Best Ford Edge Car Insurance in 2026 (Check Out the Top 10 Companies)

For the best Ford Edge car insurance, consider State Farm, Erie, and USAA. These top providers offer comprehensive coverage at competitive rates with State Farm starting at a minimum of $40/mo. Their strong customer service, diverse coverage options, and available discounts make them ideal for Ford Edge owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated February 2026

Company Facts

Full Coverage for Ford Edge

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Ford Edge

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Ford Edge

A.M. Best Rating

Complaint Level

Pros & Cons

For the best Ford Edge car insurance, consider State Farm, Erie, and USAA as the top three providers. These companies stand out for their comprehensive coverage options, exceptional customer service, and valuable discounts.

This article examines why these insurance providers are ideal for Ford Edge owners, highlighting their key strengths and advantages.

Our Top 10 Company Picks: Best Ford Edge Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 12% B Many Discounts State Farm

#2 10% A+ 24/7 Support Erie

![]()

#3 15% A++ Military Savings USAA

#4 18% A+ Innovative Programs Progressive

#5 20% A Customizable Polices Liberty Mutual

#6 14% A Online App AAA

#7 17% A++ Custom Plan Geico

#8 13% A+ Add-on Coverages Allstate

#9 19% A++ Accident Forgiveness Travelers

#10 11% A Local Agents Farmers

Dive in to find out how they can meet your insurance needs. Learn more in our guide titled “Compare Car Insurance by Coverage Type.”

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

#1 – State Farm: Top Overall Pick

Pros

- Competitive Pricing: Rates start as low as $59 per month, making it a cost-effective option. Offers a 12% multi-vehicle discount, which further reduces costs for Ford Edge drivers who insure multiple vehicles. This makes it one of the best Ford Edge car insurance options for budget-conscious owners.

- Wide Range of Discounts: Provides numerous discounts, including for safe driving and bundling policies. This helps Ford Edge enthusiasts maximize their savings and get the best Ford Edge car insurance rates available. Learn more in our in our guide titled State Farm car insurance review.

- Comprehensive Coverage Options: Offers various coverage types tailored to meet diverse needs, including comprehensive and collision. Ford Edge drivers will appreciate the flexibility in choosing the best Ford Edge car insurance coverage for their specific requirements.

Cons

- Limited Online Tools: The website and app may not be as advanced as some competitors, potentially leading to a less convenient experience for Ford Edge owners who prefer digital management of their policies.

- Customer Service Variability: While generally strong, customer service experiences can vary, which may be a drawback for Ford Edge drivers seeking consistent, high-quality support. This variability could affect those looking for the best Ford Edge car insurance experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for 24/7 Support

Pros

- 24/7 Customer Support: Offers round-the-clock support, ensuring Ford Edge owners have access to assistance whenever needed. This feature is a significant advantage for drivers seeking reliable help with their best Ford Edge car insurance needs. Check out insurance savings in our complete guide titled “Erie Car Insurance Review.”

- 10% Multi-Vehicle Discount: Provides savings for insuring more than one vehicle, making it ideal for Ford Edge enthusiasts with multiple cars. This discount enhances the overall value of the best Ford Edge car insurance.

- Customizable Coverage: Offers flexible policy options to suit various needs, allowing Ford Edge owners to tailor their coverage. This adaptability ensures that drivers can find the best Ford Edge car insurance that fits their specific requirements.

Cons

- Limited National Presence: Available primarily in the eastern U.S., which might not be ideal for Ford Edge drivers located in other regions seeking nationwide coverage options.

- Higher Premiums for Some: Premiums might be higher compared to other providers for certain drivers, which could affect those looking for the most cost-effective best Ford Edge car insurance.

#3 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: Offers up to 15% discount for military families, making it the best Ford Edge car insurance for service members. This significant saving is tailored to those who qualify.

- Exceptional Customer Service: Known for excellent support, especially for military families. Ford Edge drivers who are veterans or active duty will appreciate the dedicated service and reliable assistance. Check out insurance savings in our complete article called USAA car insurance review.

- Comprehensive Coverage Options: Provides extensive coverage options including rental reimbursement and roadside assistance. This thorough coverage ensures that Ford Edge owners are well-protected and can access additional benefits as needed.

Cons

- Eligibility Limitations: Exclusively available to military personnel and their families, which excludes Ford Edge drivers outside this group from accessing the best Ford Edge car insurance benefits.

- Limited Coverage Options for Non-Military: Coverage options are tailored to military families, potentially limiting choices for Ford Edge drivers who do not meet the eligibility requirements.

#4 – Progressive: Best for Innovative Programs

Pros

- Innovative Programs: Features programs like Snapshot for tracking driving habits, which can reduce premiums for safe Ford Edge drivers. This innovation helps Ford Edge enthusiasts get the best Ford Edge car insurance tailored to their driving behavior.

- 18% Multi-Vehicle Discount: Provides substantial savings for insuring multiple vehicles. This discount is advantageous for Ford Edge owners with more than one car, making it a strong contender for the best Ford Edge car insurance. More information is available about this provider in our article called Progressive car insurance review.

- User-Friendly Online Tools: Provides a robust online platform for managing policies and claims, making it easy for Ford Edge drivers to handle their insurance needs efficiently. This convenience is a key factor for those seeking the best Ford Edge car insurance experience.

Cons

- Potentially Higher Rates for Some Drivers: Rates may be higher for drivers with less-than-ideal driving records, which could affect Ford Edge drivers seeking the lowest premium for the best Ford Edge car insurance.

- Complex Coverage Options: The variety of coverage options can be overwhelming, potentially complicating the process for Ford Edge enthusiasts looking for straightforward insurance solutions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Offers a range of customizable options, including add-ons for unique coverage needs. This flexibility allows Ford Edge owners to create the best Ford Edge car insurance policy for their specific requirements.

- 20% Multi-Vehicle Discount: Provides a substantial discount for insuring multiple vehicles, benefiting Ford Edge drivers with more than one car. This can significantly reduce the cost of the best Ford Edge car insurance. Discover more about offerings in our article called, “Liberty Mutual Car Insurance Review.”

- Wide Range of Coverage Add-Ons: Offers various add-ons such as accident forgiveness and new car replacement, which can enhance the protection for Ford Edge drivers. These options contribute to finding the best Ford Edge car insurance coverage.

Cons

- Higher Premiums for Some Drivers: Premiums may be higher for certain drivers, potentially making it less ideal for those seeking the most cost-effective best Ford Edge car insurance.

- Complexity in Policy Options: The range of customization options can be overwhelming, which might make it challenging for Ford Edge drivers to select the best Ford Edge car insurance plan.

#6 – AAA: Best for Online App

Pros

- User-Friendly Online App: Offers an easy-to-use app for managing policies and claims, which is a significant advantage for Ford Edge drivers who prefer digital tools. This convenience makes it a strong option for the best Ford Edge car insurance.

- 14% Multi-Vehicle Discount: Provides a discount for insuring multiple vehicles, which is beneficial for Ford Edge owners with more than one car. This helps in securing the best Ford Edge car insurance at a lower cost.

- Strong Roadside Assistance: Includes robust roadside assistance services, ideal for Ford Edge enthusiasts who value emergency support. This added benefit enhances the overall value of the best Ford Edge car insurance. More information is available about this provider in our article called “AAA Car Insurance Review.”

Cons

- Regional Availability: Availability might be limited in some areas, which could be a drawback for Ford Edge drivers in regions where AAA coverage is not offered. This can limit access to the best Ford Edge car insurance options.

- Higher Rates for Some Drivers: Insurance rates may be higher compared to some competitors, which could be a disadvantage for those seeking the most affordable best Ford Edge car insurance.

#7 – Geico: Best for Custom Plans

Pros

- Customizable Plans: Offers a range of customizable coverage options, allowing Ford Edge drivers to tailor their policies. This adaptability ensures they receive the best Ford Edge car insurance suited to their individual needs.

- 17% Multi-Vehicle Discount: Provides significant savings for insuring multiple vehicles, which benefits Ford Edge owners with more than one car. This discount helps in obtaining the best Ford Edge car insurance at a lower rate.

- High A.M. Best Rating: Rated A++, reflecting strong financial stability and reliability. This high rating reassures Ford Edge enthusiasts that their insurer can be trusted to provide the best Ford Edge car insurance coverage. Read up on the “Geico Car Insurance Review” for more information.

Cons

- Customer Service Variability: Customer service experiences can be inconsistent, which might affect Ford Edge owners looking for reliable support with their best Ford Edge car insurance.

- Potentially Higher Rates for High-Risk Drivers: Rates may be higher for drivers with poor credit or accident histories, which could be a drawback for some Ford Edge drivers seeking the most affordable best Ford Edge car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Add-on Coverages

Pros

- Extensive Add-On Coverages: Offers various add-on options such as accident forgiveness and new car replacement. This flexibility allows Ford Edge drivers to customize their policies and find the best Ford Edge car insurance.

- 13% Multi-Vehicle Discount: Provides a discount for insuring multiple vehicles, which is beneficial for Ford Edge owners with more than one car. This can reduce the cost of the best Ford Edge car insurance. Learn more in our article called “Allstate Car Insurance Review.”

- Strong Online and Mobile Tools: Offers user-friendly online and mobile tools for managing policies and claims. This convenience is particularly appealing to Ford Edge enthusiasts who prefer handling their insurance needs digitally.

Cons

- Premiums May Be Higher: Insurance rates might be higher compared to some competitors, which could be a disadvantage for Ford Edge drivers seeking the most cost-effective best Ford Edge car insurance.

- Complex Policy Options: The variety of coverage options can be overwhelming, potentially making it difficult for Ford Edge drivers to choose the best Ford Edge car insurance plan for their needs.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Includes accident forgiveness in some policies, which can prevent premiums from rising after a first accident. This feature is valuable for Ford Edge drivers looking for the best Ford Edge car insurance with added protection.

- 19% Multi-Vehicle Discount: Provides a substantial discount for insuring multiple vehicles, which benefits Ford Edge owners with more than one car. This discount can help achieve the best Ford Edge car insurance rates.

- Comprehensive Coverage Options: Offers a wide range of coverage options including rental reimbursement and roadside assistance. This flexibility ensures Ford Edge drivers can find the best Ford Edge car insurance that meets their needs. Learn more in our article called “Travelers Car Insurance Review.“

Cons

- Complex Coverage Options: The range of options might be overwhelming, making it difficult for some Ford Edge drivers to determine the best Ford Edge car insurance for their needs.

- Premiums for High-Risk Drivers: Rates may be higher for drivers with poor credit or accident history, which could be a drawback for Ford Edge drivers in those categories seeking affordable coverage.

#10 – Farmers: Best for Local Agents

Pros

- Local Agents: Provides access to local agents who can offer personalized service and advice. This is particularly beneficial for Ford Edge drivers who prefer face-to-face interactions for their best Ford Edge car insurance needs. Delve into our evaluation of Farmers car insurance review.

- Customizable Coverage: Offers a range of customizable coverage options to suit various needs, allowing Ford Edge drivers to tailor their insurance policies. This flexibility helps in securing the best Ford Edge car insurance.

- Strong Customer Service: Known for good customer support and comprehensive claims processing. This reliability ensures that Ford Edge enthusiasts receive the best Ford Edge car insurance experience with effective support.

Cons

- Limited National Presence: Coverage might be less comprehensive in some regions, which could affect Ford Edge drivers in areas where Farmers is not widely available. This could limit access to the best Ford Edge car insurance options.

- Higher Premiums for Certain Drivers: Insurance rates may be higher compared to some competitors, which might be a disadvantage for Ford Edge drivers looking for the most affordable best Ford Edge car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Free Ford Edge Car Insurance Quotes Online

When comparing free Ford Edge insurance quotes online, you can start by using our free tool to obtain rates from top car insurance companies. This tool helps you gather multiple quotes quickly, allowing you to see how different insurers might price your Ford Edge coverage.

It’s important to understand that various factors influence insurance premiums, making it challenging to pinpoint an exact cost. These factors include the type of coverage you choose, your driving history, and the availability of discounts.

Ford Edge Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $59 $192

Allstate $70 $126

Erie $85 $176

Farmers $69 $226

Geico $51 $237

Liberty Mutual $56 $219

Progressive $40 $173

State Farm $67 $174

Travelers $58 $145

USAA $59 $196

For instance, comprehensive and collision coverage will generally increase your premium compared to basic liability coverage. Additionally, discounts for safe driving, bundling policies, or having certain safety features in your vehicle can also affect the overall cost.

Furthermore, it’s crucial to be aware of the minimum car insurance requirements by state as these requirements can influence your insurance needs and potentially impact your premium. On average, you might expect to pay slightly over $1,000 annually for car insurance on a Ford Edge. This figure provides a general benchmark, but individual rates can vary based on personal circumstances and insurance provider policies.

Most Necessary Forms of Ford Edge Car Insurance Coverage

When evaluating essential forms of car insurance coverage, liability coverage stands out as the most critical component. Comparing liability car insurance options is crucial because this coverage is designed to shield policyholders financially if they are deemed responsible for causing an accident.

Liability insurance is essential due to the high costs associated with accidents, including injuries and property damage, which can quickly escalate and lead to significant out-of-pocket expenses if the responsible party lacks sufficient insurance.

Liability coverage is generally divided into two categories: bodily injury and property damage. Bodily injury coverage provides financial protection if an accident caused by the policyholder results in injury or death to others. This coverage ensures that medical expenses, legal costs, and compensation for pain and suffering are covered, reducing the financial burden on the policyholder.

Property damage coverage, on the other hand, addresses the repair or replacement costs for damage inflicted on another vehicle or any other property, such as buildings, due to the policyholder’s actions.

In addition to liability coverage, uninsured and underinsured motorist coverage is another critical form of protection. Comparing liability car insurance options should include this type of coverage because it safeguards policyholders from the financial repercussions of accidents involving drivers who either lack adequate insurance or have no insurance at all.

Without this coverage, policyholders could face significant expenses if they are involved in an accident with an underinsured or uninsured motorist. By incorporating uninsured and underinsured motorist coverage, policyholders can ensure they have additional financial protection, providing peace of mind and a safeguard against potential gaps in other drivers’ insurance. Enter your ZIP code now to begin.

Common but Completely Optional Forms of Car Insurance Coverage for the Ford Edge

Frequently Asked Questions

Are there any specific safety features in the Ford Edge that can help lower insurance rates?

Yes, certain safety features in the Ford Edge can potentially help lower insurance rates.

Features such as anti-lock brakes, airbags, stability control, lane departure warning, blind-spot monitoring, and advanced driver assistance systems (ADAS) may be taken into consideration by insurance companies when determining premiums.

It’s always a good idea to inquire with your insurance provider about potential discounts for safety features.

Will the cost of insurance for the Ford Edge vary based on the model year?

Yes, the cost of insurance for a Ford Edge can vary based on the model year. Generally, newer vehicles tend to have higher insurance rates due to their higher market value and potentially costlier repairs or replacement parts.

However, other factors, such as the availability of safety features and historical data on the vehicle’s performance, also play a role in determining insurance rates. Enter your ZIP code now to begin comparing.

How does the Ford Edge’s trim level affect insurance rates?

The trim level of a Ford Edge can affect insurance rates, with higher trims potentially leading to higher premiums due to increased value and repair costs.

In states providing full glass coverage, this might offset some costs associated with higher trim levels, but the overall impact on premiums will still vary by insurance company.

Are insurance rates for the Ford Edge impacted by the driver’s age?

Yes, the driver’s age can impact insurance rates for the Ford Edge. Younger drivers, particularly those under the age of 25, often face higher insurance premiums due to statistical data indicating that they are more prone to accidents.

Older, more experienced drivers, on the other hand, may be eligible for lower insurance rates. However, other factors such as driving history and location also influence the overall insurance premium.

How can I save on Ford Edge insurance?

There are several ways to save on Ford Edge insurance. These include practicing safe driving habits, comparing quotes from different insurance companies, taking advantage of discounts for safety features, multiple policies, and driver training courses. Enter your ZIP code now to begin comparing.

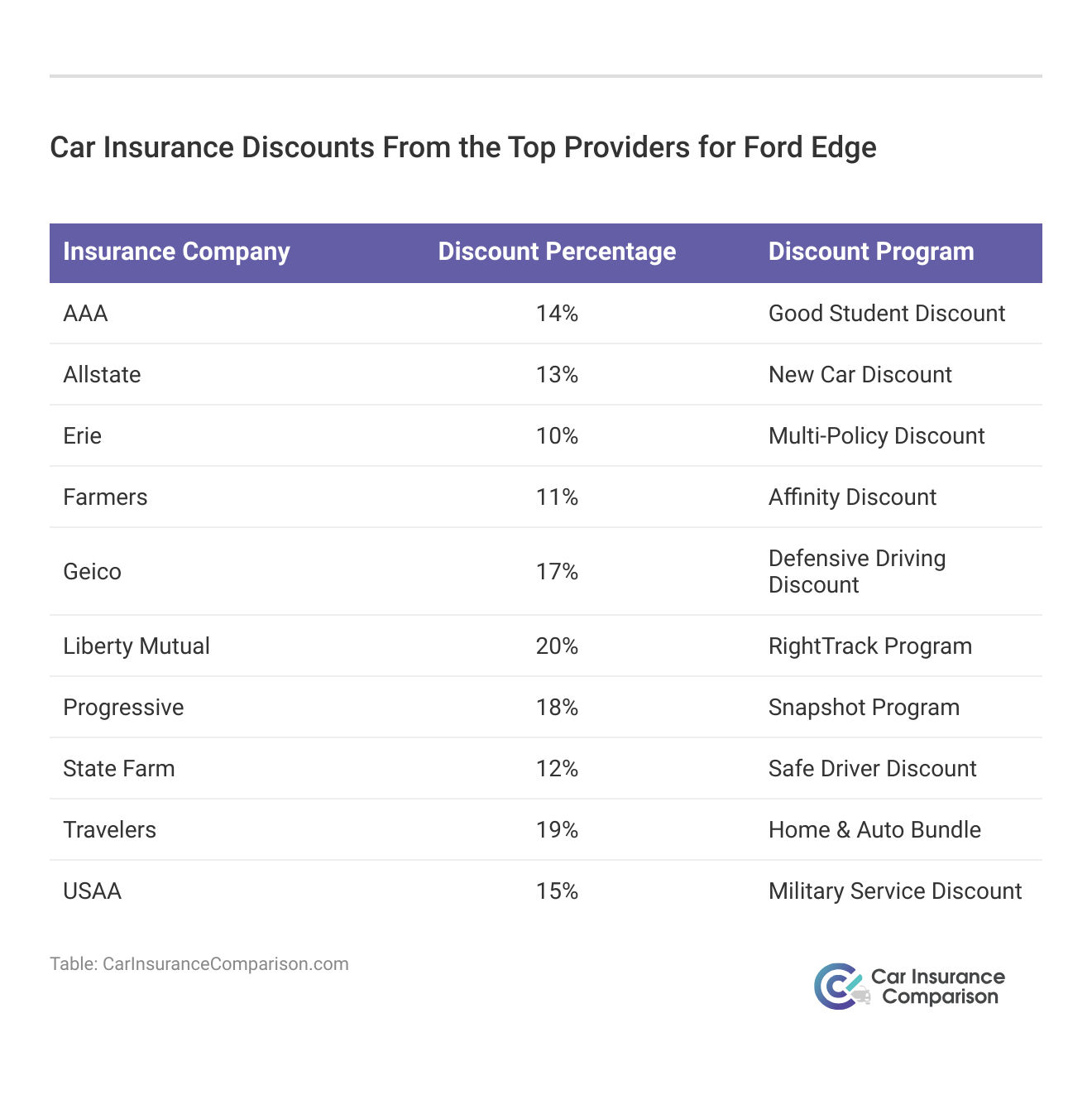

Which insurance provider offers the highest multi-vehicle discount for Ford Edge drivers?

Liberty Mutual offers the highest multi-vehicle discount at 20%, which can significantly reduce the cost of insuring multiple vehicles for Ford Edge owners.

When comparing multiple car insurance quotes online, this discount can make a substantial difference in your premiums.

It’s worth exploring Liberty Mutual’s offers alongside other providers to ensure you’re getting the best possible rate for your coverage needs.

What is the A.M. Best rating for the insurance company ranked #3 in the list?

USAA, ranked #3, has an A++ A.M. Best rating. This indicates its superior financial strength and reliability, making it a strong choice for Ford Edge enthusiasts.

Which provider is noted for its innovative programs and high multi-vehicle discount?

Progressive is recognized for its innovative programs and offers an 18% multi-vehicle discount. This combination makes it a compelling option for Ford Edge drivers looking for modern insurance solutions. Enter your ZIP code now to begin comparing.

How does the accident forgiveness feature benefit Ford Edge drivers?

Travelers provides accident forgiveness, which helps prevent rate increases after a first at-fault accident. This safety feature is particularly valuable for Ford Edge owners seeking to avoid higher premiums due to minor mishaps.

Which insurance company is highlighted for its strong 24/7 customer support?

Erie is noted for its exceptional 24/7 customer support. This ensures that Ford Edge drivers have access to assistance anytime, making it a reliable choice for comprehensive car insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.