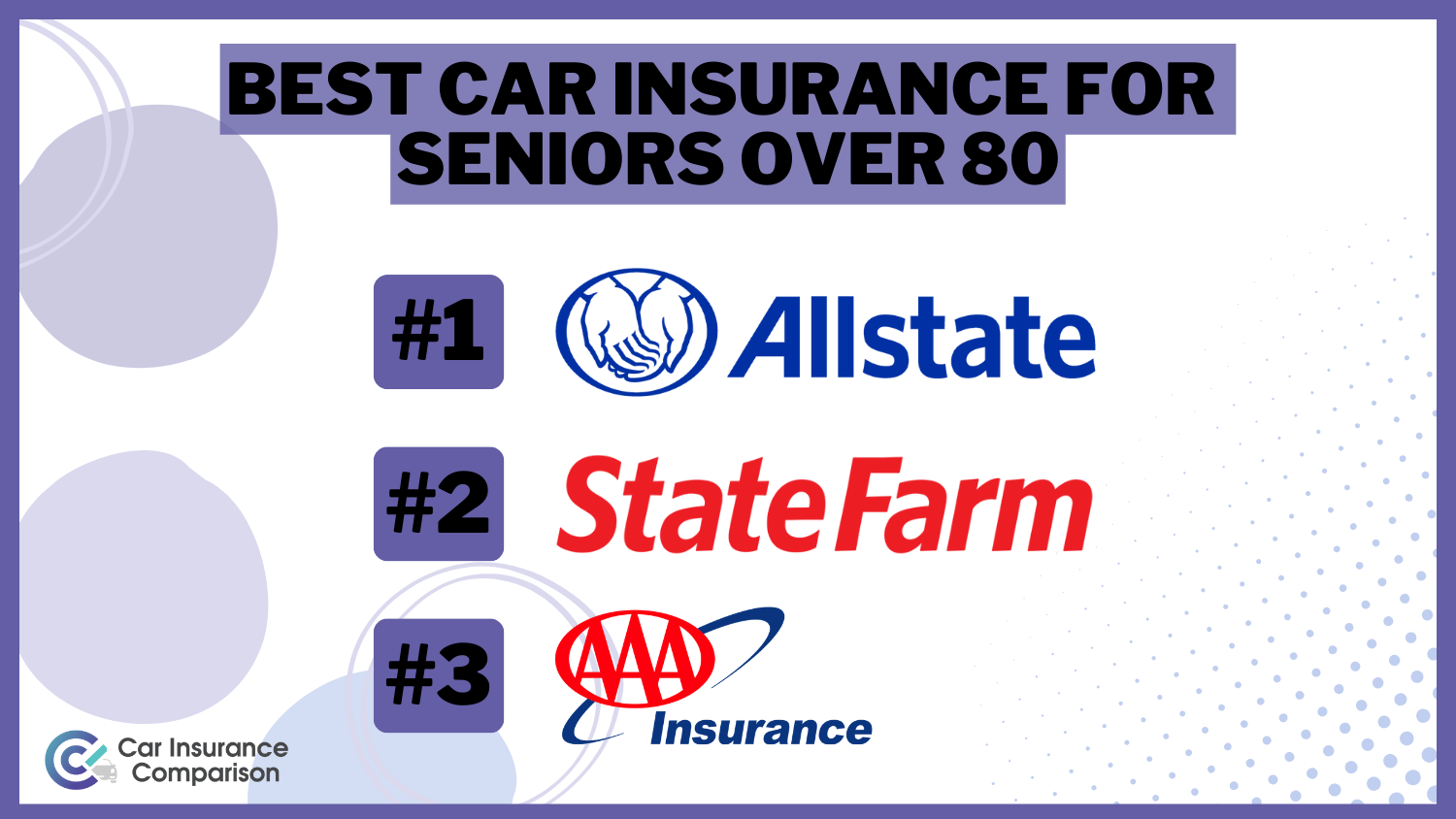

Best Car Insurance for Seniors over 80 in 2026 (Top 10 Companies Ranked)

Compare rates for the best car insurance for seniors over 80 with industry leaders such as Allstate, State Farm, and AAA. Benefit from discounts up to 24% with Allstate, and discover why these companies excel with affordable rates and tailored coverage options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated November 2024

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Seniors Over 80

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Seniors Over 80

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Seniors Over 80

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsDiscover the best car insurance for seniors over 80 and why Allstate stands out as the top pick overall, with competitive rates and innovative programs like Drivewise. State Farm and AAA offer personalized service and coverage deductibles, respectively. Explore coverage rates and tailored options for senior drivers.

If you are approaching a milestone birthday and will soon celebrate the start of your ninth decade, you may wonder if you have to pay more for over-80 insurance. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Our Top 10 Picks: Best Car Insurance Companies for for Seniors Over 80

| Company | Rank | Safe Driver Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 24% | 16% | Drivewise Program | Allstate | |

| #2 | 18% | 20% | Personalized Service | State Farm | |

| #3 | 16% | 19% | Vanishing Deductible | AAA |

| #4 | 20% | 15% | Military Affiliation | USAA | |

| #5 | 15% | 20% | Signal App | Farmers | |

| #6 | 15% | 25% | Online Convenience | Geico | |

| #7 | 16% | 20% | RightTrack Program | Liberty Mutual |

| #8 | 32% | 14% | Snapshot Program | Progressive | |

| #9 | 18% | 20% | IntelliDrive Program | Travelers | |

| #10 | 20% | 22% | AARP Partnership | The Hartford |

We understand your budget concerns. Here’s guidance for getting the best over-80 car insurance quotes.

- Explore industry leaders such as Allstate, State Farm, and AAA

- Car insurance rates based on coverage levels, driving history, and location impacts

- These insights help seniors find the best rates based on their unique circumstances

#1 – Allstate: Top Overall Pick

Pros

- Safe Driving Incentives: Drivewise rewards safe driving habits, providing discounts for responsible behavior on the road.

- User-Friendly App: The Drivewise app is intuitive, making it easy for users to track their driving habits and potential savings.

- Personalized Feedback: Offers personalized feedback to drivers, promoting awareness of habits and encouraging safer driving.

Cons

- Privacy Concerns: As outlined in our Allstate car insurance review, some users may have privacy concerns as the program collects driving data to determine discounts.

- Limited Availability: Drivewise availability may vary by location, limiting access for certain policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Personalized Service

Pros

- Agent Accessibility: Emphasizes personalized service with a network of agents, offering direct assistance and tailored advice.

- Variety of Coverage Options: Provides a range of coverage options to meet individual needs and preferences. Learn more in our State Farm car insurance review.

- Discount Opportunities: Offers various discount opportunities, rewarding factors such as safe driving and bundling policies.

Cons

- Premium Costs: Some customers may find State Farm’s premium costs relatively higher compared to other providers.

- Limited Online Tools: Online tools and digital resources may not be as robust as those offered by some competitors.

#3 – AAA: Best for Vanishing Deductible

Pros

- Deductible Reduction: AAA’s Vanishing Deductible rewards safe driving by reducing deductibles over time.

- Member Benefits: Beyond car insurance, AAA members enjoy additional benefits like roadside assistance.

- Customizable Policies: Offers customizable policies to cater to individual preferences and needs.

Cons

- Membership Fee: As mentioned in our AAA car insurance review, they require a membership fee, adding an extra cost for those solely seeking car insurance.

- Regional Variations: Coverage options and benefits may vary by region, impacting the consistency of services.

#4 – USAA: Best for Military Affiliation

Pros

- Exclusive to Military Members: USAA caters exclusively to military members and their families, providing specialized services.

- High Customer Satisfaction: Known for exceptional customer service, often leading to high satisfaction rates.

- Financial Strength: USAA’s strong financial standing adds a layer of stability and reliability for policyholders. Learn more about their reliability in our USAA car insurance review.

Cons

- Limited Eligibility: Only available to military members and their families, excluding the general public.

- Fewer Physical Locations: Limited physical branch locations compared to some larger insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Signal App

Pros

- Usage-Based Discounts: Signal app allows drivers to earn discounts based on actual driving behavior. Learn more about their discounts in our Farmers car insurance review.

- Real-Time Feedback: Provides real-time feedback on driving habits, fostering safer behavior.

- Potential Savings: Farmers promote potential savings for good driving habits monitored through the Signal app.

Cons

- Privacy Concerns: Similar to other usage-based programs, Signal collects driving data, raising privacy considerations.

- Limited to Certain States: Availability of the Signal app and its benefits may be limited to specific states.

#6 – Geico: Best for Online Convenience

Pros

- Online Tools: Geico offers a user-friendly online platform for policy management and claims.

- Digital ID Cards: Convenient features like digital ID cards make policy access and information readily available.

- Discount Opportunities: Geico provides various discount options, potentially lowering premium costs.

Cons

- Customer Service: Some customers report less favorable experiences with Geico’s customer service. For more information, read our Geico car insurance review.

- Discount Limitations: While discounts are available, they may not be as extensive as those offered by some competitors.

#7 – Liberty Mutual: Best for RightTrack Program

Pros

- Safe Driving Rewards: The right track program offers rewards for safe driving habits, potentially reducing premiums.

- Personalized Feedback: As mentioned in our Liberty Mutual car insurance review, they provide personalized feedback to help drivers improve their habits.

- Easy Installation: The program is easy to install and use, minimizing disruptions for policyholders.

Cons

- Data Collection Concerns: Similar to other usage-based programs, concerns about data collection for discounts may arise.

- Limited Availability: RightTrack availability may vary by location, limiting access for certain policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Snapshot Program

Pros

- Usage-Based Discounts: Snapshot Program offers discounts based on actual driving behavior.

- Mobile App Convenience: Progressive’s mobile app provides easy access to policy information and driving data.

- Potential Savings: Good driving habits monitored through Snapshot can lead to significant savings.

Cons

- Privacy Considerations: Users may have privacy concerns as driving data is collected for discount determination.

- Limited to Progressive Customers: As mentioned in our Progressive car insurance review, the Snapshot Program is exclusive to Progressive policyholders.

#9 – Travelers: Best for IntelliDrive Program

Pros

- Driving Behavior Discounts: Intellidrive program rewards safe driving behavior with potential discounts.

- Customizable Coverage: Offers customizable coverage options to suit individual needs.

- Online Tools: Provides convenient online tools for policy management and information access.

Cons

- Data Privacy Concerns: Similar to other usage-based programs, there may be concerns about data privacy.

- Availability Limitations: Intellidrive program availability may vary by location. Learn more in our Travelers car insurance review.

#10 – The Hartford: Best for AARP Partnership

Pros

- AARP Member Benefits: Partnership with AARP provides exclusive benefits for AARP members.

- Experienced Driver Discounts: Recognizes the experience of older drivers with potential discounts. (Read more: The Hartford Car Insurance Discounts)

- Customized Policies: Offers customizable policies to meet the unique needs of older drivers.

Cons

- Limited to AARP Members: Exclusive benefits are restricted to AARP members, limiting access for others.

- Potential Premium Costs: While discounts are available, premium costs may still be perceived as relatively high.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Analysis of Premiums for 80-Year-Old Driver

As individuals reach the age of 80, insurance costs become a notable consideration, especially in the realm of driving. Various insurance companies provide coverage options, ranging from minimum coverage to full coverage, each associated with distinct costs. When examining the coverage rates for 80-year-old drivers, notable variations emerge among different providers.

Car Insurance for Seniors Over 80: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $84 |

| Allstate | $60 | $157 |

| Farmers | $52 | $136 |

| Geico | $30 | $78 |

| Liberty Mutual | $67 | $170 |

| Progressive | $38 | $103 |

| State Farm | $33 | $84 |

| The Hartford | $42 | $109 |

| Travelers | $37 | $97 |

| USAA | $22 | $57 |

Allstate offers a minimum coverage rate of $60 and a full coverage rate of $157, while State Farm presents a minimum coverage option at $33 and a full coverage alternative at $84. AAA, with a minimum coverage rate of $32 and a full coverage rate of $84, competes in the market alongside USAA, which provides a minimum coverage plan for $22 and full coverage for $57.

Farmers, Geico, Liberty Mutual, Progressive, Travelers, and The Hartford all contribute to the spectrum of coverage rates, offering different price points for both minimum and full coverage. The coverage rates for 80-year-old drivers exhibit considerable diversity across insurance companies. The choice between minimum and full coverage involves weighing cost considerations against the extent of protection provided.

Allstate stands out for 80-year-old drivers with its innovative Drivewise program, offering personalized coverage and potential savings through safe driving habits.

Brad Larson Licensed Insurance Agent

Individual factors such as driving history, location, and specific coverage needs further influence the decision-making process for 80-year-old drivers seeking insurance plans tailored to their circumstances. Careful consideration and comparison of these rates are advised to ensure a well-informed decision in selecting the most suitable insurance option.

Read more: Best Full Coverage Car Insurance

Senior Discounts on Insurance

Rates can vary widely by the insurance company, and it’s essential to shop around to make a realistic comparison. Besides that, you can also look for discounts, although there may not be such a thing as a specific “senior discount.” (For more information, read our “Compare Best Car Insurance Companies for Seniors“).

Instead, you may find lower rates if you have a clean driving record or may be eligible for a reduced rate if you prove your ability by taking a safe driving course.

How to Lower Rates for Over-80 Car Insurance

Many older drivers cover a far less distance than their younger counterparts and if this is the case for you, consider getting a low mileage insurance discount. You’ll need to get a device fitted to the vehicle to tell the insurance company how many miles you drive, which will adjust the rate accordingly.

Some people think it’s a good idea to reduce their level of coverage to get cheaper insurance. However, you should think carefully about this before getting rid of collision or comprehensive coverage from your policy.

If you’re happy to pay a higher deductible in the event of a claim, this will usually lower your car insurance rates as well.

Read More: Who Has the Cheapest Car Insurance for Seniors?

Why Over-80 Car Insurance Costs so Much

Age is one of the factors that affect car insurance rates. Insurers often consider drivers over 80 years old to be a higher risk than younger drivers, and you can expect to pay higher rates once you pass that milestone. However, you may be able to look at other ways to reduce your premiums through discounts or other programs.

Some people think you should get lower insurance rates as you age because you typically have much more experience behind the wheel. The insurance companies will try to be as fair as possible and want to offer policies to as many people as possible, as it is in the business of making profits.

However, insurers have to balance risks and will gather a lot of statistics to set those rates.

What Researchers Say About Older Drivers

When looking at statistics, one study by the AAA Foundation found that the number of crashes increased significantly for the 80+ group, especially involving fatal accidents. Still, another study by the Insurance Institute for Highway Safety found that the fatality rate for seniors involved in car accidents had decreased by 15% since 1997.

While these are just some of the statistics that the insurance companies may consider, it may be no surprise that premiums can increase as people get older.

DMV Policies for Drivers Over 80 Years Old

Licensing renewal requirements can vary considerably by state. For example, Florida insists on license renewal every eight years, but that decreases to every six years following the 80th birthday. Those aged 80 and over must also pass an eye exam each time they renew. (Read more: Can you get car insurance with an expired license?)

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Need to Know About Over-80 Car Insurance

Some older drivers ask the question — can I get auto insurance after turning 80? Thankfully, most insurance companies will be able to provide you with a quote, which will depend on several factors, including your age.

It’s a good idea to compare car insurance quotes to get the best rate for your unique situation and see if you can qualify for any other discounts. For more information, read our article titled “How do you get competitive quotes for car insurance?“.

Case Studies: Navigating Car Insurance Horizons of Resilient 80-Year-Old Drivers

Explore real-life case studies of 80-year-old drivers who are navigating the complexities of car insurance in their retirement years.

- Case Study #1 – Safeguard Your Savings With Drivewise: Meet Mary, an 82-year-old retiree who enjoys taking short trips and visiting her grandchildren. Mary decides to explore Allstate’s offerings, particularly their Drivewise program. She appreciates the opportunity to safeguard her savings through this usage-based program. By opting for Drivewise, Mary not only gets personalized coverage but also benefits from potential discounts based on her safe driving habits.

- Case Study #2 – Personal Touch, Tailored Coverage: John, an 81-year-old veteran, values personalized service and coverage that caters to his specific needs. John turns to State Farm for its reputation in providing tailored coverage and a personal touch. State Farm’s agent accessibility appeals to him, ensuring he can discuss his needs directly with a professional. The various discount opportunities, including those for safe drivers, make State Farm an attractive option. (Read more: State Farm Car Insurance Review)

- Case Study #3 – Vanishing Deductible and Customizable Policies: Meet Robert and Susan, an active couple in their 80s who enjoy traveling in their retirement. Robert and Susan discover AAA’s offerings, particularly the vanishing deductible feature and customizable policies. The vanishing deductible appeals to them as a potential way to reduce costs over time. The ability to tailor their coverage ensures they have the protection they need for their frequent travels.

These case studies highlight the diverse needs and preferences of resilient 80-year-old drivers when it comes to car insurance. Each individual values different aspects such as cost-effectiveness, personalized service, and coverage that adapts to their lifestyle.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

Are there senior discounts on insurance?

While there may not be specific “senior discounts,” you may find lower rates if you have a clean driving record or if you take a safe driving course.

Read more: Safe Driver Car Insurance Discounts

How can I get lower rates for over-80 car insurance?

Consider getting a low mileage insurance discount if you don’t drive much. You can also lower rates by choosing a higher deductible.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Why is over-80 car insurance more expensive?

Age is a factor that affects car insurance rates. Insurance companies consider drivers over 80 to be a higher risk, leading to higher rates.

What does research say about older drivers?

Studies show that the number of crashes increases for drivers over 80, but the fatality rate for seniors involved in accidents has decreased.

What are the DMV policies for drivers over 80?

Licensing renewal requirements vary by state. In some states, like Florida, license renewal is required more frequently after turning 80. (Read more: Florida Car Insurance Regulations)

What factors determine car insurance rates for seniors over 80?

Factors such as driving history, location, type of coverage, and the insurance company’s policies all influence car insurance rates for seniors over 80. Comparing quotes from different companies can help find the best rates.

Can I get auto insurance after turning 80?

Yes, most insurance companies provide coverage for drivers over 80. The cost and availability of insurance will depend on various factors, including your driving history, location, and the type of coverage you’re seeking.

How often should seniors over 80 review their car insurance policies?

It’s a good idea for seniors over 80 to review their car insurance policies annually. Circumstances can change, and reviewing your policy ensures that you have the right coverage for your current needs and may help identify potential savings.

What happens if I want to add a driver over 80 to my existing policy?

If you want to add a driver over 80 to your existing car insurance policy, the premium may increase due to the perceived higher risk associated with older drivers. The exact impact will depend on your insurance company’s policies and the driving history of the senior driver.

Do insurance companies offer coverage for senior drivers with health conditions?

Yes, many insurance companies offer coverage for senior drivers with pre-existing health conditions. However, the availability and cost of coverage may vary depending on the severity of the condition and its impact on driving ability. It’s important to disclose any relevant health information when applying for insurance to ensure you receive appropriate coverage.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.