The Hartford Car Insurance Review for 2025 [Insider Evaluation]

The Hartford car insurance reviews are generally positive, especially for its lifetime renewability option, solid customer service ratings, and perks for AARP members. However, The Hartford car insurance rates are not the cheapest, with prices starting above the national average at $43 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The Hartford

Min. Coverage

$43A.M. Best:

A+Complaint level:

HighPros

- Special savings for AARP members

- Lifetime renewability option

- Solid customer service reviews

Cons

- Higher average premiums

- AARP membership requirements

The Hartford car insurance reviews say this company is a reputable choice known for its partnership with AARP.

The Hartford earns its spot as one of the best car insurance companies for seniors with its excellent customer service, comprehensive coverage options, and valuable benefits. However, The Hartford insurance may not be the best choice for younger drivers or those seeking the lowest premiums, as its rates can be higher compared to competitors.

The Hartford Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.5 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 5 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.5 |

| Policy Options | 4.1 |

| Savings Potential | 4.3 |

Read on to learn more about The Hartford insurance company, including if you’re eligible to purchase a policy. Then, enter your ZIP code into our free comparison tool to compare rates in your area.

- The Hartford sells car insurance exclusively to AARP members

- Customers generally recommend The Hartford as an insurance provider

- The Hartford auto insurance rates tend to be higher than average

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hartford Car Insurance Rates

While there are many tips to finding competitive car insurance rates, the most important step to take is comparing rates. Although The Hartford only sells AARP auto insurance, older drivers should still compare rates before signing up for a policy.

First, you can get an overall sense of what The Hartford car insurance rates might look like for you below.

The Hartford Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $215 | $552 |

| Age: 16 Male | $235 | $577 |

| Age: 18 Female | $175 | $407 |

| Age: 18 Male | $201 | $469 |

| Age: 25 Female | $51 | $135 |

| Age: 25 Male | $54 | $143 |

| Age: 30 Female | $47 | $126 |

| Age: 30 Male | $50 | $133 |

| Age: 45 Female | $44 | $115 |

| Age: 45 Male | $43 | $113 |

| Age: 60 Female | $39 | $101 |

| Age: 60 Male | $40 | $103 |

| Age: 65 Female | $43 | $112 |

| Age: 65 Male | $42 | $109 |

You might notice that rates for young drivers are included in the table above. Although you can only buy AARP car insurance from The Hartford, AARP members can add younger drivers to their policies.

While you can add young drivers to your policy from The Hartford, it may not be the best option. Teen car insurance rates are notoriously high, so you’ll likely find better prices at a company that specializes in coverage for young drivers.

Scott W. Johnson Licensed Insurance Agent

More factors play a role in your insurance rates besides your age and gender. One of the most important is your driving record – drivers with clean records pay significantly less for insurance. Check below to see how The Hartford car insurance quotes change by driving record.

The Hartford auto insurance reviews are usually positive, but they frequently mention that it can be expensive. If you compare the rates above with other companies, you’ll likely find cheaper prices elsewhere.

Compare The Hartford Car Insurance Rates to Top Providers

Generally speaking, The Hartford tends to be pricier than many of its competitors. Compare average quotes from The Hartford with its top competitors below.

The Hartford Monthly Car Insurance Cost vs. Competitors

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $86 |

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $43 | $113 |

| $37 | $99 |

Learning how to compare multiple free car insurance quotes is a simple step you can take to find the cheapest provider for you.

The Hartford Car Insurance Options

The Hartford offers the same basic policy options that most companies sell. This includes the following types of car insurance:

- Liability Insurance: Liability car insurance coverage covers the cost of injuries and property damage to others if you’re at fault in an accident. It does not cover your own injuries or vehicle damage.

- Comprehensive Insurance: Comprehensive insurance protects against non-collision events like theft, vandalism, fire, natural disasters, and hitting an animal.

- Collision Insurance: Collision car insurance coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault.

- Uninsured/Underinsured Motorist Insurance: Uninsured/underinsured motorist coverage pays for medical bills and damage to your vehicle if you’re hit by a driver without insurance or with insufficient coverage.

- Personal Injury Protection (PIP)/Medical Payments Insurance: PIP and medical payments covers medical expenses, lost wages, and other related costs for you and your passengers after an accident.

The amount of coverage you should purchase from The Hartford depends on your needs and where you live. If you want the cheapest policy, you’ll probably only need liability insurance. If you have a loan or lease on your vehicle, you’ll probably need full coverage.

If you want to purchase more coverage than a basic policy can offer, The Hartford offers a variety of add-ons. Some of the most popular choices include:

- Gap Insurance: Gap insurance covers the difference between the actual cash value of your car and the remaining balance on your auto loan or lease if your car is totaled or stolen.

- New Car Replacement Coverage: If your new car is totaled within a certain time or mileage limit (usually the first year or 15,000 miles), this coverage helps you replace it with a brand-new car of the same make and model.

- Accident Forgiveness: Accident forgiveness prevents your insurance premium from increasing after your first at-fault accident.

- Disappearing Deductible: Add this to your policy to lower your deductible over time for each year you remain accident-free.

When you get a quote from The Hartford, you’ll have the chance to pick which coverages you want. Filling out a quote request form is simple and takes just a few minutes.

If you already have a policy, you can call The Hartford car insurance phone number to add more coverage. Alternatively, you can manage your policy coverages online.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Hartford Car Insurance Discounts

The best car insurance discounts can help you lower your premiums by a significant amount. To help its customers save money, The Hartford offers a variety of car insurance discounts. Take a look below to see the discounts The Hartford offers.

The Hartford Insurance Discounts

| Discount Name | Potential Savings | Who Qualifies? |

|---|---|---|

| Bundle | 20% | Customers who bundle auto with home or renters insurance |

| Vehicle Safety | 10% | Owners of vehicles equipped with safety features |

| Defensive Driver | 10% | Drivers who complete an approved defensive driving course |

| AARP Member | 10% | AARP members |

| Paid-in-Full | 10% | Customers who pay their policy in full upfront |

| Anti-Theft Device | 5% | Owners of vehicles with anti-theft devices |

| Good Student | 15% | Students with good academic performance |

| Driver Training | 5% | Young drivers who complete a training program |

| New Vehicle | 10% | Owners of newly purchased vehicles |

| Electric/Hybrid Vehicle | 5% | Owners of electric or hybrid vehicles |

Most discounts automatically apply to your account. Others, like the good student discount, need proof of eligibility submitted to The Hartford before you can earn the savings.

TrueLane by The Hartford

Like most insurance companies, The Hartford offers a UBI program to help drivers save.

The Hartford’s UBI program is called TrueLane. Signing up for TrueLane automatically earns you a 12% discount. However, this 12% discount only applies to your account if you have a new policy and sign up within 60 days.

You’ll need to download the TrueLane app to participate. The TrueLane app monitors driving behavior to offer additional savings based on your performance. The safest drivers can earn a maximum discount of 40%, while the average driver saves about 25%.

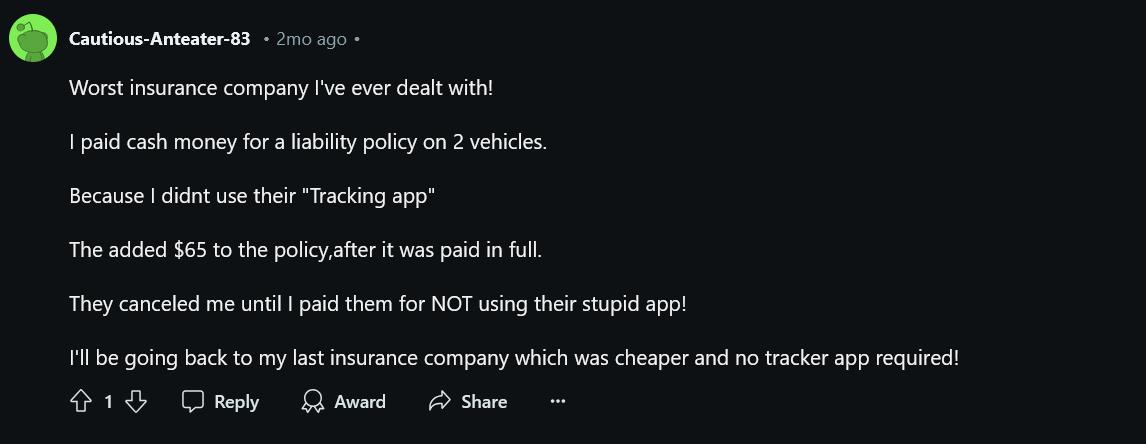

The Hartford Car Insurance Customer Reviews

When it comes to The Hartford customer service reviews, feelings are mixed. Some drivers love the service they get from the AARP auto insurance program from The Hartford, while others are less than impressed.

Satisfied customers usually mention being happy with the perks their AARP membership gets them, like access to The Hartford’s comprehensive coverage options. Many also appreciate the special efforts The Hartford takes to serve senior citizens.

Did you know more than 10 million people age 50+ live in poverty? The Hartford is proud to partner with 4000+ volunteers in support of AARP Foundation’s 2019 Celebration of Service event, packing 1 million meals for hungry seniors. pic.twitter.com/DoX6aO9SxG

— The Hartford (@TheHartford) September 12, 2019

Other customers are less pleased, and reviews frequently report that The Hartford car insurance claims process is slow. There are also complaints about high prices and unexpected rate increases. For example, you can see the frustration this Reddit user has with The Hartford.

This Reddit user’s experience is one reason why experts recommend that you research your options before signing up for a policy.

Customer reviews play an important role in picking your insurance company, but you should also consider other reviews. Experts suggest looking at third-party rating companies like the Better Business Bureau, the NAIC, J.D. Power, and A.M. Best to see a more complete picture of an insurance company.

Kalyn Johnson Insurance Claims Support & Sr. Adjuster

While The Hartford isn’t one of the best car insurance companies overall, the mixture of coverage options and AARP perks means you should at least get a quote. The Hartford has a loyal base of customers who highly recommend the company.

The Hartford Car Insurance Business Reviews

While reviews for The Hartford are mixed, third-party rating companies don’t seem to have the same opinions. Most ratings for The Hartford are positive.

The Hartford Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 905 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Financial Strength |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: A+ Superior Financial Strength |

These ratings can give you valuable information about an insurance company. For example, The Hartford’s A.M. Best rating of A+ means it’s a financially strong company. Drivers won’t have to worry about filing car insurance claims with The Hartford because the company can afford to pay them.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of The Hartford Car Insurance

Before you visit the website or call The Hartford insurance phone number, you should read through the pros and cons of AARP car insurance.

When you shop at The Hartford, you’ll enjoy the following pros:

- AARP Benefits: The Hartford offers special discounts and perks for AARP members, including unique coverage options tailored for older drivers.

- Strong Customer Service: With strong customer support ratings, The Hartford offers a great insurance experience.

- Lifetime Renewability: Unlike most other companies, The Hartford guarantees policy renewal as long as you meet basic eligibility criteria.

Like most other companies, The Hartford is not without its drawbacks. Here are the most important cons to look out for when you shop at The Hartford.

- Higher Premiums: Premiums at The Hartford are generally more expensive than some competitors, particularly for younger or high-risk drivers.

- Limited Availability: Some of The Hartford’s best benefits, like AARP discounts, are only available to AARP members, which limits access for non-members.

The Hartford is an excellent choice for older drivers with AARP memberships, but it’s not right for everyone. You should always do a car insurance comparison before you sign up for a policy.

See if The Hartford is Right for You Today

Overall, The Hartford offers strong car insurance options, especially for AARP members and older drivers seeking tailored coverage and excellent customer service. Its standout feature is its lifetime renewability, providing long-term peace of mind. However, its higher premiums mean The Hartford does not have the best car insurance for teen drivers.

Before you sign up for a policy from The Hartford, you should compare rates with as many companies as possible. Enter your ZIP code into our free comparison tool below to get started.

Frequently Asked Questions

Is The Hartford a good choice for car insurance?

The Hartford is a good choice for car insurance, particularly for older drivers and AARP members. It offers excellent customer service, a range of coverage options, and valuable benefits like lifetime renewability and accident forgiveness.

However, it may not be the best fit for everyone. Drivers looking for cheap car insurance will likely find better prices elsewhere.

Is The Hartford good at paying claims?

The Hartford generally receives positive reviews for its claims handling process. Most claims through The Hartford are paid within 30 days of filing.

Is The Hartford insurance only for AARP members?

You need an AARP membership to purchase a policy from The Hartford. However, non-members can be insured by The Hartford through a family plan.

Is The Hartford cheaper than Geico?

While not the most expensive option on the market, The Hartford car insurance almost always costs more than Geico. Geico is well known for its affordable rates but doesn’t have the AARP perks that The Hartford offers. See which company is right for you by comparing our Geico car insurance review.

How much does car insurance from The Hartford cost?

There are many factors that affect car insurance rates, but the average driver pays $43 for minimum insurance and $113 for full coverage at The Hartford.

Does The Hartford have usage-based insurance?

Yes, The Hartford offers a UBI program called TrueLane. You can earn a 12% savings just for signing up and up to 40% off total for being a safe driver. To participate, you need to download the TrueLane mobile app. If you’re interested in UBI savings, make sure to compare TrueLane with the best usage-based car insurance companies.

How do you file a claim with The Hartford?

There are two options for filing a claim from The Hartford. The first is to call The Hartford insurance claims phone number and speak with a representative, who will walk you through the process. The more convenient option is to start a claim online.

Does The Hartford sell other types of insurance?

The Hartford sells a variety of policies, including homeowners, renters, flood, umbrella, and business insurance.

Can you add a younger driver to an AARP policy from The Hartford?

As long as the policyholder is an AARP member, they can add other non-members from their household to their policy. However, younger drivers can usually find cheaper rates at other companies. Enter your ZIP code into our free comparison tool to find the best rates if you need to insure a young driver.

What states does The Hartford sell car insurance in?

The Hartford sells car insurance in all 50 states, plus Washington, D.C.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.