Cheapest Alabama Car Insurance Rates in 2026 (Unlock Savings With These 10 Companies!)

Get the cheapest Alabama car insurance rates from Safeco, Travelers, and Geico, with rates as low as $27 monthly. These providers stand out due to their affordable pricing, comprehensive coverage options, and exceptional customer service, making them the top choices for residents seeking budget-friendly car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2024

Company Facts

Min. Coverage for Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Alabama

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

The cheapest Alabama car insurance rates are from Safeco, Travelers, and Geico, starting at $27 per month. These top providers offer competitive pricing, comprehensive coverage, and excellent customer service.

This article explores key factors to help you make an informed decision and find the best budget-friendly car insurance.

Our Top 10 Company Picks: Cheapest Alabama Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $27 A Various Discounts Safeco

#2 $28 A++ Financial Stability Travelers

#3 $32 A++ Affordable Premiums Geico

#4 $34 A+ Customer Service Nationwide

#5 $38 A Loyalty Discount American Family

#6 $38 B Competitive Rates State Farm

#7 $39 A+ Comprehensive Coverage Allstate

#8 $40 A+ Snapshot Discounts Progressive

#9 $48 A Safe-Driving Discounts Farmers

#10 $58 A Customizable Policies Liberty Mutual

Navigating Alabama’s car insurance coverage types can be daunting. Our guide simplifies the search for the best rates, coverage, and carriers, emphasizing why car insurance comparison is essential for informed decisions.

Find the best comprehensive car insurance quotes by entering your ZIP code above into our free comparison tool today.

- Find cheapest Alabama car rnsurance rates with comprehensive coverage

- Compare quotes for affordable premiums in Alabama

- Safeco offers competitive pricing and excellent service

#1 – Safeco: Top Pick Overall

Pros

- Flexible Coverage Options: As mentioned in our Safeco car insurance review, Safeco offers a wide range of coverage options that can be tailored to fit individual needs, providing flexibility for customers.

- Bundling Discounts: Customers can save significantly by bundling their auto insurance with other types of insurance, such as home or renters insurance.

- Accident Forgiveness: Safeco offers accident forgiveness, which helps prevent your premiums from increasing after your first accident.

Cons

- Average Customer Service: Some customers report that Safeco’s customer service is only average, with issues taking longer to resolve compared to other insurers.

- Limited Availability: Safeco is not available in all states, which can limit accessibility for some potential customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Financial Stability

Pros

- Comprehensive Coverage: Travelers provides extensive coverage options, including gap insurance and new car replacement, which can be very beneficial for policyholders.

- Strong Financial Stability: With a strong financial rating, Travelers is a reliable choice for customers looking for a stable insurance provider. See more details on our Travelers car insurance review.

- Discount Opportunities: Offers various discounts, such as multi-policy, good student, and safe driver discounts, helping customers reduce their premiums.

Cons

- Higher Premiums: Some customers find that Travelers’ premiums are higher compared to other insurers, especially for certain types of coverage.

- Mixed Customer Reviews: Travelers receives mixed reviews regarding its claims process and customer service, indicating inconsistency in customer experiences.

#3 – Geico: Best for Affordable Premiums

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates in the industry, making it an attractive option for budget-conscious customers.

- Excellent Customer Service: Geico consistently receives high marks for customer service, providing a smooth and efficient experience for policyholders.

- Easy Online Tools: Geico offers a robust online platform, including a user-friendly website and mobile app, making policy management convenient. Learn more in our Geico car insurance review.

Cons

- Limited Agent Interaction: Geico primarily operates online, which might not appeal to customers who prefer face-to-face interactions with their insurance agents.

- Coverage Limitations: Some customers have reported that Geico’s coverage options can be limited compared to other insurers, particularly for specialized needs.

#4 – Nationwide: Best for Customer Service

Pros

- Wide Range of Coverage: Nationwide offers a comprehensive range of coverage options, including unique add-ons like accident forgiveness and vanishing deductibles.

- Strong Customer Service: Known for its strong customer service, Nationwide provides personalized attention and support to its policyholders.

- Discount Programs: Offers various discount programs, such as multi-policy and safe driver discounts, which can help reduce premium costs. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Higher Than Average Rates: Some customers find that Nationwide’s rates are higher than those of other insurers, particularly for basic coverage.

- Policy Restrictions: There are reports of restrictive policies and underwriting guidelines, which might limit flexibility for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Loyalty Discount

Pros

- Extensive Coverage Options: American Family offers a broad range of coverage options, including customizable policies to suit individual needs.

- Strong Customer Satisfaction: Generally receives positive reviews for customer satisfaction, with policyholders praising its attentive and helpful service.

- Discounts and Rewards: American Family car insurance review provides various discounts and reward programs, such as loyalty rewards and multi-policy discounts, making it a cost-effective choice.

Cons

- Availability Issues: American Family is not available in all states, which can limit its accessibility for potential customers.

- Premium Cost: Some customers report that premiums can be higher compared to other insurers, especially for certain types of coverage.

#6 – State Farm: Best for Competitive Rates

Pros

- Wide Agent Network: State Farm has a vast network of agents, providing personalized service and local expertise to customers.

- Comprehensive Coverage: Offers a wide range of coverage options and add-ons, ensuring that customers can tailor their policies to fit their needs.

- Strong Financial Stability: State Farm is financially robust, giving customers confidence in its ability to pay out claims. Unlock details in our State Farm car insurance review.

Cons

- Higher Premiums: Some customers find that State Farm’s premiums are higher than those of its competitors, which can be a deterrent for budget-conscious individuals.

- Inconsistent Customer Service: There are reports of inconsistent customer service experiences, with some policyholders experiencing delays and issues with claims processing.

#7 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Allstate offers a comprehensive range of coverage options, including unique add-ons like accident forgiveness and new car replacement.

- Good Discount Opportunities: Provides numerous discounts, such as safe driver and multi-policy discounts, helping customers save on premiums. Discover more about offerings in our Allstate car insurance review.

- Strong Mobile App: Allstate’s mobile app is highly rated, offering convenience and ease of managing policies and filing claims.

Cons

- Mixed Customer Service Reviews: Some customers report mixed experiences with Allstate’s customer service, particularly regarding claims handling.

- Higher Premiums: Allstate’s premiums can be higher compared to other insurers, which might not appeal to budget-conscious customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Snapshot Discounts

Pros

- Competitive Pricing: Progressive is known for its competitive pricing and willingness to offer lower rates than many competitors.

- Innovative Tools: Offers unique tools like the Name Your Price tool, which helps customers find coverage that fits their budget. Delve into our evaluation of Progressive car insurance review.

- Extensive Discounts: Provides a variety of discounts, such as multi-policy, multi-car, and safe driver discounts, helping to reduce costs.

Cons

- Mixed Customer Reviews: Progressive has received mixed reviews regarding customer service and claims handling, indicating inconsistency in customer experiences.

- Potential for Higher Rates Post-Claim: Some customers report significant rate increases after filing a claim, which can be a concern for policyholders.

#9 – Farmers: Best for Safe-Driving Discounts

Pros

- Strong Agent Network: Farmers has a strong network of local agents, offering personalized service and expertise. Learn more in our Farmers car insurance review.

- Comprehensive Coverage Options: Provides a wide range of coverage options, including unique add-ons and customizable policies.

- Discount Programs: Offers a variety of discount programs, such as good student and multi-policy discounts, which can help reduce premiums.

Cons

- Higher Premiums: Some customers find that Farmers’ premiums are higher compared to other insurers, especially for basic coverage.

- Mixed Customer Service Reviews: There are mixed reviews about Farmers’ customer service, with some policyholders experiencing issues with claims processing and service quality.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Coverage: Liberty Mutual offers a wide range of customizable coverage options, allowing customers to tailor their policies to their specific needs.

- Strong Financial Ratings: Known for its financial strength, Liberty Mutual provides reliability and assurance to policyholders. Learn more in our Liberty Mutual car insurance review.

- Discount Opportunities: Provides numerous discounts, including multi-policy, safe driver, and new car discounts, helping to reduce premium costs.

Cons

- Higher Than Average Premiums: Liberty Mutual’s premiums can be higher than those of other insurers, particularly for certain coverage options.

- Mixed Customer Reviews: Some customers report mixed experiences with Liberty Mutual’s customer service and claims handling, indicating potential areas for improvement.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alabama Car Insurance Companies

Remember that location is not the only factor used when an auto insurance company sets your rates. They will also look at your age, driving record, credit score, gender, and marital status. Drivers with a poor credit history or bad driving record will generally pay a higher insurance premium.

If this applies to you, make sure to ask your provider about any car insurance discounts you might be eligible for. Most major insurance companies offer a wide variety of discounts, like the safe driving car insurance discount, good student discount, defensive driver car insurance discount, and more.

Alabama Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $39 $108

American Family $38 $105

Farmers $48 $133

Geico $32 $89

Liberty Mutual $58 $162

Nationwide $34 $96

Progressive $40 $112

Safeco $27 $71

State Farm $38 $108

Travelers $28 $79

If you’re shopping for coverage, ask about discounts when you get an auto insurance quote.

When I had to buy insurance for my car, I used every research methodology known to man to find out the best provider in my state. Although a cheap quote was one of my criteria in narrowing down the list of carriers, I also wanted to focus on ratings, claims settlement history, and customer service.

While considering an insurance carrier, do remember to check for customer reviews, financial ratings and their overall image in the market. Although USAA car insurance has the lowest average monthly premium in AL, there are many factors to consider when choosing the best car insurance in Alabama.

To make the process effortless for you, we have done the necessary research so that your decision to purchase coverage from a carrier is based on facts and historic data that helps if you have to file a claim in the future.

Let’s dig deep to find out the best providers in Alabama.

You Need to Know About Alabama Coverage and Rates

To start with you must be aware of the minimum insurance coverage in your state, without which it would be illegal for you to drive. The minimum coverage not only protects you from paying hefty damages in the event of an accident but also saves you from state penalties and the possibility of losing your license. Let’s look at Alabama’s car insurance requirements.

Liability car insurance for bodily injury and property means that you are liable to pay the cost of harm/damages to people and property caused by you. In the event of an accident, your insurer would pay $25,000 per person towards medical expenses and a maximum of $50,000 overall. For damage to property, the insurer would pay a maximum of $25,000.

Alabama Car Insurance Minimum Limit by Coverage Type

| Coverage | Limit |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person per accident $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

Remember, liability car insurance in Alabama only covers the other party and doesn’t pay for medical expenses/damages to you/your co-passengers or your property.

Explore car insurance rates across various cities in Alabama with our comprehensive comparison table. By comparing rates across different cities, you can identify which locations offer more affordable options and make informed decisions about your car insurance.

Alabama Car Insurance Cost by City

Quickly find the best rates for your location to ensure you’re getting the most value for your coverage. This comparison can also highlight regional differences in insurance costs, helping you understand the factors that influence premiums in various areas.

Alabama’s Minimum Car Insurance and why Full Coverage Matters

Though the state minimum for Alabama isn’t on the lower side, those numbers wouldn’t be enough to cover the medical expenses and property damages if you’re involved in a serious accident. Also, if you end up in an accident with a high-value or luxury car, your property damage cost would be much higher than what your state minimum coverage could pay.

Liability insurance also only covers the other person’s damages. If you want your own damages covered after an accident, you would need to add collision coverage.

A policy containing liability, collision, and comprehensive coverage is called full coverage car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Penalty for not Carrying Auto Insurance in Alabama

What is the penalty for driving without insurance in Alabama? If a driver is found in violation of Alabama’s Mandatory Liability Insurance law, he/she could be charged a fine up to $500 on the first offense. Any subsequent violations can lead to a fine of $1,000 and/or a license suspension for a period of six months.

In addition, you would also have to face vehicle registration suspension, meaning a $200 reinstatement fee for the first time.

Here’s the worst part – You would end up paying significant damages if you’re involved in a serious accident without auto insurance.

If you drive uninsured the second time, registration reinstatement would cost you $400 and a mandatory suspension of four months.

Optional Auto Insurance Coverage in Alabama

Even after you have bought the necessary auto coverage to protect yourself from an unfortunate accident, you might find yourself in a situation that leaves a lasting impact on your bank balance.

Take for example the tornado outbreak of 2011 during which Alabama witnessed around 64 tornadoes in a day. Do you think your auto insurance would cover the damage to your car from those tornadoes? The short answer: Collision and liability insurance doesn’t cover damages from natural calamities.

Let’s take another example: While driving, you get hit by another motorist who is found to be at fault. Naturally, you would feel relieved in a situation like this. But, what if the other motorist is uninsured or underinsured?

Knowing your auto insurance options, like comprehensive coverage and uninsured motorist protection, can prevent costly surprises on the road.

Daniel Walker LICENSED INSURANCE AGENT

Alabama ranks at number 6th amongst the top worst states with the highest percentage of uninsured motorists. This should be a cause of worry if you’re driving in Alabama since the uninsured motorist percentage hovers around 18.4%.

To know about how you can protect yourself from these above-mentioned scenarios, we would explain other optional coverages that you must know about.

- Uninsured/Underinsured Motorist Coverage: Pays the damages of your physical injury or property in an accident when the at-fault motorist is uninsured or underinsured.

- Comprehensive Car Insurance: Comprehensive car insurance covers the repair or replacement cost of your car in the event of damage not resulting from a collision. This includes events such as fire, tornadoes, falling objects, vandalism etc.

We are here to help you uncover all facets of auto insurance coverage.

Premiums as Percentage of Income in Alabama

These stats would definitely make you happy. After all, Alabama ranked at number 36th for average auto insurance expenditure in America in 2016.

In 2014, the monthly per capita personal disposable income in Alabama was $3,535 while the average full coverage auto premium was $83 monthly. The average premium was around 2% of the disposable income.

Don’t worry, we have done the math for you.

On an average, if you’re a driver in Alabama, your monthly premiums for a full auto coverage would be around $69.

Disposable income is the money at your disposal after you have paid your income tax. Do make sure that you budget smartly to accommodate for the cost of auto insurance premiums.

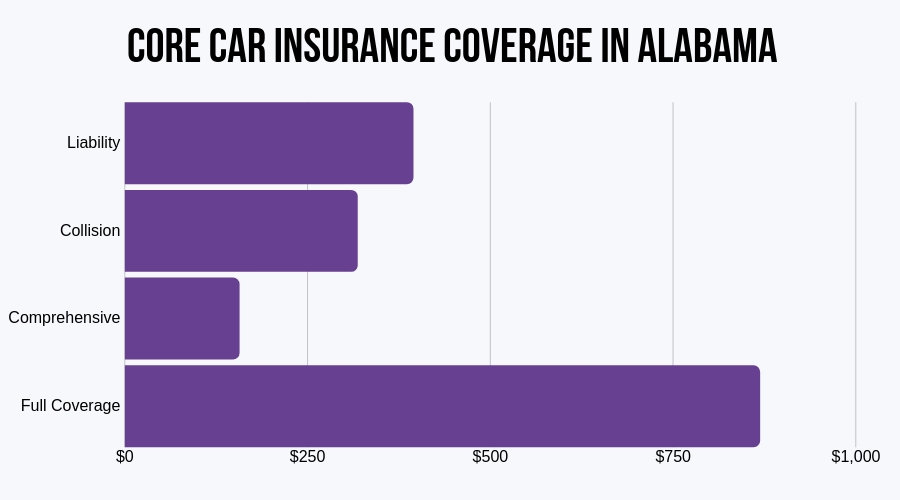

Core Car Insurance Coverage in Alabama

The table below illustrates the average cost of covering collision, liability, and comprehensive auto premiums in the year 2015 sourced from the leading authority on the insurance industry.

The numbers in this table would offer you a more realistic idea of the auto insurance cost.

The premiums illustrated in this table are the actual average premiums with varying coverage limits starting from state minimum liability requirements to full coverages. Keep in mind that your auto premiums would depend on the coverage you choose.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Additional liability coverage in Alabama

Apart from the basic coverage, there are additional liability coverage options that offer you protection under different circumstances. Medical Expenses, Uninsured and Underinsured Motorist Coverage. Though the state of Alabama doesn’t require motorists to buy coverage for medical expenses and uninsured motorists, it’s recommended to consider these while exploring additional coverage options.

In the event of an unforeseen accident, you would be covered for damages irrespective of who is at fault, and you wouldn’t need to worry if the at-fault motorist is uninsured/underinsured.

Alabama ranks at number 6th amongst the top worst states with the highest percentage of uninsured motorists.

Add-ons, Endorsements, and Riders

Apart from the coverage options explained in the video, there are few add-ons and riders that may help you during certain circumstances, such as engine protection or roadside assistance in case of a breakdown.

By now, you must be concerned about the additional cost of these optional coverages and riders. That’s why we have designed a highly-intuitive car insurance comparison tool to help you get the cheapest rate in your state.

To get a detailed overview of all the optional add-ons and riders that you can buy along with the state minimum coverage, do browse the following quickly:

- Gap insurance

- Personal umbrella policy (pup)

- Rental car reimbursement

- emergency roadside assistance

- mechanical breakdown insurance

- non-owner car insurance

- modified car insurance coverage

- classic car insurance

Explore optional add-ons like Gap Insurance, Personal Umbrella Policy (PUP), and more to tailor your coverage. Use our car insurance comparison tool for the best rates and to understand these options fully.

Male vs. Female Average Car Insurance Rates in Alabama

Usually, young male drivers in their 20’s are believed to pay higher premiums compared to their female counterparts in the same age group because they cause more accidents. Our internal research data strengthens that belief as young male drivers are charged more by almost all carriers in Alabama.

Alabama Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 35 Female Married | Age: 35 Male Married | Age: 60 Female Married | Age: 60 Male Married | Age: 17 Female Single | Age: 17 Male Single | Age: 25 Female Single | Age: 25 Male Single |

|---|---|---|---|---|---|---|---|---|

| Allstate | $167 | $159 | $151 | $154 | $576 | $619 | $187 | $192 |

| Geico | $171 | $170 | $162 | $167 | $449 | $440 | $181 | $168 |

| Mid-Century | $199 | $198 | $178 | $189 | $768 | $790 | $227 | $236 |

| Nationwide | $145 | $147 | $132 | $137 | $380 | $490 | $161 | $180 |

| Progressive | $201 | $189 | $165 | $176 | $823 | $919 | $235 | $250 |

| Safeco | $257 | $278 | $211 | $236 | $938 | $1,043 | $274 | $292 |

| State Farm | $245 | $245 | $221 | $221 | $736 | $922 | $276 | $318 |

| Travelers | $125 | $127 | $117 | $117 | $670 | $1,053 | $119 | $136 |

| USAA | $110 | $112 | $103 | $101 | $328 | $364 | $144 | $155 |

In the 60-year-old age group, the average car insurance in Alabama is more or less the same for males and females.

Point to note: Do remember that your driving record and coverage limits play a huge role in determining your monthly premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Financial Ratings of Largest Auto Insurance Providers in Alabama

Financial ratings are determined by noteworthy credit rating agencies that assess whether the company has the financial strength to pay-off claims. An A.M. Best Rating of A++, A+ means that an insurance provider has a superior ability to meet their current insurance obligations.

Read more: How do customer satisfaction ratings affect car insurance companies?

Alabama’s Car Insurance Companies With the Least Complaints

Another important data point to look at while browsing the top car insurance companies is the complaint data. Though this is subjective, based on individual opinions, you must take a look to strike off any company that racks up numerous complaints.

Alabama Customer Complaints by Company

| Insurance Company | Customer Complaints |

|---|---|

| State Farm Auto Ins Co. | 10,000 |

| Alfa Mutual | 500 |

| Allstate | 15,000 |

| Progressive | 12,000 |

| USAA | 1,000 |

| Nationwide | 8,000 |

Please note that we have mentioned the combined complaint numbers for all business lines of an insurance carrier in the US.

Largest Car Insurance Companies in Alabama

The table below provides an overview of the largest car insurance providers in Alabama. It includes information on the direct written premiums, loss ratio, and market share for each company.

Alabama Largest Car Insurance Companies by Loss Ratio & Market Share

| Insurance Company | Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Alfa Mutual | $275,000,000 | 66% | 15% |

| Allstate Ins Co | $125,000,000 | 45% | 2% |

| Nationwide | $175,000,000 | 75% | 2% |

| Progressive | $225,000,000 | 59% | 5% |

| State Farm | $425,000,000 | 69% | 25% |

| USAA | $125,000,000 | 79% | 3% |

To get more details about other players in the market, you can check the official website of the Alabama Department of Insurance with information about each carrier’s market share.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Average Premiums by Commute Rates in Alabama

As you can see from the table below, the premium rates remain more or less the same even when the monthly mileage being driven is different.

Alabama Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $276 | $276 |

| Farmers | $348 | $373 |

| Liberty Mutual | $521 | $568 |

| Progressive | $574 | $599 |

| State Farm | $590 | $632 |

| Travelers | $308 | $345 |

Except for State Farm car insurance, all the insurance carriers offer the same quote for different commute rates. Understanding these nuances can help you make more informed decisions about your car insurance coverage and potentially save on your premium costs.

Number of Car Insurance Providers in Alabama

Choosing the right car insurance provider can be overwhelming given the multitude of options available. The table below provides an overview of the number of insurance providers operating in Alabama, helping you understand the landscape of the insurance market in the state.

Number of Alabama Car Insurance Companies

| Company Type | Total |

|---|---|

| Domestic | 18 |

| Foreign | 858 |

Alabama hosts a diverse insurance market with a significant presence of foreign insurers compared to domestic ones. Understanding the composition of the insurance market can empower consumers to make more informed decisions when selecting their car insurance provider.

What you Need to Know About Alabama’s laws

Keeping a tab on the state laws with respect to driving can save you from unexpected fines and license suspensions which have an impact on your auto insurance rates. Keep reading to learn about the laws specific to the state of Alabama.

Read more: Understanding Car Insurance Codes and Laws

Alabama’s Texting and Mobile Phone Usage While Driving Laws

Talking on a mobile phone while driving is allowed for most of the drivers in Alabama, except those who are under 18 and drive with a Stage II License. For these drivers, state laws prohibit the use of any handheld communication device while driving.

Fines and Penalty: For violations by an underage driver, the state levies a fine in the range of $150 to $350, along with two points on the driver’s record.

Read more: Does a cell phone ticket affect car insurance rates?

While talking on the phone is allowed for most drivers, Alabama completely prohibits text messaging while driving on a public road or highway for everyone. If found in violation, a fine of $25 is levied on the first instance, $50 on the second instance, and $75 for the third and any subsequent violations thereafter. And, it also adds two points to the driving record.

Teen Driver License Laws in Alabama

In the state of Alabama, teens can get a learner’s license at the age of 15. There are some specific laws and restrictions for teen drivers in the state of Alabama.

Learner’s Permit: At the age of 15, one can obtain a learner’s permit by passing a written knowledge test and vision test. However, the permit allows the teen driver to drive only if accompanied by a licensed driver in the front seat who’s 21 or older.

Read more: Do you need car insurance with a learner’s permit?

To get a restricted license, teens must complete 30 hours of driving with a parent or legal guardian or complete a driver education course approved by the state Department of Education.

Restricted License: Once a teen obtains a restricted license, he/she can drive unaccompanied. However, the state doesn’t allow them to drive between the hours of 12-6 AM to ensure safety. The law also doesn’t allow restricted permit holders to drive with more than one passenger, except when the accompanied passengers are family members.

The restricted license can be obtained at the age of 16 after having the learner’s permit for six months.

Unrestricted License: At the age of 17, the state of Alabama allows teens to obtain an unrestricted license if they have held a restricted driving permit for six months without any violations.

Once a teenager has completed the requirements for getting a driver’s license, the next step is finding teen car insurance.

Windshield Damage Law in Alabama

The tiny chips and cracks on your car’s windshield might not be visible to our eyes but can be dangerous at times. However, there aren’t any specific laws in Alabama that penalizes motorists who are driving with a damaged windshield or require broken windshield car insurance.

If you’re replacing your windshield, the state of Alabama requires you to replace your windshield with another of similar quality and kind.

Alabama’s Vehicle Licensing Laws

As buyers of coverage, we are pretty uninterested in the idea of spending money on something that may or may not reap any benefits in the future. That is why some motorists might decide to not buy insurance coverage.

If you choose to not buy coverage in Alabama, you’re in violation of the Mandatory Liability Insurance Law that has several penalties for violators:

- On the first violation, you may be fined up to $500 and up to $1,000 for the second and any subsequent violations

- Suspension of driver’s license for six months

- Vehicle impoundment

In addition, the motorists vehicle registration would also be suspended attracting more fee for reinstatement.

- On the first violation, you would need to pay $200 for vehicle registration and driving license reinstatement

- On second and subsequent violations you would need to pay $400 for reinstatements

Note: You would be able to get your registration and license reinstated only if you show proof of current insurance coverage.

In 2017, Alabama implemented a mandatory auto insurance law that allows the state to slap fines up to $200 on the first offense if caught driving without an auto insurance policy.

Seat Belt Laws

Wearing seat belts protects motorist and passengers from injuries in an event of an unfortunate accident.

While the old seat belt laws in Alabama only required all front-seat occupants of a vehicle to wear a seat belt, a new law went into effect on September 1st, 2019, that requires back seat passengers to also wear seat belts.

If cited for a violation, the state can slap a fine of $25 for children and adults.

Alabama Child Restraint Law

All children under the age of 6 should be placed in an appropriate restraint system while being driven on any street – the restraint system varies with age and size of the child. For specific details about the car seat requirements, please refer to the Alabama Department of Health guide.

Ridesharing Law in Alabama

In 2016, the Alabama Legislature passed a rideshare car insurance law to close the insurance gap after experiencing growth of transportation network companies in various major cities.

The new law, SB262, requires the drivers to buy coverage that would protect them as well as the riders from the time they pick a ride to the moment they drop their ride.

In July 2018, a new law in Alabama allowed ridesharing organizations, such as Lyft and Uber, to operate across the state.

Alabama Car Insurance for High-Risk Drivers

Motorists who have filed a claim, been at fault in an accident, or were cited for a severe moving violation are considered high-risk drivers and may/may not be subjected to higher premiums for high-risk car insurance. The increase in premiums for drivers with a bad record depends on many other factors as well, such as the insurance carrier’s internal policies, state laws, and the driving history.

In Alabama, if a motorist is unable to obtain coverage due to a bad driving record, the Alabama Automobile Insurance Plan can provide insurance for eligible risks.

As a motorist, you must also know about SR-22 filings. If the state of Alabama determines that you’re a dangerous driver (based on your driving history, DUI incidences or accumulated points on the driving record), you must file an SR-22 with your Insurance.

As a motorist, you must also know about SR-22 filings. If the state of Alabama determines that you are a dangerous driver (based on your driving history, DUI incidences or accumulated points on the driving record), you must file an SR-22 with your Insurance.

What is an SR-22 Insurance

An SR-22 car insurance filing is an assurance that you have the necessary coverage to pay-off any obligations in case you are involved in a dangerous accident. This also helps in reinstating your license, if it was suspended due to your dangerous driving habits.

Who should carry an SR-22 filing in Alabama

A motorist is required to file an SR-22 under the following circumstances:

- If a motorist was caught driving under the influence of alcohol

- If a motorist was involved in an accident that caused damage/injuries

- If a motorist didn’t have the Mandatory License Insurance

- If there were more than the necessary number of points on a motorists driving record

This requirement aims to ensure that high-risk drivers maintain the necessary liability insurance coverage.

Automobile Insurance Fraud in Alabama

In August 2012, Act 12-429 was enacted which classified insurance fraud as a felony crime. Under the law, any fraud under the amount of $1,000 would be a Class C Felony, while any amount over that would be a Class B Felony.

Alabama Key State Laws Against Insurance Fraud

| Key State Law | Yes/No |

|---|---|

| Insurance Fraud Classified as a Crime | Yes |

| Immunity Statutes | Yes |

| Fraud Bureau | Yes |

| Mandatory Insurer Fraud Plan | No |

| Mandatory Auto Photo Inspection | No |

The law also requires insurance carriers to report any instances of insurance fraud.

The Statute of Limitations in Alabama

Have you been injured personally in an accident or had your vehicle damaged and you wanted to file a claim or sue the other party?

Alabama Statute of Limitations

| Civil Statutes of Limitation | Details |

|---|---|

| Personal Injury | Under a contract: 6 yrs General: 2 yrs |

| Damage to Property | Negligence: 2 yrs Trespass: 6 yrs |

The statute of limitations in Alabama states the deadline within which you need to file your claims or press charges.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

License Renewal Procedures in Alabama

After you have obtained a license, it needs to be renewed from time to time. See below the timelines you must follow in Alabama.

Alabama License Renewal Procedures by Population

| License Renewal Cycle in Alabama | Period |

|---|---|

| General Population | Four Years |

| Older Population | Four Years |

Since the state allows people to renew their licenses online, it’s not much of a hassle. Also, there’s no need to provide proof of adequate vision on renewals.

New Residents in Alabama [Points to Remember]

If you’re new to Alabama, you must remember a few important points about the auto insurance laws in the state.

- Alabama uses the tort system which puts someone at fault if an accident occurs, so your insurance company would be liable to pay all damages if you’re held responsible for an accident.

- The minimum amount of liability insurance coverage required for drivers in Alabama is $25,000 for bodily injury per person/$50,000 for bodily injury per incident, and $25,000 for property damage liability.

Since auto insurance is an expensive purchase, you must gather as much information as possible before buying coverage.

Rules of the Road

Knowing the rules of the road helps you in passing your written knowledge test, driving safely on the road and avoiding any violations that might attract fines.

Fault vs. No-Fault

Alabama uses the tort system which places one party at fault if an accident happens. The at-fault party is required to pay the damages and medical expenses arising from personal injuries to the other party.

Keep Right and Move Over Laws

The traffic laws in Alabama require motorists to move to the right lane if driving slower than other vehicles on the road. Passing a vehicle from its right side is permissible under a few circumstances.

Recently, Alabama passed a new law that allows law enforcement to ticket drivers who stay in the left lane for over a mile without passing other drivers. This new law is meant to reduce road rage by reserving the left lane for passing only.

Read more: How You Can Avoid Becoming a Contributor to Road Rage

Alabama also has a move over law. Anytime there is a vehicle parked on the side of the road with flashing lights, you must move over a lane or slow down.

Some examples of vehicles to move over for are below.

- Law enforcement

- Fire trucks

- Ambulances

- Utility vehicles

- Tow trucks

The move-over law is meant to protect workers who may be walking around the vehicle.

Speed Limits

Speed limits vary from state to state and it’s a good practice to keep tabs while driving. Or just notice the speed limit signs posted on roads.

Alabama Speed Limits by Location

| Location | Speed |

|---|---|

| Rural Interstates | 70 mph |

| Urban interstates | 65 mph |

| Other limited access roads | 65 mph |

| Other roads | 65 mph |

Alabama’s speed limits vary by road type, with rural interstates allowing for higher speeds compared to urban interstates and other roads.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alabama Can’t-Miss Facts

Our detailed guide on insurance in Alabama must have broadened your knowledge with many facts and good-to-know information that would help you in buying coverage for yourself and your family members.

If you wish to compare the best rates in your ZIP code, you can use our comparison tool. And, don’t worry, we wouldn’t push you to buy coverage.

Before we complete this guide, we would like to enlighten you with some more information about road safety that would help you in making a more informed decision.

Vehicle Theft in Alabama

Vehicle theft is a significant concern for car owners and insurance companies alike. The table below highlights the most commonly stolen vehicle makes and models in Alabama. Understanding which vehicles are most at risk can help owners take preventive measures and potentially reduce their insurance premiums.

Alabama Vehicle Theft by Make and Model

| Make and Model | Year | Total Vehicles Stolen |

|---|---|---|

| Chevrolet Impala | 2024 | 7,500 |

| Chevrolet Pickup (Full Size) | 2024 | 32,000 |

| Dodge Pickup (Full Size) | 2024 | 28,500 |

| Ford Explorer | 2024 | 18,000 |

| Ford Mustang | 2024 | 7,000 |

| Ford Pickup (Full Size) | 2024 | 36,500 |

| GMC Pickup (Full Size) | 2024 | 30,000 |

| Honda Accord | 2024 | 40,500 |

| Nissan Altima | 2024 | 25,000 |

| Toyota Camry | 2024 | 16,500 |

In Alabama, Honda Accord were the most-common stolen vehicle in the year 2015. This trend highlights the importance of implementing robust security features and being vigilant about where and how you park your vehicle. By staying informed about vehicle theft trends, car owners can better protect their assets and contribute to overall community safety.

Read more: Common Ways Cars Are Stolen

Vehicle Theft in Alabama [By City]

In case you’re wondering which cities are most vulnerable to vehicle thefts, we have collated the data for you. Vehicle theft can have a significant impact on your insurance premiums, and understanding the trends in different cities can help you take preventive measures.

Alabama Vehicle Theft by City

| City | Number of vehicles stolen |

|---|---|

| Birmingham | 1,042 |

| Montgomery | 1,101 |

| Huntsville | 710 |

| Mobile | 552 |

| Phenix City | 211 |

| Tuscaloosa | 202 |

| Gadsden | 196 |

| Prichard | 193 |

| Dothan | 130 |

| Decatur | 128 |

As you can see, the number of vehicles stolen is significantly higher in the first four cities i.e. Birmingham, Montgomery, Huntsville, and Mobile, which are also the most popular cities in Alabama. Being aware of these statistics can help residents and policymakers implement better security measures.

Traffic Fatalities in Alabama

Moving on from vehicle thefts, another factor that might impact your insurance rates is the number of traffic fatalities in your state. Fatalities on the road are a serious concern, affecting not only insurance costs but also public safety initiatives.

Alabama Traffic Fatalities by Road Type

| Type of Road | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 550 | 530 | 520 | 510 | 500 | 490 | 480 | 470 | 460 | 450 |

| Urban | 320 | 310 | 300 | 290 | 280 | 270 | 260 | 250 | 240 | 230 |

Below are the cities in Alabama that have witnessed the highest death rates from traffic fatalities. This information is for understanding where road safety improvements are most needed.

Alabama Traffic Fatalities by City

| City | Total Deaths | Death Rate (per 100,000 residents) |

|---|---|---|

| Birmingham | 44 | 21 |

| Mobile | 35 | 18 |

| Montgomery | 27 | 14 |

| Huntsville | 22 | 11 |

We have also compiled data for the top-10 counties with the highest fatality rates in Alabama. These statistics highlight areas that might benefit from targeted road safety campaigns and infrastructure investments.

Alabama Traffic Fatalities by County

| Counties | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Jefferson | 85 | 78 | 82 | 88 | 84 |

| Mobile | 70 | 75 | 71 | 76 | 73 |

| Madison | 30 | 32 | 25 | 40 | 35 |

| Tuscaloosa | 25 | 35 | 40 | 48 | 36 |

| Baldwin | 35 | 28 | 33 | 38 | 27 |

| Talladega | 25 | 14 | 18 | 28 | 25 |

| Etowah | 12 | 14 | 13 | 30 | 24 |

| Cullman | 13 | 18 | 24 | 23 | 22 |

| Shelby | 15 | 19 | 18 | 25 | 23 |

| Blount | 12 | 5 | 4 | 16 | 22 |

Next, we will look at the number of fatalities by person type – which types of vehicles were involved, or how many pedestrians were affected? Understanding these details can guide more effective safety regulations and vehicle design improvements.

Alabama Traffic Fatalities by Person Type

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 357 | 337 | 355 | 416 | 395 |

| Light Truck - Pickup | 151 | 150 | 156 | 169 | 145 |

| Light Truck - Utility | 137 | 116 | 111 | 166 | 143 |

| Light Truck - Van | 20 | 15 | 23 | 24 | 27 |

| Light Truck - Other | 1 | 0 | 3 | 9 | 1 |

| Large Truck | 25 | 15 | 16 | 35 | 20 |

| Bus | 3 | 0 | 1 | 0 | 0 |

| Other/Unknown Occupants | 12 | 15 | 10 | 25 | 9 |

| Total Occupants | 706 | 648 | 675 | 844 | 740 |

| Total Motorcyclists | 80 | 65 | 67 | 112 | 79 |

| Pedestrian | 59 | 96 | 98 | 120 | 119 |

| Bicyclist and Other Cyclist | 6 | 9 | 9 | 3 | 7 |

| Other/Unknown Non occupants | 2 | 2 | 1 | 4 | 3 |

| Total Non occupants | 67 | 107 | 108 | 127 | 129 |

| Total | 853 | 820 | 850 | 1,083 | 948 |

The data on fatalities by person type in Alabama reveals that occupants of passenger cars and light trucks (pickups and utility vehicles) consistently represent the majority of traffic fatalities over the five-year period. This indicates a need for focused safety measures for these vehicle types.

Fatalities by Crash Type in Alabama

What kind of crashes are actually causing these fatalities? Here’s a five-year trend for the crash types in Alabama. Analyzing crash types can help in formulating strategies to reduce these incidents.

Alabama Fatalities by Crash Type

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 853 | 820 | 850 | 1,083 | 948 |

| Single Vehicle | 512 | 508 | 482 | 639 | 564 |

| Involving a Large Truck | 109 | 84 | 101 | 144 | 99 |

| Involving Speeding | 253 | 237 | 236 | 329 | 257 |

| Involving a Rollover | 278 | 249 | 269 | 331 | 290 |

| Involving a Roadway Departure | 580 | 492 | 540 | 663 | 605 |

| Involving an Intersection (or Intersection Related) | 123 | 125 | 158 | 208 | 145 |

The five-year trend for fatalities by crash type in Alabama indicates that single-vehicle crashes consistently account for a significant portion of fatalities. This insight can drive specific interventions aimed at reducing single-vehicle incidents.

Teen Drinking and Driving

As parents, you must be careful of teen drunk driving laws in your state since the penalties and suspensions can severely impact your child’s driving record at an early age. Monitoring and educating teens about the dangers of drinking and driving can save lives.

Alabama Teen Drinking and Driving Statistics

| Category | Data |

|---|---|

| DUI Arrests (Under 18 years old) | 175 |

| DUI Arrests Total Per Million People (Under 18 years old) | 60 |

| Rank (Among the US States) | 22 |

| Alcohol-Impaired Driving Fatalities Per 100,000 (Under 21) | 2 |

The death rate for alcohol-impaired driving fatalities under the age of 21 was quite high for the state of Alabama compared to the national average of 1 per 100,000 in the year 2016. This alarming statistic underscores the importance of strict enforcement and educational programs.

EMS Response Time in Alabama

The data on EMS response times in Alabama shows a significant disparity between rural and urban areas. Quick response times are critical for saving lives, and understanding these disparities can help in improving emergency services across the state.

Alabama EMS Response Time by Location

| EMS Response Times | Rural | Urban |

|---|---|---|

| Time of Crash to EMS Notification | 38 | 6 |

| EMS Notification to EMS Arrival | 39 | 7 |

| EMS Arrival at Scene to Hospital Arrival | 40 | 25 |

| Time of Crash to Hospital Arrival | 70 | 35 |

Response times in rural areas are consistently longer across all stages, from the time of crash notification to hospital arrival. Addressing these gaps can lead to better outcomes for crash victims in rural areas.

Transportation

Now that you are aware of the fatality rates in your state, let’s get to the transportation details – how many cars are owned by households in your state, what are the commuting times or which cities have the highest traffic congestion?

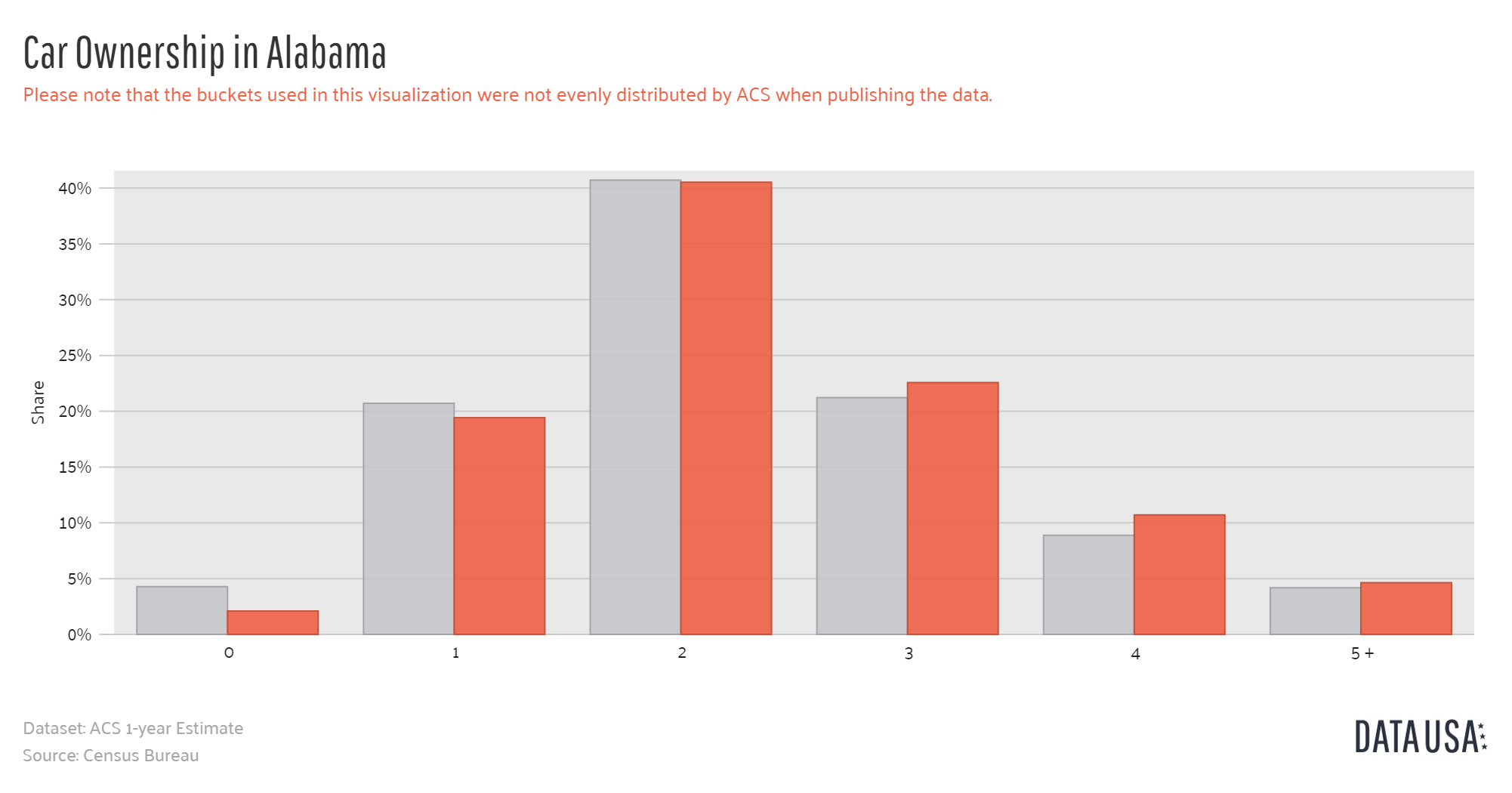

Car Ownership

In Alabama, most of the households own two cars on an average.

The image below reflects the four-year trend comparing Alabama to the U.S. average:

In 2016, 19% of households in Alabama had one car, 40% had two, and 22% had three.

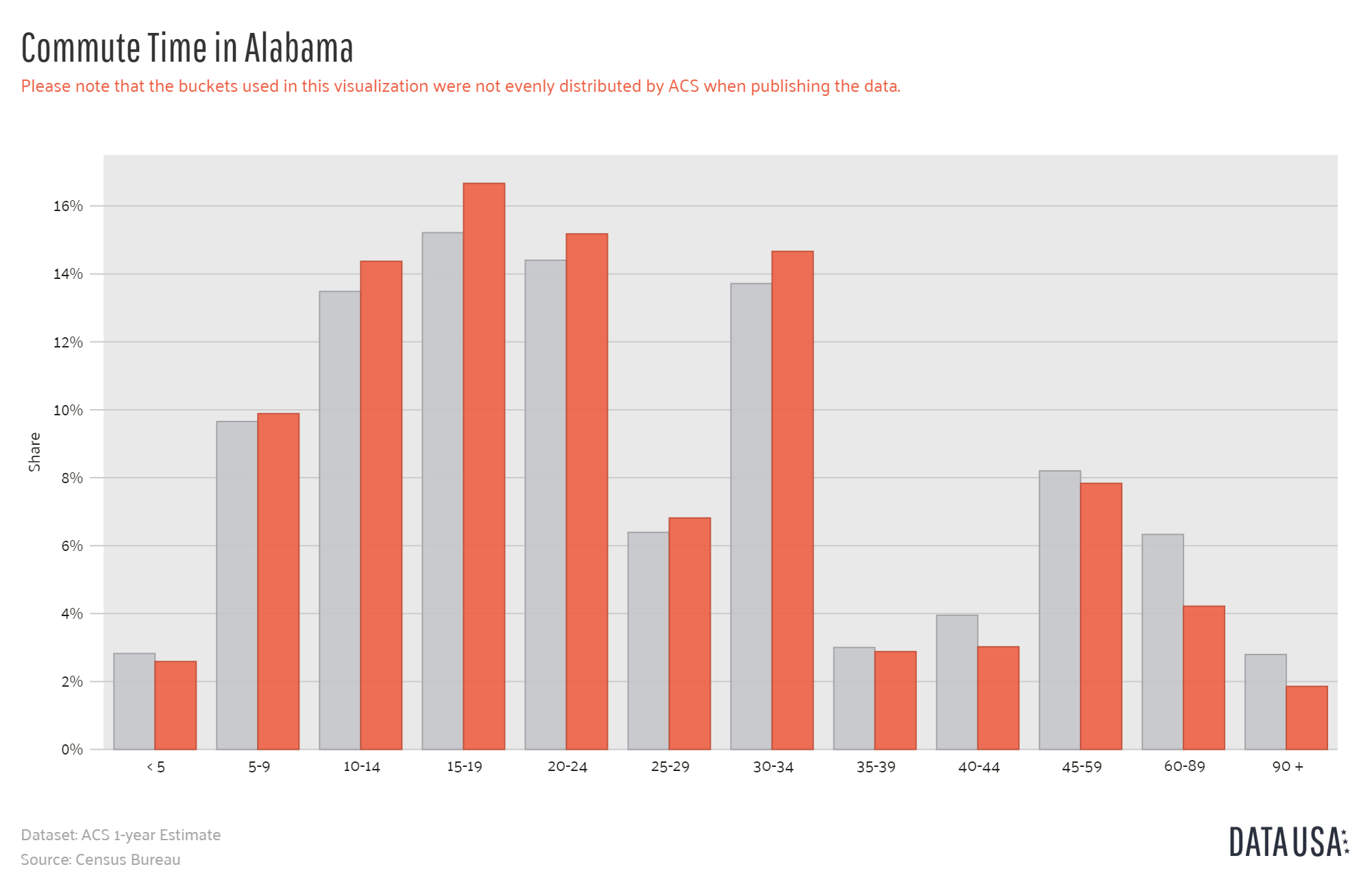

Commute Time in Alabama

Here’s an image of the commute times in Alabama compared to the U.S. average in different time buckets.

The average commute times for employees in Alabama is 23 minutes which is lower than the U.S. average of 25 minutes.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

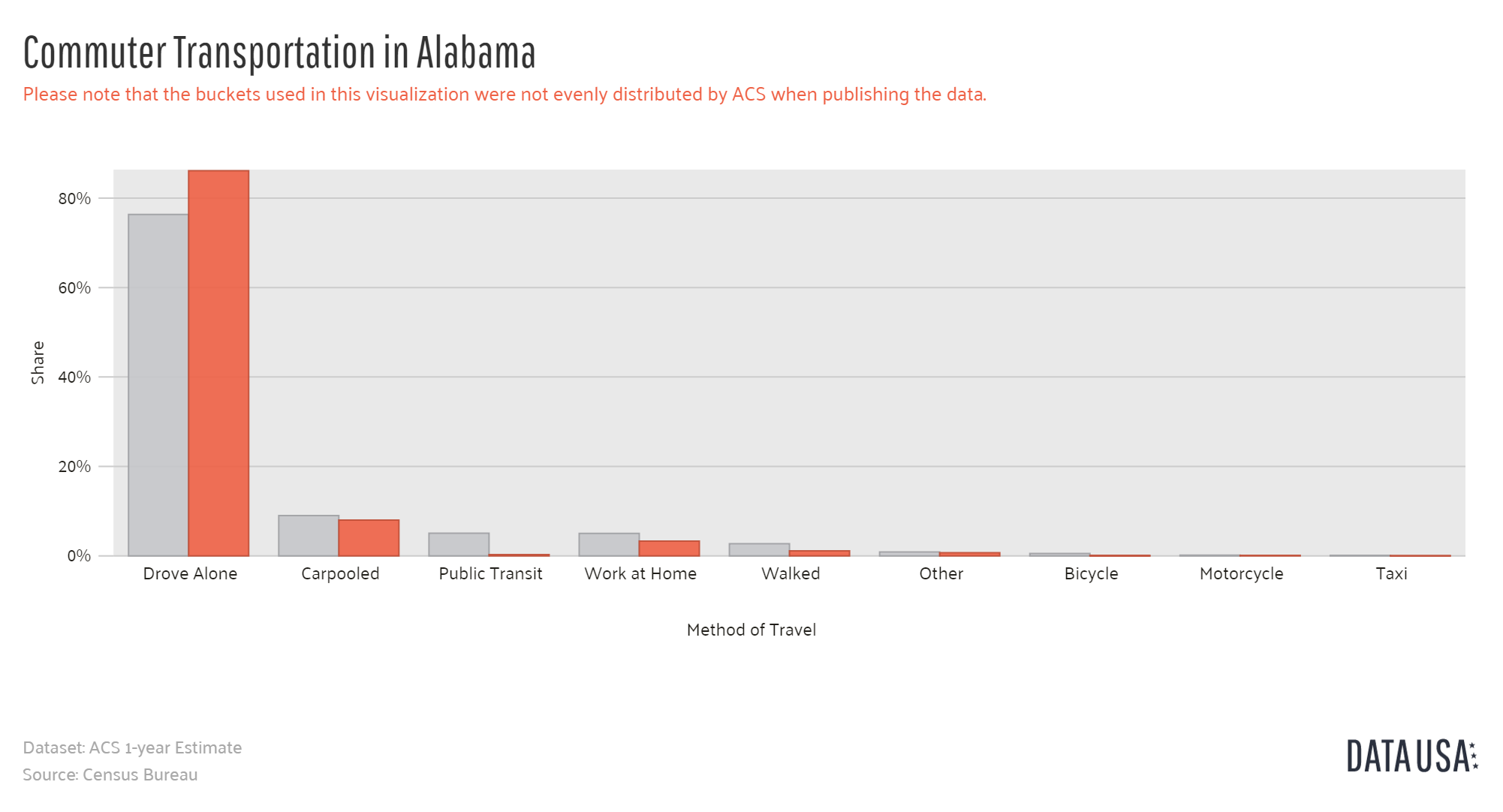

Commuter Transportation

Around 86$ of commuters in Alabama drive alone. As evident from the image above, other modes of transportation are fairly uncommon in the state.

Since the percentage of people driving alone is that high, it’s bound to lead to some traffic congestion, at least in the major cities.

As per traffic congestion data, the rising congestion on roads is a grave matter of concern for the residents of Alabama as it costs them time and money. The annual cost for congestion is around $1 billion in the state due to the lost hours and extra fuel consumption.

Now that you’re well informed about everything you need to know about auto insurance – let’s get you started with a car insurance comparison.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

How can I compare car insurance rates in Alabama?

To compare car insurance rates in Alabama, gather your vehicle and driving details, research reputable providers, use online tools for quotes, review coverage options, check customer reviews, inquire about discounts, and choose the best policy for your needs and budget.

Read more: How do you compare multiple car insurance quotes online?

What factors can affect car insurance rates in Alabama?

Car insurance rates in Alabama are influenced by your driving record, age, gender, vehicle type, coverage levels, credit history, location, and annual mileage.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Are there any specific car insurance requirements in Alabama?

Alabama requires liability insurance with minimum limits of $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage; higher coverage limits are recommended for better protection.

Can I get discounts on car insurance in Alabama?

You can get discounts for having a clean driving record, bundling multiple policies, having safety features in your car, maintaining good grades as a student, or completing a defensive driving course.

Read more: Multiple Policy Car Insurance Discounts

How often should I compare car insurance rates?

Compare car insurance rates at policy renewal, after major life changes, following significant life events, when facing a rate increase, or every couple of years to stay updated on market trends and discounts.

What should I consider when choosing a car insurance provider in Alabama?

When choosing a provider, consider their financial stability, customer service quality, coverage options, discounts, and overall cost of the policy.

Can I switch car insurance companies mid-policy in Alabama?

Yes, you can switch mid-policy by ensuring your new policy is in place before canceling the old one, checking for cancellation fees, and confirming any refund for unused premiums.

What happens if I drive without insurance in Alabama?

Driving without insurance in Alabama can result in fines, license and registration suspension, higher future premiums, and legal and financial liabilities if involved in an accident.

How does my credit score affect car insurance rates in Alabama?

In Alabama, a higher credit score can lower your insurance premiums, while a lower score can increase them, making it important to maintain good credit. For more information, read our article titled “Good Credit Car Insurance Discounts“.

What is SR-22 insurance and do I need it in Alabama?

SR-22 insurance in Alabama is a certificate proving you meet the state’s minimum insurance requirements, typically needed after certain traffic offenses, license suspension, or driving without insurance.

Find cheap car insurance quotes by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.