Best Santa Clara, CA Car Insurance in 2026

Although the cheapest Santa Clara, CA car insurance is offered by GEICO, some drivers may qualify for low-cost coverage through the CLCA program. Auto insurance in Santa Clara must meet the state minimum requirements of 15/30/5 in liability coverage. Compare online Santa Clara, CA car insurance quotes to find the cheapest coverage for you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated November 2024

- The cheapest car insurance on average in Santa Clara, CA is from Geico

- Santa Clara car insurance is more expensive than the national average

- Low-income drivers in Santa Clara may qualify for the California Low-Cost Auto program if they meet certain requirements

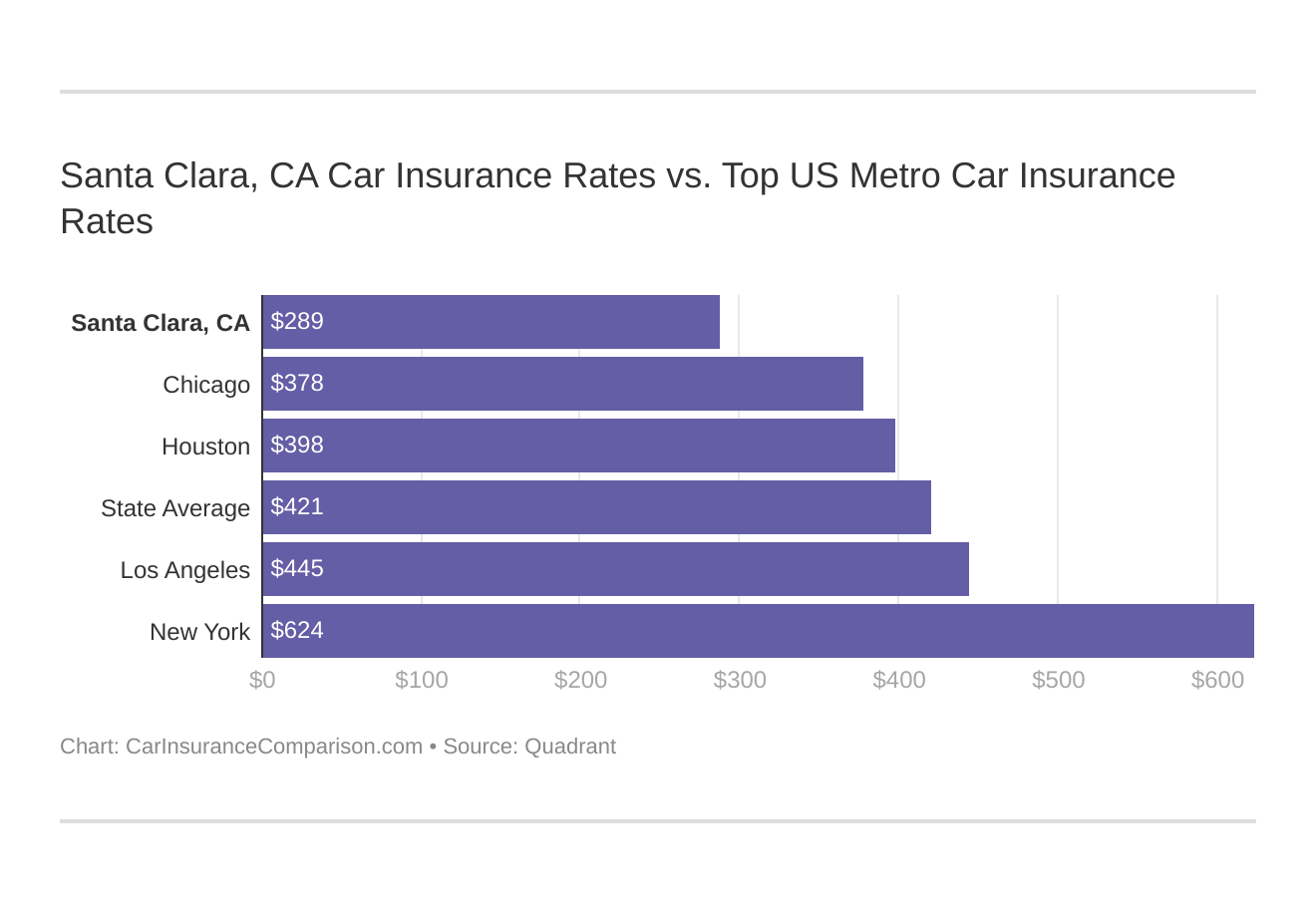

Santa Clara car insurance is less expensive than the average California car insurance but more expensive than the national average.

Although some drivers may be eligible for the California Low-Cost Auto low-income car insurance program, don’t worry if you don’t qualify. You can still get affordable Santa Clara, CA car insurance if you shop around.

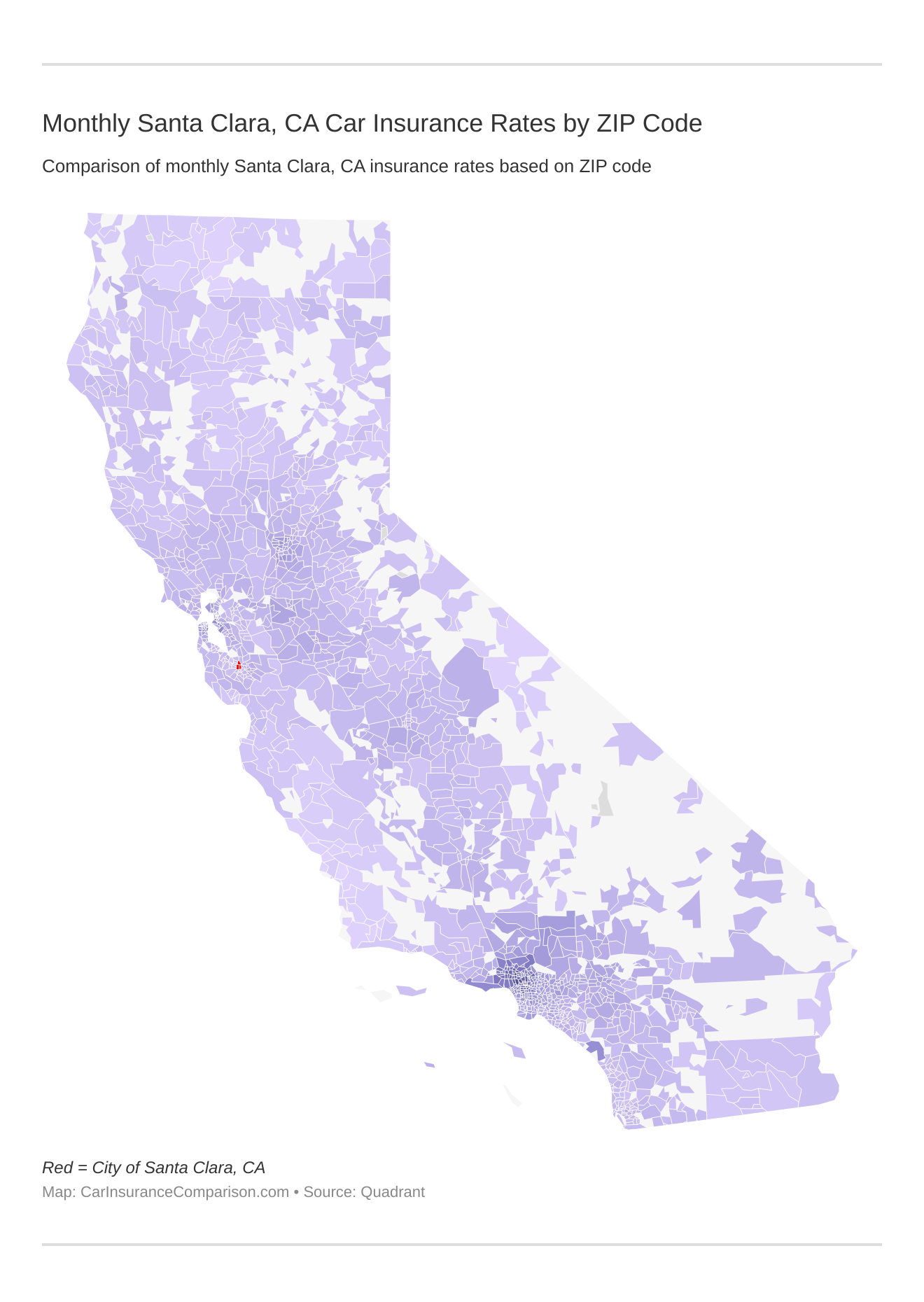

Monthly Santa Clara, CA Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Santa Clara, CA auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Santa Clara, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Santa Clara, CA against other top US metro areas’ auto insurance costs.

Enter your ZIP code now to compare Santa Clara, CA car insurance quotes from multiple companies near you for free.

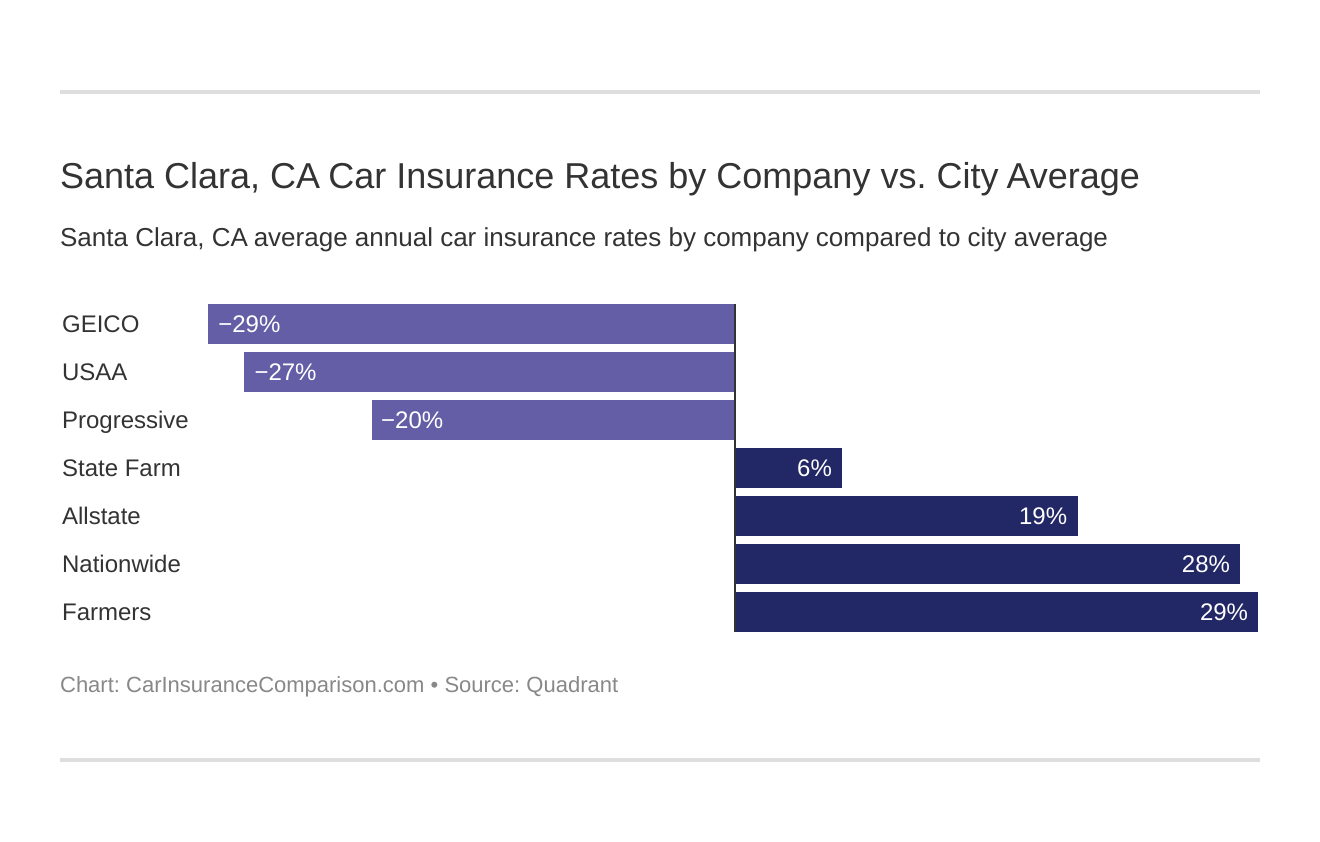

What is the cheapest car insurance company in Santa Clara, CA?

The cheapest Santa Clara, CA car insurance company on average is Geico, although rates are different for every driver.

The cheapest Santa Clara, CA car insurance providers can be found below. You also might be wondering, “How do those Santa Clara, CA rates compare against the average California car insurance company rates?” We uncover that too.

The top car insurance companies in Santa Clara, CA listed from cheapest to most expensive are:

- Geico car insurance – $2,594.63

- USAA car insurance – $2,633.23

- Progressive car insurance – $2,847.65

- Liberty Mutual car insurance – $2,867.21

- Travelers car insurance – $3,212.26

- State Farm car insurance – $3,679.54

- Allstate car insurance – $4,185.59

- Nationwide car insurance – $4,581.22

- Farmers car insurance – $4,647.55

Read more: Liberty Mutual vs. Travelers Car Insurance Comparison

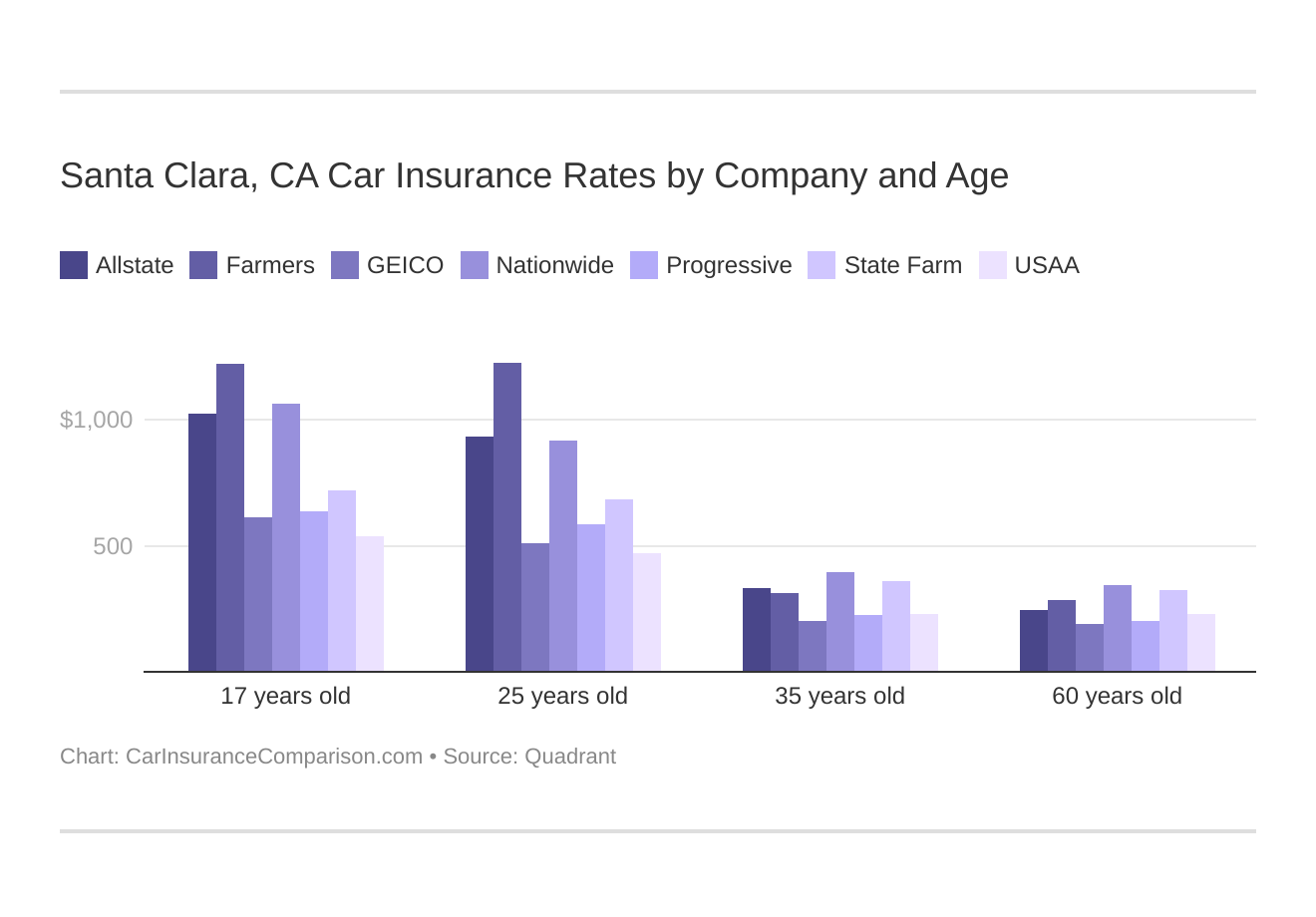

Many factors affect car insurance rates, including your age and driving record. While most car insurance companies consider your gender when calculating your rates, California is one of the few states that has made this practice illegal.

Your rates are also affected by where you live and the size of your city. Car insurance would be more expensive in larger cities with more crime and traffic. Los Angeles car insurance, for example, is much more costly than coverage in Santa Clara.

It’s also worth noting that low-income drivers in California can get low-cost car insurance. For low-income drivers who meet certain conditions, the California Low-Cost Auto (CLCA) program provides very low coverage.

Comparing Santa Clara, California car insurance rates by age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

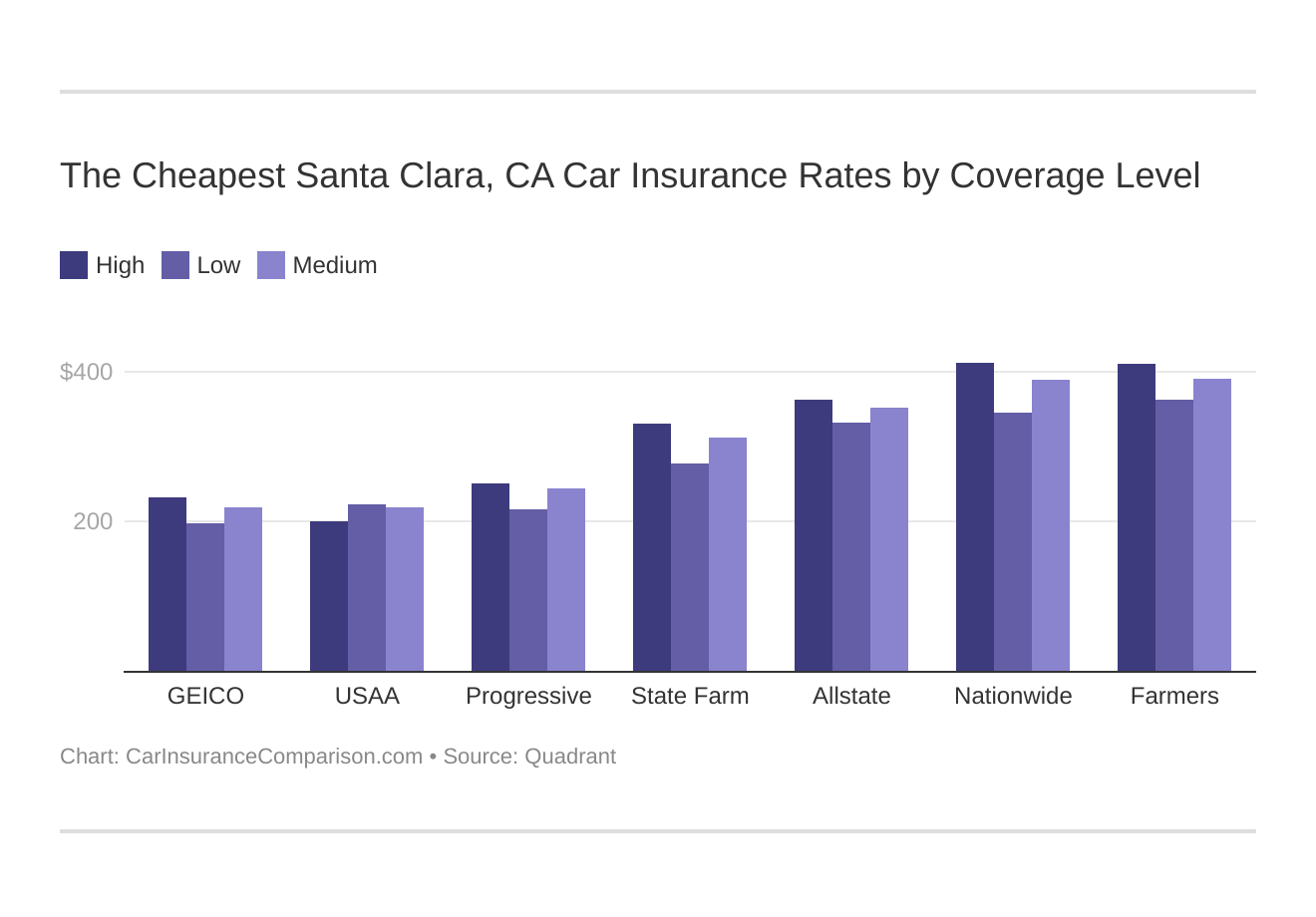

Your coverage level will play a major role in your Santa Clara, CA car insurance costs. Find the cheapest Santa Clara, California car insurance costs by coverage level below:

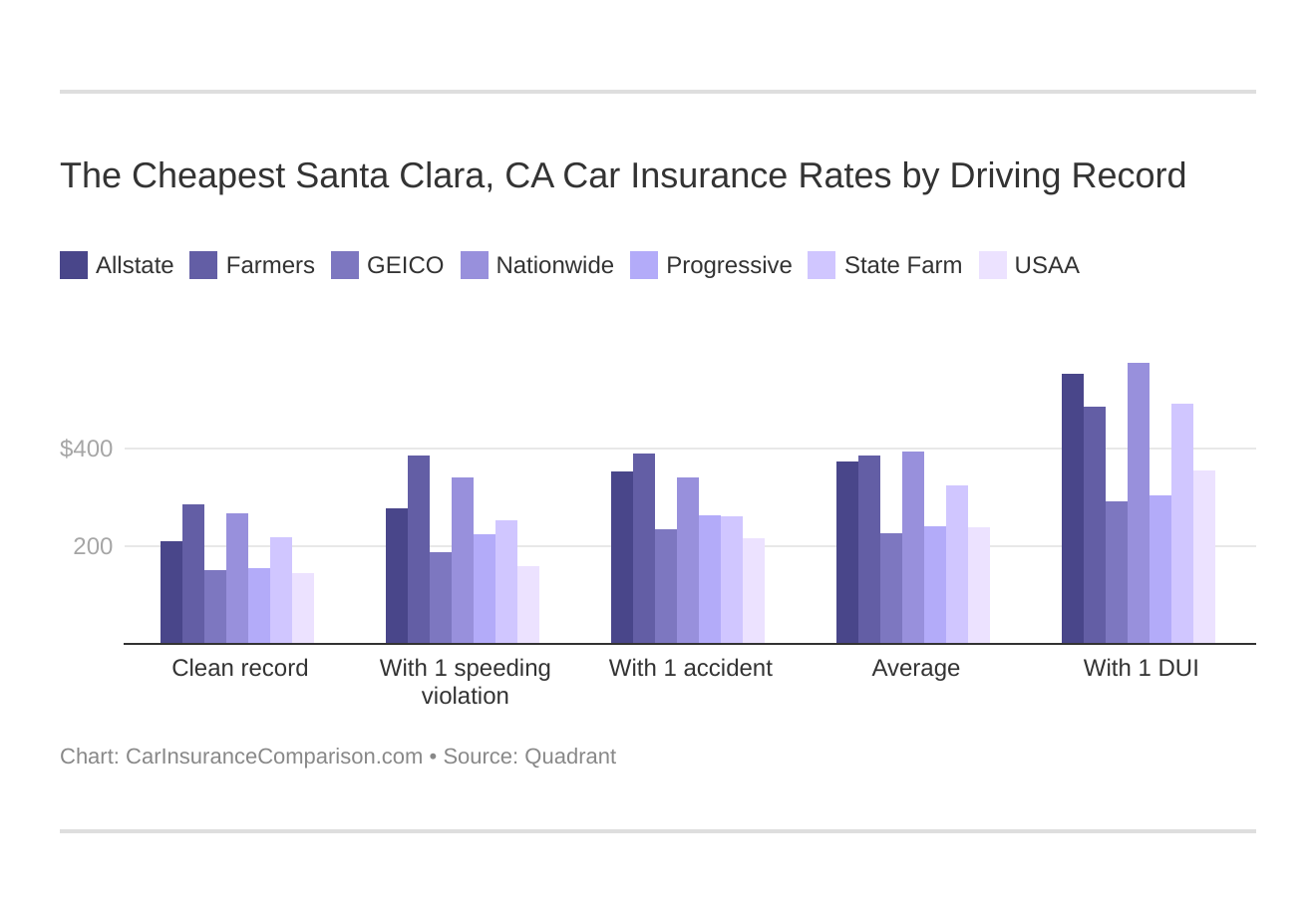

Your driving record will affect your Santa Clara, CA car insurance costs. For example, a Santa Clara, California DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Santa Clara, California car insurance with a bad driving record.

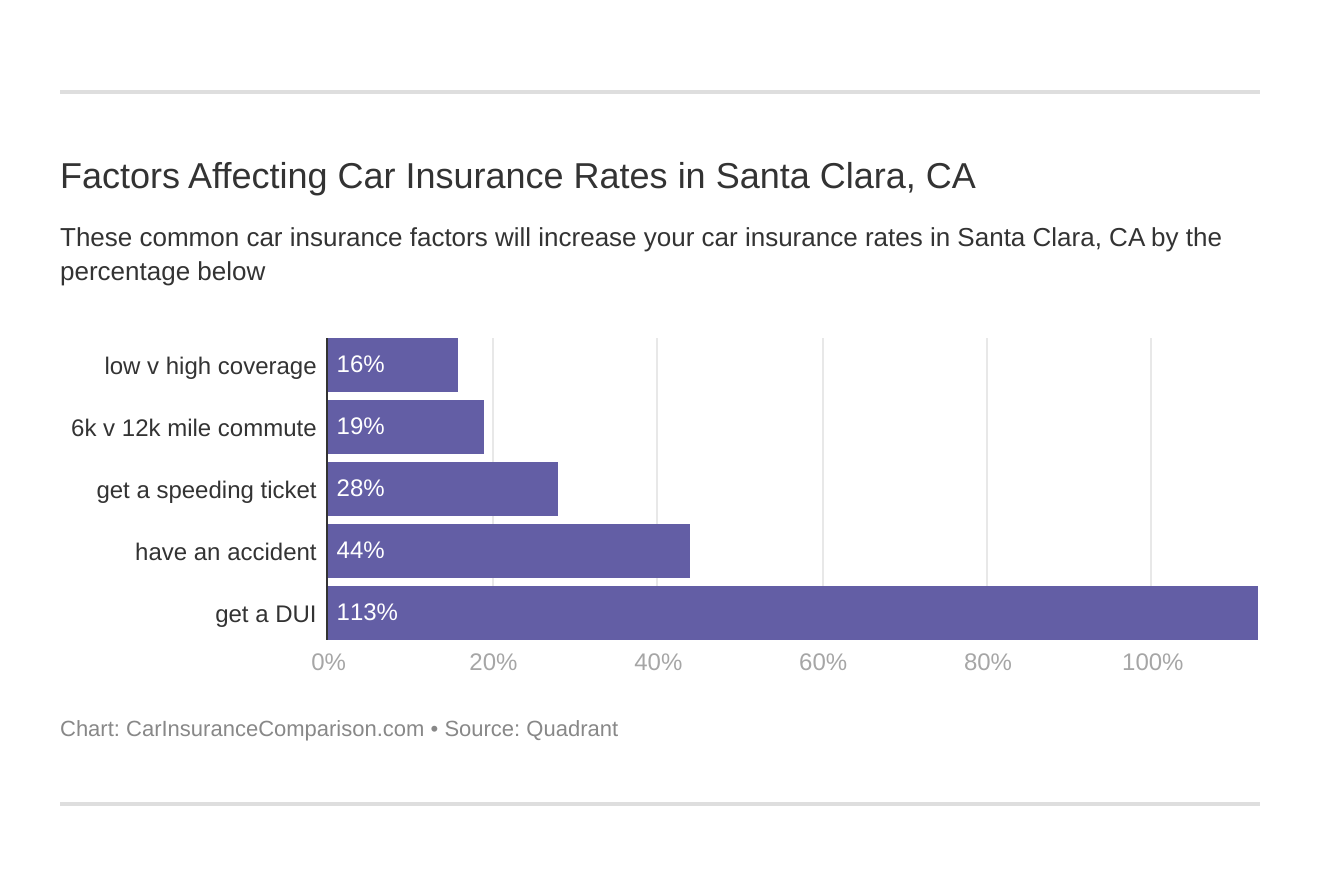

Controlling these risk factors will ensure you have the cheapest Santa Clara, California car insurance. Factors affecting car insurance rates in Santa Clara, CA may include your commute, coverage level, tickets, DUIs, and credit.

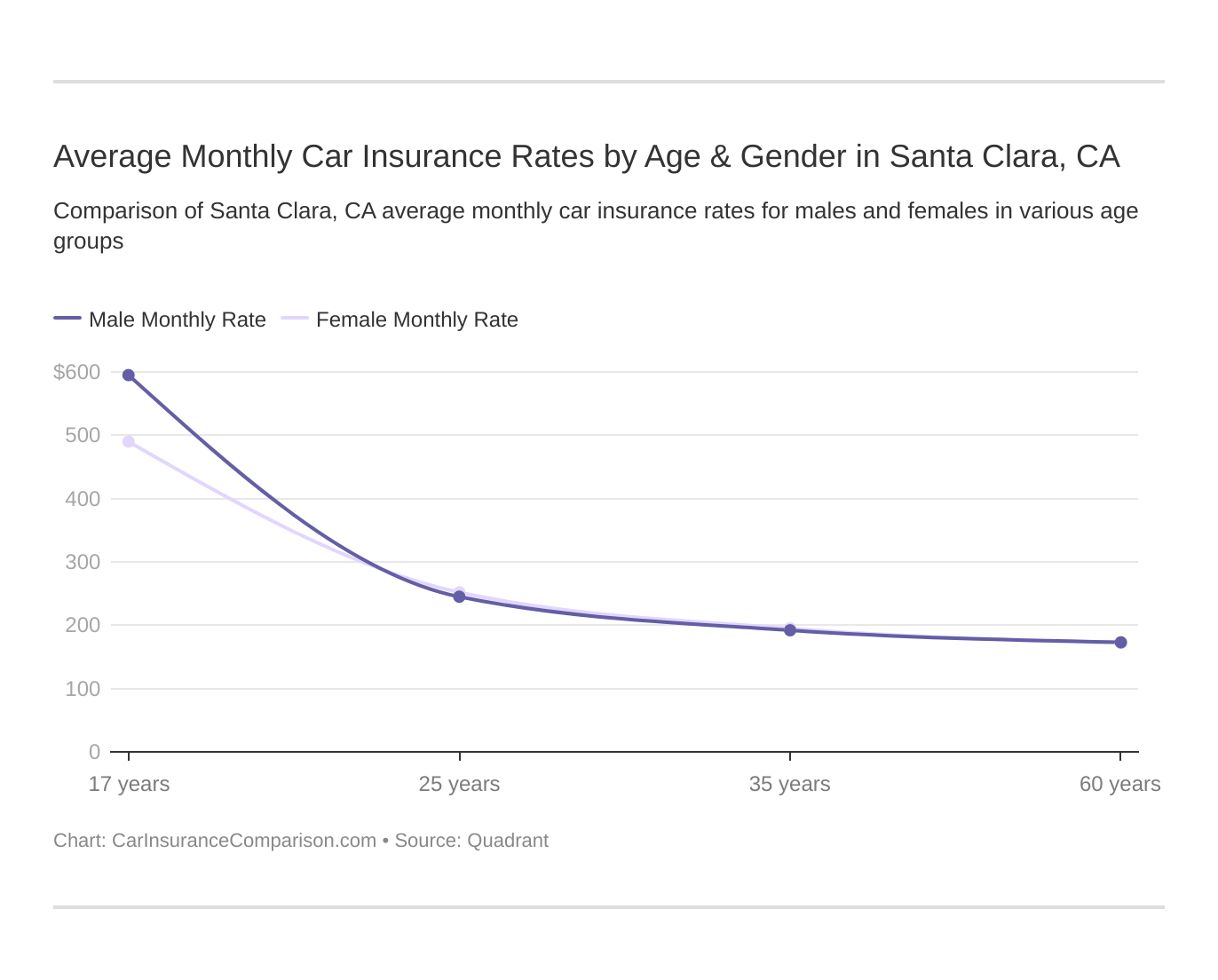

Age is a significant factor for Santa Clara, CA car insurance rates. Young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. Santa Clara, California does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Santa Clara, CA.

What car insurance coverage is required in Santa Clara, CA?

To drive legally in almost every state, including California, drivers must have at least a minimum amount of car insurance required by the state.

In California, Santa Clara drivers must have at least the following minimum auto insurance coverage:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

These are very low minimums, and drivers should consider increasing them and adding additional coverages. These low minimums won’t completely protect you in a major accident, leaving you to pay out of pocket for everything not covered.

Consider adding collision and comprehensive insurance to your policy. Collision car insurance helps pay for damages incurred as a result of an accident. Comprehensive car insurance covers accidents that aren’t caused by an accident, such as theft, vandalism, or fire.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Santa Clara, CA?

Since more vehicles on the road equal a higher risk of an accident, traffic can also impact your car insurance rates.

INRIX doesn’t have data for Santa Clara, but it does rank San Fransico as the sixth most congested city in the U.S. and the 38th most congested city in the world.

City-Data reports that most drivers in Santa Clara commute around 35 minutes, but a significant number commute an hour or more.

Theft can also cause your auto insurance rates to increase. According to the FBI, there were 400 motor vehicle thefts in one year in Santa Clara, CA.

Santa Clara, CA Car Insurance: The Bottom Line

Although Geico offers the cheapest Santa Clara, CA car insurance on average, some drivers may qualify for the CLCA program for very cheap coverage.

However, you still need to shop around before you buy Santa Clara, CA car insurance to get the best deal. Compare multiple companies to find the cheapest coverage that meets your needs.

Enter your ZIP code to compare Santa Clara car insurance rates from multiple companies near you.

Frequently Asked Questions

How are car insurance rates determined in Santa Clara, CA?

Car insurance rates in Santa Clara, CA are determined by several factors, including your age, driving history, type of vehicle, location, coverage limits, and deductibles. Insurance companies assess these factors to evaluate the level of risk associated with insuring you and calculate your premium accordingly.

What are the average car insurance rates in Santa Clara, CA?

The average car insurance rates in Santa Clara, CA can vary depending on individual circumstances and insurance providers. On average, car insurance rates in Santa Clara tend to be higher compared to other areas in California due to factors such as higher population density and traffic congestion. It’s best to obtain quotes from multiple insurance companies to get a more accurate estimate based on your specific situation.

Are there any specific requirements for car insurance coverage in Santa Clara, CA?

Yes, like the rest of California, Santa Clara has specific requirements for car insurance coverage. Drivers must have liability insurance with minimum limits of $15,000 for injury or death to one person, $30,000 for injury or death to multiple people, and $5,000 for property damage. Additional coverage options, such as comprehensive and collision, are recommended but not mandatory.

How can I find affordable car insurance rates in Santa Clara, CA?

To find affordable car insurance rates in Santa Clara, CA, consider the following tips:

- Shop around and obtain quotes from multiple insurance companies.

- Maintain a clean driving record and avoid accidents and traffic violations.

- Consider raising your deductibles, but ensure you can afford them in case of a claim.

- Look for discounts such as multi-policy, good driver, or vehicle safety features.

- Ask your insurance agent about any available discounts or savings programs.

Are there any specific discounts available for car insurance in Santa Clara, CA?

Yes, many insurance companies offer various discounts that can help lower your car insurance rates in Santa Clara, CA. Some common discounts include multi-policy discounts (for bundling multiple policies with the same insurer), good driver discounts (for maintaining a clean driving record), discounts for safety features in your vehicle, and discounts for completing defensive driving courses. It’s advisable to inquire with insurance providers about the specific discounts they offer and see if you qualify for any.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.