Best Irving, TX Car Insurance in 2026

Irving, TX car insurance is $4,373/yr or $364/mo on average. However, USAA and State Farm offer the cheapest car insurance rates in Irving, Texas. However, your Irving, TX car insurance quotes vary for each driver based on the company and other factors. Compare multiple Texas auto insurance companies online to find the best rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated November 2024

- Irving, TX auto insurance is $330 more per year than the Texas average

- You can secure cheap car insurance by keeping a good credit score and maintaining a clean driving record

- Vehicle theft has a low effect on car insurance in Irving, Texas

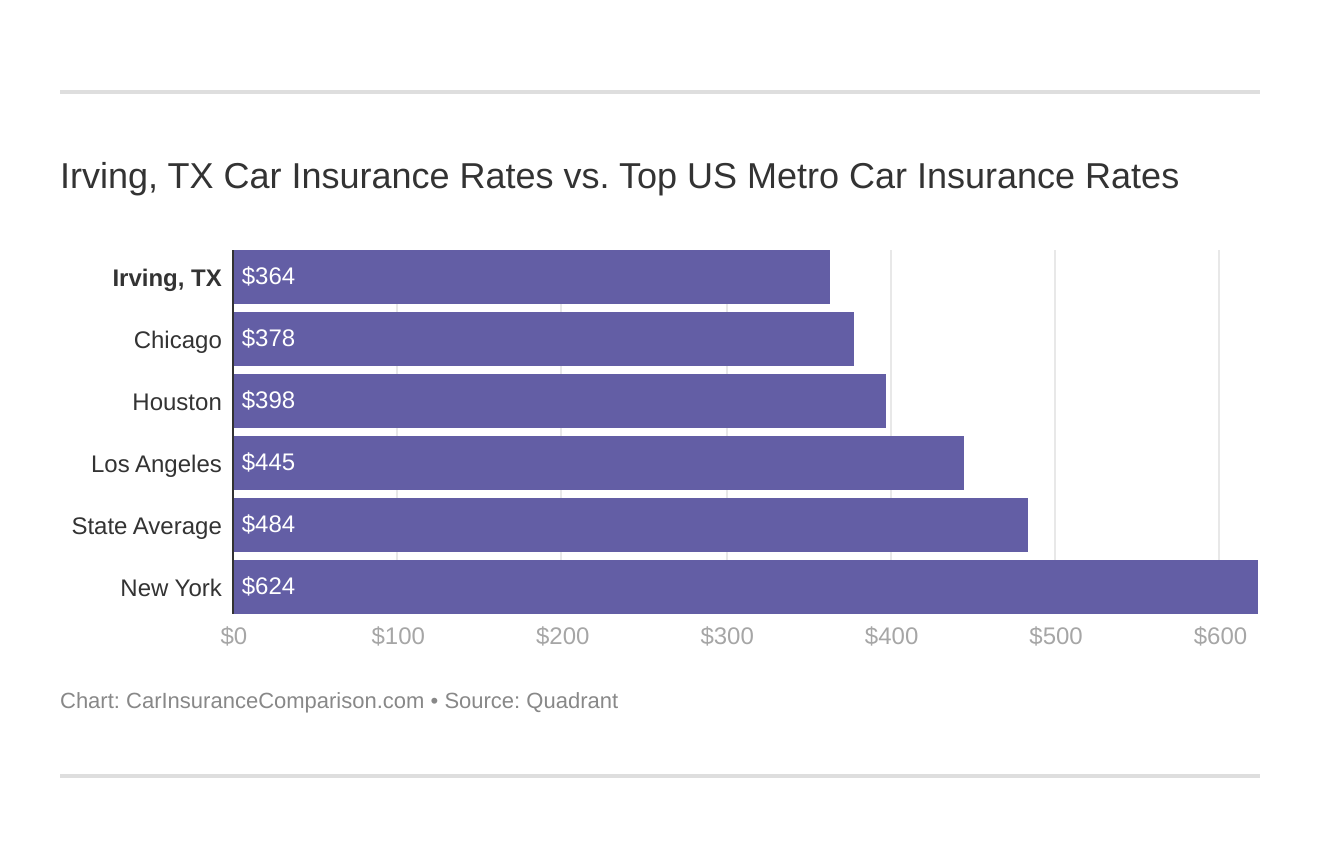

On average, Irving, TX car insurance is $364 per month. However, the Texas car insurance average is $337 per month. Therefore, car insurance in Irving, Texas, is $36 more than the national average.

But why is Irving, TX car insurance so expensive?

Car insurance rates are determined by various factors, including the company you choose, your driving history, and much more. Don’t worry – we’re here to help. Our guide explains how you can get cheap car insurance in Irving, Texas.

Ready to find affordable Irving, TX car insurance? Enter your ZIP code above to get started.

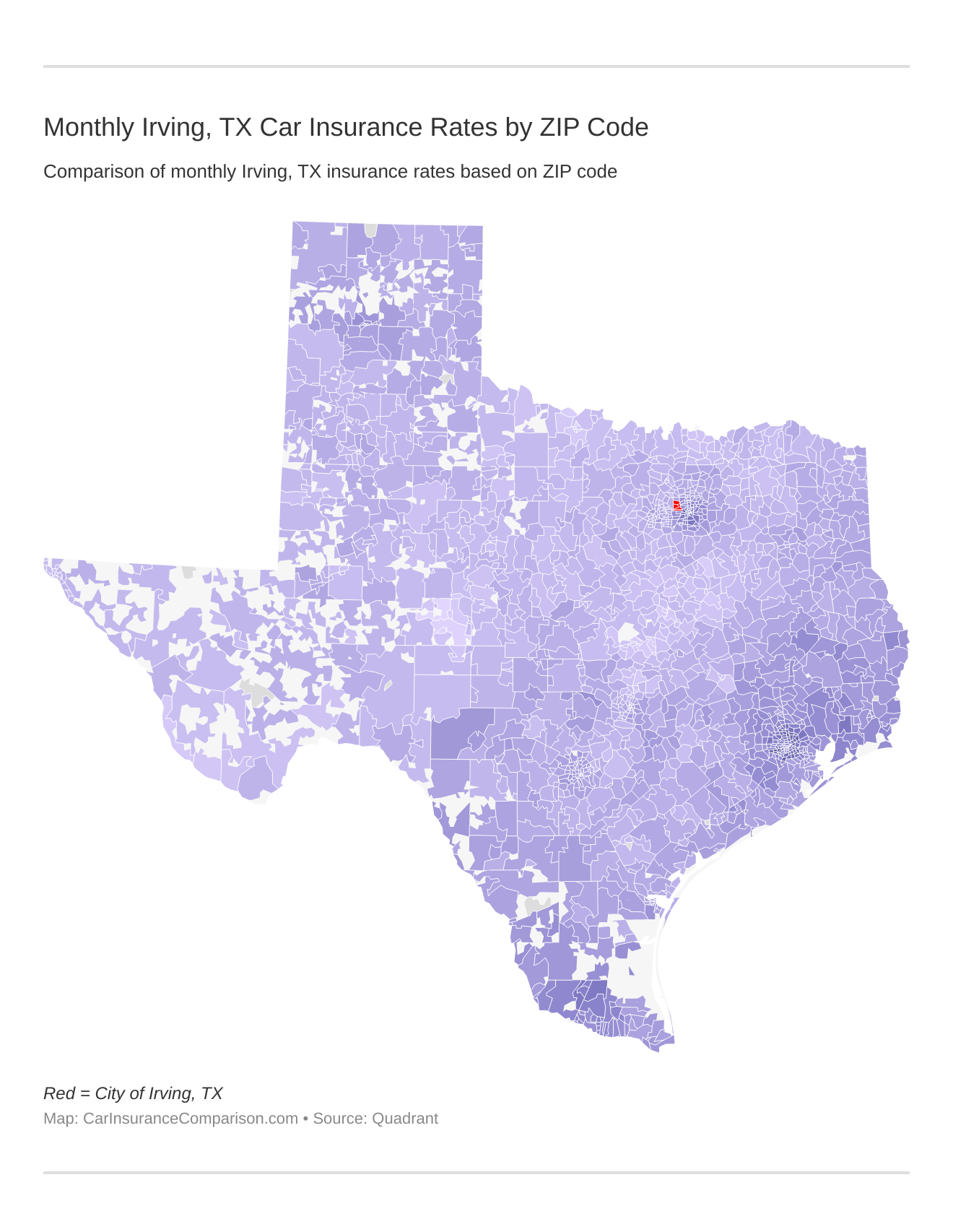

Monthly Irving, TX Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Irving, TX auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Irving, TX Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Irving, TX against other top US metro areas’ auto insurance costs.

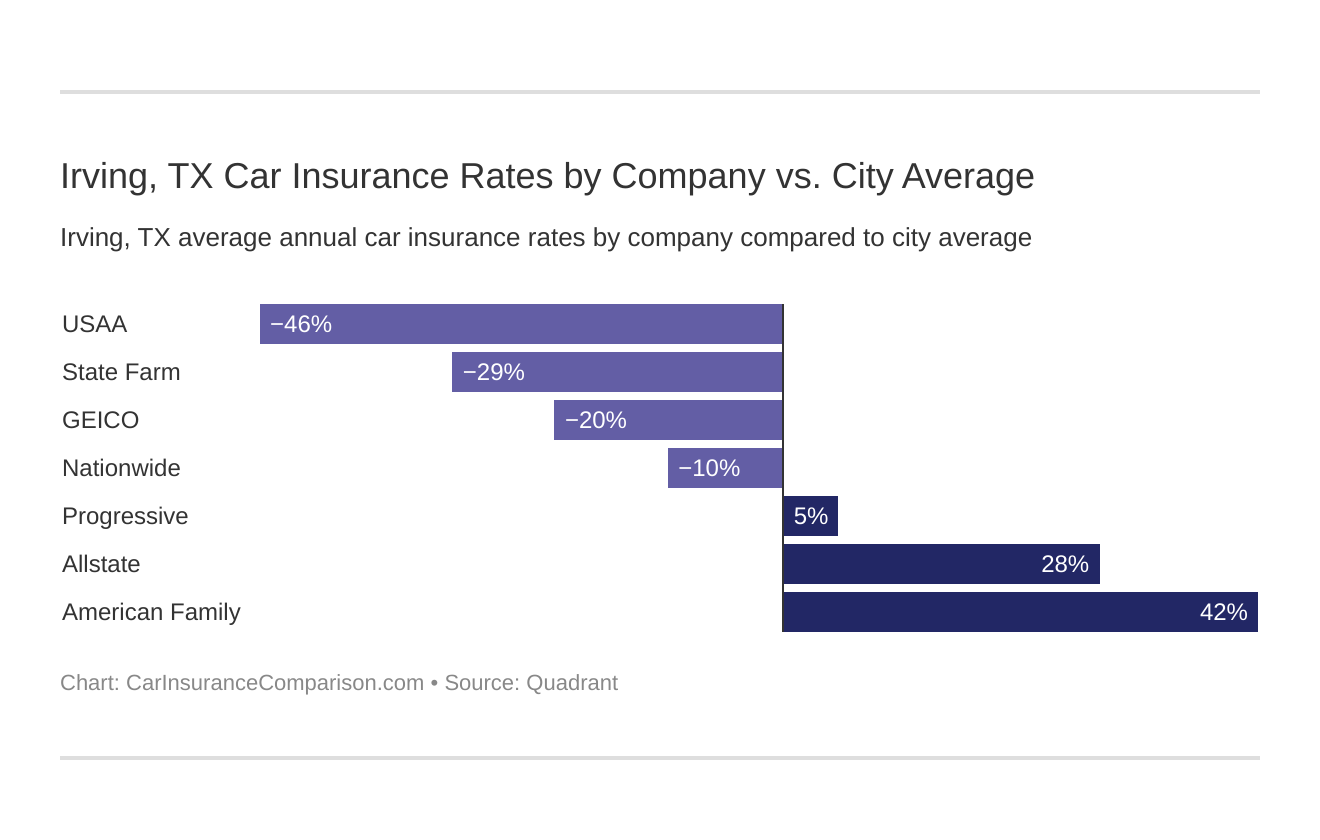

What is the cheapest car insurance company in Irving, TX?

The cheapest car insurance company in Irving, Texas, is USAA. However, USAA is only available for military veterans and their immediate families. The following most affordable companies are State Farm and Geico.

The cheapest Irving, TX car insurance providers can be found below. You also might be wondering, “How do those Irving, TX rates compare against the average Texas car insurance company rates?” We uncover that too.

Here are the best auto insurance companies in Irving, Texas, ranked from cheapest to most expensive:

- USAA car insurance – $2,722

- State Farm car insurance – $3,272

- Geico car insurance – $3,561

- Nationwide car insurance – $3,966

- Progressive car insurance – $4,615

- Allstate car insurance – $5,770

- American Family car insurance – $6,706

USAA, State Farm, Geico, and Nationwide are the only Irving companies with cheaper than average auto insurance rates. However, your car insurance rates will depend on personal factors.

The most significant factor is your driving record. Some car insurance companies provide up to 40 percent off if you have a clean driving record. You can even save money on monthly premiums if your credit history is good.

Another critical factor that determines auto insurance is location. Car insurance companies can base your rates on the neighborhood ZIP code.

So what’s the cheapest neighborhood in Irving, TX? The most affordable ZIP code in Irving, Texas, is 75039, and its average car insurance cost is $515 per month.

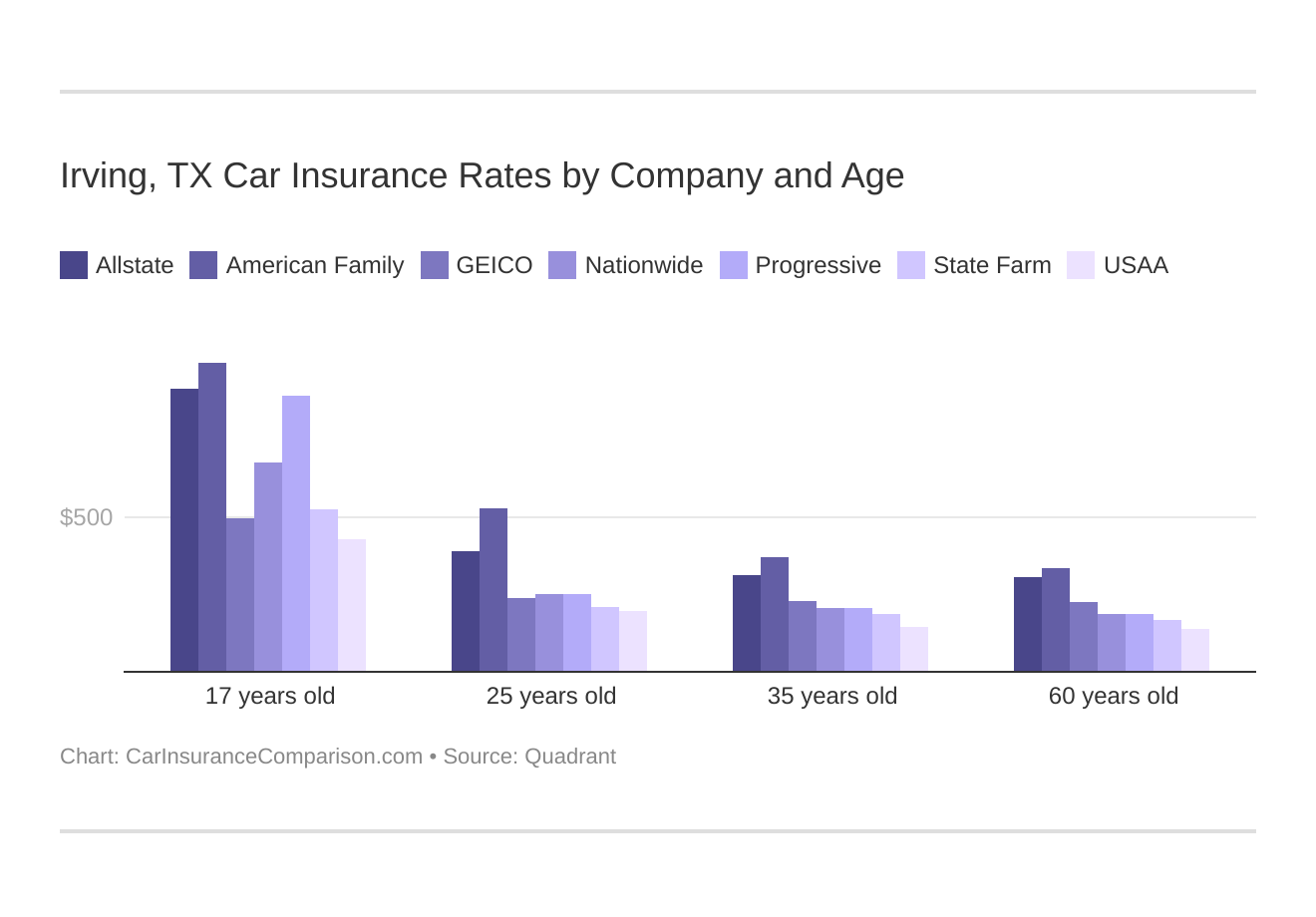

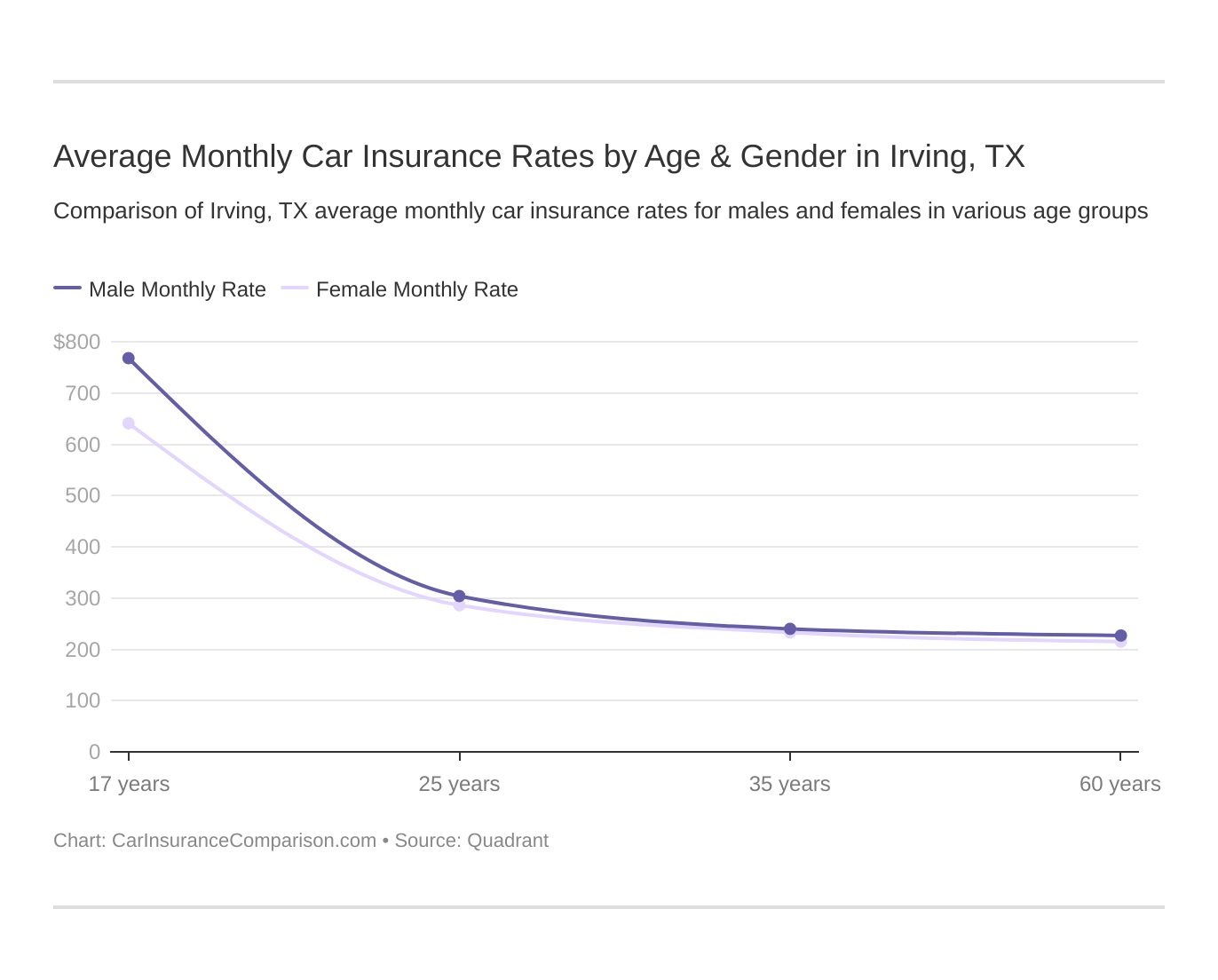

Irving male drivers under 25 may have car insurance rates that are three times more than average. Meanwhile, drivers who are 25 and older will pay $1,000 less at the very least.

Irving, Texas car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

Your coverage level will play a major role in your Irving, TX car insurance costs. Find the cheapest Irving, Texas car insurance costs by coverage level below:

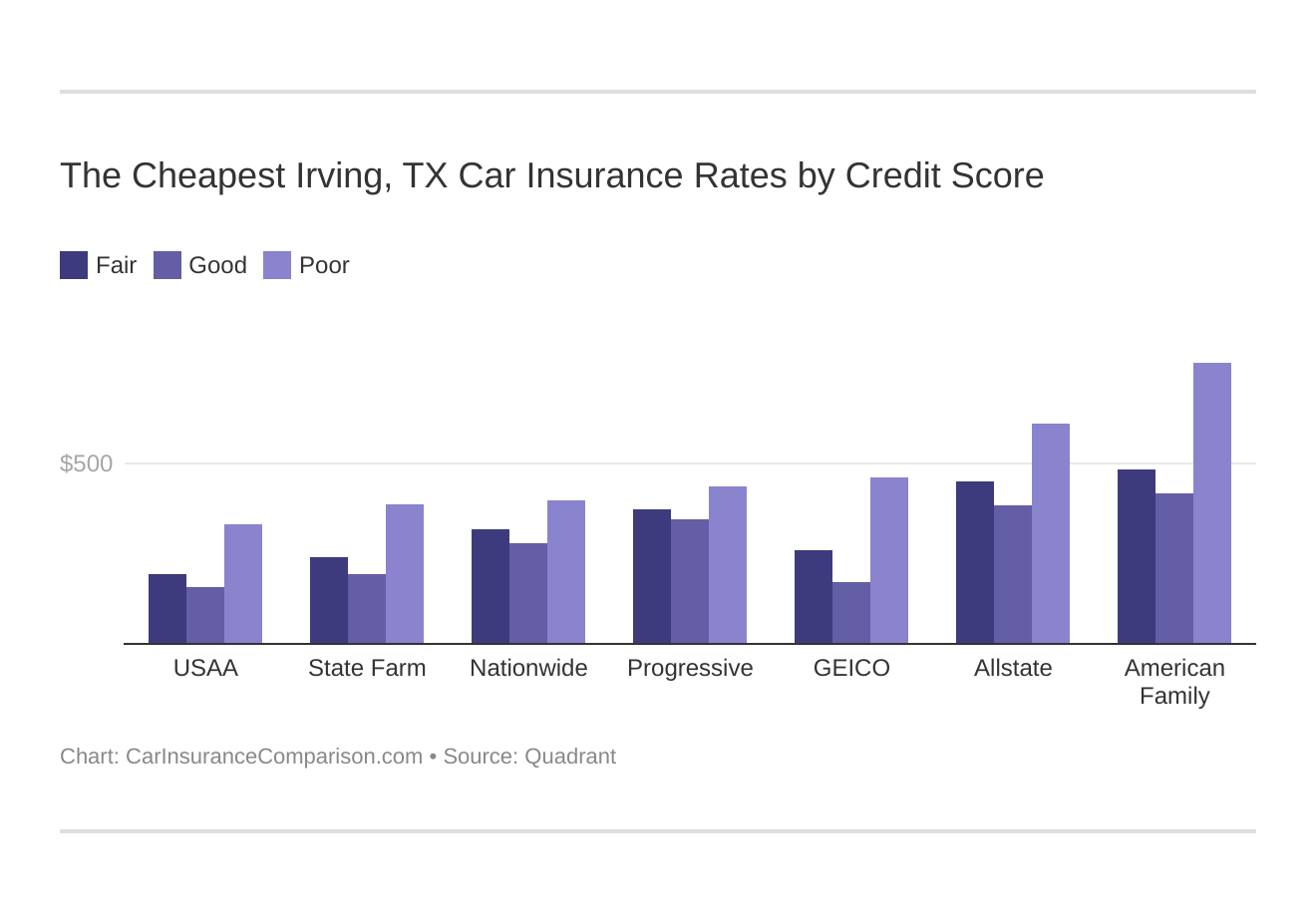

Your credit score will play a major role in your Irving, TX car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. You may be able to get a good credit discount. Find the cheapest Irving, Texas car insurance costs by credit score below.

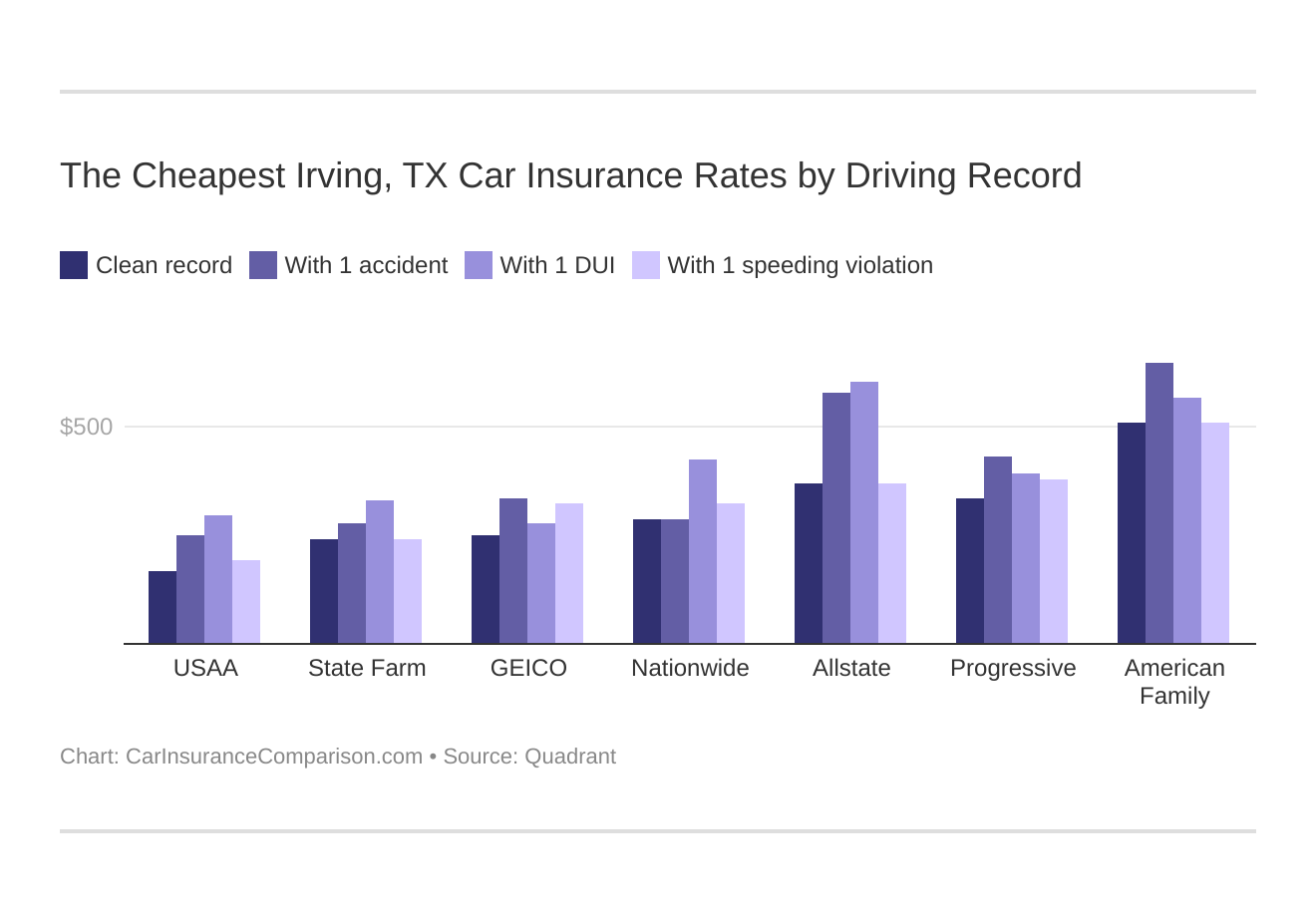

Your driving record will affect your Irving, TX car insurance costs. For example, a Irving, Texas DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Irving, Texas car insurance with a bad driving record.

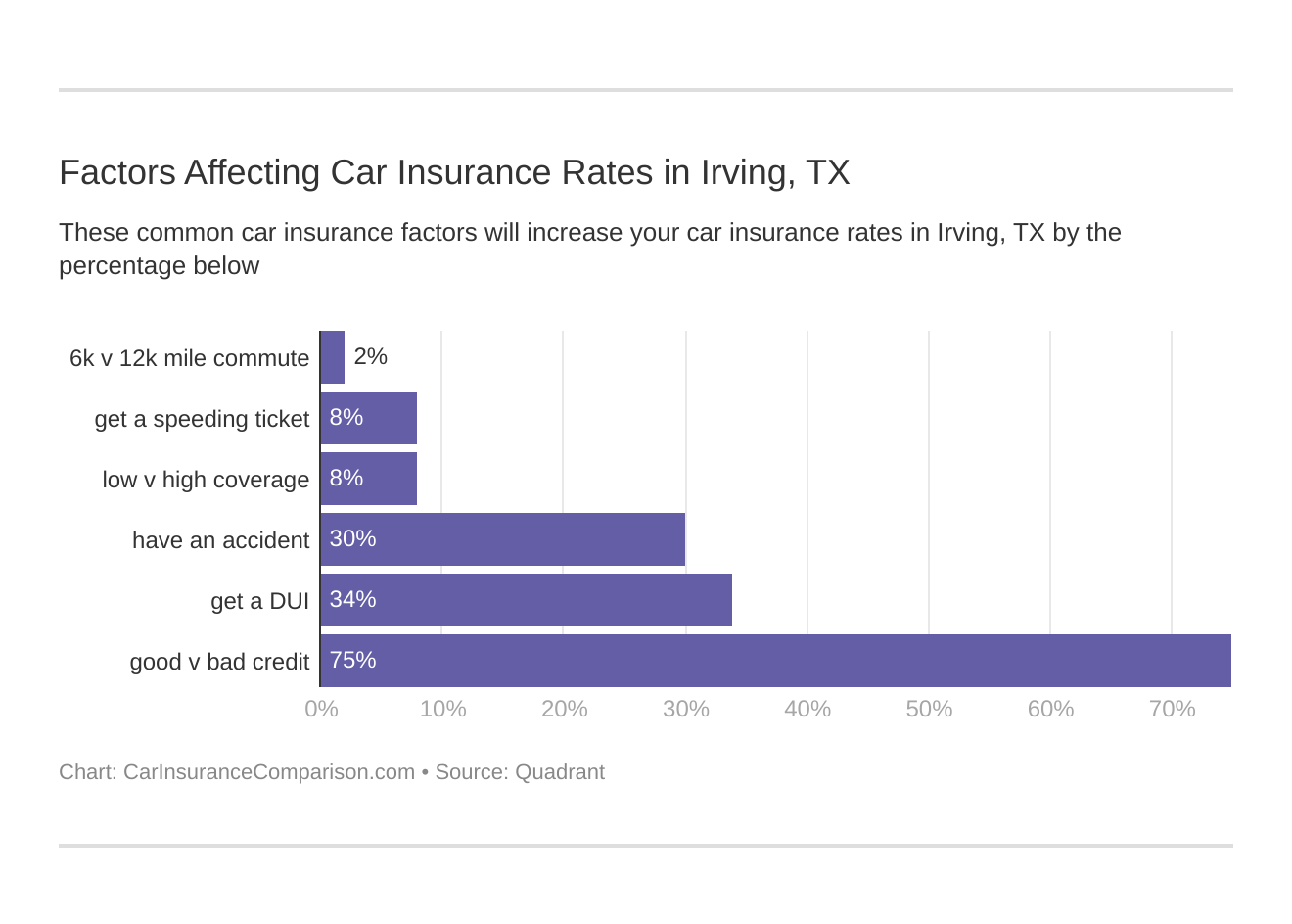

Controlling these risk factors will ensure you have the cheapest Irving, Texas car insurance. Factors affecting car insurance rates in Irving, TX may include your commute, coverage level, tickets, DUIs, and credit.

Age is a significant factor for Irving, TX insurance rates. Young drivers are often considered high-risk. This Irving, Texas does use gender as a car insurance factor, so check out the average monthly car insurance rates by age and gender in Irving, TX.

What are the minimum car insurance coverage requirements in Irving, TX?

The minimum amount of liability car insurance requirements in the Irving, TX area are:

- $30,000 per person and $60,000 per incident for bodily injury liability

- $25,000 per incident for property damage

Health insurance and car prices continue to rise. To reduce out-of-pocket expenses, consider increasing coverage limits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Irving, TX?

Your commute to work and your location’s vehicle theft rate can determine your car insurance cost. How come? Your chances of getting into an accident increase the more you drive.

Meanwhile, vehicle thefts determine your chances of filing a comprehensive insurance claim. According to the FBI statistics, the city of Irving, TX, had 711 auto thefts.

According to City-Data, it takes 23 minutes for the average driver to get work in Irving, TX.

Irving, TX Car Insurance: The Bottom Line

You can secure cheap car insurance in Irving, TX, by maintaining a clean driving record. If you have a good credit score, take advantage of the low prices provided by your auto insurance provider.

Also, your vehicle’s safety and anti-theft features can save you money on car insurance. Most car insurance companies will issue discounts for certain vehicle features.

Before you buy car insurance in Irving, Texas, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Irving, TX car insurance quotes.

Frequently Asked Questions

How much is the average car insurance rate in Irving, TX?

The average car insurance rate in Irving, TX is $4,373 per year or $364 per month.

Why is car insurance in Irving, TX expensive?

Car insurance rates in Irving, TX are determined by various factors such as the insurance company chosen, driving history, and other factors specific to the individual. Factors like higher crime rates and traffic congestion in certain areas can contribute to higher insurance premiums.

Which car insurance company offers the cheapest rates in Irving, TX?

The cheapest car insurance company in Irving, TX is USAA, but it is only available for military veterans and their immediate families. Other affordable options in Irving, TX include State Farm and Geico.

How does coverage level affect car insurance costs in Irving, TX?

The coverage level you choose will have an impact on your car insurance costs in Irving, TX. Higher coverage levels generally come with higher premiums, while lower coverage levels may have lower premiums but offer less protection.

What factors affect car insurance rates in Irving, TX?

Several factors can affect car insurance rates in Irving, TX, including your driving record, credit score, age, commute distance, and the vehicle’s theft rate in your location. Insurance companies use these factors to assess the level of risk associated with insuring a driver and determine the premium amount.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.