How to Get USAA Car Insurance Quotes Online in 2026 [Follow These 10 Steps]

To get USAA car insurance quotes online, visit their official website, log into your account, and enter your personal and vehicle information. USAA offers competitive rates, including a potential 10% discount for safe drivers. You can quickly receive customized USAA auto insurance quotes online.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

You may be interested in how to get USAA car insurance quotes online. It’s as easy as A-B-C: Visit their website, log in to your account, and fill in your vehicle and driving record details.

In return, you could save up to 10% with customized car insurance coverage limits. Get fast, reliable, and competitive USAA auto insurance quotes online to make informed decisions.

Compare more insurance rates by entering your ZIP code above and comparing free quotes!

- Step #1: Visit the USAA Website – Access the official USAA car insurance page

- Step #2: Sign Up or Log In – Create or log into your USAA account

- Step #3: Provide Personal Details – Enter your personal information accurately

- Step #4: Enter Vehicle Information – Submit details about your car

- Step #5: Answer Questions & Save Money – Complete questions to find discounts

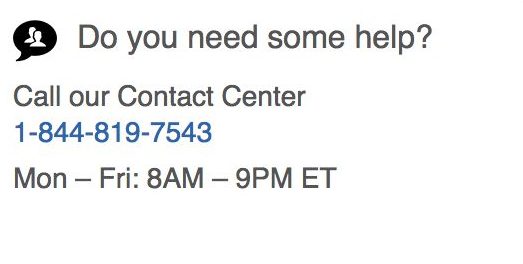

- Step #6: Get Help if You Need It – Contact support for any assistance

- Step #7: Add Vehicle Details – Include additional vehicle-specific data

- Step #8: Check Out Discounts – Explore savings options on your policy

- Step #9: Review Your Coverage Needs – Confirm the coverage matches your needs

- Step #10: Get Your Quote – Receive your online car insurance quote instantly

10 Steps to Get a USAA Car Insurance Quote Online

If you are unsure whether you meet the eligibility requirements for USAA membership, you can quickly find out on their site. You’ll need your date of birth, contact information, social security number, and military information for yourself or your relative

If you or a relative doesn’t have any ties to the military, you won’t be able to purchase auto insurance from USAA.

Step #1 – Visit the USAA Website

For military members whose posts change, USAA is a good provider to consider because they understand the unique needs and challenges a servicemember can face with auto insurance.

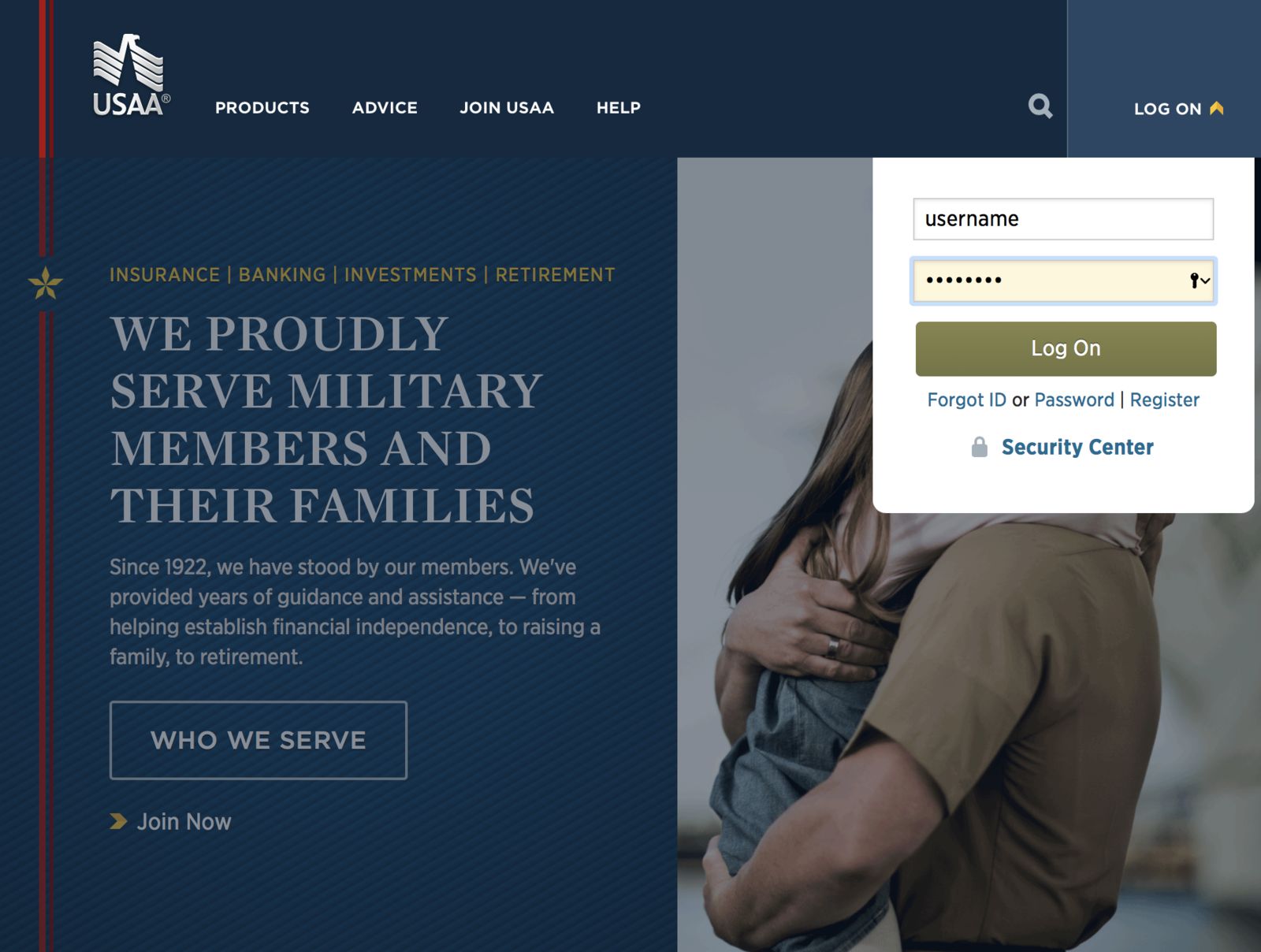

Step #2 – Sign Up or Log In

Register for a USAA account or log in if you’re a member.

For pre-existing members already being USAA members, your quote process will be more straightforward since your information is already in the system and will be automatically imported. If you’re thinking, “I can’t remember my car insurance company, how do I find it?” USAA’s system can help you organize and update your policy details efficiently.

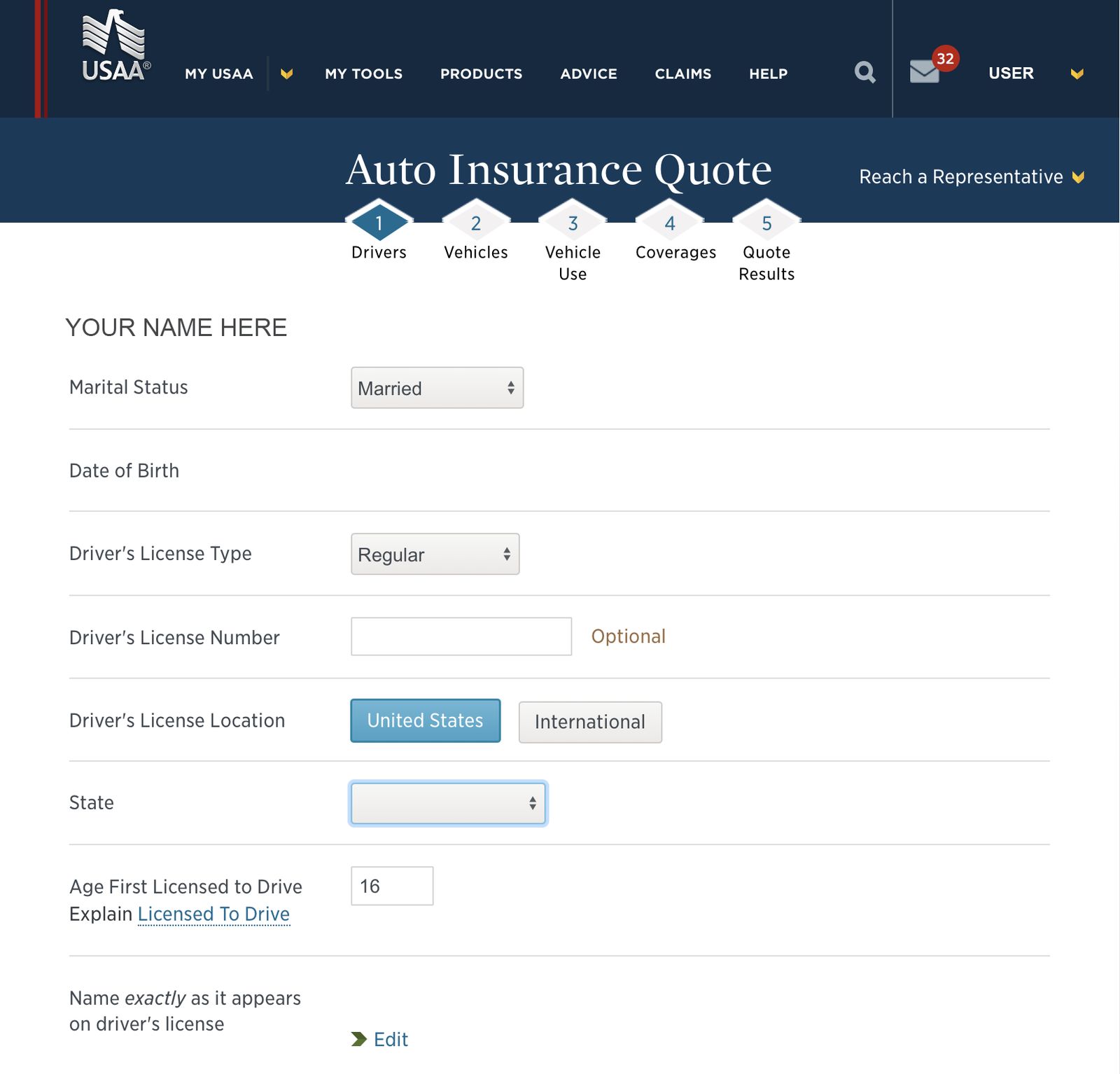

Step #3 – Provide Personal Details

If you’re a returning customer, you’ll be greeted with a welcome screen that reveals your current policy’s benefits and coverages. This will allow you to assess whether you need additional car insurance coverage options.

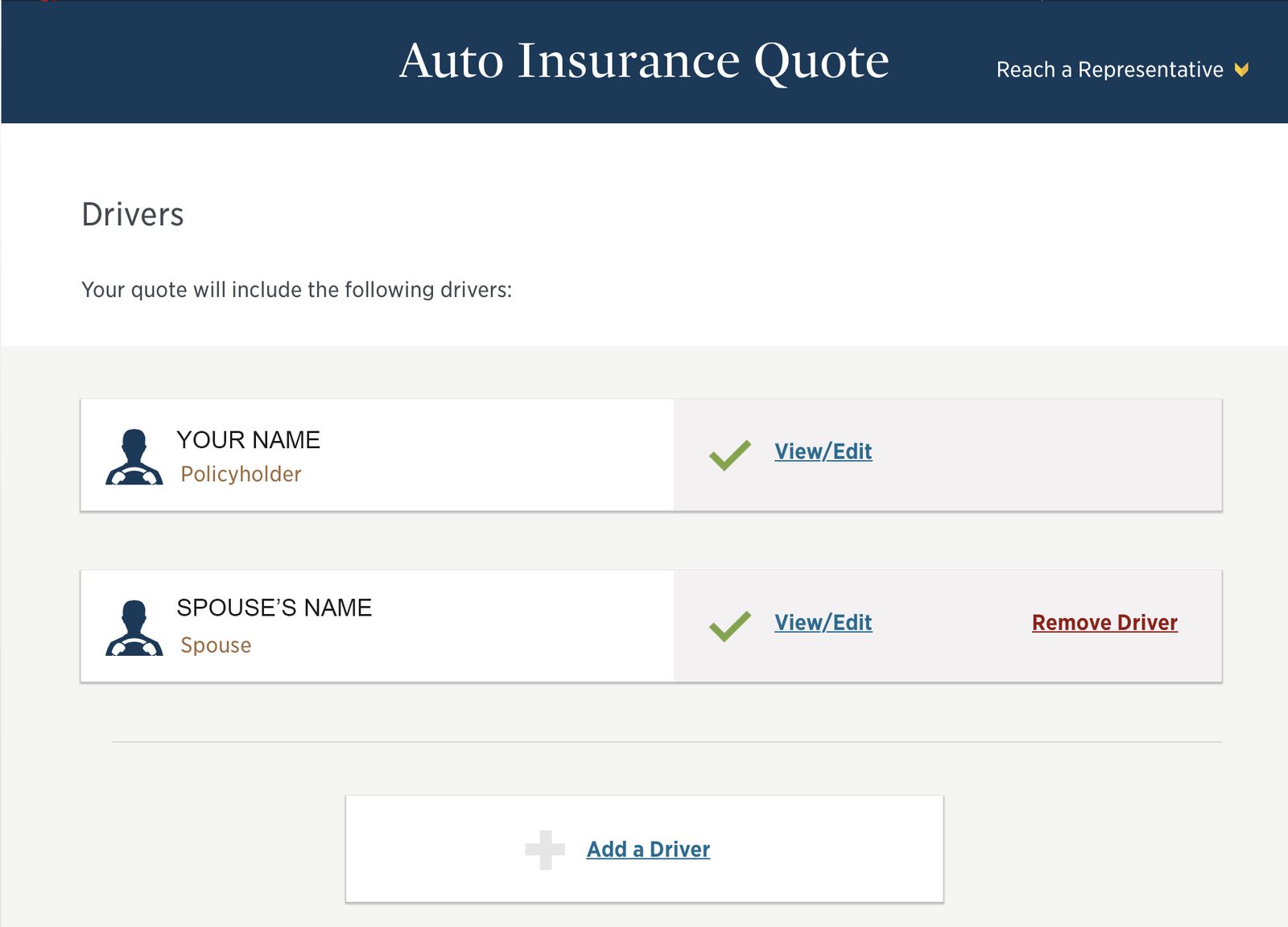

Step #4 – Enter Vehicle Information

USAA can review and update most of the necessary information for pre-existing conditions. If you’re requesting an auto insurance quote from USAA for the first time, follow the prompts on the screen and enter the appropriate information into each box.

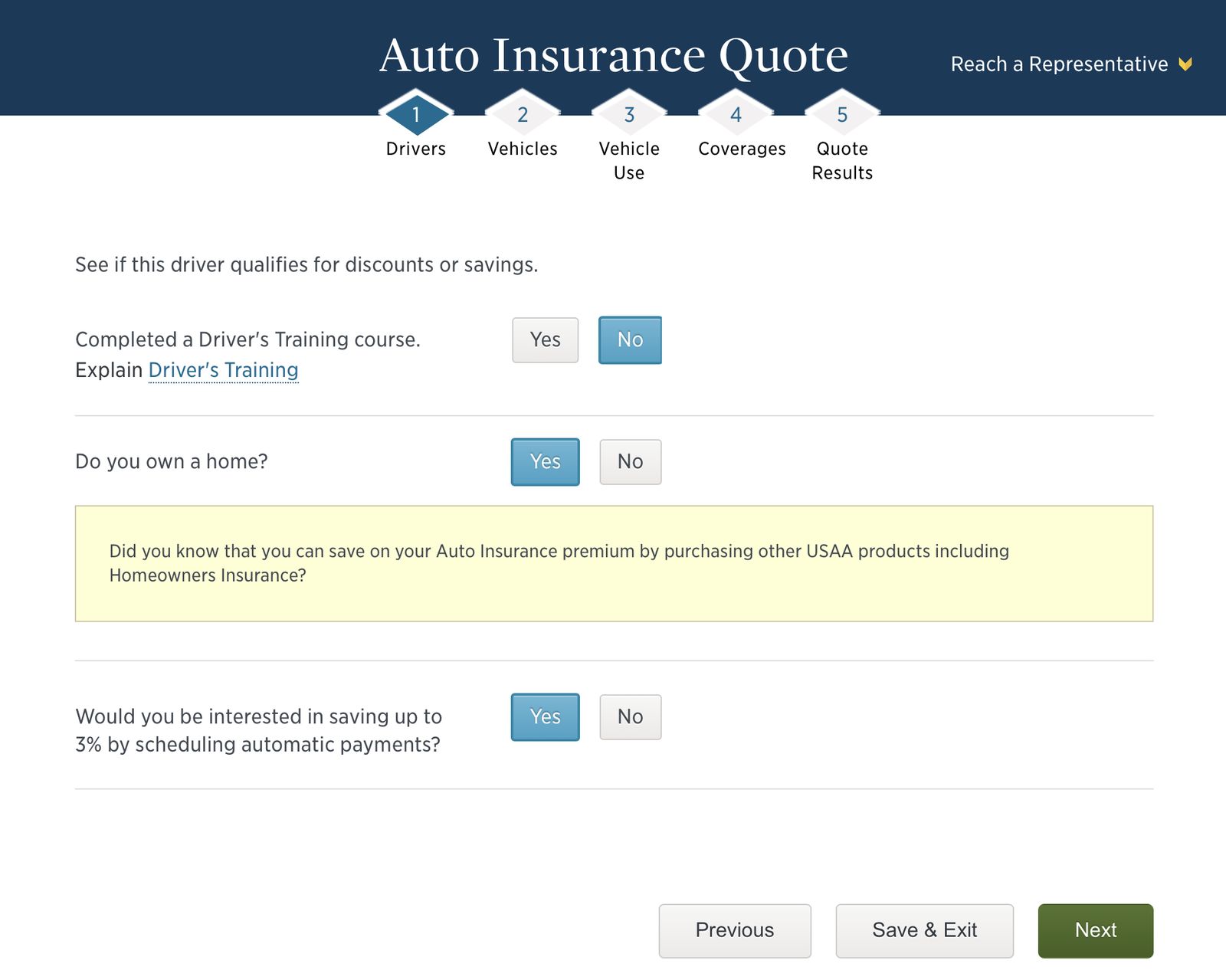

Step #5 – Answer Questions & Save Money

Step #6 – Get Help if You Need It

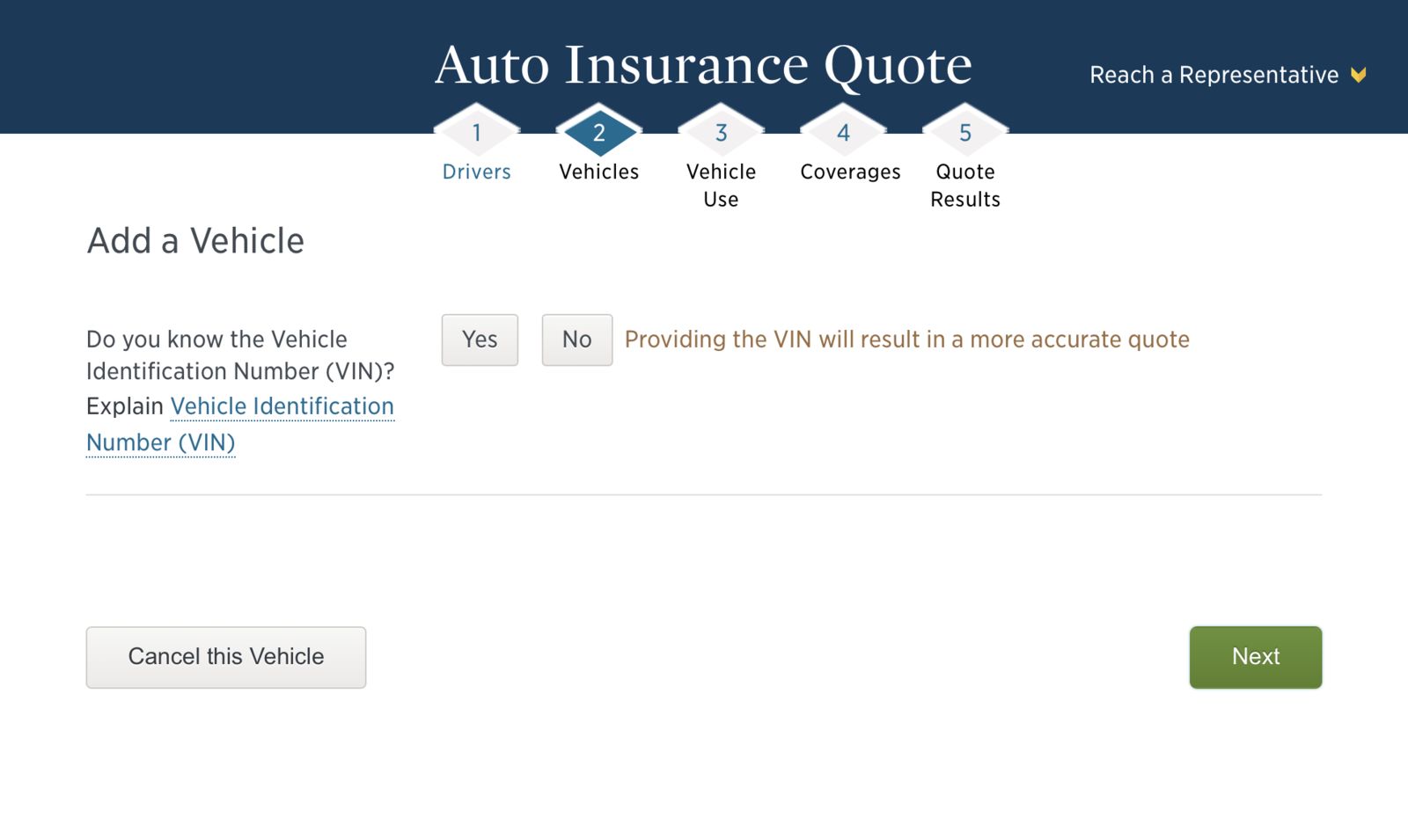

Step #7 – Add Vehicle Details

After entering your car’s details, you might ask, “How can I add a car to my insurance policy?“ Follow the prompts to add another vehicle or proceed to the next step.

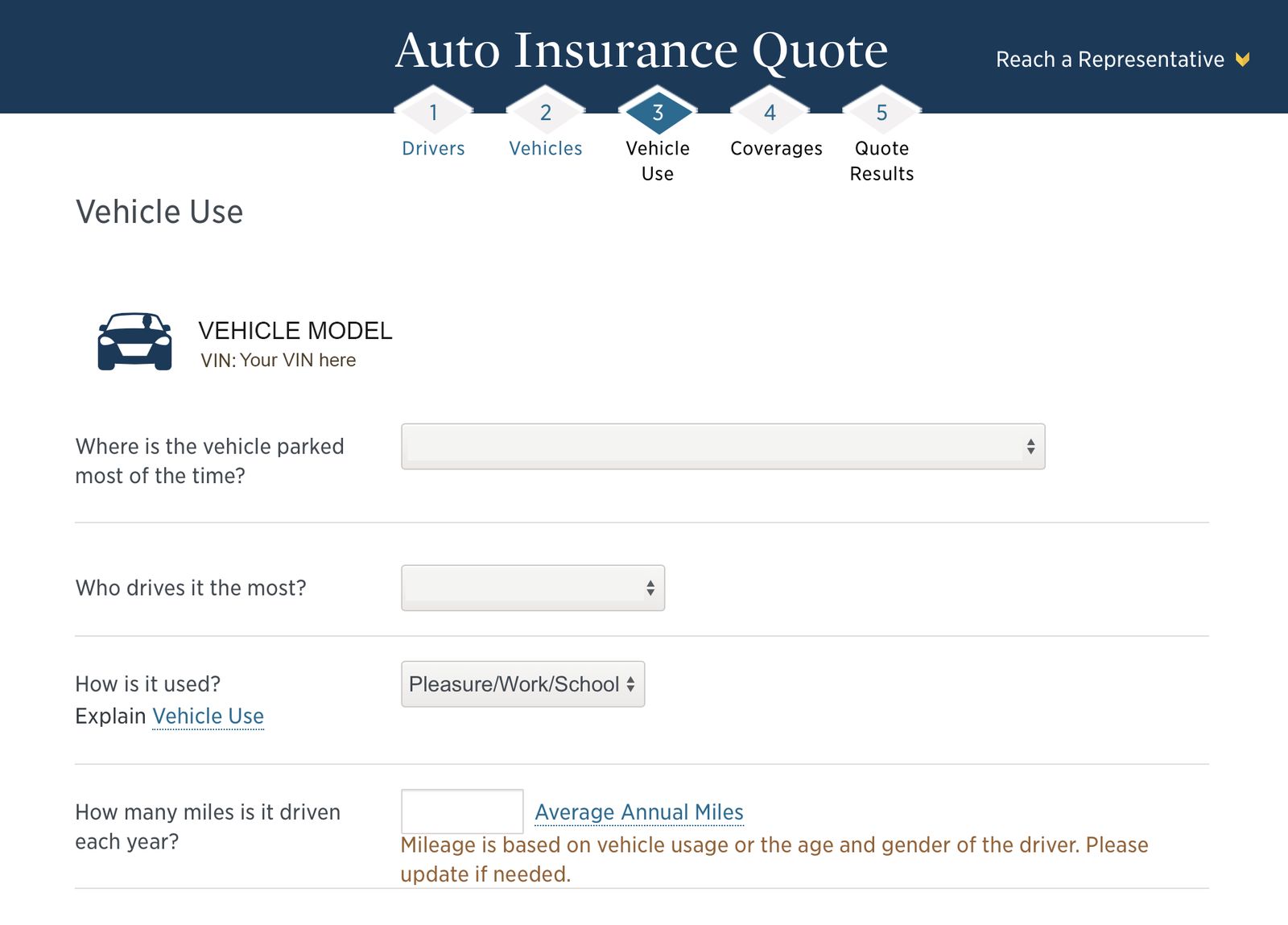

Review Your Car Usage and its Features

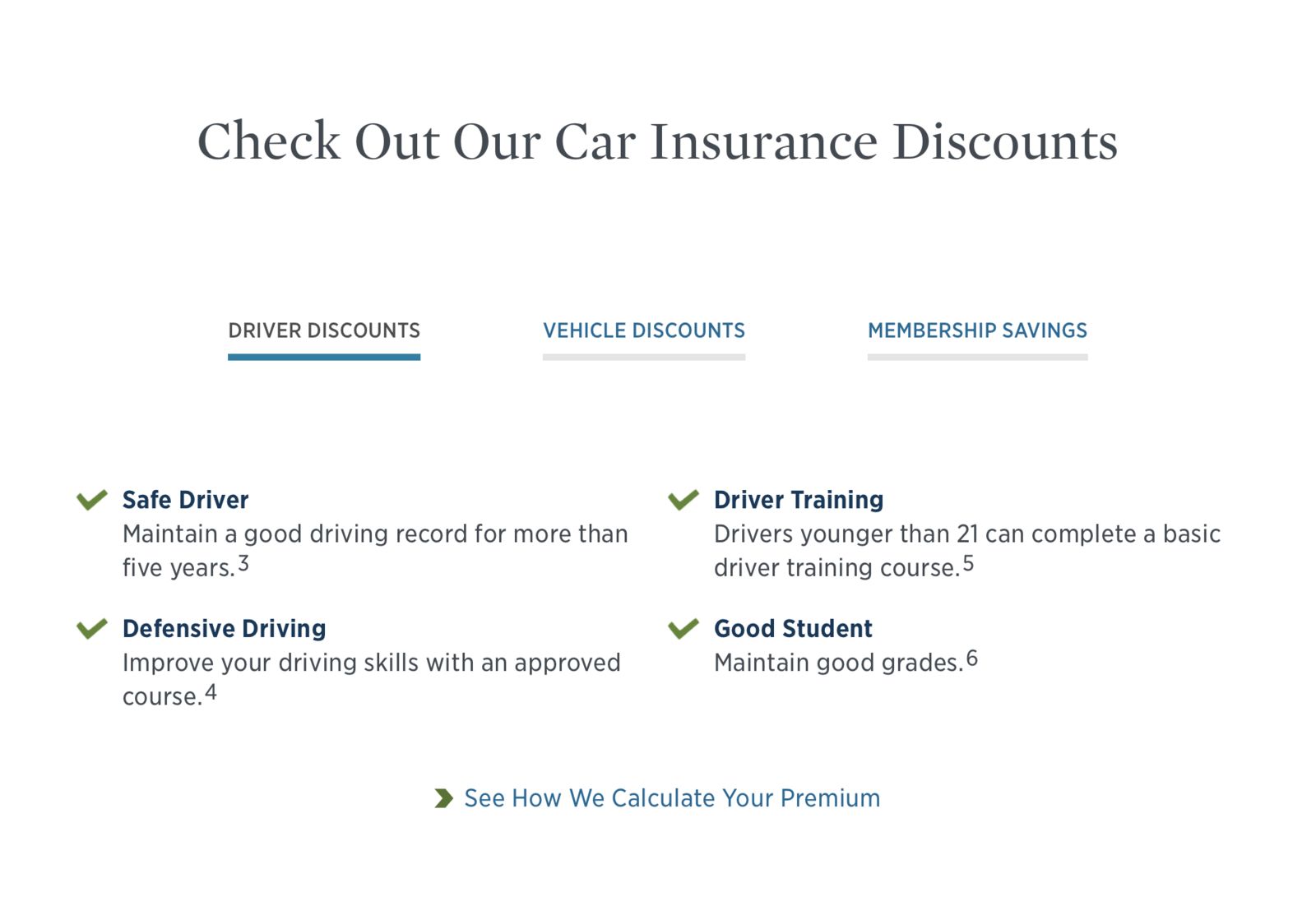

Step #8 – Check Out Discounts

Any discounts you qualify for, such as multiple-policy car insurance discounts, will automatically be applied to your quote.

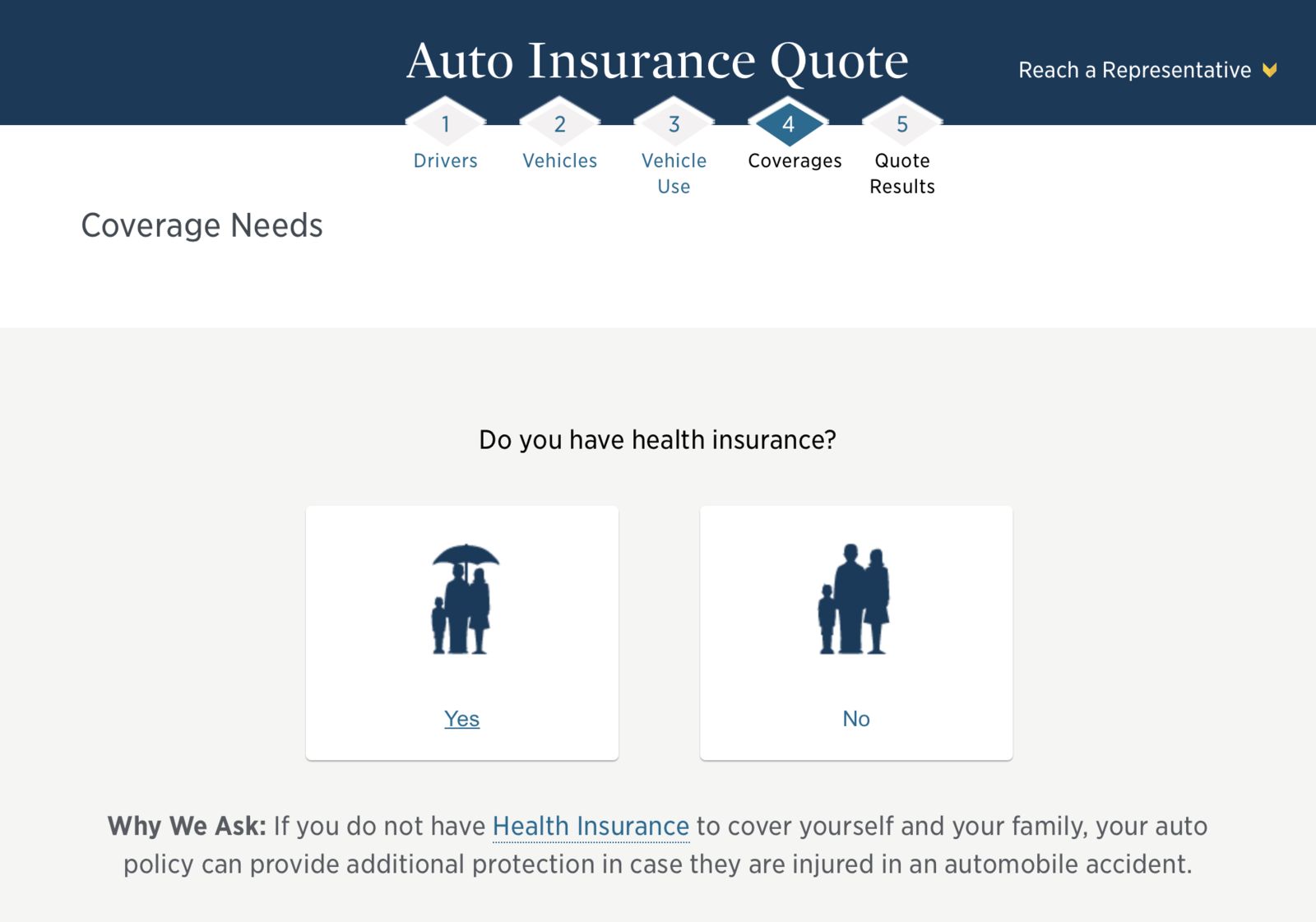

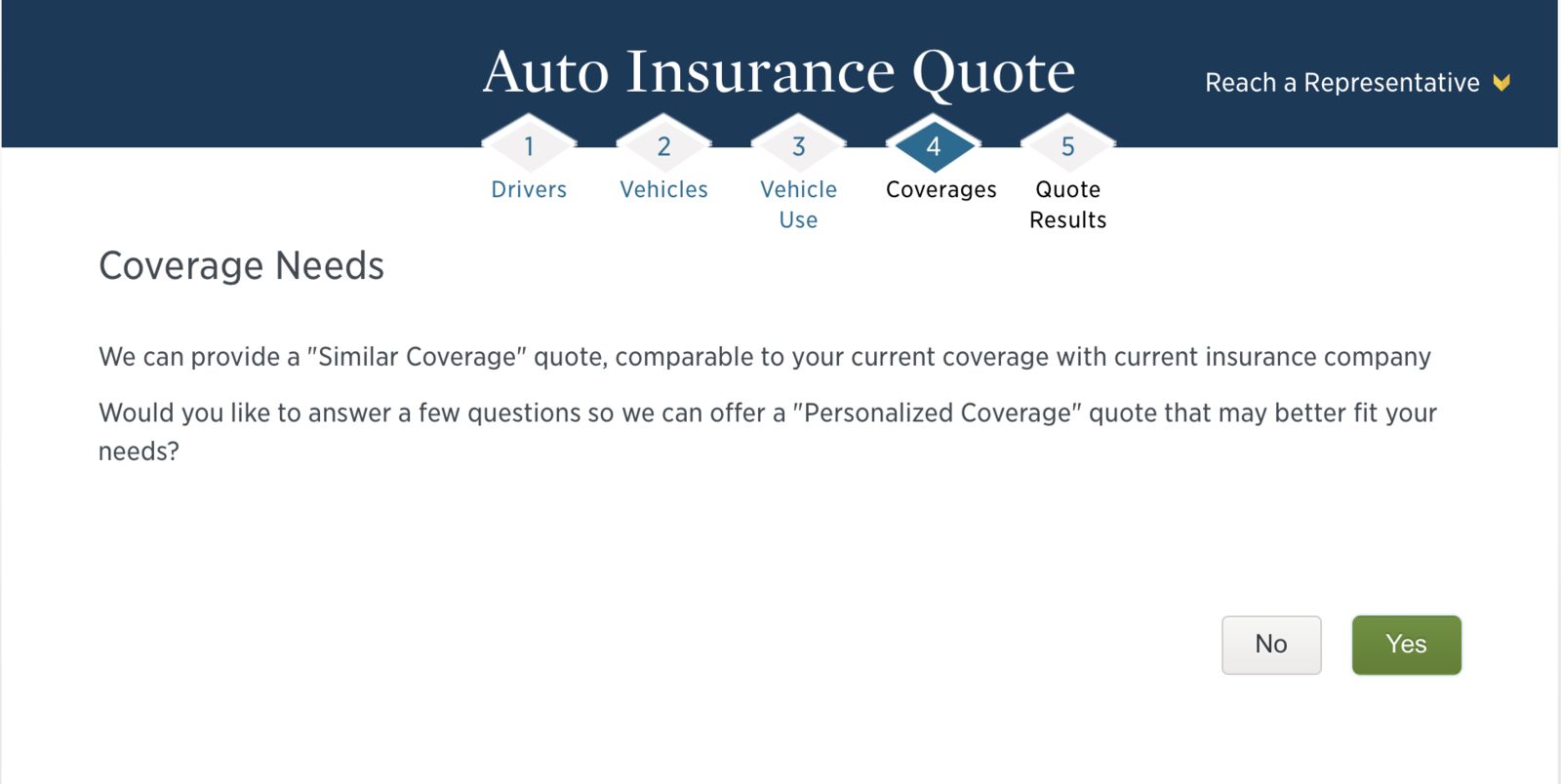

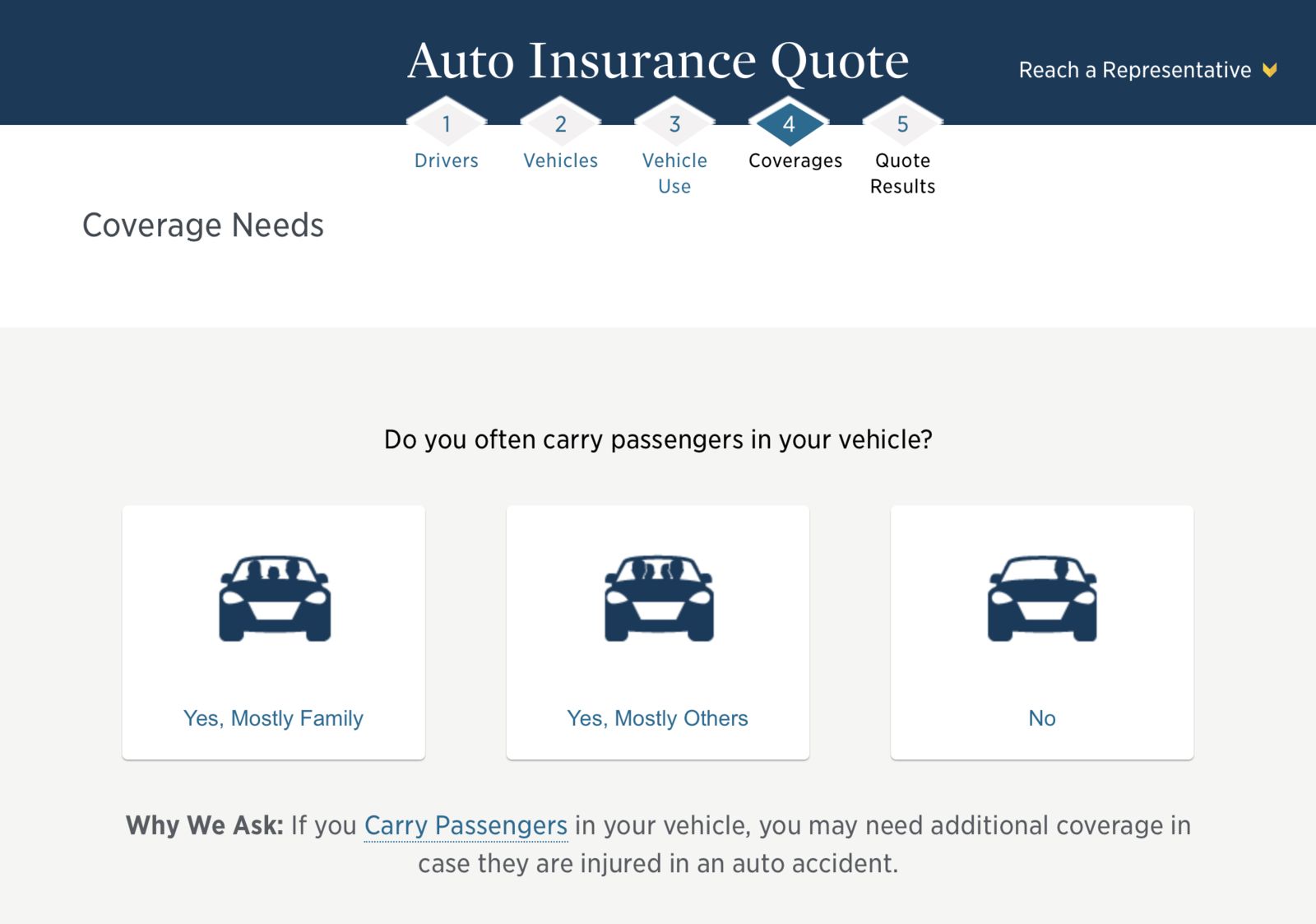

Step #9 – Review Your Coverage Needs

We recommend using this walkthrough to assess your coverage needs and personalize your quote as much as possible. Understanding how to find car insurance coverage requirements in your state helps you compare rates accurately and ensures you get the best policy for your needs.

Expanding your coverage options and carefully evaluating each policy allows you to understand the full scope of an insurer’s services, uncover potential savings, and ensure your policy aligns with your specific needs.

Dani Best Licensed Insurance Producer

You can always reduce your auto insurance policy if you add additional coverage. Still, it’s a good idea to go into the shopping process looking for precisely what you need, not avoiding coverage options to salvage a few dollars.

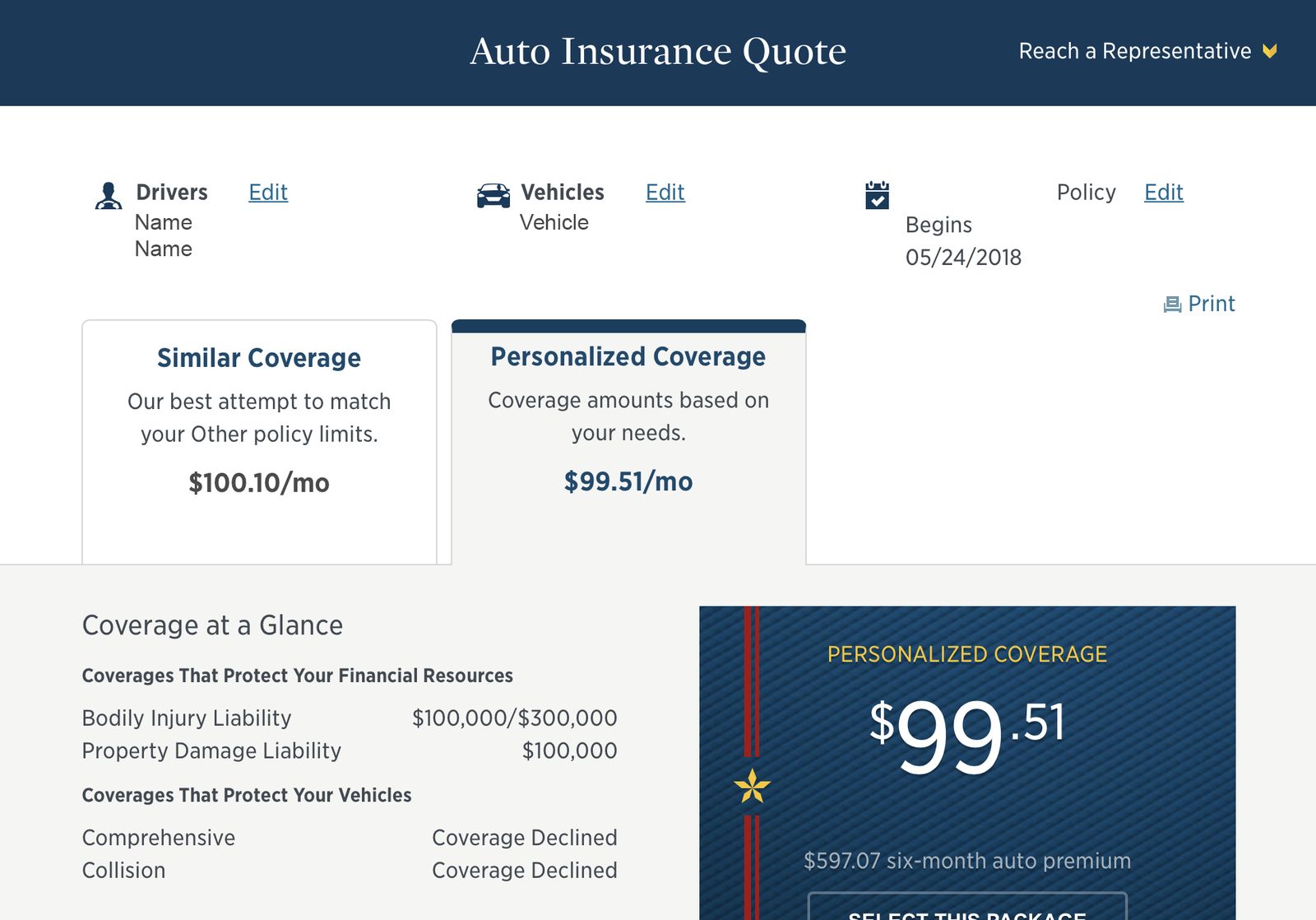

Step #10 – Get Your Quote

Please take note of these rates and keep them somewhere you can quickly return to eat them before you must test several other quotes online and compare them to find the best deal.

Read more: How do you get a Liberty Mutual car insurance quote online?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

USAA Car Insurance is Exclusively for Military Members

USAA was founded for active-duty military officers, but its eligibility requirements have changed. To purchase most of its insurance products, you still have to be in the military or related to someone who is or has been.

If you or your parent or spouse are not a service member or veteran, you won’t qualify for a USAA membership. However, you can still compare military personnel car insurance rates with other providers to find the best options available.

Comparing USAA Car Insurance Quotes: Rates and Discounts

USAA auto insurance is the first choice for military personnel and their families. It offers competitive rates for various needs.

USAA Car Insurance Quotes: Rates and Discounts Comparison

| Category | Young Drivers (16-25) | Middle-Aged Drivers (26-45) | Senior Drivers (65+) | Military/Active Duty |

|---|---|---|---|---|

| Minimum Coverage | $70 | $55 | $50 | $45 |

| Full Coverage | $120 | $90 | $80 | $75 |

| With One Accident | $140 | $110 | $100 | $95 |

| With One Ticket | $130 | $100 | $90 | $85 |

| Discount (Bundling) | 25% | 25% | 25% | 30% |

| Safe Driver Discount | 10% | 10% | 10% | 15% |

| Military Discount | N/A | N/A | N/A | 15% |

Their quotes generally include unique discounts, such as savers for safe drivers, policy bundling, and vehicles with extra safety features. Customers, including eligible veterans, may save up to 10% on premiums by comparing USAA rates with other providers, taking advantage of options like best disabled veteran car insurance discounts.

USAA also provides individuals with customized recommendations based on personal coverage to ensure each member gets the best value. Obtain the USAA online quote tool to compare their insurance rates and discounts for savings opportunities.

Case Studies: USAA Car Insurance Quotes in Action

Find out how USAA car insurance quotes work in real-life situations. These case studies will demonstrate how users went through the process, accessed discounts, and got customized coverage online. Get practical insights on how to get the most out of your USAA car insurance quote experience.

Case Study 1: Military Family Discount

John and Sarah are a military couple looking for car insurance. They qualify for USAA membership and decide to get a quote. By comparing quotes from other companies, they discover that USAA offers a significant discount for military families, making it the most affordable option for them.

Case Study 2: Accident Forgiveness Benefit

Lisa, a USAA member, had an at-fault accident last year and is concerned about its impact on her insurance rates. She learns about their accident forgiveness benefit when she requests a quote from USAA. After comparing accident forgiveness car insurance, she finds that this coverage ensures her premium won’t increase because of her previous accident, making USAA the best choice.

Case Study 3: International Coverage Advantage

Mark, a military officer, frequently travels abroad for assignments. He needs car insurance coverage that protects him wherever he goes. He discovers that USAA offers global coverage for overseas military members when he compares quotes. This feature gives Mark peace of mind, knowing he is fully protected, no matter where his duties take him.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why You Should Compare Car Insurance Before You Buy

USAA is cheaper than other auto insurance providers because it is the largest insurer of the military community. That volume allows USAA to offer more competitive rates.

In short, USAA is a strong choice for many active-duty servicemen and women, retired military members, and their families. One of the few drawbacks is the company’s online experience.

USAA Auto Insurance – USAA Car and Auto Insurance Quotes Online Sign Up https://t.co/42ZMDumymL pic.twitter.com/LgdnBIndbb

— Fansextra (@Fansextra1) September 21, 2019

Car insurance is an investment in your vehicle and your safety. To ensure you’re inadequately covered, it’s essential to explore your options and see what’s available. A good car insurance company will strike a balance between cost and coverage. If you’re wondering how to upgrade car insurance, avoid settling for the bare minimum, as it may not even meet the legal requirements.

In its 2021 U.S. Property Claims Satisfaction Study, J.D. Power gave USAA a 905 out of 1,000 rating. Enter your ZIP code on our site to get matched with multiple car insurance providers near you so you can compare rates and find the right policy today.

Frequently Asked Questions

How do you get an insurance quote from USAA?

Visit their website or mobile app for car insurance quotes online with USAA. Log in or create an account, enter your personal details and vehicle information, and customize your coverage options to receive an accurate quote tailored to your needs.

Which factors affect USAA Tesla Model 3 insurance?

USAA offers competitive Tesla insurance rates for Model 3 vehicles, with discounts for safe driving and bundling multiple policies. Rates for USAA Tesla insurance may vary based on location, driving record, and selected coverage options.

When are the USAA pay dates?

USAA pay dates depend on your banking type and employer. If you have direct deposit with USAA, funds may be available one to two days earlier than standard pay dates. Knowing how much car insurance coverage you need for a new car is essential when considering your finances. You can quickly get a car insurance quote from USAA to help you determine the proper coverage.

How does USAA compare to Mercury insurance?

USAA often provides lower rates, superior customer service, and exclusive benefits for military members compared to Mercury Insurance. However, Mercury may offer competitive options in states where USAA has limited availability.

Does USAA offer cheap car insurance?

USAA is known for its affordable car insurance, especially for military members and their families. Discounts such as multi-policy, safe driver, and vehicle storage make rates more affordable.

Are you looking for lower USAA car insurance rates? Enter your ZIP code below to compare car insurance quotes online at USAA and find the best coverage for your budget.”

How can I use the car insurance calculator that the USAA offers?

How do I contact USAA customer service?

USAA customer service can be reached at 1-800-531-8722. You can also contact them via their website or mobile app for assistance with policies or claims.

How does USAA compare to Infinity Insurance?

USAA generally offers better rates, coverage options, and customer satisfaction for military families, while Infinity Insurance may be a better fit for non-military customers in certain regions.

How do I get a USAA motorcycle insurance quote?

You can obtain a motorcycle insurance quote from USAA by visiting their website or calling customer service. Provide your bike details and coverage preferences for a tailored quote. Is basic car insurance coverage-wise? It’s worth considering what level of protection best fits your needs.

Does USAA offer coverage for rebuilt title insurance?”

USAA provides coverage for rebuilt titles, but the policy terms may vary based on the vehicle’s condition and location. Contact USAA for specific requirements.

What is the USAA insurance quote phone number?

What is the USAA rental car discount code?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.