Best Indianapolis, IN Car Insurance in 2026

Rates for car insurance in Indianapolis, IN, are $292.73/mo on average. Indiana requires 25/50/10 in minimum liability coverage. Compare quotes below for free.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated October 2024

4388-Indianapolis-Overview-Table-2019-11-19.csv

| Indianapolis Statistics | Details |

|---|---|

| Population | 863,002 |

| Density | 2,387 people per square mile |

| Average Cost of Car Insurance | $3,512.78 |

| Cheapest Insurance Company | USAA Geico |

| Road Conditions | Fair |

Whether you’ve come to this great city to explore the midwest, cheer on the Colts, or watch the greatest spectacle in racing at the Indianapolis 500, one thing is for certain: you should make the most of it.

Indianapolis is home to 863,000 people and is our nation’s 17th-largest city. Well-known as “Indy” across the world, it is known for its sports teams, car racing, and as the gateway to the midwest. Folks in the city enjoy a vibrant city life filled with arts, entertainment, and excellent food.

With so many sites and things to do, we know the streets are filled with taxis, pedestrians, and all makes and models of vehicles, which, in turn, can make driving hazardous. Accidents can and do happen, and that can make your car insurance go up.

In this comprehensive guide, we’re going to show you rates, company comparisons, and other specific factors that make Indianapolis a city filled with fun and adventure. There’s something for everyone.

Read on to learn how to compare Indianapolis, Indiana car insurance rates. Ready to search for car insurance? Enter your ZIP code for FREE in our tool above to compare rates easily.

The Cost of Car Insurance in Indianapolis

The average cost of car insurance in Indianapolis is over $3,513 per year. Ever wonder what are the factors that affect car insurance rates? Car insurance rates can be based on your age, marital status, and whether you live in Irvington or closer to Castleton.

We know there are ways to save money on car insurance.

In this section, we’re going to show you specific rates on what folks pay for their car insurance in Indianapolis based on some of these factors. Of course, these rates are average, and your rates can be higher or lower, depending upon your circumstances.

Male vs. Female vs. Age

Your age plays a significant role when it comes to deciding the cost of car insurance. Not only do people 55 and older get discounts on everything from food to hotels, but they also pay hundreds less for car insurance. Find out more about low cost car insurance for seniors.

Not so for young drivers, especially male teen drivers who pay more for their car insurance than any other demographic. Here’s why the cost of car insurance is higher for teenage boys than for teenage girls.

The good news is that Indianapolis does not allow insurers to consider gender when calculating rates. Excluding seven states (CA, HI, MA, MT, PA, NC, and parts of MI), insurance rates differ by gender across the country.

According to DataUSA, the mean age in Indianapolis is 34.2 years.

Let’s review the average rates charged by insurance companies in Indianapolis for different age groups.

4389-Indianapolis-Rates-by-Age-2019-11-19.csv

| 17 | 25 | 35 | 60 | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|

| $8,085.57 | $2,416.35 | $2,040.98 | $1,876.95 | $1,876.95 | 60 |

As the data shows, as drivers mature, their rates decrease over time by thousands of dollars.

Considering popping the question? You may be surprised to know that marital status has an impact on your car insurance rates. Find out more about the cost of married car insurance vs. single car insurance.

For the data below, we partnered with Quadrant, which looks at actual numbers from purchased policies to provide average rates across many categories.

https://docs.google.com/spreadsheets/d/1BJcpE5thDqAnU5ze-vMWpDNOz1R1Wf0b7Cy-YC_qg5Q/edit#gid=745847325

| Demographic | Average Annual Rates |

|---|---|

| Single 17-year-old female | $7,099.65 |

| Single 17-year-old male | $9,071.49 |

| Single 25-year-old female | $2,265.85 |

| Single 25-year-old male | $2,566.84 |

| Married 35-year-old female | $2,042.35 |

| Married 35-year-old male | $2,039.61 |

| Married 60-year-old female | $1,849.21 |

| Married 60-year-old male | $1,904.68 |

Rates for married couples are nearly identical for people in their 30s. The largest difference is for married couples in their 20s, where males pay more than $300 for insurance coverage. Married females in their 60s enjoy the lowest rates of any demographic.

Cheapest ZIP Codes in Indianapolis

Where you live in Indianapolis can also impact how much you pay for car insurance. Check out this great tourism video from VisitIndy.com:

Who knew there was so much to do in Indianapolis? But seriously, most metropolitan areas have certain areas plagued with poverty, crime, and decay. If you live in such a neighborhood, you may pay more for your car insurance.

Check out the table below to see how much you pay for car insurance based upon your location.

4391-Indianapolis-Zip-Codes-Average-Rates-2019-11-19.csv

| Zip Code | Average Rates |

|---|---|

| 46201 | $3,810.79 |

| 46202 | $3,745.72 |

| 46203 | $3,707.05 |

| 46204 | $3,698.19 |

| 46205 | $3,725.41 |

| 46208 | $3,717.08 |

| 46214 | $3,467.94 |

| 46216 | $3,521.97 |

| 46217 | $3,400.62 |

| 46218 | $3,815.46 |

| 46219 | $3,489.50 |

| 46220 | $3,435.45 |

| 46221 | $3,614.21 |

| 46222 | $3,663.91 |

| 46224 | $3,607.19 |

| 46225 | $3,817.96 |

| 46226 | $3,635.25 |

| 46227 | $3,549.21 |

| 46228 | $3,503.62 |

| 46229 | $3,472.21 |

| 46231 | $3,427.98 |

| 46234 | $3,394.96 |

| 46235 | $3,504.56 |

| 46236 | $3,431.65 |

| 46237 | $3,403.43 |

| 46239 | $3,510.03 |

| 46240 | $3,427.53 |

| 46241 | $3,458.51 |

| 46250 | $3,389.25 |

| 46254 | $3,478.81 |

| 46256 | $3,395.47 |

| 46259 | $3,326.62 |

| 46260 | $3,477.91 |

| 46268 | $3,371.41 |

| 46278 | $3,428.78 |

| 46280 | $3,098.61 |

| 46282 | $3,500.45 |

| 46290 | $3,061.03 |

| Average | $3,512.78 |

Folks in the Carmel area have the cheapest rates at $3,061 yearly, while those living around Garfield Park pay the most at just over $3,817 per year. Geographically separated by 25 miles, these locales are over $800 apart when it comes to car insurance. Remember, it is illegal to use a fake address for cheap car insurance.

What’s the best car insurance company in Indianapolis?

Who is the best car insurance company in Indianapolis? The word best can mean different things to different people. In the sections below, we’ll explain what’s considered best, in various categories, to see if it can help you save on your car insurance.

Cheapest Car Insurance Rates by Company

We’re all looking for ways to save money, whether it’s brown-bagging to work, skipping the line at Starbucks, or eating at home with the family. But one thing many of us don’t do is shop around for car insurance. Here’s out ultimate guide to car insurance discounts. But which companies have the cheapest rates for Indianapolis?

Most of the top providers are licensed in Indianapolis. For your convenience, we listed those companies, and the average annual cost, in the table below.

4392-Indianapolis-Cheapest-Companies-2019-11-19.csv

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| $8,199.29 | $10,354.82 | $2,627.12 | $2,859.35 | $2,604.72 | $2,662.02 | $2,294.51 | $2,509.11 | $4,263.87 | |

| $7,073.22 | $10,190.81 | $2,526.77 | $3,092.23 | $2,526.77 | $2,526.77 | $2,279.90 | $2,279.90 | $4,062.05 | |

| $8,027.43 | $8,572.78 | $1,967.88 | $2,127.11 | $1,490.21 | $1,472.11 | $1,272.95 | $1,429.93 | $3,295.05 | |

| $5,268.68 | $4,887.93 | $2,020.54 | $1,771.45 | $1,760.01 | $1,755.89 | $1,655.39 | $1,719.96 | $2,604.98 | |

| $9,148.93 | $13,773.78 | $4,221.86 | $5,758.89 | $4,221.86 | $4,221.86 | $3,886.83 | $3,886.83 | $6,140.11 |

| $5,663.41 | $7,332.80 | $2,248.82 | $2,455.69 | $1,907.65 | $1,947.19 | $1,673.57 | $1,782.91 | $3,126.51 |

| $10,866.99 | $12,214.98 | $2,284.76 | $2,327.70 | $1,817.25 | $1,714.68 | $1,647.85 | $1,658.19 | $4,316.55 | |

| $5,046.17 | $6,439.56 | $1,789.54 | $1,995.57 | $1,612.78 | $1,612.78 | $1,450.36 | $1,450.36 | $2,674.64 | |

| $8,395.62 | $13,267.17 | $1,402.78 | $1,611.47 | $1,319.93 | $1,341.61 | $1,243.88 | $1,241.17 | $3,727.95 | |

| $3,306.78 | $3,680.29 | $1,568.47 | $1,668.91 | $1,162.30 | $1,141.19 | $1,086.90 | $1,088.41 | $1,837.91 | |

| Average | $7,099.65 | $9,071.49 | $2,265.85 | $2,566.84 | $2,042.35 | $2,039.61 | $1,849.21 | $1,904.68 | $3,604.96 |

Of the top providers, USAA has the cheapest car insurance rates. One thing to remember about USAA is that you must be affiliated with the military to be a customer. For non-military drivers, Geico has the lowest rates, so if “best” means cheap rates, they are the company for you. Read our USAA car insurance review and our Geico car insurance review for more information.

Best Car Insurance for Commute Rates

In Indiana, according to the Federal Highway Administration, drivers average more than 17,806 miles driven each year. How far do you commute? Did you know your daily commute has an impact on your car insurance rate?

We partnered with Quadrant Data Solutions to understand the impact of an above-average commute on your insurance. Check out the chart below to see how your commute stacks up against what others pay.

4393-Indianapolis-Commute-Rates-2019-11-19.csv

| Company | 10 miles commute / 6,000 annual mileage | 25 miles commute / 12,000 annual mileage | Average |

|---|---|---|---|

| $4,263.87 | $4,263.87 | $4,263.87 | |

| $4,013.01 | $4,111.08 | $4,062.05 | |

| $3,295.05 | $3,295.05 | $3,295.05 | |

| $2,560.76 | $2,649.21 | $2,604.99 | |

| $5,978.99 | $6,301.22 | $6,140.11 |

| $3,126.51 | $3,126.51 | $3,126.51 |

| $4,316.55 | $4,316.55 | $4,316.55 | |

| $2,600.17 | $2,749.11 | $2,674.64 | |

| $3,727.96 | $3,727.96 | $3,727.96 | |

| $1,813.70 | $1,862.12 | $1,837.91 | |

| Average | $3,764.76 | $3,640.27 | $3,604.96 |

Liberty Mutual and State Farm have the largest difference when it comes to commute rates, but most companies have the same rates no matter the length of your commute. Read our Liberty Mutual car insurance review and State Farm car insurance review to learn more.

One thing to consider:

When switching jobs, be sure to update your commute with your insurance company: it could save you hundreds of dollars.

Best Car Insurance for Coverage Level Rates

Do you understand collision vs. comprehensive coverage? Have you thought that having the lowest minimum coverage in Indianapolis is the best way to ensure you and your family are protected? Sometimes, that’s not necessarily the case, because the difference in low to high coverage is less than you think.

Check out the table below to see the differences in coverage.

Imported from Manual Input

| Company | Low | Medium | High | Average |

|---|---|---|---|---|

| $4,056.21 | $4,244.77 | $4,490.63 | $4,263.87 | |

| $4,014.19 | $4,194.97 | $3,976.99 | $4,062.05 | |

| $3,185.65 | $3,290.01 | $3,409.48 | $3,295.05 | |

| $2,442.58 | $2,598.31 | $2,774.06 | $2,604.98 | |

| $5,925.79 | $6,121.98 | $6,372.55 | $6,140.11 |

| $3,162.14 | $3,101.99 | $3,115.39 | $3,126.51 |

| $4,081.89 | $4,250.61 | $4,617.15 | $4,316.55 | |

| $2,540.77 | $2,674.30 | $2,808.85 | $2,674.64 | |

| $3,656.18 | $3,762.34 | $3,765.35 | $3,727.96 | |

| $1,770.60 | $1,833.40 | $1,909.72 | $1,837.91 |

American Family and Nationwide have less than a $50 difference between low and high coverage. This cost is negligible if you have an expensive car and want to be sure your investment is covered in case of an accident. Learn more in our American Family car insurance review.

Best Car Insurance for Credit History Rates

Do you know your credit score? Having good credit is critical if you do not want to pay higher rates from car loans to mortgages. You can get car insurance without a credit check, but it’s typically more expensive.

Did you know poor credit can also affect how much you pay for car insurance? With some providers, the difference can be thousands of dollars.

The following table shows how much rates can vary by credit score among the top providers.

https://docs.google.com/spreadsheets/d/1BJcpE5thDqAnU5ze-vMWpDNOz1R1Wf0b7Cy-YC_qg5Q/edit#gid=1121902397

| Company | Good | Fair | Poor | Average |

|---|---|---|---|---|

| $3,573.75 | $3,935.99 | $5,281.87 | $4,263.87 | |

| $3,019.57 | $3,605.80 | $5,560.78 | $4,062.05 | |

| $2,906.58 | $3,137.18 | $3,841.39 | $3,295.05 | |

| $2,072.62 | $2,604.98 | $3,137.34 | $2,604.98 | |

| $4,924.17 | $5,323.59 | $8,172.56 | $6,140.11 |

| $2,809.68 | $3,004.39 | $3,565.45 | $3,126.51 |

| $3,980.85 | $4,217.90 | $4,750.90 | $4,316.55 | |

| $1,806.57 | $2,326.40 | $3,890.95 | $2,674.64 | |

| $3,517.14 | $3,518.49 | $4,148.24 | $3,727.96 | |

| $1,404.99 | $1,637.53 | $2,471.20 | $1,837.91 |

The average credit score in the U.S. is 675. If your credit score is lower than this, you may face increased rates on car insurance. In some states, poor credit can raise your rates by thousands of dollars. If your insurance provider is Liberty Mutual and you have poor credit, your rates can be $3,000 more than someone with good credit.

Best Car Insurance for Driving Record Rates

If you get a speeding ticket, have an accident, or get a DUI, your rates will probably increase in most situations. Finding car insurance for a minor with a DUI can get even more expensive.

The table below shows rates with these three violations compared to the rate for a clean record.

https://docs.google.com/spreadsheets/d/1BJcpE5thDqAnU5ze-vMWpDNOz1R1Wf0b7Cy-YC_qg5Q/edit#gid=91535044

| Company | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI | Average |

|---|---|---|---|---|---|

| $3,388.84 | $4,045.30 | $5,003.01 | $4,618.33 | $4,336.73 | |

| $2,806.87 | $3,341.68 | $4,449.64 | $5,650.00 | $4,302.17 | |

| $2,946.44 | $3,252.54 | $3,440.92 | $3,540.30 | $3,309.22 | |

| $1,695.34 | $2,355.87 | $2,691.08 | $3,677.64 | $2,688.02 | |

| $4,736.88 | $5,239.14 | $5,624.20 | $8,960.20 | $6,440.43 |

| $2,691.82 | $3,028.38 | $3,463.57 | $3,322.26 | $3,159.22 |

| $3,226.43 | $4,493.89 | $5,690.95 | $3,854.92 | $4,257.43 | |

| $2,608.59 | $2,608.59 | $2,872.79 | $2,608.59 | $2,696.66 | |

| $3,166.27 | $3,395.72 | $3,914.42 | $4,435.41 | $3,838.70 | |

| $1,383.73 | $1,717.39 | $1,977.95 | $2,272.56 | $1,878.08 |

Having one too many can not only land you in jail, but it can cost you thousands on your car insurance. For example, a DUI will increase your rates by nearly $3,000 if you have car insurance through American Family. Your rates will vary, and we encourage you never to drink and drive. You can compare car insurance rates after a DUI to find the best option for you.

There is good news, however, and if you are a State Farm customer and get caught speeding, your rates will not increase. Here is our list of recommendations for the best high-risk car insurance.

Car Insurance Factors in Indianapolis

Car insurance rates are not based solely on the driver-specific factors which we’ve mentioned above. Rates are also calculated on city-specific factors such as your ZIP code, economic prosperity in your city, and average income levels.

In this section, we’ll discuss how these external factors influence your car insurance rates in Indianapolis.

Metro Report – Growth & Prosperity

According to the Brookings Institute, Indianapolis ranks 38th in growth and 60th in prosperity nationally.

Let’s break this down and see what it means.

Out of major metro areas in the United States from 2007 to 2017, Indianapolis ranked 38th in growth.

- Percentage change in jobs: 10.3 percent

- Percentage change in GMP: 14.3 percent

- Percentage change in jobs at young firms: -17.8 percent

It ranked 60th overall in prosperity.

- Percentage change in productivity: 3.6 percent

- Percentage change in the standard of living: 2.9 percent

- Percentage change in average annual wage: 5 percent

This means that the economy in the Indianapolis area is healthy and thriving, and healthy economies encourage more business and bring in higher-paying jobs.

Median Household Income

According to Data USA, in 2016, the median household income of Indianapolis was $47,225, whereas the national median household income is $60,336.

However, in 2017, the average median income in Indianapolis was $49,268. This means income has increased by 1.58 percent. Car insurance premiums average $3,512. Therefore, the average Indianapolis resident’s premium as a percentage of income is 7.43 percent.

If you want to compare your insurance as a percentage of your income, use the calculator below to get started.

Homeownership in Indianapolis

Owning a home is a dream many of us have and, surprisingly, may impact what rates you pay for insurance. Homeownership indicates the general health of local economies, and providers consider it to be a good indicator of your financial stability. Find out more about how your occupation affects car insurance.

Being a homeowner won’t directly impact your auto insurance rates or your ability to qualify for a plan. But there may be additional discounts you are eligible for, such as bundling policies for auto and home insurance, so be sure and check with your provider.

In 2017, about 53.5 percent of homes in the Indianapolis area were occupied by the people who own them. This number was up from 52.4 percent from the previous year.

If you are thinking of buying a home in the Indianapolis area, it is good to know that the median property value in the city stands at around $137,600.

Education in Indianapolis

Insurance providers often offer special car insurance rates for students. There are many colleges and universities around the Indianapolis area that offer a varied assortment of programs and degrees.

The largest of these are:

- Ivy Tech Community College: 19,383 degrees awarded

- Indiana University-Purdue-University-Indianapolis: 7,425 degrees awarded

- American College of Education: 1,546 degrees awarded

If a four-year degree isn’t something you’re searching for, then community colleges, which offer two-year degrees as well as technical certificates and diplomas, might be a better option.

In 2015, the most common degrees varied among healthcare, business, and the liberal arts.

- Registered Nursing: 11.1 percent or 1,174 degrees awarded

- General Business Administration & Management: 10.9 percent or 1,156 degrees awarded

- Other Liberal Arts & Sciences, General Studies, & Humanities: 8.89 percent or 943 degrees awarded

- Medical Assistant: 5.4 percent or 573 degrees awarded

- Healthcare Management & Clinical Assistant: 4.5 percent or 478 degrees awarded

Although there is an assortment of career opportunities to choose from in Indianapolis, over 30 percent of degrees conferred were in the healthcare industry.

Wage by Race & Ethnicity in Common Jobs

According to DataUSA, Whites are the highest-paid ethnicity in Indianapolis, who were paid over $725 more than Asians, the second-highest paid group. The percentage of annual income spent on car insurance by the various races/ethnicities reveals why it is necessary to do your homework before purchasing your car insurance policy.

https://staging.carinsurancecomparison.com/wp-admin/admin.php?page=tablepress&action=edit&table_id=4854

| Race/Ethnicity | Miscellaneous Managers | Premium as a % of Income | Drivers/Sales Workers & Truck Drivers | Premium as a % of Income | Registered Nurses | Premium as a % of Income |

|---|---|---|---|---|---|---|

| White | $85,773 | 4.10% | $47,152 | 7.45% | $55,325 | 6.35% |

| Asian | $85,146 | 4.13% | - | - | $59,188 | 5.93% |

| Black | $69,568 | 5.05% | $40,916 | 8.59% | $39,536 | 8.89% |

| Two or More Races | $61,167 | 5.74% | $22,103 | 15.89% | $48,247 | 7.28% |

| Other | - | - | $61,395 | 5.72% | - | - |

Wage by Gender in Common Jobs

For every dollar a man earns, a woman earns just 79 cents. Although the wage gap is closing among male and female workers, there is still room for improvement.

According to DataUSA, the average male salary in Indianapolis is $60,734, while the average female wage is $44,436.

What does this mean? In a state where car insurance is already high, females are shelling out 7.79 percent of their income on car insurance. Males, on the other hand, only pay 5.78 percent of their income.

Poverty by Age & Gender

In Indianapolis, 13.7 percent of the city’s population lives below the poverty line, whereas the national average is 13.4 percent. Females aged 25-34 are the largest demographic living below the poverty line, while males in the same age group face similar challenges.

Poverty by Race & Ethnicity

The most common racial/ethnic group to be in poverty in Indianapolis is White (51. percent), followed by Black at 24.6 percent.

Employment by Occupations

Indianapolis employs more than 1.01 million people across different industries. The largest employers in the city are education, healthcare, manufacturing, and retail. Food preparation and serving related occupations make up 5.41 percent of the Indianapolis workforce.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving in Indianapolis

We’ve mentioned that your credit score, driving record, education level, and other factors contribute to the cost of car insurance. But insurance companies also base rates on the car you drive, road conditions, traffic congestion in your area, crime reports, and so much more. And keep in mind, it’s illegal to use a fake address for cheap car insurance.

Roads in Indianapolis

With a metro area as large as Indianapolis, there are bound to be certain roads that are confusing and disorienting if you’re new to the town. Your GPS wants you to turn left, but somehow, you’ve managed to turn into a dead-end street, and your device goes into “recalculating mode.”

If you’re tired of trying to figure out which road to take to work, Indy has a citywide network of cameras to help motorists avoid trouble spots.

In this section, we’ll cover the highways and interstates and help you calculate which way you need to go so you’ll never make another wrong turn.

Major Highways in Indianapolis

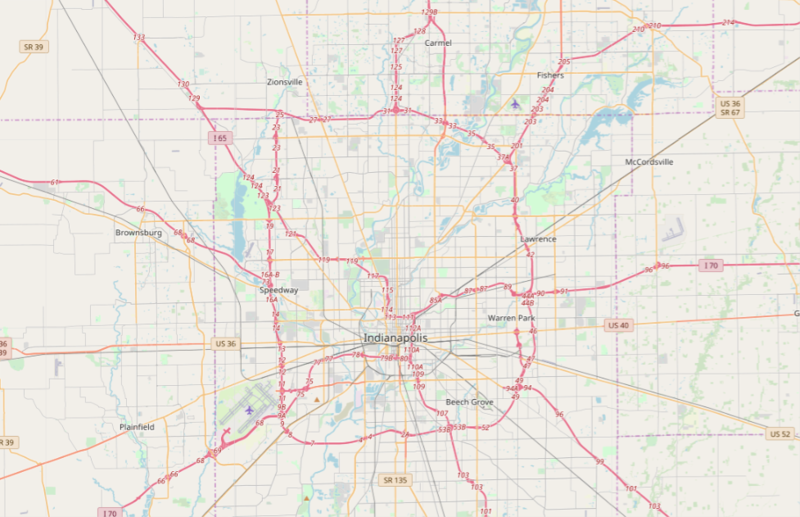

The following graphic shows the roads and highways that make up the Indianapolis metropolitan area.

Indianapolis has 12 highways and interstates that take drivers wherever they need to go throughout the city. The following list shows the names and length of each road.

- I-65 – 261 miles

- I-69 – 294 miles

- I-70 – 157 miles

- I-74 – 172 miles

- I-465 – 53 miles

- I-865 – 5 miles

- US 36 – 216 miles

- US 40 – 2,286 miles

- US 136 – 804 miles

- US 421 – 941 miles

- SR 37 – 229 miles

- SR 135 – 139 miles

What about toll roads?

There aren’t any toll roads in the city of Indianapolis. However, there are two toll roads elsewhere in the state of Indiana.

One is the Indiana Toll Road, which runs 156 east-west through northern Indiana. Your options of paying include cash, Visa or Mastercard credit card, Visa debit card, or an E-ZPass Transponder.

The RiverLink system in Louisville connects Kentucky and Indiana. Payment options include payment through a prepaid account with a transponder, by plate, and then through an invoice by your plate. The transponder is the least expensive, followed by the prepaid account by plate.

Popular Road Trips/Sites

Indianapolis is known for its sports teams and car racing, but what other attractions and sites are available for tourists to discover and enjoy?

This video tells us more:

Thrillist offers a great list of Indy’s best restaurants on the Indianapolis Cultural Trail to keep you well-fed. It also lists bars and taverns to check out when you hit the downtown scene. Also, the greatest spectacle in racing, the Indianapolis 500 race takes place at Indianapolis Motor Speedway every May. It might interest you to know race car insurance is a special coverage.

Road Conditions in Indianapolis

The average vehicle operating costs for Indy residents is about $575 a year. Poor road conditions can also add a substantial amount to your vehicle operating costs, which is why residents of the city are concerned with things such as potholes or inadequate drainage.

Here’s how the percentages break down:

- Poor Share: 22 percent

- Mediocre Share: 22 percent

- Fair Share: 15 percent

- Good Share: 42 percent

If you need to report an issue with your street, you can go to the City of Indianapolis website and fill out a simple form.

Does Indianapolis use speeding or red light cameras?

No, they don’t. Speeding and red light cameras are illegal in Indianapolis, but officials are considering adding cameras to work zones. There are some things you should know about cameras on traffic lights.

Read more:

- If You Do Not See Workers in a Work Zone, You Could Be in Serious Trouble

- How to Avoid Being Involved in a Work Zone Crash

Vehicles in Indianapolis

Your insurance rates are also dependent on vehicular factors such as what car you drive and if it is on the theft list. From car insurance for a muscle car to electric car insurance, rates can vary greatly. In this section, we will cover these topics and more.

Most Popular Vehicles Owned

Your Mechanic released a report in 2016 that detailed which cities favored specific cars. They did this through their repair shops across the country. The more type of a particular car came in, the more popular it was in the city.

Check out the breakdown below:

- Percentage of cars that were American-made: 66

- Most unusually popular car: Pontiac Grand Am

- Percentage of cars that were hybrids: 0.6

- Percentage of cars that had V8 engines: 11.6

- Percentage of cars that were Suburus: 0.9

One thing to consider if your vehicle continually breaks down is extra breakdown coverage, which can help pay some of those repair bills.

How Many Cars Per Household

In Indianapolis, the average household has two vehicles, followed by three-car households and one-car households. Find out how to get cheaper insurance coverage for a second car.

Households Without a Car

Indianapolis has a well-developed mass transit system. Most residents of the city have a car; however, in 2016, 8.7 percent of households didn’t have a personal vehicle.

Even though you don’t own a car, that doesn’t mean you shouldn’t buy a car insurance policy. Many car insurance companies offer non-owner car insurance for people who drive on occasion even if they don’t personally own a vehicle.

Speed Traps in Indianapolis

We know the feeling of freedom you get driving on the open road, rocking out to your favorite song, when suddenly you spot blue lights in your rearview mirror.

Busted. Where did they come from? It’s a well-known fact that speed traps are annoying and can ruin a perfectly good day.

According to the folks at Speedtrap.org, the following is a list of the speed traps in the Indianapolis area.

- 5400 Southeastern Avenue, Eastbound lane: The cops were pulling over a long line of people for tickets. I had to wait in line behind a lot of other cars. On this road, traffic speeds up because it’s going to the Interstate.

- 465 northbound between 10th and Crawfordsville: About 14 police officers pulling cars over. It seemed very dangerous because everyone was slamming on brakes, trying to figure out what was going on.

- I-465 west & east between Meridian and Allisonville: I-465 westbound & eastbound between Meridian and Allisonville, north side of Indianapolis.

One great way to save money on car insurance and not worry about speed traps is always to obey posted speed limit signs.

Vehicle Theft in Indianapolis

According to the FBI, 5,081 vehicle thefts occurred in Indianapolis in 2017. When considering your next car purchase, one thing to consider is that certain vehicles are stolen more frequently, and thus, may have higher insurance rates.

Find out more about states with the highest vehicle theft rates.

The FBI has also put together the 10 safest neighborhoods in Indianapolis:

- Acton / Charle Sumac Estates

- E 96th St / Fall Creek Rd

- E Hanna Ave / 5 Points Rd

- Fairwood Hills

- Glenns Valley / Sunshine Gardens

- Promontory Rd / Old Stone Dr

- Shore Acres

- S Franklin Rd / E Edgewood Ave

- Wanamaker

- W 56th St / Dandy Trl

The chart below tells more about specific crimes in the city:

https://www.neighborhoodscout.com/

| Indianapolis Total Crimes | Violent | Property | Total |

|---|---|---|---|

| Number of Crimes | 11,664 | 38,962 | 50,626 |

| Crime Rate (per 1,000 residents) | 13.52 | 45.15 | 58.66 |

| Indiana Crime Rate (per 1,000 residents) | 3.99 | 24.17 | 28.16 |

The Indianapolis violent crime rates are double and sometimes quadruple that of national rates. In particular, robbery and assault rates are significantly higher than the U.S. rates.

https://www.neighborhoodscout.com/

| Area | Murder (Total) | Murder Rate | Rape (Total) | Rape Rate | Robbery (Total) | Robbery Rate | Assault (Total) | Assault Rate |

|---|---|---|---|---|---|---|---|---|

| Indianapolis | 156 | 0.18 | 682 | 0.79 | 3,495 | 4.05 | 7,331 | 8.49 |

| United States | 17,284 | 0.05 | 135,755 | 0.42 | 319,356 | 0.98 | 810,825 | 2.49 |

Whether you live in a neighborhood that isn’t safe or in one where there are no issues, it’s always a good idea to have extra coverage on your vehicles to protect your investment. Does car insurance cover stolen items? Find out today.

Traffic in Indianapolis

Waiting. Stressing. Aggravation. Being honked at, or even worse. We’ve all been there. Traffic is the worst. In this section, we cover congestion, commute times, how good or bad the drivers are, and where to get your car repaired if you get into an accident.

Ready. Set. Go!

Traffic Congestion

According to the folks at INRIX, Indianapolis ranks 177th-worse in the world for congestion and 38th-worse in the United States. Fortunately for drivers in Indianapolis, there isn’t much of a traffic issue.

RTV6 The Indy Channel explains more:

Sitting in traffic congestion isn’t just frustrating; it’s also expensive. City residents spend $826 yearly stuck in gridlock.

Transportation

Residents of Indianapolis enjoy a lower commute time at 23.6 minutes each way. The national average is 25.5 minutes. Additionally, 1.41 percent of the workforce in Indy has “super commutes” of over 90 minutes.

Data USA also reports that:

In 2017, the most common method of travel for workers in Indianapolis was Drove Alone (82.8 percent), followed by those who Carpooled (8.04 percent) and those who Worked At Home (5.16 percent).

If you do find yourself lucky enough to work from home, be sure and check with your insurance provider to see if you are eligible for discount car insurance.

Busiest Highways

The busiest highway in Indianapolis is I-65, specifically between W. 21st St. and Central Avenue, which sees over 60,700 cars daily.

How safe are Indianapolis streets & roads?

Though the National Highway Traffic Safety Administration doesn’t track city-specific roadway safety statistics, they do provide countywide statistics for Marion County, of which Indianapolis is the largest city and the county seat.

In 2017, 109 fatalities were recorded on the county’s streets. The table below provides the number of fatalities in Marion County by crash type from 2013-2017.

https://cdan.nhtsa.gov/

| County Statistics | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|

| Total Fatalities | 83 | 97 | 104 | 102 | 109 | 495 |

| Alcohol-Impaired | 14 | 21 | 33 | 33 | 33 | 134 |

| Single Vehicle | 43 | 52 | 58 | 59 | 62 | 274 |

| Speeding | 20 | 30 | 31 | 18 | 23 | 122 |

| Roadway Departure | 30 | 39 | 52 | 39 | 53 | 213 |

| Intersection-Related | 31 | 28 | 31 | 37 | 28 | 155 |

| Passenger Car | 30 | 28 | 46 | 37 | 42 | 183 |

| Pedestrian | 18 | 31 | 21 | 27 | 27 | 124 |

| Pedalcyclist | 1 | 1 | 7 | 2 | 4 | 15 |

Alcohol-impaired fatalities totaled 33 for Marion County while single-vehicle crashes totaled 62. One fatality is too many. We encourage you never to drink and drive and always obey posted speed limit signs.

The majority of crashes in Indiana occur on arterial roads. These are high-volume roads that move people quickly from one part of the city to the next. The table below provides the number of fatalities in the state by type of road.

https://cdan.nhtsa.gov/stsi.htm#

| Road Type | Fatal Crashes |

|---|---|

| Collector Arterial | 186 |

| Freeway/Expressway | 13 |

| Minor Arterial | 188 |

| Other | 240 |

| Other | 131 |

| Rural Interstate | 48 |

| Unknown | 2 |

| Urban Interstate | 28 |

| Total | 836 |

Another category we’ve looked at is accidents involving trains. According to the U.S. Department of Transportation, there were 23 railway incidents in Indianapolis between 2012 and 2016.

Operation Lifesaver, a railway safety education organization, has some tips for driving safely around train tracks.

- Trains and cars don’t mix.

- The train you see is closer and faster-moving than you think.

- Be aware that trains cannot stop quickly.

- Never drive around lowered gates — it’s illegal and deadly.

- Do not get trapped on the tracks.

- If your vehicle ever stalls on the tracks, get out and get away from the tracks, even if you do not see a train.

- At a multiple track crossing waiting for a train to pass, watch out for a second train on the other tracks.

- When you need to cross train tracks, go to a designated crossing, look both ways, and cross the tracks quickly.

Allstate America’s Best Drivers Report

In 2019, Allstate created a list of the top cities where drivers are least likely to get into a car accident. They looked at two categories: the time between claims and hard-braking incidents. Read our Allstate insurance review to find out more about their coverage.

Indianapolis drivers are doing better than some, ranking 75th out of 200 cities.

Needless to say, more accidents equals more insurance claims, driving up premiums.

An average driver in Indianapolis spends 9.5 years between claims, whereas the national average is 10.6 years. In hard-braking incidents, Indy is above the national average averaging 21, while the nationwide average is 19.

Ridesharing

According to RideGuru, the following rideshare services are available in Indianapolis:

- Carnel

- Lyft

- Taxi

- Uber

Many companies now offer additional rideshare insurance.

They are:

- Allstate

- Erie

- Farmers

- Geico

- Safeco

- State Farm

- USAA

If considering ridesharing as an employment opportunity, most companies require a one million dollar insurance policy before beginning employment.

E-star Repair Shops

Has your car broken down, and you’re not sure where to take it? Esurance created an E-star repair shop network that provides a list of reputable and top-quality repair shops near your location.

https://www.esurance.com/info/car/e-star-direct-repair-program

| Name of Facility | Address | Contact Information |

|---|---|---|

| BLOSSOM CHEVROLET INC._CF | 1850 N SHADELAND AVE INDIANAPOLIS IN 46219 | email: [email protected] P: (317) 357-1121 F: (317) 375-3510 |

| CALIBER - AVON | 55 VISTA PARKWAY AVON IN 46123 | email: [email protected] P: (317) 272-2048 F: (317) 272-2818 |

| CALIBER - GREENWOOD - MELODY AVE | 155 MELODY AVE GREENWOOD IN 46142 | email: [email protected] P: (317) 882-8280 F: (317) 885-4280 |

| CALIBER - INDIANAPOLIS - BEECH GROVE | 4002 S. ARLINGTON AVENUE INDIANAPOLIS IN 46203 | email: [email protected] P: (317) 787-8366 F: (317) 782-2491 |

| CALIBER - INDIANAPOLIS - DOWNTOWN | 135 W MCCARTY ST INDIANAPOLIS IN 46225 | email: [email protected] P: (317) 262-5159 F: (317) 262-1064 |

| CALIBER - INDIANAPOLIS - LAWRENCE | 10520 PENDLETON PIKE INDIANAPOLIS IN 46236 | email: [email protected] P: (317) 823-9154 F: (317) 823-1026 |

| CALIBER - INDIANAPOLIS - NORTHWEST | 8818 ROBBINS ROAD INDIANAPOLIS IN 46268 | P: (317) 875-9325 F: (317) 875-9333 |

| CALIBER - INDIANAPOLIS - SHADELAND | 751 NORTH SHADELAND INDIANAPOLIS IN 46219 | email: [email protected] P: (317) 454-7400 F: (317) 454-7393 |

| CALIBER - INDIANAPOLIS - WEST | 3855 ROCKVILLE ROAD INDIANAPOLIS IN 46222 | email: [email protected] P: (317) 244-9571 F: (317) 244-2106 |

| CALIBER - ZIONSVILLE | 4806 NORTHWESTERN DR ZIONSVILLE IN 46077 | email: [email protected] P: (317) 875-8434 F: (317) 876-7702 |

Weather in Indianapolis

The weather. Everyone’s favorite topic. What’s the weather like in Indianapolis, you may be wondering?

- Annual high temperature: 62.4 F

- Annual low temperature: 43.8 F

- Average temperature: 53.1 F

- Average annual precipitation: 42.2 inches

Indianapolis is unique in the fact that it can be involved in multiple types of natural disasters. The city has had 15 natural disasters, which are above the national average of 13 natural disasters, which include hurricanes, snow, ice, and tornadoes. Here’s what you need to know about car insurance after a natural disaster.

Public Transit in Indianapolis

Not everyone owns a car in Indianapolis, as we mentioned previously, so public transit is vital to transport residents across the city. The city operates one primary public transportation called IndyGo.

RTV6 The Indy Channel explains about a recent expansion:

It is the largest transportation company in the state of Indiana and maintains 30 routes throughout Indiana and provides nearly 10 million passenger trips per year.

IndyGo has routes that go throughout the city. The fee schedule starts at $1.75 and goes up to $30.

The list below shows what’s available for your specific needs.

- 2-hour transfer ticket: Full fare $1.75 | Half fare $0.85

- One-day pass: $4 | $2

- 10 trips ticket: $17.50 | $8.50

- Seven-day pass: $20 | $10

- 31-day pass: $60 | $30

- Open Door one trip: $3.50

- Summer Youth pass: $30

- College S-Pass: $30

- Veterans Pass: $2 for initial | $5 for replacement

Cost of Alternate Transportation in Indianapolis

There are three electric scooter companies in Indianapolis.

- Bird charges an unlocking fee of $1 and then .29 cents a minute after that.

- Lime charges an unlocking fee of $1 and then .27 cents a minute after that.

- According to their website, Spin charges $1 for every 30 minutes.

Parking in Indianapolis

According to Downtown Indy, Inc., there are 73,000 parking spaces available in downtown Indianapolis. These include side-street parking, off-street lots, and parking garages.

Fees range from first hour $5 to $10 or more and daily maximums between $5 and $24 or more. Daily, weekly, and monthly rates are available.

The first hour for parking meters is $1.50, with a daily maximum of $21. All meters are free on Sundays.

Air Quality in Indianapolis

Many large cities have problems with pollution, and Indianapolis is no exception. The city’s Air Quality Index (AQI) was slightly above average, with the national average at 93.6.

Although the emergence of alternative and green vehicles has alleviated some of the problems, traditional transportation contributes to air pollution by releasing particulate matter, volatile organic compounds, nitrogen oxide, and other such compounds.

The Environmental Protection Agency showed the following data for Indianapolis in 2018:

- Days with good air quality: 187

- Days with moderate air quality: 162

- Days with unhealthy air for sensitive groups: 15

- Days with unhealthy air: One

Military/Veterans

Many insurance companies offer car insurance discounts for military members, their extended families, and veterans. In this section, we will discuss the rates and discounts that the men and women in uniform can expect from insurance companies operating in Indianapolis.

In Indianapolis, the majority of military personnel and veterans have served in Vietnam and the Second Gulf War.

If you are a veteran or in the military, the following providers offer military discounts:

- Allstate

- Farmers

- Geico

- Liberty Mutual

- Nationwide

- State Farm

- USAA

USAA consistently ranks as one of the best auto insurance companies, and they insure only military personnel, active or retired, and their immediate family members. The chart below shows how USAA stacks up against other providers in the state.

Quadrant

| Company | Average Premium | Difference (+/-) | Difference (%) |

|---|---|---|---|

| $3,978.81 | $563.84 | 16.51% | |

| $3,679.68 | $264.71 | 7.75% | |

| $3,437.55 | $22.58 | 0.66% | |

| $2,261.07 | -$1,153.90 | -33.79% | |

| $5,781.35 | $2,366.38 | 69.29% |

| No Data Available | No Data Available | No Data Available |

| $3,898.00 | $483.03 | 14.14% | |

| $2,408.94 | -$1,006.03 | -29.46% | |

| $3,393.75 | -$21.22 | -0.62% | |

| $1,630.86 | -$1,784.11 | -52.24% |

Indianapolis has one military base within an hour’s drive: Grissom Air Reserve Base Air Force.

To all military personnel, we salute you and thank you for your service.

Unique City Laws

If you’re new to Indianapolis, there may be some laws you are unfamiliar with, including this unique Indianapolis law: it’s illegal to bathe between the months of October and March.

Here are some other laws that may help you navigate around the city:

Hands-Free Laws

Have you thought about cell phone ticket car insurance rates? Indianapolis doesn’t have a specific hands-free law in the city, but all drivers are prohibited from sending, writing, or reading electronic messages while driving. This effectively makes it illegal to text and drive. Food Trucks

According to Bizfluent, food vendors get their specific regulations from local governments rather than the state. However, there are still some state regulations that apply to all municipalities. A food truck under Indiana regulations would be considered a retail food establishment, as it sells directly to customers.

Marion County has a food truck application process that includes five parts.

- Completed questionnaire

- Extended menu (including toppings and condiments)

- A floor plan, drawn to scale

- A plumbing diagram

- A completed commissary agreement

All of these requirements must be included before a license is issued.

Parking Laws

If you’re new to Indy, there may be some parking laws that you’re unfamiliar with. Here are a few from Indianapolis’s city code.

- Parallel-to-curb parking shall be used in all parking meter spaces, and vehicles shall not be parked otherwise except where the Code expressly permits angle parking.

- The maximum period of time during which a vehicle may be continuously parked stopped or left standing in one (1) parking meter space, at all times…shall be four (4) hours….

- No parking space shall be designed or located so that the only way to access that space is by entering directly from or exiting directly to a highway, freeway, or primary arterial.

- It shall be a violation of this Code for any person, not authorized by the city, to deface, injure, tamper with, open or willfully break, destroy or impair the usefulness of any parking meter….

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Indianapolis Car Insurance FAQs

We’ve covered a lot of ground as we have compared Indiana car insurance rates in Indianapolis, but you may still have some questions. Our last section looks at some commonly asked questions about the great city of Indianapolis.

Who handles the utilities in Indianapolis?

Citizens Energy Group provides Indianapolis and Marion County residents water, waste, and recycling services. Indiana Power & Light (IPL) is the primary electric provider for the city of Indianapolis. IPL also serves the communities of Beech Grove and Speedway. Contact IPL at (888) 261-8222 or visit www.iplpower.com.

What are the state minimums for car insurance in Indianapolis?

According to the Indiana Department of Transportation, the minimum car insurance coverage that you must carry to comply with state laws is:

- Bodily injury (per person): $25,000

- Bodily injury (total per accident): $50,000

- Property damage: $10,000

What time is it in Indianapolis, Indiana?

Indianapolis is in the Eastern Standard Time zone. This means that if you are not in the same time zone, you will need to add or subtract hours from your day to determine what time it is in the city, or you can use Timeanddate.com’s convenient tool. Enter a city or time zone and hit the go button.

How much is car insurance in Indianapolis?

The average cost of car insurance in Indianapolis is $3,512.

I’m a high-risk driver. What insurance do I need in Indianapolis?

In Indiana, if you are labeled a high-risk driver, you may be required to get an SR-22. This is a certificate of insurance purchased through an insurer. It essentially states that legally, you have insurance. Without it, you might not be able to drive legally. Here’s our guide to best high-risk car insurance.

What happens if I get into an accident in Indianapolis?

Indiana is an at-fault state. This means that the responsible party may be held liable for all damages, including damage to the other person’s property and their medical bills. How long does a car accident stay on your insurance record? You’ll be surprised.

What else do I need to know about Indianapolis?

That’s a good question. It’s a growing city with lots of exciting things to do. We don’t know the answers to all of the questions you may have, but we do know how to help you find a great deal on car insurance.

What part of this guide was the most helpful? Was there something we could explain better so that you can make a better-informed car insurance decision?

To get started on finding the best car insurance rates in Indianapolis for you and your family, enter your ZIP code below to get started.

Frequently Asked Questions

How can I compare car insurance rates in Indianapolis, IN?

To compare car insurance rates in Indianapolis, IN, you can follow these steps:

- Research insurance providers: Start by researching different insurance companies that operate in Indianapolis, IN.

- Gather quotes: Contact multiple insurance companies or use online platforms to gather quotes specific to your needs.

- Compare coverage options: Review the coverage options provided by each insurance company and ensure they meet your requirements.

- Evaluate premiums: Compare the premiums offered by different companies for the same coverage levels.

- Consider discounts: Inquire about available discounts that can help lower your insurance premium.

- Read customer reviews: Take the time to read customer reviews and ratings of the insurance companies you are considering.

- Make an informed decision: Based on your research and comparison, choose an insurance provider that offers the best combination of coverage and affordability for you.

What factors affect car insurance rates in Indianapolis, IN?

Several factors can influence car insurance rates in Indianapolis, IN. These factors include:

- Age and gender: Younger and male drivers generally pay higher rates due to statistical risk factors.

- Driving record: A clean driving record with no accidents or traffic violations often leads to lower premiums.

- Vehicle type: The make, model, and year of your car can impact insurance rates.

- Coverage levels: The type and amount of coverage you choose affect your premium.

- Deductible amount: A higher deductible can result in a lower premium, but you’ll pay more out of pocket in case of an accident.

- Location: Indianapolis, IN has its own unique risks and traffic patterns, which can impact insurance rates.

- Credit history: Some insurance companies consider credit history when determining premiums.

- Annual mileage: The more you drive, the higher the potential risk, which can affect your rates.

Are there any specific discounts available for car insurance in Indianapolis, IN?

Yes, insurance providers in Indianapolis, IN often offer various discounts to help lower car insurance rates. Some common discounts include:

- Safe driver discount: This is usually available to drivers with a clean driving record.

- Multi-policy discount: If you have multiple policies with the same insurance company, such as auto and home insurance, you may qualify for a discount.

- Good student discount: Students who maintain good grades can often receive a discount on their car insurance.

- Anti-theft device discount: Installing anti-theft devices in your vehicle can lead to a discount on your premium.

- Low mileage discount: If you drive fewer miles than the average driver, you may be eligible for a discount.

- Defensive driving course discount: Completing a defensive driving course can sometimes qualify you for a discount.

Can I get car insurance if I have a bad driving record in Indianapolis, IN?

Yes, even if you have a bad driving record, you can still get car insurance in Indianapolis, IN. However, it’s important to note that insurance companies may consider you a higher risk and charge higher premiums. Some insurance providers specialize in providing coverage to drivers with less-than-perfect records, so it’s worth exploring different options and comparing quotes to find the best possible rate.

Can car insurance rates vary by ZIP code in Indianapolis, IN?

Yes, car insurance rates can vary by ZIP code in Indianapolis, IN. Insurance companies consider factors such as crime rates, accident rates, population density, and other risk factors associated with specific areas. As a result, you may notice differences in premiums when comparing insurance rates between different ZIP codes in Indianapolis. It’s important to obtain quotes specific to your location to get accurate rate comparisons.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.