Best Providence, RI Car Insurance in 2026

The cheapest Providence, RI car insurance is offered by State Farm. Auto insurance in Providence must meet the minimum Rhode Island state requirements of 25/50/25 for both liability and uninsured/underinsured motorists coverages. Compare rates online to find the cheapest Providence, RI car insurance rates near you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2024

- State Farm has the cheapest car insurance in Providence, RI

- Rhode Island has the sixth most expensive car insurance in the U.S.

- Heavy traffic contributes to the high cost of auto insurance in Providence

Providence, RI car insurance is quite expensive. This is partly because heavy traffic makes Rhode Island car insurance the sixth most expensive in the U.S.

But, drivers can still find cheap auto insurance in Providence. The best way to find affordable Providence, RI car insurance is to shop around to find the best prices since every auto insurance company will charge different rates.

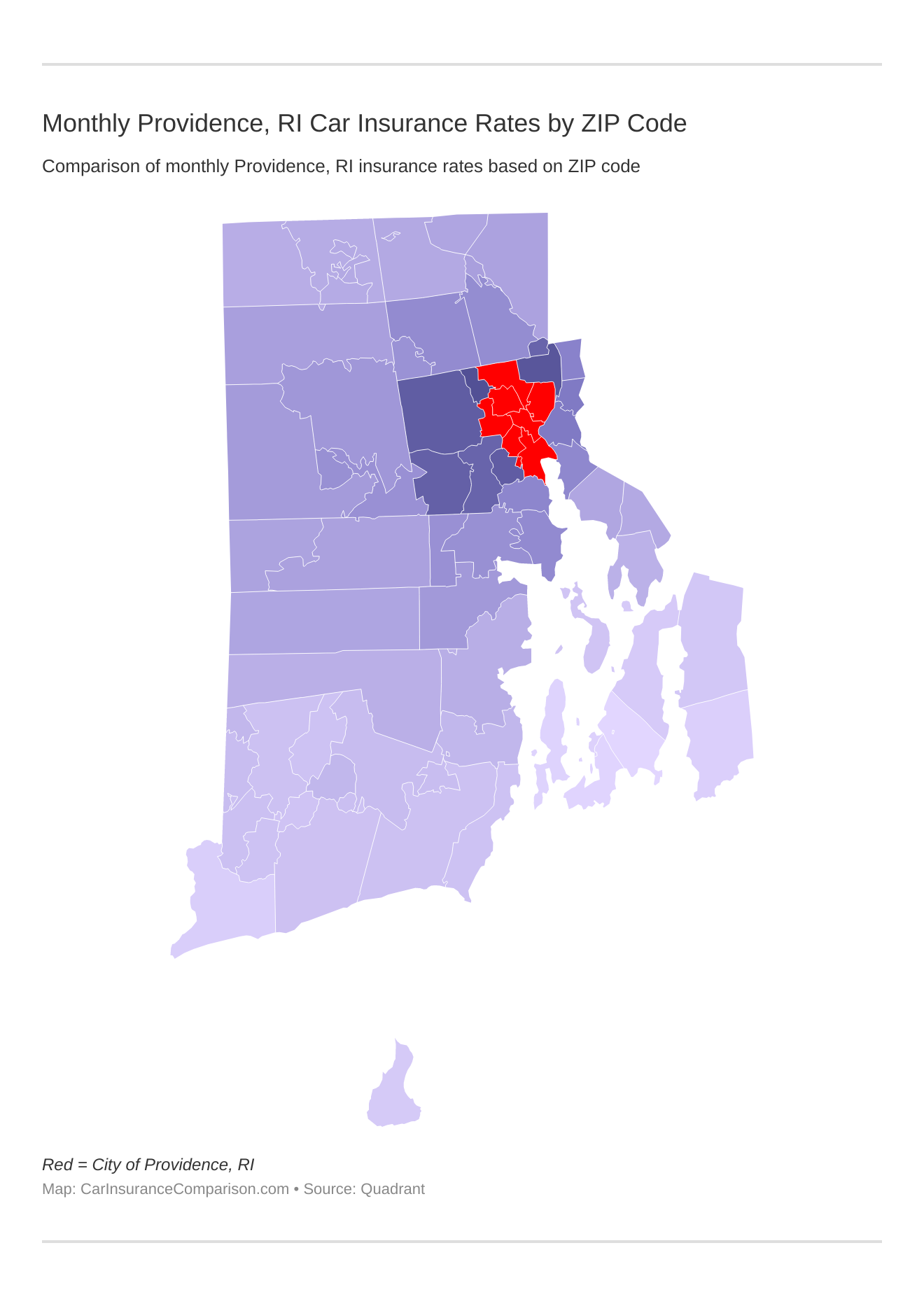

Monthly Providence, RI Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Providence, RI auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

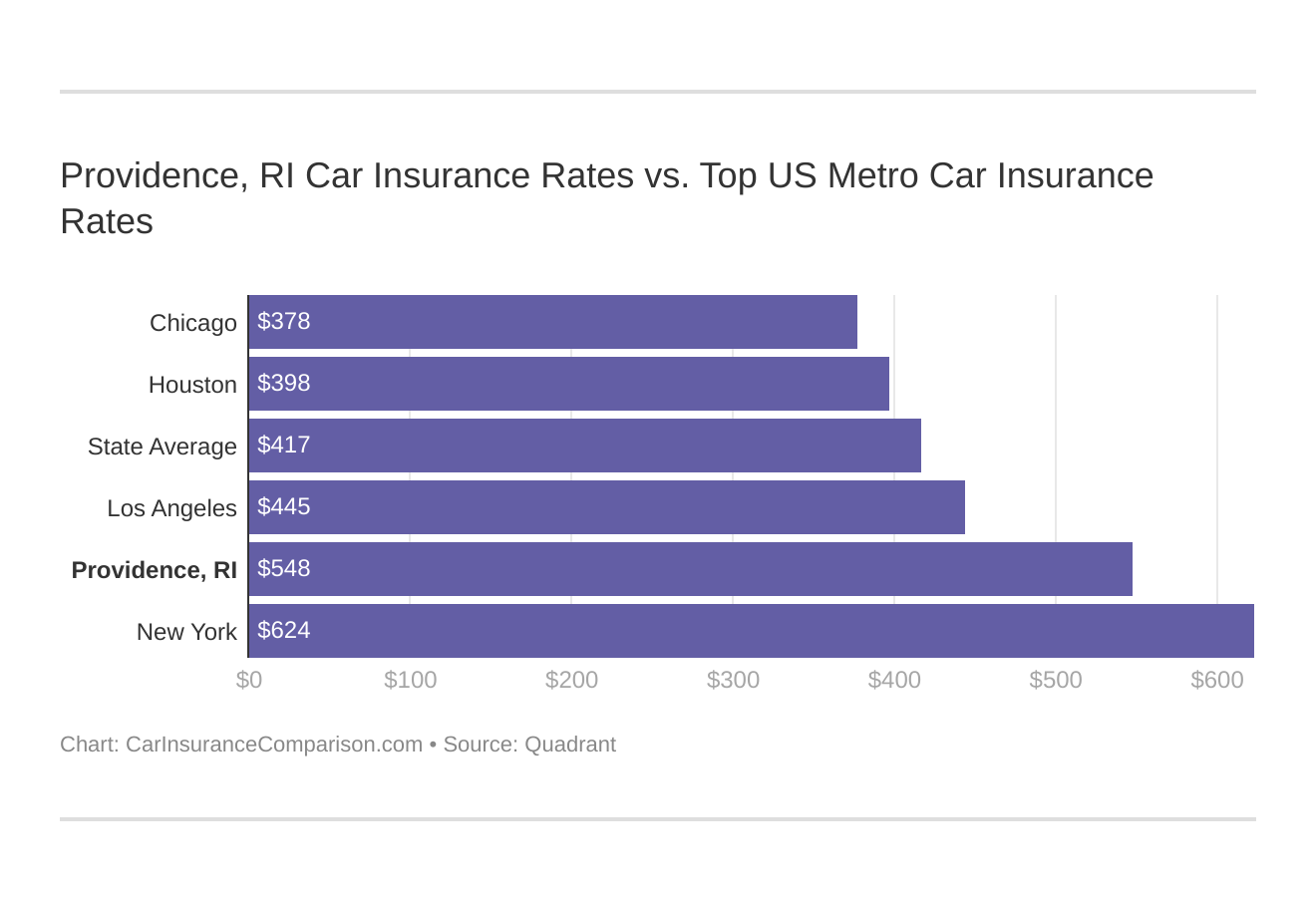

Providence, RI Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Providence, RI against other top US metro areas’ auto insurance costs.

This makes it necessary to compare quotes. Enter your ZIP code now to compare Providence, RI car insurance quotes from local companies for free.

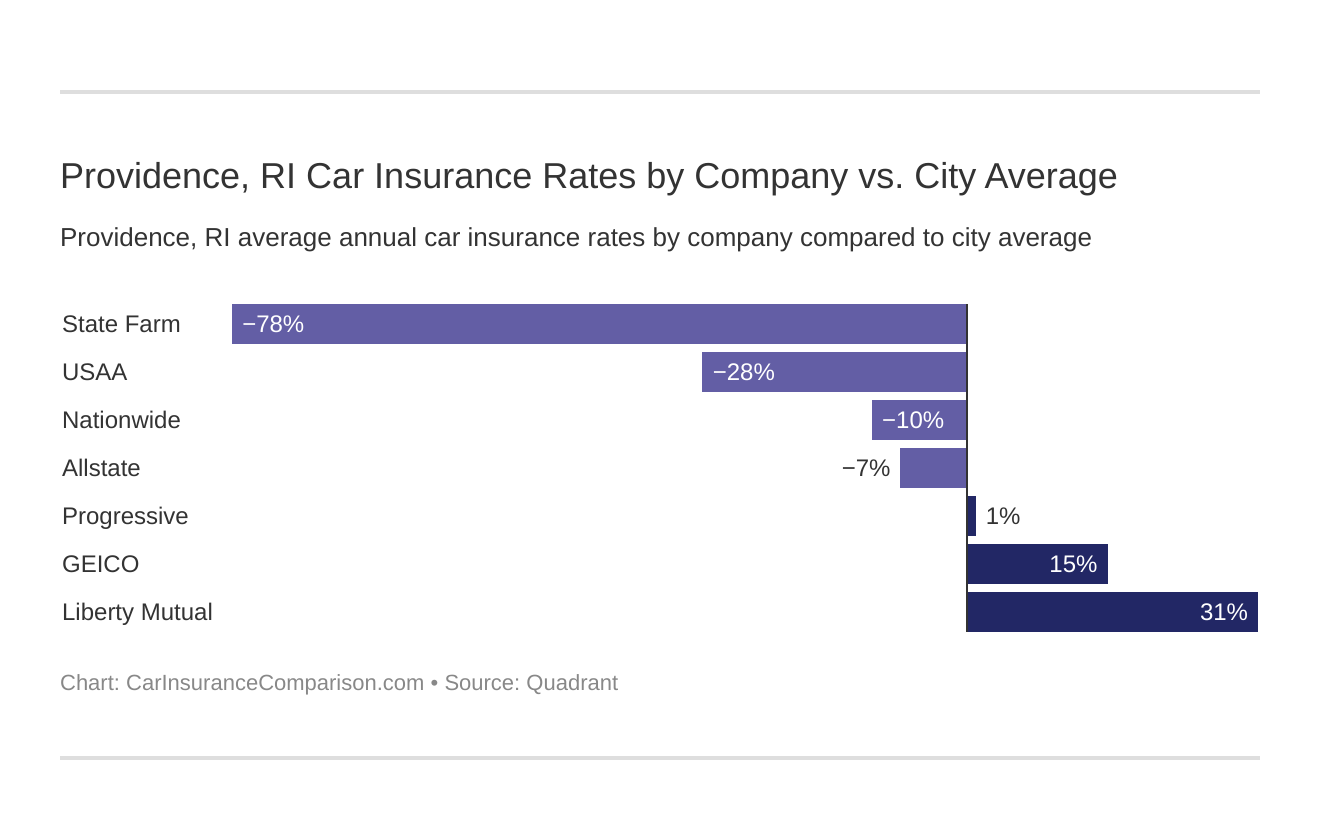

What is the cheapest car insurance company in Providence, RI?

The cheapest car insurance company in Providence is State Farm, although rates will vary from driver to driver.

The cheapest Providence, RI car insurance providers can be found below. You also might be wondering, “How do those Providence, RI rates compare against the average Rhode Island car insurance company rates?” We uncover that too.

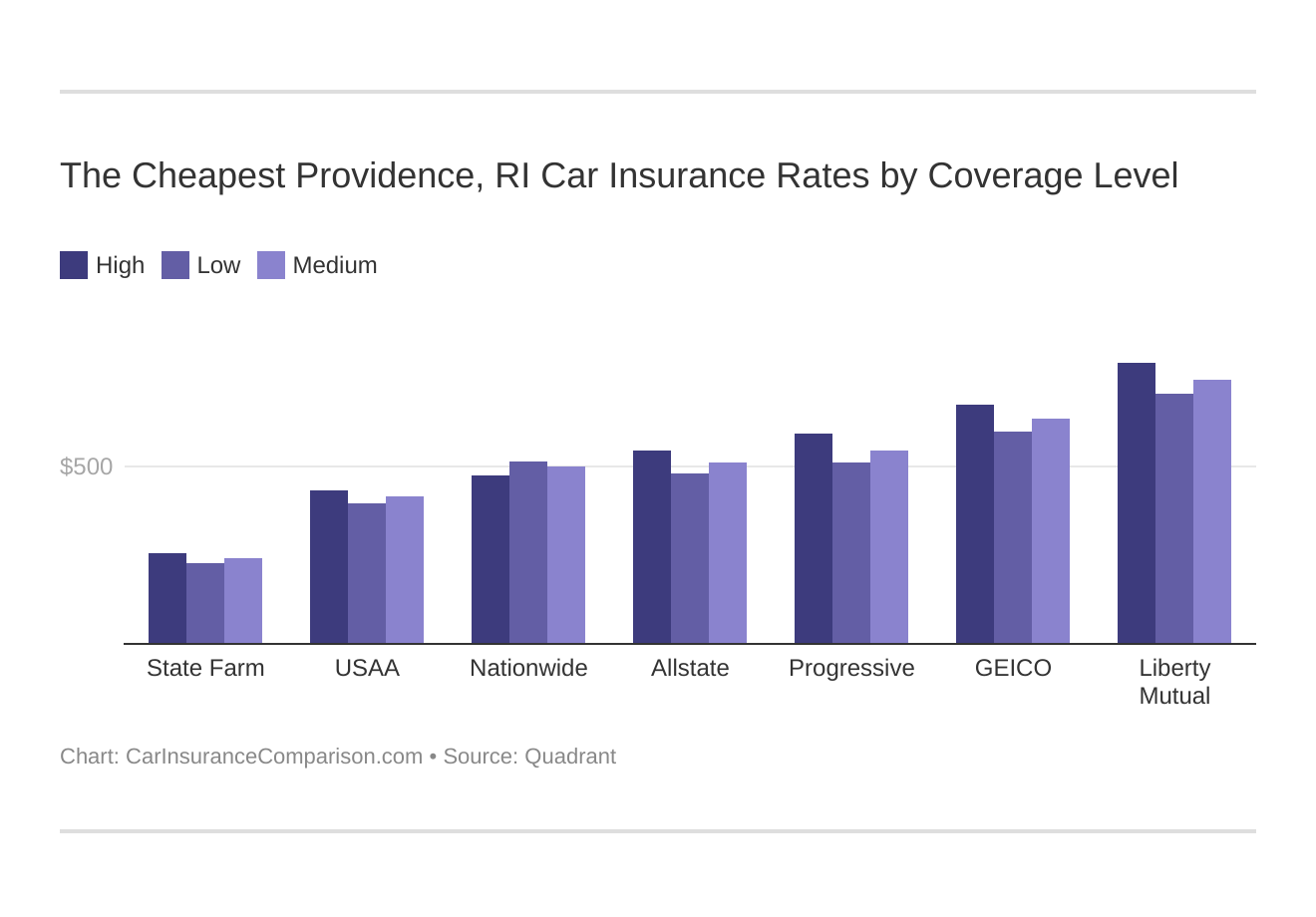

The top car insurance companies in Providence, RI listed from cheapest to most expensive are:

- State Farm car insurance – $2,897.12

- USAA car insurance – $4,973.73

- Nationwide car insurance – $5,966.30

- Allstate car insurance – $6,154.90

- Progressive car insurance – $6,605.88

- Geico car insurance – $7,636.69

- Liberty Mutual car insurance – $8,976.30

- Travelers car insurance – $9,357.66

Read more: Liberty Mutual vs. Travelers Car Insurance Comparison

There are many different factors that affect car insurance rates in Providence, RI, such as age, gender, marital status, driving record, ZIP code, and credit history.

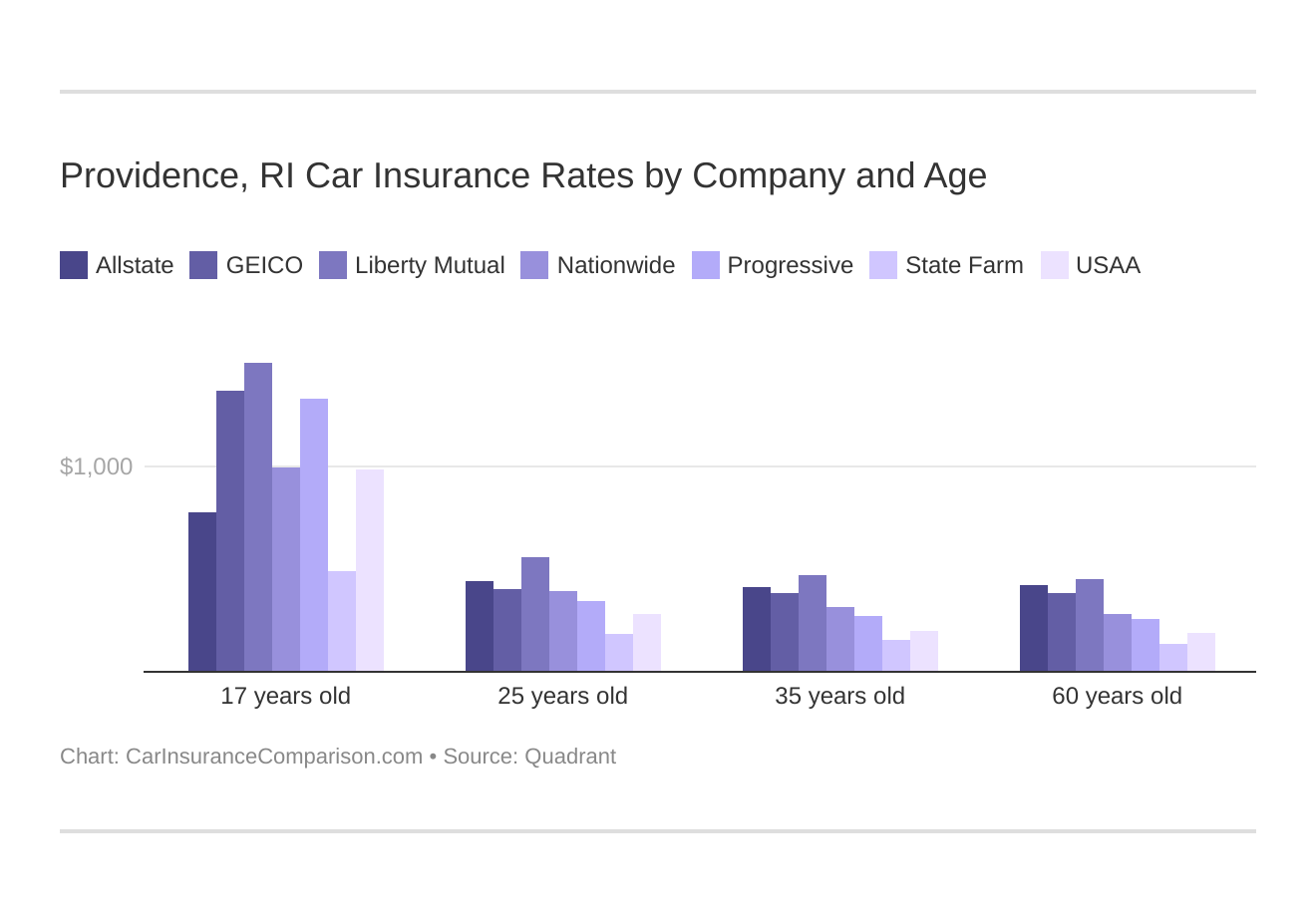

Comparing Providence, Rhode Island car insurance rates by age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

Your coverage level will play a major role in your Providence, RI car insurance costs. Find the cheapest Providence, Rhode Island car insurance costs by coverage level below:

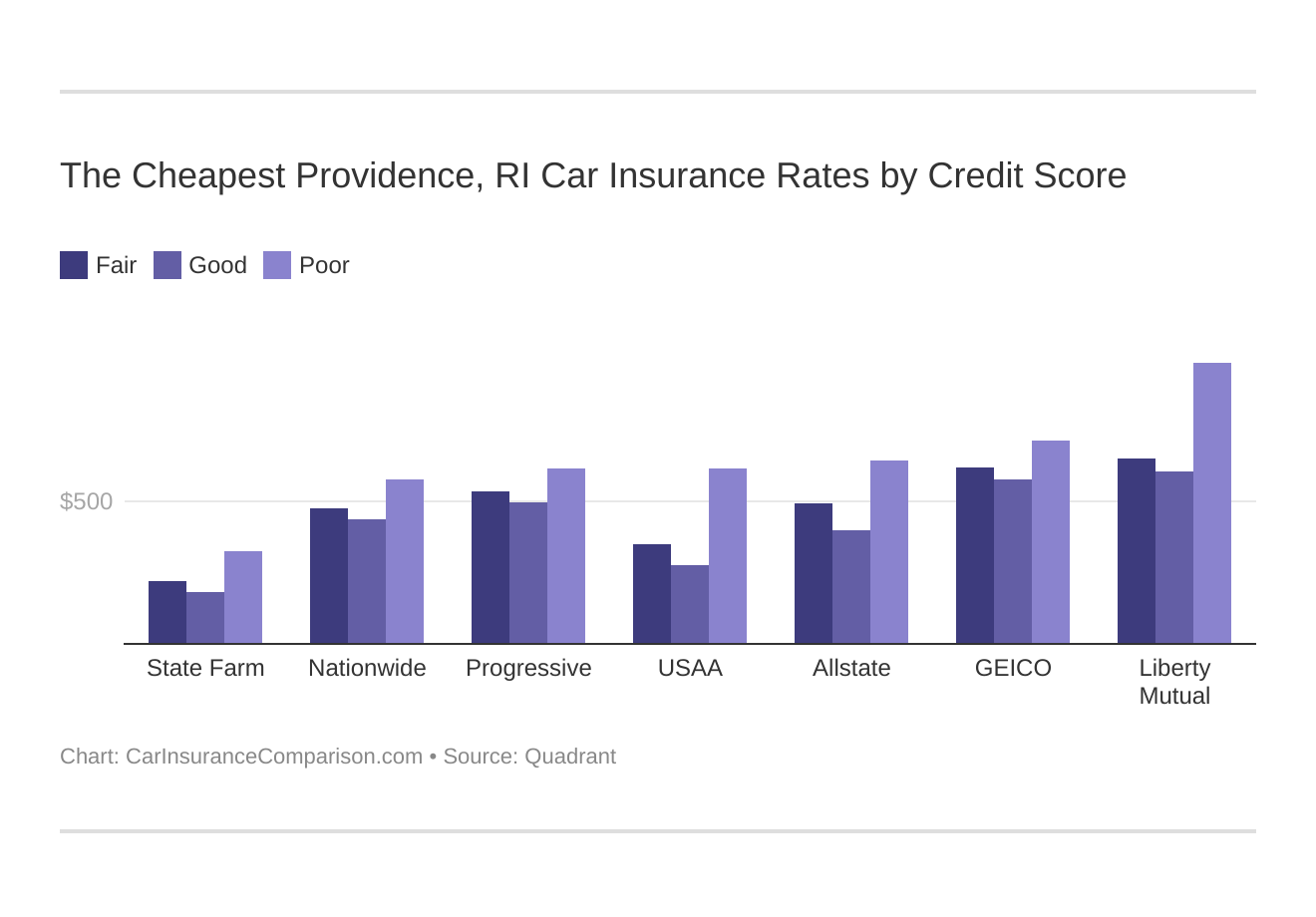

Your credit score will play a major role in your Providence, RI car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. You may be able to get a good credit discount. Find the cheapest Providence, Rhode Island car insurance costs by credit score below.

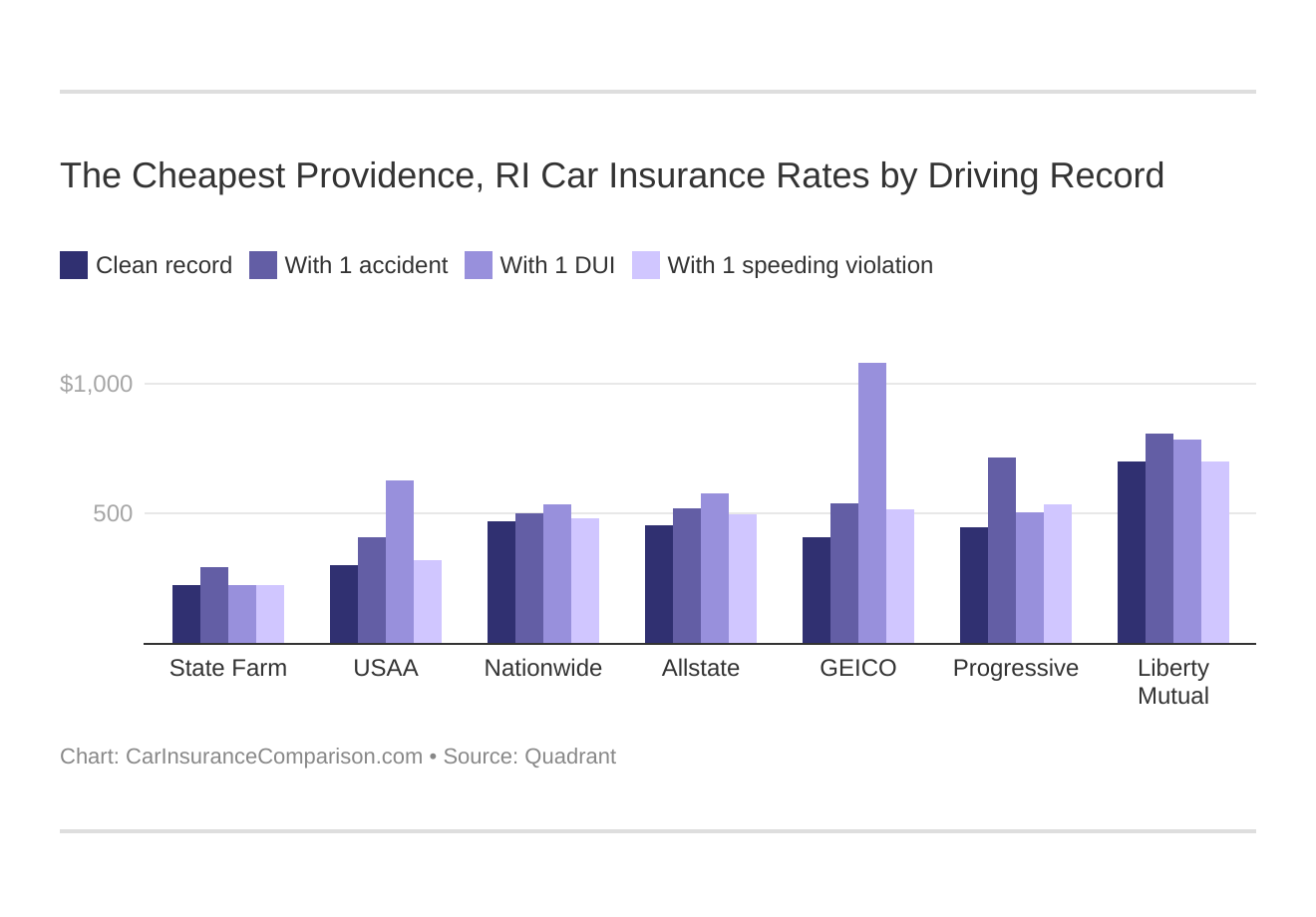

Your driving record will affect your Providence, RI car insurance costs. For example, a Providence, Rhode Island DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Providence, Rhode Island car insurance with a bad driving record.

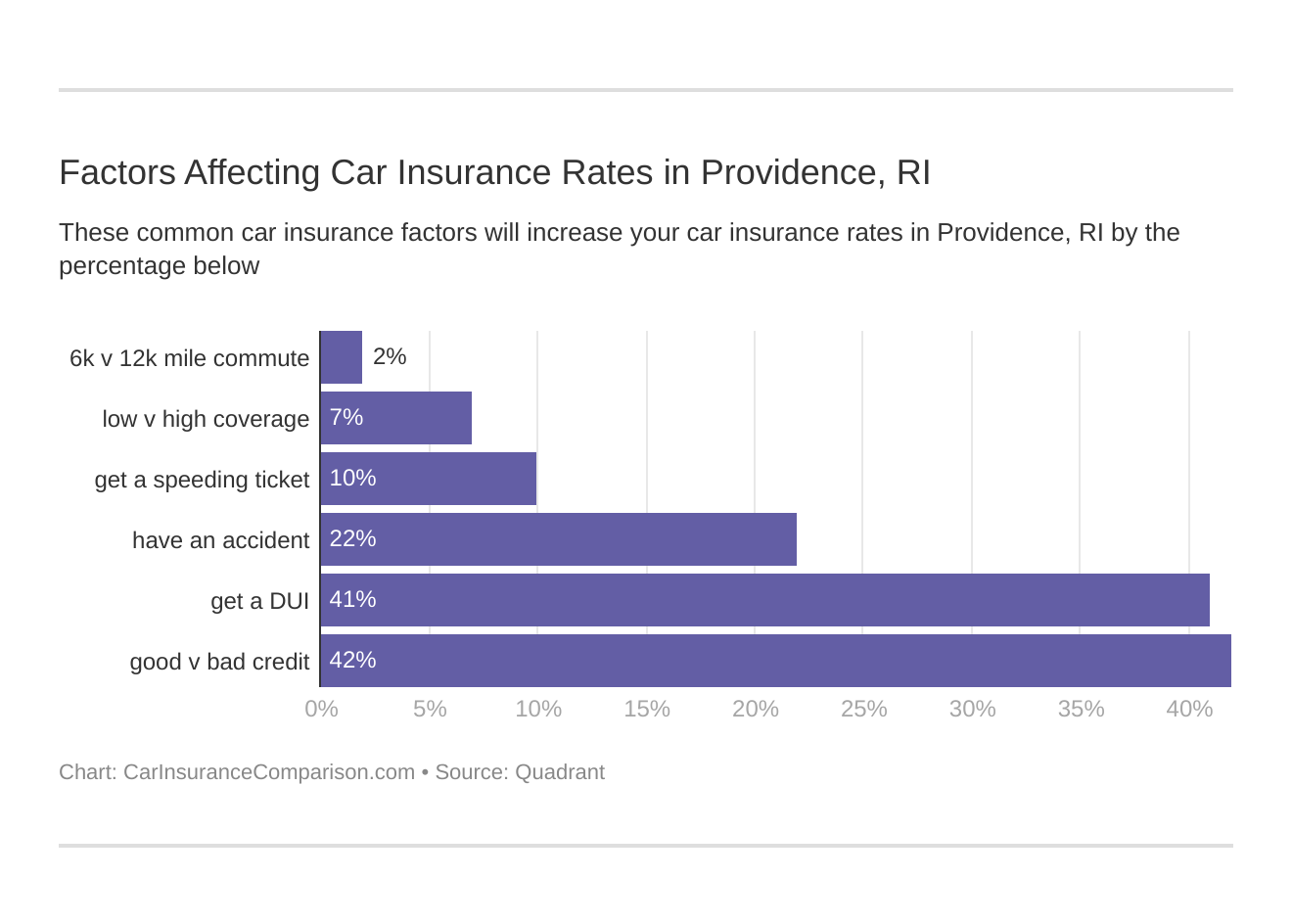

Controlling these risk factors will ensure you have the cheapest Providence, Rhode Island car insurance. Factors affecting car insurance rates in Providence, RI may include your commute, coverage level, tickets, DUIs, and credit.

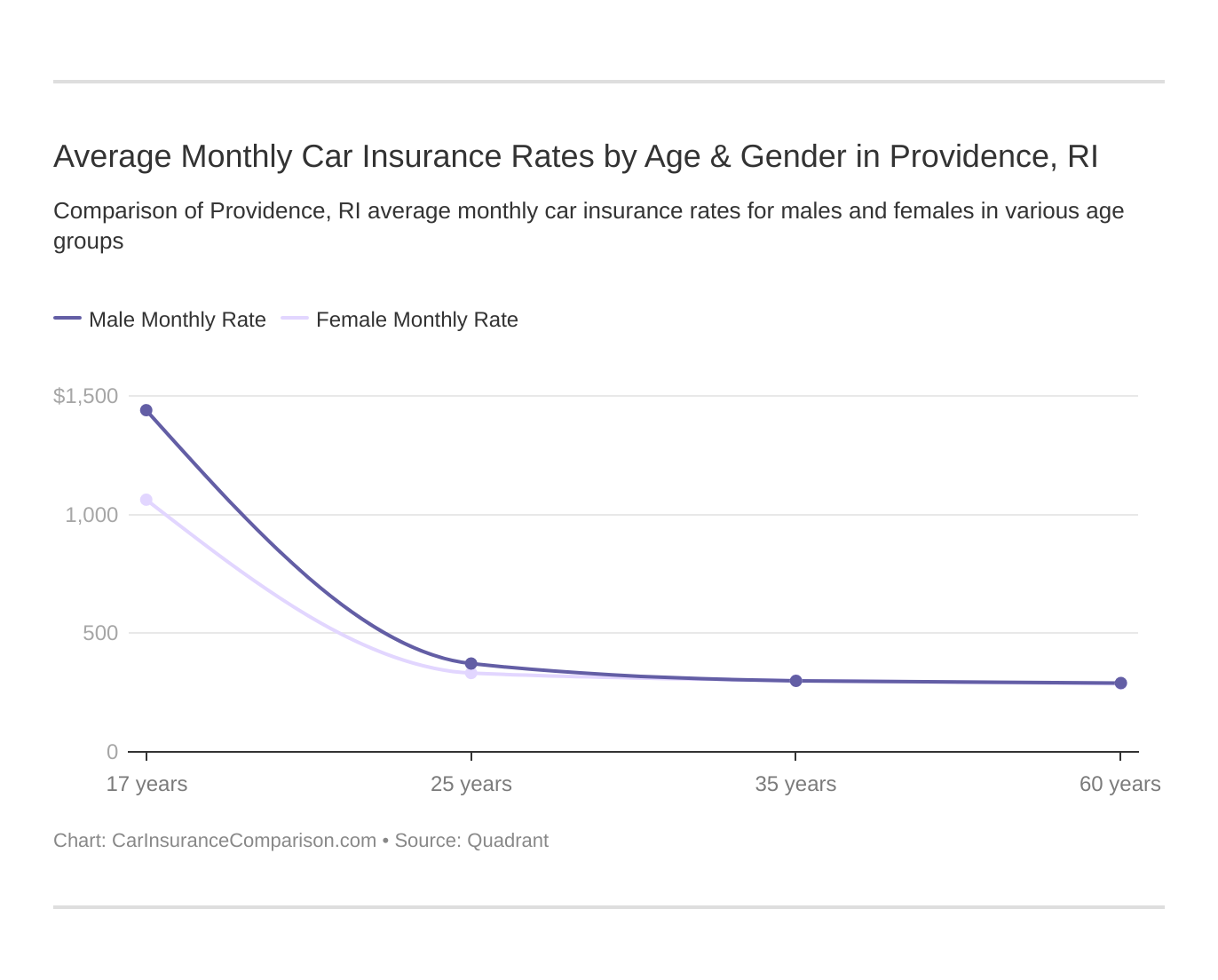

Age is a significant factor for Providence, RI car insurance rates. Young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. Providence, Rhode Island does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Providence, RI.

What car insurance coverage is required in Providence, RI?

In Providence, RI, drivers have to carry at least the minimum car insurance required by the state. The required car insurance in Rhode Island is:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $25,000 per incident for property damage

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist coverage

When it comes to car insurance Rhode Island is an at-fault state. This means that the at-fault driver in the accident will be responsible for damages, as much as they are at fault. Drivers only cover the costs of the accident equal to how much fault they had in the crash.

For example, if you are 100 percent at-fault, you and your insurance company will pay for 100 percent of the damages. However, if you are only 50 percent at fault, you will only have to cover half of the damages.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Providence, RI?

RI, Providence, is rather heavily populated, meaning heavy road traffic. More traffic equals more incidents.

INRIX ranks Providence as the 16th most congested city in the U.S. and 74th most congested city in the world.

City-Data reports that Providence, RI drivers’ average commute time is less than 25 minutes. Although the majority of drivers choose to drive alone, a good number carpool or walk to work.

Also, the FBI shows that there were 580 motor vehicle thefts in Providence. That’s about one theft for every 310 people.

Providence, RI Car Insurance: The Bottom Line

Shop around before you buy Providence, RI car insurance since it is so expensive. Compare quotes from multiple companies to find the best coverage at the right price for you.

Enter your ZIP code now to compare Providence, RI car insurance rates, and find the cheapest auto insurance.

Frequently Asked Questions

How are car insurance rates determined in Providence, RI?

Car insurance rates in Providence, RI are determined by several factors, including the driver’s age, driving history, type of vehicle, coverage limits, and the insurance company’s underwriting guidelines. Additionally, factors such as the location, crime rates, and traffic congestion in Providence can also impact insurance premiums.

What are the average car insurance rates in Providence, RI?

The average car insurance rates in Providence, RI can vary depending on individual circumstances and the coverage selected. However, as of my knowledge cutoff in September 2021, the average annual car insurance premium in Rhode Island, which includes Providence, was around $1,350.

Are car insurance rates higher in Providence compared to other areas in Rhode Island?

Car insurance rates in Providence can be slightly higher compared to other areas in Rhode Island due to factors such as higher population density, traffic congestion, and the possibility of increased risk of accidents or theft. However, rates can vary significantly depending on individual factors, so it’s recommended to obtain personalized quotes from insurance providers to get accurate estimates.

What are the factors that can affect car insurance rates in Providence, RI?

Several factors can affect car insurance rates in Providence, RI. These include the driver’s age, gender, marital status, driving history (including accidents and traffic violations), credit score, the type of vehicle being insured, coverage limits, deductible amounts, and the insurance company’s underwriting guidelines.

How can I find the best car insurance rates in Providence, RI?

To find the best car insurance rates in Providence, RI, consider the following steps:

- Compare quotes from multiple insurance providers to ensure you’re getting competitive rates.

- Evaluate the coverage options and limits offered by each insurer to ensure they meet your needs.

- Check for any available discounts or bundling options that could lower your premium.

- Research the financial stability and customer service reputation of the insurance companies you’re considering.

- Consider working with an independent insurance agent who can help you navigate the options and find the best rates for your specific situation.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.