Cheap Car Insurance for Young Male Drivers in 2026 (Top 10 Companies)

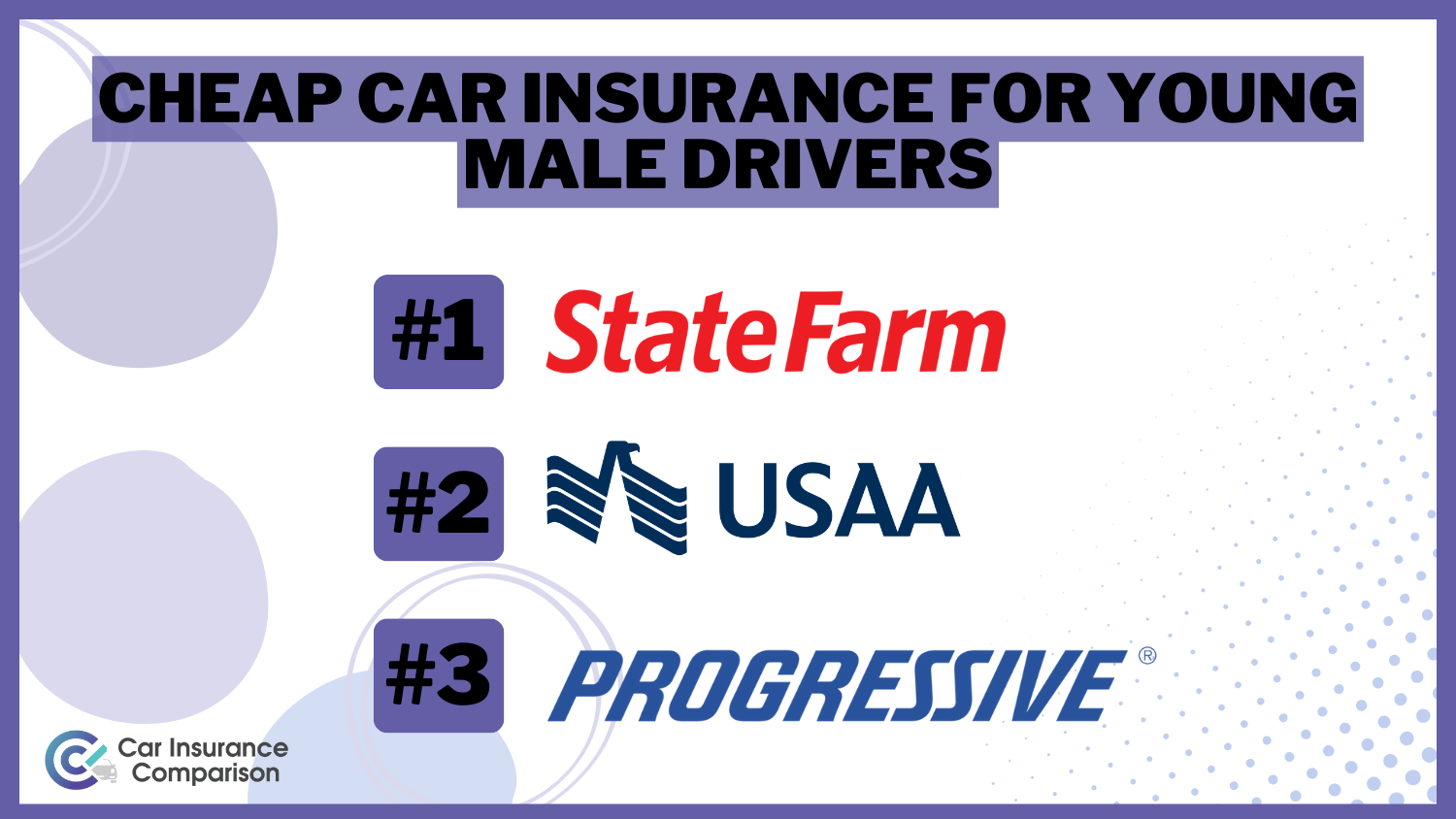

Explore cheap car insurance for young male drivers with top picks from State Farm, which offers a minimum coverage rate of $42, followed by USAA and Progressive. State Farm leads the pack with the most competitive monthly rate for minimum coverage among these reputable providers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Young Male Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Young Male Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Young Male Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsWith State Farm leading at $150 per month, followed closely by USAA at $130 and Progressive at $160, young male drivers can find affordable coverage tailored to their needs. Explore our data on accidents occurring within the United States for further details.

Our Top 10 Best Companies: Cheap Car Insurance for Young Male Drivers

Company Rank Multi-Policy Discount Low-Mileage Discount Best For Jump to Pros/Cons

#1 17% 25% Many Discounts State Farm

#2 10% 15% Military Savings USAA

#3 10% 30% Online Convenience Progressive

#4 10% 35% Add-on Coverages Allstate

#5 20% 20% Usage Discount Nationwide

#6 15% 25% Cheap Rates Geico

#7 15% 30% Customizable Polices Liberty Mutual

#8 13% 10% Accident Forgiveness Travelers

#9 10% 15% Local Agents Farmers

#10 10% 20% Policy Options Esurance

These companies not only offer competitive rates but also provide discounts of up to 15%, making it easier for young male drivers to secure comprehensive coverage without breaking the bank.

Although comparing car insurance is easy, finding cheap car insurance for young drivers can take some effort. Rates for male young drivers are usually higher on average because they are less experienced and seen as a risk by insurers.

Especially, drivers in their early 20s are more likely to get in an auto accident than older adults. Enter your ZIP code into our free quote comparison tool above to instantly compare car insurance rates online.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Young Male Drivers Save More on Their Parent’s Insurance Policy

Finding budget-friendly car insurance as a young male driver is often an uphill battle. The data presented above sheds light on the monthly premiums for liability and comprehensive coverage offered by leading insurance providers.

Car Insurance Monthly Rates for Young Male Drivers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $190 | |

| $48 | $128 | |

| $68 | $180 | |

| $35 | $93 | |

| $83 | $215 |

| $57 | $150 |

| $54 | $146 | |

| $42 | $111 | |

| $43 | $116 | |

| $32 | $85 |

For instance, State Farm stands out with a reasonable liability premium of $42 per month and a comprehensive coverage cost of $111. Similarly, USAA caters to military personnel and their families, providing an enticing option with a liability premium of $32 and comprehensive coverage at $85.

Among the competitive options, Progressive catches attention with a liability premium of $54 and comprehensive coverage at $146. As young male drivers weigh their choices, it’s crucial to consider not just the cost but also additional factors like discounts, add-on coverages, and policy features.

State Farm emerges as the top choice for young male drivers, offering competitive rates, numerous discounts, and comprehensive coverage tailored to individual needs

Brad Larson Licensed Insurance Agent

By carefully navigating the insurance landscape, young drivers can strike a balance between affordability and comprehensive coverage that aligns with their unique driving needs and circumstances. Explore further to compare car insurance rates tailored for inexperienced drivers and gain valuable insights.

Young Male Drivers Qualify for Discounts Tailored to Their Needs

Fortunately, young male drivers can qualify for certain discounts of their own. It is important to take advantage of every discount possible, so find insurance companies that offer discounts for:

- Completion of safety driving courses

- Completion of driver’s education

- College students enrolled in college

- Students with good grades

If you want to save money on your car insurance, you need to show the auto insurance companies that you are serious about safe driving. Read further to compare car insurance rates for drivers with a college degree and gain more insights into their insurance options.

When you take safety courses and are conscientious about your grades, the insurance company sees you as less of a risk. This translates into lower rates for you! Read further to explore information regarding comparing rates for car insurance for student drivers.

Young Male Drivers Nenefit From Shopping Around

Shopping around is the best way to find cheap car insurance. As a young male, you may have to pay more for car insurance than an older man, but that doesn’t mean that you have to settle. You should get a quote from your parents’ company, but you need to shop around to other companies as well.

Despite your driving inexperience and good grades, there are other factors that affect your premiums. Such factors include your driving record, experience, and credit score. All of them affect the price you pay for an auto insurance policy.

New drivers and early 20s drivers who maintain a clean record and good credit history can expect their car insurance rates to decrease significantly. However, if your driving record has multiple speeding tickets or a DUI, you will get higher insurance rates. Moreover, auto insurers can charge drivers with low credit ratings higher insurance premiums. Read more about Finding Inexpensive Rates for Auto Insurance for further information.

Using our free quote tool is the easiest way to do this. You can enter your information right now and get instant quotes. Enter your ZIP code into our free tool below to start comparing car insurance quotes today.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating the Roads: Young Male Driver Case Studies

Welcome to our in-depth exploration of car insurance solutions tailored for young male drivers. In this series of case studies, we delve into the quest for affordable coverage, with State Farm emerging as a frontrunner, offering rates as low as $42 per month.

- Case Study #1 – Smart Savings: Alex, a 22-year-old recent graduate and military member, found affordable car insurance with USAA. With a $32 monthly liability premium and $85 comprehensive coverage, USAA offered tailored benefits for military members, making it a top choice for young male car insurance. His smart choice saved him money and provided specialized coverage.

- Case Study #2 – Balancing Affordability:Emily, a 24-year-old professional, chose State Farm for insurance for young male drivers. State Farm offered her a liability premium of $42 per month and comprehensive coverage at $111. The provider’s discounts and flexible coverage options allowed Emily to customize her policy, ensuring adequate protection without breaking the bank.

- Case Study #3 – Online Convenience:Mark, a tech-savvy 21-year-old, opted for Progressive insurance. With a liability premium of $54 and comprehensive coverage at $146, Progressive’s online platform streamlined the process and provided a user-friendly experience. Its innovation and competitive rates made it an ideal choice for Mark, emphasizing convenience and affordability.

- Case Study #4 – Comprehensive Protection:Sarah, a 23-year-old driver, selected Liberty Mutual for her car insurance. With a liability premium of $83 and comprehensive coverage at $215, Liberty Mutual offered her customization options. The provider’s emphasis on customizable policies allowed Sarah to add specific coverages, ensuring comprehensive protection while meeting her preferences.

- Case Study #5 – Savings: Jake, a 20-year-old college student, opted for Geico to benefit from safe driving discounts. Geico offered him a liability premium of $35 and comprehensive coverage at $93. Jake’s commitment to responsible driving earned him additional discounts, showing that young male drivers can reduce insurance costs through proactive measures.

Join us as we navigate the world of insurance, uncovering exclusive discounts and personalized options to ensure young male drivers drive with confidence and peace of mind.

Overview: Insurance Solutions for Young Male Drivers

The article emphasizes the importance of affordable yet comprehensive car insurance for young drivers. It showcases top insurance providers such as State Farm and Geico, highlighting their competitive rates and safe driving discounts. It also presents examples of young drivers who have lowered their insurance costs by taking proactive steps like safety courses and maintaining good grades.

Read further to assess Young Driver Temporary Car Insurance: Rates, Discounts, & Requirements for additional details. Overall, the summary underscores the importance of shopping around, comparing quotes, and taking advantage of available discounts to find the best insurance options for young male drivers. Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

Why is car insurance more expensive for young male drivers?

Car insurance tends to be pricier for young male drivers due to statistical trends indicating higher accident rates among this demographic. The lack of driving experience and the perception of increased risk contribute to elevated insurance premiums.

How can young male drivers save on insurance costs?

Young male drivers can explore various avenues for savings. Enrolling in safety courses, maintaining good grades, and choosing a vehicle wisely are ways to qualify for discounts. Additionally, comparing quotes from different insurance providers and exploring the option of being added to their parents’ insurance policies can lead to cost savings.

What are some top insurance picks for young male drivers?

According to the 2024 data, State Farm, USAA, and Progressive emerge as top choices for young male drivers seeking competitive rates. These providers offer a combination of affordability, tailored solutions, and discounts for factors like good grades and safe driving.

Is being added to parents’ insurance a cost-effective option for young male drivers?

Yes, being added to parents’ insurance can be a cost-effective option, especially if the vehicle is not financed. However, it’s essential to consider factors like the type of coverage needed and the impact on overall costs before making this decision.

What are the best auto insurance options for young male drivers?

Searching for the best auto insurance for young male drivers can lead to options like State Farm, USAA, and Progressive, known for offering competitive rates and tailored solutions for this demographic. Explore our car insurance for new drivers to gain further insights.

What role do discounts play in reducing insurance costs for young male drivers?

Discounts play a crucial role in lowering insurance costs for young male drivers. Insurers often offer discounts for factors such as safe driving, completing safety courses, maintaining good grades, and even affiliations like military service. Exploring these discounts can significantly contribute to more

Which is the best car insurance for a 23 year-old male?

What’s the best car insurance for a 24 year-old male?

Determining the most suitable cheap car insurance for a 24 year-old male could involve comparing quotes from insurers like USAA, Progressive, and Nationwide, known for providing affordable coverage options tailored to young drivers

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Which insurance companies offer the best car insurance for young male drivers?

Multiple insurers offer the best car insurance for young men, including State Farm, USAA, and Progressive, recognized for delivering competitive rates and tailored discounts to this demographic.

Who are the best insurance companies for young drivers?

The optimal choices for insurance companies targeting young drivers frequently encompass State Farm, Geico, and Progressive, renowned for their provision of economical premiums and comprehensive coverage options specifically tailored to cater to the needs of acquiring cheap car insurance for young male drivers.

Which insurance companies offer cheap car insurance for teenage males?

Where can I get cheap car insurance quotes for young male drivers?

Are there specific discounts available for obtaining cheap male car insurance?

How can I compare cheap car insurance for young drivers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.