Shelter Car Insurance Review for 2026 [Honest Report]

Our Shelter car insurance review found it stands out for its various coverage options. However, Shelter car insurance rates are higher than some competitors, starting at $80/month. Despite this, Shelter auto insurance coverage options and strong financial stability may outweigh the cost for some customers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated February 2025

This Shelter car insurance review found the company’s key benefits include a wide variety of coverage options like custom equipment coverage and attractive discounts, such as those for bundling multiple policies.

However, Shelter’s rates are higher than those of some competitors, especially for drivers with poor records. While the company offers financial stability and good customer service ratings, it may not be the best choice for cheap car insurance.

Shelter Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 3.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.1 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 4.2 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.0 |

| Policy Options | 3.1 |

| Savings Potential | 4.3 |

Shelter is best suited for drivers seeking a broad range of coverage options and those who can take advantage of its discounts.

It’s important to compare multiple insurance quotes to ensure you get the best deal for your needs.

- Shelter car insurance rates start at $80 monthly for minimum coverage

- Customers can save by bundling insurance policies at Shelter Insurance

- Customers have mixed feedback regarding Shelter agent customer service

Shelter Car Insurance Rates

Most people are looking for an affordable auto insurance company, so checking Shelter’s average car insurance rates is one of the most important parts of evaluating the company. Many factors affect what you pay for car insurance, but your age is a big factor, so let’s start by looking at Shelter rates by age and gender.

Shelter Car Insurance Monthly Rates by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $212 | $340 |

| Age: 16 Male | $235 | $368 |

| Age: 18 Female | $198 | $325 |

| Age: 18 Male | $222 | $352 |

| Age: 25 Female | $134 | $238 |

| Age: 25 Male | $147 | $249 |

| Age: 30 Female | $108 | $198 |

| Age: 30 Male | $120 | $210 |

| Age: 45 Female | $87 | $164 |

| Age: 45 Male | $92 | $171 |

| Age: 60 Female | $76 | $152 |

| Age: 60 Male | $83 | $160 |

| Age: 65 Female | $80 | $148 |

| Age: 65 Male | $85 | $155 |

The amount of coverage you get will affect your rates as well. While it may be tempting for young drivers to go with minimum coverage because it is so much cheaper, it doesn’t offer much protection.

Instead, teens can join their parents’ policy at Shelter for cheaper rates than the ones we showed above for teens purchasing their own policy (Read More: How long can you stay on your parent’s car insurance?). Another factor that will affect rates for both teens and adults is a driver’s record.

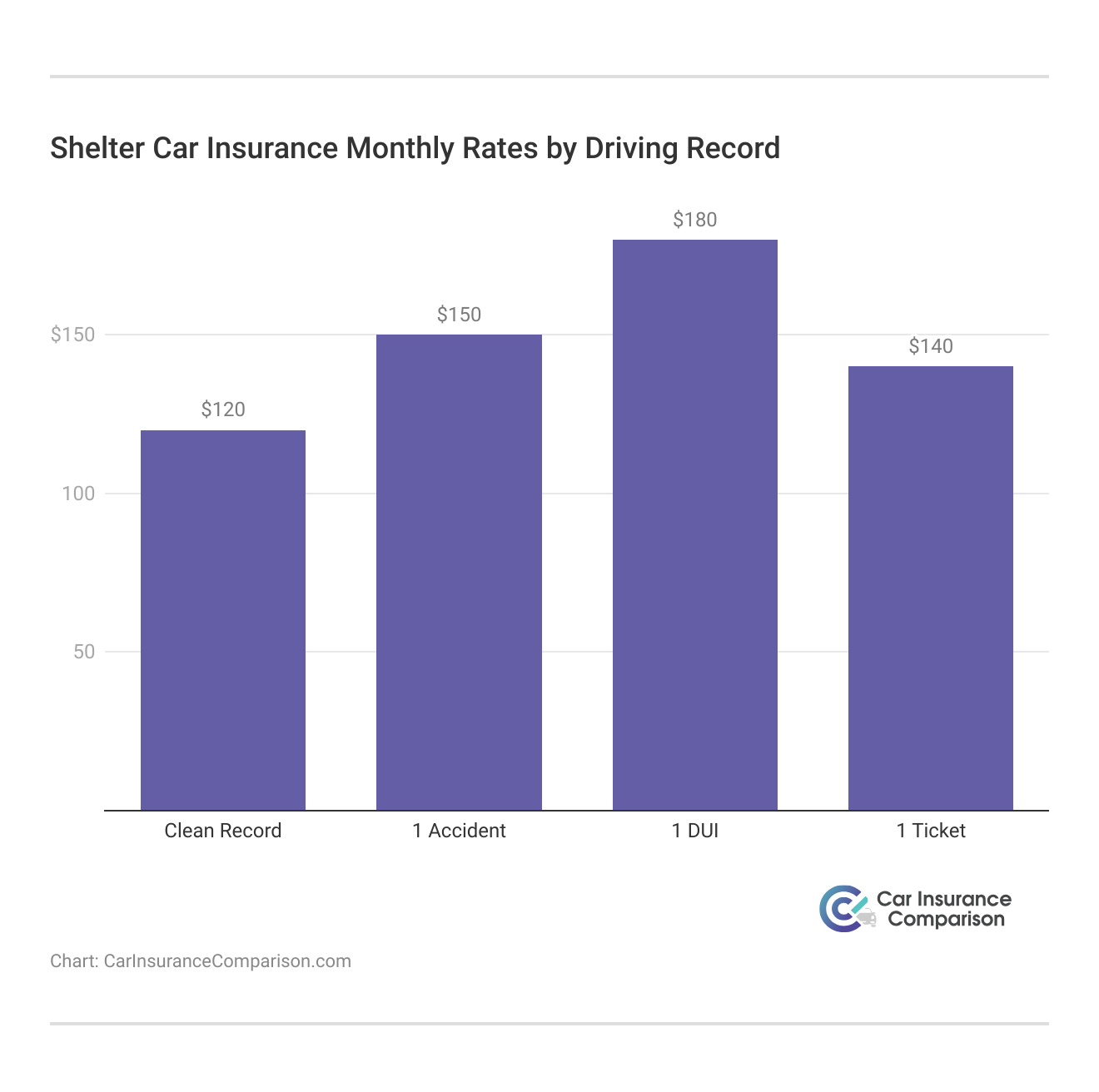

Most car insurance companies count DUIs as the worst offense that can be on a driver’s record, which is why they increase rates the most for a DUI driver.

Shelter Insurance will increase your auto insurance rates if you're convicted of a DUI, reflecting the higher risk you pose as a driver. However, Shelter does offer options to help manage your coverage, such as SR-22 filings, to comply with state requirements after a DUI conviction.

Kristen Gryglik Licensed Insurance Agent

After DUIs, at-fault accidents are the next most expensive mistake on a record, followed by a traffic ticket. You can expect higher rates for at least a few years if you have a poor driving record.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Shelter Car Insurance Rates vs. the Competition

Let’s look deeper into Shelter’s car insurance rates by comparing them to other popular companies’ prices, starting again with rates by age and gender.

Shelter Car Insurance Monthly Rates Compared to Top Providers by Age & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $290 | $320 | $185 | $205 | $145 | $155 | $115 | $125 | |

| $285 | $315 | $182 | $202 | $142 | $152 | $112 | $122 | |

| $260 | $290 | $170 | $190 | $130 | $140 | $100 | $110 | |

| $300 | $330 | $190 | $210 | $150 | $160 | $120 | $130 |

| $265 | $295 | $172 | $192 | $132 | $142 | $102 | $112 |

| $275 | $305 | $175 | $195 | $135 | $145 | $105 | $115 | |

| $280 | $310 | $180 | $200 | $140 | $150 | $110 | $120 |

| $270 | $300 | $175 | $195 | $135 | $145 | $105 | $115 | |

| $280 | $310 | $180 | $200 | $140 | $150 | $110 | $120 | |

| $250 | $270 | $160 | $180 | $120 | $130 | $90 | $100 |

Shelter is not the most expensive company compared to competitors, which is great. However, when you compare Shelter to a few other companies, such as Shelter Insurance vs. State Farm or Geico, they are cheaper on average than Shelter (Read More: Geico Car Insurance Review). Shelter also isn’t the cheapest for drivers with poor driving records.

Shelter Car Insurance vs. Top Competitors: Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $145 | $170 | $195 | $260 | |

| $142 | $167 | $192 | $255 | |

| $130 | $155 | $180 | $230 | |

| $150 | $175 | $200 | $270 |

| $132 | $157 | $182 | $235 |

| $135 | $160 | $185 | $240 | |

| $140 | $165 | $190 | $250 |

| $135 | $160 | $185 | $240 | |

| $140 | $165 | $190 | $250 | |

| $120 | $145 | $170 | $220 |

If you are looking for the cheapest possible rates, Shelter may not be for you. However, there are several other factors to consider besides price, like coverage options and customer reviews, as the cheapest doesn’t always equal the best.

Car Insurance Coverage Options at Shelter

Shelter Insurance Company sells quite a few different types of car coverage, from the basics like liability insurance to extras like custom equipment coverage.

Car Insurance Coverages Offered by Shelter Insurance

| Coverage Name | Offered? | What it Covers |

|---|---|---|

| Liability | ✅ | Others' bodily injury and property damage |

| Collision | ✅ | Damages to your vehicle after a collision |

| Comprehensive | ✅ | Damages to your car from theft, vandalism, etc. |

| Uninsured/Underinsured Motorist | ✅ | If the at-fault driver lacks insurance |

| Roadside Assistance | ✅ | Towing, flat tire changes, jump-starts, etc. |

| Rental Reimbursement | ✅ | Cost of a rental car after a covered loss |

| Medical Payments (MedPay) | ✅ | Medical bills for you and your passengers |

| Personal Injury Protection (PIP) | ✅ | Medical expenses and lost wages |

| Rideshare | ❌ | Coverage for drivers using their cars for ridesharing services |

| Custom Equipment | ✅ | Aftermarket or custom modifications |

| Gap Insurance | ❌ | Difference between a loan and car's value |

Shelter has a great variety for customers looking for less common coverages. However, Shelter does not offer rideshare insurance, so Uber and Lyft drivers must shop elsewhere (Learn More: Compare Rideshare Car Insurance: Rates, Discounts, & Requirements).

Shelter Car Insurance Discounts

If you want to work to lower your Shelter auto insurance rates, one of the things you can do is apply for the discounts that Shelter offers.

Shelter Car Insurance Discounts by Savings

| Discount Name |  |

|---|---|

| Bundling | 25% |

| Safe Driver | 20% |

| Good Student | 15% |

| Multi-Vehicle | 10% |

| Anti-Theft | 10% |

| Defensive Driving | 10% |

| Pay-in-Full | 8% |

| Paperless Billing | 5% |

| Loyalty | 5% |

| New Vehicle | 5% |

Multiple policy car insurance discounts will be the biggest saver at Shelter Insurance Company, and you can qualify by purchasing another type of insurance from Shelter, such as home insurance. Families can also save by insuring multiple cars on one policy.

The more discounts you qualify for, the better your Shelter insurance rates will be. Even small discounts like a paperless discount will contribute to lower rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Reviews of Shelter

Customer reviews of Shelter are mixed, with some customers posting glowing reviews of the agents they worked with for quotes and claims and other customers posting negative feedback about agent responsiveness, like the Yelp review below.

How do customer satisfaction ratings affect car insurance companies? Mixed reviews of companies are common and don’t necessarily mean a company is awful. In addition to looking at Shelter Insurance Google reviews and Yelp reviews, it is also important to look at the business ratings of a company to get a full picture of complaints, customer satisfaction, and more.

Business Reviews of Shelter

Several businesses have rated Shelter Mutual Insurance Company, from BBB to J.D. Power. Take a look at how Shelter Insurance ranks below.

Shelter Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices |

|

| Score: 75/100 Good Customer Feedback |

|

| Score: 0.85 Fewer Complaints |

|

| Score: A Excellent Financial Strength |

Several ratings indicate good customer service, such as J.D. Power’s above-average Shelter insurance rating and the lower NAIC complaint score (Read More: Car Insurance Companies With the Worst Customer Satisfaction).

J.D. Power bases its car insurance ratings on surveys of thousands of customers, rating customer service, claims handling, and other essential business practices.

Brandon Frady Licensed Insurance Producer

Shelter also has a good financial standing, according to the Shelter Insurance AM Best rating, and good business practices based on Shelter insurance reviews from BBB.

Shelter Car Insurance Pros and Cons

Now that we’ve covered the most important aspects of Shelter Insurance Company, let’s take a minute to recap the company’s pros and cons. Some great aspects of Shelter are:

- Variety of Coverages: Shelter has less-commonly offered extras like custom equipment coverage, which is some of the best car insurance for modified cars.

- Discount Variety: Shelter customers can apply for several different types of discounts on their auto insurance policies.

- Financial Strength Rating: Shelter is a financially stable company, according to its A.M. Best rating.

While these are some great perks, the downsides that Shelter Insurance customers may experience include the following:

- Higher Rates: Shelter is not the cheapest car insurance company available on the market, although rates aren’t astronomically high.

- Some Negative Customer Feedback: While Shelter has decent ratings from businesses, some negative reviews are left on sites like Reddit and Yelp.

Fully consider the pros and cons of Shelter before committing, as a company that is right for one customer may be a poor choice for another customer.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding if Shelter Car Insurance is Best for You

Our Shelter car insurance review found that one major pro is its wide variety of coverage options, including custom equipment coverage. Shelter also stands out with an A.M. Best A rating, indicating strong financial stability.

However, one major con is its higher-than-average rates, particularly for drivers with poor records, so it may not be the best choice financially for certain drivers (Read More: Best Car Insurance for a Bad Driving Record).

If Shelter isn’t the right choice for you, there are plenty of other car insurance companies to choose from. To ensure you’re getting the best deal, be sure to compare quotes from multiple insurance companies before making your final decision.

Frequently Asked Questions

Is Shelter car insurance a good company?

Shelter is not the highest-rated company on the market, as it only has an A rating from A.M. Best and BBB, but it is still a solid choice for some customers.

Has there been a Shelter insurance lawsuit?

Yes, there have been a few lawsuits against Shelter for claim denials and other actions.

Is Shelter insurance expensive?

Is Shelter insurance more expensive than other providers? Yes, Shelter insurance is more expensive, with rates starting at $80/month. (Read More: ). If you’re wondering why is my car insurance so expensive, find cheaper auto insurance in your area with our free tool.

Where does Shelter Insurance rank?

Shelter has an A rating from A.M. Best and BBB for financial strength and business practices. It also has a score of 850 / 1,000 from J.D. Power for above-average customer satisfaction.

Who owns the Shelter Insurance company?

Shelter is a mutual insurance company, meaning that policyholders own the company.

Does Shelter car insurance have a grace period?

Yes, Shelter offers a grace period on car insurance for late payments (Learn More: What happens after a late car insurance payment?).

Is Shelter Insurance a standard insurance company?

Yes, Shelter is a standard car insurance company. This means that Shelter offers car insurance for regular vehicles and drivers; it doesn’t specialize in insurance for expensive, collector vehicles or high-risk drivers.

How old is Shelter insurance?

The Shelter Insurance Company was founded in 1946.

How many agents does Shelter Insurance have?

Shelter has around 1,400 agents, so you should have a few agents to choose from (Read More: How to Change Car Insurance Agents).

What is Shelter Insurance Companies A.M. Best rating?

Shelter has an A rating from A.M. Best.

Is Shelter a captive agency?

Do Shelter insurance agents set rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How much does Shelter Insurance pay?

Shelter is not the highest-rated company on the market, as it only has an A rating from A.M. Best and BBB, but it is still a solid choice for some customers.

Yes, there have been a few lawsuits against Shelter for claim denials and other actions.

Is Shelter insurance expensive?

Is Shelter insurance more expensive than other providers? Yes, Shelter insurance is more expensive, with rates starting at $80/month. (Read More: ). If you’re wondering why is my car insurance so expensive, find cheaper auto insurance in your area with our free tool.

Where does Shelter Insurance rank?

Shelter has an A rating from A.M. Best and BBB for financial strength and business practices. It also has a score of 850 / 1,000 from J.D. Power for above-average customer satisfaction.

Who owns the Shelter Insurance company?

Shelter is a mutual insurance company, meaning that policyholders own the company.

Does Shelter car insurance have a grace period?

Yes, Shelter offers a grace period on car insurance for late payments (Learn More: What happens after a late car insurance payment?).

Is Shelter Insurance a standard insurance company?

Yes, Shelter is a standard car insurance company. This means that Shelter offers car insurance for regular vehicles and drivers; it doesn’t specialize in insurance for expensive, collector vehicles or high-risk drivers.

How old is Shelter insurance?

The Shelter Insurance Company was founded in 1946.

How many agents does Shelter Insurance have?

Shelter has around 1,400 agents, so you should have a few agents to choose from (Read More: How to Change Car Insurance Agents).

What is Shelter Insurance Companies A.M. Best rating?

Shelter has an A rating from A.M. Best.

Is Shelter a captive agency?

Do Shelter insurance agents set rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How much does Shelter Insurance pay?

Is Shelter insurance more expensive than other providers? Yes, Shelter insurance is more expensive, with rates starting at $80/month. (Read More: ). If you’re wondering why is my car insurance so expensive, find cheaper auto insurance in your area with our free tool.

Shelter has an A rating from A.M. Best and BBB for financial strength and business practices. It also has a score of 850 / 1,000 from J.D. Power for above-average customer satisfaction.

Who owns the Shelter Insurance company?

Shelter is a mutual insurance company, meaning that policyholders own the company.

Does Shelter car insurance have a grace period?

Yes, Shelter offers a grace period on car insurance for late payments (Learn More: What happens after a late car insurance payment?).

Is Shelter Insurance a standard insurance company?

Yes, Shelter is a standard car insurance company. This means that Shelter offers car insurance for regular vehicles and drivers; it doesn’t specialize in insurance for expensive, collector vehicles or high-risk drivers.

How old is Shelter insurance?

The Shelter Insurance Company was founded in 1946.

How many agents does Shelter Insurance have?

Shelter has around 1,400 agents, so you should have a few agents to choose from (Read More: How to Change Car Insurance Agents).

What is Shelter Insurance Companies A.M. Best rating?

Shelter has an A rating from A.M. Best.

Is Shelter a captive agency?

Do Shelter insurance agents set rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How much does Shelter Insurance pay?

Shelter is a mutual insurance company, meaning that policyholders own the company.

Yes, Shelter offers a grace period on car insurance for late payments (Learn More: What happens after a late car insurance payment?).

Is Shelter Insurance a standard insurance company?

Yes, Shelter is a standard car insurance company. This means that Shelter offers car insurance for regular vehicles and drivers; it doesn’t specialize in insurance for expensive, collector vehicles or high-risk drivers.

How old is Shelter insurance?

The Shelter Insurance Company was founded in 1946.

How many agents does Shelter Insurance have?

Shelter has around 1,400 agents, so you should have a few agents to choose from (Read More: How to Change Car Insurance Agents).

What is Shelter Insurance Companies A.M. Best rating?

Shelter has an A rating from A.M. Best.

Is Shelter a captive agency?

Do Shelter insurance agents set rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How much does Shelter Insurance pay?

Yes, Shelter is a standard car insurance company. This means that Shelter offers car insurance for regular vehicles and drivers; it doesn’t specialize in insurance for expensive, collector vehicles or high-risk drivers.

The Shelter Insurance Company was founded in 1946.

How many agents does Shelter Insurance have?

Shelter has around 1,400 agents, so you should have a few agents to choose from (Read More: How to Change Car Insurance Agents).

What is Shelter Insurance Companies A.M. Best rating?

Shelter has an A rating from A.M. Best.

Is Shelter a captive agency?

Do Shelter insurance agents set rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How much does Shelter Insurance pay?

Shelter has around 1,400 agents, so you should have a few agents to choose from (Read More: How to Change Car Insurance Agents).

Shelter has an A rating from A.M. Best.

Is Shelter a captive agency?

Do Shelter insurance agents set rates?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How much does Shelter Insurance pay?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How much does Shelter Insurance pay?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.