Cheapest New York Car Insurance Rates in 2026 (Save With These 10 Companies!)

Discover the cheapest New York car insurance rates with Erie, Geico, and Progressive, offering monthly premiums starting as low as $22. These companies are known for strong customer satisfaction ratings, providing peace of mind, financial security, and reliable coverage to car owners across the state.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated September 2024

Company Facts

Min. Coverage for New York

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for New York

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for New York

A.M. Best Rating

Complaint Level

Pros & Cons

When it comes to the cheapest New York car insurance rates, Erie, Geico, and Progressive stand out with rates as low as $22 per month. Erie stands out for affordability, customer service, and comprehensive coverage. Discover how these top providers offer savings and peace of mind on the road.

Car insurance in New York often costs less than the national average. Factors like location significantly influence rates.

Our Top 10 Company Picks: Cheapest New York Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A+ Customer Satisfaction Erie

#2 $40 A++ Affordable Rates Geico

#3 $50 A+ Online Tools Progressive

#4 $70 B Local Agents State Farm

#5 $71 A Multi-Policy Discounts American Family

#6 $76 A+ Comprehensive Coverage Allstate

#7 $85 A+ Claims Satisfaction Nationwide

#8 $86 A Personalized Service Farmers

#9 $90 A++ Financial Strength Travelers

#10 $104 A Many Discounts Liberty Mutual

Read on to learn the best place to find low car insurance quotes in New York, including which companies might have the lowest rates for you. By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- Driving history and vehicle type affect rates

- Compare rates across New York for best deals

- Erie excels in pricing, service for car insurance

- Compare New York Car Insurance Rates

- Best Woodstock, NY Car Insurance in 2026

- Best Unadilla, NY Car Insurance in 2026

- Best Troy, NY Car Insurance in 2026

- Best South Salem, NY Car Insurance in 2026

- Best Schroon Lake, NY Car Insurance in 2026

- Best Schoharie, NY Car Insurance in 2026

- Best Rhinebeck, NY Car Insurance in 2026

- Best Oswego, NY Car Insurance in 2026

- Best New Hyde Park, NY Car Insurance in 2026

- Best Mount Vernon, NY Car Insurance in 2026

- Best Morris, NY Car Insurance in 2026

- Best Irving, NY Car Insurance in 2026

- Best Glen Cove, NY Car Insurance in 2026

- Best Florida, NY Car Insurance in 2026

- Best Fine, NY Car Insurance in 2026

- Best Ellenville, NY Car Insurance in 2026

- Best Clifton Park, NY Car Insurance in 2026

- Best Center Moriches, NY Car Insurance in 2026

- Best Catskill, NY Car Insurance in 2026

- Best Buffalo, NY Car Insurance in 2026

- Best Binghamton, NY Car Insurance in 2026

- Best Amenia, NY Car Insurance in 2026

- Best New York City, NY Car Insurance in 2026

#1 – Erie: Top Overall Pick

Pros

- Customer Satisfaction: Erie is renowned for high customer satisfaction, ensuring a positive experience for policyholders.

- Competitive Rates: With a monthly rate of $22, Erie offers some of the lowest car insurance rates in New York.

- Strong Financial Stability: Holding an A+ rating from A.M. Best, Erie is financially stable, providing peace of mind for policyholders.

Cons

- Limited Availability: Erie’s coverage options may not be available in all areas. Learn more about their availability in our Erie car insurance review.

- Fewer Online Tools: Compared to some competitors, Erie may offer fewer online tools and resources for managing policies and claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best For Affordable Rates

Pros

- Affordable Rates: Geico offers very competitive rates at $40 per month, making it an attractive option for budget-conscious drivers.

- Excellent Financial Strength: With an A++ rating from A.M. Best, Geico is highly reliable in terms of financial stability.

- Extensive Discounts: Geico provides a wide range of discounts, learn more in our Geico car insurance review.

Cons

- Mixed Customer Service Reviews: While many customers are satisfied, Geico has some mixed reviews regarding customer service experiences.

- Higher Rates in Urban Areas: Geico’s rates can be significantly higher in urban areas like New York City, affecting affordability for city dwellers.

#3 – Progressive: Best For Online Tools

Pros

- Online Tools: Progressive is known for its robust online tools, including an easy-to-use website and mobile app for managing policies and claims.

- Strong Financial Rating: Progressive holds an A+ rating from A.M. Best, indicating solid financial health.

- Snapshot Program: Progressive offers the Snapshot program, which can help safe drivers save more based on their driving habits.

Cons

- Higher Base Rates: Progressive’s rates are higher than some competitors. More information about their rates in our Progressive car insurance review.

- Average Customer Service: Progressive’s customer service is often rated as average, which might not meet the expectations of all policyholders.

#4 – State Farm: Best For Local Agents

Pros

- Local Agents: State Farm provides personalized service through a network of local agents, offering a more personal touch for customers.

- Comprehensive Coverage: State Farm offers a wide variety of coverage options to suit different needs.

- Good Discounts: As mentioned in our State Farm car insurance review they have a range of discounts, especially for safe drivers and those with multiple policies.

Cons

- Higher Rates: With rates starting at $70 per month, State Farm is more expensive than some other providers.

- Lower Financial Rating: Holding a B rating from A.M. Best, State Farm’s financial stability is not as strong as top competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best For Multi-Policy Discounts

Pros

- Multi-Policy Discounts: American Family offers substantial discounts for customers who bundle multiple policies.

- Good Customer Service: Known for strong customer service, American Family often receives positive feedback from policyholders.

- Comprehensive Coverage Options: The company provides a variety of coverage options, ensuring drivers can find a policy that fits their needs.

Cons

- Higher Monthly Rates: At $71 per month, American Family’s rates are higher than some competitors, making it less attractive for those seeking the lowest cost.

- Limited Availability: Coverage options may not be as widely available as those of larger, national providers. Learn more about their availability in our American Family car insurance review.

#6 – Allstate: Best For Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate offers extensive coverage options, including add-ons like accident forgiveness and new car replacement.

- Strong Financial Rating: With an A+ rating from A.M. Best, Allstate is financially stable.

- Many Discounts: Allstate provides numerous discounts, such as for safe driving and bundling policies.

Cons

- Higher Rates: Allstate’s monthly rates are higher than many competitors. Learn more about their rates in our Allstate car insurance review.

- Mixed Customer Service Reviews: While some customers report positive experiences, others have had issues with claims processing and customer service.

#7 – Nationwide: Best For Claims Satisfaction

Pros

- Claims Satisfaction: Nationwide is well-regarded for its claims satisfaction, ensuring smooth and efficient claims processing.

- Financial Stability: With an A+ rating from A.M. Best, Nationwide is a financially sound choice.

- Variety of Coverage Options: Nationwide offers a wide range of coverage options and add-ons. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Higher Monthly Rates: At $85 per month, Nationwide’s rates are higher than many other providers.

- Average Online Tools: Nationwide’s online tools and resources are considered average compared to some competitors with more advanced offerings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best For Personalized Service

Pros

- Personalized Service: Farmers is known for providing personalized service through local agents.

- Flexible Coverage Options: Farmers offers a variety of customizable coverage options to fit different needs.

- Good Financial Stability: With an A rating from A.M. Best, Farmers is a reliable choice. Learn more in our Farmers car insurance review.

Cons

- Higher Rates: At $86 per month, Farmers’ rates are higher than those of many competitors.

- Limited Discounts: Farmers offers fewer discounts compared to other major insurance providers, potentially making it more expensive for some drivers.

#9 – Travelers: Best For Financial Strength

Pros

- Financial Strength: Travelers holds an A++ rating from A.M. Best, indicating excellent financial stability.

- Extensive Discounts: Travelers offers a wide array of discounts, including for safe driving and bundling policies.

- Comprehensive Coverage: As mentioned in our Travelers car insurance review, the company provides robust coverage options, including specialty and high-risk coverage.

Cons

- Higher Rates: With monthly rates at $90, Travelers is one of the more expensive options.

- Customer Service Variability: Travelers’ customer service experiences can vary, with some customers reporting issues with responsiveness.

#10 – Liberty Mutual: Best For Many Discounts

Pros

- Many Discounts: Liberty Mutual provides a wide range of discounts, helping customers save on their premiums.

- Comprehensive Coverage: The company offers extensive coverage options, including unique add-ons like better car replacement.

- Good Financial Rating: With an A rating from A.M. Best, Liberty Mutual is financially secure. Learn more in our Liberty Mutual car insurance review.

Cons

- Higher Monthly Rates: At $104 per month, Liberty Mutual has the highest rates among the listed companies.

- Mixed Customer Reviews: Some customers report mixed experiences with claims processing and customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare New York Car Insurance Rates

If you have an idea about the minimum coverage requirements, available coverage options, and rates in your ZIP code, chances are you will be able to get a quote that’s suitable for your needs.

New York Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $76 $147

American Family $71 $137

Erie $22 $58

Farmers $86 $165

Geico $40 $78

Liberty Mutual $104 $200

Nationwide $85 $164

Progressive $50 $96

State Farm $70 $137

Travelers $90 $175

As we can see above, location, location, location is everything when it comes to determining your rates. Also, if you’re new to New York, you can choose a ZIP code to live in that would help you minimize the cost of premiums – we understand that’s not the sole criterion for choosing an apartment anywhere. However, in a city like Manhattan, it can save you thousands of dollars.

Now, let’s get into the details that matter the most.

New York Car Insurance Requirements

New York is a no-fault car insurance state which means that your insurance carrier would pay for the damages in an accident irrespective of who was at fault.

The financial outlay required after an accident to cover damages is paid from the personal injury protection (PIP) coverage that motorists in New York have to carry with their car insurance policy.

But how do the minimum car insurance costs in New York compare with its continental neighbors? See our chart below.

We would cover the different types of auto insurance coverage that you must know about, but before that, let’s look at the state-mandated coverage that you are required to buy.

- Personal injury Liability Coverage: $25,000 per person with a maximum of $50,000 per accident

- Liability Coverage for Death: $50,000 per person with a maximum of $100,000 per accident

- Property Damage Liability Coverage: $10,000 per accident

- Personal Injury Protection: $50,000 per person

- Uninsured Motorist Coverage: $25,000 per person with a maximum of $50,000 per accident

Coverage Options:

In New York, liability insurance covers costs for injuries and property damage you cause in an accident, with higher limits for fatalities. Personal Injury Protection (PIP) covers medical bills and lost wages for you, your passengers, or pedestrians, no matter who is at fault. Uninsured Motorist Coverage pays for damages if you’re hit by a driver without insurance.

In most of the states — that follow the at-fault system — motorists aren’t required to buy PIP coverage. This might save you some money on a monthly basis, however, in the event of an accident, PIP really saves your day.

As New York follows the no-fault system, motorists aren’t allowed to bring a lawsuit against the at-fault party in an accident, unless they sustain a serious injury as defined in the New York Insurance Law §5102(d).

What is considered a serious injury that would allow someone to sue the at-fault party?

- Death

- Dismemberment

- Broken Bone

- Fetus Loss

- Major Disfigurement

- Losing the ability to use a body organ permanently

If your injury falls in one of the above categories, only then you can file a suit to claim damages for your pain and suffering. Lawsuits can also be brought if the expenses of damages are more than the coverage limit.

Important Note: Since auto insurance is mandatory in New York, make sure that you continuously maintain car insurance coverage as the New York Department of Motor Vehicles uses a system known as the Insurance Information and Enforcement System (IIES) to monitor the coverage status of registered vehicles.

Forms of Financial Responsibility in New York

In case you cause an accident, you’re legally responsible for paying the damages that may arise from the aftermath. Buying insurance coverage would absolve you from any financial responsibility, as your car insurance carrier would be liable to settle the damages.

But what if you don’t want to buy insurance coverage? You have a few alternatives to car insurance coverage.

- You can keep a security deposit of $150,000 with the New York DMV

- You can also keep a surety bond that covers the minimum state coverage requirement

- Those who own 25 or more vehicles can insure themselves through a self-insurance policy along with proof of their financial ability to pay off damages in an accident

Although these options are available to motorists, it’s usually much easier and less expensive to buy car insurance coverage instead.

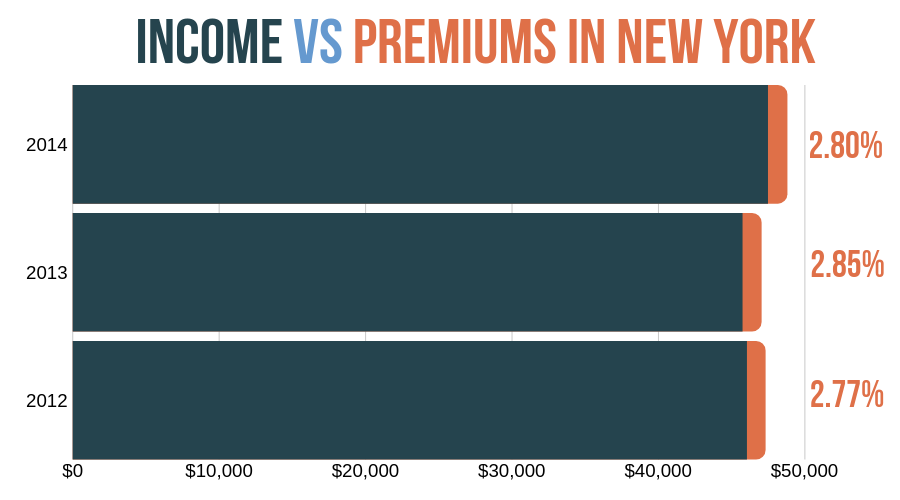

Compare New York Car Insurance Rates as a Percentage of Income

In 2014, the full coverage monthly premium was $132, while the personal disposable income was $47,446. If you do the math, New Yorkers had to spend around 2.8% of their income on auto insurance premiums.

From 2012, the ratio of premiums to income has increased from 2.77% to 2.80%in New York. In it’s adjacent state of New Jersey, motorists had to spend around 2.76% of their income on premiums in 2014.

Knowing about the percentage that you would spend on premiums helps you to budget for auto insurance costs in advance.

Compare New York Car Insurance Rates by Coverage

The chart below compares the average costs of different car insurance coverages in New York, highlighting the variation in premiums for liability, collision, and comprehensive coverage. It shows how these costs can impact your overall insurance expenses.

New Yorkers paid an average of $804 annually for liability coverage, which is significantly higher than the $385 for collision and $171 for comprehensive coverage. Liability insurance is required by law in New York and covers damages and injuries you cause to others in an accident.

Collision coverage helps pay for repairs if you hit another vehicle or object, while comprehensive coverage addresses damage from events like fire, vandalism, or natural disasters. Although liability coverage is mandatory, having collision and comprehensive coverage can save you money on repairs.

Additional Liability Coverage in New York

The table below illustrates the loss ratio of insurance companies for a period of three years. The percentage shows the ratio of premiums that the insurers have settled as claims.

New York Additional Liability Coverage by Loss Ratio

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments | 76% | 63% | 56% |

| Personal Injury Protection | 72% | 70% | 72% |

| Uninsured/Underinsured Motorist | 58% | 55% | 57% |

Let’s try to understand loss ratio with an example – If an insurer has earned $100 in premiums and the loss ratio is 76%, then the insurance company has paid $76 in claims settlement.

Medical payments cover medical and funeral expenses for the passengers and pedestrians from an auto accident irrespective of fault. It tends to augment the amount required for medical expenses if the accident was severe.

Though many consider medical payments as an unnecessary expense, the benefits can outweigh the expenditure if you are involved in a major crash. Nonetheless, it’s advisable to assess your personal situation before adding medical payments to your coverage.

What else can you buy to protect yourself from unforeseen circumstances?

Insurance companies offer many add-ons and riders, which you should take a look at before buying coverage.

- Guaranteed Auto Protection (Gap)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

The state law of New York requires everyone to carry uninsured motorist coverage, which helps to pay damages if you’re hit by a motorist who’s uninsured or underinsured.

In New York, around 6.10% motorists were uninsured in 2015 as per the Insurance Information Institute. Thankfully, the percentage of uninsured motorists in New York is the second-lowest amongst all the states in America.

Still, if you’re hit by an uninsured motorist, chances of which are low in New York, your coverage would pay damages over and above what the at-fault motorist can pay if he has any insurance at all.

Pay-As-You-Drive or Usage-Based Insurance

Are you tired of paying a high auto premium in New York?

And do you think that insurance companies should reward good driving behavior by way of lower premiums?

Well, if the answer to those questions is a yes, then you should look at usage-based insurance.

In usage-based insurance, also known as “pay-how-you-drive,” “pay-as-you-drive,” or “pay-as-you-go car insurance”, insurers record your driving behavior and offer discounts on premiums if you drive within the speed limit, rarely slam breaks, or have low daily mileage.

With the advent of the Internet of Things, insurance companies have started installing telematics devices in motor vehicles that keep a track of your driving pattern and relays the data to your insurer.

Interestingly, the state of New York encourages insurance carriers to explore the benefits of telematics devices for consumers and actively seeks applications from insurers to implement this new-age technology across the state.

These discounts from top insurance providers in New York offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road. If you want to understand usage-based insurance in detail, you can watch this quick video.

Since pay-as-you-go has gained traction in the last couple of years only, your insurance agent may not remember to mention this to you. While taking a quote, don’t forget to ask if your insurance company offers usage-based discounts.

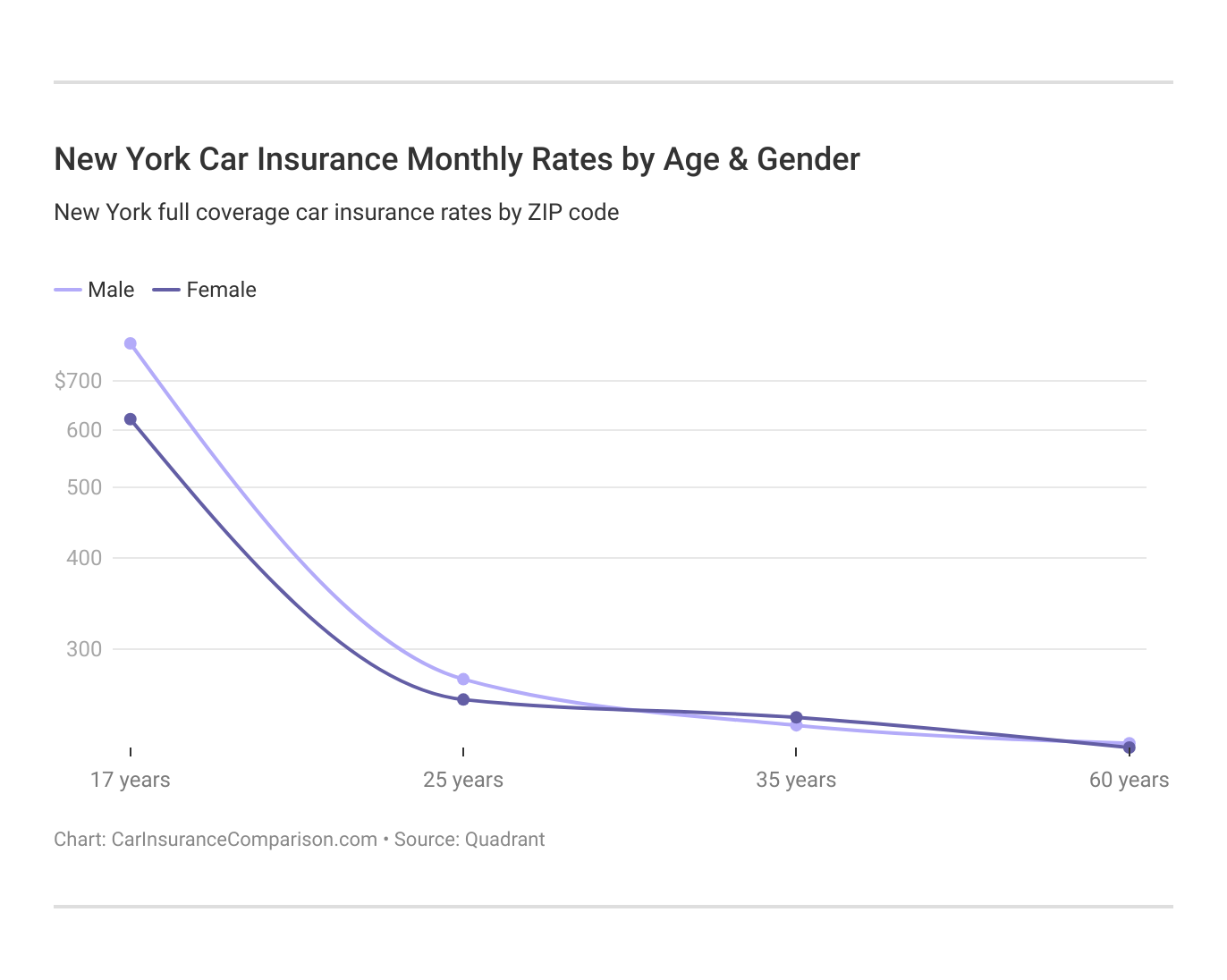

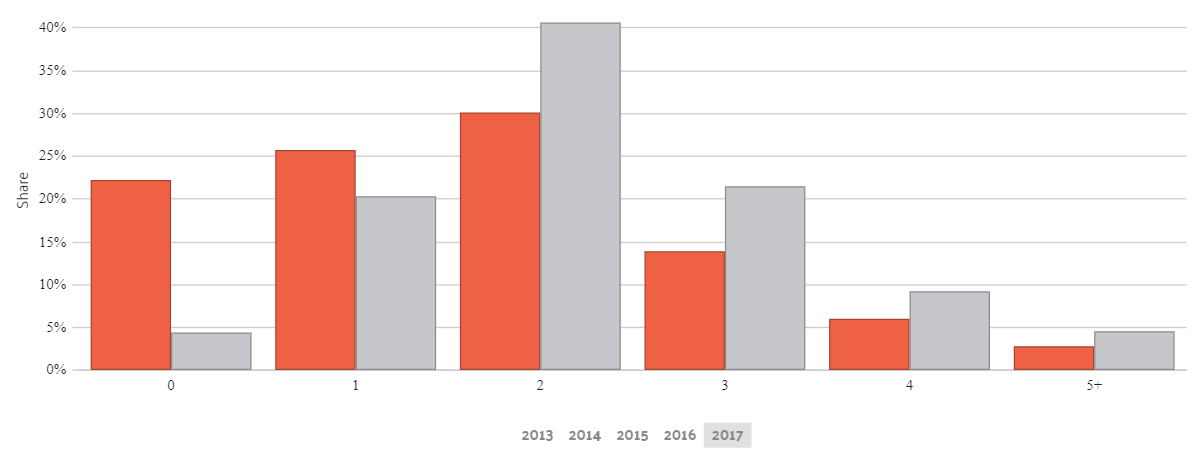

Compare New York Car Insurance Rates Demographics

When you look at the premium rates for different age groups and gender, you would notice that for single 17-year-old males, the rates are much higher than their female counterparts.

New York Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $210 | $200 | $82 | $82 | $130 | $125 | $79 | $78 |

| Geico | $190 | $180 | $45 | $40 | $100 | $95 | $40 | $40 |

| Liberty Mutual | $250 | $240 | $121 | $106 | $150 | $145 | $96 | $96 |

| Nationwide | $220 | $210 | $122 | $87 | $135 | $130 | $80 | $80 |

| Progressive | $200 | $190 | $71 | $72 | $110 | $105 | $44 | $44 |

| State Farm | $210 | $200 | $86 | $81 | $125 | $120 | $62 | $62 |

| Travelers | $230 | $220 | $101 | $99 | $140 | $135 | $90 | $85 |

| USAA | $180 | $170 | $67 | $60 | $90 | $85 | $41 | $41 |

In other age groups, the rates are more or less the same for males and females.

This just bolsters the fact that as you grow older, insurance companies tend to incorporate other personal factors into rate calculation, and a person’s gender takes a backseat.

Car Insurance Companies in New York

This summary provides key statistics on car insurance and road safety in New York, including vehicle registrations, theft rates, and average monthly premiums. It also highlights the most popular vehicle and the cheapest insurance provider in the state.

New York Statistics Summary

| Data | Details |

|---|---|

| Road Miles in New York | Vehicle Miles: 127.2 billion Miles of Roadway: 114,365 |

| Vehicles | Registered Vehicles: 10.3 million Motor Vehicle Thefts: 15,313 |

| State Population | $19,819,347.00 |

| Most Popular Vehicle in New York | Nissan Rogue |

| Percent of Motorists Uninsured | 6.10% State Rank: 50 |

| Total Driving Related Deaths | 2017-2023 Speeding Fatalities: 308 Drunk Driving Fatalities: 295 |

| Monthly Premiums | Liability: $67 Collision: $32 Comprehensive: $14 |

| Cheapest Provider | Geico |

Some people might say that they want their insurer to settle claims as soon as possible in the event of an accident, and others would want an insurer that offers the convenience of digital interactions.

Everyone has different needs, so why buy coverage by just looking at the premium rates?

The decision to buy car insurance coverage must be a well-thought out process and involve thorough investigation of an insurer’s financial ratings, customer reviews, complaints data, market standing, etc.

We have done the research for the best car insurance companies in New York that would help in making the purchase decision easy for you.

Financial Ratings of Leading Insurance Companies in New York

Financial ratings were devised to help consumers understand the long-term financial viability of companies because everyone can’t understand balance sheets like a financial analyst.

To give you an idea about the financial standing of leading insurers in New York, we would assess their A.M.Best Ratings, the leading name in financial ratings.

How to understand A.M.Best Ratings?

A.M.Best evaluates insurance companies on their financial strength and the ability to meet their insurance obligations in the future. For this purpose, the credit rating agency assigns alphabetical ratings starting from A+ to S. Any rating of A+, A, and A- falls under the category of excellent.

A.M. Best Financial Strength Ratings From the Top New York Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| Amtrust | A- |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| NYCM | A |

| Progressive | A+ |

| State Farm | B |

| Travelers | A++ |

| USAA | A++ |

The A.M. Best ratings highlight the financial strength of top car insurance providers in New York, indicating their ability to meet policyholder obligations. Geico, Travelers, and USAA stand out with the highest rating of A++, reflecting exceptional financial stability.

Car Insurance Companies With Best Customer Reviews in New York

As consumers, you always check reviews online before buying anything, from PlayStation to mobile phones. Then, why do you rely on mere quotes to buy a car insurance policy?

Checking customer satisfaction surveys and online reviews should be a part of your car insurance buying process, as it’s important to choose a reliable insurer who will respond to you instantly if you get involved in an accident.

As per a recent customer satisfaction survey by a trusted source in auto insurance ratings, J.D. Power, consumers these days are more satisfied with their car insurers despite the continuously rising premiums.

The survey found that frequent interactions with consumers through digital channels have contributed to the high satisfaction level among consumers. Cost might be the determining factor in choosing an insurer, but the continuity of impeccable service wins in the end.

Complaint Data of Leading Car Insurers in New York

Another data that would really help you in making a decision faster is the number of complaints against the insurance carriers.

Since customer ratings are based on a sample group of customers, the complaint data offers a more realistic measure of customer satisfaction.

Compare New York Car Insurance Rates by Annual Commute

If your daily commute is around 10 miles, then you might get discounts on your premium rates. As you can see in the table, there are a few insurance carriers who offer a lower rate for low mileage.

New York Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $142 | $160 |

| American Family | $135 | $150 |

| Amica | $125 | $140 |

| Farmers | $138 | $155 |

| Geico | $110 | $120 |

| Liberty Mutual | $145 | $165 |

| Progressive | $132 | $145 |

| State Farm | $118 | $124 |

| The Hartford | $130 | $140 |

| USAA | $105 | $115 |

| U.S. Average | $118 | $124 |

Annual mileage is among the more minor factors that affect your rates. The table shows how annual mileage affects car insurance rates, with lower mileage generally leading to discounted premiums. Geico and USAA offer the most competitive rates for drivers with lower annual mileage.

Use this comparison to find insurance carriers that offer lower rates for low mileage, ensuring you get the best value based on your driving habits.

Compare New York Car Insurance Rates by Credit Score

Credit history plays a significant role in determining car insurance rates. This section compares how rates vary based on different credit scores, providing insights into how your credit rating affects your premiums.

New York Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $254 | $189 | $167 |

| Geico | $320 | $237 | $203 |

| Liberty Mutual | $345 | $263 | $232 |

| Nationwide | $146 | $116 | $104 |

| Progressive | $248 | $184 | $159 |

| State Farm | $295 | $220 | $191 |

| Travelers | $210 | $180 | $157 |

| USAA | $175 | $140 | $120 |

| U.S. Average | $115 | $140 | $210 |

Credit history has a major impact on your premium rates. A poor credit rating means an inability to meet your premium payment obligations, hence, insurers penalize you with higher premiums to cover any future losses.

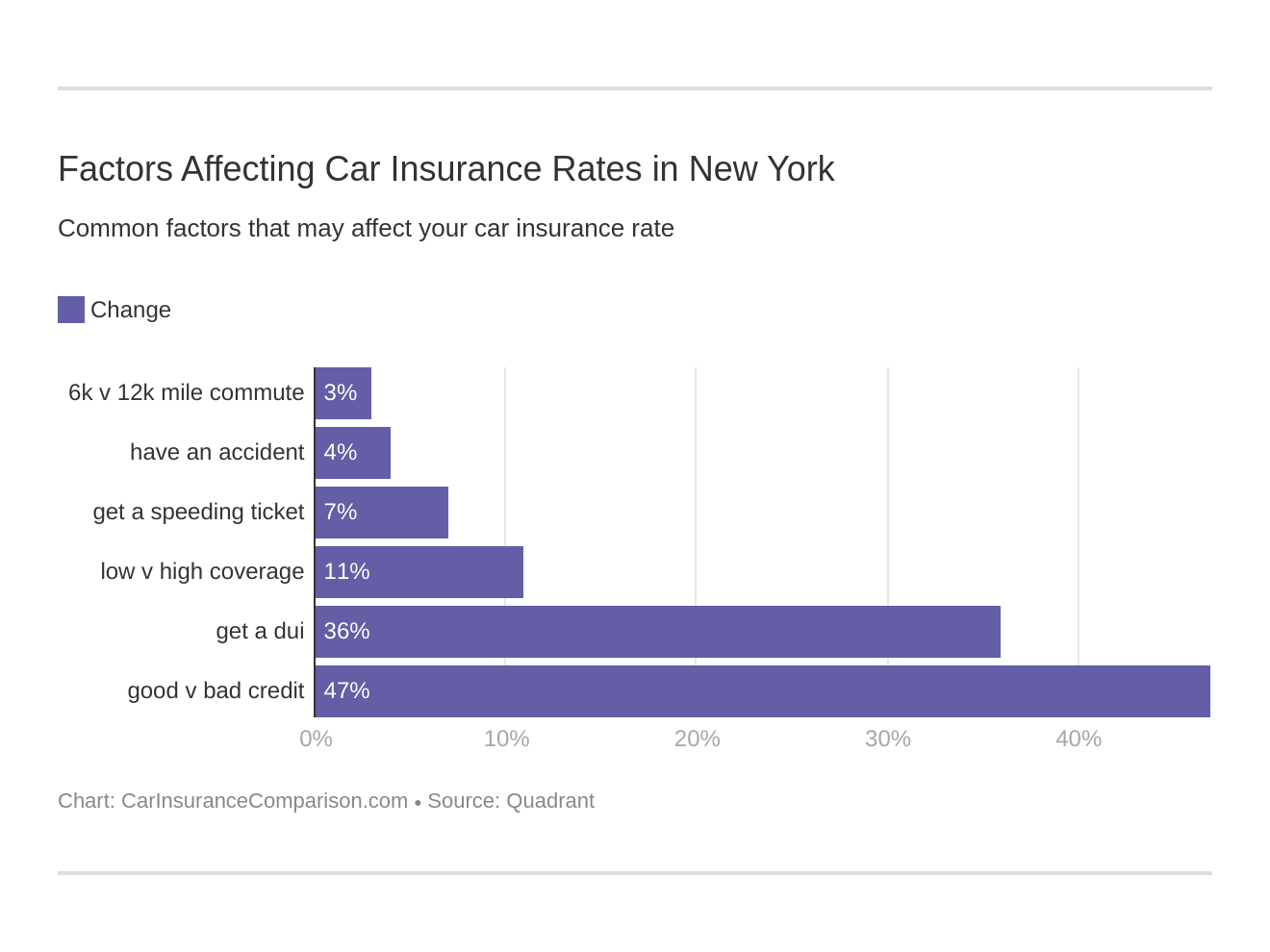

Compare New York Car Insurance Rates by Driving Record

If you have a driving under the influence (of alcohol) record on your license, insurance companies would charge a comparatively higher premium from you.

New York Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $171 | $250 | $310 | $240 |

| Geico | $145 | $230 | $270 | $210 |

| Liberty Mutual | $180 | $255 | $320 | $250 |

| Nationwide | $108 | $195 | $260 | $190 |

| Progressive | $137 | $132 | $102 | $115 |

| State Farm | $163 | $232 | $280 | $220 |

| Travelers | $223 | $290 | $350 | $270 |

| USAA | $120 | $175 | $200 | $165 |

Any record of DUI is taken more seriously than speeding violations and accidents due to the reckless nature of drunk driving. Most of the insurance carriers levy a much higher rate for such carelessness.

How Much Auto Insurance Costs in New York

Explore auto insurance rates in various New York cities – Amenia, Binghamton, Buffalo, Catskill, Clifton Park, Ellenville, New York City, and more. Gain insights into the dynamics shaping car insurance rates for informed decision-making.

New York Auto Insurance Cost by City

Understanding auto insurance rates across different cities in New York can help you make well-informed decisions tailored to your specific locale.

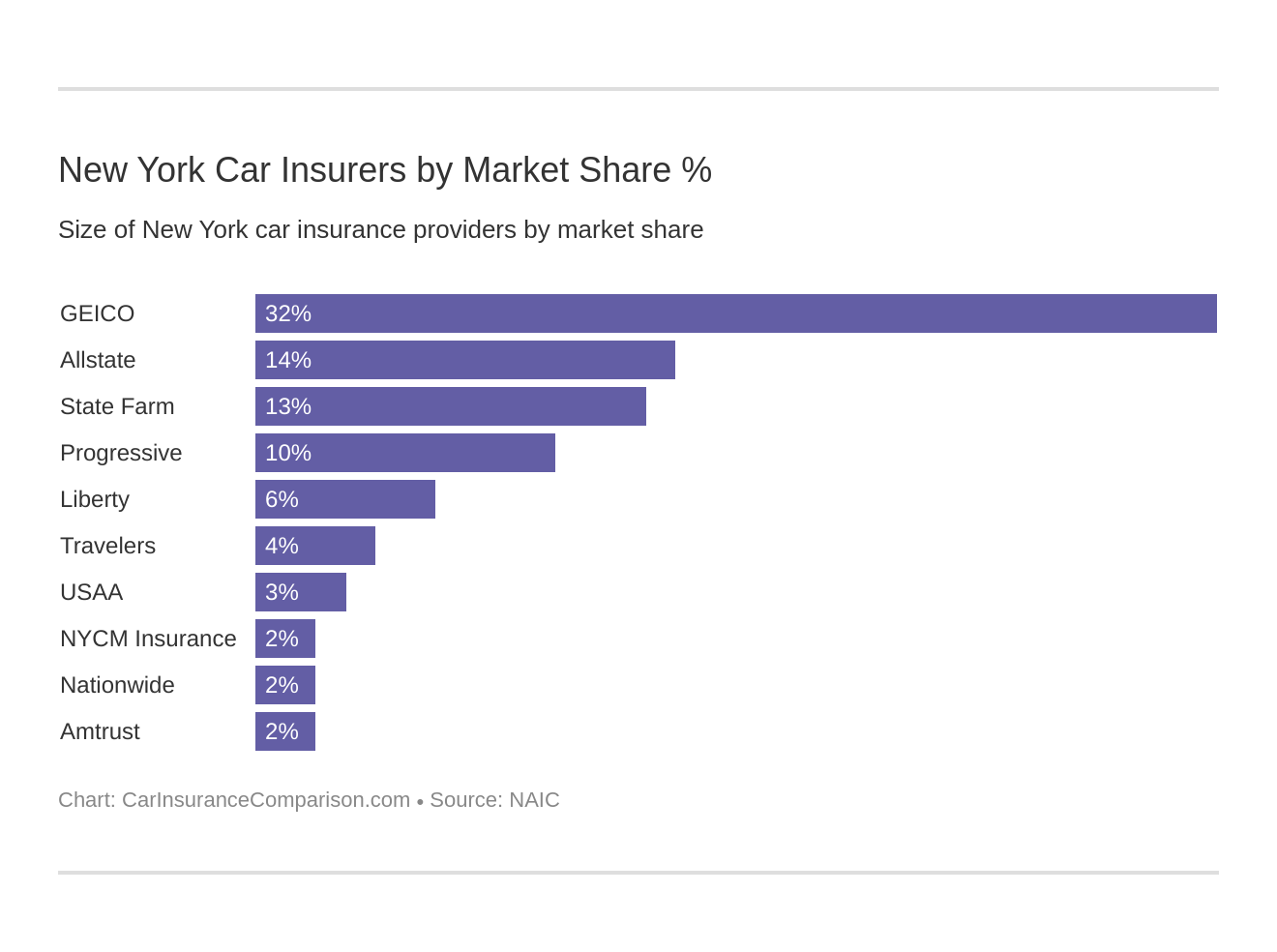

Leading Insurance Carriers in New York

Now that you have a fair idea about insurance carriers and their rates in different categories, let’s see which companies have the largest market share in New York.

Knowing the market share of car insurance providers in New York helps you understand the industry’s dynamics and competitive landscape. Use this information to evaluate the most prominent insurers and make informed decisions about which company might best meet your insurance needs based on their market presence and reliability.

Number of Insurance Carriers in New York

The table below provides a breakdown of the number of foreign and domestic insurers, highlighting the variety of options available to consumers.

Number of New York Car Insurance Companies

| Summary | Totals |

|---|---|

| Foreign | 709 |

| Domestic | 173 |

With a substantial number of both foreign and domestic insurance carriers, New York offers a wide range of choices for consumers.

State Laws in New York

Without laws in place, it would be difficult for law enforcement officers to manage traffic on roads or for the Department of Motor Vehicles to issue driving licenses.

Knowing about coverage and the best insurance carriers would help you in making the right buying decision, but it’s really important to be safe on the road. Also, if you follow the law, you would rarely get involved in accidents or speeding violations, which in turn would keep your premium rates low.

Let’s look at the laws that govern driving on the roads.

Car Insurance Laws in New York

Without car insurance laws, the oversight of insurance carriers wouldn’t be possible, which would lead to unfair practices in the market.

Car insurance laws not only help consumers by reducing the overall cost they might have to bear if involved in an accident but also provide a framework to operate for insurance carriers.

Windshield Coverage Laws in New York

Cracked, chipped, or broken windshields can be hazardous to driving as they block visibility and may shatter if hit by loose gravel or other objects. The state law of New York strictly prohibits driving with a cracked windshield that distorts visibility.

To replace a windshield, automobile owners can get an aftermarket part that is similar in quality and finish.

High-Risk Drivers in New York

If you have multiple records of speeding violations and accidents to your credit, there’s a high probability that your coverage application will be rejected by most of the insurers in New York.

High-Risk Drivers Can’t get Coverage in the Voluntary Insurance Market

Insurance carriers collect premiums from all motorists to make a pool from which they settle claims whenever there’s an accident. Through this process, insurers aim to gain from the remaining premiums after paying off claims.

If a driver tends to get involved in accidents time and again, insurers might have to bear losses on account of frequent claims settlements. As a result, they refuse coverage to those who are high-risk drivers.

Obtaining Coverage for High-Risk Drivers

Driving without auto insurance is illegal in New York, hence every motorist must obtain coverage. The state of New York offers an auto plan known as the New York Automobile Insurance Plan (NYAIP) to offer coverage to high-risk drivers.

Coverage Available for High-Risk Drivers

You must be wondering who exactly offers coverage to these high-risk drivers who accumulate losses for insurers.

Every insurer who is licensed to operate in New York has to offer coverage to a certain percentage of high-risk drivers directly proportionate to its market share.

Motorists enrolled in the NYAIP are randomly distributed among different insurers based on a pre-decided quota. Needless to say, these motorists are required to pay a significantly high premium.

Automobile Insurance Fraud in New York

Auto insurance frauds increase the premiums of New Yorkers by millions of dollars every year as it’s an enormous problem in the state.

There are two sides to car insurance fraud – one where the motorists furnish incorrect information knowingly to gain from the claim settlement amount and the other wherein medical providers pad costs to earn from procedures that were not performed.

The auto insurance system of New York is massive, with 300 auto insurers vying for their share in the state’s $10 billion in premiums, according to the Insurance Information Institute. Touted as the fourth largest system in America, the state has around nine million insured motor vehicles.

With such a large system in place, the state has witnessed many fraudulent medical practitioners and attorneys who work together to defraud auto insurance companies.

On the other side of the spectrum, motorists also participate in raising premiums for everyone by making fraudulent claims. Misrepresentation of facts on insurance applications, staging an accident, and inflating insurance claims are some of the unfair practices prevalent in the state.

Penalties: Motorists who are caught by the state committing insurance fraud are penalized through fines and prison time-varying in degree depending on the severity of the crime committed.

Statute of Limitations for Car Accidents in New York

The statute of limitations restricts the time period until which you can bring a lawsuit against the at-fault party after an accident.

In New York, if you are unable to bring a lawsuit within a period of three years from the crash, most probably your case would be rejected by the court system, unless some rare circumstance allows the extension of your deadline.

Vehicle Licensing Laws in New York

Is your driver’s license Real ID compliant? Do you know what’s the minimum age to get a learner’s permit in New York? Does the state of New York allow license renewals online?

Every state has different laws for licensing, so whether you’re new to New York or a long-time resident — you must know about the licensing laws in your state.

Real ID Compliance in New York

The Real ID Act was established as a security measure and governs the issuance of driver’s licenses and other identification cards in compliance with the law’s minimum standards.

If your license is Real ID compliant, you would be allowed entry into Federal facilities, nuclear power plants, and commercial aircraft by showing your driver’s license. New York is a Real ID compliant state. Motorists in New York can get three types of driver’s licenses – Standard, Enhanced, and Real ID.

Important Note: Your standard license won’t be accepted as proof of identification for travel by air or entry into federal buildings after October 1, 2020. If you wish to use your driver’s license for those purposes after the above-mentioned date, you would have to apply for a Real ID-compliant license.

Penalties for Driving Without Insurance in New York

In New York, owning a motor vehicle without insurance is undoubtedly unsafe, and it can lead to hefty fines along with license revocation.

The fines for driving without insurance could be up to $1,500, along with the possibility of jail time for 15 days. Also, your license would be immediately revoked for a year.

That’s not it, though. At the end of your license suspension period, you would be required to pay $750 to the DMV for the restoration of your license.

Lapse in Insurance

If you don’t plan to buy insurance because you won’t drive in the near future, you should cancel your vehicle registration and surrender your number plates. At no point in time you are allowed to keep a registered vehicle without insurance coverage.

If you’re caught driving without insurance – your vehicle could be impounded, you could be arrested, and your license & registration would be revoked by the DMV.

Proof of Auto Insurance: Insurance ID cards are accepted in both paper and electronic forms as proof of insurance in New York and can be presented when asked by the DMV during vehicle registration, by police at a traffic stop, or by a judge during summons.

Teen Driver Laws in New York

We know how restless you get when your teenage children start driving — their inexperience makes you fidgety.

Inculcating good driving habits from the beginning is vital for everyone’s safety on the roads, and that’s why you should lead by example.

Don’t be that parent who looks at their mobile phone while driving. Most of the crashes where a teenager is involved, the chief reasons for accident are speeding, distracted driving, failure to yield, inexperience, and not maintaing enough distance from vehicles.

As parents, you should ensure that your children understand the importance of safe driving. Please refer to the Parent’s Guide to Teen Driving by the NY DMV to prepare better.

Monitor your Teen Driver (TEENS): The DMV offers The Teen Electronic Event Notification Service (TEENS) in which parents receive electronic notifications when a specific event — tickets, traffic violations, license suspensions — is added to the driving record of their children.

If you feel that your kid's driving behavior is unsafe, you can withdraw their driving privileges by submitting a withdrawal of consent form to the DMV.

Jeffrey Manola Licensed Insurance Agent

Learner’s Permit: At age 16, teens can apply for a learner’s permit and start driving by passing a vision and knowledge test. You can find the nearest DMV location to write the test and prepare by studying the DMV Driver Manual and taking practice tests.

Teens with a learner’s permit must abide by certain restrictions to ensure the safety of everyone.

- You’re allowed to drive a vehicle only with a supervising adult who’s 21 or older and has a valid license.

- You aren’t allowed to drive on the following roads in New York:

- Streets that are inside a park in New York City.

- Bridges or tunnels under the jurisdiction of the Triborough Bridge and Tunnel Authority.

- Parkways in Westchester County – Hutchinson River Parkway, Cross County Parkway, Saw Mill River Parkway, and Taconic State Parkway.

- There are certain restrictions on nighttime driving as well that vary across the three different regions i.e. New York City, Long Island, and Upstate New York. Driving at night comes with risks like falling asleep at the wheel. (For more information, read our “Does car insurance cover falling asleep at the wheel?“)

Junior License: If a teen driver has successfully completed six months, he/she is eligible to get a junior license by passing the road test. The teen must have completed supervised driving of 50 hours with nighttime driving of 15 hours under the learner’s permit.

Keeping in mind the safety of everyone, junior license holders have to abide by certain restrictions.

- New York City Restrictions: Under any circumstance, if you hold a junior license, you aren’t allowed to drive in New York City.

- Upstate New York Restrictions: Driving with a junior license is allowed in Upstate New York, but you may not drive with any passengers under 21 unless they are family members. Between 9 PM to 5 AM, you can only drive between your home to school and your place of work.

- Long Island Restrictions: To drive in Suffolk and Nassau counties, you need to be under the supervision of either a parent or guardian, or driving school instructor, or someone authorized by your parents. Without a supervising adult, you’re allowed to drive between your home and a few places authorized by the state.

Unrestricted License: Those who complete a driver’s education without any record can apply for an unrestricted license at the age of 17.

License Renewal Procedure in New York

In New York, motorists are required to renew their licenses every eight years. Renewals by mail and online renewals are permitted for everyone, irrespective of age.

Important Note: If you renew your New York standard license online, your new license will not be Real ID compliant and show “not for federal purposes”. After October 2020, this standard license wouldn’t be accepted in federal buildings or for domestic travel by commercial flights.

Rules of the Road in New York

If you don’t follow the rules while driving, you will get a ticket in New York instantly.

Especially in New York City, you must strictly follow the speed limits, car seat laws, move-over laws, etc., to avoid getting stopped by the police.

Fault vs No-Fault

New York is amongst the twelve states in the US that follow the no-fault system allowing motorists to file claims with their own insurance company in the event of an accident, irrespective of fault.

To overcome the inefficiencies and delay in claim settlement under the fault system, New York adopted the no fault system in the 1970s which aimed to expedite the process of claims settlement after a crash.

Seat Belt and Car Seat Laws in New York

In New York, front-seat passengers are required to wear seat belts. Children under 16 must wear seat belts irrespective of their position in the car, and those who are under four must be put inside a child restraint system.

Choosing the Correct Child Safety Seat

The state of New York recommends motorists carefully assess the dimensions and weight capacity for car seats available in the market and select one that’s suitable for their children. There are certain basic rules to follow for child safety seats:

- All children below the age of eight must be put inside a child restraint system

- The restraint system should meet the weight and height requirements as per the Federal standards

- The car safety seat cannot be placed in the front seat

- The restraint system can mean a harness, booster seat, or child seat that is attached to the car seat

The child safety seats and restraint system must comply with the Federal Motor Vehicles Safety Standard 213. If you aren’t sure about the fitting of child seat, you can visit one of the child safety seat inspection sites in New York.

Keep Right and Move Over Laws in New York

If you’re going slower than the normal traffic speed, the law in New York states that you should move to the right lane unless you’re taking a left turn or passing traffic.

While driving, if you notice an authorized emergency stationary vehicle with flashing lights, you should move further from the vehicle to the next lane if it’s safe to do so.

Speed Limits in New York

Speed limits in New York vary depending on the type of road and the specific area to ensure safety and efficient traffic flow. Here are the designated speed limits for different types of roads in New York:

New York Speed Limits by Road Type

| Road Type | Speed Limit |

|---|---|

| Freeways and Interstates | 65 mph |

| Default Speed Limit | 55 mph |

| Divided Roads | 45 mph |

| Residential Areas | 25-45 mph |

| Slow Zones in NYC | 20 mph |

| School Zones | 15-30 mph |

The table illustrates the speed limits across New York, but it’s recommended to be careful and look for posted limits while driving, especially in the NYC area.

Ridesharing Laws in New York

Ridesharing companies, technically known as Transportation Network Companies (TNC), work on a contractual basis with their drivers, wherein the drivers aren’t direct employees of these companies. Drivers should look into rideshare insurance.

Since the TNC doesn’t own the vehicles being operated by the drivers which means they can’t be held responsible for accidents, the state government has mandated TNC’ to cover the drivers under a group policy.

The statutory limit that requires TNC to offer coverage includes:

- When the ridesharing driver is online or waiting for a pick-up request: Coverage limits for personal injury liability are $50,000 per person/$100,000 per accident, along with property damage liability of $25,000. The coverage also includes PIP of $50,000 and uninsured/underinsured (UM/UIM) coverage of $25,000/$50,000.

- When the driver is riding to pick up a person/during the ride: Drivers are covered by liability and UM/UIM coverage of $1.25 million each and PIP coverage of $50,000.

As per a Gallup poll, around 59% of Americans have shown their discomfort towards self-driving cars although people like autonomus features such as self-parking, emergency braking, and lane change assistance.

The state of New York allows testing of autonomous vehicles though there have been obstacles in the adoption of this emerging technology. The law requires a licensed driver to be behind the wheel when an autonomous vehicle is being tested, which should have insurance coverage of $5 million.

Safety Laws in New York

The reason behind most of the accidents is distracted driving or driving under the influence of alcohol and other substances. Naturally, there are strict laws to curb such behavior.

DUI Laws in New York

What are the DUI insurance laws in New York? If you’re caught drinking and driving in New York, you could lose your driving privileges and face substantial fines along with jail time.

Driving While Intoxicated (DWI): Motorists driving with a Blood Alcohol Content (BAC) of .08 or more can be booked for a DWI violation. Commercial drivers are in violation of the law if their BAC is .04 or more. Let’s look at the consequences of a DWI violation.

New York DWI Insurance Laws

| Offense Type | Mandatory Fine | Prison Term | License Suspension |

|---|---|---|---|

| First DWI | $500 - $1,000 | 1 year | Revocation for a minimum of six months |

| Second DWI within 10 years | $1,000 - $5,000 | 4 years | Revocation for a minimum of one year |

| Third DWI within 10 years | $2,000 - $10,000 | 7 years | Revocation for a minimum of one year |

Zero Tolerance Law: If you’re under 21, a BAC level between .02 and .07 falls under the purview of a DWI violation.

Distracted Driving Laws in New York

Under the state laws of New York, the use of hand-held mobile devices for texting and calling is banned for everyone.

The fines for violations can range from $50 to $450, depending on the number of offenses you commit. In addition, the violation would add five points to your record.

While driving, you should refrain from using cell phones as it can lead to disastrous accidents

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Road Dangers in New York

We are sure that you’re updated about all the state laws in New York with respect to driving and car insurance by now.

Let’s face some facts and figures that would tell you about the reasons behind accidents, fatality rates, vehicle theft data, and much more.

Vehicle Theft in New York

This section provides a detailed list of the top vehicles targeted by thieves, helping you understand the trends in vehicle theft.

Top 10 New York Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Honda Accord | 2018 | 923 |

| Honda Civic | 2020 | 557 |

| Toyota Camry | 2016 | 578 |

| Nissan Altima | 2020 | 473 |

| Dodge Caravan | 2015 | 358 |

| Ford Econoline E350 | 2006 | 377 |

| Nissan Maxima | 2015 | 388 |

| Honda CR-V | 2020 | 735 |

| Toyota Corolla | 2021 | 338 |

| Jeep Cherokee/Grand Cherokee | 2019 | 501 |

Vehicle theft remains a significant concern in New York. Stay informed about which vehicles are most targeted and take preventive measures to protect your car from theft.

Vehicle Theft by City in New York

The table below highlights the cities in New York with the highest vehicle theft rates. Understanding these figures can help you gauge the safety of different urban areas.

Top 10 New York Car Thefts by City

| City | Total |

|---|---|

| Albany | 1,178 |

| Binghamton | 100 |

| Amherst Town | 50 |

| Brighton Town | 45 |

| Amsterdam | 40 |

| Auburn | 35 |

| Bedford Town | 30 |

| Batavia | 28 |

| Bethlehem Town | 27 |

| Amityville Village | 25 |

Vehicle theft rates vary significantly by city. Use this information to stay vigilant and implement security measures if you live in or frequently visit these high-risk areas.

Fatal Crashes by Weather Conditions in New York

Explore how different weather conditions impact the occurrence of fatal crashes in New York. This section provides a breakdown of fatalities based on weather and lighting conditions.

New York Traffic Fatalities by Weather Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 409 | 238 | 128 | 36 | 1 | 812 |

| Rain | 34 | 28 | 14 | 4 | 0 | 80 |

| Snow/Sleet | 12 | 5 | 4 | 0 | 0 | 21 |

| Other | 2 | 0 | 6 | 0 | 0 | 8 |

| Unknown | 4 | 2 | 3 | 1 | 2 | 12 |

| TOTAL | 461 | 273 | 155 | 41 | 3 | 933 |

Adapting your driving to different weather conditions can significantly reduce the risk of fatal accidents. Stay aware and drive cautiously, especially in adverse weather.

Fatalities by County in New York

This section provides a detailed overview of traffic fatalities by county in New York. Understanding these trends can help identify high-risk areas.

Top 10 New York Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Bronx | 50 | 52 | 48 |

| Erie | 60 | 63 | 61 |

| Kings | 120 | 125 | 122 |

| Monroe | 40 | 43 | 42 |

| Nassau | 76 | 78 | 75 |

| New York | 45 | 48 | 47 |

| Orange | 35 | 37 | 36 |

| Queens | 61 | 64 | 62 |

| Suffolk | 145 | 148 | 146 |

| Westchester | 35 | 37 | 36 |

Awareness of fatality statistics by county can inform better safety practices and local policy decisions. Stay informed and contribute to making your county’s roads safer.

Traffic Fatalities by Road Type in New York

Compare traffic fatalities on rural and urban roadways in New York over the years. This data reveals the differences in safety between these two types of environments.

New York Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 420 |

| Urban | 690 |

Understanding the disparity in fatality rates between rural and urban areas can help you take appropriate precautions. Drive safely, regardless of your location.

Fatalities by Person Type in New York

This section provides statistics on traffic fatalities in New York, broken down by person type. Understanding these figures can help identify the most vulnerable road users.

New York Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Bicyclist and Other Cyclist | 50 |

| Bus | 10 |

| Large Truck | 35 |

| Light Truck - Other | 25 |

| Light Truck - Pickup | 40 |

| Light Truck - Utility | 55 |

| Light Truck - Van | 30 |

| Non-Occupants | 420 |

| Passenger Car | 600 |

| Pedestrian | 300 |

| Total Motorcyclists | 90 |

| Total Occupants | 800 |

| Other/Unknown Nonoccupants | 20 |

| Total | 2475 |

Awareness of fatality statistics by person type can inform better safety practices. Protect yourself and others by driving responsibly.

Fatalities by Crash Type in New York

Explore the different types of crashes that result in fatalities in New York. This data highlights the most common and deadly crash scenarios.

New York Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Single Vehicle | 920 |

| Involving a Large Truck | 210 |

| Involving Speeding | 720 |

| Involving a Rollover | 150 |

| Involving a Roadway Departure | 370 |

| Involving an Intersection (or Intersection Related) | 500 |

| Total Fatalities (All Crashes) | 2,870 |

Recognizing the types of crashes that lead to fatalities can help you avoid risky situations and adopt safer driving habits. Stay informed and drive cautiously.

Fatalities Involving Speeding by County in New York

This section examines fatalities involving speeding by county in New York. It underscores the severe impact of speeding on road safety.

New York Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Albany | 10 | 12 | 15 |

| Allegany | 3 | 4 | 5 |

| Bronx | 40 | 42 | 45 |

| Broome | 12 | 13 | 15 |

| Cattaraugus | 4 | 5 | 6 |

| Cayuga | 6 | 7 | 8 |

| Chautauqua | 5 | 6 | 7 |

| Chemung | 8 | 9 | 10 |

| Chenango | 4 | 5 | 6 |

| Clinton | 5 | 6 | 7 |

| Columbia | 7 | 8 | 10 |

| Cortland | 3 | 4 | 5 |

| Delaware | 4 | 5 | 6 |

| Dutchess | 10 | 12 | 15 |

| Erie | 45 | 47 | 50 |

| Essex | 3 | 4 | 5 |

| Franklin | 4 | 5 | 6 |

| Fulton | 5 | 6 | 7 |

| Genesee | 5 | 6 | 7 |

| Greene | 5 | 6 | 7 |

| Hamilton | 1 | 2 | 3 |

| Herkimer | 4 | 5 | 6 |

| Jefferson | 8 | 9 | 10 |

| Kings | 60 | 62 | 65 |

| Lewis | 2 | 3 | 4 |

| Livingston | 3 | 4 | 5 |

| Madison | 4 | 5 | 6 |

| Monroe | 25 | 27 | 30 |

| Montgomery | 4 | 5 | 6 |

| Nassau | 40 | 42 | 45 |

| New York | 45 | 47 | 50 |

| Niagara | 6 | 7 | 8 |

| Oneida | 10 | 12 | 14 |

| Onondaga | 20 | 22 | 25 |

| Ontario | 8 | 9 | 10 |

| Orange | 15 | 17 | 20 |

| Orleans | 4 | 5 | 6 |

| Oswego | 6 | 7 | 8 |

| Otsego | 4 | 5 | 6 |

| Putnam | 7 | 8 | 9 |

| Queens | 50 | 52 | 55 |

| Rensselaer | 5 | 6 | 7 |

| Richmond | 20 | 22 | 25 |

| Rockland | 10 | 12 | 15 |

| Saratoga | 8 | 9 | 10 |

| Schenectady | 10 | 12 | 15 |

| Schoharie | 2 | 3 | 4 |

| Schuyler | 2 | 3 | 4 |

| Seneca | 2 | 3 | 4 |

| St. Lawrence | 4 | 5 | 6 |

| Steuben | 7 | 8 | 9 |

| Suffolk | 60 | 62 | 65 |

| Sullivan | 4 | 5 | 6 |

| Tioga | 3 | 4 | 5 |

| Tompkins | 5 | 6 | 7 |

| Ulster | 10 | 12 | 15 |

| Warren | 5 | 6 | 7 |

| Washington | 4 | 5 | 6 |

| Wayne | 5 | 6 | 7 |

| Westchester | 25 | 27 | 30 |

| Wyoming | 3 | 4 | 5 |

| Yates | 2 | 3 | $4 |

Speeding significantly increases the risk of fatal accidents. Always adhere to speed limits and drive at safe speeds to ensure everyone’s safety.

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County in New York

Explore the fatalities in crashes involving alcohol-impaired drivers by county in New York. This data emphasizes the deadly consequences of drunk driving.

New York DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Albany | 8 | 10 | 12 |

| Allegany | 2 | 3 | 4 |

| Bronx | 30 | 32 | 35 |

| Broome | 10 | 11 | 13 |

| Cattaraugus | 3 | 4 | 5 |

| Cayuga | 4 | 5 | 6 |

| Chautauqua | 4 | 5 | 6 |

| Chemung | 6 | 7 | 8 |

| Chenango | 3 | 4 | 5 |

| Clinton | 4 | 5 | 6 |

| Columbia | 5 | 6 | 8 |

| Cortland | 2 | 3 | 4 |

| Delaware | 3 | 4 | 5 |

| Dutchess | 8 | 10 | 12 |

| Erie | 35 | 37 | 40 |

| Essex | 2 | 3 | 4 |

| Franklin | 3 | 4 | 5 |

| Fulton | 4 | 5 | 6 |

| Genesee | 4 | 5 | 6 |

| Greene | 4 | 5 | 6 |

| Hamilton | 1 | 2 | 3 |

| Herkimer | 3 | 4 | 5 |

| Jefferson | 6 | 7 | 8 |

| Kings | 50 | 52 | 55 |

| Lewis | 2 | 3 | 4 |

| Livingston | 2 | 3 | 4 |

| Madison | 3 | 4 | 5 |

| Monroe | 20 | 22 | 25 |

| Montgomery | 3 | 4 | 5 |

| Nassau | 35 | 37 | 40 |

| New York | 40 | 42 | 45 |

| Niagara | 5 | 6 | 7 |

| Oneida | 8 | 10 | 12 |

| Onondaga | 15 | 17 | 20 |

| Ontario | 6 | 7 | 8 |

| Orange | 12 | 14 | 17 |

| Orleans | 3 | 4 | 5 |

| Oswego | 4 | 5 | 6 |

| Otsego | 3 | 4 | 5 |

| Putnam | 5 | 6 | 7 |

| Queens | 45 | 47 | 50 |

| Rensselaer | 4 | 5 | 6 |

| Richmond | 15 | 17 | 20 |

| Rockland | 8 | 10 | 12 |

| Saratoga | 6 | 7 | 8 |

| Schenectady | 8 | 10 | 12 |

| Schoharie | 2 | 3 | 4 |

| Schuyler | 1 | 2 | 3 |

| Seneca | 2 | 3 | 4 |

| St. Lawrence | 3 | 4 | 5 |

| Steuben | 6 | 7 | 8 |

| Suffolk | 50 | 52 | 55 |

| Sullivan | 3 | 4 | 5 |

| Tioga | 2 | 3 | 4 |

| Tompkins | 4 | 5 | 6 |

| Ulster | 8 | 10 | 12 |

| Warren | 4 | 5 | 6 |

| Washington | 3 | 4 | 5 |

| Wayne | 4 | 5 | 6 |

| Westchester | 20 | 22 | 25 |

| Wyoming | 2 | 3 | 4 |

| Yates | 1 | 2 | 3 |

Driving under the influence remains a leading cause of fatal accidents. Stay responsible and never drive while impaired to protect yourself and others.

Teen Drinking and Driving in New York

In New York, there were 113 arrests for underage drinking and driving in 2016.

The national average for alcohol-impaired driving fatalities is 1.2 deaths per 100,000 people, whereas New York witnessed only 0.6 deaths per 100,000 people in 2016.

EMS Response Time in New York

Timely EMS response is crucial in saving lives after an accident. Continued efforts to improve response times can enhance the overall safety and effectiveness of emergency services in both rural and urban areas.

New York EMS Response Time by Location

| Location | Notification | Arrival |

|---|---|---|

| Rural | 3 | 11 |

| Urban | 2 | 6 |

The table above compares EMS response times in rural and urban areas of New York. Understanding these times can highlight areas for improvement in emergency services.

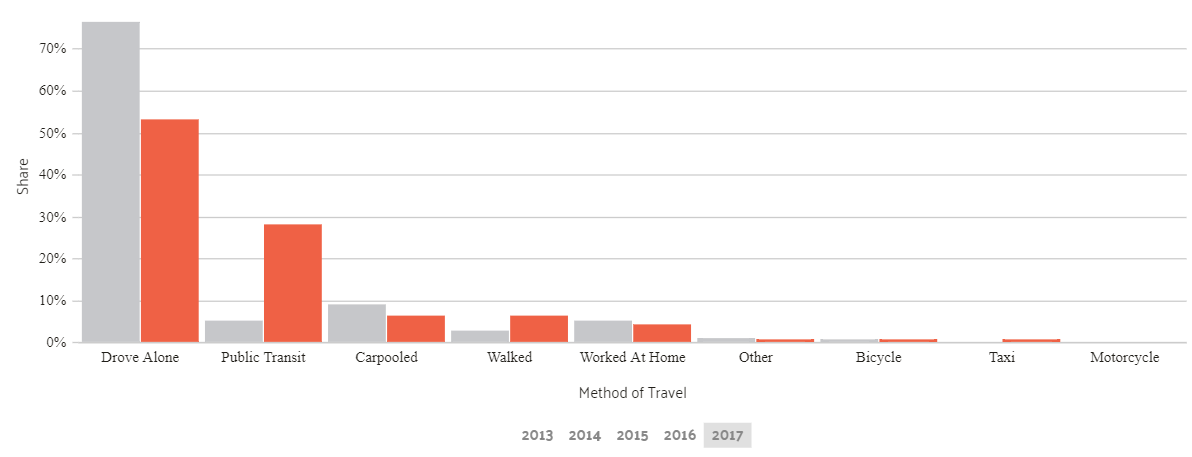

Transportation in New York

Traffic congestion on the road bothers everyone, especially the never-ending jams to commute to work in Manhattan.

The number of vehicles owned by each household and the commuting preferences of residents add to the woes of everyday commuters. Let’s see what New Yorkers prefer for transportation.

Officer goers in New York have a longer commute to work than the national average of 25.5 minutes. It takes New Yorkers 32.2 minutes to reach to work.

Traffic Congestion in New York

New York City is the 40th most congested city around the world and 4th most congested in the US. Motorists spent around 133 minutes in traffic jams in 2018 in the famous city.

In Upstate New York, the traffic in Buffalo makes it the 29th most congested city in the US, where drivers spend around 72 minutes stuck in traffic.

We know that was a lot of information to download, but it would really help you in getting better quotes on car insurance. Start comparison shopping today using our free online tool. Enter your ZIP code below to get started.

Frequently Asked Questions

What is the minimum car insurance required in New York?

In New York, the minimum car insurance requirement is liability coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage per accident.

Read More: Minimum Car Insurance Requirements by State

What factors influence the cheapest car insurance rates in New York?

Factors include your driving record, coverage levels, vehicle type, credit score, and annual mileage.

What are the options for financial responsibility in New York besides buying insurance?

In addition to buying insurance coverage, alternatives for meeting the financial responsibility requirement in New York include keeping a security deposit of $150,000 with the New York DMV, maintaining a surety bond that covers the minimum state coverage requirement, or qualifying for self-insurance if you own 25 or more vehicles.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How can I find the cheapest car insurance rates in New York?

Compare quotes from different providers, adjust coverage levels, and use online tools to find the best rates.

What additional liability coverage options are available in New York?

In New York, you can enhance your coverage with options like guaranteed auto protection (gap), personal umbrella policy (pup), rental reimbursement, emergency roadside assistance, mechanical breakdown insurance, non-owner car insurance, modified car insurance, classic car insurance, and pay-as-you-drive or usage-based insurance.

Read More: Best Rental Car Reimbursement Coverage

Does having a good driving record help in getting cheaper car insurance rates in New York?

Yes, maintaining a good driving record can significantly reduce your car insurance rates in New York. Insurance companies often offer lower premiums to drivers with clean records as they are considered lower risk.

How can high-risk drivers obtain car insurance in New York?

High-risk drivers in New York can obtain coverage through the New York Automobile Insurance Plan (NYAIP), which is an auto plan designed to provide coverage to drivers who have been rejected by other insurers due to their high-risk status. The NYAIP assigns high-risk drivers to different insurers based on a pre-determined quota.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Are there specific discounts available for low-mileage drivers in New York?

Yes, many insurance providers offer discounts for drivers with low annual mileage. If you drive fewer miles, you may qualify for reduced premiums due to the decreased risk of accidents.

What are the penalties for driving without insurance in New York?

Driving without insurance in New York can result in fines of up to $1,500, possible jail time for 15 days, and a license revocation for one year. Additionally, after the license suspension period, a fee of $750 must be paid to the DMV for license restoration.

What types of additional coverage can affect the cost of my car insurance in New York?

Additional coverage options like Guaranteed Auto Protection (Gap), Rental Reimbursement, and Emergency Roadside Assistance can impact your car insurance costs. While these add-ons may increase your premium, they provide extra protection and convenience.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.