Best Roseville, CA Car Insurance in 2026

The cheapest Roseville, CA car insurance is offered from GEICO, although drivers who can’t afford coverage may qualify for the California Low-Cost Auto program. Auto insurance in Roseville must meet the state minimum requirements of 15/30/5 in liability coverage. These limits are very low and drivers should consider increasing them and adding additional coverages. Compare Roseville, CA car insurance quotes online to find the best deal for you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated October 2024

- Geico offers the cheapest car insurance in Roseville, CA on average

- Car insurance in Roseville is more expensive than the national average but lower than the state average

- Some drivers may qualify for the California Low-Cost Auto program to get lower coverage and rates

Although Roseville, CA car insurance is cheaper than the California car insurance average, it is more expensive than the overall national average. However, California is one of the few states that offer low-income car insurance to residents who meet certain income requirements.

Even if you don’t qualify for the low-cost insurance program, you can still find affordable Roseville, CA car insurance. Shop around and compare rates to see which company can offer you the best deals.

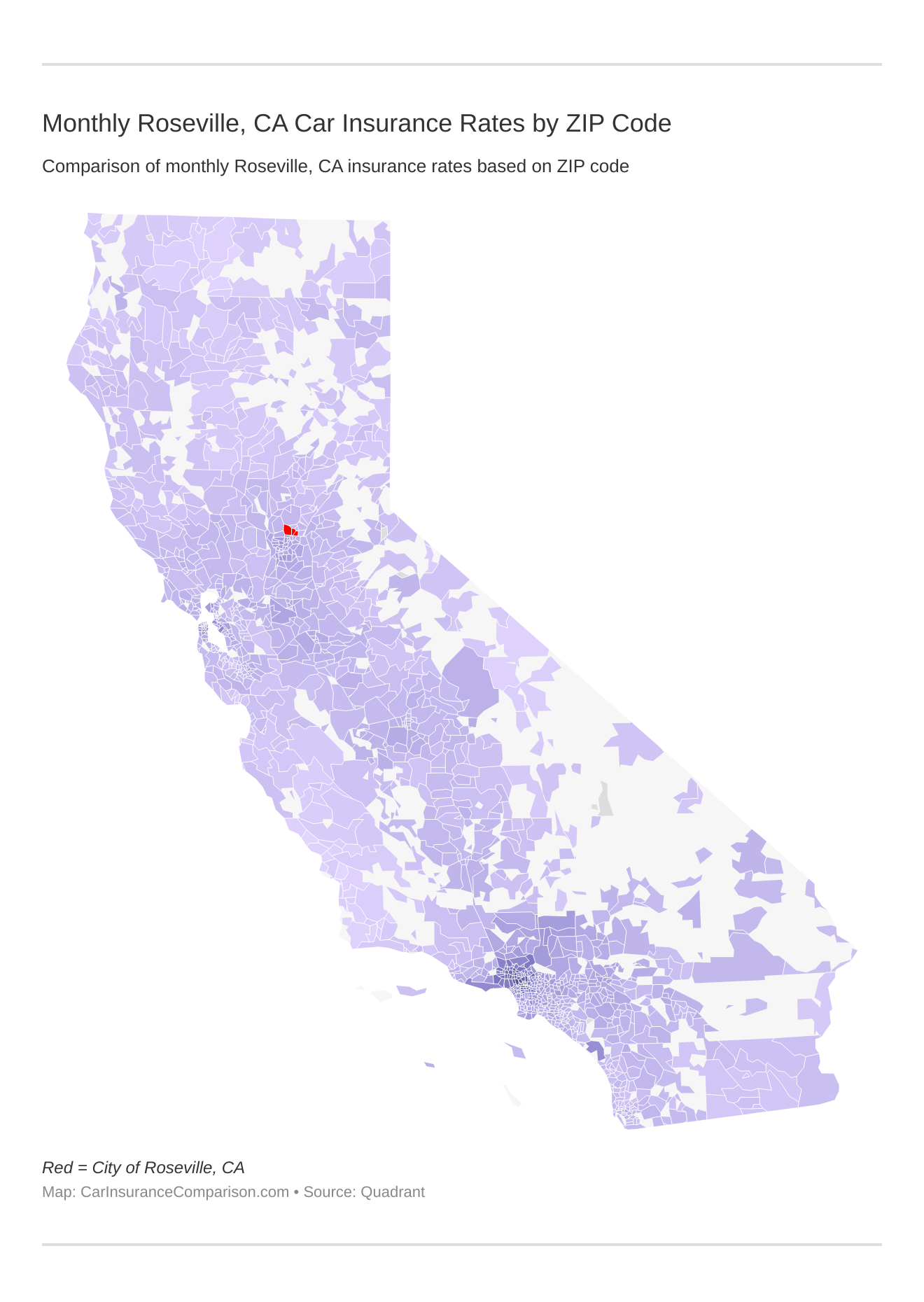

Monthly Roseville, CA Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Roseville, CA auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

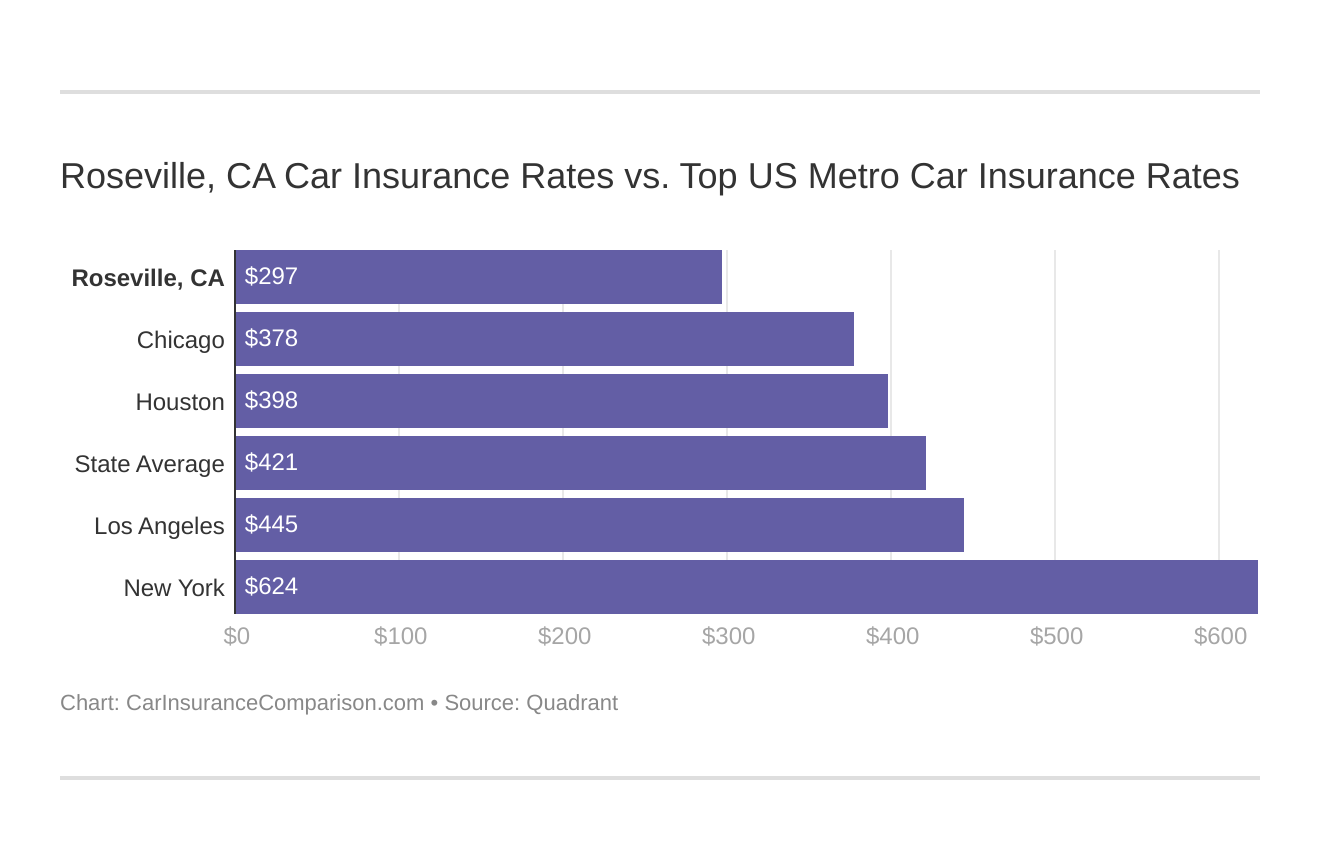

Roseville, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Roseville, CA against other top US metro areas’ auto insurance costs.

Enter your ZIP code now to compare Roseville, CA car insurance quotes from multiple companies for free.

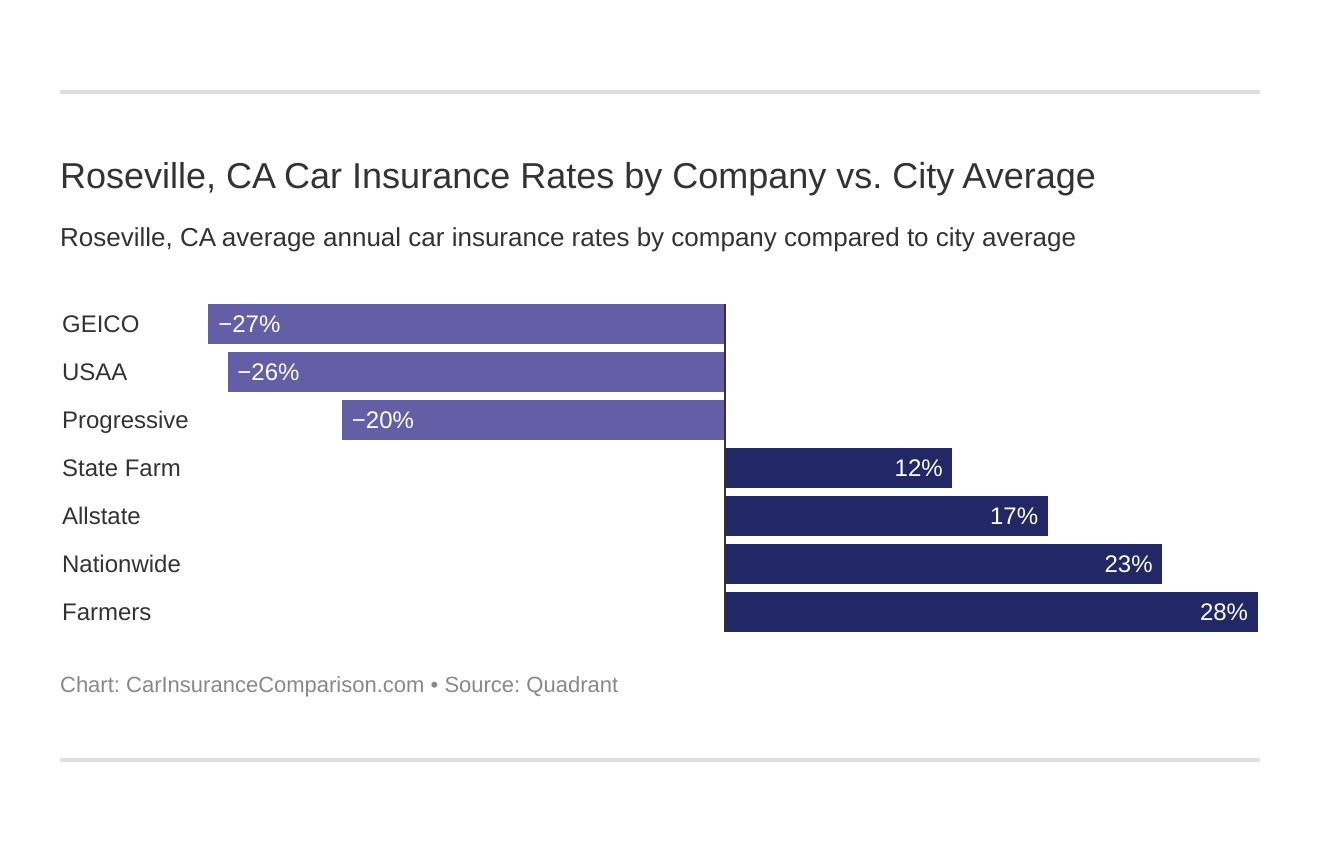

What is the cheapest car insurance company in Roseville, CA?

The cheapest Roseville, CA car insurance company on average is Geico, although rates will be different for every driver.

The cheapest Roseville, CA car insurance providers can be found below. You also might be wondering, “How do those Roseville, CA rates compare against the average California car insurance company rates?” We uncover that too.

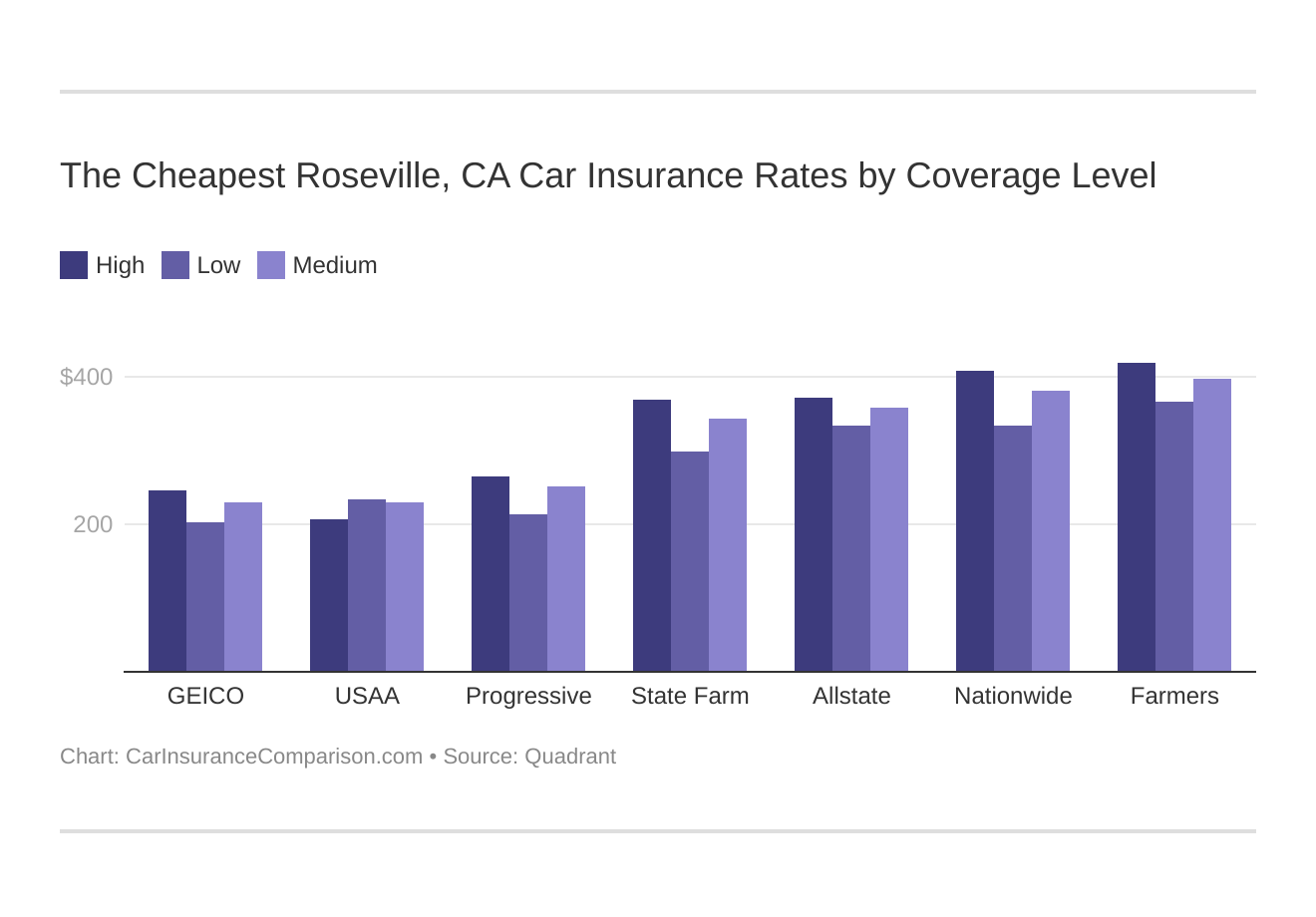

The top car insurance companies in Roseville, CA listed from least to most expensive are:

- Geico car insurance – $2,713.28

- USAA car insurance – $2,742.78

- Progressive car insurance – $2,916.34

- Liberty Mutual car insurance – $2,988.09

- Travelers car insurance – $3,242.65

- State Farm car insurance – $4,042.29

- Allstate car insurance – $4,251.25

- Nationwide car insurance – $4,492.34

- Farmers car insurance -$4,726.85

Read more: Liberty Mutual vs. Travelers Car Insurance Comparison

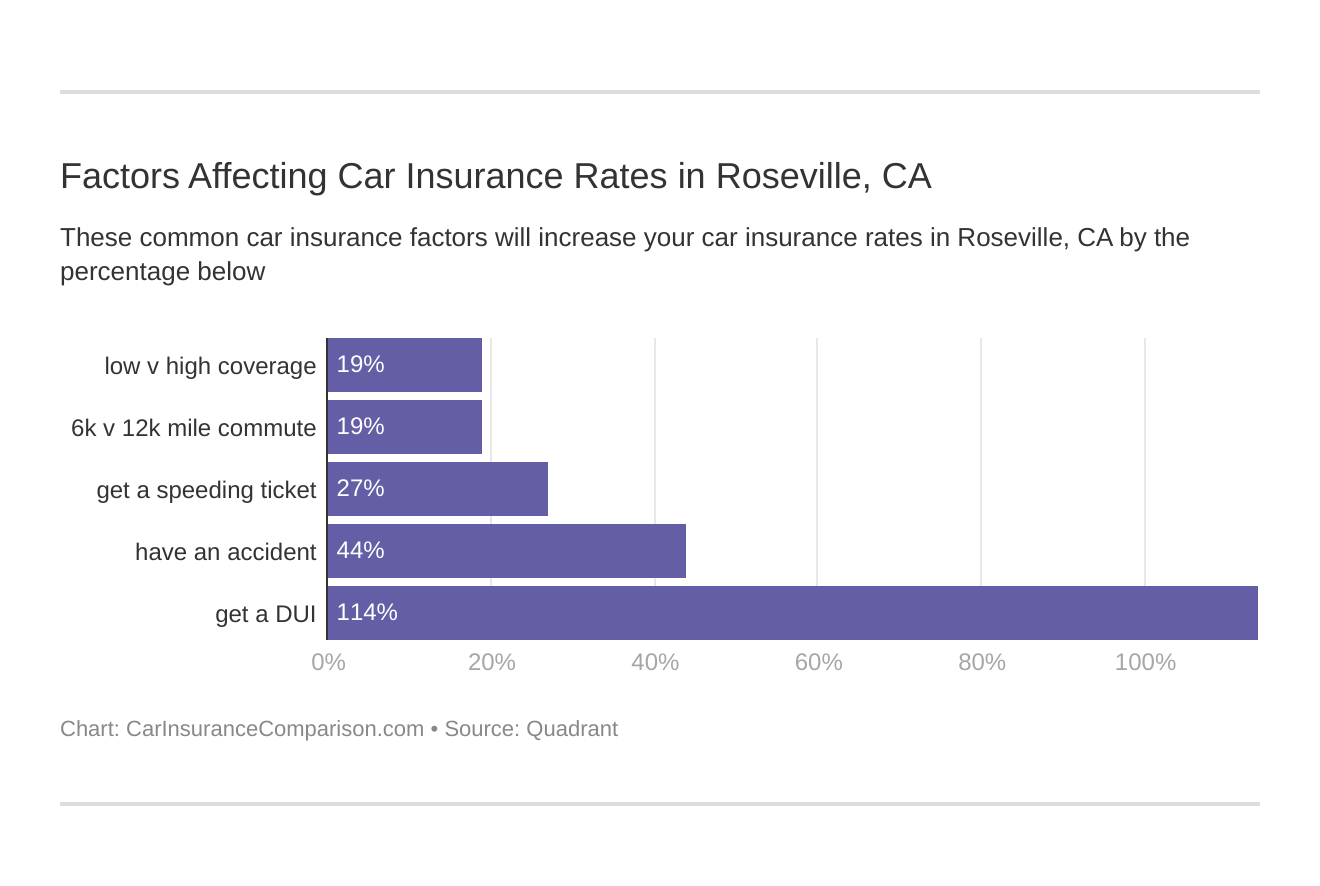

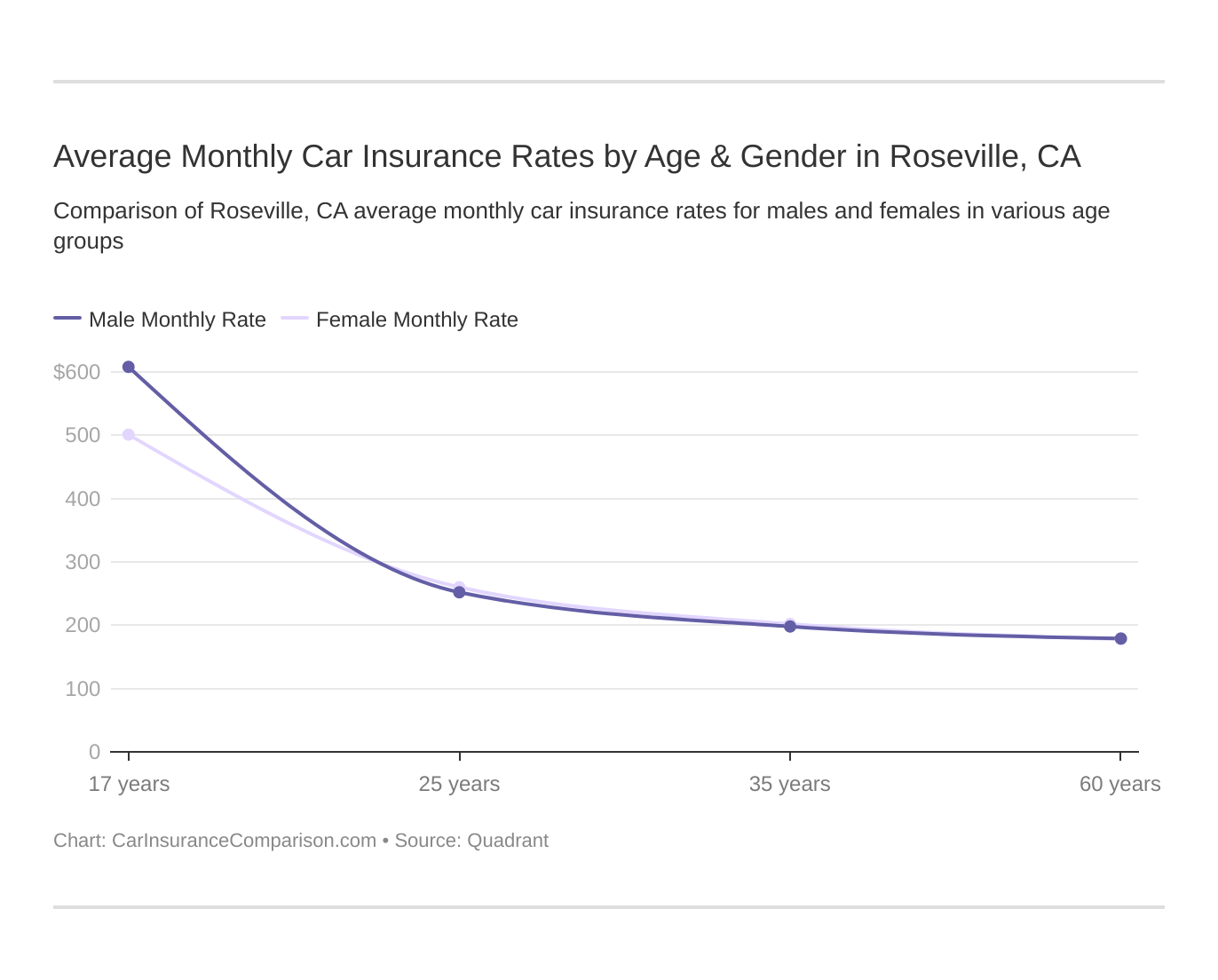

There are many factors that affect car insurance rates, such as your age and driving record. Many companies will also use gender to determine your rates, but California is one of the few states that doesn’t allow it.

Where you live affects your rates also. Larger cities with more crime and traffic will pay more for car insurance. For example, Los Angeles car insurance is more expensive than coverage in Roseville.

California does offer low-cost auto insurance for low-income drivers. The California Low-Cost Auto (CLCA) program offers very low coverage for drivers who meet certain requirements.

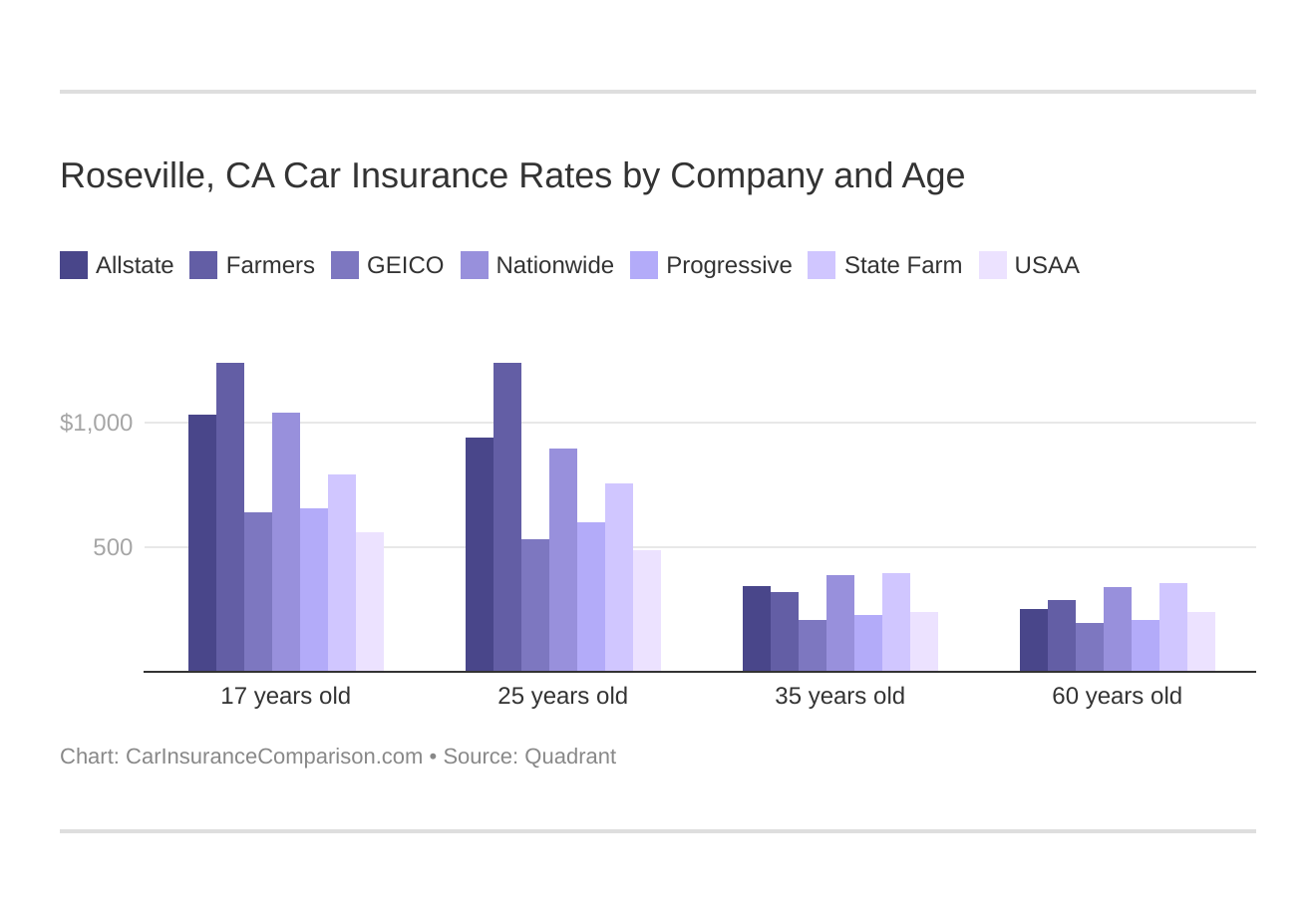

Comparing Roseville, California car insurance costs by age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

Your coverage level will play a major role in your Roseville, CA car insurance costs. Find the cheapest Roseville, California car insurance costs by coverage level below:

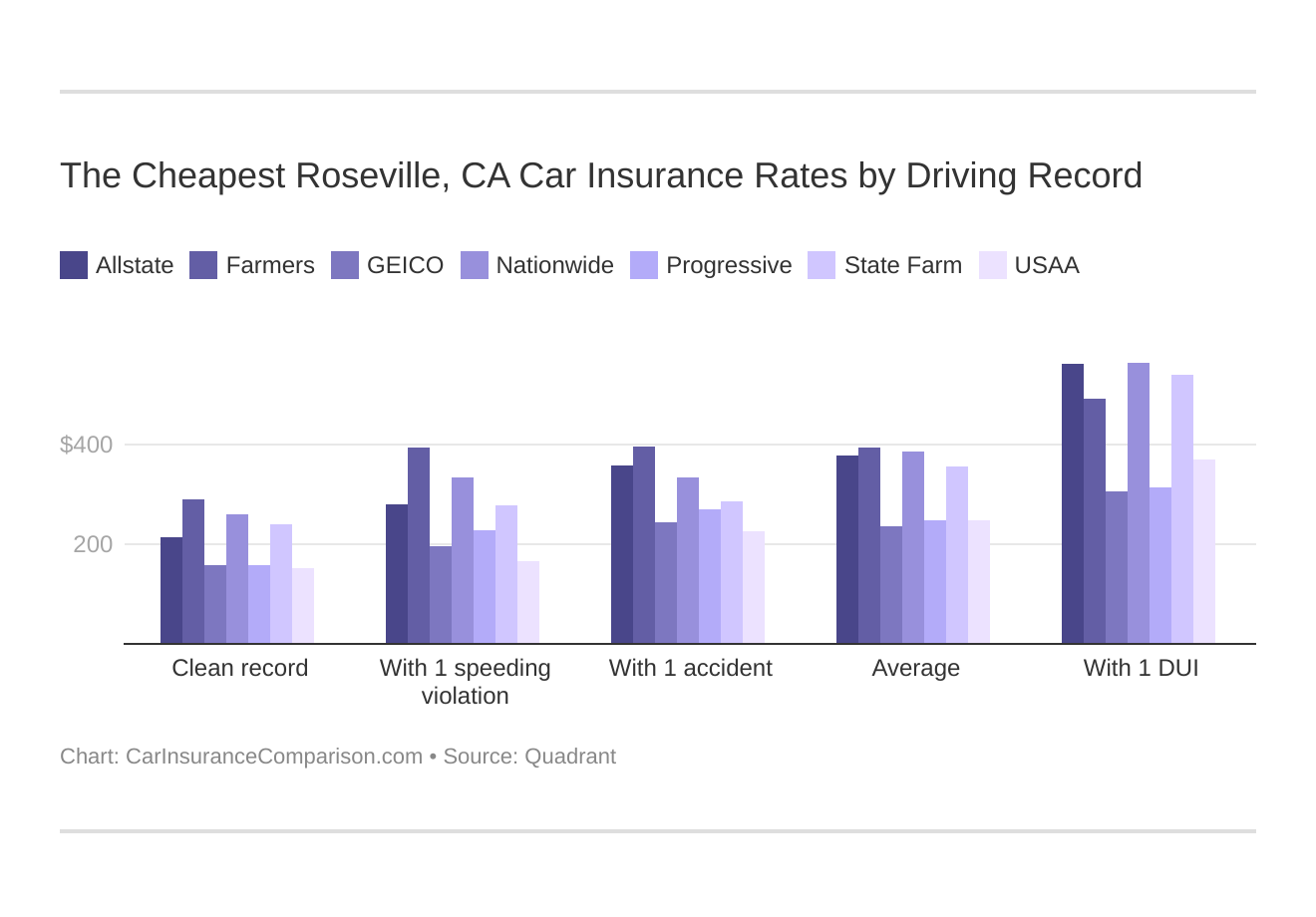

Your driving record will affect your Roseville, CA car insurance costs. For example, a Roseville, California DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Roseville, California car insurance with a bad driving record.

Controlling these risk factors will ensure you have the cheapest Roseville, California car insurance. Factors affecting car insurance rates in Roseville, CA may include your commute, coverage level, tickets, DUIs, and credit.

Age is a significant factor for Roseville, CA car insurance rates. Young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. Roseville, California does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Roseville, CA.

What car insurance coverage is required in Roseville, CA?

Almost every state requires at least a minimum amount of car insurance for drivers to drive legally. California is no exception.

The minimum auto insurance requirements in California for Roseville drivers are:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

These minimums are very low, and drivers should consider raising these limits and carrying additional coverages. In a serious accident, these low minimums won’t fully cover you, and you’ll be left to pay out of pocket for anything not covered.

Consider adding collision and comprehensive coverages. Collision car insurance helps pay for damages from an accident. Comprehensive car insurance covers damages not resulting from an accident, such as theft, vandalism, and natural disasters.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects car insurance rates in Roseville, CA?

Traffic can have an impact on your car insurance rates because you have a greater chance of being in an accident.

Although INRIX doesn’t have data for Roseville, it does rank nearby Sacramento, CA as the 55th most congested city in the U.S.

City-Data reports that most drivers in Roseville commute about 15-20 minutes, but a good number commute an hour or more.

Theft can also raise your car insurance rates. According to the FBI, there were 310 motor vehicle thefts in one year in Roseville.

Roseville, CA Car Insurance: The Bottom Line

Roseville car insurance is more expensive than the national average, but some drivers will qualify for low-cost coverage. Before you buy Roseville, CA car insurance, compare rates from top-rated companies to get your best deal.

Enter your ZIP code to compare Roseville, CA car insurance quotes for free today.

Frequently Asked Questions

What factors determine car insurance rates in Roseville, CA?

Several factors contribute to determining car insurance rates in Roseville, CA. These factors include your age, driving history, type of vehicle, coverage limits, deductible, credit score, and the amount of coverage you choose.

How can I find the best car insurance rates in Roseville, CA?

To find the best car insurance rates in Roseville, CA, it’s essential to compare quotes from multiple insurance providers. You can either contact insurance companies directly or use online comparison tools to get quotes and compare coverage options.

Are there any specific discounts available for car insurance in Roseville, CA?

Yes, many insurance companies offer various discounts to policyholders in Roseville, CA. These discounts may include safe driver discounts, multi-policy discounts, good student discounts, anti-theft device discounts, and discounts for taking defensive driving courses. It’s worth exploring these options to potentially lower your insurance premiums.

What is the minimum car insurance requirement in Roseville, CA?

In California, including Roseville, the minimum car insurance requirement is liability coverage. The minimum liability coverage limits are 15/30/5, which means $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage per accident.

Should I purchase more than the minimum required car insurance in Roseville, CA?

While the minimum liability coverage is legally required, it’s often advisable to consider purchasing additional coverage beyond the minimum. This can help protect you financially in the event of a more significant accident or if you are at fault for damages that exceed the minimum coverage limits.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.