Cheapest Virginia Car Insurance Rates in 2026 (Unlock Big Savings From These 10 Companies!)

The top providers for the cheapest Virginia car insurance rates are USAA, Progressive, and State Farm, offering the lowest rates, starting at $18/month. These companies excel in affordability, customer satisfaction, and financial stability, making them the best choices for Virginia drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated February 2026

Company Facts

Min. Coverage for Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the cheapest Virginia car insurance rates are USAA, Progressive, and State Farm, offering exceptional benefits with a minimum rate of $18/month.

These companies excel in affordability, customer satisfaction, and financial stability, making them the top picks for Virginia drivers. By comparing quotes from these top providers, you can find the most affordable coverage tailored to your needs.

Our Top 10 Company Picks: Cheapest Virginia Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $18 A++ Military Benefits USAA

![]()

#2 $26 A+ Flexible Coverage Progressive

![]()

#3 $27 B Reliable Coverage State Farm

#4 $29 A++ Competitive Rates Geico

#5 $31 A++ Multi-Policy Savings Travelers

#6 $35 A Customer Service American Family

#7 $36 A+ Accident Forgiveness Nationwide

#8 $42 A Safe Driver Farmers

#9 $43 A+ Bundling Options Allstate

#10 $54 A Customizable Plans Liberty Mutual

Dive into this comprehensive guide to learn how to unlock big savings and make informed decisions about your car insurance.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- USAA offers the best rates and coverage for Virginia drivers, starts at $18/month

- Compare top companies to find the cheapest Virginia car insurance rates

- Tailor your policy to your needs to ensure you get the best value and savings

#1 – USAA: Top Overall Pick

Pros

- Affordability: USAA offers some of the lowest rates in Virginia, with minimum coverage starting at $18/month, making it a cost-effective option for many drivers.

- Customer Satisfaction: USAA car insurance review highlights its exceptional customer service and efficient claims handling process, which contribute to its high customer satisfaction.

- Comprehensive Coverage Options: USAA provides a wide range of coverage options, including rental reimbursement, roadside assistance, and mechanical breakdown insurance.

Cons

- Limited Local Offices: USAA primarily operates online and over the phone, which might be inconvenient for those who prefer face-to-face interactions.

- No Usage-Based Insurance: Unlike some competitors, USAA does not offer a usage-based insurance option, which could be a drawback for low-mileage drivers seeking discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Progressive car insurance review highlights a range of coverage options, such as gap insurance, custom parts and equipment coverage, and pet injury coverage.

- Strong Online Tools: Progressive’s online tools and mobile app are user-friendly, allowing customers to easily manage their policies, file claims, and compare rates.

- Market Leader: As one of the largest insurance providers, Progressive has a strong market presence and extensive resources for customer support and claims processing.

Cons

- Higher Rates for High-Risk Drivers: Progressive may charge higher premiums for drivers with poor driving records or other high-risk factors.

- Mixed Customer Reviews: While many customers are satisfied, Progressive has received mixed reviews regarding their claims process and customer service.

#3 – State Farm: Best for Reliable Coverage

Pros

- Affordable Rates: State Farm car insurance review highlights its competitive rates, positioning it as one of the more affordable choices for many drivers in Virginia.

- Comprehensive Coverage Options: State Farm provides a wide range of coverage options, allowing customers to tailor their policies to fit their specific needs.

- Local Presence: With numerous local agents, State Farm provides personalized service and easy access for policy management and claims assistance.

Cons

- Higher Rates for Some Drivers: While generally affordable, State Farm can be more expensive for certain demographics, particularly young drivers.

- Availability of Discounts: Although offering several discounts, some customers might find that State Farm’s discount offerings are not as extensive as those of other insurers.

#4 – Geico: Best for Competitive Rates

Pros

- User-Friendly Digital Experience: Geico excels in its digital tools, offering a highly functional website and mobile app for easy policy management and claims filing.

- Wide Range of Discounts: Geico offers numerous discounts, including those for good drivers, multiple policies, and safety features, helping customers save more.

- National Presence: Geico car insurance review highlights Geico’s extensive national presence as one of the largest insurers in the U.S., showcasing its consistency and reliability.

Cons

- Mixed Customer Service Reviews: While Geico has a strong digital presence, its customer service reviews are mixed, with some customers reporting less satisfactory experiences.

- Higher Rates for Full Coverage: While offering low rates for minimum coverage, Geico’s rates for full coverage can be higher compared to other budget insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Multi-Policy Savings

Pros

- Discounts: They offer numerous discounts, such as multi-policy, safe driver, pay-in-full, early quote, and good student discounts. These can significantly lower premiums.

- Strong Financial Stability: Travelers car insurance review highlights the company’s high A.M. Best rating, showcasing its strong financial stability and capability to pay out claims.

- Extensive Customer Support: Travelers provides 24/7 customer support, which is accessible through various channels, including phone, online chat, and their mobile app.

Cons

- Average Customer Satisfaction: While Travelers provides good coverage, customer satisfaction ratings are average, indicating some clients may experience issues with claims processing or customer service.

- Limited Local Agents: In some areas, Travelers may have fewer local agents, which can be a disadvantage for customers who prefer face-to-face interactions.

#6 – American Family: Best for Customer Service

Pros

- Excellent Customer Service: Known for their attentive customer service, American Family has high customer satisfaction ratings and offers personalized service through a network of local agents.

- Comprehensive Discounts: American Family car insurance review highlights a variety of discounts, including multi-policy, loyalty, young volunteer, and safe driving discounts, which contribute to reducing overall insurance costs.

- Community Involvement: American Family is actively involved in community programs and charitable activities, which enhances their reputation and customer loyalty.

Cons

- Limited Availability: American Family insurance is not available in every state, which restricts access for some potential customers.

- Higher Premiums for New Drivers: Rates can be higher for young or inexperienced drivers, making it less competitive for families with teenage drivers.

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Wide Range of Coverage Options: Nationwide offers a variety of insurance products, including auto, home, renters, and life insurance, allowing for comprehensive coverage in one place.

- Discounts and Savings: Nationwide car insurance discounts showcases a variety of discounts available such as multi-policy, safe driver, and good student discounts, which can substantially lower premiums.

- Customer Service: Nationwide is known for its responsive customer service and claims handling, offering a hassle-free experience for policyholders.

Cons

- Higher Premiums: Some customers report higher-than-average premiums compared to other insurers, especially for certain types of coverage.

- Mixed Customer Reviews: While many customers praise Nationwide’s service, others report dissatisfaction with claim resolutions and billing practices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Safe Driver

Pros

- Comprehensive Coverage Options: Farmers offers a wide array of insurance products, including auto, home, life, and business insurance, making it easy to bundle policies.

- Customizable Policies: Farmers car insurance review highlights the ability for policyholders to customize their coverage with a range of add-ons and endorsements to meet their unique needs.

- Discounts and Rewards: Farmers provides several discounts, such as multi-policy, safe driver, and pay-in-full discounts, helping customers save on their premiums.

Cons

- Customer Service Variability: Customer service experiences can vary significantly depending on the local agent, leading to inconsistent service quality.

- Complex Policies: Some customers find Farmers’ policies and billing practices to be more complex and harder to understand compared to simpler alternatives.

#9 – Allstate: Best for Bundling Options

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of insurance products, including auto, home, renters, and life insurance, providing a one-stop-shop for all your insurance needs.

- Discounts: Allstate car insurance review highlights several discounts, including safe driver, multi-policy, and new car discounts, which help customers save on premiums.

- User-Friendly Technology: The Allstate mobile app and website offer easy access to policy information, claim filing, and payment options.

Cons

- Mixed Customer Service Reviews: Customer service experiences with Allstate can be inconsistent, with some customers reporting long wait times and unsatisfactory resolutions.

- Limited Availability of Local Agents: In some regions, finding a local Allstate agent can be challenging, making personalized service less accessible.

#10 – Liberty Mutual: Best for Customizable Plans

Pros

- Wide Range of Discounts: Liberty Mutual provides a variety of discounts, such as multi-policy, safe driver, and good student discounts, making their policies more affordable.

- Strong Financial Ratings: Liberty Mutual car insurance review showcases the company’s financial strength, ensuring efficient claims handling and reliable service.

- Nationwide Availability: Liberty Mutual operates in all 50 states, making it a widely accessible option for consumers across the country.

Cons

- Mixed Claims Handling Reviews: While many customers are satisfied, some have reported issues with the claims process, including delays and difficulties in communication.

- Aggressive Sales Tactics: Some customers have reported feeling pressured by Liberty Mutual’s sales tactics, which can be off-putting and lead to a negative customer experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Virginia Car Insurance Rates and Coverage

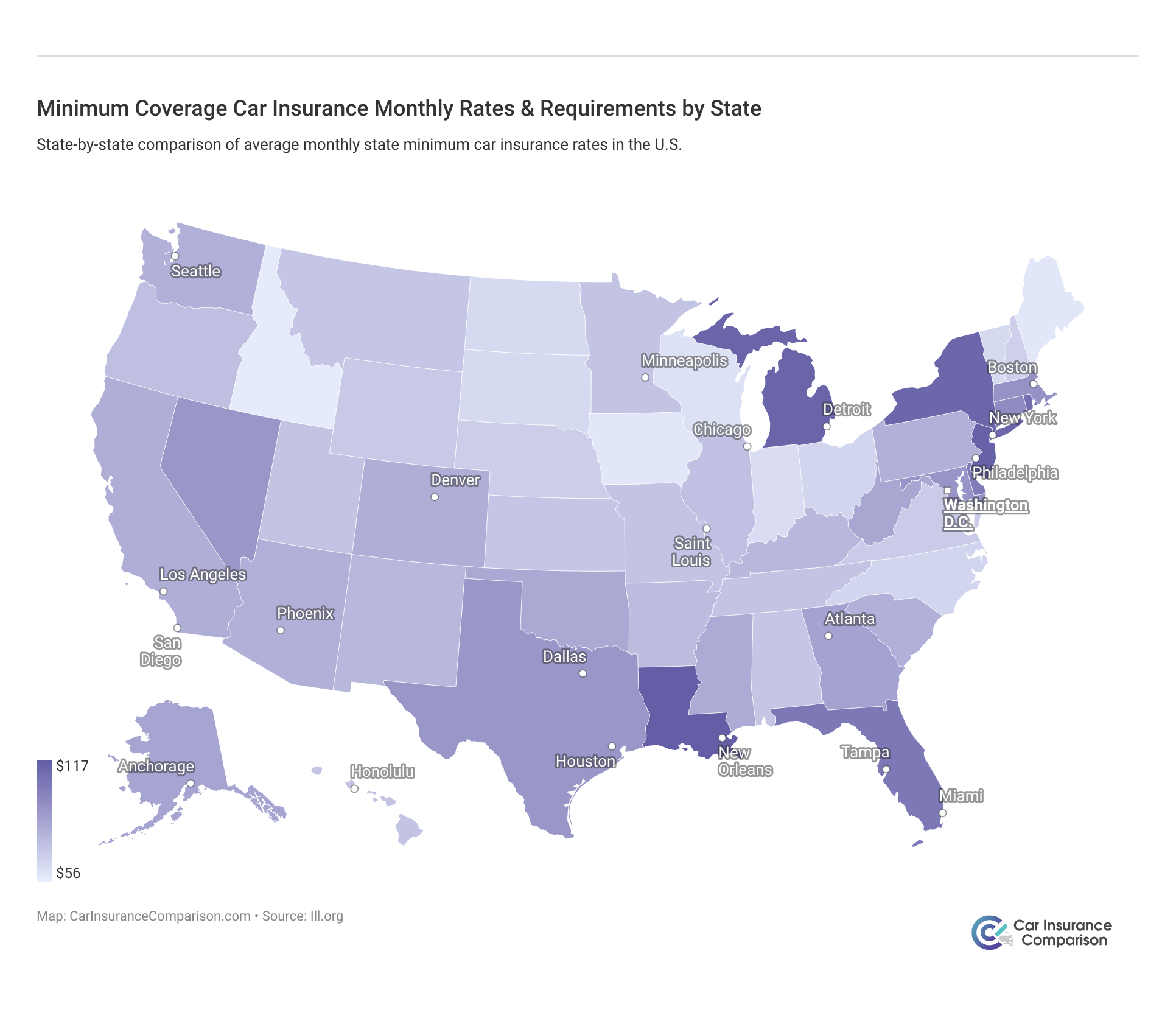

The median household income in Virginia was over $71,535, and drivers, on average paid over $843 for car insurance. There’s certainly nothing to love about that. We think consumers in the Old Dominion State are spending way too much money on car insurance. There has to be a better way to find cheap car insurance.

USAA offers the lowest rates and best overall value for Virginia drivers, starting at just $18 per month.

Brad Larson Licensed Insurance Agent

Understanding the minimum coverage requirements in Virginia is essential for all motorists. Below, we have provided detailed information and helpful advice to ensure you get the best coverage options for your needs. By familiarizing yourself with these requirements, you can make informed decisions about your car insurance policy, ensuring that you are adequately protected in case of an accident.

Whether you are a new driver or looking to update your existing policy, this guide will help you navigate the complexities of car insurance in Virginia, helping you find the most affordable and comprehensive coverage available. Below, we have provided information and helpful advice so you can get the best coverage options for your needs.

Virginia Car Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $20,000 |

The basic coverage requirements in Virginia for liability insurance are $25,000 to cover the death or injury per person, $50,000 to cover the total death or injury per accident, and $20,000 to cover property damage per accident.

Liability car insurance pays all individuals (drivers, passengers, pedestrians, etc.) who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes. If you cause a wreck, liability insurance pays everyone affected by the accident.

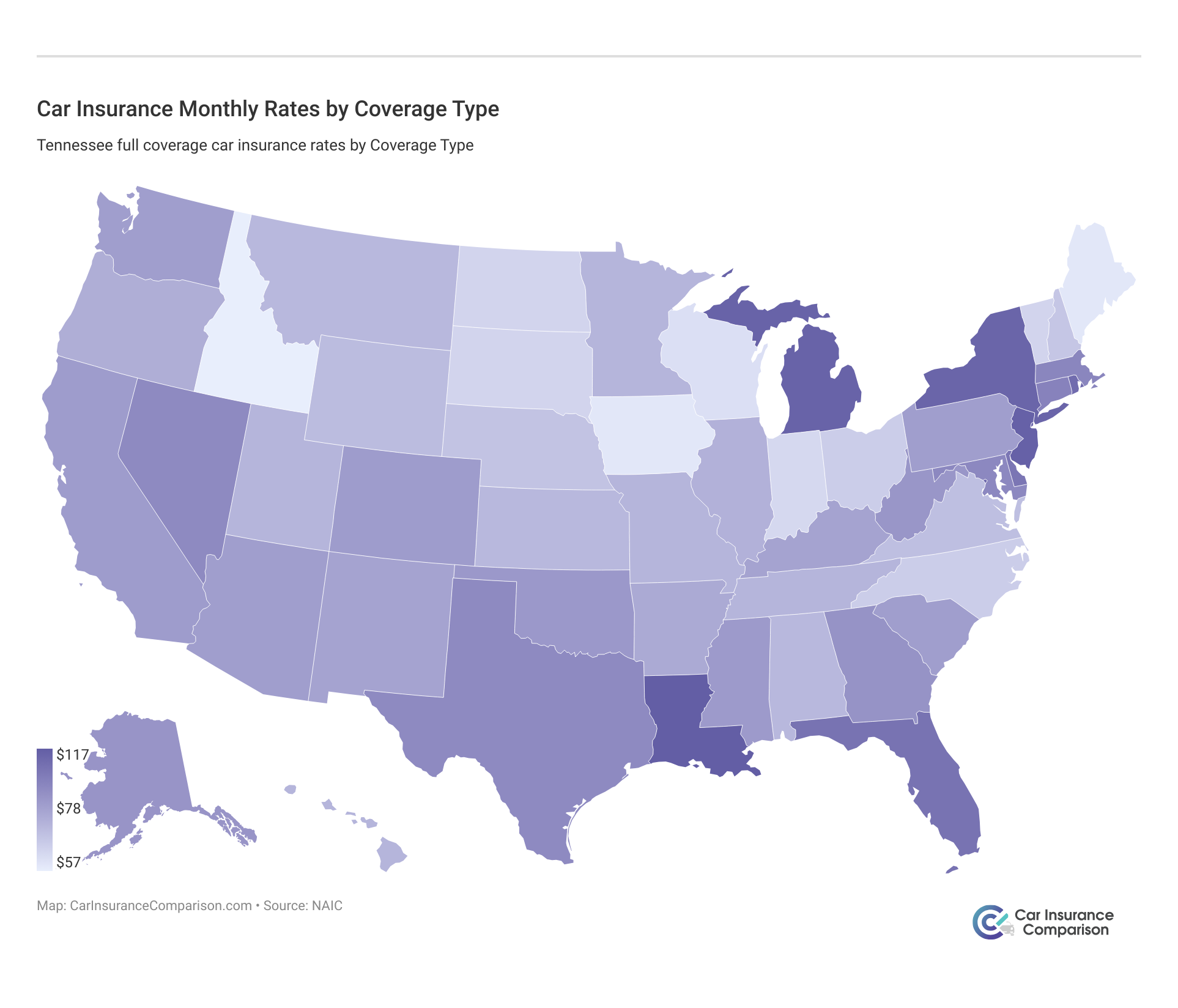

Virginia Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $43 $103

American Family $35 $83

Farmers $42 $100

Geico $29 $69

Liberty Mutual $54 $129

Nationwide $36 $86

Progressive $26 $61

State Farm $27 $63

Travelers $31 $73

USAA $18 $43

In Virginia, USAA offers the cheapest car insurance rates at $18 for minimum coverage and $43 for full coverage. Progressive and State Farm also have low rates, while Liberty Mutual is the most expensive, with $54 for minimum coverage and $129 for full coverage. Geico provides competitive rates, and companies like Allstate, American Family, Farmers, Nationwide, and Travelers fall in the mid-range.

Virginia may be for lovers, but there’s nothing to love about high car insurance rates. Auto insurance isn’t required in Virginia, and insured drivers often suffer the consequences by paying more for coverage. You can buy liability insurance in Virginia for around $70 per month, but comparing Virginia car insurance rates from multiple companies will get you the best price possible.

| Virginia Summary Statistics | Details |

|---|---|

| Road Miles | Total In State: 75,061 Vehicle Miles Driven: 81 billion |

| Vehicles | Registered In State: 6.96 million Total Stolen: 4,486 |

| State Population | 8,517,685 |

| Most Popular Vehicle | Honda CR-V |

| Uninsured Motorists | 9.90% Rank: 34th |

| Total Driving Fatalities | 2008 - 2017 Speeding: 2,031 Drunk Driving: 2,316 |

| Average Annual Premiums | Liability: $425/yr Collision: $280/yr Comprehensive: $136/yr Average Full Coverage Rates: $841/yr |

| Cheapest Providers | Nationwide and USAA |

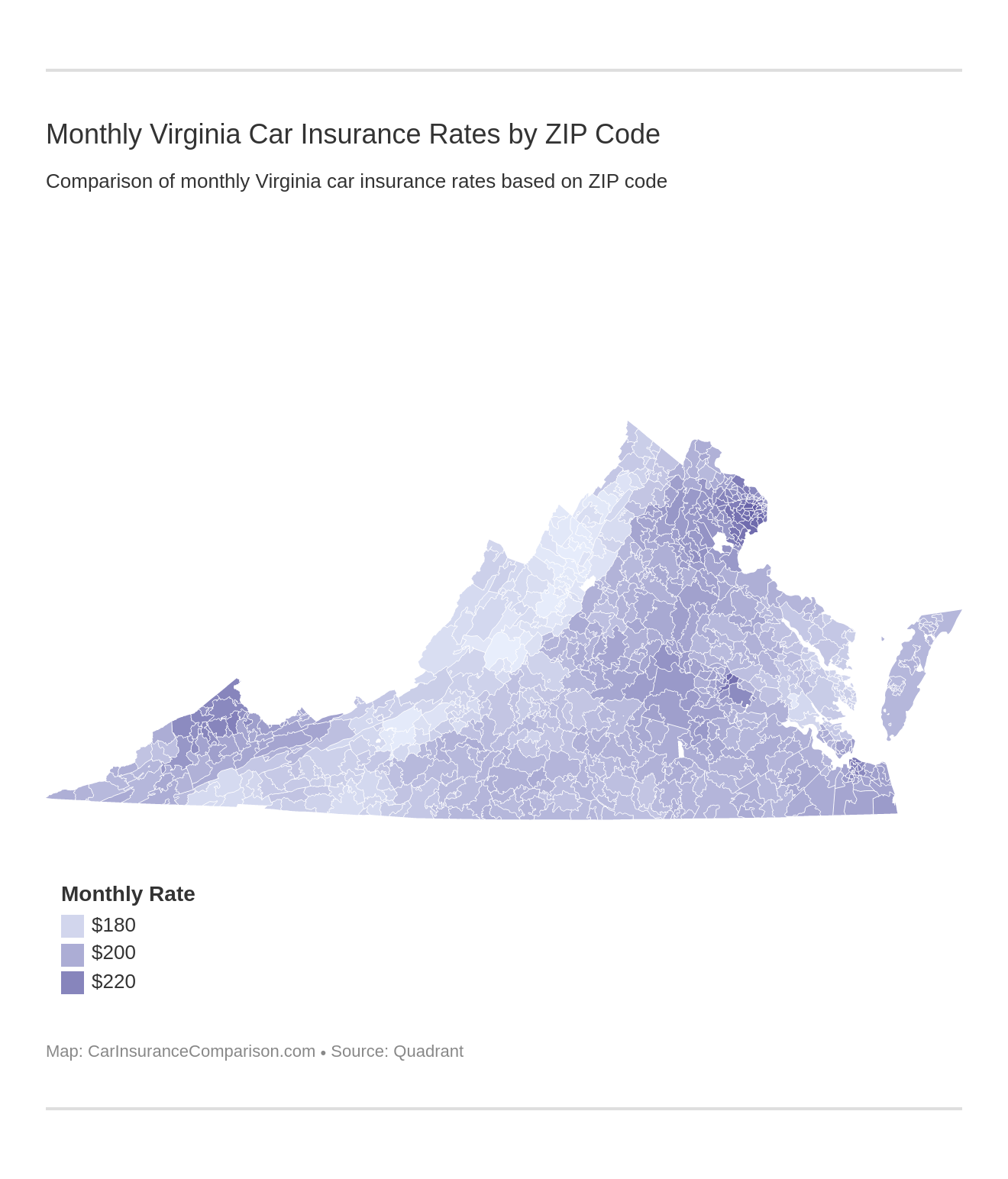

Where you live is one of the factors that affect car insurance rates, so compare quotes by city or ZIP code to get the most affordable Virginia insurance. Everything you need to know about buying cheap car insurance in Virginia, including how to compare Virginia car insurance rates, is in this comprehensive guide.

Understanding Financial Responsibility and Car Insurance Costs in Virginia

Financial responsibility means proving you have the state’s minimum liability coverage for your vehicle. Drivers must always carry proof of insurance, such as an insurance ID card or electronic proof. Alternatively, paying a $500 Uninsured Motor Vehicle (UMV) fee allows you to drive uninsured, but this expires with your registration and must be renewed.

USAA stands out as the top choice for Virginia drivers with unmatched affordability and exceptional customer satisfaction.

Michelle Robbins Licensed Insurance Agent

Driving without insurance can lead to issues if you’re in an accident. Virginians generally pay less for car insurance than the national average and neighboring states. With a per capita disposable income of $43,904, residents spend a smaller portion of their income on car insurance. Use a calculator for precise monthly cost comparisons.

Frequently Asked Questions

Who has the cheapest car insurance rates in Virginia?

USAA offers the cheapest car insurance rates in Virginia, starting at $18 per month for minimum coverage. However, this is available only to military members and their families. For others, Progressive and State Farm are also among the most affordable providers.

Who typically has the cheapest car insurance?

Generally, USAA and Geico are known for offering the most affordable car insurance rates nationwide. However, rates can vary significantly based on individual circumstances, such as driving history and location.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

What is the lowest form of car insurance?

The lowest form of car insurance is liability insurance, which covers damages and injuries you cause to others in an accident. In Virginia, the minimum requirements are $25,000 for bodily injury per person, $50,000 per accident, and $20,000 for property damage.

For a thorough understanding, refer to our detailed analysis titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

What is the state minimum for car insurance in Virginia?

Virginia’s minimum car insurance requirements are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage per accident.

What is the cheapest category for car insurance?

Minimum liability coverage is typically the cheapest category for car insurance. It meets the state’s legal requirements and is less expensive than comprehensive or collision coverage.

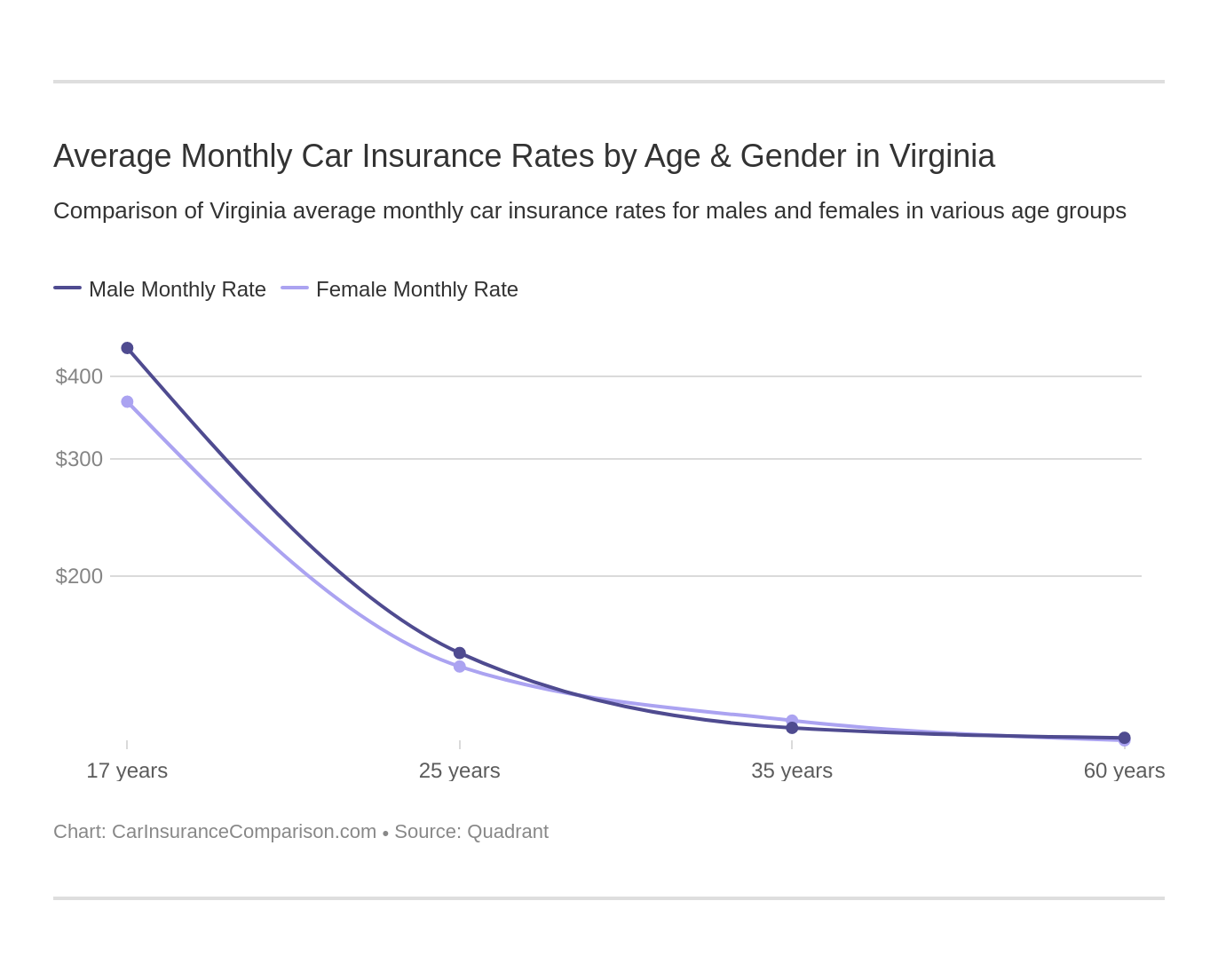

At what age is car insurance cheapest?

Car insurance rates generally become cheaper for drivers in their mid-30s to early 50s. Rates typically start to decline after the age of 25, assuming a good driving record, and continue to decrease until drivers reach around 55.

To delve deeper, refer to our in-depth report titled “Compare Car Insurance Rates by Vehicle Make and Model.”

What car insurance is the cheapest for full coverage?

USAA often provides the cheapest rates for full coverage, but for those who are not eligible, Geico and State Farm offer competitive rates for full coverage, which includes liability, collision, and comprehensive insurance.

What insurance is mandatory in Virginia?

In Virginia, the mandatory insurance includes liability insurance with the state minimum limits or payment of a $500 Uninsured Motor Vehicle (UMV) fee. However, the UMV fee does not provide insurance coverage.

What is the new law in Virginia about car insurance?

As of recent updates, Virginia now requires higher minimum liability coverage limits: $30,000 for bodily injury per person, $60,000 per accident, and $25,000 for property damage per accident. This change aims to provide better protection for drivers involved in accidents.

To learn more, explore our comprehensive resource on insurance titled “Minimum Car Insurance Requirements by State.”

Did car insurance go up in Virginia?

Yes, car insurance rates in Virginia have increased recently due to various factors, including higher repair costs, increased claims, and changes in state minimum coverage requirements. Comparing quotes from multiple providers can help find the best rates.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.