I avoid my car insurance deductible?

There is no legal way to do this. If you chose a $1,000 deductible, you are stuck paying a $1,000 towards the repairs or going without a car until you can scrape up the money.

This is why it is always risky to try and save money short-term with a high deductible. While you’ll save money on your premium, you may end up spending more than you saved after an accident because the deductible is so high.

When is a car insurance deductible waived?

A car insurance deductible may be waived at an insurers’ discretion. Common situations when a deductible is waived are:

- You live in an at-fault state, and the other driver is more than 50 percent responsible for the crash.

- There is only a tiny crack or repair needed on a windshield.

- You have uninsured/underinsured motorist coverage in an at-fault state.

Ask your insurer to find out more about possible situations when deductibles may be waived, especially if you carry comprehensive insurance with a comprehensive deductible.

What are other ways to save on car insurance rates?

If you need to save money to meet your deductible amount, there are a few ways to lower car insurance rates.

- Shop around at different providers

- Take advantage of discounts and money-saving programs (such as accident-forgiveness)

- Keep as clean a driving record as possible

By shopping around and taking advantage of discounts, you can help lower your car insurance costs.

Did we miss anything in this guide to car insurance coverages and deductibles? Hopefully, all your questions are now answered, and you feel prepared to start shopping around.

If you want to jump right into comparing rates, enter your ZIP code in our free tool below.

Frequently Asked Questions

What are the types of car insurance coverage?

The types of car insurance coverage include:

- liability coverage

- collision coverage

- comprehensive coverage

What are car insurance coverage limits?

Car insurance coverage limits refer to the maximum amount your insurance policy will pay for a specific type of coverage. For example, if your liability coverage limit is $50,000, your insurance company will pay up to that amount for bodily injury or property damage caused by you in an accident.

How much car insurance do I need?

The amount of car insurance you need depends on various factors, including your state’s minimum requirements, the value of your vehicle, and your personal financial situation. While it’s important to meet the minimum legal requirements, it’s generally recommended to have higher coverage limits to ensure adequate protection.

Should I choose the cheapest or the best car insurance coverage?

When choosing car insurance coverage, it’s important to strike a balance between cost and quality. While the cheapest option may save you money upfront, it might provide less coverage or have poor customer service. It’s advisable to research insurance companies, compare quotes, and read reviews to find a reputable provider that offers good coverage at a competitive price.

How do car insurance deductibles work?

A car insurance deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and file a claim for $2,000 in damages, you would pay the first $500, and the insurance company would cover the remaining $1,500. Choosing a higher deductible generally results in lower monthly premiums, while a lower deductible leads to higher premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.