Best Albuquerque, NM Car Insurance in 2026

Albuquerque car insurance rates are $151.34/mo on average. New Mexico requires 25/50/10 in minimum liability coverage from all drivers.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

- Serious penalties can occur as a result of driving without proper coverage in Albuquerue

- Auto insurance policies can be cancelled if the client forgets to pay his premium on time

- Albuquerque drivers often have higher insurance rates because so many people drive without insurance

- Additional coverage options are available to supplement the state’s minimum coverage requirements

One of its most visited tourist sites, Old Town, was founded in 1706 and eventually came to be known as Albuquerque.

In the city of Albuquerque, drivers aren’t exempt from needing to purchase car insurance. They need to be able to prove that they have bodily injury and property damage liability coverage before they can drive their vehicles on the roads.

If they fail to purchase this car insurance coverage and decide to drive without insurance, they will put their ability to drive at all in jeopardy. That’s why finding the right car insurance policy is the best step towards safe driving.

New Mexico requires all drivers to have proof of insurance available in the car at all times. The minimum limits for New Mexico car insurance are $25,000 for the injury or death of a single person involved in a car accident, while $50,000 for the injury or death of multiple persons. The minimum property damage liability insurance requirements are $10,000 property damage liability per accident.Enter your ZIP code into the FREE tool above now to find great deals on Albuquerque car insurance!

Albuquerque Auto Insurance Requirements

In the following charts you will find helpful information about auto insurance in Albuquerque, New Mexico.

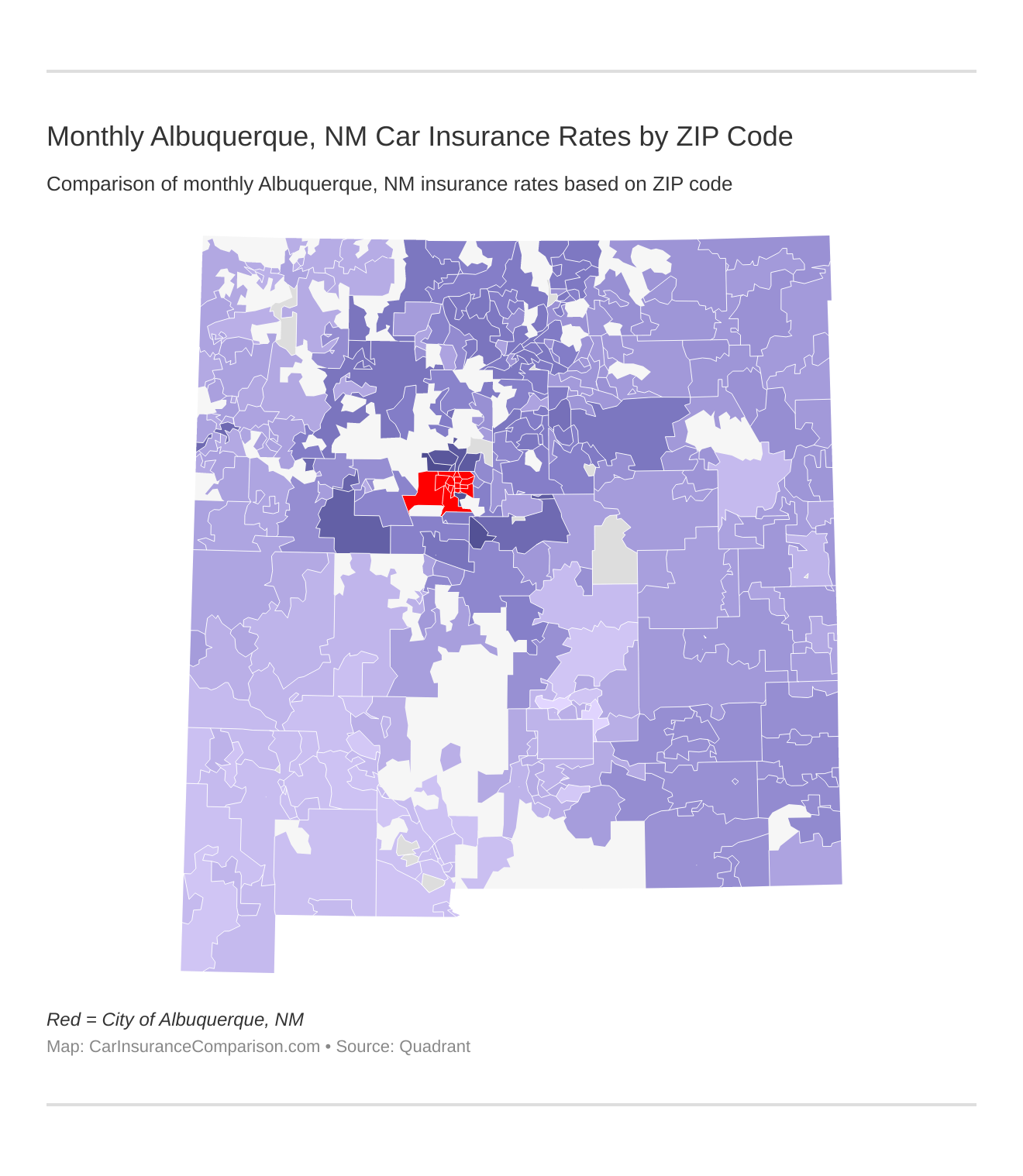

Monthly Albuquerque, NM Car Insurance Rates by ZIP Code

Find more info about the monthly Albuquerque, NM car insurance rates by ZIP Code below:

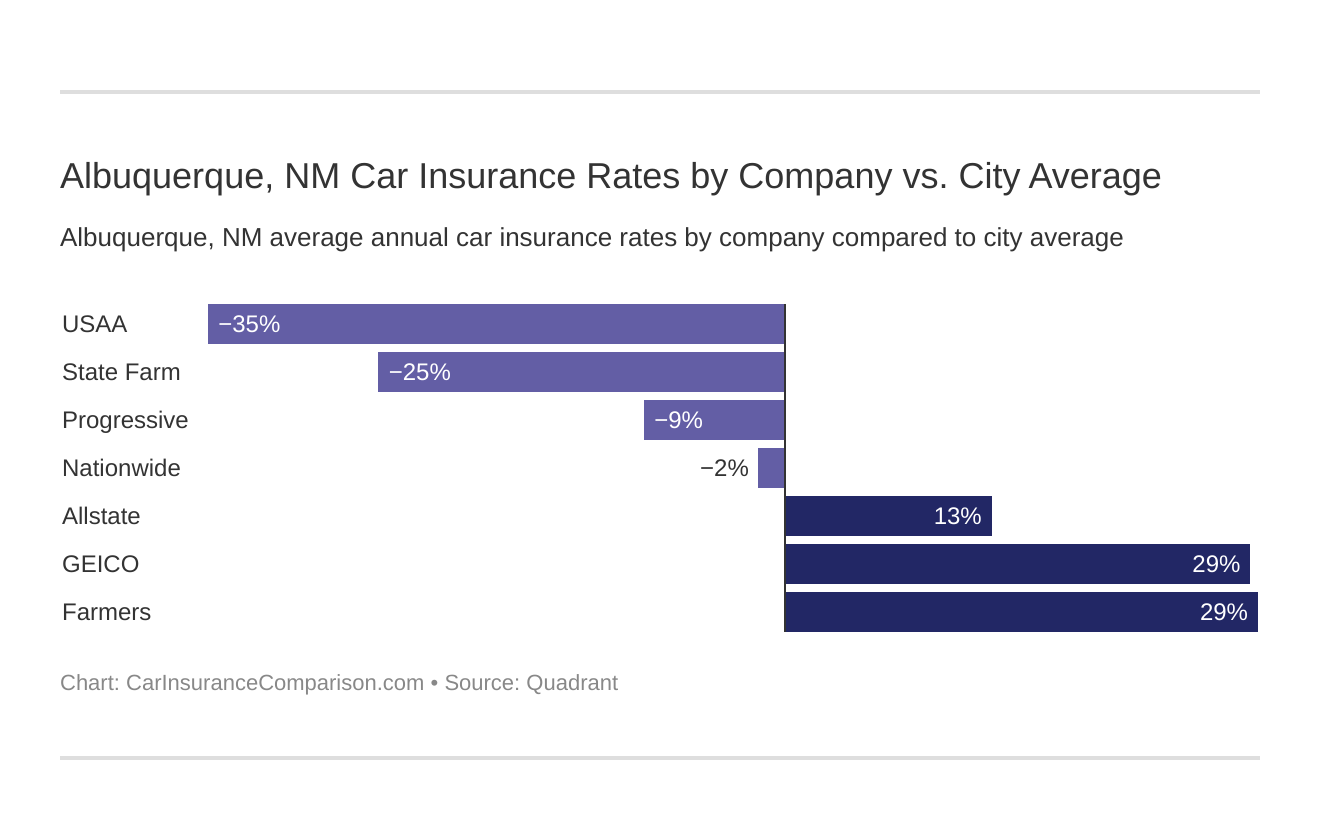

Albuquerque, NM Car Insurance Rates by Company vs. City Average

The cheapest Albuquerque, NM auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average New Mexico auto insurance company rates?” We cover that as well.

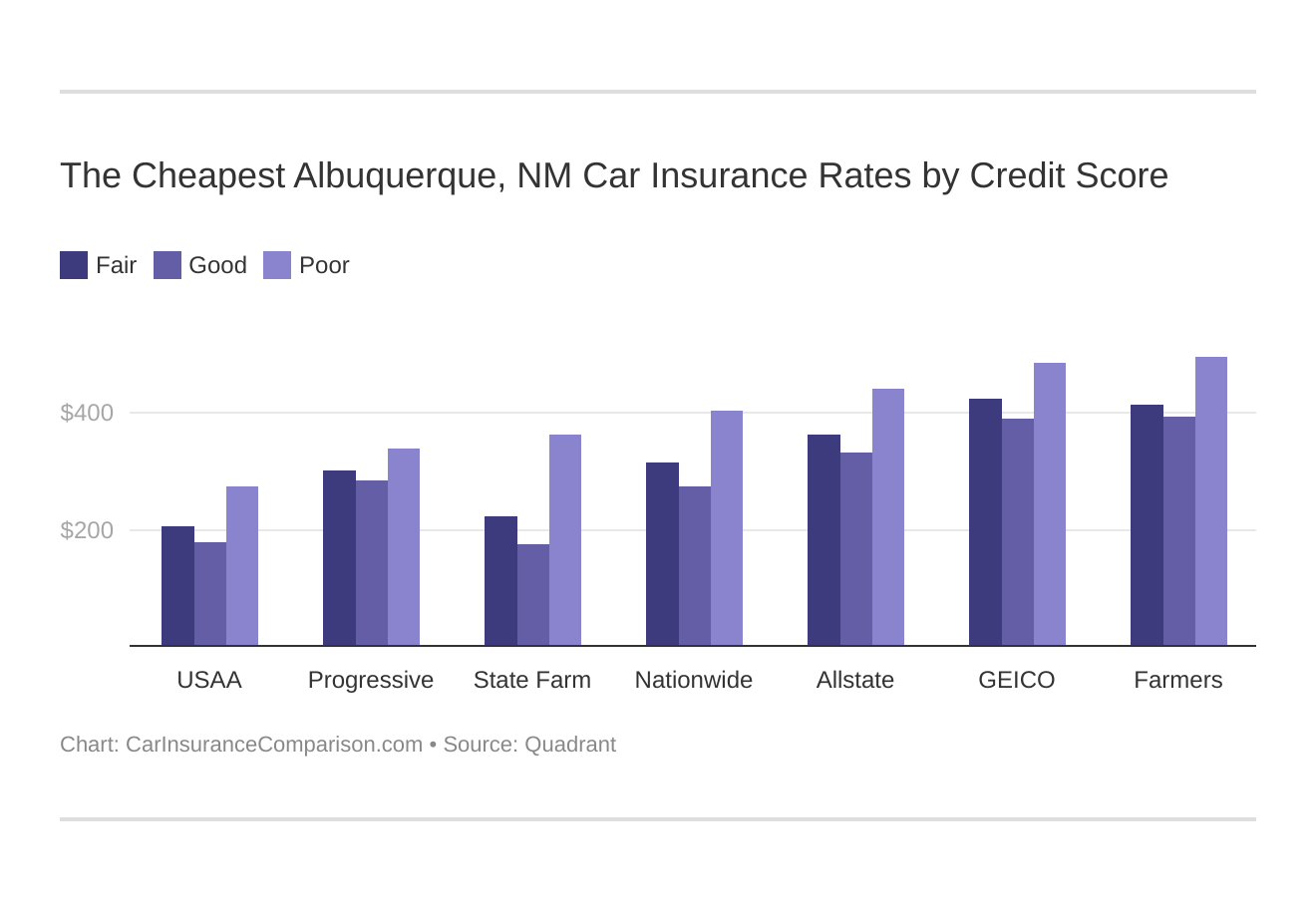

The Cheapest Albuquerque, NM Car Insurance Rates by Credit Score

Your credit score will play a major role in your Albuquerque, NM auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. If your credit is good, you may be able to get a good credit discount. Find the cheapest Albuquerque, New Mexico auto insurance rates by credit score below.

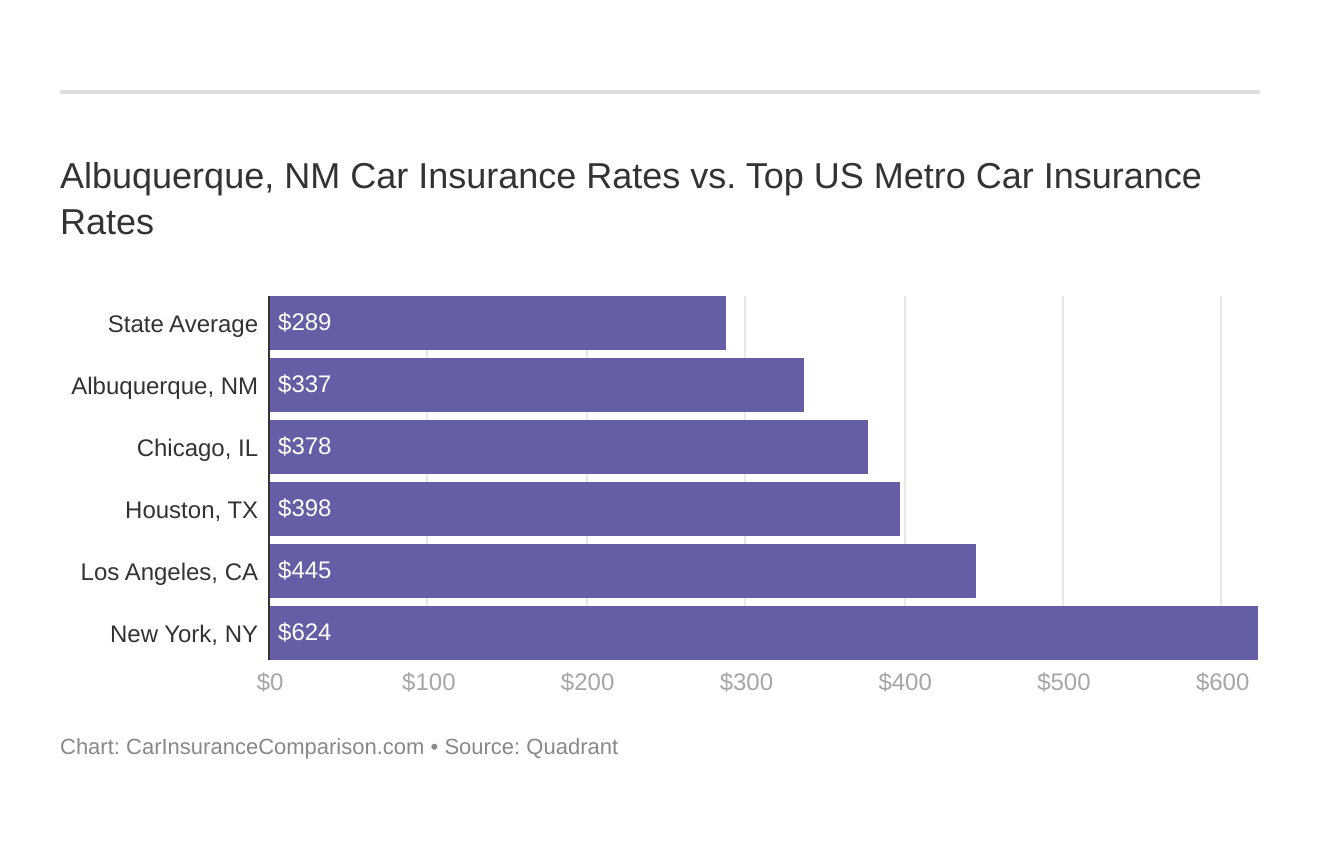

Albuquerque, NM Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Albuquerque, NM against other top US metro areas’ auto insurance rates.

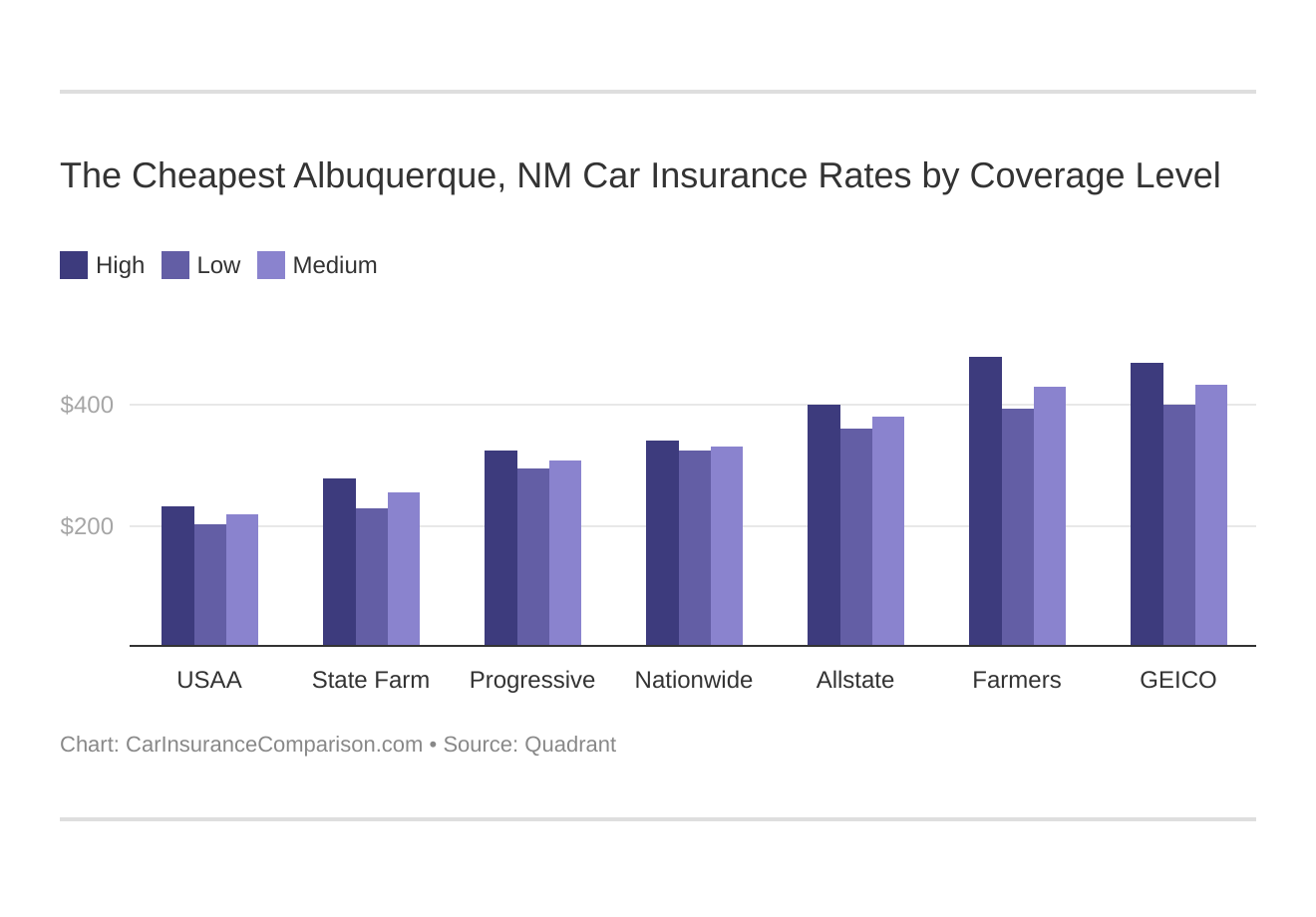

The Cheapest Albuquerque, NM Car Insurance Rates by Coverage Level

How much car insurance you need will play a significant role in your Albuquerque, NM auto insurance rates. Find the cheapest Albuquerque, New Mexico auto insurance rates by coverage level below:

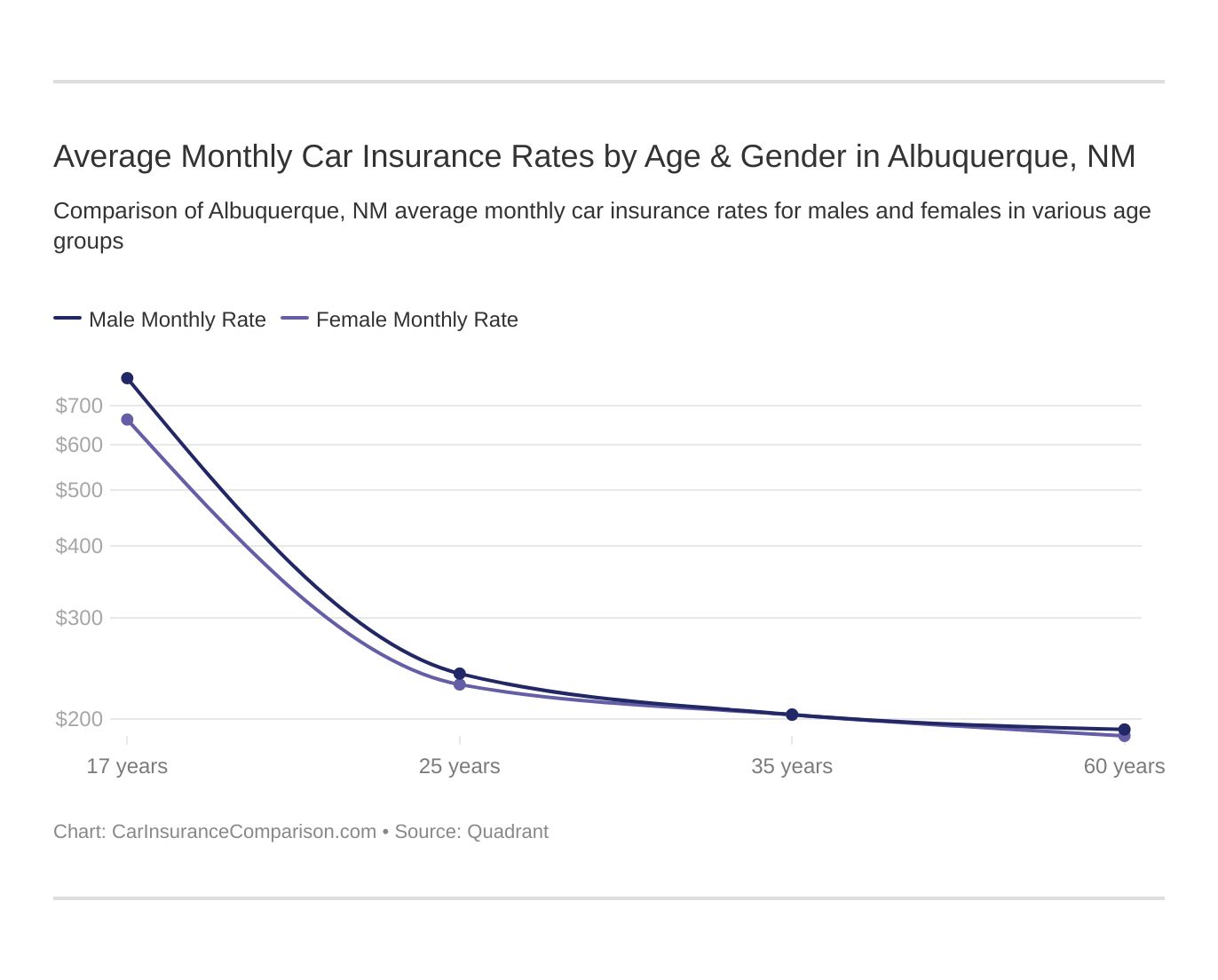

Average Monthly Car Insurance Rates by Age & Gender in Albuquerque, NM

These states no longer use gender to calculate your auto insurance rates Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because a young driver is considered a high-risk driver in Albuquerque. New Mexico does use gender, so check out the average monthly car insurance rates by age and gender in Albuquerque, NM.

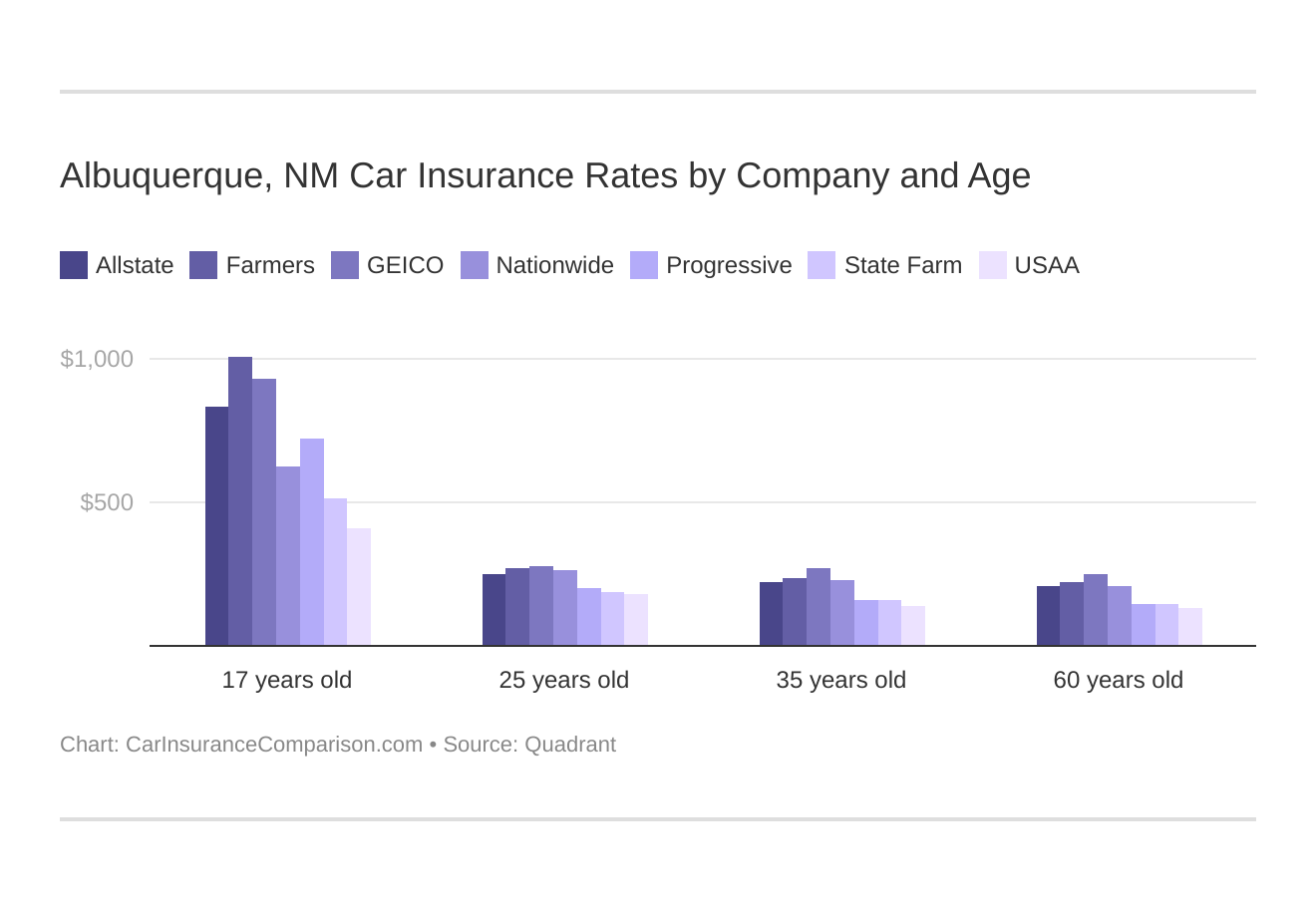

Albuquerque, NM Car Insurance Rates by Company and Age

Albuquerque, NM auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

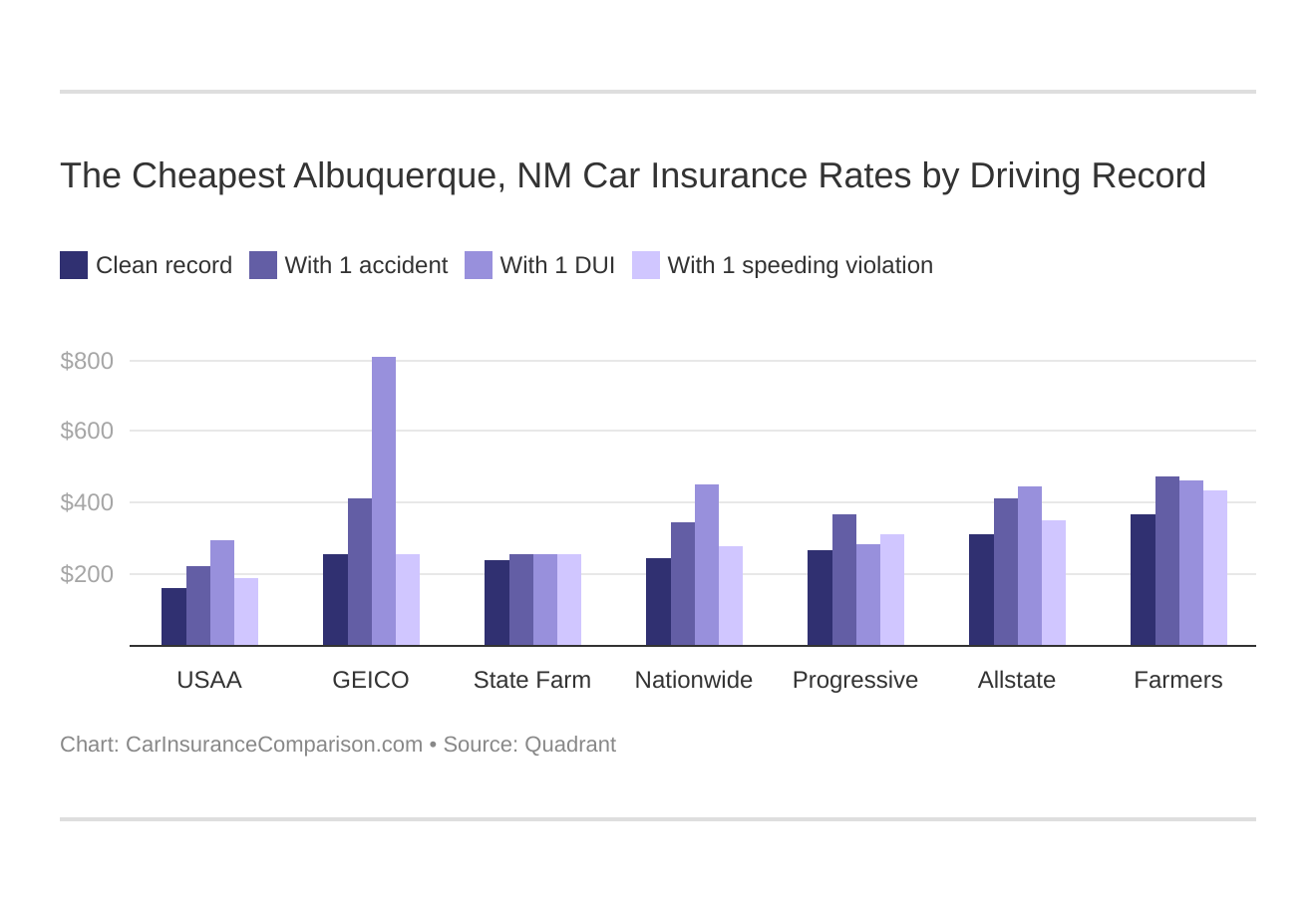

The Cheapest Albuquerque, NM Car Insurance Rates by Driving Record

Your driving record will affect your Albuquerque auto insurance rates. For example, a Albuquerque, NM DUI may increase your auto insurance rates 40 to 50 percent. Maintaining a clean driving record is something you can control. Those with no violations on their record will save money on their car insurance rates. This means no at-fault accidents, DUIs, speeding tickets, or other violations. On the opposite side, car insurance with a bad driving record will cause your rates to skyrocket.

Read more: What are the DUI insurance laws in New Mexico?

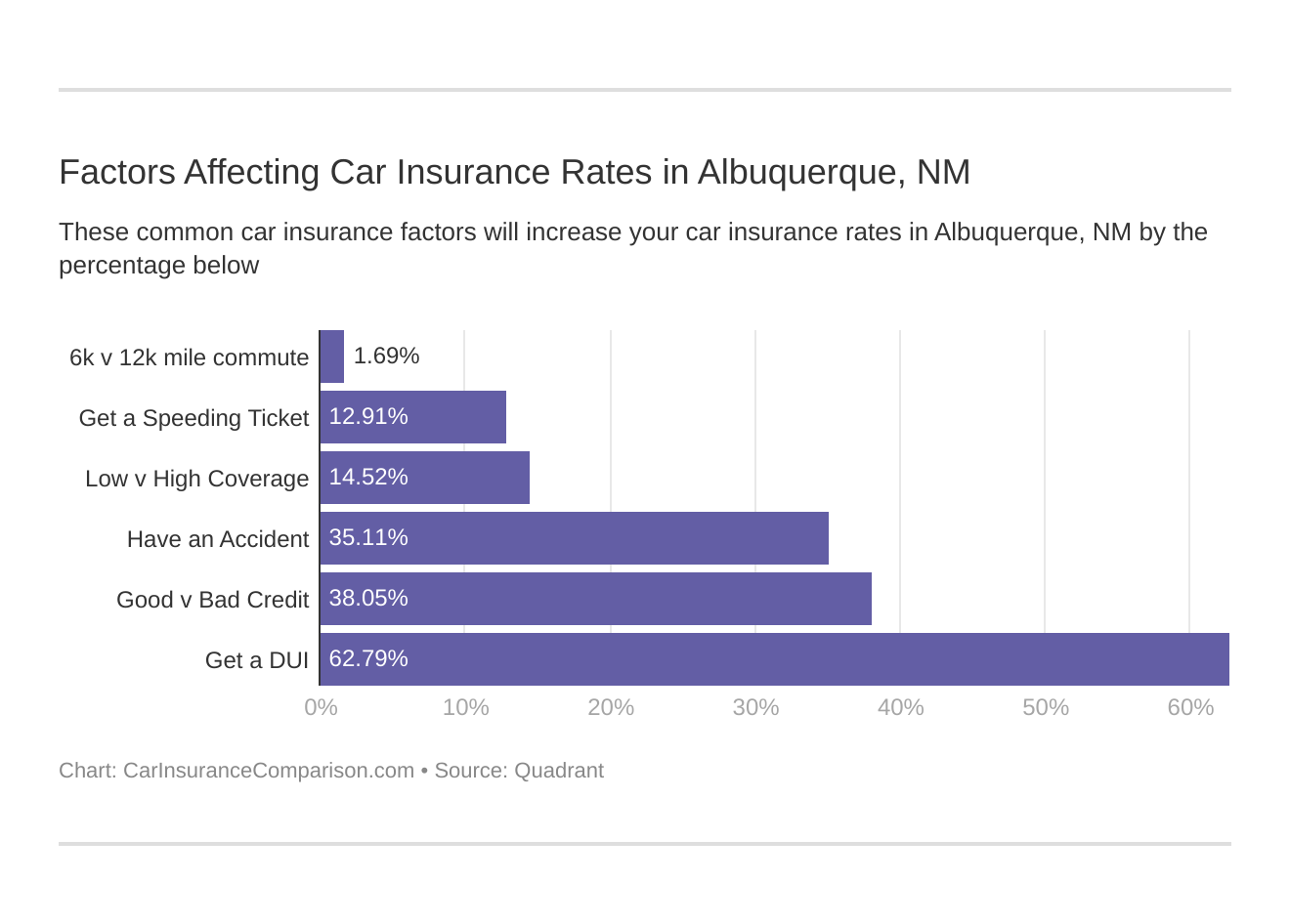

Factors Affecting Car Insurance Rates in Albuquerque, NM

The factors that affect car insurance rates in Albuquerque, NM may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Albuquerque, New Mexico auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Penalties in Albuquerque

Several unpleasant car insurance penalties can be given to people who drive without bodily injury and property damage liability in Albuquerque. Just a few of them are listed below:

- A suspended license

- Suspended vehicle registration

- A no insurance coverage ticket

- Possibly need to file the SR-22 car insurance form

Accidental Cancellation of Car Insurance in Albuquerque

A common reason that people are driving without car insurance is because they forget to pay their premiums on time. When people neglect to diligently pay their premiums every month, their car insurance is canceled. But there are several ways that Albuquerque residents can ensure that this never happens to them.

Albuquerque drivers who pay their premiums in one lump sum won’t have to worry about making monthly car insurance payments.

Since this option decreases the work that car insurance companies must do, it entitles these clients to car insurance discounts. Those clients who can’t afford to pay the entire amount all at once have another option; they can agree to electronic payments that also eliminate the need for car insurance companies to send bills out which usually also results in a discount.

Never Stop Making Car Insurance Payments

One huge mistake that people make when they no longer need their car insurance coverage is to stop paying for the insurance. Car insurance companies are required to notify the DMV when their clients cancel their own policies. The DMV will then follow up with these clients, and they will need to be able to prove that they have car insurance coverage or else their licenses may be suspended.

To avoid being contacted by the DMV, people with car insurance need to make sure that they cancel their auto insurance policies when they sell their vehicles or they switch insurance companies.

The easy way for one to manage a policy is to have an online car insurance policy.

Clients also need to tell the DMV that they have done this before the insurance company does, or they will receive the unfriendly notice requiring them to prove they have auto insurance coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Insurance Drivers Must Purchase in Albuquerque

To keep from receiving any of the penalties listed above, Albuquerque drivers need to purchase liability car insurance with amounts of at least $20,000 bodily injury liability coverage for bodily injuries or death to one person. For injuries and death caused to everyone in the car collision, $40,000 bodily injury liability is required. Property damage liability must amount to at least $10,000.

High Average Car Insurance Rates in Albuquerque

Albuquerque drivers will undoubtedly be quoted high car insurance rates because the average rate in this city has been found to be equal to $1,816.

One reason that Albuquerque car insurance companies charge so much for insurance may be because the city is located in a state that has the most people driving without insurance. New Mexico has a total of 29 percent of its residents driving without purchasing the minimum car insurance required by the state.

Purchasing Only the State’s Limits

Because of the high uninsured motorist statistics, Albuquerque drivers may want to purchase optional coverage. Since Albuquerque is located within a tort state, drivers hit by an uninsured motorist can sue these people for payment of their medical bills and to have their vehicles repaired. The real possibility exists that these drivers are incapable of paying these bills.

Albuquerque drivers who have only purchased New Mexico’s minimum amounts of liability coverage won’t have insurance to pay their own medical bills or to have their cars repaired.

If the car’s market value is lower than it would cost to repair the vehicle, it would make more sense to purchase another vehicle. But the driver who was hit may not be in good enough financial standing to do either one of those things.

Read more: Compare Full Tort Car Insurance: Rates, Discounts, & Requirements

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Optional Coverage Can Help

Auto insurance companies in Albuquerque can prevent the above from happening to their drivers by selling them optional insurance coverage. Every driver should take the time to compare car insurance by states to insure they are getting the best car insurance rates for New Mexico. These drivers have several choices:

- Uninsured Motorist Bodily Injury

- Underinsured Motorist Bodily Injury

- Uninsured Motorist Property Damage

- Underinsured Motorist Property Damage

- Collision car insurance coverage

- Personal Injury Protection car insurance

1. Uninsured motorist bodily injury coverage will pay the drivers’ medical bills as well as the members of their family and the passengers who were riding in the vehicle at the time of the accident. The uninsured motorist property damage insurance will repair the vehicle up to a certain limit set by the state. This insurance can be tapped when Albuquerque drivers have been hit either by someone driving without insurance or after someone hit them and left the scene.

2. Underinsured motorist bodily injury and underinsured motorist property damage insurance is also available to Albuquerque residents. This insurance applies when the person who causes the car collision doesn’t have enough insurance to cover everyone’s medical bills. In this case, everyone hurt in the accident can sue the underinsured driver, but it may not result in receiving any money for their medical bills. Underinsured motorist property damage coverage also places a limit on how much it will pay for repairs. In some cases, this limit is $3,500.

Uninsured motorist coverage/underinsured motorist property damage coverage will have some effect if the cost of the repairs fall below the limits, but if this is not the case, the driver who has been hit will still have unpaid bills.

3. Collision coverage is a type of optional insurance that ensures that all of the bills for property damage are paid when an uninsured or underinsured motorist can’t do it. With this coverage, if the policyholder’s vehicle is hit by another driver, the policyholder’s repairs will be paid no matter who hit whom. If the car insurance company totals the vehicle, collision insurance coverage will offer the policyholder the market value of the car at the time of the accident.4. Personal Injury Protection (PIP) insurance may be an Albuquerque driver’s best bet when driving in a city with a high number of people breaking the auto insurance laws. It doesn’t matter who caused the accident; PIP insurance pays medical expenses and funeral costs of those who suffered bodily injuries or death in a car collision.

Finding Optional Coverage in Albuquerque

Albuquerque drivers may decide that they need uninsured/underinsured motorist coverage, collision coverage, and PIP insurance. They will also have to make sure that they have the liability coverage they are supposed to purchase. With Albuquerque car insurance so expensive, these drivers would be doing themselves a big favor by comparing the car insurance quotes that multiple insurance companies can give them.

Car insurance companies require several pieces of information before they can offer someone a quote. None of the information can be omitted, even if it seems that it doesn’t relate to auto insurance.

For example, auto insurance companies will be interested in their prospective clients’ occupations. If the occupation is considered to be low risk, the person working in that profession also has the privilege of being part of a low-risk occupation.

Each auto insurance company has a different formula for determining who is a high risk. Sometimes people who are engineers will be quoted the lowest rates because insurance companies have found that engineers cause the fewest accidents. In order to find out if they belong to a low risk demographic, Albuquerque drivers just need to start comparing auto insurance companies and their quotes now. Don’t wait any longer! Find cheap car insurance and begin saving big by entering your ZIP code below!

Frequently Asked Questions

How can I compare car insurance options in Albuquerque, NM?

To compare car insurance options in Albuquerque, NM, follow these steps:

- Assess your coverage needs: Determine the types and levels of coverage required for your vehicle.

- Obtain multiple quotes: Collect quotes from different insurance providers in Albuquerque, NM.

- Compare coverage and premiums: Evaluate the coverage options and premiums offered by each insurer.

- Consider additional factors: Take into account customer reviews, the financial stability of the insurance company, available discounts, and the quality of customer service.

- Make an informed decision: Choose the car insurance policy that best fits your needs and budget.

What factors should I consider when comparing car insurance in Albuquerque, NM?

When comparing car insurance in Albuquerque, NM, consider the following factors:

- Coverage options: Evaluate the types of coverage available, such as liability, collision, comprehensive, uninsured/underinsured motorist coverage, and personal injury protection.

- Premiums: Compare the premiums quoted by different insurers for similar coverage.

- Deductibles: Consider the deductible amounts and how they impact your premiums.

- Discounts: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for anti-theft devices.

- Customer reviews: Read reviews and ratings from other policyholders to gauge the customer service and claims handling of the insurance companies.

- Financial stability: Check the financial ratings of insurance companies from reputable sources to ensure they can meet their financial obligations.

Are there any specific car insurance requirements in Albuquerque, NM?

Yes, there are specific car insurance requirements in New Mexico, including Albuquerque. The state requires drivers to carry liability insurance with the following minimum coverage limits:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $10,000 property damage liability coverage per accident

Can I get discounts on car insurance in Albuquerque, NM?

Yes, many car insurance providers offer various discounts that can help lower your premiums in Albuquerque, NM. Some common discounts include:

- Safe driver discounts: Offered to drivers with a clean driving record and no at-fault accidents.

- Multi-policy discounts: Available when you bundle multiple insurance policies, such as auto and home insurance, with the same provider.

- Good student discounts: Offered to students who maintain good grades.

- Anti-theft device discounts: Provided for vehicles equipped with anti-theft devices.

- Defensive driving course discounts: Available to drivers who complete an approved defensive driving course.

How can I lower my car insurance premiums in Albuquerque, NM?

To lower your car insurance premiums in Albuquerque, NM, consider the following:

- Shop around: Obtain quotes from multiple insurance providers to find the most competitive rates.

- Increase deductibles: Opting for a higher deductible can lower your premiums. However, ensure you can afford to pay the deductible in case of an accident.

- Maintain a good driving record: Avoid accidents and traffic violations, as a clean driving record often leads to lower premiums.

- Take advantage of discounts: Inquire about all available discounts and take advantage of those you qualify for.

- Bundle policies: Consider bundling your car insurance policy with other policies, such as home insurance, to receive multi-policy discounts.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.