Best Henderson, NV Car Insurance in 2025

The average Henderson car insurance rates are $78/mo. Henderson car insurance must meet the 15/30/10 minimum liability coverage requirements in Nevada.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Henderson requires vehicle insurance in accordance with Nevada state law

- There are many national companies that are authorized to sell insurance in Nevada

- There are many factors that go into the determination of your car insurance premiums

- Compare prices, coverage, and discounts to decide which insurance company is right for you

Quotes for car insurance in Henderson, Nevada can be found quite readily for reasonable prices, but one must first do some research.

Insurance policies are based on many factors that include age and driving record. Not all policies can be expected to have the best price and coverage for you. So, if you want to get a good price and good coverage, car insurance research will offer some options for you.

Use our ZIP code comparison tool to save the most money possible on car insurance! We will help you find Nevada coverage for car insurance that fits Henderson’s requirements!

Henderson Auto Insurance Rates

Two different types of car insurance rates are often discussed when looking at the expenses of car insurance. You have the overall premium that includes the full price paid for insurance coverage. This can be expressed as a monthly amount or a yearly amount.

There is also the minimum required liability insurance. This number will always be lower and is usually set by law.

- The premium cost, when averaged in 2013, for Nevada was about $936.

- The cost for collision insurance was about $285.

- The cost for comprehensive was about $155.

- The basic liability cost was $648.

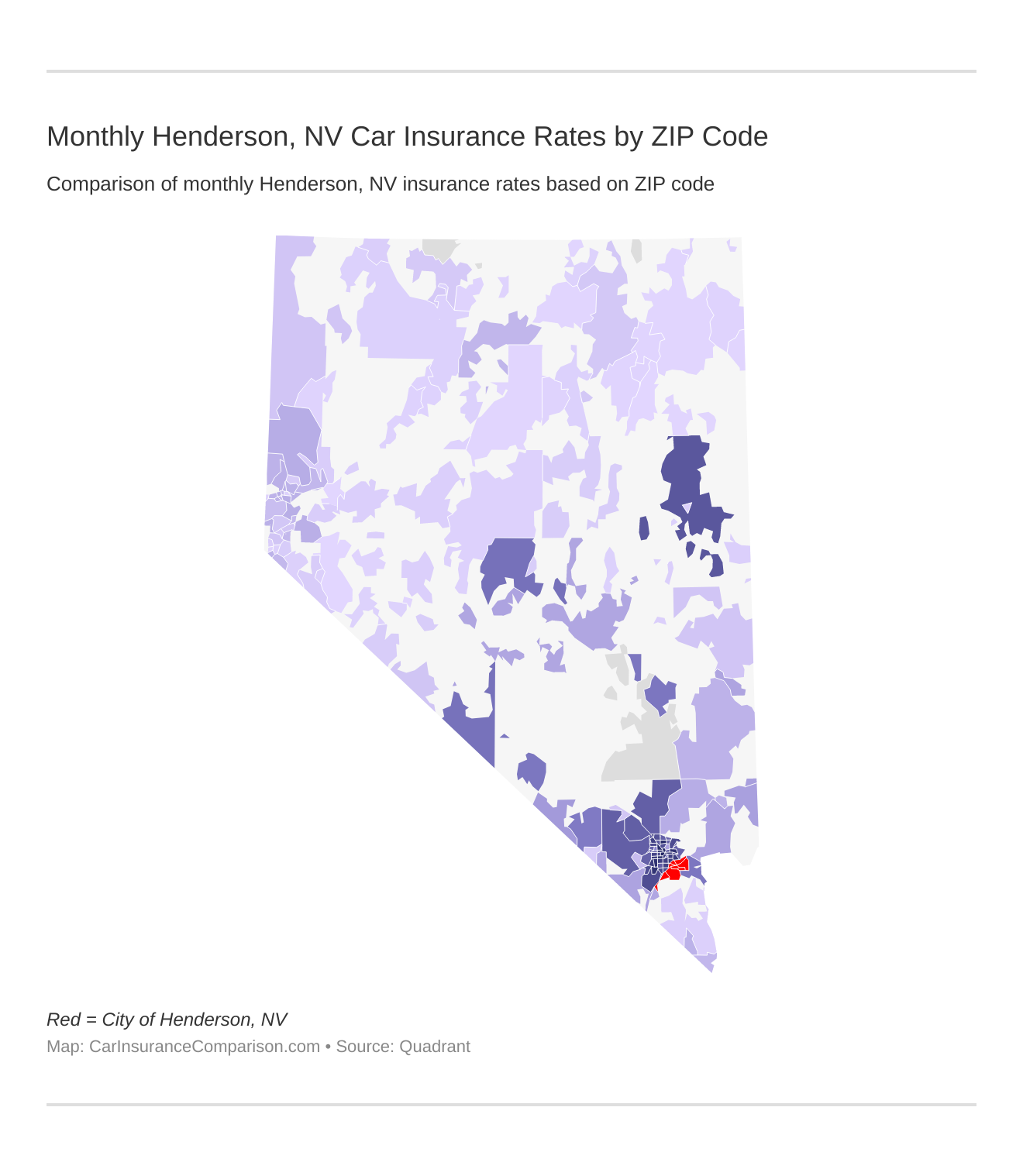

Monthly Henderson, NV Car Insurance Rates by ZIP Code

Find more info about the monthly Henderson, NV car insurance rates by ZIP Code below:

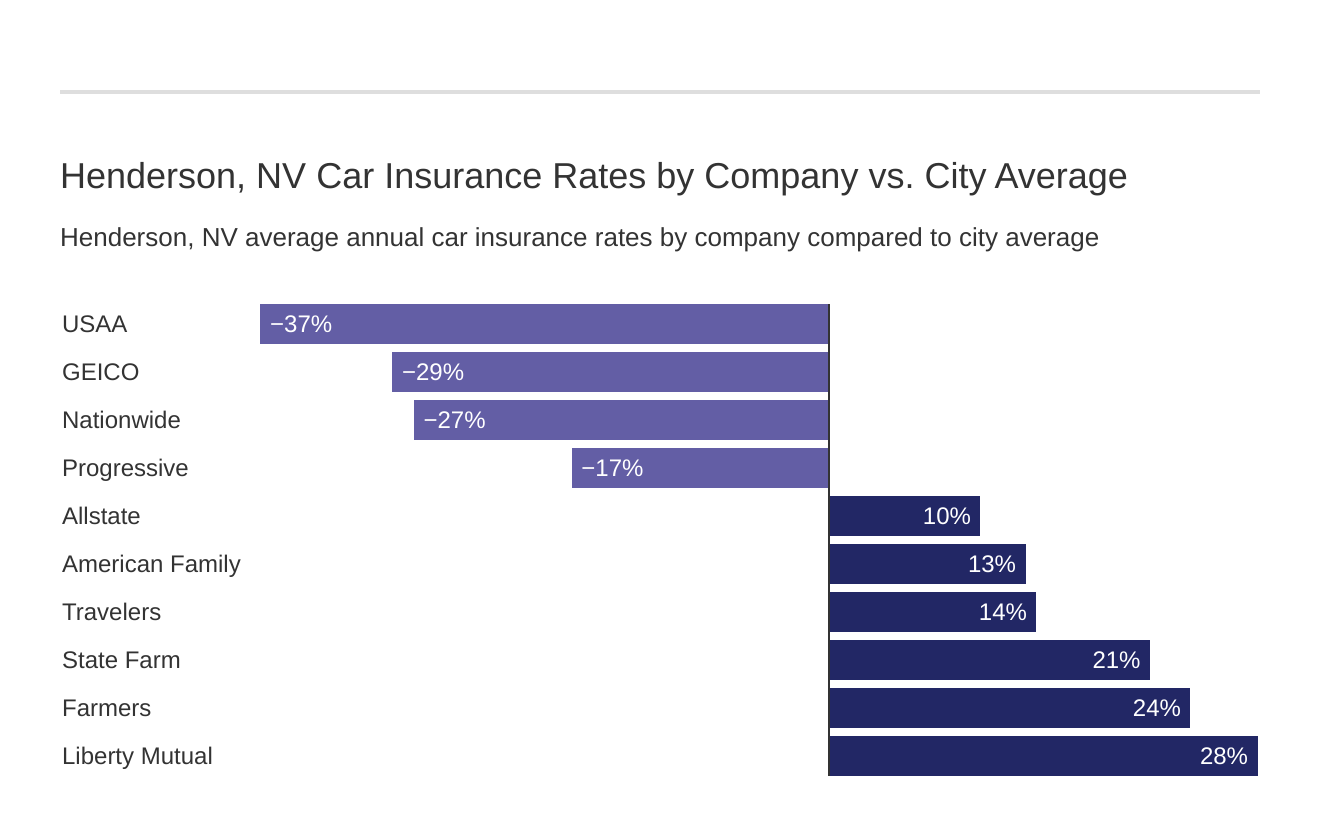

Henderson, NV Car Insurance Rates by Company vs. City Average

The cheapest Henderson, NV auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Nevada auto insurance company rates?” We cover that as well.

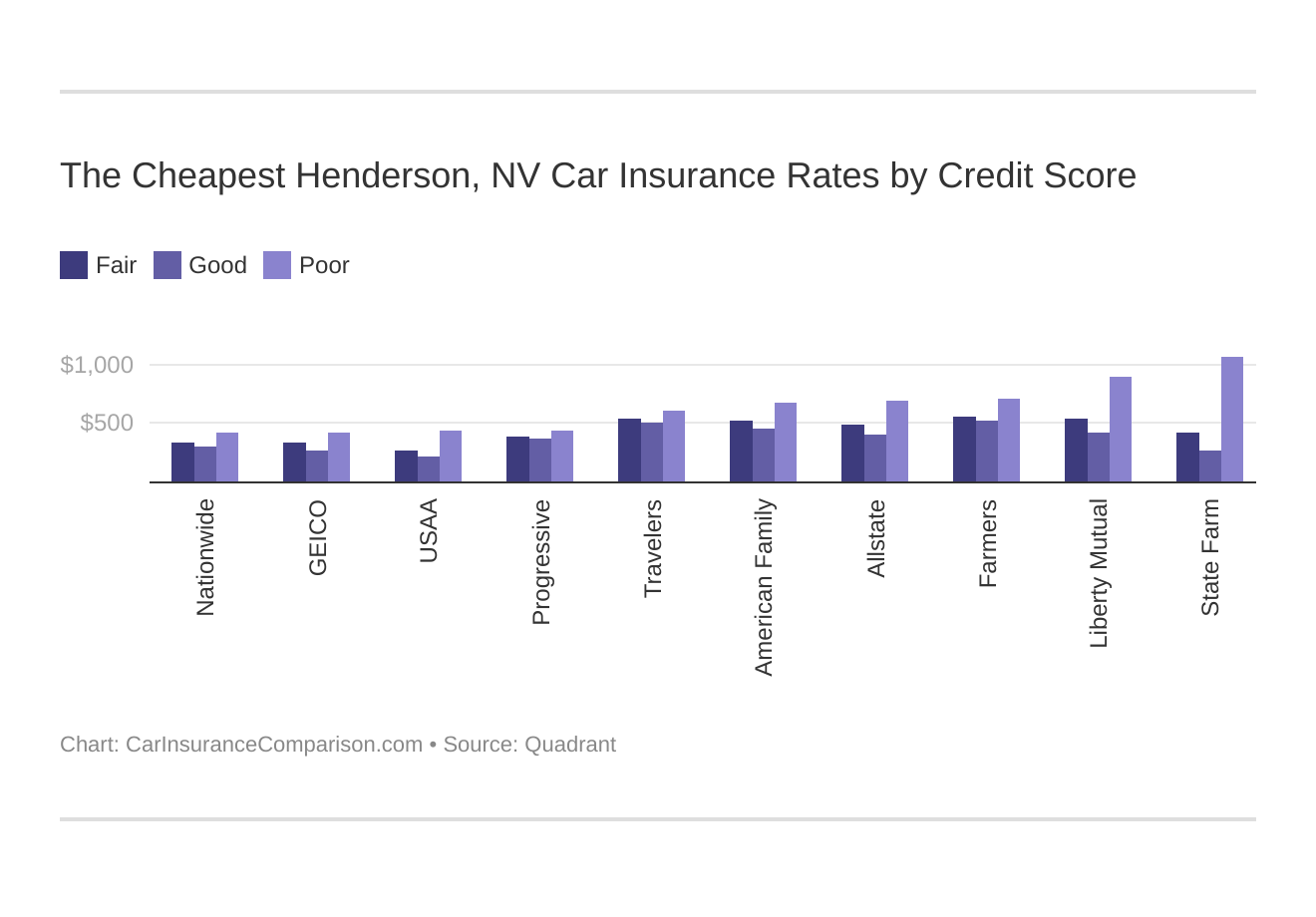

The Cheapest Henderson, NV Car Insurance Rates by Credit Score

Your credit score will play a major role in your Henderson, NV auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Henderson, Nevada auto insurance rates by credit score below.

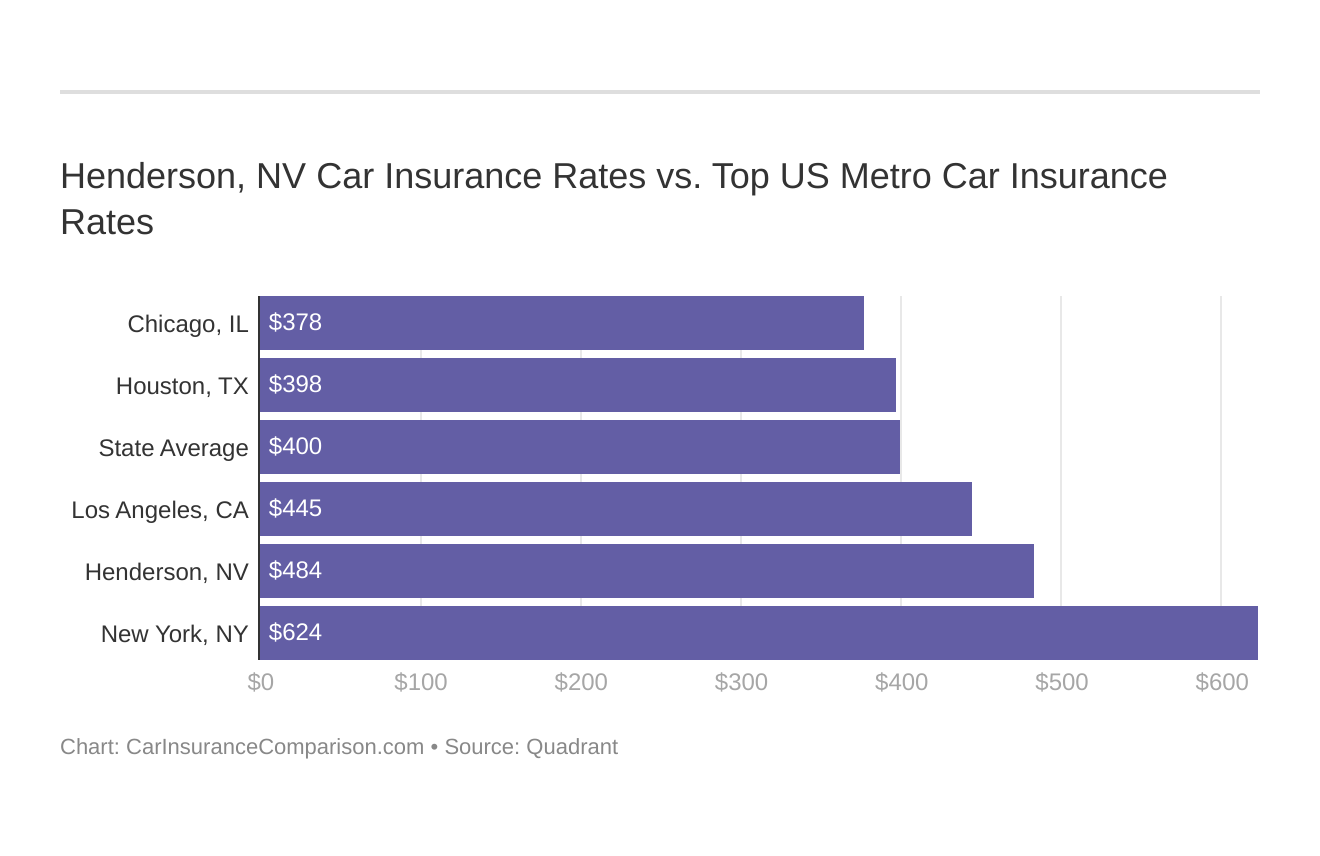

Henderson, NV Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Henderson, NV against other top US metro areas’ auto insurance rates.

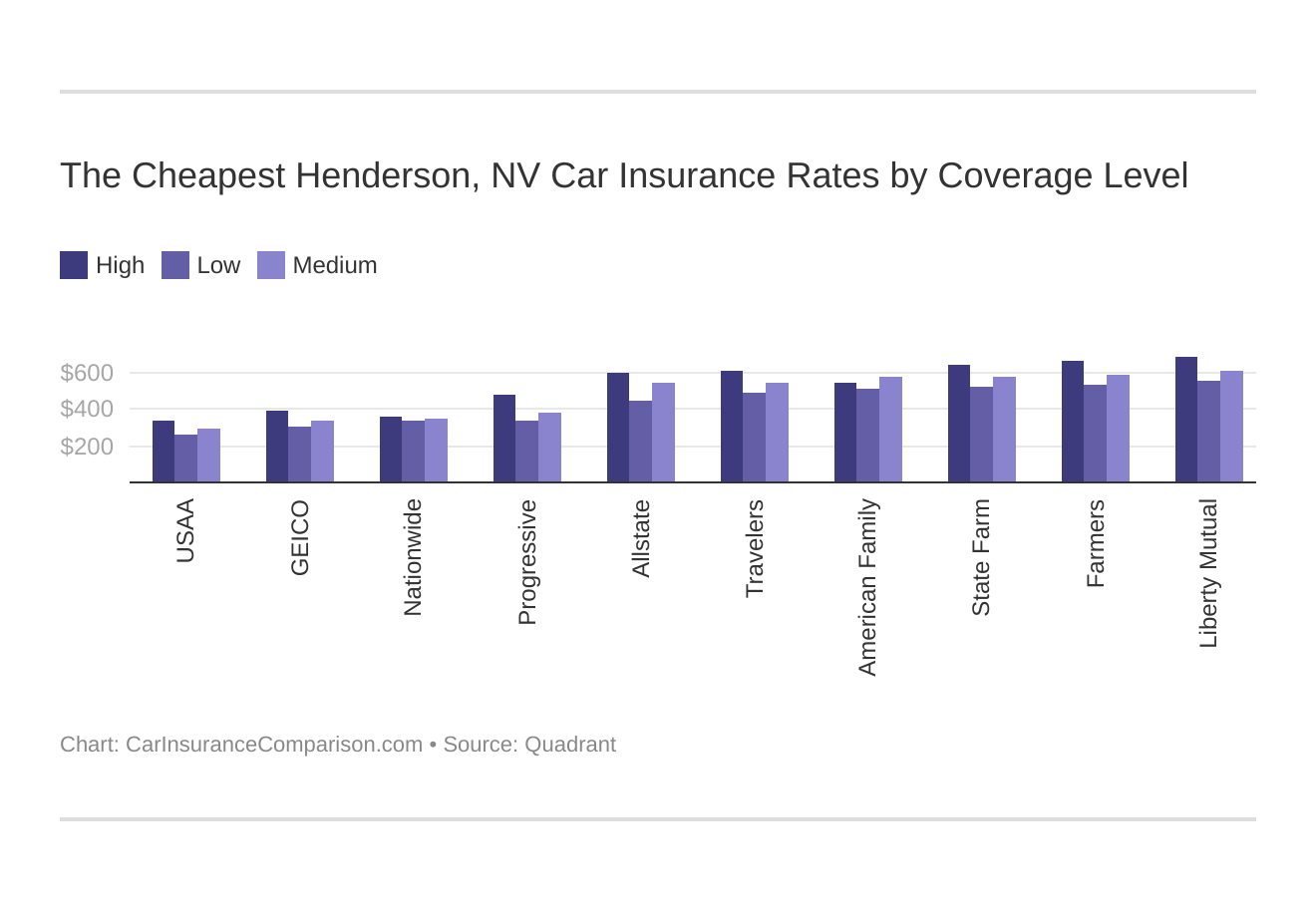

The Cheapest Henderson, NV Car Insurance Rates by Coverage Level

Your coverage level will play a significant role in your Henderson, NV auto insurance rates. Find the cheapest Henderson, Nevada auto insurance rates by coverage level below:

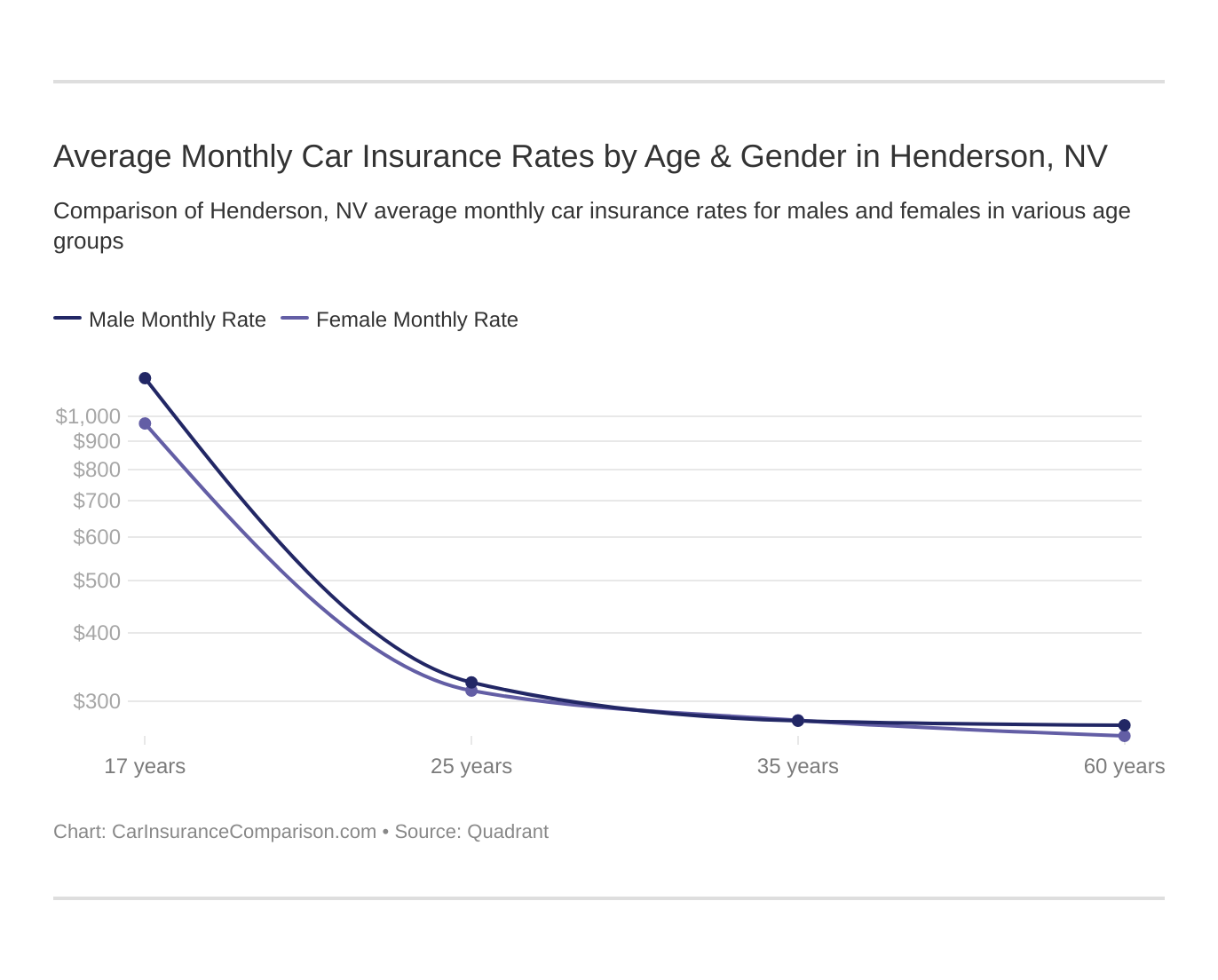

Average Monthly Car Insurance Rates by Age & Gender in Henderson, NV

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Henderson. Nevada does use gender, so check out the average monthly auto insurance rates by age and gender in Henderson, NV.

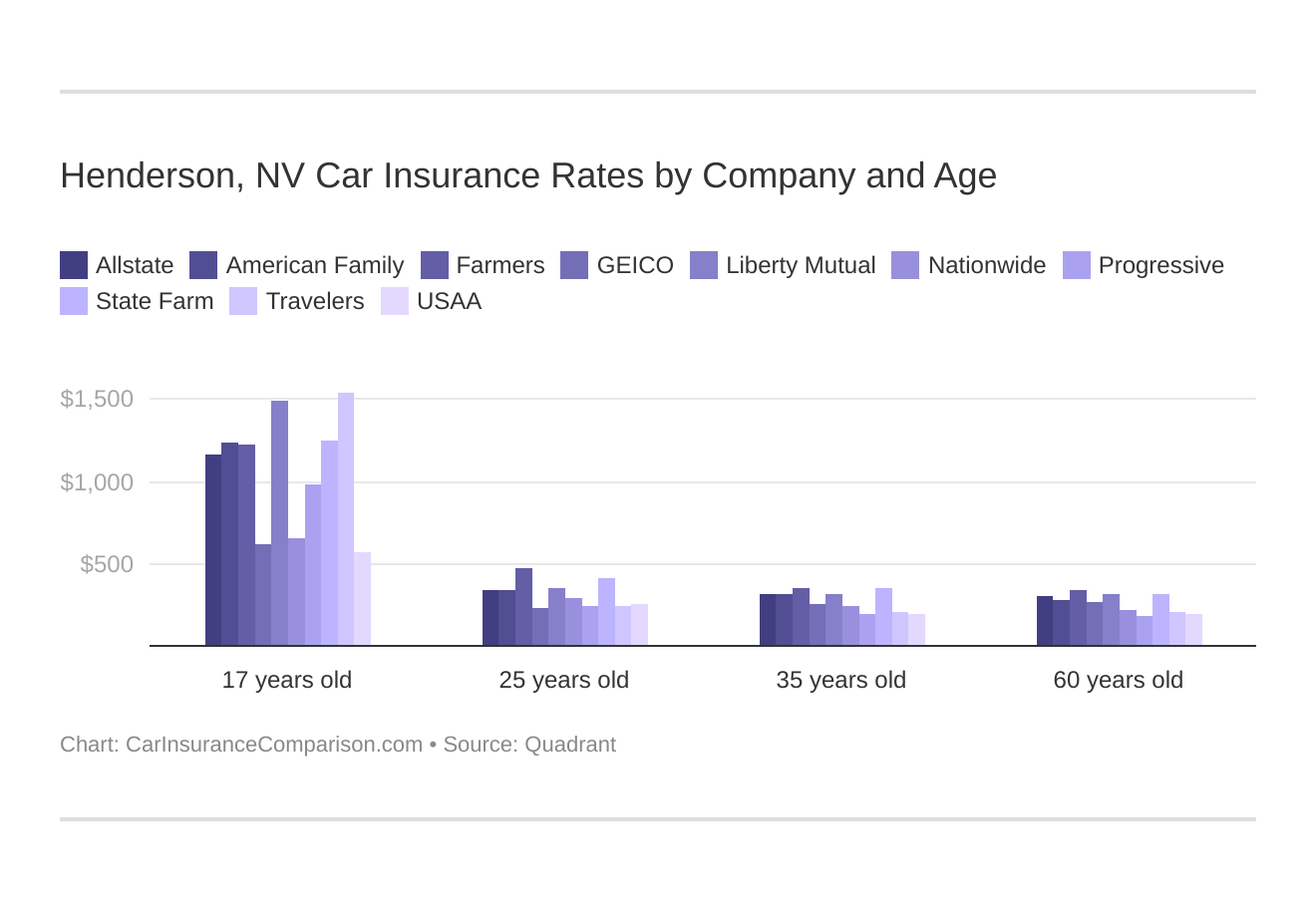

Henderson, NV Car Insurance Rates by Company and Age

Henderson, Nevada auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

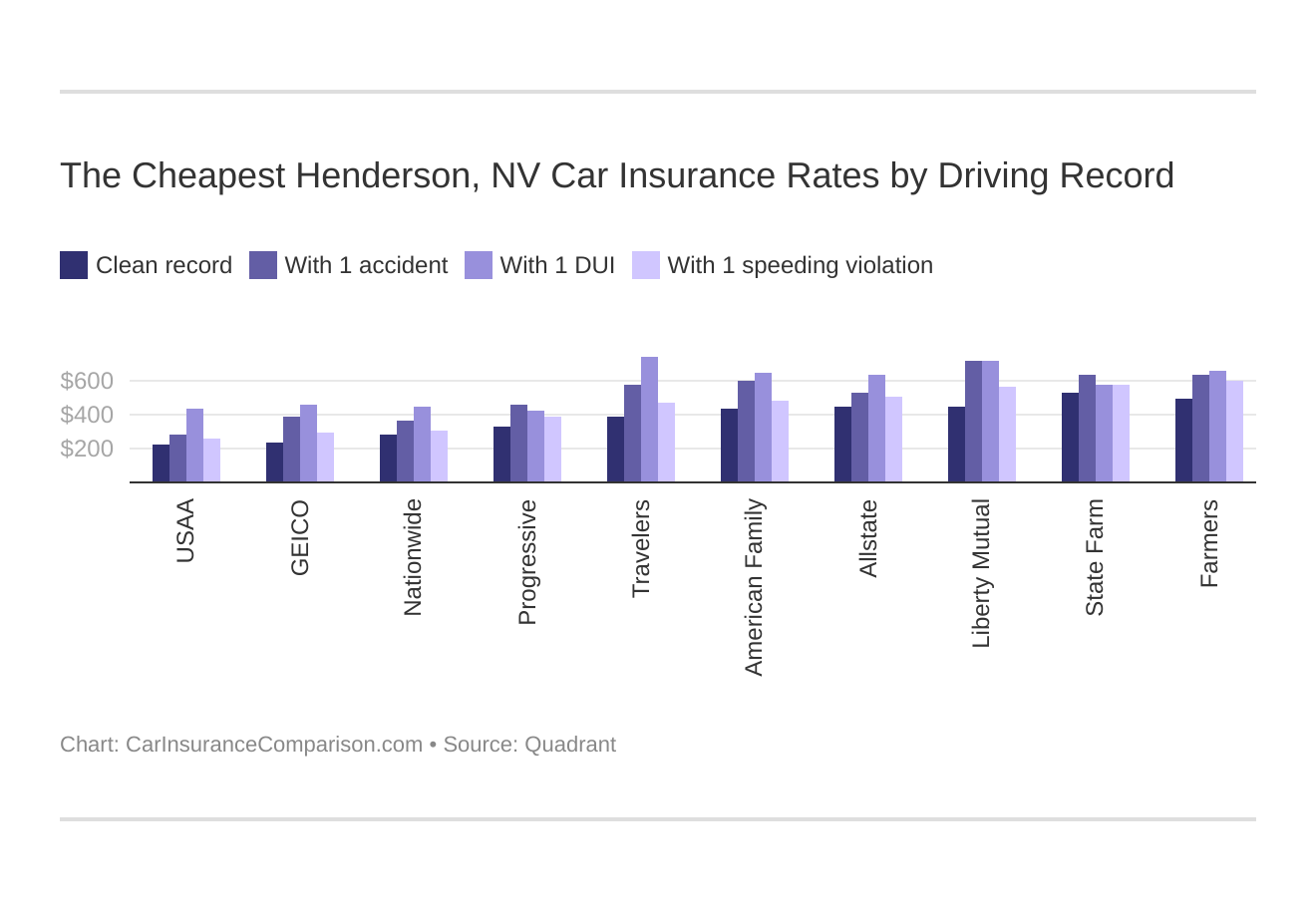

The Cheapest Henderson, NV Car Insurance Rates by Driving Record

Your driving record will affect your Henderson auto insurance rates. For example, a Henderson, Nevada DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Henderson, Nevada auto insurance rates by driving record.

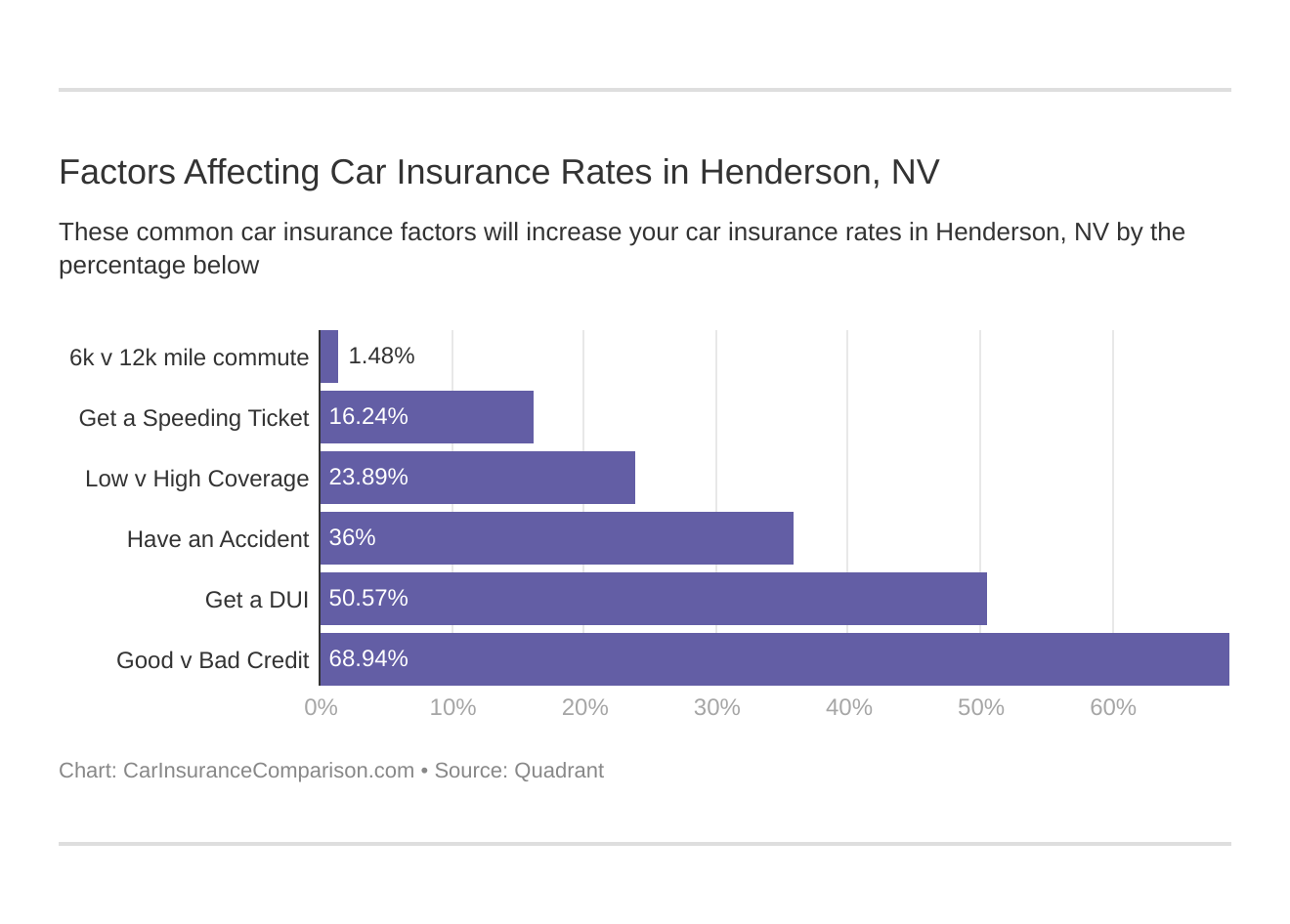

Factors Affecting Car Insurance Rates in Henderson, NV

Factors affecting auto insurance rates in Henderson, NV may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Henderson, Nevada auto insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Facts about Henderson

Henderson is the second largest Nevada city after Las Vegas with a population of about 260,000. Although the city has very little water of its own, the population has been rising steadily for decade after decade.

The demographics include about 70% White, 12% Hispanic, 6% Black, and 9% Asian.

People originally came in large numbers to mine magnesium. Now, they come because it is one of the top 50 livable cities in the USA as well as one of the best places for walking. Henderson, Nevada has some of the best walking trails in all of the United States.

Even though there are some of the best walking trails in Nevada, people still need to drive places, so still need insurance.

Liability Insurance at a Glance

Most states have a minimum set amount for liability coverage. This is considered the coverage that all people operating a motor vehicle on the roads must have. Henderson minimum car insurance coverage is governed by Nevada laws which require:

- $15,000 to cover injury/death per single person per accident

- $30,000 to cover injury/death for two or more persons per accident

- $10,000 to cover destruction of property of others

This is called liability insurance. There are other types of insurance available and they will affect your premium cost. Some other popular insurance types include:

- Collision

- Comprehensive

- Theft

- Fire

Henderson Drivers Under the Microscope

Check out these Henderson, Nevada statistics:

- Since 2005 auto thefts have been decreasing yearly.

- Henderson experiences less crime than the national average.

- In 2013, there were 7 fatal accidents in the Henderson.

- These accidents involved 10 vehicles

- Of these accidents, 3 involved alcohol

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Henderson Law is Nevada Law

Henderson, Nevada follows the laws of the Nevada state system. These car insurance rules are sometimes strict when compared with those of other states, so a word of warning is required.

You must not let your car insurance expire. If you do, you may be subject to a $250 fine to reinstate it. You may also lose your registration.

Particulars of the Law

Here are some further details worth knowing:

- If you have some time left on your registration when selling a vehicle, sometimes this credit can be transferred to a new vehicle.

- If you have stopped using your vehicle and you don’t want to pay for insurance anymore, your registration must be canceled first.

- If you have personalized plates, these can be used on your new vehicle if you so desire.

- Upon selling your vehicle, first, remove the plates then cancel your registration.

Are you covered?

When you are asked for insurance proof by an officer of the law, you must provide it. If your insurance is from another state, but your car is registered in Nevada, your coverage will not be considered valid.

Furthermore, there are laws which govern the cancellation of your insurance and regulate registration. Know the details of your policy and what your car insurance covers!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Companies Licensed to Operate in Henderson

Companies such as AAA Insurance, Allstate Insurance, Farmers Insurance, Geico, Liberty Mutual, State Farm Insurance, Travelers and more are all licensed to sell you car insurance.

However, not all of the policies offered are the same. It is important to note that different companies may specialize in different types of policies.

These policies may favor students, or the elderly, or frequent drivers.

You must be able to take a few notes and comparison shop knowing that you may get good coverage and a high rate from one company and poor coverage and a low car insurance rate from another company.

There are no standards set except for the liability coverage as dictated by the state laws.

Hundreds of Agents

Agents are paid to sell car insurance. You will find hundreds of them if you search. They can be very helpful to see what is available for you, but they are not always completely objective.

These agents are paid on a commission basis and they don’t represent every policy available.

Although they may be able to provide you with thousands of different policies, they are only human and can only specialize in a few companies and a few policies.

Even if they use a computer to search, there are things that they will not know about and may skip over. Because of this, diligence is that much more important on your part.

There may be many agents clamoring for your business, but not all will have what is best for you. You must take some notes and do some comparison shopping to ensure a good deal.

Geography Matters

Local Henderson driving statistics may have little effect on your rates, or they may have a major effect. Sometimes your insurance rates will be higher in one zip code as compared with another. This has no relationship to the safe driving habits of any single driver.

If your car is among the most stolen in the nation, (which include the Honda Accord, the Honda Civic, and the Toyota Camry) cost for theft insurance will certainly be higher than for other vehicles.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Why is my quote so high?

Look at your factors such as:

- driver age

- driver credit standing

- driver driving safety record

- driver marital status

- driver gender

- driver driving habits

- driver zip code

- type of vehicle

- vehicle usage

Factors Cost Money

The above factors and more will be part of your search for the proper policy. These factors are used by the car insurance companies to set prices and create policies for drivers like you. Once you understand your category as a driver, you will be able to negotiate a better policy.

Being aware of your strong points as well as your weak points can help the agency or provider give you a better deal. One area may penalize you where another area may provide a discount.

Henderson Auto Insurance Rates Comparison

Although some of this information can be confusing and a bit tedious, it is not too complicated that the average shopper cannot get a better policy and price.

Visit several agencies and get to know the rates and standard policies. It is imperative to take notes and compare the rates offered from one company to the next and one agency to the next.

Although the agent may be friendly and happy to help you, it is your responsibility as a good shopper to compare the details of the car insurance rates being offered.

All policies are not the same and once you become familiar with the market, you can feel more comfortable making a decision.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

A Final Note of Advice

Making the proper decision is not only a matter of saving money. It is much more than that. If there is a mishap on the road and you or others end up needing this coverage, you will feel satisfied that you thought it through and made the best decision you could make.

Otherwise, insurance coverage may not help you at all if the wrong coverage is purchased and an accident happens. Let us help you find car insurance with our ZIP comparison tool! Enter your ZIP and begin comparing TODAY!

Frequently Asked Questions

What are the average car insurance rates in Henderson, NV?

The average car insurance rates in Henderson, NV are around $78 per month, meeting the minimum liability coverage requirements of 15/30/10.

How can I compare car insurance rates in Henderson?

You can compare car insurance rates in Henderson by using our free quote tool. Enter your ZIP code to get quotes from top companies and find the best coverage at the best price.

What factors affect car insurance rates in Henderson, NV?

Factors such as age, driving record, credit score, coverage level, and location can affect car insurance rates in Henderson, NV. Understanding these factors can help you negotiate a better policy.

What are the minimum liability coverage requirements in Henderson?

In Henderson, NV, the minimum liability coverage requirements are 15/30/10, which means $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $10,000 for property damage.

What should I know about car insurance laws in Henderson?

Car insurance laws in Henderson follow Nevada state laws. It’s important to maintain continuous coverage, provide proof of insurance when asked by law enforcement, and be aware of the details of your policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.