Cheapest South Dakota Car Insurance Rates in 2026 (Top 10 Low-Cost Companies)

Geico, USAA and State Farm are the best options for the cheapest South Dakota car insurance rates, starting at $9 per month. These companies are known for their competitive pricing and comprehensive coverage. Discover how to compare South Dakota car insurance rates and find the cheapest options available.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated July 2024

Company Facts

Min. Coverage for South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the cheapest South Dakota car insurance rates are Geico, USAA and State Farm, offering plans starting at just $9 per month. Ensuring you find the most affordable and comprehensive coverage for your needs.

This guide explores the factors influencing rates and highlights the best providers for cheap car insurance in South Dakota.

Our Top 10 Company Picks: Cheapest South Dakota Car Insurance Rates

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $9 | A++ | Cheap Rates | Geico | |

| #2 | $10 | A++ | Military Savings | USAA | |

| #3 | $11 | B | Many Discounts | State Farm | |

| #4 | $12 | A+ | Usage Discount | Nationwide |

| #5 | $16 | A++ | Accident Forgiveness | Travelers | |

| #6 | $17 | A+ | Online Convenience | Progressive | |

| #7 | $18 | A | Local Agents | Farmers | |

| #8 | $22 | A+ | Add-on Coverages | Allstate | |

| #9 | $24 | A | Student Savings | American Family | |

| #10 | $37 | A | Customizable Polices | Liberty Mutual |

We’re going to fill you in on everything you need to know about South Dakota car insurance coverage, carrier rates, driving laws, vehicle licensing laws, and how to compare car insurance by coverage type in South Dakota.

Ready to find cheaper car insurance coverage? Enter your ZIP code above to begin.

- Driving without insurance is a Class Two misdemeanor in South Dakota

- Geico is the top pick for low rates and comprehensive coverage

- Find the cheapest South Dakota car insurance rates for your needs

- Compare South Dakota Car Insurance Rates

#1 – Geico: Top Pick Overall

Pros

- Competitive Pricing: Geico offers the lowest rates at $9 per unit in South Dakota, ideal for car owners looking to save on insurance costs. Learn more in our Geico car insurance review.

- Wide Range of Discounts: Geico provides significant discounts for South Dakota residents, including safe driver, multi-vehicle, and military discounts, making it affordable for car owners.

- Online Tools and Mobile App: Geico’s digital platform offers convenient policy management and easy claims processing, which is beneficial for car owners in rural areas of South Dakota where local agent access may be limited.

Cons

- Limited Local Agents: Geico’s primarily online service may not cater as well to South Dakota residents who prefer face-to-face interactions or local agent support.

- Coverage Options: While Geico offers competitive pricing, the range of customizable coverage options may not be as extensive as some other providers, potentially limiting choices for car owners with specific insurance needs in South Dakota.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exclusive to Military Members: USAA offers specialized coverage tailored to car owners by military personnel in South Dakota, including deployments and military-related discounts.

- High Customer Satisfaction: As mentioned in our USAA car insurance review, USAA consistently receives high marks for customer service and claims handling in South Dakota, providing peace of mind to car owners.

- Competitive Pricing: With a rate of $10 per unit, USAA provides affordable insurance options specifically designed for the unique needs of military members in South Dakota.

Cons

- Membership Requirement: USAA membership is limited to military personnel and their families, which excludes non-military residents of South Dakota from accessing their insurance products.

- Limited Branch Access: While USAA offers robust online and phone support, the lack of physical branches in South Dakota may inconvenience residents seeking in-person assistance for complex insurance needs.

#3 – State Farm: Best for Many Discounts

Pros

- Extensive Agent Network: State Farm’s extensive network of local agents across South Dakota ensures personalized service and support, particularly beneficial for car owners in rural areas.

- Customizable Policies: State Farm offers a wide range of customizable coverage options tailored to the specific needs of South Dakota residents, including comprehensive and collision coverage.

- Good Customer Service: State Farm is known for its excellent customer service and efficient claims processing in South Dakota, providing reliability and accessibility to car owners. Learn more about their rates in our State Farm car insurance review.

Cons

- Potentially Higher Costs: While State Farm offers comprehensive coverage options, their premiums may be higher compared to some competitors in South Dakota, depending on the specific vehicle and coverage needs.

- Varied Agent Experience: The quality of service from State Farm agents in South Dakota may vary, impacting the consistency of customer experience across different regions of the state.

#4 – Nationwide: Best for Usage Discount

Pros

- Competitive Rates: Nationwide offers consistently competitive rates tailored to South Dakota’s insurance market, making it an attractive option for cost-conscious drivers.

- Multi-Policy Discounts: South Dakota residents can benefit significantly from bundling auto with home insurance, unlocking substantial savings. Check out insurance savings in our complete Nationwide car insurance discount.

- Strong Financial Stability: Nationwide’s strong financial ratings ensure policyholders in South Dakota can rely on their stability and claims-paying ability.

Cons

- Limited Local Agents: In rural areas of South Dakota, access to in-person agents may be limited, requiring reliance on online and phone support.

- Mixed Customer Service: While generally positive, some South Dakota customers have reported varying levels of satisfaction with claims processing and customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Accident Forgiveness

Pros

- Customizable Policies: Travelers offers a wide range of customizable policy options suitable for South Dakota drivers, allowing them to tailor coverage to their specific needs.

- Excellent Claims Service: Known for its efficient and responsive claims handling, Travelers ensures quick resolution and support for South Dakota policyholders.

- Good Driving Record Rewards: South Dakota drivers with clean records can enjoy significant discounts, promoting safe driving practices. See more details on our Travelers car insurance review.

Cons

- Higher Premiums: Initial premium quotes from Travelers may be higher compared to some competitors in the South Dakota market, though this can vary based on individual circumstances.

- Limited Agent Network: While Travelers provides solid online and phone support, the availability of local agents in rural South Dakota may be more limited.

#6 – Progressive: Best for Online Convenience

Pros

- Name Your Price Tool: Progressive’s innovative tool allows South Dakota drivers to customize policies that fit their budget constraints while ensuring adequate coverage.

- Discount Opportunities: Progressive offers various discounts such as multi-policy, safe driver, and continuous coverage discounts, making it easier for South Dakota residents to save money.

- Strong Online Presence: Progressive’s user-friendly website and mobile app provide convenient access to manage policies, make claims, and track discounts. Delve into our evaluation of Progressive car insurance review.

Cons

- Rate Increases: Some South Dakota customers have reported premium increases after the initial policy term, which could affect long-term affordability.

- Mixed Customer Service: While Progressive excels in digital services, customer satisfaction regarding claims processing and support can vary in South Dakota.

#7 – Farmers: Best for Local Agents

Pros

- Local Agent Network: Farmers Insurance boasts a robust network of local agents across South Dakota, offering personalized service and support. Learn more in our Farmers car insurance review.

- Customizable Coverage Options: South Dakota drivers can choose from a variety of coverage options, including unique perks like accident forgiveness and new car replacement.

- Additional Coverage Benefits: Farmers provides additional benefits that appeal to South Dakota residents, such as coverage for recreational vehicles and other specialized vehicles.

Cons

- Higher Premiums: Farmers’ premium rates in South Dakota may be higher compared to some competitors, reflecting their extensive coverage options and personalized service.

- Policy Complexity: Some South Dakota customers find Farmers’ policies complex, requiring careful review to fully understand coverage details and exclusions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Add-on Coverages

Pros

- Wide Range of Discounts: Allstate offers numerous discounts tailored for South Dakota drivers, including savings for safe driving, anti-theft devices, and bundling policies.

- User-Friendly Technology: Allstate’s intuitive mobile app and online tools make it easy for South Dakota policyholders to manage policies, file claims, and access roadside assistance.

- Strong Financial Stability: With top financial ratings, Allstate provides assurance to South Dakota customers regarding their ability to pay claims promptly. Discover more about offerings in our Allstate car insurance review.

Cons

- Higher Premiums: Initial premiums with Allstate may be higher in South Dakota, although this can vary based on individual driving history and coverage needs.

- Mixed Customer Reviews: While Allstate excels in technology and financial stability, some South Dakota customers report mixed experiences with claims handling and customer service.

#9 – American Family: Best for Student Savings

Pros

- Local Agent Support: American Family’s extensive network of local agents in South Dakota offers personalized guidance and support, ensuring customers receive tailored insurance solutions.

- Bundle Discounts: South Dakota residents can benefit from significant savings by bundling home and auto insurance policies with American Family.

- Customer Loyalty Benefits: American Family car insurance review highlights the rewards for long-term customers in South Dakota with additional discounts and benefits, enhancing overall satisfaction.

Cons

- Limited Online Tools: Some South Dakota customers may find American Family’s online tools and mobile app less comprehensive compared to other insurers, impacting convenience.

- Rate Increases: Like many insurers, American Family’s premiums may increase after the initial policy term, potentially affecting long-term affordability.

#10 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: Liberty Mutual offers customizable policies that cater to the specific needs of South Dakota drivers, ensuring adequate coverage options.

- 24/7 Claims Assistance: South Dakota policyholders benefit from round-the-clock claims support, providing peace of mind in case of emergencies or accidents. Learn more in our Liberty Mutual car insurance review.

- Additional Coverage Options: Liberty Mutual provides unique coverage options such as better car replacement, which can be beneficial for South Dakota residents.

Cons

- Higher Premiums: Liberty Mutual’s premiums in South Dakota tend to be higher compared to other insurers, reflecting their extensive coverage options and additional benefits.

- Mixed Customer Service: Customer reviews regarding Liberty Mutual’s customer service in South Dakota vary, with some customers expressing dissatisfaction with claims processing times and communication.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

South Dakota Car Insurance Coverage and Rates

South Dakota is a wonder of nature with rich farmland, beautiful prairies, striking mountains, and exquisite lakes spread across the state. From the famous Badlands to the Missouri River winding through the southeastern and central regions, South Dakota has no end of outdoor wonders to behold.

The table below compares monthly rates for minimum and full coverage car insurance in South Dakota from various providers.

South Dakota Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $22 $136

American Family $24 $151

Farmers $18 $113

Geico $9 $57

Liberty Mutual $37 $230

Nationwide $12 $76

Progressive $17 $105

State Farm $11 $67

Travelers $16 $97

USAA $10 $58

Famous for the astounding Mount Rushmore National Memorial nestled in the Black Hills, nature lovers and adventure seekers find plenty to see and do in this beautiful state.

South Dakota, known as The Mount Rushmore State, ranks 16th in size and became the 40th state in 1889. With over 77,000 square miles and a population under a million, it boasts more shoreline miles than Florida and the highest point east of the Rockies.

Agriculture, notably wheat, corn, and soybeans, dominates its economy, while it also hosts world-renowned caves like Jewel Cave National Monument. Understanding South Dakota’s car insurance requirements is crucial whether you’re new to the state or a long-time resident.

South Dakota Minimum Car Insurance Coverage Requirements

Here are South Dakota’s minimum car insurance coverage requirements to ensure you comply with state laws and protect yourself on the road.

South Dakota Car Insurance Minimum Coverage Requirements

| Coverages | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured/Underinsured Motorist | $25,000 per person and $50,000 per accident for bodily injury |

| Personal Injury Protection (PIP) | $30,000 per person |

In the table above, you’ll see the minimum liability car insurance coverage required in the state of South Dakota. Let’s delve deeper into what this means for you:

- $25,000 in Bodily Injury Liability per Person: Covers the costs associated with the injury or death of an individual as the result of an accident you cause

- $50,000 in Bodily Injury Liability per Accident: Covers the costs associated with the total bodily injury or death liability resulting from an accident you cause

- $25,000 in Property Damage Liability: Covers the costs associated with property damages incurred by another individual or individuals resulting from an accident you cause

While not mandatory in all states, South Dakota car insurance laws also mandate that drivers carry uninsured/underinsured motorist coverage that matches their selected liability policy limits. Uninsured motorist coverage is there to protect you if you ever get into a crash for which you are not responsible, are injured, and the at-fault driver does not have a valid policy to pay for your damages or the collision is a hit-and-run incident.

Underinsured motorist coverage also offers protection for you as the policyholder. In the event that you get into a collision for which you are not responsible, and the other driver does not have sufficient coverage to pay for your damages, the underinsured motorist coverage will kick in to cover the difference. According to the South Dakota Division of Insurance Consumer Information page:

If a motorist has 25/50 coverage and you have 100/300 of underinsured motorist, your insurance will cover you once the medical costs exceed $25,000 (for one person) up to a maximum of $100,000 minus $25,000 of the other person’s liability, $75,000 of your uninsured motorist coverage.

Liability insurance covers medical expenses, property damages, and other costs resulting from accidents you cause. It’s important to note these coverages aren’t stackable; they have specific limits and cannot be combined beyond those limits.

Your liability insurance will cover these expenses up to and until your policy limits have been exhausted. As such, it is very advisable to consider taking out coverages above the recommended limits.

If you ever get into a serious collision for which you are at fault, after your limits have been exhausted, your personal assets could be at stake to cover the remaining costs incurred by the injured party or parties.

By taking out higher coverages above the state-required minimums, you’ll not only have a security blanket in the event of an accident but ensure your personal assets are protected as well. Your liability insurance also applies to any member of your family or authorized user to whom you have given permission to drive your vehicle. Bear in mind, that your liability insurance does not cover the costs of any injuries you might incur.

Forms of Financial Responsibility in South Dakota

If you ever get into a wreck in the state of South Dakota, you will probably be required to present proof of insurance to a responding officer.

The easiest way to offer proof of financial responsibility is to show the officer your insurer-issued proof of insurance card or the electronic version on your mobile device.

A reportable collision is an auto accident involving an injury or death, or property damage at a minimum of $1,000, or combined damages equaling $2,000.

If you get into an auto accident in the state of South Dakota, you need to exchange insurance information, residential addresses, names, and VIN numbers with the other motorist or motorists. If the auto accident meets the reportable requirements, you are required to report the crash to the nearest police station in the jurisdiction.

In addition, other options to show proof of financial responsibility that pose an alternative to regular auto insurance are a certificate of deposit of securities or money, a surety bond, or a certificate of self-insurance.

In the state of South Dakota, you have the option to deposit a sum of $50,000 with the state treasurer to receive a certificate of insurance. If the Department of Public Safety and the state treasurer accept your deposit, the certificate can serve as an acceptable form of financial responsibility.

You may also post a surety bond from a licensed surety entity in the state of South Dakota and present it to the DMV.

If you get into an accident, the surety bond amount should at minimum equal the insurance policy held by the other driver in a collision for which you were responsible. Assuming the DMV commissioner accepts the surety bond, you will be issued a certificate as an acceptable form of financial responsibility. (For more information, read our “Alternatives to Car Insurance: Surety Bonds“)

Finally, in the state of South Dakota, if you have over 26 vehicles registered to your name, you might be eligible to apply for self-insurance. Assuming the Department of Public Safety issues you a self-insurance certificate, this can also serve as an acceptable form of financial responsibility.

That said, in most scenarios, the easiest and most cost-effective option will be to carry South Dakota auto insurance at or above the state minimum and present your proof of insurance either in the physical card form or electronically. It is also important to note, that penalties for driving without insurance under South Dakota car insurance laws are steep.

If you are caught driving without insurance, the offense is considered to be a Class Two Misdemeanor, with associated penalties including 30 days imprisonment and/or $100 in fines.

Furthermore, your driver’s license would be suspended for a period ranging from 30 days to one year. On top of this, if convicted, you will be required to file an SR-22 car insurance document with the state of South Dakota for a period of three years after the suspension of your driving privileges is lifted. Failure to do so will lead to suspension of not just your driver’s license, but your license plates and vehicle registration to boot.

Premiums as a Percentage of Income in South Dakota

As you can see, the percentage of income eaten up by insurance premiums increased steadily in the years between 2012 and 2014. While the average South Dakota resident’s annual personal income dipped in 2013, making the slight spike in rates have an even greater impact, incomes rose again in 2014 which helped to level the playing field.

Your personal income is the amount of money you have left after taxes are taken out to pay your bills, save, or spend on life’s little extras.

Our researchers discovered that South Dakota’s ratio of premiums to the percentage of income they comprise is a bit high when compared with other states in the region, such as North Dakota. Case in point, North Dakota’s insurance as a percentage of income was around 1.50% in 2014. However, the average resident earned a bit more in that year too at approximately $51,311.

Average Monthly Car Insurance Rates in SD (Liability, Collision, Comprehensive)

Explore the current average monthly car insurance rates in South Dakota, detailing costs for liability, collision, comprehensive, and full coverage based on the latest data from the NAIC database.

Our researchers compiled the latest data from the National Association of Insurance Commissioners (NAIC) database.

You should definitely be prepared for South Dakota car insurance premiums to rise in the state from 2019 and moving forward.

Additional Liability Coverage in South Dakota

In this table, we’ve compiled the NAIC’s most recent data revealing the average loss ratio for South Dakota car insurance carriers between the years 2013 and 2015.

South Dakota Liability Car Insurance Loss Ratio by Coverage Type

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments | 0.85 | 0.8 | 0.78 |

| Uninsured/Underinsured Motorist Coverage | 0.9 | 0.88 | 0.85 |

The loss ratio indicates the percentage of premiums insurers pay out in claims. In 2013, South Dakota insurers allocated less than 50% of premiums for uninsured/underinsured motorist coverage claims, suggesting potential for rate reductions.

The good news is, the data here shows that in the years following, South Dakota insurers have experienced gains to losses within the normal, healthy range for both uninsured/underinsured motorist coverage and MedPay. Currently, the NAIC has not released data regarding gains to losses for South Dakota insurers for Personal Injury Protection (PIP) coverage.

South Dakota currently ranks 42nd in the nation for uninsured motorists, with 7.7% of drivers getting behind the wheel without coverage.

While it’s easy to think that you’ll be one of the lucky ones on the road, there’s no way to predict whether you could get into a collision with one of these uninsured drivers. In the event that you do, additional coverages like MedPay and collision insurance coverage are excellent options to consider to ensure you’re not left in the lurch.

MedPay (Medical Payments) provides coverage for things like medical bills or funeral expenses in the event of injuries incurred during a collision, no matter who was at fault.

MedPay provides coverage for you and any family members and/or passengers as laid out in your policy who was in the car or struck as a pedestrian during the course of the collision. Collision coverage will pay for property damage to your vehicle if you get involved in a wreck with another car or object.

Add-ons, Endorsements, and Riders

Here are the key car insurance add-ons you’ll want to contemplate adding to your South Dakota car insurance policy. Check them out.

- Gap insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Considering these add-ons can help you tailor your South Dakota car insurance policy to better suit your needs. Evaluate each option to ensure comprehensive protection and peace of mind on the road.

Average Monthly Car Insurance Rates by Age & Gender in SD

We’ve always been taught that age and gender were two of the most (if not the most) critical factors car insurance carriers use to assess consumer rates. Is this really the case?

Understanding how age and gender impact car insurance rates in South Dakota helps you make more informed choices. Tailor your coverage to your profile for the best rates and protection. Let’s take a look at what our researchers discovered.

Demographic and Insurance Carrier

South Dakota Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $465 | $420 | $180 | $170 | $140 | $130 | $120 | $115 |

| American Family | $450 | $410 | $175 | $165 | $135 | $125 | $115 | $110 |

| Amica | $480 | $435 | $190 | $180 | $145 | $135 | $125 | $120 |

| Farmers | $470 | $425 | $185 | $175 | $140 | $130 | $120 | $115 |

| Geico | $410 | $370 | $170 | $160 | $130 | $120 | $110 | $105 |

| Liberty Mutual | $490 | $445 | $195 | $185 | $150 | $140 | $130 | $125 |

| Progressive | $460 | $420 | $180 | $170 | $140 | $130 | $120 | $115 |

| State Farm | $400 | $360 | $160 | $150 | $125 | $115 | $105 | $100 |

| The Hartford | $470 | $425 | $185 | $175 | $140 | $130 | $120 | $115 |

| USAA | $380 | $345 | $150 | $140 | $120 | $110 | $100 | $95 |

If you browse through the table above, you’ll notice that there is frequently a disparity between the rates male drivers are charged vs. female drivers.

In some cases, the gap is wider than in others. For instance, Allstate charges single 25-year-old males approximately $200 more in annual premiums than they do female drivers of the same age, while a company like Geico actually charges 25-year-old female drivers about $80 more each year than they do 25-year-old male drivers.

However, teen driver car insurance rates are highest of all. Safeco, for instance, charges single, 17-year-old male drivers approximately $13,500 more in annual rates than they do married, 35-year-old male drivers. The disparity is huge.

To age and gender, insurance carriers can take your marital status into account when assessing rates.

Michelle Robbins LICENSED INSURANCE AGENT

Car insurance for married people is lower because insurers usually see marriage as a sign of stability and responsibility. The train of thought is that married individuals are going to be more cognizant behind the wheel than younger, single drivers, thereby posing less risk to insure.

Rank by Demographic and Insurance Carrier

Car insurance rates by age can change drastically. If you have teen drivers in your household and are concerned about how to insure them without breaking the bank. It is interesting to note, that the older a driver gets, the less disparity there often is between male vs. female rates.

One example is AMCO Insurance. As you can see, they charge 25-year-old male drivers just under $200 more in annual rates than they do 25-year-old female drivers. The moral of the story is, the South Dakota car insurance company you pick is going to be the ultimate determinant of rates. Finding the coverage you need at the price you want isn’t impossible, provided you know where to look.

Highest and Lowest Rates in South Dakota by ZIP Code

Check out the video above for a detailed explanation of some of the key tools carriers use to assess consumer rates.

Explore how car insurance rates vary across South Dakota with a detailed breakdown by ZIP code. This data reveals the impact of your specific location on your insurance premiums.

These zip code-specific average monthly car insurance rates in South Dakota highlight varying premiums across carriers, reflecting localized factors influencing insurance costs.

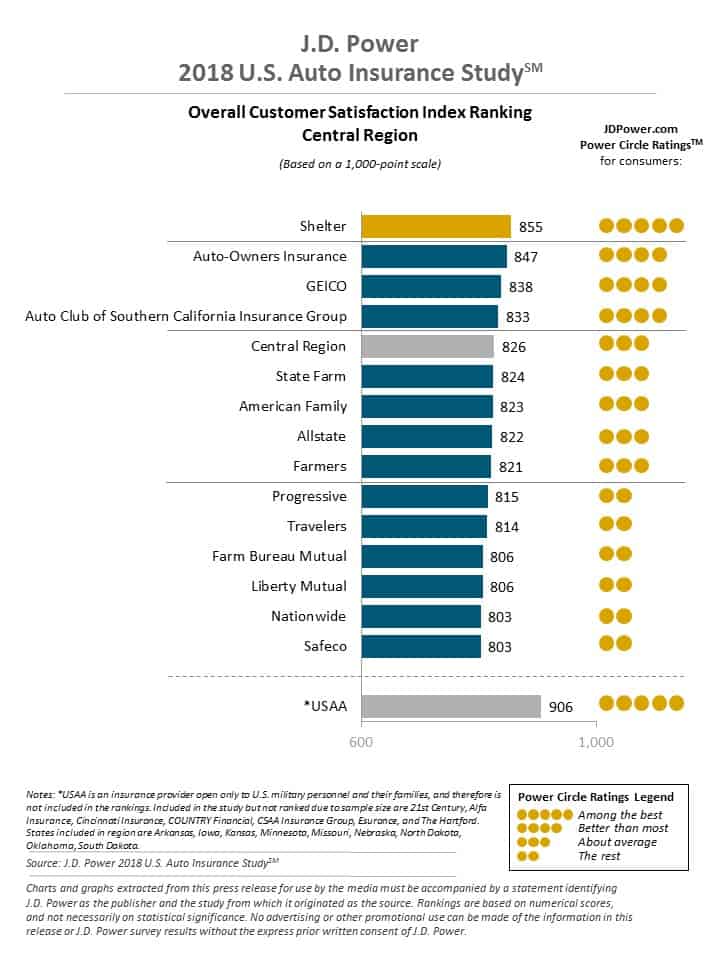

Best South Dakota Car Insurance Companies

When you’re on the hunt for South Dakota car insurance companies, it’s natural to wonder what consumers actually think of the top carriers in the state. Well, you’ve come to the right place. For everything from the financial ratings of the 10 largest South Dakota car insurance companies to carriers with the most complaints, keep scrolling.

The 10 Largest South Dakota Car Insurance Companies’ Financial Ratings

A South Dakota car insurance company’s financial strength rating is an essential factor to take into account when selecting a carrier, as this reveals the ability an insurer has to fulfill its financial obligations to consumers.

AM Best is a global rating agency that awards insurance carriers ratings based on their level of creditworthiness and financial strength. The top rating they award carriers is A++, while secondary A ratings show that an insurer has an excellent ability to meet its financial promises to consumers.

Discover the variety of car insurance discounts offered by top providers in South Dakota to help you save on your premiums.

Check out the 10 largest South Dakota insurance companies’ financial ratings in the table below to see where your current carrier ranks.

A.M. Best Financial Strength Ratings From the Top South Dakota Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A |

| CSAA | A |

| Geico | A++ |

| Liberty Mutual | A- |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| The Hartford | A+ |

| Travelers | A+ |

| USAA | A++ |

Bear in mind, that AM Best is a voluntary rating system, which is why companies like De Smet Insurance Group may not currently have a rating on file.

South Dakota Car Insurance Companies With the Best Customer Ratings

Explore the top-rated South Dakota car insurance companies known for exceptional customer satisfaction and service quality.

These South Dakota car insurance companies with the best customer ratings demonstrate their commitment to service excellence and customer satisfaction.

South Dakota Car Insurance Companies With the Most Customer Complaints

The table below shows the most recent data our researchers gathered from the NAIC, detailing the complaint ratio for the top 10 South Dakota car insurance companies.

South Dakota Customer Complaints: NAIC Score by Car Insurance Provider

| NAIC # | Insurance Company | Premiums | Total Complaints | Complaint Index |

|---|---|---|---|---|

| 21253 | Garrison | $10,799 | 2 | 3.70 |

| 25941 | United Service | $33,342 | 2 | 0.88 |

| 26271 | Erie | $156,630 | 4 | 0.93 |

| 39217 | QBE | $264,894 | 1 | 0.31 |

| 11198 | Loya | $1,020,790 | 2 | 0.21 |

| 15032 | Guideone | $595,878 | 1 | 0.32 |

| 25054 | Hudson | $604,842 | 1 | 0.31 |

| 39098 | Omni | $2,107,044 | 3 | 0.15 |

| 42404 | Liberty | $815,224 | 1 | 0.12 |

| 33600 | LM | $1,666,446 | 2 | 0.12 |

| 35289 | Continental | $1,001,305 | 1 | 0.10 |

| 10864 | American Freedom | $10,464,341 | 10 | 0.35 |

| 10655 | Unique | $2,087,202 | 2 | 0.23 |

| 44245 | 21st Century | $1,126,992 | 1 | 0.11 |

| 14249 | Founders | $24,516,935 | 18 | 0.16 |

| 14941 | Lighthouse | $2,775,797 | 2 | 0.18 |

| 13056 | RLI | $1,763,035 | 1 | 0.06 |

| 10336 | First Acceptance | $9,721,986 | 4 | 0.13 |

| 37648 | Permanent | $21,944,533 | 8 | 0.11 |

| 10730 | American Access | $18,370,556 | 6 | 0.11 |

| 11185 | Foremost | $3,035,976 | 1 | 0.03 |

| 13986 | Frankenmuth | $3,510,809 | 1 | 0.08 |

| 11004 | Trexis One | $4,207,389 | 1 | 0.05 |

| 13137 | Viking | $4,368,438 | 1 | 0.05 |

| 19240 | Allstate | $9,380,967 | 2 | 0.04 |

| 13688 | Elephant | $4,742,452 | 1 | 0.02 |

| 34690 | The Hartford | $4,753,235 | 1 | 0.02 |

| 28188 | Travco | $14,005,377 | 3 | 0.02 |

| 19658 | Bristol West | $15,258,233 | 3 | 0.02 |

| 26298 | Metropolitan | $10,736,831 | 2 | 0.01 |

| 25405 | Safe Auto | $31,047,710 | 6 | 0.01 |

| 19283 | American Standard | $5,478,415 | 1 | 0.01 |

| 11558 | AssuranceAmerica | $5,463,895 | 1 | 0.01 |

| 22640 | Consolidated | $55,840,770 | 10 | 0.01 |

| 10648 | Geneva | $1,641,309 | 3 | 0.18 |

| 28401 | American National | $6,334,686 | 1 | 0.03 |

| 21326 | Empire | $6,279,485 | 1 | 0.03 |

| 16144 | Grinnell | $6,124,176 | 1 | 0.03 |

| 22667 | Ace America | $6,818,835 | 1 | 0.03 |

| 11150 | Arch | $6,453,691 | 1 | 0.03 |

| 10322 | Grange | $6,853,804 | 1 | 0.02 |

| 19070 | Standard | $46,312,500 | 7 | 0.01 |

| 13587 | First Chicago | $22,770,536 | 3 | 0.01 |

| 42579 | Allied | $9,348,636 | 1 | 0.01 |

| 19275 | American Family | $105,497,365 | 12 | 0.01 |

| 25712 | Esurance | $17,490,230 | 2 | 0.01 |

| 41653 | Milbank | $9,508,880 | 1 | 0.01 |

| 19992 | American Select | $19,593,305 | 2 | 0.01 |

| 37214 | American States | $10,456,815 | 1 | 0.01 |

| 24082 | Ohio Security | $10,299,628 | 1 | 0.01 |

| 11215 | Safeco | $119,087,321 | 11 | 0.01 |

| 15350 | West Bend | $23,598,227 | 2 | 0.01 |

| 14138 | Geico Advantage Ins Co | $29,078,992 | 2 | 0.01 |

| 19259 | Selective | $15,184,280 | 1 | 0.01 |

| 24112 | Westfield | $13,384,635 | 1 | 0.01 |

| 22292 | Hanover | $17,744,284 | 1 | 0.01 |

| 23787 | Nationwide | $31,025,294 | 2 | 0.01 |

| 37770 | CSAA | $21,594,213 | 1 | 0.01 |

| 27120 | Trumbull | $19,962,617 | 1 | 0.01 |

| 40118 | Trustgard | $20,860,827 | 1 | 0.01 |

| 18988 | Auto-Owners | $114,691,864 | 5 | 0.01 |

| 38784 | Progressive | $226,241,918 | 8 | 0.01 |

| 15288 | United Farm | $291,607,837 | 11 | 0.01 |

| 18600 | USAA | $28,393,360 | 1 | 0.01 |

| 42587 | Depositors | $30,041,847 | 1 | 0.01 |

| 25178 | State Farm | $847,420,643 | 26 | 0.01 |

| 22624 | Indiana Farmers | $93,833,871 | 1 | 0.01 |

Just bear in mind that the complaint ratio reveals overall consumer satisfaction and should be one of a plethora of factors you take into account when choosing your carrier.

Commute Rates

The table below reveals the average annual rates South Dakota car insurance companies assess for insureds based on their annual commute.

South Dakota Full Coverage Car Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $112 | $120 |

| American Family | $115 | $125 |

| Amica | $110 | $120 |

| Farmers | $118 | $126 |

| Geico | $105 | $115 |

| Liberty Mutual | $120 | $130 |

| Progressive | $110 | $120 |

| State Farm | $100 | $110 |

| The Hartford | $115 | $125 |

| USAA | $95 | $105 |

| U.S. Average | $118 | $124 |

It is interesting to note, that while some car insurance carriers spike rates for higher annual commutes, others show little to no rate difference between 10 vs. 25-mile commutes.

While companies like Allstate have an approximately $230 rate jump based on 10 vs. 25-mile commutes, insurers such as Liberty Mutual and Nationwide charge consumers the exact same rates regardless of the length of their commute.

So, your commute may or may not affect the rates you can expect to pay, and it often comes down to the South Dakota car insurance company you pick.

Understanding how factors like coverage levels, driving history, and credit scores impact your car insurance rates can help you manage costs effectively. Tailor your insurance choices to minimize expenses and maximize coverage.

Credit History Rates

While the practice is forbidden in a handful of states, the vast majority of car insurance companies throughout the country (including those in South Dakota) can and do use your credit score as a key factor when assessing your rates.

South Dakota Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $295 | $200 | $155 |

| American Family | $259 | $210 | $165 |

| Farmers | $262 | $215 | $170 |

| Geico | $244 | $175 | $130 |

| Liberty Mutual | $300 | $225 | $180 |

| Metromile | $270 | $220 | $175 |

| Nationwide | $209 | $165 | $130 |

| Progressive | $250 | $190 | $145 |

| State Farm | $225 | $170 | $130 |

| Travelers | $275 | $210 | $165 |

| USAA | $200 | $150 | $115 |

| U.S. Average | $210 | $140 | $115 |

In South Dakota, car insurance rates vary widely based on credit scores. Liberty Mutual, for example, charges nearly $5,700 more for poor credit compared to good credit.

Farmers shows a smaller gap of about $800. Overall, maintaining good credit can significantly impact your insurance costs.

Driving Record Rates

Your driving record is another key element South Dakota car insurance companies use to determine your annual premiums.

South Dakota Full Coverage Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $150 | $180 | $225 | $170 |

| American Family | $140 | $170 | $220 | $160 |

| Amica | $135 | $165 | $210 | $155 |

| Farmers | $145 | $175 | $230 | $165 |

| Geico | $130 | $160 | $200 | $150 |

| Liberty Mutual | $160 | $190 | $240 | $180 |

| Progressive | $140 | $170 | $220 | $160 |

| State Farm | $120 | $150 | $200 | $140 |

| The Hartford | $145 | $175 | $225 | $165 |

| USAA | $115 | $145 | $195 | $135 |

If you take a look at the table above, you’ll notice that depending on the carrier, the difference in rates for individuals with one DUI vs. a clean record is astronomical.

For example, Geico charges insureds with one DUI on their record approximately $3,000 more in annual premiums than insureds with a clean record. Those numbers can really add up. However, if you note carriers like State Farm, the company only shows an approximate $144 rate difference for car insurance after a DUI vs. a clean record.

Practicing safe driving habits on the road will not only help you save big with South Dakota car insurance companies but ensure you stay secure whenever you get behind the wheel.

That said, if you do have a less-than-stellar driving history, this does not necessarily mean that you won’t be able to find the coverages you need.

However, with a history of repeated driving offenses, you might find that you aren’t able to secure car insurance through traditional methods and must instead apply to high-risk car insurance companies. More on that further down. For now, let’s take a look at the 10 largest car insurance companies in South Dakota, including their average loss ratio and market share.

How Much Auto Insurance Costs in South Dakota

Explore auto insurance costs in South Dakota’s Highmore and Keystone. This concise citywise comparison provides insights into the unique factors influencing car insurance rates in these locales, helping you make informed decisions about coverage.

South Dakota Car Insurance Cost by City

Understanding these specifics can aid in making informed decisions about coverage options tailored to these locales.

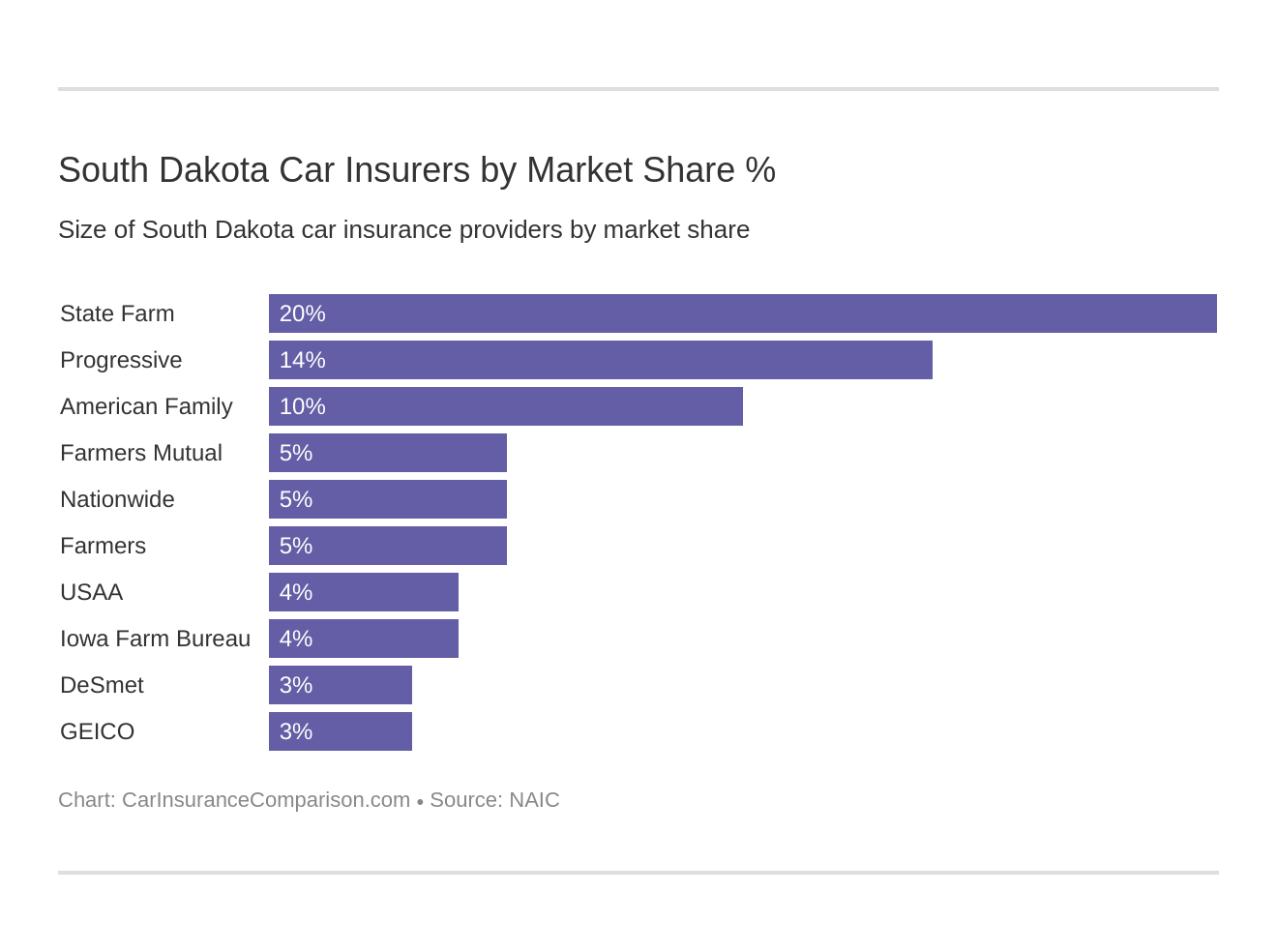

The 10 Largest Car Insurance Companies in South Dakota

Here’s a breakdown of the market share percentages for leading car insurance providers in South Dakota, reflecting their dominance in the state’s insurance landscape.

Understanding the market share of insurers in South Dakota can help drivers make informed decisions when selecting coverage, considering both popularity and reputation within the state.

These insights into direct premiums written, loss ratios, and market shares offer a comprehensive view of the competitive landscape among South Dakota car insurance providers, reflecting their financial stability and market influence within the state.

Number of Car Insurance Providers in South Dakota

South Dakota boasts a diverse insurance market with a total of 850 providers, comprising 16 domestic and 834 foreign insurers offering a range of property and casualty coverage options.

Number of South Dakota Car Insurance Companies

| Summary | Totals |

|---|---|

| Domestic | 16 |

| Foreign | 834 |

With 850 insurance providers operating in South Dakota, including a mix of domestic and foreign companies, consumers have ample choices to find coverage that meets their specific needs and preferences.

Driving Laws in South Dakota

Now that you have a thorough grasp of the primary components that South Dakota car insurance companies factor into the decision-making process when assessing your car insurance rates, it’s time to delve into a different subject: driving laws. Trust us, you won’t want to miss these. Let’s get started.

South Dakota’s Car Insurance Laws

State laws are always changing and developing, so it is crucial to stay current with the driving laws governing all South Dakota motorists. In the state of South Dakota, teens as young as 14 are permitted to obtain their learner’s permit.

Texting while driving is banned across the board for all motorists, while individuals under the age of 18 may not use a wireless handheld device while behind the wheel, period.

Under current South Dakota law, texting while driving is considered a secondary offense. What this means, is that a law enforcement officer must actually witness the motorist committing the violation before having the authority to pull the driver over and issue him or her a citation.

Ready to learn everything you need to know about South Dakota’s car insurance laws? Let’s get this show on the road.

High-Risk Insurance

If you have a poor driving history afflicted with tickets or collisions, South Dakota car insurance companies may see your record and view you as a high-risk driver, which means they feel it very likely that you would be filing a claim with them in the near future.

If you find yourself unable to obtain South Dakota car insurance as a result of your driving record, you might be eligible for the South Dakota Automobile Insurance Plan (SD AIP).

Since its commencement in 1949, South Dakota car insurance companies have been required to participate in the SD AIP. Insurance companies are assigned high-risk drivers based on their share of the insurance market in the state. For example, if State Farm comprises 15% of the state’s insurance market, State Farm will be given 15% of high-risk drivers under the SD AIP.

If you have tried to obtain South Dakota car insurance through the regular avenues and have been unable to do so, you may inquire with your insurance agent to try and obtain a quote via SD AIP. If you meet the eligibility requirements, the insurance agent can send in the application on your behalf, and you can secure insurance through the SD AIP high-risk pool.

It is important to note, that you will not be able to pick your insurance company if you opt for high-risk insurance through the South Dakota Automobile Insurance Plan. Rather, the SD AIP will assign you an insurance carrier that is part of the program.

It is also worth emphasizing that seeking coverage through the South Dakota Automobile Insurance Plan should be your very last resort if you simply cannot secure insurance via any other avenue.

If you’re seeking high-risk car insurance through SD AIP in South Dakota, ensure you’ve attempted to secure insurance in the past 60 days without success, have a vehicle registered in the state, hold a valid driver’s license, and complete the application truthfully and completely. Meeting these criteria should enable you to obtain coverage through the program without complications.

This weekend, we’re interviewing NASCAR drivers! If you could ask a driver one question, what would it be? We may just ask ’em for you… #GEICO500 #Talladega #NASCAR 🏁 pic.twitter.com/NqBLOFekGm

— GEICO (@GEICO) April 21, 2023

Low-Cost Insurance

Only a few states offer low-cost car insurance programs for individuals who meet certain eligibility requirements and income thresholds. At this time, South Dakota does not offer such a program.

Windshield Coverage

When it comes to windshield coverage, a number of states require a waived deductible if you have repairs done, while others require you to use manufacturer replacement parts only in the event a repair is needed.

South Dakota doesn’t have any laws specific to windshields, and insurers are allowed to use aftermarket crash parts (not from the original manufacturer) with broken windshield car insurance.

Read More: Does car insurance cover broken car windows?

Insurance companies are not allowed to require that you use a particular repair shop to have your car fixed, according to South Dakota’s 58-33-67 statute.

Automobile Insurance Fraud in South Dakota

South Dakota car insurance fraud is a serious offense, ranging from a Class Two misdemeanor to a Class Four felony based on the amount involved. Fraudulent activities include filing false claims, possessing counterfeit insurance documents, and misrepresenting information to insurers.

Penalties include a Class Two misdemeanor for fraud up to $400, a Class One misdemeanor for amounts between $400 and $1,000, and a Class Four felony for fraud exceeding $1,000. These actions can result in significant legal consequences depending on the severity of the deception committed.

Visit the South Dakota Code Section 58-4A-2 for additional information. The lesson to be learned here is that car insurance fraud in South Dakota is a grave crime with potentially grave penalties. Don’t commit insurance fraud, and you can set your mind at rest.

Statute of Limitations

If you get into a wreck in the state of South Dakota and are injured as a result, you might find yourself considering a personal injury claim against the at-fault driver.

A statute of limitations is the time in which you have to file a lawsuit with the courts from the date of the incident. If you do not file your claim by the statute of limitations deadline, you can expect your claim to be thrown out of court.

A case’s statute of limitations is not to be confused with the time in which you must file a car insurance claim with your South Dakota car insurance company in the period following a collision. Most carriers will mandate that you file your claim (or at the very least offer notice) within days or at the most, weeks after the crash.

Under South Dakota Codified Laws Section 15-2-14, your personal injury statute of limitations deadline is three years from the date of the incident. What this means, is that if you get into an auto accident in South Dakota and are injured as a result, you have three years from the date of the accident to file suit or be forever barred from doing so.

If someone was killed because of the collision, South Dakota Codified Laws Section 21-5-3 starts the clock of the three-year statute of limitations for any wrongful death suit on the date of the individual’s death. If you suffered property damage as a result of your South Dakota car accident, a six-year statute of limitations applies as directed by the South Dakota Codified Laws Section 15-2-13.

South Dakota’s Comparative Negligence Law

Following on the discussion of the South Dakota car accident statute of limitations above, we would be remiss to overlook the state’s equally relevant comparative negligence law.

Let us say that you get into a crash in the state of South Dakota, file a lawsuit, and the case proceeds to court. Once the jury hears the case for each party, they determine that the other party was at fault, but that you bear a modicum of fault as well.

According to the South Dakota Codified Laws Section 20-9-2, the fact that you contributed to the accident does not necessarily bar you from recovering damages if your portion of the fault was slight when compared to that of the other party.

The key word here is “slightly”. You must only be slightly at fault for the accident when compared to the other driver. However, it does mean that any damages you are awarded will be reduced by the percentage of fault you bear in the crash. In fact, South Dakota is the only state that adheres to this particular interpretation of the comparative negligence doctrine, because there is no amount of “slight” fault that is set in stone.

The decision is ultimately up to the jury to determine the amount of fault you bear and the reduction of damages you could potentially experience as a result. For example, let us say you get into a crash, and when the case goes to trial the court determines that you bore only a “slight” amount of fault at 15 percent. They further decided that your total damages due are $15,000.

Under South Dakota’s comparative negligence doctrine, you would only receive $12,750, which is $15,000 minus the 15% of fault you bore in the accident.

South Dakota’s Vehicle Licensing Laws

You’ve made it this far. Let’s keep going. Now, it’s time to delve into South Dakota’s key vehicle licensing laws that every driver in the state needs to know about. From the penalties for driving without insurance to teen driver laws to new resident procedures, we’ve got you covered.

Penalties for Driving Without Insurance

According to South Dakota Codified Laws Section 32-35-113, driving without proof of financial responsibility, such as driving without insurance, is a Class Two misdemeanor. Acceptable proofs include insurance certificate of a bond, deposits, or self-insurance.

Penalties include fines up to $1,000, up to six months imprisonment, a $100 fine for first-time offenders, and potential license suspension for one year, with subsequent SR-22 insurance requirements for three years. Driving on a suspended license incurs similar penalties.

Teen Driver Laws

In South Dakota, teens must be at least 14 years old to get a learner’s license. After holding it for six months (or three months with driver’s education), they can apply for a license or intermediate license at 14 years and six months (or 14 years and three months with driver’s education).

During the intermediate period, driving is restricted between 10 p.m. and 6 a.m. until age 16, unless supervised by a parent or guardian.

Older Driver and General Population License Renewal Procedures

In South Dakota, older drivers renew their licenses every five years, needing proof of adequate vision every time. They can renew online or by mail every other time. For the general population, renewal also occurs every five years, requiring proof of vision for in-person renewals and allowing online or mail renewals every other time.

New Residents

New residents moving to South Dakota must transfer their out-of-state driver’s license within 90 days. This process requires an in-person visit where you’ll need to bring your current out-of-state license, proof of Social Security number, two documents showing your residential address, proof of name change (if applicable), and proof of lawful U.S. status. Some locations allow you to schedule appointments online for added convenience.

Negligent Operator Treatment System

South Dakota’s laws on reckless and unsafe driving, governed by Chapter 32-24, classify reckless driving as a Class One misdemeanor. This includes driving with a disregard for others’ safety or in a manner likely to endanger people or property. Convictions can lead to up to a year in prison and fines up to $2,000.

Subsequent convictions within a year may result in license suspension. Reckless driving also adds eight points to the driver’s record; accumulating 15 points in a year or 22 in two years can lead to license suspension. Careless driving, a less serious offense, is a Class Two misdemeanor, punishable by up to 30 days in jail and/or fines up to $500.

South Dakota’s Rules of the Road

Ready to learn about South Dakota’s key rules of the road? Here’s what every driver in the state needs to know to stay safe and secure behind the wheel.

Fault vs. No-Fault

South Dakota adheres to the fault system regarding who is held responsible to cover losses such as medical expenses, lost wages, and property damage incurred due to a collision.

In practical terms, this means that whoever causes the accident is held responsible for compensating the injured party for any damages they experience as a result. In reality, the at-fault party’s insurance company will compensate the injured party or parties for damages received up to and until policy limits are exhausted.

Keep Right and Move Over Laws

The state’s “Keep Right Law”, South Dakota Codified Law 32-26-1 requires vehicles driving slower than the flow of traffic to keep to the right side of the roadway. South Dakota’s Move Over Law, 32-31-6.1 requires motorists to come to a stop when nearing an authorized emergency vehicle with its red signals and lights on. You are also required to move over and slow when passing by a vehicle flashing yellow or amber lights.

Speed Limits

In South Dakota, motorists must adhere to speed limits of 80 mph on both rural and urban interstates, and 70 mph on limited access roads and all other roads.

Seat Belt and Carseat Laws

In South Dakota, children four years old and younger who weigh less than 40 pounds must be restrained in a child safety seat. Children between the ages of 5-17 and all children who weigh over 40 pounds (no matter how old) may wear an adult safety belt. Violation of these laws incurs a maximum base fine of $25 for first-time offenders.

There are no state laws in South Dakota imposing restrictions on who may ride in the cargo seat areas of pickup trucks.

Ridesharing

In March 2016, the governor of South Dakota signed a bill into effect governing ridesharing drivers. The bill requires rideshare insurance liability coverages of $50,000 per person and $100,000 per accident to cover drivers whenever they are logged into the app but are not transporting a passenger.

The bill also mandates $1,000,000 in coverage whenever the rideshare driver is transporting a passenger. Rideshare services such as Uber and Lyft carry commercial policies for drivers to protect all parties involved in the event of a collision. Rideshare drivers very rarely carry individual commercial policies.

Automation on the Road

South Dakota does not currently have any laws in place authorizing the testing or deployment of autonomous vehicles.

South Dakota’s Safety Laws

Check out South Dakota’s important safety laws regarding DUIs, marijuana impairment, and distracted driving. Here’s what you need to know.

DUI Laws

South Dakota’s DUI laws set a BAC limit at 0.08, with escalating penalties for repeat offenses within a 10-year period.

South Dakota DUI Laws

| Laws | Details |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.17 |

| Criminal Status | 1st-2nd: Class 1 misdemeanors; 3rd: Class 6 felony; 4th: Class 5 felony; 5th+: Class 4 felonies |

| Look Back Period | 10 years |

| 1st Offense | License Suspension: 30 days - 1 year; Imprisonment: Up to 1 year; Fine: Minimum $2,000 |

| 2nd Offense | License Suspension: 6 months minimum, restricted permit eligible; Imprisonment: Up to 120 days; Fine: Minimum $2,000; Other: 3 days jail if driving with suspended license |

| 3rd Offense | License Suspension: 1 year post-imprisonment, restricted permit eligible; Imprisonment: Up to 2 years; Fine: $4,000; Other: 10 days jail if driving with suspended license |

| 4th Offense | License Suspension: 2 years, restricted permit eligible; Imprisonment: Up to 10 years; Fine: $20,000; Other: 20 days jail if driving with suspended license |

| 5th+ Offense | License Suspension: Minimum 3 years; Imprisonment: Up to 10 years; Fine: $20,000; Other: 20 days jail if driving with suspended license |

| Mandatory Interlock | No |

Knowing South Dakota’s strict DUI laws is essential to avoid severe penalties, including fines and license revocations, emphasizing responsible driving and adherence to legal alcohol limits for road safety.

Marijuana-Impaired Driving Laws

South Dakota maintains a zero-tolerance policy for THC and metabolites for drivers under the age of 21. Furthermore, it is illegal to drive while under the influence of drugs in the state, according to South Dakota Code Section 32-23-1.

South Dakota has some of the strictest anti-marijuana laws in the country, with possession of even a tiny amount of the drug incurring penalties including a year’s imprisonment and $2,000 in fines.

Distracted Driving Laws

South Dakota imposes a young driver’s cellphone ban on teens with a learner’s permit and intermediate license. All drivers are forbidden to text while driving, regardless of age. There is not currently a ban in place on hand-held devices, other than for young drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fascinating Facts Every South Dakota Driver Needs to Know

We’re almost there. Let’s delve into the fascinating facts every driver in South Dakota needs to know.

Vehicle Theft in South Dakota

In 2013, there were 264 motor vehicle thefts in Sioux Falls alone. Check out the FBI’s Crime in the U.S. Report to see where your city or town ranks, then take a look at the table below to discover the top 10 stolen cars in the state of South Dakota.Top 10 South Dakota Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Ford F-150 | 2020 | 126 |

| Chevrolet Silverado 1500 | 2019 | 110 |

| Hyundai Elantra | 2021 | 102 |

| Honda Civic | 2018 | 95 |

| Hyundai Sonata | 2020 | 89 |

| Kia Optima | 2019 | 85 |

| Toyota Corolla | 2018 | 80 |

| GMC Pickup (Full Size) | 2018 | 75 |

| Honda Accord | 2017 | 70 |

| Dodge Pickup (Full Size) | 2001 | 68 |

Vehicle thefts remain a significant concern, with certain models being targeted more frequently in South Dakota. Stay informed about theft trends and take preventive measures to protect your vehicle.

Risky/Harmful Driving Behavior

In order to foster safe driving habits, it’s important to know the top risky/harmful driving behaviors in your state so you can stay cognizant and prepared when you get behind the wheel. Let’s dig deeper.

Traffic Fatalities by Weather Condition and Light Condition

This data outlines South Dakota traffic fatalities categorized by weather and light conditions, reflecting the varying risks associated with different driving environments.

South Dakota Traffic Fatalities by Weather and Light Condition

| Weather Condition | Daylight | Dark, but Lit | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 56 | 2 | 36 | 2 | 2 | 98 |

| Rain | 1 | 0 | 3 | 1 | 0 | 5 |

| Snow/Sleet | 4 | 0 | 1 | 0 | 0 | 5 |

| Other | 1 | 0 | 0 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 2 | 0 | 0 | 2 |

| TOTAL | 62 | 2 | 42 | 3 | 2 | 111 |

Understanding the impact of weather and light conditions on traffic fatalities underscores the importance of cautious driving practices and preparedness for diverse road conditions to enhance safety on South Dakota roads.

Fatalities by County

This data presents South Dakota motor vehicle fatalities by county from 2019 to 2023, illustrating the variation in road safety outcomes across different regions.

South Dakota Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Aurora County | 3 | 2 | 0 |

| Beadle County | 4 | 0 | 2 |

| Bennett County | 1 | 0 | 0 |

| Bon Homme County | 0 | 3 | 0 |

| Brookings County | 2 | 4 | 3 |

| Brown County | 1 | 1 | 1 |

| Brule County | 0 | 0 | 0 |

| Buffalo County | 0 | 1 | 0 |

| Butte County | 1 | 2 | 3 |

| Campbell County | 1 | 2 | 0 |

| Charles Mix County | 1 | 1 | 3 |

| Clark County | 0 | 1 | 0 |

| Clay County | 2 | 1 | 0 |

| Codington County | 2 | 2 | 2 |

| Corson County | 0 | 1 | 2 |

| Custer County | 5 | 2 | 1 |

| Davison County | 3 | 2 | 1 |

| Day County | 2 | 0 | 1 |

| Deuel County | 0 | 0 | 0 |

| Dewey County | 0 | 0 | 1 |

| Douglas County | 0 | 1 | 0 |

| Edmunds County | 6 | 2 | 2 |

| Fall River County | 1 | 0 | 2 |

| Faulk County | 2 | 1 | 0 |

| Grant County | 1 | 1 | 3 |

| Gregory County | 2 | 0 | 0 |

| Haakon County | 0 | 0 | 0 |

| Hamlin County | 1 | 1 | 0 |

| Hand County | 1 | 1 | 0 |

| Hanson County | 7 | 1 | 1 |

| Harding County | 1 | 0 | 2 |

| Hughes County | 1 | 1 | 3 |

| Hutchinson County | 2 | 0 | 0 |

| Hyde County | 0 | 3 | 0 |

| Jackson County | 3 | 3 | 6 |

| Jerauld County | 0 | 0 | 2 |

| Jones County | 1 | 1 | 2 |

| Kingsbury County | 0 | 1 | 2 |

| Lake County | 0 | 1 | 2 |

| Lawrence County | 8 | 10 | 8 |

| Lincoln County | 4 | 3 | 6 |

| Lyman County | 0 | 3 | 0 |

| Marshall County | 1 | 1 | 1 |

| Mccook County | 1 | 0 | 2 |

| Mcpherson County | 0 | 0 | 0 |

| Meade County | 6 | 4 | 3 |

| Mellette County | 2 | 0 | 0 |

| Miner County | 1 | 0 | 0 |

| Minnehaha County | 10 | 9 | 12 |

| Moody County | 4 | 0 | 1 |

| Pennington County | 16 | 10 | 17 |

| Perkins County | 0 | 0 | 1 |

| Potter County | 0 | 1 | 1 |

| Roberts County | 4 | 5 | 5 |

| Sanborn County | 1 | 0 | 1 |

| Shannon County | 6 | 14 | 11 |

| Spink County | 0 | 1 | 2 |

| Stanley County | 0 | 0 | 0 |

| Sully County | 1 | 0 | 1 |

| Todd County | 0 | 1 | 1 |

| Tripp County | 0 | 1 | 0 |

| Turner County | 1 | 2 | 2 |

| Union County | 2 | 2 | 1 |

| Walworth County | 2 | 3 | 0 |

| Yankton County | 7 | 3 | 6 |

| Ziebach County | 0 | 0 | 0 |

Analyzing motor vehicle fatalities by county highlights the need for targeted safety measures and awareness campaigns to reduce road accidents and improve overall traffic safety across South Dakota.

2017 Traffic Fatalities

The data details traffic fatalities in South Dakota categorized by rural and urban areas, offering insights into the differing safety challenges faced across these environments.

South Dakota Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 109 |

| Urban | 20 |

Understanding the distribution of traffic fatalities between rural and urban areas underscores the importance of tailored road safety strategies to mitigate risks and enhance transportation safety statewide.

Fatalities by Person Type

This report presents South Dakota’s traffic fatalities categorized by person type, highlighting the impact on occupants of enclosed vehicles, motorcyclists, and nonoccupants.

South Dakota Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Occupants (Enclosed Vehicles) | 103 |

| Motorcyclists | 16 |

| Non-Occupants | 10 |

Analyzing fatalities by person type underscores the varied risks faced by different road users in South Dakota, emphasizing the need for targeted safety measures to protect both vehicle occupants and vulnerable road users.

Fatalities by Crash Type

This report details South Dakota’s traffic fatalities categorized by crash type, including incidents involving single vehicles, large trucks, speeding, rollovers, roadway departures, and intersections.

South Dakota Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Single Vehicle | 69 |

| Involving a Large Truck | 21 |

| Involving Speeding | 31 |

| Involving a Rollover | 58 |

| Involving a Roadway Departure | 93 |

| Involving an Intersection (or Intersection Related) | 19 |

Examining fatalities by crash type provides critical insights into the primary factors contributing to road accidents in South Dakota. Addressing these specific crash scenarios through targeted safety initiatives and enforcement measures is essential to reducing fatalities and improving overall road safety in the state.

Fatalities Involving Speeding by Top 10 Counties

This data highlights fatalities involving speeding in South Dakota’s top 10 counties from 2013 to 2017, providing insights into the prevalence of speed-related accidents in these regions.

South Dakota Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Aurora County | 1 | 0 | 0 |

| Beadle County | 0 | 0 | 1 |

| Bennett County | 0 | 0 | 0 |

| Bon Homme County | 0 | 0 | 0 |

| Brookings County | 1 | 1 | 1 |

| Brown County | 0 | 1 | 0 |

| Brule County | 0 | 0 | 0 |

| Buffalo County | 0 | 0 | 0 |

| Butte County | 0 | 0 | 0 |

| Campbell County | 0 | 0 | 0 |

Examining fatalities involving speeding across these counties underscores the ongoing challenge of speeding-related accidents in South Dakota. The data underscores the need for continued efforts to enforce speed limits and promote safe driving behaviors to reduce fatalities on the state’s roads.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by Top 10 Counties

This data examines fatalities in crashes involving an alcohol-impaired driver in South Dakota’s top 10 counties from 2019 to 2023, shedding light on the impact of alcohol-related accidents in these areas.

South Dakota DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Aurora County | 1 | 0 | 0 |

| Beadle County | 3 | 0 | 0 |

| Bennett County | 0 | 0 | 0 |

| Bon Homme County | 0 | 0 | 0 |

| Brookings County | 1 | 0 | 0 |

| Brown County | 1 | 0 | 0 |

| Brule County | 0 | 0 | 0 |

| Buffalo County | 0 | 0 | 0 |

| Butte County | 0 | 1 | 2 |

| Campbell County | 0 | 1 | 0 |

The fatalities in crashes involving alcohol-impaired drivers across these counties underscore the critical need for continued efforts in combating drunk driving. Enhancing enforcement and promoting awareness of the dangers of impaired driving remain essential to reducing these tragic incidents on South Dakota’s roads.

Teen Drinking and Driving

This data highlights the issue of teen drinking and driving in South Dakota, including statistics on alcohol-impaired driving fatalities and DUI arrests among individuals under 21 years old.

South Dakota Teens & Drunk Driving Data

| Data | Details |

|---|---|

| Under 21 Alcohol-Impaired Driving Fatalities Per 100K of the Population | 2.8 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 Years Old) | 77 |

| DUI Arrests (Under 18 Years Old) Total Per Million People | 361.02 |

With alcohol-impaired driving fatalities among teens higher than the national average, and a significant number of DUI arrests involving minors, addressing underage drinking and driving remains a crucial concern for South Dakota’s road safety initiatives.

EMS Response Time

This data presents EMS response times in South Dakota, detailing the duration from the time of crash to EMS notification, EMS notification to EMS arrival, EMS arrival at the scene to hospital arrival, and overall time from crash to hospital arrival in both rural and urban settings.

South Dakota EMS Response Time

| Location | Notification | Arrival |

|---|---|---|

| Rural | 7.63 | 15.16 |

| Urban | 7.18 | 11.91 |

Understanding EMS response times is crucial for improving emergency medical services across South Dakota, ensuring quicker and more efficient responses to crashes and potentially reducing fatalities through prompt medical intervention.

Transportation

The average South Dakota resident spends just 15.7 minutes in commute time, which is almost 10 minutes shorter than the average nationwide commute of 25.3 minutes. Just 1.26% of South Dakota workers have super commutes beyond 90 minutes in length.

Take control of your car insurance journey and start maximizing your savings today. Compare South Dakota car insurance prices by getting your free rate quote for multiple South Dakota car insurance providers in one place. Just enter your ZIP code below to get started.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Frequently Asked Questions

What should I do if I can’t afford car insurance in South Dakota?

Consider adjusting your coverage limits or car insurance deductibles to lower your premium. You can also reach out to insurance companies to inquire about any available discounts or payment plans that could make the insurance more affordable.

Additionally, some states offer low-cost or subsidized insurance programs for individuals with limited incomes. Contact your state’s insurance department or a local insurance agent to inquire about such programs in South Dakota.

How can I compare car insurance rates in South Dakota?

You can reach out to individual insurance companies and request quotes directly. Additionally, you can use online comparison tools, such as ours, that provide multiple quotes from different insurers. These tools typically require you to provide some personal information and details about your vehicle and driving history to generate accurate quotes.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

What factors affect car insurance rates in South Dakota?

Car insurance rates in South Dakota can be influenced by several factors. Common factors include your driving record, age, gender, marital status, type of vehicle you drive, your credit history, and the coverage options you choose.

Additionally, factors like the location where you reside in South Dakota, the frequency of car thefts and accidents in that area, and the state’s insurance regulations can impact insurance rates.

Are there any discounts available for car insurance in South Dakota?

Common discounts include safe driver discounts, multiple policy car insurance discounts (if you have multiple policies with the same insurer), good student discounts, low-mileage discounts, and discounts for having safety features installed in your vehicle. It’s worth checking with insurance providers to see which discounts you may qualify for.

Are car insurance rates higher in South Dakota compared to other states?

Car insurance rates can vary from state to state, and South Dakota may have different rates compared to other states. Insurance companies consider factors like state regulations, population density, crime rates, and accident statistics when determining rates for a specific area.

How can I lower my car insurance rates in South Dakota?

There are several strategies you can consider to lower your car insurance rates in South Dakota. Maintaining a clean driving record, bundling multiple policies with the same insurer, opting for higher deductibles, taking advantage of available discounts, and periodically comparing quotes from different insurance companies are some effective methods.

Is it necessary to have full coverage car insurance in South Dakota?

Full coverage car insurance is not legally required in South Dakota. However, if you have a loan or lease on your vehicle, your lender or leasing company may require you to have comprehensive and collision coverage. Even if it’s not mandatory, having full coverage can provide added protection for your vehicle in case of accidents, theft, or other covered events.

Read More: Best Full Coverage Car Insurance

What are the minimum car insurance requirements in South Dakota?

South Dakota requires drivers to carry liability insurance with minimum coverage limits of 25/50/25. This means coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage liability.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

What are the consequences of a DUI conviction on car insurance rates in South Dakota?

A DUI conviction in South Dakota typically results in significantly higher car insurance rates. Insurers consider DUI convictions as a major risk factor, leading to increased premiums. Additionally, you may be required to obtain an SR-22 form, which certifies your financial responsibility, further impacting insurance costs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.