Best Springfield, MA Car Insurance in 2026

The cheapest Springfield, MA car insurance is offered by State Farm, but rates will vary by driver. Auto insurance in Springfield must meet the state minimum requirements of 20/40/5 in liability coverage, 20/40 in uninsured/underinsured coverage, and $8,000 in no-fault personal injury coverage. Compare Springfield, MA auto insurance rates online to find your best deal.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

- State Farm offers the cheapest average car insurance rates in Springfield, MA

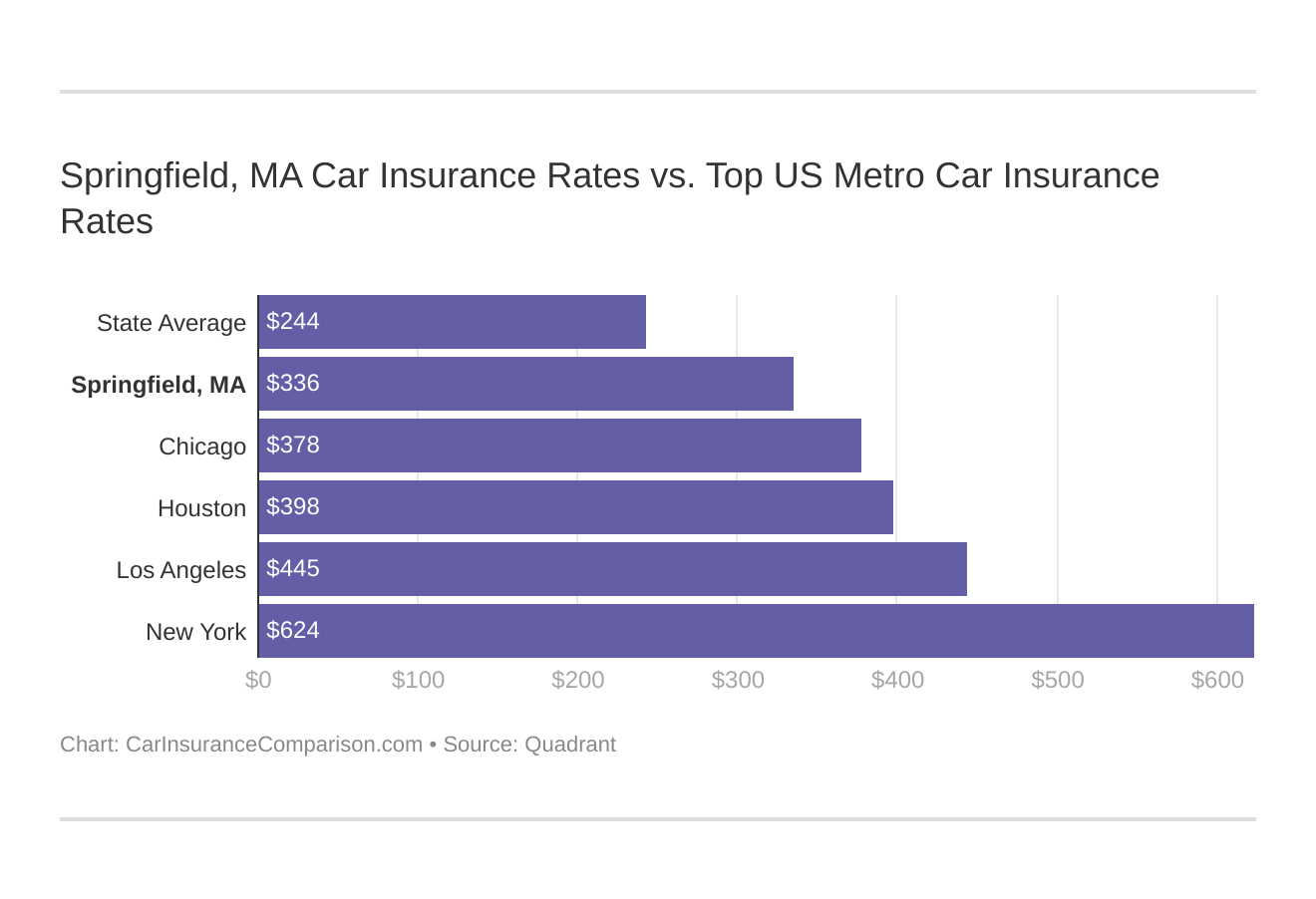

- Springfield car insurance rates are higher than the national average

- Massachusetts is a no-fault state, meaning your car insurance pays for damages no matter who caused the accident

Springfield, MA car insurance is more expensive than the national average. This isn’t surprising since average Massachusetts car insurance rates are higher than average in general.

You can still find affordable Springfield, MA car insurance if you know where to look. Shop around and compare rates from multiple companies to find the cheap car insurance that meets your needs.

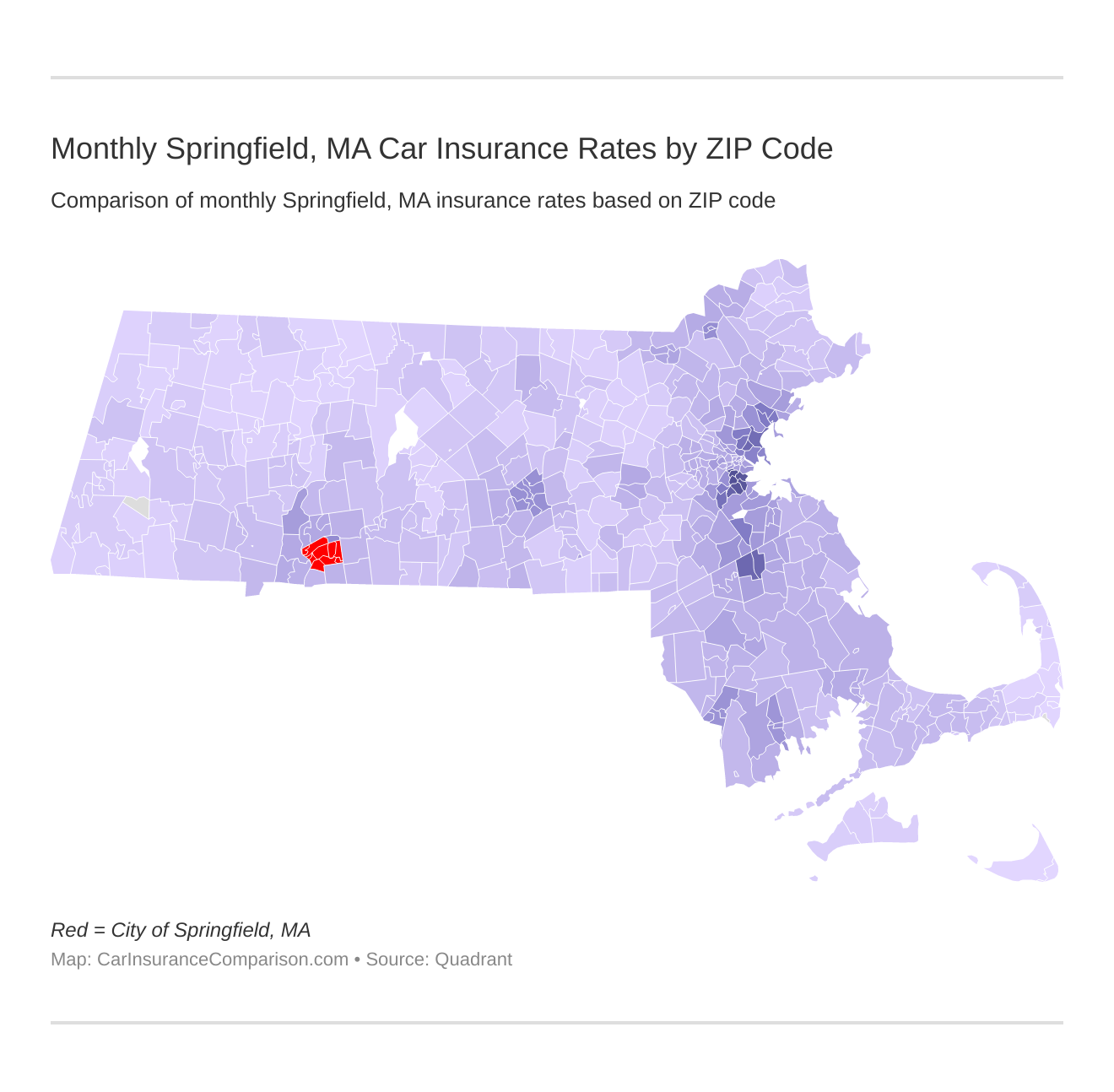

Monthly Springfield, MA Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Springfield, Massachusetts auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Springfield, MA Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Springfield, MA stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

Enter your ZIP code now to compare Springfield, MA car insurance quotes for free today.

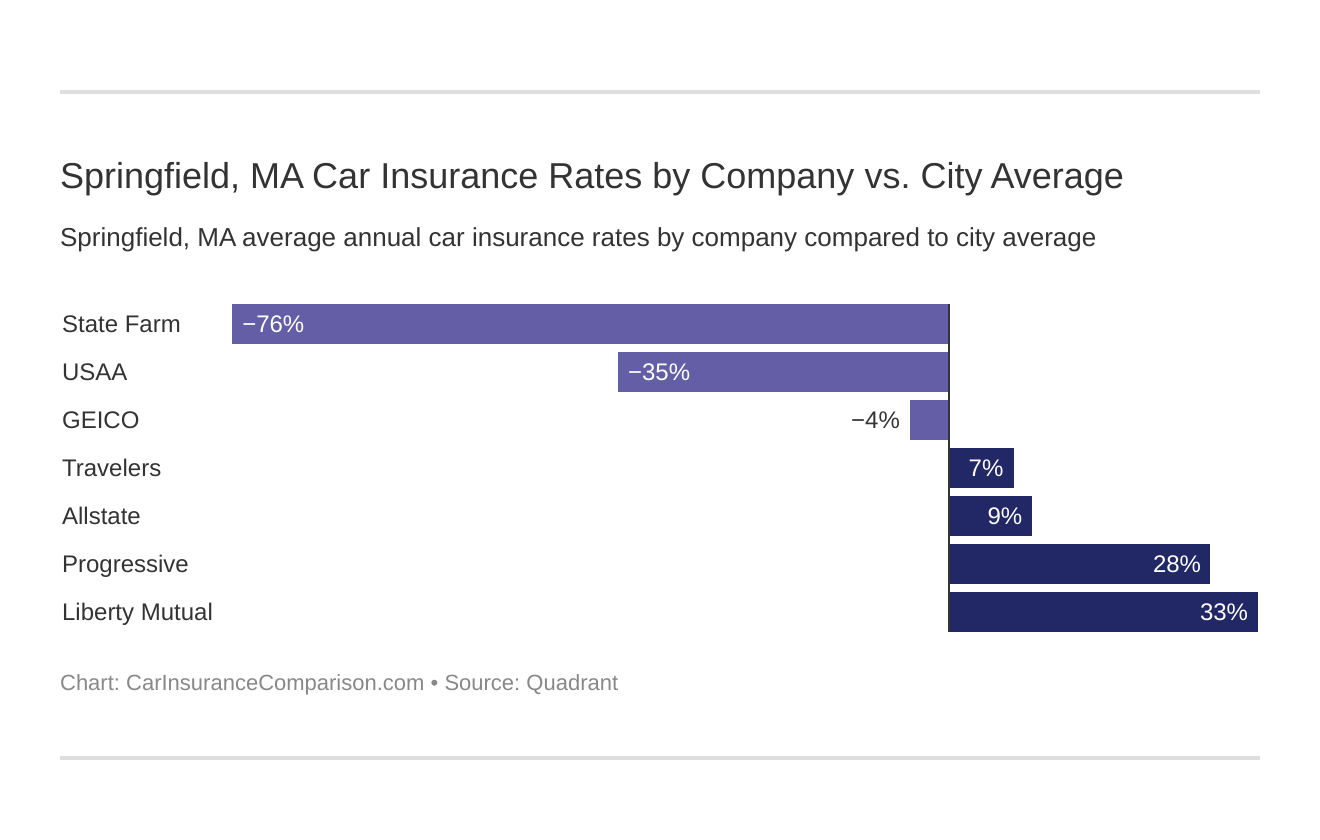

What is the cheapest car insurance company in Springfield, MA?

The cheapest car insurance in Springfield is from State Farm, although rates will vary by driver.

Which Springfield, MA car insurance company has the best rates? And how do those rates compare against the average Massachusetts car insurance company rates? We’ve got the answers below.

The top car insurance companies in Springfield, MA listed from least to most expensive are:

- State Farm car insurance – $1,800.81

- USAA car insurance – $2,828.84

- Geico car insurance – $3,865.31

- Travelers car insurance – $4,335.55

- Allstate car insurance – $4,423.04

- Progressive car insurance – $5,333.03

- Liberty Mutual car insurance – $5,603.76

There are many factors that affect car insurance rates. Your age, driving record, and ZIP code can all affect your rates.

Even the icy Springfield, MA weather can make insurance companies charge you more. Whether it’s Springfield or nearby Worcester car insurance, accidents caused by rain, snow, and ice on the roads can allow car insurance companies to increase rates.

It’s important to note that Massachusetts is one of the few states that does not allow gender and credit history to be used to calculate your auto insurance rates.

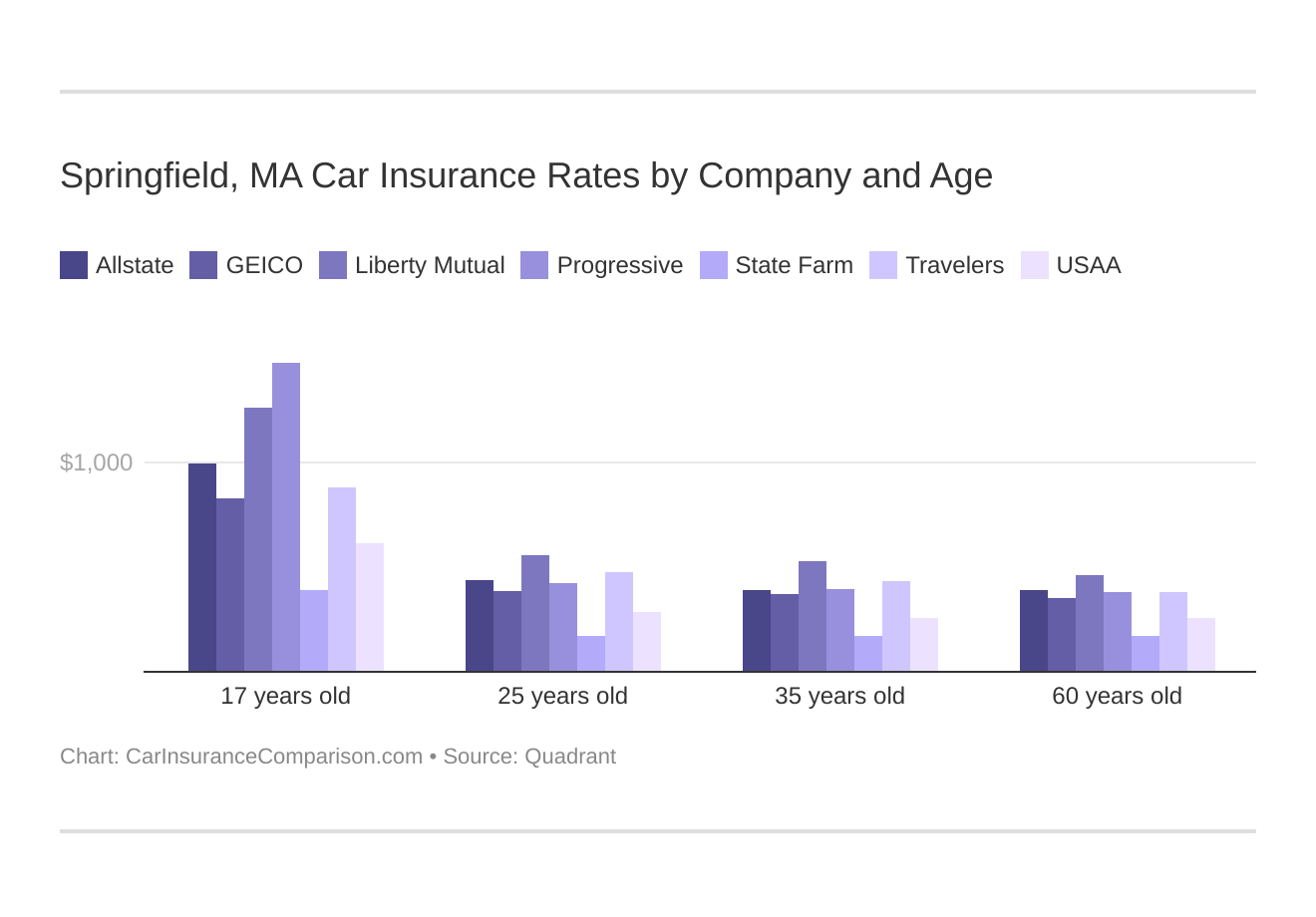

Comparing Springfield, MA car insurance rates by age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

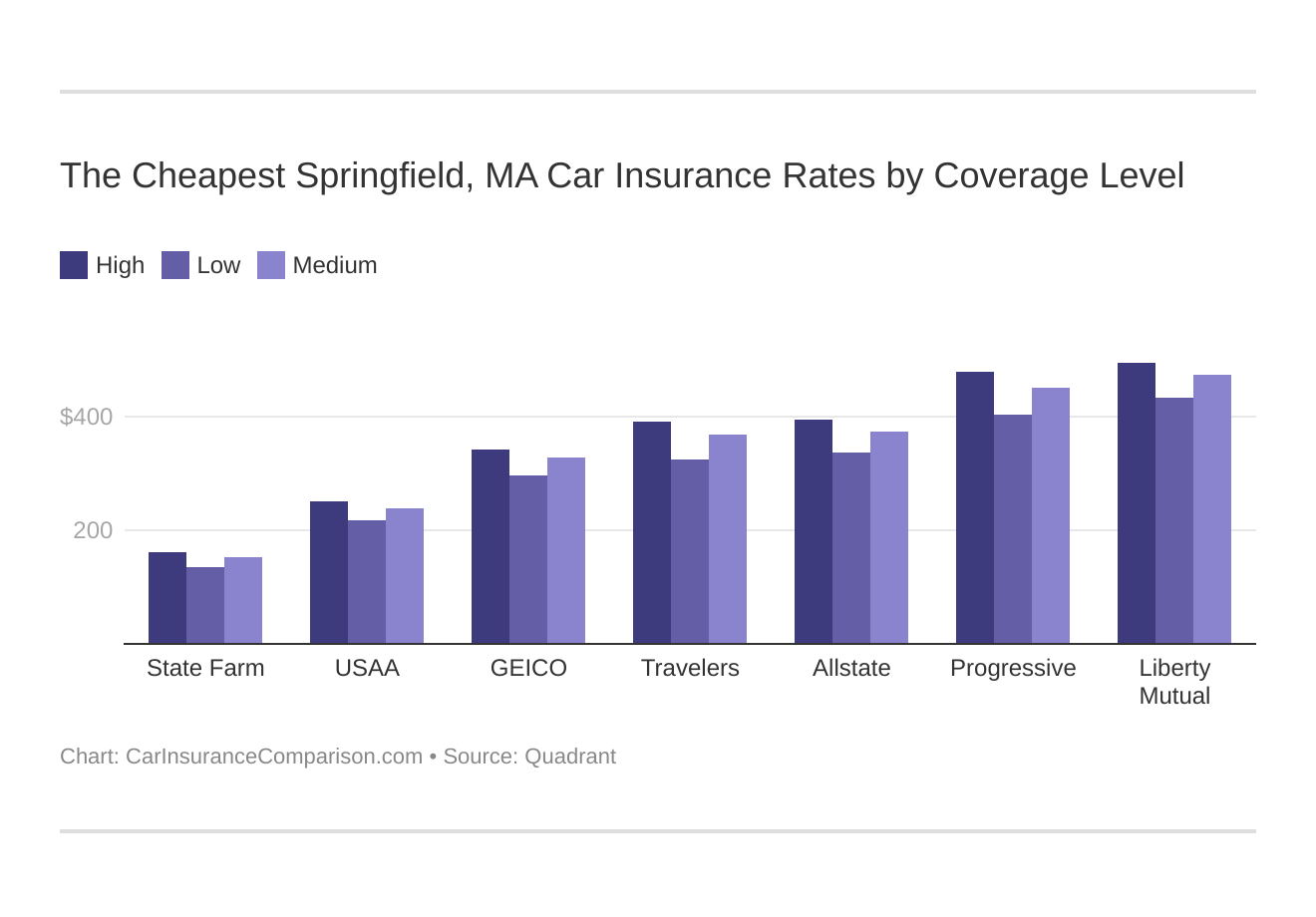

Your coverage level will play a major role in your Springfield car insurance rates. Find the cheapest Springfield, MA car insurance rates by coverage level below:

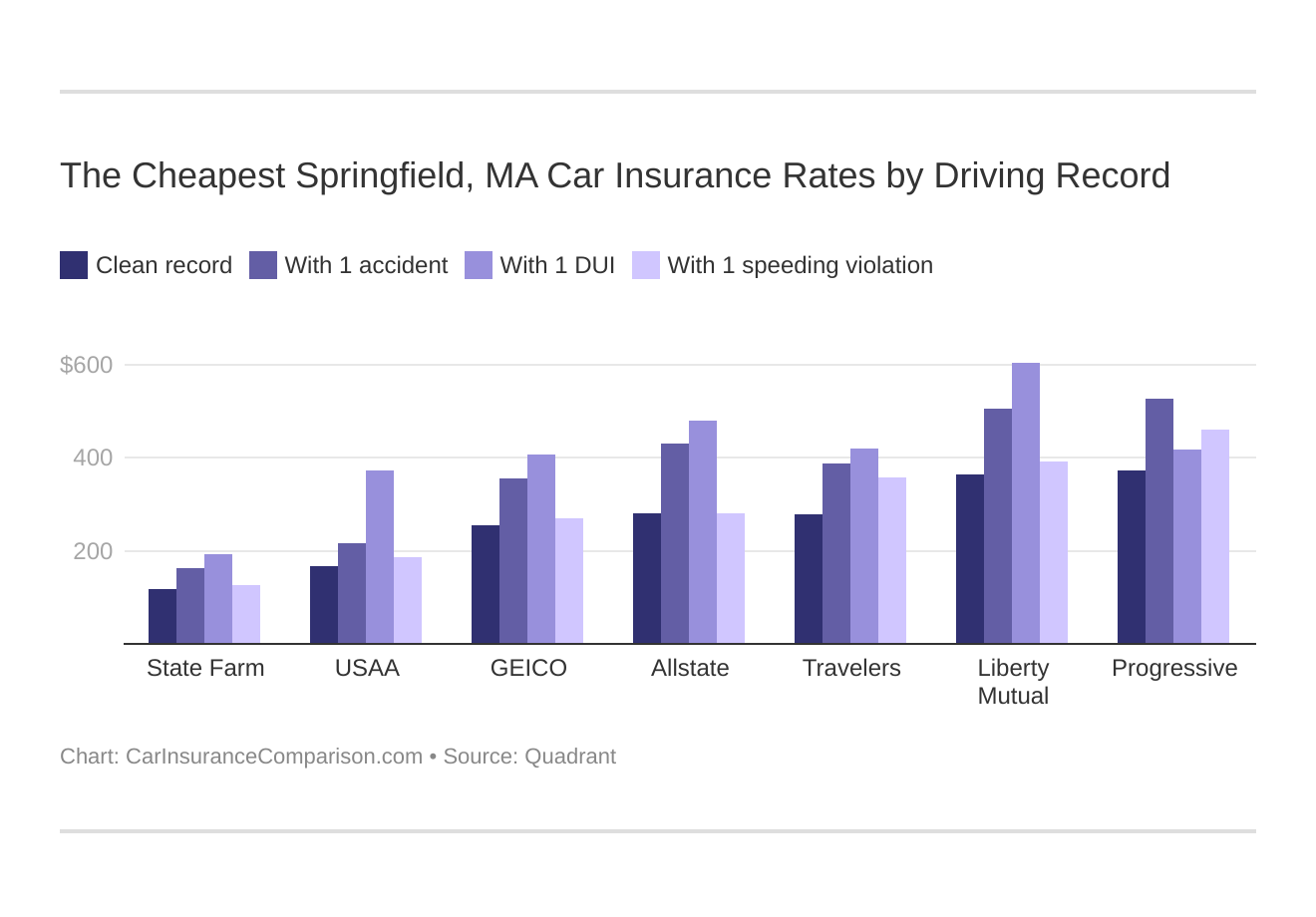

Your driving record will play a major role in your Springfield car insurance rates. For example, other factors aside, a Springfield, MA DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Springfield, MA car insurance with a bad driving record.

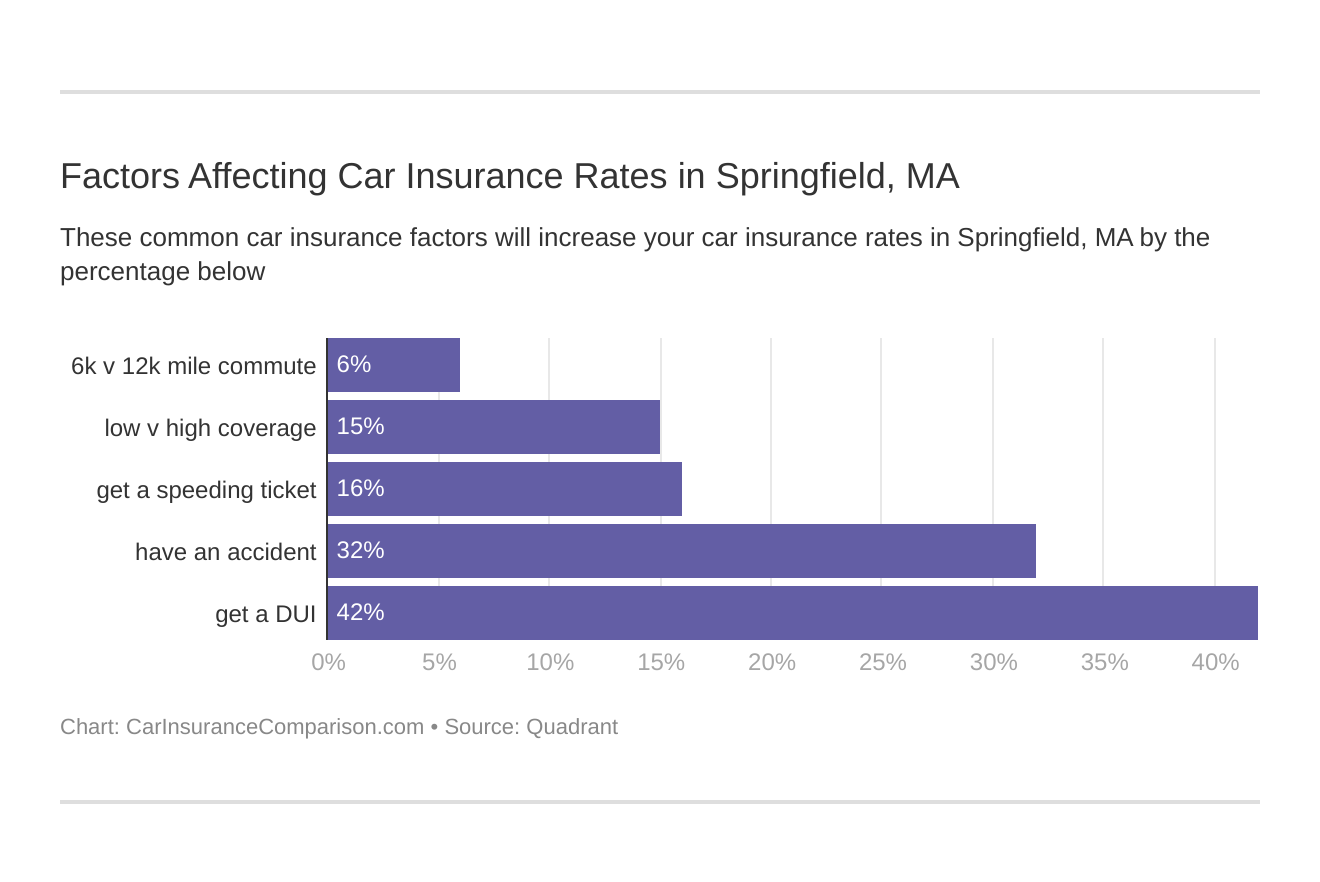

Factors affecting car insurance rates in Springfield, MA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Springfield, Massachusetts car insurance.

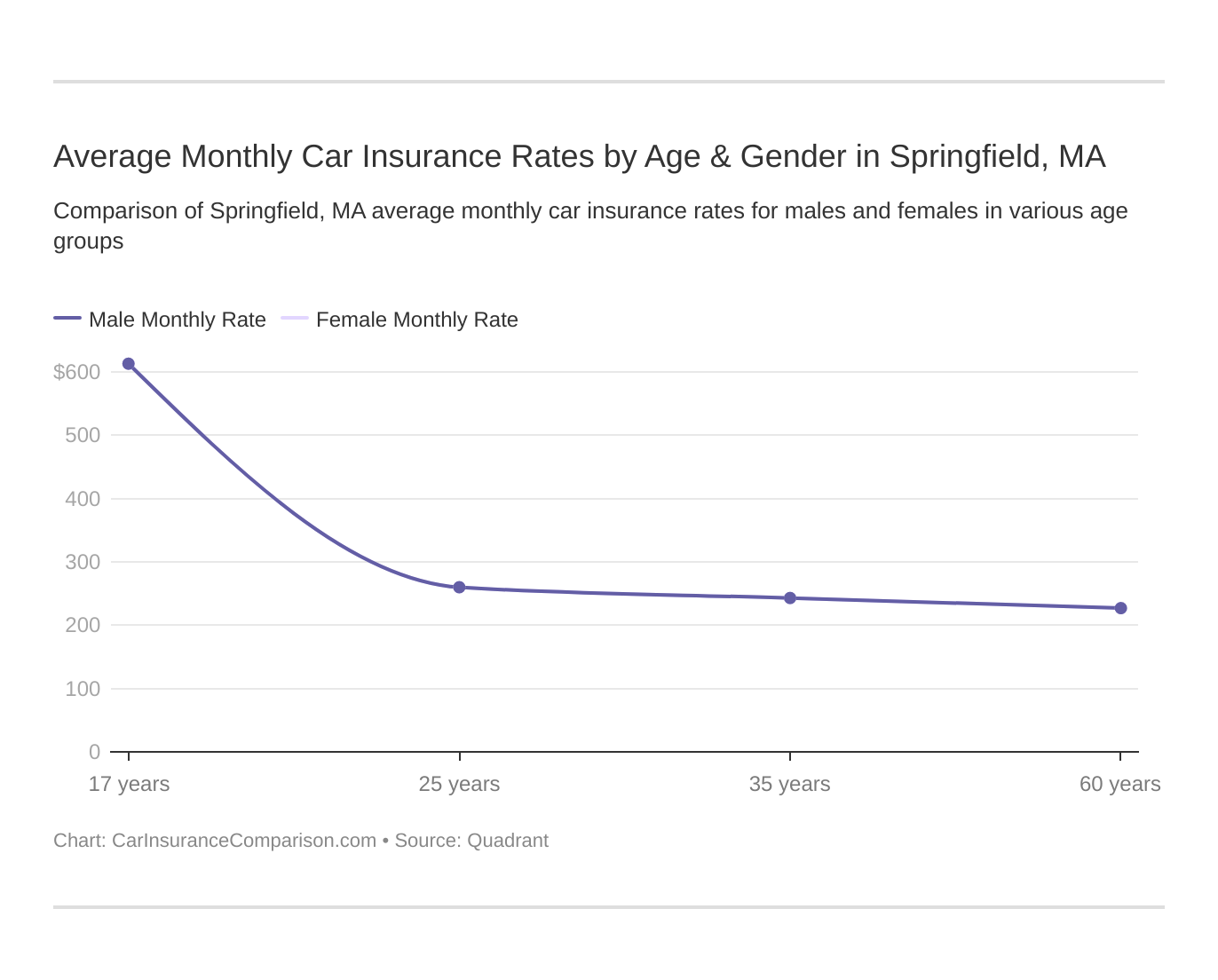

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. MA does not use gender, so check out the average monthly car insurance rates by age in Springfield, MA.

What car insurance coverage is required in Springfield, MA?

Like in most states, Massachusetts drivers must carry at least a minimum amount of car insurance required by the state. Drivers in Springfield must carry:

- $20,000 per person and $40,000 per incident for bodily injury liability

- $5,000 per incident for property damage

- $8,000 in no-fault personal injury coverage

- $20,000 per person and $40,000 per incident for uninsured/underinsured motorist coverage

Massachusetts is a no-fault state. This means that your car insurance company pays for damages no matter who caused the accident.

These minimum requirements are very low and will be exhausted quickly in a serious accident. Consider upping these limits and adding additional coverages like collision car insurance and comprehensive car insurance so that you are fully insured.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Springfield, MA?

Traffic can impact your car insurance rates because more cars on the road equal a greater chance of being in an accident.

INRIX ranks Springfield, MA as the 190th most congested city in the U.S. Not having to sit in traffic for long periods of time is good news for area drivers.

City-Data reports that most drivers in Springfield commute about 25 minutes.

Auto theft can also raise your rates. According to the FBI, there were 509 motor vehicle thefts in Springfield in one year.

Springfield, MA Car Insurance: The Bottom Line

Springfield auto insurance is more expensive than the state and national averages. Before you buy Springfield, MA car insurance, compare quotes to see which company can offer you the best deal.

Enter your ZIP code to compare Springfield, MA car insurance rates from multiple companies near you for free.

Frequently Asked Questions

What are the minimum car insurance requirements in Springfield, MA?

Springfield, MA requires 20/40/5 liability coverage, 20/40 uninsured/underinsured coverage, and $8,000 in no-fault personal injury coverage.

Which company offers the cheapest car insurance in Springfield, MA?

State Farm generally offers the cheapest rates, but prices vary by driver.

How can I find affordable car insurance in Springfield, MA?

Shop around and compare quotes from different companies online.

What factors affect car insurance rates in Springfield, MA?

Factors include age, driving record, ZIP code, and weather conditions.

Where can I compare car insurance quotes in Springfield, MA?

Use free online quote tools to compare rates from multiple companies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.