Best Car Insurance for Single Moms in 2025 (Top 10 Companies)

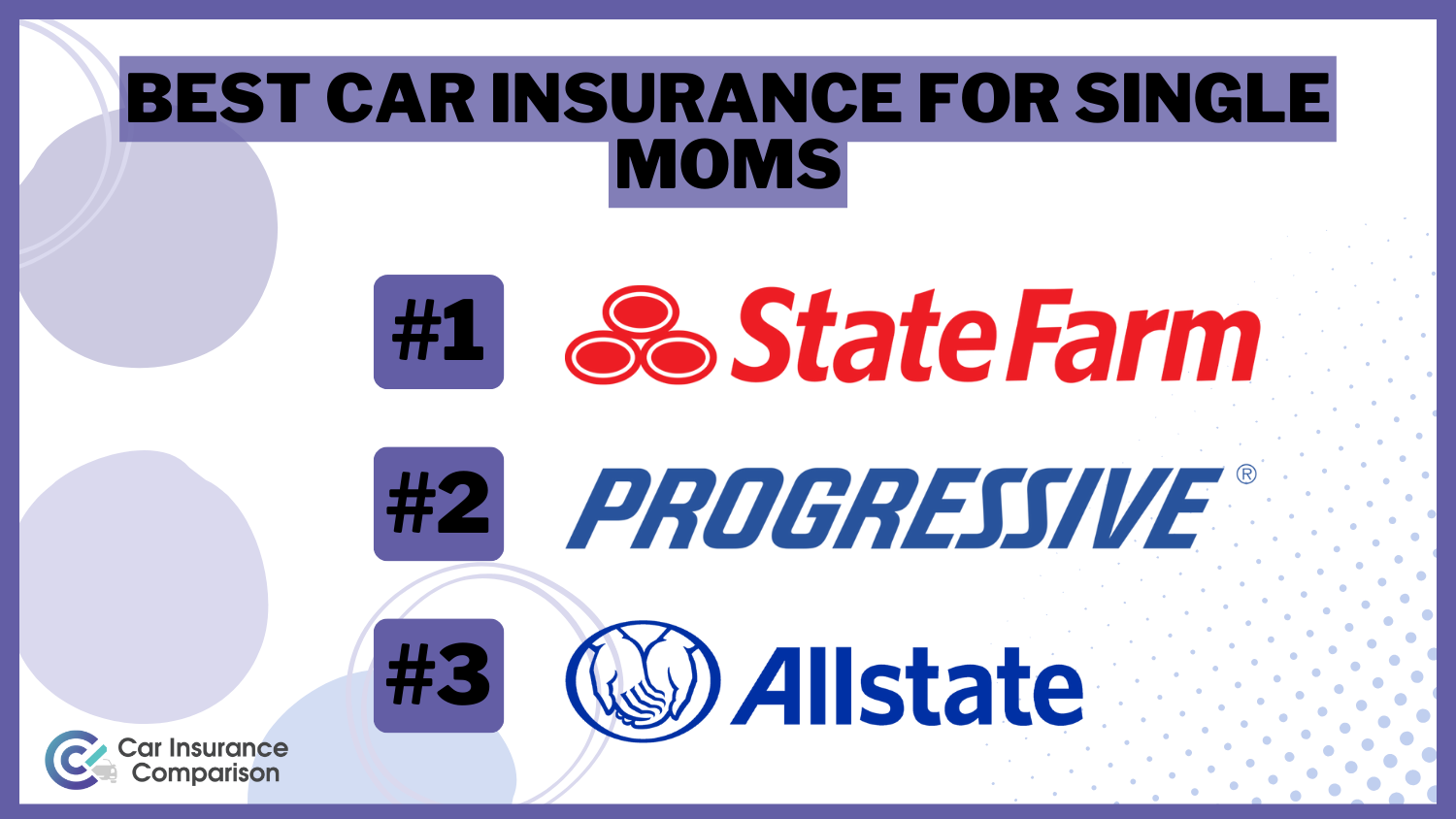

Best car insurance for single moms is offered by top companies like State Farm, Progressive, and Allstate. These providers offer competitive monthly rates, starting as low as $33. With exclusive discounts and personalized coverage, they prioritize single mothers' needs for affordability and comprehensive protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Single Moms

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Single Moms

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Single Moms

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, Progressive, and Allstate are the top companies that offer best car insurance for single moms. State Farm prioritizes affordability and peace of mind with comprehensive coverage for families on the road.

As a single mother, time and money are precious. You likely spend more time in your car with your children than others. Finding affordable auto insurance is crucial, as most of your income goes to ensuring your family’s protection.

Our Top 10 Best Companies: Best Car Insurance for Single Moms

| Company | Rank | Single Mom Discount | Multi-Policy Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Comprehensive Coverage | State Farm | |

| #2 | 12% | 12% | Multi-Policy Discounts | Progressive | |

| #3 | 15% | 18% | Personalized Coverage | Allstate | |

| #4 | 8% | 14% | Policy Options | Liberty Mutual |

| #5 | 10% | 15% | Accident Forgiveness | Nationwide |

| #6 | 9% | 13% | Loyalty Rewards | Farmers | |

| #7 | 7% | 10% | Bundle Discounts | American Family | |

| #8 | 11% | 16% | 24/7 Support | Travelers | |

| #9 | 8% | 14% | Safe-Driving Discounts | Erie |

| #10 | 10% | 15% | Online Convenience | Esurance |

You still want to enjoy quality of life, so saving money wherever possible can be a huge benefit. Take care of the bills by feeling comfortable with what you’re paying, and you and your child will not only be protected but given peace of mind as well.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code above into our free comparison tool to find the lowest prices in your area.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage: State Farm car insurance review offers various coverage options tailored for different business needs.

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Potential Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#2 – Progressive: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discount: Progressive car insurance review offers a substantial discount for bundling multiple insurance policies.

- Decent Single-Mother Discount: Provides a notable discount specifically tailored for single mothers.

- Flexible Policy Options: Offers a variety of policy options to suit individual needs.

Cons

- Limited Single-Mother Discount: The discount for single mothers may not be as high as some competitors.

- Average Customer Service: Some customers report issues with the responsiveness of customer support.

#3 – Allstate: Best for Personalized Coverage

Pros

- Personalized Coverage Options: Allstate Car insurance review offers customizable coverage tailored to individual needs.

- Multi-Policy Discounts: Offers competitive discounts for bundling multiple insurance policies.

- Diverse Coverage Options: Provides a wide array of coverage options to suit individual needs.

Cons

- Premium Costs May Vary: Some customers report higher premium costs compared to other providers.

- Limited Discount Options: May not offer as many discount opportunities as some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Policy Options

Pros

- Wide Range of Policy Options: Offers diverse coverage options to meet various needs.

- Competitive Single-Mother Discount: Liberty Mutual car insurance review offers a notable discount specifically tailored for single mothers.

- Solid Multi-Policy Discount: Provides a decent discount for bundling multiple insurance policies.

Cons

- Average Customer Satisfaction: Some customers report dissatisfaction with the claims process.

- Limited Additional Discounts: May not offer as many additional discount opportunities as some competitors.

#5 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness Feature: Offers forgiveness for certain accidents, helping to keep premiums low.

- Competitive Single-Mother Discount: Offers a significant discount specifically tailored for single mothers.

- Decent Multi-Policy Discount: Provides a notable discount for bundling multiple insurance policies.

Cons

- Limited Coverage Options: May not offer as many coverage options as some competitors.

- Potential Premium Increases: Despite forgiveness, premiums may still increase after accidents.

#6 – Farmers: Best for Loyalty Rewards

Pros

- Loyalty Rewards Program: Offers incentives and discounts for long-term customers.

- Competitive Single-Mother Discount: Provides a significant discount specifically tailored for single mothers.

- Flexible Policy Options: Farmers car insurance review offers customizable coverage to suit individual needs.

Cons

- Limited Availability: May not be available in all areas, limiting options for some customers.

- Potentially Higher Premiums: Some customers report higher premiums compared to other providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Bundle Discounts

Pros

- Bundle Discounts: Offers significant savings for bundling multiple insurance policies.

- Decent Single-Mother Discount: American Family car insurance review provides a notable discount specifically tailored for single mothers.

- Wide Range of Coverage Options: Offers various coverage options to meet different needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount may not be as high as some competitors.

- Average Customer Service: Some customers report issues with the responsiveness of customer support.

#8 – Travelers: Best for 24/7 Customer Support

Pros

- 24/7 Customer Support: Travelers car insurance review provides round-the-clock assistance for customers.

- Competitive Single-Mother Discount: Offers a significant discount specifically tailored for single mothers.

- Strong Multi-Policy Discount: Provides a notable discount for bundling multiple insurance policies.

Cons

- Limited Online Tools: Some customers report that online tools and resources could be improved.

- Potential Premium Increases: Premiums may increase over time, especially after claims.

#9 – Erie: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Erie car insurance review offers significant savings for safe driving habits.

- Decent Single-Mother Discount: Provides a notable discount specifically tailored for single mothers.

- Competitive Multi-Policy Discount: Provides a substantial discount for bundling multiple insurance policies.

Cons

- Limited Coverage Options: May not offer as many coverage options as some competitors.

- Availability Restrictions: Limited availability in certain regions may limit options for some customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Provides easy access to quotes, policy management, and claims filing online.

- Competitive Single-Mother Discount: Offers a notable discount specifically tailored for single mothers.

- Decent Multi-Policy Discount: Provides a notable discount for bundling multiple insurance policies. For more information, read our “How do you get an Esurance car insurance quote?“

Cons

- Limited Local Agents: Lack of physical locations may make it difficult for some customers to access in-person support.

- Average Customer Service: Some customers report issues with the responsiveness of customer support representatives.

Car Insurance Monthly Rates for Single Moms by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $62 | $162 |

| American Family | $43 | $115 |

| Erie | $22 | $59 |

| Esurance | $46 | $114 |

| Farmers | $53 | $139 |

| Liberty Mutual | $66 | $171 |

| Nationwide | $43 | $113 |

| Progressive | $41 | $112 |

| State Farm | $33 | $86 |

| Travelers | $37 | $98 |

Erie offers the most affordable rates for both full and minimum coverage, with $59 and $22 respectively. State Farm follows closely with $86 for full coverage and $33 for minimum coverage. Liberty Mutual and Allstate present higher rates across the board, with $171 for full coverage and $66 for minimum coverage from Liberty Mutual, and $162 for full coverage and $62 for minimum coverage from Allstate.

The Importance of Car Insurance for Single Mothers

It is important to have car insurance for single moms, no matter their life circumstances. It can be a huge slice of income that we may not want to set aside, but it’s a must-have.

However, for single moms, it is even more valuable. You have many lives and assets to protect that you alone are responsible for.

Not to mention that in nearly every state car insurance is a legal requirement. Without the proper car insurance coverage, you could be without a car, owe a lot of money, or worse yet, face legal consequences.

In the event that you’re pulled over, one of the first things that an officer is going to ask for is proof of auto insurance. You don’t want to be found without it, especially if you have a dependent child who needs you. Check our comprehensive guide titled “Does my car insurance cover my child?” for more information.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Legal Penalties for Driving Without Car Insurance

While auto insurance is an added expense to car ownership, it will cost you more money, in the long run, to not have car insurance if you are in an accident or simply found by law enforcement not to have insurance.

State Farm emerges as the top choice for single mothers, offering comprehensive coverage and an exclusive Single-Mother Discount up to 10%.

Dani Best Licensed Insurance Producer

Not obtaining the legally mandated types and amounts of auto insurance coverage in your state can lead to several different penalties, including:

- Suspension or revocation of your driver’s license

- Suspension or revocation of your car registration

- Jail time

- Vehicle impoundment

- Community service

- Fines

The penalties become more severe for each instance you are cited without insurance. In most cases, you will have to go before a judge. It will become more expensive for you to obtain auto insurance as you will be required to have SR22 insurance coverage. Also, if you are found to be at fault in an accident, you can be held financially responsible for the damages you caused.

The price you ultimately pay for having no insurance can amount to hundreds of thousands of dollars, depending on the severity of the accident. You may have to pay medical bills, funeral expenses, lost wages, and for property damages.

Types of Car Insurance Coverage You Need

Think of your auto insurance policy as several smaller policies all rolled into one. They are like pieces of a puzzle that fit together to give you the coverage that you need. Each of the coverage options you can have covers different situations.

To find out what types are legally required in your state, check with your insurance company. Here are the various coverage types:

Liability is the basic coverage required by most states. Bodily injury liability covers damages that you cause to someone else. It covers medical expenses and, if needed, funeral expenses.

Property damage liability covers damages you cause to another party’s vehicle or structures. It is important to note that your liability coverage does not pay for any of your own damages.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Distinguishing Between Comprehensive and Collision

Though not legally required in any state, these coverages are contractually required if you finance or lease your vehicle. They are also important to have if you could not afford to replace your car if something happened to it.

Collision covers damages to your vehicle as a result of a crash. Comprehensive is relied upon if your vehicle is damaged in other ways such as:

- Hitting wildlife

- Fires

- Floods

- Other natural disasters

- Vandalism

- Theft

With comprehensive and collision, you select your coverage amounts and also your deductible. Drivers should note that the lower their deductible, the higher their premium will be.

Dealing with an Accident Involving an Underinsured Motorist

While most drivers comply with auto insurance laws, some do not. Unfortunately, not complying with auto insurance laws can cause you problems if you are in an accident with someone who is not compliant.

Uninsured motorist coverage will pay if you are in an accident with another driver who does not have insurance or if you are a victim of a hit-and-run accident. Underinsured motorist will help pay your accident-related expenses when and if the other driver’s insurance coverage is exhausted. In some states, uninsured/underinsured motorist coverage is legally mandated.

Understanding Medical Payments and Personal Injury Protection

Sometimes referred to as med pay or simply PIP, this coverage pays for your medical expenses, lost wages, and in some cases, for any needed hired household help like housekeeping and childcare, if you are injured in an accident. It can provide the financial and medical care you’ll need while you get back on your feet.

Being a single parent is difficult, but being one without income can be even more troubling, underscoring the importance of single parent car insurance. You can file a claim on your med pay coverage no matter who is at fault for the accident. Some states require drivers to have PIP.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Explaining Gap Coverage

If you have a leased vehicle, you likely already have gap coverage rolled into your lease payments. If it is not, you are usually required to obtain gap coverage.

If you have a financed vehicle, you may want to consider purchasing gap insurance.

Gap coverage is important because it will pay the difference between what is owed on your loan or lease and what your insurance company decides your car is worth if it is totaled for its damages.

You probably should get gap coverage if you:

- Made less than 20 percent of a down payment

- Financed your car for longer than 60 months

- Rolled over negative equity from a previous vehicle into your current loan

- Have a car that depreciates faster than other types

Availability of Rental Car Coverage

If your car is damaged and needs to be repaired, you can be left in a bind as far as what to do for a vehicle or transportation. Not having a vehicle can be especially problematic for single moms as they are more likely only to have one car and are relied upon as the sole means of transportation for their children, emphasizing the importance of finding cheap car insurance for single moms.

Rental car coverage will pay for your rental car expenses when your car is in the shop being repaired. This type of coverage typically pays a certain amount per day up to 30 days.

Exploring Roadside Assistance Services

We often take for granted that our cars run smoothly and we get to where we need to go without any problems; it’s just not something we need to care about all the time. More often than not we have reliable vehicles for our day to day uses.

However, there are times when you may need a jump start for your car, you may unexpectedly run out of gas, or you may simply experience another car problem while away from home.

It is times like these that having roadside assistance from your auto insurance company can pay off, especially when considering single mom car insurance. As a single mom, you may not have many other people you can call or rely upon if you get into a bind with your car.

However, having roadside assistance can give you the piece of mind that someone will be there to come to your aid, day or night, no matter where you may be.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Strategies for Decreasing Coverage Costs

Single moms can have difficulty affording the coverages they need to have. Not being able to afford coverage may cause them to forgo optional coverages that would benefit them in an accident and give them peace of mind while driving their kids around.

Here are some useful tips to help you save money on your auto insurance premiums and stretch your hard-earned dollar farther.

Considering Raising Your Deductible

A deductible is a pre-determined amount you pay out of your own pocket before your insurance company pays on your claim. Having a lower deductible increases the amount of your premium. If you have the financial resources to pay a higher deductible if you are in an accident, you should raise your deductible to lower your premium.

Options for Lowering Limits or Adjusting Coverage Amounts

Outside of what is legally required in your state, you should think about which coverages you really need and can potentially use and which ones you cannot.

If a friend or relative has a car you can borrow from time to time, you may not need rental car coverage. If you do not have a leased or financed vehicle and it wouldn’t cost you much to replace it, you may consider dropping your comprehensive and collision coverage.

State Farm emerges as the top choice for single mothers, offering comprehensive coverage and an exclusive Single-Mother Discount up to 10%.

Justin Wright Licensed Insurance Agent

In addition, lowering your coverage limits will help to decrease your overall auto insurance premium. No matter what you decide, it is important to carefully consider your financial situation and available resources.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Unveiling the Benefits of Insurance Discounts

This series of case studies unveils the tangible benefits of insurance discounts offered by top providers. From State Farm’s exclusive Single-Mother Discount to Progressive’s strategic Multi-Policy Discounts and Allstate’s personalized coverage coupled with generous savings, each case study delves into real-life scenarios showcasing how these discounts empower individuals and families alike.

Explore how these discounts not only enhance coverage but also provide financial relief, illustrating the symbiotic relationship between affordability and comprehensive protection in the world of car insurance.

- Case study #1 – Comprehensive Coverage and Single-Mother Discount: State Farm car insurance review secures the top spot with its comprehensive coverage options and unique Single-Mother Discount. Examining real-life scenarios, we delve into how single mothers have benefited from State Farm’s up to 10% discount, providing financial relief without compromising on coverage.

- Case study #2 – Multi-Policy Discounts Driving Customer Loyalty: Progressive’s strategic focus on Multi-Policy Discounts takes center stage in this case study. We explore instances where policyholders have leveraged Progressive’s up to 12% discount for combining multiple policies, illustrating how this approach enhances both coverage and cost-effectiveness.

- Case study #3 – Personalized Coverage and Generous Discounts: Allstate stands out with its commitment to personalized coverage and significant discounts of up to 15%. Through case studies, we illustrate how Allstate tailors insurance solutions to individual needs while maximizing savings through its up to 18% Multi-Policy Discount.

By examining real-life scenarios, we’ve seen how these discounts offer financial relief without compromising on comprehensive coverage. Whether it’s single mothers seeking support, families consolidating policies, or individuals craving personalized solutions, these case studies illustrate how insurance discounts play a crucial role in driving customer satisfaction and loyalty in the competitive car insurance landscape.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Exploring Available Car Insurance Discounts

Most auto insurance carriers offer several different discounts. In many cases, however, the caveat is that you have to ask for them. Common auto insurance discounts that you may qualify for include:

- Good Driver: If you have a history of being a good driver with no accidents or points off of your driver’s license, most auto insurance companies will reward you with better rates.

- Defensive Driving Course: Taking a defensive driving course can be a good way to ensure you know how to drive safely and decrease the chances of an accident. Due to this, some auto insurance carriers will reduce your premium.

- Safe Vehicle: Discuss your car’s safety features with your auto insurance agent or representative. Since safety features can decrease their cost on an insurance claim, you may see a discount on your premium.

- Anti-Theft: If your car is equipped with an anti-theft device, you are less of a financial risk for your insurance company, and they may provide you with a lower rate.

- Green Vehicle: If you have a hybrid car or another type of car that is environmentally friendly, many car insurance companies will reward your green efforts with reduced rates.

- Good Student: Maintaining good grades can earn students discounts on their auto insurance premiums. Be prepared to supply a report card or other proof of grades.

- Military/Veteran: If you have served or are serving in a branch of the United States military, you are likely eligible for a discount.

- Occupational: Some auto insurance companies will provide you with a discount for working in a certain occupation such as law enforcement, first responders, teaching, and those in the medical field.

- Affiliation: Belonging to a certain organization or having been in a sorority or fraternity can potentially give you an auto insurance premium discount.

- Multi-Policy: Using the same insurance carrier for multiple coverage needs such as homeowners, renters or life insurance, in addition to car insurance can decrease your premium on each policy. Not only is this convenient but it also saves you money.

- Multi-Vehicle: Having more than one vehicle insured on the same auto policy can help you pay lower premiums on each car.

- Loyalty: If you have stayed with the same auto insurance company for several years, they may reward you with a discount.

- Low Mileage: The less you drive, the less of a risk your insurance carrier takes on by insuring you and your vehicle. If you do not drive over a certain amount of miles in a set time period, such as a week or a year, your auto insurance company may provide you with a reduced rate. In some cases, electronic monitoring may be required.

Being a single mom comes with many challenges, responsibilities, and rewards. Finding affordable auto insurance can be a bit of a struggle, but hopefully in the end it will save you money so that you and your child, or children, will be safer on the road.

You can potentially decrease some of your financial problems by using an online price comparison calculator. Every penny of your income is precious. These tools allow you to easily compare several different auto insurance carriers, policies, and rates all in one place. Start comparison shopping today by using our FREE online quote tool! Enter your ZIP code below to begin!

Frequently Asked Questions

Why is it important for single mothers to have car insurance?

Car insurance is essential for all drivers, including single mothers, as it protects their lives and assets. It is also a legal requirement in most states.

Are there any legal penalties for driving without car insurance?

Yes, driving without insurance can lead to penalties such as fines, license suspension, and increased insurance costs. In the event of an accident, you may be held financially responsible for damages.

What types of car insurance coverage do single mothers need?

Single mothers should have liability coverage, which includes bodily injury and property damage. They can also consider additional coverage like comprehensive, collision, uninsured/underinsured motorist, medical payments/personal injury protection, gap coverage, rental car coverage, and roadside assistance.

How can single mothers decrease their insurance costs?

To reduce costs, single mothers can consider raising their deductible, lowering coverage limits, and taking advantage of available discounts such as good driving records, safety features, and good school grades for their children.

How can single mothers compare car insurance rates?

Single mothers can use online price comparison tools to compare quotes from different insurance companies. This allows them to find the best rates that fit their budget and provide adequate coverage.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Are there any legal penalties for driving without car insurance?

Yes, driving without insurance can lead to penalties such as fines, license suspension, and increased insurance costs. In the event of an accident, you may be held financially responsible for damages.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

How can single mothers decrease their insurance costs?

To reduce costs, single mothers can consider raising their deductible, lowering coverage limits, and taking advantage of available discounts such as good driving records, safety features, and good school grades for their children.

Gain further insights by checking our comprehensive guide titled “How to combine car insurance coverage with the right deductible“.

How can single mothers compare car insurance rates?

Single mothers can use online price comparison tools to compare quotes from different insurance companies. This allows them to find the best rates that fit their budget and provide adequate coverage.

What is liability coverage?

Liability coverage is the basic coverage required by most states. Bodily injury liability covers damages that you cause to someone else, including medical expenses and funeral expenses. Property damage liability covers damages you cause to another party’s vehicle or structures.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

What is the best car insurance for single moms?

Determining the best car insurance for single moms can depend on various factors such as budget, coverage needs, driving history, and individual preferences. However, several insurance companies offer features and discounts that may be particularly beneficial for single moms. Here are a few options to consider: State Farm, Progressive and Allstate.

Read our “Compare car insurance rates with a bad driving record” to gain further details“.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.