Best Seattle, WA Car Insurance in 2026

Car insurance in Seattle, WA averages $310 a month. Seattle, Washington car insurance requirements are 25/50/10, but you might need full coverage insurance if your car is financed. To find cheap Seattle car insurance rates, compare quotes from the top car insurance companies in Seattle, WA.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated February 2026

- The cheapest car insurance company in Seattle for teen drivers is Geico

- The cheapest ZIP code in Seattle is 98154

- Average car insurance rates in Seattle, WA after a DUI are $4,332/year

If you need to buy Seattle, Washington car insurance, the options can be confusing. Everything you need to know about car insurance in Seattle, WA is right here.

You’ll find Seattle car insurance rates, the cheapest Seattle, WA car insurance companies, and information on Washington car insurance laws. You can also compare Seattle, Washington car insurance rates to Spokane car insurance rates, and Vancouver car insurance rates.

Ready to find affordable Seattle, WA car insurance today? Enter your ZIP code for fast, free Seattle car insurance quotes.

Cheapest Seattle, WA Car Insurance Rates By Age, Gender, and Marital Status

What are the factors that affect car insurance rates? Age, gender, and marital status affect Seattle, WA car insurance rates. Every Seattle, Washington car insurance company weighs these factors differently, so check out the comparison rates.

Annual Car Insurance Rates by Age, Gender, and Marital Status in Seattle, Washington

| Insurance Company | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $2,503 | $2,470 | $2,316 | $2,434 | $9,303 | $10,808 | $2,658 | $2,760 |

| American Family | $2,662 | $2,662 | $2,432 | $2,432 | $10,252 | $13,958 | $2,662 | $3,552 |

| Farmers | $2,785 | $2,860 | $2,549 | $2,899 | $6,449 | $6,936 | $3,517 | $3,639 |

| Geico | $1,856 | $1,889 | $1,739 | $1,739 | $4,089 | $5,329 | $3,167 | $2,284 |

| Liberty Mutual | $2,228 | $2,427 | $1,983 | $2,331 | $12,672 | $13,918 | $2,361 | $2,563 |

| Nationwide | $1,708 | $1,746 | $1,587 | $1,653 | $4,757 | $5,775 | $2,056 | $2,217 |

| Progressive | $1,803 | $1,683 | $1,631 | $1,650 | $9,260 | $10,360 | $2,155 | $2,138 |

| State Farm | $1,941 | $1,941 | $1,751 | $1,751 | $5,686 | $7,192 | $2,211 | $2,543 |

| USAA | $1,282 | $1,262 | $1,242 | $1,238 | $5,726 | $6,748 | $1,626 | $1,781 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Car Insurance in Seattle, WA

Every driver must carry the minimum car insurance in Seattle, WA. It’s important to know how to find car insurance coverage requirements in your state. Take a look at the Washington car insurance requirements.

Minimum Required Car Insurance Coverage in Seattle, Washington

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

Washington car insurance designed to cover accidents caused by uninsured or underinsured drivers is not required in Seattle, but professionals recommend that all drivers purchase this additional coverage.

Cheapest Seattle, WA Car Insurance Rates by Credit Score

Your credit affects car insurance costs in Seattle, WA. Compare credit history car insurance rates in Seattle from top companies for good, fair, and poor credit. What is a good credit discount? You may qualify for a discounted car insurance rate if you have good credit.

Annual Car Insurance Rates by Credit Score in Seattle, Washington

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $5,442 | $4,189 | $3,589 |

| American Family | $5,992 | $4,894 | $4,344 |

| Farmers | $4,807 | $3,654 | $3,402 |

| Geico | $3,287 | $2,630 | $2,368 |

| Liberty Mutual | $7,233 | $4,457 | $3,490 |

| Nationwide | $3,211 | $2,509 | $2,343 |

| Progressive | $4,214 | $3,772 | $3,519 |

| State Farm | $4,542 | $2,723 | $2,115 |

| USAA | $3,294 | $2,417 | $2,128 |

Cheapest Seattle, WA Car Insurance Rates by Driving Record

Did you know car insurance companies check your driving record? Your driving record is one of the biggest factors affecting car insurance costs. Compare car insurance rates with a bad driving record in Seattle, WA to rates for a clean record with top companies.

Annual Seattle, Washington Car Insurance Rates by Driving Record

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $3,674 | $4,641 | $5,176 | $4,136 |

| American Family | $4,061 | $5,218 | $6,037 | $4,991 |

| Farmers | $3,274 | $4,085 | $4,387 | $4,072 |

| Geico | $2,134 | $2,725 | $4,054 | $2,134 |

| Liberty Mutual | $4,311 | $5,444 | $5,546 | $4,941 |

| Nationwide | $2,083 | $2,829 | $3,557 | $2,280 |

| Progressive | $3,100 | $4,883 | $3,614 | $3,744 |

| State Farm | $2,837 | $3,417 | $3,127 | $3,127 |

| USAA | $1,914 | $2,784 | $3,487 | $2,266 |

Cheapest Seattle, WA Car Insurance for Teen Drivers

Teen car insurance in Seattle, WA can be expensive. Compare car insurance rates for teen drivers from the top car insurance companies in Seattle.

Annual Car Insurance Rates for Teen Drivers in Seattle, Washington

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male |

|---|---|---|

| Allstate | $9,303 | $10,808 |

| American Family | $10,252 | $13,958 |

| Farmers | $6,449 | $6,936 |

| Geico | $4,089 | $5,329 |

| Liberty Mutual | $12,672 | $13,918 |

| Nationwide | $4,757 | $5,775 |

| Progressive | $9,260 | $10,360 |

| State Farm | $5,686 | $7,192 |

| USAA | $5,726 | $6,748 |

Cheapest Seattle, WA Car Insurance for Seniors

Take a look at Seattle, WA senior car insurance rates from top companies. Shopping around can make a big difference for senior drivers. Many providers offer low cost car insurance for seniors.

Annual Car Insurance Rates for Senior Drivers in Seattle, Washington

| Insurance Company | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|

| Allstate | $2,316 | $2,434 |

| American Family | $2,432 | $2,432 |

| Farmers | $2,549 | $2,899 |

| Geico | $1,739 | $1,739 |

| Liberty Mutual | $1,983 | $2,331 |

| Nationwide | $1,587 | $1,653 |

| Progressive | $1,631 | $1,650 |

| State Farm | $1,751 | $1,751 |

| USAA | $1,242 | $1,238 |

Cheapest Seattle, WA Car Insurance Rates After a DUI

A DUI in Seattle, WA increases car insurance rates. Compare car insurance rates after a DUI by company in Seattle, Washington to find the cheapest option.

Annual Car Insurance Rates After a DUI in Seattle, Washington

| Insurance Company | Annual Car Insurance Rates With a DUI |

|---|---|

| Allstate | $5,176 |

| American Family | $6,037 |

| Farmers | $4,387 |

| Geico | $4,054 |

| Liberty Mutual | $5,546 |

| Nationwide | $3,557 |

| Progressive | $3,614 |

| State Farm | $3,127 |

| USAA | $3,487 |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Seattle, WA Car Insurance Rates by Commute Length

How does how far you drive affect car insurance rates in Seattle, WA by commute? Take a look at a comparison of the top companies by commute length. If you don’t have a commute, you can get lower car insurance by driving less.

Annual Car Insurance Rates by Commute Length in Seattle, Washington

| Insurance Company | 10 Mile Commute, 6,000 Annual Mileage | 25 Mile Commute, 12,000 Annual Mileage |

|---|---|---|

| Allstate | $4,407 | $4,407 |

| American Family | $4,974 | $5,180 |

| Farmers | $3,954 | $3,954 |

| Geico | $2,726 | $2,797 |

| Liberty Mutual | $5,060 | $5,060 |

| Nationwide | $2,687 | $2,687 |

| Progressive | $3,835 | $3,835 |

| State Farm | $3,040 | $3,213 |

| USAA | $2,587 | $2,639 |

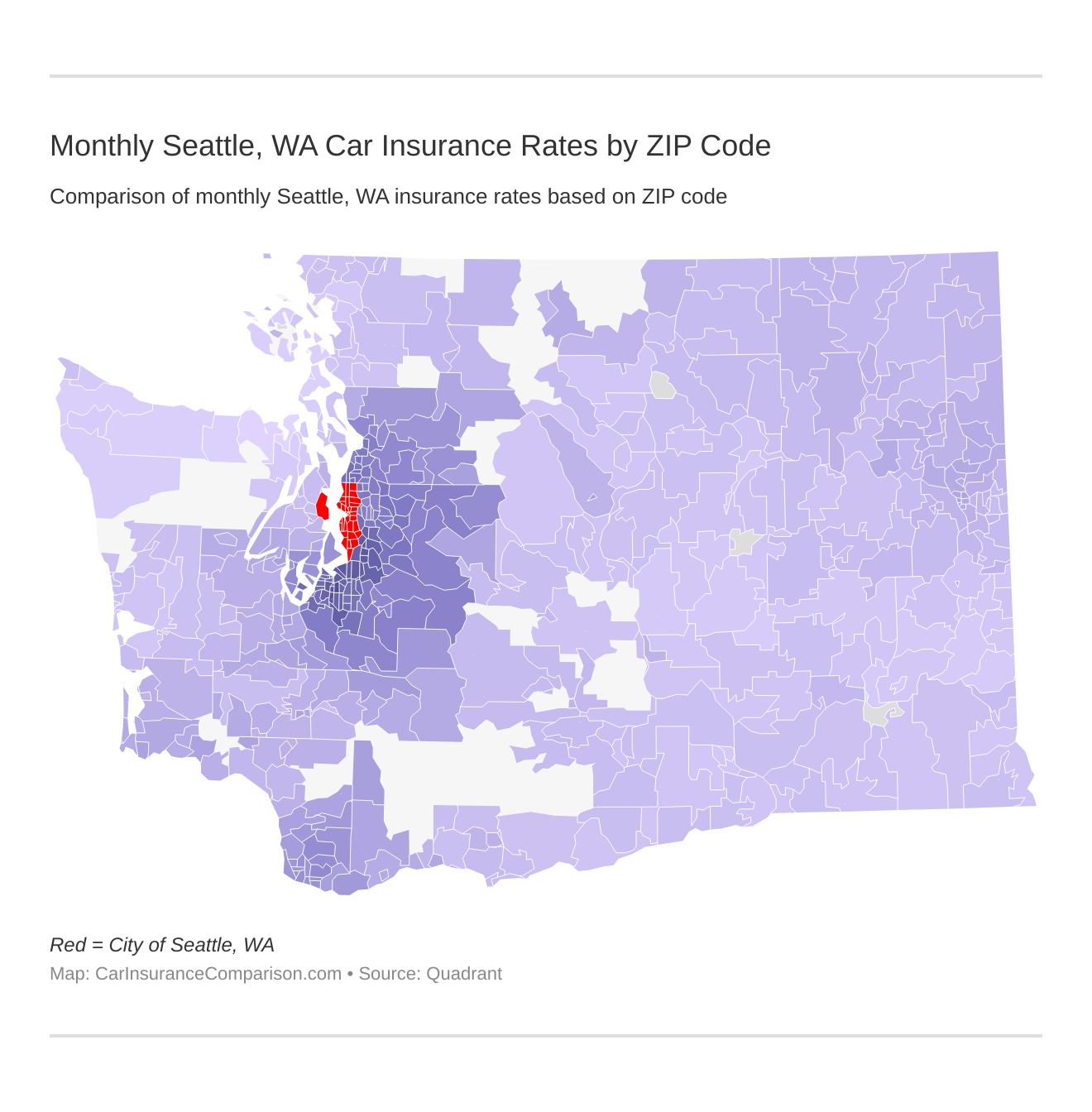

Monthly Seattle, WA Car Insurance Rates by ZIP Code

Check out the monthly Seattle, WA auto insurance rates by ZIP Code below:

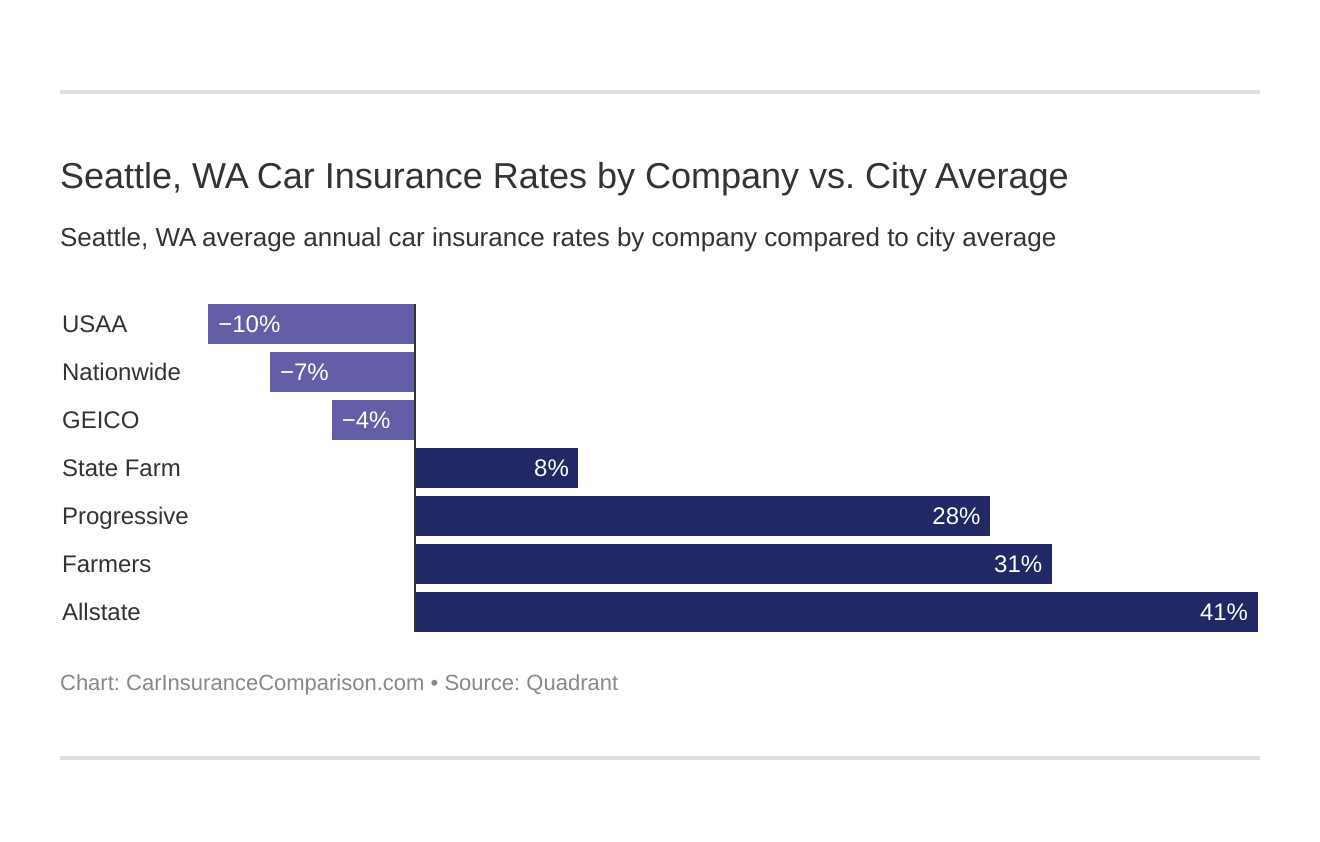

Seattle, WA Car Insurance Rates by Company vs. City Average

Which Seattle, WA auto insurance company has the cheapest rates? And how do those rates compare against the average Washington auto insurance company rates? We’ve got the answers below.

The Best Cheap Car Insurance Companies in Seattle, WA

Take a look at a side-by-side comparison of the top car insurance companies in Seattle, WA to find the best option for your needs. See how they stack up to America’s best car insurance companies.

Average Annual Car Insurance Rates by Company in Seattle, Washington

| Insurance Company | Average Annual Rates |

|---|---|

| Allstate | $4,407 |

| American Family | $5,077 |

| Farmers | $3,954 |

| Geico | $2,762 |

| Liberty Mutual | $5,060 |

| Nationwide | $2,687 |

| Progressive | $3,835 |

| State Farm | $3,127 |

| USAA | $2,613 |

Category Winners: Cheapest Car Insurance in Seattle, Washington

Find the cheapest car insurance companies in Seattle, WA for each category right here.

Best Annual Car Insurance Rates by Company in Seattle, Washington

| Category | Insurance Company |

|---|---|

| Teenagers | Geico |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | Geico |

| With 1 DUI | State Farm |

| With 1 Speeding Violation | Geico |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Seattle, WA Car Insurance Rates by Coverage Level

How much coverage you choose will have an impact on your Seattle car insurance rates. Understanding the types of car insurance is crucial. Find the cheapest Seattle, WA car insurance rates by coverage level.

Annual Car Insurance Rates by Coverage Level in Seattle, Washington

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $4,161 | $4,393 | $4,665 |

| American Family | $4,789 | $5,072 | $5,369 |

| Farmers | $3,666 | $3,956 | $4,240 |

| Geico | $2,591 | $2,765 | $2,929 |

| Liberty Mutual | $4,761 | $5,073 | $5,347 |

| Nationwide | $2,537 | $2,688 | $2,837 |

| Progressive | $3,450 | $3,731 | $4,324 |

| State Farm | $2,907 | $3,142 | $3,332 |

| USAA | $2,439 | $2,613 | $2,787 |

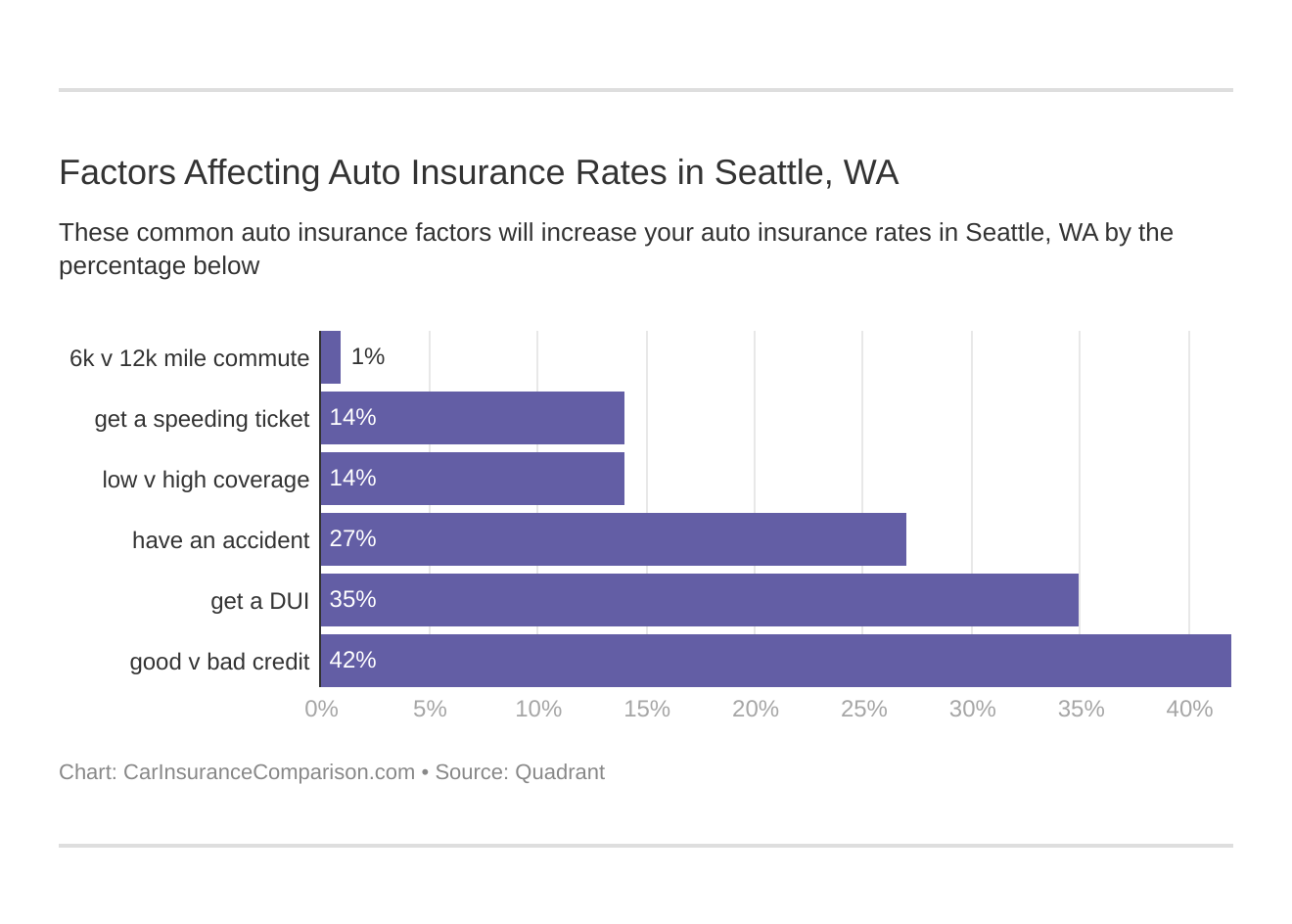

What affects car insurance rates in Seattle, Washington?

What factors can have an impact on Seattle, WA car insurance? There are several reasons why Seattle car insurance may be different from surrounding cities. Take a look at what affects car insurance rates in Seattle, Washington.

Factors affecting auto insurance rates in Seattle, WA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Seattle, Washington auto insurance.

Car Theft in Seattle

High levels of vehicle theft can make car insurance more expensive. Seattle, WA car theft statistics from the FBI indicate 4,042 vehicle thefts a year. Find out if Washington is among the states with the highest vehicle theft rates.

Commute Time in Seattle

The more time you spend in your car the higher the risk of an accident. The average commute length in Seattle, WA is 27.9 minutes according to City-Data.

Traffic in Seattle

Traffic and commute times go hand in hand, with more traffic meaning more time on the road. Seattle, WA traffic data from INRIX ranks Seattle as the 130th-most congested in the world.

What insurance companies are based in Seattle?

Several auto insurance companies are based in Seattle.

These companies include:

- PEMCO

- Grange Insurance

- Seattle Auto Insurance

- Safeco

Some agencies offer low rates to customers who buy several different types of insurance at the same time, so it is important to ask about any discounts you may be eligible for.

Thousands of car insurance agencies that are not based in the Seattle area may also offer low rates and exceptional coverage to Seattle drivers.

Other car insurance agencies that offer car insurance to drivers in the Seattle area include:

- Progressive

- Geico

- Allstate

- USAA

- State Farm

- Travelers Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Car Insurance Quotes in Seattle, WA

Read our quick tips on how to compare multiple car insurance quotes online. Ready to find affordable Seattle, Washington car insurance today? Enter your ZIP code for fast, free Seattle, WA car insurance quotes.

Frequently Asked Questions

What is the minimum car insurance coverage required in Seattle, WA?

The minimum car insurance coverage required in Seattle, WA includes $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $10,000 in property damage liability coverage.

How does commute length affect car insurance rates in Seattle, WA?

Commute length can affect car insurance rates in Seattle, WA. If you have a longer daily commute, you may have higher rates compared to someone with a shorter commute or no regular commute at all.

How does a DUI affect car insurance rates in Seattle, WA?

A DUI can significantly impact car insurance rates in Seattle, WA. After a DUI, insurance rates often increase, and you may need to obtain an SR-22 form to demonstrate financial responsibility to the state.

Are there special car insurance rates for senior drivers in Seattle, WA?

Some insurance companies offer special rates for senior drivers in Seattle, WA. It’s advisable to compare rates from different companies to find the most affordable options for senior drivers.

What are the car insurance rates for teen drivers in Seattle, WA?

Car insurance rates for teen drivers in Seattle, WA tend to be higher compared to older and more experienced drivers. Rates can vary depending on the insurance company, but shopping around can help find more affordable options.

How does driving record impact car insurance rates in Seattle, WA?

Your driving record has a significant impact on car insurance rates in Seattle, WA. Having a clean driving record with no accidents or violations generally leads to lower rates, while a history of accidents, DUIs, or speeding violations can result in higher rates.

How can I lower my car insurance rates in Seattle?

There are several ways to potentially lower your car insurance rates in Seattle. Some strategies include maintaining a clean driving record, taking defensive driving courses, bundling your insurance policies with the same company, choosing a higher deductible, and considering the coverage levels you truly need. Additionally, shopping around and comparing quotes from different insurance companies can help you find the best rates.

Does my Seattle car insurance cover rental cars?

The coverage for rental cars can vary depending on your insurance policy. Some car insurance policies in Seattle may offer coverage for rental cars, while others may require you to purchase additional coverage, such as a rental car reimbursement or a separate rental car insurance policy. It’s important to review your policy or contact your insurance provider to understand the extent of rental car coverage provided.

What should I do if I’m involved in a car accident in Seattle?

If you’re involved in a car accident in Seattle, you should prioritize the safety of all parties involved. Contact emergency services if necessary and exchange insurance and contact information with the other driver(s). It’s also important to document the accident scene and gather evidence, such as photos and witness statements. Finally, notify your insurance company as soon as possible to report the accident and initiate the claims process.

Can I insure a leased or financed car in Seattle?

Yes, you can insure a leased or financed car in Seattle. In fact, most leasing and financing agreements require you to carry comprehensive and collision coverage on the vehicle. This helps protect the car’s value and cover potential damages in case of an accident. It’s important to check with your leasing or financing company for any specific insurance requirements they may have.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.