Best Boise, ID Car Insurance in 2026

The cheapest car insurance companies in Boise, Idaho, are USAA, State Farm, and Liberty Mutual insurance. Car insurance cost in Boise, Idaho, varies for each person based on factors like driving record. You can pay as little as $137/mo for Boise, ID car insurance rates. Boise, Idaho car insurance law requires that you carry at 25/50/15 in liability coverage as well as uninsured/underinsured motorist coverage with the same limits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2024

- On average, Boise, Idaho car insurance rates are $2,650 per year

- Five of the nation’s top companies have cheaper than average car insurance quotes in Boise

- Idaho’s car insurance requirements are 25/50/15

- Boise is the highest populated city in Idaho, and it has the most vehicle thefts in the state.

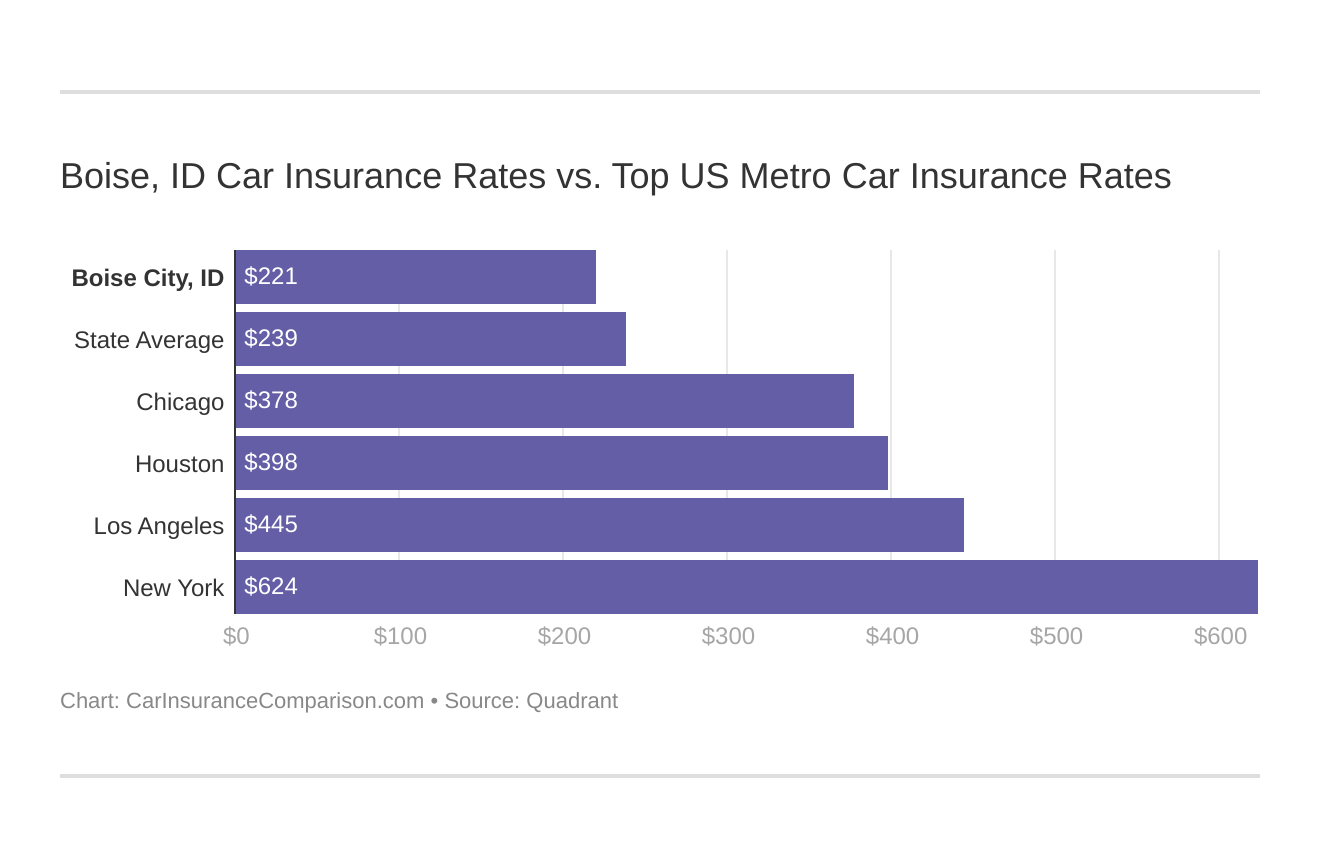

Boise, ID car insurance products are $1,282 less than the national average and $329 less than the state average. However, Boise, ID car insurance rates depend on the company and other factors that affect car insurance.

Those factors include age, driving record, credit history, and even marital status. Our guide explains how you can secure cheap car insurance in Boise, Idaho.

Ready to find an affordable Boise, ID auto insurance policy? Enter your ZIP code above to get started.

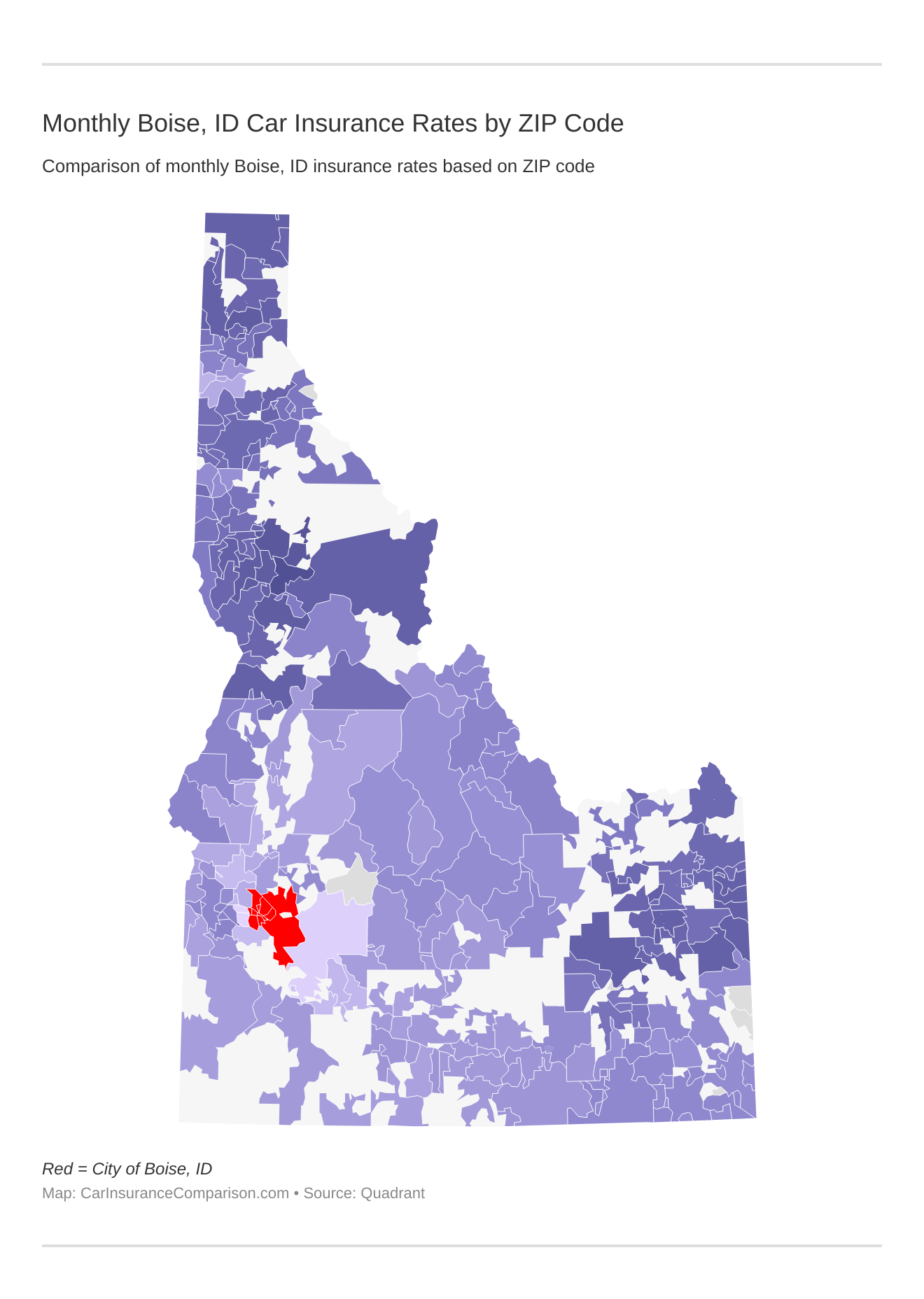

Monthly Boise, ID Car Insurance Rates by ZIP Code

Find more info about the monthly Boise, ID car insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Boise, ID Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major effect on car insurance. That’s why it’s essential to compare Boise, Idaho against other top US metro areas’ auto insurance rates. Read about car insurance by city to make sure you’re up to date on the differences in coverage between different areas.

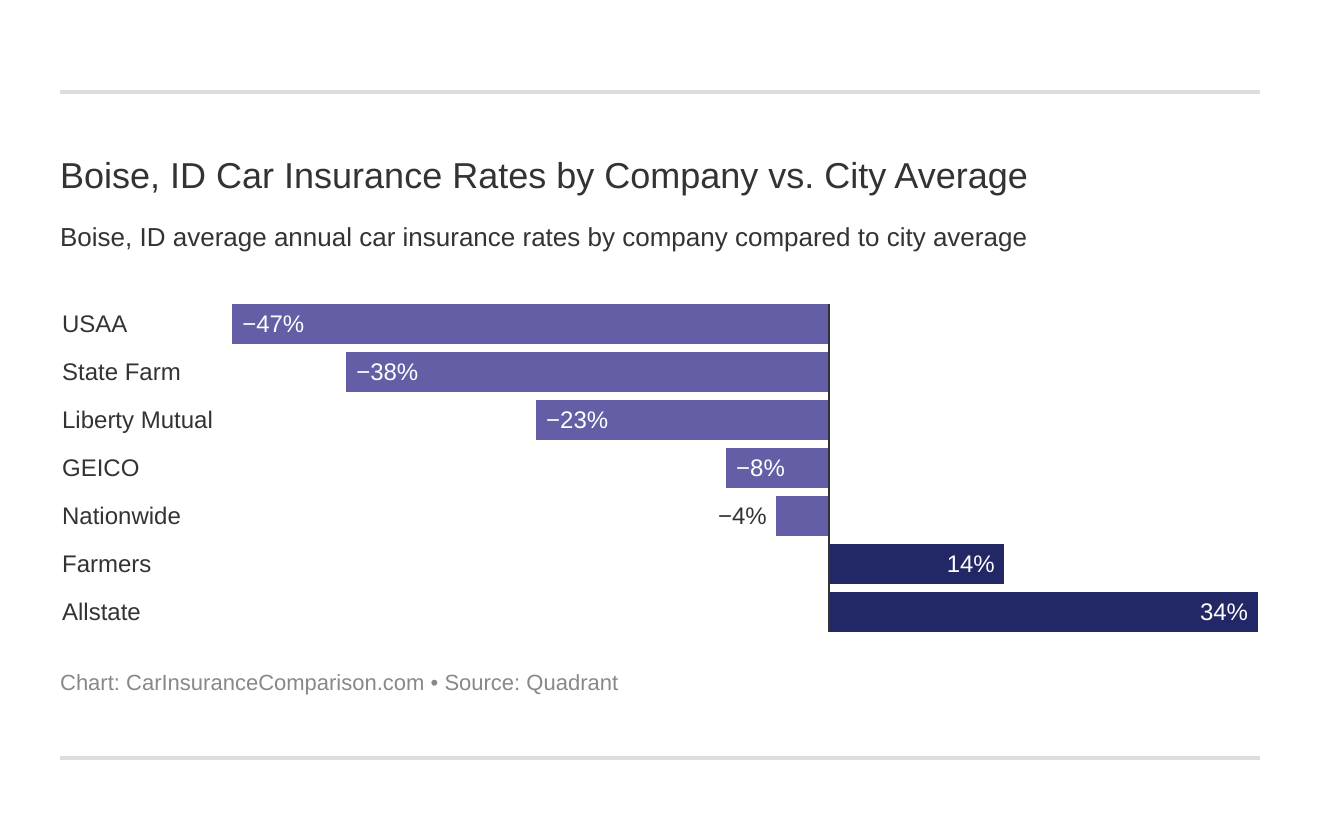

What is the cheapest car insurance company in Boise, ID?

The cheapest auto insurance company in Boise, ID, is USAA. However, USAA is only available for military veterans and their immediate families. The following most affordable insurance companies are State Farm and Liberty Mutual insurance company.

The cheapest Boise, ID auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Idaho auto insurance company rates?” We cover that as well.

Here are the best car insurance companies in Boise Idaho, ranked from cheapest to most expensive:

- USAA – $1,644

- State Farm – $1,801

- Liberty Mutual – $2,101

- Geico – $2,436

- Nationwide – $2,546

- Farmers – $3,048

- Travelers – $3,076

- American Family – $3,470

- Allstate – $3,723

USAA, State Farm, Geico, Nationwide, and Liberty Mutual insurance, are the only companies in Boise that provide cheaper than average auto insurance rates. With the right discounts, you can lower your annual costs.

Before you get any discount, car insurance providers will determine your base car insurance rates using a number of factors such as age, gender, marital status, driving record, and credit history.

The most critical factor is your driving history. Some auto insurance companies provide up to 40 percent off if you have a clean driving record. In addition to having no traffic violations or accidents, a good credit score can lower your car insurance rates even more. It’s still possible to get car insurance with a bad driving record if you shop around, but rates are usually higher.

Even your location is a factor. Did you know your neighborhood ZIP code can save you hundreds more if you live in a statistically less risky location? The cheapest ZIP code in Boise, ID, is 83716, and its average car insurance cost is $218 per month.

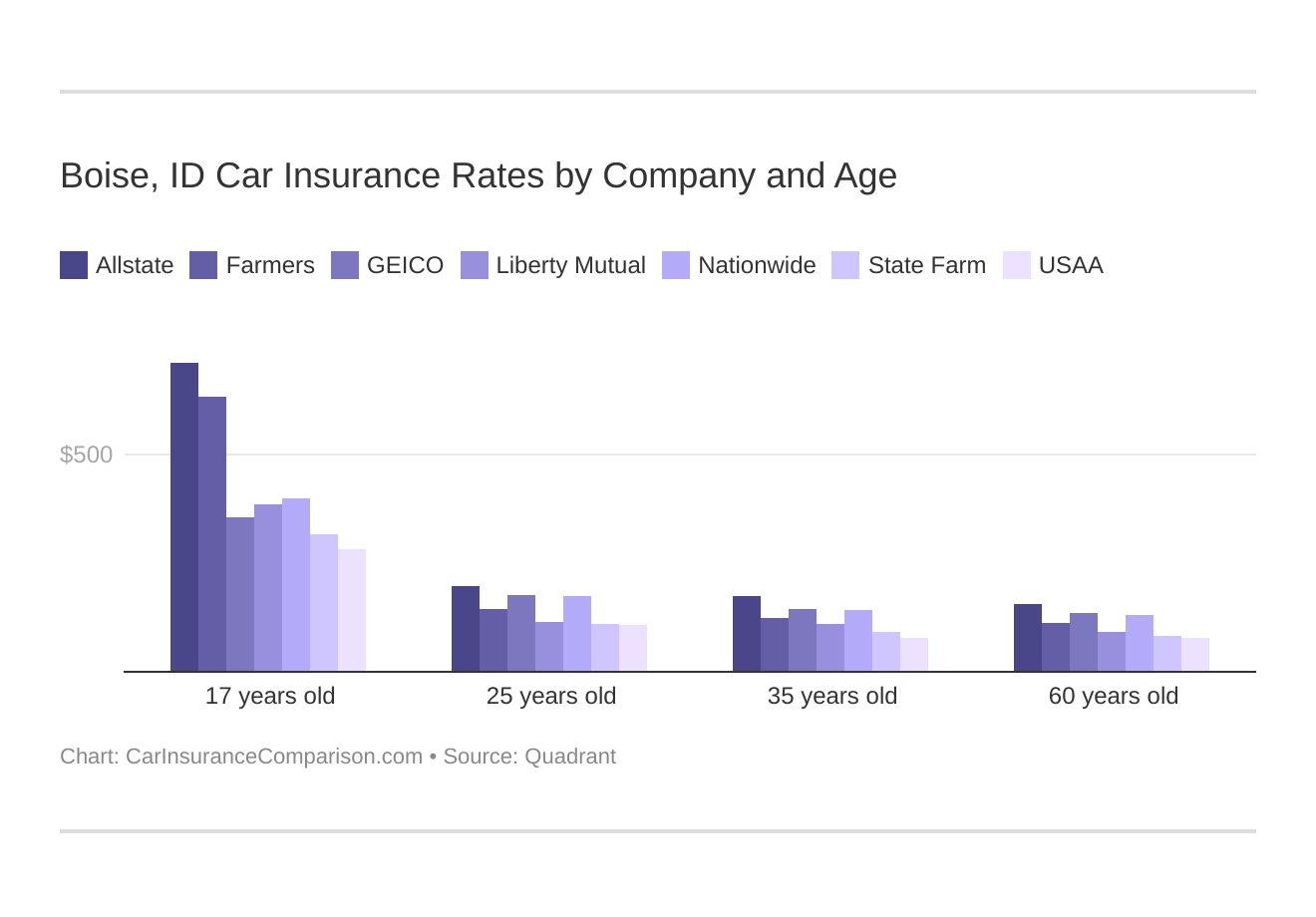

If you’re a single driver under 25 years old, you could face auto insurance quotes up to $6,555 per year. On the other hand, married drivers over 24 years old may have car insurance rates that cost $1,800 per year.

Boise, Idaho auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group. Car insurance rates by age differ depending on the company.

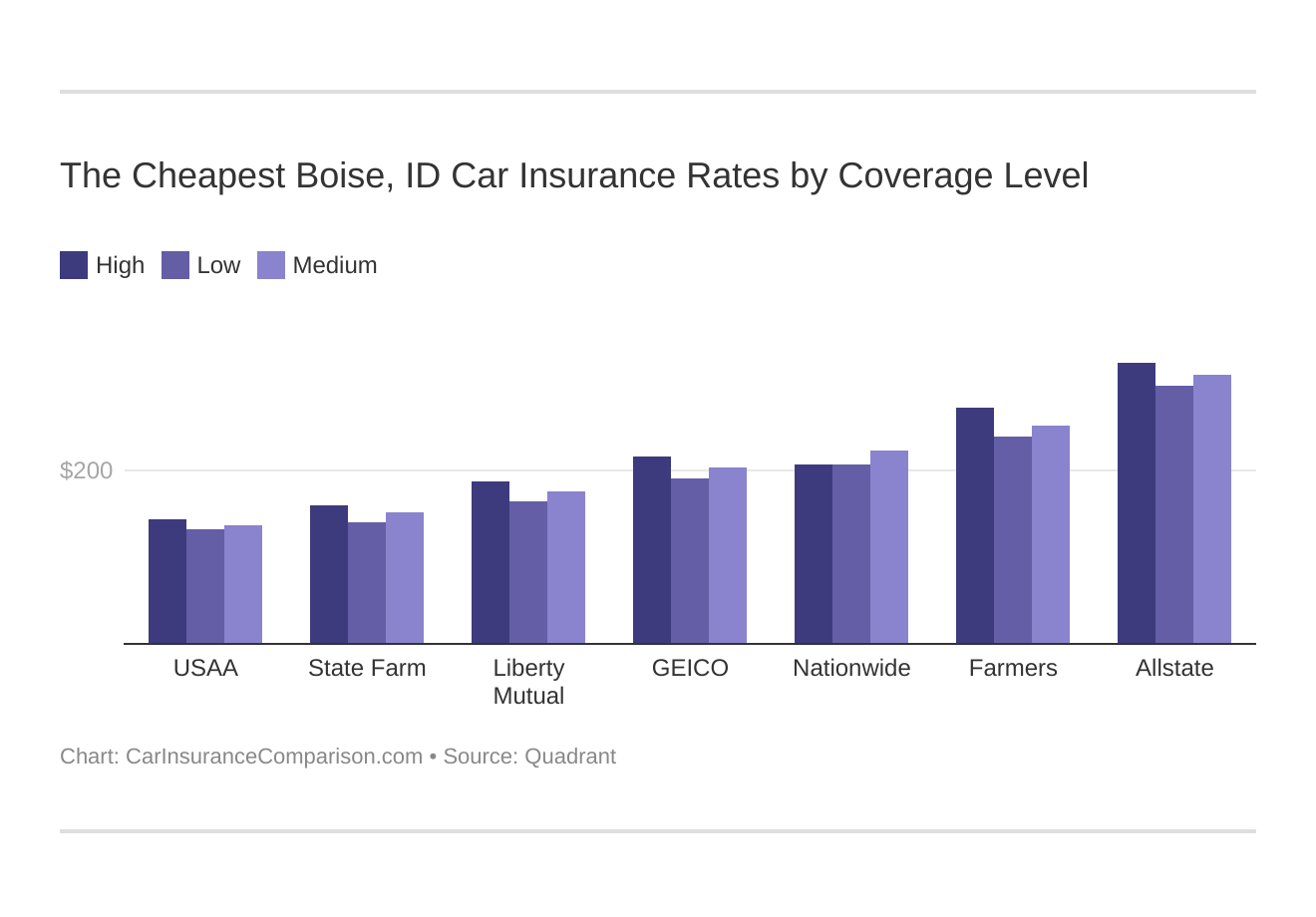

Your coverage level will play a significant role in your Boise, ID auto insurance rates. Find the cheapest Boise, Idaho auto insurance rates by coverage level below:

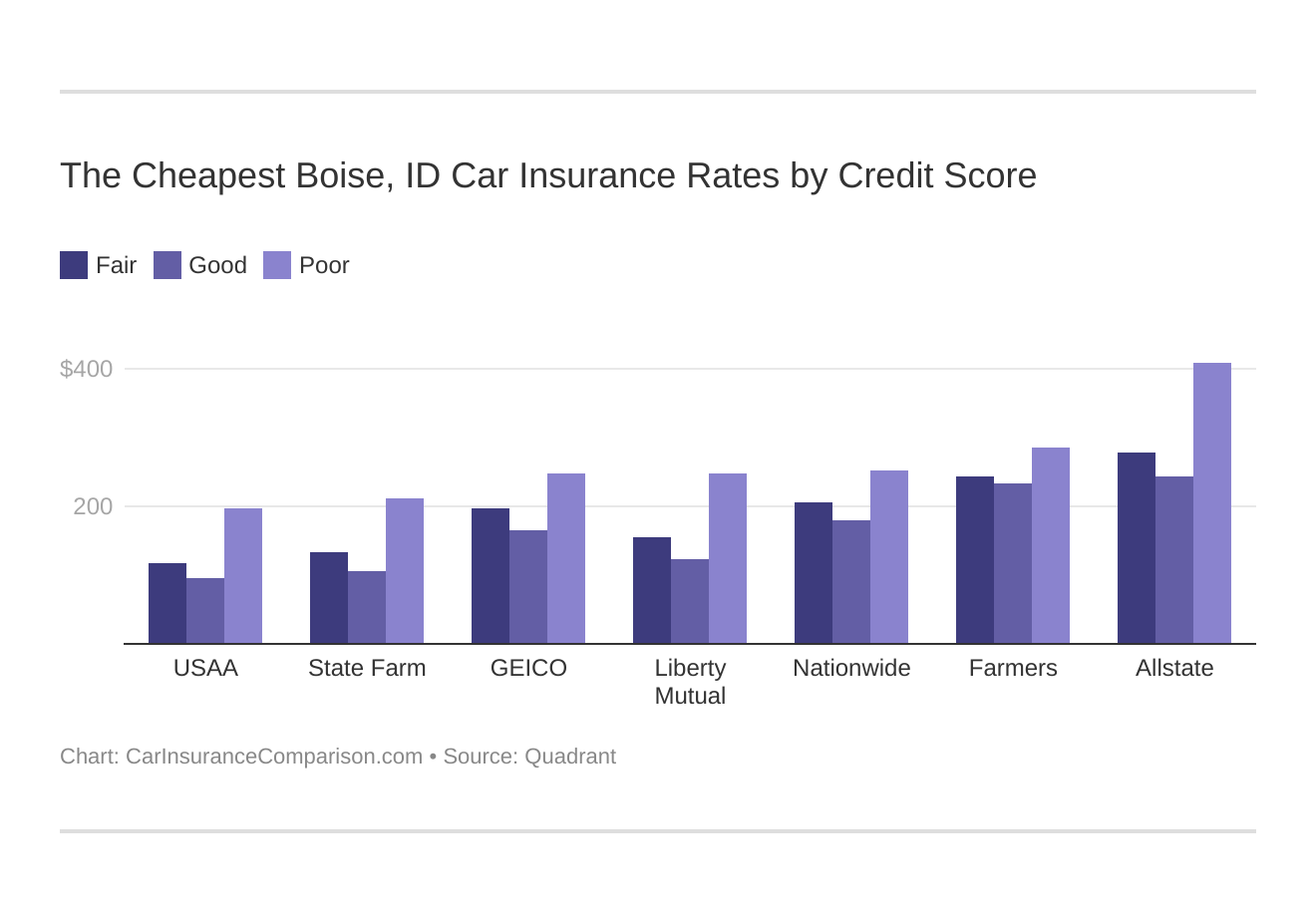

Your credit score will play a major role in your Boise, ID auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Boise, ID auto insurance rates by credit score below.

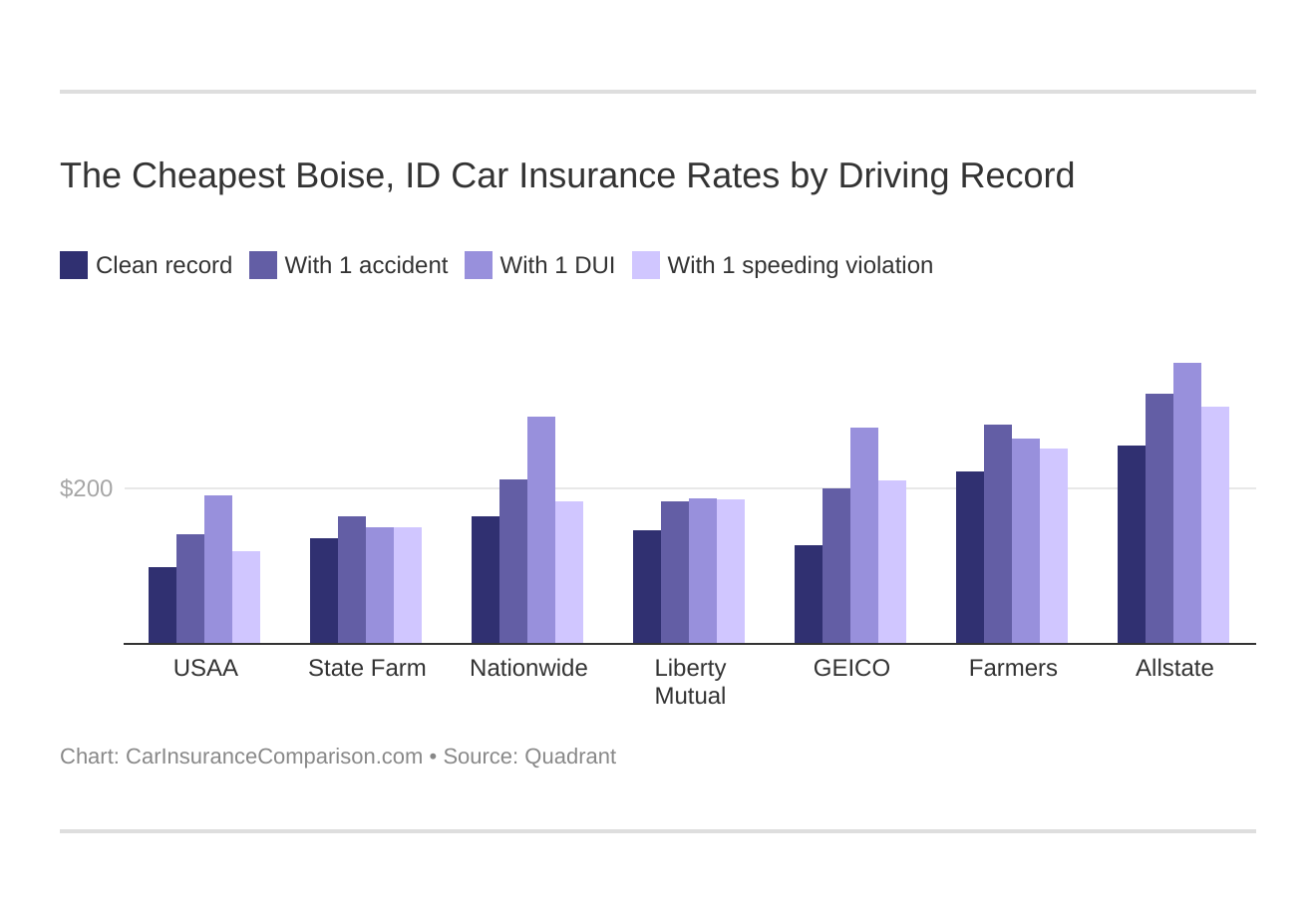

Your driving record will affect your Boise auto insurance rates. For example, a Boise, Idaho DUI may increase your auto insurance rates 40 to 50 percent. However, if you’re a safe driver, your rates could be substantially lower. What is a safe driver discount? It’s a discount companies offer customers who have clean driving records. Find the cheapest auto insurance rates in Boise, Idaho by driving record.

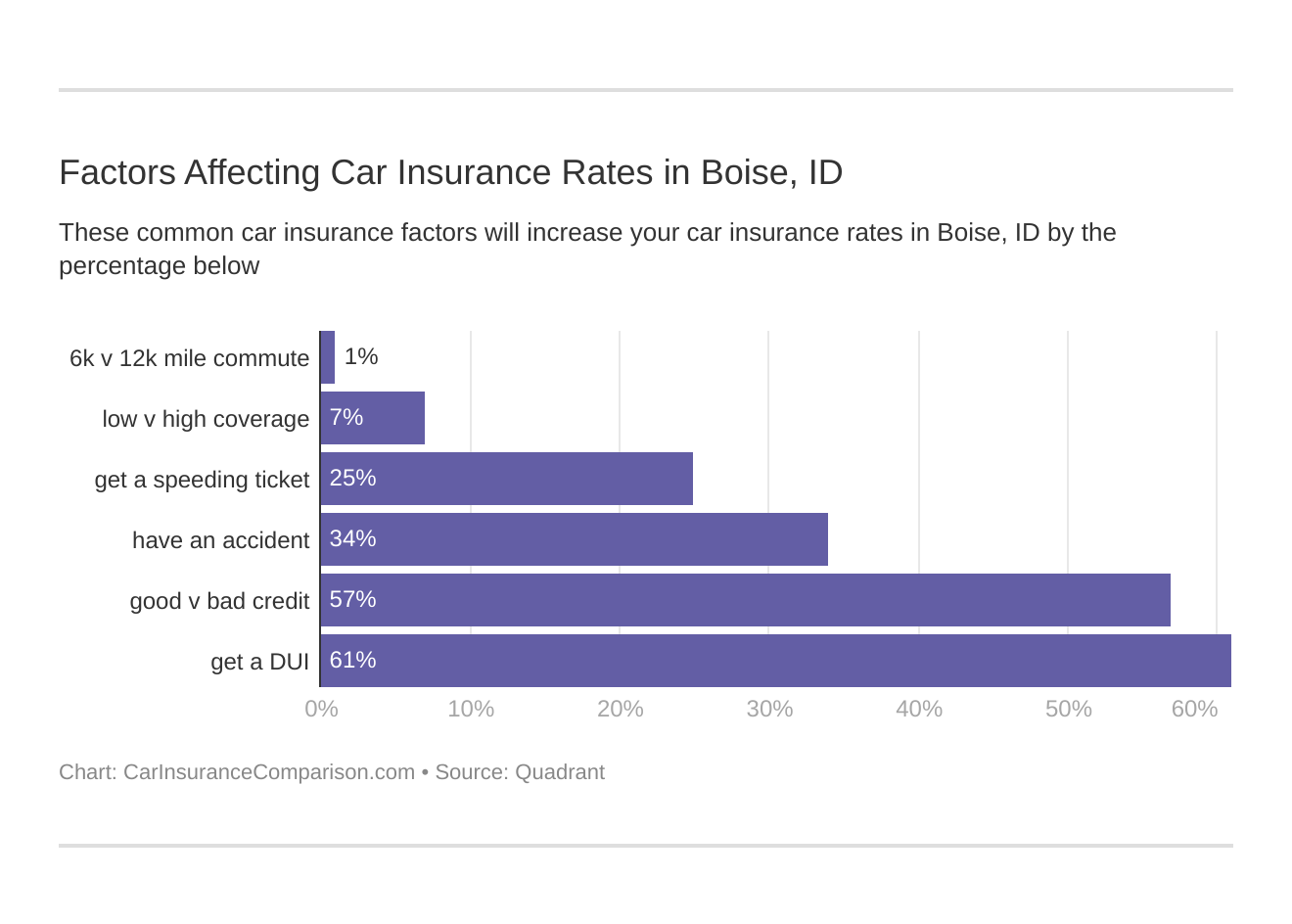

Factors affecting auto insurance rates in Boise, ID may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Boise, Idaho auto insurance.

Read more: What are the DUI insurance laws in Idaho?

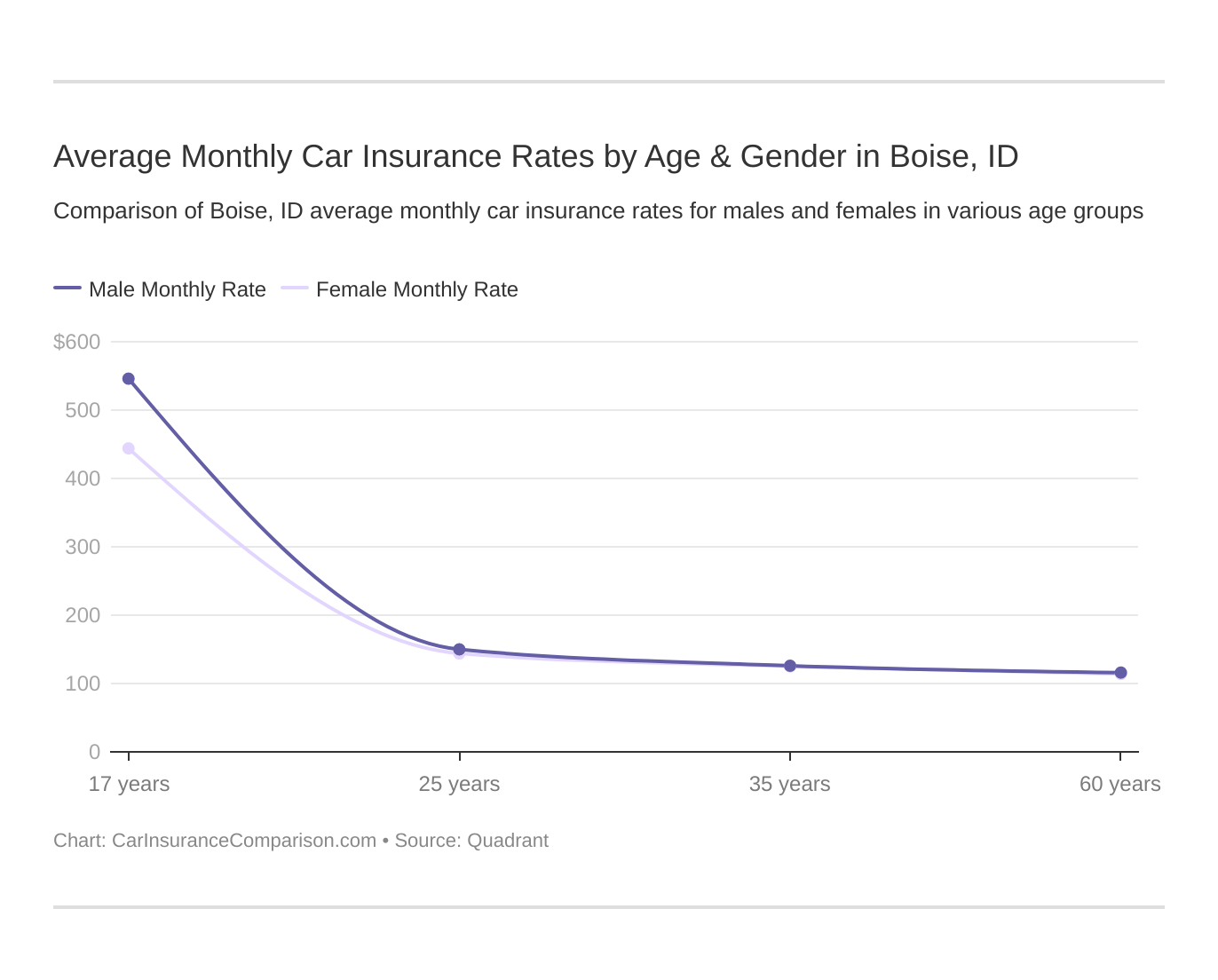

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Boise. Idaho does use gender, so check out the average monthly auto insurance rates by age and gender in Boise, ID.

What are the minimum car insurance coverage requirements in Boise, ID?

All Boise, Idaho, drivers must have the minimum Idaho car insurance requirements, which are:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $15,000 per incident for property damage

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist

Most car insurance experts recommend higher coverage limits to cut possible out-of-pocket costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Boise, ID?

Did you know that your daily commute affects your car insurance? Even a city’s motor vehicle thefts affect car insurance quotes.

And more residents means more drivers on the road. According to INRIX, Boise is ranked 103rd in the most congested cities in the United States.

What about the daily drive to work? How long does it usually take to get to work in Boise? According to Data USA, it takes the average Boise driver 17 minutes to get to work – that’s eight minutes faster than the national average.

Vehicle theft has a significant impact on comprehensive car insurance. Higher rates of motor vehicle theft will certainly increase car insurance costs. The FBI annual statistics reported that Boise had 231 auto thefts in 2019.

Boise, ID Car Insurance: The Bottom Line

Boise, Idaho car insurance rates are more affordable than most cities in the United States. You can save hundreds on car insurance if you maintain a clean driving record and a good credit score. Also, married drivers that are 25 and older can save thousands. The cost of married car insurance vs. single car insurance can definitely differ.

Before you buy car insurance in Boise, ID, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Boise, ID car insurance quotes.

Frequently Asked Questions

What are the cheapest car insurance companies in Boise, ID?

The cheapest car insurance companies in Boise, Idaho, are USAA, State Farm, and Liberty Mutual insurance.

What factors affect car insurance rates in Boise, ID?

Car insurance rates in Boise, Idaho, vary for each person based on factors like driving record, age, credit history, and marital status.

How much does car insurance cost in Boise, ID?

Car insurance cost in Boise, Idaho, varies for each person. You can pay as little as $137 per month for car insurance rates in Boise, ID.

What are the minimum car insurance coverage requirements in Boise, ID?

All Boise, Idaho, drivers must have a minimum liability coverage of 25/50/15 as well as uninsured/underinsured motorist coverage with the same limits.

How can I find affordable car insurance in Boise, ID?

To find affordable car insurance in Boise, Idaho, compare quotes from multiple insurance companies and consider factors like discounts, driving record, and coverage levels.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.