What state has the highest car insurance rates?

Some states with highest car insurance rates include the District of Columbia, Florida, Louisiana, Massachusetts, New Jersey, and New York. If you live in these states, try comparing rates using our free tool.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated October 2024

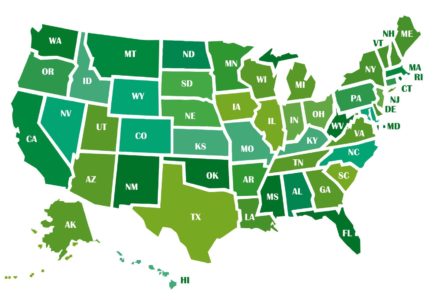

Wondering what state has the highest auto insurance rates? We reviewed rates to answer this question for you. Although the statistics vary year to year, the same ones tend to show up in the top six slots each time to include District of Columbia, Florida, Louisiana, Massachusetts, New Jersey, and New York.

There are several reasons why the same states keep competing for the highest car insurance ranking and the exact opposite reasons are usually why other states tend to fall in the least expensive category each year.

To compare car insurance rates by states is essential because insurance costs can differ significantly depending on local laws, demographics, and driving conditions. Taking the time to compare rates will help you find the best coverage options that suit your budget and provide comprehensive protection, regardless of your location.

However, there are ways to reduce the premiums and make your rates a little more affordable. Enter your zip code above and start the money saving process with a free car insurance comparison now!

- Where you live can have a dramatic impact on your car insurance premiums

- District of Columbia is known for having extraordinarily high car insurance rates

- States that are more affluent tend to have higher car insurance because consumers tend to buy new vehicles more often

High Car Insurance States

According to the National Association of Insurance Commissioners 2009 report, the states that ranked highest for car insurance in 2007 are District of Columbia, New Jersey, Louisiana, New York, Florida, Rhode Island, Delaware, Nevada, Massachusetts, and Connecticut.

Read more: Compare Rhode Island Car Insurance Rates

The annual average expenditure for the District of Columbia in 2007 was $1,140, followed by New Jersey’s $1,104. Connecticut closed the top ten ranking with an annual spending of $964 for car insurance.

The reason some states are higher than others is based on a variety of factors. Typically, the states that are more affluent tend to have higher car insurance because consumers tend to buy new vehicles more often.

In addition, congested metropolitan areas have a higher average rate because more traffic means an increased risk for accidents. Anytime there is a statistical citation for increased auto accidents, the car insurance rates will be higher for everyone in the area. (For more information, read our “Will an expired vehicle inspection citation increase my car insurance rates?“)

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Reducing Car Insurance Premiums

People who live in the District of Columbia will automatically be subjected to high car insurance premiums. However, there are ways to reduce your premium. Before you buy a car, call your agent and ask which vehicle models are less expensive to insure.

The type of car you buy can make a huge difference in the cost of your insurance policy. If your car does not come equipped with safety features, consider installing them aftermarket to reduce your premium.

Make sure your vehicle to meet minimum state requirements, but be sure to add enough coverage to be adequately insured as well.

Depending on the age and model of your car, you may or may not need optional comprehensive and collision insurance. You may also be able to reduce your premium by raising your deductible if you can safely afford to do so.

Be sure to take advantage of all discounts offered by your insurance company, such as defensive driving discounts, good student discounts, and multiple insurance policy discounts

Lowest Car Insurance States

Just as there are states with the highest car insurance rates, some states are also known for having the lowest car insurance states. States that have the lowest auto insurance costs are usually smaller in population density and also tend to be less wealthy overall.

The ten least expensive states for 2007 car insurance, according to the National Associate of Insurance Commissioners, is North Dakota, Iowa, South Dakota, Nebraska, Idaho, Kansas, Wisconsin, North Carolina, Maine, and Indiana. Other states with very low auto insurance premiums include Montana, Tennessee, and West Virginia.

Indiana ranks number ten with an average annual expenditure of $618 for car insurance, while North Dakota came in first place for the least expensive state with an annual average cost of $512.

Indiana ranks number ten with an average annual expenditure of $618 for car insurance, while North Dakota came in first place for the least expensive state with an annual average cost of $512. (For more information, read our “Compare North Dakota Car Insurance Rates“).

Most people do not move to certain states because of average car insurance rates. However, it helps to know what the cost of insurance rates are so you can compare your own premium to average car insurance premiums in your state. Being an informed insurance buyer is the smart thing to do.

If you live in a state where car insurance is at an all-time high, try comparing insurance quotes with a third party rate quote tools like the one on this page to see what your best options are. Get started by entering your zip code below!

Case Studies: What state has the highest car insurance rates?

Case Study 1: The District of Columbia’s High Rates

John, a resident of the District of Columbia, experienced high car insurance rates. Despite his clean driving record, he found that the high population density and increased risk of accidents in the city contributed to the elevated premiums. This case study highlights how living in an area with a higher population density can result in higher car insurance rates.

Case Study 2: Florida’s Insurance Challenges

Emily, a driver in Florida, faced higher car insurance rates due to various factors. The state’s high incidence of fraud and uninsured drivers, as well as its vulnerability to natural disasters, contributed to the elevated premiums. This case study demonstrates how external factors specific to a state can impact car insurance rates.

Case Study 3: Louisiana’s Costly Coverage

David, a driver in Louisiana, dealt with some of the highest car insurance rates in the country. The state’s high number of accidents, frequent severe weather events, and legal environment influenced the premium costs. This case study illustrates how factors such as accident rates and legal considerations can contribute to elevated car insurance rates.

Frequently Asked Questions

Can I negotiate car insurance rates with my insurance company?

While car insurance rates are generally set by the insurance company based on various factors, it’s worth discussing your situation with your insurance agent. They may be able to help you find potential discounts or adjust your coverage to better fit your budget.

Are there any discounts available to help lower car insurance rates?

Yes, insurance companies often offer various discounts that can help lower car insurance rates. These discounts may include safe driver discounts, good student discounts, bundling multiple policies, and more. Be sure to ask your insurance provider about available discounts.

Do car insurance rates vary within a state or region?

Yes, car insurance rates can vary within a state or region. Factors such as ZIP code, crime rates, and local traffic patterns can influence rates. It’s always a good idea to compare quotes from multiple insurance providers to find the best rate for your specific location.

Will my car insurance rates increase if I move to a different state?

Yes, moving to a different state can potentially affect your car insurance rates. Each state has its own insurance regulations and factors that impact premiums, so it’s important to update your insurance policy and compare rates after moving.

Can the type of car I drive affect my insurance rates?

Yes, the type of car you drive can impact your insurance rates. Insurance companies take into account factors such as the car’s make, model, age, safety features, and its likelihood of being stolen or involved in accidents when calculating premiums.

Will having a clean driving record reduce my car insurance rates?

Yes, having a clean driving record, meaning no accidents or traffic violations, can often lead to lower car insurance rates. Insurance companies typically offer discounts to drivers with a history of safe driving.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.