Best Car Insurance for Engineers in 2024 (Top 10 Companies)

Explore the best car insurance for engineers with leading providers such as State Farm, USAA, and Progressive, offering rates as low as $95 for minimum coverage. Ensure you have the necessary protection for your needs. Secure your coverage today for peace of mind on the road.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

A/B Active Test Data

Not visible on live sitesTest Name: ab_mda_paid_copy_1

Test Info: Starting when a user lands on one of our basic fire templates, we either leave the hero MDA heading & subheading as it is (control), or we replace it with copy we use on paid traffic (variant). This control/variant assignment will be passed along via experiment ID with any MDA submission after the user lands on a basic fire template.

Test Assignment: MDAPaidCopy1:control

Control Heading: Free Car Insurance Comparison

Control Subheading: Compare Quotes From Top Companies and Save

Variant Heading: Stop Paying Too Much For Car Insurance

Variant Subheading: Compare Free Quotes Online In Minutes, Check Now

Company Facts

Full Coverage For Engineers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage For Engineers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage For Engineers

A.M. Best Rating

Complaint Level

Pros & Cons

Professional engineers can trust these insurers to provide tailored coverage that aligns with their unique needs, ensuring peace of mind on every journey.

Company Rank Multi-Policy Discount Low-Mileage Discount Best For Jump to Pros/Cons

#1 17% 20% Many Discounts State Farm

#2 10% 20% Military Savings USAA

#3 10% 31% Online Convenience Progressive

#4 25% 35% Add-on Coverages Allstate

#5 20% 20% Usage Discount Nationwide

#6 20% 10% Local Agents Farmers

#7 30% 10% Customizable Polices Liberty Mutual

#8 13% 10% Accident Forgiveness Travelers

#9 20% 10% Student Savings American Family

#10 10% 10% Local Agents AAA

Compare professional engineer car insurance rates today and find the perfect coverage for your profession.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers a wide range of discounts, providing flexibility for Professional Engineers to maximize savings.

- Maximum Multi-Policy Discount: With a discount of up to 17%, combining policies with State Farm can lead to significant savings.

- Coverage Options: State Farm’s extensive coverage options cater to diverse needs, ensuring comprehensive protection.

Cons

- Limited Online Convenience: State Farm’s online tools may not be as advanced or user-friendly as some competitors.

- Varied Customer Service: When evaluating State Farm car insurance review, the level of customer service can vary depending on the local agency.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA excels in providing exclusive savings for military professionals, making it an ideal choice for Professional Engineers in the armed forces.

- High Low-Mileage Discount: In the USAA car insurance review, the company offers a discount of up to 20% for low-mileage drivers.

- Customer Satisfaction: USAA is renowned for its exceptional customer service, offering a seamless experience.

Cons

- Membership Restrictions: USAA is only available to military personnel and their families, limiting access to a specific group.

- Limited Local Agents: USAA’s physical presence may be limited, impacting face-to-face interactions for some customers.

#3 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive stands out for its user-friendly online platform, providing ease of use for Professional Engineers seeking quick and efficient service.

- High Low-Mileage Discount: With a maximum low-mileage discount of up to 31%, Progressive encourages and rewards safe driving habits.

- Innovative Coverage Options: Progressive offers innovative add-on coverages, allowing customization based on individual needs.

Cons

- Potentially Higher Rates: In examining Progressive car insurance review, it’s found that while convenient, its rates may exceed those of some competitors.

- Limited Local Presence: For those who prefer face-to-face interactions, Progressive’s local agent network is not as extensive as some traditional insurers.

#4 – Allstate: Best for Add-on Coverages

Pros

- Generous Multi-Policy Discount: Allstate offers a substantial multi-policy discount of up to 25%, encouraging customers to bundle their insurance for added savings.

- High Low-Mileage Discount: In an Allstate car insurance review, significant incentives are offered for safe driving behaviors, including a low-mileage discount of up to 35%.

- Add-on Coverages: Allstate excels in offering a variety of add-on coverages, allowing Professional Engineers to tailor their policies to meet specific needs.

Cons

- Potentially Higher Premiums: While offering extensive coverage options, Allstate’s premiums may be higher compared to some competitors.

- Varied Customer Service: Customer service experiences with Allstate can be subjective, with some customers reporting mixed reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide stands out with a usage discount of up to 20%, rewarding Professional Engineers for lower mileage.

- Multi-Policy Savings: Nationwide car insurance discount offers up to 20% for bundling policies.

- Wide Network: Nationwide’s extensive network ensures that Professional Engineers can easily find local agents for personalized service.

Cons

- Limited Online Tools: Nationwide’s online tools may not be as advanced or user-friendly as some competitors.

- Average Customer Satisfaction: While providing reliable service, Nationwide’s customer satisfaction ratings are average compared to some competitors.

#6 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers emphasizes local agents, providing Professional Engineers with face-to-face interactions and personalized service.

- Multi-Policy Discount: With a multi-policy discount of up to 20%, Farmers encourages customers to bundle their insurance for added savings.

- Various Discounts: Farmers offers a variety of discounts beyond multi-policy, providing options for further cost reductions.

Cons

- Potentially Higher Rates: Farmers car insurance review suggests rates could be higher compared to competitors, experiences may vary.

- Online Tools Limitations: While Farmers offers online services, its digital tools may not be as robust as those of some other insurers.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual excels in providing customizable policies, allowing Professional Engineers to tailor coverage to their specific needs.

- Generous Multi-Policy Discount: With a multi-policy discount of up to 30%, Liberty Mutual encourages customers to bundle their insurance for added savings.

- Coverage Options: Liberty Mutual offers a wide range of coverage options, ensuring comprehensive protection for diverse needs.

Cons

- Potentially Higher Premiums: While offering flexibility, Liberty Mutual’s premiums may be on the higher side compared to some competitors.

- Online Service Limitations: In evaluating Liberty Mutual car insurance review, it’s clear their online tools might not match competitors’.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers stands out with its accident forgiveness feature, providing Professional Engineers with peace of mind and potential savings.

- Multi-Policy Discount: With a multi-policy discount of up to 13%, Travelers encourages customers to bundle their insurance for added savings.

- Digital Tools: Travelers offers advanced online tools, providing convenience and ease of use for customers managing their policies online.

Cons

- Limited Discounts: In a Travelers car insurance review, the coverage is solid, but the company may offer fewer discounts than competitors.

- Customer Service Variability: Customer service experiences with Travelers can vary, with some customers reporting mixed reviews.

#9 – American Family: Best for Student Savings

Pros

- Student Savings: American Family car insurance review emphasizes student-specific discounts, appealing to Professional Engineers with student drivers.

- Multi-Policy Discount: With a multi-policy discount of up to 20%, American Family encourages customers to bundle their insurance for added savings.

- Coverage Options: American Family provides a variety of coverage options, ensuring comprehensive protection for Professional Engineers.

Cons

- Limited Online Presence: American Family’s online tools may not be as robust or user-friendly as those of some other insurers.

- Potentially Higher Rates: While offering tailored coverage, American Family’s rates may be higher compared to some competitors.

#10 – AAA: Best for Local Agents

Pros

- Local Agents: AAA emphasizes local agents, providing Professional Engineers with face-to-face interactions and personalized service.

- Multi-Policy Discount: With a multi-policy discount of up to 10%, AAA encourages customers to bundle their insurance for added savings.

- Membership Benefits: AAA car insurance review reveals supplementary benefits and discounts, amplifying overall value for its members

Cons

- Limited Online Tools: AAA’s online tools may not be as advanced or user-friendly as those of some other insurers.

- Membership Costs: To access AAA’s insurance services, Professional Engineers need to be AAA members, which may involve additional costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How Your Occupation as an Engineer Affects Your Insurance Rates

For professional engineers seeking optimal car insurance coverage, we’ve curated a selection of top providers with rates designed to align with your unique needs. State Farm takes the lead in affordability, offering a minimum coverage rate of $100 and full coverage at $189. USAA, recognized for military savings, presents engineers with a tailored option at $108 for minimum coverage and $224 for full coverage.

With Progressive closely following suit at $115 for minimum coverage and $196 for full coverage, these providers understand the specific requirements of the engineering profession, providing comprehensive yet cost-effective insurance solutions.

Insurance Company Minimum Coverage Full Coverage

State Farm 100 189

USAA 108 224

Progressive 115 196

Allstate 119 215

Nationwide 98 200

Farmers 106 205

Liberty Mutual 107 203

Travelers 113 210

American Family 95 199

AAA 99 203

Engineers can explore coverage rates from a range of reputable providers, including Allstate, Nationwide, Farmers, Liberty Mutual, Travelers, American Family, and AAA. Each option caters to the distinct needs of professional engineers, with coverage rates reflecting the commitment of these insurers to offer competitive and nuanced solutions.

By leveraging this detailed comparison, engineers can make informed decisions, selecting an insurance provider that not only recognizes the unique aspects of their profession but also provides peace of mind on every journey. Explore our comparison of car insurance rates for members of professional groups for more details.

Others Factors That Impact Engineer Auto Insurance Cost

The majority of factors that determine your auto insurance rates relate directly to your personal situation. The amount that you drive your vehicle has an effect on your rate. This may have less to do with your occupation and more to do with your proximity to your workplace.

The factor that will have the biggest influence on insurance rate is your driving record. Tickets, claims, and accidents will all increase your car insurance premium. Most car insurance companies will look at the last three years of your driving record when determining risk.

State Farm stands out as the top choice for professional engineers, offering tailored coverage with many discounts, making it the most affordable and reliable option in 2024.

Melanie Musson Published Insurance Expert

Where you reside will also have an effect on your car insurance rate. Areas that are considered high crime will have higher insurance rates. These areas are more likely to have damage due to vandalism or theft.

If the vehicle you drive is listed as one of the most stolen vehicles, you will likely have higher insurance rates. Gender and age will also be considered when determining auto insurance rates. All drivers under 25 are deemed to be high-risk.

When renewing a policy or getting a new car insurance policy after the age of 25, you can expect your insurance rate to decrease.

The under 25 age group will also be the only group with a significant difference in car insurance rates based on gender. Younger males are higher risk than females in the same age group.

How to Save on Car Insurance Rates as an Engineer

Insurance companies will have their own potential discounts for motorists.

- Multi-Policy: If your car insurance provider offers other insurance products, you can save money by having multiple policies. Examples could be home, life, health or insuring multiple vehicles.

- Lump Sum: Insurance carriers may provide you a discount based on how you make your payments. Making a lump sum payment for a six-month premium may save you money on your car insurance policy.

- Automatic Withdrawal: If you are unable to make the payment in a lump sum, you may be able to save by having your payment drafted automatically from your bank account.

- Safety Features: Safety discounts exist based on features that you have in your car. You can speak with an insurance agent to find out what features will save you money on your car insurance policy.

- Minimum Requirement: While it is not recommended, you can save money by opting for the minimum insurance requirements for the state you live. For most states the minimum is liability insurance.

- Safe Driver Course: Taking a safe driver course is another potential discount offered by car insurance companies. You can check with your current insurance provider to find out if they have this type of discount.

If there is a lien on your vehicle, the financing institution will require you to have full coverage. If your car is paid for, you can save money by not having collision and comprehensive. You will have to determine if the risk is worth the savings on your insurance premium.

If you are interested in saving money on your car insurance, shop around to find the best deal. When speaking with an agent, ask about discounts that are available.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Engineer Insurance Success Stories: Tailored Coverage for Every Journey

In the realm of professional engineering, securing suitable car insurance is crucial. This series of case studies examines the tailored coverage options available for engineers from top insurance providers. From exploring how occupation impacts insurance rates to cost-saving strategies, these case studies provide concise insights to help engineers make informed decisions.

- Case Study #1 – Affordable Protection: Alex, a structural engineer, opted for State Farm car insurance. With rates starting at $100 for minimum coverage and $189 for full coverage, State Farm provided affordable and reliable protection. Now, Alex drives confidently, knowing their insurance matches the precision required in engineering.

- Case Study #2 – Military Savings: Sarah, a civil engineer, valued USAA’s military savings. With rates of $108 for minimum coverage and $224 for full coverage, USAA’s tailored options matched her dedication. USAA’s understanding of military lifestyles makes it a standout choice for engineers like Sarah, prioritizing both savings and appreciation for their service.

- Case Study #3 – Tech-Savvy Solutions: James, a software engineer, found a fitting insurance partner in Progressive. With rates starting at $115 for minimum coverage and $196 for full coverage, Progressive’s online convenience and innovative solutions complemented James’s tech-savvy lifestyle. The ability to manage policies seamlessly online makes Progressive an attractive choice for engineers like James.

- Case Study #4 – Customization for Environmental: Emily, an environmental engineer, appreciated Liberty Mutual’s customizable policies. With rates starting at $107 for basic coverage and $203 for comprehensive protection, Liberty Mutual provided tailored solutions matching Emily’s dedication to sustainability.

- Case Study #5 – Usage Discount for Transportation: Mark, a transportation engineer, found Nationwide’s usage discount beneficial. With minimum coverage at $98 and full coverage at $200, Nationwide recognized his low mileage and specific usage needs. This, coupled with comprehensive coverage, makes Nationwide a top choice for engineers prioritizing savings and tailored coverage.

Join us as we navigate the complexities of car insurance within the context of the engineering profession, offering practical advice for comprehensive coverage and peace of mind on the road. Explore our discounts on car insurance tailored to occupations for further details.

Synopsis: Car Insurance Rates for Professional Engineers

The content provides a thorough comparison of car insurance rates designed for professional engineers. It highlights leading insurance companies offering competitive rates for both basic and full coverage, including details on discounts and benefits. The synopsis stresses the importance of tailored coverage for engineers, highlighting key factors like driving record, location, and vehicle type in rate determination.

The synopsis also offers money-saving tips for engineers on insurance premiums and answers common questions about insurance coverage for engineering professionals. It summarizes the main points of the comparison, providing a brief guide for engineers looking for the best car insurance solutions. Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today

Frequently Asked Questions

Why do engineers have lower car insurance rates?

Engineers generally have low-stress work environments and don’t use their vehicles for business purposes, which reduces their insurance risk.

What factors determine car insurance rates?

Car insurance rates are influenced by factors such as driving record, location, vehicle type, gender, and age.

How can I save money on car insurance?

You can save money on car insurance by considering the coverage you need, shopping around for the best deal, and asking about available discounts.

Does my occupation affect car insurance rates?

Yes, occupations with higher risks for accidents or claims often have higher insurance rates. Engineers, with their low-risk work environments, typically enjoy lower rates. What should I do to lower my car insurance premiums?

What should I do to lower my car insurance premiums?

To lower your premiums, maintain a clean driving record, choose a safe location to live, and consider factors like vehicle type, age, and gender. Shopping around for better rates is also recommended.

What discounts are available for car insurance for engineers?

Many insurance companies offer engineer insurance discounts tailored specifically for professionals in the engineering field. These discounts can help reduce premiums for engineers based on their low-risk occupations and other factors such as education level and job stability.

Will Geico assist in unlocking my car for engineers?

Geico provides roadside assistance services that may include unlocking a vehicle if keys are locked inside. As an engineer, you may be eligible for this service depending on your policy coverage. It’s essential to review your specific policy details to determine if this assistance is available to you.

How can engineers qualify for engineer insurance discounts?

Engineers can qualify for insurance discounts by maintaining a clean driving record, opting for higher deductibles, bundling policies, and taking advantage of engineer-specific discounts offered by insurance providers. These discounts acknowledge the typically low-risk nature of engineering professions.

What factors affect engineering insurance costs?

Professional engineer insurance costs may be impacted by a variety of elements, including the engineer’s driving history, geographical location, vehicle type, available coverage selections, and the chosen insurance company. Furthermore, professional engineers should also take into account the expenses associated with liability insurance tailored to their occupation.

How do professional engineer insurance rates compare across providers?

Professional engineer insurance rates may vary among insurance providers based on factors such as coverage options, discounts offered, and underwriting criteria. It’s recommended for professional engineers to compare rates from multiple providers to find the most competitive premiums.

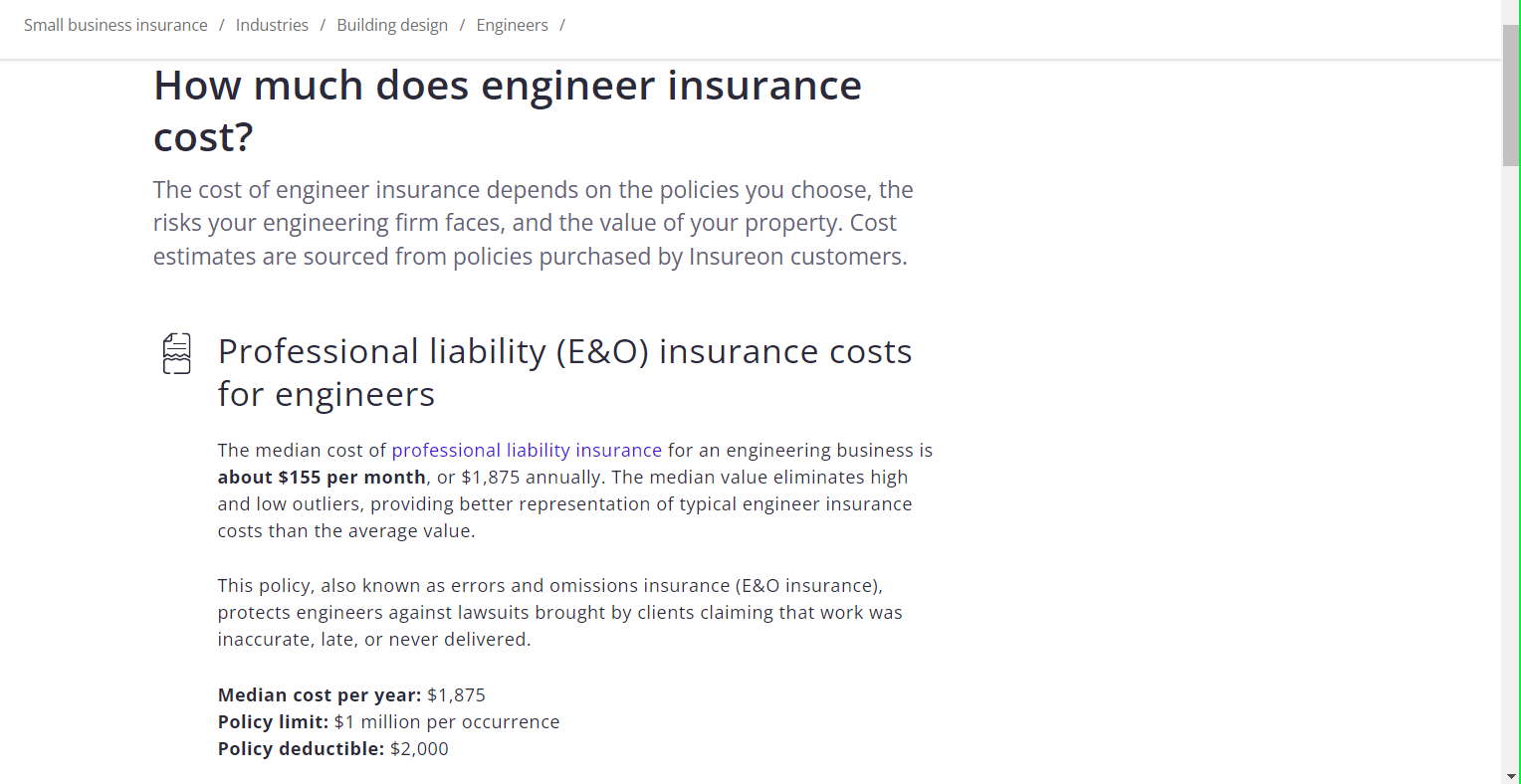

What are the typical costs associated with professional engineer liability insurance?

Professional engineer liability insurance costs can vary depending on factors such as coverage limits, the engineer’s specialization, and the scope of their practice. Engineers may incur costs ranging from several hundred to several thousand dollars per year for liability coverage tailored to their profession.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.