Cheapest Oklahoma Car Insurance Rates in 2026 (Big Savings With These 10 Companies!)

Find the cheapest Oklahoma car insurance rates with USAA, State Farm, and Travelers, offering rates as low as $22 monthly. These companies stand out for their affordability and excellent service, making them top choices for drivers in Oklahoma. Compare quotes to find the best coverage for your needs today.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated November 2024

Company Facts

Min. Coverage for Oklahoma

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Oklahoma

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Oklahoma

A.M. Best Rating

Complaint Level

When seeking the cheapest Oklahoma car insurance rates, USAA, State Farm, and Travelers emerge as top contenders, offering premiums as low as $22 per month. USAA stands out not only for its affordability but also for its exclusive benefits for military personnel. Compare quotes to find the optimal coverage that suits your needs and budget.

While finding the cheapest car insurance in Oklahoma doesn’t take much work, some drivers will see higher rates than others.

Our Top 10 Company Picks: Cheapest Oklahoma Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A++ Military Savings USAA

#2 $29 B Many Discounts State Farm

#3 $34 A++ Accident Forgiveness Travelers

#4 $35 A++ Cheap Rates Geico

#5 $36 A+ Online Convenience Progressive

#6 $38 A Student Savings American Family

#7 $40 A+ Usage Discount Nationwide

#8 $44 A+ Add-on Coverages Allstate

#9 $45 A Local Agents Farmers

#10 $60 A Customizable Polices Liberty Mutual

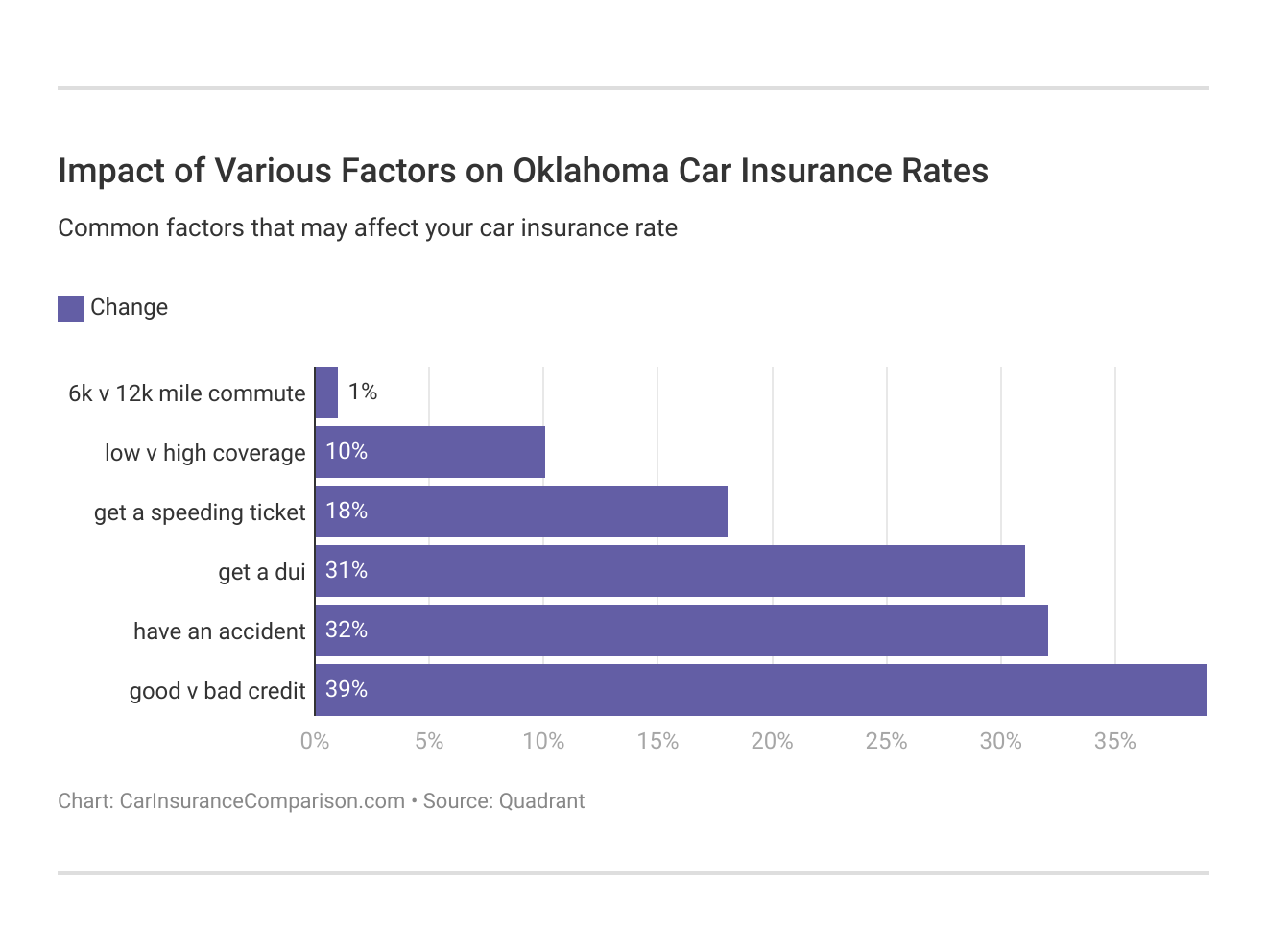

For example, Oklahoma car insurance costs more for drivers with an accident in their driving record or a low credit score.

Discover the best car insurance rates in Oklahoma and compare policies to find your ideal coverage. Find cheap car insurance quotes by entering your ZIP code above.

- Factors like driving history, vehicle type influence rates

- Understand Oklahoma insurance laws for coverage needs

- USAA offers Oklahoma’s cheapest rates at $22 per month

- Compare Oklahoma Car Insurance Rates

- Best Stillwater, OK Car Insurance in 2026

- Best Owasso, OK Car Insurance in 2026

- Best Miami, OK Car Insurance in 2026

- Best Maysville, OK Car Insurance in 2026

- Best Lawton, OK Car Insurance in 2026

- Best Keota, OK Car Insurance in 2026

- Best Guymon, OK Car Insurance in 2026

- Best Eufaula, OK Car Insurance in 2026

- Best Enid, OK Car Insurance in 2026

- Best Boswell, OK Car Insurance in 2026

- Best Altus, OK Car Insurance in 2026

#1 – USAA: Top Overall Pick

Pros

- Lowest Rates for Military Families: USAA offers the cheapest car insurance in Oklahoma at $22 per month, making it an unbeatable option for military members and their families seeking substantial savings on their premiums. Learn more in our USAA car insurance review.

- Exceptional Military Benefits: USAA provides unique benefits tailored to military personnel, such as lower rates and specialized coverage options, which contribute to its status as the top choice for affordable car insurance in Oklahoma.

- High Customer Satisfaction: Consistently rated highly for customer service, USAA ensures a positive experience with its affordable car insurance, with a reputation for efficient claims handling and personalized support for its members.

Cons

- Eligibility Limitations: USAA’s coverage is exclusive to military members, veterans, and their families, meaning a significant portion of the population in Oklahoma cannot access these low rates and benefits.

- Online-Only Service: The predominantly online and phone-based service model may not appeal to those in Oklahoma who prefer face-to-face interactions with insurance agents, potentially limiting accessibility and personalized support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best For Many Discounts

Pros

- Competitive Rates with Discounts: State Farm offers affordable rates starting at $29 per month, coupled with a range of discounts, such as multi-policy and safe driver discounts, that further enhance savings for Oklahoma drivers.

- Extensive Local Agent Network: With numerous local agents across Oklahoma, State Farm provides personalized service and expert advice, which is beneficial for finding the best rates and coverage tailored to individual needs.

- Flexible Payment Options: State Farm provides various payment options and plans, including monthly, quarterly, and annual payments, allowing for greater flexibility in managing your insurance costs.

Cons

- Average Rate Comparisons: While State Farm’s rates are competitive, they are not the absolute lowest in the market, with the average monthly cost of $29 being higher than USAA’s rates, which might be a drawback for budget-conscious drivers.

- Mixed Customer Service Reviews: Some customers report inconsistent experiences with State Farm’s claims processing and customer service, which could impact satisfaction despite the company’s affordable rates. More information about their rates in our State Farm car insurance review.

#3 – Travelers: Best For Accident Forgiveness

Pros

- Accident Forgiveness Benefit: Travelers provides accident forgiveness, which helps keep rates from increasing after your first at-fault accident, a valuable feature for drivers in Oklahoma seeking to avoid rate hikes despite affordable starting rates of $34 per month.

- Strong Financial Ratings: With an A++ financial rating, Travelers is a secure choice for affordable car insurance in Oklahoma, ensuring that even with competitive rates, the company maintains financial strength and reliability.

- Customizable Coverage Options: Travelers offers a variety of add-ons and customizable coverage options, allowing Oklahoma drivers to tailor their policies according to personal needs while benefiting from competitive rates. See more details on our Travelers car insurance review.

Cons

- Higher Average Monthly Rate: Although Travelers’ rates start at $34, this is higher compared to the lowest options like USAA, which could be a disadvantage for those seeking the absolute lowest premiums.

- Limited Discount Availability: While offering accident forgiveness, Travelers’ discount options may not be as extensive as competitors such as State Farm, potentially limiting overall savings opportunities for drivers in Oklahoma.

#4 – Geico: Best For Cheap Rates

Pros

- Affordable Premiums: Geico offers competitive car insurance rates in Oklahoma, starting at $35 per month, making it a budget-friendly choice for those seeking low-cost coverage without compromising on essential services.

- User-Friendly Online Services: Geico’s efficient online platform and mobile app simplify policy management and claims filing, enhancing convenience for Oklahoma drivers who prefer managing their insurance digitally. Learn more in our Geico car insurance review.

- Diverse Discount Opportunities: Geico provides a range of discounts, including for good drivers and federal employees, which can further reduce rates and provide additional savings for Oklahoma residents.

Cons

- Limited Local Agent Access: Geico’s focus on online service means there are fewer local agents available in Oklahoma, which may not be ideal for those who value in-person interactions for personalized service.

- Mixed Customer Service Reviews: While generally positive, Geico’s customer service reviews are more mixed compared to some competitors, potentially affecting the overall experience despite its low rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best For Online Convenience

Pros

- Innovative Online Tools: Progressive offers advanced online tools, such as the Snapshot program, which tracks driving habits and can help safe drivers in Oklahoma lower their premiums, making it a tech-savvy choice for affordable insurance.

- Wide Coverage Options: With a broad range of coverage options and add-ons, including rental car reimbursement, Progressive provides comprehensive insurance solutions at competitive rates starting at $36 per month.

- Usage-Based Discounts: Progressive’s Snapshot program allows for potential savings based on actual driving behavior, providing an opportunity for Oklahoma drivers to reduce their insurance costs by demonstrating safe driving practices.

Cons

- Potential Rate Increases: Some customers report significant rate hikes upon policy renewal with Progressive, which could impact long-term affordability despite the initial competitive rate of $36 per month. Learn more about their rates in our Progressive car insurance review.

- Average Customer Satisfaction: Progressive’s customer service and claims handling receive average ratings, which may be a concern for those prioritizing high-quality support alongside affordable insurance rates.

#6 – American Family: Best For Student Savings

Pros

- Student Discounts: American Family offers valuable discounts for students with good grades, making it a cost-effective option for families with young drivers in Oklahoma, starting at $38 per month for basic coverage.

- Personalized Local Service: With a network of local agents, American Family provides personalized service and attention to detail, which is beneficial for Oklahoma drivers seeking tailored insurance solutions and expert advice.

- Solid Financial Stability: American Family’s A financial rating indicates strong financial stability, ensuring reliable and affordable insurance options for Oklahoma drivers seeking dependable coverage. More information about their stability in our American Family car insurance review.

Cons

- Higher Average Premiums: At $38 per month, American Family’s rates are higher than some competitors, which could be a disadvantage for those prioritizing the lowest possible car insurance rates in Oklahoma.

- Limited Availability: American Family may not be accessible in all areas of Oklahoma, potentially limiting options for drivers seeking their coverage and discounts in certain regions of the state.

#7 – Nationwide: Best For Usage Discount

Pros

- Usage-Based Discount: Nationwide’s SmartRide program offers a usage-based discount for safe driving, allowing Oklahoma drivers to potentially lower their premiums based on their driving behavior, starting at $40 per month. Check out their ratings in our complete Nationwide car insurance discount.

- Comprehensive Coverage Options: Nationwide provides a wide range of coverage options and add-ons, ensuring that drivers in Oklahoma can find a policy that meets their specific needs while benefiting from competitive rates.

- Financial Security: With an A+ financial rating, Nationwide offers a secure and reliable choice for affordable car insurance, ensuring stability and confidence for Oklahoma drivers seeking dependable coverage.

Cons

- Moderate Monthly Rates: With an average rate of $40 per month, Nationwide’s premiums are higher compared to some of the cheapest options, which might be a drawback for budget-conscious drivers in Oklahoma.

- Mixed Customer Reviews: Customer feedback on Nationwide’s claims handling and customer service is varied, which may impact overall satisfaction despite the competitive rates and available discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best For Add-on Coverages

Pros

- Extensive Add-On Coverages: As mentioned in our Allstate car insurance review, Allstate offers a wide range of add-on coverages, such as accident forgiveness and new car replacement, providing additional value for drivers in Oklahoma who need extra protection beyond basic insurance.

- Strong Financial Ratings: With an A+ financial rating, Allstate ensures financial stability and reliability, making it a dependable choice for affordable car insurance despite the higher starting rate of $44 per month.

- Local Agent Availability: Allstate’s network of local agents provides personalized service and expert advice, which is beneficial for Oklahoma drivers seeking tailored insurance solutions and support.

Cons

- Higher Premiums: At $44 per month, Allstate’s rates are on the higher side compared to other options, which could be a drawback for those specifically looking for the cheapest car insurance rates in Oklahoma.

- Average Customer Satisfaction: Customer satisfaction ratings for Allstate are average, with some complaints about claims processing, which may affect the overall experience despite the comprehensive coverage options.

#9 – Farmers: Best For Local Agents

Pros

- Personalized Local Service: Farmers is known for its extensive network of local agents, providing personalized service and tailored insurance solutions for drivers in Oklahoma, starting at $45 per month.

- Comprehensive Coverage Options: Farmers offers a variety of coverage options and add-ons, ensuring that Oklahoma drivers can find a policy that meets their specific needs and preferences while maintaining affordability.

- Solid Financial Stability: With a strong financial rating, Farmers provides reliable and stable insurance coverage, ensuring confidence in the quality of service and protection for Oklahoma drivers. Learn more in our Farmers car insurance review.

Cons

- Higher Average Rates: At $45 per month, Farmers’ premiums are higher than many competitors, which may be a disadvantage for those prioritizing the lowest possible car insurance rates in Oklahoma.

- Limited Discounts: Farmers offers fewer discounts compared to other leading insurers, which might limit potential savings opportunities for drivers in Oklahoma seeking the most cost-effective coverage.

#10 – Liberty Mutual: Best For Customizable Policies

Pros

- Customizable Policies: Liberty Mutual provides highly customizable policies with various coverage options and add-ons, allowing Oklahoma drivers to tailor their insurance according to individual needs, starting at $60 per month.

- Good Financial Health: With an A financial rating, Liberty Mutual ensures strong financial stability, providing a secure and reliable choice for drivers in Oklahoma despite the higher premium costs.

- Robust Online Tools: Liberty Mutual offers advanced online tools for managing policies and filing claims, enhancing convenience for Oklahoma drivers who prefer digital interactions with their insurance provider.

Cons

- Potential for Rate Increases: Liberty Mutual may adjust rates based on factors like claims history or policy renewals, leading to potentially higher costs over time despite initial savings.

- Limited Discount Impact: While discounts are available, they may not be sufficient to significantly offset the higher base premiums, resulting in less overall savings compared to lower-cost providers. Learn more in our Liberty Mutual car insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Oklahoma Car Insurance Companies

When you move to Oklahoma, you’re going to have dozens and dozens of provider options. Choosing one to stick with isn’t easy, especially when you’re not in the mood to spend hours comparing rates and policies yourself or using a car insurance calculator.

Oklahoma Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $44 $135

American Family $38 $118

Farmers $45 $136

Geico $35 $109

Liberty Mutual $60 $184

Nationwide $40 $122

Progressive $36 $110

State Farm $29 $91

Travelers $34 $105

USAA $22 $68

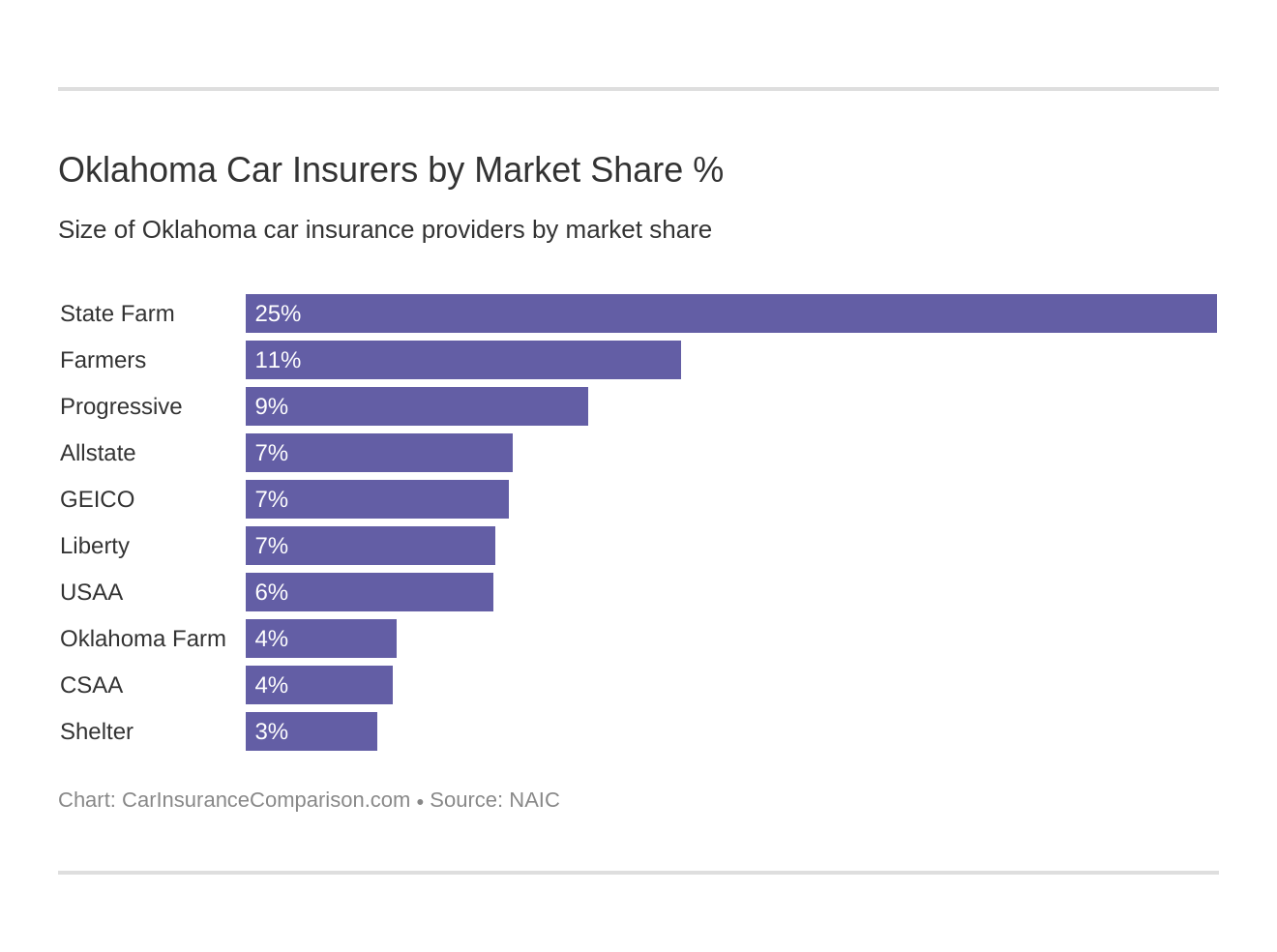

That’s where we come in, and your life gets a little easier. We’ve taken a look at all of the car insurance providers in the state of Oklahoma, broken down their financial ratings, and pitted them against each other so that you can see which provider will serve you best. We’ve also included AM best ratings, market share percentages, and customer complaints, just for kicks.

So, what are you waiting for? Take a look at the best insurance companies in Oklahoma and see if your perfect provider is on one of our lists.

Car Insurance Companies with Most Complaints in Oklahoma

Comparatively, take a look at the insurance providers who’ve garnered the most complaints in the state of Oklahoma. The worst car insurance companies in America often have lots of complaints. (For more information, read our “Traits of the Worst Car Insurance Companies“).

Oklahoma Car Insurance Companies With the Highest Complaint Index

| Insurance Company | Rank | Complaint Index | Total Complaints |

|---|---|---|---|

| CSAA | #1 | 1.62 | 30 |

| Liberty Mutual | #2 | 1.51 | 85 |

| Farmers | #3 | 1.48 | 67 |

| Shelter | #4 | 1.5 | 34 |

| Farm Bureau | #5 | 1.38 | 39 |

| Progressive | #6 | 1.35 | 123 |

| Allstate | #7 | 1.24 | 105 |

| USAA | #8 | 1.25 | 52 |

| Geico | #9 | 1.22 | 180 |

| State Farm | #10 | 1.2 | 249 |

While these complaints aren’t necessarily reflective of a company’s ability to provide for those whom it insures, it does reflect a provider’s ability to communicate with individuals and resolve issues with coverage.

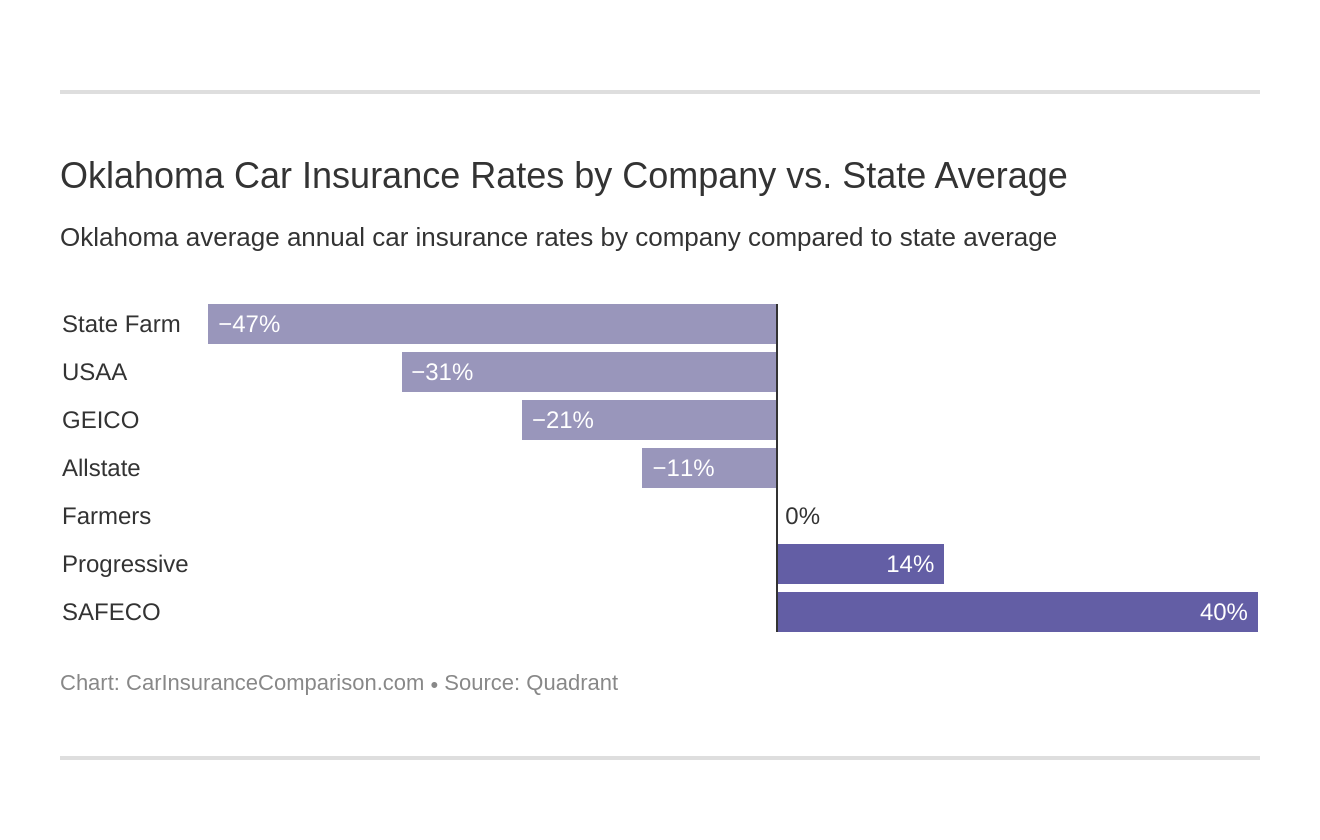

Oklahoma Car Insurance Rates by Company as Compared to the National Average

As you can see, for drivers in Oklahoma, State Farm Mutual and USAA have monthly rates that are significantly lower than the national average, meaning that they’ll be more affordable in the long run.

Comparatively, Progressive Northern and SAFECO Insurance of America have rates that expand on or are higher than the national average rate of coverage.

Coverage Cost as Determined by Different Annual Commutes

Some of the time, your commute can add a few extra dollars to your car insurance coverage, but that really depends on where you’re living.

Oklahoma Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $145 | $165 |

| American Family | $140 | $160 |

| Amica | $135 | $155 |

| Farmers | $155 | $175 |

| Geico | $125 | $140 |

| Liberty Mutual | $150 | $170 |

| Progressive | $99 | $110 |

| State Farm | $110 | $125 |

| The Hartford | $130 | $150 |

| USAA | $120 | $135 |

| U.S. Average | $118 | $124 |

As you can see, the car insurance providers in Oklahoma don’t put too much stake in the difference between a 10-mile commute and a 25-mile commute.

USAA, Geico, and State Farm, however, stand out by adding roughly one hundred dollars to your bill when you insure a longer commute. If your morning drive goes on for a little longer than you’d like, then you may want to consider how it’ll impact your monthly car insurance costs. You can purchase usage-based car insurance if you prefer to be charged by the amount you drive.

How Much Auto Insurance Costs in Oklahoma

Car insurance rates can vary significantly across Oklahoma cities, reflecting local factors and coverage needs. Exploring these costs can help you identify the best options for your area and budget.

Oklahoma Car Insurance Cost by City

Understanding car insurance costs across different Oklahoma cities can help you make informed decisions and find the best rates. Compare quotes based on your specific location to ensure you’re getting the most competitive coverage.

Compare Oklahoma Car Insurance Rates by ZIP Code

Then again, we can’t forget one of the tenets of life: it’s all about location, location, location. How is your ZIP code impacting your Oklahoma car insurance costs? Take a look.

That minor difference and all the others in between is what makes researching and comparing available car insurance companies so important, especially when you’re just moving into a new area and need to update your car insurance.

Summary from Oklahoma Statistics Summary

| Oklahoma Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 112,637 Vehicle Miles Driven: 47.7 billion |

| Driving Deaths | Speeding: 143 Drunk Driving: 683 |

| Vehicles | Registered: 3.4 million Total Stolen: 10,583 |

| Most Popular Vehicle | Ford F-150 |

| Average Premiums (Annual) | Liability: $461.01 Collision: $318.47 Comprehensive: $225.84 Combined Premium: $1,005,32 |

| Percentage of Motorists Uninsured | 10.50% State Rank: 31th |

| Cheapest Provider | State Farm Mutual Auto |

Just the mention of Oklahoma conjures visions of bright blue skies, golden and rocky landscapes, and miles upon miles of open road. That opportunity to satisfy your wanderlust isn’t the only variety that the great state of Oklahoma has to offer.

For every mile of interstate, there’s a car insurance company offering the state’s 3,943,079 residents coverage and rate options meant to keep those roadways busy.

Sometimes, though, variety can be overwhelming. As you sift through Oklahoma’s available car insurance providers and their policies, you’ll likely find yourself wondering:

- Which provider is going to protect my car most effectively?

- Who has the cheapest car insurance in Oklahoma?

- How carefully should I drive in order to stay within the letter of my policy and Oklahoma’s driving laws?

- Is car insurance mandatory in Oklahoma?

The good news is that you don’t have to answer those questions on your own.

It’s important to find the best rates and coverage for your car, and we’re more than happy to help guide you along your car insurance adventure. You can start comparison shopping today with our free online tool. Just enter your ZIP code in order to get started.

Compare Oklahoma Car Insurance Coverage and Rates

Traveling through Oklahoma is a treat. The “Sooner State” is home to some of the most beautiful natural attractions in the United States, and its cities are bustling with energy. Oklahoma City, after all, was ranked among the top 100 places to live by US News.

When you opt to settle in the expanse of the Sooner State, though, you’ll have to have a handle on the average vehicle operating costs and the way the state’s coverage and cost may impact your lifestyle, especially when compared with the other states.

The most difficult part of auto insurance research is finding a place to start. Let’s find our feet by breaking down your Oklahoma car insurance options.

Oklahoma, at a minimum, requires its drivers to have liability insurance on hand. That coverage consists of bodily injury and property damage coverage, as seen below.

Oklahoma Car Insurance Requirements

Liability car insurance is the insurance you’ll need in order to be compensated for property damage or injuries that come as a result of a car accident for which you or anyone you’re insuring are responsible.

If you happen to be the driver at fault, you’ll fall under Oklahoma’s “at fault” legislation, as the state makes the driver at fault liable for any injuries caused by or property damaged in an auto accident.

Minimum liability coverage in Oklahoma, needs to consist of:

- $25,000 to cover the injury or death per person

- $50,000 to cover the total injury or death per accident

- $25,000 to cover damage to personal property per accident

It’s worth noting again that this is the absolute minimum coverage required of drivers by the state of Oklahoma. If, after an accident, it’s possible that your minimum liability coverage won’t provide you with enough funds to take responsibility for any injuries or property damage.

In order to prevent placing yourself in an awkward situation, you’ll want to consider adding additional coverage to your plan.

Oklahoma’s Required Forms of Financial Responsibility

When driving or owning a car in Oklahoma, you’ll have to keep proof of coverage with your vehicle at all times in order to comply with the state’s legislation requiring proof of vehicular financial responsibility. There are three different forms available to you that serve as acceptable insurance proof.

These include:

- Valid Liability Insurance ID Card(s)

- Copies of your current car’s insurance policy

- Valid Insurance Binder (this is a temporary form of car insurance and should not be substituted for a form of financial responsibility in the long term)

If you live and drive in Oklahoma, you must have at least one of the above-listed approved forms of proof of financial security on your person or in your glove box while operating your vehicle.

Without one of these forms, you are likely to face legal consequences. If you’re caught driving uninsured or without proof of insurance, you risk the following:

- Fine up to $250

- 30 days in jail

- Suspension of your driver’s license

- Suspension of your vehicle’s registration

Most, if not all, insurance providers make it easy for you to print out verification of your policy. Don’t procrastinate or dawdle. Driving without proof of insurance in Oklahoma isn’t worth the hassle.

Compare Oklahoma Car Insurance Rates as a Percentage of Income

What is disposable personal income, or DPI? DPI serves as the amount of money available to a single person that can be spent post-tax payments.

What does this mean for the folks in Oklahoma? Well, after tax season passes, the majority of Oklahoma residents will have $3,311 available to them on a monthly basis that can be spent on general necessities, including food, rent, and utilities.

That’s not too much of a budget to operate on, which means that an Oklahoman has to think carefully about what kind of car insurance she wants to invest in.

The careful Oklahoman can spend up to 2% of their DPI on monthly car insurance payments, or $82 per month. That means that, over the course of a year, residents of Oklahoma will spend an average of $986 on comprehensive car insurance.

If you’re trying to figure out how to divvy up your paycheck with that kind of payment in mind, don’t fret. American Consumer Credit Counseling recommends that you save 20% of every paycheck you get in order to ensure that you have a little bit of wiggle room in your budget each month. If we take the average Oklahoman DPI in mind, that percentage comes in at $662 a month.

Even so, you’ll want to do everything you can to make sure that you’re getting the best cheap car insurance coverage for the most forgiving price. That’s why we’re here to help you make sure you’re considering all of your options from every angle.

Compare Oklahoma Car Insurance Rates by Coverage Types

The monthly costs in the graph below reflect the amount of money you might expect to spend to maintain liability, collision, comprehensive, or combined car insurance over the course of a year. You can see below how monthly costs vary from state to state.

What do you do in the face of rising insurance costs? Remember: At an absolute minimum, Oklahoma drivers and vehicle owners are required to apply for and operate with liability coverage.

However, because Oklahoma is an “at-fault” state and will pin you, if you’re the driver at fault, with the check for any injuries or property damage done unto another driver, you’ll want to put a little more money down on your vehicular future.

Oklahoma’s Additional Liability Coverage

MedPay and Uninsured or Underinsured Motorists coverage are some of the most popular coverage options to add to a standard car insurance policy. Why? Let’s break them down.

Oklahoma Car Insurance Loss Ratio vs. U.S. Average

| Loss Ratio | Oklahoma | U.S. Average |

|---|---|---|

| Medical Payments (MedPay) | 63% | 66% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 65% | 63% |

MedPay, to start, will cover any medical payments you may have to make after an accident, meaning that the coverage will make it easier for you to afford any hospital bills that another driver may receive.

Uninsured and Underinsured Motorist coverage will have your back in case you’re in a car accident with someone who doesn’t have enough insurance to cover your expenses. This is an especially important add-on to consider, as 10.5% of drivers in Oklahoma were uninsured.

Oklahoma as a whole ranks 31st in the United States for the number of uninsured motorists it has operating on the road.

Do yourself and another driver a favor, then, and look into UM — it could keep both of you from going bankrupt after an accident.

Oklahoma Loss Ratios

Another thing worth noting: overall, car insurance providers in Oklahoma have lower loss ratios than most. Loss ratios across the nation ranged from 94-112 percent. Comparatively, Oklahoma’s loss ratios have decreased in the past several years.

How does that apply to you? Well, car insurance providers who have higher loss ratios are statistically noted to pay out more claims than those with low ratios.

That higher loss ratio serves as a double-edged sword – you’ll receive a payment if you’re in an accident, yes, but your car insurance provider is also losing money, overall, and risking bankruptcy.

Comparatively, car insurance providers with loss ratios on the lower end are not paying out on claims. Again, we’re stuck between a rock and a hard place. You might not receive as much or any payment when you get in an accident, but at least the company will still be able to cover you in the long run.

Our best advice to you is to avoid signing with car insurance providers who have loss ratios on the high or low side of things. In this case alone, finding a company that’s average is your best course of action.

Oklahoma Add-ons, Endorsements, and Riders

Those aren’t the only insurance add-ons that you can consider as an Oklahoman. There are additional affordable and efficient extras that you can include in your coverage without a problem.

If you’re looking to expand your car insurance coverage as an Oklahoma citizen, you have the option of including:

- Guaranteed Auto Protection (Gap)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Including these add-ons can enhance your protection and offer financial security, making sure you’re covered no matter what happens on the road. Be sure to discuss these options with your insurance provider to create the most comprehensive plan for you.

Compare Oklahoma Car Insurance Rates by Age and Gender

One driving myth claims that male drivers — and particularly younger male drivers — are likely to pay more for their insurance coverage due to a perceived recklessness on the road. This isn’t necessarily the case, but some insurance companies keep it in mind.

As you can see, the coverage rates in Oklahoma reflect that sentiment, showing that males often pay more for their auto coverage than females. It might surprise you to learn, though, that the reverse is true in many other states.

Oklahoma is one of only a few states wherein males are charged more for their car insurance than females, suggesting a dismissal of that pesky, gender-based driving myth.

In fact, Oklahoma is even making moves towards lessening the difference between the cost of car insurance for males and the cost for females.

Even so, be aware of how your gender might impact how you’re charged for your insurance. Your driving record, though, still remains the most important factor in determining overall coverage costs.

Oklahoma’s State Laws

So: we’ve talked about coverage, average monthly rates, and the potential ways you can increase or decrease your overall insurance payments. One of the best ways to avoid a spike in the payments your provider requires of you is to comply with your state’s driving laws.

Now, state laws can be challenging to get a grip on, especially if you’re a new resident. Each state has its own policies on speed limits, seat belt usage, and driving under the influence of either alcohol or marijuana.

You can’t defend yourself from an insurance bump or a legal fine, though, by pleading ignorance. When you familiarize yourself with Oklahoma’s state laws, you’re doing preventative work that’ll save your wallet in the long run.

We’ve done some of that work for you here. Take a look at our compact guide to Oklahoma’s state laws, and do what you can to stay out of trouble. You sometimes should consult a car insurance attorney for more legal advice.

Oklahoma’s Car Insurance Laws

We’ve mentioned that Oklahoma requires minimum insurance coverage for any drivers who live in the state as residents or who have vehicles registered with the state’s DMV. As an Oklahoma resident or driver, you’re also required to have proof of financial responsibility for your vehicle on you while driving.

What happens, though, if you move to Oklahoma with a driving record that isn’t so stellar? It doesn’t matter if you happen to own a car. Car insurance providers do not have to provide you with coverage if they think that your driving record will cost them an exceptional amount of money in the long run.

In other words, no car insurance company is required to cover a “high-risk” driver.

Luckily, the Oklahoma DMV recommends that drivers who can’t find coverage through a car insurance provider can turn to Oklahoma’s Automobile Insurance Plan. With that kind of option available to them, drivers in Oklahoma have no excuse for not having coverage.

Oklahoma’s High-Risk Insurance

Accidents, though, are called accidents for a reason. Some of us are going to end up with marks on our driving records, no matter how careful we are. In Oklahoma, drivers with accidents on their driving records are considered “high-risk drivers.” These drivers need to file an SR-22 form in order to apply for high-risk insurance.

You’ll need to file an SR-22 form if:

- Your license has been suspended or revoked due to a DUI/DWI

- You have no insurance and are in a vehicular accident

- You have been involved in an accident that’s caused severe injury to another driver

- You are caught driving while uninsured

- There are a significant number of points on your driving record

These discounts below can significantly impact rates by offering savings based on factors helping to lower monthly premiums.

These discounts from top insurance providers in Oklahoma offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Low-Cost Oklahoma Car Insurance Coverage

Unfortunately, Oklahoma does not provide its low-income families with a government-sponsored car insurance program, meaning that if you can’t afford car insurance, you cannot rely on the state government to support you.

Some states offer their low-income families this level of support, but that’s no need to fret. By carefully examining your needs and comparing the providers available to you, you can find a car insurance plan that fits your lifestyle.

Oklahoma Windshield Coverage Laws

Oklahoma does not require you to replace your windshield when it gets cracked or broken. Insurers, too, are not required to replace your windshield for you if it is compromised. A comprehensive plan can see your windshield replaced with aftermarket or used parts, but that will depend on the provider and plan that you’ve sought out. Broken windshield car insurance sometimes costs more money.

Automobile Insurance Fraud in Oklahoma

Car insurance fraud is defined in two different ways. There is both hard fraud and soft fraud. Deliberate falsehoods regarding insurance claims or accident is considered hard fraud. Soft fraud, comparatively, occurs when an accident has genuine happened, but the victim has padded their claim.

Oklahoma authorities recovered $345,924 from falsified auto insurance claims, as reported by the Oklahoma Department of Insurance. These findings accompanied 1,286 complaints of fraudulent claims and $152,456 submitted findings for criminal prosecution.

While you might be tempted to get all that you can once you’ve been in an accident, falsifying your accident claims is a) illegal, and b) not worth the consequences.

Statute of Limitations

Once you’ve been in an accident, you need to move quickly in order to get the compensation from your insurance that you need to repair your car or pay any other necessary fees.

Oklahoma Claims Statute of Limitations

| Types | Limits |

|---|---|

| Personal Injury | 2 years |

| Property Damage | 2 years |

Timely filing is crucial for securing compensation and ensuring your claims are processed efficiently. Be aware of these statute of limitations to protect your rights and manage any potential claims effectively.

State Specific Laws

Oklahoma also makes itself unique from other states in its implementation of an Unfair Claims Settlement Practices Act. This piece of legislation makes insurers to clients – that is to say, you – precisely what your policy with the insurer will cover. That way, you know exactly what you can use your insurance for and how much money you should have available to you if you seek compensation.

That is to say, the Unfair Claims Settlement Practices Act keeps your insurer from overlooking or deliberately ignoring a part of your coverage that might cost them significant sums of money. This move towards fairness keeps you in the black and ensures that your provider remains as honest as possible.

Vehicle Licensing Laws in Oklahoma

Now, if you’re pinching pennies, you may think that forgoing insurance is the way to save money. However, in Oklahoma, driving without insurance and getting caught can result in some significant fees.

We’ve touched on viable proof of insurance previously, but for a refresher, they include:

- A valid liability insurance ID card

- A copy of your car’s up-to-date insurance policy

- A valid insurance binder, which serves only as temporary car insurance

It’s crucial to maintain proper insurance coverage to avoid hefty fines and legal issues. Always ensure you have the necessary proof of insurance to stay compliant and protected while driving in Oklahoma.

Penalties for Driving Without Car Insurance in Oklahoma

| Offenses | Penalties |

|---|---|

| 1st Offense | Fine: $250; Jail time: up to 30 days; License suspension with $275 reinstatement fee; Possible vehicle impounding; Possible seizure of license plates and fines for return |

| 2nd Offense | Fine: $500; Jail time: up to 1 year; License suspension with $275 reinstatement fee; Mandatory SR-22 insurance filing; Possible vehicle impounding; Possible seizure of license plates and fines for return |

| Subsequent Offenses | Fine: $500; Jail time: up to 1 year; License suspension with $275 reinstatement fee; Mandatory SR-22 insurance filing; Possible vehicle impounding; Possible seizure of license plates and fines for return |

Without proof of insurance, you risk Oklahoma authorities suspending your car’s registration. If your registration is suspended, you’ll get a letter from the Oklahoma government, and you’ll have to provide proof of insurance before your registration can be reinstated.

Proof of insurance is essential not only to drive a car but to register that car in the state of Oklahoma. You’ll be required to present proof of insurance when you go to secure an Oklahoma license plate.

If you are ever pulled over by a police officer, either for speeding, possession, or something else, you’ll be required to provide proof of vehicle insurance along with your driver’s license to the officer in question. Knowing how police check car insurance will help you stay ready if you’re ever pulled over.

Teen Driver Laws

Most teens are excited to turn 16 because it means they can start practicing to earn their driver’s licenses. However, in Oklahoma, teenagers can get their driver’s permit at 15 1/2 years old.

Oklahoma Teen Driver License Restrictions

| Restrictions | Limitations |

|---|---|

| Nighttime restrictions | 10 p.m. to 5 a.m. |

| Passenger restrictions (family members excluded unless noted otherwise) | no more than 1 passenger |

| Minimum Age at which Restrictions may be Lifted | |

| Nighttime restrictions | -6 months with driver education -12 months without driver education or until age 18 (minimum age: 16 1/2) |

| Passenger restrictions | -6 months with driver education -12 months without driver education or until age 18 (minimum age: 16 1/2) |

They have to sit through a mandatory holding period of six months before applying for a license, of course, but the ability of a young person to practice their driving is hardly a bad thing. Teenagers in Oklahoma also have to consider other restrictions on their driver’s licenses.

These restrictions will be lifted within 12 months of the driver receiving her license or at age 18. If a young driver opts to take driver’s education classes, though, these restrictions will be removed twice as quickly.

Oklahoma Older Driver License Renewal Procedures

As unpleasant as the DMV is, it is a necessary evil for everyone, no matter how long you’ve had your license. Oklahoma residents who’ve lived in the state for a long while need to make sure to renew their driver’s licenses every four years, which serves as a constant renewal point for drivers all across the United States.

You are not able to renew your license over the Internet or by mail. The good news, though, is that while you do still have to visit the DMV in person, older drivers in Oklahoma don’t have to pass a vision test in order to renew their licenses.

New Oklahoma Residents

If you’re new to Oklahoma and intend to stay in the state for a good, long while, you’ll need to secure a license plate and car insurance policy within the state. Share your new address with your provider and make sure that you have the minimum coverage required in Oklahoma.

Oklahoma Car Insurance Minimum Coverage Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured/Underinsured Motorist | $25,000 per person and $50,000 per accident for bodily injury |

| Personal Injury Protection (PIP) | $30,000 per person |

You’ll also want to check in with your provider to see if you need to take your car to the Oklahoma Department of Public Safety (DPS) or Oklahoma Tax Commission (OTC). A representative at either of these agencies will be able to double-check your vehicle identification number in order to ensure that you’re the proper owner of the car. After that, you’ll be good to go.

Rules of the Road

Oklahoma also has state-specific road laws that you’ll need to consider when taking to the interstate. Keep these in mind in order to keep your driving record as clean as possible.

Fault vs. No-Fault

As we’ve mentioned, Oklahoma is an at-fault state. That means that when you get in an accident in Oklahoma, one of the drivers will be determined to be at fault. Whoever is determined to be at fault will be responsible for paying for any damages, medical expenses, or other costs that result. Knowing about no-fault car insurance is also valuable.

Keep Right and Move Over Laws

The left lane on the highway is reserved for drivers who go a bit faster than average. If you’re going under the speed limit, either due to a flat tire or personal preference, you cannot drive in the left lane.

This means that if you intend to pass, you need to use your turn signal and make sure that it’s safe to pass first.

Speed Limits in Oklahoma

Oklahoma’s speed limits vary depending on the type of road, with rural interstates having the highest allowable speeds. Understanding these limits can help you drive safely and avoid potential fines.

Oklahoma Speed Limits

| Road Type | Speed Limit |

|---|---|

| Other Limited Access Roads | 70 mph |

| Other Roads | 70 mph |

| Rural Interstates | 75 mph |

| Urban Interstates | 70 mph |

Adhering to these speed limits ensures not only compliance with Oklahoma’s traffic laws but also contributes to safer driving conditions for everyone. Always stay updated on local regulations and drive responsibly.

Seat Belt and Car Seat Laws

Oklahoma also takes care to enforce seat belt policies. Seat belt laws impact car insurance. If you choose to drive or ride without a seat belt, keep in mind the following consequences:

Oklahoma Car Seat Laws

| Requirements | Age |

|---|---|

| Rear-Facing Child Safety Seat | Younger than 2 years (or until a child outgrows the manufacturer's top height or weight recommendations) |

| Child Restraint System | Younger than four years old |

| Child Restraint or Booster Seat | Four to seven years old (can't be taller than 4'9") |

| Adult Belt Permissible | Over eight years old (or taller than 4'9") |

Car seat laws work similarly. The first time you violate Oklahoma’s car seat laws, you not only put your child at risk, but you risk a $50 or more fine.

Oklahoma Ridesharing

With the popularity of Uber and Lyft on the rise, you may be interested in registering your car to rideshare. Only the following insurers in Oklahoma allow drivers to use their cars for ridesharing:

- Allstate

- Farmers

- Geico

- Mercury

- State Farm

- USAA

If you’re considering ridesharing in Oklahoma, ensure your insurer permits this activity to avoid coverage issues. Check with your insurance provider to confirm that you’re covered for ridesharing before hitting the road.

Oklahoma Safety Laws

We’ve touched on drunk driving and its consequences before. Oklahoma has severe DUI laws in place to dissuade drivers from driving while under the influence.

Oklahoma DUI Laws

| Requirements | Details |

|---|---|

| BAC Limit | 0.08% for general drivers; 0.00% for drivers under 21 |

| Criminal Status | First offense: Misdemeanor; Second or subsequent within 10 years: Felony |

| High BAC Limit | Typically higher penalties for BAC substantially above 0.08% |

| Look Back Period | 10 years; prior offenses within this period influence penalties |

Driving While Impaired, you’ll notice, registers as a misdemeanor – but only the first time. If you get caught driving under the influence a second time, you earn yourself a felony.

For the sake of your health, not to mention your wallet, do what you can to avoid driving drunk. The consequences are the same for driving under the influence of marijuana, as Oklahoma has not yet legalized the use of THC for medical or recreational purposes.

Distracted Driving Laws

Oklahoma enforces specific laws regarding cell phone use while driving to enhance road safety. Understanding these regulations can help you stay compliant and avoid potential penalties.

Oklahoma Cell Phone Use Laws While Driving

| Laws | Details |

|---|---|

| Hand-held ban | Learner's permit and intermediate license holders |

| Text ban | All drivers |

| Enforcement | Primary |

No text is worth getting into a car accident, as you risk more than an increase in your insurance payments. There is not a single text that’s worth your life.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving in Oklahoma

Whenever you head out on the road, you want to do your best to stay safe. If you’ve just moved to a new home or an entirely new state, though, you might not know about some of the local laws or trends that might impact the roadways.

That’s why you have us. Below are all of the vehicular trends that have a presence in Oklahoma and should influence the way you drive around your new — or old — home.

From fatality rates to the areas most prone to vehicular left, you can count on us.

Vehicle Theft in Oklahoma

It seems like the bigger your car is in Oklahoma, the more likely it is to draw attention — the bad kind as well as the good kind.

Top 10 Oklahoma Car Thefts by Model

| Make & Model | Total Thefts |

|---|---|

| Chevrolet Pickup (Full Size) | 1143 |

| Ford Pickup (Full Size) | 780 |

| Dodge Pickup (Full Size) | 419 |

| GMC Pickup (Full Size) | 304 |

| Honda Civic | 292 |

| Honda Accord | 269 |

| Chevrolet Impala | 181 |

| Chevrolet Pickup (Small Size) | 127 |

| Ford Explorer | 123 |

| Chevrolet Malibu | 119 |

If you have a pickup, try to keep an eye on it or install an additional security system, especially if you’re visiting one of the upcoming worst cities for vehicular theft in Oklahoma, as reported by the FBI.

Top 10 Oklahoma Car Thefts by City

| City | Total |

|---|---|

| Midwest | 261 |

| Lawton | 229 |

| Norman | 168 |

| Broken Arrow | 135 |

| Moore | 133 |

| Shawnee | 129 |

| Endid | 90 |

| Del | 81 |

Naturally, Oklahoma City, as one of the state’s biggest cities, is more prone to vehicular theft than some of the smaller towns in the area.

This doesn’t mean that you have to be hyper-paranoid as an Oklahoma City local, but it does encourage you to be cautious.

Fatality Rates in Oklahoma

Car crash fatalities in Oklahoma vary significantly by city, with Oklahoma City and Tulsa reporting the highest numbers. This data highlights the critical need for ongoing road safety measures.

Oklahoma Car Crash Fatalities by City

| City | Total |

|---|---|

| Oklahoma | 87 |

| Tulsa | 52 |

You’ll note that just two cities make the NHTSA report: Oklahoma City and Tulsa. Some of this has to do with the varying risks that arise in urban areas versus rural areas.

Oklahoma Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 417 |

| Urban | 238 |

However, you’ll also note that the more rural parts of Oklahoma are less kind to interstate drivers. The congestion of rural roads has nothing on the speeding that open rural roads encourage.

But that’s not all. Different types of people are prone to different kinds of fatalities. Pedestrians will endure different fatalities than a car’s occupants, so let’s dig into that divide.

Oklahoma Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Passenger Car Occupants | 198 |

| Light Pickup Truck Occupants | 123 |

| Light Utility Truck Occupants | 86 |

| Van Occupants | 27 |

| Large Truck Occupants | 28 |

| Other/Unknown Occupants | 11 |

| Bus Occupants | 0 |

| Motorcyclists | 93 |

| Pedestrians | 78 |

| Bicyclists and Other Cyclists | 6 |

| Non-Occupants | 5 |

Do your best to keep an eye on the road while you’re driving in Oklahoma. Passenger cars are the most likely to be involved in a car crash in the state, with pickup trucks just behind. Bicyclists and walking pedestrians, too, are at additional risk, so you’ll want to keep your eyes open. But what types of crashes and crash fatalities are most likely to occur in Oklahoma?

Oklahoma Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Total Fatalities (All Crashes) | 655 |

| Single Vehicle | 357 |

| Involving a Large Truck | 133 |

| Involving Speeding | 143 |

| Involving a Rollover | 210 |

| Involving a Roadway Departure | 370 |

| Involving an Intersection (or Intersection Related) | 126 |

Most recently, then, the majority of car crashes that have occurred in Oklahoma involve a roadway departure, with single-vehicle accidents following in a close second.

That’s a lot of variables to consider. We haven’t yet taken into account, though, the counties in Oklahoma that are home to the most traffic fatalities.

Oklahoma Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Oklahoma County | 85 | 88 | 90 |

| Tulsa County | 72 | 67 | 70 |

| Cleveland County | 28 | 14 | 25 |

| Canadian County | 12 | 17 | 24 |

| Comanche County | 12 | 15 | 16 |

| Le Flore County | 14 | 18 | 16 |

| Grady County | 17 | 16 | 14 |

| McClain County | 7 | 16 | 14 |

| Mayes County | 7 | 21 | 14 |

| Ottawa County | 11 | 7 | 14 |

Some of these statistics may seem overwhelming. When you compare Oklahoma’s fatality numbers to those of other states, though, these rates are comparatively low.

The nearby New Mexico, for example, is rated second among the top-10 worst states for drivers.

Even so, speeding is still a pretty pervasive problem throughout the state. It can result in being a dangerous state for pedestrians, too.

Oklahoma Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Adair | 2 | 1 | 3 |

| Alfalfa | 0 | 0 | 0 |

| Atoka | 0 | 1 | 4 |

| Beaver | 1 | 1 | 0 |

| Beckham | 3 | 2 | 0 |

| Blaine | 0 | 0 | 1 |

| Bryan | 2 | 7 | 2 |

| Caddo | 2 | 4 | 4 |

| Canadian | 1 | 2 | 6 |

| Carter | 3 | 1 | 0 |

| Cherokee | 1 | 3 | 7 |

| Choctaw | 0 | 2 | 2 |

| Cimarron | 0 | 1 | 0 |

| Cleveland | 8 | 3 | 6 |

| Coal | 0 | 1 | 0 |

| Comanche | 2 | 3 | 2 |

| Cotton | 0 | 0 | 0 |

| Craig | 0 | 0 | 1 |

| Creek | 0 | 3 | 4 |

| Custer | 1 | 3 | 2 |

| Delaware | 2 | 3 | 5 |

| Dewey | 0 | 1 | 1 |

| Ellis | 1 | 1 | 0 |

| Garfield | 3 | 0 | 1 |

| Garvin | 3 | 1 | 0 |

| Grady | 4 | 2 | 0 |

| Grant | 1 | 1 | 0 |

| Greer | 0 | 4 | 0 |

| Harmon | 0 | 0 | 0 |

| Harper | 0 | 3 | 0 |

| Haskell | 0 | 1 | 0 |

| Hughes | 0 | 1 | 1 |

| Jackson | 0 | 0 | 0 |

| Jefferson | 0 | 4 | 0 |

| Johnston | 2 | 0 | 1 |

| Kay | 3 | 1 | 1 |

| Kingfisher | 1 | 1 | 0 |

| Kiowa | 1 | 0 | 0 |

| Latimer | 1 | 1 | 0 |

| Le Flore | 6 | 5 | 8 |

| Lincoln | 1 | 0 | 0 |

| Logan | 1 | 0 | 1 |

| Love | 0 | 1 | 1 |

| Major | 1 | 0 | 0 |

| Marshall | 2 | 1 | 0 |

| Mayes | 1 | 5 | 4 |

| Mcclain | 2 | 3 | 2 |

| Mccurtain | 2 | 2 | 4 |

| Mcintosh | 2 | 4 | 0 |

| Murray | 0 | 1 | 0 |

| Muskogee | 3 | 1 | 2 |

| Noble | 1 | 1 | 0 |

| Nowata | 1 | 1 | 0 |

| Okfuskee | 0 | 1 | 0 |

| Oklahoma | 36 | 30 | 21 |

| Okmulgee | 3 | 4 | 0 |

| Osage | 3 | 4 | 1 |

| Ottawa | 3 | 0 | 1 |

| Pawnee | 1 | 1 | 1 |

| Payne | 1 | 4 | 2 |

| Pittsburg | 7 | 3 | 3 |

| Pontotoc | 1 | 1 | 2 |

| Pottawatomie | 5 | 3 | 0 |

| Pushmataha | 0 | 0 | 0 |

| Roger Mills | 0 | 0 | 0 |

| Rogers | 2 | 6 | 4 |

| Seminole | 3 | 3 | 1 |

| Sequoyah | 4 | 0 | 2 |

| Stephens | 0 | 0 | 0 |

| Texas | 1 | 1 | 3 |

| Tillman | 0 | 0 | 0 |

| Tulsa | 22 | 24 | 20 |

| Wagoner | 4 | 4 | 1 |

| Washington | 0 | 2 | 2 |

| Washita | 1 | 1 | 0 |

| Woods | 0 | 1 | 0 |

| Woodward | 3 | 4 | 3 |

Tulsa, you’ll note again, comes in at number one for counties that have notable speeding problems and, in turn, fatalities. Urban areas, then, require your increased awareness.

There is another threat, though, that puts Oklahomans at risk: intoxicated drivers.

Despite widespread information dissuading people from drinking and driving, drunk driving remains one of the most common causes of driver fatalities throughout the whole of the United States.

Oklahoma DUI Fatalities by County

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Carter County | 3 | 6 | 4 |

| Cimarron County | 7 | 3 | 5 |

| Comanche County | 7 | 5 | 5 |

| Dewey County | 5 | 5 | 3 |

| Grant County | 3 | 3 | 8 |

| Jackson County | 7 | 7 | 3 |

| Johnston County | 26 | 26 | 32 |

| Kay County | 18 | 25 | 25 |

| Logan County | 10 | 4 | 7 |

| Marshall County | 7 | 4 | 1 |

This kind of drunk driving is often undertaken by teenagers. The combination of driving inexperience and the discombobulation of alcohol results in a startling number of fatalities.

Oklahoma Teen Drunk Driving Arrests

| Statistic | Number |

|---|---|

| Total Teen DUI Arrests | 200-300/year |

| Male Teens Arrested | 60% of total |

| Female Teens Arrested | 40% of total |

| Teens with BAC above 0.08% | 70% of arrests |

| Arrests Resulting in Conviction | 80% of cases |

| Repeat Offenders | 5-10% |

Oklahoma’s underage fatalities as a result of intoxicated driving rank at 1.3 fatalities, placing the whole of the state slightly above the national average, which is 1.2 fatalities. Luckily, EMS response time is fairly good in Oklahoma. This means that no matter how severe the accident, help will arrive quickly should you be hurt.

Oklahoma EMS Response Times by Location

| Location | Notification | Arrival |

|---|---|---|

| Rural | 9 min | 16 min |

| Urban | 4 min | 7 min |

With a response time between four and nine minutes, calling for help is the best thing you can do if you find yourself in an accident. Urban response time is naturally a bit faster than rural response time, but it’s still reassuring to know that, in case of an unfortunate incident, help is always nearby.

Transportation

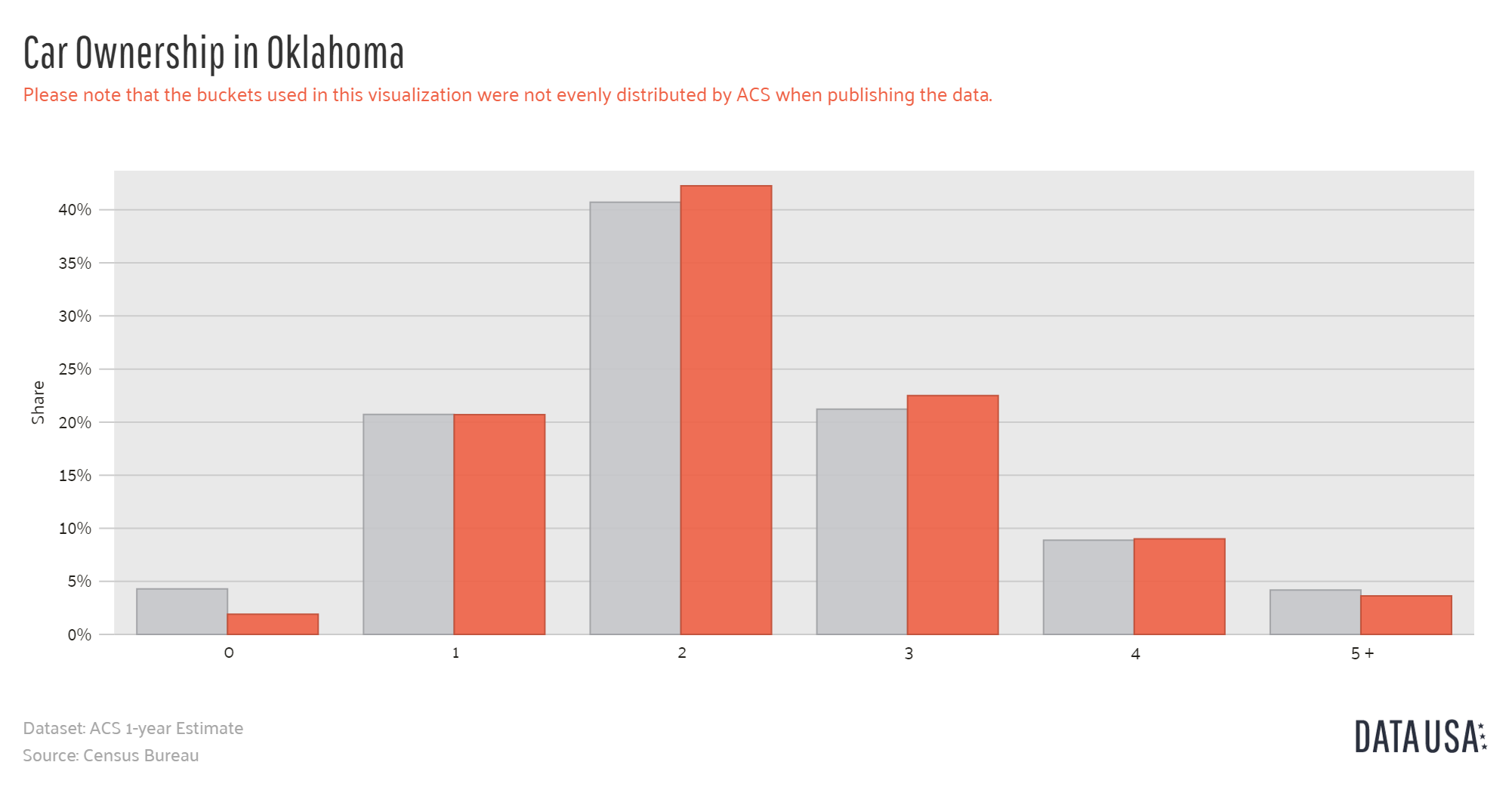

Do you own more than one car? In general, Oklahoma residents own an average of two cars. If you have any more than that, well, we’re jealous.

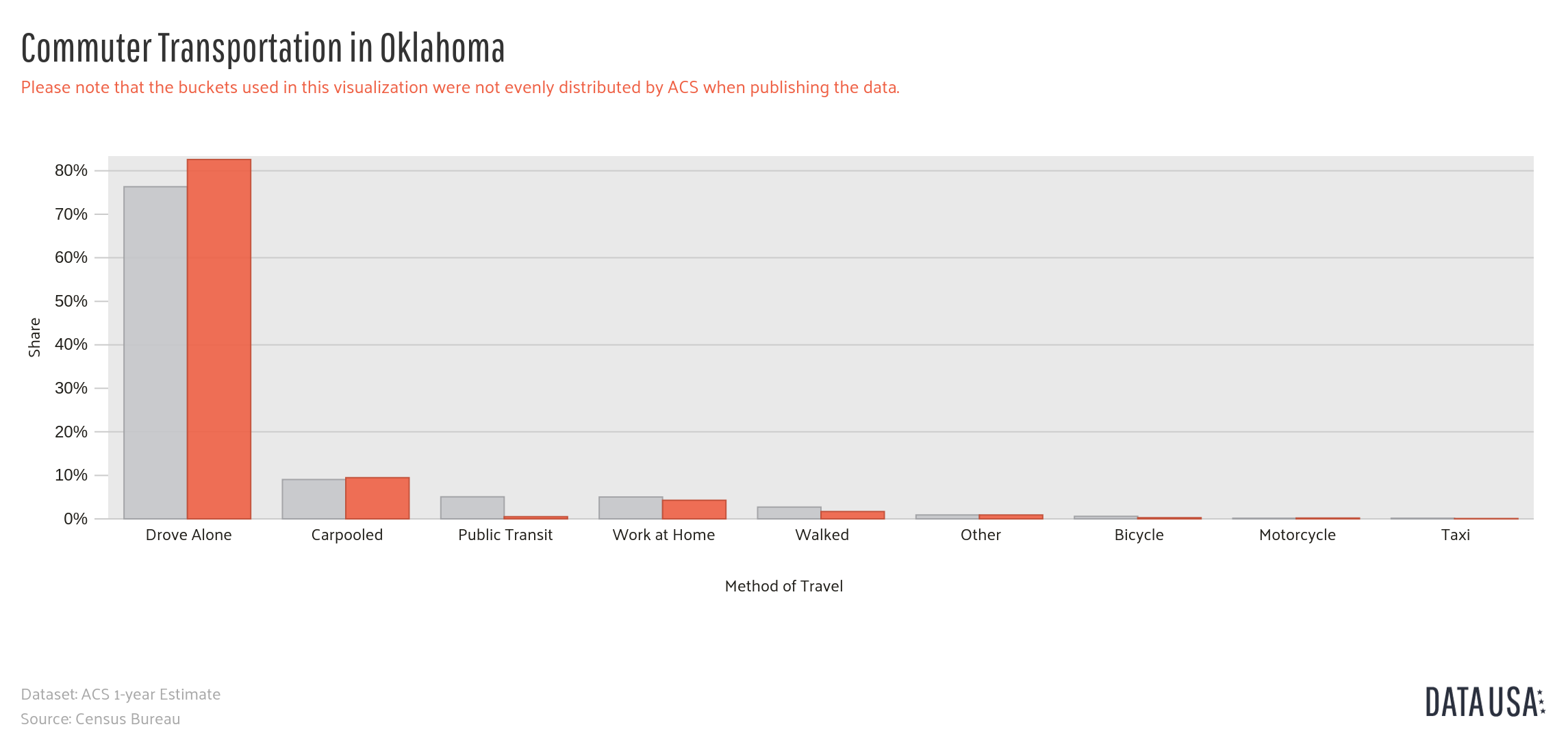

While commuting isn’t the worst thing in the world, it’s certainly not what most people would willfully choose to go through at 8 a.m. on an average morning. For the employed living in Oklahoma, though, things aren’t so bad. The average commute to work in Oklahoma is reported to take less than 25 minutes, the national average.

How is that commuting being done? Most people in Oklahoma prefer to get to work by car, but that’s not the only mode of transportation available. Public transportation is an entirely viable option for Oklahoma residents, as is carpooling or heading to work via motorcycle.

While driving remains the most popular commuting choice in Oklahoma, exploring options like public transit, carpooling, and motorcycles can offer convenience and cost savings. Consider these alternatives to enhance your daily commute and reduce expenses.

Oklahoma’s Top Cities for Traffic Congestion

That said, there are some cities wherein the troubles of traffic are unavoidable. You’ll want to plan your morning drive pretty carefully if you live in either Tulsa or Oklahoma City.

While the state doesn’t make the specific percentage of time spent in congestion during the day’s peak hours available, you can tell pretty readily that driving through Tulsa or Oklahoma may be slow going right before work begins and just as the day ends.

Oklahoma Traffic Congestion by City

| City Name | Hours |

|---|---|

| Tulsa | 33 |

| Oklahoma | 51 |

Even so, there’s no need to fret. Of all of the cities in Oklahoma, only these two make the list. The rest of the state is able to maneuver its roadways with ease, barring construction, and thereby spend a little less time getting stressed out by the other drivers in the area.

So: if by now you’re not an expert on Oklahoma’s car insurance, driver laws, and the ways you can compare insurance providers and save, never fear. Compare car insurance rates now by entering your ZIP code below in our free online tool.

Best Oklahoma Car Insurance Companies

Licensed drivers in the state of Oklahoma are required to carry the minimum liability coverage protecting themselves and their passengers in the event of a car accident.

Those who have 25 or more vehicles registered under their names can take out a self-insurance policy. The average car insurance premium in Oklahoma is $1,811. Rates vary from state to state. Drivers who live in Tulsa pay approximately $1,932 for coverage. The average premium for car insurance in Oklahoma City is $1,806.

Car insurance rates in Oklahoma run just above the national average. Costs may also vary from one insurer to another. Comparing auto insurance quotes online is the fastest and easiest way to find a company that sells flexible policies at affordable rates. Oklahoma follows a tort system, which is why most insurance companies recommend drivers to purchase additional coverage.

Reading customer reviews and shopping around can help you get a good deal on car insurance. Compare car insurance rates with our free comparison search by entering your ZIP code above.

Some Car Insurance Options for Oklahoma

Here is a list of auto insurance providers that offer extensive coverage at reasonable rates:

Cole, Paine & Carlin Insurance Agency, Inc.

Cole, Paine & Carlin Insurance Agency offers home, auto, flood, business, and general liability coverage. This independent insurance provider represents different insurance companies with a strong reputation.

If you buy coverage for your car from Cole, Paine & Carlin Insurance Agency, you will be able to make payments, update your contact information, and file claims online.

The company offers teen rewards, safe driver discounts, and other special savings.

LeBlanc Family Insurance

Founded in 2002, LeBlanc Family Insurance is a local agency that works with well-established insurance companies such as State Farm, Allstate, and Safeco. Oklahoma residents can purchase an auto, homeowners, mobile home, motorcycle, flood, and boat insurance.

The company also sells business insurance plans, including commercial auto general liability coverage. LeBlanc Family Insurance offers free auto insurance quotes. If you are interested in buying coverage for your car, visit the company’s website and complete the application form.

As an independent Oklahoma insurance agency, LeBlanc Family Insurance offers multiple quotes from different providers.

State Farm

State Farm has been selling auto insurance policies since 1922. The company handles over 35,000 claims per day and has more tan 68,000 employees throughout the U.S. and Canada. Customers have access to a wide range of insurance products, including business, life, auto, homeowners, health, and life insurance.

This auto insurance provider operates in 50 states, including Oklahoma. Drivers can opt for bodily injury and property damage liability coverage, collision coverage, personal injury protection coverage, emergency road service coverage, and uninsured/underinsured motorist protection insurance.

State Farm offers low-cost auto insurance policies specifically designed for safe drivers, good students, and new teen drivers. You can read our State Farm car insurance review for more information.

Safe Auto

Established in 1992, Safe Auto is a top insurance provider that operates in 16 states, including Indiana, Ohio, Oklahoma, and Illinois. The company has a network of licensed insurance agents that are ready to help customers find affordable car insurance policies.

Unlike most auto insurance providers, Safe Auto does not check your credit history. Customers can pay online, by email, or by phone. Other payment options include checks, money orders, and Western Union. Oklahoma drivers can pay their auto insurance rates in full, bi-monthly, or monthly.

In addition to the minimum car insurance requirements, Safe Auto offers additional types of coverage at affordable rates. Customers can obtain free auto insurance quotes, fill claims, and manage their policies through the company’s website.

ACE Cash Express

ACE Cash Express specializes in payday loans, title loans, and personal auto insurance. Oklahoma drivers can choose from liability coverage, medical payment coverage, personal injury protection, and uninsured/underinsured motorist protection insurance.

The company also provides car rental reimbursement, comprehensive, and collision coverage. Customers can pay at any ACE Cash Express location, online, or over the phone. Unlike other insurance companies, ACE Express offers competitively priced auto insurance plans to those with a less-than-perfect driving record. The company requires no credit checks.

Most payment plans have discount options. The policies are flexible and can be customized to fit your individual needs. Getting an online car insurance quote from ACE Cash Express takes less than 15 seconds.

MetLife

MetLife has been in business for more than 140 years. This global insurance company is rated “A+” by A.M. Best, “Aa3” by Moody’s Investors Service, and “AA-” by Standard & Poor’s. With over 90 million customers in 50 countries, MetLife is a leading provider of auto, life, dental, homeowners, and disability insurance.

This auto insurance company features comprehensive plans that include enhanced rental car damage coverage, safe driver credits, and special discounts for safe drivers. The policies available at MetLife go beyond basic liability and collision coverage.

Customers benefit from free identity theft protection services and guaranteed repairs to their vehicles. MetLife offers multi-policy auto insurance discounts, safe driver discounts, and special group discounts.

Knights Insurance Agency

Knights Insurance Agency has been offering auto, life, motorcycle, and homeowners insurance since 1992. This local insurance provider features affordable policies, low monthly payments, low down payments, and massive discounts.

Even those who have had car accidents or received speeding tickets can apply for free car insurance quotes. The company offers instant proof of insurance.

For an extra fee, customers receive roadside service nationwide. Shopping for car insurance requires time and effort.

Before you make a decision, contact the Department of Insurance to find out if a company is licensed in Oklahoma. Provide correct and complete answers when applying for free car insurance quotes.

Make sure you know what type of auto coverage suits your needs. Search for information about the main types of auto insurance, check the minimum coverage requirements in your state, and calculate your monthly rates.

Our website provides an online rate car insurance calculator and free quote comparison tools.

With a few mouse clicks, you can find a comprehensive policy that includes optional services such as roadside assistance and multiple payment options. Compare at least three auto insurance quotes before choosing a specific plan.

Find out what factors may affect your premium and ask about the current discounts. The competition is tight in the auto insurance industry, so make sure you get the best deal out there.

Find cheap car insurance when you enter your zip into our free comparison quote tool.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Oklahoma City Car Insurance Laws

Oklahoma follows the Tort system, which means that one of theindividuals involved in an accident has to be at fault.

The minimum requirements for car insurance in Oklahoma are as follows:

- $25,000 for the injury or death of one person in one accident

- $50,000 for the injury or death of more than one person in one accident

- $25,000 for any property damaged in an accident

Non-compliance with car insurance laws results in harsh penalties. If one is unable to supply proof of insurance or is charged with not carrying the minimum amount required, then he could end up facing up to $250 in fines, 30 days in jail, and even the possibility of having his license and registration suspended.

If the insurance policy is canceled, then one has thirty days to notify the Oklahoma Department of Public Safety of the new policy. Failure to do this can result in the car registration being suspended.

Additionally, the state needs to be notified if there’s a change in the place of residence. Should the department find out that the address is not current, the registration can be suspended.

While uninsured or under-insured policies are not mandatory in Oklahoma, some people do drive without insurance, and if one is in an accident with an individual without insurance, then they are protected.

Read More: What is the penalty for driving without insurance in Oklahoma?

Oklahoma City Car Insurance Companies

Consumers in Oklahoma City have dozens of insurance companies to select from when they are seeking car insurance coverage. Obviously, finding the right insurer involves more than finding the cheapest insurance provider.

When searching for an insurance provider, it is a good idea to shop around and compare the various options available.

There are some steps that can be taken to reduce the premiums when searching for insurance in the Oklahoma City market. Every driver should try to maintain a spotless driving record, and if you get a ticket, try to have it expunged from the driving history by attending traffic school.

Having low deductibles is good if you are involved in an accident. However, you need to be sure that you can afford to pay out of pocket.

Remember to ask for any special discounts, as most insurers offer discounts for things like making the car theft-proof or insuring a car that has a high government rating for safety. You may have to shop for car insurance to cover the theft of items from your vehicle.

Oklahoma City Average Car Insurance Rates

Oklahoma City motorists pay an average of $151 per month for car insurance. This is 0.88% less than what insurers pay in some of the neighboring counties, but 19% more than the average rate in Oklahoma State.

Driving and talking on a cell phone or texting while driving is dangerous and is the cause of a significant number of accidents in Oklahoma City. Unlike some places, however, there is no statewide ban on the use of cell phones while driving.

Driving under the influence of alcohol is another major cause of accidents, according to Oklahoma City statistics; hence, drivers are prohibited from having open alcohol.

Read More: Most Dangerous States for Drunk Driving

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Oklahoma City Car Insurance Quotes

Comparing monthly car insurance rates online is one of the best ways to find the cheapest rates from the best companies. Once the online search yields two or three promising insurance providers, it is a good idea to see what their financial standing is.

- Standard & Poor’s is one of the world’s leading credit ratings providers, helping individuals and organizations around the globe make better financial decisions

- The Fitch Ratings Insurance Group provides ratings for insurance and insurance-related companies

- Every state has a Department of Insurance that keeps information about companies public

Evaluating financial stability is crucial after finding competitive car insurance rates. By using reputable rating agencies and state insurance departments, you can ensure your chosen provider is both affordable and reliable.

Enter your ZIP below and start saving today by finding affordable car insurance.

Frequently Asked Questions

Are there specific discounts available for cheaper car insurance rates in Oklahoma?

Yes, many insurers offer specific discounts that can lower your car insurance rates in Oklahoma. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for having safety features in your vehicle. Some companies also offer discounts for low mileage, defensive driving courses, and paperless billing. It’s beneficial to ask your insurer about all available discounts.

Read More: Defensive Driver Car Insurance Discounts

What factors determine car insurance rates in Oklahoma?

Car insurance rates in Oklahoma are determined by various factors, including your driving record, age, gender, location, credit score, type of vehicle, coverage limits, and deductible amounts. Insurance companies also consider statistical data on accidents, theft rates, and the overall cost of claims in the area.

Are car insurance rates higher in Oklahoma compared to other states?

Car insurance rates in Oklahoma may vary compared to other states. Factors such as population density, traffic conditions, weather patterns, crime rates, and state-specific regulations can influence insurance premiums. It’s recommended to compare quotes from different insurers to find the best rate for your specific location.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

How does my credit score affect my car insurance rates in Oklahoma?

In Oklahoma, your credit score significantly impacts your car insurance rates. Insurers use credit-based insurance scores to assess risk, with higher scores often resulting in lower premiums. Maintaining a good credit score by paying bills on time, reducing debt, and regularly checking your credit report for errors can help you secure cheaper car insurance rates.

How often should I review my car insurance rates in Oklahoma?

It’s recommended to review your car insurance rates in Oklahoma annually or whenever significant life events occur, such as buying a new car or moving to a new address.

Read More: How to Change Your Car Insurance When Moving Out of State

How can I find the best car insurance rates in Oklahoma?

To find the best car insurance rates in Oklahoma, it’s recommended to shop around and obtain quotes from multiple insurance providers. You can use online comparison tools, consult with insurance agents or brokers, or directly contact insurance companies to request personalized quotes based on your specific needs and circumstances.

Are there any specific car insurance requirements in Oklahoma?

Yes, there are specific car insurance requirements in Oklahoma. The state requires drivers to carry liability insurance with minimum coverage limits of 25/50/25. This means $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $25,000 in property damage liability coverage per accident.

How does a teen DUI impact car insurance rates in Oklahoma?

A teen DUI in Oklahoma significantly increases car insurance rates, often doubling or tripling premiums. It also limits the availability of coverage options, as many insurers may refuse to cover high-risk drivers.

Read More: Best Car Insurance for Minors With a DUI

How does MetLife compare in offering the cheapest car insurance rates in Oklahoma?

MetLife offers competitive rates in Oklahoma, often providing discounts for safe driving, multiple policies, and good student drivers. However, it’s essential to compare quotes from multiple providers to ensure you get the best deal.

Does adding roadside assistance to my policy affect the cheapest car insurance rates in Oklahoma?

Adding roadside assistance may slightly increase your premiums, but the impact is usually minimal. It provides services like towing and lockout assistance, offering valuable peace of mind.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.